Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Risk Management in the Public Sector Seminar

The objective of the audit was to assess whether the Department of Health and Aged Care has effectively managed the expansion of telehealth services during and post the COVID-19 pandemic.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Immigration and Border Protection’s identity verification arrangements for applicants in the Citizenship Program.

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine whether the Department of Infrastructure, Transport, Regional Development and Communications exercised appropriate due diligence in its acquisition of the ‘Leppington Triangle’ land for the future development of the Western Sydney Airport.

Please direct enquiries through our contact page.

The acting Auditor-General responded on 24 September 2024 to correspondence from Senator the Hon Richard Colbeck dated 27 August 2024, requesting that the Auditor-General conduct an investigation to examine the COVID-19 Vaccine Claims Scheme.

Please direct enquiries through our contact page.

The objective of the performance audit was to review the progress in the delivery of contractual commitments for Industry Development (ID) for the five contracts awarded under the IT Outsourcing Initiative. In particular, the audit examined the effectiveness of the monitoring by DCITA of achievement against contractual commitments for ID; assessed the impact of changes to the IT outsourcing environment on the management and monitoring of ongoing ID obligations; and identified practices that have improved administrative arrangements.

The Auditor-General responded on 19 November 2021 to correspondence from Ms Alicia Payne MP dated 5 November 2021, requesting that the Auditor-General clarify some points of concern about the potential audit of the Australian War Memorial expansion (Management of the Australian War Memorial's development project).

Please direct enquiries relating to requests through our contact page.

The objective of this audit was to assess the effectiveness of the design and award of funding for Round 6 of the Mobile Black Spot Program.

Please direct enquiries through our contact page.

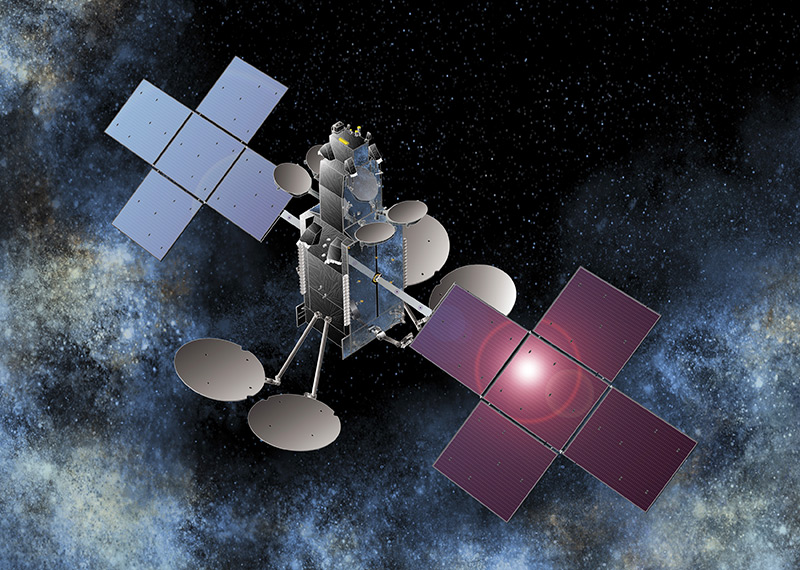

The audit objective was to assess whether nbn co limited effectively administered the National Broadband Network Satellite Support Scheme.

Please direct enquiries relating to reports through our contact page.

The acting Auditor-General responded on 14 August 2024 to correspondence from Senator David Shoebridge dated 26 July 2024, requesting that the Auditor-General conduct an investigation to the use of public funds allocated towards the OneSchool Global schools.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness to date of the Department of Defence’s procurement of six evolved Cape class patrol boats.

Please direct enquiries through our contact page.

The audit objective was to assess the effectiveness of the management of human biosecurity for international air travellers during the COVID-19 pandemic.

Please direct enquiries through our contact page.

The objective of the audit was to examine whether WSA Co Limited’s procurement framework and procurement activities are achieving value for money.

Please direct enquiries through our contact page.

The audit objective was to assess the establishment and administration of the Australian Border Force’s framework to ensure the lawful exercise of powers in accordance with applicable legislation.

Please direct enquiries relating to reports through our contact page.

The audit reviewed collection management practices and management information systems of the National Library of Australia, National Gallery of Australia, National Museum of Australia and the Australian War Memorial. The objective of the audit was to assess the efficiency and effectiveness of the management processes employed in safeguarding national collections.

The audit assessed whether Centrelink effectively manages customer debt, excluding debt relating to Family Tax Benefit, consistently across its network, ensuring integrity of payments made on behalf of the Department of Family and Community Services (FaCS). The audit assessed five components of Centrelink's debt management processes, including administration, prevention, identification, raising and recovery.

Grant Hehir, Auditor-General for Australia, attended the Institute of Internal Auditors-Australia ‘Public Sector Internal Audit Conference’ on 31 July 2018, and presented an opening keynote session titled Strategic governance of risk: Lessons learnt from public sector audit. The accompanying paper to the speech, which was delivered against a conference theme of ‘internal auditor as a trusted advisor’, is available here.

Please direct enquiries through our contact page.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Third ACAG Conference, Canberra

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the IPAA ACT Division, Half day seminar

The Auditor-General responded on 22 October 2021 to correspondence from Senator Mehreen Faruqi dated 27 September 2021, requesting that the Auditor-General conduct an investigation to examine the administration of the Australian Research Council's funding application processes.

Please direct enquiries relating to requests for audit through our contact page.

The objective of the audit was to assess whether the contractual arrangements that have been put in place for the delivery of the Moorebank Intermodal Terminal (MIT) will provide value for money and achieve the Australian Government’s policy objectives for the project.

Please direct enquiries relating to reports through our contact page.

The audit reviewed the Australian Taxation Office's fraud prevention and contol arrangements in relation to the Goods and Services Tax. The audit objective was to assess whether the ATO has implemented administratively effective GST fraud control arrangements, consistent with the Commonwealth Fraud Control Guidelines.

The objective of this audit was to assess the effectiveness of the Department of Communications and the Arts’ assessment and selection of base stations for funding under the first round of the Mobile Black Spot Programme.

Please direct enquiries relating to reports through our contact page.

The objective of this follow-up audit was to assess Austrade's implementation of the recommendations contained in ANAO Report No. 4 of 1998-99 (Client Service Initiatives - Australian Trade Commission (Austrade)), and whether the implementation of the recommendations or appropriate alternative measures has improved the management and delivery of Austrade's client service.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the 18th Commonwealth Auditors-General Conference, Malaysia

The Commonwealth has significant foreign exchange risk exposures including $A8.4 billion of foreign currency transactions with the Reserve Bank of Australia in 1998-99. Under the Financial Management and Accountability Act and its associated Regulations, all agencies are required to assess and, where possible, manage, foreign exchange risk. The audit reviewed four agencies that have substantial foreign currency payment exposures namely:

- the Department of Defence;

- the Australian Agency for International Development;

- the Department of Foreign Affairs and Trade; and

- the Department of Finance and Administration.

The objective of the audit was to identify and assess the efficiency and cost effectiveness of the management of foreign exchange risk across the selected agencies, also to identify opportunities to improve the management of foreign exchange risk, including any associated potential financial savings that could accrue to the Commonwealth.

The objective of the audit was to assess the effectiveness of the design and conduct of the third and fourth funding rounds of the Regional Development Australia Fund.

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to assess whether the Australian Taxation Office (ATO) has effectively managed risks related to the rapid implementation of COVID-19 economic response measures.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of the Department of Veterans’ Affairs’ and the Department of Defence’s administration of the Australian Government’s $55 million support package announced in the May 2010 Budget for former F-111 fuel tank maintenance workers and their families. The audit examined the implementation of the 14 agreed recommendations in the Government Response to the 2009 Parliamentary Inquiry into the F-111 deseal/reseal issues, which formed the basis of the May 2010, F-111 support package.

Please direct enquiries relating to reports through our contact page.

The Commonwealth has significant involvement in national emergency management arrangements through its roles in planning, coordination between agencies, operational response, financial support, education and training, public awareness and research activities. The objectives of this performance audit were to identify the Commonwealth's current emergency management arrangements; to provide assurance to Parliament concerning the adequacy of the arrangements; and to highlight areas for improvement.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Government in Excellence Summit 2000 - Reinventing Government - A Manifesto for Achieving Excellence and Managing for Results; Singapore

Medicare is Australia's universal health insurance scheme. Underpinning Medicare is one of Australia's largest and more complex computer databases the Medicare enrolment database. At the end of 2004 the Medicare enrolment database contained information on over 24 million individuals. This audit examines the quality of data stored on that database and how the Health Insurance Commission (HIC) manages the data.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Department of Finance and Administration's Learning Centre Lecture Series

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Association of Risk and Insurance Managers of Australasia - South Australia Chapter

The Superannuation Guarantee, which came into effect on 1 July 1992, was introduced to reduce reliance on the age pension as a means of funding retirement for individuals. The objective of the performance audit was to review the ATO's administration of the Superannuation Guarantee and to identify appropriate opportunities for improvement.

The objective of this audit was to assess the effectiveness of NBN Co’s service continuity operations relating to the migration of telecommunication services to the National Broadband Network (NBN).

Please direct enquiries through our contact page.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the CPA Australia National Public Sector Convention, Perth

Mr P.J. Barrett (AM) - Auditor-General for Australia, Occasional Paper

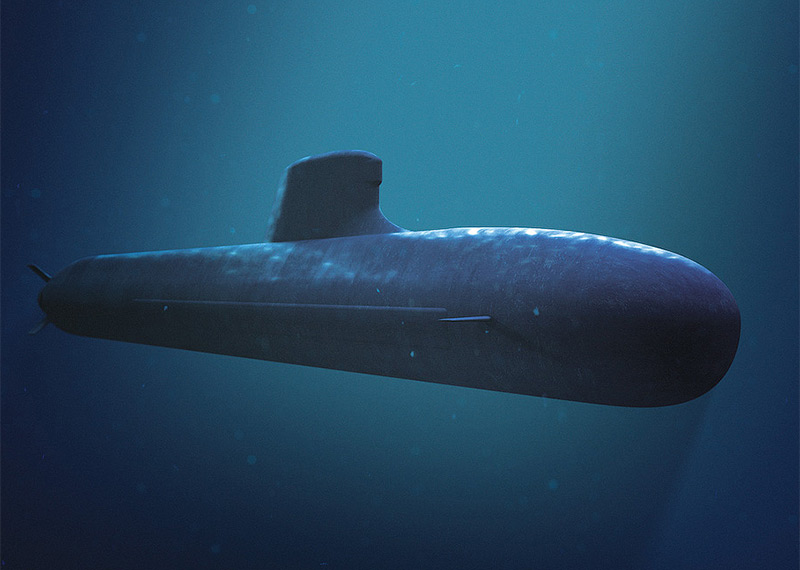

The audit objective was to examine the effectiveness of the Department of Defence's administration of the Future Submarine Program to date.

Please direct enquiries through our contact page.

This benchmarking study across 14 agencies examined how line managers plan for and manage their staff and how the human resource (HR) function supports them to do that. People management was categorised into nine, practice areas, to enable comparisons between the participating agencies. The study also assessed each people management practice area against four criteria: quality, HR integration, effectiveness & efficiency and business contribution.

The objective of the audit was to form an opinion on the administrative effectiveness, efficiency and accountability of the Department of Health and Aged Care's delivery of health services to the Aboriginal and Torres Strait Islander population.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the Senate Occasional Lecture Series

The objective of the audit was to assess the effectiveness of the Department of Defence’s procurement of Hunter class frigates and the achievement of value for money to date.

Please direct enquiries through our contact page.

The objective of the audit was to assess the effectiveness of Australian Government agencies' management and implementation of measures to protect and secure their electronic information, in accordance with Australian Government protective security requirements.

The audit reviewed whether DEWR is efficiently and effectively managing the provision of entitlements to eligible former employees under the Employee Entitlements Support Scheme (EESS) and its replacement, the General Employee Entitlements and Redundancy Scheme (GEERS). The audit sought to determine whether DEWR had a mechanism to ensure that claims were properly assessed, taking into account the prevailing risks, whether performance information was adequate, whether relationships with claimants and insolvency practitioners were managed appropriately and whether a cost-effective recovery strategy was in place.

In a military context, individual readiness refers to the ability of an individual member to be deployed, within a specified notice period, on operations, potentially in a combat environment, to perform the specific skills in which he or she has been trained. Individual readiness is the foundation on which military preparedness is built. Maintenance of a specified level of individual readiness in peacetime (along with other factors such as equipment readiness and collective training) influences the speed with which personnel can deploy on operations. The objective of this audit is to ensure that members can be deployed on operations, potentially in a combat environment, to perform their specific skills within a notice period of 30 days.

The audit reviewed the Australian Taxation Office's administration of the payment of tax by non-residents. The audit objectives were to:

- provide Parliament with assurance about how efficiently and effectively the ATO administers the payment of tax in respect of non-residents;

- identify any scope for more effective and efficient administration of the function; and

- identify any opportunities for the cost-effective collection of additional revenue.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented to the Australasian Council of Public Accounts Committees (ACPAC)

The audit objective was to assess the effectiveness of Defence’s management of the acquisition of medium and heavy vehicles, associated modules and trailers for the Australian Defence Force.

Please direct enquiries relating to reports through our contact page.

The audit surveyed a wide range of Commonwealth agencies' Year 2000 preparedness, their management of the problem and their application of core corporate governance principles, including risk management disciplines. The scope of the audit reflected the wide ranging ramifications of the Year 2000 problem for agencies' overall functions (whole-of-business) internally as well as in terms of external interactions. The audit objectives were to:

- assess the adequacy of agencies' planning in relation to achieving Year 2000 compliance;

- review and assess agencies' implementation, management and monitoring of Year 2000 compliance strategies;

- review agencies' strategic risk assessments in relation to the Year 2000 changeover; and

- raise surveyed agencies' and other Commonwealth agencies' awareness of the various aspects of the Year 2000 problem.

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the House of Representatives Occasional Seminar Series

Mr P.J. Barrett (AM) - Auditor-General for Australia, presented at the CPA Australia's Government Business Symposium, Melbourne

The objective of the audit was to assess whether the design and early implementation of the Australian Government’s response to Recommendation 86 of the Royal Commission into Aged Care Quality and Safety has been effective.

Please direct enquiries through our contact page.

The examined the $1 billion Federation Fund program, which was established by the Government to mark the Centenary of Federation. The objectives of the examination were to assess the:

- extent to which the administration of the FCHP program complied with better practice in the assessment of applications, especially in relation to the transparency and rigour of the decision-making process;

- equity of the geographic spread of grants to States and electorates; and

- process for the announcement of the results of grant applications.

Mr Ian McPhee - Auditor-General for Australia, presented at the Public Sector Governance Forum of the Australian Institute of Company Directors and The Institute of Internal Auditors - Australia

The audit reviewed the retention of military personnel that are managed by the Australian Defence Force which comprises the three Services. The objective of the audit was to review the management of personnel retention within the ADF with a view to evaluating the measures Defence has in place to monitor and control the flow of trained personnel from the Services

Mr Ian McPhee - Auditor-General for Australia, presented at the Canberra Evaluation Forum

The audit examined the ATO's management of its relationship with tax practitioners (tax agents and the wider group of professionals working on taxation matters for clients). However, our main focus was the ATO's management of its relationship with tax agents because they are the core element of the tax practitioner grouping and their role is fundamental to the effective operation of the tax system. The objective of the audit was to assess how well the ATO manages its relationship with tax practitioners, focussing on selected ATO relationships with tax practitioners, in particular its regulatory relationship with tax agents, its service support relationship with tax agents and its relationship with tax agents and members of the wider tax practitioner group in the professional bodies as key stakeholders in tax administration.

Mr Ian McPhee - Auditor-General for Australia, presented at the 20th Commonwealth Auditors-General Conference

The objective of the audit was to assess the effectiveness and value for money of Defence’s acquisition of a Battle Management System and a Tactical Communications Network through Land 200 Tranche 2 Work Packages B–D.

Please direct enquiries through our contact page.