Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Australian Taxation Office’s Management of Risks Related to the Rapid Implementation of COVID-19 Economic Response Measures

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- This audit is one of five performance audits conducted under phase one of the ANAO’s multi-year strategy that focuses on the effective, efficient, economical and ethical delivery of the Australian Government’s response to the COVID-19 pandemic.

- The rapid implementation of COVID-19 economic response measures created new and increased risks for the Australian Taxation Office (ATO) to effectively identify, consider and manage.

- Risks may arise from workforce redeployment, IT system development and data integrity, stakeholder engagement and coordination, adapting service delivery, potential internal and external fraud, and non-compliance with regulatory requirements.

Key facts

- Nearly $70 billion in JobKeeper payments had been disbursed as at 1 November 2020.

- Over 800,000 businesses had been credited with cash flow boosts totalling $30.28 billion as at 20 October 2020.

- Over 2.8 million individuals had applied for early release of superannuation as at 30 September 2020.

What did we find?

- The ATO has been effective in managing risks related to the rapid implementation of COVID-19 economic response measures.

- The ATO undertook appropriate planning to support the rapid implementation of the six economic response measures — predominantly using its existing systems and processes to support governance, resourcing, and consultation.

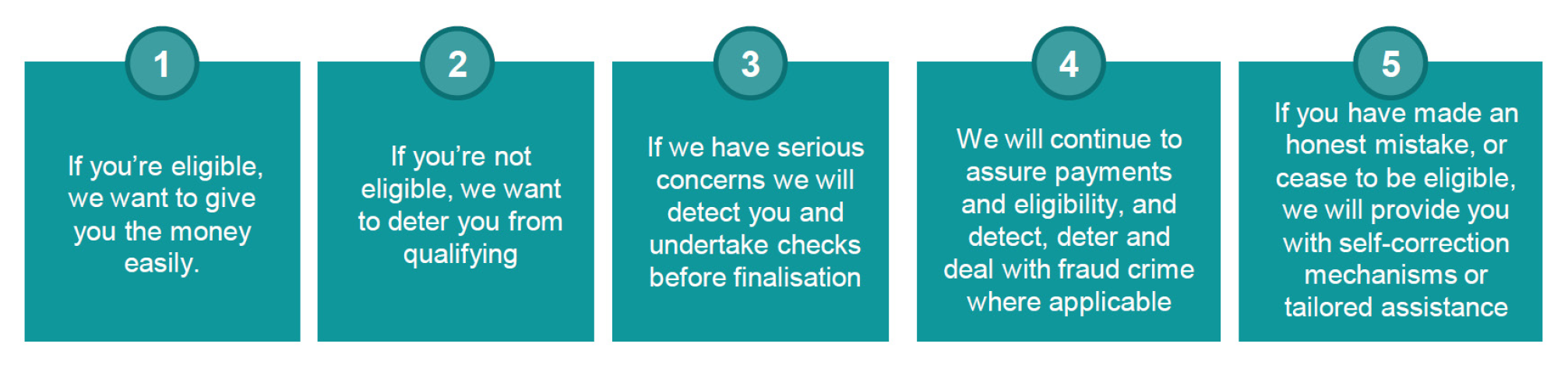

- The ATO’s risk documentation evidences its priority of implementing the measures in a timely manner, while also managing fraud and other integrity risks on a progressive basis.

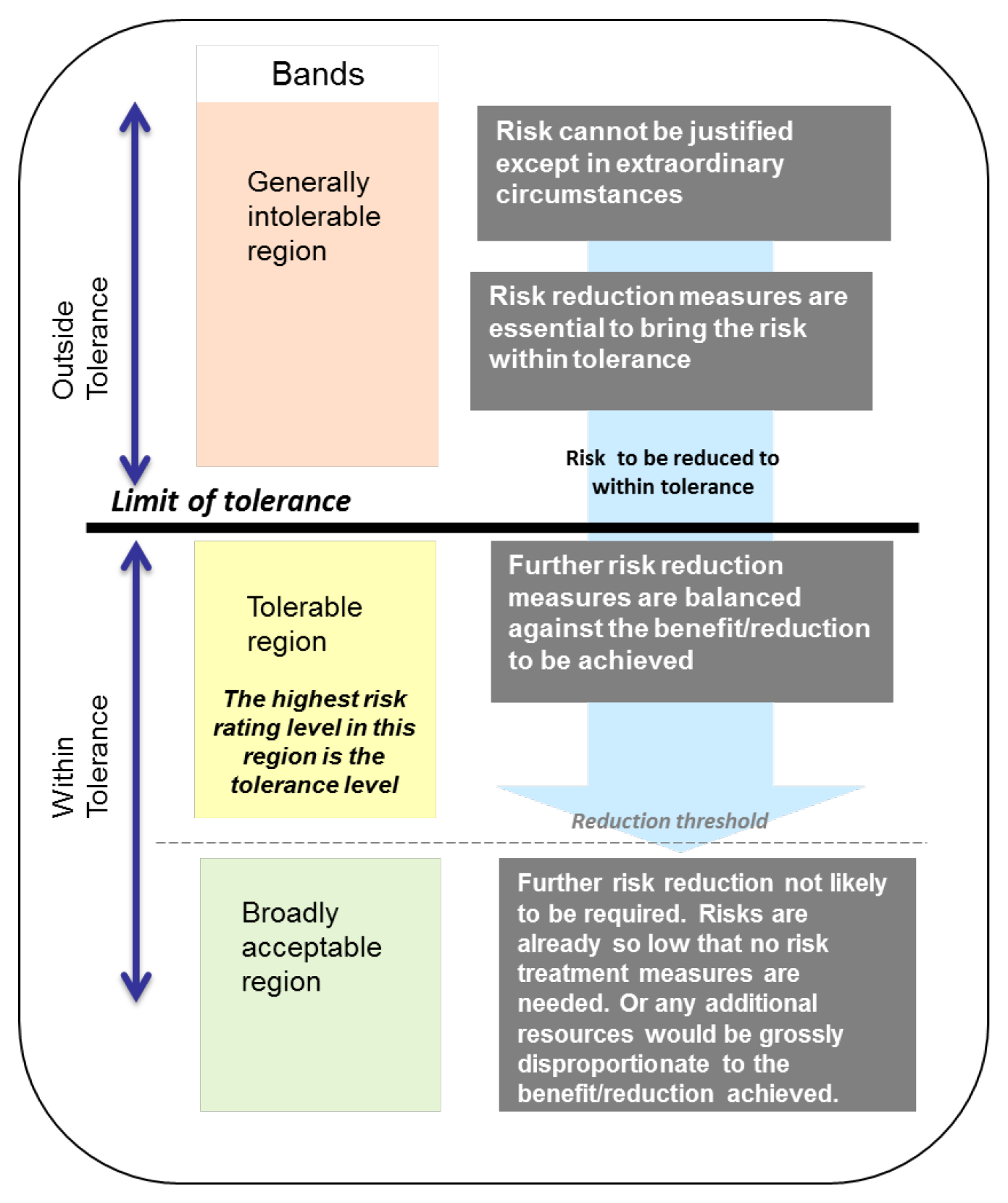

What did we recommend?

- The Auditor-General made no recommendations but identified key messages for Australian Government entities to consider in identifying and responding to the challenges and risks associated with the rapid implementation of initiatives.

$101.3 billion

Total forecasted cost of the JobKeeper scheme

Over 10,000

ATO staff members reassigned duties to support the six economic response measures

4 to 6 weeks

The time period between announcement and implementation for three of the six measures

Summary

Background

1. Since its emergence in late 2019, coronavirus disease 2019 (COVID-19) has become a global pandemic that is impacting on human health and national economies. From February 2020, the Australian Government commenced the introduction of a range of policies and measures in response to the emergence of COVID-19 that included:

- travel restrictions and international border control and quarantine arrangements;

- delivery of substantial economic stimulus, including financial support for affected individuals, businesses and communities; and

- support for essential services and procurement of critical medical supplies.

2. The Australian Taxation Office (ATO) is responsible for implementing and administering six measures as part of the Australian Government’s economic response to the COVID-19 pandemic (Box 1).

|

Box 1: COVID-19 economic response measures implemented and administered by the ATO |

|

1. Enhancing the Instant Asset Write-Off — from 12 March to 31 December 2020a, businesses with aggregated turnover of less than $500 million can access an immediate tax deduction through their 2019–20 or 2020–21 tax returns for certain depreciating assets purchased for less than $150,000. 2. Backing Business Investment — businesses with aggregated turnover of less than $500 million can access an accelerated rate of depreciation for certain new assets, provided the asset is first held and used or ready for use between 12 March 2020 and 30 June 2021. 3. Boosting Cash Flow for Employers — small and medium-sized businesses and not-for-profit organisations with aggregated turnover under $50 million who employ staff are eligible to receive credits totalling between $20,000 and $100,000 when they lodge their activity statements for tax periods from March 2020 through to and including the September 2020 period. 4. Early Release of Superannuation — eligible individuals affected by COVID-19 could access up to $10,000 of their superannuation in 2019–20 and a further $10,000 in 2020–21. Eligible temporary visa holders were eligible to access up to $10,000 of their superannuation in 2019–20. 5. Temporary Reduction of Superannuation Minimum Drawdown Rates — for 2019–20 and 2020–21, the superannuation minimum drawdown requirements for account-based pensions and similar products have been reduced by 50 per cent. 6. JobKeeper scheme — the JobKeeper Payment is a wage subsidy (paid in arrears) designed to help businesses affected by COVID-19 to cover the costs of their employees’ wages, so that more employees can retain their job and continue to earn an income. |

Note a: The government announced an extension to this measure on 6 October 2020 (see Box 3).

Source: ANAO, based on public records and the ATO’s records.

3. The six measures were announced and implemented over the period from 12 March to 1 July 2020.1

Rationale for undertaking the audit

4. The COVID-19 pandemic and the pace and scale of the Australian Government’s response impacts on the risk environment faced by the Australian public sector. This audit is one of five performance audits conducted under phase one of the ANAO’s multi-year strategy that will focus on the effective, efficient, economical and ethical delivery of the Australian Government’s response to the COVID-19 pandemic.

5. The ATO is playing a significant role in supporting the Australian Government’s economic response to the COVID-19 pandemic. An early stage audit examining the ATO’s risk management arrangements will inform ongoing administration of the measures, including strategies to support the integrity of the measures.

Audit objective and criteria

6. The objective of the audit was to assess whether the ATO has effectively managed risks related to the rapid implementation of COVID-19 economic response measures.

7. The three high-level criteria were:

- Was appropriate planning undertaken for rapid implementation?

- Were changes in the ATO’s risk environment appropriately assessed, documented and communicated?

- Have identified risks been effectively managed, monitored and reviewed?

Conclusion

8. The ATO has been effective in managing risks related to the rapid implementation of COVID-19 economic response measures.

9. The ATO undertook appropriate planning to support the rapid implementation of the six economic response measures — predominantly using its existing systems and processes to support governance, resourcing, and consultation.

10. In implementing the six economic response measures, the ATO assessed, documented and communicated changes in its risk environment in an appropriate manner. The ATO’s risk documentation evidences its priority of implementing the measures in a timely manner, while also managing fraud and other integrity risks on a progressive basis.

11. The ATO has established effective arrangements to monitor identified risks and associated risk mitigation strategies through the project management and governance structures established for the six economic response measures. The ATO has commenced planning for the further adjustment of existing operations in line with changed circumstances and risks.

Supporting findings

Planning for rapid implementation

12. The ATO implemented fit-for-purpose governance and oversight arrangements for the six economic response measures, drawing on existing bodies and frameworks where it could, and introducing specific and additional structures where needed.

13. The ATO followed a sound process to identify and obtain required resources and capabilities to support the rapid implementation of the six economic response measures, and to understand the impacts on its business-as-usual activities. The ATO identified constraints and developed responses to address staffing and ICT capability requirements to deliver the measures.

14. The ATO consulted with government entities and external stakeholders during the implementation of the six economic response measures — generally leveraging its existing relationships and arrangements. The ATO’s strategies for managing identified shared risks were not documented consistently.

Identifying risks and impacts

15. The ATO identified new and changing risks, including to existing operations. The ATO adopted an iterative approach to identifying risks at a project and program level that was fit-for-purpose.

16. The ATO identified risk tolerances, controls and treatment strategies. Risks associated with the implementation of the six economic response measures were assessed to be within tolerance, to be managed by identified controls, with the exception of integrity risks where the need for additional treatment strategies was identified. Aspects of the ATO’s approach to determining risk tolerances could have been better documented to support risk-informed decision-making.

17. The ATO informed government decision-makers of risks, mitigation strategies and broader impacts through a variety of operationally focused briefs, submissions and reports.

Monitoring identified risks

18. The ATO has progressively developed and commenced the implementation of treatment strategies for fraud and compliance risks associated with the economic response measures.

19. The ATO has appropriately monitored identified risks and strategies. At August 2020, the ATO had revised Risk Assessment and Treatment Plans for four measures. A range of monitoring activities have been undertaken at a project level for all six measures.

20. The ATO has reviewed business arrangements in line with changed circumstances and risks. Future state strategic planning has commenced, including for the adjustment of pre-existing arrangements for debt and lodgment.

Australian Taxation Office summary response

21. The ATO’s summary response to the audit is provided below, while its full response is reproduced at Appendix 1.

The ATO welcomes this review and considers the report supportive of our approach to managing risks related to the rapid implementation of COVID-19 economic response measures. This rapid implementation, particularly in an operational environment impacted by COVID-19, prompted a significant review of the minimum viable products that support new measures. This enabled the economic response measures to be implemented within weeks, where the typical timeline for these types of activities would be at least 6–12 months.

In finding the ATO effective in managing risks related to the rapid implementation of the economic response measures, we do support the suggestions made within the key messages and will be reviewing these opportunities for improvement within our future risk management processes. In particular, the ATO had already recognised shared risk and risk tolerance to be two areas that could be further enhanced to better support our overall risk management practices within the organisation.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

1. Background

Introduction

1.1 Since its emergence in late 2019, coronavirus disease 2019 (COVID-19) has become a global pandemic that is impacting on human health and national economies. On 21 January 2020 the Australian Government listed COVID-19 as a disease of pandemic potential under the Biosecurity Act 2015.2 The World Health Organisation declared COVID-19 to be a ‘public health emergency of international concern’ on 30 January 2020.

1.2 From February 2020, the Australian Government commenced the introduction of a range of policies and measures in response to the emergence of COVID-19. On 18 March 2020, in response to the pandemic in Australia, the Governor-General of the Commonwealth of Australia declared that a human biosecurity emergency exists.3

1.3 The Australian Government’s health and economic response has included:

- travel restrictions and international border control and quarantine arrangements;

- delivery of substantial economic stimulus, including financial support for affected individuals, businesses and communities; and

- support for essential services and procurement of critical medical supplies.

1.4 With the release of the 2020–21 Budget on 6 October 2020, the Australian Government reported it had committed $507 billion in overall support since the onset of the pandemic, including $272 billion over five years (2019–20 to 2023–24) in direct economic and health support.

1.5 Risks in relation to the rapid development and implementation of major new measures may arise from workforce redeployment, IT system development and data integrity, stakeholder engagement and coordination, adapting service delivery, potential internal and external fraud, and non-compliance with regulatory requirements.

Key Commonwealth requirements on risk management

1.6 Under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), the accountable authority must establish and maintain:

- an appropriate system of risk oversight and management for the entity; and

- an appropriate system of internal control for the entity; including by implementing measures directed at ensuring officials of the entity comply with the finance law.4

1.7 This legislative requirement is supported by the Commonwealth Risk Management Policy, which sets out nine elements that non-corporate Commonwealth entities must comply with in order to establish an appropriate system of risk oversight and management (Box 2).5

|

Box 2: The nine elements of the Commonwealth Risk Management Policy |

|

Source: Reproduced from the Commonwealth Risk Management Policy (1 July 2014).

1.8 The stated goal of the Commonwealth Risk Management Policy is to embed risk management as part of the culture of Commonwealth entities where the shared understanding of risk leads to well informed decision making.

Economic response measures administered by the ATO

1.9 The Australian Taxation Office (ATO) is a non-corporate Commonwealth entity within the Treasury portfolio. Under the PGPA Act, the accountable authority of the ATO is the Commissioner of Taxation. The responsibilities of the ATO includes the administration of legislation governing tax, superannuation and the Australian Business Register, and supporting the delivery of government benefits to the community. The ATO has a workforce comprising just over 21,000 staff (as at 30 June 2020). The ATO is structured into five main groups — Client Engagement, Law Design and Practice, Service Delivery, Enterprise Solutions and Technology, and Enterprise Strategy and Corporate Operations.

1.10 The ATO is responsible for implementing and administering six measures as part of the Australian Government’s economic response to the COVID-19 pandemic (Table 1.1).

Table 1.1: Overview of the six economic response measures administered by the ATO

|

Measure |

Summary of the measure |

Uptake and cost |

|

Enhancing the Instant Asset Write-Off |

For the period from 12 March to 31 December 2020a, businesses with aggregated turnover of less than $500 million (previously $50 million) can access an immediate tax deduction through their 2019–20 or 2020–21 tax returns for certain depreciating assets purchased for less than $150,000 (previously $30,000). Together with the Backing Business Investment measure (see below), this measure was designed to support business sticking with investment they had planned, and encouraging them to bring investment forward to support economic growth over the short term. |

The measure announced on 12 March 2020 is estimated to reduce revenue by $700 million over the forward estimates period. The extension to the measure announced on 9 June 2020 is estimated to reduce revenue by $300 million over the forward estimates period. |

|

Backing Business Investment |

Businesses with aggregated turnover of less than $500 million can access an accelerated rate of depreciation for certain new assets, provided the asset is first held and used or ready for use between 12 March 2020 and 30 June 2021. Businesses can deduct 50% of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost. Deductions are claimed through 2019–20 or 2020–21 tax returns. |

This measure is estimated to have a cost of $3.2 billion over the forward estimates period. |

|

Boosting Cash Flow for Employers |

Small and medium-sized businesses and not-for-profit organisations with aggregated turnover under $50 million who employ staff are eligible to receive credits totalling between $20,000 and $100,000 when they lodge their activity statements for tax periods from March 2020 through to and including the September 2020 period. The amount provided is automatically credited against PAYG withholding and GST due in these quarters, with any excess credit paid directly to the business as a refund. The cash flow boosts are provided in two phases. Eligible businesses received the first cash flow boost for the March to June 2020 periods. These payments equate to 100% of the tax withheld on their employees’ salary and wages in this period. The minimum initial payment was $10,000 and the maximum initial payment $50,000. Businesses who received an initial cash flow boost will receive an additional cash flow boost for the June to September 2020 tax periods. The total additional cash flow boost received will equal the total initial cash flow boost received and will be paid in equal instalments across the June to September 2020 tax periods. |

801,660 businesses credited with an initial cash flow boost (as at 20 October 2020). $30.28 billion credited (as at 20 October 2020). $7.92 billion excess credits paid as a refund (as at 20 October 2020). |

|

Early Release of Superannuation |

Eligible individuals affected by COVID-19 could access up to $10,000 of their superannuation in 2019–20 and a further $10,000 in 2020–21. Individuals will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments. Eligible temporary visa holders were eligible to access up to $10,000 of their superannuation in 2019–20. |

2,873,608 individual applicants (as at 30 September 2020). $35.6 billion approved for release (as at 30 September 2020). |

|

Temporary Reduction of Superannuation Minimum Drawdown Rates |

For 2019–20 and 2020–21, the superannuation minimum drawdown requirements for account-based pensions and similar products have been reduced by 50%. For instance, the minimum drawdown requirement for a retiree between 65–74 years old was reduced from 5% per annum to 2.5%. This measure is aimed at benefiting retirees by providing them with more flexibility as to how they manage their superannuation assets. |

The nature of this measure is such that a reliable estimate of financial impact was not included in the Explanatory Memorandum.b |

|

JobKeeper schemec |

The JobKeeper Payment is a wage subsidy (paid in arrears) designed to help businesses affected by COVID-19 to cover the costs of their employees’ wages, so that more employees can retain their job and continue to earn an income. For the first phase of the scheme, from 30 March to 27 September 2020, payments of $1500 per fortnight per employee were available to eligible employers. The payments are made to the employers monthly in arrears by the ATO. For the second phase of the scheme, payments change to $1200 per fortnight from 28 September 2020 to 3 January 2021, and to $1000 per fortnight from 4 January 2021 to 28 March 2021. Lower payment rates apply to employees working less than 20 hours per week. |

1,051,338 applications from businesses (as at 1 November 2020). 3,549,895 employees and eligible business participants subsidised (based on September reporting period). $69.6 billion in payments disbursed (as at 1 November 2020). |

Note: The ATO informed the ANAO that the introduction of the 2020–21 Budget measure, JobMaker Plan — temporary full expensing to support investment and jobs (see Box 3), is likely to reduce the uptake and cost of Enhancing the Instant Asset Write-Off and Backing Business Investment measures over the forward estimates period.

Note a: The government announced an extension to this measure on 6 October 2020 (see Box 3).

Note b: See page 13 of the Explanatory Memorandum, available at: https://www.legislation.gov.au/Details/C2020B00036/Explanatory%20Memorandum/Text [accessed 6 October 2020].

Note c: On 22 May 2020, the Department of the Treasury and the ATO issued a joint statement advising of a reporting error in estimates of the number of employees likely to access the JobKeeper scheme. The statement advised that Treasury’s revised estimate of the cost of the JobKeeper scheme is around $70 billion (not $130 billion).

Source: ANAO, based on public records and the ATO’s records.

Announcement, legislation and implementation timeframes

1.11 The six economic response measures were announced, legislated and implemented between 12 March and 1 July 2020. Key implementation milestones are listed in Figure 1.1.

Figure 1.1: Key implementation milestones for the six economic response measures administered by the ATO

Source: ANAO, based on public records and the ATO’s records.

1.12 All six measures required legislation to be passed in the Parliament of Australia. The six measures were contained in three pieces of legislation:

- the Coronavirus Economic Response Package Omnibus Act 2020, which provides for Enhancing the Instant Asset Write-Off, Backing Business Investment, Early Release of Superannuation, and Temporary Reduction of Superannuation Minimum Drawdown Rates, and consequential amendments to enable Boosting Cash Flow for Employers;

- the Boosting Cash Flow for Employers (Coronavirus Economic Response Package) Act 2020, which provides for the named measure; and

- the Coronavirus Economic Response Package (Payments and Benefits) Act 2020, which provides for the Treasurer to make rules relating to economic response payments.

- On 9 April 2020, the Treasurer made rules for the JobKeeper scheme, which were set out in a legislative instrument called the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020.

1.13 The period between announcement and implementation was between four to six weeks for three measures — JobKeeper, Boosting Cash Flow for Employers, and Early Release of Superannuation.

Subsequent announcements

1.14 Since the six measures were originally announced and legislated, the Australian Government has announced a number of further changes to some measures, particularly JobKeeper (Box 3).

|

Box 3: Announced changes to the economic response measures |

|

Note: As at 25 November 2020 all of the announced changes had been legislated.

Source: ANAO, based on public records.

1.15 In his opening statement to the Parliament of Australia’s Senate Select Committee on COVID-19 on 7 May 2020, the Commissioner of Taxation articulated the ATO’s approach to administering the economic response measures as follows:

In response to COVID-19, the ATO has pivoted our focus to ensure the efficient rollout of the five key measures, in particular the JobKeeper payments, early release of superannuation, cash flow boost, increasing the instant asset write-off, and accelerated depreciation. Our priority has been to deliver on the government’s commitment to get millions of Australians access to financial support quickly and as easily as possible during this difficult time.6

The ATO’s risk management policy and Enterprise Risk Management Framework

1.16 The ATO’s risk management policy is set out in a Chief Executive Instruction on Risk Management.7

1.17 The ATO’s Enterprise Risk Management Framework (ERMF) is an overarching document that sets out how the ATO addresses requirements under the PGPA Act, the Commonwealth Risk Management Policy, and in accordance with AS ISO 31000:2018.8

1.18 As illustrated in Figure 1.2, the ATO’s ERMF is built on four pillars — governance, informing decisions, culture, and data-driven insights. The ERMF includes a four-step methodology to support the identification and management of risks.

Figure 1.2: The ATO’s Enterprise Risk Management Framework and risk methodology

Source: Reproduced from the ATO’s Enterprise Risk Management Framework (Version 1.3, 24 April 2020).

1.19 The ATO’s ERMF is supported by a number of guidance documents and tools, including a Risk Management Guide9, a Shared Risk Guide, a Risk Tolerance Guide, and various templates such as the Risk Assessment and Treatment Plan template.

1.20 The ATO’s ERMF distinguishes between three levels of risk — strategic, enterprise, and business — and sets out the responsibilities for managing risks across the ATO. This includes defining roles for the Commissioner of Taxation, various committees (such as the Enterprise Risk Management Committee, and the Audit and Risk Committee), a Chief Risk Officer supported by a Corporate Risk and Assurance Branch, as well as individual risk owners and risk managers.

Rationale for undertaking the audit

1.21 The COVID-19 pandemic and the pace and scale of the Australian Government’s response impacts on the risk environment faced by the Australian public sector. This audit is one of five performance audits conducted under phase one of the ANAO’s multi-year strategy that will focus on the effective, efficient, economical and ethical delivery of the Australian Government’s response to the COVID-19 pandemic.10

1.22 The ATO is playing a significant role in supporting the Australian Government’s economic response to the COVID-19 pandemic. An early stage audit examining the ATO’s risk management arrangements will inform ongoing administration of the measures, including strategies to support the integrity of the measures.

Audit approach

Audit objective, criteria and scope

1.23 The objective of the audit was to assess whether the ATO has effectively managed risks related to the rapid implementation of COVID-19 economic response measures.

1.24 The three high-level criteria were:

- Was appropriate planning undertaken for rapid implementation?

- Were changes in the ATO’s risk environment appropriately assessed, documented and communicated?

- Have identified risks been effectively managed, monitored and reviewed?

1.25 The scope of the audit focused on the six economic response measures, announced in March 2020, and the impact of those measures on the ATO’s existing operations.

Audit methodology

1.26 The audit methodology involved:

- document examination, including the ATO’s advice on implementation matters to government and other entities, governance committee agendas and minutes, project material, and information recorded in the ATO’s Enterprise Risk Register; and

- interviews with ATO staff, including the Chief Risk Officer, the project leads for the economic response measures, and members of governance and oversight committees.

1.27 The audit did not include an assessment of the design, effectiveness or outcomes of the six measures.

1.28 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $437,000.

1.29 The team members for this audit were Michael McGillion, Amanda Reynolds, Chay Kulatunge and Mark Rodrigues.

2. Planning for rapid implementation

Areas examined

This chapter examines whether the Australian Taxation Office (ATO) undertook appropriate planning to support the rapid implementation of the six economic response measures.

Conclusion

The ATO undertook appropriate planning to support the rapid implementation of the six economic response measures — predominantly using its existing systems and processes to support governance, resourcing, and consultation.

2.1 To form a view on the ATO’s planning to support the rapid implementation of the six economic response measures, this chapter examines whether the ATO:

- established suitable governance and oversight arrangements for the six measures;

- followed a sound process to identify and obtain required resources and capabilities for the six measures; and

- undertook consultation with government entities and external stakeholders, including on shared risks.

Were suitable governance and oversight arrangements implemented?

The ATO implemented fit-for-purpose governance and oversight arrangements for the six economic response measures, drawing on existing bodies and frameworks where it could, and introducing specific and additional structures where needed.

2.2 The Commonwealth Risk Management Policy includes a number of requirements in relation to the governance and oversight of entity risks, in particular that:

- the accountable authority of an entity must define the responsibility for managing risk, including by defining entity roles and responsibilities in managing individual risks; and

- each entity must ensure that the systematic management of risk is embedded in key business processes, including in the establishment of governance arrangements.

2.3 The Commonwealth Risk Management Policy defines ‘risk oversight’ as the ‘supervision of the risk management framework and risk management process’.

2.4 The policy requirements in relation to risk governance and oversight arrangements are reflected in the ATO’s Enterprise Risk Management Framework, and in the ATO’s Chief Executive Instruction on Risk Management.

Responsibilities for managing risk

2.5 As discussed in paragraph 1.20, the ATO’s Chief Executive Instruction on Risk Management refers to two key roles responsible for managing individual risks. The ‘risk owner’ is personally accountable for an identified risk, and is responsible for setting risk tolerance and overseeing risk management activities in relation to that risk. The ‘risk manager’ supports the risk owner by managing the risk under the risk owner’s direction, and escalating emerging risks to the risk owner for consideration.

2.6 As shown in Table 2.1, the corporate Risk Assessment and Treatment Plans (discussed further in paragraph 3.14) for four of the six measures identified the Senior Accountable Officer (see paragraph 2.11) as the risk owner, and the project manager as the risk manager. The remaining two measures identified the supervisor of the Senior Accountable Officer11 as the risk owner, and the Senior Accountable Officer as the risk manager.

Table 2.1: Identified risk owners and risk managers for the six economic response measures

|

Measure |

Measure risk owner(s) |

Measure risk manager(s) |

|

JobKeeper scheme |

|

|

|

Boosting Cash Flow for Employers |

|

|

|

Early Release of Superannuation |

|

|

|

Backing Business Investment |

|

|

|

Enhancing the Instant Asset Write-Off |

|

|

|

Temporary Reduction of Superannuation Minimum Drawdown Rates |

|

|

Note: ‘SES’ is a Senior Executive Service officer, ‘EL’ is an Executive Level officer.

Source: ANAO, based on the ATO’s records.

2.7 Supporting the risk owners and risk managers nominated at a whole-of-measure level, the ATO identified officers who would be responsible for managing one or more project-level risks recorded in the project risk register for three measures (JobKeeper, Early Release of Superannuation and Boosting Cash Flow for Employers).12 The officers were recorded in the risk registers as ‘risk owners’ for these subordinate risks.

2.8 As well as identifying risk owners for each measure, the ATO had previously identified the Deputy Commissioner, Integrated Compliance as the risk owner for enterprise risks associated with external fraud and serious and organised crime, and recorded this detail on the Enterprise Risk Register. On 9 April 2020 the Deputy Commissioner, Integrated Compliance assigned four SES Band 1 officers, each supported by an EL2 officer, to develop strategies to mitigate risks to the integrity of the tax and superannuation system specifically stemming from the economic response measures. Five of the six Risk Assessment and Treatment Plans listed SES officers from Integrated Compliance under ‘other risk owners, managers or contacts’.

Project management and governance

2.9 The ATO has an established methodology, process and set of governance arrangements associated with the implementation of new policy and law measures where the ATO is responsible for administering implementation, either whole or in part.

2.10 The ATO adjusted its existing project management framework for new policy measures, with the purpose of providing a ‘streamlined approach to governance’ for the six measures. This approach involved reducing the number of ‘gates’ through which each project had to pass compared to the ATO’s established project pathway, as well as reducing or changing the project ‘artefacts’13 that needed to be maintained.

2.11 The ATO assigned a ‘Senior Accountable Officer’ (SAO) for each of the six measures in accordance with its governance framework for new programs/projects.14 The SAO is accountable for ensuring the project is governed according to the ATO’s Program and Project Management Policy, including meeting project objectives and outcomes, escalating significant risks, and meeting assurance requirements unless an oversight committee is in place.15

2.12 An ATO COVID-19 Steering Committee, chaired by an acting Second Commissioner, was formed in March 2020. The Committee’s role was to provide high-level strategic leadership and oversight of the ATO’s activities in response to the pandemic ‘from the initial impact to returning operations to normality’. Deputy Commissioners from across the ATO are members of the Committee, providing advice and guidance on business continuity management, risks and business operations including the six measures.

2.13 Governance structures were established for all of the six measures as illustrated in Figure 2.1. For five of the measures, this involved using pre-existing committees:

- the Policy and Implementation Committee for Enhancing the Instant Asset Write-Off, and Backing Business Investment; and

- the Superannuation and Employer Obligations Project Change Committee for the Early Release of Superannuation, Temporary Reduction of Superannuation Minimum Drawdown Rates, and Boosting Cash Flow for Employers.

2.14 A new governance committee was established for the JobKeeper scheme called the JobKeeper Program Board, initially consisting of Second, Deputy, and Assistant Commissioners from across the ATO. The Charter stated that the JobKeeper Program Board was responsible for the operation of the scheme, to focus on the end-to-end design of the scheme, emerging risks and issues and significant changes that threatened the scheme’s implementation, and to monitor the scheme’s performance.

Figure 2.1: Governance structures for the six economic response measures

Source: ANAO, based on the ATO’s records.

2.15 The ATO categorised the Temporary Reduction of Superannuation Minimum Drawdown Rates measure as a ‘Business Line’ project. The ATO considered that as the measure involved a change in the drawdown rate from that in prior legislation and no major transition strategies were required, ongoing management could be undertaken as part of business-as-usual activities by the business area.

Oversight of the measures

2.16 Oversight of the six measures was provided through the COVID-19 Steering Committee and governance committees for each measure, such as the JobKeeper Program Board, and, at a higher level, through the ATO’s existing oversight mechanisms — principally, the ATO Executive Committee.

2.17 The Chair of the COVID-19 Steering Committee provided regular briefings to the ATO Executive Committee on the issues arising in conducting the ATO’s functions, covering both measure-specific and existing activities. From 17 March until 8 May 2020, these briefings occurred on a daily basis, but were reduced to a weekly meeting from 15 May 2020 as implementation progressed. Deputy Commissioners updated the Steering Committee members on the issues arising within their business lines as a result of COVID-19 and advised how these were being addressed. On 31 July 2020 the COVID-19 Steering Committee was advised by its Chair that the ATO’s COVID-19 response was mature and that any operational issues would be managed in the future by the Chief Operating Officer.

2.18 A number of papers were provided to the ATO Executive Committee on the six measures. This included a paper considered by the Committee on 2 June 2020 entitled ‘Risk approach to COVID-19 stimulus measures’. The paper explained that the ATO’s risk appetite and risk tolerances for the measures were being established through ‘lived experiences’ (with examples provided of this approach). The paper also provided risk profiles for the JobKeeper, Boosting Cash Flow for Employers and Early Release of Superannuation measures, as well as a summary of the risk and decision process for each measure. The ATO Executive Committee endorsed the risk strategy for the economic response measures, noting that additional work was required to clearly articulate the risks arising along with the mitigation and compliance strategies.

2.19 To address the request from the ATO Executive Committee, a further paper was provided to the Committee on 30 June 2020 with an update on the compliance programs for JobKeeper, Boosting Cash Flow for Employers, and Early Release of Superannuation. The paper noted that the top three joint risks for JobKeeper and Boosting Cash Flow for Employers were:

- enterprise risk (for example, whether the entity exists and shows signs of business activity);

- registration risk (for instance, the ATO would check for Australian Business Number manipulation); and

- turnover (as indicated by changes in GST data).

2.20 The paper also noted that, for the most part, the compliance programs are not anticipated to take longer than the life of the measures unless there has been fraudulent or criminal behaviour. The ATO Executive Committee agreed that an important factor of the compliance program is to balance the government requirements with community views on fairness. The Executive Committee further agreed that it is essential to have the correct settings to maintain community confidence and these may need to be recalibrated regularly.

Other committees

2.21 The ATO’s Enterprise Risk Management Committee (ERMC) did not have a significant role in overseeing the six measures. As discussed further in paragraph 3.15, none of the six measures (individually or collectively) were categorised as ‘enterprise risks’, which would have required direct oversight by the ERMC. Consistent with its role of overseeing enterprise risks, the ERMC considered matters associated with the ATO’s response to the COVID-19 pandemic.16

2.22 On 10 June 2020, the ATO’s Audit and Risk Committee was briefed on the ATO’s role in the Australian Government’s pandemic response. The role of the Audit and Risk Committee is to provide independent assurance to the Commissioner of Taxation on the appropriateness of the ATO’s financial reporting, performance reporting, system of risk oversight and management and system of internal control.

Review of governance arrangements for JobKeeper

2.23 In May 2020, the ATO engaged an external firm (PwC) to undertake a review and provide recommendations for a fit-for-purpose accountability and governance structure for the next phase of the JobKeeper scheme. In July 2020, ATO’s Chief Risk Officer presented a paper to the ATO Executive Committee recommending the establishment of an oversight committee for the JobKeeper program.17 The paper also recommended that the scope of the oversight committee include the six economic response measures, and that the Senior Accountable Officer for the JobKeeper measure remain at Deputy Commissioner level (rather than being elevated to Second Commissioner as was proposed in the review).

2.24 The ATO Stimulus Measures Oversight Committee held its first meeting on 25 August 2020.18 At this meeting, the Committee received the executive summary of a draft report from an external firm (PwC) that had been engaged to review the ATO’s governance, risk and assurance over the six economic response measures. The draft report identified a number of opportunities for improvement, including that the ATO provide greater definition of its risk appetite and tolerances, to provide more guidance for all people involved in how key decisions are made and the trade-offs. The draft report also noted that the boundaries of accepted tolerances should be based on reliable, relevant data, and regularly re-calibrated.

Record keeping

2.25 The ATO’s Risk Management Guide states that the purpose of recording and reporting in the risk management process is to:

- communicate risk management activities and outcomes across the organisation;

- provide information for decision-making;

- improve risk management activities; and

- assist interaction with stakeholders, including those with responsibility and accountability for risk management activities.

2.26 The ATO used its Internal Audit staff to support the measure-specific project teams by establishing ‘decision logs’ for each of the measures. The decision logs were intended to complement the record of risk management considerations in the implementation of the measures. Other records, such as the Risk Assessment and Treatment Plans, were retrospectively prepared by the ATO’s Corporate Risk and Assurance Branch in conjunction with the project teams, drawing on contemporaneous documents created for the measures.

2.27 The email and other records maintained in the decision logs evidence a range of activities undertaken across the ATO to implement the six measures, including responding to questions raised by the Department of the Treasury and addressing IT issues.

2.28 The ATO has also maintained documentation of the key meetings, deliberations and decisions of the governance committees and boards for each of the measures and the higher level oversight committees.

Was a sound process followed to identify and obtain required resources and capabilities?

The ATO followed a sound process to identify and obtain required resources and capabilities to support the rapid implementation of the six economic response measures, and to understand the impacts on its business-as-usual activities. The ATO identified constraints and developed responses to address staffing and ICT capability requirements to deliver the measures.

2.29 Key lessons from previous performance audits of entities involved in the rapid implementation of Australian Government initiatives have highlighted the importance of:

- drawing upon the full range of human resources available to support the design, implementation and administration of significant programs, adopting a strategic, entity-level approach where necessary; and

- quickly identifying and addressing necessary ICT system enhancements and development required to support rapid program delivery.19

2.30 In implementing the economic response measures, the ATO also needed to identify the impacts on its business-as-usual activities, including preparations for Tax Time 2020.

Securing the full range of necessary human resources

2.31 The ATO’s records indicate that over 10,000 staff were reassigned or placed on standby to support the implementation of the economic response measures (Box 4).

2.32 The ATO adapted its existing processes to train staff to support the economic response measures, as the measures were delivered through existing business line areas rather than discrete new areas. These processes primarily comprised the reallocation of existing resources within each group, the redeployment of staff internally between groups within the ATO, and the increased recruitment of casual and contracted staff through mechanisms used to boost staffing numbers to meet the demands of Tax Time.

|

Box 4: ATO staff reassignment at a glance |

|

By 22 June 2020:

|

Source: ANAO, based on the ATO’s records.

2.33 On 17 March 2020, the ATO tasked its groups20 to collate a list of both critical functions that would be a priority for staffing, and those functions that could cease work immediately and redeploy to support priority areas. This task identified four likely impacts on ATO staffing:

- business continuity needs during the pandemic, both within the ATO and whole-of-government;

- a strategic decision to temporarily scale down the ATO’s discretionary work programs in the face of disruption to business-as-usual interaction with taxpayers as well as to alleviate regulatory burden on the community (Box 5);

- increased demand-driven work associated with taxpayers contacting the ATO to seek relief or advice as a result of the economic effects of the pandemic; and

- the announcement (on 12 March 2020) of the first tranche of economic support measures to be led by the ATO (Boosting Cash Flow for Employers, Backing Business Investment and Enhancing the Instant Asset Write-Off, later supplemented with the remaining measures).

|

Box 5: Strategic reprioritisation of the ATO’s Client Engagement Group |

|

On 26 March 2020 the acting Second Commissioner of the ATO’s Client Engagement Group issued a set of guiding principles to the group to define work to be continued or suspended during the initial phase of the pandemic. These principles included:

|

Source: ANAO, based on the ATO’s records.

2.34 The critical functions lists were intended to inform discussions between groups to internally redeploy staff, where a group could not secure adequate staffing to support the economic response measures from within its existing resources. Responsibility for determining the number of staff and level of training required to support the new measures lay with the receiving group (that is, the group who would use the staff). Groups offering staff would then liaise with the receiving group to match available staff to vacant positions and identify any skill gaps requiring training based on the existing experience of the identified staff members.

2.35 The COVID-19 Steering Committee maintained oversight of these discussions, but did not adopt a decision-making role in relation to individual redeployments. On 26 March 2020, an SES officer within the ATO’s Enterprise Strategy and Corporate Operations Group was appointed to coordinate efforts to identify re-deployable staff. This officer was responsible for:

- briefing the Assistant Minister to the Prime Minister and Cabinet on the ATO’s internal redeployments;

- identifying excess non-critical staff that might be redeployed across the broader Australian Public Service; and

- ensuring internal redeployments supported the ATO’s strategic priorities (that is, new measures and critical business-as-usual functions).

2.36 On 30 March 2020, the ATO Executive Committee was briefed on a consolidated version of the critical functions list (Table 2.2), which had been further refined to categorise staff by availability to move.

Table 2.2: ATO assessment of staff availability for redeployment as at 30 March 2020

|

Category |

Number of staff identified at 30 March 2020 |

|

Critical role |

14,226 |

|

Back-up for critical role / new economic measures |

3547 |

|

Good candidate for internal reassignment to support critical roles |

1919 |

|

Left/leaving the ATO or on long term leave |

473 |

|

Not critical but unavailable for redeployment due to high risk personal circumstances (relating to COVID-19) |

485 |

|

Able to be freed for redeployment externally if required |

807 |

Source: ANAO, based on the ATO’s records.

2.37 Later on 30 March 2020 the ATO provided summarised figures and advice on its staffing needs to the Chief Operating Officer of the Australian Bureau of Statistics. The advice was to be included in a consolidated response from the Treasury portfolio to the Australian Public Service Commission in compliance with a direction from the Prime Minister under section 21(1) of the Public Service Act 1999. The advice concluded that apart from ‘small individual requests’ to redeploy staff to other Australian Public Service agencies, the ATO would generally be unable to support requests to redeploy staff due to its need for staff to support ATO critical functions (both immediately and in a contingency capacity), noting the ATO’s role in the COVID-19 economic response.

Engagement of casual staff

2.38 Besides internal redeployment of staff, the ATO adjusted its existing practice of engaging casual staff to meet the seasonal demand experienced by the ATO during Tax Time. The ATO prepared a revised forecast of casual staffing needs based on an analysis of contact centre traffic throughout March and April 2020. The ATO informed the ANAO that it brought forward the engagement of casual staff because staffing demand driven by the pandemic and economic response measures occurred earlier in the year than the demand expected for Tax Time 2020 (Box 6).

2.39 The ATO conducted a risk review of its pre-engagement and integrity clearance (PEIC) processes in April 2020. Based on this assessment the ATO approved a temporary relaxation of PEIC requirements that would permit casual staff to be conditionally engaged while certain integrity checks were being completed. The risk associated with this decision was categorised as a ‘business risk’21, and placed on the Enterprise Risk Register on 4 April 2020 with a review date of 8 November 2020. This risk was ‘closed’ by the ATO on 3 August 2020 following a return to business-as-usual practices for pre-engagement checks.

|

Box 6: Recruitment of casuals at a glance |

|

The ATO recruited over 1500 casual employees to support the economic response measures and Tax Time 2020 requirements.a The ATO informed the ANAO that:

In addition, approximately 800 casual staff (as at 30 June 2020) were placed into a casual pool for potential shift work allocation if required. The ATO also entered into an outsourcing arrangement engaging a workforce of over 2500 personnel from a private call centre provider to cover Tax Time 2020 demand. |

Note a: For comparison, the ATO informed the ANAO that it engaged 459 casual employees for Tax Time 2019 and was planning to hire 600 casual employees for Tax Time 2020.

Source: ANAO, based on the ATO’s records.

Changes to IT infrastructure and systems

2.40 The ATO identified three major ICT change requirements for the delivery of the economic response measures:

- the rapid, wide-scale adoption of working from home arrangements as a business continuity measure in March 2020;

- provisioning large numbers of new staff with ICT equipment and systems access and expanding telephony capacity as staffing surged to support ATO contact centre operations; and

- the rapid development and implementation of ICT systems enabling the delivery of the economic response measures.

2.41 The ATO informed the ANAO that, prior to March 2020, the ATO’s remote working solution permitted a maximum of 1400 staff to connect remotely to ATO systems. The ATO engaged with service providers to identify a scalable solution using existing platforms, and commenced a pilot on 16 March 2020. The pilot was expanded each day. By 27 March 2020 the COVID-19 Steering Committee was briefed that approximately 9000 staff were able to log in remotely and by 1 April 2020 this had increased to approximately 11,000 staff.

2.42 The COVID-19 Steering Committee was briefed that the ATO had procured 2000 additional laptops and monitors for staff who required them to work remotely, and that these were distributed to staff from 2 April 2020 onwards. The ATO informed the ANAO that routing contact centre traffic to remote working staff was within the capacity of a new telephony platform that the ATO had deployed in February 2020, and the reconfiguration of the system was tested before full deployment.

2.43 The ATO forecasted likely telephony demands for the contact centre based on Tax Time 2019 call volumes, known peak periods in the implementation schedule for the economic response measures, and information collected in early registration phases of relevant measures. The ATO informed the ANAO that it used configuration changes of existing telephony infrastructure and negotiated flexible license arrangements with vendors to address the forecasted contact centre demand.

2.44 Systems development for JobKeeper, Early Release of Superannuation and Boosting Cash Flow for Employers followed standard but expedited development processes.22 ICT system design was integrated into the core design teams for these measures, ensuring it supported policy, legal and business requirements. The ATO informed the ANAO that senior decision makers for each measure provided direction for ICT design on a daily basis, to a greater extent than would ordinarily occur, and that developers were reassigned from lower priority projects and worked extended hours or in around-the-clock shift arrangements for surge periods before key roll-out dates. The risk of staff burnout under these conditions was monitored and reported to the COVID-19 Steering Committee.

Sufficiency of mobilised resources

2.45 The ATO mobilised staff to manage the increased contact centre traffic associated with the new measures. Key announcements on 12 and 22 March 2020 and commencement dates on 20 April (for JobKeeper, and Early Release of Superannuation) and 4 May 2020 (for JobKeeper) precipitated record-setting contact centre demand, as shown in Figure 2.2. Full ICT capacity and/or staffing capacity was reached at peak periods on several days, resulting in calls being blocked.23 These issues were transient and actively managed by the ATO.

Figure 2.2: Inbound call statistics for the ATO contact centre 13 March to 21 May 2020 (business days only)

Source: ANAO, based on the ATO’s data.

2.46 In addition to the call blocking depicted in Figure 2.2, in the period 21–28 April 2020, the ATO blocked 71,563 calls at a network level24 to manage the load on its telephony networks.

2.47 The ATO also experienced service degradation between 20–22 April 2020 that prevented at least 109,457 calls from connecting to the ATO.25 On 21 April 2020 the ATO commenced an investigation into the service degradation and identified that 16 per cent of its contact centre trunk capacity was unavailable as it had been used to enable a working from home pilot. The COVID-19 Steering Committee was briefed that the full contact centre trunk capacity was restored on 22 April 2020.

2.48 The ATO informed the ANAO that it experienced some issues on-boarding new staff such as temporarily running out of available telephone number ranges and delays to system access. Between April to July 2020 the COVID-19 Steering Committee expressed its overall satisfaction at the level of ICT support being provided to support the recruitment of staff and the significant contact centre demand.

2.49 The ATO identified ICT system enhancements and developments and mobilised resources to support the implementation of the measures. Systems for JobKeeper, Early Release of Superannuation and Boosting Cash Flow for Employers were deployed in accordance with the scheduled timeframe. System capacity for ATO Online and related services was exceeded once between 1–2 July 2020. The ATO responded by limiting the number of external users accessing the service concurrently. The ATO had prepared for this contingency by implementing a ‘wait-listing’ solution prior to 18 April 2020 that permitted users up to maximum capacity to continue using the service while excess users were directed to try again later.

2.50 As the ATO’s experience demonstrated, clear assessment and decision-making about business priorities can support appropriate reallocation of existing staff. Where feasible and necessary, reallocating existing staff to meet staffing needs leverages existing access to equipment, information and premises, and may reduce some training requirements, particularly for staff with relevant previous experience.

Was consultation undertaken with government entities and relevant stakeholders, including on shared risks?

The ATO consulted with government entities and external stakeholders during the implementation of the six economic response measures — generally leveraging its existing relationships and arrangements. The ATO’s strategies for managing identified shared risks were not documented consistently.

2.51 The Commonwealth Risk Management Policy requires entities to implement arrangements to:

- communicate and consult about risk in a timely and effective manner to both internal and external stakeholders; and

- understand and contribute to the management of shared risks — which are described as risks extending beyond a single entity which require shared oversight and management.

2.52 These requirements are reflected in the ATO’s Enterprise Risk Management Framework. In addition, the ATO has prepared a Shared Risk Guide26 that provides additional guidance to staff on the identification and management of shared risks.

Engagement with government entities

2.53 In fulfilling its legislative purposes, the ATO has a key existing relationship with the Department of the Treasury (Treasury), with whom the ATO works closely to influence the development of policies and legislation for the tax and superannuation systems.27

2.54 The ATO’s records provide evidence of regular engagement and consultation between the Treasury and the ATO during the development of the six economic response measures, particularly in the design of the law and explanatory material. For each of the measures, ATO staff provided input (often of a tax technical nature) on the proposed legislative arrangements, typically under compressed timeframes (Box 7).

|

Box 7: Engagement between the ATO and Treasury on Enhancing the Instant Asset Write-Off measure |

|

The ATO informed the ANAO that ATO Second Commissioners and Band 2 and Band 1 Senior Executives were informed of the Enhancing the Instant Asset Write-Off measure by Treasury during the weekend of 7–8 March, prior to the announcement of the measure on 12 March 2020. At 2.05 pm on Tuesday 10 March 2020 Treasury forwarded to the ATO the anticipated timetable for introducing legislation to enable the economic response measures, including the Enhancing the Instant Asset Write-Off measure, to proceed. At 3.31 pm on Wednesday 11 March 2020, the first draft of the legislative amendments was sent to the ATO by Treasury, with comments to be returned to Treasury by close of business Thursday 12 March 2020. The ATO responded with a number of tax technical issues including the potential risk that assets purchased to take advantage of the increased thresholds would not be first ‘used or installed ready for use’ between the announcement and the original end date of 30 June 2020. At 3.46 pm on Friday 13 March 2020 Treasury provided the draft explanatory memorandum (EM) to the ATO for input and requested the ATO’s comments by Monday 16 March 2020 at 9.30 am. The revised EM and draft bill was returned to the ATO at 4.01 pm on 16 March 2020 with final comments to be provided to Treasury by 9.00 am on 17 March 2020. The ATO’s comments included revised wording to clarify the terms of the measure and to provide businesses with greater certainty as to what was allowed. |

Source: ANAO, based on the ATO’s records.

2.55 The ATO engaged with Services Australia to develop a data-matching protocol and arrangements for JobSeeker and JobKeeper. An ‘Abridged Arrangement’ to the Services Schedule for Data Exchange between the ATO and Services Australia was signed between the entities on 15 May 2020 (and expires on 30 October 2020). The principal aim of the data-matching arrangement is for the ATO to provide JobKeeper data to assist Services Australia in identifying eligibility issues for JobSeeker. The agreement provided for data provision to commence on 18 May 2020 with a weekly transfer of data to occur thereafter.

2.56 In addition, the ATO participated in various cross-agency arrangements including:

- an inter-departmental committee (IDC) on JobKeeper — and the Program Risk and Integrity Working Group (which reports to the IDC);

- representation on the Chief Operating Officers (COO) Committee, and the Assurance and Risk Working Group (which reported to the COO Committee); and

- the Serious Financial Crime Taskforce, a multi-agency taskforce targeting serious financial crime in Australia, led by the ATO.

2.57 The ATO’s representation on the JobKeeper Program Risk and Integrity Working Group provides an example of the management of shared risks between the entities involved (Box 8).

|

Box 8: The establishment and operation of the JobKeeper Program Risk and Integrity Working Group |

|

The JobKeeper Program Risk and Integrity Working Group was established by the JobKeeper Inter-Departmental Committee (IDC) at the IDC’s inaugural meeting on 23 April 2020.a The Working Group comprised representatives from Treasury (which chairs the group), the Attorney-General’s Department, the ATO, the Fair Work Commission, and the Fair Work Ombudsman. The key role of the Working Group is to identify, monitor and mitigate risks in relation to the JobKeeper program, as well as to monitor the effectiveness of the integrity measures that have been put in place for the program. The Working Group’s key tasks include:

In July 2020, the Working Group drafted a JobKeeper Program Strategic and Shared Risk Strategy — a draft document aimed at providing a fit-for-purpose guide and framework to support management of strategic and shared risks to the Program. On 21 July 2020, the Working Group drafted a Job Keeper Program Strategic and Shared Risk Report. The report sets out 12 identified risks to the JobKeeper program — 4 of which are assigned to the ATO as the risk owner. These risks are:

All 12 identified risks were assessed to have a risk rating of ‘medium’. The ATO developed individual risk response plans for the 4 risks for which it was the assigned risk owner. |

Note a: The IDC is chaired by Treasury, with SES representatives from the ATO, the Attorney-General’s Department, the Fair Work Commission, the Fair Work Ombudsman, Services Australia, the Department of Education, Skills and Employment, the Department of Social Services, and the Department of the Prime Minister and Cabinet.

Source: ANAO, based on the ATO’s records.

Identification of shared risks

2.58 The ATO’s corporate Risk Assessment and Treatment Plan template requires staff to indicate whether the risk being identified is shared externally.

2.59 Shared risks were identified in two of the corporate Risk Assessment and Treatment Plans developed for the six measures — Early Release of Superannuation, and Temporary Reduction of Superannuation Minimum Drawdown Rates. In both cases, the ATO identified the Australian Prudential Regulation Authority (APRA) as another government entity that was sharing the risk of these measures. For the Early Release of Superannuation measure, the ATO also identified APRA-regulated funds (including their administrators), Self-managed Super Funds, the Australian Securities and Investments Commission (ASIC), and Services Australia (in relation to myGov).

2.60 The ATO’s Shared Risk Guide outlines a number of specific actions that ATO staff should take to manage identified shared risks. These include developing and implementing procedures to manage shared risks, and recording, monitoring and reporting information on shared risks. The Guide also states that ‘For all shared risks, it is paramount that each entity acknowledges the interdependency, agrees on roles and responsibilities, and how to actively manage the risk.’

2.61 The documentation maintained by the ATO did not demonstrate that the actions outlined in the Shared Risk Guide were followed for the two measures where shared risks were specifically identified. In particular, for the Early Release of Superannuation measure, the ATO’s documentation did not clearly outline which risks were shared and how these risks would be monitored and reported on by the identified parties.

2.62 The ATO informed the ANAO that the shared risks for the Early Release of Superannuation measure were managed through a cross-agency working group in a more informal manner given the speed of implementation. A ‘Fraud & Compliance Controls’ map was developed by the ATO and was shared with the members of the cross-agency working group in April 2020.28

Engagement with external stakeholders

2.63 The ATO’s records provide evidence of consultation with external stakeholders for all six measures. The consultation was undertaken through the ATO’s existing consultation arrangements such as ‘Stewardship Groups’29 and other existing committees and forums including Digital Service Providers. The bodies consulted included the Tax Practitioner Stewardship Group, BAS Agent Association Group, Tax Practitioner Professional Association representatives, Not-for-profit Stewardship Group, Private Groups Stewardship Group, Small Business Stewardship Group, Superannuation Industry Stewardship Group, the Super and Employment Change Network meeting, and the Superannuation Administration Group.

2.64 Consultation undertaken by the ATO on the two superannuation measures is outlined in Box 9.

|

Box 9: Examples of the ATO’s consultation on Early Release of Superannuation and the Temporary Reduction of Superannuation Minimum Drawdown Rates |

|

Source: ANAO, based on the ATO’s records.

3. Identifying risks and impacts

Areas examined

This chapter examines whether, in implementing the six economic response measures, the Australian Taxation Office (ATO) appropriately assessed, documented, and communicated changes in its risk environment.

Conclusion

In implementing the six economic response measures, the ATO assessed, documented and communicated changes in its risk environment in an appropriate manner. The ATO’s risk documentation evidences its priority of implementing the measures in a timely manner, while also managing fraud and other integrity risks on a progressive basis.

3.1 The COVID-19 pandemic and the Australian Government’s response to it have impacted on the risk environment faced by the Australian public sector.

3.2 For the ATO, the changed risk environment includes the responsibility of rapidly implementing six measures as part of the Australian Government’s economic response to the pandemic, as well as managing other risks and impacts associated with its ongoing responsibility for administering the tax and superannuation systems.

3.3 This chapter examines whether the ATO has:

- identified new or changed risks associated with the six measures and to its existing operations;

- determined ‘risk tolerances’30 to guide its implementation of the six measures, and developed associated risk mitigation strategies; and

- informed decision-makers of identified risks, mitigation strategies and broader impacts on its operations.

Were new or changed risks identified, including to existing operations?

The ATO identified new and changing risks, including to existing operations. The ATO adopted an iterative approach to identifying risks at a project and program level that was fit-for-purpose.

3.4 The first three steps in the ATO’s four-step risk methodology concern risk identification and assessment:

- clearly articulate the objectives31 so that the scope, context and criteria for the risk management process can be established;

- plan the key strategies that will be used to achieve the objectives; and

- identify and assess areas of uncertainty (risks) that may impact the implementation of the strategies and achievement of the objectives.

3.5 The fourth step of the ATO’s risk methodology relates to the monitoring of risk management activities, and is discussed at paragraph 4.18.

Articulating the objectives

3.6 The ATO articulated the objectives for its administration of all six economic response measures in an iterative fashion.

3.7 In March 2020, the ATO Executive Committee noted the intent of the measures ‘to stimulate the Australian economy and achieve a flow of money in the community’. As further details became available with the passage of legislation and the maturing of the ATO’s key implementation strategies and governance arrangements, Senior Accountable Officers refined and formally articulated objectives specific to each measure.

3.8 Examples of objectives as articulated by the ATO are depicted in Table 3.1. These objectives contained a greater level of detail than the requirements outlined in the enabling legislation.

Table 3.1: Tailored objectives articulated for three economic response measures

|

JobKeeper (14 April 2020) |

Early Release of Superannuation (7 May 2020) |

Boosting Cash Flow for Employers (21 May 2020) |

|

The JobKeeper Program has been established to…ensure that the community has confidence in the administration of the JobKeeper scheme and:

|

The Early Release of Super Program has been established to…ensure that:

|

The Cash Flow Boost Program…will ensure that:

|

Source: ANAO, reproduced from the ATO’s records.

3.9 When briefing the ATO Executive Committee on 2 June 2020 regarding the risk approach to the six measures, the Chief Risk Officer articulated the primary objective of each measure in broad terms as ‘[ensuring] that implementation gives effect to the government’s policy intent and conforms with the law as enacted by the Parliament.’

Planning key implementation strategies

3.10 The design of the economic response measures was largely based on leveraging existing ATO systems and operations to provide the foundation of the ATO’s implementation strategies:

- repurposing the ATO’s existing ICT systems to implement new operations for JobKeeper;

- withholding tax and business activity statements for Boosting Cash Flow for Employers;

- existing superannuation system for Early Release of Superannuation and Temporary Reduction of Superannuation Minimum Drawdown Rates; and

- annual tax returns for Backing Business Investment and Enhancing the Instant Asset Write-Off.

3.11 In the Risk Assessment and Treatment Plans for each measure, the ATO identified several distinct lines of work (‘streams’) necessary to achieve the objective. The streams nominated by the ATO for each measure are depicted in Table 3.2. Each stream was led by a representative drawn from a relevant area of the ATO. The stream leads collaborated as an interdisciplinary core design team32 to develop the implementation strategy for each measure. For three measures (JobKeeper, Early Release of Superannuation and Boosting Cash Flow for Employers) stream leads were also responsible for executing the strategy as it applied to that stream. For the remaining measures, a single project team was responsible for executing the strategy decided by the core design team.

Table 3.2: Implementation streams for the six economic response measures

|

JobKeeper |

Early Release of Superannuation |

Boosting Cash Flow for Employers |

Backing Business Investment |

Enhancing the Instant Asset Write-Off |

Temporary Reduction of Superannuation Minimum Drawdown Rates |

|

|

|

|

|

|

Source: ANAO, reproduced from the ATO’s records.

3.12 Within each stream, some further strategy documents were prepared in coordination with other streams through the core design team. Three measures that required significant ICT systems development (JobKeeper, Boosting Cash Flow for Employers and Early Release of Superannuation) used standard templates to plan system design, development and deployment. Individual integrity strategy documents were prepared for each measure by Integrated Compliance. The ATO developed a communication strategy for each of the six measures. The strategies detailed how the ATO would raise awareness and provide information to relevant stakeholders on the measures, including on its website and through other channels such as social media, news articles, and webinars.

Identifying risks to objectives and implementation strategies

3.13 As discussed in paragraph 3.19, records retained by the ATO demonstrate that risks were considered during the initial implementation phase (March to April 2020). However, for four measures with earlier implementation milestones (Early Release of Superannuation, JobKeeper, Boosting Cash Flow for Employers, and Temporary Reduction of Superannuation Minimum Drawdown Rates), consolidated risk assessments in accordance with the requirements of the ATO’s Enterprise Risk Management Framework were not prepared until after critical implementation decisions had been made.

3.14 Risk Assessment and Treatment Plans for each of the six measures were prepared in May and June 2020. The plans assessed a single risk, namely that ‘the implementation and delivery of’ each measure ‘fails to meet Government intent’. The ATO described the intent of these post-decision assessments as an assurance exercise to retrospectively capture a consolidated view of the ATO’s risk management of each measure that would otherwise be evidenced by project artefacts. These assessments played a limited role in informing risk choices made by the ATO.

3.15 The six measure-level risks identified by the ATO in the consolidated risk assessments were categorised as ‘business risks’ rather than as ‘enterprise’ or ‘strategic’ risks, as per the three categories listed in the ATO’s Enterprise Risk Management Framework (Table 3.3).

Table 3.3: The ATO’s risk hierarchy and risk owners

|

Risk level |

Definition |

Owner |

|

Strategic risk |

A risk that may impact the achievement of our purpose and/or 2024 aspirations. They are informed by our external environment, determined by the ATO Executive and included in the ATO’s corporate plan. |

Accountability for strategic risks may be assigned to individual ATO Executive members. |

|

Enterprise risk |

A risk that has a material impact on the achievement of an ATO strategic objective. A risk may be material if it is:

Enterprise risks are linked to one or more strategic objectives in the corporate plan. |

Owned and managed at the Senior Executive Service level and overseen by the Enterprise Risk Management Committee. |

|

Business risk |

All other risks associated with the day-to-day operations of the ATO. This may be at the group, business line, team or project level. |

Owned and managed by a Senior Executive Service Band 1, Executive Level 2 or Executive Level 1 staff member. |

Source: ANAO, reproduced from the ATO’s Enterprise Risk Management Framework (dated 24 April 2020).

3.16 The ATO’s decision to categorise the six measures as ‘business’ risks was not consistent with the nature and implications of the risk levels as defined by the ATO. In particular, the JobKeeper scheme has been described by Treasury as one of the largest fiscal and labour market interventions in Australia’s economic history. On this basis, the JobKeeper scheme aligns with the ATO’s criteria of a significant government commitment that is likely to have broader impacts across government.

3.17 The categorisation of the six measures as business risks meant that those risks were not considered by the ATO’s Enterprise Risk Management Committee alongside other enterprise risks to the ATO. In practice, the categorisation did not materially detract from the ATO’s attention towards the measures. The ATO managed these risks through the governance and oversight arrangements for each measure (see paragraphs 2.2 to 2.24), which included reporting to the ATO Executive Committee on JobKeeper, Boosting Cash Flow for Employers and Early Release of Superannuation.

3.18 In July 2020, the ATO informed the ANAO that its classification of enterprise risks was under review.

Risk identification at the project level

3.19 In the absence of a contemporaneous formal risk assessment for each measure, the ATO adopted an iterative approach to identifying risks that ran parallel to its implementation planning. Risk registers were maintained for five of the six measures in accordance with the ATO’s existing project management methodology:

- For three measures (JobKeeper, Boosting Cash Flow for Employers and Early Release of Superannuation), risks were identified, recorded on the risk register and assigned to risk owners from the earliest stages of the projects.

- Two of these registers (JobKeeper and Early Release of Superannuation) assigned risk ratings to individual risks.

- For Backing Business Investment, a risk register was created on 27 May 2020 after most implementation decisions had been made but before 1 July 2020 when the first claims could be made under the measure. Key risks were also identified in monthly project status reports in April and May 2020.

- As Enhancing the Instant Asset Write-Off was a change to an existing measure, the existing project risk register was continued and updated.