Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

2021–22 Major Projects Report

Please direct enquiries through our contact page.

Audit snapshot

What is the purpose of the MPR?

The MPR is an annual review of the Department of Defence’s (Defence’s) major defence equipment acquisitions, undertaken at the request of the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA).

Its purpose is to provide information and assurance to the Parliament on the performance of selected acquisitions as at 30 June 2022.

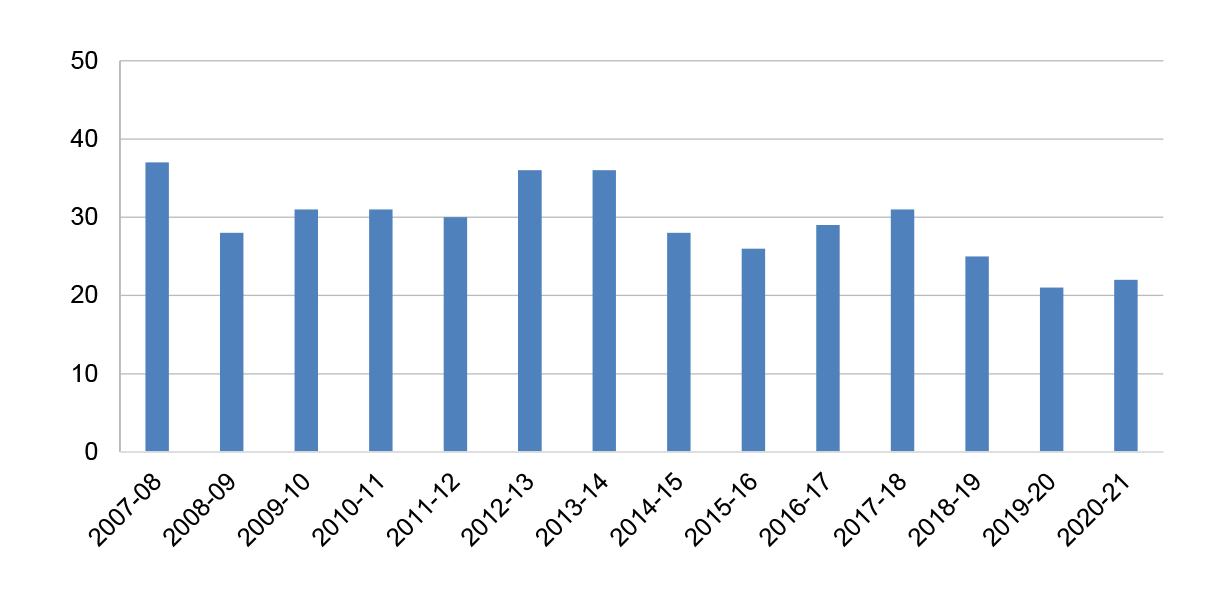

This year, it includes 21 major projects. This is the fifteenth MPR since its commencement in 2007–08.

What did we find?

The Auditor–General concluded that:

Based on the procedures I have performed and the evidence I have obtained, nothing has come to my attention that causes me to believe that the information in the 21 Project Data Summary Sheets in Part 3 (PDSSs) and the Statement by the Secretary of Defence, excluding the forecast information, has not been prepared in all material respects in accordance with the 2021–22 Major Projects Report Guidelines, as endorsed by the JCPAA.

I have made an Emphasis of Matter drawing attention to disclosures within the Statement by the Secretary of Defence that some information in the PDSSs is not for publication after a Defence security classification review conducted in November 2022. My conclusion is not modified in respect of this matter.

What is reviewed?

Defence prepares Project Data Summary Sheets (PDSS) on selected major defence equipment acquisition projects in accordance with guidelines endorsed by the JCPAA. The PDSSs cover:

- Background and government approvals

- Financial performance

- Schedule performance

- Delivery against agreed scope

- Risks and issues

- Lessons learned by the project

- Management accountability for the project

The ANAO reviews the information in Defence’s PDSSs in accordance with the ANAO Auditing Standards specified by the Auditor-General under the Auditor-General Act 1997. This year Defence decided that key schedule information was not for publication in four PDSSs, on security grounds. The ANAO has reviewed the information not published by Defence.

$59.0bn

was the value of the 21 Defence Major Projects as at 30 June 2022.

4 of 21

Defence PDSSs indicated that key schedule information is not for publication.

87%

was the expected delivery against agreed scope across the Major Projects at 30 June 2022 — with 10 projects reporting that some elements of capability/scope delivery are under threat or unlikely to be met.

Due to the complexity of material and the multiple sources of information for the 2021–22 Major Projects Report, we are unable to represent the entire document in HTML. You can download the full report in PDF or view selected sections in HTML below. PDF files for individual Project Data Summary Sheets (PDSS) are also available for download.

!Part 1. ANAO Review and Analysis

Summary

Background

1. The Department of Defence’s (Defence) Capability Acquisition and Sustainment Group (CASG) manages the process of bringing most new specialist military equipment into service for the Australian Defence Force (ADF). On 4 October 2022, a new Naval Shipbuilding and Sustainment Group (NSSG) came into effect, with responsibility for building and sustaining maritime capabilities.1 As at 30 June 2022, CASG was managing 168 active major and minor capital equipment projects worth $130.5 billion with an in-year budget of $11.2 billion.2 Defence capitalised some $8.2 billion from these projects in 2021–22.3

2. The Major Projects Report (MPR) contains Defence information and commentary on a selection of its major projects (the Major Projects) and assurance and analysis of that information by the Australian National Audit Office (ANAO). This report is the fifteenth annual MPR.

3. Major Projects are selected for inclusion in the MPR based on criteria endorsed by the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA).4 The projects represent a selection of the most significant major projects managed by CASG and the new NSSG.

4. The total approved budget for the 21 Major Projects in this report is approximately $59.0 billion, which is 45 per cent of the $130.5 billion budget for active major and minor capital equipment projects.

Selected projects

5. The 21 Major Projects selected for review comprise seven AIR projects, eight SEA projects, five LAND projects and one joint (JNT) project. These projects and their government approved budgets as at 30 June 2022 are listed in Table 1, on p. 4.

Table 1: 2021–22 MPR — selected projects and approved budgets at 30 June 2022

|

Project Number (Defence Capability Plan) |

Project Name (on Defence advice) |

Abbreviation (on Defence advice) |

Approved Budget $m |

|||

|

AIR 6000 Phase 2A/2B |

New Air Combat Capability |

Joint Strike Fighter2 |

15,795.7 |

|||

|

SEA 5000 Phase 1 |

Hunter Class Frigate Design and Construction |

Hunter Class Frigate2 |

6055.7 |

|||

|

LAND 400 Phase 2 |

Combat Reconnaissance Vehicles |

Combat Reconnaissance Vehicles2 |

5606.3 |

|||

|

SEA 1000 Phase 1B |

Future Submarines Design Acquisition |

Future Subs2 |

4816.2 |

|||

|

AIR 9000 Phase 2/4/6 |

Multi-Role Helicopter |

MRH90 Helicopters2 |

3770.7 |

|||

|

SEA 1180 Phase 1 |

Offshore Patrol Vessel |

Offshore Patrol Vessel2 |

3648.6 |

|||

|

LAND 121 Phase 3B |

Medium Heavy Capability, Field Vehicles, Modules and Trailers |

Overlander Medium/Heavy2 |

3399.6 |

|||

|

AIR 555 Phase 1 |

Airborne Intelligence, Surveillance, Reconnaissance and Electronic Warfare (ISREW) Capability |

Peregrine1 |

2233.6 |

|||

|

AIR 7000 Phase 1B |

MQ-4C Triton Remotely Piloted Aircraft System |

MQ-4C Triton |

1999.5 |

|||

|

LAND 121 Phase 4 |

Protected Mobility Vehicle – Light (PMV-L) |

Hawkei2 |

1962.9 |

|||

|

AIR 8000 Phase 2 |

Battlefield Airlift – Caribou Replacement |

Light Tactical Fixed Wing2 |

1421.6 |

|||

|

LAND 19 Phase 7B |

Short Range Ground Based Air Defence |

SRGB Air Defence |

1216.3 |

|||

|

AIR 2025 Phase 6 |

Jindalee Operational Radar Network |

JORN Mid-Life Upgrade2 |

1146.2 |

|||

|

SEA 1654 Phase 3 |

Maritime Operational Support Capability |

Repl Replenishment Ships |

1077.9 |

|||

|

AIR 5431 Phase 3 |

Civil Military Air Management System |

CMATS2 |

1010.8 |

|||

|

LAND 200 Tranche 2 |

Battlefield Command System |

Battlefield Command System2 |

966.2 |

|||

|

JNT 2072 Phase 2B |

Battlespace Communications System Phase 2B |

Battle Comm. Sys. (Land) 2B |

942.9 |

|||

|

SEA 1439 Phase 5B2 |

Collins Class Communications and Electronic Warfare Improvement Program |

Collins Comms and EW2 |

610.1 |

|||

|

SEA 3036 Phase 1 |

Pacific Patrol Boat Replacement |

Pacific Patrol Boat Repl |

502.3 |

|||

|

SEA 1442 Phase 4 |

Maritime Communications Modernisation |

Maritime Comms2 |

434.8 |

|||

|

SEA 1448 Phase 4B |

ANZAC Air Search Radar Replacement |

ANZAC Air Search Radar Repl 2 |

429.2 |

|||

|

21 |

|

|

59,047.1 |

|||

Note 1: AIR 555 Phase 1 Airborne Intelligence, Surveillance, Reconnaissance and Electronic Warfare (ISREW) Capability is included in the MPR Program for the first time in 2021–22.

Note 2: These projects have been the subject of individual performance audits. See Appendix 2, on p. 76, for more information.

Source: Defence’s Project Data Summary Sheets (PDSSs) in Part 3 of this report.

Rationale for undertaking the review

6. The MPR is prepared at the request of the Parliament. The JCPAA has stated that the objective of the MPR is ‘to improve the accountability and transparency of Defence acquisitions for the benefit of Parliament and other stakeholders.’5 The JCPAA commissions the MPR in the public interest, for the benefit of users of the report inside and outside the Parliament. The MPR informs parliamentary scrutiny and the national conversation on major Defence acquisitions, and is intended to assist users by adopting a consistent reporting format over time and through the inclusion of summary and longitudinal analysis prepared by the ANAO.

7. Defence’s major defence equipment acquisition projects remain the subject of parliamentary and public interest due to their: high cost and contribution to national security in a changing strategic environment; the challenges involved in completing them within the specified budget and schedule, and to the required capability; and their contribution to industrial and employment policy objectives.

Conduct of the review

8. The MPR is prepared by Defence and the ANAO. Defence prepares information for ANAO review in accordance with the 2021–22 Major Projects Report Guidelines (Guidelines) endorsed annually by the JCPAA (included in Part 4 of this report).6 The status of the Major Projects selected for review is reported in the Statement by the Secretary of Defence (included in Part 3 of this report) and a Project Data Summary Sheet (PDSS) prepared by Defence for each of the Major Projects (included in Part 3 of this report).

9. The ANAO has reviewed each of the PDSSs prepared by Defence as a ‘priority assurance review’ under subsection 19A(5) of the Auditor-General Act 1997 (the Act), which allows the ANAO full access to the information gathering powers under the Act.

10. The ANAO’s review provides limited assurance7 and was undertaken in accordance with the applicable auditing standards. The ANAO’s review included an assessment of Defence’s systems and controls, including the governance and oversight in place, to ensure appropriate project management. The ANAO also sought representations and confirmation from Defence senior management and industry (through Defence) on the status of the selected Major Projects.

11. The objective of this ANAO assurance engagement and the ANAO review procedures is to allow the Auditor-General to provide independent assurance over the status of the Major Projects selected for review. The Auditor-General’s summary conclusion is set out in paragraph 22. The full conclusion is found in the Auditor-General’s Independent Assurance Report in Part 3 of this report.

12. Certain forecast information found in the PDSSs is excluded from the scope of the ANAO’s review, such as forecast dates, expected capability/scope delivery performance and future risks.8 Accordingly, the Auditor-General’s Independent Assurance Report does not provide any assurance in relation to this information. However, material inconsistencies identified in relation to this information are considered in forming the Auditor-General’s conclusion. These exclusions to the scope of the review are due to a lack of Defence systems from which to provide complete and/or accurate evidence9 in a sufficiently timely manner to facilitate the review. This has been an area of focus of the JCPAA over a number of years10, and it is intended that all components of the PDSSs will eventually be included within the scope of the ANAO’s review.

13. In addition to the formal assurance review, the ANAO has undertaken an analysis of key elements of the PDSSs, including longitudinal analysis.11

14. Defence provides additional insights and context in its commentary and analysis contained in Part 2 of the MPR. This commentary and analysis is not included in the scope of the ANAO’s assurance review. Information on significant events occurring post 30 June 2022 is outlined in the Statement by the Secretary of Defence contained in Part 3 of the MPR, and is included in the scope of the ANAO’s assurance review.

Treatment of classified information

15. The Guidelines approved by the JCPAA set out the information to be included by Defence in its Project Data Summary Sheets (PDSSs) for each MPR project, including key forecast dates. The Guidelines also provide (at paragraph 1.20 of Part 4) that:

Defence is responsible for ensuring information of a classified nature is made available to the ANAO for review, as it relates to the data contained within the PDSSs. Data of a classified nature must be prepared in such a way as to allow for unclassified publication. Defence will confirm to the ANAO the classification of information proposed to be published in the MPR. Defence will provide advice with regards to the aggregated security classification of information contained within the PDSS suite, and suitability for unclassified publication.

16. Defence has advised the ANAO of its decision that key schedule information for four projects (Offshore Patrol Vessel, Peregrine, SRGB Air Defence, and JORN Mid-Life Upgrade) is not for publication, and has not been published in the relevant PDSSs.

17. The Secretary of Defence advised the ANAO on 29 November 2022 that:

It is assessed that some details, both in independent projects and in the aggregate, would or could reasonably be expected to cause damage to the security, defence or international relations of the Commonwealth without sanitisation of the data.

18. As required by the Guidelines, the classified information was provided to the ANAO for review. The ANAO obtained assurance over the information provided.

19. The Auditor-General has included an Emphasis of Matter, in the Independent Assurance Report (see Part 3), relating to the PDSSs for these four projects. This is the first time that information of this type has been excluded from a PDSS. The exclusion of key forecast dates and variance information means that this information is not available to users of the MPR.

20. Due to the non-publication of this key information by Defence, the ANAO was not in a position to publish a complete analysis of schedule performance for the suite of MPR projects, as in the past. The ANAO analysis involves both in-year analysis (across the current MPR projects) and longitudinal analysis (across all projects included in the MPR over time). As a consequence, this year’s MPR does not provide the user with the same level of information, reducing the level of transparency and accountability over the MPR projects as a whole. Impacts on the ANAO’s analysis are discussed further in paragraph 35 and highlighted in the relevant text in Part 1.

Overall outcomes

Auditor-General’s summary conclusion

21. The Auditor-General has concluded in the Independent Assurance Report for 2021–22 that ‘nothing has come to my attention that causes me to believe that the information in the 21 Project Data Summary Sheets in Part 3 (PDSSs) and the Statement by the Secretary of Defence, excluding the forecast information, has not been prepared in all material respects in accordance with the 2021–22 Major Projects Report Guidelines (the Guidelines), as endorsed by the Joint Committee of Public Accounts and Audit.’

22. The Auditor-General has made an Emphasis of Matter drawing attention to disclosures within the Statement by the Secretary of Defence that some information in the PDSSs12 is not for publication after a Defence security classification review conducted in November 2022. The Auditor-General’s conclusion is not modified in respect of this matter.

Statement by the Secretary of Defence

23. The Statement by the Secretary of Defence was signed on 20 January 2023. The Secretary’s statement provides his opinion that the PDSSs for the 21 selected projects ‘comply in all material respects with the Guidelines and reflect the status of the projects as at 30 June 2022’. The Secretary has also included a statement on the non-publication of information by Defence in certain PDSSs:

A security classification review of the Capability Acquisition and Sustainment Group and sponsor information contained within the Project Data Summary Sheets for release in the 2021-22 Major Projects Report has been completed.

The purpose of the security review is to ensure that each individual Project Data Summary Sheet is presenting data at an ‘unclassified’ level and to confirm the aggregated information is not a risk to national security, and is suitable for public release by tabling in parliament.

It is assessed that some details, both in independent projects and in the aggregate, would or could reasonably be expected to cause damage to the security, defence or international relations of the Commonwealth without sanitisation of the data.

24. The Statement by the Secretary of Defence (Statement) also details significant events occurring post 30 June 2022, which materially impact the projects included in the report and should be read in conjunction with the individual PDSSs. The Statement includes information on: Hunter Class Frigates, Hawkei, Repl Replenishment Ships, and CMATS.13

Key observations

25. The ANAO’s review (found in Part 1 of this report) includes Defence’s project management and reporting arrangements contributing to the overall governance of the Major Projects. A summary of key observations is provided below.

Non-publication of information by Defence and more limited data and analysis in this year’s MPR

- As noted at paragraph 16 above, Defence has not published key schedule information in four PDSSs (Offshore Patrol Vessel, Peregrine, SRGB Air Defence, and JORN Mid-Life Upgrade).14

- The ANAO was not in a position to publish a complete analysis of schedule performance, as in the past.

- This year’s MPR does not provide the user with the same level of information, reducing the level of transparency and accountability over the MPR projects as a whole.

Status of JCPAA recommendations and requests

- Following JCPAA recommendations made in May 2014, May 2016 and October 2017, Defence has yet to implement a consistent measure of capability performance with a robust methodology applicable to materiel acquisition (see paragraph 2.50 to 2.60).15

- Following a JCPAA recommendation made in September 2018, Defence advised the Committee in May 2020 that ‘Predict!’ was CASG’s risk management system.16 Defence mandated the use of ‘Predict!’ to record all CASG project risks in August 2021. Following JCPAA Recommendation 3 made in March 2022, Defence updated the JCPAA on ‘Predict!’ and CASG projects that have yet to fully transition to it.17 This update is consistent with the findings of the ANAO (see paragraphs 1.90 to 1.95).

- Following a JCPAA request made to the ANAO in 2018 ‘on how Defence major project cost variations and the costs of retaining project staff over time might be reported annually in future Major Projects Reports’, Defence advised that it is still unable to provide project staffing costs as its systems cannot track the movement of staff costs across projects over time (see paragraphs 1.79 to 1.81).18

- Following a JCPAA recommendation made in March 2022, Defence is revisiting the criteria for Projects of Concern. Defence has advised the committee that this body of work is anticipated for completion by June 2023 (see paragraph 1.32 and 1.33).

- Following a JCPAA recommendation made in March 2022 that Defence define terms used in the Major Projects Report associated with a delta or deviation from a project milestone achievement19, Defence definitions were published in late 2022 as part of the normal cycle for updating capability guidance. This is consistent with the understanding of the ANAO (see paragraphs 1.106).

- Following a JCPAA recommendation made in March 2022, Defence responded to the committee on the outcome of the Smart Buyer review of the MPR20, 21 (see paragraph 1.57).

Status of Auditor-General report recommendations

- Auditor-General Report No. 34 2020–21 Implementation of ANAO and Parliamentary Committee Recommendations — Department of Defence was tabled in April 2021 and included an assessment of four recommendations relevant to the MPR.22 ANAO assessed one of these recommendations as implemented, one as largely implemented, and two as not implemented.

- In July 2020 Defence closed two recommendations from Auditor-General Report No. 31 2018–19 Defence’s Management of its Projects of Concern. The ANAO assessed these recommendations as not implemented (see paragraphs 1.26 to 1.30).23 This is being addressed by Defence and the recommendations are anticipated to be implemented by June 2023.

- Auditor-General Report No. 18 2020–21 Defence’s Procurement of Combat Reconnaissance Vehicles (LAND 400 Phase 2) included a recommendation for improvement in Defence’s Independent Assurance Review processes. Reporting on the recommendation was provided to the Defence Audit and Risk Committee in February 2022, noting that the recommendation had been closed with an agreed closure date of April 2021.

- Auditor-General Report No. 15 2021–22 Department of Defence’s Procurement of Six Evolved Cape Class Patrol Boats included a recommendation on probity management for unsolicited procurement proposals received from industry. Actions for implementation were tabled and closed at the February 2022 Defence Audit and Risk Committee, with a planned implementation date of March 2022.

Defence acquisition governance

26. When reviewing Defence’s Project Data Summary Sheets (PDSSs), the ANAO considered the following items.

- Defence’s use of the Independent Assurance Review (IAR) process to report on the status of acquisition projects. In 2021–22, Defence completed an IAR on 14 of the 21 projects in this report (see paragraphs 1.13 to 1.18).24

- Defence’s approach to entry and exit from the Projects of Interest and Projects of Concern lists (see paragraphs 1.19 to 1.34).

- Defence’s reporting to senior department leadership and government stakeholders on the delivery of capability to the ADF. The ANAO observed a gap in reporting activity (see paragraphs 1.35 to 1.47).

- The importance of capturing government decisions in internal Defence documentation and ensuring that Materiel Acquisition Agreements are appropriately aligned with these decisions (see paragraphs 1.48 to 1.54).

- Defence’s implementation of the Smart Buyer Framework to support strategic decision making in the acquisition of major projects. The framework was not used at the Second Pass government approval stage for projects in the current MPR (see paragraphs 1.55 to 1.58).

- Defence’s implementation of new business systems to report on the status of acquisition projects (see paragraphs 1.59 to 1.62).

- Defence’s use of project contingency funds (see paragraphs 1.71 to 1.75). Four MPR projects committed contingency funds in 2021–22. These were: MRH90 Helicopters (to manage supportability and performance risks), Offshore Patrol Vessel (to address risk relating to delivery of the third vessel), SRGB Air Defence (for treatment of COVID related impacts), and Battle Comm. Sys. (Land) 2B (to address COVID related delays).

- The status of Capability Acquisition and Sustainment Group’s (CASG) Risk Management Reform Program and the establishment of the CASG Risk Management Framework (see paragraphs 1.82 to 1.89).

- Projects that had not fully met the requirements of CASG’s Risk Management Manual Version 1 and Financial Policy (titled Management Of Defence Capability Project Contingency) for contingency allocation (see paragraph 1.73) and risk management (see paragraph 1.90 to 1.94).

- The status of CASG’s Lessons Learned policy. The policy was updated in February 2022 and Defence is yet to fully implement it, including the compliance monitoring arrangements (see paragraphs 1.97 to 1.98).

- The recent inclusion of definitions, in Defence’s internal policies, of terms relating to the declaration of significant capability milestones, including ‘caveat’ and ‘deficiency’.25 The ANAO has continued to observe the use of these and other terms by Defence to represent exceptions to the achievement of significant milestones (see paragraphs 1.101 to 1.108).

27. The ANAO did not review Defence’s governance and co-ordination arrangements for the new Naval Shipbuilding and Sustainment Group (NSSG), which took effect on 4 October 2022. Defence provides more information about the NSSG in its contribution (Part 2). Defence internal communications indicate that the NSSG:

will be the dedicated entity, in partnership with the Royal Australian Navy, to deliver the Naval Shipbuilding and Sustainment Enterprise, building and sustaining maritime capabilities.

Project performance analysis

28. In addition to its limited assurance review, the ANAO has undertaken an analysis of key elements of the Defence PDSSs, including in-year analysis across the 21 current Major Projects, and longitudinal analysis across all projects included in the MPR over time. As discussed in paragraph 20 above, Defence’s decision to not publish key schedule information in four PDSSs means that the ANAO was not in a position to publish a complete analysis of schedule performance, as in the past. Consequently, this year’s MPR does not provide the user with the same level of information, reducing the level of transparency and accountability over the MPR projects as a whole.

29. A summary of the ANAO’s analysis is found in Table 5, p. 17. The detailed analysis is found in Chapter 2.

Cost

30. Cost management is an ongoing process in Defence’s administration of the Major Projects. Defence has reported that all 21 projects could continue to operate within the total approved budget of $59.0 billion. The MRH90 Helicopters, Offshore Patrol Vessel, SRGB Air Defence and Battle Comm. Sys. (Land) 2B projects drew upon contingency funds to complete project activities.

31. The total approved budget for the 21 Major Projects has increased by $17.5 billion (30 per cent) since initial Second Pass Approval by government.

32. Budget variations greater than $500 million are detailed in Table 2, on p. 13.26

33. As the MPR focuses on the approved capital budget for Defence acquisition, the ongoing costs of project offices, training, replacement capability, etc., are not reported here.27

34. Cost information was not affected by Defence’s decision to not publish certain information in four PDSSs this year.

Table 2: Budget variations over $500 million — post initial Second Pass approval by variation type 1,2

|

Project |

Variation |

Explanation |

Year |

Amount $bn |

|||

|

|

Scope Increases |

|

|

14.2 |

|||

|

MRH90 Helicopters |

|

34 additional aircraft at Phase 4/6 Second Pass Approval |

2005–06 |

2.63

|

|||

|

Joint Strike Fighter |

|

58 additional aircraft at Stage 2 Second Pass Approval |

2013–14 |

10.5

|

|||

|

MQ-4C Triton |

|

Second Pass Approval – Tranche 2 (one additional aircraft), Tranche 3 (one additional aircraft) and Tranche 4 (sustainment funding for first 7 years) |

2019–20 2020–21 |

1.1 |

|||

|

|

Real Cost Increases |

|

|

0.7 |

|||

|

Overlander Medium/Heavy |

|

Project supplementation4 ($684.2m) and additional vehicles, trailers and equipment ($28.0m) at Revised Second Pass Approval |

2013–14 |

0.7 |

|||

|

|

Real Cost Decreases |

|

|

(1.0) |

|||

|

Future Subs |

|

Government decisions to transfer funding to other submarine and shipbuilding projects following cancellation of the Future Subs project |

2021–22 |

(1.0) |

|||

|

|

Other budget movements |

|

|

0.5 |

|||

|

Other |

Scope increase/budget transfers (net) |

Other scope changes and transfers |

Various |

0.5 |

|||

|

|

|||||||

|

2.1 |

|||||||

|

|

17.5 |

||||||

Note 1: For the variations related to all projects and their value, refer to Table 9 on pp. 48–49 of this report. For the breakdown of in-year variation, refer to Table 10 on pp. 50–51 of this report.

Note 2: For projects with multiple Second Pass Approvals, this table shows variations from the initial approval.

Note 3: Since 2017–18 a variation of $2.3b has been reported in this Table under ‘Scope Increases’ for MRH 90 Helicopters. An additional $0.3b was included in this table under ‘Other budget movements’. This year an amount of $2.6b has been reported under ‘Scope increases’ for MRH 90 Helicopters, and the ‘Other budget movements’ item has been reduced accordingly by $0.3b.

Note 4: Defence has advised that ‘project supplementation’ is a unique term used to describe the approvals history of this project as follows: ‘The original amount of $2549.2, was the Government decision to split Phase 3 into Phase 3A and 3B. In 2011, Government approved Second Pass approval of Phase 3A and the ‘Interim Pass’ Government approval for Phase 3B. The decision to grant Phase 3B ‘Interim Pass’ was to allow greater bargaining power for Defence while negotiating Phase 3A. Phase 3B was always going to return to Government for formal Second Pass approval, which occurred in July 2013, once contract negotiations were complete.’

Note 5: Before 1 July 2010, projects were periodically supplemented for price indexation, whereas the allocation for price indexation is now provided for on an out-turned basis at Second Pass Approval.

Source: ANAO analysis of Defence’s 2021–22 PDSSs.

Schedule

35. As discussed in paragraph 20 above, this year the ANAO was not in a position to publish a complete analysis of schedule performance, as in the past. This is due to seven projects either not disclosing their Final Operational Capability (FOC) forecast date, or not having a settled FOC date.28 Therefore the figures for total schedule slippage and in-year schedule slippage in 2021–22 are not reported in this year’s MPR analysis.

- Defence has decided to not publish FOC forecast dates in three PDSSs (Offshore Patrol Vessel, Peregrine, and JORN Mid-Life Upgrade).29 This represents 14 per cent of all PDSSs.30

- Four (19 per cent) of the 21 PDSSs did not have FOC forecast dates at 30 June 2022.31

- The combined effect of Defence’s non-publication of the three FOC forecast dates, and the four FOC dates not settled, is that seven (33 per cent) of the 21 PDSSs do not include FOC dates this year. Any aggregated analysis of the remaining 14 projects (which have included FOC dates in their PDSS) would be incomplete.

- The inclusion of incomplete schedule performance analysis would misinform users of the MPR, as the 14 projects that have included FOC dates in their PDSS are not representative of all the Major Projects.

36. Delivering Major Projects on schedule continues to present challenges for Defence. Schedule slippage can affect when the capability is made available for operational release and deployment by the ADF, as well as the cost of delivery.

37. Defence’s management of platform availability has contributed to slippage in some projects.32 For example, Maritime Comms and Collins Comms and EW have been impacted by changes to docking schedules of the ANZAC Class frigates and Collins Class submarines respectively.

38. Projects with developmental content have also experienced significant delays. These projects are MRH90 Helicopters, MQ-4C Triton, CMATS, and Battle Comm. Sys. (Land) 2B.

39. Table 3, p. 15, details the slippage for projects that have exited the MPR. The 34 projects which have exited the MPR have accumulated slippage of 1363 months as at their respective exit dates.33

Table 3: Schedule slippage for projects which have exited the MPR1

|

Project |

Total (months) |

Project |

Total (months) |

|

AWD Ships |

37 |

Additional Chinook |

6 |

|

P-8A Poseidon |

29 |

HF Modernisation |

136 |

|

Wedgetail |

77 |

Armidales |

43 |

|

Super Hornet |

0 |

HATS |

0 |

|

Growler |

1 |

Collins RCS |

107 |

|

MH-60R Seahawk |

0 |

Night Fighting Equip Repl |

0 |

|

LHD Ships |

37 |

Collins R&S |

108 |

|

Hornet Upgrade |

39 |

Battle Comm. Sys. (Land) 2A |

39 |

|

ARH Tiger Helicopter |

82 |

Hw Torpedo |

61 |

|

C-17 Heavy Airlift |

0 |

UHF SATCOM |

42 |

|

Air to Air Refuel |

64 |

SM-2 Missile |

26 |

|

FFG Upgrade |

132 |

ANZAC ASMD 2A |

80 |

|

Bushmaster Vehicles |

1 |

155mm Howitzer |

7 |

|

Overlander Light |

4 |

Stand Off Weapon |

37 |

|

Additional MRTT |

21 |

Battle Comm. Sys. |

24 |

|

Next Gen Satellite2 |

0 |

C-RAM |

2 |

|

ANZAC ASMD 2B |

75 |

LHD Landing Craft |

46 |

|

Total |

1363 |

||

Note 1: The Hornet Refurb and Battle Management System (BMS) projects are not included in this table as they did not have FOC milestones approved by government.

Note 2: Next Gen Satellite shows slippage in Figure 8a, on p. 63, which related to the final capability milestones at the time. By the time it reached FOC, a new final capability milestone had been introduced and slippage was reduced.

Source: Defence PDSSs in Major Projects Reports and ANAO analysis.

40. ANAO analysis has been included in relation to the Acquisition Categorisation (ACAT) level.34 Reporting against the ACAT level has identified that there has been an increase in projects at the ACAT I35 and ACAT II36 levels. ACAT I projects carry a higher level of technical risk.

Capability/scope

41. The third principal component of project performance examined in this report is progress towards the delivery of capability as approved by government. While the assessment of expected capability/scope delivery by Defence is outside the scope of the Auditor-General’s formal review conclusion, it is included in the ANAO analysis to provide an overall perspective of the three principal components of project performance. The Hunter Class Frigate and Future Subs PDSSs do not report quantified capability/scope information as these projects did not have approved materiel capability/scope to be delivered at 30 June 2022. These two projects report narratives describing their current project activities.

42. The Defence PDSSs report that 11 projects in this year’s report will deliver all key capability/scope requirements. Four projects — Future Subs, MRH90 Helicopters, Hawkei, and Battlefield Command System — report that they are unable to deliver all of the required capability/scope by FOC (this is indicated in red in the PDSS traffic light diagram). Table 12, on pp. 69–71, outlines the reasons for each project’s ‘red’ assessment.

43. Defence’s assessment indicates that some elements of capability/scope to be delivered by projects may be ‘under threat’, but the risk is assessed as ‘manageable’ (‘amber’). The eight projects experiencing challenges with expected capability/scope delivery (2020–21: four) are Joint Strike Fighter, Hunter Class Frigate, MRH90 Helicopters, Offshore Patrol Vessel, Overlander Medium/Heavy, Battlefield Command System, Battle Comm. Sys. (Land) 2B and Pacific Patrol Boat Repl.

44. For the first time in 2021–22, PDSSs also quantified increases to projects’ materiel capability/scope delivery (‘blue’). Two projects, Hunter Class Frigates and Pacific Patrol Boat Repl, reported an increase in project materiel capability/scope delivery. Hunter Class Frigates will construct additional prototyping blocks, and Pacific Patrol Boat Repl will acquire an additional boat to replace one damaged and decommissioned from service.

45. Table 4, below, summarises expected capability/scope delivery as at 30 June 2022, as reported by Defence and analysed by the ANAO.

Table 4: Capability/scope delivery

|

Expected Capability/Scope (Defence Reporting) |

2019–20 MPR (%) |

2020–21 MPR (%) |

2021–22 MPR (%) |

|

High confidence (Green) |

98 |

97 |

87 |

|

Under threat, considered manageable (Amber) |

2 |

2 |

10 |

|

Unlikely or removed from scope (Red) |

0 1 |

1 |

3 |

|

Added to scope (Blue) |

– 2 |

– 2 |

0 3 |

|

Total |

100 4 |

100 4 |

100 4 |

Note 1: Defence advised in this year that AWD Ships would not deliver one element of capability/scope at FOC (which equated to approximately one per cent). However, across all the Major Projects this percentage rounded to zero per cent.

Note 2: The Blue reporting metric representing additional capability/scope was not used in these years.

Note 3: Defence advised in this year that Pacific Patrol Boat Repl would deliver an additional element of capability/scope at FOC (which equated to approximately five per cent). However, across all the Major Projects this percentage rounded to zero per cent.

Note 4: The Hunter Class Frigate and Future Subs projects are excluded from this analysis, as their capability/scope delivery was not quantified in these years.

Source: Defence PDSSs in Major Projects Reports and ANAO analysis.

46. In addition to reporting on expected capability/scope delivery, Defence has continued the practice of including in the PDSSs declassified information on contractual remedies for projects, including stop payments and liquidated damages.

47. In 2021–22, Battlefield Command System negotiated contractual remedies involving stop payments and Hawkei negotiated contractual remedies involving additional goods and services in lieu of liquidated damages.

48. Capability/scope information was not affected by Defence’s decision to not publish certain information in four PDSSs this year.

Summary longitudinal analysis

Summary analysis — 2019–20 to 2021–22

49. Table 5, below, summarises published PDSS data on Defence’s progress toward delivering the capabilities for the Major Projects covered in this year’s report (2021–22), and compares current data with that reported in the two most recent editions of the MPR (2019–20 and 2020–21).

50. As noted in paragraphs 20 and 35, aggregate schedule data for 2021–22 is not reported by the ANAO in Table 5 this year. This is due to the combined effect of Defence’s decision to not publish Final Operational Capability (FOC) forecast dates in three PDSSs this year, and the fact that four projects do not have settled FOC dates. Information that is not reported as part of the ANAO’s analysis is clearly identified in Table 5.

Table 5: Summary longitudinal analysis 2019–20 to 2021–221

|

|

2019–20 MPR |

2020–21 MPR |

2021–22 MPR |

|

Number of Projects |

25 |

21 |

21 |

|

Total Approved Budget at 30 June |

$78.7 bn |

$58.0 bn |

$59.0 bn |

|

Total Approved Budget at final Second Pass Approval |

$68.9 bn |

$54.2 bn |

$56.8 bn |

|

Total Expenditure Against Total Approved Budget |

$38.9 bn (49.4%) |

$28.1 bn (48.4%) |

$34.6 bn (58.7%) |

|

Total In-year Expenditure Against In-year Budget |

$5.7 bn (92.5%) |

$6.1 bn (98.4%) |

$5.7 bn (96.2%) |

|

Total Budget Variation since initial Second Pass Approval2 |

$24.2 bn (30.7%) |

$18.3 bn (31.5%) |

$17.5 bn (29.7%) |

|

Total Budget Variation since final Second Pass Approval3 |

$9.8 bn (12.5%) |

$3.8 bn (6.7%) |

$2.2 bn (3.9%) |

|

In-year Approved Budget Variation |

$0.1 bn (0.1%) |

-$1.0 bn (-1.7%) |

-$0.7 bn (-1.2%) |

|

Total Schedule Slippage4 |

507 months (21%) |

405 months (22%) |

⬤5 |

|

Average Schedule Slippage across Projects |

22 months |

23 months |

⬤5 |

|

In-year Schedule Slippage |

68 months (3%) |

73 months (4%) |

⬤5 |

|

Total Reported Risks and Issues6, 7 |

142 |

119 |

114 |

|

Expected Capability/scope (Defence Reporting)8, 9

|

98% |

97% |

87% |

|

2% |

2% |

10% |

|

0% 10 |

1% |

3% |

|

– 11 |

– 11 |

0 12 |

Refer to paragraphs 24 to 44 in Part 1 of this report.

Note 1: The data for the 21 Major Projects in the 2021–22 MPR compares the data from projects in the 2020–21 MPR and 2019–20 MPR. The Major Projects included in each MPR are based on entry and exit criteria in the Guidelines endorsed by the JCPAA, which are in Part 4 of this report. The entry and exit of projects should be considered when comparing data across years.

Note 2: See Table 2 on p. 13 for a breakdown of the major components of this variance and Table 10 on pp. 50–51 for all real variations.

Note 3: Where a project has multiple Second Pass Approvals, the budget at Second Pass Approval reported in the header refers to the total budget in the final Second Pass Approval. The figures in this row use this methodology.

Note 4: Slippage refers to a delay in the current forecast date compared with the original government approved date of FOC. Slippage can occur due to late delivery, increases in scope or at times can be a deliberate management decision.

Note 5: As discussed in paragraph 35 above, the ANAO was unable to publish this analysis due to the non-publication by Defence of FOC information in three PDSSs and because four projects do not have approved FOC dates.

Note 6: The grey section of the table is excluded from the scope of the ANAO’s priority assurance review, due to a lack of systems from which to obtain complete and accurate evidence in a sufficiently timely manner to facilitate the review.

Note 7: The figures represent the combined number of open ‘high’ and ‘extreme’ risks and issues reported in the PDSSs across all projects. Risks and issues may be aggregated at a strategic level.

Note 8: These figures represent the average predicted capability/scope delivery across the Major Projects. This method reduces the effect of an individual project’s size on the aggregate figure.

Note 9: The Hunter Class Frigate and Future Subs projects are excluded from this analysis, as their capability/scope delivery was not quantified in these years.

Note 10: Defence advised in this year that AWD Ships would not deliver one element of capability/scope at FOC (which equated to approximately one per cent). However, across all the Major Projects this percentage rounded to zero per cent.

Note 11: The Blue reporting metric representing additional scope was not used in these years.

Note 12: Defence advised in this year that Pacific Patrol Boat Repl would deliver an additional element of capability/scope at FOC (which equated to approximately five per cent). However, across all the Major Projects this percentage rounded to zero per cent.

Source: Defence PDSSs in Major Projects Reports and ANAO Analysis.

COVID-19 impacts

51. In March 2022, the JCPAA recommended that Defence update the committee on the latest impacts of COVID-19 on the Major Projects.37

52. Fifteen Major Projects reported disruptions to project delivery in 2021–22 caused by the COVID-19 pandemic.38 All of these projects reported delays to their schedules, with five of these projects reporting additional impacts on project budgets.

Cost

53. One project (SRGB Air Defence) reported an application for contingency funds while four projects reported budget underspends. Each project reporting cost impacts indicated that the COVID-19 pandemic impacted one or more of the following factors: supply chain, workforce (including contractors) and travel.

Schedule

54. All 15 of the Major Projects that reported an impact on scheduling resulting from the COVID-19 pandemic cited additional impacts on supply chains, workforce (including contractors) and travel. This was disclosed as:

- six projects reported an impact on supply chains;

- eight projects reported an impact on workforce (including contractors); and

- nine projects reported an impact on travel.

Capability/scope

55. No projects reported an impact to capability/scope delivery caused by the COVID-19 pandemic.

1. The Major Projects Review

1.1 The Major Projects Report (MPR) contains Department of Defence (Defence) information and commentary on a selection of its major projects (the Major Projects) and independent assurance and analysis of that information by the Australian National Audit Office (ANAO). This chapter provides the ANAO’s overview of the scope and approach adopted for its limited assurance review of the 21 Project Data Summary Sheets (PDSSs) prepared by Defence for this year’s MPR. The chapter also includes information and commentary on developments in Defence’s acquisition governance processes, based on the ANAO’s review.

Review scope and approach

1.2 In 2012, the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA) identified the ANAO’s review of Defence PDSSs as a priority assurance review, under subsection 19A(5) of the Auditor-General Act 1997 (the Act). This provided the ANAO with full access to the information gathering powers under the Act. The ANAO’s review of the individual PDSSs, which are included in Part 3 of the MPR, was conducted in accordance with the auditing standards set by the Auditor-General under section 24 of the Act through the incorporation of the Australian Standard on Assurance Engagements (ASAE) 3000 Assurance Engagements Other than Audits or Reviews of Historical Financial Information, issued by the Australian Auditing and Assurance Standards Board.

1.3 The following forecast information provided by Defence is excluded from the scope of the ANAO’s review: capability/scope delivery; risks and issues; and forecast dates. These exclusions are due to the lack of Defence systems from which to provide complete and/or accurate evidence39, in a sufficiently timely manner to complete the review. Accordingly, the Independent Assurance Report by the Auditor-General does not provide any assurance in relation to this information. However, material inconsistencies identified in relation to this information are required to be considered in forming the Auditor-General’s conclusion.

1.4 The ANAO’s work is appropriate for the purpose of providing an Independent Assurance Report in accordance with the ANAO Auditing Standards. Review of individual PDSSs is based on a limited assurance approach and is not as extensive as individual performance audits and financial statement audits conducted by the ANAO, in terms of the nature and scope of issues covered, and the extent to which evidence is required by the ANAO. Consequently, the level of assurance provided by this review, in relation to the 21 major Defence equipment acquisition projects (Major Projects), is less than that provided by the ANAO’s program of performance and financial statement audits.

1.5 In addition to the assurance review, the ANAO considers developments in Defence’s acquisition governance processes (information and commentary on governance issues appears in this chapter) and undertakes analysis of key elements of Defence’s PDSSs (information and commentary on systemic issues, and in-year and longitudinal analysis for the Major Projects, appears in the next chapter).

1.6 The ANAO’s review was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $1.8 million.

Review methodology

1.7 The ANAO’s review of the information presented in the individual Defence PDSSs included:

- examination and assessment of the governance and oversight in place to ensure appropriate project management40;

- an assessment of the systems and controls that support project financial management, risk management and project status reporting within Defence;

- an examination of each PDSS and the documents and information relevant to them;

- a review of relevant processes and procedures used by Defence in the preparation of the PDSSs;

- meetings with personnel responsible for the preparation of the PDSSs and management of the projects;

- analysis of project information, for example, cost and schedule variances;

- taking account of industry contractor comments provided on draft PDSS information;

- assessing the assurance by Defence managers attesting to the accuracy and completeness of the PDSSs;

- examination of the representations by the Chief Finance Officer supporting the project financial assurance and contingency statements;

- examination of confirmations, provided by the Capability Managers, relating to each project’s progress toward Initial Materiel Release (IMR), Final Materiel Release (FMR), Initial Operational Capability (IOC) and Final Operational Capability (FOC); and

- examination of the Statement by the Secretary of Defence, including significant events occurring post 30 June, and management representations by the Secretary of Defence.

1.8 The ANAO’s review of Defence PDSSs also focused on project management and reporting arrangements contributing to the overall governance of the Major Projects. The ANAO considered:

- developments in acquisition governance (see paragraphs 1.12 to 1.62, below);

- the financial framework, particularly as it applies to the project financial assurance and contingency statements (see Section 2 of the PDSSs);

- schedule management and test and evaluation processes (see Section 3 of the PDSSs);

- materiel capability/scope delivery forecast assessments, including Defence statements of the likelihood of delivering key capabilities, particularly where caveats are placed on the Capability Manager’s declaration of significant milestones (see Section 4 of the PDSSs);

- changes due to Defence’s reform of the Defence Enterprise Risk Management Framework, and the completeness and accuracy of major risk and issue data (see Section 5 of the PDSSs); and

- the impact of acquisition issues on sustainment to ensure the PDSS is a complete and accurate representation of the acquisition project.

1.9 This review activity informed the ANAO’s understanding of the systems and processes supporting the PDSSs for the 2021–22 review period. It also highlighted issues in those systems and processes that warrant attention.

Quality and timeliness of PDSS preparation

1.10 A quality PDSS preparation process by Defence will reduce the risk of untimely and/or inaccurate reporting and will reduce the incidence of multiple reviews for the same project. The ANAO noted ongoing issues relating to processes supporting the preparation and delivery of draft PDSSs for ANAO review. The MPR Engagement Letter provided by the ANAO to Defence requires Defence to prepare quality assured evidence packs, which include a complete and accurate PDSS, in addition to copies of relevant supporting evidence, and sets the expectation that there will be no more than three versions of each project’s PDSS submitted to the ANAO for review.

1.11 Efficiency can be gained through Defence process standardisation, a project management approach and continued engagement and review by Defence leaders.

Acquisition governance

1.12 Consistent with previous years, the ANAO considered Defence’s Major Project acquisition governance processes when planning and conducting the review for the 2021–22 MPR. While some of these processes are now established, others continue to mature or require further development to achieve their intended impact.

Defence Independent Assurance Reviews

1.13 The Defence Independent Assurance Review (IAR) process provides the Defence Senior Executive with assurance that projects and products will deliver approved objectives and are prepared to progress to the next stage of activity. These management-initiated reviews consider a project’s status while sufficient time remains for corrective action to be implemented.41

1.14 IARs are intended to commence at project initiation and are conducted through to FOC; for higher-complexity projects, ideally on an annual basis. They are an important input to key acquisition and sustainment decision points or milestones.42

1.15 Fourteen of the 21 Major Projects had an IAR completed during 2021–2243, which formed key evidence for the ANAO’s review.

1.16 The ANAO has published three performance audit reports which recommended improvements in Defence IAR processes:

- Auditor-General Report No. 12 2020–21 Defence’s Procurement of Offshore Patrol Vessels — SEA 1180 Phase 1;

- Auditor-General Report No. 18 2020–21 Defence’s Procurement of Combat Reconnaissance Vehicles (LAND 400 Phase 2); and

- Auditor-General Report No. 15 2021–22 Department of Defence’s Procurement of Six Evolved Cape Class Patrol Boats.

1.17 The assessment of whether these recommendations have been implemented by Defence is outside the scope of this review. The Defence Audit and Risk Committee has accepted closure of the two recommendations from Auditor-General Report No. 12 of 2020–21 Defence’s Procurement of Offshore Patrol Vessels — SEA 1180 Phase 1 and the recommendation in Auditor-General Report No. 18 of 2020–21 Defence’s Procurement of Combat Reconnaissance Vehicles (LAND 400 Phase 2).

1.18 Auditor-General Report No. 15 2021–22 Department of Defence’s Procurement of Six Evolved Cape Class Patrol Boats identified that no independent assurance reviews of this project had been conducted to date. Therefore, Defence and its senior leaders had not had the benefit of the full suite of inputs which contribute to providing assurance that capability requirements are being successfully delivered by an acquisition project.44

Projects of Concern

1.19 The Projects of Concern process is intended to focus the attention of the highest levels of government, Defence and industry on remediating problem projects.45 As at 30 June 2022, two MPR projects, MRH90 Helicopters and CMATS, were continuing Projects of Concern.

MRH90 Helicopters project

1.20 The MRH90 Helicopters project was placed on the list in November 2011 due to contractor performance relating to significant technical issues preventing the achievement of milestones on schedule.46 The project has progressed the materiel capability/scope delivery relating to the Taipan Gun Mount, Aero-Medical Evacuation Equipment and the Common Mission Management System.47 FOC is scheduled for March 2023, nine months later than stated last year, with a total of 104 months slippage over the life of the project.

1.21 In December 2021, the government announced plans to investigate other aircraft types to immediately replace the MRH90 helicopter fleets. Following this decision, Navy has commenced project SEA 9100 Phase 1 Improved Embarked Logistics Support Helicopter Capability to replace its fleet of six MRH90 helicopters with thirteen MH-60R Seahawk helicopters. In May 2022, Navy ceased operation of its MRH90 fleet. In January 2023, government announced the acquisition of 40 UH-60M Black Hawk helicopters to replace the Army MRH90 fleet. This is expected to result in the withdrawal from service of the Army MRH90 fleet 13 years earlier than planned.48

CMATS project

1.22 The CMATS project was a Project of Concern between August 2017 and May 2018 due to protracted negotiations leading to a delay in entering the contract. Following contract signature, CMATS was managed as a Project of Interest.

1.23 In September 2021, the Minister for Defence made a written direction that CMATS return to the Projects of Concern list. Defence did not update internal reporting, such as the Acquisition and Sustainment Update and its Projects of Concern list, in response to the Minister’s direction. In September 2022 Defence advised the ANAO that ‘the decision to declare this project a Project of Concern required extensive consultation with Airservices49 and with the Department of Infrastructure, Transport, Regional Development and Communications, which needed to occur post the Ministers 25 August 2021 decision’. Defence guidance states that ‘entry to … the Projects of Concern list is decided by the Minister for Defence and the Minister for Defence Industry’.50 Defence was unable to provide the ANAO with evidence of any limitation on the Minister’s decision-making authority, or evidence of an updated policy or guidance.

1.24 CMATS has continued to experience schedule delays to its IOC and FOC dates and the contractor has been unable to provide authoritative forecast dates for system acceptance milestones.

1.25 CMATS was publicly announced as a Project of Concern by the Minister for Defence Industry on 27 October 2022.

Governance

1.26 Auditor-General Report No. 31 2018–19 Defence’s Management of its Projects of Concern assessed whether Defence’s Projects of Concern regime was effective in managing the recovery of underperforming projects. It concluded that while the regime is an appropriate mechanism for escalating troubled projects to the attention of senior managers and ministers, Defence was not able to demonstrate the effectiveness of its regime in managing the recovery of underperforming projects. Moreover, the audit observed that the transparency and rigour of the framework’s application had declined in recent years. The ANAO recommended that:

- Recommendation No. 1: Defence introduce, as part of its formal policy and procedures, a consistent approach to managing entry to, and exit from, its Projects of Interest and Projects of Concern lists. This should reflect Defence’s risk appetite and be made consistent with the new Capability Acquisition and Sustainment Group Risk Model and other, Defence-wide, frameworks for managing risk. To aid transparency, the policy and the list should be made public.

- Recommendation No. 2: Defence evaluates its Projects of Concern regime.51

1.27 In July 2020, Defence closed both these recommendations, advising that the Capability Acquisition and Sustainment Group (CASG) had developed a consistent approach to entry and exit from the Projects of Interest and Projects of Concern lists; that the Projects of Concern list was publicly available; and that CASG had evaluated the Projects of Concern regime and had effective assurance mechanisms in place, underpinned by IARs.52

1.28 Auditor-General Report No. 34 2020–21 Implementation of ANAO and Parliamentary Committee Recommendations — Department of Defence concluded that the two ANAO recommendations relating to the management of Projects of Concern had not been implemented. The ANAO reported that there was no evidence that Defence established a clear basis or criteria to ensure a consistent approach to entry to and exit from the Projects of Concern or Projects of Interest lists, and that no evidence of an evaluation was provided to the ANAO.53

1.29 At the JCPAA’s September 2021 hearings on the 2019–20 Major Projects Report, the Deputy Secretary CASG stated that:

We are working to improve the way in which we’re able to measure the underperforming projects. Invariably, it’s data driven quite easily on cost and schedule against the documented milestones and loaded milestones and then the capability a little more to that. As we develop up the program report or the project and sustainment report that we’re doing to supplement the sequencing in between portfolio budget statements, portfolio additional estimates statements and from this major projects report itself, we will continue to mature that by feeding in capability manager assessments and information. That’s important because, ultimately, they are the first principles responsible for the capability delivery and we are the delivery agency but the operational effect is through the capability manager.54

1.30 In July 2022, CASG advised the ANAO that Project of Concern/Interest reporting will be provided through a bi-annual information product that is not to be used for decision-making, or to vary approved project parameters or budget plans and is for information purposes only. Defence records indicate that ‘Reporting data is not to be considered as a request for a decision to vary approved project parameters or budget plans. Advice on these matters will be requested through submissions specific to the project and issue as necessary.’55

1.31 Recommendation 2 of JCPAA Report 48956 was that Defence revisit its effort to provide criteria for projects to enter and exit the Projects of Concern and Projects of Interest categories and create processes for their consistent application, enabling these to be reviewed as part of the next MPR, and that the ANAO give further consideration to these issues in the next MPR. In its September 2022 response to the recommendation, Defence advised the JCPAA that the body of work to address this recommendation was under development, with completion anticipated by June 2023. Defence also stated that a Project of Concern/Interest report is presented to the Defence Investment Committee to increase oversight of performance issues.

1.32 On 10 October 2022 Defence Ministers announced57 that the Government would ‘strengthen and revitalise Defence’s projects of concern process’, by doing the following.

- Establishing an independent projects and portfolio management office within Defence.

- Requiring monthly reports on Projects of Concern and Projects of Interest to the Minister for Defence and Minister for Defence Industry.

- Establishing formal processes and ‘early warning’ criteria for placing projects on the Projects of Concern and Projects of Interest lists.

- Fostering a culture in Defence of raising attention to emerging problems and encouraging and enabling early response.

- Providing troubled projects with extra resources and skills.

- Convening regular Ministerial summits to discuss remediation plans.58

1.33 The ANAO will monitor implementation of the changes announced in October 2022 and include relevant commentary in the next MPR.

Longitudinal analysis

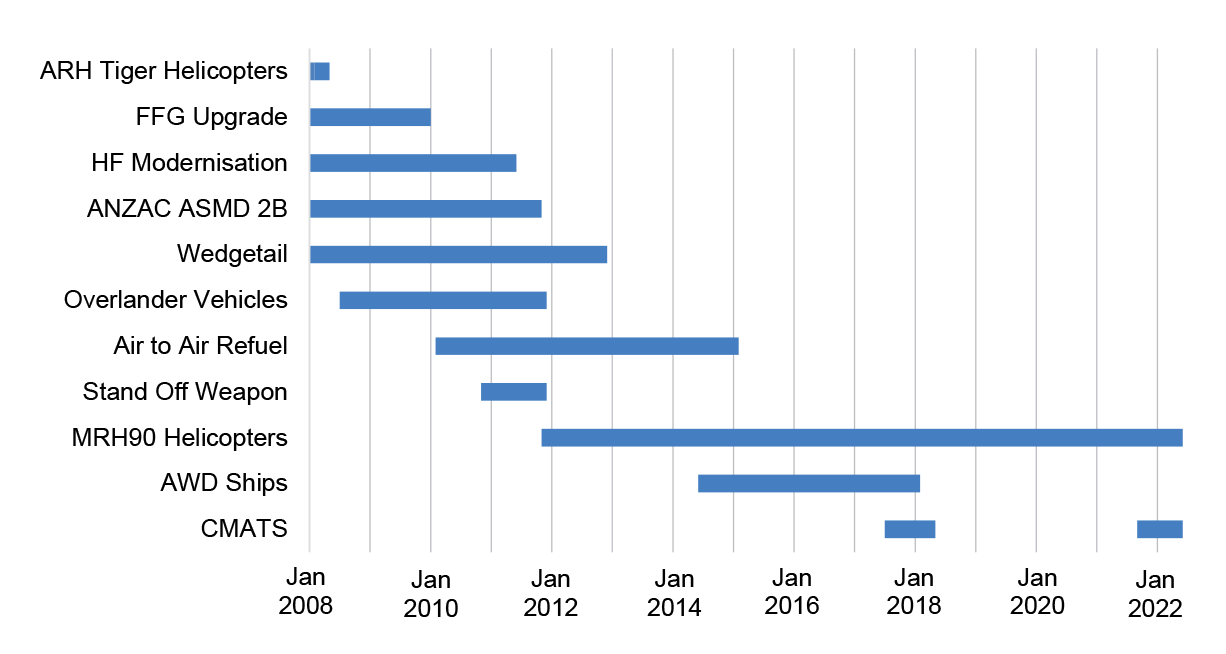

1.34 ANAO longitudinal analysis of all MPR projects on the Projects of Concern (POC) List indicates that 11 MPR projects have been included, with an average of four years on the POC list (Figure 1, p. 28).

Figure 1: MPR projects identified as Projects of Concern

Source: ANAO review of previous MPRs and Ministerial direction in September 2021 in relation to CMATS.

Acquisition and Sustainment Update (formerly Quarterly Performance Report and Project and Sustainment Report)

1.35 The aim of the Capability Acquisition and Sustainment Quarterly Performance Report (QPR) was to provide senior stakeholders within government and Defence with insight into the delivery of capability to the ADF.59 The report was provided to the Minister for Defence and the Minister for Defence Industry on a quarterly basis.60

1.36 In July 2019, the ANAO completed an audit on the effectiveness of the QPR in providing senior stakeholders with accurate and timely information on the status of projects and emerging risks and issues. It found the June 2018 QPR, reviewed by the ANAO, to be largely effective, contained mostly accurate information, and was valued by senior stakeholders.61 The ANAO recommended that Defence improve the QPR as a tool for senior leaders by reporting on:

- trend performance data for sustainment products; and

- emerging candidates for the Projects/Products of Concern list and Products/Projects of Interest list that have been recommended by an Independent Assurance Review (IAR) or which are under active consideration by senior management.62

1.37 During its review for the 2018–19 MPR, the ANAO observed that Defence’s June 2019 QPR reported on both improved and deteriorated performance for both acquisition and sustainment products since the previous QPR. This reflected a change in trend reporting consistent with the agreed ANAO recommendation. Additionally, the ANAO observed that Defence’s June 2019 QPR reported the emerging candidates for the Projects/Products of Concern list and Projects/Products of Interest list which had been recommended either by an IAR or which were under active consideration. This change was also consistent with the agreed ANAO recommendation.63 Defence closed this recommendation in March 2020.64

1.38 CASG ceased producing QPRs after June 2020, with the report superseded in February 2021 by the Project and Sustainment Report (PSR).

1.39 During Budget Estimates hearings held on 1 June 2021, the Deputy Secretary CASG stated that the PSR was anticipated to be issued on a six-monthly basis. A six-month gap in reporting activity introduces a risk of diminished information being available for decision making by senior leaders. Further, compared to the QPR, the PSR contained less information on acquisition projects and sustainment products that are not classified as a Project/Product of Concern or Project/Product of Interest.

1.40 Defence advised the ANAO in September 2021 that it has ‘management processes that ensure Capability Managers and Delivery groups are informing the Secretary of Defence and the Chief of Defence Force through weekly roundtable discussions and the Ministers are … informed on pertinent issues as they arise’. Defence also advised the ANAO that the next PSR was still in development and a draft would not be ready prior to the completion of the 2020–21 MPR.

1.41 In October 2021, Defence further advised the ANAO that the PSR was only an interim report, and that a new ‘Capability Report’ originally intended to replace the QPR was not sufficiently mature to be implemented.

1.42 The new report, the Acquisition and Sustainment Update (ASU) was trialled in September 2021 and accepted as the CASG replacement report for the PSR by the Deputy Secretary CASG in October 2021.

1.43 The ASU provides CASG leadership with significantly less detail of project/product performance, at a lower security classification. CASG has stated that it plans to migrate the ASU to a dynamic dashboard presentation. The ASU provides high level quarterly reporting on the following areas.

- Capability and Finance Overview.

- Delivery Group Updates.

- Planned Investment.

- Key Numbers.

- Portfolio Budget Statements.

- CASG – Top 30 Project/Product Performance Dashboard.

- CASG – Projects/Products of Concern/Interest.

- CASG – Independent Assurance Reviews.

- An explanation of CASG Performance Measures.

1.44 Defence advised the ANAO that: decision makers can seek additional information, including at a higher security classification through a project-specific brief; and that project-specific briefings are provided where issues need to be escalated or decisions are required.

1.45 Defence’s March 2022 ASU included developments of note for two MPR Projects of Interest65, CMATS and Battlefield Command System, and MRH90 Helicopters as a Project of Concern. The March 2022 ASU did not include developments of note for other Projects of Concern or Projects of Interest included in the MPR.66

- In respect to MRH90 Helicopters, the ASU reported that Defence continues to seek improved performance around supply chain and confidence in industry’s ability to support the capability and its planned withdrawal date.

- In respect to CMATS, the ASU reported that the schedule review had been completed and re-baselining activities were in progress; however, Defence remained concerned at the quality and timeliness of the re-baselining activities. The ASU also reported that a number of significant design artefacts had not been delivered until later than expected, putting at risk the contractor’s ability to complete the outstanding actions in time to prevent further project delay.67

- In respect to the Battlefield Command System, the ASU reported that the combination of vehicle integration, contractor software development delays, and test and evaluation difficulties continued to impact the schedule.

1.46 This reporting aligns with the results of the ANAO’s review of the relevant PDSSs.

1.47 As at October 2022, the most recent finalised ASU was the March 2022 version. This report was received by Defence leaders in August 2022. This indicates a risk that the information in the ASU will be outdated by the time it reaches decision-makers. The ANAO will continue to monitor implementation of the ASU.

Project Directives and Materiel Acquisition Agreements

1.48 Project Directives (previously known as Joint Project Directives) state the terms of government approval, reflecting the approved scope and timeframes for activities, responsibilities and resources allocated, and key risks and issues.68 Project Directives have historically been used to inform internal Defence documentation such as Materiel Acquisition Agreements (MAAs) between CASG and the Service Chiefs.69,70 Project Directives had previously been described as a key governance document under the Capability Life Cycle71, intended to ensure that all parties in Defence are informed of government decisions.

1.49 Defence updated the Capability Life Cycle Manual in June 2020, no longer referring to Project Directives as a key governance document. The Capability Life Cycle Manual was superseded by the Defence Capability Manual in December 2020. The Defence Capability Manual also does not refer to Project Directives. Defence has advised the ANAO that government decisions are recorded in CapabilityOne, which records government decisions in relation to a project. In some cases, the Joint Force Authority72,73 may provide a specific documented directive. The ANAO has previously highlighted the importance of ensuring that Project Directives properly reflect the relevant government decision, and that MAAs are appropriately aligned with the relevant Project Directive.74

1.50 Last year, the SRGB Air Defence project advised that it did not have direct access to government approval documentation. The new project entering the 2021–22 MPR, Peregrine, advised that it has access to relevant approval documentation via CapabilityOne.

1.51 There has been no change to the advice provided in November 2020, that ‘the internal Cabinet Liaison Services section provides advice to Defence in relation to information pertaining to government approvals. Where a Project has not been identified as having a need to know, the Project can request access to relevant Cabinet documents via a business case.’

1.52 The risk of misalignment or error is reduced if Defence has appropriate access to government records, such as that previously provided by Project Directives. If projects can access original Cabinet documentation, there is no residual impact.

1.53 The ANAO requires access to original approval documents to validate the requirements of projects. Validation based on internal Defence documentation is not always possible or may not meet evidentiary standards.

1.54 First advised by Defence in July 201675, Product Delivery Agreements (PDAs)76 were to be developed to replace the existing MAAs and Materiel Sustainment Agreements (MSAs). In October 2021, Defence advised the ANAO that in the absence of the PDA framework, Capability Managers and Delivery Groups continue to use the Materiel Acquisition Agreement and Materiel Sustainment Agreement Framework. The ANAO has not observed any progress on the PDA initiative during preparation of the 2021–22 MPR.

Smart Buyer Framework

1.55 The 2015 First Principles Review recommended the construction of a ‘smart buyer’ framework, with the aim of ‘[ensuring] Defence can make strategic decisions regarding the most appropriate procurement and contracting methodologies’. None of the projects currently in the Major Projects portfolio have been approved under the Smart Buyer processes.

Application to MPR projects

1.56 The one project entering the MPR in 2021–22, Peregrine, was not approved under the Smart Buyer process. The consequence is that ten projects in the MPR were approved after the Smart Buyer framework was introduced in 2016 but were not subject to its processes. Defence advised the ANAO that three MPR projects were involved in Smart Buyer activities during 2021–22, separate to the approvals process of these projects.77

1.57 A Defence internal audit in March 2022 found that ‘the design of the Smart Buyer Program’s activities [was] considered effective in assisting Defence achieve expected outcomes in alignment with the 2020 Force Structure Plan, however … the overall effectiveness of the Smart Buyer Program is currently measured in a basic manner’. The audit identified that ‘the outcomes are not adequately monitored or reported on to Defence’s senior management, including its key sponsor – the [Vice Chief of the Defence Force].’

Application to MPR process

1.58 In 2020 Defence conducted a management-initiated review of the MPR process, applying its Smart Buyer methodology. The Defence review did not request JCPAA or ANAO input. Following a JCPAA recommendation made in March 2022 for a joint briefing on the review78, the ANAO and Defence responded to the committee’s recommendation on 8 and 13 September 2022 respectively. Both Defence and the ANAO agreed to the recommendation. The ANAO also advised that as the Smart Buyer review was a Defence initiative, it would be appropriate for Defence to provide the review report and a briefing to the Committee. The ANAO would be available to attend the briefing.

Business systems

1.59 Defence continues to review its business systems with the aim of consolidating them to provide a more manageable ICT environment. Project reporting occurs via the Monthly Reporting Module (MRM). A second system, the Project Performance Review Information Platform (PPRIP), delivers a platform for projects to also conduct monthly reviews of their project and enable the raising of risks and actions with line management.

1.60 Errors in MRM were identified by the ANAO in the 2020–21 MPR and Defence advised the ANAO in November 2021 that:

In relation to the internal processes to assess accuracy and completeness, the process has been: data checking and reconciliation work with DFG [Defence Finance Group] to ensure BORIS [the Budget and Output Reporting Information System, Defence’s corporate budget development and reporting system] file uploads reflect the accrual accounting position (complete Oct 20); daily automated system checks to ensure that data flows are maintained and messages are provided to users when data is not up to date; prior to each MRM [Monthly Reporting Module] lockdown period reminders on data requirements are sent to reduce human error; after each lockdown period system statistics are used to drive lessons on sign off and identify areas of improvement; and to assure that in each reporting round if the data was accurate trend information over time is used to identify anomalies and drive improvements.

1.61 As the MRM is not entirely system generated, issues remain regarding its reliability as a source of evidence for the ANAO’s review of Defence PDSSs. The ANAO has continued to identify errors within MRM reports and they are not sufficiently reliable as supporting evidence for review purposes. Additional evidence was therefore sourced to support the ANAO’s review. The ANAO will continue to monitor the completeness and accuracy of data in MRM.

1.62 Defence advised the ANAO that these business systems will be replaced by the Enterprise Resource Planning program. Timing for the replacement of these business systems, MRM and PPRIP, has not been confirmed.

New Naval Shipbuilding and Sustainment Group

1.63 The Secretary of Defence and Chief of the Defence Force announced on 4 October 2022 that a new Naval Shipbuilding and Sustainment Group (NSSG) took effect from that date. The announcement included the following information.

- The Minister for Defence agreed to establish the new group in ‘recognition of the scale and complexity of Australia’s naval enterprise.’ It would ‘focus on naval acquisition and sustainment, as well as developing a competitive shipbuilding and sovereign sustainment industry.’

- The group would ‘be the dedicated entity, in partnership with the Royal Australian Navy, to deliver the Naval Shipbuilding and Sustainment Enterprise, building and sustaining maritime capabilities’ and would ‘drive, inform and influence decision-making related to the acquisition and sustainment of Navy’s current and future fleet.’ 79

- The Deputy Secretary, Naval Shipbuilding and Sustainment, would head the group. The group’s leadership would include the First Assistant Secretary (FAS) Submarines, the FAS National Shipbuilding and Sustainment Enterprise Headquarters, the FAS Major Surface Combatants and Combat Systems, the Head of Patrol Boats and Specialist Ships, and the Head of Maritime Sustainment Division.

1.64 As the changes were announced in October 2022, the ANAO did not review acquisition governance arrangements for the new group, or its co-ordination arrangements with the existing Capability Acquisition and Sustainment Group (CASG). The ANAO will monitor implementation and include relevant commentary in the next MPR.

Results of the ANAO’s review

1.65 The following sections outline the results of the ANAO’s review. The results inform the overall conclusion in the Independent Assurance Report by the Auditor-General for 2021–22.

Financial framework