Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

ANAO Annual Report 2017-18

Please direct enquiries relating to annual reports through our contact page.

This annual report documents the performance of the Australian National Audit Office (ANAO) in the financial year ending on 30 June 2018. The report addresses all applicable obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act); the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule); the Auditor-General Act 1997; the performance measures set out in the outcome and programs framework in the ANAO’s 2017–18 Portfolio Budget Statements (PBS) and the ANAO 2017–18 Corporate Plan and annual reporting requirements set out in other relevant legislation.

Part 1—Foreword by the Auditor-General

The year in review

As Auditor-General for Australia I am pleased to present this annual report to the Parliament. This year has seen the Australian National Audit Office (ANAO) continue to deliver high quality audit reports to ensure it delivers against its mandate under the Auditor-General Act 1997 (the Act).

On 21 February 2018, the Prime Minister and Cabinet Legislation Amendment (2017 Measures No. 1) Act 2018 amended the Act to reintroduce my ability to table ANAO annual reports directly to the Parliament. This aligns my annual reporting requirements with my responsibility to the Parliament and supports the independence of the Auditor-General.

The ANAO Corporate Plan 2017–18 sets out how the ANAO will deliver on its purpose and outlines 21 performance measures that are reported in Part 3: Report on Performance. In 2017–18, the ANAO issued 238 financial statements opinions and presented three financial audit related reports to the Parliament. The office also tabled 47 performance audits and provided briefings or submissions to parliamentary committees on 36 occasions.

The ANAO continues to focus on making full use of the audit mandate through developing methodology and building different report types including limited assurance reviews and information reports. In 2017–18 the ANAO published two assurance reviews under section 19A(1) of the Act and one information report in accordance with section 25 of the Act. The development of different audit techniques allows the ANAO to provide a greater range of assurance to the Parliament. The ANAO also continued to increase its coverage of efficiency issues with four performance audits focussing on efficiency tabled in 2017–18. The increased focus on efficiency reflects the Public Governance, Performance and Accountability Act 2013 (the PGPA Act) defining proper use or management of public resources to mean efficient, effective, economical and ethical.

As part of its focus on the implementation of the PGPA Act the ANAO also continued its work on performance statement audits, tabling the second audit in the series in March 2018 and commencing the third, which is due to table in November 2018. This work will ensue that the ANAO is well placed to respond to the recommendation by the JCPAA and draft recommendation by the PGPA Act Review relating to the expansion of this work. As I have informed the JCPAA and the Review, I believe that the mandatory annual auditing of Performance Statements is essential for the effective implementation of this important component of the accountability framework.

In 2017–18 the ANAO introduced reporting on ‘key learnings for all Australian Government entities’ in performance audit reports. This identifies key issues arising out of ANAO audits that all entities should consider. The ANAO has also increased its publication of audit insights. These publications identify and discuss common recurring issues, shortcomings and good practice examples, identified through our financial statement and performance audit work. Six audit insight publications were released covering a broad range of topics. As highlighted in the ANAO Annual Work Program, key issues emerging from reports tabled in 2017–18 included:

- Getting the basics right on important governance issues such as compliance with mandatory requirements, assessing performance, record keeping, and risk management.

- Maximising value for money from having an understanding of the market and maintaining competition through the procurement process.

- Using evidence in the design, implementation and review of programs.

The ANAO strives to achieve the highest quality in all of its work and particularly values the insights given by external reviews. In 2017–18, the ANAO for the first time engaged the Australian Securities and Investments Commission (ASIC) to conduct an external independent review of the ANAO’s Quality Assurance Framework and two audits of financial statements for the year ended 30 June 2017. The reviews were conducted using ASIC’s methodology for reviewing private sector audits. ASIC made a number of recommendations that the ANAO is in the process of implementing. The Independent Auditor undertook a performance audit of the ANAO’s cyber security processes which was tabled in Parliament on 4 December 2017. The report included a number of valuable recommendations relating to the ANAO’s own IT environment and the ANAO’s cyber security performance audits of other Australian entities. The ANAO response to the report’s recommendations is available on the ANAO website.

During this financial year the Systems Assurance and Data Analytics Group was established as part of the ANAO’s corporate structure. Its focus is on increasing quality and productivity in our audit work in an environment of increased data collection and generation in the public sector. Investing in the data analysis capability of the ANAO is also expected to support audit planning, improved audit outcomes, and potentially new audit products and services.

In April 2018 the ANAO finalised the 2018–2022 Workforce Plan. The objective of the plan is to ensure that the ANAO has a professional and capable workforce that can respond to the Auditor-General’s mandate and priorities in coming years.

The ANAO has a close working relationship with the JCPAA, established and governed by the Act and the Public Accounts and Audit Committee Act 1951. Throughout the year, the ANAO made 11 appearances or submissions assisting the JCPAA inquiries into Auditor-General reports and its inquiries into the Performance Management Reform agenda.

The year ahead

Publication of the ANAO’s annual audit work program is a significant step in the organisation’s performance information. It highlights to the Parliament and the sector at large, the areas of focus for the ANAO in the year ahead. Key features of the ANAO’s 2018–19 Annual Audit Work Program include:

- an ongoing focus on the key accountabilities as outlined in the PGPA Act, including efficiency, effectiveness, economy and ethics;

- compliance with legislation and government policy frameworks;

- promoting transparency on the effective use of taxpayers’ money through audits of procurement processes, contract management and grants management;

- program implementation and risk management in major areas of public investment, such as in Defence capability; large-scale infrastructure such as the national broadband network; the National Disability Insurance Scheme; and programs targeting Aboriginal and Torres Strait Islander peoples;

- value-for-money and transparency of the operations of government business enterprises;

- transparency in the measurement of performance and impact against agreed program objectives;

- effective delivery of services to citizens; and

- cyber resilience, including IT security and systems controls.

In 2016, the ANAO introduced the Future Ready Change Program (Future Ready) which was designed to position the ANAO to deliver audit services to the Parliament into the future. As the ANAO’s Future Ready strategy has come to a close the ANAO is transitioning to managing change as an ongoing part of business and embed a culture of continuous improvement. As outlined in the ANAO Corporate Plan 2018–19, the ANAO will support the delivery of its purpose by investing in improved ways of working, data and analysis, and workforce capability. 2018-19 will be a period of significant change for the ANAO as the office:

- transitions to new ways of working in a refurbished office;

- transitions to a new IT services contract; and

- implements the ANAO Workforce Plan.

Building the office’s data analytics capability is a particular priority as the entities the ANAO audits continue to collect, generate and share ever-increasing volumes of data and information. Increased capacity in this space will enable automation of some audit processes, supporting a focus on high risk areas within entities and driving efficiency within the audit process. Increasing the data analytics capability will be driven by the implementation of the ANAO’s data analytics road map and a data analytics pilot with the Department of Infrastructure, Regional Development and Cities. I have flagged in my liaison with Accountable Authorities that more real time electronic access to data and records has the potential to increase efficiency and quality for the ANAO and for them. I thank the Department of Infrastructure, Regional Development and Cities for participating in a pilot to help us build our approach.

Finally, a key focus for 2018-19 will be to continue to improve the ANAO’s support to the Parliament. We have a number of measures already in place including briefing individual members and committees, making submissions and appearances and providing summaries of reports to Senate estimates committees. A key challenge for us will be to seek to improve our support and we will continue to develop our strategic communication strategy, asking what more can be done to inform the Parliament and improve the ANAO’s relationship with the Parliament.

Grant Hehir

Auditor-General

Part 2—Overview of the ANAO

Purpose

The purpose of the Australian National Audit Office (ANAO) is to improve public sector performance and support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, the executive and the public.

The ANAO is established under Part 6 of the Auditor-General Act 1997 (the Act). Section 39 of the Act states that the function of the Audit Office is to assist the Auditor-General in performing the Auditor-General’s functions, and Part 6 of the Act establishes the ANAO under the Public Service Act 1999 and requires it to operate as an entity under the Public Governance, Performance and Accountability Act 2013 (the PGPA Act). The ANAO supports the Auditor-General in the role as an independent officer of the Parliament.

The executive arm of the Australian Government is accountable to Parliament for its use of public resources and the administration of legislation passed by the Parliament. The Auditor-General scrutinises and provides independent assurance as to whether the executive is operating and accounting for its performance in accordance with Parliament’s intent.

Role

The Auditor-General is appointed for a term of ten years by the Governor-General on the recommendation of the Joint Committee of Public Accounts and Audit (JCPAA) and the Prime Minister. As an independent officer of the Parliament, the Auditor-General has complete discretion in the performance or exercise of the functions or powers under the Act. In particular, the Auditor-General is not subject to direction in relation to:

- whether a particular audit is to be conducted;

- the way a particular audit is to be conducted; or

- the priority given to any particular matter.

In the exercise of the functions or powers under the Act, the Auditor-General must have regard to the audit priorities of the Parliament, as determined by the JCPAA.

Under the Act, the Auditor-General’s functions include:

- auditing the financial statements of Commonwealth entities, Commonwealth companies and their subsidiaries;

- conducting performance audits, assurance reviews, and audits of the performance measures, of Commonwealth entities and Commonwealth companies and their subsidiaries, other than government business enterprises where a request from the JCPAA is required for the wok to be undertaken;

- conducting a performance audit of a Commonwealth partner as described in section 18B of the Act;

- providing other audit services as required by other legislation or allowed under section 20 of the Act; and

- reporting directly to the Parliament on any matter or to a minister on any important matter.

Values

The ANAO values respect, integrity and excellence — values that align with the Australian Public Service (APS) values and address the unique aspects of the ANAO’s role and operating environment. The ANAO’s values guide the office in performing its role objectively, with impartiality and in the best interests of the Parliament.

Organisation

The ANAO has one outcome: to improve public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the executive and the public. The ANAO outcomes and programs framework can be found in Appendix 1.

To deliver on the ANAO’s purpose, the Auditor-General has organised the ANAO into five functional areas.

- Assurance Audit Services Group provides independent assurance on the financial statements and financial administration of all Australian Government entities. It also conducts assurance reviews.

- Corporate Management Branch leads corporate strategy and change for the ANAO. It provides services based on specialised knowledge, best practices and technology that enable the delivery of the ANAO’s purpose and audit outcomes.

- Performance Audit Services Group conducts performance audits and assurance reviews of Australian Government entities and their activities and produces related publications and other information reports.

- Professional Services and Relationships Group provides technical accounting, audit and legal advice and support to the Auditor-General, establishes, manages and monitors the implementation of the quality assurance framework, and manages the ANAO’s external relations.

- Systems Assurance and Data Analytics Group provides IT audit and data analytics support to the ANAO’s assurance and performance audit work, with staff from a range of professional and technical backgrounds including project management, system administration, database development, data analysis and financial systems management.

The ANAO created the Systems Assurance and Data Analytics Group in late 2017. Its focus is on increasing quality and productivity in delivery of audit work in an environment of increased data collection and generation in the public sector. Investing in the data capability of the ANAO is also expected to support audit planning, improve audit outcomes, and new audit products and services.

The organisational and senior management structure of the ANAO at 30 June 2018 is shown in Figure 2.1.

Figure 2.1: Organisational and senior mangement structure at 30 June 2018

Relationship with the Parliament

Through the audit and related services the ANAO provides to the Parliament, the Australian public can have confidence that the Auditor-General is examining and reporting on the actions of public sector entities and whether public funds are being used economically, efficiently, effectively and ethically.

Joint Committee of Public Accounts and Audit

The JCPAA is the ANAO’s oversight committee. The JCPAA is one of the joint committees of the Commonwealth Parliament, and is established by the Public Accounts and Audit Committee Act 1951. The JCPAA formally links the Auditor-General and the ANAO to the Parliament. The Committee approves the proposed appointment of the Auditor-General, reviews all Auditor-General reports, reviews annual resource requirements and operations of the ANAO and reports of the Independent Auditor, and advises the Auditor-General on the Parliament’s audit priorities.

The JCPAA is required to review all reports that the Auditor-General tables in the Parliament and to report the results of its deliberations to both houses of Parliament. In 2017–18, officers of the ANAO attended ten private briefings and public hearings as part of the JCPAA’s review of audit reports. The JCPAA conducted 11 inquiries throughout 2017–18, resulting in the tabling of eight reports on its review of Auditor-General reports. The Auditor-General and staff from the ANAO assist the Committee throughout its inquiries, including appearing in hearings. An outline of these inquiries and reports is provided in Table 2.1.

Table 2.1: JCPAA inquiries and reports

In total, officers of the ANAO attended 11 private briefings and public hearings in relation to the committee’s functions to review Auditor-General reports, the reports of the Independent Auditor, annual resource requirements and operations of the ANAO.

The Act requires the Auditor-General to comply with requests by the JCPAA to submit draft estimates for the ANAO for a financial year before the annual Commonwealth budget for that financial year. The JCPAA has a duty in its legislation to make recommendations to both Houses of Parliament, and to the Minister who administers the Act, on the draft estimates of the ANAO. In 2017–18, the ANAO was subject to a budget savings measure after the draft estimates were submitted to the JCPAA. The ANAO sought authority from the Treasurer to brief the JCPAA on the impact of the measure. Consistent with normal budget operating rules authority was not forthcoming. Subsequent to this the ANAO received advice from the Australian Government Solicitor that the Auditor-General must comply with requests from the JCPAA notwithstanding budget operating rules. On this basis the Auditor-General has provided advice to the JCPAA that it is open to the JCPAA to make more than one request per budget cycle to provide an update on the ANAO’s budget estimates.

The JCPAA also advises the Auditor-General on the Parliament’s audit priorities.

Other parliamentary committees

The ANAO briefs and appears before other parliamentary committees, including Senate estimates committees and in the context of specific parliamentary inquiries. ANAO staff also provide briefings to individual members and senators on request. The ANAO was invited to provide private briefings and appear at public hearings before a number of other parliamentary committees in 2017–18. Details of these appearances are provided in the response to Criterion 15 in the report on performance.

Part 3—Report on Performance

Annual performance statements

As the accountable authority of the Australian National Audit Office, I present the 2017–18 annual performance statements of the Australian National Audit Office, as required under paragraphs 39(1)(a) and 39(1)(b) of the Public Governance, Performance and Accountability Act 2013 (PGPA Act); and section 16F of the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). In my opinion, these annual performance statements are based on properly maintained records, accurately reflect the performance of the entity for the reporting period, and comply with subsection 39(2) of the PGPA Act.

Grant Hehir

Auditor-General

7 August 2018

Purpose

The purpose of the ANAO is to improve public sector performance and support accountability and transparency in the Australian Government sector through independent reporting to the Parliament, the executive and the public (Outcome 1).

The ANAO seeks to achieve its purpose through its audit services, which include:

- financial statement audits of Australian Government entities (Program 1.1); and

- performance audits of Australian Government programs and entities (Program 1.2).

The ANAO audits the annual financial statements of Australian Government entities and the Consolidated Financial Statements of the Australian Government. The Consolidated Financial Statements present the consolidated whole-of-government financial result inclusive of all Australian Government controlled entities, including entities outside the general government sector. These audits are designed to give assurance to the Parliament that an entity’s financial statements fairly represent its financial operations and financial position at year end. The ANAO also undertakes a range of assurance reviews by arrangement with entities, and in accordance with section 20 of the Auditor-General Act 1997.

A performance audit is a review or examination of any aspect of the operations of an entity which is undertaken in accordance with the ANAO Auditing standards. The ANAO’s performance audits are presented to the Parliament and identify areas where improvements can be made to aspects of public administration. They often make specific recommendations to assist public sector entities to improve performance. Performance audits may also involve multiple entities and examine common aspects of administration or the joint administration of a program or service. An assurance review of defence major projects is also undertaken annually.

Analysis of performance against purpose

The performance measurement framework is based on measuring:

- what we did (output);

- how well we did it (quality and/or efficiency); and

- what the benefits were (impact).

Taken together, the performance measures tell a story of the ANAO’s achievement of its purpose. The output measures relay progress in the delivery of the ANAO’s audit work. This audit work generates findings and recommendations for improvement that are directed at entities and tabled in Parliament. The impact measures seek to provide information on entities’ implementation of audit findings and recommendations for the information of the Parliament, and the extent to which Parliament’s engagement with our work leads to improvements in public sector administration.

The ANAO performance measures also include measures relating to quality and/or efficiency. The ANAO is committed to demonstrating transparency of its operations. The quality and efficiency measures are intended to demonstrate efficient use of taxpayer resources and the ANAO’s commitment to quality in its work.

Overall the ANAO achieved 15 measures out of 21. Where measures were not achieved, the ANAO is comfortable with the justification and has provided details in the response to each criterion on the following pages.

The ANAO’s Annual Audit Work Program 2017–18 outlined the Office’s focus on: influencing more timely delivery of annual reports and enhancing accessibility of financial statements audit opinions; the delivery of performance audit activity across the full scope of the Auditor-General’s mandate; and performance audit coverage across the full spectrum of public sector activity.

Over the course of the year, the ANAO actively engaged with public sector entities to influence more timely delivery of annual reports, including audited financial statements, through advice and support regarding the transition to tiered reporting and simplified financial statements that assist in the readability and transparency of financial information. More timely delivery of annual reports supports transparency of entities operation to the Parliament through being available in time for use at Senate Estimates. In relation to the 2016–17 financial year, reported in 2017–18, 87 per cent of entities had signed their financial statements and the associated auditor’s report issued within three months of the end of the year, compared to 80 per cent in the prior year. This supports entities tabling their annual report ahead of the October Senate Estimates period.

The ANAO also tabled three assurance reports in Parliament which summarised the ANAO’s assurance audit findings and an assurance review of major defence equipment acquisition projects which reported on 27 Major Projects. At the conclusion of the 2015–16 audit cycle 22 significant and moderate findings were reported. At the conclusion of the 2016–17 audit cycle 68 per cent (15) of these findings were reported as resolved within 12 months of being reported to Parliament. When the timeframe is extended to 18 months the percentage of findings addressed by material entities increases to 95 per cent.

In 2017–18 the ANAO completed 47 performance audits. The primary focus of ANAO performance audits was effectiveness – the extent to which entities delivered on intended objectives. 2017–18 also saw continued emphasis on the economy and efficiency with which entities manage and use public resources, reflecting the Auditor-General’s mandate. During the year, the ANAO continued to develop a methodology and associated guidance for examining efficiency themes in performance audits and continued to broaden its coverage to also focus on corporate entities and government business enterprises (GBEs)—noting that the Auditor-General undertakes audits of GBEs only at the request of the JCPAA. In 2017–18, the ANAO tabled four audits of GBEs.

ANAO performance audits identify areas where improvements can be made to aspects of public administration and makes specific recommendations to assist public sector entities to improve their program management. Entities indicate their agreement to implement ANAO recommendations in the audit report, which is tabled in Parliament. In this way, entities inform Parliament of improvements they intend to make as a result of ANAO audits. In 2017–18, 85 per cent of recommendations made in audit reports were agreed by entities. Further information in relation to this measure can be found in the response to Criterion 13.

The ANAO has started measuring entities implementation of performance audit recommendations over time. The ANAO also sought advice from all relevant entities on progress in implementing recommendations made in audits tabled in 2015–16. Entities reported that 89 percent of recommendations made during the period had been implemented within 24 months.

Through delivery of its annual audit work program, the ANAO continues to play an important role in advising the Parliament, through the JCPAA, on the implementation of reforms to the resource management framework following the introduction of the PGPA Act. A key aspect of this role has included an examination of the effectiveness of corporate planning, performance reporting and risk management in the public sector. Along with the examination of new areas of public administration, a continuing role for the ANAO is reviewing entities’ implementation of recommendations arising from earlier audits, with eleven performance audits that either followed up on an entity’s progress in implementing recommendations, or followed on from other related audits.

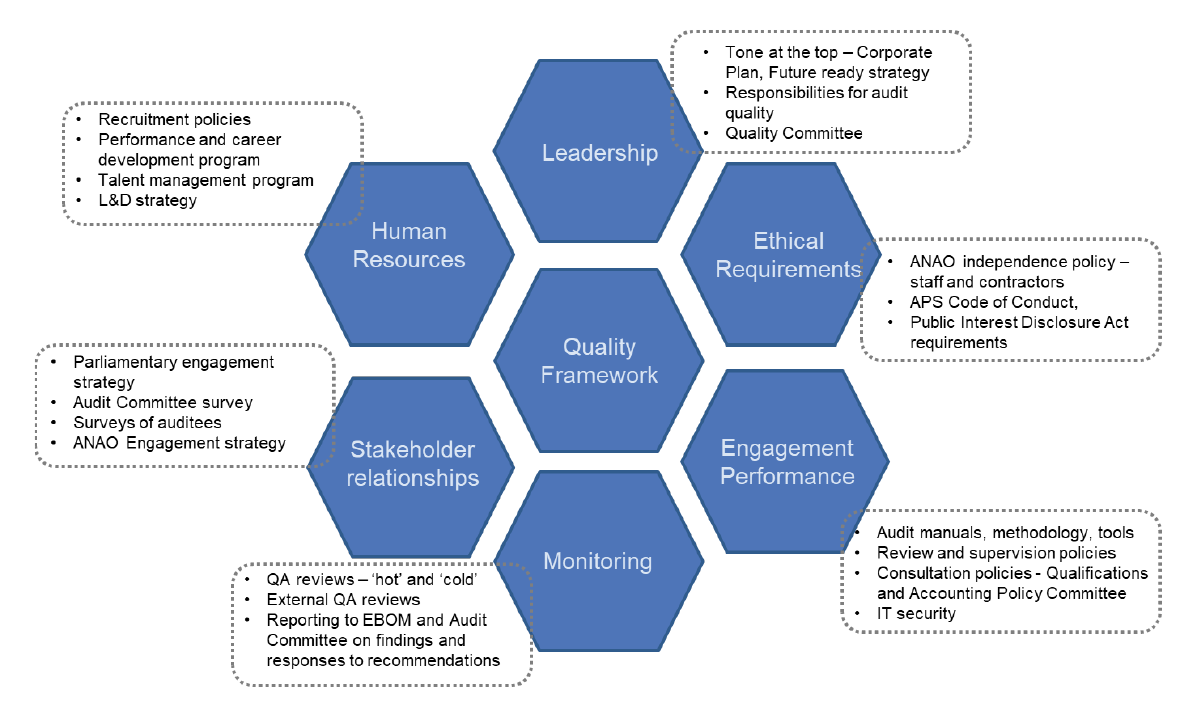

A sound quality framework supports delivery of high-quality audit work and enables the Auditor-General to have confidence in the opinions and conclusions in reports prepared for the Parliament. A key element of the ANAO Quality Assurance Framework is monitoring of compliance with policies and procedures that comprise the system of quality control. The monitoring system comprises internal and external quality assurance reviews of the ANAO’s audit and other assurance engagements. All assurance conclusions were found to be appropriate in the audits reviewed under the monitoring program.

In 2017–18 the ANAO invited the Australian Securities and Investments Commission (ASIC) to conduct an external independent review of the ANAO’s Quality Assurance Framework and two audits of financial statements for the year ended 30 June 2017. In respect of the quality framework and within the scope of ASIC’s review, no areas were identified where the design of the framework did not satisfy the requirements of the ANAO Auditing Standards. The ASIC report made two good practice recommendations that the ANAO is in the process of addressing. In respect of the file reviews, ASIC made findings in respect of the sufficiency and adequacy of audit documentation, including evidencing judgements made by the audit team. The ANAO has considered these findings and assured itself that there was no impact on the audit conclusion.

The ANAO is committed to demonstrating transparency of its operations. The results relating to average cost per audit, staff utilisation and learning and development hours all met or exceeded their targets.

In addition, the ANAO continues to be responsive to requests from Parliament, through briefing Members of Parliament (MPs), submissions to and/or appearances before parliamentary committees. Notably, the ANAO engagement with Parliament has expanded beyond the primary relationship with the JCPAA. In 2017–18 the ANAO received a number of requests for submission and/or appearance from committees other than the JCPAA.

Performance results

The ANAO measures its performance against its purpose using a range of performance criteria, which were outlined in the ANAO’s 2017–18 Corporate Plan and 2017–18 Portfolio Budget Statements. These criteria include deliverables that assist the ANAO with assessing the value created by its activities and performance measures that help with assessing the value added for the Parliament, the executive and the public.

Program 1.1 – Assurance Audit Services

The primary purpose of financial statements is to provide relevant and reliable information to users about a reporting entity’s financial performance and position. In the public sector, the users of financial statements include Ministers, Parliament and the community. The preparation of timely and accurate audited financial statements is also an important indicator of the effectiveness of an entity’s financial management, which fosters confidence in an entity on the part of users.

The ANAO’s financial statements audits, undertaken in accordance with the ANAO Auditing Standards, provide an independent examination of the financial accounting and reporting of public sector entities. They provide independent assurance that financial statements have been prepared in accordance with the Government’s financial reporting framework and Australian accounting standards. The ANAO’s assurance audits contribute to improvements in the financial administration of Australian Government entities.

The Auditor-General reports on audits of financial statements to the Parliament twice a year. The first of these reports, Interim Phase of the Audits of the Financial Statements of Major General Government Sector Entities, reports on ANAO coverage of key financial systems and controls in major Commonwealth entities. The second report, Audits of the Financial Statements of Australian Government Entities, reports on the results of the financial statements audits of all Commonwealth entities. The independent reporting to the Parliament on this activity supports accountability and transparency in the Australian Government sector.

Key to the ANAO’s audit process is an assessment of entities’ internal control frameworks as they apply to financial reporting. An effective internal control framework provides the ANAO with a level of assurance that entities are able to prepare financial statements that are free from material misstatement. In 2017–18, a total of 99 findings were reported to the entities included in the interim audit report to Parliament, comprising no significant, 12 moderate and 87 minor findings. This is a decrease on the interim audit results of 2016–17 with a total of 114 findings reported comprising two significant, 22 moderate and 90 minor findings. Eighty-three per cent of moderate findings continue to be in the areas of:

- compliance and quality assurance frameworks supporting program payments, revenue collection and financial reporting; and

- management of IT controls, particularly the management of privileged users.

The Consolidated Financial Statements present the consolidated whole of government financial results inclusive of all Australian Government controlled entities, as well as the General Government Sector financial report. The 2016–17 Consolidated Financial Statements were signed by the Minister for Finance on 27 November 2017 and an unmodified auditor’s report was issued on the same day.

A total of 222 findings were reported to entities as a result of the 2016–17 financial statements audits. These comprised two significant, 20 moderate and 200 minor findings. Most of the significant and moderate findings were in the areas of:

- management of IT controls, particularly the management of privileged users;

- compliance and quality assurance frameworks supporting program payments;

- revenue, receivables and cash management; and

- the management of non-financial assets.

Six legislative breaches were also reported to entities during 2016–17. Three of the legislative breaches were significant and 3 were non-significant. A significant breach is reported where: a significant potential or actual breach of the Constitution occurs; or non-compliance with an entity’s enabling legislation, legislation the entity is responsible for administering, or the PGPA Act is identified. A non-significant legislative breach is reported where instances of non-compliance with other legislation, or sub-ordinate legislation, are identified.

Performance measures

Assurance audit services contribute to achieving the ANAO’s purpose through:

- providing assurance on the fair presentation of financial statements of the Australian Government and its controlled entities by providing independent audit opinions for the Parliament, the executive and the public;

- presenting two reports annually addressing the outcomes of the financial statement audits of Australian Government entities and the consolidated financial statements of the Australian Government, to provide the Parliament with an independent examination of the financial accounting and reporting of public sector entities; and

- contributing to improvements in the financial administration of Australian Government entities.

To assess its performance against its purpose in relation to assurance audit activities, the ANAO measures:

- the percentage of the estimated 250 entities provided an auditor’s report for tabling in Parliament;

- the number of assurance reports presented to the Parliament;

- the number of other assurance reports produced;

- the percentage of auditor’s reports issued within three months of the financial year end reporting date;

- the percentage increase to the average cost per audit;

- the percentage of assurance audit staff available hours charged to audit work;

- the percentage of recommendations agreed by audited entities; and

- the percentage of moderate and significant findings that are addressed by material entities within one year of reporting.

|

Criterion 1 |

Percentage of the estimated 250 entities provided an auditor’s report for tabling in the Parliament |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1, p.87 |

|

Result |

Achieved a result of 99.6% against a target 100% |

The number of financial statements auditor’s reports issued is a key measure of the ANAO’s core business in achieving its purpose. Financial statements auditor’s reports provide assurance to the Parliament that the financial statements of the entity comply with Australian Accounting Standards and other reporting requirements (such as the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015) and present fairly the entity’s financial position and its financial performance and cash flows for the period. The target of 250 reflects the expected number of entities that would require an audit opinion on financial statements for the year ended 30 June 2017.1

During the 2017–18 financial year, the ANAO completed 238 mandated2 financial statements audits for the year ended 30 June 2017. This included the Consolidated Financial Statements (CFS) of the Australian Government. All entities that provided the ANAO with a set of financial statements for audit received an auditor’s report for tabling in Parliament. At 30 June 2018, the Minjerribah Camping Partnership had not presented the ANAO with signed financial statements for the year ended 30 June 2017 therefore no auditor’s report was issued for this entity during 2017–18.

In addition to the financial statements audits, the ANAO also completed two mandated non-financial statement audits in 2017–18. These are compliance audits required by the Australian Postal (Performance Standards) Regulations 1998 and s.313 (3) of the Bankruptcy Act 1966.

Details of issues identified during the financial statements audits are included in the Auditor-General Report Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2017.

|

Criterion 2 |

Number of assurance reports presented to the Parliament |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1, p.87 |

|

Result |

Achieved a result of 3 against a target 3 |

The Auditor-General presents insights and findings from the outcomes of the financial statement audits of Australian government entities and the CFS of the Australian Government through independent reports to the Parliament. The reports support accountability and transparency in the Australian Government sector and provide Parliament an independent examination of the financial accounting and reporting of public sector entities.

- Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2017 was tabled in December 2017. This report complemented the interim phase report published in June 2017, and provided a summary of the final results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of Australian Government entities.

- Interim Report on Key Financial Controls of Major Entities was tabled in June 2018. This report focused on the results of the interim audit phase, including an assessment of entities’ key internal controls, of the 2017–18 financial statements audits of 26 entities including all departments of state and a number of major Australian government entities.

- 2016–17 Major Projects Report was tabled in January 2018. This report is the ANAO’s priority assurance review of major defence equipment acquisition projects which reported on 27 Major Projects. The Auditor-General provided a qualified Independent Assurance Report relating to progress and performance as reported in one Project Data Summary Sheet (PDSS) for the ARH Tiger Helicopters. This was the tenth annual Major Projects report to the Parliament. It built on previous reports, further enabling longitudinal analysis, and identified that: all projects continued to operate within their total approved budget; delivering Major Projects on schedule remained an ongoing challenge; and the presentation of Defence capability information had an element of uncertainty.

|

Criterion 3 |

Number of other assurance reports produced |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1, p.87 |

|

Result |

Achieved a result of 45 against a target 45 |

In addition to the conduct of mandated financial statements audits, the ANAO undertakes other assurance activities by arrangement with audited entities to support accountability and transparency in the Australian Government sector. Measuring section 20 audits (i.e. audits by arrangement) contributes to the delivery of program 1.1 by independently identifying improvements in the financial administration of Australian Government entities. In 2017–18, the ANAO completed 45 other assurance activities.

These activities generally consist of audits or reviews conducted under section 20 of the Auditor-General Act 1997. These activities include financial statements audits and audits or review of compliance with legislative requirements. Once inquiries by the ANAO have been concluded, the outcomes and any findings from these individual assurance activities are communicated through the issue of a formal report or by other correspondence. The ANAO charges a fee for these audits and reviews.

|

Criterion 4 |

Percentage of auditor’s reports issued within three months of the financial year end reporting date |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1, p.87 |

|

Result |

Achieved a result of 87% against a target 85% |

In order to support timely reporting of entities’ financial performance to the Parliament through annual reports, the ANAO aims to issue 85 per cent of auditor’s reports within 3 months of the financial year end reporting date.

Providing timely auditor’s reports also supports entities in meeting requirements to provide audit cleared financial information to the Department of Finance in accordance with deadlines that are set to assist the Australian Government to prepare the Final Budget Outcome by 30 September and the CFS by 30 November each year. The CFS present whole-of-government financial results, inclusive of all Australian Government–controlled entities.

Achievement of this measure relies on entities providing the ANAO with auditable Financial Statements within the timeframe. The ANAO works closely with entities to facilitate the timely finalisation of the financial statements with the objective of issuing auditor’s reports within two business days of the financial statements being signed.

The result of 87 per cent of entities issued a signed auditor’s report within three months of the financial year end is an increase from 80 per cent in the prior year.

|

Criterion 5 |

Percentage increase to average cost per audit |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1, p.87 |

|

Result |

Achieved a result of -2% against a target 0% |

The ANAO is committed to delivering cost-effective audits through increased efficiency and effectiveness. One way of demonstrating this is to measure the cost of delivering audits over time. This new measure is designed to track the ANAO’s organisational performance against the delivery of audit outcomes.

In 2017–18 the ANAO is reporting on audits of financial statements from the 2016–17 audit cycle, as the financial year ends on 30 June and the audit occurs post the end of the financial year. Therefore, the average cost per audit for AASG is calculated by comparing the average cost of the 2016–17 audit cycle, which is completed in September 2017, to the average cost of the 2015–16 audit cycle, which is completed in September 2016. The 2016–17 average cost was $153,726 and the 2015–16 average cost was $156,587 representing a 2 per cent decrease.

|

Criterion 6 |

Percentage of assurance audit staff available hours charged to audit work3 |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1, p.87 |

|

Result |

Achieved a result of 90% against a target 85% |

The ANAO is committed to demonstrating transparency of its operations. Monitoring the percentage of audit staff available hours charged to audit work gives an indication of staff utilisation which is an indicator of the efficient and effective allocation of resources in delivering financial statements audits.

The target rate of 85 per cent of available hours being charged to audit work reflects the need for staff to undertake professional development and contribute to corporate tasks. The result of 90 per cent utilisation is within the ANAO’s tolerance for this measure.

This was a new measure in the 2017–18 Corporate Plan.

|

Criterion 7 |

Percentage of recommendations included in audit reports agreed by audited entities |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1, p.87 |

|

Result |

Achieved a result of 100% against a target 90% |

The ANAO adds value by providing entities with audit findings and recommendations to improve internal controls and business processes, based on observations noted during the conduct of financial statements audits. These matters are reported to the accountable authority and copied to the chair of the audit committee and the chief financial officer via an interim management letter, a closing report or a final management letter. All factual observations concerning the audit findings are agreed with entities before finalising these reports. Included in the measure of agreed recommendations are situations where the audited entity agrees with the ANAO’s factual observations, but the entity may suggest an alternative method to resolve the issue.

The audit findings and recommendations are reported using a rating scale whereby significant and moderate risk issues are reported individually to the audited entities, the Minister and the Parliament. Lower risk issues are also reported individually to each entity, and in aggregate in the ANAO’s reports to Parliament.4

All audit findings and recommendations are followed up as part of the audit of the following year’s financial statements.

|

Criterion 8 |

Percentage of moderate and significant findings that are addressed by material entities within one year of reporting |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1, p.87 |

|

Result |

Achieved a result of 68% against a target 90% |

The ANAO measures the percentage of moderate and significant findings that are implemented by entities in order to measure the impact that the ANAO’s audit work has on public administration. This criteria relates to the percentage of moderate or significant findings5 for material entity audits, addressed within 12 months of being reported to the entity. ‘Addressed’ means that the entity has responded to and actioned the ANAO finding.

In order to calculate this measure a full 12 month period is required following the end of an audit cycle to allow entities time to respond to findings and provide the ANAO the opportunity to evaluate the timeliness and appropriateness of their response and confirm the finding as resolved or unresolved. As a result this performance measure considers the unresolved significant and moderate findings reported at the conclusion of the 2015–16 audit cycle. At the conclusion of the 2015–16 audit cycle 22 significant and moderate findings were reported. At the conclusion of the 2016–17 audit cycle 68 per cent (15) of these findings were reported as resolved within 12 months of being reported to Parliament.

When the timeframe is extended to 18 months the percentage of findings addressed by material entities increases to 95 per cent.

Program 1.2 – Performance Audit Services

The ANAO reports to the Parliament on aspects of public administration, and makes specific recommendations to assist Parliament in holding government entities to account for meeting expectations of, and making improvements to, proper use of resources as required by the PGPA Act. Performance audits may report on one entity, or involve multiple entities on a common aspect of administration or policy implementation or where there is joint administration of a program or service.

The ANAO’s performance audit services include audit activities which involve performance audits of all or part of an entity’s operations and result in independent performance audit reports to the Parliament. Other reports are also prepared, including the Defence Major Projects Report, limited assurance reviews and information reports. These reports, along with performance audits contribute to accountability and transparency of public sector administration.

In 2017–18, the primary focus of ANAO performance audits was effectiveness – the extent to which entities delivered on intended objectives. The year also saw continued emphasis on economy and efficiency with which entities manage and use public resources, reflecting the Auditor-General’s mandate. During the year the ANAO continued to develop methodology and associated guidance for examining efficiency in performance audits and continued to broaden its coverage to also focus on corporate entities and government business enterprises (GBEs)—noting that the Auditor-General undertakes audits of GBEs only at the request of the JCPAA. In 2017–18, the ANAO tabled performance audits of four GBEs.

In 2017–18, 13 audits were cross entity audits (audits of the same topic across multiple entities) and included topics such as corporate planning, performance reporting, contract management, government policy implementation, risk management and financial management.

In response to ongoing parliamentary interest in entities’ implementation of ANAO audit recommendations, in 2017–18 the Auditor-General tabled 11 performance audits that either followed up on an entity’s progress in implementing recommendations, or followed on from other related audits. The 2018–19 annual audit work program continues a series of audits that will examine entity progress in implementing recommendations arising from a previous performance audit, or from a related Parliamentary enquiry.

Performance measures

Performance audit services contribute to achieving the ANAO’s purpose through:

- audits of the performance of Australian Government programs and entities, including identifying recommendations for improvement and key learnings for all government entities; and

- other assurance reviews and information reports to Parliament.

To assess performance against purpose in relation to performance audit activities, the ANAO measures the number of: performance audits presented to Parliament; the time and cost of these audits (our efficiency); percentage of recommendations agreed to and the status of their implementation by entities (our impact and effectiveness).

|

Criterion 9 |

Number of performance audit reports presented |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program1.2, p.89 |

|

Result |

Achieved a result of 47 against a target 48 |

In 2017–18, the Auditor-General presented 47 performance audits for the information of the Parliament. The publication of the 48th report (Army’s Protected Mobility Vehicle – Light) was expected to occur in December 2017. It has however been delayed as a result of an application made by Thales Australia on 5 January 2018 to the Attorney-General to consider issuing a certificate under subsection 37(1)(b) of the Auditor-General Act 1997 prohibiting the inclusion of particular information in a public audit report. A certificate from the Attorney-General was received on 29 June 2018 requiring consideration of the impact of the certificate on the proposed public report. Thales Australia also sought orders from the Federal Court of Australia to restrain the publication of particular information in the proposed audit report. The Federal Court action was dismissed by consent shortly after the issuance of the Attorney-General’s certificate.

In addition to the performance audits presented to Parliament, the Auditor-General also presented the limited assurance reviews of Murray-Darling Basin National Partnership Agreement and Achieving value for money from the Fair Entitlements Guarantee Recovery Program as well as the Australian Government Procurement Contract Reporting information report.

Table 3.2: Number of performance audit reports, 2015–16 to 2017–18

|

Year |

Number of performance audits |

|

|

|

Target |

Result |

|

2017–18 |

48 |

47 |

|

2016–17 a |

48 |

58 |

|

2015–16 a |

49 |

35 |

Note a: 2015–16 and 2016–17 - the number of performance audits presented to the Parliament was affected by the double dissolution of the Parliament of Australia on 9 May 2016.

|

Criterion 10 |

Average elapsed time (months) for performance audits |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.2, p.89 |

|

Result |

Achieved a result of 9.6 months against a target 10.5 months |

There are two issues that impact the length of an ANAO Performance Audit. The first issue which impacts on average audit length is finding and leveraging efficiencies in the audit production process. In 2017–18 efficiencies included: reducing the time taken to print and prepare reports for tabling; more effective use of resourcing; and improved processes for audit clearance. These have all contributed to reduction in time without compromising audit quality.

The second issue relates to the selection of performance audits. Some audits will be more complex and/or cover multiple agencies and therefore take longer, whereas other audits will be an in-depth review on a targeted issue, so can be completed in a shorter timeframe. In selecting audit topics the ANAO ensures an appropriate balance between the level of complexity and depth of the audit program as a whole. While no analysis has been undertaken to assess the impact of this issue there was no strategy to change the audit mix in this regard for 2017–18.

Table 3.3: Duration of performance audit reports, 2015–16 to 2017–18

|

Year |

Time taken to complete report (months) |

||

|

|

Target |

Average |

Range |

|

2017–18 |

10.5 |

9.6 |

6.2–15.9 |

|

2016–17 |

N/A |

10.6 |

5.2–22 |

|

2015–16 |

N/A |

11.6 |

6.9–18.6 |

|

Criterion 11 |

Percentage increase to average cost per performance audit |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.2, p.89 |

|

Result |

Achieved a result of -9.8%against a target 0% |

The ANAO is committed to delivering cost-effective audits through increased efficiency and effectiveness. One way of demonstrating this is to measure the cost of delivering audits over time. This new measure is designed to track the ANAO’s organisational performance against the delivery of audit outcomes.

The average cost per audit for PASG is calculated by comparing the average cost of the 2016–17 audit cycle to the average cost of the 2017–18 audit cycle.

This result is consistent with the reduction in the average length of the audit as outlined in Criterion 10.

Table 3.4: Cost of performance audit reports, 2015–16 to 2017–18

|

Year |

Percentage increase |

Cost per performance audit ($’000) a |

|

|

|

Target |

Average |

Range |

|

2017–18 |

0% |

422 |

159–786 |

|

2016–17 |

N/A |

468 |

102–1,500 |

|

2015–16 |

N/A |

526 |

230–767 |

Note a: Cost is calculated on a nominal cost recovery basis using an accrual-based costing model.

|

Criterion 12 |

Percentage of performance audit staff available hours6 charged to audit work |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.2, p.89 |

|

Result |

Achieved a result of 89% against a target 80% |

The ANAO is committed to demonstrating transparency of its operations. Monitoring the percentage of audit staff available hours charged to audit work gives an indication of staff utilisation which is an indicator of the efficient and effective allocation of resources in delivering performance audits.

The ANAO continues to streamline its processes to ensure that to the extent possible, staff are working on audit related activities. In particular, in 2017–18, a new resourcing approach was rolled out to minimise the transition time for staff between audits. While this delivered some improvements, the resourcing approach will be further refined through 2018–19 to further optimise the percentage of hours allocated to audit work. The 80 per cent target reflects the need for staff to undertake professional development and contribute to corporate tasks.

|

Criterion 13 |

Percentage of recommendations included in audit reports agreed by audited entities |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.2, p.89 |

|

Result |

Achieved a result of 85% against a target 90% |

The ANAO makes recommendations in performance audits reports to support Parliament to hold entities to account for their administration and service delivery. Throughout a performance audit, the ANAO keeps entities informed of findings and discusses potential recommendations to ensure entities understand the basis and intention of recommendations. Over time, this approach has resulted in a consistently high percentage of entities agreeing to ANAO recommendations, although 2017–18 saw an increase in the number of recommendations that were agreed with qualifications which has affected the average. Table 4 provides details of recommendations agreed against those made. Only recommendations that were agreed without qualification are included as ‘agreed’ recommendations – 12 recommendations were agreed with qualification.

There were four recommendations made where entities did not either agree or disagree. Specifically, the recommendations were in two reports Management of the Contract for Telephone Universal Service Obligations and Australia Post’s Efficiency of Delivering Reserved Letter Services. In both reports, the Department of Communications and the Arts elected not to state whether or not it agreed with the recommendations directed towards it. In the latter report, the Department of Finance also elected not to state whether or not it agreed with the recommendations directed towards it. This approach to dealing with recommendations does not assist the Parliament in holding entities to account.

Table 3.5: Agreement to recommendations in performance audit reports, 2015–16 to 2017–18

|

Year |

Recommendations (number) |

Recommendations fully agreed (%) |

Recommendations agreed with qualifications (%) |

Recommendations not agreed (%) |

|

2017–18 |

126 a |

85 |

9.5 |

2 |

|

2016–17 |

99 |

92 |

4 |

3 |

|

2015–16 |

103 |

94 |

6 |

0 |

Note a: There were also 4 recommendations for which no response was provided.

|

Criterion 14 |

Percentage of ANAO recommendations implemented within 24 months of a performance audit report |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.2, p.89 |

|

Result |

Achieved a result of 89% against a target 70% |

The ANAO monitors entities’ implementation of performance audit recommendations by attending entity audit committees, and conducting audits which follow up on entity progress in implementing previously made audit and related Parliamentary enquiry recommendations. For the first time this year, the ANAO also sought advice from all relevant entities on progress in implementing recommendations made in audits tabled in 2015–16. The self-reported evidence suggests that entities are implementing ANAO recommendations largely within 24 months of the recommendation being agreed. For those recommendations that have not yet been implemented, entities have advised that work is underway.

ANAO-wide

There are a number of measures that are shared across the ANAO and they generally relate to relationships, corporate and professional services. This area of activity contributes to achieving the ANAO’s purpose through:

- facilitating dissemination of the ANAO’s findings to members of Parliament, the executive and the public;

- providing organisation-wide support services for the ANAO, based on specialised knowledge, professional practice and technology; and

- ensuring ANAO audits are of high quality and compliant with auditing standards.

The ANAO supports the work of the Parliament by providing independent assurance and opinions, including information, assistance and briefings to parliamentarians and to parliamentary committees, particularly the JCPAA.

Performance measures

To assess performance against its purpose in relation to ANAO-wide activities, the ANAO measures:

- performance in delivering audit services through the ANAO’s key relationship with the Parliament;

- whether the Quality Assurance Program indicates that audit conclusions are appropriately supported and the ANAO quality assurance framework is operating effectively;

- the number of learning and development hours undertaken by ANAO staff; and

- increase in social media followers.

|

Criterion 15 |

Number of appearances and submissions to Parliamentary Committees |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Shared by Program 1.1 and 1.2, p.91 |

|

Result |

Achieved a result of 36 against a target 20 |

The ANAO supports the work of Parliamentary Committees by providing private briefings on request, and making appearances and submissions to Committee inquiries. In 2017–18, the ANAO made 36 appearances and submissions to parliamentary committees as detailed in Table 3.6.

The result exceeded the target and is comparable to the 2016–17 result of 39. The relationship with the JCPAA remains the ANAO’s key parliamentary engagement. However, in order to support the work of the Parliament more broadly the ANAO has focused on proactively seeking broader opportunities to engage with the Parliament and improve the utilisation of audit reports in parliamentary proceedings. More than half (sixty seven per cent) of ANAO appearances and submission in 2017–18 were to Parliamentary Committees other than the JCPAA, the ANAO’s oversight committee. Engagement activities included:

- the inclusion of a key learnings section in performance audit reports which is included in an Executive Summary for parliamentary briefings;

- development of Audit insights products that provide information on audit issues and examples of good practice, as identified through financial statement and performance audit work, by way of shared learnings for all Commonwealth entities;

- providing a summary before each estimates hearings to Estimates Committees which includes information about all audit reports that have tabled since the last estimates hearings; and

- reviewing all Senate, House and Joint Committee inquiries and making submissions and being available to appear at hearings where there is relevant audit coverage to the committee inquiry terms of reference.

Table 3.6: ANAO appearances and submissions to Parliamentary Committees

|

Date |

Committee |

Topic |

Type |

|

5 July 2017 |

Senate Select Committee on a National Integrity Commission |

Adequacy of the Australian government’s framework for addressing corruption and misconduct |

Appearance at public hearing |

|

13 July 2017 |

Senate Economics Reference Committee |

Inquiry into the Operations of existing and proposed toll roads in Australia |

Submission |

|

28 July 2017 |

Senate Community Affairs Reference Committee |

Inquiry into the Effectiveness of the Aged Care Quality Assessment and accreditation framework for protecting residents from abuse and poor practices, and ensuring proper clinical and medical care standards are maintained and practised |

Submission |

|

28 July 2017 |

Joint Standing Committee on the National Capital and External Territories |

Inquiry into Australia’s Antarctic Territory |

Submission |

|

1 August 2017 |

Joint Committee on the Australian Commission for Law Enforcement Integrity |

Inquiry into the Integrity of Australia’s border arrangements |

Appearance at public hearing |

|

3 August 2017 |

Senate Economics Reference Committee |

Inquiry into the Operations of existing and proposed toll roads in Australia |

Appearance at public hearing |

|

7 August 2017 |

Joint Standing Committee on the National Disability Insurance Scheme |

Inquiry into the Transition arrangements for the NDIS |

Submission |

|

16 August 2017 |

Joint Committee of Public Accounts and Audit |

Inquiry into Defence sustainment expenditure |

Appearance at public hearing |

|

6 September 2017 |

Joint Committee of Public Accounts and Audit |

Commonwealth Performance Framework - Inquiry based on Auditor-General Report No.31 (2015–16), No.6 (2016–17) and No.58 (2016–17) |

Appearance at public hearing |

|

29 September 2017 |

Senate Standing Committees on Finance and Public Administration |

Inquiry into Digital Delivery of Government Services |

Submission |

|

29 September 2017 |

Senate Standing Committees on Community Affairs References |

Inquiry into Availability and accessibility of diagnostic imaging equipment around Australia |

Submission |

|

17 November 2017 |

Joint Committee on Intelligence and Security |

Review of Administration and Expenditure No. 16 (2016-2017) |

Submission |

|

29 November 2017 |

Joint Committee of Public Accounts and Audit |

ANAO audit batch selection |

Appearance for private briefing |

|

6 December 2017 |

Senate Rural and Regional Affairs and Transport Legislation Committee |

Australian Wool Innovation |

Appearance at public hearing |

|

7 February 2018 |

Joint Committee of Public Accounts and Audit |

Inquiry based on Auditor-General Report No. 5 (2017–18) |

Appearance at public hearing |

|

8 February 2018 |

Joint Committee of Public Accounts and Audit |

Australian Government Contract Reporting - Inquiry based on Auditor-General Report No.19 (2017–18) |

Submission |

|

14 February 2018 |

Joint Committee of Public Accounts and Audit |

Commonwealth Procurement - Inquiry based on Auditor-General Report No.61 (2016–17), No.9 (2017–18) and No.12 (2017–18) (Procurement of the National Cancer Screening Register and Management of the Contract for Telephone Universal Service Obligations) |

Appearance at public hearing |

|

14 February 2018 |

Joint Committee of Public Accounts and Audit |

ANAO draft budget estimates and the Independent Auditor’s report Review of Cyber Security |

Appearance for private briefing |

|

14 February 2018 |

Joint Standing Committee on Electoral Matters |

Auditor-General Report No.25 (2017–18) Australian Electoral Commission’s Procurement of Services for the Conduct of the 2016 Federal Election |

Appearance for private briefing |

|

16 February 2018 |

Joint Committee of Public Accounts and Audit |

Commonwealth Procurement - Inquiry based on Auditor-General Report No.61 (2016–17), No.9 (2017–18) and No.12 (2017–18) (Management of the Pre-construction Phase of the Inland Rail Programme) |

Appearance at public hearing |

|

16 February 2018 |

Joint Committee of Public Accounts and Audit |

Inquiry into Australian Government Contract Reporting - Inquiry based on Auditor-General Report No.19 (2017–18) |

Appearance at public hearing |

|

27 February 2018 |

Senate Finance and Public Administration Committee |

Additional Estimates 2017–18 |

Appearance at public hearing |

|

28 February 2018 |

Standing Committee on the Environment and Energy |

Auditor-General Report No.17 (2017–18) New South Wales’ Protection and use of Environmental Water in the Murray-Darling Basin |

Appearance for private briefing |

|

28 February 2018 |

Standing Committee on Tax and Revenue |

Auditor-General Report No.29 (2017–18) Unscheduled Taxation System Outages and Auditor-General Report No.15 (2017–18) Costs and Benefits of the Reinventing the ATO Program |

Appearance for private briefing |

|

1 March 2018 |

Standing Committee on Agriculture and Water |

Inquiry into Auditor-General Report No. 56 (2016–17) |

Appearance at public hearing |

|

23 March 2018 |

Joint Committee of Public Accounts and Audit |

Inquiry into Defence Major Projects |

Appearance at public hearing |

|

28 March 2018 |

Joint Committee of Public Accounts and Audit |

Commonwealth Procurement – Inquiry into Auditor-General Report No.16 (2016–17), No.9 (2017–18) and No.12 (2017–18) |

Appearance at public hearing |

|

29 March 2018 |

Joint Standing Committee on the National Broadband Network |

Inquiry into the business case for the National Broadband Network |

Submission |

|

29 March 2018 |

Joint Standing Committee on the National Broadband Network |

Inquiry into the rollout of the NBN in rural and regional areas |

Submission |

|

27 April 2018 |

Joint Standing Committee on Migration |

Inquiry into the review processes of visa cancellations due to criminal activity |

Submission |

|

21 May 2018 |

Senate Finance and Public Administration Committee |

2018–19 Budget Estimates |

Appearance at public hearing |

|

5 June 2018 |

Joint Committee on Law Enforcement |

Inquiry into the trade in elephant ivory and rhino horn |

Submission |

|

7 June 2018 |

Senate Economics Reference Committee |

Inquiry into the Future of Australia’s naval shipbuilding industry |

Appearance at public hearing |

|

20 June 2018 |

Joint Committee of Public Accounts and Audit |

ANAO audit batch selection |

Appearance for private briefing |

|

25 June 2018 |

Standing Committee on Education and Employment |

Inquiry into the role of Commonwealth, state and territory Governments in addressing the high rates of mental health conditions experienced by first responders, emergency service workers and volunteers |

Submission |

|

27 June 2018 |

Senate Environment and Communications References Committee |

Inquiry into the Great Barrier Reef 2050 Partnership Program |

Appearance for private briefing |

|

Criterion 16 |

Percentage of requests from Parliamentarians for private briefings or educational sessions that are undertaken |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Shared by Program 1.1 and 1.2, p.91 |

|

Result |

Achieved a result of 100% against a target 100% |

In 2017–18 the ANAO provided 21 private briefings to individual Parliamentarians on request. Of these briefings, 19 related to specific audit reports and two briefings were to provide a general outline on the role of the Auditor-General and functions of the ANAO. Most briefing requests are prompted by the receipt of an audit tabling notice from the ANAO to relevant Ministers, Shadow Ministers, party leaders and independent Senators.

All briefings provided by the ANAO to parliamentarians or a parliamentary committee are published on the ANAO website.

|

Criterion 17 |

Percentage of inquiries and audit requests from parliamentarians finalised7 within 28 days |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Shared by Program 1.1 and 1.2, p.91 |

|

Result |

Achieved a result of 87.5% against a target 90% |

In determining the ANAO’s audit work program, the Auditor-General must consider the priorities of the Parliament, as determined by the JCPAA. Formal consultation with the JCPAA about the audit priorities of the Parliament occurs in approximately April to May each year to inform the development of ANAO’s Annual Audit Work Program. Throughout the year the Auditor-General also receives direct requests from Members and Senators of the Parliament of Australia, for audits of particular areas of public administration as new issues emerge. Where the Auditor-General determines that further examination is warranted as a result of an audit request, a response can be provided through a range of mechanisms, including by initiating a performance audit, an assurance review, or an information report, or through correspondence.

In 2017–18 the Auditor-General received eight requests for audit from members of the Parliament. A response to seven of the eight requests was provided in 28 days. The one request not finalised within 28 days was due to the ANAO conducting a range of inquiries to enable a response. Table 3.7 outlines the ANAO’s actions regarding these requests.

Table 3.7: Parliamentary request for audit

|

Date of request |

Date of response |

Requestor |

Audit request relating to |

Response provided to request |

|

25 July 2017 |

28 July 2017 |

Hon Tony Burke MP |

Allegations concerning the Murray-Darling Basin |

Assurance review report tabled, 28 November 2017 |

|

6 September 2017 |

19 September 2018 |

Mr Stephen Jones MP |

Community Development Grants Programme – Central Coast Group Training Ltd |

Performance audit commenced, due to table August 2018 |

|

27 October 2017 |

23 November 2017 |

Senators Abetz, Paterson and Reynolds |

Administration and governance arrangements relating to the Student Services and Amenities Fee |

Not included in 2018–19 Audit Program |

|

26 March 2018 |

20 April 2018 |

Mr Stephen Jones MP |

Regional Jobs and Investments Package |

Included in 2018–19 Audit Program |

|

6 April 2018 |

20 April 2018 |

Hon Dr Mike Kelly MP |

Regional Jobs and Investments Package |

|

|

24 April 2018 |

10 May 2018 |

Senators Patrick, Griff, Hanson-Young and Bernardi, Ms Rebekha Sharkie MP and the Hon Tony Burke MP |

Allegations concerning the purchases of water for environmental flows in the Murray-Darling Basin |

Included in 2018–19 Audit Program |

|

24 April 2018 |

18 May 2018 |

Senator Whish-Wilson |

Declaration of interests and conflicts of interest within the Australian Securities and Investments Commission |

Under consideration (after the Royal Banking Commission report is released) |

|

31 May 2018 |

In progress8 |

Hon Catherine King MP |

The listing of afatinib on the Pharmaceutical Benefit Scheme |

Under consideration |

|

Criterion 18 |

Percentage of JCPAA members surveyed9 who were satisfied that the ANAO improved public sector performance and supported accountability and transparency |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Shared by Program 1.1 and 1.2, p.91 |

|

Result |

Achieved a result of 100% against a target 90% |

The ANAO engaged an independent research firm, ORIMA Research Pty Ltd, to conduct a survey of JCPAA members and other parliamentarians in 2018. The result of 100 per cent against a target of 90 per cent was based on the percentage of JCPAA members who responded to the survey that agreed or strongly agreed to the following statements:

- The ANAO’s reports and services have contributed to improved public sector accountability and transparency; and

- The ANAO’s reports and services help improve public sector administration.

The response rate of JCPAA members to the 2018 survey (27 per cent), representing 4 of the 15 members surveyed, was significantly lower than in the 2015 survey (67 per cent). Comparative analysis of the 2015 and 2018 surveys in respect to the satisfaction ratings that the ANAO improved public sector performance and supported accountability and transparency, indicate that the JCPAA results were similar in terms of the level of agreement. In addition, JCPAA members were positive in their ratings of the ANAO’s engagement with the JCPAA, particularly in relation to the ANAO’s engagement on issues of relevance, representation of the ANAO at JCPAA public hearings, provision of private briefings, and general communication and consultation by the ANAO. Recognising the surveys limited response rate, the ANAO will consider alternative methods to measure this performance indicator in the future.

The ANAO supports accountability and transparency in the Australian Government sector through independent reporting to the Parliament. To provide some insights into the Parliament’s utilisation of ANAO reports, preliminary analysis of mentions of ANAO reports by Parliamentarians or Parliamentary Committees was conducted for internal reporting purposes. The results of the analysis reveals that in 2017–18 there were over 230 individual mentions of ANAO reports, with a significant increase of mentions by Parliamentary Committees during the Senate Estimate hearings held in October 2017, and in February and May 2018. The high number of mentions reflects the continued and respected contribution of the ANAO in informing Parliament on a wide range of matters relating to the performance of the public sector. It is expected that over time, this analysis may reveal trends in parliamentary interest and utilisation of ANAO’s reports, which will inform continued improvement to the audit services and support provided to the Parliament.

|

Criterion 19 |

The ANAO independent QA Program indicates that: audit conclusions are appropriate; and, the ANAO quality assurance framework is operating effectively |

|

Source |

ANAO Corporate Plan 2017–18 2017–18 Portfolio Budget Statements, Program 1.1 and 1.2, p.87 and p.89 |

|

Result |