Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Interim Report on Key Financial Controls of Major Entities

Please direct enquiries through our contact page.

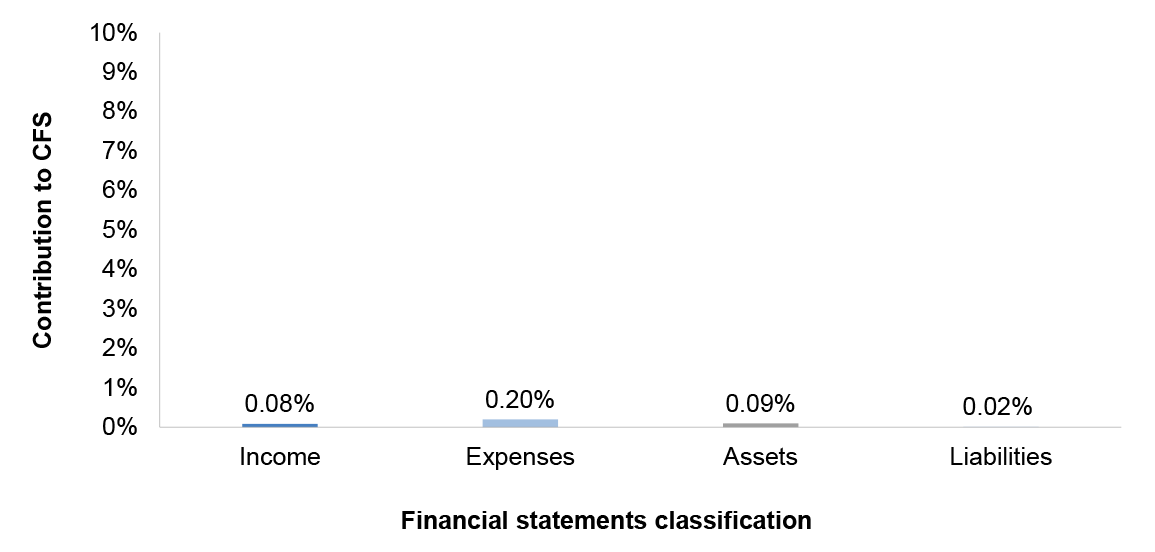

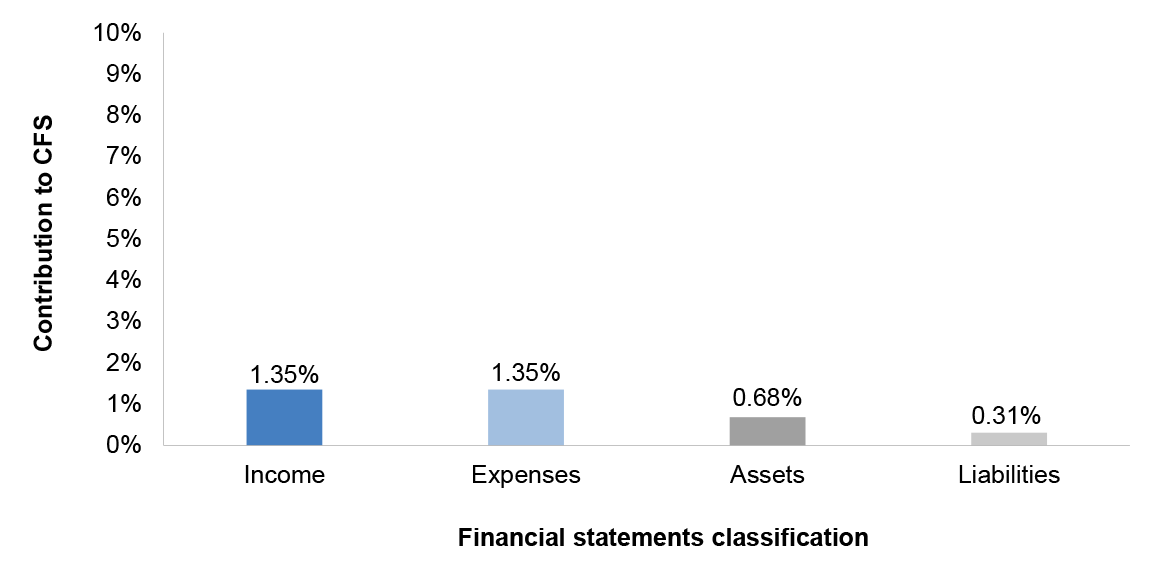

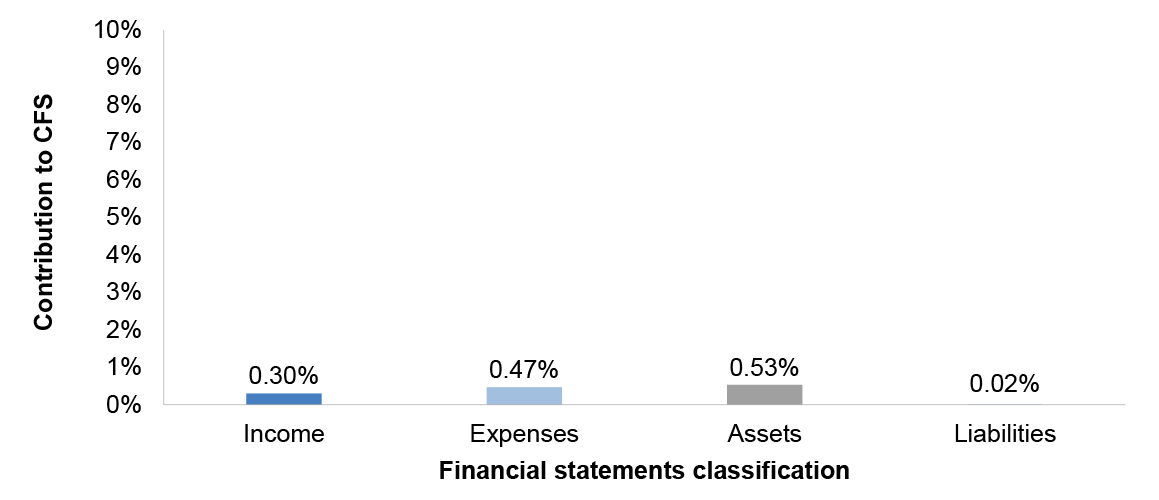

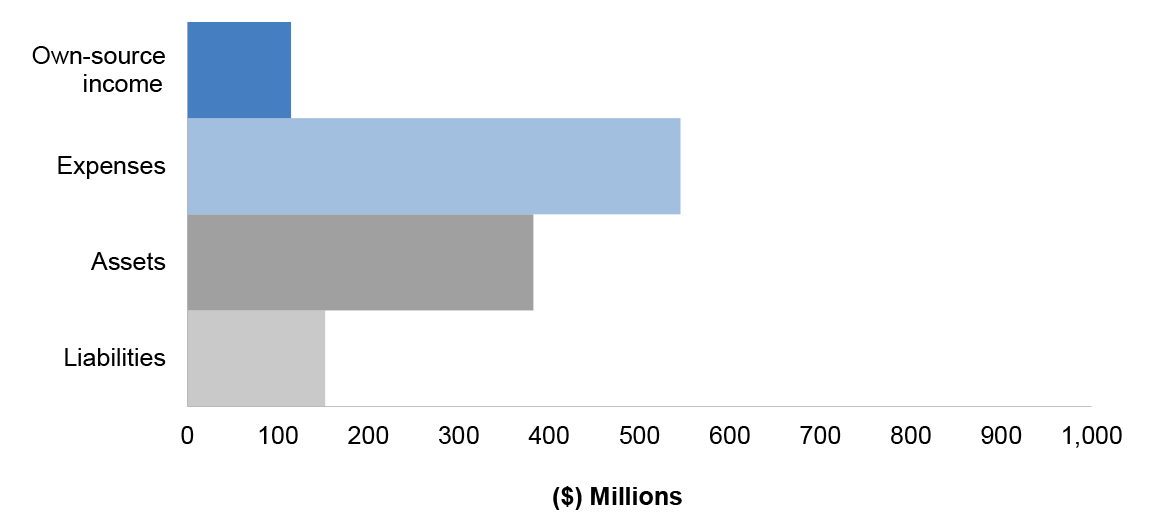

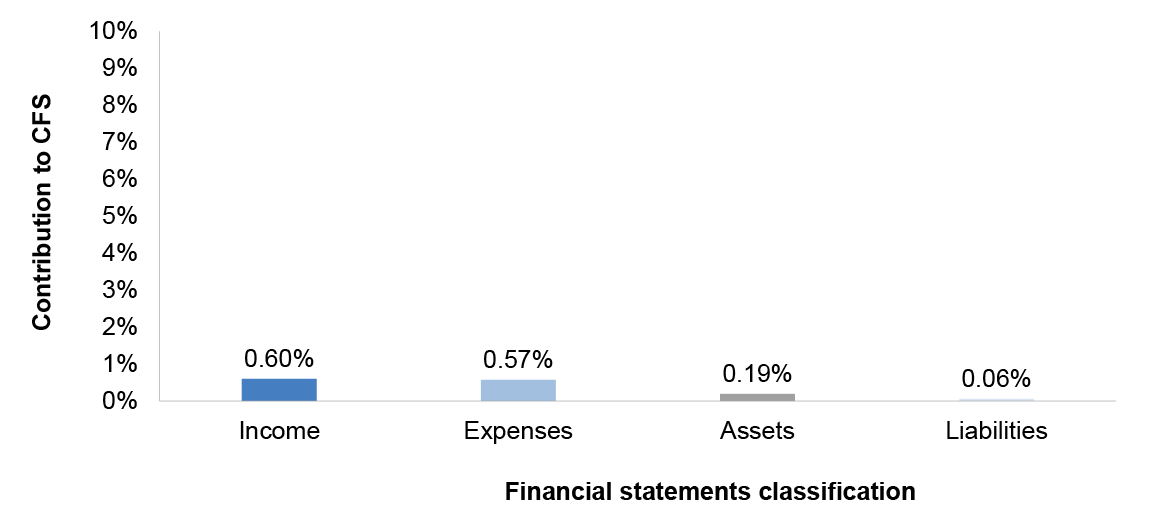

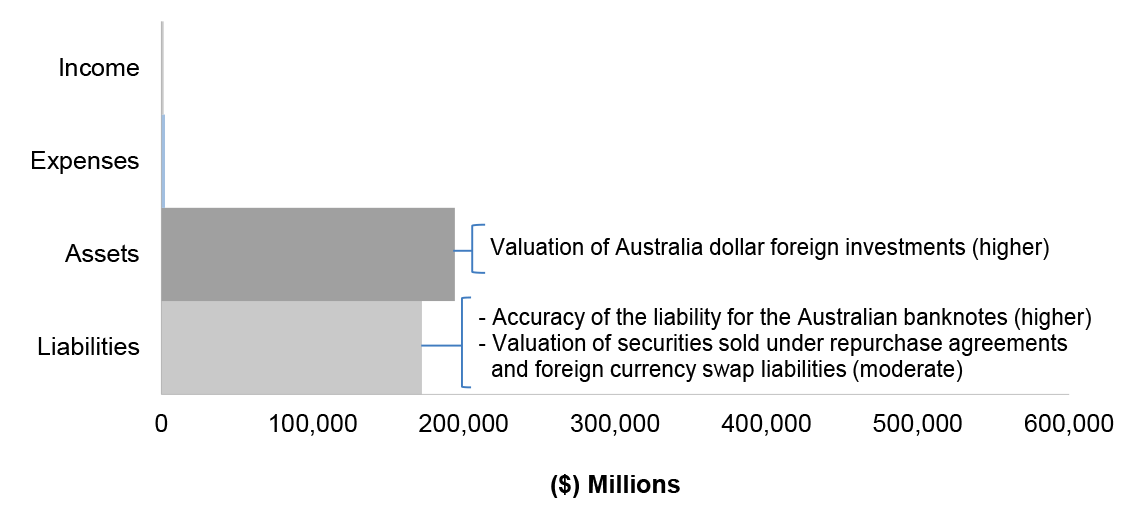

The Australian National Audit Office (ANAO) publishes two reports annually addressing the outcomes of the financial statement audits of Australian government entities and the Consolidated Financial Statements (CFS) of the Australian Government, to provide the Parliament of Australia with an independent examination of the financial accounting and reporting of public sector entities. This report focused on the results of the interim audit phase, including an assessment of entities’ key internal controls, of the 2017–18 financial statements audits of a range of entities including all departments of state and a number of major Australian government entities.

Executive summary

1. The primary purpose of financial statements is to provide relevant, reliable information to users about a reporting entity’s financial position. In the public sector, the users of financial statements include Parliament, Ministers and the community. The preparation of timely and accurate audited financial statements is also an important indicator of the effectiveness of an entity’s financial management and fosters confidence in an entity on the part of users.

2. The Australian National Audit Office (ANAO) prepares annually two publications that report the outcomes of the financial statements audits of Australian government entities1 and the Consolidated Financial Statements (CFS) of the Australian Government. These reports provide Parliament with an independent examination of the financial accounting and reporting of public sector entities.

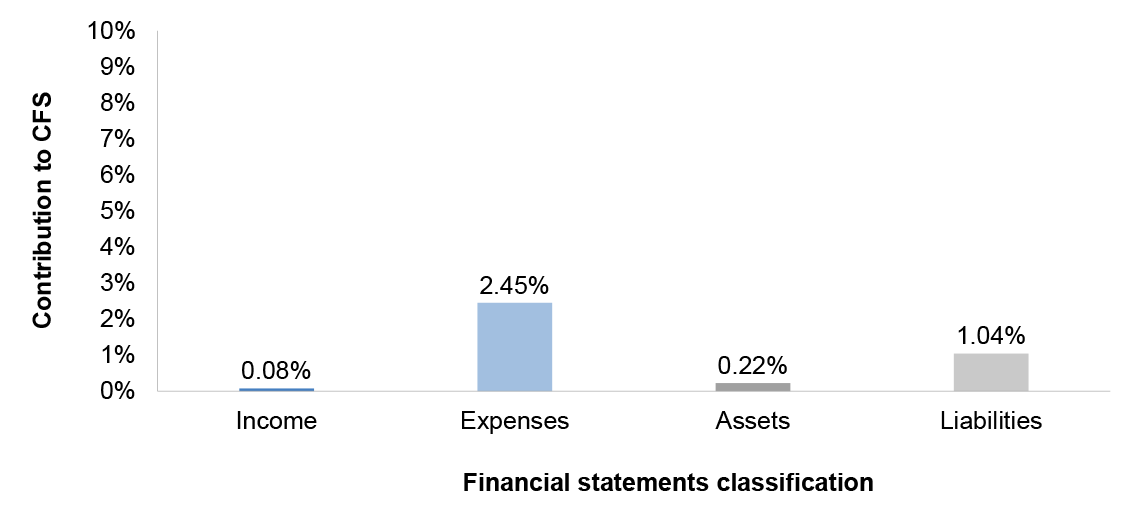

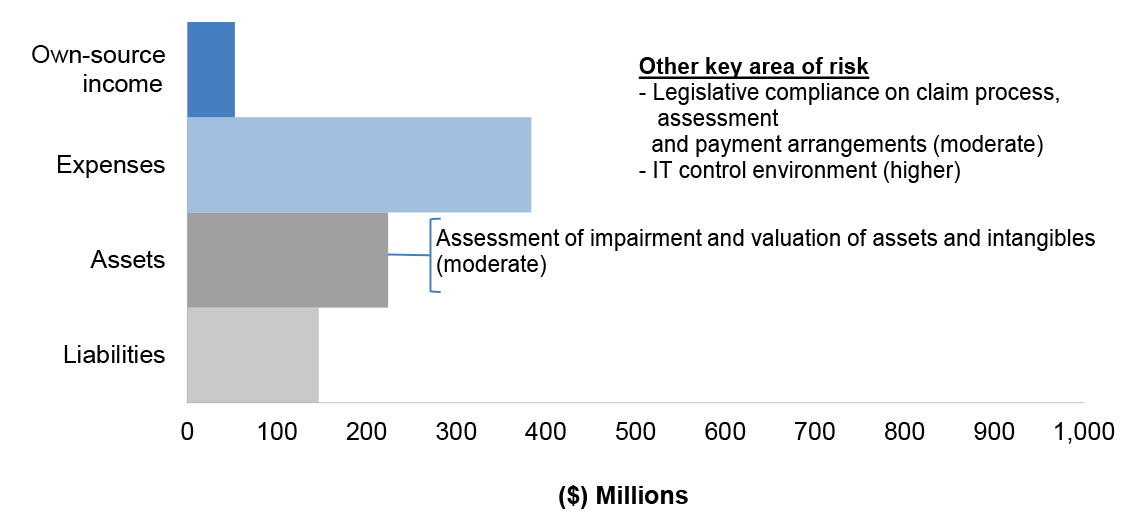

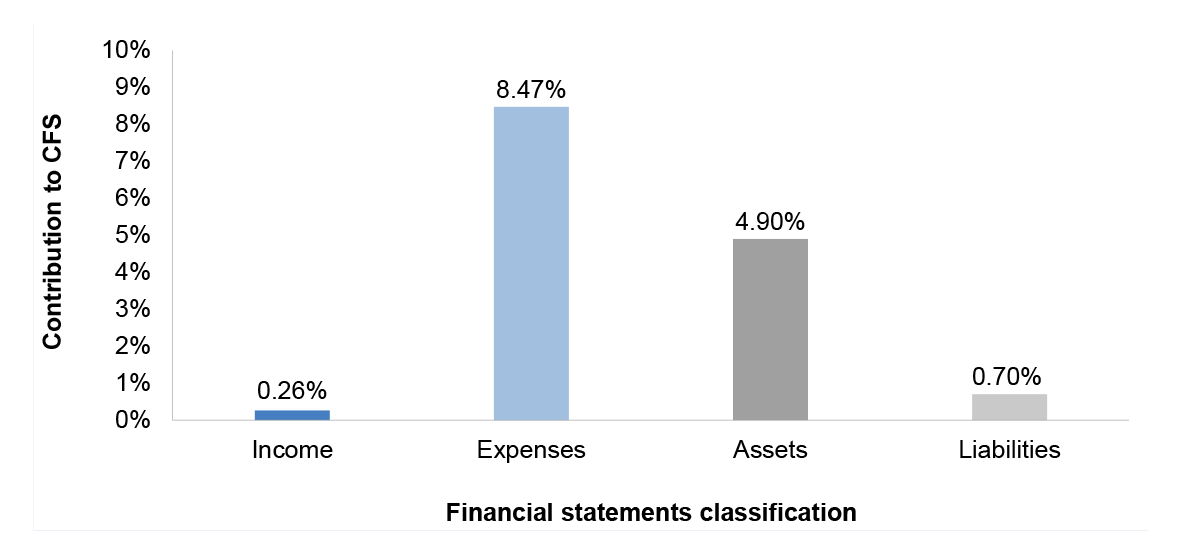

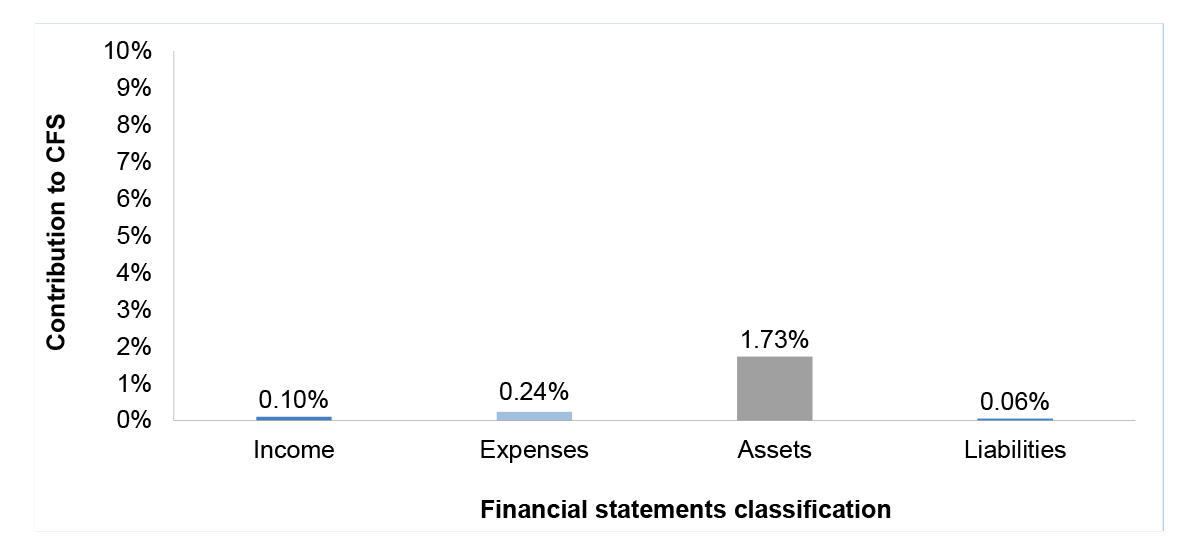

3. This report focuses on the results of the interim audits, including an assessment of entities’ key internal controls, supporting the 2017–18 financial statements audits. This report examines 26 entities, including all departments of state and a number of major Australian government entities. The entities included in the report are selected on the basis of their contribution to the income, expenses, assets and liabilities of the 2016–17 CFS. Significant and moderate findings arising from the interim audits are reported to the responsible Minister(s), and all findings are reported to those charged with governance of each entity.

4. The second report provides the results of the 2017–18 final audits of the financial statements of all Australian Government controlled entities and the CFS.

Summary of audit findings and related issues

Entity internal controls

5. A central element of the ANAO’s financial statements audit methodology and the focus of the planning phase of ANAO audits is a sound understanding of an entity’s environment and internal controls. This understanding informs our audit approach, including the reliance placed on entity systems to produce financial statements that are free from material misstatement. To do this, the ANAO uses the framework contained in the Australian Auditing Standard 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment (ASA 315).

6. The interim audit phase includes an assessment of the effectiveness of each entity’s internal controls as they relate to the risk of misstatement in the financial statements. At the completion of our interim audits for the 26 entities included in this report we noted that key elements of internal control were operating effectively for 20 entities. For five entities2, except for particular finding/s outlined in chapter 3, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement. For the National Disability Insurance Agency, the ANAO identified a number of findings which reduced the level of confidence that could be placed on key elements of internal control and limited the assurance that could be obtained from that entity’s control framework.

Summary of audit findings

7. A total of 99 findings were reported to the entities included in this report as a result of interim audits, comprising of nil significant, 12 moderate and 87 minor findings. This is a decrease from the interim results of 2016–17 with a total of 114 findings reported comprising two significant, 22 moderate and 90 minor findings.

8. Eighty-three per cent of moderate findings continue to be in the areas of: compliance and quality assurance frameworks supporting program payments, revenue collection and financial reporting; and management of IT controls. These areas warrant further attention by entity management.

Reporting of gifts and benefits

9. The ANAO has reviewed the gifts and benefits policies of the entities in this report. The ANAO sees merit in the development of a whole of government gifts and benefits policy setting the minimum requirements for entities to include within their policies, to promote good practice across Commonwealth entities. A gifts and benefits policy incorporating regular review and monitoring increases accountability, while transparency would be enhanced through the publication of entity gifts and benefits registers on the internet. The maintenance of a central register may assist entities in meeting accountability and transparency obligations.

Reporting relating to compliance with finance law

10. The ANAO observed that entities had processes in place for monitoring and reporting instances of non-compliance with finance law. Following changes to the mandatory external reporting of non-compliance in 2015–16, there is evidence that some entities are reducing the level of internal reporting of non-compliance captured and reported to audit committees and accountable authorities.

Reporting and auditing frameworks

Summary of developments

11. There are no significant accounting standards changes for the Commonwealth public sector for 2017–18. Major changes in accounting standards will be applicable in 2018–19 and 2019–20 with the implementation of revised standards for financial instruments, revenue and leases. The majority of entities included in this report have indicated that they are still in the planning stage of transition to the new standards with approximately half of entities having both updated accounting policies and transition plans for standards expected to have a material impact.

Cost of this report

12. The cost to the ANAO of producing this report is approximately $405,000.

1. Summary of audit findings and related issues

Chapter coverage

This chapter provides:

- an overview of the ANAO’s audit approach to financial statements audits;

- a summary of observations regarding the internal control environments of the entities included in this report;

- a summary of audit findings identified at the conclusion of the interim audit; and

- observations relating to: the establishment and monitoring of gifts and benefits policies; and reporting relating to compliance with finance law.

Conclusion

Key to our audit process is our assessment of entities’ internal control frameworks as they apply to financial reporting. An effective internal control framework provides the ANAO with a level of assurance that entities are able to prepare financial statements that are free from material misstatement. At the completion of our interim audits for the 26 entities included in this report we noted that key elements of internal control were operating effectively for 20 entities. For five entitiesa, except for particular finding/s outlined in chapter 3, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement. For the National Disability Insurance Agency, the ANAO identified a number of findings which reduced the level of confidence that could be placed on key elements of internal control and limited the assurance that could be obtained from that entity’s control framework.

A total of 99 findings were reported to the entities included in this report as a result of interim audits, comprising of nil significant, 12 moderate and 87 minor findings. This is a decrease on the interim audit results of 2016–17 with a total of 110 findings reported comprising two significant, 22 moderate and 90 minor findings.

Eighty-three per cent of moderate findings continue to be in the areas of: compliance and quality assurance frameworks supporting program payments, revenue collection and financial reporting; and management of IT controls, particularly the management of privileged users. These areas warrant further attention by entity management.

The ANAO has reviewed the gifts and benefits policies of the entities in this report. The ANAO sees merit in the development a whole of government gifts and benefits policy setting the minimum requirements for entities to include within their policies, to promote good practice across Commonwealth entities. A gifts and benefits policy incorporating regular review and monitoring increases accountability, while transparency would be enhanced through the publication of entity gifts and benefits registers on the internet. The maintenance of a central register may assist entities in meeting accountability and transparency obligations.

The ANAO observed that entities had processes in place for monitoring and reporting instances of non-compliance with finance law. Following changes to the mandatory external reporting of non-compliance in 2015–16, there is evidence that some entities are reducing the level of internal reporting of non-compliance captured and reported to audit committees and accountable authorities.

Note a: The Departments of: Communications and the Arts; Defence; Home Affairs; the Prime Minister and Cabinet; and the Australian Taxation Office.

Introduction

1.1 The ANAO publishes an Annual Audit Work Program (AAWP) which reflects the ANAO’s strategy and deliverables for the forward year. The purpose of the AAWP is to inform the Parliament, the public and government sector entities of the planned audit coverage for the Australian Government sector by way of financial statements audits, performance audits and other assurance activities.

1.2 The financial statements audit coverage, as outlined in the AAWP, includes presenting two reports to the Parliament addressing the outcomes of the financial statements audits of Australian Government entities and the Consolidated Financial Statements of the Australian Government (CFS). These reports provide Parliament with an independent examination of the financial accounting and reporting of public sector entities.

1.3 This report focuses on the results of the interim audits of 26 entities.3 This includes a review of the governance arrangements related to entities’ financial reporting responsibilities and an examination of the relevant internal controls, including information technology system controls, that support the preparation of financial statements that are free from material misstatement.

1.4 The second report presents the final results of the financial statements audits of the CFS and all Australian Government entities.

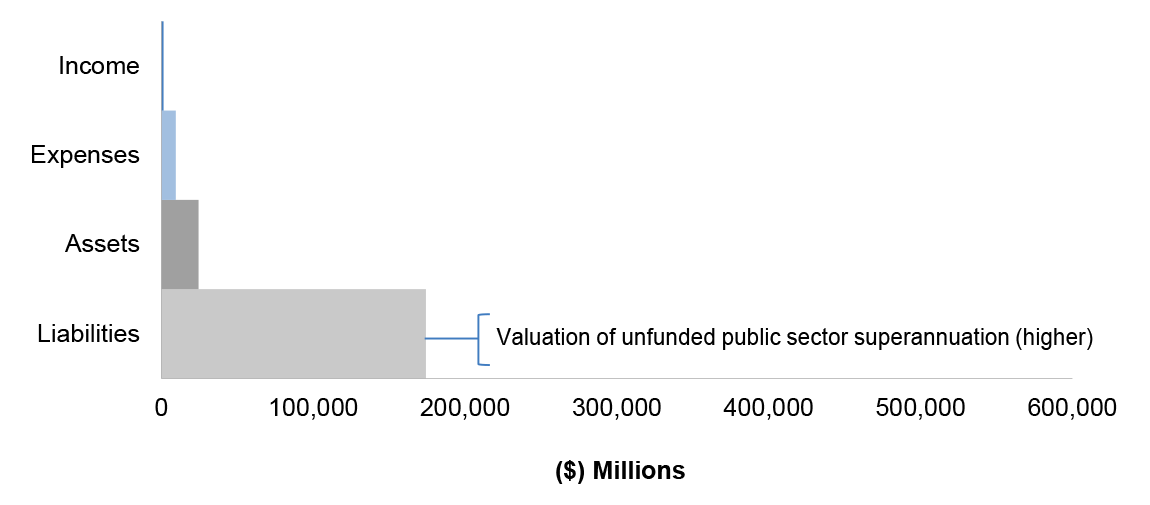

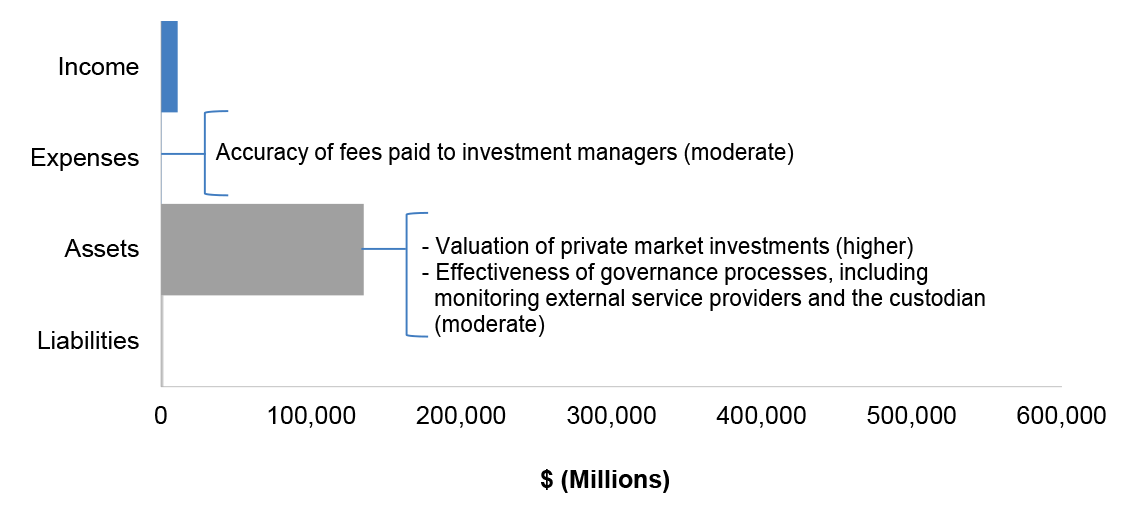

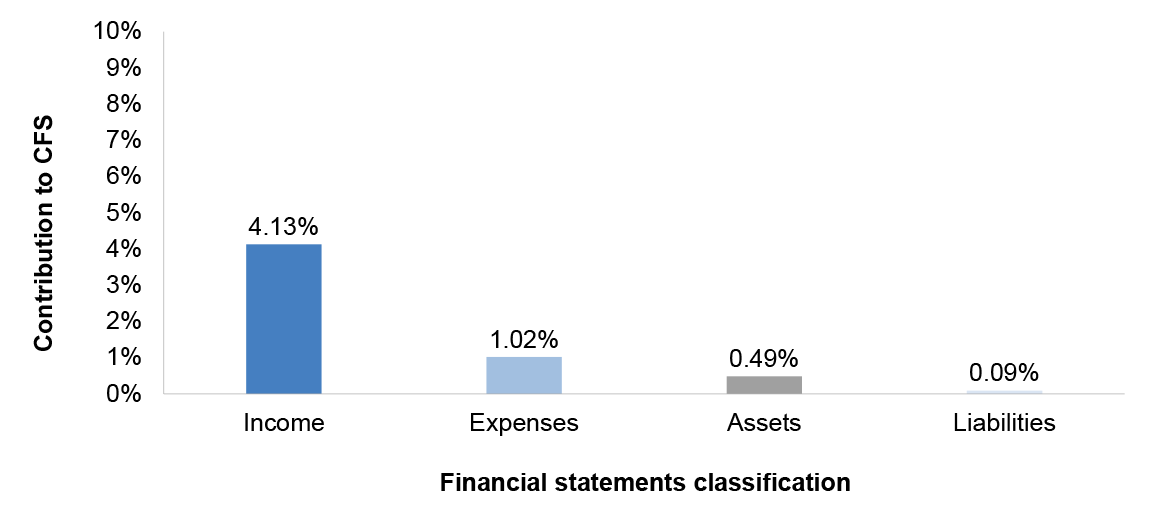

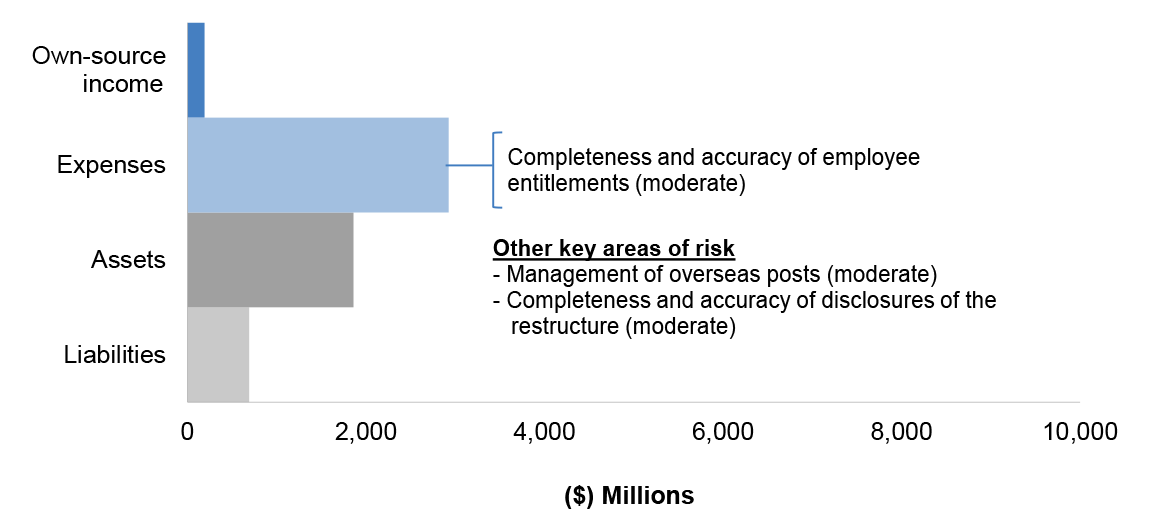

1.5 The entities included in this report are those entities that contribute significantly to the three sectors of the CFS: the General Government Sector (GGS), Public Non-Financial Corporation (PFNC) sector and Public Financial Corporation (PFC) sector. A listing of these entities is provided in Appendix 1.

1.6 The ANAO conducts its financial statements audits in four phases: planning, interim, final and completion. Figure 1.1 outlines the key elements of each phase.

Figure 1.1: ANAO financial statements audit process

1.7 Accountable authorities4 of all Commonwealth entities and companies subject to the Public Governance, Performance and Accountability Act 2013 (PGPA Act) are required to govern the entity in a way that promotes the proper use and management of public resources, the achievement of the purposes of the entity and the entity’s financial sustainability.5 This requires the development and implementation of effective corporate governance arrangements and internal controls designed to meet the individual circumstances of each entity. These processes also assist in the orderly and efficient conduct of the entity’s business, and compliance with applicable legislative requirements, including the preparation of annual financial statements that present fairly the entity’s financial position, financial performance and cash flows.

1.8 A central element of the ANAO’s financial statements audit methodology, and the focus of the planning phase of the ANAO audits, is a sound understanding of an entity’s environment and internal controls relevant to assessing the risk of material misstatement in the financial statements. This understanding informs the ANAO’s audit approach, including the reliance that may be placed on entity systems to produce financial statements that are free from material misstatement. The interim phase of the audit assesses the operating effectiveness of controls. In the final audit phase the ANAO completes its assessment of the effectiveness of controls for the full year, undertakes detailed testing of material balances and disclosures in the financial statements, and finalises its audit opinion on entities’ financial statements.

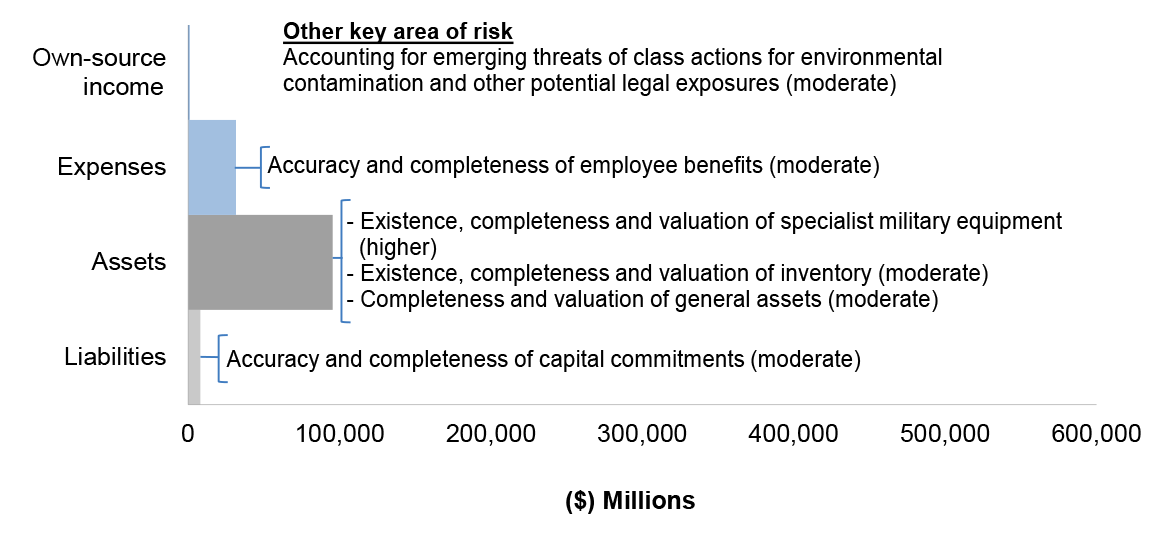

1.9 The auditor’s understanding of the entity, its environment and its controls, helps the auditor design the work needed and respond to risks that bear on financial reporting. The key areas of financial statements risks identified through this planning approach are discussed in chapter 3 for each entity included in this report.

1.10 In accordance with generally accepted auditing practice, the ANAO accepts a low level of risk that the audit will fail to detect that the financial statements are materially misstated. This low level of risk is accepted because it is too costly to perform an audit that is predicated on no level of risk. Specific audit procedures are performed to ensure that the risk accepted is low. These procedures include: obtaining knowledge of the entity and its environment; reviewing the operation of internal controls; undertaking analytical reviews, testing samples of transactions and account balances; and confirming significant year end balances with third parties.

Understanding entities and their environments

1.11 The ANAO uses the framework in ASA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment to consider the impact of different elements of an entity’s internal controls that support the preparation of financial statements. This approach provides a basis for designing and implementing responses to the assessed risk of material misstatement. Figure 1.2 outlines these elements.

Figure 1.2: Elements of entity internal controls

Source: ASA 315 Identifying and assessing the risk of material misstatement through understanding the entity and its environment, paragraph A59.

1.12 This chapter discusses each of these elements and outlines observations based on the ANAO’s review of aspects of each entity’s internal controls, relevant to the risk of material misstatement to the financial statements, including the detailed results of the interim audits.

1.13 At the completion of our interim audits for the 26 entities included in this report we noted that key elements of internal control were operating effectively for 20 entities. For five entities6, except for particular finding/s outlined in chapter 3, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement. For the National Disability Insurance Agency, the ANAO identified a number of findings which reduced the level of confidence that could be placed on key elements of internal control and limited the assurance that could be obtained from that entity’s control framework.

1.14 The key elements of internal controls for the full financial year will be assessed in conjunction with additional audit testing during the 2017–18 final audits.

Control environment

1.15 The PGPA Act sets out the requirements to establish and maintain systems relating to risk and control. Division 2, section 16 of the PGPA Act states that:

The accountable authority of a Commonwealth entity must establish and maintain:

- an appropriate system of risk oversight and management for the entity; and

- an appropriate system of internal control for the entity;

including by implementing measures directed at ensuring officials of the entity comply with finance law.7

1.16 In assessing an entity’s control environment that supports the preparation of financial statements that are free from material misstatement, the ANAO reviews aspects of the governance structures. The ANAO considers whether management has established frameworks and processes that promote positive attitudes, awareness and actions concerning the entity’s internal controls and their importance in the entity. The main elements reviewed included: governance structures relevant to the preparation of the financial statements; audit committee and assurance arrangements; and systems of authorisation, processes for recording financial transactions.

1.17 All entities included in this report had established executive management structures that met at least monthly, in the form of executive committees and sub-committees, supporting financial decision making at the strategic and operational levels.

1.18 Consistent with previous years, consideration of financial reporting was included on the agendas of all 26 entities’ executive and audit committees. The financial information provided to the entities’ executives was supplemented by non-financial operational information.

1.19 Clear accountability structures are important in establishing a strong internal control environment for the purposes of preparing the financial statements. The involvement of those charged with governance is an important element of these structures. Just as important is ensuring that staff at all levels understand their own role in the control framework. This can be achieved through the issuance of accountable authority instructions8, and delegation instruments. All entities had established accountable authority instructions and delegations reflecting current business arrangements.

Audit committees

1.20 The PGPA Act9 requires audit committees to be established for Commonwealth entities and Commonwealth companies. An independent audit committee is a fundamental principle of good governance.10 The audit committee plays a key role in assisting the accountable authority to fulfil its governance, risk management and oversight responsibilities through the provision of independent assurance and advice.

1.21 Section 17 of the Public Governance Performance and Accountability Rule 2014 (PGPA Rule) sets out the minimum requirements relating to the audit committee of a Commonwealth entity. Key requirements of the PGPA Rule include:

- A written charter, set by the accountable authority, determining the functions of the audit committee for the entity. These functions must include reviewing the appropriateness of the accountable authority’s: financial reporting; performance reporting; system of risk oversight and management; and system of internal control for the entity.

- Membership of the committee to include at least three persons with appropriate qualifications, knowledge, skills or experience to assist the committee to perform its functions and a majority of committee members must be independent of the entity.

- Persons that must not be a member of the audit committee: the accountable authority or, if the accountable authority has more than one member, the head; the Chief Financial Officer; and the Chief Executive Officer.

1.22 The ANAO observed that all entities had established audit committees consisting of a majority of members which were assessed by the entity to be independent. Twenty-two entities had appointed an independent audit committee chair for the full financial year with the remaining four entities appointing independent chairs during the financial year.11

1.23 All entities included in this report had established an audit committee and had developed and endorsed an audit committee charter which set out the responsibilities required by the PGPA Rule. These entities have met the minimum requirements set out in the PGPA rule for the establishment of audit committees in relation to financial reporting.

Reporting of gifts and benefits

1.24 Section 27 of the PGPA Act, Duty in relation to use of position, states than an official of a Commonwealth entity must not improperly use his or her position to gain, or seek to gain, a benefit or an advantage for himself or herself or any other person.

1.25 The practical guide APS Values and Code of Conduct in Practice produced by the Australian Public Service Commission notes that:

The acceptance of a gift or benefit that is connected with an employee’s employment can create a real or apparent conflict of interest that should be avoided.12

All valuable gifts or benefits should be registered. Any gift accepted by an employee because of their employment becomes the property of the agency, unless there are agency policies to the contrary.13

1.26 Accepting gifts and benefits from customers, suppliers, visiting delegates or professional bodies exposes the public service to real or perceived conflicts of interest. There is increasing sensitivity to the appropriateness of accepting gifts and benefits as an officer in an organisation or a government entity. There may be instances when it is inappropriate to refuse a gift or benefit, for example, if it would cause cultural offence to refuse. In those circumstances transparency is maintained through reporting the receipt of the gift or benefit and the judgements made in accepting the gift or benefit.

1.27 A number of Australian States and Territory governments provide guidance to the government entities within their jurisdiction on the minimum requirements for acceptance, retention, reporting and monitoring of gifts and benefits.14 There is no whole of government guidance issued to Commonwealth entities that details the minimum requirements to report the offer and acceptance of gifts and benefits and the information to be included in a register.

1.28 A gifts and benefits policy is an important component of a robust control environment and assists entities with demonstrating compliance with the APSC’s guidance for all valuable gifts and benefits to be registered. The ANAO has confirmed that all entities included in this report have published a gifts and benefits policy that is available to all staff on their intranet. A summary of these policies is included in appendix 2. Policies for 19 entities have been updated within the last two financial years.15

1.29 Each policy outlines the entity’s requirement to report gifts accepted and the approval process for the retention of gifts or benefits by the recipient. The ANAO has reviewed the entities’ policies and has made the following observations.

- All entities require that gifts and benefits accepted are reported as soon as possible with five entities setting a maximum timeframe by when items need to be reported. These five entities require gifts and benefits be reported within 10 to 14 days of the receipt of a gift or benefit16 or by the end of the month in which the gift or benefit was received.17

- Twenty-five entity’s policies require employees to obtain approvals from their supervisor to personally retain the gift.18

- The gifts and benefits policies for 25 entities include a requirement to provide written notification of gifts and benefits above set thresholds. The policy of the remaining entity does not specify whether receipt of gifts and benefits needs to be notified in writing.19 The reporting thresholds set by entities varies as follows: five require written notification of the receipt of all gifts and benefits irrespective of value; one requires written notification of all gifts which are not inconsequential20; and 19 specify a dollar threshold above which all gifts and benefits are required to be disclosed in writing. The thresholds set by entities range from $20 to $250.

1.30 An important element of a gifts and benefits policy is that it provides a process for monitoring and managing the gifts and benefits offered and/or accepted by officers within the entity. This can be supported by a centralised register to enable an assessment of the effectiveness of implementation of an entity’s policies; the types and frequency of gifts and benefits received by an entity; and the identification of potential conflict of interest risks. Sixteen entities maintain a centralised register. The remaining entities21 maintain registers within divisions/branches or geographical locations with no consolidation at the whole of entity level.

1.31 In most cases entity policies require the recipient to determine the value of the gift or benefit being declared and provide supporting information to the approver. Four entities22 have specified a role within the organisation, independent of the recipient, to determine the value of the gift or benefit. All entities record gifts and benefits in the asset register if the value is above the entity’s asset capitalisation threshold. Upon capitalisation those assets are subject to the entity’s revaluation policies and stocktake procedures. Two entities require a stocktake to be completed of items recorded on the gifts and benefits register that have not been capitalised.23

1.32 The ANAO sees merit in the development of a whole of government gifts and benefits policy setting the minimum requirements for entities to include within their policies, to promote good practice across Commonwealth entities. A gifts and benefits policy incorporating regular review and monitoring increases accountability, while transparency would be enhanced through the publication of entity gifts and benefits registers on the internet. The maintenance of a central register may assist entities in meeting accountability and transparency obligations.

Risk assessment processes

1.33 Section 16 of the PGPA Act sets out an accountable authority’s responsibilities in regard to the establishment of appropriate risk oversight and management in an entity. An understanding of an entity’s risk assessment process is essential to an effective and efficient financial statements audit. The ANAO reviews how entities identify risks relating to financial statements, how these risks are managed and considers the risk of material misstatement of an entity’s financial statements.

1.34 All entities reviewed had a risk management process to develop and update risk management plans at the organisational and work area levels. In addition, each entity had developed processes for the identification and notification of risks relevant to financial statements preparation either as part of the overall risk management plan, or through a targeted risk identification exercise. The monitoring of risks, and the entities’ implementation of risk management strategies, was typically assigned to either an executive committee and/or the audit committee.

Fraud control management

1.35 The Commonwealth Fraud Control Framework (the Framework) outlines the principles for fraud control within the Australian Government and sets minimum standards to assist entities in carrying out their responsibilities to combat fraud against government programs. As with risk management plans, fraud control plans need to be reviewed regularly and updated when significant changes to roles or functions occur, so that they reflect an entity’s current fraud risk and control environment. There are benefits in entities assessing fraud risks as part of risk management processes.

1.36 The importance of entities establishing effective fraud control arrangements is recognised in section 10 of the PGPA Rule, which specifies that accountable authorities must develop and implement a fraud control plan for the entity. The Framework requires entities to conduct fraud risk assessments regularly and when there is a substantial change in the structure, functions or activities of the entity.24

1.37 In assessing the risks of material misstatement of an entity’s financial statements, the ANAO considers misstatements arising from both fraud and error. In respect of fraud, two types of intentional misstatements are relevant – misstatements arising from fraudulent financial reporting and misstatements resulting from the misappropriation of assets. ASA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of a Financial Report contains requirements for identifying the risks of material misstatement due to fraud, and designing audit procedures to detect such misstatement.

1.38 As part of the 2017–18 interim audits, the ANAO noted that all entities included in this report had established a fraud control plan that had been reviewed within the last two years. Entities had also assigned responsibility for the oversight and monitoring of fraud control strategies and initiatives, to specified fraud and governance roles or dedicated branches and the audit committee.

Monitoring of controls

1.39 Entities undertake many types of activities as part of their monitoring of control processes, including external reviews, self-assessment processes, post-implementation reviews and internal audits. The level of review of these activities by the ANAO is determined through a risk assessment approach that takes into consideration the nature, extent and timing of each activity and the activities application to the preparation of the financial statements.

Internal Audit

1.40 As part of its financial statements audit coverage, the ANAO reviews the activities of internal audit and gains an understanding of its role and activities in the entity. Where an internal audit function has been established it can play an important role in providing assurance to the accountable authority that the internal control framework is operating effectively. The ANAO encourages entities to identify opportunities for internal audit coverage of key financial systems and controls as a means of providing increased assurance to accountable authorities to support their opinion on the entity’s financial statements.

1.41 The ANAO considers the extent to which it may be able to use the work of internal audit in a constructive and complementary manner, noting that this will vary between entities and is more likely to occur where internal audit work is focused on financial controls and legislative compliance. If the ANAO expects to use the work of internal audit, in accordance with ASA 610 Using the Work of Internal Auditors, the ANAO is required to assess whether internal audit has appropriate organisational status and relevant policies and procedures to support their objectivity; an appropriate level of competence; and whether they apply a systematic and disciplined approach in the execution of their work including quality control.

1.42 When it is determined that the work of internal audit can be used to support an effective audit approach the ANAO will perform audit work to confirm its adequacy to support the external audit. This will include confirmation that the scope of the work is appropriate, that there is sufficient evidence to support the conclusions drawn and selected re-performance of internal audit’s testing.

1.43 The ANAO observed that, for the entities included in this report, internal audit coverage is based on an internal audit plan that is aligned with entities’ risk management plans and includes a combination of audits that address assurance, compliance, performance improvements and IT systems reviews. In addition, suggested topics from management, audit committees and external influences, such as the ANAO’s planned performance and financial statements coverage, are factors considered in the development of internal audit work plans.

Reporting relating to compliance with finance law

1.44 Entities are required to comply with the finance law25 and this would lead to an expectation that entities are able to identify instances of non-compliance. Instances of non-compliance should be assessed to determine whether they indicate new or increased areas of risk for an entity. The PGPA Act sections 19 and 91 require accountable authorities of Commonwealth entities, to give the responsible Minister, reasonable notice, of any significant issue that may affect the entity. Prior to 2015–16, general government sector entities were required to submit an annual Certificate of Compliance to the Minister for Finance and the responsible Minister summarising all non-compliance with the PGPA Act Framework. From 2015–16, the Department of Finance changed the compliance reporting process to require entities to report only significant non-compliance with finance law to both the Minister for Finance and the responsible Minister.

1.45 To support the change in requirements, the Department of Finance issued guidance in relation to reporting of significant non-compliance through the Resource Management Guide 214 Notification of significant non-compliance with finance law (PGPA Act, section 19) (RMG 214). The guide outlines factors which may be considered when determining whether significant non-compliance occurred including:

- failure to comply with the duties of accountable authorities (sections 15 to 19 of the PGPA Act);

- serious breaches of the general duties of officials (sections 25 to 29 of the PGPA Act) including any fraudulent activity by officials;

- systemic issues reflecting internal control failings or high volume instances of non-compliance; and

- non-compliance issues that are likely to impact on the entity’s financial sustainability.

1.46 RMG 214 notes that the accountable authority should consider their entity’s environment when determining whether instances of non-compliance are significant. As part of the interim audits the ANAO considered entities’ application of RMG 214.26

1.47 Entities advised that professional judgement is applied and consideration given, to the nature and volume of breaches when assessing significance.27 The ANAO observed that three entities28 included a specific financial impact threshold for which all non-compliance above the threshold would be considered significant within their formal definition of significant non-compliance.

1.48 As part of the Audit Committee’s governance role the committee generally has oversight of the process for collating instances of non-compliance and the subsequent assessment regarding their significance. The Departments of: Foreign Affairs and Trade; and the Prime Minister and Cabinet provides only those breaches assessed as significant to their audit committees. The Department of Infrastructure, Regional Development and Cities did not provide a paper to the audit committee on its 2016–17 compliance with finance law. In addition the Department of Foreign Affairs and Trade’s policy requires only significant non-compliance to be reported to the audit committee and the accountable authority, therefore a complete listing of non-compliance breaches was not compiled. As a result, DFAT has been excluded from the analysis of non-compliance summarised in Figure 1.3.

1.49 In addition to notifying the relevant Minister of any significant issues which occur, the entity must also report any significant non-compliance in its annual report in line with the PGPA Rule section 17AG. The Department of Defence was the only entity to report an instance of significant non-compliance with finance law in their 2016–17 annual report as outlined below.

The Department of Defence reported 29 instances of significant noncompliance with the finance law, for circumstances proven as fraud committed by an official and addressed by Defence authorities through criminal, disciplinary or administrative action. Significant fraud cases are also reported separately to the Minister for Defence in accordance with reporting requirements set out in the Commonwealth Fraud Control Framework.29

1.50 Entities undertake a range of activities to identify instances of non-compliance and support their assessments of whether identified breaches meet the definition of significant breaches. These activities include self-reporting, internal assurance activities and questionnaires completed by officers holding delegations. Through these processes, in 2016–17 the entities included in this report30 identified a total of 3,185 instances of non-compliance. Two entities reported no non-compliance31, three entities reported 50 per cent of the non-compliance32 and the remaining 19 entities each reported between one and nine per cent of the non-compliance.

1.51 Figure 1.3 provides the ANAO analysis of instances of non-compliance by category as identified by entities in 2016–17.

Figure 1.3: Non-compliance identified during 2016–17 by entities

Source: ANAO analysis of non-compliance identified by entities.

1.52 Further details of the areas of non-compliance reported in 2016–17 are detailed below.

- Of the non-compliance with Commonwealth Procurement Rules, 95 per cent of the breaches related to rule 7.16 which requires entities to report contracts entered into or amended over $10,000 on AusTender within 42 days. The following three entities identified the highest levels of non-compliance in this area: the Department of Home Affairs (540 instances); the Department of Finance (143 instances); and the Department of Agriculture and Water Resources (108 instances).

- Section 23 of the PGPA Act33 provides the powers for accountable authorities of non-corporate entities to enter into or vary contracts, agreements or deeds of understanding relating to the affairs of the entity and approve commitment of funds. Of the instances of non-compliance in 2016–17: 392 were instances were identified by the Department of Defence; 194 instances by the Department of Human Services; and 132 instances by the Department of Agriculture and Water Resources.

- The instances of non-compliance of the PGPA Act excluding section 23 related to the misuse of corporate credit cards and the commitment of expenditure.

- The non-compliance with the PGPA rule relates to failure to document the approvals to enter into arrangements under section 23 of the PGPA Act and banking monies within 5 days from receipt.

- Non-compliance with the Commonwealth Grant Rules and Guidelines resulted from entities not meeting the requirement to publish grants on the website within 14 days.

1.53 The ANAO has noted that there are divergent practices in respect to determining the significance of identified non-compliance breaches. Following the changes to the mandatory external compliance reporting process in 2015–16, there is evidence that some entities are reducing the level of internal reporting of non-compliance captured and reported to audit committees and accountable authorities. The collation of this information, promotes greater transparency and enables the entity’s management to assess risks and determine training requirements or changes to procedures required to address trends.

Information systems

1.54 A review of the entity’s information system and related controls forms a significant part of the ANAO’s audit examination of internal controls. Information system controls include entity-wide general controls that establish an entity’s IT infrastructures, policies and procedures as well as specific application controls that validate, authorise, monitor and report financial and human resource transactions.

1.55 As discussed at paragraph 1.11, ASA 315 provides guidance on identifying and assessing the risks of material misstatement of financial statements, including risks associated with an entity’s IT environment. Where those risks are applicable to its particular business and operational circumstances, it is expected that an entity will implement appropriate controls to mitigate them, and these controls are assessed by the ANAO.

1.56 Table 1.1 outlines the areas of focus used by the ANAO in assessing an entity’s information system controls, including common controls tested to determine the effectiveness of those systems in supporting complete and accurate financial statements reporting.

Table 1.1: Information system controls – areas of focus

|

Area of focus |

Control element |

Control subject to ANAO assessment |

|

IT General controls |

IT security |

|

|

IT change management |

|

|

|

Application controls |

Financial management information systems (FMIS) Human resources information systems (HRMIS) |

|

|

Business continuity arrangements |

Significant systems supporting financial reporting (including FMIS & HRMIS) |

|

Source: ANAO compilation.

1.57 Observations from the ANAO’s interim audit phase relating to entities’ information system controls are provided under the IT Control environment section included in Control activities below. Refer to paragraphs 1.65 to 1.91.

Control activities

1.58 As part of the interim audits, the ANAO assesses the effectiveness of key controls identified during the planning stages. This assessment is made at a point in time and provides the Parliament and entities with an insight into weaknesses which have the potential to impact the financial statements at year end. The broad categories of control activities assessed by the ANAO include:

- IT control environment;

- compliance and quality assurance frameworks;

- accounting and control of non-financial assets;

- revenue, receivables and cash management processes;

- human resources financial processes; and

- purchases and payables management.

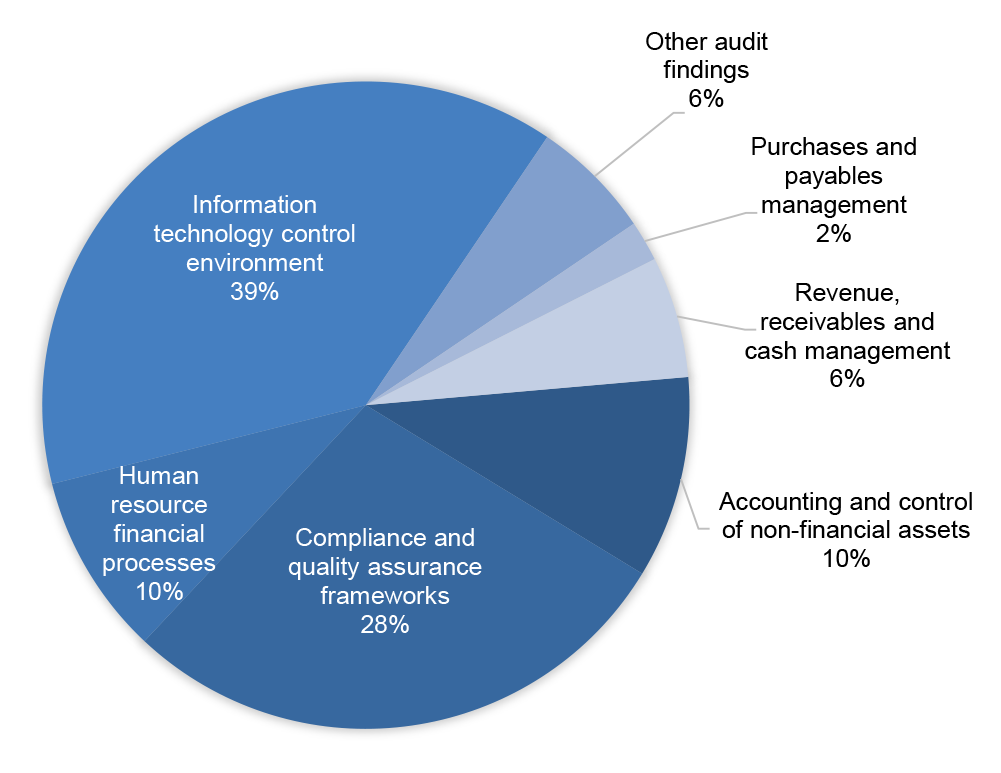

1.59 Figure 1.4 presents the percentage of total audit findings by category, reported for the 26 entities considered in this report during the 2017–18 interim audits.

Figure 1.4: 2017–18 interim audit findings – by category

Source: ANAO compilation of interim findings.

1.60 The following section provides a summary of interim audit findings identified in these categories across the past four financial years, as well as making observations regarding common weaknesses identified in the 2017–18 interim audits.

Interim audit findings

1.61 The ANAO rates audit findings according to the potential business or financial management risk posed to the entity. The rating scale is presented in Table 1.2.

Table 1.2: Findings rating scale

|

Rating |

Description |

|

Significant (A) |

Issues that pose a significant business or financial management risk to the entity. These include issues that could result in a material misstatement of the entity’s financial statements. |

|

Moderate (B) |

Issues that pose a moderate business or financial management risk to the entity. These may include prior year issues that have not been satisfactorily addressed. |

|

Minor (C) |

Issues that pose a low business or financial management risk to the entity. These may include accounting issues that, if not addressed, could pose a moderate risk in the future. |

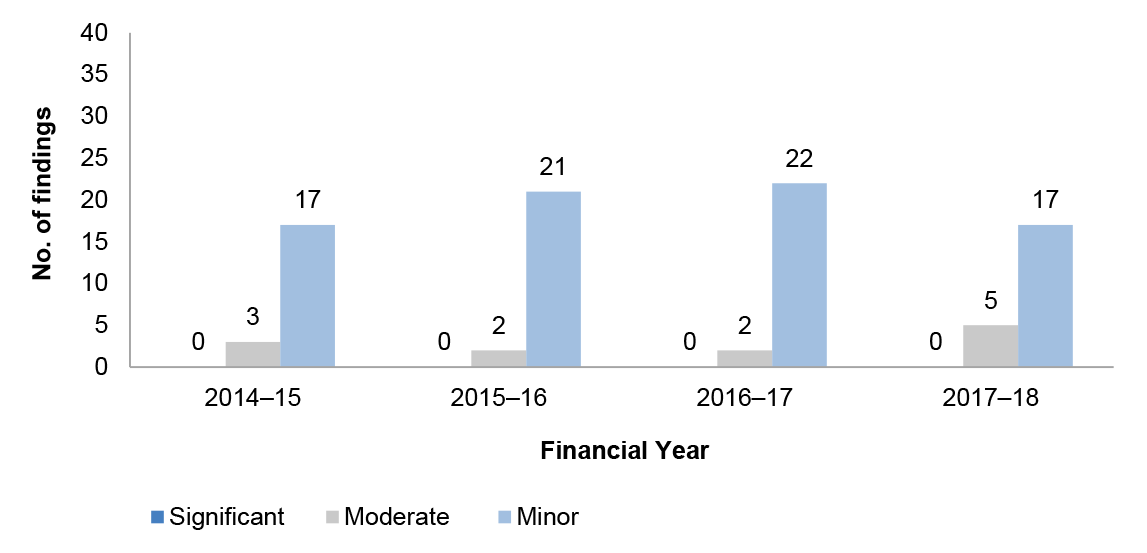

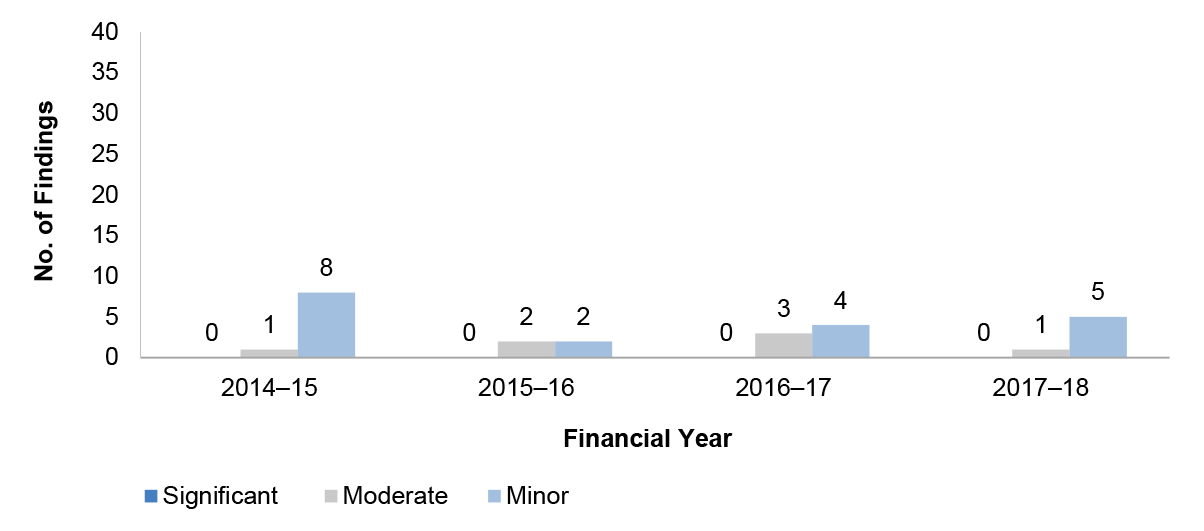

1.62 A summary of all significant, moderate and minor audit findings identified at the conclusion of the interim audits across the past four financial years is presented in Figure 1.5 below.34

Figure 1.5: Aggregate audit findings

1.63 The ANAO has observed a decrease of approximately 13 per cent in total audit findings in 2017–18 when compared with the 2016–17 interim period. Eighty-three per cent of moderate findings are in the areas of: compliance and quality assurance frameworks supporting program payments, revenue collection and financial reporting; and management of IT controls, particularly the management of privileged users.

1.64 Table 1.3 summarises the number of significant, moderate and minor findings in each category of control activity and common weaknesses noted in each area.

Table 1.3: Significant, moderate and minor audit findings by category

|

Category |

Significant |

Moderate |

Minor |

Main areas of weakness |

|

IT control environment |

– |

5 |

33 |

|

|

Compliance and quality assurance frameworks |

– |

5 |

23 |

|

|

Accounting and control of non-financial assets |

– |

1 |

9 |

|

|

Revenue, receivables and cash management |

– |

– |

6 |

|

|

Human resources financial processes |

– |

– |

9 |

|

|

Purchases and payables management |

– |

– |

2 |

|

|

Other audit findings |

– |

1 |

5 |

|

|

Total |

– |

12 |

87 |

99 |

Source: ANAO compilation of interim findings.

Information Technology control environment

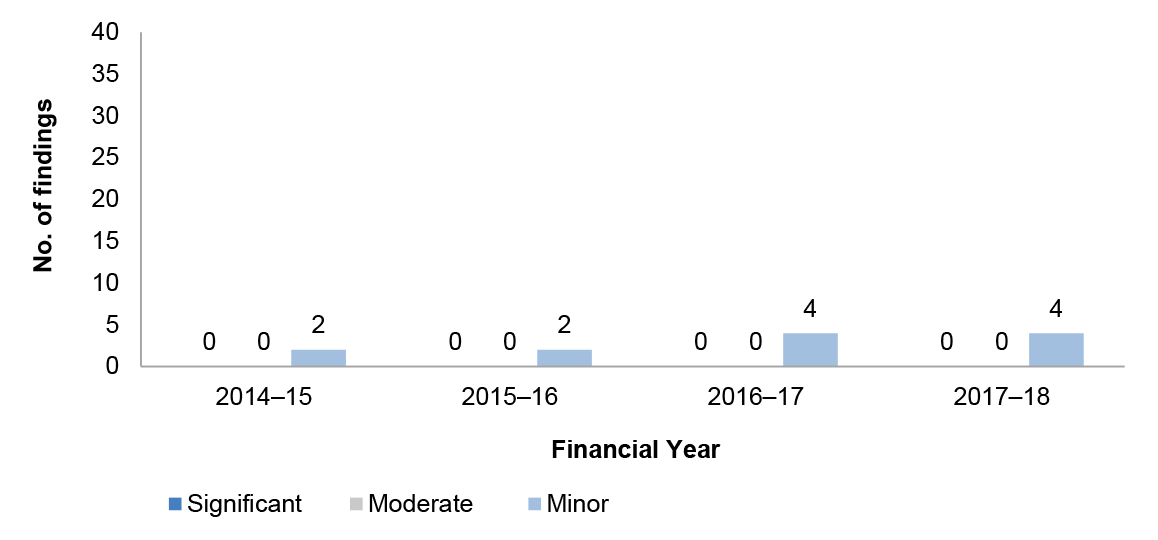

1.65 As described in paragraph 1.54, the review of information systems and related controls is an integral part of an entity’s control environment. Figure 1.6 demonstrates the trends in interim audit findings related to entities’ overall IT control environments from 2014–15 to 2017–18.

1.66 At the time of this report, testing of the operating effectiveness of IT controls had not been completed for three entities35 and therefore those results are not reflected in this summary.

Figure 1.6: IT control environment findingsa

Note a: One moderate and two minor audit findings were reported in 2014–15 and three minor audit findings were reported in 2015–16 which do not relate to entities’ IT general controls. In 2017–18 one finding relates to both change and security. As a result, the number of audit findings reported in paragraph 1.70 - 1.91 does not fully align to the number of findings reported in Figure 1.6

1.67 Findings related to entities’ IT control environments represent 33 per cent of total findings identified during the 2017–18 interim period. IT control environment findings continue to represent the highest proportion of all findings, as observed in previous years.

1.68 Five moderate findings were reported in 2017–18, two of which remain unresolved from 2016–17. 36

1.69 An overview of the findings reported at the conclusion of the 2017–18 interim audits for the entities included in this report is provided below, relating to each of the information system control elements:

- IT security;

- IT change management;

- IT application controls; and

- business continuity management

IT security

1.70 IT security is concerned with protecting an entity’s information assets from internal and external threats. It includes controls to prevent or detect unauthorised access to systems, programs and data. In the context of the financial statements audit, the focus is on the financially significant systems and data only.

1.71 The key controls that address risks relating to IT security and that are assessed by the ANAO as part of the interim audit are:

- IT security governance;

- general and privileged user access; and

- monitoring and reporting.

1.72 Figure 1.7 illustrates the trends in findings observed by the ANAO in entities’ IT security arrangements between 2014–15 and 2017–18.

Figure 1.7: IT security findings

1.73 Consistent with previous years IT security continues to be the component within the IT control environment with the largest number of findings reported. The number of moderate findings has increased from two in 2016–17 to five in 2017–18. Further details of the moderate findings is detailed in chapter 3.37 Findings related to:

- management of segregation of duties conflicts;

- removal of user access when it is no longer required;

- logging and monitoring of privileged user activity; and

- blocking privileged users from accessing the internet.

1.74 Terminating a user account when the user no longer has a requirement to access it, such as upon departure from an entity, can prevent unauthorised use. Entities must remove or suspend user access on the same day a user no longer has a legitimate business requirement for its use. 38 Of the findings raised in this category seven related to entities not removing user access in a timely manner.

1.75 Users with administrative privileges, commonly referred to as privileged user access, are able to make significant changes to IT systems configuration and operation, bypass critical security settings and access sensitive information. As part of reviewing IT security arrangements, the ANAO examined different groups of privileged users, including:

- application administrators, sometimes referred to as super users;

- database administrators;

- system administrators; and

- network or domain administrators.

1.76 To reduce the risks associated with this access, the Australian Government Information Security Manual (ISM) requires that privileged user access be appropriately restricted and when provided, that the access is logged, regularly reviewed and monitored. The ANAO reported two moderate39 and four minor findings related to entities that had not implemented adequate logging and monitoring procedures over privileged user accounts.

1.77 Restricting privileged accounts from accessing email and the internet minimises opportunities for these accounts to be compromised. Entities must prevent privileged accounts from accessing email and the internet.40 The ANAO reported five minor findings relating to entities that had not blocked privileged accounts from accessing the internet.

1.78 The findings within this category increase the risk of unauthorised changes being made to systems and data, or unauthorised data leakage. Entities should review their management of these areas in light of the recommendations of the ISM and the risks to their operational environment.

IT change management

1.79 IT change management provides a disciplined approach to making changes to the IT environment. It includes controls to prevent unauthorised changes being introduced, and to ensure that the implementation of authorised changes does not disrupt normal business operations.

1.80 Figure 1.8 illustrates the trends in findings identified by the ANAO in entities’ IT change management controls between 2014–15 and 2017–18.

Figure 1.8: IT change management findings

1.81 The ANAO observed that changes to entities’ IT environments were managed using a standardised process, usually based on the ITIL Framework.41 The moderate audit finding reported in 2017–18 relates to approved release of changes at the Department of Defence. Further detail regarding this can be found in chapter 3 at paragraphs 3.6.14 to 3.6.20. The minor findings related to tracking of changes through to completion. The ANAO notes that there has been an increase in the number of minor findings in this area, entities are encouraged to monitor the operating effectiveness of their IT control environments to mitigate risks.

IT application controls

1.82 All Australian Government entities rely on two key financial reporting systems in the preparation of financial information. These are the financial management information system (FMIS) and the human resource management information system (HRMIS).

1.83 Where appropriate to do so, the ANAO assesses entities’ key FMIS and HRMIS controls in view of their importance for financial reporting. Areas of focus include:

- changes to the systems or data that are not assessed through the entity’s IT change management system. These are changes that only affect the users of the FMIS or the HRMIS and are therefore often out of scope for the main change management process;

- controls over invoice payment and payroll processing; and

- management of general and privileged user access to the FMIS and HRMIS.

1.84 Figure 1.9 illustrates the trend in findings observed by the ANAO in relation to entities’ FMIS and HRMIS application controls between 2014–15 and 2017–18.

Figure 1.9: IT application control findings

1.85 Privileged user access in the FMIS or HRMIS includes the ability to bypass normal application controls or make changes to system settings and data. This access is often necessary to administer applications, and should be restricted and monitored to reduce the risk of errors or unauthorised activity. Six of the seven minor findings were in relation to entities’ management of application privileged user access.

1.86 Controls over payment processing support the accurate processing of payments to vendors and employees. Additionally, payment processing is an area that is particularly susceptible to fraud. One minor finding relating to securing payment files to prevent unauthorised modification was raised during the interim phase of the 2017–18 audits.

Business Continuity Management

1.87 Business Continuity is defined as the capability of an entity to continue delivery of products or services at acceptable predefined levels following a disruptive incident. It includes three key elements:

- effective back-up and recovery arrangements, to allow data to be recovered from current versions of key IT systems;

- business continuity planning, including the development, maintenance and testing of a business continuity plan for each key business area to enable the entity to continue operations while waiting for systems and data to be restored; and

- disaster recovery planning, including the development, maintenance and testing of a disaster recovery plan to enable IT systems to be recovered in line with defined business requirements.

1.88 The ANAO assesses entities’ business continuity arrangements in view of the potential for a disruptive event to impact on financial reporting.

1.89 Figure 1.10 illustrates the trend for findings identified by the ANAO in entities’ business continuity arrangements between 2014–15 and 2017–18.

Figure 1.10: Business continuity findings

1.90 All entities had business continuity and disaster recovery plans in place. Four entities received minor audit findings relating to not undertaking testing of their business continuity or disaster recovery plans.

1.91 Overall, the majority of IT controls continued to be effective in most entities included in this report during 2017–18. Consistent with observations in previous years, IT Security, particularly with regard to management of user access, continues to be an area requiring improvement to address the risk of inappropriate access to systems and data.

Cyber resilience

1.92 In addition to work performed as part of the financial statements audit, ANAO also reviews information systems and related controls as part of its program of performance audits. This year, the ANAO has also extended some of this assessment to the entities included in this report. Since 2013–14, the ANAO has conducted three performance audits to assess the cyber resilience of eleven different government entities.42 These audits assessed both IT general controls and the entities’ implementation of the mandatory Strategies to Mitigate Targeted Cyber Intrusions (the Top Four mitigation strategies) in the ISM43, which are required by the Protective Security Policy Framework (PSPF). A fourth audit in this series is being conducted as part of the 2017–18 Annual Audit Work Program.

1.93 All non-corporate Commonwealth entities are required to undertake an annual point in time self-assessment against the requirements of the PSPF. These requirements are divided into four categories:

- Governance, to implement and manage protective security protocols;

- Personnel Security, to ensure the suitability of personnel to access Australian Government resources;

- Information Security, to ensure the confidentiality, availability and integrity of all official information; and

- Physical Security, to ensure a safe working environment for employees, contractors, clients and the public, and to provide a secure environment for official assets.

1.94 Corporate Commonwealth entities and Commonwealth companies are not required to report on their compliance with the PSPF, however NBN Co Limited has elected to do so, and their results are included in this section.

1.95 Entities are required to report the results of the self-assessment to the relevant Portfolio Minister, with a copy to be sent to the Secretary of the Attorney-General’s Department and to the Auditor-General.

1.96 The Strategies to Mitigate Cyber Intrusions form part of INFOSEC 4, one of the mandatory requirements of the PSPF under Information Security.

1.97 Figure 1.11 summarises the 2017 PSPF compliance reporting by the entities included in this report that that have reported.44 Eleven entities reported that they were compliant, which is an increase from eight in the previous year. Seven entities reported partial compliance and five entities reported that they were not compliant.

Figure 1.11: Entity compliance with INFOSEC 4

Source: ANAO analysis.

1.98 Figure 1.12 summarises the 2017 PSPF compliance reporting by the entities included in this report that are required to report as well as corporate entities who have reported voluntarily. INFOSEC 4 continues to be the area of least compliance. This is consistent with the outcomes of the ANAO performance audits, which found that eight of the eleven entities assessed were not fully compliant with INFOSEC 4.

Figure 1.12: PSPF compliance comparison by mandatory requirement

Source: ANAO analysis

1.99 Not implementing the mandatory Top Four mitigation strategies reduces an entity’s ability to continue providing services while deterring and responding to cyber intrusions. It also increases the likelihood of a successful cyber intrusion. The recent ANAO reports in relation to cyber security include a number of recommendations to assist with this, which entities should review and implement where applicable.

Compliance and quality assurance frameworks

1.100 The business of government requires, in many circumstances, placing reliance on internal and external systems, parties and information in decision making processes. For this reason, the implementation of effective compliance frameworks, and processes that provide assurance regarding the completeness and accuracy of information, are integral to an entity’s internal control. Figure 1.13 demonstrates the trends in interim audit findings related to entities’ compliance and quality assurance frameworks from 2014–15 to 2017–18.

Figure 1.13: Compliance and quality assurance frameworks

1.101 There has been a reduction in the number of significant and moderate findings reported in 2017–18 compared to 2016–17. The two significant findings reported in the prior year have both been resolved. The significant finding relating to weaknesses in the child care compliance program administered by the Department of Education and Training was resolved during the 2016–17 final audit.45 The other significant audit finding related to the National Disability Insurance Agency and was resolved as part of the interim audit. This finding is outlined detail in chapter 3 at paragraphs 3.22.18 to 3.22.24.

1.102 The five moderate findings reported in 2017–18 related to weaknesses in: entities processes to obtain assurance over information sourced from third parties; and compliance frameworks supporting revenue collection and program payments.46

1.103 There has been an increase in the number of minor audit findings in comparison to the prior two financial years. The number of moderate and minor audit findings reported indicates a need for entities to focus greater attention on:

- maintaining effective governance over third party or joint service delivery arrangements;

- the risk management frameworks that support the effective management of risk in the delivery of programs; and

- implementing effective quality assurance processes over key financial statements inputs particularly those subject to professional judgement and uncertainty.

Accounting and control of non-financial assets

1.104 Entities control a diverse range of non-financial assets on behalf of the Commonwealth, with the main asset classes being land and buildings, specialist military equipment, leasehold improvements, infrastructure, plant and equipment, inventories and internally‐developed software.

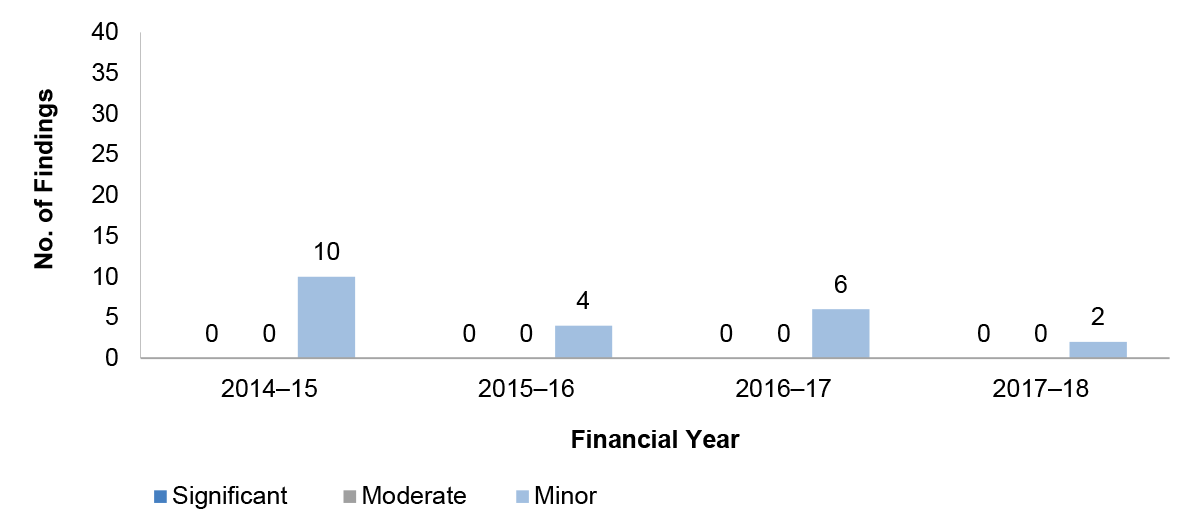

1.105 The number of audit findings related to entities’ controls in this area over the last four years is presented in Figure 1.14 below.

Figure 1.14: Accounting and control of non-financial assets audit findings

1.106 One moderate audit finding remains unresolved at the conclusion of the 2017–18 interim audit. This finding was first reported to the Department of Defence during the 2015–16 final audit and relates to the data integrity of the Specialist Military Equipment fixed asset register. Further detail regarding this findings can be found in chapter 3 at paragraphs 3.6.21 to 3.6.22.

1.107 The number of minor audit findings reported in 2017–18 has decreased compared with 2016–17. The nine minor audit findings reported in 2017–18 relate to the accuracy of entities; fixed asset registers; asset valuation; and stocktaking procedures. Of these unresolved audit findings two minor audit findings remain unresolved from 2013–14 and four from 2015–16.

Revenue, receivables and cash management

1.108 The key financial statements items related to revenue and receivables consist of Parliamentary appropriations, taxation revenue, recoveries, customs and excise duties and administered levies. Other revenue is also generated by entities from the sale of goods and services and a range of other sources including interest earned from cash funds on deposit. Cash management involves the collection and receipt of public monies and the management of official bank accounts.

1.109 Figure 1.15 outlines trends in findings related to revenue, receivables and cash management identified during interim phases between 2014–15 and 2017–18.

Figure 1.15: Revenue, receivables and cash management audit findings

1.110 There are no significant or moderate audit findings reported in 2017–18 and a reduction in the number of minor audit findings compared to 2016–17. During the 2017–18 interim audit phase, the ANAO observed weaknesses in entities’ reconciliation processes and controls supporting the completeness and accuracy of revenue reported.

Human resource financial processes

1.111 Human resources encompass the day-to-day management and administration of employee entitlements and payroll functions. Expenditure associated with employee benefits represents the largest departmental expenditure item for most entities and employee entitlement liabilities are typically the largest liability. It is therefore important for entities to establish robust controls in these areas to support complete and accurate payment and recording of transactions.

1.112 The number of audit findings reported in this category over the past four financial years is presented in Figure 1.16.

Figure 1.16: Human resources financial processes audit findings

1.113 The two moderate audit findings reported in 2016–17 related to weaknesses in the Department of Home Affairs and the National Disability Insurance Agency’s human resource management process. These findings were resolved during the 2016–17 final audit.47

1.114 Minor audit findings have increased in 2017–18 and relate to weaknesses identified in relation to commencements and terminations of employees and the monitoring of controls over payroll processing and reporting. Of these findings, three were identified as part of the 2016–17 interim audits.

Purchases and payables management

1.115 The main financial statements components of purchases and payables are payments to, or due to, suppliers including contractor and consultancy expenses, lease payments and general administrative and utility payments. These payments typically comprise the other significant departmental expenditure item of entities following employee entitlements. The number of audit findings identified in this category over the past four financial years is presented in Figure 1.17.

Figure 1.17: Purchases and payables management audit findings

1.116 The figure above demonstrates the controls in this area for entities included in this report are typically strong, with no significant or moderate audit findings identified in the past four years. The most common areas requiring attention over the past four years are:

- processes supporting the authorisation of expenditure, including maintaining proper segregation of duties;

- maintenance of vendor records; and

- processes supporting the accurate recording of accrual information.

Other audit findings

1.117 Other audit findings include items regarding maintenance of appropriate documentation to support decision making, general reconciliation processes, and incomplete policies and procedures affecting the administration of government programs, including grants. The number of audit findings identified in this category over the past four financial years is presented in Figure 1.18.

1.118 The moderate finding relates to weaknesses identified in the fraud and integrity reporting process at the Department of Home Affairs. Further details can be found in the Department of Home Affairs sections in chapter 3 at paragraphs 3.14.20 to 3.14.21.

Figure 1.18: Other audit findings

2. Reporting and auditing frameworks

Chapter coverage

This chapter outlines recent and future changes to the public sector reporting framework and the Australian auditing framework relating to the auditor’s report on financial statements.

Summary of developments

There are no significant accounting standards changes for the Commonwealth public sector for 2017–18. Major changes in accounting standards will be applicable in 2018–19 and 2019–20 with the implementation of revised standards for financial instruments, revenue and leases. The majority of entities included in this report have indicated that they are still in the planning stage of transition to the new standards with approximately half of entities having both updated accounting policies and transition plans for standards expected to have a material impact.

Introduction

2.1 The Australian Government’s financial reporting framework is based, in large part, on standards made independently by the Australian Accounting Standards Board (AASB). The framework is designed to support decision-making by, and accountability to, the Parliament.

2.2 The AASB bases its accounting standards on the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). Because IFRS are designed primarily for use by private sector and for-profit organisations, the AASB amends the IFRS to reflect significant transactions and events that are particularly prevalent in the public and not-for-profit private sectors. In doing so, it takes into account standards issued by the International Public Sector Accounting Standards Board.

2.3 The Finance Minister prescribes additional reporting requirements for Commonwealth entities. These are contained in the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 (the FRRs). The Rule is made under the Public Governance, Performance and Accountability Act 2013 (the PGPA Act).

2.4 The audits of the financial statements of Australian Government entities are conducted in accordance with the ANAO Auditing Standards, which are made by the Auditor-General under section 24 of the Auditor-General Act 1997. The ANAO Auditing Standards incorporate, by reference, the auditing standards made by the Australian Auditing and Assurance Standards Board (AUASB). The AUASB bases its standards on those made by the International Auditing and Assurance Standards Board, an independent standard setting board of the International Federation of Accountants.

2.5 The financial reporting and auditing frameworks that apply in 2017–18 are illustrated in appendices 4 and 5 of this report.

Changes to the Australian public sector reporting framework

Future changes to accounting standards

2.6 Public sector entities will need to prepare for a number of new standards for 2018–19 and 2019–20. These new standards represent major revisions to existing standards for financial instruments, revenue and leases. The effort and time required to transition to these new standards should not be underestimated with entities required to develop business models, write new accounting policies, revise existing accounting policies, undertake a review of all the underlying contracts and in some instances consider amending contracts.

Financial instruments

2.7 The new financial instruments standard AASB 9 Financial Instruments (AASB 9) is effective for financial years commencing on or after 1 January 2018; this means it will have implications for entities in the 2018–19 financial year. AASB 9 moves away from recognition and disclosure primarily determined by the type of instrument to recognition and disclosure determined in large part by an entity’s purpose for acquiring and holding the instrument. Where the financial instrument is held for the purpose of government policy, the entity will need to document the relationship between classification and policy.

2.8 AASB 9 amends the existing historical loss model for the assessment of credit risk to an expected loss model. This will require entities to consider the initial and ongoing ability of the creditor to settle the obligation.

Revenue

2.9 The new revenue standard AASB 15 Revenue from Contracts with Customers (AASB 15) is effective for financial years commencing on or after 1 January 2019 for not-for-profit entities, meaning it will impact most Commonwealth entities in the 2019–20 financial year.48 AASB 15 applies to all exchange transactions and provides a consistent approach to revenue recognition. The principle underpinning AASB 15 is that revenue is earned when the customer receives the goods or services that have been promised under the contract. AASB 15 will impact entities where:

- funding is given to provide goods or services to a third party - the entity will recognise revenue when the goods or services are provided to the third party. Under standards currently in force, revenue is recognised when the money is received from the funding provider;

- funding agreements do not identify specific goods or services to be delivered over the term of the contract. Entities will recognise revenue up front unless contract completion is a deliverable;

- both revenue and the related expense are deferred until the goods or services are delivered, entities with significant non-appropriation revenue are likely to see an impact on their balance sheet and operating result, particularly for long term projects with a significant delay between establishment and initial delivery.

Leases

2.10 The revised leasing standard AASB 16 Leases (AASB 16) is effective for financial years commencing on or after 1 January 2019; this means it will impact entities in the 2019–20 financial year. AASB 16 significantly increases the recognition and disclosure of leases by lessees with the majority of leases currently treated as operating leases recognised on the balance sheet. The net impact on the balance sheet is expected to be limited as the right-of-use asset and liability for future lease payments will be largely offsetting as the value of the right-of-use asset is based on the net present value of the future lease payments. In terms of profit or loss impact, rather than the current annual rent expense over the term of the lease two expenses will be recognised - interest on the lease liability and amortisation of the right-of-use asset. The effect of AASB 16 is to “front-load” the recognition of expense, rather than recognising it on a straight-line basis.

2.11 The adoption of AASB 16 is expected to be a time consuming task for those entities with significant numbers of operating leases. Entities will need to review all lease agreements to identify the right-of-use asset, unbundle any service arrangements and identify where the lease payments are significantly below market value. Lessees will also need to consider that AASB 16 requires entities to include known contingent rents on initial measurement of the asset and liability and subsequently remeasure the lease asset and liability as subsequent contingent rent events become known.

Transition work to date

2.12 The ANAO requested, from entities included in this report, an indication of their progress in preparing for the new standards. All 26 entities covered by this report responded, with only one entity, the Department of Education and Training indicated that it was yet to make an assessment of the implication of AASB 15.

2.13 Table 2.1 shows that AASB 16 is expected to have the greatest impact with 21 entities (approximately 81 per cent) expecting AASB 16 to have a material impact on their financial statements.

Table 2.1: ANAO analysis of entities’ expectations of the impact of new accounting standards

|

Standard |

Entities expecting a material impact |

Entities not expecting a material impact |

Entities who have not yet considered the impact |

|

AASB 9 |

8 (31%) |

18 (69%) |

0 (0%) |

|

AASB 15 |

4 (15%) |

21 (81%) |

1 (4%) |

|

AASB 16 |

21 (81%) |

5 (19%) |

0 (0%) |

Source: ANAO analysis of advice provided by entities.

Table 2.2: ANAO analysis of entities’ progress in preparation for new accounting standards expected to have a material impact

|

Standard |

Entities with updated accounting policies |

Entities with a transition plan |

Entities who have quantified impact |

Entities has sought external advice |

|

AASB 9 |

4 (50%) |

3 (38%) |

1 (13%) |

3 (38%) |

|

AASB 15 |

3 (75%) |

2 (50%) |

1 (25%) |

2 (50%) |

|

AASB 16 |

10 (48%) |

12 (57%) |

2 (10%) |

4 (19%) |

Source: ANAO analysis of advice provided by entities.

2.14 Table 2.2 indicates that the majority of entities are still in the planning stage with approximately half of entities having both updated accounting policies and transition plans for standards expected to have a material impact. In particular, eight entities are expecting AASB 9 to have a material impact, however only four entities have determined their accounting policies and only one entity has quantified the impact.

2.15 The ANAO’s analysis of the responses indicates that there were a number of entities (AASB 16: four entities and AASB 9: one entity) that have prepared transition plans without first updating their accounting policies. The presence of a transition plan without updated accounting policies indicates the possibility of poor planning and limited senior management involvement as there are a number of significant management decisions that should have been made and documented prior to commencing transition planning. For example AASB 16 requires selection of a transition approach, identification of the incremental rate of borrowing, the setting of a low value lease threshold and choosing whether or not to exempt short term leases.

2.16 AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors includes a requirement to disclose “reasonably estimable information relevant to assessing the possible impact” new standards will have on the financial statements. While this disclosure is not required for Tier 2 entities applying reduced disclosure requirements, it is required for Consolidated Financial Statements as they are Tier 1 and apply full disclosures. The significant amount of work still to be done in relation to the quantification of the impact of the new standards and collection of information from Tier 2 entities presents a challenge for the preparation of 2017–18 Consolidated Financial Statements. The ANAO will continue to monitor entity’s progress in this area.

Changes to the Australian auditing framework

Auditor’s report on financial statements

2.17 The ANAO Report No 24 2017-18 Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2017 reported on the adoption of a number of changes to the auditor’s reports for 2016–17, including the application of a new auditing standard ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report (ASA 701). While ASA 701 only requires Key Audit Matters (KAM) reporting for listed entities, the Auditor–General considers KAM reporting to be better practice in the financial statements auditing profession and consistent with the ANAO’s outcome of improving public sector performance and accountability through independent reporting on Australian Government administration to the Parliament, the Executive and the public. Consequently, the Auditor-General adopted KAM reporting in 2016–17 for the 25 entities included in ANAO Report No. 60. 2016–17 Interim Report on Key Financial Controls of Major Entities.

2.18 In 2016–17, the ANAO reported a total of 57 KAM across the 25 entities, the majority of which related to the valuation of assets and liabilities. The concentration of KAM within the balance sheet of key bodies within the Commonwealth reflects the complexities and judgement required in determining the value of the significant public assets and liabilities managed by the Commonwealth. For a number of these assets there are particular considerations regarding valuing assets that are managed for a public service delivery rather than profit-based reason.

2.19 The Auditor-General will continue to adopt KAM reporting in 2017–18 for the 26 entities included in this report as well as for the Consolidated Financial Statements of the Australian Government.