Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of Higher Education Loan Program Debt and Repayments

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the administration of the Higher Education Loan Program (HELP) debts and repayments.

Summary and recommendations

Background

1. The Australian Government provides income-contingent loans to eligible students through the Higher Education Loan Program (HELP), which removes up-front cost barriers to tertiary education and training. HELP provides students with loans to cover relevant costs associated with higher education. Students are required to repay the loan(s) once their income reaches a minimum threshold.

2. HELP is regulated by provisions in the Higher Education Support Act 2003 and is administered by the Department of Education and Training (Education). HELP debt and repayments are collected and managed by the Australian Taxation Office (ATO). A Memorandum of Understanding sets out the arrangements between Education and the ATO in relation to the administration of HELP.

3. As at 30 June 2015, the value of total outstanding HELP debt was $44.1 billion, associated with approximately 2.2 million payees. The estimated value of the debt that is not expected to be collected is around $10.2 billion. This debt is projected to continue growing to approximately $67.6 billion by 2017–18, with almost 23 per cent of that debt not expected to be collected.

Audit objective and criteria

4. The objective of the audit was to assess the effectiveness of the administration of HELP debt and repayments. To form a conclusion against this objective the audit examined whether:

- the ATO and Education fulfil their responsibilities as set out in the Memorandum of Understanding, and Education effectively monitors HELP debt and repayments to inform program decision-making;

- the ATO effectively supports employers and payees to meet their responsibilities in relation to HELP withholdings and repayments, and detects and deters those that do not; and

- the ATO accurately records debts, repayments, write-offs, waivers and deferments, and effectively collects outstanding HELP debt.

The audit did not examine other aspects of Education’s administration of HELP or verify the integrity of enrolment and debt information supplied by higher education providers.

Conclusion

5. The Higher Education Loan Program (HELP) is a mature program, based on a solid foundation of collecting student loan debt through the income tax system. Nevertheless, there is scope for the ATO and Education to make meaningful improvements to important aspects of the program’s administration. In particular, the program does not have a robust program of evaluation and review based on rigorous analysis of sound data. Program performance measures and reporting reflect a primary focus on access and there is limited measurement of the sustainability of the program despite Education’s projection that HELP debt will total almost $200 billion in 2024–25 and almost one-third of this debt will not be collected. In addition to a lack of focus on examining the growth in HELP debt to support policy design, there is no risk-based strategy to target compliance efforts; the ATO and Education are not fulfilling their broader program risk management responsibilities; and the controls for recording students’ HELP debts need to be improved.

Supporting findings

HELP debt recording

6. Education and the ATO have a number of controls in place to support the collection, transfer and upload of reliable and accurate HELP debt data. Nevertheless, issues with the integrity of data contained in files transferred from Education complicate the processes to upload the student debt data into the ATO’s Integrated Core Processing information technology system, and sometimes result in extensive manual data matching processes. The full extent and cost of these issues is unknown as their occurrence is not routinely recorded by the ATO or Education.

7. For 2014–15, the ATO properly applied the HELP indexation factor and compulsory repayment thresholds in updating the Integrated Core Processing system. It was not possible to test the ATO’s processing of the revised HECS-HELP Benefit thresholds as the ATO did not provide reliable data.

8. Other than the HELP repayment calculator, the ATO updated its key information resources and tools with the revised compulsory repayment income thresholds and HECS-HELP Benefit amounts in a timely manner. It would be helpful for payees if the ATO updates the HELP repayment calculator earlier in, or prior to, the relevant financial year.

HELP debt collection

9. HELP voluntary repayments have largely been effectively managed. However, the voluntary repayment bonus has been incorrectly provided for FEE-HELP and OS-HELP loans despite the then Australian Government indicating that they would not be available for these loan types in the 2003–04 Budget.

10. The ATO accurately calculates HELP compulsory repayments and effectively manages these repayments through income tax arrangements. However, the ATO could not advise the ANAO of the value of HELP compulsory repayments that have been raised and not collected.

11. The ATO’s Integrated Core Processing system does not support accurate processing of the HECS-HELP Benefit in all circumstances, and the ATO estimates that some 12 000 payees are affected by errors including incorrect account balances. The ATO has not met its timeliness standards for processing applications for the HECS-HELP Benefit for the past four years.

12. The ATO manages relatively few HELP write-offs, waivers and deferments, and applies its broader corporate policies and processes in this regard. To improve the effectiveness of these processes for HELP, the ATO is revising its broader guidance for write-offs, which is out of date and incomplete, and may need to introduce guidance on waivers. It also needs to improve the timeliness of processing applications for the deferment of HELP debt repayments in order to meet internal standards.

13. The ATO has quality assurance arrangements in place to support the accurate recording of HELP repayments, discounts, write-offs, waivers and deferments, particularly through its Service Delivery Quality Framework and Service Delivery Coaching Framework. Assessments conducted as part of the Service Delivery Quality Framework indicated that the main team responsible for administering HELP is performing strongly. There is scope to improve arrangements to check these quality assessments.

14. An enterprise-wide quality assurance framework aimed at identifying systemic issues, ATO Quality, has not yet covered HELP administration.

Risk management and compliance

15. Existing risk management arrangements do not support the effective management of HELP risks. The risk management arrangements outlined in the Memorandum of Understanding should assist with the effective management of HELP risks. However, neither Education nor the ATO have met their respective risk management requirements under this agreement.

16. The ATO and Education provide sufficient information to support individuals willing to meet their HELP obligations. These individuals have ready access to information about most aspects of the scheme, particularly through the agencies’ websites and ATO social media posts. However, some inaccurate and incomplete information has been provided. In finalising its HELP communication strategy, it would be useful for the ATO to outline a forward work program.

17. The ATO ceased mailing out account statements in 2013, without introducing an alternative means of informing payees of changes to their HELP debt. Consequently, there is an increased risk of students being unaware of incurring a HELP debt.

18. The ATO and Education have a range of activities in place to detect and deter non-compliant behaviour among HELP participants, including business-as-usual and targeted compliance efforts. However, these activities are not supported by a risk-based compliance and enforcement strategy. Introducing such a strategy would assist the agencies to target compliance activities and provide assurance in relation to the mitigation of HELP compliance risks.

Monitoring and reporting HELP debt and repayments

19. While there are deliverables and key performance indicators for HELP, there is insufficient measurement of sustainability, which is an increasing focus for the Australian Government in the education sector.

20. The ATO and Education report limited information publicly on HELP, and should report a broader range of information—particularly in relation to the sustainability of the program—for the benefit of stakeholders, including Parliament. Further, the absence of detailed repayment information impacts on the accuracy of program forecasts.

21. Education estimates that by 2024–25 outstanding HELP debt will total $192.5 billion and almost thirty per cent ($55.0 billion) will not be repaid. Despite its projections of strong, accelerating growth and high levels of HELP debt, Education was unable to demonstrate that it routinely monitored and analysed factors affecting the repayment of HELP debt. Improving its analysis of the growth in HELP debt and repayment rates would enable Education to better assess the sustainability of the program and inform program design. The Australian Government approved Education’s proposal for an enhanced HELP database in November 2015, which should improve Education’s capacity to analyse the factors that influence payees’ capacity to repay HELP debt.

Recommendations

|

Recommendation No. 1 Paragraph 2.10 |

To simplify and improve the debt recording process, the ANAO recommends that Education and the ATO redesign the controls for the initial recording, transfer and upload of HELP debts. |

|

Recommendation No. 2 Paragraph 4.13 |

To improve the management of risks associated with the Higher Education Loan Program and support Education’s and the ATO’s compliance with the risk management requirements set out in the Memorandum of Understanding, the ANAO recommends that Education and the ATO:

|

|

Recommendation No. 3 Paragraph 4.46 |

To provide assurance that compliance risks associated with HELP are effectively identified and mitigated, the ANAO recommends that the ATO and Education work together to develop a risk-based compliance and enforcement strategy for HELP. |

|

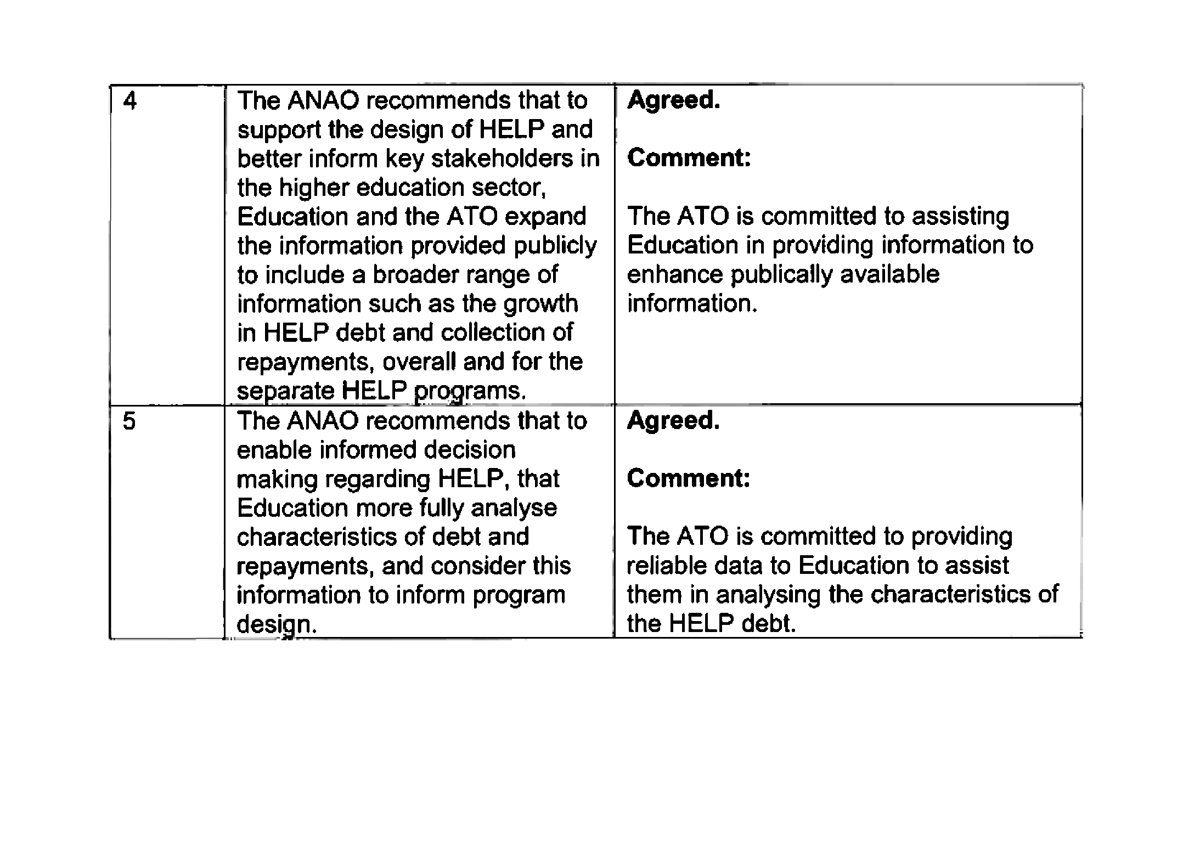

Recommendation No. 4 Paragraph 5.10 |

To support the design of HELP and better inform key stakeholders in the higher education sector, the ANAO recommends that Education and the ATO expand the information provided publicly to include a broader range of information such as the growth in HELP debt and collection of repayments, overall and for the separate HELP programs. |

|

Recommendation No. 5 Paragraph 5.26 |

To enable informed decision making regarding HELP, the ANAO recommends that Education more fully analyses characteristics of debt and repayments, and consider this information to inform program design. |

22. The ATO and Education agreed to all five recommendations.

Summary of entity responses

23. The first two paragraphs of the entities’ response are included below. Appendix 1 reproduces the full summary responses and overall responses to the audit.

Australian Taxation Office

The ATO welcomes this review and considers the report supportive of our overall approach to managing Higher Education Loan Program debts and repayments.

The review recognises the overall effectiveness of the administration of HELP debts and repayments and acknowledges the solid foundation the income tax system provides for collecting student loan debts. The review identified a number of opportunities for improvement in our risk management and compliance processes and with recent innovations and the implementation of a robust program of evaluation, a more efficient and effective administration of the program will be attained.

Department of Education and Training

The Department of Education and Training (‘the department’) acknowledges the Australian National Audit Office’s (ANAO) report on the Administration of Higher Education Loan Program (HELP) Debt and Repayments. HELP provides significant economic benefits for individuals and Australia’s communities including wider societal benefits such as reduced unemployment and welfare dependency. It also produces good repayment outcomes with around four in every five dollars of new HELP debt currently expected to be repaid.

The department supports the direction of the report’s recommendations including the need to consider improvements to elements of the administration of HELP and to data management, analysis and reporting. Significant work is already being undertaken by the department to address these priorities.

1. Background

Higher Education Loan Program

1.1 The Australian Government provides income-contingent loans to eligible students through the Higher Education Loan Program (HELP), ‘which removes up-front cost barriers to tertiary education and training’.1 Students are required to repay the loan(s) once their income reaches a minimum threshold.

1.2 HELP is regulated by provisions in the Higher Education Support Act 2003 and is administered by the Department of Education and Training (Education). HELP debts and repayments are collected and managed by the Australian Taxation Office (ATO).

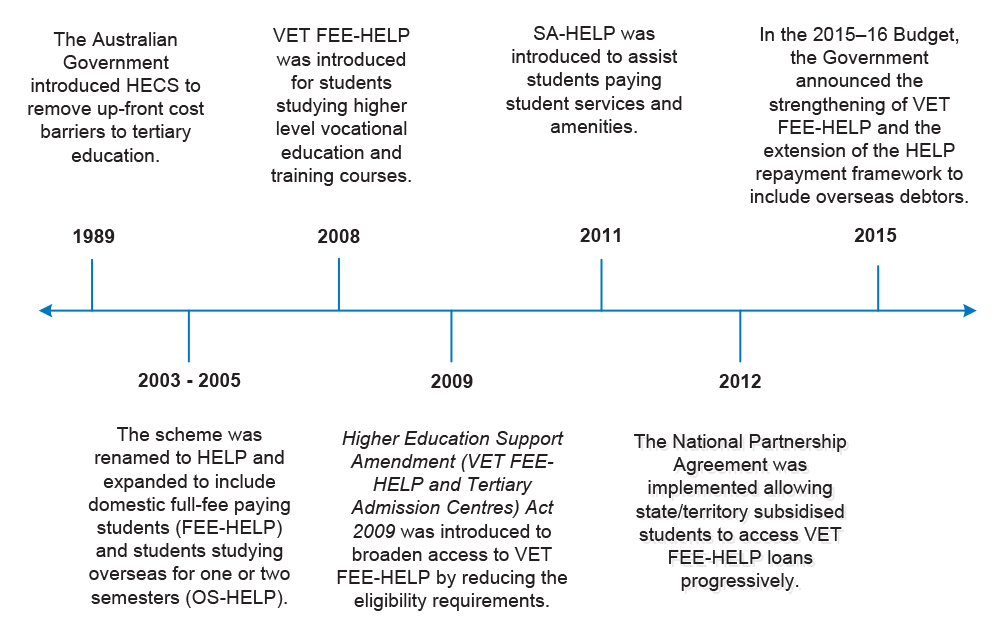

1.3 In 1989, the Australian government introduced the Higher Education Contribution Scheme (HECS) to facilitate the re-introduction of charges for Australian higher education undergraduate students. In 2003, there were major reforms to higher education, including significant changes to HECS, as illustrated in Figure 1.1.

Figure 1.1: Expansion of the HELP scheme from 1989 to 2015

Source: ANAO analysis of Education data.

1.4 Major changes to the income-contingent loan arrangements also included the introduction of additional loan types and the renaming of the program. HECS was absorbed into HELP and is now referred to as HECS-HELP. HELP was further extended in 2008 to introduce VET FEE-HELP and in 2011 to introduce SA-HELP. The Australian Government introduced arrangements aimed at ensuring a fairer HELP scheme in the 2015–16 Budget, as outlined in Figure 1.1, to provide savings estimated at $25.4 million from 2015–16 to 2018–19.

HELP schemes

1.5 There are currently five loan types under the HELP scheme, as illustrated in Table 1.1.

Table 1.1: HELP schemes

|

HELP scheme |

Scheme purpose |

Number of student loans in 2014–15 |

|

HECS-HELP |

A loan to cover all or part of a student contribution. |

507 629 |

|

SA-HELP |

A loan to cover the fee charged by higher education providers for student services and amenities of a non-academic nature, such as sporting activities, career advice, child care and food services. |

444 344 |

|

VET FEE-HELP |

A loan to cover all or part of their tuition up to the VET FEE-HELP lifetime loan limit.1 |

131 344 |

|

FEE-HELP |

A loan to cover all or part of the tuition fees up to the FEE-HELP lifetime loan limit.1 |

76 613 |

|

OS-HELP |

A cash loan to cover expenses associated with overseas study, such as accommodation and travel. There is a lifetime limit of two loans per student. |

10 986 |

Note 1: In 2015, the VET FEE-HELP and FEE-HELP limit was $97 728 for most students. For students undertaking medicine, dentistry and veterinary science courses the limit was $122 162.

Source: Department of Education and Training, Annual Report 2015–16.

Collection of HELP debt

1.6 HELP debts can be repaid through compulsory and voluntary repayments. Employers are required to withhold a higher proportion of a payee’s income, as their compulsory HELP loan repayments, when the payee’s income reaches the minimum repayment threshold.2 The minimum threshold is determined by Education and then advised to the ATO in advance of each financial year. For the 2015–16 income year, the minimum repayment income threshold is $54 126. Payees who make voluntary repayments receive a five per cent bonus, however, the Australian Government has announced the discontinuation of the bonus from 1 January 2017.

1.7 Payees who have completed a course in maths, science, education, early childhood education and nursing may be eligible to apply for a HECS-HELP Benefit discount, which either reduces their compulsory repayment amount or total HELP debt. There are complex eligibility requirements for the HECS-HELP Benefit including the type of employment undertaken and certain geographical eligibility requirements.3

1.8 Payees suffering from serious hardship can also apply for a deferment of their compulsory repayments for the current, previous and next financial years. This does not reduce the payee’s accumulated debt as the deferred value remains part of the total outstanding debt and continues to be indexed each year.

Debt write-offs and waivers

1.9 Debts can be written off for three reasons: irrecoverable at law; uneconomical to pursue; and death. Further, under section 63 of the Public Governance, Performance and Accountability Act 2013, payees can apply to the Minister for Finance to have their debt waived. Debts that have been waived cannot be pursued at a later date.

Level of HELP debt

1.10 As at 30 June 2015, the value of total outstanding HELP debt was $44.1 billion, associated with approximately 2.2 million payees. The estimated value of the debt that is not expected to be collected is around $10.2 billion.

1.11 As illustrated in Figure 1.2, this debt is projected to continue growing to approximately $55.3 billion in 2016–17 and $67.6 billion by 2017–18, with around 23 per cent of that debt not expected to be collected. This growth in debt is largely due to an expected increase in university commencements, mainly as a result of the uncapping of Commonwealth supported places for undergraduate courses from 1 January 2012 and the broadening of the HELP scheme to include the VET FEE-HELP scheme.

1.12 In 2014–15, the value of repayments collected by the ATO for HELP was $1.9 billion or 4.7 per cent of the total outstanding HELP balance.4

Figure 1.2: Value and collection of HELP debt

Source: ANAO analysis of Education data.

International comparison

1.13 Many countries offer government-administered student loan schemes for further education, including the United Kingdom, New Zealand and Canada. In most cases, the structure of these programs is similar to that of Australia; payees are eligible to borrow funds to help cover tuition and living expenses, and payments can be deferred until after study is completed. Table 1.2 summarises the key aspects of these income-contingent loan programs.

Table 1.2: Summary of student loan repayment plans, 2014–15

|

|

Australia |

New Zealand |

United Kingdom |

Canada |

United States of America |

|

Program |

HELP |

StudyLink |

Plan 1 and 2 |

CanLearn |

PAYE |

|

Collected with taxes |

Yes |

Yes |

Yes |

No |

No |

|

Interest rate |

CPI1 |

0% |

RPI2 + 0.3% |

Prime + 2.5% or 5% |

10-year repayment plan + 2.05% |

|

Loan fees |

FEE-HELP 25% fee3 VET FEE-HELP 20% fee3 |

$60 initial $40 annual |

No |

No |

No |

|

Minimum income threshold |

$53 345 |

$18 482 |

$41 643 |

Varies by family size |

Varies by family size |

|

Repayment begins |

Exceeds income threshold |

Exceeds income threshold |

April after school ends |

After 6 month grace period |

After 6 month grace period |

|

Repayment rate |

4%-8% |

12% (over threshold) |

9% (over threshold) |

0-20% (over threshold) |

10% (over threshold) |

|

Repayment increase with income? |

Yes |

No |

No |

Yes |

No |

|

Loan forgiveness4 |

No |

No |

After 30 years |

After 15 years |

After 20 years |

|

Overseas payees |

Debt is indexed; unenforced repayments required |

Not specified |

Must continue to repay at normal rate |

Continue to pay by completing annual form |

Not specified |

Note 1: CPI is the consumer price index.

Note 2: RPI is the retail price index.

Note 3: The FEE-HELP loan fee is for 25 per cent of the loan amount and applies to undergraduate courses only. The VET FEE-HELP loan fee is for 20 per cent of the loan amount and applies to full-fee paying and fee for service students only.

Note 4: Loan forgiveness refers to the automatic write-off of debt following a period of time.

Source: ANAO analysis.

Administrative responsibilities

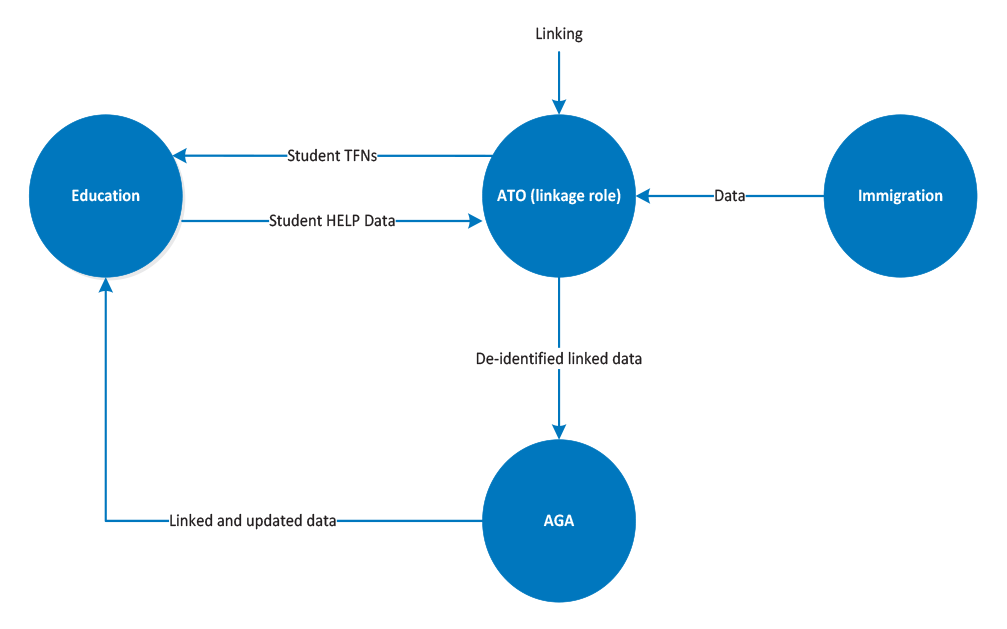

1.14 A Memorandum of Understanding sets out the arrangements between Education and the ATO in relation to the administration of HELP. Under this agreement, Education is responsible for the policy, legislation and stakeholder communications for the HELP program. Approved Higher Education Providers and Vocational Education and Training institutions submit student debt information to Education using its online Higher Education Provider Client Assistance Tool. Education then collates this data and transfers it to the ATO to be recorded on students’ records. This process is outlined in Figure 1.3.

Figure 1.3: HELP data collection and upload process

Note*: A Tax File Number is a unique identification number assigned to taxpayers by the ATO.

Source: ANAO analysis of ATO information.

1.15 The Memorandum of Understanding also provides the ATO with responsibility for collecting and administering HELP debts. This involves: the application of the indexation factor; collection of repayments; processing of deferments, write-offs and HECS-HELP Benefit discounts; and providing reports to Education regarding the level of HELP debt. The ATO’s responsibilities are further illustrated in Figure 1.4.

Figure 1.4: The ATO’s responsibilities for administering HELP

Source: ANAO analysis of ATO information.

Audit objective, criteria and scope

1.16 The objective of the audit was to assess the effectiveness of the administration of Higher Education Loan Program debt and repayments.

1.17 To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

- the ATO and Education fulfil their responsibilities as set out in the Memorandum of Understanding, and Education effectively monitors HELP debt and repayments to inform program decision-making;

- the ATO effectively supports employers and payees to meet their responsibilities in relation to HELP withholdings and repayments, and detects and deters those that do not; and

- the ATO accurately records debts, repayments, write-offs, waivers and deferments, and effectively collects outstanding HELP debt.

1.18 The audit did not:

- examine other aspects of Education’s administration of HELP;

- verify the integrity of enrolment and debt information supplied by higher education providers; or

- verify the Australian Government Actuary’s estimate of the value of the HELP debt expected to be collected.

Audit methodology

1.19 The audit methodology included:

- interviewing relevant ATO and Education staff and stakeholders;

- conducting data integrity testing to confirm that the ATO maintains the debt in line with requirements and monitors employer and payee obligations;

- examining complaints and objections information to identify potential issues with the ATO’s administration of the HELP debt and repayments;

- reviewing training and guidance material for ATO staff; and

- analysing the ATO’s and Education’s HELP debt and repayment monitoring and reporting processes.

1.20 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $585 000.

2. HELP debt recording

Areas examined

This chapter examines the transfer of HELP debt files from Education and the upload of those files by the ATO. It also examines the ATO’s application of the HELP indexation factor, compulsory repayment income thresholds and the HECS-HELP Benefit.

Conclusion

The controls for the collection, transfer and upload of HELP debt data could be strengthened and streamlined. For 2015–16, the ATO effectively updated its core information technology processing system, and information resources and tools, to apply the legislated HELP indexation factor and revise compulsory repayment income thresholds. The ATO partially met its responsibility to update information products and tools in a timely manner with the revised HECS-HELP Benefit thresholds. There was insufficient information available to test the accuracy of the ATO’s HECS-HELP Benefit processing.

Areas for improvement

The ANAO made one recommendation aimed at improving the debt recording process (paragraph 2.10). The ANAO also suggested that the ATO update the HELP repayment calculator earlier each year (paragraph 2.24).

Does the ATO have effective processes to transfer, upload and match HELP debt data?

Education and the ATO have a number of controls in place to support the collection, transfer and upload of reliable and accurate HELP debt data. Nevertheless, issues with the integrity of data contained in files transferred from Education complicate the processes to upload the student debt data into the ATO’s Integrated Core Processing information technology system, and sometimes result in extensive manual data matching processes. The full extent and cost of these issues is unknown as their occurrence is not routinely recorded by the ATO or Education.

2.1 Approved higher education providers and vocational education and training institutions submit student debt information to Education via its online Higher Education Provider Client Assistance Tool. This data contains the personal details of students, type of study undertaken and value of loan debt incurred. This data is subsequently collated into files by Education and transferred to the ATO for recording on the payees’ income tax records. The ATO is then primarily responsible for administering and collecting the HELP debts, which involves updating its systems to reflect revised annual HELP thresholds.

Data collection and transfer

2.2 Education transfers student debt data in three file types to the ATO: DUE file; Previously Unreported Debt file5; and Revisions file. These files are transferred to the ATO each year in July, September, December and May.

2.3 There are a number of shortcomings in the processes to collect student debt data that compromise the integrity of the data. The magnitude of these issues is unknown as their occurrence is not routinely recorded by the ATO or Education. These shortcomings include:

- Tax File Numbers (TFNs) are confirmed as valid TFNs when providers submit the student debt data, however, they are not confirmed as belonging to the relevant student. Therefore, some student debt files are transferred to the ATO containing incorrect TFNs. For example, the TFNs may be incorrectly transcribed.

- When providers seek Commonwealth Higher Education Student Support Numbers (CHESSNs)6 for students, Education’s Higher Education Information Management System sometimes allocates one student’s CHESSN to another student resulting in those two students sharing a CHESSN and sometimes allocates more than one CHESSN to a student resulting in that student having multiple CHESSNs.7 Despite Education advising the ANAO that the Higher Education Information Management System conducts a nightly check to identify duplicate CHESSNs, student debt files are transferred to the ATO containing duplicate and/or shared CHESSNs.

- Student debt data must pass a series of validation rules before it can be submitted. One of the validation rules is that the TFN field cannot be blank, with the exception of students who have not incurred a HELP debt.8 However, some files relating to students who have incurred a debt are transferred to the ATO without a TFN.

- The Higher Education Provider Client Assistance Tool data field rules and the ATO’s Integrated Core Processing system data field rules do not align. For example, while the Higher Education Provider Client Assistance Tool will accept apostrophes in the address fields, the Integrated Core Processing system will not.

2.4 These shortcomings can prevent student debts from being matched to ATO client records as well as prevent the initial upload of debts into the ATO’s Integrated Core Processing system. Consequently, the ATO is required to undertake a number of further checks of the data to identify records that contain these errors.

ATO data upload and matching

2.5 As illustrated in Figure 2.1, the ATO undertakes three data validation checks and a debt matching process prior to uploading the student files into the Integrated Core Processing system. For the September 2015 debt upload, a total of 550 453 records were loaded into the Integrated Core Processing system.

Figure 2.1: The ATO’s processes for uploading information about HELP debts

Source: ANAO interpretation of ATO information.

2.6 There are multiple checks for some errors. For example, both the first and third checks are designed to detect data decryption errors. The ATO advised that this error may not be addressed in the first check if the responsible ATO officer does not resolve the error. In practice, these checks do not ensure that all errors are identified and addressed.

2.7 The ATO could not advise the ANAO of the number of records that fail checks one to four (outlined in Figure 2.1), although it advised that the number of records that failed the Integrated Core Processing system upload process (check 5) and consequently required manual intervention was 28 940 records in 2013–14 and 11 851 records in 2014–15.9 The approximate cost to the ATO to manage these records in 2013–14 was $450 000 and in 2014–15 was $193 000.10

2.8 While the ATO did not provide information on the number of records that failed the first four checks, it would be expected that a larger number of records fail the first check and that number decreases with each subsequent check. Consequently, the number of records that required manual intervention in 2013–14 and 2014–15 and the resulting cost to the ATO would be significantly higher than reported in paragraph 2.7.

2.9 The ATO advised the ANAO that it expects limited manual intervention will be required following the introduction of the Message Queue (MQ) Platform11 as it will require TFNs to be verified before providers can submit student files and intervention will only be necessary for records with an incorrect or compromised TFN. TFN verification is expected to improve the efficiency of the debt matching process. However, there is further scope to address the underlying data integrity and system misalignment issues—in particular, by further aligning the data field rules between the ATO’s and Education’s systems and improving the completeness of student data.

Recommendation No.1

2.10 To simplify and improve the debt recording process, the ANAO recommends that Education and the ATO redesign the controls for the initial recording, transfer and upload of HELP debts.

The ATO’s response: Agreed.

2.11 The ATO is committed to improve the debt recording process. Following recent changes to the law, the ATO and the Department of Education are currently developing a Message Queue (MQ) platform which will streamline the process for reporting of debts to the ATO and allow for the redesign of the controls for more simpler and efficient recording, transfer and upload of HELP debts. The MQ platform is expected to be operational from 1 July 2017.

Education’s response: Agreed.

2.12 The department and the ATO are currently implementing Message Queue technology to support more timely and efficient transmission of data between the two agencies. In implementing these improvements, the department is seeking to build on current processes to realign data fields between both agencies’ systems and improve the completeness of student data.

Debt matching processes

2.13 Although designed as unique identification numbers, students’ CHESSNs and TFNs are not used for debt matching purposes due to the integrity issues outlined in paragraph 2.3. Rather, the ATO attempts to automatically match the debt records provided by Education to its client records by comparing information fields. Programmed combinations of between two and four fields are used to determine a successful match, for example, given and family names, date of birth and postcode or TFN, given name and date of birth.

2.14 If the ATO cannot automatically match a debt to a record, ATO staff attempt to manually match the debt to a client record, as outlined in Figure 2.2.

Figure 2.2: The ATO’s manual processes for matching information about HELP debts

Note *: Two TFNs are recorded and these may be different as one is provided by the student and the second is the TFN identified by the ATO from the student’s tax record.

Source: ANAO interpretation of ATO information.

2.15 As demonstrated in Figure 2.2, debts that cannot be matched automatically can result in a manually intensive matching process. As noted in paragraph 2.7, the number of records that failed the Integrated Core Processing system upload process and consequently required manual intervention was 28 940 records in 2013–14 and 11 851 records in 2014–15. The ATO was unable to advise the ANAO of the number of instances it was required to contact providers regarding students’ incorrect TFNs.

2.16 For 2013–14 and 2014–15, 22 debts were cancelled by providers and as at 16 September 2015, there were 62 unresolved student debts for the same period. Notices have been issued to the providers in all 62 instances requesting them to cancel the student’s enrolment and remit the debt.12 Follow-up notices have also been issued in those instances where the original notice was sent in 2013 (11 instances). There are unmatched debts that the ATO first advised providers to cancel in January 2014 for which no subsequent action has been taken by the ATO, as it is still awaiting advice from the providers. This is an unreasonable length of time to elapse between the first notice to a provider and any subsequent action.

2.17 In 27 of the outstanding instances, the ATO has received further debt files in relation to the associated students. Section 193-5 (2) of the Higher Education Support Act 2003 states that the provider must not accept a further enrolment of the person in a unit as a Commonwealth supported student if their enrolment has been cancelled. The ATO advised the ANAO that additional debt can be incurred by a student while the ATO carries out the steps outlined in Figure 2.2. The ATO should review its cancellation notice processes to ensure that students are unenrolled in a timely manner and the incurrence of debt associated with ineligible students is minimised.

Does the ATO properly apply the HELP indexation factor, compulsory repayment thresholds and HECS-HELP Benefit thresholds?

For 2014–15, the ATO properly applied the HELP indexation factor and compulsory repayment thresholds in updating the Integrated Core Processing system. It was not possible to test the ATO’s processing of the revised HECS-HELP Benefit thresholds as the ATO did not provide reliable data.

Other than the HELP repayment calculator, the ATO updated its key information resources and tools with the revised compulsory repayment income thresholds and HECS-HELP Benefit amounts in a timely manner. It would be helpful for payees if the ATO updates the HELP repayment calculator earlier in, or prior to, the relevant financial year.

Indexation

2.18 In accordance with the Higher Education Support Act 2003, on 1 June HELP debts are potentially subject to an indexation factor that is calculated annually.13 The ATO is required to: calculate the indexation factor; report it in the Government Notices Gazette; and apply it to HELP debts which remain unpaid for the preceding 11 months.14

2.19 The ANAO tests the ATO’s indexation process on an annual basis to confirm that the parameters used for calculating the indexation factor and the calculated factor were correct, and that the gazetted factor had been correctly applied in the Integrated Core Processing system. The ANAO’s testing undertaken in 2012–13, 2013–14 and 2014–15 confirmed that the ATO had correctly calculated and applied indexation in those years.

Compulsory repayment income thresholds

2.20 Under the Memorandum of Understanding, the ATO is required to update the Integrated Core Processing system with the revised annual compulsory repayment income thresholds. The revisions are calculated according to a formula based on the Average Weekly Earnings figure.15

2.21 As part of the annual financial statement audit program, the ANAO recalculates the repayment income and compulsory repayments, where relevant, for a sample of income tax returns with a HELP and/or Student Financial Supplement Scheme debt.16 The Student Financial Supplement Scheme was a voluntary loan scheme to help tertiary students cover their expenses while studying. The Scheme closed on 31 December 2003 and existing debts continue to be collected through the tax system. Payees with a Student Financial Supplement Scheme loan were included in this testing as it is also an income contingent loan and has similar attributes as HELP, for example thresholds for compulsory repayments.

2.22 The ANAO’s testing did not identify any variances with the ATO’s calculations; providing assurance that the ATO updated the Integrated Core Processing system with the correct income repayment thresholds and accurately calculated HELP compulsory repayments.

2.23 The Memorandum of Understanding also requires the ATO to update its annual information materials and website tools with the revised compulsory repayment thresholds. Education is required to provide the ATO with compulsory repayment income thresholds by March for the upcoming financial year.

2.24 For the 2015–16 compulsory repayment income thresholds, the ATO updated its HELP and TSL repayment thresholds and rates webpage in May 2015—prior to the commencement of the financial year. The ATO did not update its online HELP repayment calculator17 with the compulsory repayment incomes thresholds for 2014–15 until 25 June 2015—over one year after it was advised of the revised rates. Payees were therefore unable to use the calculator to estimate their compulsory repayment for most of the 2014–15 financial year. The ANAO suggests that the ATO update the HELP repayment calculator with the compulsory repayment income threshold amount earlier in, or prior to, the relevant financial year.

2.25 The ATO is also required to update the Pay-As-You-Go withholding rate information for employers:

- on its website, which was updated with the 2015 compulsory repayment rates on 18 June 201518, prior to the commencement of the 2015–16 financial year; and

- in its annual Statement of formulas for calculating Higher Education Loan Program (HELP), Trade Support Loan (TSL) and Student Financial Supplement Scheme (SFSS) components schedule, which was also published on 18 June 2015.

HECS-HELP Benefit

2.26 The HECS-HELP Benefit aims to encourage graduates of maths, science, education and nursing study courses to gain employment in specified occupations. HECS-HELP Benefit also applies to early childhood education graduates who are employed in eligible geographic locations.19 In 2014–15, payees received a total of $31.9 million of HECS-HELP Benefit discounts.

2.27 There are maximum HECS-HELP Benefit amounts. In 2015–16, for maths, science, education and nursing the benefit is $1798.46, and for early childhood education, it is slightly higher at $1918.39. The benefit amounts are indexed by the consumer price index each year on 1 June. If approved, the payee’s compulsory repayment is reduced by the HECS-HELP Benefit amount. The ANAO was unable to test the accuracy of HECS-HELP Benefit processing as the ATO could not provide the ANAO with a reliable extract of HECS-HELP Benefit data (refer to Chapter 3 for more information).

2.28 Education is required to advise the ATO by 7 May of the maximum HECS-HELP Benefit amounts for the next financial year. The Memorandum of Understanding requires that the ATO update the HECS-HELP Benefit application form and publish the revised amounts on the ATO’s website.

2.29 In 2015–16, Education met its responsibility under the Memorandum of Understanding by advising the ATO of the maximum rates on 4 May 2015. The ATO partially met its responsibility by publishing the revised rates on its website on 16 June 2015—prior to the commencement of the financial year. However, the revised HECS-HELP Benefit application form for the 2014–15 income year was not available until 10 July 2015. The ATO advised that to minimise the impact on payees, it accepted the previous form during this period.

3. HELP debt collection

Areas examined

This chapter examines the ATO’s processing of HELP debt repayments, waivers and write-offs. It also examines the ATO’s relevant quality assurance processes.

Conclusion

The ATO accurately calculates HELP compulsory repayments but could not advise the ANAO of the value of these repayments that had been raised but not collected. In respect of voluntary repayments, the ATO and Education did not implement a measure in the 2003–04 Budget and have been incorrectly providing bonuses for FEE-HELP and OS-HELP. The ATO has acknowledged shortcomings with its guidance on writing-off HELP debt and is revising its current guidance material. In undertaking a program of quality assurance activities, HELP administration was found to be performing well under service delivery assessments, but was not assessed under the ATO’s broader quality assurance framework.

Areas for improvement

The ANAO suggested that the ATO provide guidance about requests for waivers (paragraph 3.25), disseminate the outcome of deferment reviews (paragraph 3.29), and reassess its targets and reporting for the quality assessor reviews (paragraph 3.37).

3.1 Under the Memorandum of Understanding with Education, the ATO is primarily responsible for the collection and administration of HELP debts. Debts are repaid by compulsory repayments, which are mostly collected by employers through the Pay-As-You-Go withholding system. Payees can also make voluntary repayments to reduce their HELP debts.

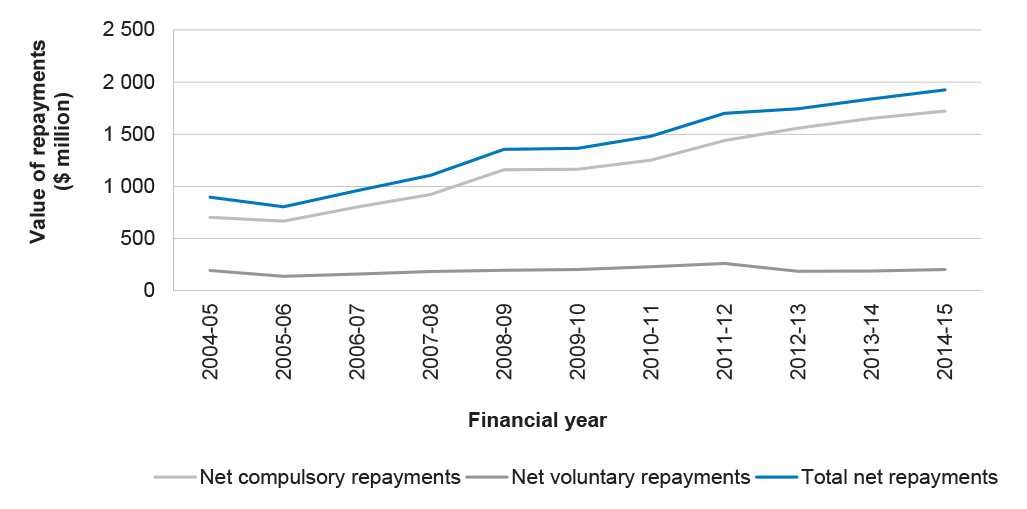

3.2 Figure 3.1 illustrates that the value of compulsory repayments collected has increased substantially over the past decade, while the net value of voluntary repayments collected has remained stable (but declined as a proportion of new debt from 23 per cent to three per cent). This trend is expected as HELP has been expanded in that period, and in most instances repayments for new loans is delayed while payees complete their studies and gain suitable employment. The increasing value of compulsory HELP repayments highlights the importance of the ATO effectively administering these payments. The declining value of repayments as a proportion of the HELP debt affects the sustainability of the program (refer to Chapter 5).

Figure 3.1: HELP repayments from 2004–05 to 2014–15

Source: ANAO analysis of ATO information.

Does the ATO have effective processes to manage voluntary and compulsory repayments and associated discounts?

HELP voluntary repayments have largely been effectively managed. However the voluntary repayment bonus has been incorrectly provided for FEE-HELP and OS-HELP loans despite the then Australian Government indicating that they would not be available for these loan types in the 2003–04 Budget.

The ATO accurately calculates HELP compulsory repayments and effectively manages these repayments through income tax arrangements. However, the ATO could not advise the ANAO of the value of HELP compulsory repayments that have been raised but not collected through income tax arrangements.

The ATO’s Integrated Core Processing system does not support accurate processing of the HECS-HELP Benefit in all circumstances, and the ATO estimates that some 12 000 payees are affected by errors including incorrect account balances. The ATO has not met its timeliness standards for processing applications for the HECS-HELP Benefit for the past four years.

Collection of voluntary repayments

3.3 Payees can make voluntary repayments through the ATO’s payment channels, including online and over the phone. Voluntary repayments of more than $500, or that are less than $500 and will payout the HELP debt in full, attract a bonus of five per cent of the repayment amount. For example, if a voluntary repayment of $1500 is made, the value of the HELP debt would be reduced by $1575. However, the bonus will be discontinued from 1 January 2017.

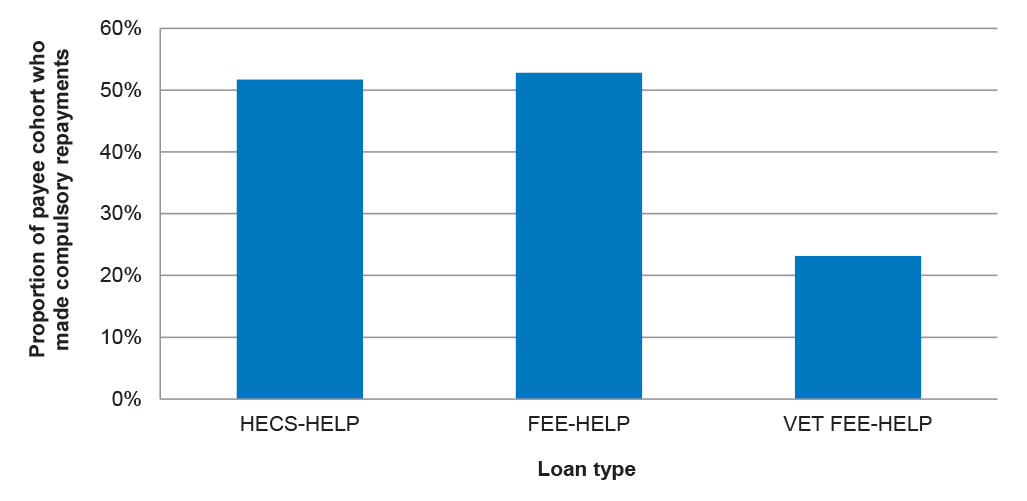

3.4 The ANAO analysed voluntary repayments for the period 2010–11 to 2012–13 for HELP payees who had a final debt recorded in 2009–10 and who were in receipt of a HECS-HELP, VET FEE-HELP or FEE-HELP loan. During this period, $74.5 million of voluntary repayments were made by this cohort; of which 77.8 per cent (or $58.0 million) were made in 2010–11 and 2011–12. Comparatively, in 2012–13, only $16.5 million of voluntary repayments were made. It is expected that the spike in repayments was due to payees taking advantage of the higher ten per cent bonus before it was reduced to five per cent in 2012. Table 3.1 illustrates the proportion of loan recipients who made a voluntary repayment.

Table 3.1: Proportion of payees who made a voluntary repayment, 2010–11 to 2012–13

|

Loan type |

No. of payees |

No. of payees who made a voluntary repayment |

Proportion of the cohort who made a voluntary repayment |

|

HECS-HELP |

91 834 |

8677 |

9.4% |

|

FEE-HELP |

35 981 |

3820 |

10.6% |

|

VET FEE-HELP |

6469 |

236 |

3.6% |

|

Total |

134 284 |

12 733 |

9.5% |

Source: ANAO analysis.

3.5 When FEE-HELP and OS-HELP were introduced in 2005, the then Australian Government indicated that the bonus would not be available for voluntary repayments on these two loan types. However, this restriction was never applied by the ATO or Education and voluntary repayments towards debts associated with these loan types have received the five per cent bonus. While Education advised the ANAO that this measure could not be implemented as the ATO’s Integrated Core Processing information technology system is unable to differentiate repayments by loan type, Education could not provide documentation to demonstrate that there was a formal decision to not implement the measure.20

3.6 As the ATO’s Integrated Core Processing system is unable to differentiate repayments by loan type, it is not possible to accurately quantify the value of bonuses associated with voluntary repayments for FEE-HELP and OS-HELP. The ANAO estimated that the value of bonuses incorrectly processed in 2014–15 was around $2 million.21 Applying the same assumptions, an estimate of the total value of voluntary repayment bonuses relating to FEE-HELP and OS-HELP loans since they were introduced in 2004–05 is around $10 million.

Collection of compulsory repayments

3.7 Compulsory repayments are raised for payees when they earn an income equal to or greater than the compulsory repayment threshold. The ATO calculates and raises compulsory repayments when payees submit their income tax return. As outlined in Chapter 2, the ANAO’s testing of 120 income tax returns with a HELP and/or Student Financial Supplement Scheme debt provided assurance that the ATO accurately calculated HELP compulsory repayments.

3.8 The ATO advised the ANAO that all compulsory repayments are recorded as collected when they are raised. This process is effective when payees have sufficient Pay-As-You-Go withholdings to offset their compulsory repayments as these liabilities are deemed to be paid first from income tax withholdings. In instances where there is insufficient income tax withholdings to offset compulsory repayments, for example payees who do not participate in the Pay-As-You-Go system, such as some who are self-employed, the shortfall is converted to an income tax debt.22 Therefore, in practice, the ATO records all compulsory repayments raised as collected irrespective of whether a repayment has been received. The ATO could not advise the ANAO of the value of HELP compulsory repayments that have been raised and not collected.

HECS-HELP Benefit

3.9 As outlined in Chapter 2, the HECS-HELP Benefit was expected to provide an incentive for graduates of particular courses to take up related occupations or work in specified locations by reducing either compulsory repayments or HELP debt balances. There are complex eligibility requirements for the HECS-HELP Benefit, including the type of course completed, the type of employment undertaken and for early childhood education there are also geographic and other eligibility requirements.23

3.10 Payees are required to apply for the HECS-HELP Benefit each income year and must apply within two years of the conclusion of the relevant income year. There is a lifetime limit of five years for each benefit type and payees can receive multiple benefit types for the same financial year.24

3.11 The ANAO planned to undertake testing of the ATO’s processing of HECS-HELP Benefit applications including confirming that no payees had breached the lifetime limit as well as confirming the number of payees receiving multiple benefits. However, the ATO did not provide the ANAO with an extract of HECS-HELP Benefit data that was reliable for testing purposes and consequently this testing was not undertaken.

3.12 There are a number of limitations associated with the Integrated Core Processing system’s processing of HECS-HELP Benefit transactions, including that it:

- records HECS-HELP Benefit transactions twice on payees’ accounts. This error does not result in a reduction of HECS-HELP Benefit balances for payees in receipt of maths and science HECS-HELP Benefit, however, it does reduce the balances of nursing and education HECS-HELP Benefit recipients; and

- incorrectly calculates the HECS-HELP Benefit amount available to payees with a nil or small balance.25

3.13 These issues were initially identified in 2011, and while there have been internal requests for the system to be improved since this time, they have not been actioned. The ATO estimated that these issues affect 12 000 payees and cost approximately $180 000 per annum in staff time to manage. Further, the ATO identified the potential impact to payees as receiving an incorrect benefit amount or incorrectly being denied a benefit.

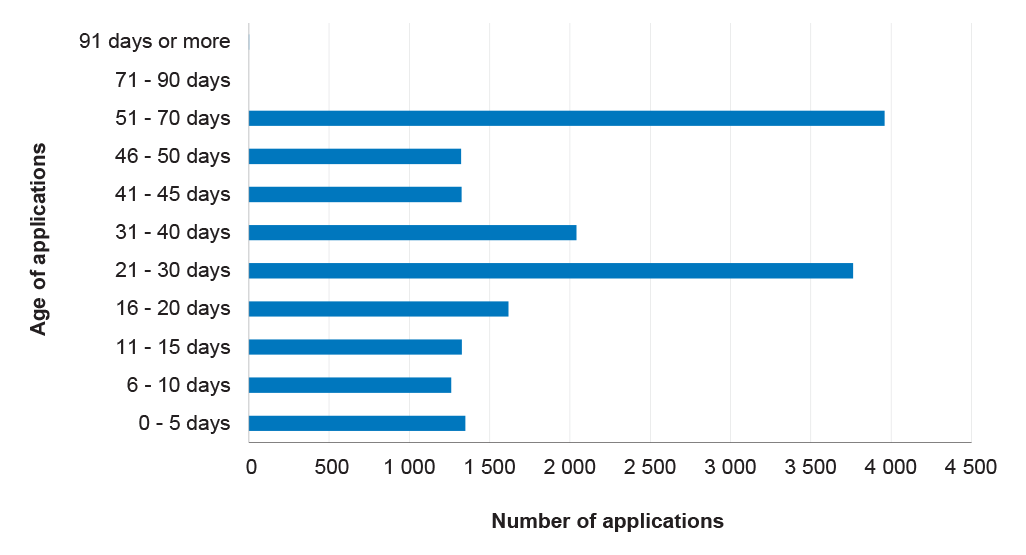

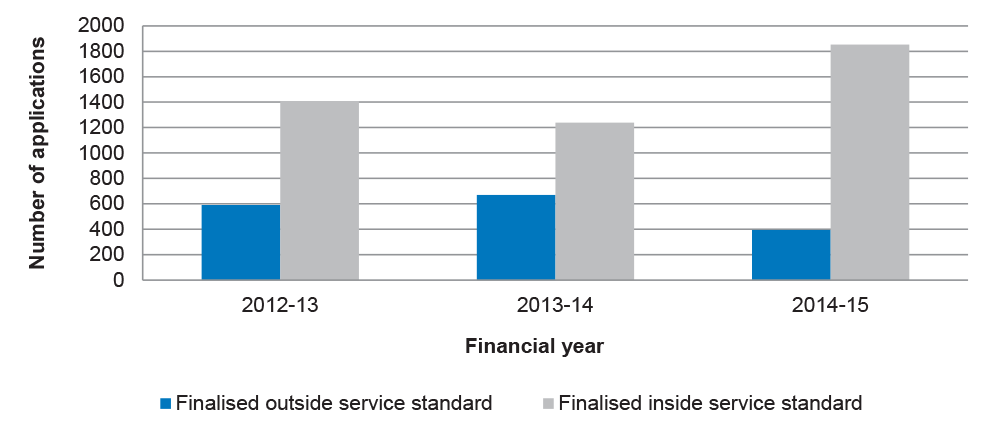

3.14 In line with the ATO’s service standard, HECS-HELP Benefit applications should be processed within 28 days. The ATO is not achieving this standard and as at 19 October 2015, the ATO had received 17 959 HECS-HELP Benefit applications for 2013–14 and 2014–15; of which 17 930 had not been allocated for action.26 Figure 3.2 illustrates that 8645 applications were 31 days or older.

Figure 3.2: Age of applications for the HECS-HELP Benefit in 2015

Source: ANAO analysis of ATO information.

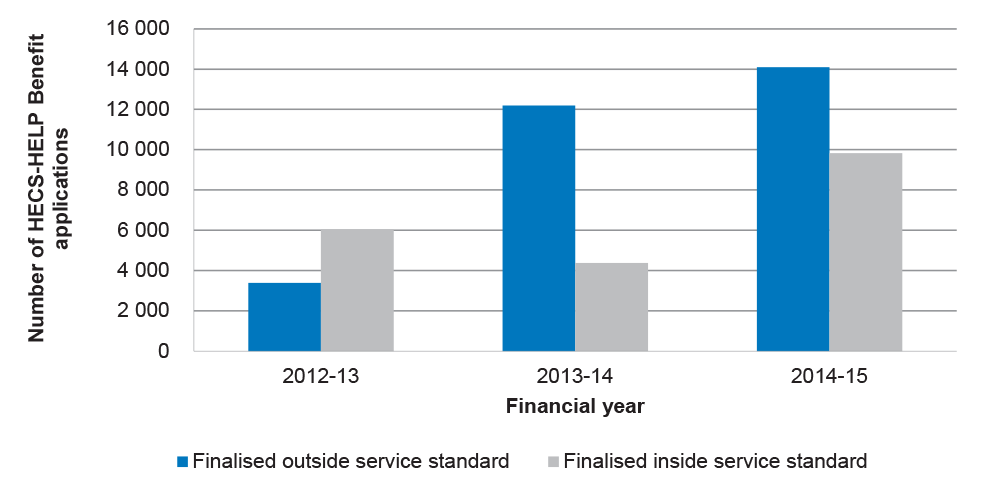

3.15 Figure 3.3 illustrates that in the preceding two years, most HECS-HELP Benefit applications have been processed outside the service standard. The ATO advised the ANAO that the 28 day service standard is an electronic standard, and as HECS-HELP Benefit applications cannot be received and processed electronically it intends to change the standard to 50 days.

Figure 3.3: Timeliness for processing HECS-HELP Benefit applications

Source: ANAO analysis of ATO information.

Does the ATO have effective processes to administer HELP debt write-offs, waivers and deferments?

The ATO manages relatively few HELP write-offs, waivers and deferments, and applies its broader corporate policies and processes in this regard. To improve the effectiveness of these processes for HELP, the ATO is revising its broader guidance for write-offs, which is out of date and incomplete, and may need to introduce guidance on waivers. It also needs to improve the timeliness of processing applications for the deferment of HELP debt repayments in order to meet internal standards.

Write-offs

3.16 Debts can be written off for three reasons: irrecoverable at law; uneconomical to pursue; and death.

Irrecoverable at law and uneconomical to pursue

3.17 The ATO advised the ANAO that debts classified as irrecoverable at law are mostly amounts that could not be collected as a result of an ATO administrative error. Since 2004–05, the ATO has written off $283 439 in HELP debt as irrecoverable at law. This amount includes four debts totalling $6132 that were written off in 2013–14. These debts were aged between five and 20 years old and could not be matched to an ATO client record.

3.18 Debts that are deemed as uneconomical to pursue and are subsequently written-off are mostly low-value debt amounts. For example, since 2012 the ATO has been writing off debts owed to the ATO and to clients of less than $1 as uneconomical to pursue. The net total amount that the ATO has written off as uneconomical to pursue since 2004–05 is $21 306—noting that this includes both debts owed to and by clients.

3.19 The ATO does not have specific guidance on processing HELP debt write-offs that are either irrecoverable at law or uneconomical to pursue. Instead, these types of transactions are covered by general guidance on debts that will not be pursued by the ATO. This guidance does not indicate the types of debts that may be considered irrecoverable at law or indicate debt amounts that may be considered uneconomical to pursue. Further, the guidance is outdated as it refers to the Financial Management and Accountability Act 1997 that was replaced by the Public Governance, Performance and Accountability Act 2013 on 1 July 2014. The ATO advised the ANAO that it is updating these procedures and expects to publish them by 30 June 2016.

Deceased clients

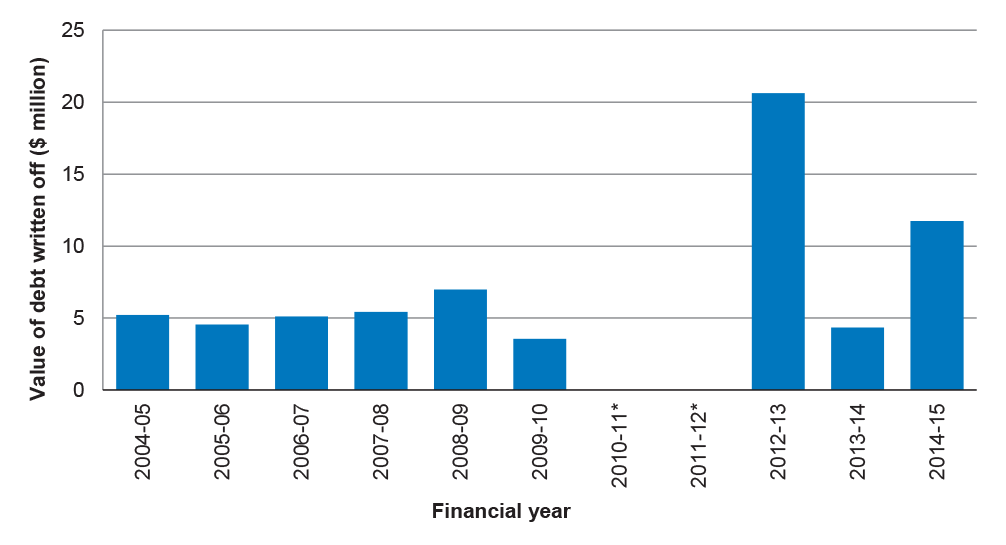

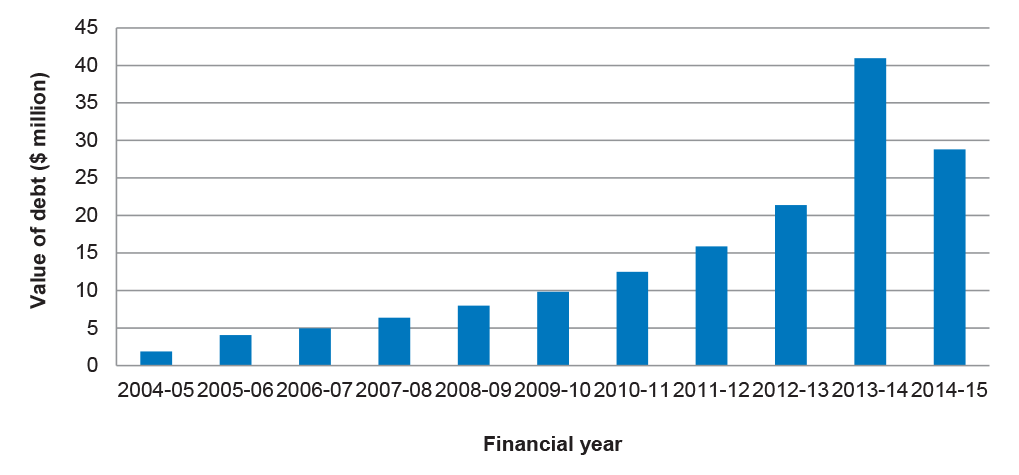

3.20 Debts associated with deceased clients are the largest write-off category for HELP. Compulsory repayments relating to the period prior to a person’s death are to be paid from the estate and the remainder of the HELP debt balance is written-off.27 As indicated in Figure 3.4, $67.5 million in HELP debt associated with deceased clients has been written-off since 2004–05.

Figure 3.4: Value of written off debt associated with deceased clients, 2004–05 to 2014–15

Note *: When the Integrated Core Processing system was introduced in 2010, the HELP debt write-off functionality was not available. Consequently, write-offs were not processed in 2010–11 and 2011–12. The large increase in 2012–13 is the result of processing the backlog of these cases.

Source: ANAO analysis of ATO information.

3.21 The ATO receives files containing data on deceased individuals from the state and territory registries of births, deaths and marriages. Client files are updated with a date of death and HELP debts are written-off when a final income tax return is submitted for the deceased customer. If after three years, no final income tax return is submitted, the debt can be written-off. The ATO has guidance available to assist staff with writing off these debts.

Waiver

3.22 Section 63 of the Public Governance, Performance and Accountability Act 2013 enables the Minister for Finance to waive an amount owing to the Commonwealth.28 Debts that have been waived cannot be pursued at a later date. Guidance issued by the Department of Finance (Finance) indicates that waivers should not be considered when there are other alternatives available.29 Since 2004–05, approximately $650 000 of HELP debt has been waived.

3.23 To apply for a waiver, payees can lodge an application with Finance or the ATO, and the ATO can also lodge a waiver request on behalf of a payee to Finance. The ATO is required to lodge a submission to Finance in response to a waiver application.30 In 2013–14 and 2014–15, the ATO was required to provide submissions to Finance for 27 waiver requests. The ATO supported six of these requests and Finance waived a total of seven debts.31

3.24 Where preparing a waiver submission for Finance, an ATO procedure indicates that the submission should include whether the ATO supports the debt waiver request, but does not provide guidance for determining this position. For example, the procedure does not identify factors that should be considered in relation to the request or provide examples of the circumstances in which the ATO may support a waiver request. Further, both procedures are outdated in that they refer to the Financial Management and Accountability Act 1997.

3.25 Waiver submissions are prepared and reviewed by two ATO officials. While not documented, the ATO advised the ANAO that there is an understanding among these officers of the types of waiver requests that the ATO would support. Should responsibility for preparing submissions be disseminated more widely, or be allocated to other officers, there would be merit in the ATO providing guidance on the circumstances in which the ATO would support a request for waiver.

Deferment of compulsory repayments

3.26 Payees can apply for a compulsory repayment deferment for the current, previous and next financial years.32 Deferring a compulsory repayment does not reduce the payee’s accumulated debt value, as the value of the compulsory repayment remains part of the total accumulated debt and continues to be indexed on an annual basis. In 2014–15, the ATO processed 2166 applications for deferment and approved a total of $5.9 million in HELP repayments to be deferred.

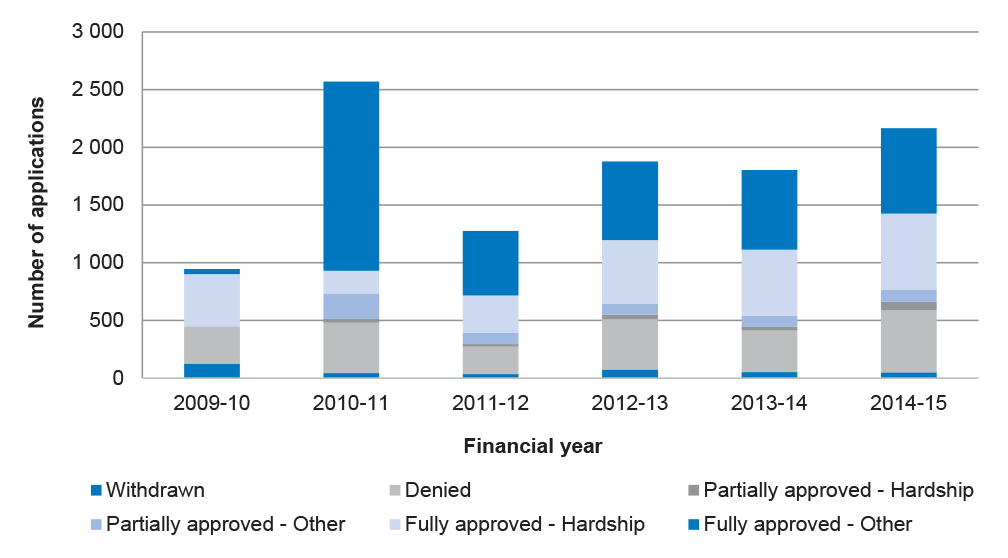

3.27 Payees can apply on the grounds of severe financial hardship; or for other reasons that make it fair and reasonable to defer the payment.33 Payees can also apply to defer their compulsory repayment in full or in-part by specifying the amount they seek to defer.34 Figure 3.5 illustrates that, with the exception of 2009–10 and 2010–11, the outcome of deferment applications has remained relatively stable since 2011–12.35 Most applications are at least partially allowed and only 21.9 per cent applications have been denied since 2009–10. Further, as a proportion of compulsory repayments, the total value of deferments approved each year has remained relatively stable.36

Figure 3.5: Outcomes of HELP deferment applications since 2009–10

Note: The ‘number of applications’ refers to deferment applications processed in the relevant financial year.

Source: ANAO analysis of ATO information.

3.28 The ATO is not meeting the processing timeframes for deferments. Applications are required to be processed within 28 days. As at 9 August 2015, the ATO had received 21 applications for deferment, of which five were 29 (or more) days old. These results are consistent with the ATO’s historical performance as illustrated in Figure 3.6.

Figure 3.6: Timeliness for processing deferment applications

Note: The ‘number of applications’ refers to applications received in the relevant financial year.

Source: ANAO analysis of ATO information.

3.29 If payees are dissatisfied with the outcome of their deferment application, they can apply to the ATO to have the decision reviewed. In 2014–15, of 718 deferment applications that were denied or partly approved, there were 353 applications for review, of which: 42 were denied, 170 were approved, 135 were partially approved and six were withdrawn.37 With 86 per cent of these review outcomes favouring applicants to some extent, the ATO should disseminate the outcomes of these reviews to improve the quality of decision-making as well as consider whether additional guidance or training should be implemented to better support original decision makers.

3.30 If payees are then dissatisfied with the ATO’s review decision, they can apply to the Administrative Appeals Tribunal for a review of the ATO’s decision within 28 days of receiving the ATO’s review decision. In 2014–15, the Administrative Appeals Tribunal received three applications for review; two of these were subsequently withdrawn and one was dismissed as it could not be reviewed by the Administrative Appeals Tribunal.

Does the ATO have quality assurance arrangements to support the accurate recording of HELP repayments, discounts, write-offs, waivers and deferments?

The ATO has quality assurance arrangements in place to support the accurate recording of HELP repayments, discounts, write-offs, waivers and deferments, particularly through its Service Delivery Quality Framework and Service Delivery Coaching Framework. Assessments conducted as part of the Service Delivery Quality Framework indicated that the main team responsible for administering HELP is performing strongly. There is scope to improve arrangements to check these quality assessments.

An enterprise-wide quality assurance framework aimed at identifying systemic issues, ATO Quality, has not yet covered HELP administration.

3.31 The ATO’s quality assurance activities form part of a broader governance framework involving three lines of defence. ATO quality assurance activities sit within the first and second lines of defence, and in relation to HELP include:

- activities undertaken through the Service Delivery Quality Framework and coaching and assurance programs of service delivery business areas (first line of defence); and

- the enterprise-wide process, ATO Quality (second line of defence).38

First line of defence

3.32 In January 2015, the ATO introduced the Service Delivery Quality Framework to drive consistent quality across service delivery areas, regardless of business line or the type of work being actioned. Under this framework, each officer has three pieces of work assessed per month, rated as one of four categories (exceeds standard, met standard, met standard with feedback and standard not met) against eight criteria.39 If an officer achieves a result of 100 per cent40 for three consecutive months then the number of assessments is reduced to two in the following months.

3.33 While three pieces of work is not a statistically valid sample, applying a smaller sample size to quality assurance activities carries a lower risk with an experienced processing team that is likely to have a minimal error rate. However, in mid-2015, the ATO expanded HELP processing responsibility to include a team of 20 staff who had not previously carried out this type of work. Depending on the results of subsequent assessments, the ATO should consider applying a statistically valid sampling approach to quality assurance activities in relation to work completed by staff who are relatively unfamiliar with the content.

3.34 Monthly reports outlining the results of the Service Delivery Quality Framework assessments are distributed to the Service Delivery Deputy and Assistant Commissioners and can be accessed by all ATO staff on a central intranet site. Between January 2015 and June 2015, an average of 50 pieces of work completed by the Higher Education Loans Accounts team was assessed each month.41 The assessment results indicate that the team was performing strongly. On average, only 0.8 per cent of cases were assessed as ‘met standard with feedback’ and only 0.3 per cent were assessed as ‘standard not met’ compared to 4.4 per cent and 3.0 per cent, respectively, for the Business Exceptions Management section.42

3.35 Quality assessors are also subject to review, as illustrated in Table 3.2.

Table 3.2: Reviews of quality assessors’ decisions under the Service Delivery Quality Framework

|

Type of check |

Description of check |

Reporting |

|

Check-the-checker reviews |

Assessors have their completed quality assessments checked for accuracy, alignment and relevancy for coaching each month. The results of the assessments are provided to the team leaders of the quality assessors for coaching purposes. |

Number of checks undertaken.1 |

|

‘Standard not met’ outcome reviews |

A sample of assessments resulting in the rating of ‘standard not met’ is reviewed for accuracy. The performance target for this check is that 30 per cent of reviews do not result in a varied assessment. |

Number of reviews undertaken, recommended for variation and varied. |

|

Assessment reviews |

ATO officers who disagree with their assessment outcome can request a review. |

Number of reviews lodged and overturned. |

Note 1: A target for the sample size was in place however this target was removed in May 2015.

Source: ANAO analysis of ATO information.

3.36 None of the reviews have check frequency targets and only the ‘standard not met’ outcome reviews have a performance target. There is:

- no check frequency target for the check-the-checker results. Previously, each assessor was to have had three pieces of work assessed, however this requirement was removed in May 2015 (following four months when the target was not met). Consequently, the ATO has no measure of the extent of checking and whether assessments are accurate or in alignment with the Service Delivery Quality Framework;

- no check frequency target and an extremely low performance target of 30 per cent in place for ‘standard not met’ outcome reviews, implying that the ATO will accept a 70 per cent error rate among its assessors; and

- no performance target for assessment reviews, which could focus on reducing the number of reviews that result in an assessment being overturned.

3.37 To address these shortcomings, the ANAO suggests that the ATO reassess its targets and reporting for the quality assessor reviews to focus on improving the accuracy of quality assessors’ assessments.

3.38 In addition to the Service Delivery Quality Framework, in December 2014 the ATO introduced the Service Delivery Coaching Framework. Under the framework, team leaders are expected to have a coaching conversation with each team member once a month. The basis of the conversation is the My Contribution report, which outlines staff members’ performance in relation to indicators associated with the four high level areas of: productivity, quality, skilling and capability, and attendance and wellbeing. A survey of 1000 frontline staff in June 2015, indicated that the ATO could improve the consistency with which these monthly conversations are held as on average 72 per cent of survey respondents had a conversation each month, although this was trending downwards, and 13 per cent had no conversations in the preceding four months.43

Second line of defence

3.39 ATO Quality, introduced in July 201444, is the ATO’s enterprise-wide quality assurance system. With a primary focus on quality from the taxpayer’s perspective, the ATO Quality framework was designed to help track the ATO’s performance towards achieving the ATO’s 2020 vision.45 Part of the role of ATO Quality is also to challenge and validate information provided by first line of defence quality assurance activities and to hold the first line to account for implementing quality.

3.40 ATO Quality involves a quarterly assessment process of a statistically valid sample of ATO transactions (around five per cent) against four elements: customer service; accountability; accuracy; and performance. Each element is graded one of four ways: exceeded; achieved; improvement needed; and considerable improvement needed.46 ATO Quality assessments are intended to be tailored based on risk.47

3.41 These assessments aim to identify critical or systemic issues that are then allocated to an area for action. Issues are monitored quarterly by the ATO’s Audit and Risk Committee through an ATO Quality Report. The reports present high-level results against the four ATO Quality criteria for the preceding quarter. HELP administration was not presented as a focus in these reports.

4. Risk management and compliance

Areas examined

This chapter examines the ATO’s and Education’s risk management approaches. It also discusses the ATO’s compliance activities, including its communication strategy for encouraging compliance.

Conclusion

The ATO and Education do not meet their risk management responsibilities under the Memorandum of Understanding, and consequently do not effectively manage HELP risks. The agencies provide a range of information to support voluntary compliance with HELP obligations, including through a draft communication strategy. The two agencies also undertake compliance activities to detect and deter non-compliant behaviour among HELP participants. However, these activities are not supported by a compliance and enforcement strategy informed by an assessment of HELP risks.

Areas for improvement

The ANAO made two recommendations aimed at the ATO and Education developing risk management plans and sharing relevant risks as required under the Memorandum of Understanding (paragraph 4.13), and developing a compliance strategy (paragraph 4.46).

The ANAO also made five suggestions aimed at: enhancing the ATO’s communication strategy (paragraph 4.21); including additional information in the ATO’s and Education’s HELP information products (paragraphs 4.24, 4.25 and 4.27); and monitoring the target populations of the ATO’s non-lodger program in relation to HELP payees (paragraph 4.39).

Do risk management arrangements support the effective management of HELP risks?

Existing risk management arrangements do not support the effective management of HELP risks. The risk management arrangements outlined in the Memorandum of Understanding should assist with the effective management of HELP risks. However, neither Education nor the ATO have met their respective risk management requirements under this agreement.

4.1 Under the Memorandum of Understanding, Education and the ATO are required to:

- maintain risk management plans, in line with their respective risk management policies and procedures, for the services outlined in the Memorandum of Understanding that they are responsible for delivering; and

- raise any matters that are likely to have risk management impacts for the other’s administration of HELP.

Risk management plans

Education’s management of risk

4.2 Education has risk management plans in place for FEE-HELP, SA-HELP and VET FEE-HELP, but does not have plans for HECS-HELP and OS-HELP. It also has a risk management plan for the Higher Education Funding Branch. Having these plans in place, however, does not meet Education’s responsibilities under the Memorandum of Understanding as the intent of the requirement was to capture and address the risks associated with the services delivered by each party.

4.3 For Education, the services specified in the Memorandum of Understanding are providing the quarterly student debt files to the ATO and providing accurate CHESSN reports. The FEE-HELP and VET FEE-HELP risk management plans both identify the risk of providers submitting false or misleading information or not providing necessary information48, which is relevant to Education’s transfer of data to the ATO. By preparing a risk management plan that examines this risk in more detail and reflects other risks specific to these services, Education could focus more effectively on resolving some of the shortcomings associated with the data collection process outlined in Chapter 2.

4.4 Consistent with Education’s Risk Management Framework and Policy (October 2014), the risk management plans have been stored in the department’s official risk register (RiskActive), and included scheduled review points. The framework also requires that internal and external fraud is considered as part of assessing risks. Across the four risk management plans, there were ten risks categorised as fraud related—indicating that Education’s framework is conducive to identifying compliance risks associated with HELP.

4.5 Management of HELP risks rated as ‘high’ could better align with the department’s risk management framework and policy.49 The VET FEE-HELP risk management plan includes seven operational risks and six departmental risks rated as ‘high’. The Higher Education Funding Branch risk management plan identified a further three departmental and operational risks rated as ‘high’. These risks should be monitored every three months according to the framework and policy, however, the review dates for these plans are 12 months in advance, and in October 2015 the Higher Education Funding Branch risk management plan had not been reviewed for approximately 17 months.

The ATO’s management of risk

4.6 The ATO has not developed a risk management plan for HELP.

4.7 Under the Memorandum of Understanding, the ATO is responsible for delivering a series of reports to Education as well as providing data to the Australian Government Actuary.50

4.8 The ATO’s risk management framework refers to four risk categories: strategic, enterprise, operational and tactical.51 Enterprise risks are mapped to the ATO’s six strategic risks in an enterprise wide risk register.52 The framework indicates that enterprise and operational risks are to be managed through business line plans, and tactical risks should be managed through team plans.

4.9 Six risk assessments have been completed for the Client Account Services business line, and none of the risk assessments include risks associated with HELP. Further, while the framework indicates that tactical risks are managed through team plans, the ATO advised that business areas are not required to maintain their own risk registers. The ATO was not required to maintain risk management plans on aspects of the administration of HELP under its risk management policies and procedures, although it was required under the Memorandum of Understanding to develop a risk plan. Consequently, there is no explicit coverage of HELP risks by the ATO. Further, the ATO has not conducted an assessment of compliance risks associated with the services it is responsible for delivering under the Memorandum of Understanding, including the collection and administration of HELP debt.

Communication about risks

4.10 The Memorandum of Understanding between Education and the ATO states that the Management Committee’s53 role includes managing risks and formulating strategies to minimise risks. According to the Memorandum of Understanding, the Management Committee should meet at least four times a year, and may also meet on an ad-hoc basis.

4.11 Meetings between Education and the ATO, referred to as Higher Education Meetings, have occurred on a regular basis. While these meetings have discussed a range of issues, there has been no formal and explicit risk assessments and mitigation strategies discussed and shared in these meetings.

4.12 Education’s risk management plans identify risks, including risks associated with non-compliant behaviour of providers and payees, which could be considered jointly by the ATO and Education. Accordingly, the ATO and Education need to share their risk assessments to ensure that administration of HELP effectively mitigates risks to an acceptable level. Introducing a standing agenda item on risk management for the Higher Education Meetings could better facilitate the sharing of relevant risks between Education and the ATO.

Recommendation No.2

4.13 To improve the management of risks associated with the Higher Education Loan Program and support Education’s and the ATO’s compliance with the risk management requirements set out in the Memorandum of Understanding, the ANAO recommends that Education and the ATO:

- develop risk management plans for their respective services under the Memorandum of Understanding; and

- introduce a standing agenda item for risk management at Higher Education Meetings to facilitate discussion of relevant risks.

The ATO’s response: Agreed.

4.14 The ATO is committed to working with Education to identify and manage the risks associated with the Higher Education Loan Program, in order to support compliance with the risk management requirements set out in the Memorandum of Understanding.

Education’s response: Agreed.

4.15 The department is working with the ATO to develop a more comprehensive risk management plan. The department also now has a formal and comprehensive risk plan in place for HELP, and has introduced risk management as a standing agenda item for department/ATO meetings.

Do the ATO and Education effectively support individuals who are willing to meet their HELP obligations?

The ATO and Education provide sufficient information to support individuals willing to meet their HELP obligations. These individuals have ready access to information about most aspects of the scheme, particularly through the agencies’ websites and ATO social media posts. However, some inaccurate and incomplete information has been provided. In finalising its HELP communication strategy, it would be useful for the ATO to outline a forward work program.

The ATO ceased mailing out account statements in 2013, without introducing an alternative means of informing payees of changes to their HELP debt. Consequently, there is an increased risk of students being unaware of incurring a HELP debt.

Communication strategy

4.16 The ATO developed a draft communication strategy for income contingent loan debts, including HELP debts.54 The strategy outlines communication channels and relevant target audiences.55 Under the strategy, loan recipients and intermediaries are to be supported to use a range of products and channels tailored to their specific needs, although online and other digital services are to be the driving focus in delivering messages to targeted audiences.