Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Agriculture, Fisheries and Forestry portfolio is responsible for advising the government and implementing programs on rural adjustment and drought issues, plant and animal biosecurity and Australia’s agricultural, fisheries, food and forestry industries.

The Department of Agriculture, Fisheries and Forestry (the department) is the lead entity in the portfolio. It is responsible for developing and implementing policies and initiatives to promote more sustainable, productive, internationally competitive and profitable Australian agricultural, food and fibre industries; and safeguarding Australia’s animal and plant health status to maintain overseas markets and protect the economy and environment from exotic pests and diseases. Further information is available from the department’s website.

In addition to the Department of Agriculture, Fisheries and Forestry, there are eight entities within the portfolio that are responsible for: Commonwealth fisheries; regulating pesticides and veterinary medicines; farm business loans; and research and development for wine, cotton, fisheries, grains and rural industries.

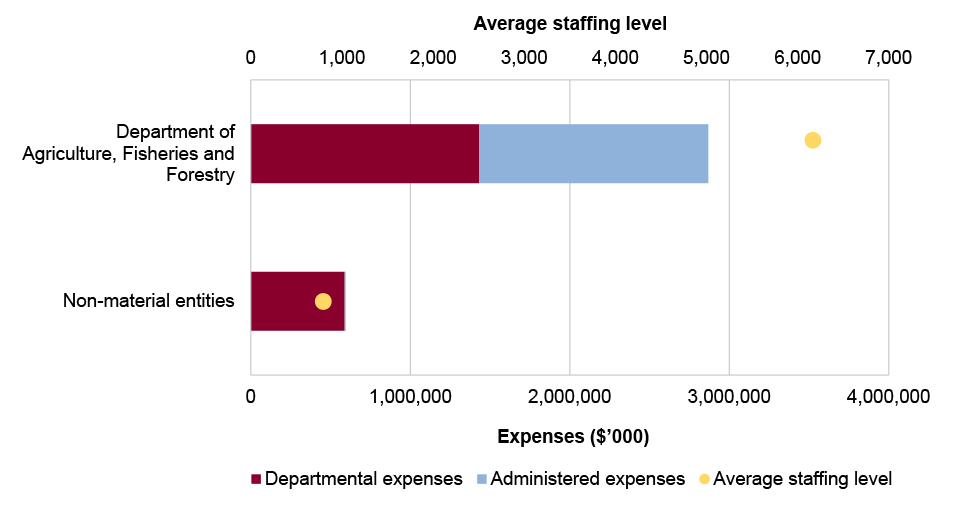

In the 2024–25 Portfolio Budget Statements (PBS) for the Agriculture, Fisheries and Forestry portfolio, the aggregated budgeted expenses for 2024–25 totalled $3.5 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Agriculture, Fisheries and Forestry represents the largest proportion of the portfolio’s expenses, and departmental expenses of the portfolio are the most material component, representing 58 per cent of the entire portfolio’s expenses.

Figure 1: Agriculture, Fisheries and Forestry portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2024–25 Portfolio Budget Statements.

Audit focus

In determining the 2024–25 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from new investments or changes in the operating environment.

The ANAO had regard to the final report of the capability review of the Department of Agriculture, Fisheries and Forestry that was endorsed by the Australian Public Service Commissioner in August 2023. The review noted that improvements are required in relation to: the department’s governance framework including stronger alignment between priorities and resource allocation; proactive engagement with stakeholders on policy matters; capability improvement that recognises the future operating environment; developing and embedding a workforce planning framework; strengthening financial reporting and forecasting; and data management maturity.

The primary risks identified for the portfolio relate to the department’s implementation of risk based regulatory regimes and effective management of resources to achieve its purpose. In 2022–23, the Department of Agriculture, Fisheries and Forestry was allocated $127 million to meet a funding shortfall predominantly related to cost recovered activities. The value of agricultural production, estimated to be $85 billion in 2024–25 highlights the importance of implementing risk based regulatory regimes and effective management of resources to achieve the department’s purpose.

The Agriculture, Fisheries and Forestry portfolio’s strategic risks relate to governance, service delivery, regulation and financial management.

Governance

Past audits of the Department of Agriculture, Fisheries and Forestry have found weaknesses in the department’s governance and culture: in particular, the audits identified issues in risk management and demonstrating value for money in the department’s procurement activities. There is a risk that these weaknesses have not been addressed.

Effectively managing and implementing change occurs over time. Effective change programs require ongoing and active oversight. Past audits of the Department of Agriculture, Fisheries and Forestry have identified weaknesses in the department’s: documentation of the rationale for key decisions; implementation of recommended actions and following through; maintenance of complete records; and monitoring and reporting progress to demonstrate outcomes.

Service delivery

Several measures were announced for the Agriculture, Fisheries and Forestry portfolio in the 2024–25 Budget, some of which involve the establishment of new programs relating to drought preparedness and resilience, phasing out of live sheep exports by sea, and biosecurity operations. There is a risk that new initiatives may not achieve desired outcomes if they are not supported by sufficient planning, a clear rationale of where intervention is required, use of the best available evidence, and application of appropriate risk management and performance measurement frameworks.

Regulation

The department is responsible for regulating agricultural goods imported into and exported from Australia; agricultural levies; imported food safety; imported wood and paper products; and pest and disease risks of goods, people and vessels arriving in Australia. Past ANAO audits have identified deficiencies in the department’s arrangements to manage its performance as a regulator. The department’s 2022–23 performance statements did not provide a complete or unbiased basis for measuring and assessing the department’s performance in regulating exports.

Financial management

In 2023–24, a revised biosecurity funding model included an additional $198.7 million in appropriation funding and $36.0 million in cost recovery fees and charges. The department also established a financial improvement taskforce to implement recommendations related to efficiencies and mechanisms to strengthen internal budget processes. Effective implementation of actions to improve the department’s financial management is required to manage the risk that financial management practices do not support the department to deliver key functions, therefore affecting its performance as a regulator and its ability to effectively deliver services.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2019–20 to 2023–24 entities within the Agriculture, Fisheries and Forestry portfolio were included in tabled ANAO performance audits 18 times. The conclusions directed toward entities within this portfolio were as follows:

- none were unqualified;

- seven were qualified (largely positive);

- 10 were qualified (partly positive); and

- one was adverse.

Figure 2 shows the number of audit conclusions for entities within the Agriculture, Fisheries and Forestry portfolio that were included in ANAO performance audits between 2019–20 and 2023–24 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2019–20 to 2023–24 : entities within the Agriculture, Fisheries and Forestry portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Agriculture, Fisheries and Forestry portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Agriculture, Fisheries and Forestry portfolio, 2019–20 to 2023–24

Source: ANAO data.

Performance statements audit

The audit of the 2023–24 Department of Agriculture, Fisheries and Forestry (DAFF) annual performance statements is being conducted following a request from the Minister for Finance on 18 July 2023, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

DAFF is in its third year of inclusion in the annual performance statements audit program. There are four carried over significant findings as a result of the 2022–23 audit.

DAFF’s performance statements are complex with an immature performance reporting framework and the engagement risk has been assessed as high.

Key risks for DAFF’s performance statements that the ANAO has highlighted include:

- the lack of a fully implemented enterprise-wide performance framework;

- unresolved qualifications and category A findings from previous audit and eight new measures;

- immature measure methodologies, IT controls, quality assurance processes and data governance; and

- capacity and resourcing.

Financial statements audits

Overview

Entities within the Agriculture, Fisheries and Forestry portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Agriculture, Fisheries and Forestry portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Agriculture, Fisheries and Forestry |

Non-corporate |

Moderate |

1 |

3 |

|

Non-material entities |

||||

|

Australian Fisheries Management Authority |

Non-corporate |

Low |

|

|

|

Australian Pesticides and Veterinary Medicines Authority |

Corporate |

Low |

|

|

|

Cotton Research and Development Corporation |

Corporate |

Low |

|

|

|

Fisheries Research and Development Corporation |

Corporate |

Low |

|

|

|

Grains Research and Development Corporation |

Corporate |

Low |

|

|

|

Regional Investment Corporation |

Corporate |

Moderate |

|

|

|

Rural Industries Research and Development Corporation (trading as Agrifutures Australia) |

Corporate |

Low |

|

|

|

Wine Australia |

Corporate |

Low |

|

|

Note a: Sourced from Public Governance, Performance and Accountability Act 2013 (Flipchart of PGPA Act) Commonwealth entities and companies (Department of Finance) as at 1 March 2024.

Material entities

Department of Agriculture, Fisheries and Forestry

The Department of Agriculture, Fisheries and Forestry (DAFF) is responsible for developing and implementing policies and initiatives to promote more sustainable, productive, internationally competitive and profitable Australian agricultural, food and fibre industries; safeguarding Australia’s animal and plant health status to maintain overseas markets and protect the economy and environment from exotic pests and diseases.

The Department of Agriculture, Fisheries and Forestry’s total budgeted revenues for 2024–25 are $2.3 billion, with other taxes and sales of goods and rendering of services representing 27 per cent and 24 per cent, respectively, as shown in Figure 4. Loan receivables represents 60 per cent of total budgeted assets.

Figure 4: Department of Agriculture, Fisheries and Forestry’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2024–25 Portfolio Budget Statements.

There are four key risks for the Department of Agriculture, Fisheries and Forestry’s 2023–24 financial statements that the ANAO has highlighted for specific audit coverage. The ANAO considers three of these risks as potential key audit matters (KAMs).

- The accuracy and completeness of revenue relating to import and export regulatory functions. There is a risk that the complex administrative and information technology processes that support the collection of import and export fees and charges could result in the under collection of revenue. Fees and charges are recognised on the basis of declarations by importers and exporters. (KAM – Accuracy and completeness of own-source revenue)

- The accuracy and completeness of primary industry levies and charges, due to the complex calculations used to derive the estimated collections based on agricultural production and the risk of under collection arising from the submission of inaccurate levy returns and declarations. (KAM – Accuracy and completeness of the collection and distribution of primary industry levies and charges)

- The valuation of drought and farm finance assistance loans due to the nature of eligibility criteria, differing limits and lending terms and the complexity of calculations in determining the valuation and impairment of the loans balance at year end. These loans are coordinated through the state and territory governments and, for new loans made after 1 July 2018, through the Regional Investment Corporation. (KAM – Valuation of loans to the state and territory governments for drought and farm finance assistance)

- DAFF experienced a tight liquidity position during the 2022–23 financial year and received $127.0 million of additional appropriations through Appropriation Act No. 3 2022–23 under the measure ‘funding supplementation’ in June 2023 to cover its cost and pay current liabilities. Given the tight liquidity position in 2022–23 and its potential impact on the 2023–24 financial year, the ANAO has assessed financial sustainability as a key risk for DAFF.