Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Implementation of the Annual Performance Statements Requirements 2016–17

Please direct enquiries through our contact page.

The objective of the audit was to continue to examine the progress of the implementation of the annual performance statements requirements under the PGPA Act and the PGPA Rule by the selected entities. The audit was also designed to:

- provide insights to entities more broadly, to encourage improved performance; and

- continue the development of the ANAO’s methodology to support the possible future implementation of annual audits of performance statements.

Summary and recommendations

Background

1. The current performance measurement and reporting requirements for Commonwealth entities (corporate and non-corporate) are established under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the accompanying Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). The introduction of the PGPA Act was intended to establish a strong performance reporting system to demonstrate to the Parliament and the public that resources are being used effectively and efficiently.1

2. The PGPA Act and PGPA Rule, and any formal guidance issued by the Department of Finance, are collectively referred to as the Commonwealth performance framework (the framework).2 The framework is principles based, and focuses on entities designing their performance measurement and reporting to provide sufficient performance information to users, including operating context, to allow an assessment of progress against intended purposes. The aim is to provide users with a greater understanding of how entities have utilised resources, not just in producing outputs, but also the entity’s impact and efficiency in delivering outcomes.

3. The Auditor-General has flagged to the Joint Committee of Public Accounts and Audit (JCPAA) and the Parliament, the intention to position the ANAO to conduct annual audits of performance statements. This would provide a similar level of assurance to the Parliament and the public as provided by mandatory annual audits of financial statements.3 The JCPAA provided their support for this approach, and in Report 469: Commonwealth Performance Framework, released on 7 December 2017, recommended amending the PGPA Act in this context. The Committee also referred this matter to the attention of the Independent Review of the PGPA Act.

4. This performance audit follows ANAO Report No.58 2016–17 Implementation of the Annual Performance Statements Requirements 2015–16, which was the ANAO’s first examination of entities’ implementation of the annual performance statements (performance statements) requirements. Report No.58 identified a number of key learnings for entities in regard to the appropriateness of performance criteria; processes supporting the development, collection and assurance of performance information; and recordkeeping to support the results reported in the performance statements. The timing of this audit is intended to inform entities’ development of 2018–19 Corporate Plans and the publication of 2017–18 Performance Statements.

5. The Department of the Environment and Energy (Environment), the former Department of Employment (Employment)4, the Australian Trade and Investment Commission (Austrade) and the Australian Sports Commission (the Sports Commission) were selected to participate in this audit on the basis of a review of their respective 2016–17 Corporate Plans. The mixture of entities, reflected by two departments of state, a non-corporate Commonwealth entity, and a corporate Commonwealth entity, was considered to provide the opportunity to make observations that would be relevant to a range of Commonwealth entities. By sharing key learnings this audit aims to continue to facilitate improved understanding and implementation of the performance reporting framework.

Audit objective, rationale and criteria

6. The objective of the audit was to continue to examine the progress of the implementation of the annual performance statements requirements under the PGPA Act and the PGPA Rule by the selected entities. The audit was also designed to:

- provide insights to entities more broadly, to encourage improved performance; and

- continue the development of the ANAO’s methodology to support the possible future implementation of annual audits of performance statements.

7. To form a view against the audit objective, the following high level criteria were adopted:

- the selected entities complied with the requirements of the PGPA Act and PGPA Rule;

- the performance criteria presented in the selected entities’ PBS, corporate plans, and performance statements were appropriate5;

- the selected entities had effective supporting frameworks to develop, gather, assess, monitor, assure and report performance information; and

- sufficient records were retained to support the results reported by the selected entities against the performance criteria in the performance statements.

Conclusion

8. All of the entities met the requirement to publish performance statements under section 39 of the PGPA Act. Each of the entities’ performance statements also contained the basic elements (statements, results and analysis) set out in section 16F of the PGPA Rule. However, improvements to the quality of those elements, including the development of purposes that better define impact, and more appropriate performance measures, are still required by entities to support the presentation of meaningful performance information to the Parliament and the public under the PGPA Act.

9. Each of the entities had processes to support the coordination and collation of the performance statements. The ANAO observed the scale and complexity of processes varied depending on the entity, and the implementation of those processes required improvement in some instances. The effectiveness of the systems, methodologies, and assurance processes established for the collection and reporting of performance information also varied across the selected entities. In particular, this impacted the accuracy of information presented in Environment’s and the Sports Commission’s performance statements.

10. Observations made in this report indicate that there is still some way to go in the maturity of entities’ implementation of the annual performance statements requirements.

Supporting findings

Measurement and reporting of performance

11. All of the entities met the requirement to publish performance statements under section 39 of the PGPA Act. Each of the entities’ performance statements also contained the basic elements (statements, results and analysis) set out in section 16F of the PGPA Rule. However, improvements to the quality of those elements presented by Employment, Environment and the Sports Commission are required for the performance statements to provide more meaningful information to the Parliament and the public.

12. Each of the entities’ corporate plans had areas that may be improved to support the quality of performance measurement and reporting presented in the performance statements. This included clearly describing the impact intended to be achieved in an entity’s purpose, and focusing on outlining significant, rather than minor or supporting, activities to provide a meaningful basis for measuring performance.

13. Each of the entities’ performance criteria require improvement to support the reporting of progress against their purpose/s. The majority of the selected entities’ performance criteria were assessed as either demonstrating all, or most of, the characteristics of relevance. However, less performance criteria were able to fully demonstrate the characteristics of reliability, with the majority only mostly or partly meeting this criterion. The completeness of performance criteria is a particular area requiring consideration, including increasing the use of effectiveness and efficiency measures, or where appropriate, making clear the intention to use input, activity and/or output measures as proxies. Entities are also not realising the full potential arising from the minimum four year horizon of corporate plans, by developing performance criteria that assess a mixture of short, medium and long-term objectives.

14. The selected entities had all either made minor improvements to their 2017–18 Corporate Plan, or were establishing arrangements to consider and/or implement improvements to their 2018–19 performance measurement and reporting cycle. The observations within this report should be considered as part of any ongoing efforts by each of the selected entities to improve performance measurement and reporting in future reporting periods.

Systems and processes to support measurement and reporting of performance

15. Each of the entities had processes to support the coordination and collation of the performance statements. The ANAO observed the scale and complexity of processes varied depending on the entity, and the implementation of those processes required improvement in some instances. This included where a central unit charged with developing and improving an entity’s performance reporting lacked sufficient influence to effect changes necessary to improve an entity’s performance measurement and reporting.

16. The effectiveness of systems and methodologies established for the collection and reporting of performance information varied across the selected entities. An absence of clearly documented methodologies, or where the chosen methodology led to a result that did not reflect the measure as described, were areas requiring improvement by each of the entities.

17. Processes were established by all four entities to provide assurance that the results reported in the performance statements were an accurate representation of performance. Observations made in other sections of this report regarding the appropriateness of the selected entities’ measures, systems, methodologies, and the accuracy of results supported by suitable records, indicate that there is still some way to go in the maturity of entities’ consideration of, and audit committees’ assurance and advice on, entity performance reporting.

18. The results and analysis presented in Austrade’s and Employment’s performance statements accurately presented their performance. Environment’s and the Sports Commission’s performance statements each presented results and analysis that contained inaccuracies and/or were not supported by suitable records.

Recommendations

Recommendation no.1

Paragraph 2.81

Entities review their performance measurement and reporting frameworks to develop measures that provide the Parliament and public with an understanding of their efficiency in delivering their purpose/s.

Department of Jobs and Small Business response: Agreed.

Department of the Environment and Energy response: Agreed.

Australian Trade and Investment Commission response: Agreed.

Australian Sports Commission response: Agreed.

Recommendation no.2

Paragraph 2.105

Environment review the design of its performance measurement and reporting framework to ensure it is addressing the requirements of the Public Governance, Performance and Accountability Act 2013, to demonstrate progress against its purpose/s and provide meaningful information to the Parliament and the public.

Department of the Environment and Energy response: Agreed.

Recommendation no.3

Paragraph 2.110

The Sports Commission review the design of its performance measurement and reporting framework and in particular its purpose, to address the requirements of the Public Governance, Performance and Accountability Act 2013.

Australian Sports Commission response: Agreed.

Recommendation no.4

Paragraph 3.69

Environment, Austrade and the Sports Commission review their audit committee charters to ensure they reflect the requirements of section 17 of the Public Governance, Performance and Accountability Rule 2014.

Department of the Environment and Energy response: Agreed.

Australian Trade and Investment Commission response: Agreed.

Australian Sports Commission response: Agreed.

Summary of entity responses

19. Summary responses from the selected entities are provided below, while the full responses are provided at Appendix 1.

Department of Jobs and Small Business

The Department of Jobs and Small Business is continuing to make improvements to its performance framework. The work of the ANAO in the performance audit of the Implementation of the Annual Performance Statements Requirements 2016–17 has provided valuable analysis to inform the work already underway to improve the Department’s performance information. As the ANAO intended, the timing of this audit will support the Department in its development of the 2018–19 Corporate Plan and the publication of its 2017–18 Annual Performance Statements.

Department of the Environment and Energy

The Department agrees to recommendations 1, 2 and 4.

The Department welcomes the report and acknowledges that it contains valuable information to guide improvements to the implementation of performance reporting of the audited entities, and more broadly across the Australian Public Service. The Department also recognises the report will support clarification of our audit committee’s role in improving the effectiveness of non-financial performance reporting.

The Department is committed to addressing the issues raised in the report. As with other major reform agendas, we note mature implementation of the enhanced Commonwealth performance framework will take several years. We have already commenced a targeted review and revision of our performance measurement and reporting framework. This provides a sound basis from which continuous improvement of our performance reporting systems and processes can build.

The scheduled review of the Portfolio Audit Committee Charter in 2017 was put on hold until the release of this report, specifically to reflect its key learnings, and finalisation of the Department of Finance’s guidance for audit committees.

The Department will now progress with the scheduled review of the Portfolio Audit Committee charter.

Australian Trade and Investment Commission

Austrade agrees with the ANAO’s findings, which will assist Austrade in ongoing performance measurement reform across the entire cycle of planning, monitoring, analysis and reporting. Austrade will continue active engagement with the Department of Finance, including participation in the Community of Practice.

Australian Sports Commission

The Australian Sports Commission welcomes the ANAO’s findings and acknowledges the support provided by the ANAO through the review process. In early 2017, under the direction of a new Chief Executive Officer, the ASC commenced the development of a new strategic plan and has commenced a process of enhancing its performance framework. The ASC will use the findings in this report to continue to improve the plan and performance framework.

Department of Finance

The Department of Finance supports the findings of the report.

Key learnings for all Australian Government entities

The key learnings summarised in ANAO Report No.58 2016–17 Implementation of the Annual Performance Statements Requirements 2015–16, remain a valid reference point for entities seeking to improve their performance measurement and reporting. Below is a summary of further key learnings identified during this audit that may be considered in meeting the performance statements requirements set out by the PGPA Act and PGPA Rule.

Corporate planning and performance frameworks

Presentation of results and analysis

Relevance, reliability and completeness of performance criteria

Systems, processes and methodologies

Assurance processes

Accurate presentation of entity performance

1. Background

Introduction

1.1 Since the mid-1980s public sector management frameworks have emphasised the importance of measuring program performance. While the frameworks have changed over the years, the fundamental aim has remained consistent—to be able to measure and assess the impact and outcomes of government programs, not just the inputs, activities and outputs. Some of the frameworks have also included a focus on program efficiency. This enables public sector management to regularly assess the impact and outcomes of programs, and realign resources where necessary, to achieve the required government outcomes on behalf of the Parliament and the public.

1.2 The current performance measurement and reporting requirements for Commonwealth entities (corporate and non-corporate) are established under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the accompanying Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). The introduction of the PGPA Act was intended to establish a strong performance reporting system to demonstrate to the Parliament and the public that resources are being used effectively and efficiently.

1.3 These requirements, and any formal guidance issued by the Department of Finance (Finance), are collectively referred to as the Commonwealth performance framework (the framework). The framework is principles based and focuses on entities providing sufficient performance information to users, including operating context, to allow an assessment of progress against intended purposes. The aim is to provide users with a greater understanding of how entities have utilised resources, not just in producing outputs, but also the impact and efficiency in delivering outcomes. The introduction of the requirement for the publication of entity information on efficiency is a key part of the Commonwealth performance framework, and will typically be presented alongside effectiveness measures.6

1.4 The Auditor-General’s responsibilities, as set out in the Auditor-General Act 1997, include auditing the annual performance statements (performance statements) of Commonwealth entities in accordance with the PGPA Act. The PGPA Act does not require the Auditor-General to conduct annual audits of performance statements, unless requested by either the Minister for Finance or the responsible Minister. This means that the Parliament does not receive assurance, as a matter of course, on performance statements included in annual reports, as it does over financial statements, where an independent audit report is mandatory.

1.5 The Auditor-General has flagged to the Joint Committee of Public Accounts and Audit (JCPAA) and the Parliament, the intention to position the ANAO to conduct annual audits of performance statements. This would provide a similar level of assurance to the Parliament and the public as provided by mandatory annual audits of financial statements.7 The JCPAA has provided its support for this approach and in Report 469: Commonwealth Performance Framework, released on 7 December 2017, recommended amending the PGPA Act in this regard.

Commonwealth performance framework

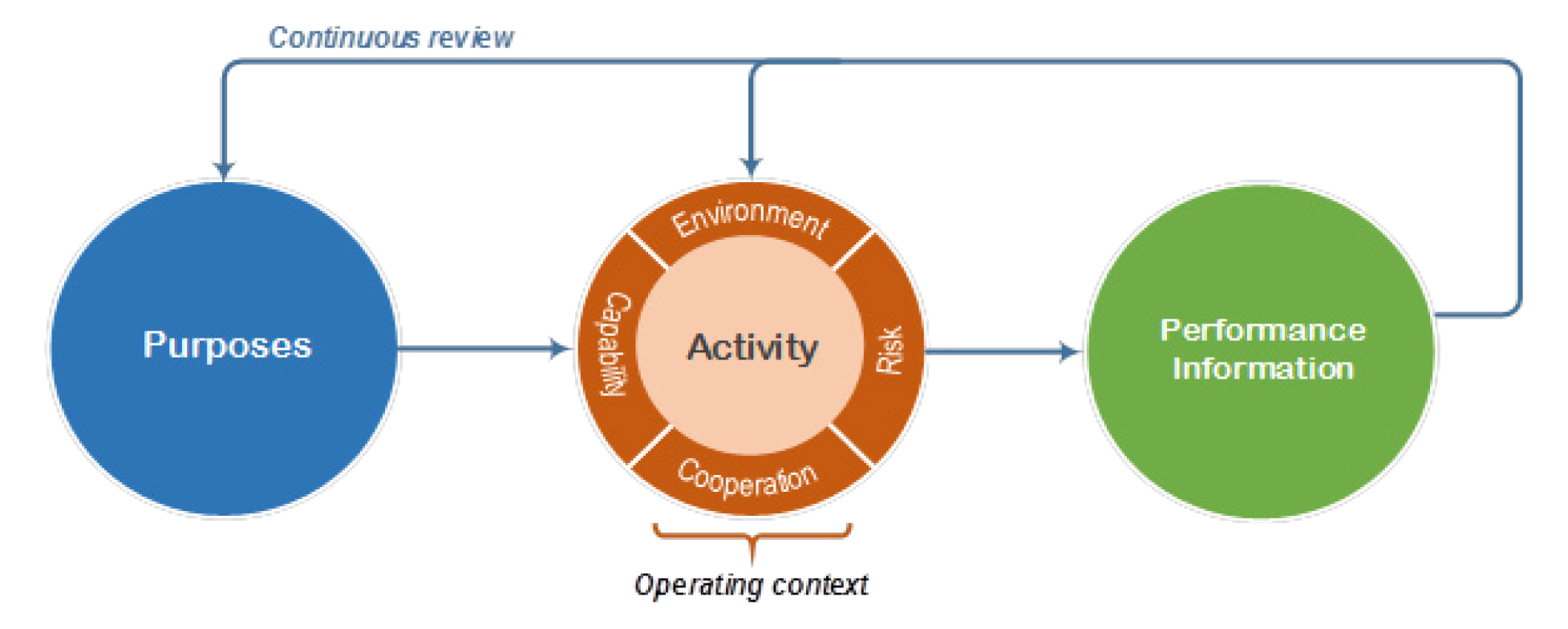

1.6 The Commonwealth performance framework came into effect with the commencement of the PGPA Act. It has three inter-dependent elements—purposes, operating context and performance information—used to demonstrate the achievement of purposes.8 These elements are demonstrated below in Figure 1.1.

Figure 1.1: Elements of the Commonwealth performance framework

Source: The Department of Finance, 2017–2018 Corporate Plan Lessons Learned, November 2017, p. 2.

1.7 Portfolio Budget Statements (PBS), which set out planned financial performance, are also required to describe at a strategic level, the outcomes intended to be achieved with the funding appropriated by the Parliament. The performance measures presented in the PBS are required to be a strategically focused subset of those included in an entity’s corporate plan.9 Entities are also required to clearly map the measures from their PBS to their purposes, which are published in their corporate plans.

1.8 As the primary planning document10, the corporate plan sets out planned non-financial performance and provides the reader with an understanding of how an entity intends to measure and assess its actual performance. The alignment of the corporate plan and PBS provides readers an insight into the expenditure expected to achieve that performance.

1.9 Entities are required to publish corporate plans at the beginning of each reporting cycle. Corporate plans must set out entities’ strategies for achieving their purposes, and measuring progress. Entities are also required to prepare performance statements at the end of the reporting period. These are to be included in entities’ annual reports. Performance statements provide an assessment of the extent to which the entity has progressed in achieving its purposes, as set out in the corporate plan.11 Key elements of the Commonwealth performance framework, and the broader Commonwealth Resource Management Framework, are set out in Figure 1.2.

Figure 1.2: Elements of the Commonwealth Resource Management Framework

Source: ANAO analysis of guidance from the Department of Finance, incorporating relevant legislation.

1.10 The elements of the framework are intended to improve the line of sight between the use of public resources and the results achieved by entities. The intended users of the PBS, corporate plan, and performance statements are the Parliament and the public. It is for this reason that an entity must carefully consider whether the level of performance information presented in these documents will meet those users’ needs. Guidance from the Department of Finance (Finance) advises that performance information can be categorised by how it communicates accountability, strategic, tactical, or management related information, as demonstrated in Figure 1.3.

Figure 1.3: Performance information hierarchy

Source: ANAO analysis of the Department of Finance, Resource Management Guide No.131: Developing Good Performance Information, April 2015, pp. 12–13, 30 & 45.

1.11 Accountability performance information demonstrates whether the use of public resources is making a difference and delivering on government objectives. Finance guidance makes it clear that this is the level of performance reporting that is the focus of the PGPA Act, and made public through corporate plans and performance statements. Performance reporting for accountability purposes is of most interest to the Parliament and the public12, and should be balanced with the other levels of the performance information hierarchy.

1.12 Well-presented and easily interpreted accountability information is essential to enable governments to coordinate policy, clarify objectives, enhance transparency and accountability, improve service delivery, and keep the wider community informed. While strategic, tactical, and management performance information are also important, they should be used to support and advance accountability information, rather than replace it. Performance measures that address these lower levels of information, without sufficient connection to accountability information, may not be appropriate to include in the corporate plan, and consequently, the performance statements.13

1.13 As the key accountability documents under the Commonwealth performance framework, an entity’s PBS, corporate plan, and performance statements should provide the Parliament and the public with sufficient information to determine whether a measure addresses the accountability, strategic, tactical or management level of the performance information hierarchy. If a user is required to rely on an in-depth understanding of an entity, the basic information needs of the Parliament and public are not being met. In this circumstance, the performance measures and the PBS, corporate plan and/or performance statements should be reviewed.

1.14 In considering the balance of performance information presented in an entity’s corporate plan, the number of performance criteria presented against the purpose should also be considered. The ANAO conducted a review of the performance criteria presented in the 2017–18 Corporate Plans for 22 major Commonwealth entities.14 The intention of the review was to identify and compare the number of performance criteria presented across a number of entities’ corporate plans.

1.15 In compiling this information, the ANAO noted the varied approaches applied by each entity in designing their performance information. For example, some entities adopted a tiered approach, with an overarching performance measure framed as an objective, supported by multiple subordinate measures addressing the current year, and also the forward estimates period. In these circumstances, the ANAO totalled all criterion presented. The results of this review are presented in Figure 1.4 on the following page.

1.16 The wide-range in the number of performance criteria presented in 2017–18 Corporate Plans indicates that entities are embracing the flexibility provided by the framework to design performance information tailored to their circumstances. Finance guidance notes the quality of performance information should be emphasised over quantity, recommending a small set of measures that is sufficiently comprehensive to cover those factors that affect an activity’s performance.15 For those entities with greater than 30 performance criteria, it may be appropriate to confirm that an appropriate balance of performance information, against the different levels of the performance information hierarchy, is being achieved.

Figure 1.4: Performance criteria presented in 2017–18 Corporate Plans

Note: The number of performance criteria presented in the figure above were confirmed by each of the listed entities.

Source: ANAO analysis of 2017–18 Corporate Plans.

Roles and responsibilities

Minister for Finance and the Department of Finance

1.17 The Minister for Finance is the Minister responsible for administering the PGPA Act. The Finance Minister may, by legislative instrument, make rules prescribing matters required or permitted by the Act to be prescribed by the rules, including those relating to performance.16 On 25 April 2015, the Finance Minister amended the PGPA Rule to reflect the requirements for entities to publish corporate plans and annual performance statements from 2015–16.

1.18 As noted previously, under section 40 of the PGPA Act, the Minister for Finance or a responsible Minister may request the Auditor-General to examine and report on the annual performance statements of an entity. As noted in paragraph 1.5, the Auditor-General intends to position the ANAO to conduct annual audits of performance statements.

1.19 The Minister for Finance is supported by the Department of Finance (Finance). Finance is responsible for the whole-of-government administration of the Commonwealth performance framework and related legislation. Section 112 of the PGPA Act requires that an independent review of the operation of the PGPA Act and Rule be conducted as soon as practicable after 1 July 2017. The Minister for Finance, in consultation with the JCPAA, commissioned this review in October 2017.17 The review is expected to be finalised in early 2018. The objectives of the review are to:

- examine whether the operation of the PGPA Act and Rule is achieving the objects of the PGPA Act in a manner consistent with the guiding principles.

- identify legislative, policy or other changes or initiatives, to enhance public sector productivity, governance, performance and accountability arrangements covered by the PGPA Act.

- examine whether policy owners’ implementation of the PGPA Act and Rule has appropriately supported their operation in Commonwealth entities.18

Joint Committee of Public Accounts and Audit

1.20 On 17 October 2016 the JCPAA announced an inquiry focused on the Commonwealth performance framework and, in particular, the implementation of appropriate performance information by departments to strengthen accountability. The purpose of the inquiry was to improve the Commonwealth performance framework and ensure line of sight between the use of public resources and the outcomes achieved by Commonwealth entities—a long-term focus of the JCPAA. Public hearings for this inquiry were held on 23 November 2016 and 6 September 2017, and were based on ANAO Reports:

- No.58 2016–17 Implementation of the Annual Performance Statements Requirements 2015–16;

- No.6 2016–17 Corporate Planning in the Australian Public Sector; and

- No.31 2015–16 Administration of Higher Education Loan Program Debt.

1.21 On 6 December 2017 the JCPAA released Report 469: Commonwealth Performance Framework. The report included ten recommendations which are reproduced in Appendix 2. Five of those recommendations related to the committee’s consideration of ANAO Report No.58 2016–17. Recommendation 6 was that ‘The Australian government amend the PGPA Act to enable mandatory audits of performance statements by the Auditor-General …’.19 The Committee also referred this matter to the attention of the Independent Review of the PGPA Act. As noted in paragraph 1.5, the Auditor-General intends to position the ANAO to meet this remit if the PGPA Act is amended.

1.22 The report also included observations in regard to entity performance measurement and reporting relevant to this audit, including the need:

- to use a mix of quantitative and qualitative performance information, along with relevant contextual information and analysis, to focus on entity impacts and outcomes (reflecting the move away from key performance indicators based solely on measuring inputs and outputs);

- for narrative utilised as part of qualitative performance information to be evidence-based, reliable and robust;

- for further work on measurement methodologies for qualitative performance information, drawing on local and international research and practice in this area;

- for further collaborative work on measuring and articulating performance outcomes, to build consistency and maximise reporting efficiencies; and

- for methodologically robust attribution of entity activities to outcomes that makes accountabilities clear.

Responsible Ministers

1.23 Under the PGPA Act, a responsible Minister may:

- access the records kept about the performance of the entities within their portfolio (section 37); and

- request that the Auditor-General examine and report on the performance statements of entities within their portfolio (section 40).

1.24 A responsible Minister, who makes a request of the Auditor-General, is required to table the report in each House of Parliament with the accompanying performance statements as soon as practicable after the report is received.

Accountable Authorities

1.25 Accountable authorities are responsible for the implementation of the requirements of the Commonwealth performance framework in their entities. Part 2–3 of the PGPA Act—relating to planning, performance and accountability—sets out the requirements of accountable authorities. The requirements relevant to this audit include:

- preparing a corporate plan each reporting period that complies, is published, and is provided to the responsible Minister and Finance Minister in accordance with any requirements prescribed by the PGPA Rule;

- keeping records about the entity’s performance in accordance with any requirements prescribed by the Rule;

- measuring and assessing the entity’s performance and complying with any requirements prescribed by the Rule; and

- preparing annual performance statements about the entity’s performance that comply with any requirements prescribed by the Rule, and including these statements in the annual report.

Audit Committees

1.26 Audit committees are appointed by the accountable authority of an entity. The functions of an audit committee are prescribed by section 17 of the PGPA Rule, and must be set out by the accountable authority in a written charter. The required functions of an audit committee are detailed below.

|

Functions of the audit committee |

|

PGPA Rule subsection 17(2) outlines the functions of the audit committee: The functions must include reviewing the appropriateness of the accountable authority’s:

|

Source: PGPA Rule.

1.27 In July 2017, Finance released Functions of audit committees: Reviewing the appropriateness of performance reporting, including for 2016–17 performance statements. The document provides additional guidance to audit committees to assist in discharging their functions under the PGPA Rule, in particular reviewing the appropriateness of an accountable authority’s performance reporting. The guidance reiterates the audit committee’s role and function, and makes explicit that audit committees are to provide a reasonable level of assurance as required by the PGPA Rule.

1.28 As presented in Appendix 2, the JCPAA Report 469 includes a recommendation that the PGPA Act and accompanying rules and guidance be amended, as necessary, to clarify that audit committee’s functions and charters must reflect their role in providing assurance of the appropriateness of performance reporting.

Requirements for annual performance statements

1.29 Performance statements under the PGPA Act are required to be published in entities’ annual reports. Specific requirements for the presentation of performance statements are outlined on the following page.

|

Matters to be included in a Commonwealth entity’s annual performance statements |

|

Under the PGPA Rule section 16F, entities’ annual performance statements must:

|

Source: PGPA Rule.

1.30 Section 37 of the PGPA Act sets out the requirement for Commonwealth entities to keep records that properly record and explain the entity’s non-financial performance as outlined below.

|

Records about performance of Commonwealth entities |

|

(1) The accountable authority of a Commonwealth entity must cause records to be kept that properly record and explain the entity’s performance in achieving its purposes. (2) The accountable authority must ensure that the records are kept in a way that:

(3) The responsible Minister and the Finance Minister are entitled to full and free access to the records kept under this section. However, those Ministers’ access is subject to any Commonwealth law that prohibits disclosure of particular information. |

Source: PGPA Act.

Audit objective, rationale, criteria and scope

1.31 The objective of the audit was to continue to examine the progress of the implementation of the annual performance statements requirements under the PGPA Act and the PGPA Rule by the selected entities. The audit was also designed to:

- provide insights to entities more broadly, to encourage improved performance; and

- continue the development of the ANAO’s methodology to support the possible future implementation of annual audits of performance statements.

1.32 To form a view against the audit objective, the following high level criteria were adopted:

- the selected entities complied with the requirements of the PGPA Act and PGPA Rule;

- the performance criteria presented in the selected entities’ PBS, corporate plans, and performance statements were appropriate20;

- the selected entities had effective supporting frameworks to develop, gather, assess, monitor, assure and report performance information; and

- sufficient records were retained to support the results reported by the selected entities against the performance criteria in the performance statements.

1.33 The audit involved assessment of the appropriateness (relevance, reliability and completeness) of the performance criteria, and the completeness and accuracy (fair presentation) of reporting. This was completed for either a subset, or all of the performance criteria presented by the selected entities in their 2016–17 Performance Statements.

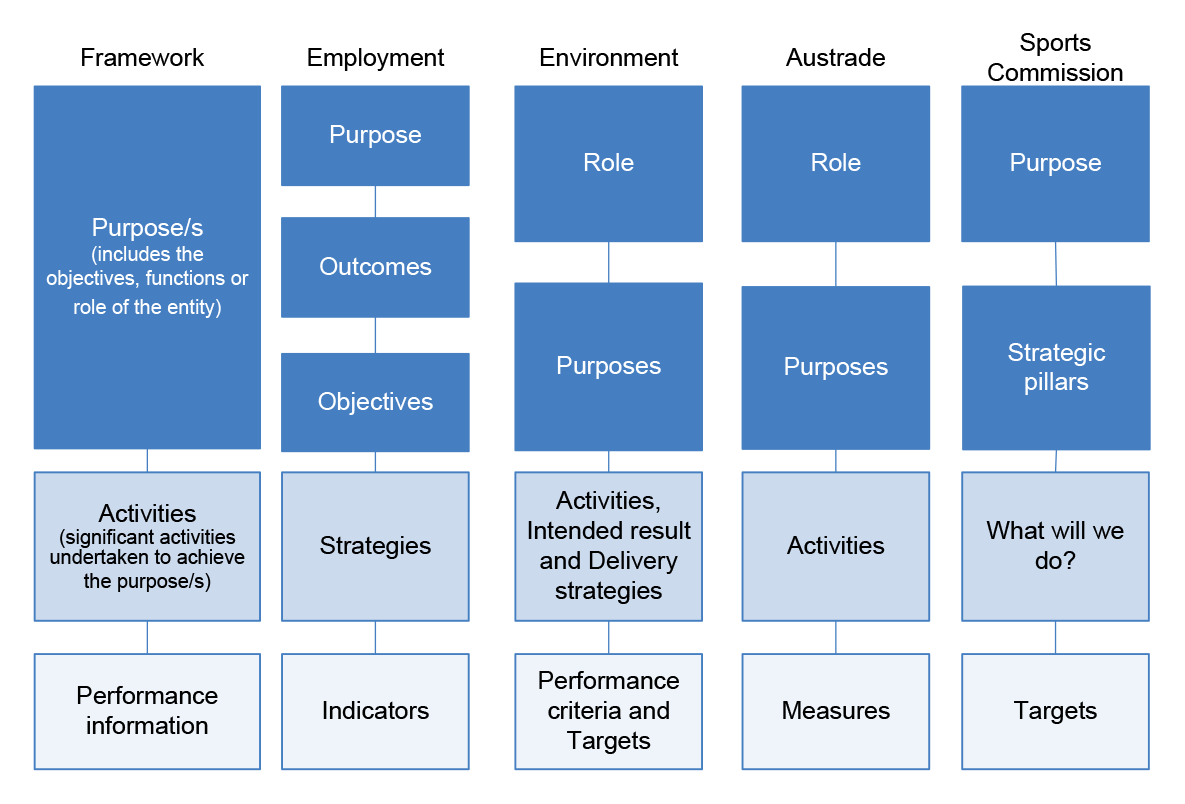

1.34 Under the PGPA Act and Rule, an entity’s purpose may be their objectives, functions or role. This has led to variability in the language used by entities when labelling elements of their corporate plans, as demonstrated in Figure 1.5, and reduces inter-entity comparability for readers. This may be an area where further consideration or guidance by Finance may assist in providing additional clarity across entity performance reporting.

Figure 1.5: Comparison of corporate plan elements

Source: ANAO analysis.

1.35 The audit considered the performance criteria established by each of the selected entities to demonstrate progress against the following elements of their corporate plans:

- Employment’s performance criteria for ‘Outcome 1—[Employment services]’;

- Environment’s performance criteria for ‘Environment and Heritage Protection—Conserve, protect and sustainably manage Australia’s biodiversity and heritage’;

- Austrade’s performance criteria for all purposes; and

- the Sports Commission’s performance criteria for its purpose.

1.36 The audit involved reviewing:

- internal systems, processes, and procedures, including the governance and oversight put in place by entities to support their development of the annual performance statements;

- records, and interviews of staff of the selected entities; and

- the selected entities’ 2017–18 PBS and Corporate Plans to identify any further opportunities for improvements to its performance measurement and reporting that may be addressed in the 2017–18 Performance Statements, or 2018–19 PBS and Corporate Plans.

1.37 The audit also included reviewing Finance’s role in whole-of-government administration of the annual performance statements requirements, including:

- administering the PGPA Act and Rule;

- publishing resource management guides and supporting papers on selected areas of the framework;

- continuing to host communities of practice to provide a forum to share examples of better practice, and improving the feedback loop between framework design, implementation and results; and

- providing advice to entities as requested.

1.38 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $536,902.

1.39 The team members for this audit were Jennifer Hutchinson, Alicia Vaughan, Kara Ball, Taela Edwards and Michael White.

Other ANAO audit coverage

1.40 This performance audit is one of three follow-on audits identified in the ANAO’s current work program that address key aspects of the implementation of the PGPA Act. The other two follow-on audits are:

- Corporate planning in the Australian Public Sector. This performance audit commenced in August 2017 and is the third in a series of audits that is assessing progress in implementing the corporate planning requirement under the PGPA Act; and

- Management of Risk by Public Sector Entities. This performance audit would be the second in a proposed series, which would assess how effectively selected public sector entities manage risk, including compliance with the Commonwealth Risk Management Policy.

1.41 The most recent audits in this series are ANAO Report No.54 2016–17 Corporate Planning in the Australian Public Sector21, and ANAO Report No.6 2017–18 The Management of Risk by Public Sector Entities. Similar to the observations of ANAO Report No.58 2016–17, both of the audits concluded that further work is required by entities to fully address the core elements of the PGPA Act.22

1.42 The ANAO’s continued focus in these areas is expected to assist in keeping the Parliament, the government, and the community informed on implementation of the resource, risk and performance management frameworks introduced by the PGPA Act and to provide insights to entities to encourage improved performance.

2. Measurement and reporting of performance

Areas examined

This chapter considers whether the selected entities met their obligations to publish performance statements in their 2016–17 annual reports. It also examines whether the performance statements, including a selection of performance criteria, met one of the objects of the PGPA Act—to provide meaningful information to the Parliament.

Conclusion

All of the entities met the requirement to publish performance statements under section 39 of the PGPA Act. Each of the entities’ performance statements also contained the basic elements (statements, results and analysis) set out in section 16F of the PGPA Rule. However, improvements to the quality of those elements, including the development of purposes that better define impact, and more appropriate performance measures, are still required by entities to support the presentation of meaningful performance information to the Parliament and the public.

Key learnings

The ANAO identified the following key learnings across the four entities:

- Adequately describing the method of measurement or assessment for each performance criteria;

- Improving the quality of analysis presented in the performance statements;

- Designing a performance planning and reporting framework to align with intended results, including an appropriate balance of efficiency, and quantitative and qualitative measures; and

- Developing performance criteria that assess a mixture of short, medium and long-term objectives including, where appropriate, beyond the four year horizon of the corporate plan.

Have entities met the requirements of the Public Governance, Performance and Accountability Act 2013 and accompanying Rule?

All of the entities met the requirement to publish performance statements under section 39 of the PGPA Act. Each of the entities’ performance statements also contained the basic elements (statements, results and analysis) set out in section 16F of the PGPA Rule. However, improvements to the quality of those elements presented by Employment, Environment and the Sports Commission are required for the performance statements to provide meaningful information to the Parliament and the public.

2.1 Table 2.1 outlines the PGPA Act and Rule requirements for the presentation of annual performance statements. To determine whether entities met these requirements, the ANAO reviewed whether the entity had published performance statements that contained the basic elements set out in the PGPA Act and Rule (statements, results and analysis). This assessment is summarised in Table 2.1 below. All of the entities met the basic requirements to publish performance statements under section 39 of the PGPA Act. However, improvements to the quality of results and analysis presented in Employment’s, Environment’s and the Sports Commission’s performance statements are required to provide meaningful information to the Parliament and the public—one of the objects of the PGPA Act.23

Table 2.1: Selected entities compliance with the PGPA Act and Rule requirements

|

Requirement |

Employment |

Environment |

Austrade |

Sports Commission |

|

Section 39 of the PGPA Act |

||||

|

Subsection (1) |

||||

|

Prepare annual performance statements for the entity as soon as practicable after the end of each reporting period for the entity. Include a copy of the annual performance statements in the entity’s annual report that is tabled in the Parliament. |

Yes |

Yes |

Yes |

Yes |

|

Subsection (2) |

||||

|

The annual performance statements must: (a) provide information about the entity’s performance in achieving its purposes; and (b) comply with any requirements prescribed by the rules. |

Requires improvement. |

Requires improvement. |

Yes |

Requires improvement. |

|

Section 16F of the PGPA Rule |

||||

|

Subsection (1) – Measuring and assessing entity’s performance |

||||

|

The accountable authority of the entity must measure and assess the entity’s performance in achieving the entity’s purposes in the reporting period in accordance with the method of measuring and assessing the entity’s performance in the reporting period that was set out in the entity’s corporate plan, and in any Portfolio Budget Statement, Portfolio Additional Estimates Statement or other portfolio estimates statement, that were prepared for the reporting period. |

Requires improvement, refer to Items 2 and 3 below. |

Requires improvement, refer to Items 2 and 3 below. |

Yes |

Requires improvement, refer to Items 2 and 3 below. |

|

Item 1: Statements A statement specifying the performance statements were prepared for subsection 39(1)(a) of the PGPA Act. |

Yes |

Yes |

Yes |

Yes |

|

A statement specifying the reporting period for which the performance statements are prepared. |

||||

|

A statement that, in the opinion of the accountable authority of the entity, the performance statements: (i) accurately present the entity’s performance in the reporting period; and (ii) comply with subsection 39(2) of the Act. |

||||

|

Item 2: Results The results of the measurement and assessment referred to in subsection 16F(1) of PGPA Rule of the entity’s performance in the reporting period in achieving its purposes. |

Requires improvement. |

Requires improvement.

|

Yes |

Requires improvement. |

|

Item 3: Analysis An analysis of the factors that may have contributed to the entity’s performance in achieving its purposes in the reporting period, including any changes to: (a) the entity’s purposes, activities or organisational capability; or (b) the environment in which the entity operated; that may have had a significant impact on the entity’s performance in the reporting period. |

Requires improvement. |

Requires improvement. |

Yes |

Requires improvement. |

Source: ANAO analysis against PGPA Act and Rule requirements.

Statements

2.2 Each of the selected entities’ 2016–17 Performance Statements included the required statement by the accountable authority. The ANAO noted that Employment and the Sports Commission both included an additional statement that the performance statements were ‘based on properly maintained records’, which is above the minimum requirement set out above. Austrade’s accountable authority also noted that the statement was made ‘based on advice from Austrade management and the agency’s Audit and Risk Committee’.

Results

2.3 All four entities either addressed, or mostly addressed the requirement, under section 16F of the PGPA Rule, to provide the results of the measurement and assessment of their performance in achieving their purpose. Those entities requiring improvement to fully address the PGPA Rule were Employment, Environment and the Sports Commission. These entities did not fully meet the requirement that results are presented in accordance with the method set out in the corporate plan and PBS (Item 2: Results).

2.4 Finance guidance indicates that a corporate plan should include a description of performance measures, when they will be reported on, the data collection techniques to be used and any targets the performance measures will be assessed against.24 Employment, Environment, and the Sports Commission did not disclose or clearly attribute data collection techniques or a method for assessment for all of their performance criteria in their corporate plans, or performance statements, and as a result could not fully meet this requirement. In addition, Environment presented results that did not address its performance criteria in some circumstances, while the Sports Commission did not present all performance criteria outlined in its corporate plan, or changed targets without adequately explaining the reasoning to the reader.

2.5 The consistency and completeness of the presentation of performance criteria and targets across the PBS, corporate plan and performance statements is important to establish a clear read. Guidance from the Department of Finance notes that entities should outline the reasoning for any changes to performance criteria and/or targets during the performance reporting cycle, in the corporate plan or performance statements.25

Employment

2.6 Employment did not disclose in its 2016–17 Corporate Plan, or Performance Statements, the data collection techniques, or methodologies, intended to be used to present results against its performance criteria. An absence of this information makes it difficult for a reader to determine whether the result is an accurate reflection of the measure as described, and whether the result presents an unbiased view of performance.

Environment

2.7 While Environment identified selected data sources, systems and methods in the ‘Assessment’ section for each activity, these were not explicitly linked to individual performance criteria and targets. Consequently, it could not be determined whether the assessment information presented by Environment was complete, and the requirement under PGPA Rule, section 16F(1) Item 2: Results, was not fully addressed.

2.8 In addition, the reported result for approximately a third of the measures did not fully address the criterion/target. For example, the result for ‘Increase in the proportion of approved assessments that apply streamlining policy initiatives’ under the Environment Protection and Biodiversity Conservation Act 1999 was reported to be ‘Achieved’. However, in the commentary supporting the result, the total number of assessments, or the proportion that applied such initiatives was not disclosed26, except to note that it was ‘the majority’. The commentary also did not specify whether an ‘increase’ had occurred. In this instance, Environment noted in the performance statements that it was improving internal reporting and data collection so that trends (such as an increase or decrease) can be ‘more meaningfully reported in future years’.

Austrade

2.9 While Austrade met the requirements for the presentation of its performance statements, the ANAO noted that four performance criteria were included in the 2016–17 PBS (May 2016) that were not repeated in the corporate plan (August 2016). The corporate plan is intended to be the primary planning document, and should contain a complete picture of an entity’s planned non-financial performance. Section 16E of the PGPA Rule requires an entity to include in its corporate plan ‘any measures, targets and assessments that will be used to measure and assess the entity’s performance for the purposes of preparing the entity’s annual performance statements under section 16F’. The approach adopted by Austrade, in presenting some performance criteria only in the PBS, does not meet this requirement.

2.10 In addition, Austrade’s 2016–17 Corporate Plan did not include targets for its performance criteria. The only exceptions were where a target was explicit in the criterion itself, such as ‘Double overnight visitor expenditure to between $115 billion $140 billion by 2020’. However, Austrade did present ‘forecasts’ of performance against the majority of performance criteria included in the 2016–17 PBS, which were then reported against in the 2016–17 Performance Statements.27 In accordance with the Finance Secretary Direction28, Austrade also included forecasts of performance against all, except one29, of its 2016–17 performance criteria in the 2017–18 PBS. Discussion of the impact of the absence of targets on the appropriateness of Austrade’s performance criteria can be found in paragraph 2.70.

Sports Commission

2.11 For the majority of its performance criteria, the Sports Commission did not present the method of assessment, or accompanying parameters in the corporate plan, to enable a complete assessment against Item 2: Results. In addition, the results presented alongside some performance criteria and targets in the performance statements did not reflect the measure as described. For example, the result for ‘Increase in the percentage of Australians participating in organised sport’ [compared to 2015–16] presents the number of participants in 2016–17, rather than an assessment of whether this represented an increase from 2015–16.

2.12 The ANAO also noted differences between the performance criteria presented across the PBS, corporate plan, and performance statements, including instances where only a target was presented without the accompanying performance criterion. For example, in the PBS the target for the performance criteria ‘Improved organisational capability of NSOs’ is: ‘the organisational capability assessment of national sporting organisations shows an improvement across the four components of the organisational development tool compared to the baseline established in 2015–16’. However, the corporate plan presents the target as ‘Baselines established across the four components of the organisational development tool’, and is presented in the performance statements without the original performance criterion from the PBS and corporate plan. As results are required to be presented in accordance with the method set out in the corporate plan and PBS, all performance criteria and targets should have been presented in the Sports Commission’s performance statements to fully address the requirements of the PGPA Rule.

Analysis

2.13 The ANAO noted there are opportunities for Employment and the Sports Commission to increase the quality of analysis presented in the performance statements. All four entities would have also benefitted from presenting analysis that addressed the purpose directly. In most cases, the entities’ analysis was limited to the performance criteria without considering how they collectively demonstrated progress against the overall purpose. Environment’s analysis should also clearly acknowledge and consider the department’s specific contribution, as compared to those of private and state and territory government delivery partners.

2.14 As noted in Figure 1.1, the operating context of an entity (risk, capability, and environment) is a key driver of an entity achieving its purpose. There is an expectation that analysis in performance statements establishes a stronger connection with the operating context elements outlined in the corporate plan. For example, where risks are outlined in the corporate plan, they would be acknowledged and discussed in the context of their impact on an entity’s performance during that reporting period in the performance statements. By providing more detailed analysis in regard to these elements, users are provided with a deeper understanding of the cyclical nature of performance, and the effectiveness of an entity in anticipating and/or addressing matters affecting their performance during the reporting period.

Employment

2.15 As demonstrated in Figure 1.5, Employment’s corporate plan is structured to reflect its purpose, which is supported by outcomes and lower level objectives. Employment’s performance criteria have been set at the objective level and are accompanied by one overarching outcome measure. Employment’s performance statements present analysis to demonstrate progress at the objectives and outcome levels, however both sets of analysis are limited and do not adequately explain the key drivers of overall performance.

2.16 The analysis presented at the objective level provides some discussion of the results for the performance criterion within each objective, however does not necessarily address the results of the criteria collectively. For example, the analysis presented for ‘Objective 1—Job seekers find and keep a job’ discusses one of the five performance criteria, focusing on the criterion ‘Count of job placements’ target that was not met. There is no analysis of what contributed to the other targets being achieved, or how the group of measures should be considered together to determine progress against the objective or purpose. In addition, the Department’s explanation for not achieving the target was:

Although labour market conditions improved during 2016–17, employment growth remains below the annual growth rate for the past decade. This has limited the number of available job opportunities in 2016–17, the second year of the jobactive program.

2.17 While employment growth may contribute to the number of job placements, the performance statements would have benefited from discussion of the factors able to be influenced through jobactive specifically.

2.18 The analysis presented at the ‘Outcome 1’ level was also limited and did not provide an indication of Employment’s overall progress against its purpose. It described the core groups which are the subject of historically higher unemployment rates, and that the Department has implemented programs to support this, however it doesn’t adequately address the progress of those activities against the overall outcome.

Environment

2.19 Analysis is presented in Environment’s performance statements for each of its key activities (see Figure 1.5). Together, the analysis sections include discussion of operational factors, such as government policy decisions and market conditions that impacted on the delivery of these activities. However, the quality of analysis could have been improved by more clearly indicating how the department’s activities, and the other factors identified, may have affected the achievement of its purposes in the reporting period. This includes demonstrating the department’s specific contribution towards the reported result.

2.20 For example, reporting against the target for ‘Continued implementation of the Reef 2050 plan’, lists various milestones and achievements against the plan. However, the results and analysis do not demonstrate how the department’s activities contributed to these achievements. This is particularly important, as 11 other agencies, supported by delivery partners, are also responsible for the delivery of actions under the plan, including the Queensland Government and the Commonwealth Great Barrier Reef Marine Park Authority. Reporting the attribution of an entity’s activities towards an objective that relies on multiple stakeholders, whether inter or intra-governmental or private enterprise, is an area that requires greater focus by entities. This is also an area of the framework and guidance that may benefit from further consideration by the Department of Finance.

Sports Commission

2.21 The analysis presented in the Sports Commission’s performance statements is aligned to the four ‘strategic pillars’ supporting its purpose (refer to Figure 1.5). Each section provides a discussion of the results for the relevant performance criteria and includes activities that were undertaken during 2016–17, or underway for the following reporting period, that contributed to the Sports Commission’s performance. In two cases, the connection between the activities and achievements outlined in the analysis section to the results presented against the performance criteria was unclear. The Sports Commission would benefit from better establishing this connection to assist a reader to understand those matters influencing the Commission’s performance.

2.22 In addition, in some cases where a target had not been achieved, for example ‘90 per cent of targeted NSOs demonstrated satisfactory progress towards compliance with the Mandatory Sports Governance Principles’, there was limited analysis of what contributed to the target not being met. In this example, the Sports Commission did describe a number of activities or initiatives that appeared to be intended to improve this result, but as noted above, without making this relationship clear, a reader’s understanding is potentially limited.

Other annual reporting requirements

Plain English and clear design

2.23 The purpose of the Commonwealth performance framework is to enhance the transparency and accountability of the public sector.30 As noted in Chapter 1, Finance guidance31 highlights the aim of the PGPA Act to improve the line of sight between what is intended and what is delivered. To support this aim, sections 17AC, 17BD and 28D of the PGPA Act include provisions for ‘Plain English and clear design’, in relation to commonwealth entities’ and companies’ annual reports, including:

- annual reports must be prepared having regard to the interests of the Parliament and any other persons who are interested in the annual report; and

- requiring information in the annual report to be relevant, reliable, concise, understandable and balanced, including through clear design and defining technical terms.

These requirements provide for clear interpretation of the annual report, including the performance statements, by users.

Environment

2.24 Finance guidance notes that ‘good performance reporting is not about the volume of data; it is about using quality data to support better decision-making and better assessment of performance’.32 While each of the three main sections of Environment’s 2016–17 Performance Statements (activity, performance criteria and results, and analysis) have a different focus depending on its purpose, a combination of activity descriptions, results and analysis are presented against all three. When combined with the volume of information presented against each criterion, and results being presented at the performance criterion and target level, Environment’s 2016–17 Performance Statements are not presented in a way that provides a clear view of the outcomes of its activities.

2.25 Environment adopted a tiered approach to the development of its 2016–17 performance criteria. Performance criteria were intended to be set at a higher level, which were then supported by more detailed targets. However, there was no clear differentiation or alignment between the criterion and targets in the 2016–17 Corporate Plan to determine how they were intended to be viewed together to demonstrate progress against the overall purpose. In some instances, a performance criterion was also repeated against multiple purposes, without any further information to determine how they were intended to be measured differently in each.

2.26 Using a performance criterion with multiple targets complementarily provides the opportunity to present information across each level of the performance information hierarchy. Where this approach is well-structured, a more comprehensive picture of performance can be achieved than would be possible with a single accountability/effectiveness measure. However, where this approach is not well structured, and an imbalance of lower-level information is presented, it is difficult for users to discern the actual progress of the entity. This is the case with Environment’s 2016–17 Performance Statements.

2.27 To enhance the line of sight between the corporate plan and performance statements, targets should be established as direct indicators of progress against performance criteria, rather than presenting them separately. Environment’s 2017–18 Corporate Plan has partly addressed this matter by mapping targets to specific performance criteria. This demonstrates how each target is intended to inform an assessment against the performance criterion to which it relates. The presentation of results and analysis against the revised structure in Environment’s 2017–18 Performance Statements will also need to be carefully considered, to ensure a clear line of sight.

Performance statements and the Annual Report

2.28 In the 2015–16 Annual Performance Statements Lessons Learned paper, Finance made the observation that the large size of some performance statements presents issues for the reader. It also noted that the intent of performance statements is to provide a concise, comprehensive and accurate picture of an entity’s performance. Finance recommends that, where the size of annual performance statements is considered to be an issue, consideration could be given to rationalising and reducing the number of performance criteria. Entities should review existing data collections and assessment methodologies to focus on information that is truly meaningful.33

2.29 In considering the above, the ANAO totalled the number of performance criteria presented by each of the selected entities and compared it to the page span of their performance statements. The results of this comparison are provided in Table 2.2. Environment had the highest number of performance criteria (65) and also the longest performance statements (123 pages). The high number of performance criteria and targets, accompanied by the volume of results and analysis presented against each, contributed to the ANAO’s observations in the previous section regarding a lack of clear design and conciseness in Environment’s performance statements.

Table 2.2: Total number of performance criteria and performance statements’ pages

|

|

Employment |

Environment |

Austrade |

Sports Commission |

|

Performance criteria |

26 |

73 |

26 |

19 |

|

Pages—performance statements |

10 |

123 |

16 |

26 |

|

Pages—other performance information |

63 |

0 |

99 |

0 |

Source: ANAO analysis of the selected entities’ performance statements.

2.30 While the remaining entities’ performance statements appeared more concise in page span, the ANAO noted this was achieved by Employment and Austrade presenting, or directing readers to, additional performance information and analysis elsewhere in the annual report. For example, Employment’s annual report had a section titled ‘Our Performance’ spanning 63 pages that preceded the performance statements and presented more in-depth analysis and additional performance information.

2.31 Similarly, Austrade’s 16 page performance statements were presented within a section of the annual report titled ‘Report on performance’ (totalling 115 pages), and the performance criteria results directed readers to areas within the section, but outside of the performance statements, for further information and analysis. However, Austrade’s performance statements still presented sufficient information without referencing the additional information presented elsewhere in its annual report to fulfil the requirements of the PGA Act and Rule, as demonstrated in Table 2.1.

2.32 While this approach may be viewed by entities as a useful way to provide additional contextual information, the performance statements are intended to be the key accountability document to inform an assessment by the Parliament and the public of an entity’s performance. As a result, the performance statements should present all information and analysis necessary to inform that assessment. Finance guidance supports this view, noting that:

From the 2015–16 reporting period, annual performance statements will replace the report on performance section that is currently included in annual reports.34

Did the entities’ corporate plans support performance measurement and reporting in the annual performance statements?

Each of the entities’ corporate plans had areas that may be improved to support the quality of performance measurement and reporting presented in the performance statements. This included clearly describing the impact intended to be achieved in an entity’s purpose, and focusing on outlining significant, rather than minor or supporting, activities to provide a meaningful basis for measuring performance.

2.33 The key elements of the corporate plan that support performance measurement and reporting in the annual performance statements are an entity’s purpose/s and activities. Section 16E of the PGPA Rule requires that an entity’s corporate plan state the entity’s purposes over the next four years. The PGPA Act defines purpose/s as including the objectives, functions or role of an entity. Finance guidance notes that:

Well-expressed purpose statements make it clear who benefits from an entity’s activities, how they benefit and what is achieved when an entity successfully delivers its purposes. Essentially, purposes describe the value an entity seeks to create or preserve.35

2.34 The aim of the purpose/s statement is to give context to the significant activities that the entity will pursue over the period covered by the plan, and should be stated in a relevant and concise manner. Finance has defined an activity as a distinct effort of an entity undertaken to achieve a specific result (fulfilling purpose/s). Activities should be aligned with the entity’s purpose/s, and be a focus for performance measurement and reporting.

Purpose

2.35 As demonstrated in Figure 1.5, the selected entities used different structures in the design of their purpose under the Commonwealth performance framework. The purpose expressed in the corporate plans of Employment, Environment, and Austrade demonstrate who will benefit from their respective activities, how they will benefit and the impact intended to be achieved in delivering against their purposes.

2.36 Employment’s purpose statement could have been more concise to better reflect the core elements of the purpose. The ANAO noted that in its 2016–17 Performance Statements, Employment removed some of the additional language used to reinforce the connection between its purpose and PBS outcomes, making the purpose more succinct.

2.37 Similarly, Environment’s purpose statement could be clearer. This may include using more measurable language to help users identify the intended impact, and clarify that the department often relies on other parties, including state departments, to assist in the achievement of national objectives.

2.38 The purpose expressed in the Sports Commission’s 2016–17 Corporate Plan demonstrates who will benefit from the Commission’s activities and how they will benefit. However, the intended impact of the Sports Commission could be better described in the purpose to reflect the outcome that is expected to be achieved.

2.39 The intended outcome of the Sports Commission’s activities, as described by the purpose, is strengthening Australian sport. However, this describes an intermediate output of activities rather than the intended impact on the population as a result of those outputs. Without adequately describing the intended impact, a reader cannot assess whether it is being achieved. By describing an output-focused purpose, the Sports Commission also limits the likelihood of designing measures that successfully demonstrate progress in achieving the intended impact.

Purposes and outcomes

2.40 As noted in paragraph 1.8, an entity’s corporate plan and PBS are intended to be complementary to establish alignment between the financial and non-financial performance of an entity, and facilitate an assessment of that performance by the Parliament and the public. Finance guidance notes that:

it does not assume that activities and purposes will necessarily equate to the ‘programs’ and ‘outcomes’ reported by Commonwealth entities in the PBS and other budget documents. However, to provide a clear line of sight between the allocation and use of public resources, entities will need to ensure that links can be made between the appropriations reported in the PBS and the performance information published in corporate plans and annual performance statements. How the links are made is left to the discretion of entities.36

2.41 Establishing these links, and ensuring the funding and organisational structures established by an entity facilitate the development and collection of meaningful performance information and reporting, can be difficult. Examples of these difficulties are provided by Environment and Austrade’s corporate plans and performance reporting approaches.

Environment

2.42 The mapping of Environment’s PBS outcomes and programs structure to the purposes and activities presented in its corporate plan is complex, as demonstrated by Figure 2.1. This is particularly evident for the ‘Environment and Heritage’ purpose and activities, which span two outcomes and six programs. Where multiple programs address a single activity, the ANAO observed the department’s approach to the development of performance criteria was complex, and failed to coordinate a cohesive performance story, as previously noted in paragraphs 2.24–2.27.

Figure 2.1: Mapping of Environment’s 2016-17 Corporate Plan to PBS

Source: Reproduced from the Department of the Environment and Energy’s 2016–17 Corporate Plan, p.45.

Austrade

2.43 Entities are required to develop performance criteria for all programs presented under the outcomes in their PBS, which are also expected to align to an entity’s purpose in its corporate plan. Austrade presents two outcomes in its 2016–17 PBS:

- Contribute to Australia’s economic prosperity by promoting Australia’s export and other international economic interests through the provision of information, advice and services to business, associations, institutions and governments; and

- The protection and welfare of Australians abroad through timely and responsive consular and passport services in specific locations overseas.

2.44 Both outcomes are reflected in Austrade’s purpose presented in its 2016–17 Corporate Plan. While ‘Outcome 1’ represents Austrade’s responsibilities as set out in its legislation, ‘Outcome 2’ is a reflection of services provided by Austrade on behalf of the Department of Foreign Affairs and Trade (DFAT). This arrangement is governed under a Memorandum of Understanding between the two entities, and Austrade is funded directly via an appropriation to deliver these services. Austrade has developed performance criteria, as required, to reflect its delivery of services on behalf of DFAT.

2.45 As noted earlier in this report, the corporate plan is intended to serve as an accountability document to inform the Parliament and the public. While Austrade is funded to deliver these services, the performance measures are more indicative of the effectiveness of the management of a contractual arrangement, rather than representing a Commonwealth outcome in its own right. As a result, the level of accountability information presented by those measures is limited and may benefit from review in conjunction with DFAT and the Department of Finance. The way in which these types of arrangements are reported in the future is an area of the framework that may benefit from further consideration by the Department of Finance, particularly as collaboration across government continues to mature.

Activities

2.46 The ANAO assessed the activities listed by the selected entities in their 2016–17 Corporate Plans against the following criteria, sourced from Finance guidance37:

- Are the activities readily identifiable?;

- Do the activities align with the entity’s purpose?;

- Do the activities clearly describe what actions the entity will undertake to achieve its purpose?; and

- Are the activities identified at an appropriate level?

2.47 Overall, all four of the entities’ activities presented in their corporate plans met, or mostly met, the assessment criteria. The ANAO has noted some minor improvements for Employment, Environment and the Sports Commission in the following paragraphs.

2.48 Activities should be aligned with an entity’s purposes, and be a focus for performance measurement and reporting. Employment described strategies to meet its objectives, which then contributed to the outcome and purpose. The positioning of the strategies and the language used to describe them denote that they are intended to be read as the activities of the department, but this could be clearer.

2.49 In addition, while it is clear from Employment’s strategies the actions it intends to undertake to contribute to achievement of its purpose, they have been presented as relevant only to 2016–17, rather than the entire four year period covered by the corporate plan. The PGPA Rule requires the corporate plan to address the entity’s purpose across the next four years, which would include the activities of the entity intended to meet that purpose. As presented, Employment’s corporate plan does not meet this requirement at the activity level. The ANAO notes Employment’s 2017–18 Corporate Plan has clearly presented its strategies across the four year horizon.

2.50 Some of Environment’s descriptions for the actions it intended to undertake could be made clearer to allow for more meaningful interpretation of the intended outcome and the specific nature of Environment’s intervention. In addition, while Environment’s performance statements mostly focus on significant activities, which contribute directly to the purpose, one-third of the delivery strategies (8 of 24) presented in the corporate plan describe minor or supporting activities which may be more appropriately monitored through internal planning and reporting.

2.51 Similarly, the Sports Commission’s activities were mostly presented at an appropriate level, with the exception of those under the ‘Organisational Excellence’ pillar. These focus on supporting, rather than significant, activities. The Sports Commission would benefit from reviewing the balance of significant activities, versus minor or internal management activities, presented in the corporate plan. The ANAO notes that the ‘Organisational Excellence’ pillar and accompanying activities were not presented in the Sports Commission’s 2017–18 Corporate Plan.

Did the entities’ performance criteria support the reporting of progress against the purposes?