Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Implementation of the Annual Performance Statements Requirements 2015–16

Please direct enquiries relating to reports through our contact page.

The objective of the audit was to examine the implementation of the annual performance statements requirements under the Public Governance, Performance and Accountability Act 2013 and the enhanced Commonwealth performance framework.

Summary

Background

1. Performance reporting frameworks have been in place in the Australian public sector for several decades, to enable the measurement and assessment of the impact of government programs. The current performance measurement and reporting requirements for Commonwealth entities are established under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the accompanying Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). These are supported by the enhanced Commonwealth performance framework, which took effect on 1 July 2015.

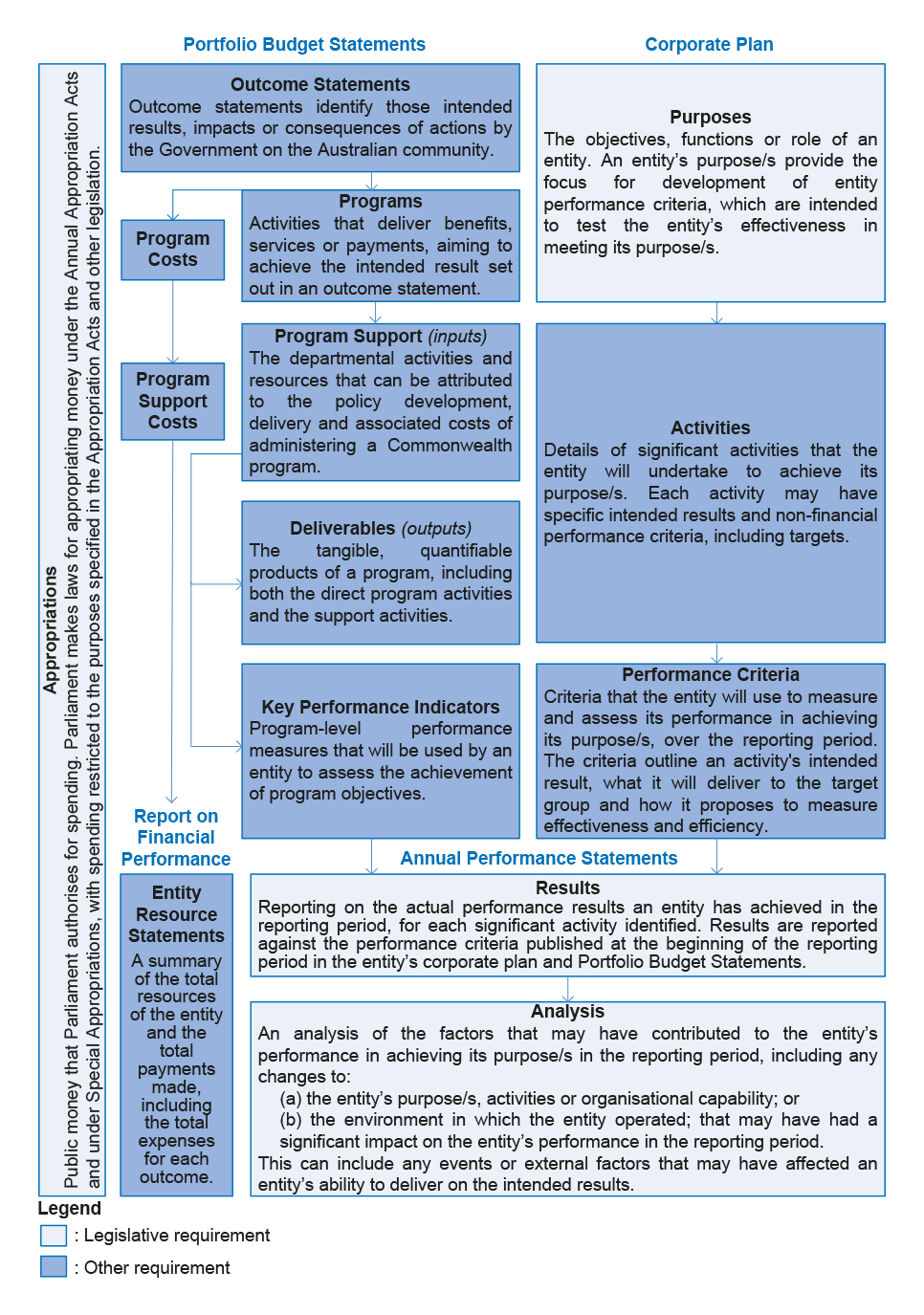

2. The framework aims to provide financial and non-financial information to the Parliament and the public, and improve the line of sight between the use of public resources and the results achieved by government entities. It differs from previous frameworks in that it broadens the performance information collected and reported by entities, and introduced the requirement for entities to publish corporate plans at the beginning of each reporting period. The framework also introduced the requirement for entities to publish annual performance statements in their annual report. Annual performance statements provide an assessment of entities’ progress in achieving their purpose/s, as set out in their corporate plans and aligned to the Portfolio Budget Statements.

3. Portfolio Budget Statements, which are updated throughout the year1, are required to describe at a strategic level, the outcomes intended to be achieved with the funding appropriated by the Parliament. The performance criteria presented in the Portfolio Budget Statements are required to be a strategically focused subset of the performance information reported in an entity’s corporate plan.2 This positions corporate plans as the primary document for setting out an entity’s planned non-financial performance and provides the reader with an understanding of how this will be measured and assessed.

4. The Department of Finance (Finance) is responsible for the whole-of-government administration of the enhanced Commonwealth performance framework, and related legislation. Accountable authorities3 are responsible for the implementation of the framework within their entities. To assist entities in implementing the enhanced Commonwealth performance framework, Finance has provided various forms of guidance and support.

5. The ANAO plays a role in advising the Parliament, and the Joint Committee of Public Accounts and Audit (JCPAA), on the implementation of the reforms to the enhanced Commonwealth performance framework. One aspect of this role includes undertaking audits to provide feedback on, and influence the development, implementation and operation of, an effective performance framework.

6. The Auditor-General’s responsibilities, as set out in the Auditor-General Act 1997, include auditing the annual performance statements of Commonwealth entities in accordance with the PGPA Act. The PGPA Act does not require the Auditor-General to conduct annual audits of performance statements unless requested by either the Minister for Finance or the responsible minister. This means that the Parliament does not receive assurance, as a matter of course, on performance statements included in annual reports, as it does over financial statements, where an independent audit is mandatory.

7. The ongoing implementation of the Commonwealth’s resource management framework, including the enhanced performance framework, will continue to be a focus in future ANAO audit work programs.

Audit objective and criteria

8. The objective of the audit was to examine the implementation of the annual performance statements requirements under the PGPA Act and the enhanced Commonwealth performance framework.

9. To form a conclusion against the audit objective, the following high level criteria were adopted:

- the selected entities met their obligations to publish annual performance statements;

- the performance criteria were appropriate and were reported against in the selected entities’ performance statements for 2015–16;

- the selected entities had effective supporting frameworks and processes to gather, assess, assure and report information included in their annual performance statements; and

- sufficient records were retained to support the results reported by the entities against their non-financial performance measurement frameworks.

10. The ANAO reviewed one purpose in the 2015–16 performance statements of the Australian Federal Police and the Department of Agriculture and Water Resources (the selected entities), including the supporting systems and processes.

11. This performance audit is one of three audits in the ANAO’s current work program that address key aspects of the implementation of the PGPA Act. These audits have been identified by the JCPAA as priorities of the Parliament. This will assist in keeping the Parliament, government and the community informed on implementation of the resource, risk and performance management frameworks introduced by the PGPA Act.

Conclusion

12. The Australian Federal Police (AFP) and the Department of Agriculture and Water Resources (Agriculture) met the minimum requirements for the preparation and publication of the first annual performance statements under the PGPA Act and the PGPA Rule. For both entities, the performance statements included reporting against the entities’ purposes, activities, and performance criteria reviewed as part of the audit.

13. The performance criteria were mostly relevant to the activities undertaken by the selected entities. Alignment of entity activities to performance criteria and measurement of the attribution of specific activities to the achievement of the entities’ purposes could be enhanced.

14. Both entities’ performance criteria mostly provided a reliable method of assessing the entities’ progress in fulfilling their purposes. Addressing any potential bias in the reported results should also be considered. In addition, describing the methodology for measurement and basis for assessment, including through a target or baseline, needs to be addressed to improve the reliability of the entities’ performance criteria.

15. As a whole, the performance criteria for both entities were substantially complete, collectively providing a balanced basis for assessing the entities’ progress in fulfilling their purposes. The selection of performance criteria will require ongoing effort by both entities to identify opportunities to clarify or increase the overall alignment of performance criteria to the purpose. The entities’ balance of performance criteria—for example qualitative, quantitative, efficiency-focused and short, medium and long term timeframes—should be reviewed.

16. Both entities established or adapted existing systems and processes to meet the requirements of the PGPA Act and the PGPA Rule. These remained in development during the audit, with further work being undertaken in 2016–17, to support the quality of information reported in future performance statements.

17. The selected entities established assurance processes to certify that the reported performance information accurately reflected entity performance. Planning and assurance processes for the entities should mature over time. As part of this process entities should give further consideration to the role and function of their respective audit committees, to ensure that the intent and requirements of the framework are met, as neither audit committee could fully demonstrate compliance with the PGPA Rule.

18. The majority of results presented in the selected entities’ annual performance statements were supported by complete and accurate records as required by the PGPA Act and PGPA Rule. Both entities could improve record-keeping to better demonstrate the calculations and analysis applied to raw data to produce results, and to support the analysis in the annual performance statements.

Supporting findings

Measurement and reporting of performance

19. Both of the 2015–16 performance statements reviewed as part of the audit complied with the PGPA Act and PGPA Rule, in relation to their publication. The performance statements were published as part of the entities’ 2015–16 Annual Reports. They included the required statements, results and analysis against the performance criteria outlined in the corporate plan and Portfolio Budget Statements reviewed as part of the audit.

20. The analysis section of both entities’ annual performance statements included some consideration of the entities’ operating environment and were supported in some cases by case studies and trend information. However the quality of the analysis could be improved, in particular, by providing further discussion of how the entities’ activities, through the results of the performance criteria, had contributed towards the achievement of their purpose/s and the external factors which impacted performance.

21. Both entities built on their existing external performance measurement and reporting framework, to meet the requirements of the enhanced Commonwealth performance framework under the PGPA Act. The information published by the entities in their corporate plan and Portfolio Budget Statements provides a foundation for reporting in the annual performance statements, although there was scope for both entities to improve how material was presented to achieve a clearer ‘line of sight’.

22. The performance criteria reviewed as part of the audit enabled the reporting of, and accountability for, the progress of each entity towards fulfilling their purposes.

23. The performance criteria for both entities were mostly relevant, providing a basis to make decisions on the entities’ progress in fulfilling their purposes. One of the AFP’s performance criteria required improvements to assist the reader to identify the benefit or beneficiary measured by the performance criterion and its link to the AFP’s activities. Agriculture’s performance criteria were mostly relevant, however the benefit or beneficiary was often not clear, or the focus of the measure was not clearly attributable to the entity.

24. The performance criteria for both entities were mostly reliable, providing a basis for reasonably consistent assessment of the entities’ progress in fulfilling their purposes. Improvements to two of the AFP’s performance criteria are required to limit the level of potential bias in the reported results. The majority of Agriculture’s performance criteria did not describe the method or basis for measurement, or provide a target or baseline, impacting the reliability of the performance criteria.

25. As a whole, the performance criteria for both entities were substantially complete, collectively providing a balanced basis for assessing the entities’ progress in fulfilling their purposes. To improve the completeness of the performance criteria, the selection of performance criteria will require ongoing effort by both entities to identify opportunities to clarify or increase the overall alignment of performance criteria to the purpose, and present a greater balance of performance criteria across the different forms of performance information and their timeframes.

Systems and processes to support performance measurement and reporting

26. Each entity adapted pre-existing processes for the preparation of the Annual Report, to facilitate the coordination and collation of information for the annual performance statements. In addition, both entities developed a project plan outlining the roles and responsibilities, risks and mitigating controls, milestones for delivery, and assurance mechanisms to guide the preparation of the performance statements. Neither entity completed a comprehensive pre-assessment of the processes of producing performance statements as part of their planning. The incremental development of performance reporting by both entities was focused on identifying lessons learnt.

27. Both entities had established, or leveraged from existing systems and methodologies to collect and report performance information for the purposes of the annual performance statements. The AFP would benefit from considering the frequency and extent of reviews of the methodology supporting one performance criterion, and strengthening processes for the validation of information sourced outside of management systems. Further consideration of data availability is required by Agriculture to establish a system to support the consistent collection, analysis and reporting of non-financial performance information.

28. Processes were established by both entities to provide assurance that the results reported in the annual performance statements were an accurate representation of performance. Further refinement of these arrangements is required by the entities. This would include documenting: guidance on the assurance process; and the review and endorsement of the annual performance statements to ensure that evidence of management and audit committee assurance is recorded and retained.

29. Each entity relied on management certifications over the selected performance criteria and the completeness and accuracy of underlying records. The entities’ audit committees also received regular briefings on the preparation of the annual performance statements, including details on the management certification processes. Additionally, Agriculture’s audit committee commissioned an internal audit on the Key Performance Indicators (performance criteria) and Performance Reporting, to inform the committee’s review responsibilities. The audit committee also monitored the implementation of key recommendations. However, the audit committee’s sign off to Agriculture’s accountable authority was limited, and did not meet the requirements of the department’s audit committee charter or the PGPA Rule and its intent. The AFP was unable to locate the final certification by its audit committee to the accountable authority over the performance statements, limiting an assessment against the audit committee charter, or the PGPA Rule and its intent.

30. There would be benefit in both entities further considering the role of the audit committee as a source of independent assurance to the accountable authority and how their audit committee charters and processes establish a basis to provide this assurance. The PGPA Rule provides that an audit committee’s functions must include reviewing the appropriateness of an accountable authority’s performance reporting. This function would necessarily involve the committee forming a view on how the entity should measure its performance. As a result, an audit committee’s charter, and any certification by the audit committee to an accountable authority discharging their performance reporting function, should reflect this requirement.

31. Records were largely available and supported the results and analysis sections reported in the annual performance statements for both entities. The AFP maintained complete and accurate records for all but one measure. Agriculture was unable to provide complete records for one performance criterion, and relied on an absence of advice as confirmation of compliance for another. Both entities could further improve record-keeping to demonstrate the calculations and analysis applied to raw data to produce results, and to support analysis in the annual performance statements.

Opportunities for improvement and key learnings

32. The ANAO recognises that this is the first year of published performance statements under the PGPA Act and has taken this into account in the conduct of this audit. It is expected that entity processes will take some time to mature. On this basis the ANAO has not made any recommendations in this audit, but has highlighted a range of matters which warrant further attention by the AFP and Agriculture.

33. In addition, guidance from Finance is being incrementally updated as lessons are learnt, through its role as policy owner in the Commonwealth. The need for further clarity in guidance, in particular for audit committees, has been acknowledged by the Department of Finance in recent discussions with audit committee chairs.4 Finance has previously advised the JCPAA that section 112 of the PGPA Act provides for an independent review of the framework in 2017.5 This review of the framework would include the PGPA Act and the rules, and presents an opportunity for Finance to further consider the accompanying guidance.

34. Below is a summary of key learnings identified in this audit report that may be considered by other Commonwealth entities in preparing their annual performance statements.

|

Box 1: Key learnings for all entities |

|

Presentation of results and analysis

Purposes and activities

Relevance, reliability and completeness of performance criteria

Systems, processes and methodologies

Assurance processes

Record-keeping

|

Summary of entities’ responses

35. Summary responses from the selected entities are provided below, while the full responses are provided at Appendix 1.

Department of Finance

The Department of Finance supports the findings of the report.

Australian Federal Police

The AFP welcomes the ANAO’s findings and acknowledges the assessment provided on the performance statement and on processes and systems related to performance measurement and reporting. The consolidated list of key learnings in the report will be useful for continued improvement.

This audit has assisted the AFP to focus efforts in ongoing performance measurement reform across the entire cycle of planning, monitoring, analysis and reporting.

The AFP will continue active participation in the Department of Finance performance community of practice and also maintain a localised law enforcement performance group to promote best practice.

Department of Agriculture and Water Resources

The Department of Agriculture and Water Resources 2015–16 annual performance statements were the first prepared under the enhanced Commonwealth Performance Framework. The department’s work under the framework is an evolving process and, as acknowledged in this report, the department has already made a range of changes to its performance framework. This audit has been an opportunity to identify further improvements.

The department agrees with most of the ANAO’s findings indicating areas in which its performance measurement and reporting can be improved. These findings will inform its continued efforts.

The department does not accept the finding that its Audit Committee did not meet the requirements of its charter, or the requirements and intent of the PGPA Rule, in providing assurance of the certification process.1 The committee undertook a range of work to meet its charter, and the department considers the assurance provided was consistent with advice from the Department of Finance on the role of audit committees in the certification process.2 The department is committed to establishing processes to ensure the Audit Committee meets the requirements of the PGPA Rule.

ANAO comments on the Department of Agriculture and Water Resources’ summary response

1. The Audit Committee’s Charter required the committee to review and provide independent advice and assurance about the appropriateness of the department’s performance reporting (see paragraph 3.49). The ANAO concluded that the advice provided to the Accountable Authority by the Audit Committee did not provide assurance about the appropriateness of the department’s performance reporting (see paragraph 3.51).

2. See paragraph 33. The Department of Finance has acknowledged the need for further clarity in guidance to audit committees.

1. Background

Introduction

1.1 Since the mid-1980s, public sector management frameworks have emphasised the importance of measuring program performance. While the focus of the frameworks has changed over the years, the fundamental goals have remained largely consistent—to be able to measure and assess the impact of government programs and not just measure the activities, deliverables and associated costs. Some frameworks have also included a focus on program efficiency.

1.2 The current performance measurement and reporting requirements for Commonwealth entities (corporate and non-corporate) are established under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the accompanying Public Governance, Performance and Accountability Rule 2014 (PGPA Rule).

1.3 The Auditor-General’s responsibilities, as set out in the Auditor-General Act 1997, include auditing annual performance statements of Commonwealth entities in accordance with the PGPA Act. The PGPA Act does not require the Auditor-General to conduct annual audits of performance statements unless requested by either the Minister for Finance or the responsible minister. This means that the Parliament does not receive assurance, as a matter of course, on performance statements included in annual reports as it does over financial statements where an independent audit report is mandatory.

1.4 The ongoing implementation of the Commonwealth’s resource management framework, including the enhanced performance framework, will continue to be a focus in future ANAO audit work programs.

Enhanced Commonwealth performance framework

1.5 The enhanced Commonwealth performance framework (the framework) took effect on 1 July 2015, to provide both financial and non-financial information to the Parliament and the public, under the PGPA Act.6 The aim is to improve the line of sight between the use of public resources and the results achieved by entities. A key change from the previous framework was to broaden the performance information collected and published by entities, in demonstrating progress against their purposes and outcomes.

1.6 The framework introduced the requirement for entities to publish corporate plans at the beginning of each reporting cycle from 2015–16. Plans must set out the entities’ strategies for achieving their purpose/s and determining how progress will be measured. In addition, the framework introduced the requirement for entities to prepare annual performance statements (performance statements) at the end of the reporting period. These are to be included in entities’ annual reports. Performance statements provide an assessment of the extent to which the entity has progressed in achieving its purpose/s, as set out in the corporate plan and aligned to the Portfolio Budget Statements (PBS).

1.7 PBSs, which are updated throughout the year7, are to describe at a strategic level, the outcomes intended to be achieved with the funding appropriated by the Parliament. The performance criteria presented in the PBSs are a strategically focused subset of the performance information included in an entity’s corporate plan. Entities are expected to clearly map the performance information from the PBSs to the entities’ purpose/s published in their corporate plans.8 This positions the corporate plan as the primary document for setting out planned non-financial performance and provides the reader with an understanding of how an entity intends to measure and assess its performance.9 Key elements of the enhanced Commonwealth performance framework, and the broader Commonwealth Resource Management Framework, are set out in Figure 1.1.

Figure 1.1: Elements of the Commonwealth Resource Management Framework

Source: ANAO analysis of guidance from the Department of Finance, incorporating relevant legislation.

Roles and responsibilities

Minister for Finance and Department of Finance

1.8 The Minister for Finance is the Minister responsible for administering the PGPA Act. The Finance Minister may, by legislative instrument, make rules prescribing matters required or permitted by the PGPA Act to be prescribed by the rules, including those relating to performance.10 On 25 April 2015, the Finance Minister amended the PGPA Rule to reflect the requirements for entities to publish corporate plans and annual performance statements from 2015–16.

1.9 As noted previously, under section 40 of the PGPA Act, the Minister for Finance or a responsible Minister also has powers to request the Auditor-General to examine and report on the annual performance statements of an entity.

1.10 The Minister for Finance is supported by the Department of Finance (Finance). Finance is responsible for the whole-of-government administration of the enhanced Commonwealth performance framework and related legislation. Finance has previously advised the Joint Committee of Public Accounts and Audit that section 112 of the PGPA Act provides for an independent review of the framework in 2017.11 This review of the framework would include the PGPA Act and the rules.

1.11 To assist entities in implementing the enhanced Commonwealth performance framework, Finance has:

- published written guidance in the form of Resource Management Guides (RMGs)12;

- reviewed draft corporate plans and performance statements on behalf of entities, when requested;

- established the Performance Community of Practice (Performance CoP) to provide a forum to share expertise and examples of better practice and establish a feedback loop between framework design, implementation and results. Four Performance CoP performance statements workshops were conducted in 201713;

- released regular Public Management Reform Agenda newsletters and emails to keep entities informed of emerging better practice and other developments;

- published lessons learned papers in February 2016 and January 2017, based on Finance’s assessment of a selection of 2015–19 and 2016–20 corporate plans, including examples of better practice; and

- released a draft lessons learned paper in March 2017 and published the final paper in May 2017, based on Finance’s assessment of a selection of 2015–16 performance statements, including examples of better practice.

1.12 Finance also completed a review of entities’ compliance with the PGPA Act and PGPA Rule in regard to the preparation and publication of annual performance statements for 2015–16. Finance’s review concluded that all Commonwealth entities required to produce annual performance statements for 2015–16 did so per section 39(1) of the PGPA Act. In addition, 82 per cent of entities were fully compliant with Section 16F of the PGPA Rule. The primary compliance matters identified through Finance’s review were minor issues in entities’ expression of the accountable authority’s introductory statement.

Joint Committee of Public Accounts and Audit

1.13 The Joint Committee of Public Accounts and Audit (JCPAA) resolved to inquire into and report on the development of the enhanced Commonwealth performance framework on 26 March 2015. Through the inquiry, the Committee sought to ensure that the rules, directions and guidance that underpin the framework provided clarity to entities regarding performance monitoring and reporting expectations, and also facilitated scrutiny.

1.14 The JCPAA released Report 453 Development of the Commonwealth Performance Framework in December 2015 and made the following observations relevant to this audit:

- The importance of a ‘clear read’ of performance information, ensuring it is presented clearly and consistently across reports produced by an entity within an annual reporting period, and across several cycles. This would also include the comparability of performance information across entities.14

- The need for strong and sustained leadership, from all levels, including all senior leadership teams within entities.15

- Active planning, monitoring, reporting and evaluation initiatives could allow programs and policies to be tracked and adjusted in real-time to improve results.16

- Central monitoring, reporting and evaluation of performance across an entity may allow specific and systemic issues to be identified and addressed.17

Portfolio Ministers

1.15 Under the PGPA Act, a Portfolio Minister has powers to:

- access the records kept about the performance of the entities within their portfolio (section 37); and

- request the Auditor-General to examine and report on the annual performance statements of entities within their portfolio (section 40).

1.16 A Portfolio Minister who makes a request of the Auditor-General, is required to table the report in each House of Parliament with the accompanying annual performance statements, as soon as practicable after the report is received.

Accountable Authorities

1.17 Accountable authorities are responsible for the implementation of the requirements of the enhanced Commonwealth Performance framework in their entities. Part 2–3 of the PGPA Act—relating to planning, performance and accountability under the Act—sets out the detailed requirements. Key requirements relevant to this audit include:

- prepare a corporate plan each reporting period that complies, is published, and is provided to the responsible Minister and Finance Minister in accordance with any requirements prescribed by the PGPA Rules;

- cause records to be kept about the entity’s performance in accordance with any requirements prescribed by the Rules;

- measure and assess the entity’s performance and comply with any requirements prescribed by the Rules; and

- prepare annual performance statements about the entity’s performance that comply with any requirements prescribed by the Rules and include it in the annual report.

Audit Committees

1.18 Audit committees are appointed by the accountable authority of an entity. The functions of an audit committee are prescribed by section 17 of the PGPA Rule, and must be set out by the accountable authority in a written charter. The required functions of an audit committee are detailed in Box 2.

|

Box 2: Functions of the audit committee |

|

PGPA Rule subsection 17(2) outlines the functions of the audit committee: The functions must include reviewing the appropriateness of the accountable authority’s:

|

Source: PGPA Rule.

Requirements for annual performance statements

1.19 The first performance statements under the PGPA Act were required to be published in entities’ annual reports in late 2016.18 Specific requirements are outlined below:

|

Box 3: Matters to be included in a Commonwealth entity’s annual performance statements |

|

Under the PGPA Rule section 16F, entities’ annual performance statements must:

|

Source: PGPA Rule.

1.20 Section 37 of the PGPA Act sets out the requirement for Commonwealth entities to keep records that properly record and explain the entity’s non-financial performance as outlined below.

|

Box 4: Records about performance of Commonwealth entities |

|

Under PGPA Act section 37: (1) The accountable authority of a Commonwealth entity must cause records to be kept that properly record and explain the entity’s performance in achieving its purposes. (2) The accountable authority must ensure that the records are kept in a way that:

(3) The responsible Minister and the Finance Minister are entitled to full and free access to the records kept under this section. However, those Ministers’ access is subject to any Commonwealth law that prohibits disclosure of particular information. |

Source: PGPA Act.

1.21 As noted above, the accountable authority of a Commonwealth entity must also ensure that the entity has an audit committee. The committee must perform functions in accordance with the requirements prescribed by the Rules (Box 2).

Audit coverage

1.22 This performance audit is one of three audits in the ANAO’s current work program that address key aspects of the implementation of the PGPA Act. The other two audits are:

- Corporate Planning in the Australian Public Sector. This performance audit is the second in a series of audits that is assessing progress in implementing the corporate planning requirement under the PGPA Act. The first in the series was ANAO Audit Report No.6 2016–17 Corporate Planning in the Australian Public Sector; and

- The Management of Risk by Public Sector Entities. This audit is assessing how effectively selected public sector entities manage risk, including compliance with the Commonwealth Risk Management Policy.

1.23 These audits have been identified by the JCPAA as priorities of the Parliament19 and will assist in keeping the Parliament, government and the community informed on implementation of the resource, risk and performance management frameworks introduced by the PGPA Act.

Audit approach

1.24 The objective of the audit was to examine the implementation of the annual performance statements requirement under the PGPA Act and the enhanced Commonwealth performance framework. To form a conclusion against the audit objective, the following high level criteria were adopted:

- the selected entities met their obligations to publish annual performance statements;

- the performance criteria were appropriate and were reported against in the selected entities’ performance statements for 2015–16;

- the selected entities had effective supporting frameworks and processes to gather, assess, assure and report information included in their annual performance statements; and

- sufficient records were retained to support the results reported by the entities against their non-financial performance measurement frameworks.

1.25 The audit involved:

- reviewing one purpose/s statement from each entity’s performance statements, and all performance criteria established to demonstrate progress against the following strategic objectives20:

- Australian Federal Police – Federal Policing and National Security (see Table 1.1); and

- Department of Agriculture and Water Resources – Building successful primary industries (see Table 1.2);

- reviewing internal systems, processes and procedures, including the governance and oversight put in place by entities, to support their development of the annual performance statements; and

- reviewing records and interviewing staff of the two selected entities.

1.26 The audit scope also included reviewing Finance’s role in whole-of-government administration of the annual performance statements requirements.

1.27 The ANAO recognises that this is the first year of published performance statements under the PGPA Act and has taken this into account. It is expected that entity processes will take some time to mature. Finance is incrementally updating guidance as lessons are learned. On this basis the audit seeks to share key learnings and point to areas for improvement.

1.28 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $390,700.

1.29 The team members for this audit were Corinne Horton, Jennifer Hutchinson, Kara Ball, Alicia Vaughan and Michael White.

Table 1.1: Audit scope: performance framework for the Australian Federal Police21

|

Australian Federal Policea |

|

|

Purpose |

Our purpose is to enforce Commonwealth criminal law, contribute to combating organised crime and protecting Commonwealth interests from criminal activity in Australia and overseas. This purpose is derived from section 8 of the Australian Federal Police Act 1979 and informed by an associated Ministerial Direction articulated under section 37 (2) of the Act. |

|

Strategic objective |

Federal policing and national security—Promoting the safety and security of the Australian community and infrastructure; preventing, deterring, disrupting and investigating serious and organised crime and crimes of Commonwealth significance; and ensuring effective collaboration with international, Commonwealth, state and territory partners.b |

|

Activities |

|

|

Performance criteria |

|

Note a: Supplementary notes from the original publications have been removed.

Note b: This reflects the AFP’s PBS Programme 1.1.

Source: Australian Federal Police 2015–19 Corporate Plan.

Table 1.2: Audit scope: performance framework for the Department of Agriculture and Water Resources22

|

Department of Agriculture and Water Resourcesa |

|

|

Purpose |

|

|

Strategic objective |

Building successful primary industries—Improve the farm-gate returns for agriculture, fisheries, food and fibre industries.b |

|

Activities |

|

|

Performance criteria |

|

Note a: Supplementary notes from the original publications have been removed.

Note b: This reflects Agriculture’s PBS Programme 1.5: Horticulture Industry, Programme 1.6: Wool Industry, Programme 1.7: Grains Industry, Programme 1.8: Diary Industry, Programme 1.9: Meat and Livestock Industry and Programme 1.10: Agricultural Resources.

Source: Department of Agriculture and Water Resources 2015–19 Corporate Plan.

2. Measurement and reporting of performance

Areas examined

This chapter considers whether the selected entities met their obligations to publish annual performance statements in their 2015–16 Annual Report. It also examines a selection of performance criteria and the reporting against those criteria in the selected entities’ 2015–16 performance statements.

Conclusion

The Australian Federal Police (AFP) and the Department of Agriculture and Water Resources (Agriculture) met the minimum requirements for the preparation and publication of the first annual performance statements under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the accompanying Public Governance, Performance and Accountability Rule 2014 (the Rule). For both entities, the performance statements included reporting against the entities’ purposes, activities, and performance criteria reviewed as part of the audit.

The performance criteria were largely relevant to the activities undertaken by the entities. Alignment of activities to criterion and measurement of the attribution of specific activities to the achievement of the entities’ purposes could be enhanced.

Both entities’ performance criteria generally provided a reliable method of assessing the entities’ progress in fulfilling their purposes. Addressing any potential bias in the reported results should be considered. In addition, describing the methodology for measurement and basis for assessment, including through a target or baseline, needs to be addressed to improve the reliability of the entities’ performance criteria.

As a whole, the performance criteria for both entities were complete, collectively providing a balanced basis for assessing the entities’ progress in fulfilling their purposes. The performance criteria selection will require ongoing effort by both entities to identify opportunities to clarify or increase the overall alignment of performance criteria to the purpose. The entities’ balance of performance criteria, for example qualitative, quantitative, and efficiency and short, medium and long term timeframes, should be reviewed.

Opportunities for improvement

The ANAO identified opportunities for improvement relating to:

- providing meaningful analysis of external factors affecting performance;

- the presentation and expression of the activities to assist a reader to identify and assess the alignment of the performance criteria to the entities’ purposes;

- a greater balance of the number of effectiveness and efficiency criteria, including: describing, where necessary, why output measures are a reasonable basis for assessing effectiveness; and how performance criteria might better reflect a mixture of short, medium and longer-term strategic objectives; and

- presenting performance criteria that clearly state who will benefit and how, and are accompanied by a target, timeframe or baseline for assessing the results.

Have entities met the requirements of the Public Governance, Performance and Accountability Act 2013 and accompanying Rule?

Both of the 2015–16 performance statements reviewed as part of the audit complied with the PGPA Act and the accompanying Rule, in relation to their publication. The performance statements were published as part of the entities’ 2015–16 Annual Reports. They included the required statements, results and analysis against the performance criteria outlined in the corporate plan and Portfolio Budget Statements reviewed as part of the audit.

The analysis section of both entities’ annual performance statements included some consideration of the entities’ operating environment and were supported in some cases by case studies and trend information. However the quality of the analysis could be improved, in particular, by providing further discussion of how the entities’ activities, through the results of the performance criteria, had contributed towards the achievement of their purposes and the external factors which impacted performance.

2.1 Table 2.1 outlines the ANAO’s summary assessment of the selected entities’ compliance with the PGPA Act and Rule for the presentation of performance statements. Both entities complied with section 39 of the PGPA Act, however improvements could be made to address the requirements of section 16F of the PGPA Rule more comprehensively.

Table 2.1: Compliance with PGPA Act and PGPA Rule requirements

|

Requirement |

AFP Compliant? |

Agriculture Compliant? |

|

Section 39 of the PGPA Act |

||

|

Subsection (1) |

||

|

Prepare annual performance statements for the entity as soon as practicable after the end of each reporting period for the entity. Include a copy of the annual performance statements in the entity’s annual report that is tabled in the Parliament. |

Yes |

Yes |

|

Subsection (2) |

|

|

|

The annual performance statements must: (a) provide information about the entity’s performance in achieving its purposes; and (b) comply with any requirements prescribed by the rules. |

Yes – refer to compliance with Section 16F of the PGPA Rule below. |

Yes – refer to compliance with Section 16F of the PGPA Rule below. |

|

Section 16F of the PGPA Rule |

||

|

Subsection (1) – Measuring and assessing entity’s performance |

||

|

The accountable authority of the entity must measure and assess the entity’s performance in achieving the entity’s purposes in the reporting period in accordance with the method of measuring and assessing the entity’s performance in the reporting period that was set out in the entity’s corporate plan, and in any Portfolio Budget Statement, Portfolio Additional Estimates Statement or other portfolio estimates statement, that were prepared for the reporting period.a |

Yes |

Partly |

|

Subsection (2) – Matters that must be included in annual performance statements |

||

|

Item 1: Statements

|

Yes |

Yes |

|

Yes |

Yes |

|

Yes |

Yes |

|

Item 2: Results The results of the measurement and assessment referred to in subsection 16F(1) of PGPA Rule of the entity’s performance in the reporting period in achieving its purposes. |

Yes |

Partly |

|

Item 3: Analysis An analysis of the factors that may have contributed to the entity’s performance in achieving its purposes in the reporting period, including any changes to: (a) the entity’s purposes, activities or organisational capability; or (b) the environment in which the entity operated; that may have had a significant impact on the entity’s performance in the reporting period. |

Partly |

Partly |

Note a: Compliance with subsection 16F(1) of the PGPA Rule is linked to compliance with subsection (2), Item 2: Results.

Source: ANAO analysis.

Results

2.2 The selected entities addressed the requirement, under section 16F of the PGPA Rule, to provide the results of the measurement and assessment of their performance in achieving their purposes. The performance statements included results against each performance criterion and references to the location of each criterion within the entities’ PBSs and corporate plans.

2.3 Subsection 16F(1) of the PGPA Rule also requires that results are presented in accordance with the method set out in the corporate plan and PBS. Finance guidance indicates that a corporate plan should include a description of performance measures, when they will be reported on, the data collection techniques to be used and any targets the performance measures will be assessed against. Agriculture’s 2015–19 Corporate Plan did not include information on the data collection techniques that would be used to measure results. Data sources were identified in the performance statements for six of the 11 performance criteria examined.

Analysis

2.4 The analysis sections of the selected entities’ performance statements contained background information to enhance the reader’s understanding of the results, including graphical representations of historical trends for some criteria. Both entities included some analysis of the factors contributing to the reported performance, in accordance with the requirements of sub-section 16F(2) of the PGPA Rule. The analysis could have been improved by further identifying and clarifying links between the reported results, and internal or external factors that influenced these results.

Australian Federal Police

2.5 The AFP’s analysis section consisted of high level statements regarding the results against each performance criterion, and how these reflected achievement of the AFP’s purpose. Where results did not meet the expected targets, the AFP identified factors contributing to the outcome and noted actions it had taken to address these factors. There was limited discussion of changes to the environment during the reporting period which may have contributed to the AFP’s performance.

2.6 The AFP provided more detailed analysis against the individual measures in the results section. A page was dedicated to each measure, detailing historical quantitative results and comparative analysis of the previous reporting period. For some criteria, relevant case studies were also listed in the performance statements and detailed later in the annual report.

Department of Agriculture and Water Resources

2.7 Agriculture discussed its results under six sub-headings, and provided case studies and references to other publications from which information was sourced. The analysis section included consideration of the broader environment, comprising the Australian economy, the overall market sector, and seasonal conditions, which may have affected the reported results.

2.8 There was limited analysis to demonstrate how the department’s activities had contributed towards the reported results. For example, the sections on ‘Managing industry levies’ and ‘Rural research and development’ advised how much revenue was collected and distributed to research and development corporations, but not how the levies or work undertaken by the corporations had contributed to improved farm-gate returns. The inclusion of case studies of specific activities that the department had undertaken throughout the year that contributed towards the reported results would have improved the quality of reporting.

|

Key Learnings 1. Presentation and analysis of results |

|

Did the entities’ corporate plans support performance measurement and reporting in the annual performance statements?

Both entities built on their existing external performance measurement and reporting framework, to meet the requirements of the enhanced Commonwealth performance framework under the Public Governance, Performance and Accountability Act 2013. The information published by the entities in their corporate plan and Portfolio Budget Statements provides a foundation for reporting in the annual performance statements, although there was scope for both entities to improve how material was presented to achieve a clearer ‘line of sight’.

2.9 For its 2015–19 Corporate Plan, the AFP built on its existing performance measurement and reporting framework as published in previous Portfolio Budget Statements (PBS). The AFP has since commenced a project to review and redevelop its performance measurement and reporting framework. The redeveloped framework will be subject to a phased implementation commencing in 2017–18.

2.10 Agriculture commenced re-development of its performance measurement and reporting framework in January 2015. This process combined the 15 programs reported in the PBSs into five objectives, identifying effectiveness, efficiency and output performance measures and deliverables. In February 2015, a Performance Reporting Project Board was established to oversee the re-development of the department’s non-financial performance reporting framework. The department reviewed its performance framework for 2016–17 and 2017–18, and advised that it intends to review the framework annually to drive continuous improvement. Performance measures from the 2015–19 Corporate Plan were revised and an amended set of measures and targets were included in the 2016–1723 Corporate Plan. The department advised that changes included:

- clarification of language;

- inclusion of relevant evaluation processes; and

- inclusion of new measures and initiatives.

Purpose statements and activities

2.11 Section 16E of the PGPA Rule requires that an entity’s corporate plan state the entity’s purposes over the next four years. The PGPA Act defines purpose/s as including the objectives, functions or role of an entity. The aim of the purpose/s statement is to give context to the significant activities that the entity will pursue over the period covered by the plan.24 Finance guidance notes that the purpose/s of an entity should be stated in a relevant and concise manner.25

2.12 Finance has defined an activity as a distinct effort of an entity undertaken to achieve a specific result (fulfilling purpose/s). Activities should be aligned with the entity’s purpose/s, and be a focus for performance measurement and reporting.

2.13 As noted in paragraph 1.7, the PBS and corporate plan are intended to be complementary and provide the foundations for the performance story presented in entity performance statements.

Australian Federal Police

2.14 The 2015–19 Corporate Plan met the requirements of the PGPA Rule and provided a foundation for performance reporting.26

2.15 The AFP’s 2015–19 Corporate Plan identified the following purpose:

to enforce Commonwealth criminal law and contribute to combating organised crime and protecting Commonwealth interests from criminal activity in Australia and overseas.

2.16 The purpose reflects the strategic objectives of the entity and is derived from the Australian Federal Police Act 1979 and associated Ministerial Direction issued in May 2014. The purpose also reflects Outcome 1 as set out in the AFP’s 2015–16 PBS. Outcome 2 is not covered by the AFP’s 2015–19 Corporate Plan, as it is subject to a separate purchasing agreement with the ACT Government. Readers are directed to separate reporting on this arrangement. The AFP’s outcomes and related programs for 2015–16 are outlined in Appendix 2.

2.17 The presentation and expression of the AFP’s activities could be improved to assist a reader to identify and assess the alignment of the performance criteria to the purpose. The AFP’s program objectives set out in the 2015–16 PBS are used as the basis for describing the AFP’s activities in the corporate plan. The activities described under Program 1.1 and 1.2 collectively address the AFP’s purpose. The activities for Program 1.1 are dispersed through narrative across the sub-sections on ‘Federal Policing’, ‘National Security’, and ‘Specialist and supporting capabilities’. Each sub-section also includes information on the AFP’s organisational structures, functions, and aspirations. As a result, it can be difficult for the reader to easily identify specific activities, and obtain a clear read of how the activities contribute towards the AFP’s purpose and objectives.

2.18 The AFP identified the presentation and expression of its activities as an area for improvement as part of its ongoing review of the performance measurement and reporting framework. As a result, the AFP’s 2016–17 Corporate Plan has been structured so that activities intended to be undertaken by the AFP to fulfil its purpose are clearly articulated. This will provide the basis for a clearer read between the 2016–17 Corporate Plan and the performance statements to be included in the 2016–17 Annual Report.

Department of Agriculture and Water Resources

2.19 The 2015–19 Corporate Plan met the requirements of the PGPA Rule and provided a foundation for the reporting of Agriculture’s annual performance. The key priorities and objectives published in the 2015–16 PBS were reflected in the 2015–19 Corporate Plan purpose statement, meeting the requirements of the PGPA Act. The plan’s purpose statement comprised five purposes, three outcomes and eight objectives. Each objective included performance measures and the key activities the department planned to undertake to achieve intended results. There was scope to better focus the purpose statement, to allow the intended results to be more readily identifiable. The structure of the purpose statement was improved in the 2016–17 Corporate Plan. The three outcomes of the department have been consolidated into a clear and concise purpose statement, including intended activities and results.

2.20 In re-developing the performance framework for the 2015–19 Corporate Plan, Agriculture also considered the outcomes, programs and performance measures already published in its PBS. The 2015–19 Corporate Plan has clear links to the outcomes and programs within the PBS. The PBS performance measures and targets are a subset of the performance measures included in the 2015–19 Corporate Plan, consistent with Finance guidance. Agriculture’s outcomes and related programs for 2015–16 are outlined in Appendix 2.

2.21 This audit focused on the following strategic objective included in the 2015–19 Corporate Plan:

Building successful primary industries – Improve the farm-gate returns for agriculture, fisheries, food and fibre industries.

2.22 The key activities from the 2015–19 Corporate Plan for the ‘Building successful primary industries’ objective are reproduced in Table 1.2.

2.23 The activities were clearly identified and reflect the government priorities listed in publications such as the Agricultural Competitiveness White Paper and on the department’s website. Improvements could be made to the identification of key activities by including the specific activities that the department will undertake, rather than broad references such as ‘in accordance with government agenda’. Broad references can hinder the development of meaningful performance criteria and reduce the reader’s ability to judge the extent to which intended results were achieved, and the factors that affected the delivery of those results.

|

Key Learnings 2. Expression and identification of activities |

|

Did the entities’ performance criteria support the reporting of progress against their purposes?

The performance criteria reviewed as part of the audit enabled the reporting of, and accountability for, the progress of each entity towards fulfilling their purposes.

The performance criteria for both entities were mostly relevant, providing a basis to make decisions on the entities’ progress in fulfilling their purposes. One of the AFP’s performance criteria required improvements to assist the reader to identify the benefit or beneficiary measured by the performance criterion and its link to the AFP’s activities. Agriculture’s performance criteria were mostly relevant, however the benefit or beneficiary was often not clear, or the focus of the measure was not clearly attributable to the entity.

The performance criteria for both entities were mostly reliable, providing a basis for reasonably consistent assessment of the entities’ progress in fulfilling their purposes. Improvements to two of the AFP’s performance criteria are required to limit the level of potential bias in the reported results. The majority of Agriculture’s performance criteria did not describe the method or basis for measurement, or provide a target or baseline, impacting the reliability of the performance criteria.

As a whole, the performance criteria for both entities were substantially complete, collectively providing a balanced basis for assessing the entities’ progress in fulfilling their purposes. To improve the completeness of the performance criteria, the selection of performance criteria will require ongoing effort by both entities to identify opportunities to clarify or increase the overall alignment of performance criteria to the purpose, and present a greater balance of performance criteria across the different forms of performance information and their timeframes.

2.24 The ANAO assessed the selected entities’ performance criteria for relevance, reliability and completeness. The basis for assessment has been adapted from the criteria for the evaluation of the appropriateness of key performance indicators as set out in ANAO Report No.21 2013–14 Pilot Project to Audit Key Performance Indicators. The criteria have been updated to reflect Finance’s guidance to support the enhanced Commonwealth performance framework and can be found at Appendix 3.

Relevance and reliability of entities’ performance criteria

2.25 In applying the ‘relevant’ criterion, the ANAO assessed whether each performance measure adopted by the selected entities for the strategic objectives under review:

- clearly indicated who benefited and how they benefited from the entity’s activities27;

- was focused on a specific aspect of the entity’s purpose/s and activity/ies, and the attribution of the result to the entity is clear 28; and

- was easily understandable.29

2.26 In applying the ‘reliable’ criterion the ANAO assessed whether each relevant performance measure:

- was measurable, that is, it used and disclosed information sources and methodologies (including a basis or baseline for measurement or assessment, for example a target or benchmark) that were fit-for-purpose and verifiable30;and

- was free from bias, allowing for clear interpretation and an objective basis for assessment of the results.31

2.27 The characteristics of the ‘relevant’ and ‘reliable’ criteria set out above are linked and observations made during an assessment against those characteristics may contribute to reporting for more than one criterion. Tables 2.2 and 2.3 summarise the ANAO’s overall assessment for the selected entities’ performance criteria. The scale used to rate each entity’s performance criteria was:

- did not display the characteristics of the criterion (No—Not relevant/reliable);

- displayed in part the characteristics of the criterion (Partly relevant/reliable);

- displayed most of the characteristics of the criterion (Mostly relevant/reliable); and

- displayed all of the characteristics of the criterion (Yes—Relevant/reliable).

Australian Federal Police

2.28 The majority of the AFP’s performance criteria were assessed to meet the relevant and reliable criteria. A summary of the ANAO’s analysis is outlined in the following paragraphs and Table 2.2. Further detail of the analysis can be found at Appendix 4.

2.29 Eight of the nine performance criteria assessed by the ANAO met the ‘relevant’ criterion. One criterion, the ‘level of external client/stakeholder satisfaction’, partly met the ‘relevant’ criterion. The satisfaction measure does not define who stakeholders or clients are, and in what context they have engaged with the AFP to be able to assess satisfaction. This limits the understanding of the performance criterion and its focus, limiting an assessment of what aspect of the purpose or activities it relates to.

2.30 The corporate plan defines and/or directs readers to further information in relation to the methodologies the measures are based on. The methodologies range from accessing results from internal databases, to participant and stakeholder surveys, and calculations that rely on inputs from internal and external sources. All of the performance criteria were capable of measurement by these methodologies, and targets have been assigned across the four year corporate plan.

2.31 Of the AFP’s performance criteria presented in Table 2.2, ‘assets restrained’, mostly met the reliable criterion, and ‘counter-terrorism investigation outcomes’ did not meet the criterion at all. This assessment was made due to the variability of the measurement outcomes of ‘assets restrained’ and the inbuilt bias of ‘counter-terrorism investigation outcomes’.

2.32 The reliability of the ‘assets restrained’ measure is impacted by the variability in the size, value and number of restraints that may occur in a given year. The ANAO notes that an explanation of contributing factors to the movement in the results of this measure is included in the AFP’s performance statements. It is important that accompanying analysis acknowledges this variability and includes evaluation of the factors contributing to the level restrained in a particular year, to allow the reader to determine the reliability of the measure as an indicator of past and future performance by the AFP.

2.33 The ‘counter-terrorism investigation outcomes’ measure compares the number of finalised (closed) counter-terrorism investigations to those that resulted in a prosecution, disruption or an intelligence referral. These three variables represent the breadth of potential outcomes for a finalised counter-terrorism investigation and invariably return a result of 100 per cent. This limits the reliability of the measure as it is biased to a positive outcome. Entities should assess performance criteria for inbuilt bias, before inclusion in their corporate plan

2.34 The remaining performance criteria were assessed to be reliable. Further discussion in relation to the suitability of the information sources supporting the performance measurement methodologies is provided in Chapter 3.

Table 2.2: Assessment of AFP performance criteria relevance and reliability

|

Strategic objective: Federal policing and national security—Promoting the safety and security of the Australian community and infrastructure; preventing, deterring, disrupting and investigating serious and organised crime and crimes of Commonwealth significance; and ensuring effective collaboration with international, Commonwealth, state and territory partners. |

||

|

AFP performance criteria |

ANAO assessment |

|

|

Relevant |

Reliable |

|

|

Level of external client/stakeholder satisfaction (percentage of clients satisfied or very satisfied). |

Partly |

Yes |

|

Percentage of cases before court that result in conviction. |

Yes |

Yes |

|

Percentage of counter-terrorism investigations that result in a prosecution, disruption or intelligence referral outcome. |

Yes |

No |

|

Level of community confidence in the contribution of the AFP to aviation law enforcement and security (percentage of aviation network users satisfied or very satisfied). |

Yes |

Yes |

|

Response to aviation law enforcement and/or security incidents within priority response times. |

Yes |

Yes |

|

Number of avoidable incidents per 5 000 Protection hours. |

Yes |

Yes |

|

Positive return on investment for investigation of transnational crime. |

Yes |

Yes |

|

Assets restrained. |

Yes |

Mostly |

|

Increased or reinforced cyber safety and security awareness (percentage of surveyed sample indicating increased awareness or reinforced awareness after delivery of presentations). |

Yes |

Yes |

Source: ANAO analysis.

Department of Agriculture and Water Resources

2.35 Agriculture’s performance criteria mostly met the ‘relevant’ and ‘reliable’ criteria. A summary of the ANAO’s analysis is outlined in the following paragraphs and Table 2.3 below. Further detail of the analysis is provided at Appendix 4.

2.36 For five of the performance criteria, the performance statements did not specify how the department’s activities contributed to the results reported, impacting their focus and relevance. The performance measures focus on the changes in the broader Australian economy and the primary industries sector, which can lead to improved farm-gate returns (meeting the department’s purposes). The outcomes are not always within the direct control or influence of the department (for example, Portfolio industries may record an increase in productivity), or are shared with another entity and do not clearly describe Agriculture’s contribution.32 This makes it difficult to attribute the results of a particular departmental activity to changes observed in the primary industries sector.

2.37 Where it is difficult to attribute the results of a particular departmental activity to changes observed in the primary industries sector and broader environment, there would be value in acknowledging this limitation in the corporate plan. The limitation could be further addressed by including specific case studies or details of activities Agriculture will undertake throughout the reporting period that influence the results being reported. For example, Agriculture could highlight the key projects or programs that are expected to contribute towards the results reported through the performance criteria and include an analysis of the progress, or otherwise, of the specific projects or programs.

2.38 To improve the relevance of the performance criteria, Agriculture should also ensure that it is clear to readers who is the beneficiary of the activity measured by the criterion, and how they will benefit. This was not clear for six of the performance criteria.

2.39 None of Agriculture’s performance criteria in 2015–16 disclosed the method and parameters (targets, timeframes or baselines) that would be used to collect data and measure performance to enable assessment by the reader. This affects the reliability of the performance criteria presented in Agriculture’s annual performance statements. For some measures, results have been informed by old data or trend analysis across a decade or more, which does not reflect progress in 2015–16. Other measures are not able to be easily measured and rely on assumptions or estimates. The performance measures included in Agriculture’s 2016–17 Corporate Plan have addressed some of these issues with the inclusion of targets, baselines or information on the basis for how results will be measured and assessed for future performance statements.

Table 2.3: Assessment of Agriculture performance criteria relevance and reliability

|

Strategic objective: Building successful primary industries—Improve the farm-gate returns for agriculture, fisheries, food and fibre industries. |

||

|

Agriculture performance criteria |

ANAO assessment |

|

|

Relevant |

Reliable |

|

|

Portfolio industries record an increase in productivity. |

Mostly |

Mostly |

|

Rate of return on capital invested across portfolio industries is maintained or increased. |

Mostly |

Mostly |

|

Rate of profit for producers and businesses is maintained or increased. |

Mostly |

Mostly |

|

Access to water, land, forest and marine resources for primary production is maintained or improved. |

Mostly |

Mostly |

|

Improved availability of safe, efficient and effective agricultural and veterinary chemicals. |

Mostly |

Mostly |

|

Investment in rural research and development corporation programs demonstrates positive returns. |

Mostly |

Mostly |

|

100% of allocated funding under the Research and Development for Profit program expended in accordance with the agreed timetable. |

Partly |

Mostly |

|

100% of rural research and development corporations are compliant with statutory and contractual requirements. |

Partly |

Mostly |

|

High level of efficiency in collecting and distributing levies to fund research and development in research and development corporations. |

Mostly |

Mostly |

|

Inspections of levy agent records cover at least 30% of levy revenue. |

Partly |

Mostly |

|

Less than 5% of quota allocations are rejected because of quota certification failures. |

Partly |

Mostly |

Source: ANAO analysis.

|

Key Learnings 3. Relevance and reliability of performance criteria |

|

Relevance of performance criteria

Reliability of performance criteria

|

Completeness of the performance criteria in assessing the entities’ activities and purpose

2.40 Finance guidance notes that it is rare for a single measure to be able to adequately determine the effectiveness of an activity. It advises that good performance information will draw on multiple sources. The quality of performance information should be emphasised over quantity. The guidance recommends a small set of measures that is sufficiently comprehensive to cover those factors that affect an activity’s performance.

2.41 Finance guidance indicates that performance measures should be a mix of quantitative and qualitative data or information. It is stated that efficiency, output and input measures will typically be used to complement effectiveness measures. The guidance also notes that in some cases, effectiveness may not be measurable, due to cost or a lack of complete information. In these cases, input, output and efficiency measures can be used as proxies for effectiveness. Entities are advised that in these circumstances, they should be clear on why effectiveness cannot be measured and how the proxy measures are suitable.

2.42 The guidance also recognises that activities often work on different timeframes, and information on one or more timeframes may not be available at the time of reporting. It is therefore recommended that the performance story told at a particular time reflect the outcome that can be reasonably expected from the relevant activities at that time.

2.43 In assessing the selected entities’ performance criteria for completeness, the ANAO considered whether the performance criteria present a basis for a collective and balanced assessment of the entity against its purpose. In particular, the ANAO considered whether the selected entities’ performance criteria:

- clearly align to the entity’s purpose through the activities identified in the corporate plan (collective);

- provide a basis for assessment of the effectiveness and efficiency of the entity in fulfilling its purpose (balanced);

- relied on a mixture of quantitative and qualitative data (balanced); and

- assess a mixture of short, medium and long-term objectives (balanced).

Australian Federal Police

2.44 The performance criteria assessed as part of the audit are substantially complete, providing a collective and balanced basis for assessing the AFP’s progress in fulfilling its purpose. Areas for improvement include clearer alignment of performance criteria to the activities, program objectives and purposes, and presenting a mixture of performance criteria that focus on short, medium and long-term objectives. In the 2016–17 Corporate Plan, the AFP has described its approach to enhancing performance measurement and reporting over the next three years. The proposed approach is to include more qualitative discussion and evaluation of overall performance.

2.45 As discussed earlier, the presentation of the activities of the AFP could be improved in the corporate plan, to assist readers to align the performance criteria to the AFP’s purpose. The ANAO identified that ‘Specialist and supporting capabilities’ could not be directly linked to the performance criteria presented in the corporate plan or performance statements. It was also not clear whether ‘External client/stakeholder satisfaction’ linked directly to a single activity, multiple activities or all AFP activities. The AFP also relies on a high proportion of output measures, rather than measures of effectiveness to assess progress in fulfilling its purpose. While this approach can be appropriate in certain circumstances, the AFP should include an explanation of why measuring outputs provides a reasonable basis for assessing its effectiveness.

2.46 Further assessment of the quantitative results against the AFP’s performance criteria may assist the AFP to present a more meaningful performance story. For example, against ‘percentage of cases before court that result in conviction’, the AFP may consider cases where a conviction was not recorded, and include a discussion of the contributing factor/s and what measures the AFP has implemented to increase the likelihood of a conviction in future cases. This type of analysis would provide users with additional information to assist in evaluating the performance of the AFP.

2.47 The AFP’s performance criteria include a mixture of quantitative and qualitative data, providing a basis for a more comprehensive performance story. Each performance criterion is reported against annually, and static targets have been set over the four years of the corporate plan for eight of the nine measures reviewed by the ANAO. ‘Assets restrained’ reports against a target of an ‘increase’ against a rolling average of the previous five years’ results.

2.48 There would be benefit in the AFP including in the Corporate Plan a description of the rationale for setting static targets, particularly where the target has been historically met, and how incremental improvement is expected to be demonstrated over time. The ANAO notes that the AFP provided historical results in the annual report appendices for performance criteria with static targets. This enables a reader to assess the AFP’s performance against targets over the longer-term, however including more detailed analysis of longer-term performance in the performance statements would be beneficial.

2.49 Table 2.4 below details the AFP’s performance criteria against the ‘complete’ criterion characteristics set out in paragraph 2.43.

Table 2.4: ANAO assessment of AFP performance criteria—completeness

|

Strategic objective: Federal policing and national security—Promoting the safety and security of the Australian community and infrastructure; preventing, deterring, disrupting and investigating serious and organised crime and crimes of Commonwealth significance; and ensuring effective collaboration with international, Commonwealth, state and territory partners. |

||||

|

Activitiesa |

Performance criteria |

Type |

Basis |

Timeframe |

|

Federal policing |

Percentage of cases before court that result in conviction. |

Output |

Quantitative |

Short-term |

|

Positive return on investment for investigation of transnational crime. |

Efficiency |

Quantitative |

Short-term |

|

|

Assets restrained. |

Output |

Quantitative |

Medium-term |

|

|

Increased or reinforced cyber safety and security awareness (percentage of survey sample indicating increased awareness or reinforced awareness after delivery of presentations). |

Effectiveness |

Qualitative |

Short-term |

|

|

National security |

Percentage of counter-terrorism investigations that result in a prosecution, disruption or intelligence referral outcome. |

Output |

Quantitative |

Short-term |

|

Level of community confidence in the contribution of the AFP to aviation law enforcement and security. |

Effectiveness |

Qualitative |

Short-term |

|

|

Response to aviation law enforcement and/or security incidents within priority response times. |

Output |

Quantitative |

Short-term |

|

|

Number of avoidable incidents per 5 000 Protection hours. |

Output |

Quantitative |

Short-term |

|

|

Specialist and supporting capabilities |

The ANAO could not:

|

|||

|

The ANAO could not determine whether this criterion related to a single activity, multiple activities, or all. |

Level of external client/stakeholder satisfaction (percentage of clients satisfied or very satisfied). |

Effectiveness |

Qualitative |

Short-term |

Note a: Performance criteria have been mapped to specific activities by the ANAO. Note that some performance criteria may relate to more than one activity.

Source: ANAO analysis.

Department of Agriculture and Water Resources

2.50 Agriculture’s performance criteria assessed as part of the audit are substantially complete, providing a collective and balanced basis for assessing the department’s progress in fulfilling its purpose. For future reporting, consideration could be given to ensuring that there are performance criteria that cover all identified key activities, to provide a more complete overview of the department’s performance in fulfilling its purposes.

2.51 As noted in Table 2.5, of the 11 performance criteria reviewed as part of the audit: