Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Compliance with Gifts, Benefits and Hospitality Requirements in the Department of the Treasury

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The giving or receiving of gifts, benefits and hospitality can create the perception that an official is subject to inappropriate external influence.

- The audit is one of a series of performance audits in relation to gifts, benefits and hospitality which continues the ANAO’s examination of integrity in Commonwealth entities.

- This audit was conducted to provide assurance to the Parliament that the Department of the Treasury (Treasury) has complied with gifts, benefits and hospitality requirements.

Key facts

- Treasury is the Australian Government’s lead economic advisor, providing advice to government and implementing policies and programs to achieve strong and sustainable fiscal outcomes for Australians.

- There were 39 items publicly reported on Treasury’s gifts and benefits register for the period 1 July 2021 to 30 September 2023.

What did we find?

- Treasury has been largely effective in complying with its gifts, benefits and hospitality requirements. Shortcomings in the alignment of Treasury’s internal policy to Australian Public Service Commission’s requirements, training and education arrangements for Treasury’s statutory office holders, and processes not detecting non-compliance reduced the effectiveness of arrangements.

- Treasury has largely effective arrangements for managing gifts, benefits and hospitality.

- Treasury’s controls and processes were partly effective in operation with 12 instances of non-compliance identified.

What did we recommend?

- The Auditor-General made four recommendations aimed at strengthening the control framework for gifts, benefits and hospitality.

- Treasury agreed to all recommendations.

2

instances of non-compliance with internal policy.

2

instances of non-compliance with the PGPA Act.

8

instances of non-compliance with APSC requirements.

Summary and recommendations

Background

1. The Public Service Act 1999 (PS Act) requires that Australian Public Service (APS) employees, agency heads and statutory office holders abide by the APS Code of Conduct. The APS Code of Conduct, consistent with duties under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), require officials to declare the receipt of gifts, benefits and hospitality. Collectively, these requirements establish obligations for officials and Commonwealth entities in relation to how they manage the provision and receipt of gifts, benefits and hospitality.

2. Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit to themselves or another person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person.1 The National Anti-Corruption Commission Act 2022 also contains provisions against conduct that adversely affects (or could adversely affect) the honest and impartial exercise of any public official’s powers, functions or duties.2

3. The Australian Public Service Commission (APSC) publishes Guidance for Agency Heads — Gifts and Benefits. The principles underpinning this guidance are that:

- agency heads are meeting public expectations of integrity, accountability, independence, transparency and professionalism in relation to gifts and benefits; and

- there is consistency in relation to agency heads’ management of gifts and benefits across APS agencies and Commonwealth entities and companies.

4. The Department of the Treasury (Treasury) is a non-corporate Commonwealth entity. Treasury is the government’s lead economic advisor, providing advice to the government and implementing policies and programs to achieve strong and sustainable economic and fiscal outcomes for Australians.3

Rationale for undertaking the audit

5. Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit to themselves or another person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person. Public service entities must meet public expectations of integrity, accountability, independence, transparency, and professionalism. Acceptance of a gift or benefit that relates to an official’s employment can create a real or apparent conflict of interest that should be avoided.4

6. Public confidence in Commonwealth entities and the APS can be damaged when gifts and benefits that create a conflict of interest are accepted or not properly declared. APSC states in its publication, APS Values and Code of Conduct in practice, that the risk of the appearance of a conflict can be damaging to public confidence:

The appearance of a conflict can be just as damaging to public confidence in public administration as a conflict which gives rise to a concern based on objective facts.5

7. This audit provides assurance to the Parliament that Treasury has complied with gifts, benefits and hospitality requirements.

Audit objective and criteria

8. The objective of the audit was to assess whether Treasury had complied with gifts, benefits and hospitality requirements.

9. To form a conclusion against the objective, the ANAO adopted the following two high-level audit criteria.

- Did Treasury have effective arrangements in place to manage gifts, benefits and hospitality?

- Were Treasury’s controls and processes for gifts, benefits and hospitality operating effectively in accordance with policies and procedures?

10. The audit examined the management of gifts, benefits and hospitality within Treasury over the period 1 July 2021 to 30 September 2023.

Conclusion

11. Treasury has been largely effective in complying with its gifts, benefits and hospitality requirements. Shortcomings in the alignment of Treasury’s internal policy to APSC requirements, training and education arrangements for Treasury’s statutory office holders, and processes not detecting non-compliance reduced the effectiveness of arrangements.

12. Treasury has established largely effective arrangements for managing gifts, benefits and hospitality. Treasury has a system, policies and training to support officials in their management of gifts, benefits and hospitality. The policy applies to all Treasury officials. The policy is aligned to the requirements of APSC Guidance for Agency Heads — Gifts and Benefits, with the exception of requirements for declaring and reporting the receipt of hospitality. As a result, Treasury has reduced the transparency in public reporting for hospitality that has been received by officials. Not all statutory office holders that are officials of Treasury are provided guidance and training in relation to gifts, benefits and hospitality.

13. The operating effectiveness of Treasury’s processes and controls for gifts, benefits and hospitality is partly effective. Training and education arrangements that had been implemented for internal staff were operating effectively. Training and education arrangements were not provided to all statutory office holders of Treasury. Treasury made a decision in 2022 not to implement detective controls such as proactive compliance monitoring so Treasury is reliant on the self-declaration of officials that receive gifts, benefits and hospitality. Treasury processes had not identified two instances of non-compliance with Treasury’s internal policy requirements and a further 10 instances of non-compliance with the PGPA Act and APSC Guidance for Agency Heads — Gifts and Benefits.

Supporting findings

Arrangements for managing gifts, benefits and hospitality

14. Treasury has established arrangements for identifying and managing risks associated with the acceptance and provision of gifts, benefits and hospitality. Treasury’s risk management policy and framework outline the requirements for assessing risks and provide related guidance. Treasury has undertaken a fraud and corruption risk assessment at an entity-level and risk assessments for each of its groups. These risk assessments have considered gifts, benefits and hospitality. There is an opportunity to specifically articulate operational controls which are of relevance to gifts, benefits and hospitality rather than only high-level enterprise controls as expressed in the Fraud Risk Assessment. (See paragraphs 2.6 to 2.12)

15. Treasury has developed policies and procedures for officials regarding the acceptance of gifts, benefits and hospitality. These policies and procedures reference other relevant departmental policy including the conflict of interest policy. These policies and procedures align with the APSC Guidance for Agency Heads — Gifts and Benefits with the exception of the processes to declare and approve the receipt of hospitality. (See paragraphs 2.13 to 2.22)

16. Treasury has developed policies and procedures for officials regarding the provision of gifts, benefits and hospitality. These policies and procedures align with the APSC Guidance for Agency Heads — Gifts and Benefits and also reference other relevant departmental policy including the conflict of interest policy. Treasury policy refers to the application of guidance provided by the Department of Foreign Affairs and Trade (DFAT) in relation to the provision of gifts by officials posted overseas. (See paragraphs 2.23 to 2.27)

17. Treasury maintains mandatory training packages which include responsibilities and expectations for officials relating to gifts, benefits and hospitality. There are mechanisms in place to monitor mandatory training completion and follow-up non-compliance with training requirements. While Treasury provides onboarding material to officials noting requirements to comply with the PGPA Act, Treasury does not have arrangements for statutory office holders (that are Treasury officials) to ensure consistency in the training and education arrangements made available to them. The Treasury Secretary has completed all mandatory training and completion of mandatory training modules by other Treasury staff ranges from 89 per cent to 92 per cent. (See paragraphs 2.28 to 2.43)

18. Treasury has implemented arrangements to support the reporting of the public register for gifts and benefits in accordance with APSC Guidance for Agency Heads — Gifts and Benefits. Treasury does not provide periodic reporting to internal governance committees on matters relating to gifts, benefits and hospitality, or have a formalised framework for monitoring compliance against internal policy requirements. (See paragraphs 2.44 to 2.49)

Implementation and effectiveness of arrangements for managing gifts, benefits and hospitality

19. Treasury’s preventative controls include its operational guidelines and online training modules. Access to the training modules was not provided to all statutory office holders that are officials of the department. Not all statutory office holders that had access to the training arrangements had completed the online training modules. (See paragraphs 3.2 to 3.20)

20. Treasury has not implemented detective controls that are specifically for the purpose of monitoring compliance with requirements for the receipt and provision of gifts, benefits and hospitality. Treasury has detective controls that can indirectly support the identification of non-compliance with related requirements. This includes assessing corporate credit card transactions and obtaining annual conflict of interest declarations from officials. (See paragraphs 3.21 to 3.35)

21. There were no documented processes for managing identified instances of non-compliance relating to gifts, benefits and hospitality. Treasury has not previously identified instances of non-compliance relating to gifts, benefits and hospitality so the effectiveness of related processes for managing non-compliance were unable to be assessed. (See paragraphs 3.36 to 3.38)

22. Treasury has not developed an evidence-based assurance framework that considers gifts, benefits and hospitality. The inclusion of gifts, benefits and hospitality in Treasury’s Financial Framework Assurance Plan was considered following a prior internal audit and decision was made by Treasury that no further assurance processes were required. (See paragraphs 3.39 to 3.40)

Recommendations

Recommendation no. 1

Paragraph 2.12

The Department of the Treasury reassess the risks associated with gifts, benefits and hospitality with consideration to the findings of this audit and whether additional controls are required (including monitoring and reporting on compliance). In reassessing the risks, operational controls related to gifts, benefits and hospitality should be identified and recorded to support monitoring their effectiveness.

Department of the Treasury response: Agreed.

Recommendation no. 2

Paragraph 2.18

The Department of the Treasury update its internal policies to ensure its guidance is consistent with APSC Guidance for Agency Heads — Gifts and Benefits which requires that all gifts, that are valued at over $AUD 100 (excluding GST) and are accepted, are declared and recorded on Treasury’s gifts and benefits register.

Department of the Treasury response: Agreed.

Recommendation no. 3

Paragraph 3.18

The Department of the Treasury improve the arrangements for communicating and outlining obligations relating to managing gifts, benefits and hospitality. The Department of the Treasury:

- circulate APSC Guidance for Agency Heads — Gifts and Benefits to its statutory office holders (who are Treasury officials) to communicate requirements and provide guidance relating to gifts, benefits and hospitality;

- provide statutory office holders (who are Treasury officials) with access to departmental training materials; and

- encourage the consideration and use of departmental travel arrangements in accordance with paragraph 10(5)(c) and section 14 of the Remuneration Tribunal (Official Travel) Determination 2023 for its statutory office holders (who are Treasury officials).

Department of the Treasury response: Agreed.

Recommendation no. 4

Paragraph 3.32

The Department of the Treasury update the public gifts and benefits register to record instances of gifts and benefits received by officials, that have not previously been declared, to ensure reporting in accordance with requirements specified in the APSC Guidance for Agency Heads — Gifts and Benefits.

Department of the Treasury response: Agreed.

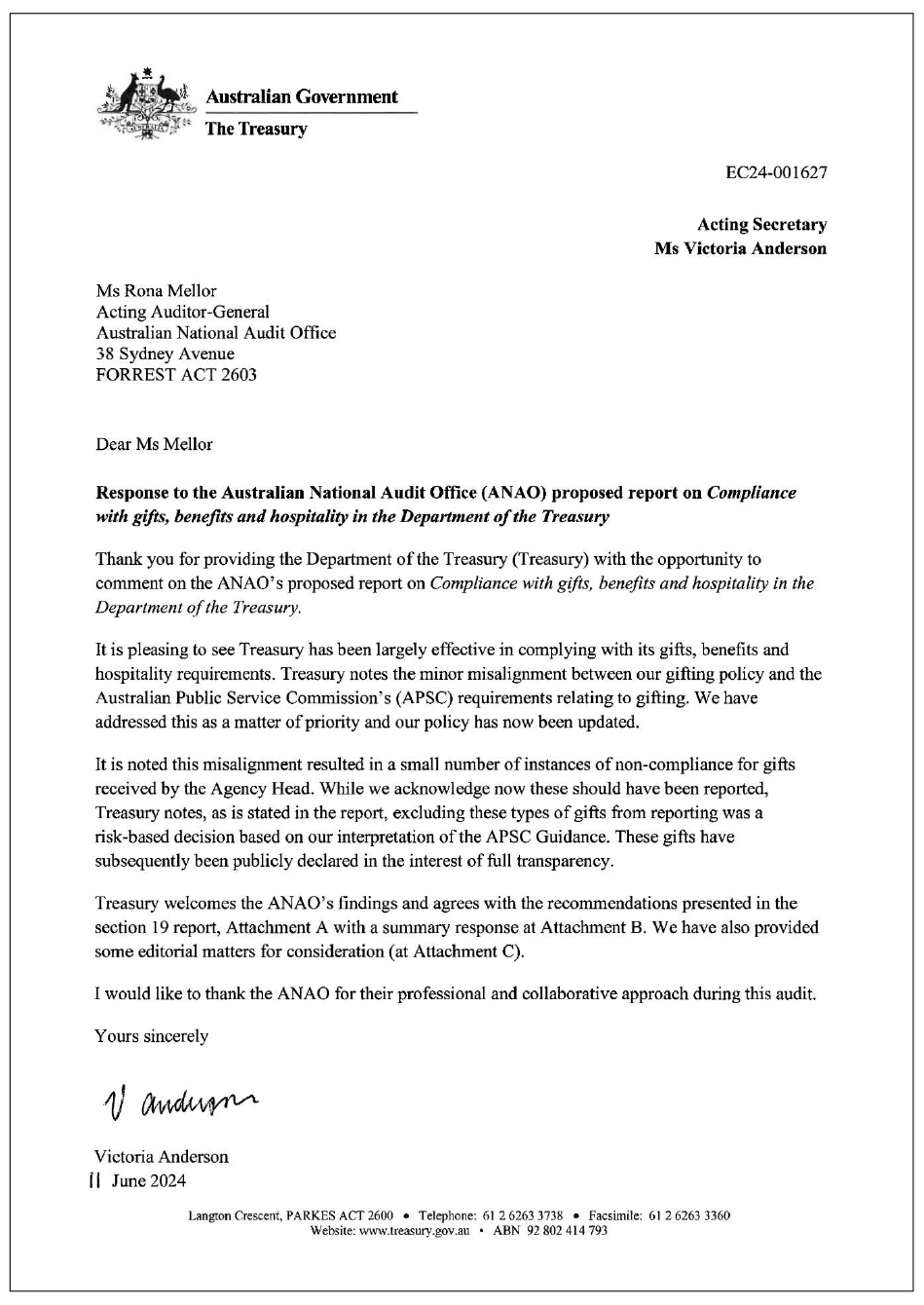

Summary of entity response

23. The proposed audit report was provided to the Department of the Treasury. The summary response to the report is below and the full response is at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

Department of the Treasury

Treasury welcomes this report and thanks the ANAO for their professional and collaborative approach to this audit. Treasury is committed to ensuring full compliance and transparency with regard to gifts, benefits and hospitality and accepts the recommendations provided by the ANAO. Treasury has already implemented changes as per recommendations 2 and 4 and will consider how best to implement recommendations 1 and 3. Implementation and closure of these recommendations will be monitored by our Audit and Risk Committee.

Treasury notes the instances of non-compliance (relating to non-declaration of gifts) identified by the ANAO were not significant in nature, nor do they suggest a systemic issue with regard to the declaration of gifts received. The minor misalignment with the Australian Public Service Commission gifting guidelines, which created the non-compliance, has been rectified and Treasury has amended its public gift register to include the 4 gifts identified in this report as non-compliant.

Treasury will continue to ensure our internal policies and systems continue to mature and function effectively.

Key messages from this audit for all Australian Government entities

24. This audit is one of a series of gifts, benefits and hospitality audits that apply a standard methodology to selected entities’ compliance with gift, benefits and hospitality requirements. The three entities included in the ANAO’s gifts, benefits and hospitality series are:

- Department of the Treasury;

- Australian Communications and Media Authority; and

- Murray-Darling Basin Authority.

25. Key messages from the ANAO’s series of gifts, benefits and hospitality audits will be outlined in an Insights product available on the ANAO website.

1. Background

Introduction

1.1 The Public Service Act 1999 (PS Act) requires that Australian Public Service (APS) employees and agency heads uphold the APS Values and Code of Conduct.6 The APS Code of Conduct, consistent with duties under the Performance, Governance and Public Accountability Act 2013 (PGPA Act), requires officials not to improperly use their duties, status, power or authority to gain, or seek to gain, a benefit for themselves or any other person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person. Collectively, these requirements establish obligations for officials and Commonwealth entities in relation to how they manage the provision and receipt of gifts, benefits and hospitality.

1.2 The National Anti-Corruption Commission Act 2022 contains provisions against conduct that adversely affects (or could adversely affect) the honest or impartial exercise or performance of a public official’s powers, functions or duties.

1.3 The Australian Public Service Commission (APSC) publishes Guidance for Agency Heads — Gifts and Benefits.7 The principles underpinning this guidance are that:

- agency heads are meeting public expectations of integrity, accountability, independence, transparency, and professionalism in relation to gifts and benefits; and

- there is consistency in relation to agency heads’ management of gifts and benefits across the APS agencies and Commonwealth entities and companies.8

1.4 Agency heads must publish a register of gifts and benefits, valued at over $100 (excluding GST), they accept on a quarterly basis. A link to the register must also be provided to APSC for publication on APSC’s website.

1.5 In the course of their official duties, APS employees may interact with many individuals and organisations, and may receive offers of gifts, benefits and hospitality as part of these interactions. The acceptance of such offers can pose risks to public confidence in entities and the APS more broadly, particularly in meeting the APS Values and the public’s expectations of integrity, accountability, independence, transparency and professionalism.9

1.6 The Department of the Treasury (Treasury) is a non-corporate Commonwealth entity. Treasury is the government’s lead economic advisor, providing advice to the government and implementing policies and programs to achieve strong and sustainable economic and fiscal outcomes for Australians.10

Treasury policy framework for gifts, benefits and hospitality

1.7 Treasury has developed Operational Guideline 10.2 — Gifting — Giving and Receiving and Operational Guideline 2.3 — Official Hospitality (including Business Catering) to support management of its gifts, benefits and hospitality arrangements. The most recent updates to these guidelines were to Operational Guideline 10.2 in October 2023 and Operational Guideline 2.3 in May 2022.

1.8 Treasury uses an IT system, Delphi, for declaring gifts, benefits and hospitality which includes automated workflows so that gifts, benefits and hospitality can be appropriately approved. Delphi supports Treasury’s processes for officials to declare gifts, benefits and hospitality. Links to the operational guidelines are available on the intranet and within Delphi. Gifts, benefits and hospitality that are not approved, or not considered to meet the definition and criteria for gifts, benefits and hospitality, will not be recorded on the public register.

1.9 Treasury maintains a public register on its website which includes gifts and benefits received by Treasury officials where the value exceeds $100 (excluding GST), and whether the gifts and benefits were retained.11 As of 7 February 2024, there were a total of 39 items reported for the period 1 July 2021 to 30 September 2023. This included 21 items reported for the period 1 July 2023 to 30 September 2023, 10 items reported in 2022–23 and eight items reported in 2021–22.

Previous reports

1.10 Auditor-General Report No. 47 2017–18 Interim Report on Key Financial Controls of Major Entities reviewed the gifts and benefits policies of 26 major Australian Government entities, including all departments of state.12 This report identified:

- the merit of developing a whole of government gifts and benefits policy setting the minimum requirements for entities to include within their policies;

- regular review and monitoring of entities’ gifts and benefits policies increase accountability;

- centrally maintained gifts, benefits and hospitality registers assist entities in meeting accountability and transparency obligations; and

- transparency is enhanced through the publication of entities’ gifts and benefits registers on the internet.

1.11 The Australian Public Service Commissioner issued guidance on 18 October 2019 for reporting of gifts and benefits. The ANAO reviewed the status of the implementation of the guidance as part of Auditor-General Report No. 38 2019–20 Interim Report on Key Financial Controls of Major Entities. The report found that all 24 entities covered by the report had established a register of gifts and benefits, and that, except for one entity, all had recorded gifts and benefits received by the agency head which exceed $100. Publication of received gifts and benefits was undertaken by approximately 79 per cent of entities.13

Rationale for undertaking the audit

1.12 Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit to themselves or another person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person. Public service entities must meet public expectations of integrity, accountability, independence, transparency, and professionalism. Acceptance of a gift or benefit that relates to an official’s employment can create a real or apparent conflict of interest that should be avoided.

1.13 Public confidence in Commonwealth entities and the APS can be damaged when gifts and benefits that create a conflict of interest are accepted or not properly declared. APSC states in its publication, APS Values and Code of Conduct in practice, that the risk of the appearance of a conflict can be damaging to public confidence:

The appearance of a conflict can be just as damaging to public confidence in public administration as a conflict which gives rise to a concern based on objective facts.14

1.14 This audit provides assurance to the Parliament that Treasury has complied with gifts, benefits and hospitality requirements.

Audit approach

Audit objective, criteria and scope

1.15 The objective of the audit was to assess whether Treasury had complied with gifts, benefits and hospitality requirements.

1.16 To form a conclusion against the objective, the ANAO adopted the following two high-level audit criteria.

- Did Treasury have effective arrangements in place to manage gifts, benefits and hospitality?

- Were Treasury’s controls and processes for gifts, benefits and hospitality operating effectively in accordance with policies and procedures?

1.17 The audit examined the management of gifts, benefits and hospitality within Treasury over the period from 1 July 2021 to 30 September 2023.

Audit methodology

1.18 To address the audit objective, the audit team:

- met with Treasury officials involved in managing arrangements related to gifts, benefits and hospitality;

- reviewed legislative, policy and internal frameworks relating to provision and receipt of gifts, benefits and hospitality;

- reviewed documentation relating to Treasury’s arrangements for managing gifts, benefits and hospitality;

- performed eDiscovery and analysis of Personal Storage Table (PST) files (emails and calendars) for a selection of 15 officials which were determined giving consideration to high-risk roles (senior officials including the Treasury Secretary and deputy secretaries, and officials involved in procurements);

- analysed corporate credit card expenditure and examined a selection of transactions relating to gifts, benefits and hospitality;

- analysed expense reimbursements relating to travel and where officials may have obtained a benefit (through accrued frequent flyer points);

- reviewed records to support the completeness and accuracy of Treasury’s gifts, benefits and hospitality registers; and

- considered monitoring and reporting arrangements for gifts, benefits and hospitality, including Treasury’s procedures for follow-up on identified instances of non-compliance.

1.19 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $281,491.

1.20 The team members for this audit were Mark Tsui, Kerrie Nightingale, Joel Gargan and David Tellis.

2. Arrangements for managing gifts, benefits and hospitality

Areas examined

The ANAO examined whether the Department of the Treasury (Treasury) had effective arrangements in place to manage gifts, benefits and hospitality.

Conclusion

Treasury has established largely effective arrangements for managing gifts, benefits and hospitality. Treasury has a system, policies and training to support officials in their management of gifts, benefits and hospitality. The policy applies to all Treasury officials. The policy is aligned to the requirements of APSC Guidance for Agency Heads — Gifts and Benefits, with the exception of requirements for declaring and reporting the receipt of hospitality. As a result, Treasury has reduced the transparency in public reporting for hospitality that has been received by officials. Not all statutory officer holders that are officials of Treasury are provided guidance and training in relation to gifts, benefits and hospitality.

Areas for improvement

The ANAO made two recommendations aimed at: reassessing risks related to gifts, benefits and hospitality to determine whether additional controls are required (paragraph 2.12); and updating internal policy to better align with APSC Guidance for Agency Heads — Gifts and Benefits (paragraph 2.18).

2.1 Section 16 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act)15 requires accountable authorities of Commonwealth entities to establish and maintain appropriate systems of risk oversight, management and internal control for the entity.

2.2 Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit to themselves or another person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person. Public service entities must meet public expectations of integrity, accountability, independence, transparency, and professionalism. Acceptance of a gift or benefit that relates to an official’s employment can create a real or apparent conflict of interest that should be avoided.

2.3 The Commonwealth Risk Management Policy16 supports the implementation of section 16 of the PGPA Act, by requiring non-corporate Commonwealth entities (including Treasury) to: formalise their approach to managing risks17; embed risk management into the culture and work practices18; define staff’s risk management responsibilities19; and review the effectiveness of controls.20

2.4 Commonwealth officials must also uphold and promote the Australian Public Service (APS) Values and Employment Principles and abide by the Code of Conduct contained in the Public Service Act 1999 (PS Act).

2.5 The audit assessed the alignment of Treasury’s arrangements for managing gifts, benefits and hospitality with the PGPA Act and APSC Guidance for Agency Heads — Gifts and Benefits, as well as examining whether training and education was available to officials.

Have appropriate arrangements been established for managing risks associated with the acceptance or provision of gifts, benefits and hospitality?

Treasury has established arrangements for identifying and managing risks associated with the acceptance and provision of gifts, benefits and hospitality. Treasury’s risk management policy and framework outline the requirements for assessing risks and provide related guidance. Treasury has undertaken a fraud and corruption risk assessment at an entity-level and risk assessments for each of its groups. These risk assessments have considered gifts, benefits and hospitality. There is an opportunity to specifically articulate operational controls which are of relevance to gifts, benefits and hospitality rather than only high-level enterprise controls as expressed in the Fraud Risk Assessment.

2.6 Treasury has a Risk Management Policy and a Risk Management Framework which requires periodic risk assessments and reporting at both an entity-level and group-level — the central risk register for the entity-level risk assessment is required to be updated twice per annum and the group risk registers for the group-level risk assessments are required to be updated annually. The Risk Management Policy and Risk Management Framework are supplemented by a Risk Management Toolkit that includes templates and guidance for officials when undertaking risk assessments.

Fraud and corruption risk assessment

2.7 Treasury has undertaken a fraud and corruption risk assessment which was last reviewed in March 2023. The risk assessment identifies three risks related to the acceptance of gifts, benefits and hospitality. Two of these three risks specifically recognise the following contributing factor (cause) to the risk:

Acceptance of gifts, favours, or payments from external parties in exchange for preferential treatment or to influence a decision regarding policy development and delivery.

2.8 The third risk relates to inappropriate tendering and contract management and recognises the risk associated with obtaining an ‘unauthorised benefit’. There were an additional three risks recorded in the fraud risk and corruption assessment which more broadly related to conflicts of interest where there is a potential for a benefit to be obtained. These three risks were not expressed with a direct reference to gifts, benefits and hospitality.

2.9 The mitigating controls recorded in the Fraud Risk Assessment for the three risks related to gifts, benefits and hospitality were preventative in nature and included conflict of interest declarations, training, policies and reference to Treasury’s operational guidelines. The Fraud Risk Assessment does not set out Treasury’s full suite of controls including declaration and approval processes in Delphi (refer to paragraph 1.8).

Internal audit

2.10 Treasury completed an internal audit, Design and Implementation of Treasury’s Financial Assurance Framework, in April 2022. The scope of the internal audit included examination of gifts and hospitality and did not assess the completeness or accuracy of identified legislative requirements and reporting (breaches). Improvements that were required to assurance arrangements for gifts and hospitality were identified as part of the internal audit. The internal audit report recognised Treasury’s reliance on officials self-reporting (making declarations) as opposed to proactive compliance monitoring. The internal audit stated no instances of non-compliance relating to gifts were reported in 2020–21. The internal audit recommended the development of a risk-based assurance plan which includes the consideration of preventative and detective controls as ‘there is a risk that current non-compliance reporting is not complete and / or accurate’. This was to provide assurance that controls were operating as designed and to follow up any identified anomalous or irregular transactions. Although this recommendation was not specific to gifts, benefits and hospitality, in response to the internal audit recommendation, Treasury documented its position in the internal audit report that it did not consider that the risk associated with gifts warranted proactive testing:

Treasury does not consider the risk associated with gifts warrants proactive testing. Reliance will be placed on existing controls, specifically the ample guidance to staff advising them of the requirements to declare gifts received.

2.11 The Financial Framework Assurance Plan was developed by Treasury in response to the internal audit recommendation. It includes a specific reference that Treasury made a decision not to implement detective controls in relation to gifts. Treasury’s Audit and Risk Committee agreed to the internal audit report which included Treasury’s decision not to implement detective controls in relation to gifts. For official hospitality, Treasury has included within the Financial Framework Assurance Plan an assurance activity which includes undertaking sample testing of transactions under $10,000, paid on corporate credit cards and coded to official hospitality. This sample testing is to assess whether approval under subsection 23(3) of the PGPA Act was provided by an appropriate delegate. No methodology for sample testing was documented by Treasury.

Recommendation no.1

2.12 The Department of the Treasury reassess the risks associated with gifts, benefits and hospitality with consideration to the findings of this audit and whether additional controls are required (including monitoring and reporting on compliance). In reassessing the risks, operational controls related to gifts, benefits and hospitality should be identified and recorded to support monitoring their effectiveness.

Department of the Treasury response: Agreed.

Has Treasury developed fit-for-purpose policies and procedures for the acceptance of gifts, benefits and hospitality?

Treasury has developed policies and procedures for officials regarding the acceptance of gifts, benefits and hospitality. These policies and procedures reference other relevant departmental policy including the conflict of interest policy.

These policies and procedures align with the APSC Guidance for Agency Heads — Gifts and Benefits with the exception of the processes to declare and approve the receipt of hospitality.

2.13 Treasury has developed policies which relate to gifts, benefits and hospitality, specifically Operational Guideline 10.2 — Gifting — Giving and Receiving and Operational Guideline 2.3 — Official Hospitality (including Business Catering). The operational guidelines outline:

- a definition of gifts and benefits, with examples;

- the related duties of officials under the PGPA Act and APS Code of Conduct;

- considerations for officials when accepting gifts, benefits and hospitality;

- processes for declaring and seeking approval when accepting gifts, benefits or hospitality; and

- the related requirements apply to all Treasury officials as a better practice standard.

2.14 The operational guidelines are supported by a documented declaration and approval process in Delphi. Delphi cross-references the operational guidelines and other relevant Treasury policies, such as conflict of interest requirements, throughout the workflow. Treasury’s Operational Guideline 10.2 — Gifting — Giving and Receiving outlines that persons receiving a gift must assess if its acceptance would represent a conflict of interest.

Alignment between Treasury’s policy and Australian Government requirements

2.15 Treasury’s policy for the acceptance of gifts and benefits includes guidance that is inconsistent with the following requirement from APSC Guidance for Agency Heads — Gifts and Benefits:

Hospitality exceeding the value of $AUD100.00 (excluding GST) that has been accepted and may give rise to a real or apparent conflict of interest must be recorded in the register.

2.16 Section 5.5 of Treasury’s Operational Guideline 10.2 — Gifting — Giving and Receiving provides examples of meals and hospitality that may be received by officials. Treasury did not consider these to be gifts or benefits for the purposes of its policy. This included meals provided as part of a conference or seminar; ‘simple working meal’; or a ‘more elaborate meal with a clear link to Treasury’s business’.

|

Excerpt of Operational Guideline 10.2 — Gifting — Giving and Receiving |

|

Section 5.5 — Gifts/Benefits (Meals) states: Meals provided as part of a conference/seminar; a simple working meal; or a more elaborate meal with a clear link to Treasury’s business are generally not considered gifts for the purposes of this policy. This could include things like:

|

2.17 Treasury indicates in its policy to officials that gifts of this nature do not require approval or declaration. This is not aligned with APSC guidance which requires all gifts greater than $100 (excluding GST) received by Agency Heads be declared and then published on its external register within 31 days.21 Declaration requirements also apply to any gift received where there is a clear link to official duties.

Recommendation no.2

2.18 The Department of the Treasury update its internal policies to ensure its guidance is consistent with APSC Guidance for Agency Heads — Gifts and Benefits which requires that all gifts, that are valued at over $AUD 100 (excluding GST) and are accepted, are declared and recorded on Treasury’s gifts and benefits register.

Department of the Treasury response: Agreed.

2.19 Treasury reviewed and updated its policies, which relate to management of gifts, benefits and hospitality, on multiple occasions during 1 July 2021 to 30 September 2023. The formal review cycle for Operational Guideline 10.2 — Gifting — Giving and Receiving is every two years. There was a version control log that recorded updates being made during 2023 and most recently in October 2023. Updates made throughout 2023 in the version control log included:

- adding an additional requirement regarding approval of a gift where a conflict of interest is identified as a result of Auditor-General Report No. 30 2022–23 Probity Management in Financial Regulators — Australian Prudential Regulation Authority;

- update to make clear that cash and shares have the same status as sponsored travel and entertainment;

- further refinement to wording in Section 5.3 in regard to cash or shares, sponsored travel or entertainment; and

- administrative updates to review and refine wording and maintain links with the guidance.

2.20 The formal review cycle for Operational Guideline 2.3 — Official Hospitality (including Business Catering) is every two years. Operational Guideline 2.3 was last updated in May 2022 and was scheduled for review and update in May 2024.

2.21 Treasury’s Chief Finance Officer is accountable for the policies and changes are communicated to officials through email and updates to intranet pages.

2.22 Operational Guideline 10.2 — Gifting — Giving and Receiving and Operational Guideline 2.3 — Official Hospitality (including Business Catering) do not make any specific reference to their applicability to statutory office holders of Treasury. Whilst Treasury provided onboarding material to its statutory office holders which note the requirements to comply with the PGPA Act, it had not provided or communicated the APSC Guidance for Agency Heads — Gifts and Benefits to them as recommended in APSC’s guidance, specifically at Paragraph 11 of ‘Further distribution and application of this guidance’:

Secretaries of departments should circulate this guidance to all statutory office holders and heads of Commonwealth entities and companies within their portfolios.

Has Treasury developed fit-for-purpose policies and procedures for the provision of gifts, benefits and hospitality?

Treasury has developed policies and procedures for officials regarding the provision of gifts, benefits and hospitality. These policies and procedures align with the APSC Guidance for Agency Heads — Gifts and Benefits and also reference other relevant departmental policy including the conflict of interest policy.

Treasury policy refers to the application of guidance provided by the Department of Foreign Affairs and Trade (DFAT) in relation to the provision of gifts by officials posted overseas.

2.23 Treasury has in place policies relating to the provision of gifts, benefits and hospitality, specifically Operational Guideline 10.2 — Gifting — Giving and Receiving and Operational Guideline 2.3 — Official Hospitality (including Business Catering). Treasury’s operational guidelines both outline:

- situations in which gifts, benefits and hospitality may be provided;

- approval requirements for officials who wish to give a gift or provide official hospitality; and

- an approach to cultural and ceremonial gifts.

2.24 There is also a requirement for procurement approval associated with subsection 23(3) of the PGPA Act for the purchase of gifts. Treasury provides documented guidance for decision makers to support assessment of the appropriateness of a decision to give a gift and gifting of relevant property within Operational Guideline 10.2 — Gifting — Giving and Receiving. Procurement guidance is also available on Treasury’s intranet pages.22 This includes guidance for delegates approving the commitment of relevant money and an email template for subsection 23(3) of the PGPA Act delegate approval for less than $10,000.

2.25 Operational Guideline 2.3 — Official Hospitality (including Business Catering) distinguishes between official hospitality and routine business catering. Approval requirements for expenditure are documented and also include a requirement for approval associated with subsection 23(3) of the PGPA Act. Key policy requirements and approval procedures relating to official hospitality are incorporated into the Delphi system.

2.26 For officials posted overseas, there is a reference contained within Operational Guideline 2.3 — Official Hospitality (including Business Catering) to the Management of Representation Funds which is a DFAT policy which includes guidance on admissible expenses, including gifts and eligible recipients of hospitality.

2.27 Treasury’s two key policies for managing gifts, benefits and hospitality, Operational Guideline 10.2 — Gifting — Giving and Receiving and Operational Guideline 2.3 — Official Hospitality (including Business Catering), are available to officials on the intranet. Supplementary guidance to these policies is also available on the intranet to support staff in understanding the requirements of the policy. These include:

- flowcharts which support staff to assess whether expenditure on hospitality falls within Operational Guideline 2.3 — Official Hospitality (including Business Catering);

- an intranet post on 27 July 2023, explaining recent updates to Operational Guideline 10.2 — Gifting — Giving and Receiving;

- an intranet post on 27 October 2023, ‘To gift or not to gift’ detailing obligations regarding the offer and acceptance of gifts; and

- guidance contained within Delphi webforms for the declaration of gifts and requests for official hospitality or business catering expenditure. This guidance is to support the implementation of key requirements from Operational Guideline 10.2 — Gifting — Giving and Receiving and Operational Guideline 2.3 — Official Hospitality (including Business Catering). This includes links to key policies and procedures (including related items such as the conflicts of interest policy, delegation instruments and Operational Guideline 2.4 (Official Travel)), decision flows and approval requirements.

Has Treasury developed effective training and education arrangements to promote compliance with policy and procedural requirements?

Treasury maintains mandatory training packages which include responsibilities and expectations for officials relating to gifts, benefits and hospitality. There are mechanisms in place to monitor mandatory training completion and follow-up non-compliance with training requirements. While Treasury provides onboarding material to officials noting requirements to comply with the PGPA Act, Treasury does not have arrangements for statutory office holders (that are Treasury officials) to ensure consistency in the training and education arrangements made available to them. The Treasury Secretary has completed all mandatory training and completion of mandatory training modules by other Treasury staff ranges from 89 per cent to 92 per cent.

Mandatory training

2.28 Training is a key preventative control and Treasury has nine mandatory training modules. Four of these mandatory training modules include content related to the management of gifts, benefits and hospitality, as detailed in Table 2.1.

Table 2.1: Overview of gifts, benefits and hospitality related training modules

|

Mandatory training module |

Summary |

|

Financial Framework Accreditation Training |

A training package which outlines obligations under the PGPA Act. The training covers Commonwealth and departmental policies, and requirements relating to financial delegations, credit cards, gifting, official hospitality, procurements, grants and travel processes. Specific reference to key Treasury policies including Operational Guideline 10.2 — Gifting — Giving and Receiving and Operational Guideline 2.3 — Official Hospitality (including Business Catering) were included. |

|

Fraud awareness |

A training package which outlines what fraud is, how it occurs, and the responsibilities of staff in responding to and managing fraud. Training included relevant content, including references to PGPA duties of officials, the APS Code of Conduct, and examples of failures to declare conflicts of interest. |

|

Integrity in the Australian Public Service |

A training package which outlines the roles and responsibilities of public servants in maintaining integrity and behaving ethically when discharging their duties. The training outlined that the acceptance of gifts in an official capacity may raise a conflict of interest. |

|

Introduction to the National Anti-Corruption Commission (NACC) |

A training package which outlines the role and jurisdiction of the NACC. The training included relevant conduct such as solicitation in the context of procurement and identifying that such interactions are likely to be corrupt conduct within the meaning of the National Anti-Corruption Commission Act 2022. |

Source: ANAO analysis of departmental training materials for the four mandatory training modules which include content related to the management of gifts, benefits and hospitality.

2.29 The mandatory training modules are required to be completed upon commencement of employment at Treasury and on an annual basis. Non-compliance with mandatory training requirements is followed up via automated emails, which notify staff in the case of non-compliance with mandatory training completion, as well as automated reminders when training remains overdue.

2.30 Executive Level 2 (EL2) staff are required to monitor the completion rates of staff they supervise as part of the annual performance cycle. A supervisor dashboard included in Treasury’s Learning Management System (LMS) supports supervisor monitoring of completion rates.

2.31 Completion of training is also centrally monitored by the People and Organisational Strategy Branch with reporting23 provided to the People and Inclusion Committee on completion rates for mandatory training modules. Reporting on training completion was provided to the People and Inclusion Committee in February 2022, April 2022, May 2022, August 2022, February 2023 and August 2023.

2.32 In May 2023, the People and Organisational Strategy Branch identified a decrease in compliance with training completion to a level below its target of 80 per cent. The People and Organisational Strategy Branch requested First Assistant Secretaries to notify their respective business areas that a decrease in training completion rates had been identified. This was accompanied by a template email for First Assistant Secretaries to distribute to staff. As at 31 August 2023, the completion rate for each of the compulsory training program modules was between 89 per cent and 92 per cent.

Statutory office holders

2.33 Treasury has not confirmed its full suite of statutory office holders that are officials of the department. Related draft advice on the matter had previously been provided by the Australian Government Solicitor (AGS) to Treasury. The AGS advice to Treasury was in draft and dated 7 February 2021. On 14 February 2024, Treasury’s Law Division advised the ANAO in its analysis of the draft AGS legal advice:

We have received external advice on such office holders, which suggests that where an office holder has a role within the Treasury portfolio and is not clearly in or part of a particular Commonwealth entity, it is likely that they would be an official of the Treasury, but this is not without doubt.

2.34 Treasury advised the ANAO on 5 April 2024:

[The legal advice] was obtained to ensure robust application of the ministerial appointments process. Treasury relied on the advice as if it was final and has reflected it as part of Treasury’s appointments framework. It was not obtained for the purposes of Gifts and Benefits and the application of this policy on Statutory Office Holders.

2.35 The Attorney-General’s Department published guidance, on 8 December 2023, relating to the use of draft legal advice. The guidance states it should be finalised before it is relied upon to make decisions:

As a matter of sound public administration and to avoid unnecessary dispute as to its status, draft advice should be finalised before it is relied upon to make decisions.24

2.36 The statutory office holders who may be officials of the department, where the related legislation is unclear, are:

- members of the Takeovers Panel;

- members of the Financial Reporting Council; and

- the Independent Reviewer under the Food and Grocery Code.

2.37 In October 2023, Treasury advised the ANAO that there were three full-time statutory office holders associated with the department:

- the Treasury Secretary25;

- Data Standards Chair26; and

- the Australian Small Business and Family Enterprise Ombudsman.27

2.38 In November 2023, Treasury advised that there were other part-time statutory office holder roles which included:

- members of the Financial Regulator Assessment Authority28; and

- members of the National Housing Affordability and Supply Council.29

2.39 The National Housing Affordability and Supply Council (NHASC) is a statutory body established under the National Housing Supply and Affordability Council Act 2023 and is supported by a secretariat within Treasury. As of February 2024, nine part-time NHASC members (inclusive of the Chair and Deputy Chair) had been appointed and are considered statutory office holders that are officials of Treasury.

Communication of requirements and training to statutory office holders

2.40 As part of onboarding statutory office holders, Treasury provides an appointment letter outlining statutory office holder obligations.

2.41 Treasury relies on broad references contained within appointment letters to raise awareness towards the responsibilities and expectations relating to gifts, benefits and hospitality. These references were not specific to gifts, benefits and hospitality and referred to accountability under law (including the PGPA Act) and training with reference to the Department of Finance’s eLearning program on the Commonwealth Resource Management Framework.

2.42 Treasury’s Secretary is the accountable authority and a statutory office holder as a board member of the Reserve Bank of Australia. The Treasury Secretary, Data Standards Chair and Australian Small Business and Family Enterprise Ombudsman were statutory office holders that had been provided access to Treasury’s IT network and therefore training modules and guidance were available to them. The Treasury Secretary was the only statutory office holder to be compliant with the mandatory training requirements as of February 2024. Treasury does not monitor whether the other two full-time statutory office holders (Data Standards Chair and Australian Small Business and Family Enterprise Ombudsman) completed the mandatory training modules.

2.43 Treasury’s Chief Operating Officer provided direction to SES officials on 29 January 2024 to outline the expectations and responsibilities of statutory office holders in relation to gifts, benefits and hospitality.

Does Treasury have appropriate arrangements for monitoring and reporting on the receipt and provision of gifts, benefits and hospitality?

Treasury has implemented arrangements to support the reporting of the public register for gifts and benefits in accordance with APSC Guidance for Agency Heads — Gifts and Benefits. Treasury does not provide periodic reporting to internal governance committees on matters relating to gifts, benefits and hospitality, or have a formalised framework for monitoring compliance against internal policy requirements.

Reporting on gifts, benefits and hospitality

2.44 The APSC Guidance for Agency Heads — Gifts and Benefits requires that agency heads must:

- publish a register of gifts and benefits they accept that are valued at over $100 (excluding GST) on their departmental or agency website on a quarterly basis;

- provide a link to the agency head gifts and benefits register to APSC for publication on the APSC’s website;

- collect and store relevant information, and manage their register, in accordance with their agency’s procedures;

- update the register within 31 days of receiving a gift or benefits; and

- publish a ‘nil’ declaration on the gifts and benefits register where agency heads have not accepted any gifts during the reporting period.

2.45 Treasury has documented requirements for reporting gifts and benefits. Treasury’s Operational Guideline 10.2 — Gifting — Giving and Receiving (Guideline 10.2) specifies requirements for recording gifts and benefits. It also incorporates APSC requirements relating to external reporting of gifts and benefits on the public register. Guideline 10.2, specifically section 5.7 — Register of Gifts and Asset Register, articulates responsibility for maintaining the register. Treasury’s policy requirements and practices for reporting on the public register includes more information than is required by the APSC guidance. This includes:

- reporting of gifts given to APS officials who are not agency heads. APSC guidance states that ‘there is a strong expectation that agency heads will also publish gifts and benefits received by staff in their agency that exceed the threshold of $AUD100.00 (excluding GST)’; and

- reporting whether the gift was retained by the recipient. This practice exceeds the requirements of the APSC guidance.

Monitoring compliance with gifts, benefits and hospitality requirements

2.46 Treasury’s internal audit report, Design and Implementation of Treasury’s Financial Assurance Framework, recognised Treasury’s reliance on officials self-reporting (making declarations) as opposed to proactive compliance monitoring (refer to paragraphs 2.10 and 2.11). Treasury made a decision that detective controls were not required and documented this in its management response to the internal audit report. The internal audit report was agreed to by the Audit and Risk Committee in June 2022.

2.47 Treasury does not have a formalised framework for monitoring compliance against internal policy requirements. There were no processes identified for monitoring compliance (detecting undeclared gifts).

2.48 Treasury does not undertake routine reporting to internal governance committees in relation to gifts, benefits and hospitality, and compliance with requirements. Treasury advised the ANAO in November 2023 that reporting had not been implemented as no systemic concerns in relation to gifts, benefits or hospitality had been identified:

We do not have a stand-alone report on these matters to our committees. We would consider introducing such reporting if we identified a serious or systemic risk in relation to gifts, benefits or hospitality.

2.49 Delphi, the workflow system used by Treasury officials to record gifts and benefits, does not have reporting capability on gifts and benefits. Treasury maintains a register in Microsoft Excel format of Delphi entries to support reporting of the public register. Treasury advised the ANAO on 20 November 2023 that it performs ad hoc checks of information recorded in Delphi, particularly where multiple officials are declaring the same item to ensure consistency in the information which is recorded in the public register (nature, estimated value).

3. Implementation and effectiveness of arrangements for managing gifts, benefits and hospitality

Areas examined

The ANAO examined whether the Department of the Treasury (Treasury) effectively implemented arrangements for managing gifts, benefits and hospitality.

Conclusion

The operating effectiveness of Treasury’s processes and controls for gifts, benefits and hospitality is partly effective. Training and education arrangements that had been implemented for internal staff were operating effectively. Training and education arrangements were not provided to all statutory office holders of Treasury. Treasury made a decision in 2022 not to implement detective controls such as proactive compliance monitoring so Treasury is reliant on the self-declaration of officials that receive gifts, benefits and hospitality. Treasury processes had not identified two instances of non-compliance with Treasury’s internal policy requirements and a further 10 instances of non-compliance with the PGPA Act and APSC Guidance for Agency Heads — Gifts and Benefits.

Areas for improvement

The ANAO made two recommendations aimed at improving arrangements for communicating requirements for gifts, benefits and hospitality to statutory office holders (paragraph 3.18) and remediating Treasury’s public gifts register to record its undeclared gifts and benefits (paragraph 3.32).

3.1 Section 16 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires accountable authorities of Commonwealth entities to establish and maintain appropriate systems of internal control.30 Implementation of effective controls aim to manage identified risks.31 In accordance with the APSC’s APS Values and Code of Conduct in practice, compliance with the requirements for gifts, benefits and hospitality supports agencies to manage actual or perceived conflicts of interest.32

Has Treasury implemented effective preventative controls for the receipt or provision of gifts, benefits and hospitality?

Treasury’s preventative controls include its operational guidelines and online training modules. Access to the training modules was not provided to all statutory office holders that are officials of the department. Not all statutory office holders that had access to the training arrangements had completed the online training modules.

Application of policy framework

3.2 Operational Guideline 10.2 — Gifting — Giving and Receiving outlines requirements relating to the management of gifts, benefits and hospitality.

3.3 The APSC Guidance for Agency Heads — Gifts and Benefits requires all items accepted greater than $100 (excluding GST) to be declared. However, Treasury states within Operational Guideline 10.2 — Gifting — Giving and Receiving at Section 5.5 Examples of Gifts/Benefits:

[m]eals provided as part of a conference/seminar; a simple working meal; or a more elaborate meal with a clear link to Treasury’s business are generally not considered gifts for the purposes of this policy.

3.4 The operational guideline further references specific examples which are not considered gifts. These include meals received from industry groups or associations such as the Australian Banking Association, CPA Australia, and National Press Club addresses, along with attendance at lunch or dinner with officials from international government agencies, state or territory governments or other Commonwealth agencies where there is no cost to the Treasury. The guidance that these gifts do not need to be declared is inconsistent with declaration requirements in APSC Guidance for Agency Heads — Gifts and Benefits.

3.5 The most recent instances of meals declared as a gift on Treasury’s public register related to dinners received as part of industry hosted events in May 2021. Treasury advised the ANAO in February 2024 that it stopped publicly reporting meals received as gifts following the implementation of its guidance in Section 5.5 of Operational Guideline 10.2 — Gifting — Giving and Receiving. Treasury further advised the ANAO on 5 April 2024:

[t]his decision was made because it didn’t consider it necessary for officials to make declarations for hospitality of this nature as receipt was considered part of the ordinary course of official duties.

Training and awareness

3.6 Training is a key preventative control (refer to paragraph 2.28) and Treasury monitors officials’ compliance with mandatory training which relates to gifts, benefits and hospitality requirements. Treasury has undertaken updates to the Learning Management System (LMS) to support monitoring and compliance with training requirements. These changes to the LMS were rolled out in November 2022 and included implementation of email reminders when completion of training is ‘due’ and, if required, when these become ‘overdue’. These email reminders are intended to support officials in complying with mandatory training requirements. The updates to the LMS also included implementation of a supervisor dashboard to provide a snapshot of completed courses, registrations and any upcoming mandatory training to be completed by that supervisor’s staff.

3.7 As of 31 August 2023, the level of compliance with mandatory training requirements, specifically the Financial Framework Accreditation module which references gifts, benefits and hospitality, was 90 per cent against a target of 80 per cent.33This is an improvement from the 80 per cent compliance rate as of February 2023.34

3.8 Treasury does not provide all its statutory office holders with system access to complete mandatory training modules. Not all statutory office holders with system access had completed training as detailed in Table 3.1. Statutory office holders (refer to paragraph 2.33 and 2.39) that do not have access to Treasury’s network have not been provided the opportunity to complete training. Treasury advised the ANAO on 5 April 2024 that access to Treasury’s network had not been provided to some part-time statutory office holders due to them not possessing the necessary security clearances to access information on Treasury’s network.35

Table 3.1: Training completion by statutory officer holders with system access

|

Statutory Office Holder |

Completed training modules |

|

Treasury Secretary |

◆ |

|

Data Standards Chair |

■a |

|

Australian Small Business and Family Enterprise Ombudsman |

▲b |

Key: ◆ — Training complete and up to date ▲ — Refresher training not complete ■ — Training not completed.

Note a: Treasury provided system and network access to the Data Standards Chair on 30 November 2023, however, training had not been completed by the Data Standards Chair as at January 2024.

Note b: The Australian Small Business and Family Enterprise Ombudsman completed the training modules in 2022, annual refresher training had not been subsequently completed in 2023.

Source: ANAO analysis of information provided in response to clarifications regarding statutory office holders.

Accrued loyalty benefits of statutory office holders from official travel

3.9 The Remuneration Tribunal Act 1973 establishes the Remuneration Tribunal as an independent statutory authority responsible for reporting on and determining the remuneration, allowances and entitlements of key Commonwealth office holders.36

3.10 The Remuneration Tribunal issued a principal determination, Remuneration Tribunal (Official Travel) Determination 2023, which took effect on 27 August 2023. The determination sets out provisions relating to travel on official business, travel expenses and allowances, including rates of travel allowance. The determination requires that statutory office holders consider any travel-related administrative guidelines put in place by their agency at paragraph 10(5)(c):

When making travel arrangements, office holders are to consider the following:

- the necessity of travel and potential alternatives to travel, such as teleconferencing or videoconferencing;

- the total cost of travel, including value for money;

- any travel-related administrative guidelines put in place by their agency;

- the flexibility to maintain an appropriate balance between work and home responsibilities, as well as safety and security.

3.11 Section 14 of the determination states:

Office holders are encouraged to use their agency’s travel-related preferred provider arrangements where these exist.

3.12 Guidance provided by the Department of Finance recognises accommodation for statutory office holders as an exception to the whole-of-government travel policy37 as their accommodation arrangements are subject to the Remuneration Tribunal (Official Travel) Determination 2023.

3.13 Subsection 10(2) of the determination states that ‘Office holders are not expected to gain or lose financially as a result of travelling on official business’.

3.14 Section 15 of the determination states that ‘Frequent flyer points accrued at the Commonwealth’s expense are not to be used for private purposes’.

3.15 The risk of using frequent flyer points accrued from official travel for private purposes does not apply to Treasury’s statutory office holders that book travel through the whole of Australian Government travel arrangements. This includes the three full-time statutory office holders (refer to paragraph 2.37) within the department that all book travel through the whole of Australian Government travel arrangements. The risk of using frequent flyer points accrued from official travel for private purposes exists for the part-time statutory office holders who book their own travel and seek reimbursement from Treasury.

3.16 Information on the accrual and use of frequent flyer points is a matter between an airline and an individual. The Remuneration Tribunal (Official Travel) Determination 2023 provides no guidance on the responsibility for monitoring compliance with this requirement. There is no guidance to statutory office holders or entities as to how to give effect to how frequent flyer points accrued from official travel are not used for private purposes. Treasury’s guidance to its statutory office holders does not draw attention to the related sections of the Remuneration Tribunal (Official Travel) Determination 2023.

3.17 Three part-time statutory office holders received reimbursements for expenses relating to airline travel during the scope period 1 July 2021 to 30 September 2023. These were:

- the Chair of the Financial Regulator Assessment Authority;

- the Independent Reviewer under the Food and Grocery Code; and

- a member of the National Housing Supply and Affordability Council.38

Recommendation no.3

3.18 The Department of the Treasury improve the arrangements for communicating and outlining obligations relating to managing gifts, benefits and hospitality. The Department of the Treasury:

- circulate APSC Guidance for Agency Heads — Gifts and Benefits to its statutory office holders (who are Treasury officials) to communicate requirements and provide guidance relating to gifts, benefits and hospitality;

- provide statutory office holders (who are Treasury officials) with access to departmental training materials; and

- encourage the consideration and use of departmental travel arrangements in accordance with paragraph 10(5)(c) and section 14 of the Remuneration Tribunal (Official Travel) Determination 2023 for its statutory office holders (who are Treasury officials).

Department of the Treasury response: Agreed.

Airline lounge memberships

3.19 The APSC Guidance for Agency Heads — Gifts and Benefits was updated most recently on 20 October 2023 to include additional guidance on acceptance and declarations of airline lounge memberships:

In circumstances where agency heads are gifted airline lounge memberships (including those which are invitation-only), these must be recorded in their agency’s gifts and benefits register annually or when circumstances change, such as a new or cancelled membership.

3.20 As of 7 February 2024, Treasury’s public register had 14 instances of airline lounge memberships recorded on 27 August 2023. There was a total of 21 gifts and benefits, including the 14 airline lounge memberships, recorded on Treasury’s public register for the period 1 July 2023 to 30 September 2023.

Has Treasury implemented effective detective controls for the receipt or provision of gifts, benefits and hospitality?

Treasury has not implemented detective controls that are specifically for the purpose of monitoring compliance with requirements for the receipt and provision of gifts, benefits and hospitality. Treasury has detective controls that can indirectly support the identification of non-compliance with related requirements. This includes assessing corporate credit card transactions and obtaining annual conflict of interest declarations from officials.

3.21 Treasury’s non-compliance framework is focused on identifying and reporting instances of non-compliance in areas which Treasury consider to be higher risk. These areas did not directly relate to gifts, benefits and hospitality (refer to paragraphs 2.10 to 2.11), and rather focused on:

- non-compliance with sections of the PGPA Act including: subsection 23(3) (approve commitments of relevant money), section 25 to section 29 (duties of officials), section 60, section 105B (Commonwealth Procurement Rules), section 105C (Commonwealth Grant Rules and Guidelines);

- instances of unintentional misuse of corporate credit cards;

- instances of non-compliance under section 83 of the Constitution39; and

- fraud or other serious misconduct.

3.22 Treasury advised the ANAO in December 2023 that other than assessing subsection 23(3) of the PGPA Act approvals, detective controls have not been implemented to identify instances of non-compliance with policy requirements. This is consistent with Treasury’s response to its internal audit in April 2022, Design and Implementation of Treasury’s Financial Assurance Framework, where Treasury determined that it would not implement additional controls related to gifts, benefits and hospitality (refer to paragraphs 2.10 to 2.11). In the absence of detective controls, Treasury is reliant on the self-declaration of officials that receive gifts, benefits and hospitality.

3.23 Treasury also advised the ANAO in March 2024 that its annual compliance process for its senior executives (compliance questionnaire) does not specifically refer to gifts, benefits and hospitality as it has not previously been an area of concern for the department:

[Treasury’s] compliance process involves asking for details of any breaches not already reported, it doesn’t specifically include a question specific to gifts, benefits and hospitality. This is because we don’t currently include gifts, benefits and hospitality in our non-compliance reporting as it was not considered an area of concern.

3.24 Treasury’s annual declaration of personal interests form (completed by Executive Level 2 officials and those in the Senior Executive Service) includes a section which asks if the official or their family members have received gifts that could, or could be seen to, influence the official’s decisions or advice.

Provision of gifts, benefits and hospitality

3.25 The absence of detective controls has not supported identification of instances of non-compliance with Treasury’s policy requirements relating to provision of gifts, benefits and hospitality.

3.26 There were four instances of non-compliance with PGPA Act and internal policy requirements:

- two instances of non-compliance with the PGPA Act relating to provision of hospitality for the Treasurer’s budget night events; and

- two instances of non-compliance with policy requirements relating to provision of hospitality for departmental budget night events.

3.27 The instances of non-compliance are summarised in Table 3.2 and totalled $34,122.85. Three of the instances were not detected by Treasury processes. One of these instances of non-compliance with the PGPA Act had previously been identified by Treasury.

Table 3.2: Non-compliance in the provision of gifts, benefits and hospitality

|

Nature of non-compliance |

Description |

|

Provision of hospitality for departmental budget night events |

Two instances identified in which official hospitality valued at $9,630.85 had been provided to officials. These instances related to internal events held in March 2022 (valued at $6,630.85) and October 2022 (valued at $3,000.00). The internal events were held for officials at the completion of budget preparation periods. There were no external attendees present and the purpose of the event did not facilitate the achievement of policy objectives in accordance with the requirements of Operational Guideline 2.3 — Official Hospitality (including Business Catering). Expenditure included venue hire, food and alcohol for Treasury officials. |

|

Provision of hospitality for the Treasurer’s budget night events |

One instance identified in which official hospitality valued at $14,990.00 was provided with no written record of approval prior to the commitment of relevant money. This instance relates to a budget night event held by the Treasurer’s office in March 2022. Verbal approval that was provided by an official from the Treasurer’s office did not have sufficient delegation. Treasury was aware of the matter and a PGPA breach was recorded on its internal non-compliance register in 2021–22. The approval process for the Treasurer’s office relating to official hospitality was subsequently revised to require Treasury to provide approval for official hospitality. A subsequent instance was identified in which official hospitality valued at $9,502.00 was again provided with no written record of approval prior to the commitment of relevant money. This instance also related to a budget night event held by the Treasurer’s office in May 2023. Treasury noted that verbal approval was provided prior to the event by an appropriate delegate at Treasury, but a written record was not made as soon as practicable in accordance with section 18 of the PGPA Rule. The written record of approval was provided on 28 June 2023 which was 55 days after the expense was incurred on 4 May 2023. |

Source: ANAO analysis of hospitality register.

Receipt of gifts, benefits and hospitality

3.28 The absence of detective controls has not supported identification of instances of non-compliance with requirements specified in APSC Guidance for Agency Heads — Gifts and Benefits. An inconsistent application of Treasury’s internal policy requirements for reporting on the public register was also identified (refer to paragraph 2.15).

3.29 Treasury processes had not identified eight instances of non-compliance with requirements specified in APSC Guidance for Agency Heads — Gifts and Benefits:

- Four instances of undeclared hospitality receipted by the Treasury Secretary that was not reported on Treasury’s public register. The four instances related to the Treasury Secretary’s attendance at a Platinum Gala Dinner hosted by the Australian Financial Review (March 2022), two attendances at post-budget luncheons hosted by Westpac (March 2022) and Qantas (October 2022), and attendance at a dinner hosted by the Business Council of Australia (August 2023). Officials from other Commonwealth entities in attendance at these events made declarations and recorded the receipt of hospitality on their public registers; and

- Four instances of gifts identified that were not reported on Treasury’s public register within timeframes specified by APSC. This included two tickets to a congress event ($900 per ticket) that were reported 22 days late and two tickets to a conference event ($1,000 per ticket) that were reported 28 days late.

3.30 Section 5.5 of Treasury’s Operational Guideline 10.2 — Gifting — Giving and Receiving requires officials to consider the potential for conflict of interest risks that can arise from accepting hospitality.

|

Excerpt of Operational Guideline 10.2 — Gifting — Giving and Receiving |

|

Section 5.5 — Gifts/Benefits (Meals) in relation to conflict of interest states: The acceptance of offers for meals more than a simple working meal with private or commercial organisations should be carefully considered and accepted with caution. The acceptance of meals under these circumstances can attract undue scrutiny and can lead to reputational damage if deemed inappropriate. While they are sometimes appropriate, they can be perceived as the Commonwealth being ‘wined and dined’ and there is often the underlying expectation of a ‘favour’ in return. This could include things like:

|