Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Compliance with Gifts, Benefits and Hospitality Requirements in the Murray–Darling Basin Authority

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The giving or receiving of gifts, benefits and hospitality can create the perception that an official is subject to inappropriate external influence.

- This audit was conducted to provide assurance to the Parliament that the Murray–Darling Basin Authority (MDBA) has complied with gifts, benefits and hospitality requirements.

Key facts

- The MDBA is responsible for coordinating how water resources are managed in the Murray–Darling Basin.

- There were 20 items reported on the MDBA’s internal gifts and benefits register for the period 1 July 2021 to 31 March 2024.

What did we find?

- The MDBA has been partly effective in complying with its gifts, benefits and hospitality requirements.

- The MDBA has established largely effective arrangements for managing gifts, benefits and hospitality. There is an opportunity to improve consistency across policies and procedures.

- The MDBA’s controls and processes were partly effective. Deficiencies were identified with reporting on mandatory training completion and compliance with policy and procedural requirements for acceptance and provision of gifts, benefits and hospitality.

What did we recommend?

- The Auditor-General made three recommendations to the MDBA to improve risk management, policy requirements and control effectiveness for gifts, benefits and hospitality.

- The MDBA agreed to all three recommendations.

1

gift was publicly reported by the MDBA Chief Executive between quarter 1 of 2021 and quarter 2 of 2024 (an airline lounge membership).

5

instances of accepted gifts, benefits or hospitality were identified that were not recorded on MDBA’s internal register.

35

hospitality or catering transactions (from a sample of 61) did not have a record of delegate approval for the hospitality or catering in the financial management system.

Summary and recommendations

Background

1. The Public Service Act 1999 (PS Act) requires that Australian Public Service (APS) employees, agency heads and statutory office holders abide by the APS Code of Conduct.1 The APS Code of Conduct, consistent with duties under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), require officials to declare the receipt of gifts, benefits and hospitality. Collectively, these requirements establish obligations for officials and Commonwealth entities in relation to how they manage the provision and receipt of gifts, benefits and hospitality.

2. Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit for themselves or another person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person.2 The National Anti-Corruption Commission Act 2022 also contains provisions against conduct that adversely affects (or could adversely affect) the honest and impartial exercise of any public official’s powers, functions or duties.3

3. The Australian Public Service Commission (APSC) publishes Guidance for Agency Heads – Gifts and Benefits. The principles underpinning this guidance are that:

- agency heads are meeting public expectations of integrity, accountability, independence, transparency and professionalism in relation to gifts and benefits; and

- there is consistency in relation to agency heads’ management of gifts and benefits across APS agencies and Commonwealth entities and companies.4

4. The Murray–Darling Basin Authority (MDBA) is a corporate Commonwealth entity established under the Water Act 2007 (the Water Act) and comprises:

- an eight-member Authority (the Authority) with functions and responsibilities defined under the Water Act and conditions set by the Remuneration Tribunal5; and

- a statutory agency of staff engaged under the Public Service Act, with an average staffing level of 367 for 2024–25.6

5. The MDBA is responsible for coordinating how water resources are managed in the Murray–Darling Basin.7

Rationale for undertaking the audit

6. Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit for themselves or another person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person. Public service entities must meet public expectations of integrity, accountability, independence, transparency, and professionalism. Acceptance of a gift or benefit that relates to an official’s employment can create a real or apparent conflict of interest that should be avoided.8

7. Public confidence in Commonwealth entities and the APS can be damaged when gifts and benefits that create a conflict of interest are accepted or not properly declared. The APSC states in its publication, APS Values and Code of Conduct in practice, that the risk of the appearance of a conflict can damaging to public confidence:

The appearance of a conflict can be just as damaging to public confidence in public administration as a conflict which gives rise to a concern based on objective facts.9

8. This audit was conducted to provide assurance to the Parliament that the MDBA has complied with gifts, benefits and hospitality requirements.

Audit objective and criteria

9. The objective of the audit was to assess whether the MDBA had complied with gifts, benefits and hospitality requirements.

10. To form a conclusion against the objective, the ANAO adopted the following two high-level audit criteria.

- Did the MDBA have effective arrangements in place to manage gifts, benefits and hospitality?

- Were the MDBA’s controls and processes for gifts, benefits and hospitality operating effectively in accordance with its policies and procedures?

11. The audit examined the management of gifts, benefits and hospitality within the MDBA over the period 1 July 2021 to 31 March 2024.

Conclusion

12. The MDBA has been partly effective in complying with gifts, benefits and hospitality requirements. While the MDBA has policies and procedures for managing gifts, benefits and hospitality, the implementation of its controls and processes for ensuring compliance with gift, benefit and hospitality requirements have not been effectively operationalised.

13. The MDBA has established largely effective arrangements for managing gifts, benefits and hospitality. The MDBA has not considered conflict of interest risks associated with gifts, benefits and hospitality within its risk management framework. While the MDBA has developed policies and procedures for the acceptance and provision of gifts, benefits and hospitality, there are opportunities to improve the consistency between policies and procedures. Whole of government training on integrity and fraud and corruption is mandatory for MDBA staff. Limited guidance is provided to Authority members. The MDBA maintains an internal register of gifts and benefits accepted by MDBA officials, and has published a register of gifts and benefits received by the Chief Executive.

14. The MDBA’s controls and processes are partly effective in supporting its compliance with gift, benefit and hospitality requirements. Deficiencies were identified with preventative controls relating to reporting on mandatory training completion and the compliance with policy and procedural requirements for the acceptance and provision of gifts, benefits and hospitality. While the MDBA does not have specific detective controls relating to acceptance of gifts, benefits and hospitality, since 2022–23 it has included a question on provision of hospitality in its biannual financial compliance survey. The MDBA has not established processes for managing non-compliance or assurance activities for gifts, benefits and hospitality.

Supporting findings

Arrangements for managing gifts, benefits and hospitality

15. The MDBA has articulated risks and controls related to bribery and corruption in a 2024 fraud and corruption risk assessment. Existing controls related to acceptance or provision of gifts, benefits and hospitality were not referenced in the 2024 assessment. Two integrity-related risks were identified in the MDBA’s November 2021 Enterprise Risk Management Plan. The MDBA developed a revised suite of enterprise risks in August 2023, which no longer includes integrity-related risks. (See paragraphs 2.6 to 2.21)

16. The MDBA has developed policies and procedures for the acceptance of gifts, benefits and hospitality through its Accountable Authority Instructions, Instrument of Delegation, Official Hospitality, Gifts and Benefits Guidelines and Declaration of Interests Policy. There were inconsistencies between these documents in relation to instructions for accepting ‘token gifts, benefits or hospitality’ (valued at $50 or below). In addition, the guidelines do not specify timeframes for obtaining delegate approval and reporting on acceptance of gifts, benefits or hospitality or sanctions associated with failure to comply with the requirements. (See paragraphs 2.22 to 2.37)

17. The MDBA has developed policies and procedures for the provision of gifts, benefits and hospitality through its Accountable Authority Instructions, Instrument of Delegation, Official Hospitality, Gifts and Benefits Guidelines and other policy documents. There were inconsistencies between these documents in relation to the distinction between official hospitality and business catering. (See paragraphs 2.38 to 2.56)

18. The MDBA has a mandatory training package which includes responsibilities and expectations for officials relating to gifts, benefits and hospitality. The relevant modules are whole of government modules on integrity and fraud and corruption. Members of the Authority have not been provided specific guidance on policy and procedural requirements for gifts, benefits and hospitality. ( See paragraphs 2.57 to 2.67)

19. The MDBA has published a register of gifts and benefits received by the Chief Executive. It updated the register in October 2024 to comply with the requirement to annually report gifted airline lounge memberships. In August 2024 the MDBA decided to commence publishing gifts and benefits received by MDBA officials, including Authority members. The MDBA maintains an internal register of gifts, benefits and hospitality accepted by officials from external parties. It expanded the register in August 2024 to cover provision of official hospitality. There were no internal reporting mechanisms in place for the Chief Executive or management committees to have oversight of gifts, benefits and hospitality accepted or provided by MDBA officials. As a result of the inconsistencies in the treatment of official hospitality and business catering events by the MDBA, and the absence of a register, the MDBA has not been well placed to accurately report to Parliament on instances of official hospitality. (See paragraphs 2.68 to 2.80)

Controls and processes for managing gifts, benefits and hospitality

20. The MDBA has implemented preventative controls for the receipt or provision of gifts, benefits and hospitality through its policies and procedures, mandatory staff training, delegations and approval requirements. The MDBA does not provide reporting on the completion of mandatory training to the Chief Executive or relevant governance committees. Requirements set out in policies and procedures prohibiting the acceptance of gifts, benefits and hospitality from contractors were not adhered to. There was inconsistent treatment of business catering and official hospitality events, and instances of non-compliance with controls for official hospitality. (See paragraphs 3.6 to 3.50)

21. The MDBA has not implemented detective controls specifically for the purpose of identifying non-compliance with requirements for the receipt and provision of gifts, benefits and hospitality. The MDBA’s biannual financial compliance survey is a detective control than can support the identification of non-compliance with requirements. Officials responding to the survey identified one instance of non-compliance with business catering or official hospitality guidelines in 2023–24, which was included in summary reporting provided to the Chief Executive. (See paragraphs 3.51 to 3.57)

22. The MDBA has not documented or implemented processes for managing identified instances of non-compliance relating to management of gifts, benefits and hospitality. The ANAO identified instances of non-compliance that had not been identified or reported by the MDBA. (See paragraphs 3.58 to 3.62)

23. The MDBA has not developed an evidence-based assurance framework that considers management of gifts, benefits and hospitality. (See paragraphs 3.63 to 3.68)

Recommendations

Recommendation no. 1

Paragraph 2.19

The Murray–Darling Basin Authority assess the risks associated with provision and acceptance of gifts, benefits and hospitality and identify appropriate controls.

Murray–Darling Basin Authority response: Agreed.

Recommendation no. 2

Paragraph 2.51

The Murray–Darling Basin Authority review and update its policy framework for the acceptance and provision of gifts, benefits and hospitality to ensure:

- instructions for accepting and keeping ‘token gifts, benefits and hospitality’ are consistent and appropriate;

- instructions for provision of hospitality include clear definitions and distinctions between official hospitality and business catering, and define relevant concepts such as ‘entertainment’ and ‘modest’;

- timeframes are specified for obtaining delegate approval and reporting on acceptance and provision of gifts, benefits and hospitality;

- consideration of any potential, perceived or actual conflicts created by the acceptance of gifts, benefits or hospitality is documented on declaration forms; and

- the framework defines sanctions associated with failure to comply with gifts, benefits and hospitality requirements.

Murray–Darling Basin Authority response: Agreed.

Recommendation no. 3

Paragraph 3.66

The Murray–Darling Basin Authority implement:

- regular reporting to the Chief Executive and relevant governance committees on mandatory training completion and acceptance and provision of gifts, benefits and hospitality; and

- arrangements to obtain assurance over controls for managing gifts, benefits and hospitality to inform continuous improvement and ensure ongoing effectiveness.

Murray–Darling Basin Authority response: Agreed.

Summary of entity responses

24. The proposed report was provided to the MDBA. Extracts of the proposed report were also provided to Callida Indigenous Consulting, Chartertech, eWater, Hudson, Paxus, Scyne Advisory and Xaana.ai. Summary responses to the report, where provided, are below and the MDBA’s full response is at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

Murray–Darling Basin Authority

The MDBA welcomes the ANAO’s findings and agrees with the three recommendations in the Report. We are pleased that no non-compliance with our legislative obligations (including PGPA Act) were identified.

We are committed to upholding the highest standards of integrity. Currently, we are working to improve consistency in policy requirements and control operating effectiveness over the management of gifts, benefits, and official hospitality.

Our actions in response to the ANAO audit include frequent reporting and increased oversight on our internal gifts, benefits, and hospitality register to identify potential conflicts of interest. We are also embedding processes to ensure compliance with mandatory staff training and internal procedures, and reviewing internal policies for consistent treatment of gifts and benefits.

The MDBA also has progressed significant work in relation to improving its risk management practices over the past 18 months and is currently focused on integrity related risks and appropriate controls, including in relation to gifts, benefits and hospitality.

The MDBA appreciates the ANAO’s approach in conducting the audit, including regular engagement, progress updates, and efforts to understand our agency’s policy and practices.

Chartertech

Chartertech’s Conflict of Interest Policy and Declaration outlines the policy for receiving gifts and benefits. This policy requires declaration of any gifts, benefits or hospitality received valued at over $100, this threshold is applied to the Chartertech Gifting Register, which was referenced in the ANAO response. Chartertech can confirm that there are no records of gifts, benefits or hospitality provided for any MDBA personnel in accordance with this policy.

Key messages from this audit for all Australian Government entities

25. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Performance and impact measurement

1. Background

Introduction

1.1 The Public Service Act 1999 (Public Service Act) requires Australian Public Service (APS) employees, agency heads and statutory office holders to uphold the APS Values and Code of Conduct. The APS Code of Conduct, consistent with duties under the Performance and Accountability Act 2013 (PGPA Act), requires officials not to improperly use their duties, status, power or authority to gain, or seek to gain, a benefit for themselves or any other person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person. Collectively, these requirements establish obligations for officials and Commonwealth entities in relation to how they manage the provision and receipt of gifts, benefits and hospitality.

1.2 The National Anti-Corruption Commission Act 2022 contains provisions against conduct that adversely affects (or could adversely affect) the honest or impartial exercise or performance of a public official’s powers, functions or duties.

1.3 The Australian Public Service Commission (APSC) publishes Guidance for Agency Heads – Gifts and Benefits.10 The principles underpinning this guidance are that:

- agency heads are meeting public expectations of integrity, accountability, independence, transparency, and professionalism in relation to gifts and benefits; and

- there is consistency in relation to agency heads’ management of gifts and benefits across the APS agencies and Commonwealth entities and companies.11

1.4 Agency heads must publish a register of any gifts and benefits that they accept, valued at over $100 (excluding GST), on a quarterly basis. A link to the register must also be provided to the APSC for publication on the APSC’s website.

1.5 In the course of their official duties, APS employees may interact with many individuals and organisations, and may receive offers of gifts, benefits and hospitality as part of these interactions. The acceptance of such offers can pose risks to public confidence in entities and the APS more broadly, particularly in meeting the APS Values and the public’s expectations of integrity, accountability, independence, transparency and professionalism.12

Murray–Darling Basin Authority functions

1.6 The Murray–Darling Basin is a major water catchment area that includes parts of Queensland, New South Wales, Victoria, South Australia and the Australian Capital Territory (known as Basin states). The 2013 intergovernmental Murray–Darling Basin Agreement outlines arrangements between the Australian Government and Basin states to implement the Basin Plan 2012 (the Basin Plan).13

1.7 The Murray–Darling Basin Authority (MDBA) is responsible for coordinating how water resources are managed in the Murray–Darling Basin.14 Activities undertaken by the MDBA include:

- working with Basin states to ensure 33 water resources plans meet the requirements of the Basin Plan and address the local requirements of water resource management;

- publishing an Annual Water Take Report documenting the MDBA’s examination of use across Murray–Darling Basin catchments including information on water use, held environmental water and Cap compliance;

- reporting on the effectiveness of the Basin Plan by publishing an annual report;

- delivering and participating in conferences, meetings and other stakeholder engagement activities, including an annual conference;

- operating the River Murray system up to the border of South Australia, which includes calculating and releasing the volumes of water needed to meet state orders or system demands; and

- delivering programs to maintain and improve the environmental health, salinity and water quality of the River Murray.

Murray–Darling Basin Authority structure and resourcing

1.8 The MDBA is a corporate Commonwealth entity established under the Water Act 2007 (the Water Act) and comprises:

- an eight-member Authority (the Authority) with functions and responsibilities defined under the Water Act and conditions set by the Remuneration Tribunal15; and

- a statutory agency of staff engaged under the Public Service Act, with an average staffing level of 367 for 2024–25.16

1.9 The MDBA’s Chief Executive is the agency head and accountable authority for the purposes of the Public Service Act and the PGPA Act.17 The Chief Executive is one of the eight members of the Authority and cannot be directed by the Authority in relation to the exercise of powers under the PGPA Act or the Public Service Act.18

1.10 The MDBA has offices in seven locations: Adelaide, South Australia; Canberra, Australian Capital Territory; Goondiwindi, Queensland; Griffith, New South Wales; Mildura, Victoria; Murray Bridge, South Australia; and Wodonga, Victoria. As at 30 June 2024, 232 of 415 of the MDBA’s staff were based in the Canberra office.

1.11 An overview of MDBA’s total resourcing and the value of MDBA’s new and amended contracts from 2019–20 to 2023–24 is presented in Table 1.1.

Table 1.1: Murray–Darling Basin Authority total net resourcing and contract value

|

|

2019–20 $ m |

2020–21 $ m |

2021–22 $ m |

2022–23 $ m |

2023–24 $ m |

|

Total expenses |

182.3 |

171.1 |

169.5 |

175.6 |

231.6 |

|

Value of contractsa |

9.5 |

3.5 |

29.5 |

55.1 |

27.1 |

Note a: Value of new and amended contracts published to Austender.

Source: Financial statements contained in MDBA annual reports and ANAO analysis of Austender data.

Previous reports related to gifts, benefits and hospitality

1.12 Auditor-General Report No. 47 2017–18 Interim Report on Key Financial Controls of Major Entities reviewed the gifts and benefits policies of 26 major Australian Government entities, including all departments of state.19 This report identified:

- the merit of developing a whole of government gifts and benefits policy setting the minimum requirements for entities to include within their policies;

- regular review and monitoring of entities’ gifts and benefits policies increases accountability;

- centrally maintained gifts, benefits and hospitality registers assist entities in meeting accountability and transparency obligations; and

- transparency is enhanced through the publication of entities’ gifts and benefits registers on the internet.

1.13 The Australian Public Service Commissioner issued guidance on 18 October 2019 for reporting of gifts and benefits. The ANAO reviewed the status of the implementation of the guidance as part of Auditor-General Report No. 38 2019–20 Interim Report on Key Financial Controls of Major Entities. The report found that all 24 entities covered by the report had established a register of gifts and benefits, and that, except for one entity, all had recorded gifts and benefits received by the agency head which exceed $100. Publication of received gifts and benefits was undertaken by approximately 79 per cent of entities.20

1.14 The ANAO tabled two audit reports related to gifts, benefits and hospitality in 2023–24.21

Rationale for undertaking the audit

1.15 Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit for themselves or another person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person. Public service entities must meet public expectations of integrity, accountability, independence, transparency, and professionalism. Acceptance of a gift or benefit that relates to an official’s employment can create a real or apparent conflict of interest that should be avoided.22

1.16 Public confidence in Commonwealth entities and the APS can be damaged when gifts and benefits that create a conflict of interest are accepted or not properly declared. The APSC states in its publication, APS Values and Code of Conduct in practice, that the risk of the appearance of a conflict can be damaging to public confidence:

The appearance of a conflict can be just as damaging to public confidence in public administration as a conflict which gives rise to a concern based on objective facts.23

1.17 This audit was conducted to provide assurance to the Parliament that the MDBA has complied with gifts, benefits and hospitality requirements.

Audit approach

Audit objective, criteria and scope

1.18 The objective of the audit was to assess whether the MDBA had complied with gifts, benefits and hospitality requirements.

1.19 To form a conclusion against the objective, the ANAO adopted the following two high-level audit criteria.

- Did the MDBA have effective arrangements in place to manage gifts, benefits and hospitality?

- Were the MDBA’s controls and processes for gifts, benefits and hospitality operating effectively in accordance with its policies and procedures?

1.20 The audit examined the management of gifts, benefits and hospitality within the MDBA from 1 July 2021 to 31 March 2024.

Audit methodology

1.21 To address the audit objective, the audit methodology included:

- examining the MDBA’s documentation including its policies, procedures, risk assessments, registers, assurance and reporting activities relating to the management of gifts, benefits and hospitality;

- meetings with the MDBA’s staff regarding the control frameworks and assurance activities in place to manage risks relating to gifts, benefits and hospitality;

- testing the effectiveness of the MDBA’s control framework for gifts, benefits and hospitality and assessing officials’ compliance with the MDBA’s control framework using the MDBA’s system tools to review and analyse emails and other files24; and

- contacting organisations with contractual relationships with the MDBA to obtain information on gifts, benefits and hospitality offered to MDBA officials.

1.22 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $403,000.

1.23 The team members for this audit were Jenny Broome, Graham Bowrey, Manish Singh, Joshua Francis and Daniel Whyte.

.

2. Arrangements for managing gifts, benefits and hospitality

Areas examined

This chapter examines whether the Murray–Darling Basin Authority (MDBA) has effective arrangements in place to manage gifts, benefits and hospitality.

Conclusion

The MDBA has established largely effective arrangements for managing gifts, benefits and hospitality. The MDBA has not considered conflict of interest risks associated with gifts, benefits and hospitality within its risk management framework. While the MDBA has developed policies and procedures for the acceptance and provision of gifts, benefits and hospitality, there are opportunities to improve the consistency between policies and procedures. Whole of government training on integrity and fraud and corruption is mandatory for MDBA staff. Limited guidance is provided to Authority members. The MDBA maintains an internal register of gifts and benefits accepted by MDBA officials, and has published a register of gifts and benefits received by the Chief Executive.

Areas for improvement

The ANAO made two recommendations aimed at: assessing risks posed by gifts, benefits and hospitality to assess whether additional controls are required; and addressing gaps and inconsistencies in the MDBA’s policy framework for acceptance and provision of gifts, benefits and hospitality.

The ANAO identified two improvement opportunities for the MDBA to: provide guidance to Authority members on gift, benefit and hospitality requirements; and clarify requirements for declaring offers that were not accepted.

2.1 Section 16 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act)25 requires accountable authorities of Commonwealth entities to establish and maintain appropriate systems of risk oversight, management and internal control for the entity.

2.2 Section 27 of the PGPA Act states that an official must not improperly use their position to gain, or seek to gain, a benefit for themselves or another person, or to cause, or seek to cause, detriment to the entity, the Commonwealth, or any other person. Public service entities must meet public expectations of integrity, accountability, independence, transparency, and professionalism. Acceptance of a gift or benefit that relates to an official’s employment can create a real or apparent conflict of interest that should be avoided.

2.3 Corporate Commonwealth entities, such as the MDBA, are encouraged to align their risk management frameworks and systems with the Commonwealth Risk Management Policy. The policy supports the implementation of section 16 of the PGPA Act, by encouraging entities to formalise their approach to managing risks, embed risk management into their culture and work practices, define staff’s risk management responsibilities, and review the effectiveness of controls.26

2.4 Commonwealth officials must also uphold and promote the Australian Public Service (APS) Values and Employment Principles and abide by the Code of Conduct contained in the Public Service Act 1999 (Public Service Act).

2.5 The audit assessed the alignment of MDBA’s arrangements for managing gifts, benefits and hospitality with the PGPA Act and the Australian Public Service Commission’s (APSC’s) Guidance for Agency heads – Gifts and Benefits, as well as examining whether training and education was available to officials.

Have appropriate arrangements been established for managing risks associated with the acceptance or provision of gifts, benefits and hospitality?

The MDBA has articulated risks and controls related to bribery and corruption in a 2024 fraud and corruption risk assessment. Existing controls related to acceptance or provision of gifts, benefits and hospitality were not referenced in the 2024 assessment. Two integrity-related risks were identified in the MDBA’s November 2021 Enterprise Risk Management Plan. The MDBA developed a revised suite of enterprise risks in August 2023, which no longer includes integrity-related risks.

Risk management framework

2.6 Between 1 July 2021 and 31 March 2024 the MDBA’s risk management framework comprised:

- an instruction in the MDBA’s Accountable Authority Instructions (April 2022) that all officials ‘must refer to and act in accordance with the MDBA’s risk management framework, policy and guidelines’;

- a Risk Management Framework and Policy (November 2021) that set out a risk management hierarchy, a risk management methodology, governance arrangements for risk, and a risk appetite and tolerance statement;

- a Fraud Control Plan and Policy (October 2022) that included governance arrangements for fraud control and policies, guidelines and templates for handling suspected fraud; and

- related guidelines, assessments and templates.

2.7 The MDBA updated its risk management framework in May and June 2024. The revised framework comprises: a risk management framework titled ‘Managing risk at the MDBA: 7 things you need to know…’ (May 2024); a 2024/25 Risk Appetite Statement (May 2024); and Risk Management Guidelines (June 2024).

Enterprise risk management

2.8 The MDBA defines enterprise risks as those that ‘have the potential to affect the entity as a whole in terms of outcomes or objectives.’

2.9 The MDBA’s January 2019 Enterprise Risk Management Plan identified eight enterprise risks. The plan included two integrity-related risks:

4. Unauthorised access to or disclosure of confidential or sensitive information

8. Material fraud or corruption incident involving MDBA staff member, contractor or grant recipient27

2.10 The plan included a table outlining a high-level risk assessment for four of the eight enterprise risks. No controls were listed for the assessed risks and there were no references to risks or controls related to conflicts of interest or gifts, benefits and hospitality. Risk 4 was not assessed. Risk 8 was assessed as having ‘moderately effective to effective’ controls, a current risk rating with existing controls of ‘moderate’, and a target risk rating of ‘low’.

2.11 At a meeting in August 2023, the MDBA’s Executive Board considered a new Enterprise Risk Report which set out draft assessments against eight revised enterprise risks.28 At subsequent Executive Board meetings, held between August 2023 and May 2024, reporting against the revised enterprise risks was provided and at least one enterprise risk was discussed at each meeting. None of the MDBA’s risk assessment worksheets for these revised enterprise risks since August 2023 has contained references to risks or controls relating to conflicts of interest or gifts, benefits and hospitality.

Fraud control plan and risk assessment

2.12 The PGPA Fraud and Corruption Rule establishes a requirement for an accountable authority to take all reasonable measures to prevent, detect and deal with fraud relating to the entity.29

2.13 The MDBA’s Fraud and Corruption Control Policy and Plan (July 2024) outlines the entities’ policies and guidelines for handling suspected fraud and corruption. The ‘policy and plan’ does not include details on fraud and corruption risks, and it notes that the MBDA’s fraud and corruption risk assessment document is held as a separate document.

2.14 The MDBA developed a draft fraud risk assessment in 2019 with six sub-categories of fraud risks.30 The assessment for each risk records: causes; consequences; controls; current rating; target rating; treatments; residual risk; contingency plan (if the risk occurs); and control effectiveness. The MDBA identified patronage, nepotism, cronyism, collusion and bribery as potential causes for two of the six fraud risks:

Risk 2: Fraudulent or corrupt behaviour in a procurement or grant process

Risk 4: Fraudulent/corrupt behaviour in recruitment

2.15 Common controls identified by the MDBA for these two risks were adherence to and training in the Public Service Act, APS Code of Conduct, MDBA Conflict of Interest Policy, MDBA Fraud Control Plan, Accountable Authority Instructions and delegation instruments. The MDBA assessed the controls as ‘Effective: No control gaps (controls are believed to be operating effectively).’ The draft fraud risk assessment did not reference any controls testing conducted to inform this assessment of control effectiveness.

2.16 From 1 July 2024, the Fraud Rule was updated to the Fraud and Corruption Rule. The MDBA developed a revised fraud and corruption risk assessment, which was approved in July 2024, with five risks.31 The assessment for each risk records threats or causes; consequences; controls; current rating; target rating; treatments; residual risk; contingency plan (if the risk occurs); and control effectiveness. The MDBA identified bribery, kickbacks, conflict of interest, favouritism and nepotism as threats for Risk 1: Corruption in decision-making. Controls identified by the MDBA for the risk included:

Adherence to and training in: Public Sector Act, APS Code of Conduct, ethics, MDBA Conflict of Interest Policy, MDBA Fraud Control Plan, Accountable Authority Instructions, fraud and conflict of interest on commencement and biennial refresher (mandatory), compliance reporting, Recruitment and Selection Policy (for non SES), Human Resources Delegations, Sub Delegations and Authorisations 2019.

2.17 The MDBA assessed the controls as ‘Moderately effective: few control gaps. The control is influencing the risk level; however, improvement is needed, but subject to business case and cost effectiveness.’ The MDBA advised the ANAO in September 2024 that control owners were consulted to review and validate controls and assess their effectiveness. The 2024 fraud and corruption risk assessment does not record control owners.

2.18 Existing controls directly related to gifts, benefits and hospitality, including the MDBA’s Official Hospitality, Gifts and Benefits Guidelines and its internal Gifts and Benefits Register, are not referenced in the 2024 fraud and corruption risk assessment.32 The MDBA identified ‘Broaden the publication of received gifts and benefits on external website’ as a treatment for the ‘Corruption in decision-making’ risk (refer paragraph 2.77).

Recommendation no.1

2.19 The Murray–Darling Basin Authority assess the risks associated with provision and acceptance of gifts, benefits and hospitality and identify appropriate controls.

Murray–Darling Basin Authority response: Agreed.

2.20 The MDBA also has progressed significant work in relation to improving its risk management practices over the past 18 months and is currently focused on integrity related risks and appropriate controls, including in relation to gifts, benefits and hospitality.

2.21 The MDBA has also updated its Fraud and Corruption Risk assessment to include consideration of additional controls over gifts, benefits and hospitality.

Has the MDBA developed fit-for-purpose policies and procedures for the acceptance of gifts, benefits and hospitality?

The MDBA has developed policies and procedures for the acceptance of gifts, benefits and hospitality through its Accountable Authority Instructions, Instrument of Delegation, Official Hospitality, Gifts and Benefits Guidelines and Declaration of Interests Policy. There were inconsistencies between these documents in relation to instructions for accepting ‘token gifts, benefits or hospitality’ (valued at $50 or below). In addition, the guidelines do not specify timeframes for obtaining delegate approval and reporting on acceptance of gifts, benefits or hospitality or sanctions associated with failure to comply with the requirements.

2.22 The MDBA’s policies and procedures for the acceptance of gifts, benefits and hospitality are established through:

- instructions in the MDBA’s Accountable Authority Instructions (April 2022) (AAIs);

- the MDBA’s Instrument of Delegation – Core Financial Arrangements (July 2023 and September 2024), which outlines approval requirements for accepting gifts; and

- policy documents, including an Official Hospitality, Gifts and Benefits Guidelines (updated August 2024)33 and Declaration of Interest Policy 2022–2024 (June 2022).

Accountable Authority Instructions

2.23 The MDBA’s AAIs include instructions related to the acceptance of gifts, benefits and hospitality. The AAIs were issued in April 2022 by the acting Chief Executive.

2.24 The AAIs include the following instructions to all officials on ‘receiving gifts and benefits’.

You must not:

- ask for, or encourage, the giving of gifts to yourself or other officials

- accept a gift of money (except in exceptional circumstances)

- accept a gift or benefit that influences or could be perceived to influence, your decision or action on a particular matter.

If you decide to accept a gift or benefit, your decision must be defensible and able to withstand public scrutiny and be approved by a delegate as per the Instrument of Delegation. You must have regard to the general duties of officials and associated instructions in deciding whether to accept a gift as outlined in the MDBA Official Hospitality, Gifts and Benefits Guidelines.

You should seek advice from Risk and Audit prior to accepting a gift or benefit.

2.25 Under the heading ‘official hospitality’, the AAIs state that MDBA officials must not:

- accept hospitality if by its nature, frequency or other circumstances it could reasonably be seen as compromising your integrity or that of the MDBA.

- accept excessive (either in scale or frequency) hospitality in connection with your official duties.

- accept secretive hospitality.

2.26 The AAIs include the following guidance on acceptance of gifts and benefits:

Officials, in the course of their work, may be offered gifts such as souvenirs, bottles of wine and personal items, or benefits such as sponsored travel, hospitality, accommodation or entertainment.

Generally, officials should not accept gifts or benefits in the course of their work. However, there may be circumstances where it is appropriate to accept a gift or benefit – for example, where refusal could cause cultural offence, where an item of token value is offered by way of public thanks, or where attendance at an event is an important means of developing and maintaining relationships with key stakeholders. Officials need to carefully consider the appropriateness of a gift or benefit before accepting or rejecting it.

Gifts provided to officials in the course of their work immediately become relevant property when received. Where a gift is token in nature an official may be able to retain the gift.

Instrument of Delegation

2.27 The MDBA’s Instrument of Delegation – Core Financial Arrangements (July 2023) established a delegation related to the acceptance of gifts by MDBA officials (see Table 2.1).34 The delegation applied to approving ‘the keeping of a gift by an official managed by the delegate’. For the Executive Director (ED) Business Services35, General Manager (GM) Finance36 and Chief Financial Officer (CFO), this delegation did not allow them to approve gifts accepted by officials outside of their direct reporting lines. The MDBA updated the Instrument of Delegation – Core Financial Arrangements in September 2024 to allow all delegates to approve gifts and benefits accepted by officials outside of their direct reporting lines (see Table 2.1).

Table 2.1: Delegations for the acceptance of gifts, benefits or hospitality

|

Delegation |

Executive Director (EDs) |

General Managers (GMs) |

ED Business Servicesa |

Executive Level 2 (EL2) |

|

Approve the keeping of a gift by an official managed by the delegate (July 2023) |

Any value |

– |

Any value |

Up to $50 |

|

Approve the keeping of a gift or benefit (September 2024) |

Any value |

Up to $50 |

Any value |

Up to $50 |

Note a: The ED Business Services is also the Chief Operating Officer of the MDBA.

Note b: The GM Finance position was removed from the September 2024 delegation instrument.

Source: MDBA, Instrument of Delegation – Core Financial Arrangements (July 2023 and September 2024).

2.28 The September 2024 Instrument of Delegation requires delegate approval for keeping gifts or benefits (including hospitality) of any value. In contrast, the March 2022 and August 2024 Official Hospitality, Gifts and Benefits Guidelines both indicate officials may accept gifts or benefits valued at less than $50 without delegate approval (refer to paragraph 2.34).

Policies and procedures related to the acceptance of gifts, benefits and hospitality

Official Hospitality, Gifts and Benefits Guidelines

2.29 The MBDA’s Official Hospitality, Gifts and Benefits Guidelines (August 2024) outline additional guidance, including general principles that officials, including Authority members must not:

- accept any gift, benefit or hospitality:

- that can be perceived as having a capacity to affect the official’s decisions or considerations;

- where there is an expectation or implication that a favour is expected in return; or

- that is travel or accommodation in connection with official duties, regardless of whether it would further the interests of the MDBA37; or

- use any information obtained in their official capacity to gain an advantage for themselves or any other person, or cause detriment to the MDBA, the Commonwealth or any other person.

2.30 The guidelines state that:

Token hospitality such as coffee or a modest meal may be accepted. Before accepting or declining other forms of hospitality such as dinners, sporting event tickets and the like, the approval of the appropriate delegate must be sought. If accepted, this must be recorded by informing the Secretariat and Governance Team…38

2.31 The Official Hospitality, Gifts and Benefits Guidelines provide additional guidance on the acceptance of ‘token’ gifts, benefits and hospitality valued up to $50 (see Box 1).

|

Box 1: Guidance to MDBA officials on acceptance of ‘token’ gifts, benefits or hospitality |

|

The MBDA’s Official Hospitality, Gifts and Benefits Guidelines state that:

Further, the guidelines state:

|

2.32 The Official Hospitality, Gifts and Benefits Guidelines state that:

Acceptance of any gift, benefit or hospitality is inappropriate and should be declined where it is from a person or company:

- involved in a tender process with the agency, either for the procurement of goods and services or sale of assets;

- meeting with a view to offer services to the MDBA;

- the subject of a decision within the discretionary power, or substantial influence of the MDBA official concerned;

- in a contractual or regulatory relationship with the Commonwealth; or

- whose primary purpose is to lobby Ministers, members or Parliament, or agencies.

2.33 The guidelines do not set out timeframes for delegate approval or for reporting on acceptance from the recipient or delegate to the Secretariat and Governance team. Further, the guidelines do not specify sanctions associated with failure to comply with the requirements.

2.34 The Official Hospitality, Gifts and Benefits Guidelines are inconsistent with the MDBA’s AAIs, which state that acceptance of gifts and benefits must ‘be approved by a delegate as per the Instrument of Delegation’ (refer to paragraph 2.24). The Instrument of Delegation does not provide a delegation for officials to keep gifts or benefits valued under $50 without manager approval (refer to paragraph 2.27). The MDBA advised the ANAO in September 2024 that:

We interpret this to be that the Instrument delegates the ability to approve the keeping of a gift by an official but then the policy notes when officials may accept gifts or benefits with or without delegate approval. This is not a contradiction as the two documents do different things.

Declaration of Interests Policy 2022–2024

2.35 The MDBA’s Declaration of Interests Policy 2022–2024 (June 2022) defines a conflict of interest as ‘a conflict between the public duty and personal interests of an individual that improperly influences the individual in the performance of their official duties and responsibilities.’ The policy requires all entity officials to make declarations of interests on commencement and annually thereafter.

2.36 The policy identifies ‘gifts’ as an interest ‘that would be considered relevant and must be declared for assessment.’ It identifies that a conflict of interest may arise ‘where a person involved in conducting a procurement/grant … has received a gift, hospitality or another benefit from a prospective supplier.’

2.37 The guidelines and notification form do not require recipients or approving delegates to include information about any potential, perceived or actual conflict created by the acceptance of gifts, benefits or hospitality.

Has the MDBA developed fit-for-purpose policies and procedures for the provision of gifts, benefits and hospitality?

The MDBA has developed policies and procedures for the provision of gifts, benefits and hospitality through its Accountable Authority Instructions, Instrument of Delegation, Official Hospitality, Gifts and Benefits Guidelines and other policy documents. There were inconsistencies between these documents in relation to the distinction between official hospitality and business catering.

2.38 The MDBA’s policies and procedures for the provision of gifts, benefits and hospitality are established through:

- instructions in the MDBA’s AAIs (April 2022), primarily relating to official hospitality;

- the MDBA’s Instrument of Delegation – Core Financial Arrangements (July 2023 and September 2024); and

- the Official Hospitality, Gifts and Benefits Guidelines (updated August 2024) and other policy documents.39

Accountable Authority Instructions

2.39 The MDBA’s AAIs establish policies and controls related to the provision of gifts, benefits and hospitality, including requirements that:

- any decision to spend relevant money on official hospitality must be publicly defensible;

- MDBA officials must not enter into an arrangement to provide official hospitality unless the arrangement has been approved by a delegate under the Instrument of Delegation;

- potential fringe benefits tax (FBT) implications must be considered before approving a commitment; and

- MDBA officials must not make a gift of relevant property, unless it complies with the instructions on gifting relevant property in MDBA’s Official Hospitality, Gifts and Benefits Guidelines.

Instrument of Delegation

2.40 The MDBA’s Instrument of Delegation – Core Financial Arrangements (July 2023 and September 2024) establishes two delegations related to the provision of gifts, benefits and hospitality by MDBA officials (see Table 2.2).

Table 2.2: Delegations related to the provision of gifts, benefits and hospitality

|

Delegation |

Executive Director (EDs) [SES Band 2] |

General Managers (GMs) [SES Band 1] |

ED Business Servicesa |

Executive Level 2 (EL2) |

|

Approve official hospitality (July 2023) |

Up to $2,000 |

Up to $2,000 |

Any value |

Up to $250 |

|

Approve the giving of a gift (July 2023) |

Any value |

– |

Any value |

– |

|

Approve official hospitality (September 2024) |

Up to $2,000 |

Up to $2,000 |

Any value |

– |

|

Approve the giving of a gift or benefit (September 2024) |

Any value |

– |

Any value |

– |

Note a: The ED Business Services is also the Chief Operating Officer of the MDBA.

Note b: The GM Finance position was removed from the September 2024 delegation instrument.

Source: MDBA, Instrument of Delegation – Core Financial Arrangements (July 2023 and September 2024).

Policies and procedures related to the provision of official hospitality

2.41 The MDBA’s policies and procedures make a distinction between providing official hospitality and business catering. Official hospitality and business catering are not consistently defined across policy and procedural documents (see Table 2.3).

Table 2.3: Definitions of official hospitality across the MDBA’s policy framework

|

Source |

Official hospitality |

Business catering |

|

Accountable Authority Instructions |

Official hospitality generally involves the use of public resources to provide hospitality to persons other than MDBA officials to facilitate the achievement of one or more MDBA objectives. Official hospitality may include the provision of refreshments, entertainment, gifts of property, prizes or other benefits. |

– |

|

Official Hospitality, Gifts and Benefits Guideline (August 2024) |

Official hospitality is a procurement and generally involves the use of public money to provide hospitality to persons other than MDBA staff to facilitate the achievement of one or more Commonwealth objectives. Official hospitality means an invitation to a function that may have an entertainment component, including work-related meals in restaurants or cafes, social functions, sporting or cultural events where the costs are met (wholly or substantially) by the host. It may also include gifts, such as MDBA Merchandise. |

Business catering is a procurement subject to standard policies and requirements to commit public money. Ensuring value for money and standards of economy, efficiency, effectiveness, and ethics apply. |

|

Official Hospitality Expense Spending Proposal form |

Meals, beverages, entertainment and social functions provided for the purpose of facilitating the conduct of official business |

– |

|

Business Catering Guidelines |

Official hospitality, which has an element of entertainment or benefit. |

Business catering generally consists of light meals and refreshments such as sandwiches, cakes, biscuits, finger food, fruit and non-alcoholic drinks. Alcoholic drinks must not be provided with business catering. Business catering is not to be provided at restaurants. |

Source: ANAO presentation of MDBA information.

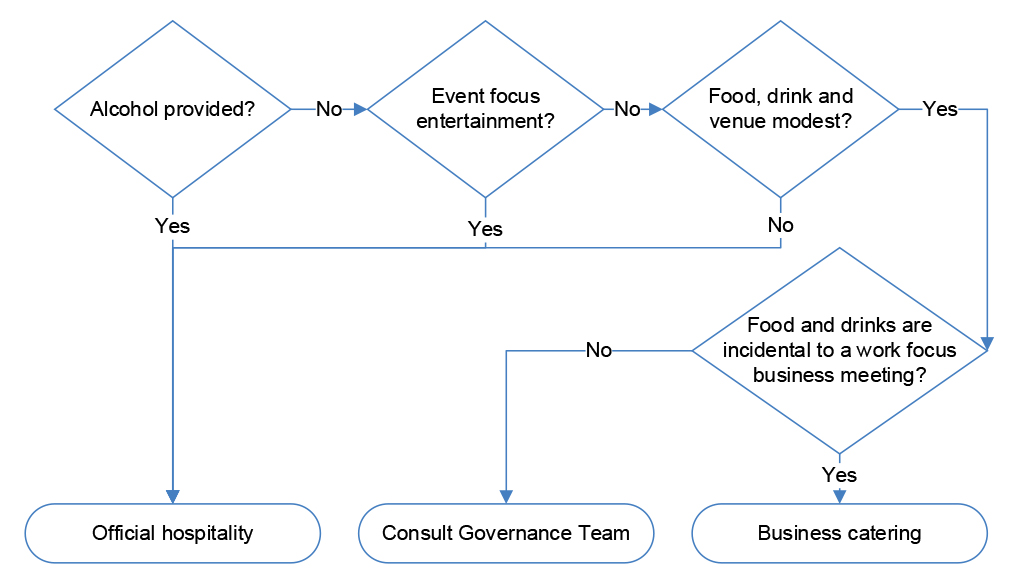

2.42 The MDBA has developed an ‘Official Hospitality or Business Catering’ flowchart outlining questions for officials to answer when deciding if an activity is official hospitality or business catering (see Figure 2.1). The effectiveness of this flowchart to support MDBA officials’ decision-making is limited by:

- the lack of definitions for ‘entertainment’ and ‘modest’ in policy and procedural documents; and

- the MDBA’s processes for approving the provision of official hospitality not being designed to record delegates’ consideration of the questions outlined in the flowchart.

Figure 2.1: MDBA’s flowchart for classifying official hospitality or business catering

Source: ANAO presentation of MDBA flowchart.

2.43 Assessment of MDBA’s classification of events as official hospitality or business catering is presented in paragraphs 3.46 to 3.48.

Official Hospitality, Gifts and Benefits Guidelines

2.44 The AAIs require MDBA officials to act in accordance with the Official Hospitality, Gifts and Benefits Guidelines. The process for the provision of official hospitality described in the Official Hospitality, Gifts and Benefits Guidelines is for MDBA officials to request and record approval from delegates on an official hospitality approval form.

2.45 The guidelines outline principles for generally acceptable hospitality and provide examples of acceptable and generally unacceptable hospitality (see Table 2.4), but do not define sanctions associated with failure to comply with the guidelines.

Table 2.4: MDBA’s examples of appropriate and unacceptable hospitality

|

When is the provision of official hospitality by the MDBA appropriate? |

What are unacceptable forms of hospitality? |

|

Principles:

Examples:

|

Examples:

|

Source: MDBA, Official Hospitality, Gifts and Benefits Guidelines (August 2024).

2.46 The guidelines include advice about the provision of alcohol with official hospitality, stating:

Alcohol is only provided by exception. If provided it:

- should only be provided with, and incidental to, a meal.

- must reflect the MDBA’s duty of care to keep attendees safe.

- must build the reputation of the department as a professional and trusted partner.

- must have a corresponding offer of non-alcoholic option.

2.47 The MDBA’s Official Hospitality Expense Spending Proposal and Official Hospitality (Special Circumstances) Standing Approval Spending Proposal forms include a field to record the reason for providing official hospitality, including the benefit to the MDBA. The forms do not prompt officials or delegates to document compliance with other policy requirements and principles.

2.48 The March 2022 version of the Official Hospitality, Gifts and Benefits Guidelines stated that MDBA officials must seek approval from the relevant delegate ‘either prior to the activity, or as soon as practicable after the activity’. This was inconsistent with the MDBA’s AAIs which state that MDBA officials must not ‘enter into an arrangement to provide official hospitality unless the arrangement has been approved by a delegate under the Instrument of Delegation’. The August 2024 version of the Official Hospitality, Gifts and Benefits Guidelines state that MDBA officials must seek pre-approval for official hospitality.

2.49 The August 2024 version of the Official Hospitality, Gifts and Benefits Guidelines specify that a ‘delegate must not approve official hospitality they may personally benefit from (including attending the event).’

2.50 The MDBA Sensitive Water Market Information Policy requires MDBA meetings to be ‘managed so that information cannot be overheard.’ The MDBA’s hospitality-related policies and procedures do not reference the Sensitive Water Market Information Policy. Its hospitality approval forms do not document consideration by MDBA officials or delegates if the location or type of hospitality provided for MDBA events are consistent with the Sensitive Water Market Information Policy.

Recommendation no.2

2.51 The Murray–Darling Basin Authority review and update its policy framework for the acceptance and provision of gifts, benefits and hospitality to ensure:

- instructions for accepting and keeping ‘token gifts, benefits and hospitality’ are consistent and appropriate;

- instructions for provision of hospitality include clear definitions and distinctions between official hospitality and business catering, and define relevant concepts such as ‘entertainment’ and ‘modest’;

- timeframes are specified for obtaining delegate approval and reporting on acceptance and provision of gifts, benefits and hospitality;

- consideration of any potential, perceived or actual conflicts created by the acceptance of gifts, benefits or hospitality is documented on declaration forms; and

- the framework defines sanctions associated with failure to comply with gifts, benefits and hospitality requirements.

Murray–Darling Basin Authority response: Agreed.

2.52 The MDBA are reviewing its policy framework for the acceptance and provision of gifts, benefits, and hospitality to ensure consistent and appropriate instructions; clear definitions and distinctions; specified timeframes for obtaining delegate approval and reporting; documentation of any potential, perceived, or actual conflicts on declaration forms; and defined sanctions associated with failure to comply with requirements.

Policies and procedures related to the provision of gifts and benefits

2.53 The MDBA’s AAIs for gifting MDBA property require officials to act in accordance with the Official Hospitality, Gifts and Benefits Guidelines. The guidelines state:

Expenditure on gifts, other than on token gifts, for the purposes of protocol and/or public relations are acceptable when the presentation is to further the aims of the MDBA. Only the Chief Executive, Executive Directors/Division Leads, the Chief Operating Officer or the Chief Finance Officer (CFO) are authorised (as per the instrument of delegation) to approve expenditure on gifts and/or benefits.

If the recipient of a proposed gift is a foreign national, foreign organisation or foreign Government, the CE must also be satisfied of the appropriateness of the proposed gift prior to purchase. [emphasis in original] …

Where an external person speaks at a conference or seminar hosted by the MDBA for no fee, a token gift may be provided with pre-approval given.

2.54 The March 2022 version of the guidelines outlined a range of MDBA gifts and merchandise that could be given as gifts, including drink bottles, books, caps, stationery, USB flash drives, drink bottles, brown paper show bags and bookmarks (see Figure 2.2).

Figure 2.2: MDBA gifts and merchandise

Source: MDBA, Official Hospitality, Gifts and Benefits Guidelines (March 2022).

2.55 The August 2024 version of the guidelines states items that can be used as MDBA gifts are: an aluminium drink bottle and the book Sharing the water – One hundred years of River Murray politics. MDBA merchandise available are: posters, fact sheets, stickers, cotton shopping bags, and Murray River salt flakes sachets.

2.56 In August 2024, the MDBA advised the ANAO that its expenditure (including GST) on MDBA gifts was $3,359.40 in 2021–22, $1,275 in 2022–23, and $0 in 2023–24. The MDBA advised that it had no expenditure on MDBA merchandise over the same period.

Has the MDBA developed effective training and education arrangements to promote compliance with policy and procedural requirements?

The MDBA has a mandatory training package which includes responsibilities and expectations for officials relating to gifts, benefits and hospitality. The relevant modules are whole of government modules on integrity and fraud and corruption. Members of the Authority have not been provided specific guidance on policy and procedural requirements for gifts, benefits and hospitality.

Mandatory training requirements

2.57 The MDBA’s Essential Skills Policy (September 2021) establishes two programs of mandatory training: the Essential Induction program and the Essential Refresher program. The policy was due for review in 2023, but as of October 2024 this had not occurred.

2.58 MBDA employees and contractors must complete the Essential Induction program within the first three months of engagement. The program contains a total of nine mandatory whole-of-government e-learning modules (available to MDBA officials via a learning management system known as Learnhub). Two modules are relevant to the management of gifts, benefits and hospitality: Integrity in the Australian Public Service, and Fraud Awareness.

2.59 The MDBA Essential Refresher program requires annual completion of five modules, including the Integrity in the Public Service module, and biennial completion of the Fraud Awareness module. While the policy listed the Integrity in the APS module in the Refresher Program, the module was not part of the program within the Learnhub system until October 2023.

2.60 An overview of the training modules relevant to the management of gifts, benefits and hospitality is presented in Table 2.5.

Table 2.5: Overview of gifts, benefits and hospitality related training modules

|

Mandatory training module |

Summary |

|

Integrity in the Australian Public Servicea |

|

|

Fraud awarenessa |

|

Note a: The e-learning module is produced by the Australian Public Service Commission.

The Fraud Awareness module was replaced with the Fraud and Corruption module in July 2024.

Source: ANAO analysis of the Learnhub training module content.

Intranet guidance

2.61 Communication to officials regarding policy requirements can occur through other mechanisms. The MDBA intranet, known as ‘Billabong’, provides news and messaging across the entity. The Billabong page that provides information about the management of gifts, benefits and hospitality to officials is the Declaration of Interests page.

2.62 The Billabong Declaration of Interests page contains an overview of MDBA’s approach to the management of gifts, benefits and hospitality and provides links to the Official Hospitality, Gifts and Benefits Guidelines, the Gifts and Benefits Notification Form, and the Official Hospitality Expense Spending Proposal and Official Hospitality (Special Circumstances) Standing Approval Spending Proposal.

2.63 On 31 March 2022, an intranet post was published advising staff of updates to the MDBA Official Hospitality, Gifts and Benefits Guidelines. The message identified that the updates:

- clarify that delegate approval is not required for an official to keep a token gift or benefit (i.e. of a value less than or equal to $50), although they should keep their own record of it.

- officials should generally not accept gifts from stakeholders to pay for travel and accommodation where travelling on MDBA business to a stakeholder sponsored tour, trip or event.

- reflect recent changes to the Australian Public Service Commission’s (APSC) reporting requirements for gifts and benefits received by the Chief Executive. The Risk and Audit team will co-ordinate internally and update the Chief Executive gifts and benefits register quarterly, then provide a link to the register to the [APSC] for publication on their website.

2.64 There was no intranet post to advise officials when the August 2024 updates to the Official Hospitality, Gifts and Benefits Guidelines were published. The MDBA advised the ANAO in September 2024 that it was waiting for approval of the updated financial delegations before providing broader communications to staff. A ‘Business Bulletin’ email was sent to all staff on 26 September 2024 notifying them of the updated Instrument of Delegation – Core Financial Arrangements. The MDBA advised the ANAO in November 2024 that it is undertaking a further review of the Official Hospitality, Gifts and Benefits Guidelines, and staff will be advised of the revised guidelines once the review is completed.

Guidance for new Authority members

2.65 As part of the induction process for new Authority members, two guidance documents are provided: Guidance for Authority Members and Conflict of Interest Guidance for Authority Members. The guidance documents set out the Authority’s powers, functions and governance supports. Requirements in relation to the conduct of meetings, delegations and the management of conflict of interests are identified. The guidance documents indicate the MDBA has adopted the APS Code of Conduct as the code of conduct for Authority members.

2.66 The guidance documents do not include information on training requirements and Authority members have not been given access to the MDBA Learnhub system nor asked to complete MDBA mandatory training requirements. No specific references are included for gift, benefit and hospitality declaration or reporting requirements.

Opportunity for improvement

2.67 The MDBA could provide guidance to Authority members on policy requirements relating to the acceptance and provision of gifts, benefits and hospitality.

Does the MDBA have appropriate arrangements for monitoring and reporting on offers, receipts and provision of gifts, benefits and hospitality?

The MDBA has published a register of gifts and benefits received by the Chief Executive. It updated the register in October 2024 to comply with the requirement to annually report gifted airline lounge memberships. In August 2024 the MDBA decided to commence publishing gifts and benefits received by MDBA officials, including Authority members. The MDBA maintains an internal register of gifts, benefits and hospitality accepted by officials from external parties. It expanded the register in August 2024 to cover provision of official hospitality. There were no internal reporting mechanisms in place for the Chief Executive or management committees to have oversight of gifts, benefits and hospitality accepted or provided by MDBA officials. As a result of the inconsistencies in the treatment of official hospitality and business catering events by the MDBA, and the absence of a register, the MDBA has not been well placed to accurately report to Parliament on instances of official hospitality.

Centralised monitoring of gifts, benefits and hospitality

2.68 The MDBA maintains a centralised internal register of gifts and benefits accepted by MDBA officials. The notification form advises officials to forward the signed form to the Secretariat and Governance Team’s shared email account. The Secretariat and Governance Team is responsible for recording these notifications on an internal Gifts and Benefits Register (the internal register). The MDBA has not established any procedural documents setting out the management of the internal register.

2.69 It is the responsibility of the individual official to ensure that a notification is made to the relevant delegate and the notification form is provided to the Secretariat and Governance Team. Once an entry is made on the internal register, the notification form, which includes the delegate’s decision, is retained in MDBA’s official record keeping system, Content Manager.

2.70 The MDBA does not maintain a register or other reporting mechanism for MDBA gifts or branded merchandise. In August 2024 it updated its internal Gifts and Benefits Register to include a section for recording official hospitality provided to MDBA officials or stakeholders.

2.71 The APSC’s APS Values and Code of Conduct in Practice provides that ‘agencies may require the employees to disclose offers which were not accepted, for example, where the offer could be perceived as a bribe’.40 The MDBA’s August 2024 Official Hospitality, Gifts and Benefits Guidelines added a requirement for officials to record any offers of gifts, benefits or hospitality in the internal register. This requirement is inconsistent with a subsequent statement in the guidelines that a notification form is required for accepted non-token gifts, benefits or hospitality. As at October 2024, the notification form had not been updated to operationalise the requirement to declare offers of gifts, benefits and hospitality.

Opportunity for improvement

2.72 The MDBA could update its guidelines for accepting gifts, benefits and hospitality and notification form to clarify requirements in relation to declaring offers that were not accepted.

Internal reporting

2.73 The APSC recommends entities measure and report on integrity performance regularly.

Agencies that can effectively measure, monitor and report on their integrity performance will be better positioned to identify risks; action and remedy integrity issues; and embed integrity into all aspects of workplace culture and practice.41

2.74 The APSC identifies a number of integrity metrics including reporting on gifts, benefits and hospitality.42 The MDBA has not established any reporting to management committees or the Chief Executive on the offer, decline, receipt or provision of gifts, benefits and hospitality.

External reporting

Alignment with the Australian Public Service Commission Guidance on gifts and benefits

2.75 The APSC’s Guidance for Agency Heads – Gifts and Benefits (the APSC Guidance) establishes the requirement that agency heads are to publish a register of gifts, benefits and hospitality that have been accepted and are valued at over $100.43 This disclosure includes gifts, benefits and hospitality accepted by their immediate families and dependants where it is related to the official duties of the agency head.44 The APSC Guidance also ‘strongly encourages’ statutory office holders to mirror the arrangements for agency heads as best practice45, and stipulates a ‘strong expectation’ that items received by staff are also published on the register.46

2.76 The MDBA’s Official Hospitality, Gifts and Benefits Guidelines include additional requirements for the Chief Executive that align with the APSC Guidance, including the requirement to publish the register quarterly. The MDBA publishes an Accountable Authority Gifts and Benefits Register on its website.47 The MDBA has been publishing the register since ‘quarter 4’ of 2021.

2.77 The March 2022 Official Hospitality, Gifts and Benefits Guidelines did not include any requirements for the public reporting of gifts, benefits and hospitality accepted by MDBA officials other than the Chief Executive. In August 2024 the MDBA added a new section to the guidelines stating:

The MDBA has chosen to voluntarily publish additional details on its website, as well as providing that information to the APSC … ALL gifts and benefits received by any MDBA staff member [including Authority members] over the value of $AUD100.00 will now be published, consistent with the approach of the Australian National Audit Office, to provide greater transparency.48

2.78 The APSC Guidance requires the annual reporting of gifted airline lounge memberships.49 The only item reported between quarter 4 of 2021 and quarter 2 of 2024 was a complimentary airline membership gifted to the Chief Executive from Qantas Airways Ltd. The gift was listed as being received ‘from 27 June 2022’ but was reported between quarter 2 and quarter 3 of 2023. On 31 October 2024, the MDBA updated the Accountable Authority Gifts and Benefits Register on its website to record the gifted airline lounge membership annually.

Reporting to Parliament

2.79 The MDBA provided responses to questions on notice from the Senate Environment and Communications Legislation Committee on the provision of hospitality that were asked of the Department of Climate Change, Energy and Water on four occasions between June 2023 and June 2024.50

2.80 As discussed at paragraph 2.41, the MDBA makes a distinction between official hospitality and business catering, and definitions of these categories vary across MDBA’s policies and procedures. As a result of the inconsistencies in the treatment of events by the MDBA, and the absence of a register of events (see paragraph 2.70), the entity has not been well placed to provide an accurate response to the questions posed. Further examination of the MDBA’s classification and management of official hospitality and business catering is presented at paragraphs 3.46 to 3.48.

3. Controls and processes for managing gifts, benefits and hospitality

Areas examined

This chapter examines whether the Murray–Darling Basin Authority (MDBA) has implemented effective preventative and detective controls and processes for managing gifts, benefits and hospitality in accordance with its policies and procedures.

Conclusion

The MDBA’s controls and processes are partly effective in supporting its compliance with gift, benefit and hospitality requirements. Deficiencies were identified with preventative controls relating to reporting on mandatory training completion and the compliance with policy and procedural requirements for the acceptance and provision of gifts, benefits and hospitality. While the MDBA does not have specific detective controls relating to acceptance of gifts, benefits and hospitality, since 2022–23 it has included a question on provision of hospitality in its biannual financial compliance survey. The MDBA has not established processes for managing non-compliance or assurance activities for gifts, benefits and hospitality.

Areas for improvement

The ANAO made one recommendation aimed at implementing reporting to senior management and arrangements to obtain assurance over controls.

The ANAO identified one opportunity for improvement for the MDBA to advise contractors that it is not appropriate to provide gifts, benefits or hospitality to officials.

3.1 Section 16 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) requires accountable authorities of Commonwealth entities to establish and maintain appropriate systems of internal control.51 Successful risk management relies on the implementation of effective controls.52 In accordance with the Australian Public Service Commission’s (APSC’s) APS Values and Code of Conduct in practice, compliance with the requirements for gifts, benefits and hospitality supports agencies to manage actual or perceived conflicts of interest.53

3.2 The Department of Finance through the Risk Management Toolkit defines a control as ‘any process, policy, device, system, practice or other action that is put in place to modify the likelihood or consequence of a risk or to detect if a risk is happening.’54

3.3 Preventative controls work by reducing the likelihood of inappropriate activities related to gifts, benefits and hospitality before they occur. Preventive controls can include: policies and procedures; education and training; deterrence messaging; declarations and acknowledgements; and pre-approvals with segregation of duties.55

3.4 Detective controls can identify failures in activities related to gifts benefits and hospitality and help identify if a risk has occurred.56 Detective controls can include: reconciliation and payment processes; monitoring activities, including the use and review of registers; exception reporting; and audit and assurance activities.57

3.5 When detective controls identify instances of non-compliance, entities should have effective processes in place for managing investigations and follow-up actions. These may include training, sanctions, or referral to law enforcement agencies.

Has the MDBA implemented effective preventative controls for the receipt or provision of gifts, benefits and hospitality?

The MDBA has implemented preventative controls for the receipt or provision of gifts, benefits and hospitality through its policies and procedures, mandatory staff training, delegations and approval requirements. The MDBA does not provide reporting on the completion of mandatory training to the Chief Executive or relevant governance committees. Requirements set out in policies and procedures prohibiting the acceptance of gifts, benefits and hospitality from contractors were not adhered to. There was inconsistent treatment of business catering and official hospitality events, and instances of non-compliance with controls for official hospitality.

Controls for enforcing staff training