Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

ANAO Audit Manual — Shared Content

Please direct enquiries through our contact page.

The shared content volume of the ANAO Audit Manual applies to all assurance activity performed by the ANAO, including financial statements and performance auditing. The shared volume addresses key matters affecting compliance with the Auditor-General Act 1997 and other aspects of the ANAO’s legislative framework. It sets out the main requirements of the ANAO’s overall system of quality control in accordance with ASQC1 Quality Control for Firms that Perform Audits and Reviews of Financial Reports and Other Financial Information, Other Assurance Engagements and Related Services Engagements.

1. Authority and maintenance

Authority and maintenance of the ANAO audit manual

Background legislation and standards

1.1 The Australian National Audit Office (ANAO) Audit Manual (the Manual) sets ANAO policies and guidance applying specifically to the audits and other assurance work performed by or on behalf of the Auditor-General consistent with ANAO Auditing Standards.

1.2 The Manual forms part of the ANAO Quality Management Framework (QMF) which demonstrates compliance with the requirements of Auditing Standard on Quality Management ASQM 1 Quality Management for Firms that Perform Audits or Reviews of Financial Reports and Other Financial Information, or Other Assurance or Related Services Engagements for policies and procedures which promote quality audits and for monitoring the application of those policies and procedures.

Policy

1.3 The Manual is issued under the authority of the Auditor-General.

1.4 Material within the Manual that is ANAO policy is displayed in bold type under the heading ‘Policy’ and is binding in respect of audits or other assurance work undertaken by the ANAO. Policies relevant to audits contracted out to an audit firm (contract out audits) are communicated to the audit firm via tender or contract documentation or as notified by the Engagement Executive1 under paragraph 105.2 of the ANAO Audit Manual - FSASG Specific and paragraph 201.2 of the ANAO Audit Manual - PASG Specific.

1.5 In rare and exceptional circumstances, substantive departures from policy may need to be considered. In these circumstances, approval by the Auditor-General, through the Qualifications and Technical Advisory Committee (QTAC), is required.

1.6 The Professional Services Group (PSG) shall monitor and analyse developments in applicable auditing and professional standards and legal and regulatory requirements. This includes consulting with service Group Executive Directors (GED) on applicable developments and their impact on the work of the ANAO and how they are incorporated into the ANAO’s policies, procedures and audit methodology.

1.7 PSG shall communicate changes to audit methodology to audit staff through technical updates and other staff meetings such as Financial Statements Audit Services Group (FSASG), Performance Audit Services Group (PASG), Performance Statement Audit Service Group (PSASG) and Systems Assurance and Data Analytics (SADA) Senior Executive Service (SES) meetings and other forums.

1.8 The Manual shall be subject to an annual review by PSG, to be completed in accordance with timeframes set out in the ANAO Quality Management Framework and Plan, published on the ANAO website annually. The annual review shall be supported by an annual assessment of ANAO quality objectives and quality risks.

1.9 The ANAO Quality Committee shall be responsible for:

- considering amendments to the Manual that substantially impact the conduct of an audit; and

- making a recommendation to the Auditor-General for approval of the amendments.

1.10 Amendments to the Manual outside of the annual review that result in substantial impacts on the conduct of an audit, shall be referred for endorsement to the ANAO Quality Committee. Amendments to the Manual that do not result in a substantial impact on the conduct of an audit but are not clearly trivial, shall be approved by the PSG GED. Administrative changes and changes to guidance made by PSG outside of the annual review do not require approval.

Guidance

1.11 The Manual addresses performance audit, financial statements audit, performance statements audit and other assurance work policy and guidance. As such, it comprises a shared content section applicable to all ANAO assurance engagements and separate chapters for specific content.

1.12 The Manual is organised as follows:

ANAO shared content

1. Authority and maintenance of the ANAO audit manual

2. Auditor-General’s mandate

3. Strategic planning

4. Governance and leadership responsibilities for quality

5. Professional, ethical and independence requirements

6. Resources

7. Information, communication and relationship with the auditee

8. Engagement performance

9. Documentation

10. Monitoring quality management policies and procedures

11 .Evaluation of the Quality Management Framework

FSASG specific content

101. Engagement performance – general

107. Engagement performance – planning

110. Engagement performance – execution

116. Engagement performance – reporting

PASG specific content

201. Engagement performance – general

205. Engagement performance – planning

210. Engagement performance – execution

224. Engagement performance – reporting

PSASG specific content

301. Engagement performance – general

311. Engagement performance – planning

321. Engagement performance – execution

331. Engagement performance – reporting

1.13 As part of the ANAO QMF, the Manual contains ANAO policy and guidance in respect of ANAO audit and assurance work. Other elements of the ANAO QMF are contained in the policy and procedures manuals and documents of the Corporate Management Group (CMG). ANAO staff are bound by these other ANAO policies where they are relevant to audit and assurance activities. Some policies within this Manual allude to these other policies.

1.14 The policies and procedures that make up the QMF respond to quality risks that arise in respect to the nature and circumstances of the ANAO and the engagements conducted. An annual review of the quality objectives and risks ensures that additional or modified quality objectives and risks are identified and modifications and additions to the QMF are designed and implemented as necessary.

1.15 The performance audit specific part of the Manual applies to performance audits. Application Guidance for Limited Assurance Reviews has been developed for guidance when applying the Manual to a Limited Assurance Review under section 19A of the Auditor-General Act 1997.

1.16 The Manual has been developed for use by ANAO executives and staff. In-house contractors must also comply with the policies in the Manual. Where audit and other assurance work has been contracted out, relevant sections of the Manual are to be made known to the contractor firm (refer to paragraph 1.4).

1.17 The Manual enables the achievement of ANAO business objectives. Audit service group executives and senior staff should raise with PSG any conflicts between the delivery of ANAO business objectives and the Manual.

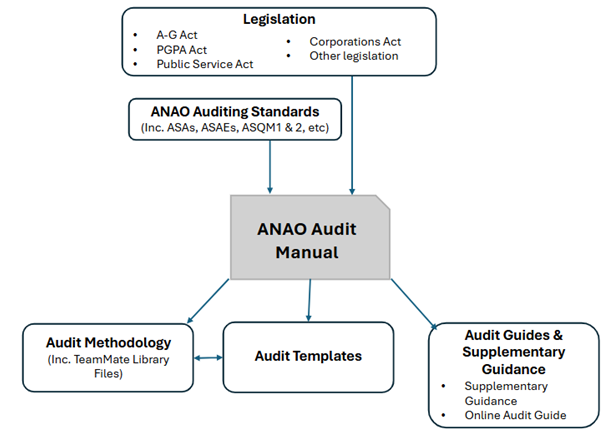

1.18 The Manual does not seek to re-express, as ANAO policy, material that is binding under other authorities (e.g. in respect of the mandatory requirements of ANAO Auditing Standards). However, the Manual does seek to enunciate the relationship between various authorities and provide guidance on their application in the ANAO. Refer to Diagram 1.

1.19 PSG has overall responsibility for the Manual and any amendments to it. This is to ensure that ANAO policy and procedures for audit and other assurance work remain consistent with the authorities governing the ANAO’s work. Amendments, other than those that are clearly trivial, will involve consultation with ANAO GEDs, Chief Operating Officer (COO) or their nominees and oversight by the ANAO Quality Committee.

1.20 An annual review of the Manual is needed to keep policies current. Minor editorial or technical amendments (e.g. updating legislative references) will be made as required by PSG.

1.21 Each section of the Manual will be subject to version control. Major changes will restart the number sequence (e.g. v1.0, v2.0). Minor changes will be designated as amendments to the previous major change (e.g. v1.2, v2.4).

1.22 All changes to the Manual, other than those that are clearly trivial, will be notified to ANAO audit staff and contractors through mechanisms such as direct email, the issue of a PSG Announcement or discussion at PSG Technical Updates and service group forums.

1.23 Material in the Manual that is superseded is archived consistent with the ANAO Information Management Framework.

1.24 The term Engagement Executive is used to describe the leader of the assurance engagement. For financial statement audits, performance statements audits, and other assurance engagements conducted by FSASG or PSASG, this means the Engagement Executive assigned to the engagement consistent with the Auditor-General’s delegations and may be a GED, Senior Executive Director (SED), Executive Director or Senior Director. For performance audits and other assurance engagements conducted by PASG, this means the Executive Director assigned to the engagement consistent with the Auditor-General’s delegations.

Diagram 1: Relationship between ANAO audit manual and authorities governing ANAO work

2. Auditor-General’s mandate and work of the ANAO

The Auditor-General’s mandate

Background

2.1 The Auditor-General Act 1997 (Cth) (A-G Act) sets out the Auditor-General’s functions (mandate) and powers, establishes the ANAO, and the requirement for ANAO Auditing Standards. It also sets out the relationship with the Parliament and the Joint Committee of Public Accounts and Audit (JCPAA) and requires the appointment of the Independent Auditor.

Policy

2.2 All ANAO audit staff shall familiarise themselves with the A-G Act and other legislation or authorities governing ANAO audits and other engagements.

2.3 Engagement Executives shall ensure at the beginning of each audit or assurance engagement that the legislative basis and requirements of the engagement are documented in the current audit file.

Use of Information Gathering Powers

2.4 The Auditor-General has formal information-gathering powers under section 32 (Power of Auditor-General to obtain information) and section 33 (Access to premises) of the A-G Act.2 The Auditor-General makes all decisions to use information-gathering powers under section 32 of the A-G Act by issuing a written notice under section 32, known as a Section 32 Notice. The Auditor-General has not delegated any powers under section 32 of the A-G Act.

2.5 The Auditor-General authorises officials to exercise powers under section 33 of the A-G Act by issuing a written authority signed by the Auditor-General (known as an authorised official card). While authorised officials may exercise their authorised power in their own right in accordance with the A-G Act, they must have regard to the fact that the section 33 powers are rarely used. It is a significant decision to use the powers, and staff shall familiarise themselves with the A-G Act requirements.

2.6 Authorised official cards must be carried when attending entity premises and must be produced if asked by the occupier as proof of authority to exercise section 33 powers (subsection 33(3)). A record of this shall be kept in the audit file.

2.7 Authorised officials shall notify their Engagement Executive when invoking section 33 powers to obtain access to premises, documents or property when the audited entity is not cooperating, and access is required. This shall be performed before the powers are exercised, unless the official considers it necessary to use the powers before the Engagement Executive can be contacted, in which case the official shall notify the Engagement Executive as soon as possible, subsequent to use.

2.8 Authorised officials shall notify their responsible GED before invoking section 33 powers to obtain access to premises, documents or property when an entity that is not being audited is not cooperating and access is required.

Use of section 32 and the Section 32 Notice

2.9 Any requests by entities or audit teams to invoke the formal section 32 information-gathering powers shall be made through the Engagement Executive and discussed with the Auditor-General. A brief setting out the Engagement Executive’s recommendation shall be provided prior to the discussion with the Auditor-General. In preparing the brief, the Engagement Executive shall have regard to the Auditor-General’s need to have confidence that the information-gathering approach will assist with the completeness, accuracy and relevance of evidence to meet the ANAO Auditing Standards. Where a direction to attend and give evidence under subsection 32(1)(b) is contemplated, the Engagement Executive shall identify the person(s) to be directed, and the nature of evidence being sought from them.

2.10 Drafting of the formal Section 32 Notice shall be performed by the audit team in consultation with ANAO Legal Services, with the final Notice signed by the Auditor-General.

2.11 If the person(s) to be directed under section 32 include Ministers, members of Parliament or their staff, the arrangements to conduct interviews shall take account of parliamentary privilege in consultation with ANAO Legal Services and be set out in the minute.

2.12 At the time of any request to formally use the section 32 information-gathering powers, the Engagement Executive shall review the engagement risk in light of the proposal (whether auditee or ANAO driven) to assess whether engagement risk has increased and then respond in accordance with the relevant financial statements, performance statements or performance audit policy. Evidence of the review of engagement risk shall be saved in the audit file.

2.13 For audits where the formal use of information-gathering powers is being considered or has occurred, the use of evidence or other information obtained from that process shall be considered during the subsequent quality review points for the audit which, for a performance audit, shall include the section 19 workshop meeting. ANAO Legal Services shall be invited to attend the relevant s19 meetings.

2.14 When formal information-gathering powers are used in a performance audit, their use shall be included in the audit report in the audit methodology section of Chapter One, unless the Auditor-General approves an alternative approach.

Directions to attend and give evidence at a judicial proceeding

2.15 Section 32 enables the Auditor-General to direct a person to attend and give evidence before the Auditor-General or an authorised official (paragraph 32(1)(b)). This power is rarely exercised. Where a direction under paragraph 32(1)(b) of the A-G Act is required, the direction to attend and provide evidence must be made in writing and signed by the Auditor-General. This shall be drafted in consultation with ANAO Legal Services.

2.16 The record of the interview shall be included in the audit file. Consideration shall be given to limiting access to the record, even within the audit team, depending on the nature of the evidence and the position/role of the interviewee.

2.17 In the event that evidence gathered using the formal information-gathering powers under section 32 is used in the draft section 19 report for a performance audit, consideration shall be given to whether the person(s) or bodies from whom the information is gathered have a special interest in, and should be provided with, the content of or an extract from the report (including but not limited to subsections 17(5), 18(3), 18A(6), 18B(6), 19(6) or 25(2)of the A-G Act). The policy and approval processes relating to providing the report or extracts to persons or bodies with a special interest are set out in Chapter 224 of the ANAO Audit Manual – PASG Specific.

Interaction with other legislation

2.18 The Legal Services Directions 2017 (Directions) are a set of binding rules issued by the Attorney-General about the performance of Commonwealth legal work. If, during an audit, the audit team becomes aware of any legal advice concerning the A-G Act, they shall advise ANAO Legal Services.

2.19 The ANAO has been granted a conditional exemption from the consultation requirement in paragraph 10 of the Directions. The ANAO is not required to share legal advice it obtains from ANAO Legal Services, or from external providers, in relation to other entities’ legislation unless the ANAO receives legal advice indicating an ambiguity or other issue in their legislation that should be addressed by remedial action. The ANAO is required to advise the entity of the issue in that circumstance. Audit teams receiving legal advice in these circumstances shall consult ANAO Legal Services so advice can be properly assessed before providing any information to the entity.

Guidance/legislative requirements

Introduction to the Auditor-General Act 1997 (Cth)

2.20 An outline of these matters is set out below and staff should refer to the authorised version of the A-G Act available on the Federal Register of Legislation.

2.21 The A-G Act is structured in eight parts.

- Part 1 - Preliminary: Outlines the commencement of the A-G Act, its application to things outside Australia and its application to the Crown.

- Part 2 - Interpretation: Contains definitions of terms within the A-G Act.

- Part 3 - The Auditor-General: Creates the office of Auditor-General. The appointment and conditions of appointment of the Auditor-General are outlined in Schedule 1.

- Part 4 - Main functions and powers of the Auditor-General: Outlines the functions and powers of the Auditor-General.

- Part 5 - Information-gathering powers and secrecy: Outlines the Auditor-General’s information -gathering powers and confidentiality obligations.

- Part 6 - The Australian National Audit Office: Establishes the ANAO, staff of the ANAO and the function of the ANAO to assist the Auditor-General in performing the Auditor-General functions.

- Part 7 - Audit of the Australian National Audit Office: Establishes the Independent Auditor. The functions of the Independent Auditor are to audit the financial statements of the ANAO and to carry out performance audits of the ANAO. The appointment and conditions of appointment of the Independent Auditor are outlined in Schedule 2.

- Part 8 - Miscellaneous: Deals with miscellaneous matters such as a Commonwealth indemnity for people carrying out Auditor-General functions.

2.22 The A-G Act establishes the statutory office of Auditor-General for the Commonwealth (section 7). The Auditor-General is an independent officer of the Parliament (section 8). The ANAO is established by the A-G Act (section 38).

2.23 The Auditor-General has complete discretion in the performance or exercise of their functions or powers, limited only by the A-G Act and other laws of the Commonwealth (subsection 8(4)). The Auditor-General is not subject to direction in relation to:

- whether a particular audit is to be conducted; or

- the way a particular audit is to be conducted; or

- the priority to be given to any particular matter (section 8(4)).

2.24 The independence of the Auditor-General and ANAO officials is further protected by subsection 40(2) of the A-G Act, which provides that directions to ANAO staff relating to the performance of the Auditor-General’s functions may only be given by the Auditor-General or ANAO staff authorised to give such directions by the Auditor-General.

2.25 The Auditor-General’s main functions include financial statement audits (sections 11 and 12), annual performance statement audits (section 15), performance audits (sections 17, 18, 18A and 18B), and assurance reviews (section 19A).

2.26 The Auditor-General may conduct audits by arrangement (section 20). The Auditor-General may enter into an arrangement with any person or body to conduct a financial statements audit or performance audit of that body or to provide services that are commonly provided by auditors. The Auditor-General must not perform functions under section 20 for a purpose that is outside the Commonwealth’s legislative power. Further policy and guidance about section 20 audits is available in the section on Audits and Audit Related Services by Arrangement.

2.27 Additionally, the Auditor-General may provide advice or information relating to the Auditor-General’s responsibilities if, in the Auditor-General’s opinion, it is in the Commonwealth’s interest to provide the information or advice (section 23). The Auditor-General may at any time report to the Parliament or a Minister on any matter (sections 25 and 26).

2.28 The Auditor-General is required to set auditing standards. All staff must comply with the ANAO Auditing Standards determined by the Auditor-General when performing the auditing functions for which the standards are specified (section 24). The auditing standards applying to other work are a matter of policy. Further guidance is available in the section on Applicable Auditing Standards.

The Auditor-General’s information-gathering powers

2.29 To assist in fulfilling audit and assurance functions set out in the A-G Act, the Auditor-General has wide-ranging information-gathering powers under the A-G Act (sections 32 and 33). In practice, information is gathered through cooperation with audited entities and the information-gathering powers are treated by the ANAO as ‘reserve’ powers. These information-gathering powers are balanced by strict confidentiality provisions, which are explained in the section on Confidentiality of audit evidence. ANAO Legal Services can provide further guidance on section 32 powers.

2.30 Section 32 provides that the Auditor-General may, by written notice, direct a person to provide the Auditor-General with any information that the Auditor-General requires, or to produce to the Auditor-General any documents in the custody or under the control of the person (paragraphs 32(1)(a) and 32(1)(c)). Further, the Auditor-General may, by written notice, direct a person to attend and give evidence before the Auditor-General or an authorised official (paragraph 32(1)(b)).3

2.31 The Auditor-General may direct that the information or answers to questions be given either orally or in writing, or that the information or answers to questions be verified or given on oath or affirmation. The oath or affirmation is an oath or affirmation that the information or evidence that the person will give will be true and is administered by the Auditor-General or an authorised official.

2.32 Self-incrimination cannot be used as a reason by a person to refuse to supply information (section 35). Penalty provisions exist for non-compliance.

2.33 These powers apply to any person and therefore extend to Ministers, members of Parliament and their staff. In practice, the principal focus of audit and assurance work will be on Ministers and their staff undertaking executive government functions. Significant care is taken by the Auditor‐General to ensure that any section 32 direction does not interfere with the proceedings of Parliament. Relevant considerations including the timing of an interview (to have regard to sitting days) and the location of an interview conducted under oath (to ensure it is outside the parliamentary precincts).

2.34 The nature of the information collected and how it is reported must also be considered. The Auditor-General’s information‐gathering powers are limited by laws relating to the powers, privileges and immunities of the Parliament, its members and committees (paragraph 30(1)(a)). Typically, information‐gathering conducted during an audit is focused on the entity whose activities are under review. In some audits, information gathering may also extend to relevant Ministers’ offices where information relating to the activities of the executive government may be held. The information sought by the ANAO tends to relate to Ministerial decisions or actions in the conduct of resource management activities such as procurement and grants administration but is not necessarily limited to this type of information.

2.35 The power of the Auditor-General or an authorised official to access premises is in section 33. Section 33 provides that the Auditor-General or an authorised official may, at all reasonable times, enter and remain on any premises occupied by the Commonwealth, a corporate Commonwealth entity, a Commonwealth company or a Commonwealth partner, and is entitled to full and free access at all reasonable times to any documents or other property, and may examine, make copies of or take extracts from any document. ANAO auditors carry a written authority, signed by the Auditor-General in the form of authorised official cards.

2.36 The Auditor-General’s preference, and long-standing practice, is for the ANAO to obtain audit evidence through cooperation with audited entities. Cooperative information-gathering means that the audit team and the audited entity cooperate to ensure that the audit team receives all of the information that is required in a timely manner.4 When auditing cooperatively, the information-gathering powers in the A-G Act are either not exercised, or are only exercised, including at the request of audited entities, to avoid a particular legal or other impediment such as a statutory secrecy provision.

2.37 Where there is a genuine legal impediment preventing an audited entity from providing audit evidence, the Audit Manager or Engagement Executive should engage with the audited entity to clarify the impediment and if necessary seek GED agreement to either request that the Auditor-General consider using section 32 to direct that the information be provided, or that an authorised official will attend the audited entity’s premises and access information using section 33.

2.38 If an entity or person is unwilling to cooperate to provide information or wishes to impose conditions on providing information, the issue should be first escalated to the Engagement Executive. Engagement Executives should not agree to any conditions that could impact on the Auditor-General’s independence and mandate such as:

- non-disclosure agreements or conditions preventing the ANAO from using information in an audit report;

- agreements that the ANAO will not copy or remove documents from audited entity premises;

- requirements to complete the audited entity’s pre-employment checks; and

- requirements to attend the audited entity’s mandatory corporate training ordinarily required for the entity’s officials.

2.39 Such requirements may be included in sign-in documentation at entity premises. ANAO personnel should not sign, or should amend, any sign-in documentation that purports to limit ANAO access powers.

2.40 Issues that cannot be resolved are to be escalated to GED level to consider the ANAO’s options, which may include consideration of whether information can be taken using section 33 or whether it will be necessary to request that the Auditor-General consider issuing a section 32 Notice.

2.41 There may also be situations where the Auditor-General determines that it is appropriate and necessary to obtain verbal interview evidence under oath to support and corroborate other evidence. More detailed guidance on the conduct of judicial proceedings is available from ANAO Legal Services.5

Confidentiality of audit evidence

2.42 If a person has obtained information in the course of performing an Auditor-General function, the A-G Act requires that they not disclose the information except in the course of performing an Auditor-General function (see subsection 36(1)).

2.43 The A-G Act also provides for circumstances where confidentiality obligations apply to any person (subsection 36(3)). The A-G Act imposes confidentiality obligations on personnel of an audited entity or any other persons who receive ANAO report preparation papers (RPPs), proposed section 19 audit report(s) or extracts of these.

2.44 Section 23A also allows a person performing an Auditor-General function to provide information to a person to assist in conducting a performance audit or assurance review and for this information to be protected by section 36(2B).

2.45 Under the A-G Act, a person who receives a copy of a proposed or any other report (including drafts) created for the purposes of preparing a proposed report, or any extracts of these, must not disclose any information from that report (subsection 36(3)). Subsection 36(4) provides that the Auditor-General may consent to a disclosure which would otherwise be prohibited by subsection 36(3).

2.46 The Auditor-General may disclose particular information to the Commissioner of the Australian Federal Police if the Auditor-General is of the opinion that the disclosure is in the public interest (subsection 36(2)).

Sensitive information not to be included in public reports

2.47 The Auditor-General must not include particular information in a public report if the Auditor-General is of the opinion that disclosure of the information would be contrary to the public interest for specified reasons (paragraph 37(1)(a)).

2.48 The Auditor-General may consider that disclosure of information would be contrary to the public interest for the following reasons specified in the A-G Act (subsection 37(2)):

- it would prejudice the security, defence or international relations of the Commonwealth;

- it would involve the disclosure of deliberations or decisions of the Cabinet or of a Committee of the Cabinet;

- it would prejudice relations between the Commonwealth and a State;

- it would divulge any information or matter that was communicated in confidence by the Commonwealth to a State, or by a State to the Commonwealth;

- it would unfairly prejudice the commercial interests of any body or person;

- any other reason that could form the basis for a claim by the Crown in right of the Commonwealth in a judicial proceeding that the information should not be disclosed.

Application of other relevant legislation

2.49 The Parliamentary Privileges Act 1987 confers special legal rights and immunities which apply to each House of Parliament, its committees and members. Parliamentary privilege applies to exclude ‘proceedings in parliament’ from legal action. Parliamentary privilege applies to certain material relating to ANAO reports prepared for a parliamentary purpose:

- all Auditor-General reports tabled in the Parliament;

- draft Auditor-General reports — privilege is not waived by the fact that a draft report is provided under embargo to an entity or entities before tabling; and

- (c) ANAO working papers relating to a report, report preparation papers (including extracts), proposed section 19 reports (including extracts), and draft management reports created during an audit. 6

2.50 The Legal Services Directions 2017 (Directions) create obligations on non-corporate Commonwealth entities to share and consult with other entities when obtaining legal advice in relation to legislation administered by an entity. Paragraph 10 of the Directions provide an entity must have a:

- reasonable opportunity to consult on the proposal to seek advice;

- a copy of the request for advice;

- a reasonable opportunity to consult on a matter prior to the advice being finalised; and

- a copy of the advice.

2.51 Audit team consultation with ANAO Legal Services, in relation to legal advice on entity administered legislation and to the A-G Act, is a requirement to ensure that the consultation requirements of the Directions are complied with by the ANAO and by other entities.

2.52 The Auditor-General is exempt from the application of the Freedom of Information Act 1982 (FOI Act). The release under FOI of information created by another entity, which was obtained by the ANAO for an audit function, is usually a matter for the entity that created the records.

2.53 The Auditor-General is exempt from the Privacy Act 1988, including from the application of the Australian Privacy Principles (APPs). As discussed, the ANAO must observe the strict confidentiality requirements of the Auditor-General Act 1997.

2.54 The National Anti-Corruption Commission (NACC) operates under the National Anti-Corruption Commission Act 2022. The NACC is an independent Commonwealth agency which detects, investigates and reports on serious or systemic corruption in the Commonwealth public sector. Guidance on Engagement with the National Anti-Corruption Commission is available for ANAO staff and contractors.

Statutory whistleblowing regimes under the Public Interest Disclosure Act 2013 and the Corporations Act 2001

2.55 The Public Interest Disclosure Act 2013 (PID Act), Corporations Act 2001 and Taxation Administration Act 1953 (Tax Act) contain whistleblower regimes which on occasion may impact on audit processes. The Corporations Act whistleblower regime and the Tax Act regime may apply to entities being audited, where ANAO staff may become aware of non-compliance when auditing.

2.56 The PID Act is designed to enable public officials who discover wrongdoing within the Commonwealth public sector to raise their concerns. The primary mechanism to achieve this is by protecting public officials from reprisal action to encourage public officials to report suspected wrongdoing.

2.57 The operation of the PID Act does not impact the way the ANAO conducts its auditing and related responsibilities that are governed by the A-G Act. In particular, during the performance of an Auditor-General function, where matters such as breaches of legislation and deficiencies in aspects of public administration are identified they should be reported to a supervisor. The ANAO’s audit policies, procedures and practices continue to apply including those procedures set out in this audit manual. All staff must also continue to comply with the confidentiality and other provisions of the A-G Act. Reporting of disclosable conduct and relevant disclosure processes outlined in the PID Act are separate from, and should not impact directly on, the way ANAO staff perform an Auditor-General function.

2.58 In rare situations, auditors may require information from an audited entity about a public interest disclosure involving that entity. The information-gathering power in section 32 of the A-G Act prevails over the PID Act. However, the A-G Act will only prevail if section 32 is used. For this reason, the information-gathering powers in the A-G Act should be used if an auditor requires information that relates to a public interest disclosure. ANAO Legal Services can help with discussing these types of issues with the audited entity.

2.59 The Corporations Act whistleblower regime provides protection to eligible whistleblowers in companies who disclose misconduct in the Commonwealth company to ANAO auditors. The information-gathering power in section 32 of the A-G Act prevails over the Corporations Act (and the Tax Act). However, the A-G Act will only prevail if section 32 is used. The information-gathering powers in the A-G Act should be used if an auditor requires information in relation to a whistleblower disclosure. ANAO Legal Services can help with discussing these types of issues with the audited corporation.

Legal professional privilege

2.60 Legal professional privilege is a rule of law that protects the confidentiality of certain communications between legal advisers and their clients. Legal professional privilege applies to a communication where the dominant purpose of the communication is to provide legal advice to the client.

2.61 Legal professional privilege cannot be claimed as the basis to refuse access to information for audit purposes where the formal information-gathering powers (sections 32 and 33) are used. The Auditor-General’s formal information-gathering powers are not limited by any rule of law relating to legal professional privilege or any other privilege, or the public interest, in relation to the disclosure of information or the production of documents (paragraph 30(1)(b)(ii)).

2.62 Where otherwise privileged information is disclosed to the ANAO under sections 32 or 33, that disclosure does not mean that legal privilege or any other privilege has been waived. Additional information on legal professional privilege is available from ANAO Legal Services.

The work of the ANAO

2.63 It is important that all audit staff and contractors understand the basis in law for each engagement they are to undertake. All audits must be undertaken with the appropriate audit delegation. Section 55 of the A-G Act provides that the Commonwealth must indemnify a person for any liability that the person incurs for an act or omission of the person in the course of performing an Auditor-General function. However, the indemnity does not apply if the liability arose from an act or omission in bad faith. There is a risk that an auditor who does not hold the appropriate delegation or operates outside the scope of the relevant delegation, cannot rely on the indemnity in section 55.

2.64 Financial statements audits, performance audits, performance statements audits and other assurance reviews must be carried out consistent with the Auditor-General’s mandate having regard to any exclusions relating to particular persons or bodies. The Auditor-General is responsible for financial, performance audits and assurance reviews of all Commonwealth entities, companies and subsidiaries. Performance audits and an audit of performance measures of Government Business Enterprises (GBEs) can only be undertaken if they are requested by the JCPAA (subsection 17(2)). In addition, a ‘follow the money’ performance audit of a Commonwealth partner that is part of, or controlled by, a state or territory government cannot be undertaken unless it is requested by the responsible minister or the JCPAA (paragraph 18B (1)(a)).

2.65 Annual financial statements audits are conducted under Part 4, Division 1 of the A-G Act, which provides for the annual financial statements’ audits of:

- Commonwealth entities consistent with the Public Governance, Performance and Accountability Act 2013 (PGPA Act) (subsection 11(a));

- Commonwealth companies consistent with the PGPA Act (subsection 11(b));

- subsidiaries of corporate Commonwealth entities and Commonwealth companies consistent with the PGPA Act (subsection 11(c)); and

- annual consolidated financial statements of the Commonwealth (section 12).

2.66 Financial statements audits can also be undertaken under other legislation. The Auditor-General’s functions include any functions given to the Auditor-General by any other Act (section 22). For example, the authority for the audit of the financial statements of the High Court is section 47 of the High Court of Australia Act 1979.

2.67 For audits conducted under the authority of an Act other than the A-G Act or the PGPA Act, there may be additional requirements under that Act (e.g. specific provisions in the particular Act requiring a report to a Minister, typically the Minister responsible for the particular Act). For example, subsection 43(1) of the High Court Act requires the Auditor-General to inspect and audit the accounts and records of the Court and under subsection 43(3), to report the results to the Attorney-General. The High Court Act also requires a report to the Attorney-General on the results of the financial statements audit under section 47.

2.68 Regular reports to Ministers on the results of interim and final financial statements audit work are provided under subsection 26(2) of the A-G Act, which provides that the Auditor-General may, at any time, give a report to any Minister on any matter. Reports to the Parliament on the results of interim and final financial statements audit work are provided under the authority of subsection 25(1), which provides that the Auditor-General may at any time cause a report to be tabled in either House of the Parliament on any matter.

2.69 There are other provisions dealing with situations where a report to a Minister (other than the audit report on the financial statements) must be provided. Subsection 26(1) of the A-G Act provides that the Auditor-General must bring to the attention of the responsible Minister any important matter that comes to the attention of the Auditor-General while conducting an audit referred to in Division 1 or performing functions as an auditor under the Corporations Act 2001. For this purpose, the Auditor-General decides what is an ‘important matter’.

2.70 Persons performing a financial statements audit under section 49 of the PGPA Act (the Annual consolidated financial statements of the Commonwealth) are required by the A-G Act to comply with the ANAO auditing standards. Standards applying to other work (audits or services by arrangement or audits under Acts other than the A-G Act) may not be required by law and are a matter of ANAO policy.

2.71 Performance audits are conducted under sections 17, 18, 18A and 18B of the A-G Act. Section 17 refers to performance audits of a single Commonwealth entity, Commonwealth company or a subsidiary of a corporate Commonwealth entity or a Commonwealth company. Section 18 refers to general performance audits, which may take the form of cross-entity audits or multi-entity audits, which are conducted to review a particular aspect of Commonwealth public sector operations across more than one entity. Section 18A refers to auditing of the appropriateness of entity performance measures and entity reporting against those measures. Section 18B refers to the conduct of a performance audit of a Commonwealth partner. Other sections in the A-G Act refer to performance statement audits (sections 15), assurance reviews (section 19A), priority assurance reviews (subsection 19A (5)) and audits by arrangement (section 20).

2.72 The Auditor-General’s functions and mandate do not extend to examining and reporting on the appropriateness of government policy. This differs from reviewing and reporting on:

- the timeliness and evidence base of policy advice provided by entities to government to help inform the development and implementation of government policy; or

- policy settings or guidance relating to implementation of the PGPA Act and Rule, the framework established under the Public Service Act 1999, and governance within the Australian public sector and audited entities.

2.73 In assessing the proper use of resources by entities, the Auditor-General has regard to agency advice provided to government in the context of designing, establishing and implementing policies and programs, and assesses whether the intended outcomes of government policies and programs are achieved.

2.74 The Auditor-General cannot audit the performance of Ministers of State about the exercise of their constitutional duties. This prohibition extends to judicial and quasi-judicial officers and Royal Commissioners about performing their statutory duties but may allow examination where the duties involve the management of an entity.7

2.75 The Auditor-General can audit the functions of statutory office holders who have administrative functions in addition to their statutory functions. When conducting audits under sections 17 or 18, the Auditor-General’s mandate extends to the actions of Ministers who discharge responsibilities under specific legislation relating to the subject matter of each audit. For example, the administrative function of grant approval or the approval of proposed expenditure by a Minister under section 71 of the PGPA Act.8

Relationship with the Parliament and the JCPAA

2.76 The Auditor-General is an independent officer of the Parliament (subsection 8(1)). The ANAO’s primary relationship is with the Parliament, and the Auditor-General and the ANAO support the work of Parliament and its committees by providing independent reporting, assurance, and assistance. Assistance can take a number of forms, including the provision of ANAO submissions, testimony and options to parliamentary committees.

2.77 Reporting requirements set out in the A-G Act are geared towards the presentation, for tabling, of independent public reports in the Parliament, for the benefit of all parliamentarians. Parliamentarians are considered to be the principal users of ANAO reports. The A-G Act provides that audit reports be tabled in the Parliament, except for reports on assurance reviews under subsection 19A(4) of the A-G Act.9

2.78 Public reporting has two main purposes. Transparency supports entity accountability to the Parliament as a whole and through it to the community. Public reporting is also a means of informing the public sector and others of ANAO findings and contributes to improved public sector performance.

2.79 The JCPAA is a joint statutory committee of the Parliament that has a special relationship with the ANAO. The JCPAA is formed under the Public Accounts and Audit Committee Act 1951 (PAAC Act) and is empowered to scrutinise the moneys spent by Commonwealth entities from funds appropriated to them.

2.80 The duties of the JCPAAs are outlined in section 8 of the PAAC Act, and include to:

- examine all reports of the Auditor-General (including reports of the results of performance audits) (subsection 8(c));

- consider the operations and resources of the ANAO and the reports of the ANAO’s Independent Auditor (subsection 8(g)) and to report to both Houses of the Parliament on any matters arising from this consideration (subsection 8(h));

- report to both Houses of the Parliament on the performance of the ANAO at any time (subsection8(i));

- consider the ANAO budget (subsection 8(j));

- consider the level of fees determined by the Auditor-General under subsection 16(1) of the A-G Act (subsection 8(ka)); and

- determine the audit priorities of the Parliament for audits of the ANAO by the Independent Auditor (subsection 8(n)).

2.81 Other Parliamentary Committees, particularly the Senate Finance and Public Administration Committee, also review ANAO audit reports and conduct enquiries that draw on the ANAO’s work and scrutinise the ANAO’s administration.

Independent auditor

2.82 Part 7 of the A-G Act provides for the appointment of an Independent Auditor for the ANAO. The Independent Auditor can undertake both financial and performance audits of the ANAO and has powers and functions similar to those provided to the Auditor-General under the A-G Act. Reports of audits undertaken by the Independent Auditor must be tabled in the Parliament and the JCPAA can review these reports.

Applicable auditing standards

Background

2.83 The ANAO Auditing Standards set by the Auditor-General under section 24 of the A-G Act must be applied by all persons performing the Auditor-General functions specified in that section of the A-G Act.

2.84 These functions include:

- auditing of the annual financial statements of:

- Commonwealth entities and Commonwealth companies consistent with the PGPA Act,

- subsidiaries of Commonwealth entities and Commonwealth companies consistent with the PGPA Act; and

- the Commonwealth under section 49 of the PGPA Act (Commonwealth consolidated financial statements);

- auditing of annual performance statements of Commonwealth entities consistent with the PGPA Act;

- performance audits of Commonwealth entities, Commonwealth companies and subsidiaries and Commonwealth partners;

- general performance audits under section 18 of the A-G Act;

- auditing of performance measures under section 18A of the A-G Act; and

- assurance reviews of Commonwealth entities, Commonwealth companies and subsidiaries of a corporate Commonwealth entity or a Commonwealth company.

2.85 This Manual (at paragraph 2.86) mandates that the ANAO Auditing Standards will apply to all assurance engagements conducted by the ANAO despite the fact that section 24 of the A-G Act does not require the ANAO Auditing Standards to apply to audits conducted under other Acts (except the annual audit of the Commonwealth Financial Statements under the PGPA Act) or audit-related services undertaken by arrangement under section 20.

Policy

2.86 Unless otherwise determined by the Auditor-General, the ANAO Auditing Standards shall apply to all ANAO assurance engagements, including those within the scope of section 24 of the A-G Act as well as those:

- authorised by section 22 of the A-G Act (a function given to the Auditor-General by an Act other than the PGPA Act); or

- entered into consistent with section 20 of the A-G Act (by arrangement).

2.87 The engagement letter shall identify the auditing standards that apply.

Guidance

2.88 The ANAO Auditing Standards set by the Auditor-General are publicly available on the Federal Register of Legislation.

2.89 It is ANAO practice to incorporate into the ANAO Auditing Standards, by reference, the standards made by the Australian Auditing and Assurance Standards Board (AUASB). The only constraint on the application of AUASB standards is that should an AUASB standard(s) conflict with a legal requirement, the legal requirements prevail.10

2.90 Some Commonwealth entities are audited under provisions in Acts other than Part 4 Division 1 of the A-G Act and are not therefore within the scope of the section 24 Standards. Nevertheless, it is appropriate for such bodies to be audited under the ANAO Auditing Standards. For example, the High Court of Australia is not a Commonwealth entity (refer to subsection 10(2) of the PGPA Act). The audit requirements are in the High Court Act 1979.

2.91 Some ANAO engagements are undertaken by arrangement under section 20 of the A-G Act. Such an engagement may be with an Australian body not wholly within the Commonwealth’s jurisdiction (for example, a body set up jointly by the Commonwealth and State Governments) or with an international or foreign body.

Relationship between the Public Governance, Performance and Accountability Act 2013 and the Corporations Act 2001

Background

2.92 Section 11 of the A-G Act states that the Auditor-General’s functions include auditing the financial statements of:

- Commonwealth entities;

- Commonwealth companies; and

- subsidiaries of corporate Commonwealth entities and Commonwealth companies.

2.93 Section 21 of the A-G Act allows the Auditor-General to accept appointment as an auditor of Commonwealth companies and Commonwealth subsidiaries under the Corporations Act 2001 (Corporations Act).

2.94 A Commonwealth company or a Commonwealth subsidiary may choose not to appoint the Auditor-General as their auditor under the provisions of the Corporations Act. However, the Auditor-General is still required by section 11 of the A-G Act and sections 44(3), 97(3) and 99(3) of the PGPA Act to audit their financial statements in addition to the audit done by the appointed auditor under the Corporations Act.

Policy

2.95 An Engagement Executive shall endeavour to have the Auditor-General appointed as auditor under the Corporations Act of all entities captured by section 21 of the A-G Act which are within the Engagement Executive’s area of responsibility.

2.96 Where an entity seeks to appoint another auditor under the Corporations Act, the Auditor-General shall be notified immediately.

Guidance

Commonwealth Entities

2.97 Audit teams performing engagements consistent with the Corporations Act need to be aware of the relationship between the Corporations Act, the PGPA Act and its impact on the Auditor-General’s mandate about companies controlled by the Commonwealth.

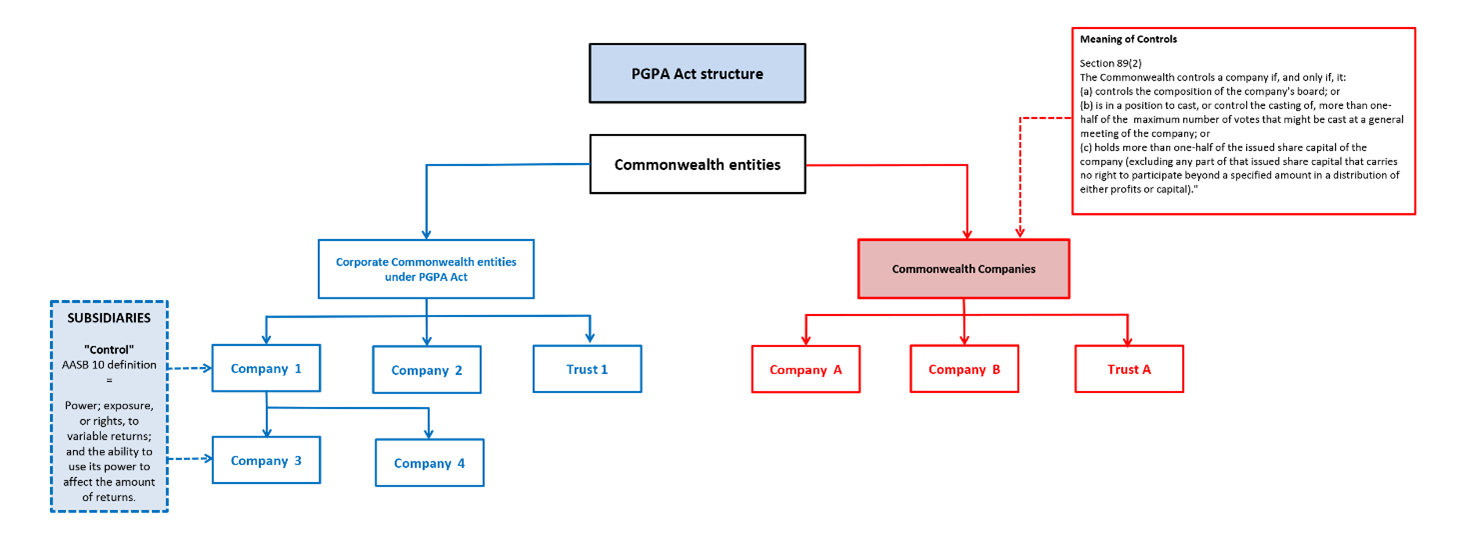

2.98 As defined in section 10 of the PGPA Act, Commonwealth entities include: Departments of State; Parliamentary Departments; listed entities; and bodies corporate.11 Commonwealth companies are not Commonwealth entities. The High Court and the Future Fund Board of Guardians are also excluded from the definition of Commonwealth entities, under section 10 of the PGPA Act (refer to Diagram 2 PGPA Act structure).

2.99 There are two types of Commonwealth entity:

- corporate Commonwealth entities – a Commonwealth entity that is a body corporate; and

- non-corporate Commonwealth entities – a Commonwealth entity that is not a body corporate.

2.100 Corporate Commonwealth entities are legally separate from the Commonwealth, whereas non-corporate Commonwealth entities are legally part of the Commonwealth. The Department of Finance maintains the Flipchart of Commonwealth entities and companies which provides a reference of all corporate and non-corporate Commonwealth entities and companies

2.101 Most bodies that meet the definition of bodies corporate are incorporated for a public purpose by an Act and hold money on their own account. Whether a Commonwealth entity is a body corporate can usually be determined from the provisions in the enabling legislation forming the body. Money is taken to be held on a corporate Commonwealth entity’s own account unless it is relevant money as defined the PGPA Act.12 The Finance Minister can make rules in relation to establishing new corporate Commonwealth entities under section 87 of the PGPA Act.

2.102 There are a small number of entities that have a body corporate status but are prescribed in the enabling legislation as non-corporate Commonwealth entities. For example, the Australian Competition and Consumer Commission, Australian Prudential Regulation Authority, and Australian Securities and Investment Commission.

2.103 There are also a small number of bodies which are corporate Commonwealth entities but whose enabling legislation states that the PGPA Act applies but only in certain respects. For example, section 4A of the Australian National University Act 1991 modifies the application of the PGPA Act to the Australian National University.

The particular definitions of ‘Commonwealth ‘company’ and ‘subsidiary’ in the PGPA Act

2.104 Subsection 89(1) of the PGPA Act defines a ‘Commonwealth company’ as a Corporations Act company that the Commonwealth controls. However, an entity that is controlled by a corporate Commonwealth entity or a Commonwealth company is referred to in the Act as a ‘subsidiary’, even if it is a company under the Corporations Act.

2.105 The distinction is important because the provisions of the PGPA Act applying to Commonwealth companies are sometimes different to those applying to subsidiaries.

Application of the Corporations Act

2.106 The Corporations Act applies under its own terms to Commonwealth companies and Commonwealth subsidiaries;13 that is, nothing in the PGPA Act detracts from the application of the Corporations Act.

2.107 There are provisions in the Corporations Act which allow certain companies not to prepare annual financial statements. A Commonwealth subsidiary that meets those requirements can use them not to report under the Corporations Act. However, subsection 97(1) of the PGPA Act requires all Commonwealth companies to give to their responsible Minister a copy of the financial report, directors’ report and auditor’s report that the company would be required to prepare if they were a public company, even if they are exempt under the Corporations Act from preparing annual financial statements.

The nature and application of the Auditor-General’s mandate in respect of Commonwealth companies and Commonwealth subsidiaries

2.108 An exception to the Auditor-General’s legislative mandate for the audit of the financial statements of a subsidiary exists when the subsidiary is incorporated or formed in a place outside Australia and certain other conditions are met (refer subsections 44(3) and 99(3) of the PGPA Act).

Diagram 2: PGPA Act structure

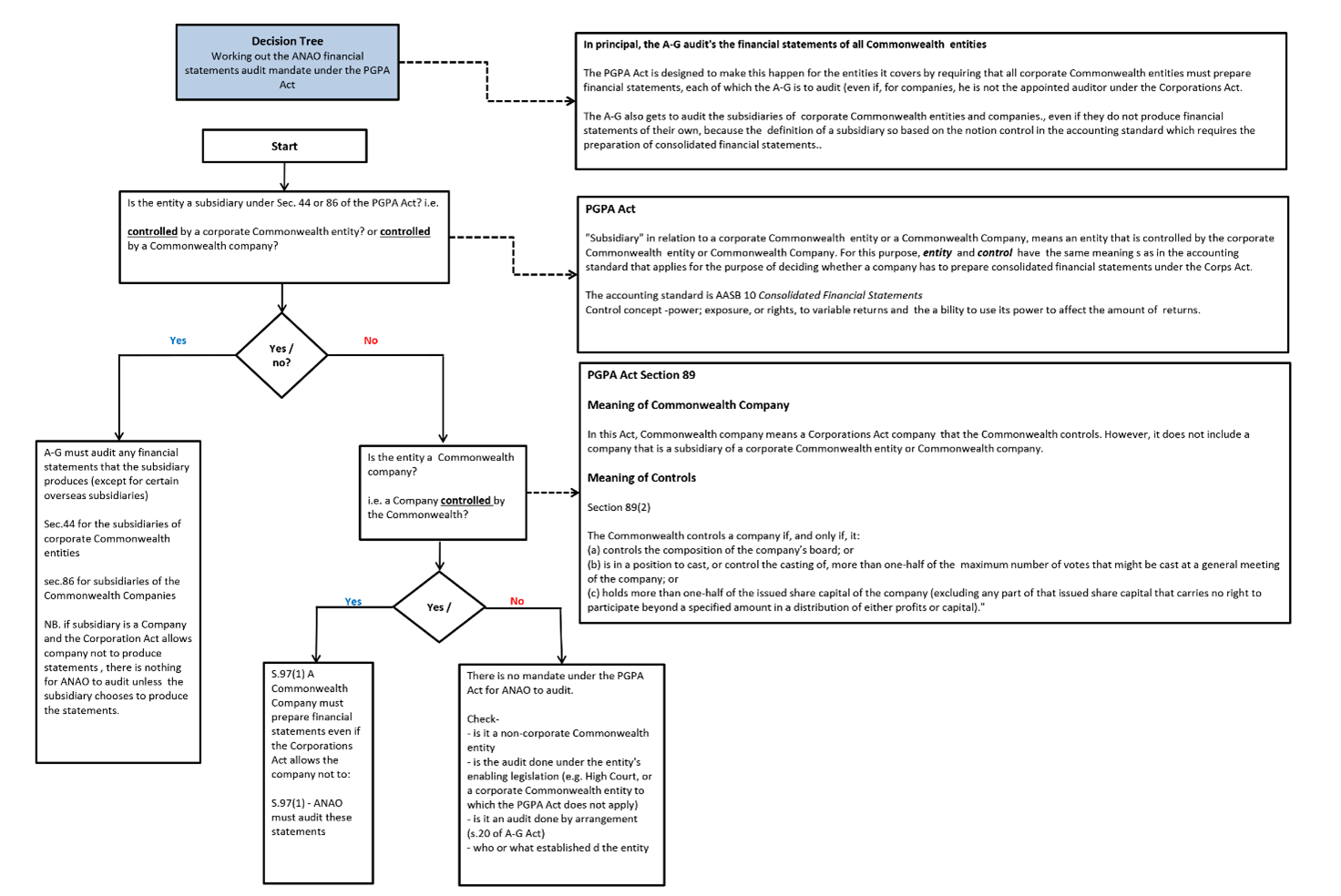

Diagram 3: Decision Tree - ANAO financial statements audit mandate under the PGPA Act

Audits and Audit Related Services by arrangement under section 20 of the A-G Act

Background

2.109 The Auditor-General determines whether to accept or continue an audit or audit related service by arrangement under section 20.

2.110 This policy deals with the matters to be considered when making a recommendation whether to accept a request to undertake an audit, or audit related service by arrangement, under section 20 of the A-G Act.

2.111 An audit by arrangement is an assurance-related service performed by the ANAO of a kind normally performed by auditors (including financial statement and performance audits) that is conducted under an agreement between the ANAO and another party.

Policy

2.112 The responsible GED shall make a written recommendation to the Auditor-General covering, at a minimum:

- the name of the organisation and the position of the person making the request;

- the reason for requesting the engagement;

- the nature, engagement risk rating14 and duration of the proposed engagement;

- whether, and on what terms, to accept the request, with supporting rationale;

- the proposed fee to be charged for the engagement, with supporting basis. For ongoing engagements, propose the arrangement for determining fees to be charged in future periods;

- the ANAO has the competence and capabilities, including available time and resources to conduct the engagement; and

- how any significant matters identified from the considerations in the guidance to this policy will be managed.

2.113 The letter of engagement shall reflect the specific terms and conditions approved by the Auditor-General, including the auditing standards that the engagement will be performed under.

2.114 The Auditor-General’s information-gathering powers under sections 32 and section 33 are not available for audits by arrangements under section 20. The Auditor-General’s ability to get information shall be agreed in the engagement letter.

2.115 An arrangement cannot be entered into unless the person responsible for the subject matter of the proposed engagement personally acknowledges the terms of the engagement in writing.

Managing the engagement

2.116 If information is obtained that would have caused the responsible GED to recommend declining the engagement, had that information been available earlier, the responsible Engagement Executive shall communicate that information promptly to the Auditor-General with a recommended course of action.

2.117 Subsection 20(2) provides for the Auditor-General to charge fees for an engagement entered into under arrangement. The Auditor-General shall determine the fee at the time of entering into the arrangement. If the engagement by arrangement covers more than one period, the recommendation shall propose the arrangement for determining the fees to be charged for future periods.

2.118 Information obtained when deciding whether to accept or continue a section 20 engagement may be relevant to identifying risks of material misstatement. If relevant, the Engagement Executive shall ensure the information is communicated to the audit team for inclusion in risk assessment procedures.

2.119 If the Auditor-General determines that it is appropriate to withdraw from an engagement, the responsible Engagement Executive shall discuss the withdrawal with the appropriate level of the entity’s management and those charged with governance (TCWG). The discussion shall include the reasons for withdrawal, and consideration of whether the withdrawal should be reported to regulatory authorities.

Guidance

Approving the engagement

2.120 Following a proposal or request to enter into an audit or audit related service by arrangement, the FSASG/PASG GED should consider and document the following in forming a view as to whether to recommend the request:

- Is the proposed arrangement a mandated Auditor-General function?

- Does the proposed arrangement involve the Auditor-General performing a function that is outside of the Commonwealth’s legislative power?

- Will the preconditions for the engagement be met, as required by the ANAO Auditing Standards?

- Who within the organisation is responsible for the preparation of the report? If the responsibility is not at the accountable authority or Director level, is the signatory appropriate and is there appropriate governance over the report?

- Who are the intended users of the ANAO report?

- Does the proposed arrangement provide the Auditor-General with the ability to report to the responsible Minister and Parliament on the results of the audit?

- Will the ANAO have satisfactory access to information, premises and relevant individuals?

- Are there any questions or concerns over the integrity of the client (key management and TCWG)?

- Will the ANAO have the competence and capabilities, including available time and resources to conduct the engagement?

- Does the engagement pose any risks to compliance with ethical requirements?

- Are there any possible legislative or public interest considerations that impact the recommendation?

Legislative requirements

2.121 Under subsection 20(1) of the A-G Act the Auditor-General may enter into an arrangement with any person or body to:

- audit financial statements of the person or body; or

- conduct a performance audit of the person or body; or

- provide services to the person or body that are of a kind commonly performed by auditors.

2.122 The Auditor-General does not delegate the power to enter into arrangements under section 20.

2.123 The Explanatory Memorandum of the original Auditor-General Bill states that audits by arrangement under section 20 may include:

- audits of Commonwealth Corporations Act companies where the audit is not otherwise permitted or required under the A-G Act;

- audits of international organisations of which the Commonwealth is a member;

- provision of services normally performed by auditors and accounting firms including workers’ compensation certificates, comfort letters, investigating accountants’ reports and help in matters of financial administration; and

- audits of organisations or people who are the recipients of Commonwealth grants or benefits.

2.124 Section 20 allows the Auditor-General to undertake engagements outside of engagements otherwise mandated by the A-G Act or other legislation, but subsection 20(3) specifies that the Auditor-General must not perform functions for a purpose that is outside of the Commonwealth’s legislative power. The Commonwealth’s legislative powers are set out in section 51 of the Australian Constitution.

2.125 When forming the recommendation, if in doubt, the GED should consult with ANAO Legal Services to confirm that a particular matter falls within the Commonwealth’s legislative powers.

2.126 Subsection 20(4) allows the Auditor-General to enter into an arrangement with a GBE under section 20.

Duration

2.127 Requests to conduct engagements by arrangement may be for a specified time period or on an ongoing basis. The Auditor-General’s approval will cover the duration of the engagement as specified in the recommendation. If an approval is limited to a specific time period, an extension will require further approval from the Auditor-General.

Preconditions and acceptance and continuance

2.128 The preconditions for the engagement are specified in:

- ASA 210 for an audit of historical financial information;

- ASRE 2410 for a review of a financial report where the ANAO is also the auditor of the annual financial reports; and

- ASAE 3000 for assurance engagements other than audits or reviews of historical financial information. For performance audits, this is complemented by ASAE 3500.

2.129 Where information is obtained on an existing engagement that would have caused the GED to recommend declining the engagement, the following procedures should be undertaken:

- consider whether there is a professional, legal or regulatory requirement for the ANAO to continue the engagement, or public interest considerations;

- discuss with the appropriate level of the entity’s management and those charged with governance the appropriate action that the ANAO might take based on the relevant facts and circumstances; and

- document significant matters, consultations, conclusions and the basis for the conclusions.

Reporting powers

2.130 The Auditor-General has powers in sections 25 and 26 of the A-G Act to provide extra reports to responsible Ministers and the Parliament.

Responding to audit requests

Policy

2.131 Each audit request received from a parliamentarian or parliamentary committee shall be considered by the responsible GEDs and a recommendation shall be made to the Auditor-General who shall determine the course of action to be taken.

2.132 Once the course of action is determined, a response shall be provided to the requestor within 28 days of receipt of the request.

2.133 Each audit request received from community groups or individuals are provided to the ANAO’s annual audit work program team and considered in the development of the annual audit work program.

Guidance

2.134 From time-to-time, the Auditor-General receives an external request to examine a matter related to public administration. Such requests commonly originate from parliamentary committees, individual parliamentarians, community groups or individuals.

2.135 The available options for responding to a request for a performance audit from a parliamentarian or a parliamentary committee are:

- agree to undertake an audit of the matter(s) outlined in the request (objectives and scope of the audit should be expressed consistent with the ANAO’s mandate and policies, which may mean that the objectives and scope are different from that requested);

- agree to take the request into account in the conduct of an audit in progress or a planned audit;

- conduct an assurance review of the matters covered by the request. Such reviews can provide limited or reasonable assurance and do not constitute an audit;

- agree to inquire into the matters and respond by correspondence;

- agree to take the request into account in future planning for the ANAO’s work program; or

- take no further action.

2.136 Responses to audit requests from members and senators of Parliament are signed by the Auditor-General and published on the ANAO Website - Requests for Audits.

2.137 Where it is intended to proceed to the conduct of an audit or a review, the response should outline the proposed focus of the audit or review (the formal objectives will generally be determined at the time a plan is prepared and approved) and clearly indicate any matters raised in the original request that will not be within the scope of the proposed audit or review.

2.138 The ANAO’s annual audit work program team consider audit requests from community groups or individuals in the development of the annual audit work program.

2.139 Responses to audit requests from community groups or individuals are sent from Ag1@anao.gov.au, managed by the CMG External Relations, and notifying that the matters referred have been forwarded to our annual audit work program team for consideration.

Audit delegations and authorisations

Background

2.140 The A-G Act and other legislation specify the Auditor-General’s functions and powers. The Auditor-General may delegate, by written instrument, any of their powers or functions to an ANAO official (section 29). ANAO officials can only exercise these functions or powers if they have the appropriate delegation or authorisation.

Policy

2.141 ANAO audit personnel responsible for the performance of an Auditor-General function or power must ensure they have the correct formal delegation or authorisation to perform that function or power.

2.142 ANAO audit personnel must exercise the responsibilities of a delegation or authorisation consistent with any attached directions.

Guidance

2.143 Where the Auditor-General has delegated some of their functions and powers, the delegation of a function or power does not prevent the Auditor-General exercising the function or power personally.

2.144 The ANAO prepares instruments of authorisations in limited circumstances. An example is where the Auditor-General has specified ‘authorised officials’ under section 33 of the A-G Act to exercise access powers.

2.145 The Auditor-General has not delegated powers under section 32 (to obtain information by written notice) or section 37 (relating to the inclusion of sensitive information in reports) of the A-G Act.

2.146 Persons who are officials of the ANAO include the Auditor-General, ANAO staff, and persons engaged under contract to perform an Auditor-General function (subsection 38(3)).

2.147 The delegations made and authorisations given can be found on MyANAO via the Delegation and Authorisation Information Hub. The responsibility for maintaining the currency of delegations and authorisations on MyANAO rests with CMG, while responsibility for advising when the delegations and authorisations need to be updated rests with FSASG and PASG respectively.

Summary overview of audit delegations specific to ANAO personnel

2.148 The Auditor-General’s audit delegations (under the A-G Act unless otherwise indicated) to specified ANAO officials are listed below and can be found here: Delegations and Authorisations.

- Section 11 – to conduct and sign reports for audits of annual financial statements of Commonwealth entities, Commonwealth companies and subsidiaries in accordance with the PGPA Act.

- Section 15 – to conduct and sign reports for audits of annual performance statements of Commonwealth entities agreed to by the Auditor-General in accordance with the PGPA Act.

- Subsection 20(1) – to conduct and sign reports for arrangements agreed to by the Auditor-General to audit financial statements of a person or body; conduct a performance audit of the person or body; or provide services to the person or body that are of a kind commonly performed by auditors.

- Section 22 – all powers and functions of the Auditor-General under section 313 of the Bankruptcy Act 1965, and all powers and functions to conduct and sign financial statements audit reports under any other Commonwealth Act.

- Section 27 – to engage any person under contract to assist in the performance of any Auditor-General function.

2.149 These delegations are made subject to the general direction that in ‘exercising any power or function, a delegate must have due regard to ANAO and Services Group policies and procedures’.

Delegations and the Corporations Act 2001

2.150 The Auditor-General is a registered company auditor under subsection 1281(1) of the Corporations Act.

2.151 Subsection 1281(2) also deems a person to whom the Auditor-General delegates the function of conducting an audit or the power to conduct an audit, to be taken to be registered as a company auditor for the purposes of applying Chapter 2M to the audit. It is important to note that subsection 1281(2) is limited to Chapter 2M of the Corporations Act, and as such, for any audits performed outside of Chapter 2M (e.g. Chapter 7 audits of Regulated Funds and AFSL audits) only the Auditor-General is taken to be registered as auditor.

Appointment and resignation as auditor under the Corporations Act

Background

2.152 The appointment and resignation of auditors for companies is governed by Division 6 of Part 2M.4 of the Corporations Act.

2.153 The directors of a public company must appoint an auditor within one month after the day the company is registered, unless an auditor was appointed at a general meeting (section 327A).

2.154 The directors of a proprietary company may appoint an auditor for the company if an auditor has not been appointed by the company in a general meeting (section 325).

2.155 A company must not appoint an auditor unless the auditor has consented to appointment by written notice to the company, or the directors of the company, before the appointment is made (section 328A).

2.156 The Auditor-General may exercise their power under section 21 of the A-G Act to accept an appointment as auditor under the Corporations Act. This power shall not be delegated. The appointment shall be accepted in writing consistent with the requirements of the A-G Act.

Policy

2.157 Before recommending that the Auditor-General accept appointment as a company auditor under the Corporations Act, the Engagement Executive for the engagement shall ensure that the entity is captured by section 21 of the A-G Act.

2.158 When the audit of a company for which the Auditor-General is the appointed auditor under the Corporations Act ceases to be within the Auditor-General’s mandate, the Engagement Executive shall make the necessary arrangements to effect the Auditor-General’s resignation with effect at the time the mandate ceases. The Auditor-General’s resignation as appointed auditor shall be notified in writing, by the Auditor-General, consistent with the requirements of the Corporations Act.

2.159 Should it appear not to be possible for the Auditor-General to resign as company auditor at the time of loss of mandate, legal advice may be needed to protect the indemnity under section 55 and the Engagement Executive shall consult with ANAO Legal Services.

2.160 If it is not possible for the resignation to take effect at the time the mandate ceases, the Engagement Executive shall advise the Auditor-General promptly and shall consult with ANAO Legal Services as to the effect on the indemnity under section 55 of the A-G Act.

Guidance

Acceptance and resignation of appointment

2.161 Proforma letters for the request to appoint (to be sent by the company) and for the Auditor-General’s consent to act are available in TeamStore.

Conditions for resignation

2.162 The Auditor-General may act as an auditor under the Corporations Act only while the audit is within the Auditor-General’s mandate. If the Auditor-General were to operate outside their mandate, the indemnity provided by section 55 of the A-G Act would not operate.

2.163 An audit may come to fall outside the Auditor-General’s mandate for many reasons, such as the Commonwealth selling the company to a private investor.

Processes for resignation

2.164 Subdivision B of Division 6 of Part 2M.4, of the Corporations Act, deals with removal and resignation of company auditors. Some provisions differ according to whether the company is a public or proprietary company. Subsections 329(5) to (9) are especially relevant.

2.165 ASIC publishes Regulatory Guides (RGs) and other information relevant to the appointment and resignation of company auditors. RG 26 Resignation of auditors should be referred to.

2.166 Matters dealt with in legislation or in the RG include:

- the auditor stating reasons for resigning;

- the consent of ASIC to resignation;

- the date of effect of resignation, including at other than the company’s annual general meeting;

- the use of prescribed forms; and

- fees.

2.167 ASIC consent is not required for an auditor to resign from a proprietary company unless it holds an Australian Financial Services licence. For a proprietary company that does not hold such a licence, the auditor can resign by giving the company a notice of resignation. The company is then required to lodge a Form 315 Notification of resignation, removal or cessation of auditor (available from ASIC’s website) within 14 days after receiving the notice of resignation from the auditor.

Authority to charge fees

Policy

2.168 Fees for an ANAO engagement shall only be charged where legal authority to do so exists.

2.169 The Engagement Executive shall consider, at the time of first undertaking an engagement, whether authority exists for the ANAO to charge a fee. The authority for charging a fee shall be documented at that time.

2.170 Where the existence of authority to charge a fee is not clear, ANAO Legal Services shall be consulted.

Guidance

2.171 The ANAO may charge a fee for work that it is required to do by law only when the law expressly provides for a fee to be charged, or it is implied necessarily that a fee may be charged.

Fee charging under the Auditor-General Act

2.172 Section 14(1) of the A-G Act provides that:

A person or body (other than a non-corporate Commonwealth entity) whose annual financial statements are audited as mentioned in section 11 of the A-G Act; or subsection 30(3) of the Governance of Australian Government Superannuation Schemes Act 2011; is liable to pay audit fees for the audit, based on a scale of fees determined by the Auditor-General.15

2.173 Section 14 provides authority for the ANAO to charge audit fees for auditing the financial statements of corporate Commonwealth entities and their subsidiaries and Commonwealth companies and their subsidiaries consistent with the PGPA Act.

2.174 There is no authority under the A-G Act for the ANAO to charge fees for performance auditing or for auditing the financial statements of: non-corporate Commonwealth entities; or a corporate Commonwealth entity that was an Agency under the Financial Management and Accountability Act 1997 as at 30 June 2014, consistent with the Public Governance, Performance and Accountability (Consequential and Transitional Provisions) Act 2014 Schedule 4, Part 2 section 57(2). However, there are a small number of Commonwealth entities which are audited under their own legislation rather than consistent with the PGPA Act. The authority to charge a fee for the audit of their financial statements’ rests with their particular legislation (see below).

2.175 Section 16(1) of the A-G Act provides authority for the ANAO to charge audit fees for annual performance statement audits of corporate Commonwealth entities consistent with the PGPA Act.