Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

ANAO Audit Manual — PASG Specific

Please direct enquiries through our contact page.

The Performance Audit Services Group (PASG) volume of the ANAO Audit Manual applies to the performance audit activity performed by PASG in collaboration with the Systems Assurance and Data Analytics (SADA) group. Relevant policies and guidance from the PASG volume are also applied to assurance reviews performed by PASG. Policies and guidance in the PASG volume address the planning, execution and reporting stages of the performance audit process.

Engagement performance — general

Chapters 201 to 204

201. Contract out audits

Background

201.1 Under section 27 of the Auditor-General Act 1997 (Cth) (A-G Act), the Auditor-General, on behalf of the Commonwealth, may engage any person under contract to assist in the performance of any Auditor-General function.1 For various reasons, the ANAO engages contractors to undertake some performance audits or discrete parts of performance audits on his behalf.

Policy

201.2 Tenders and contracts for a performance audit or part of a performance audit shall require contractors to comply with the requirements of:

- the ANAO Auditing Standards;

- legislation or regulations relevant to the audit, including minimum security clearance requirements;

- APES 110 Code of Ethics for Professional Accountants (including Independence Standards) (APES 110), as supplemented by ANAO policy in relation to the provision of other services to ANAO auditees; and

- the ANAO Audit Manual.

201.3 The ANAO Engagement Executive is the ‘lead assurance practitioner’ for the purposes of the Standards on Assurance Engagements (ASAEs) and retains responsibility for the overall quality on the engagement. This includes responsibility for:

- the engagement being planned and performed (including appropriate direction and supervision) to comply with professional standards and applicable legal and regulatory requirements;

- review of audit work being performed in accordance with the ANAO Audit Manual and reviewing the engagement documentation on or before the date of the performance audit report;

- appropriate engagement documentation being maintained to provide evidence of achievement of the audit objectives, and that the engagement was performed in accordance with relevant ASAEs and relevant legal and regulatory requirements;

- appropriate consultation being undertaken by the engagement team on difficult or contentious matters;

- remaining alert for evidence of non-compliance with relevant ethical requirements by members of the engagement team; and

- considering the results of the ANAO’s monitoring procedures and whether deficiencies noted and communicated by PSG may affect the engagement.

201.4 Where an Engagement Quality Reviewer (EQR) is assigned to the engagement in accordance with ANAO Audit Manual – Shared Content, paragraph 8.44, the Engagement Executive shall take responsibility for discussing significant matters arising during the engagement with the EQR and shall not submit the final draft report to the Auditor-General for clearance until completion of that review.

201.5 The contractor is required to plan and conduct the engagement in accordance with the ANAO’s methodology for performance audits. This requires compliance with the ANAO Audit Manual and use of ANAO templates including for the Audit Work Plan (AWP), Progress Review briefings, report preparation papers, draft proposed report under section 19 of the A-G Act and final draft report.

201.6 The Engagement Executive shall make such enquiries and document their review of such work papers as is necessary so as to be satisfied that the quality management procedures applied to the audit are in accordance with the requirements of the contract, including:

- meeting ANAO Auditing Standards and ANAO Audit Manual;

- the use of contractor staff with appropriate competence, qualifications and experience.

201.7 For high-risk audits, the Engagement Executive’s involvement shall be extended with a greater involvement in audit planning and execution, more regular meetings with the contractor and auditee, and review of significant matters arising during the audit.

201.8 Prior to submitting the final draft report to the Auditor-General for clearance, the Engagement Executive shall be satisfied that the contractor’s work provides sufficient appropriate audit evidence to support the audit findings and conclusions and the subsequent release of the performance audit report. The contract engagement partner (or equivalent) shall also provide written sign off on the audit in accordance with the approved form Contractor’s Representation Letter, available to download from TeamStore.

201.9 Audit documentation shall be complete and ready for finalisation in accordance with ANAO Audit Manual – Shared content, paragraph 9.13. In order to facilitate this, the ANAO shall provide the contractor with access to the ANAO premises and secure access to the ANAO’s document management system (E-Hive and TeamMate).

201.10 The contractor shall be required to support the ANAO’s internal and external quality assurance processes by providing audit documentation and any additional information requested relating to both in progress and completed engagements in a timely manner.

Guidance

201.11 The mandatory requirements governing ANAO audits need to be made known to contractors via tender and contract documentation.

201.12 ANAO policy is to comply with the requirements of APES 110. Those requirements apply equally to contractors and their staff. ANAO policy also adds to these professional requirements; for example, ‘Provision of other services by ANAO Contractors to ANAO auditees’ includes additional prohibited services to the requirements of APES 110.

201.13 To help ensure contractors comply with ANAO Policy, paragraph 201.2 of this manual requires tenders and contracts for audit services to make provision for the ANAO Engagement Executive to make the contractor aware of policies and procedures the ANAO requires be followed on the audit. The procedural steps relevant to performance audits are included in the PASG Workflow, which contains corporate templates to be used during an audit.

201.14 The ANAO Engagement Executive is formally the ‘lead assurance practitioner’ under the ASAEs. In practice, when the ANAO contracts out an audit, or part of an audit, some of the duties of the lead assurance practitioner (e.g. supervising the conduct of fieldwork) may be fulfilled by the contactor partner (or equivalent).

201.15 In accordance with ASQM1, the ANAO’s review policies and procedures (including the ANAO Audit Manual and PASG Workflow) are determined on the basis that the work of less experienced team members is reviewed by more experienced team members.

201.16 The Engagement Executive shall comply with the requirement under the ANAO Auditing Standards to be satisfied that sufficient appropriate audit evidence has been obtained to support the conclusions reached and auditor’s report to be issued. The Engagement Executive’s review covers critical areas of judgement, especially those relating to difficult or contentious matters identified during the course of the engagement, significant risks and other areas the Engagement Executive has identified as important.

201.17 The audit contractor is responsible for ensuring that audit work undertaken on behalf of the Auditor-General is performed in accordance with professional standards and to have in place quality management policies and assurance procedures to be employed throughout the audit engagement.

201.18 Whereas financial audit work conducted by the Auditor-General is broadly similar to the assurance work performed by the external auditing profession in Australia, performance auditing is the almost exclusive domain of Auditors-General. While based upon the same assurance framework as compliance, controls and similar assurance work commonly performed by the private sector, there are extensive differences. The ANAO Engagement Executive should be conscious of their level of familiarity with the ANAO performance audit methodology in determining the extent of their involvement in the performance audit.

201.19 The expected milestone dates should be communicated to the contract partner at the commencement of the audit. Milestones usually include:

- preparation and approval of the AWP;

- entry meeting conducted with the auditee;

- regular progress review meetings with the relevant ANAO Engagement Executive during the period of fieldwork;

- progress review briefing to the ANAO Executive during the finalisation of fieldwork;

- provisions of draft report preparation papers to the ANAO for clearance prior to issuance of RPPs to auditee(s) for comment;

- exit meeting conducted with the auditee;

- preparation of a formal draft audit report (section 19 report) and workshop/clearance of the report with the ANAO Executive prior to issuance to auditee(s) for comment;

- amendment of the section 19 report (as appropriate) for auditee responses, followed by provision of a final draft report to the Auditor-General for consideration/clearance;

- the final performance audit report to be available for tabling date; and

- audit wrap-up and lessons learnt meeting.

202. Role and responsibilities of Group Executive Directors

Policy

202.1 The GED shall participate in key stages of the planning and delivery of performance audits including in the initial selection of audit topics and in progress reviews held during the conduct of an audit.

Guidance

202.2 The GEDs manage the ANAO’s Performance Audit Services Group (PASG) and engage in key elements of the conduct of a performance audit.

202.3 The strategic priorities of the GED are set out in the Service Group plan.

202.4 The procedural steps relevant to GEDs are included in the PASG Workflow, which contains corporate templates for staff to use during an audit.

202.5 For high-risk audits, the GED is expected to have greater involvement in audit planning and execution, and to review significant matters arising during the audit.

203. Roles and responsibilities of the Engagement Executive

Background

203.1 The Engagement Executive is the ‘lead assurance practitioner’ for the purposes of the Standards on Assurance Engagements. The Engagement Executive is the head of a single administrative Branch in the Service Group that is responsible for delivering multiple performance audits in a financial year that support the delivery of the ANAO’s Annual Audit Work Program.

Policy

203.2 The Engagement Executive shall take responsibility for the overall quality on the engagement, including:

- the engagement being planned, performed and documented in accordance with the ANAO Auditing Standards, this Manual any other relevant ANAO policy, legal and regulatory requirements;

- appropriate review of the engagement documentation before the date of the assurance report; and

- that appropriate consultation has been undertaken on difficult and contentious matters.

203.3 Where this Manual specifies a policy requirement, that policy does not require the Engagement Executive to be directly involved in the performance of that action unless the policy specifically requires the Engagement Executive to do so. However, as required by 203.2 above, the Engagement Executive retains overall responsibility that the audit has been conducted in accordance with this Manual. Further, as required by Chapter 8 of the Shared Volume of this Manual, the Engagement Executive also retains overall responsibility for suitable direction, review and supervision being provided to the members of the audit team performing these policy requirements.

Guidance

203.4 The responsibilities in the auditing standards which this policy places on Engagement Executives include the following:

- the overall quality on each audit engagement to which the Engagement Executive is assigned;

- through their actions and appropriate messages to the engagement team, the Engagement Executive should emphasise the importance of compliance with ANAO Auditing Standards and quality management policies and procedures. In addition, the engagement team should have the ability to raise concerns without fear of reprisals. Quality is essential in performing audit engagements and the overall quality of the audit will be helped by ensuring that the audit is performed in a manner consistent with ANAO standard methodology;

- the engagement team’s compliance with relevant ethical requirements including APES 110;

- these include the principles of integrity, objectivity (including independence), professional competence and due care, confidentiality and professional behaviour. The Engagement Executive should remain alert, through observation and making enquiries as necessary, for evidence of breaches of relevant ethical requirements by members of the engagement team. If matters come to the Engagement Executive’s attention through the ANAO’s system of quality management or otherwise that indicate that members of the engagement team have breached relevant ethical requirements, the Engagement Executive, in consultation with others in the ANAO, shall determine the appropriate action2;

- the engagement team’s compliance with Chapter 5 Professional, ethical and independence requirements of the ANAO Audit Manual – Shared Content;

- the appropriate planning of the engagement consistent with ASAE 3500 Performance Engagements;

- being satisfied that those persons who are to perform the engagement collectively have the appropriate competence and capabilities, including having sufficient time to perform the engagement in accordance with relevant standards and applicable legal and regulatory requirements and enable an assurance report that is appropriate in the circumstances to be issued3;

- the direction, supervision and performance of the engagement consistent with professional and auditing standards and regulatory and legal requirements. The Engagement Executive should document the extent and timing of their reviews. Refer to the policy Direction, Supervision and Review (ANAO Audit Manual - Shared Content, paragraphs 8.2-8.4) for further guidance;

- that sufficient and appropriate audit evidence exists and is documented to support the conclusions reached and for the auditor’s report to be issued;

- in line with the ANAO policy Audit Documentation (ANAO Audit Manual - Shared Content, paragraphs 9.2-9.18) the only work that should be done after the issuing of the final report is that of an administrative nature.

- following appropriate procedures for consultations and differences of opinion and in particular ensure compliance with the ANAO policy on Differences of Opinion (ANAO Audit Manual - Shared Content, paragraphs 8.75-8.79);

- determine that an EQR has been appointed, as required by the ANAO Auditing Standards and ANAO policy (Refer to the Engagement Quality Review (ANAO Audit Manual - Shared Content, paragraph 8.44-8.62); and

- enough involvement in the audit engagement at appropriate stages throughout the engagement including attendance at key meetings, discussions with the engagement team, EQR and ANAO Executive and the completion of review of the planning and completion procedures at the appropriate stages of the audit.

203.5 Engagement Executives are assisted by the Audit Manager and team allocated to the engagement in fulfilling these responsibilities, including assisting in:

- consideration of whether the audit should be delivered through in-house or externally contracted resources;

- ensuring all audit related documentation is filed;

- planning the scope of work to produce the audit deliverables in the agreed timeframe;

- planning the time taken to prepare for, conduct and close the engagement;

- delivering in accordance with agreed timeframes;

- monitoring the costs associated with the audit, including recommending a variation to the budget if required;

- ensuring the quality of the audit deliverables;

- resourcing the audit to ensure that the audit team has the requisite skills to undertake the audit;

- the direction, review and supervision of audit team members;

- communication within the ANAO, among audit team members, and the entity being audited, and more broadly other interested parties;

- assessing and managing the operational and engagement risks associated with the audit;

- the procurement of any specialist resources and any associated contract management;

- documenting the agreed scope, timeliness and quality assurance arrangements in respect of any services required from SADA, FSASG or PSASG to contribute to a performance audit; and

- ensuring all persons engaged in the audit complete the required independence documentation and action is taken to manage any declared conflicts as required.

203.6 Audit Managers are expected to regularly monitor progress against established audit milestones and complete the actual date that audit milestones are achieved in the ANAO’s time monitoring systems in a timely manner. The data held in those systems forms the basis of reports to ANAO senior executives.

203.7 When engaging with the entity being audited, especially on difficult or contentious matters, the Engagement Executive and audit team should ensure that a professional and productive approach is taken. This includes, for example, trying to understand the audited entity’s circumstances, operating environment and point of view.

203.8 The Engagement Executive should be aware of any risks to audit timeliness and budget, and escalate these as soon as practicable.

203.9 The procedural steps involving the Engagement Executive are included in the PASG Workflow. As outlined in the PASG Workflow, the level of responsibility differs for audits with different risk ratings.

204. Role and responsibilities of the SADA Executive

Background

204.1 This policy sets out the responsibilities of the SADA Executive in a performance audit or any other PASG assurance engagement that engages the specialist skills of the SADA Group.

204.2 A SADA Executive is allocated to a performance audit or other assurance engagement consistent with ANAO Audit Manual - Shared Content, paragraph 6.4.

Policy

204.3 The role and responsibilities of the SADA Executive shall include:

- the direction, supervision and performance of the SADA component of the engagement;

- reviewing key documents and working papers on the audit file, including:

- the AWP and documentation of the agreed scope of SADA involvement;

- those relating to significant IT risks, judgements and difficult or contentious matters; and

- components of the section 19 report and report preparation papers relevant to SADA work undertaken during the audit;

- having sufficient involvement in the engagement at appropriate stages including attendance at key audit meetings where SADA involvement is extensive and/or potential material findings could arise from SADA work; and discussions with the engagement team and Engagement Executive where appropriate; and

- attendance at Audit Committees, where appropriate.

Guidance

204.4 The responsibility for the direction, supervision and performance of the SADA component of the engagement includes:

- emphasising the importance of audit quality on each engagement;

- tracking the progress and quality of the SADA component of the engagement;

- considering the competence and capabilities of the SADA audit team assigned to the engagement;

- ensuring that appropriate SADA procedures are planned and performed;

- addressing significant SADA matters arising during the engagement and the impact on the planned approach;

- ensuring the SADA work performed supports the conclusions reached and is appropriately documented; and

- agreeing with the performance Engagement Executive any SADA services to be provided in a performance audit, the scope, timeliness and quality assurance arrangements for those services, as well as ensuring those services are appropriately resourced.

204.5 IT can pose specific risks to an entity’s internal control. Some examples of IT risks which may be relevant to performance audits are:

- reliance on systems or programs that are inaccurately processing data, processing inaccurate data, or both;

- unauthorised access to data that may result in destruction of data or improper changes to data, including the recording of unauthorised or non-existent transactions, or inaccurate recording of transactions. Particular risks may arise where multiple users access a common database;

- the possibility of IT personnel gaining access privileges beyond those necessary to perform their assigned duties thereby breaking down segregation of duties;

- unauthorised changes to data in master files;

- unauthorised changes to systems or programs;

- failure to make necessary changes to systems or programs;

- inappropriate manual intervention; and

- potential loss of data or inability to access data as required.

204.6 Attendance at key meetings should be determined by the nature of the audit and the level of SADA involvement. If SADA involvement has been minimal and/or there are no material findings arising from SADA work performed, it may not be necessary for the SADA Executive to attend entry/exit meetings with the auditee, progress reviews or the section 19 workshop – but the reasons for their non-attendance should be documented on the audit file. On the other hand, attendance at key meetings would be expected if there was extensive SADA involvement and/or material findings arising from SADA work performed.

Engagement performance — planning

Chapters 205 to 209

205. Understanding the entity and activity subject to audit

Policy

205.1 The audit team shall obtain sufficient understanding of the entity and activity to be audited. This will assist the audit team to identify and assess the risks that the activity is not economic, efficient, effective or ethical, and design and undertake evidence-gathering procedures.

Guidance

205.2 The collection of information about the entity and activity to be audited is a key element of initial planning for an audit.

205.3 Obtaining an understanding of the activity and its context is an essential part of planning and conducting a performance audit. It includes gaining knowledge of the entity that is responsible for the activity, and where relevant, the broader program of which the activity is part.

205.4 This provides the auditor with a framework to:

- distinguish between the activity and its control systems;

- develop and assess the suitability of criteria;

- target sources of relevant evidence;

- identify performance audit operational risks;

- identify engagement risks and assess materiality;

- identify whether there is the need for specialist skills or the work of an expert; and

- estimate resource requirements.

Types of information to be collected

205.5 The types of information that it may be appropriate to collect about the entity subject to audit includes:

- objectives of the entity;

- external accountability relationships — who the stakeholders and clients are and what their interests are in the entity;

- internal accountability relationships — such as organisational arrangements, delegations and committee structures;

- resources — the physical, financial, human and information resources available to the entity;

- applicable legal and policy frameworks / requirements for the activity

- management processes including:

- governance arrangements;

- performance criteria used by management;

- assessment of performance by management;

- the nature and frequency of reporting on performance;

- the use of performance results to assess entity operations and performance;

- the systems and controls in place for controlling the entity’s resources and ensuring appropriate client service;

- risk assessments used by management; and

- the role of internal audit in performance auditing;

- performance goals — their consistency with the entity’s legislation and governance framework;

- methods of program delivery — intended outputs of programs and outcomes, delivery methods and constraints on effective delivery;

- the external environment — factors that influence the entity’s operations, over which the entity may have little control, such as economic, social and political influences, with a particular focus on changes to that environment; and

- other publicly available information on the program.

205.6 The types of information to be collected for a cross-entity audit may focus more directly on the subject matter of the activity to be examined in the audit rather than entity-wide information. For example, the subject matter could include fraud control arrangements, the corporate planning framework, project and contract management, internal audit operations, recordkeeping or human resource management.

Sources of information

205.7 As a starting point, information already available within the ANAO should be reviewed and discussions undertaken, as necessary, with other ANAO staff who have knowledge of the entity or activity to be audited. Background information may have already been collected as part of the ANAO’s annual planning process, as part of another performance audit, by FSASG as part of the audit of an entity’s financial statements, or by PSASG as part of the audit of an entity’s performance statements.

205.8 Background information can also be derived from public or other sources external to the entity such as:

- the entity’s website;

- enabling and program-specific legislation;

- Cabinet submissions and decisions;

- the entity’s Corporate Plan, Annual Report and Portfolio Budget Statements;

- audit committee papers;

- Senate Estimates and other Parliamentary hearings, parliamentary committee reports, and Second Reading Speeches;

- media reports, Ministerial and entity press releases, newspaper and journal articles, and television and radio reports;

- central entity policies, standards, directives and guidelines;

- Government and review tribunal hearings and reports, such as those by the Commonwealth Ombudsman;

- reports of other external scrutineers, such as the Inspector-General of Taxation;

- the entity’s planning documents and organisation charts; and

- Australian or overseas material from entities that have similar programs or experiences.

205.9 In addition, the audit team should hold discussions with the entity, including Internal Audit, and obtain and review documentation, including:

- relevant policies, plans and procedures; and

- reports on any evaluations or reviews.

205.10 Sources of information for cross-entity audits, in relation to the subject matter rather than specific entity information, include:

- policies or guidance promulgated by central agencies;

- audits conducted by the ANAO and other audit offices within Australia or overseas;

- internal audits and reviews conducted by the entities included within the scope of the audit; and

- professional and community organisations and standard-setting bodies such as Standards Australia.

205.11 The audit team may also hold discussions with one or more of the entities to be included in a cross-entity audit to gain a practical understanding of the subject matter of the audit. The decision to undertake such discussions and collect documents from entities will need to be decided on a case-by-case basis. Some factors to consider when making the decision include:

- whether it is likely that the particular policy or practice is widely understood and is being implemented; and

- the need for information to assist in developing a suitable audit objective, criteria and approach.

205.12 The information-gathering powers in the A-G Act can be used to obtain information and documents required for planning an audit. However, in practice, the information-gathering powers are used as ‘reserve’ powers and access to required information is almost always obtained through cooperation with entities. If an entity is not cooperating, consult with the Engagement Executive and responsible GED in the first instance to escalate the request. If necessary, they will consider possible use of either section 33 or requesting that the Auditor-General uses section 32 to obtain the necessary information. ANAO Legal Services can also assist with informing entities about the nature of the information-gathering powers.

206. Materiality and risk assessment and management

Policy

206.1 Materiality4 shall be considered when determining the nature, timing and extent of procedures.

206.2 Materiality shall be assessed in planning and reassessed if there is any indication that the basis on which the materiality was determined has changed.

206.3 Materiality shall also be considered when evaluating the effect of any identified findings (i.e. variations in the activity’s performance), taken individually and in combination.

206.4 A matter shall be considered material if it is significant to the performance of the activity in relation to economy, efficiency effectiveness and/or ethics evaluated against the criteria.

206.5 The determination of materiality is a matter of professional judgement. The factors relevant to consideration of materiality, including the basis for the professional judgements made when deciding if a matter is material shall be documented. Materiality assessments are documented throughout the audit in the AWP and working papers related to the audit steps at the planning (paragraphs 207.8, 207.25, 207.39 and 209.7(g)) and execution (paragraph 220.4) stages.

206.6 Engagement risk shall be assessed at planning and considered and addressed throughout the audit in order to reduce it to an acceptably low level. Risks shall be documented in the AWP and the risk assessment and management plan, including the risk ratings and any mitigation actions put in place.

206.7 At each progress review point (see paragraph 212.1 in Engagement Performance – Execution), the audit team shall review the risk assessment and management plan. This review includes identifying any new risks, assessing if the planned mitigation actions have been and continue to be effective and if any changes in treatments are required.

206.8 Major changes to the risk levels or mitigation actions and new identified risks shall be discussed with the Engagement Executive.

Guidance

Materiality

206.9 Materiality is defined as the relative importance of a matter, within the context in which it is being considered, that could potentially influence the decisions of intended users of the audit report.5

206.10 The audit team’s consideration of materiality is a matter of professional judgement and depends on the perception of the intended users’ needs and interests, which may vary overtime. The Parliament is considered the primary user of the ANAO’s performance audit reports.

206.11 As such, findings are considered to be material if they, individually or in the aggregate, could reasonably be expected to influence relevant decisions taken by intended users on the basis of the auditor’s report. The audit team needs to also consider the aggregate effect of individually immaterial findings.

206.12 Materiality can also be understood as the relative importance of a matter to change or influence the decisions of users of the report, such as legislatures or the executive. Materiality is considered in the context of quantitative and qualitative factors, such as the:

- the nature of the impact(s), which may relate to monetary value or the impact on the environment, society, politics, culture and economy;

- size and severity of the impact or potential impact if it can be quantified; and

- likelihood of an impact occurring.

206.13 The consideration of materiality is relevant when:

- selecting the audit topics and activities to examine;

- defining the audit objective(s), defining the criteria;

- determining the nature, timing and extent of audit procedures, including determining evidence collection techniques and types of evidence to request;

- evaluating sufficiency and appropriateness of evidence;

- evaluating variations in the activity’s performance;

- reporting findings;

- formulating the conclusion(s); and

- developing recommendations.

206.14 Professional judgement about materiality is made in light of surrounding circumstances but is not affected by the level of assurance. Materiality for a reasonable assurance engagement is the same as for a limited assurance engagement because materiality is based on the information needs of intended users.

206.15 The inherent characteristics may render a matter material by its very nature. A matter may also be material because of the context in which it occurs. Qualitative factors affecting materiality may include the following:

- the number of persons (especially vulnerable persons) or entities affected by the matter being audited;

- minor variations from several criteria may be indicative of a problem that may need to be reported as a finding;

- the interaction between, and relative importance of, various components of the activity when it is made up of multiple components, such as a report that includes numerous performance indicators;

- the nature of a finding; for example, the nature of findings in respect of a control when the assurance report includes a statement that the control is effective;

- whether a finding affects compliance with law or regulation;

- in the case of periodic reporting on an activity, the effect of an adjustment that affects past or current activities or is likely to affect future activities;

- whether a finding is the result of an intentional act or is unintentional;

- whether a finding relates to fraudulent, corrupt or otherwise unethical conduct;

- whether a finding considers known previous communications to users, for example, in relation to the expected outcome of the audit;

- whether a finding relates to the relationship between the ANAO and the auditee, or their relationship with other parties;

- when a threshold or benchmark value has been identified, whether the result of the procedure deviates from that value;

- high visibility and sensitivity of the program or audited entity;

- the benefit to be derived from correcting an issue is greater than the cost;

- the economic, social, political and environmental impact of an activity. Where there is broader societal interest in an activity or where the activity could present a significant risk to the public, for example where the health or safety of citizens is affected; and

- whether a finding relates to transparency or accountability.

206.16 Quantitative materiality factors relate to findings that are expressed or evaluated numerically. Generally, findings are more material where they relate to relatively larger numbers or values in the context of the audit. There is no standard threshold for quantitative materiality in performance audits and in each case the auditor exercises their professional judgement in determining what numerical value represents a finding that is important in the measurement of the activity’s performance. For example, an audit finding that $1 million out of $2 million in spending activity lacked documentation is likely to be material, given the relative value of the finding to the subject matter under audit. On the other hand, a finding that a high proportion of low value transactions contained an error might not be considered quantitatively material if those errors related only to rounding errors that were within the audited entity’s accepted error rates. The auditor needs to consider the aggregate effect of individually immaterial findings.

206.17 The audit team needs to also consider the aggregate effect of individually immaterial findings (other than those that are clearly trivial) as they may have characteristics (e.g. systemic issues) that indicate the combined effect of individual immaterial findings is likely to be material.

206.18 Additional guidance in respect of applying materiality to findings to form a conclusion is at Forming the Audit Conclusion.

Materiality and audit risk

206.19 Materiality and audit risk need to be considered together as considerations of materiality will consequently impact performance engagement risk.

206.20 Audit risk includes performance engagement risk, which is the risk of expressing an inappropriate conclusion based on evidence that is not soundly based. This may include evidence that is improper or incomplete as a result of inadequacies in the evidence gathering process, misrepresentation or fraud. Audit risk also includes operational engagement risk, which is the risk that an audit will not be completed in accordance with the approved budget and timeframe and to the required quality (GUID 3910).

206.21 Assessing and applying the concept of materiality throughout the audit addresses performance engagement risk by driving examination of:

- material areas where the performance engagement risk is high; and

- material areas where the performance engagement risk is low, but any significant variations or deficiencies could have a material effect on the economy, efficiency, effectiveness and/ or ethics of the activity/subject matter.

206.22 Determining materiality and performance engagement risk as a team, with Engagement Executive involvement, is vital to avoiding under, or over-auditing. This can result where team members have different views on materiality and performance engagement risk.

206.23 Audit risk is assessed in planning and throughout the conduct of a performance audit. The assessment of audit risk requires the audit team to:

- understand the entity and its environment;

- assess risks to the audit conclusion; and

- design and conduct audit procedures to reduce engagement risk to an acceptably low level.

Engagement risk considerations

206.24 Engagement risk is the risk that the audit expresses an inappropriate conclusion. Engagement risk is a function of:

- Risk of material variation – the risk that the entity’s performance falls materially short of the expected standard (in respect of economy, efficiency, effectiveness and/or ethics), or materially exceeds it; this is a combination of inherent risk and control risk; and

- Detection risk – the risk that a material variation exists which the auditor fails to detect.

206.25 The objective of a performance audit is to reduce engagement risk to an acceptable level. Because the risk of material variation is the entity’s risk, the auditor cannot mitigate this risk. The auditor therefore instead focuses on addressing detection risk through their audit procedures.

206.26 The extent of procedures necessary to reduce engagement risk to an acceptable level depends on the risk of material variation. In general, the higher the risk of material variation, the greater the extent of the audit procedures necessary to address detection risk and thereby reduce engagement risk to an acceptable level. For this reason, assessing the risk of material variation is essential to planning audit procedures. Risk assessment may also inform decisions as to the potential audit scope and the development of potential audit questions.

206.27 Indicators that there is a high risk of material variation may include:

- highly complex entities with multiple programs or functions;

- deficiencies in corporate governance;

- significant business risks which impact on the economy, efficiency, effectiveness or ethics of a program or the entity as a whole;

- poorly controlled, or changing, processes and systems;

- frequent changes in key personnel, systems or programs which are not well managed; and

- previous performance engagements may have reported on significant findings.

206.28 Relevant factors for consideration when determining the risk of material variation include:

|

Factors that may impact the assessment of the risk of material variation |

|

|

Subject matter characteristics |

The nature of transactions; for example, high volumes, large dollar values and complex transactions. |

|

The nature, size and complexity of the activity/subject matter. |

|

|

External environment |

The economic, social, political and environmental impact of the activity/subject matter. |

|

Internal factors |

The extent of management’s actions regarding issues raised in previous performance engagements. |

|

The complexity and quality of management information and external reporting. |

|

|

The effectiveness of internal control. |

|

|

The nature and degree of change in the environment or within the entity that impact on the activity or subject matter. |

|

206.29 The risk assessment should be informed by the auditor’s understanding of the entity and activity subject to audit. Based on this understanding, risks could be identified and analysed by answering the following questions:

- What can go wrong?

- What assets are at risk and from what sources?

- With whom does the risk lie?

- What factors are/can be constraining performance (economy, efficiency, effectiveness, ethics)?

- What could be the cause (including weaknesses in controls)?

- What could be the consequences or the impact, including on the entity’s reputation?

- How could this risk be managed?

206.30 The risks identified should be closely examined in order to decide on the ones that are key (significant and relevant). The risk level of the key risks should be determined by assessing the likelihood and potential impact of each risk using the risk matrix in the Risk Assessment Template.

206.31 Audit responses to address the key risks identified should then be documented in the Risk Assessment Template.

206.32 The Risk Assessment Template provides a repository for all established information on the risks and serves as a resource when communicating risk information to stakeholders.

207. The Audit Work Plan

Background

207.1 The Audit Work Plan (AWP) documents the planning activities for the audit which are required by the Auditing Standards (ASAE 3500).

Policy

207.2 An AWP shall be prepared for each audit.

207.3 Audit teams shall determine whether an examination of the performance of the entity or subject matter is a suitable focus for a performance audit.

207.4 Prior to preparing an AWP, the Group Executive Director shall seek the approval of the Auditor-General to ascertain whether the proposed audit topic is suitable for planning. This will usually occur quarterly and for multiple audits at one time via a batch approval.

207.5 The audit objective shall be rational, clearly defined and relate to the principles of compliance, economy, efficiency, effectiveness and/or ethics. It shall be expressed in terms that can be concluded against.

207.6 Suitable criteria, corresponding to the audit objective, shall be identified for each audit. They shall be reasonable quantitative or qualitative measures of performance against which the activity’s performance may be assessed.

207.7 Criteria shall be relevant, complete, reliable, neutral and understandable.

207.8 The AWP shall document materiality and engagement risk level.

207.9 The AWP shall include the estimated cost of the audit, milestones and target dates. Performance audit teams shall discuss proposed audits with SADA in the planning and conduct of individual audits.

207.10 The AWP shall include the audit team members, including the GED, Engagement Executive, Audit Manager and the number and classification levels of all other team members.

207.11 The AWP shall be provided to FSASG, and PSASG, where there is a concurrent6 performance statement audit. In return, FSASG and PSASG shall provide the Audit Strategy Document, interim and final management letters (where issued) and the closing letter, related to the relevant financial statement or performance statement audit.

207.12 Performance audit teams shall discuss proposed audits with FSASG and PSASG (where relevant)7 and consider financial and performance statement audit findings in the planning and conduct of individual audits.

207.13 Any major variation from the details about the rationale and background to the audit outlined in the Annual Audit Work Program shall be clearly communicated to the Executive in the AWP, with a detailed explanation of the reasons underpinning the variation. In those cases where the audit topic was not included in the Annual Audit Work Program, the reasons for undertaking the audit shall be set out in detail.

207.14 All AWPs shall be provided to the Auditor-General for approval, with a copy provided at the same time to the Deputy Auditor-General and the responsible Group Executive Director.

207.15 Following approval of the AWP by the Auditor-General, any subsequent changes to audit criteria shall be reviewed by the responsible Engagement Executive and approved by the Auditor-General.

207.16 The AWP for each audit shall briefly identify any significant engagement and operational risks confronting the audit, including key risks identified in the portfolio overview of the most recent Annual Audit Work Program, where relevant.

207.17 Where audit teams are likely to have intermittent contact during the course of the audit with vulnerable people such as Indigenous communities, people with disabilities, people from non-English speaking backgrounds or children under the age of 18 years of age, they shall indicate this in the AWP. Advice shall be sought from an appropriate Senior Director in the Corporate Management Group (CMG) to ensure that the appropriate support arrangements can be put in place, including whether audit team members are required to apply for a working with vulnerable people registration or a working with children check.

Guidance

207.18 Audit planning varies according to the size, nature and complexity of the audit. The resources to be used in planning an audit should be commensurate with the nature and complexity of each audit and the assessment of the risks to the audit.

207.19 The preparation of an AWP necessitates understanding the entity and activity subject to audit. Per section 205.12 of this manual, the information-gathering powers in the A-G Act can be used to obtain information and documents required for planning an audit.

207.20 An AWP template and instructions on planning are available as part of the PASG Workflow, which contains corporate templates for staff to use during an audit.

207.21 Each AWP should contain sufficient information to allow the GED and the Executive to make a fully informed decision on the conduct of the proposed performance audit. Once approved, the AWP provides the authority to conduct the audit.

207.22 In preparing the AWP, the audit team should refer to the criteria, approach, budget and timeframes for similar audits considered previously and as outlined in their AWPs.

207.23 In a small number of cases, it may not be possible to finalise elements of the AWP until the delivery phase of the audit has commenced. In these circumstances, the audit team should clearly outline in the AWP those aspects of the audit plan that may be subject to change and set a timeframe to confirm any changes. Approval will be needed to proceed with the audit while the details of the AWP are still being finalised. The audit team is responsible for progressing the audit in parallel with the refinement of the audit plan during the delivery phase.

207.24 The following paragraphs outline considerations for preparing specific elements of the AWP.

Rationale for undertaking the audit

207.25 The AWP outlines the rationale for conducting the audit. Usually, the rationale for undertaking a particular audit has been identified in the course of preparing the Annual Audit Work Program. This rationale will be included in the audit report in accordance with paragraph 224.4 of this manual, and hence should be clear and understandable to a broad audience, with reference to the relative importance of the subject matter from a stakeholder perspective. The following table illustrates examples that should be incorporated in a rationale.

|

Element |

Description |

|

Materiality |

Qualitative: High public visibility of the program; importance of the program to particular client groups; strong Parliamentary or community interest in the performance of the program. Quantitative: high value of assets, annual expenditure or annual revenue of the entity or the program, activity or function. Scope may be limited to items above a certain dollar threshold, e.g. procurement contracts greater than $xx. |

|

Impact |

Significant impact of the activity, even when it is undertaken by a small unit within an entity with low materiality. |

|

Key area/issue presenting risks or challenges to Commonwealth administration |

The program or activity being a government initiative that is directly related to a key area/issue presenting risks or challenges to Commonwealth public administration. |

|

Potential benefits from the audit |

More efficient business processes; greater accuracy in claims processing; better management of contracts; improved adherence to Commonwealth policies; greater accountability through accurate performance reporting; earlier detection of risks to good management or prevention of fraud. |

|

Previous coverage |

No previous ANAO performance audit coverage; very limited internal review of a significant program; possibility of a follow-up audit foreshadowed in a previous ANAO audit; a follow-up audit requested by a parliamentary committee. |

|

Value for money |

Multiple factors need to be taken into account when determining value for money. These include:

|

|

Auditability |

Relates to the ability to carry out the audit according to the ANAO Auditing Standards. Although some areas may be significant, they may not be auditable for one or more of the following reasons:

|

Background to the audit

207.26 Each AWP should include background information regarding the entity, program or function to be audited. This background information reflects and generally builds on the material for the particular audit that was included in the Annual Audit Work Program.

Audit objective

207.27 The audit objective, outlined in the AWP, is a key statement that is intended to define the intention of the audit. The objective of a performance audit is to provide an assessment of specified elements of an entity’s operations. The assessment should address one or more of the following terms: effectiveness; efficiency; economy; compliance; or ethics. These terms are defined in ASAE 3100, ASAE 3500 and the ANAO Auditing Standards as follows:

|

Term |

Definition |

|

Effectiveness |

The performance principle relating to the extent to which the intended objectives at a program or entity level are achieved. |

|

Efficiency |

The performance principle relating to the minimisation of inputs employed to deliver the intended outputs in terms of quality, quantity and timing.

|

|

Economy |

The performance principle relating to the minimisation of the costs of resources, within the operational requirements of timeliness and availability of required quantity or quality. |

|

Compliance |

The assessment of adherence to the requirements, as measured by suitable criteria. |

|

Ethics |

The performance principle relating to the extent to which the proposed use of public resources is consistent with the core beliefs and values of society. Where a person behaves in an ethical manner it could be expected that a person in a similar situation would undertake a similar course of action. For the approval of proposed commitments of relevant money, an ethical use of resources involves managing conflicts of interests, and approving the commitment based on the facts without being influenced by personal bias. Ethical considerations must be balanced with whether the use will also be efficient, effective, and economical.8

|

207.28 The audit objective and the audit scope (see paragraph 207.35) are interrelated and should be considered together. The audit objective needs to be realistic and achievable and give sufficient understanding to the entity and other relevant parties about the focus of the audit. The audit objective also provides the basis for developing the audit criteria and the audit approach.

Audit criteria

207.29 Audit criteria are the specific measures used to assess the performance of the activity. In accordance with ASAE 3500 paragraph 16(d), the criteria are benchmarks used to evaluate the underlying subject matter. Audit criteria are reasonable and attainable standards of performance against which the extent of effectiveness, efficiency, economy, ethical or compliance aspects of an entity’s programs or activities can be assessed.

207.30 Audit criteria are important because they provide:

- a common understanding between the audit team, the ANAO Executive and the entity regarding the standards against which the entity is to be assessed; and

- a structure for the evidence-gathering phase of the audit.

207.31 Suitable criteria are those that are relevant to the subject matters being audited and appropriate to the circumstances. As outlined in ASAE 3500 the characteristics of suitable criteria include:

- relevance: relevant criteria contribute to conclusions that assist decision-making by the intended users;

- completeness: criteria are sufficiently complete when relevant factors that could affect the conclusions in the context of the performance engagement circumstances are not omitted. Complete criteria include, where relevant, benchmarks for presentation and disclosure;

- reliability: reliable criteria allow reasonably consistent evaluation of measurement of the activity, including when used in similar circumstances by similarly qualified assurance practitioners;

- neutrality: neutral criteria contribute to conclusions that are free from bias; and

- understandability: understandable criteria contribute to conclusions that are clear, comprehensive, and not subject to significantly different interpretations.

207.32 Sources of suitable criteria and sub-criteria may include:

- policy decisions or policy statements;

- legislation and regulations;

- published performance measures and internal measures;

- policies and guidance developed by central entities, regulators or government;

- standards of good practice, relevant benchmarks and relevant practice guides developed by professions, associations or other recognised authorities;

- statistics, practices, benchmarks, performance standards or procedures developed within the entity; and

- subject matter or general literature9.

207.33 Criteria may require interpretation and modification to ensure their relevance to the audit. Criteria may need to be modified or refined as the audit proceeds and more information becomes available. Should the criteria require substantial amendment and impact on the scope of the audit, the proposed changes should be discussed, in the first instance, with the Engagement Executive. If agreed, the proposed changes can then be considered by the ANAO executive at the formal review stages (see the PASG Workflow).

207.34 For further details refer to ANAO Audit Manual – PASG Specific Chapter 208 Generic audit criteria.

Audit scope

207.35 The audit scope defines the boundary of the audit. The audit scope may identify:

- the part of the entity, management control system or organisational unit to be examined;

- the matters subject to audit;

- particular entity locations to be visited during the audit;

- the time period being examined by the audit; and/or

- any associated matters that are not within the scope of the audit and the reasons for their proposed exclusion from the audit.

207.36 The scope is usually established based on information gathered during the planning phase or obtained in previous audits.

207.37 In establishing the scope of an audit, it may be necessary to have a broad statement of scope at the outset and refine this during the course of planning the audit and in the early stages of conducting the audit.

207.38 When determining the scope of the audit, the AWP should make reference to any known relevant reports published by other external and internal scrutineers; for example, the Inspector-General of Taxation, Inspector-General of Intelligence and Security, Parliamentary committees or internal audit.

207.39 The audit team considers matters such as materiality, risks to successful program performance and/or service delivery and auditability when establishing the scope. These matters should be considered throughout the planning and conduct of the audit and, particularly, in developing the detailed audit criteria.

Audit method

207.40 The audit method sets out the extent of evidence-gathering procedures to be undertaken and the reasons for selecting them, and the means to be used to collect information relating to the audit criteria. The method explains the intended use of specific data collection tools such as sample surveys, case studies, meetings, formal interviews, document reviews, compliance and/or system control analysis and testing. The method should also consider whether testing is likely to be performed on a sample basis.

207.41 The audit method also specifies where and why particular fieldwork is to be carried out and lists the involvement of any external stakeholders.

Cost of an audit

207.42 The cost of an audit includes the estimated costs of staff resources and the engagement of contractors and experts, and the estimated costs of travel and report publication. The costs of the initial planning phase of the audit and scoping study, where undertaken, are also to be included.

207.43 The budget for the audit is derived from a consideration of:

- the estimated hours required to be spent on the audit by the audit team, Engagement Executive and the Group Executive Director;

- the cost of initial planning;

- the cost of FSASG, PSASG and SADA staff, contractors, specialists and experts;

- costs of travel, including attendance at any audit related conferences. Travel costs should include airfares, accommodation, travel allowance and taxi/car hire that will be incurred by all team members, including any contractors engaged to assist with the audit; and

- the cost of publishing the audit report.

Audit milestones and target dates

207.44 AWPs are to include the target dates for the following audit milestones:

- AWP discussion meeting;

- Audit start date (Designation letter sent);

- Progress Review 1;

- Progress Review 2;

- report preparation papers to entity;

- Section 19 workshop;

- Section 19 report to entity; and

- Audit tabled.

207.45 The PASG Workflow references a Ready Reckoner tool to assist with planning the audit phases and milestone dates.

The audit team

207.46 In determining the composition of the audit team, the following factors are taken into consideration:

- the experience of the Audit Manager;

- the number, level and experience of other team members;

- the benefit of engaging FSASG, PSASG and/or SADA to assist in conducting elements of the audit;

- the benefit of engaging specialists and/or experts (including from PSG and CMB) to support the in-house team in addressing complex and/or technical issues for example, relating to methodology); and

- the complexity and expected impact of the audit.

207.47 A specialist is an audit practitioner (either from ANAO or external) who specialises in auditing a particular subject area (e.g. IT Auditor).

207.48 An expert is a person or organisation whose expertise in an area other than auditing is used by the ANAO to assist in obtaining sufficient appropriate audit evidence. An expert would normally be external to ANAO but may include internal non-audit staff such as CMG or PSG Legal Services staff.

207.49 Where gaps are identified in the skills necessary to conduct a particular audit, there are a number of options to address this, including:

- undertaking training to obtain the skills;

- obtaining advice and assistance from within PASG or other areas of the ANAO; or

- engaging a contractor, expert and/or specialist.

207.50 As part of the AWP, the audit team are encouraged to seek the input of other PASG Audit Managers and Engagement Executives who have conducted similar themed audits or audits of the same entity to assist in scoping the audit.

207.51 As part of the AWP, the audit team should outline a summary of the pre-audit consultation with FSASG, PSASG and SADA. This summary should include any potential or planned involvement of FSASG, PSASG and SADA in the performance audit, any risks identified from financial statement auditing, and other intelligence gathered from past audits that may be of relevance for the proposed audit.

Risk

207.52 A detailed risk assessment and management plan is completed and attached to the AWP that addresses each risk and its corresponding mitigation strategy (refer to ANAO Audit Manual – PASG Specific Chapter 206 Materiality and risk assessment and management).

Contributions to audit planning

207.53 External stakeholders include people or organisations with an interest in the operations, activities, results or resources of an entity. The primary external stakeholders are members of the public, clients of the audited entity, and non-government organisations such as industry associations and special interest groups.

207.54 Increasingly, entities are expected to develop close links with interest groups such as consumer and industry associations, provider organisations and think-tanks. These relationships can go beyond the exchange of information and may involve more formal collaboration or negotiation about government decision-making.

207.55 The identification of external stakeholders — who and what their interests are in the audited entity or topic — should be completed during the audit planning stage.

Approval of the AWP

207.56 The approval processes for the AWP are outlined in the PASG Workflow, which contains corporate templates for staff to use during an audit.

208. Generic audit criteria

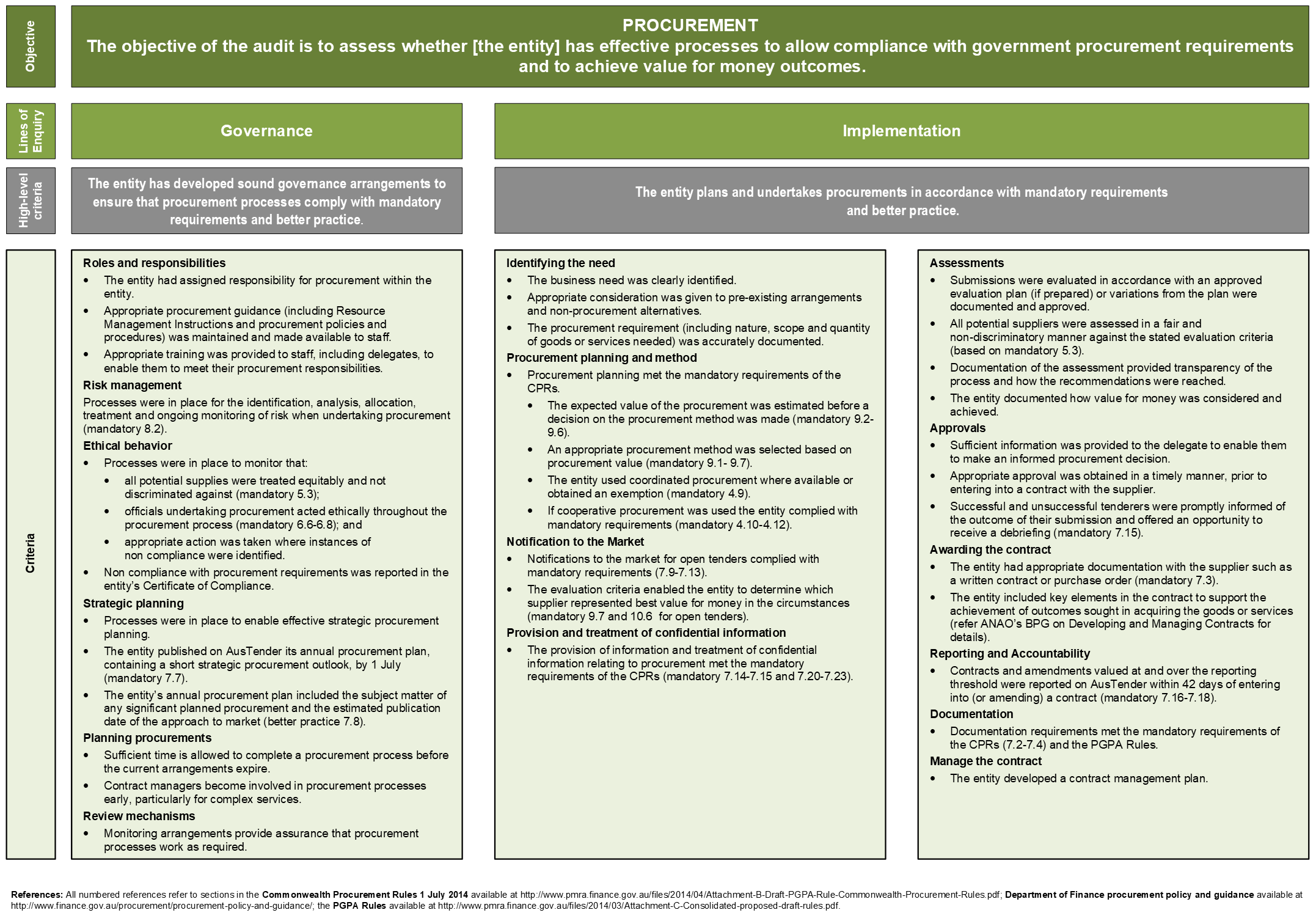

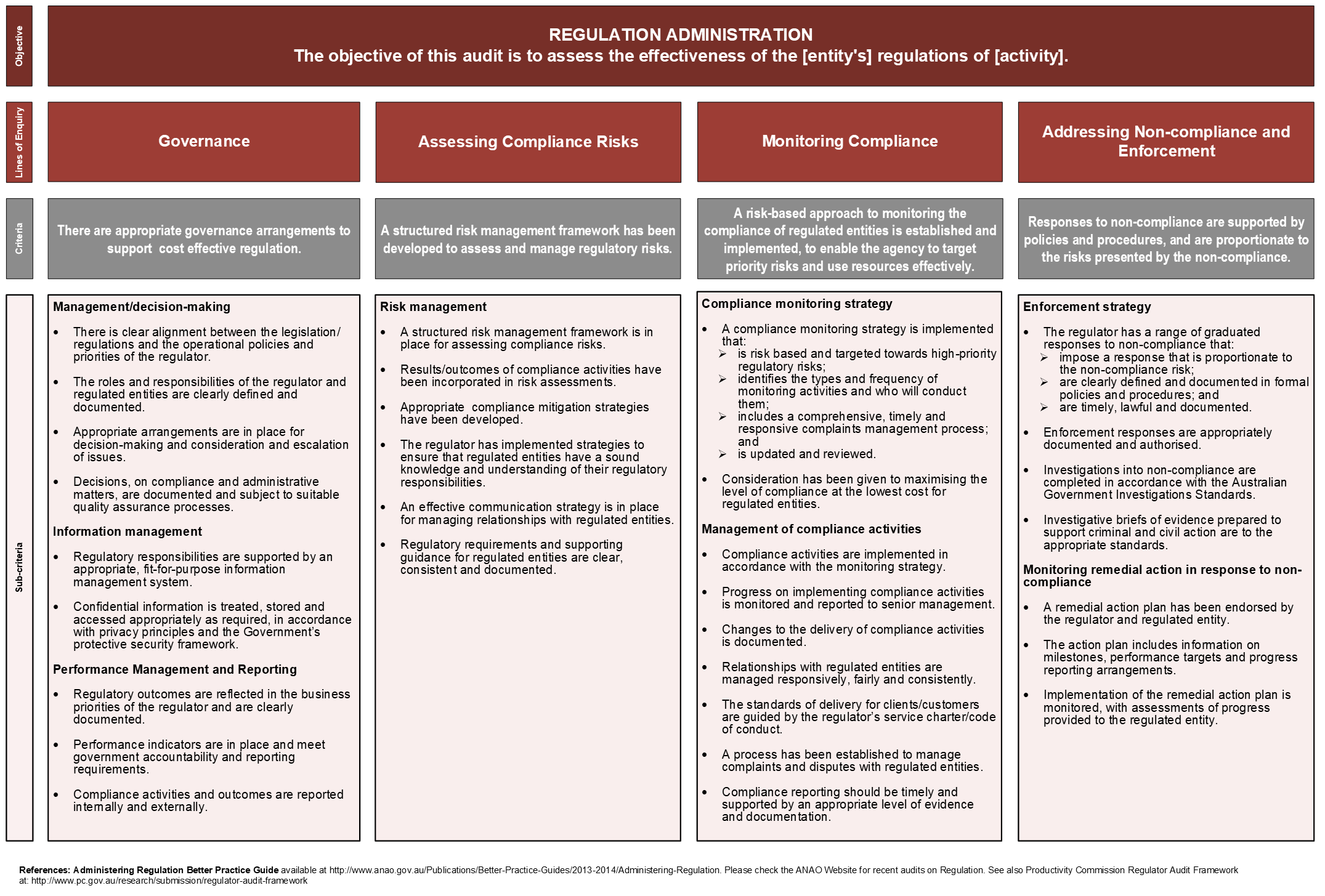

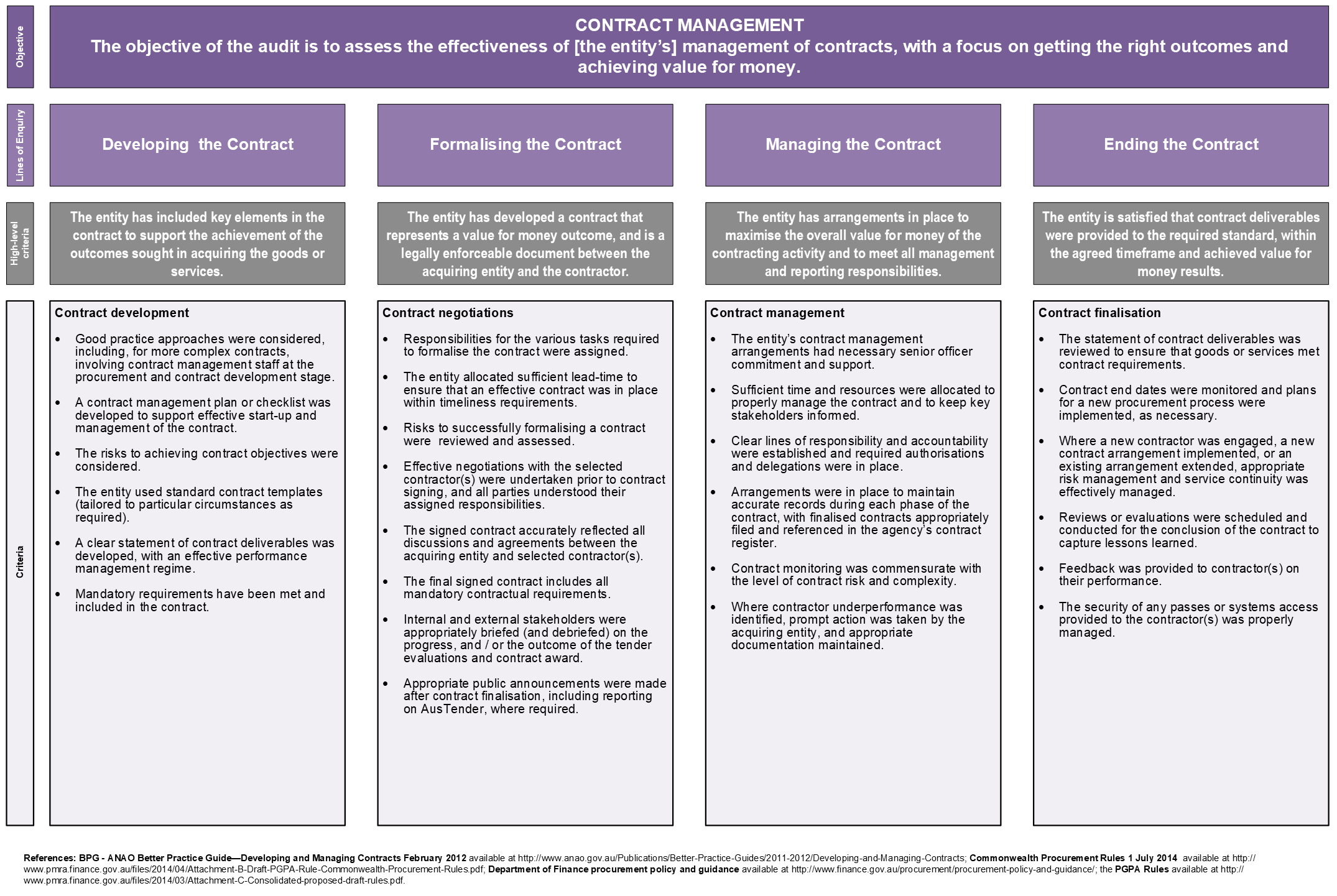

208.1 Generic audit criteria have been developed for the following four common types of performance audits conducted in the ANAO:

Grants administration (Post PGPA Act - 1 July 2014)

Procurement (Post PGPA Act - 1 July 2014)

Regulation (Post PGPA Act - 1 July 2014)

Contract Management (Post PGPA Act - 1 July 2014)

208.2 The purpose of each of the four criteria documents is to provide performance audit teams with a starting point for drafting criteria for these particular types of audits. Audit teams will still need to tailor specific criteria to their audits after identifying the time period and relevant legislative framework that applies (either prior to or post PGPA Act) and carefully considering the audit objective, the type of program or project being audited and the business risks of the entity being audited.

208.3 The generic criteria broadly describe key structures, processes and policies that would be expected to be in place within an entity. These criteria were developed using the ANAO’s Better Practice Guides (now withdrawn), relevant recent performance audits as well as Government directives. References are provided at the bottom of each document. Audit teams are encouraged to review this reference material when developing criteria for individual performance audits.

208.4 In relation to the criteria for Grants Administration, a tiered approach is warranted because the relevance of various parts of the Commonwealth Grant Rules and Guidelines often depends on the circumstances and parameters of the particular program.

209. Planning audit procedures

Policy

209.1 The audit team shall document the planned audit procedures including the nature, timing, extent and rationale for the planned procedures.

209.2 The planned audit procedures shall be updated as necessary throughout the audit and all changes in the planned procedures shall be clearly documented and explained.

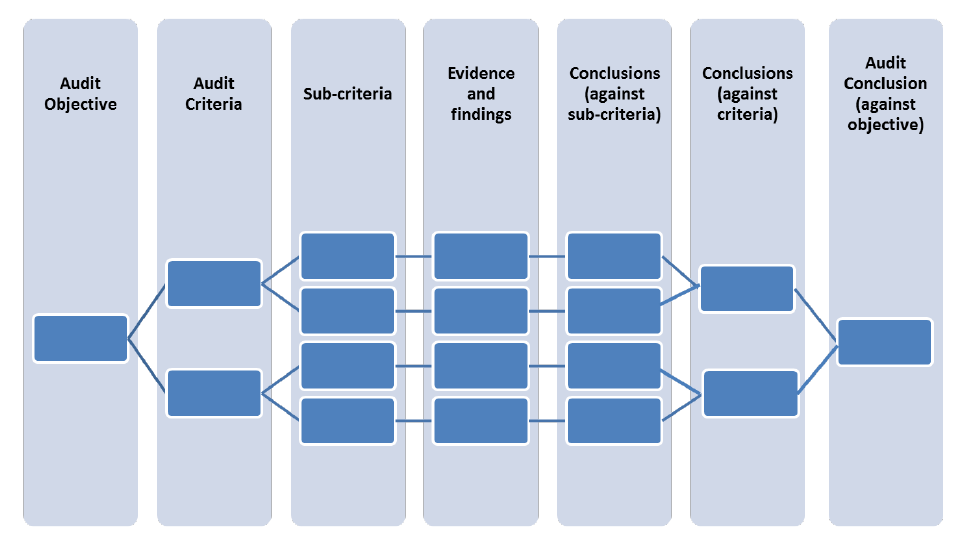

209.3 At a minimum, an audit test program shall provide a link between the criteria, evidence, audit procedures performed and the results and findings.

209.4 The planning of an audit shall include an assessment of whether the audit team has adequate skills, competence and knowledge to undertake the particular audit.

Guidance

209.5 Combined, the AWP and audit test program document the planned audit procedures, including the nature, timing and extent of evidence-gathering procedures and the rationale for selecting the approach.

209.6 When determining the extent of time and resources required for planning, audit teams are to consider the:

- audit team’s experience with and understanding of the entity and the audit topic;

- size of the team;

- level of the audit team’s auditing experience;

- scope of the audit; and

- complexity of the audit criteria and proposed tests and evidence-gathering techniques.

209.7 The AWP and/or audit test program includes:

- the types and expected sources of audit evidence;

- the techniques planned to be used to gather evidence;

- the planned audit procedures, including timing and extent (e.g., target testing of a specified number or items with defined characteristics, random sampling);

- personnel and expertise requirements, including the nature and extent of the use of specialists or experts when applicable;

- the allocation of tasks to be performed by audit team members;

- a link between the criteria, evidence, audit procedures performed and the results and findings;

- materiality: and

- assessment of engagement risk.

209.8 Planning is not a discrete phase, but a continual process and the test program may need to be revised to reflect any changes in the planned approach. It is recommended that updates to the planned approach and rationale are documented to explain why the change was necessary.

209.9 In planning and conducting a performance audit, it is not expected that audit procedures will include directly assessing whether fraud or other wrongdoing is occurring in the program or activity subject to audit. It is not the auditors’ responsibility to prevent or detect fraud or other wrongdoing through the conduct of its audits. This is the responsibility of the entity itself. The ANAO is also not in a position to determine whether a fraud or other wrongdoing has actually occurred.

209.10 As part of planning and conducting a performance audit, the audit team is required to obtain an understanding of the entity and the program or activity subject to audit. This should include making an assessment of whether fraud, or related wrongdoing, may have a significant impact on the program or activity. Such an assessment could include: a review of the entity’s fraud control plan and related information and documentation, such as fraud plans of individual work areas; and a review of the entity’s systems and procedures relating to fraud prevention, investigations, prosecutions, and reporting. If the audit team concludes that the risk of fraud and related wrongdoing may have a significant impact on the program or activity subject to audit, the audit should assess the adequacy of the entity’s management of this risk.

209.11 The extent to which matters such as potential fraud and other wrongdoing are referred to in a performance audit report will depend on the individual circumstances. It is generally not necessary or appropriate to refer to individuals or specific instances in audit reports. In circumstances where such matters are systemic and have the potential to significantly impact the operations of the program or activity subject to audit, they may warrant specific audit coverage and reference in the audit report.10

Engagement performance — execution

Chapters 210 to 223

210. Designation: Communicating the terms of the audit

Background

210.1 The designation email provides notification of the Auditor-General’s decision to conduct an audit and mandate, states the section of the A-G Act under which the audit is to be conducted and advises that the audit report will be tabled in the Parliament as soon as practicable after the completion of the audit. It also provides specific details about the audit and audit team.

Policy

210.2 The ANAO shall issue a written designation message that communicates the terms of the performance engagement (audit or review) to each entity subject to the performance engagement (ASAE 3500). The designation shall include the legislation creating the Auditor-General’s mandate to perform the audit, being sections 17, 18, 18A or 18B of the A-G Act.

210.3 Where the scope of an audit is subsequently changed or extended to include more than one entity, the section under which the audit is conducted will change from section 17 to section 18 of the A-G Act. In these circumstances, a revised designation message shall be sent to the original entity and a section 18 designation message provided to the other entity(s).

Guidance

210.4 The ANAO issues a designation email that communicates the terms of the performance engagement to each entity subject to audit at the commencement of each audit before commencing audit fieldwork. A standard designation template is attached to the PASG Workflow, which contains corporate templates for staff to use during an audit.

210.5 The designation email is sent to the accountable authority of a Commonwealth entity (refer to PGPA Act, section 12 – normally the Chair of the accountable authority where the authority has more than one member) and to the Chair of the Board of Directors of a Commonwealth company.

210.6 The designation message provides notification of the:

- Auditor-General’s decision to conduct and audit;

- Auditor-General’s mandate;

- section of the A-G Act under which the audit will be conducted;

- audit focus, including the objective and scope of the proposed audit;

- entity’s opportunity to provide written representations on the program or activity subject to the audit; and

- ANAO contact details.

210.7 In addition, it may be useful to provide the entity with a scope diagram that includes the audit objective, high-level criteria and sub-criteria, and a separate list of the initial information requirements for the audit.

210.8 Section 17 of the A-G Act is limited to the audit of a single Commonwealth entity, company or subsidiary. Section 18 of the A-G Act does not limit an audit to an audit of single Commonwealth entity, company or subsidiary. It is necessary for audits conducted of more than one entity, company or subsidiary to be separated from audits of a single entity, company or subsidiary. Should the audit change or be extended to include more than one entity, company or subsidiary, it is to be conducted under section 18 of the A-G Act and the change shall be communicated to the original entity, company or subsidiary. Refer to paragraph 210.3.

211. Entry meetings

Policy

211.1 The ANAO shall conduct an entry meeting with each entity, unless the entity declines an entry meeting or it is impractical to do so; for example, where the audit involves a survey of a large number of entities.

211.2 Approval to not proceed with an entry meeting shall be obtained from the Engagement Executive and documented in the audit file.

211.3 A record of the entry meeting, including the outcomes and any significant decisions made, shall be documented in the audit file.

Guidance

211.4 Following the designation of an audit, the entry meeting serves a number of purposes, including introducing the audit team and allowing discussion of the audit objective, process and timing with the entity.

211.5 The purpose of an entry meeting is to inform the entity and establish the basis for a successful engagement by:

- outlining the purpose of performance audits and opportunities to minimise the impact on the auditee;

- drawing attention to information access powers under the A-G Act;

- introducing to entity management the staff of the ANAO who will be involved in the audit;

- explaining the background and objectives of the audit, discussing the audit criteria and responding to any questions the entity may have about these issues;

- giving entity management the opportunity to ask questions about the audit process or any other relevant matter relating to the audit, including key milestones and expectations;

- drawing attention to subsection 36(1) of the A-G Act concerning the confidentiality of information obtained during the course of an audit, particularly when an entity has had little previous exposure to performance audit requirements and processes;

- allowing entity managers to bring to the attention of the ANAO any contextual matters that might influence the way the audit is conducted, particularly documentation that assists in explaining the program and/or relevant issues;

- informing the entity about information the audit team is expected to require — specifically, classified and/or sensitive records and where arrangements need to be made to access systems together with applicable milestones — to help ensure an efficient and timely audit process; and

- discussing the administrative arrangements surrounding the audit and establishing coordination arrangements with the entity.

211.6 It is advisable that the auditee(s) is informed at the entry meeting about the citizen contribution facility on the ANAO website and that the audit is open for stakeholders contributing information during the evidence collection stage. Also refer to the PASG Workflow.

211.7 ANAO officials are expected to approach entry meetings as an educative opportunity for audited entities and to not assume a high level of knowledge about ANAO processes.

212. Progress reviews

Policy

212.1 Progress reviews shall occur:

- 20 per cent into the allocated audit hours;

- 50 per cent into the allocated audit hours; and

- before or after the exit meeting (optional).

212.2 The third Progress Review (PR3; which may occur before or after exit meeting) shall occur when:

- the ANAO Executive requests a meeting;

- there is a significant audit issue arising from previous progress reviews remaining unresolved; or

- the responsible Engagement Executive or Group Executive Director considers a meeting necessary.

212.3 The audit team shall prepare briefs on the audit’s progress in accordance with the appropriate templates provided by the service group, or as otherwise specified by practice management.

212.4 The Engagement Executive shall seek approval for variations to the objective, scope, criteria, budget or tabling date following the approval of AWP from:

- the Auditor-General for variations to the audit objective, scope or criteria;

- the Auditor-General or Deputy Auditor-General for variations to the budget in excess of five per cent and variations to the tabling date in excess of one month; and

- the responsible GED for variations to the budget less than or equal to five per cent and variations to the tabling date less than or equal to one month.

212.5 The outcomes and all significant decisions made in key meetings and briefings with the ANAO Executive, responsible GED and/or Engagement Executive shall be documented in the audit working papers.

212.6 The relevant FSASG Engagement Executive or Signing Officer, as appropriate, shall be invited to attend the second Progress Review (PR2) meeting. Where there is a concurrent11 performance statement audit, the relevant PSASG Engagement Executive or Signing Officer, as appropriate, shall be invited to attend the PR2 meeting.

212.7 In addition to the minimum progress review meetings outlined in paragraph 212.1, the audit team shall engage with the GED and the ANAO Executive at any other critical stages of the audit, and in relation to any significant issues.

212.8 The outcomes and all significant decisions made in key meetings and briefings with the ANAO Executive shall be documented in the audit working papers. Where notes or comments are made by the ANAO Executive on Progress Review briefing papers prepared by audit teams, these records shall be retained on the audit working papers.

Guidance

212.9 Performance audit teams are required to undertake a series of progress reviews with the Service Group Executive and ANAO Executive staff at key specified intervals during the conduct of the audit.

212.10 The audit team completes an initial progress review (PR1) in order to confirm that planning for the audit remains appropriate or to suggest a variation to the conduct of the audit or to discuss any emerging issues, such as difficulties in accessing information or data.