Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Portfolio overview

The Defence portfolio includes a number of entities that together are responsible for the defence of Australia and its national interests. The principal entities within the portfolio are the Department of Defence, the Department of Veterans’ Affairs, the Australian Signals Directorate, the Australian War Memorial, Defence Housing Australia and the Australian Submarine Agency. The Department of Veterans’ Affairs and the Australian War Memorial are discussed separately.

The purpose and mission of the Department of Defence and the Australian Defence Force (ADF) (collectively known as ‘Defence’) is to defend Australia and its national interests in order to advance Australia’s security and prosperity. Further information is available from the department’s website.

The portfolio’s entities include statutory offices, trusts and companies that are subject to the Public Governance, Performance and Accountability Act 2013, and while are independent, reside administratively within the Defence portfolio.

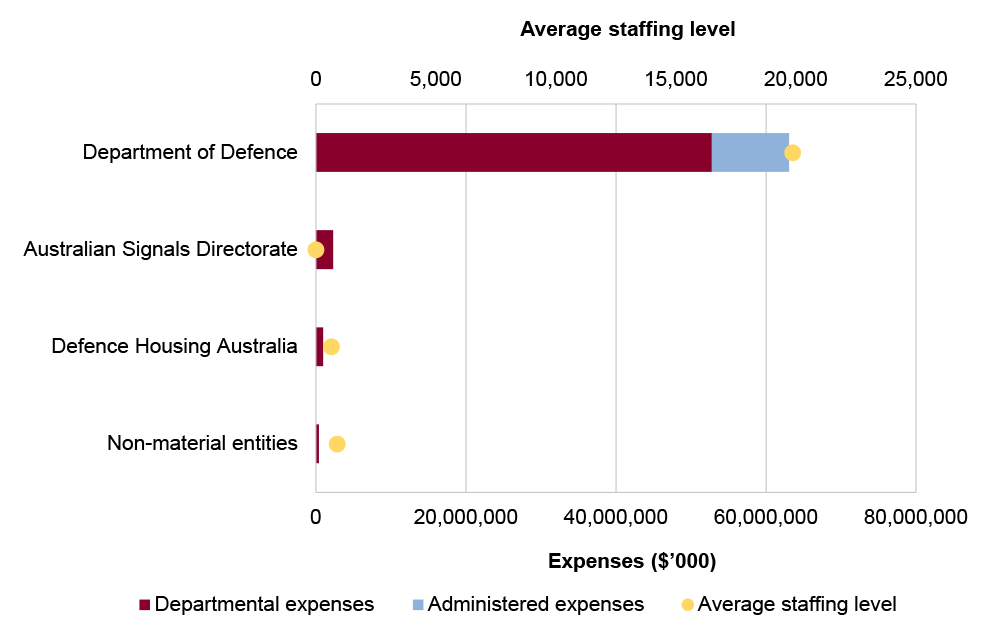

In the 2025–26 Portfolio Budget Statements (PBS) for the Defence portfolio, the aggregated budgeted expenses for 2025–26 total $66.8 billion. The PBS contain budgets for those entities in the general government sector (GGS) that receive appropriations directly or indirectly through annual appropriation Acts.

The level of budgeted departmental and administered expenses, and the average staffing level for entities in the GGS within this portfolio are shown in Figure 1. The Department of Defence represents the largest proportion of the portfolio’s expenses, and departmental expenses of the portfolio are the most material component, representing 85 per cent of the entire portfolio’s expenses.

Figure 1: Defence portfolio – total expenses and average staffing level by entity

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

Note a: The Department of Defence’s average staffing level excludes Australian Defence Force personnel.

Note b: The Australian Signals Directorate does not publish average staffing levels in the Portfolio Budget Statements.

Audit focus

In determining the 2025–26 audit work program, the ANAO considers prior-year audit and other review findings and what these indicate about portfolio risks and areas for improvement. The ANAO also considers emerging risks from changes in the operating environment and new investments.

The primary risks identified for the Defence portfolio relate to the implementation of the 2024 National Defence Strategy in the context of a changing strategic and operating environment. This includes Defence’s ability to anticipate, prepare for and respond to threats to Australia’s interests, including prioritising effort and investment in capability and workforce.

Specific risks in the Defence portfolio relate to governance, procurement, asset management and sustainment and financial management.

Governance

Good information management is essential for demonstrating compliant, transparent and accountable public administration. Recent audit work indicates systemic weaknesses in Defence’s record-keeping practices for its ICT security, procurement and contract management activities.

The Australian Government’s 2023 Defence Strategic Review (DSR) and 2024 National Defence Strategy (NDS) set an agenda affecting Australia’s Defence capability, force posture, force structure, acquisition, recruitment and international engagement. Audit work on enterprise level reforms and change management in Defence has highlighted the value of effective governance, review and reporting arrangements to inform senior leaders and decision-makers on the progress of key activities. Management assurance processes are also necessary to help mitigate the risk of optimism bias and non-compliance with requirements.

In the context of reprioritising the Integrated Investment Program (IIP), the DSR observed limited scrutiny for project entry. Audit work on Defence’s IIP administration identified a need to maintain records on when each project in the IIP was authorised and by whom it was authorised. A revised IIP was released in 2024 which set out a reprioritisation of investment, and reforms to capability acquisition. Effective implementation will require appropriate oversight and risk management.

Defence has a significant number of systems that it uses to gather information required to conduct its business. Specific risks for Defence include the management of IT controls, such as the timely termination of user access; and the introduction of new enterprise-level systems. Defence is managing major upgrades and rollouts in its information and communications technology infrastructure.

The DSR and NDS also highlighted workforce risks for Defence, including a need to increase Australian Defence Force (ADF) recruitment efforts and the management of its contracted workforce. Audit activity has identified probity risks and weaknesses in decision-making when Defence relied heavily on its contracted workforce to deliver outcomes without making necessary adjustments to governance arrangements.

Procurement

Defence is undertaking substantial procurement activity. It must plan for procurements identified in the 2024 IIP, in the context of planned changes to capability acquisition arrangements, the reprioritisation of investment, and accelerated procurements. Audit work on Defence materiel procurement activity has identified risks relating to: maintaining a value for money focus in procurement; the completeness of advice, record keeping and design maturity; the handling of rapid and unsolicited procurement proposals; partnership arrangements with industry; the monitoring of program and project performance; effective management of prepayments including for Foreign Military Sales; and the delivery of all approved capability in accordance with the approved budget and schedule.

Effective acquisition planning and management is required to manage the risk of a capability gap which may result from delays to the delivery of major platforms. Activities relating to the AUKUS agreement will also require the development of new expertise within Defence and more broadly. The 2024 NDS identifies key issues relating to the ownership, operation, maintenance and regulation of AUKUS capabilities by Australia, including nuclear powered submarines.

Defence has established a range of contracts of significant value for the delivery of essential services, such as base management and health care. The implementation of effective assurance arrangements across these contracts contributes to the achievement of value for money, and the mitigation of risks to the successful delivery of contracted outcomes. Recent audit work has identified shortcomings in this respect.

Asset management and sustainment

The department maintains assets to support achievement of its purposes. Accurate budgeting information and valuations of assets are important elements in determining ongoing maintenance and sustainment investment required, the cost of future asset replacement, and reporting of the assets’ fair value in the annual financial statements. Valuation of the capability held at a point in time is challenging for specialist military equipment, inventory, infrastructure and land due to the significant judgement and estimation involved.

Pending the introduction into service of replacement platforms, Defence has planned to maintain certain platforms beyond their normal lifetime. Audit work has observed limited planning to support the timely transition from the Anzac class to the Hunter class frigates. For the submarine fleet, the risk of a capability gap has been recognised and a Collins class life-of-type extension was identified as a key risk mitigation strategy. This strategy remains important for maintaining capability until nuclear powered submarines are procured under AUKUS arrangements. For the Armidale class patrol boats, a planned life-of-type extension was set aside in favour of procuring additional Cape class patrol boats. Delays in the delivery of the new patrol boats has required Defence to plan for the life-of-type extension of some Armidale class patrol boats, at additional cost.

Financial management

The military superannuation liabilities associated with Defence personnel are subject to assumptions and calculations underpinning the actuarial assessment of these liabilities.

Previous performance audit coverage

The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an entity’s operations and administrative support systems. Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

During the performance audit process, the ANAO gathers and analyses the evidence necessary to draw a conclusion on the audit objective. Audit conclusions can be grouped into four categories:

- unqualified;

- qualified (largely positive);

- qualified (partly positive); and

- adverse.

In the period between 2020–21 to 2024–25 entities within the Defence portfolio were included in tabled ANAO performance audits 25 times. The conclusions directed toward entities within this portfolio were as follows:

- none were unqualified;

- 10 were qualified (largely positive);

- 13 were qualified (partly positive); and

- two were adverse.

Figure 2 shows the number of audit conclusions for entities within the Defence portfolio that were included in ANAO performance audits between 2020–21 and 2024–25 compared with all audits tabled in this period.

Figure 2: Audit conclusions 2020–21 to 2024–25: entities within the Defence portfolio compared with all audits tabled

Source: ANAO data.

The ANAO’s annual audit work program is intended to deliver a mix of performance audits across seven audit activities: governance; service delivery; grants administration; procurement; policy development; regulation and asset management and sustainment. These activities are intended to cover the scope of activities undertaken by the public sector. Each performance audit considers a primary audit activity. Figure 3 shows audit conclusions by primary audit activity for audits involving entities in the Defence portfolio.

Figure 3: Audit conclusions by activity for audits involving entities within the Defence portfolio, 2020–21 to 2024–25

Source: ANAO data.

Performance statements audits

The audit of the 2024-25 Department of Defence (Defence) annual performance statements is being conducted following a request from the Minister for Finance on 2 July 2024, under section 40 of the Public Governance, Performance and Accountability Act 2013. The audit is conducted under section 15 of the Auditor-General Act 1997.

Defence is in its first year of inclusion in the annual performance statements audit program.

Given the significant changes to Defence’s performance information in the 2024-25 year and the complexity of Defence’s operating environment, ANAO considers the risk associated with Defence’s performance statements audit as high.

Key risks for Defence’s performance statements that the ANAO has highlighted include:

- the use of qualitative measures, including case studies;

- Defence’s performance statements preparation processes;

- the appropriateness of Defence’s performance measures and targets; and

- the completeness of Defence’s performance information.

Financial statements audits

Overview

Entities within the Defence portfolio, and the risk profile of each entity, are shown in Table 1.

Table 1: Defence portfolio entities and risk profile

|

|

Type of entity |

Engagement risk |

Number of higher risks |

Number of moderate risks |

|

Material entities |

||||

|

Department of Defence |

Non-corporate |

High |

4 |

2 |

|

Australian Signals Directorate |

Non-corporate |

Moderate |

1 |

2 |

|

Defence Housing Australia |

Corporate |

Moderate |

4 |

1 |

|

Non-material entities |

||||

|

AAF Company |

Company |

Low |

||

|

Army and Air Force Canteen Service |

Corporate |

Low |

||

|

Australian Military Forces Relief Trust Fund |

Corporate |

Low |

||

|

Australian Strategic Policy Institute Ltd |

Company |

Moderate |

||

|

Australian Submarine Agency |

Non-corporate |

Low |

||

|

Royal Australian Air Force Veterans’ Residences Trust |

Corporate |

Low |

||

|

Royal Australian Air Force Welfare Recreational Company |

Company |

Low |

||

|

Royal Australian Air Force Welfare Trust Fund |

Corporate |

Low |

||

|

Royal Australian Navy Central Canteens Board |

Corporate |

Moderate |

||

|

Royal Australian Navy Relief Trust Fund |

Corporate |

Low |

||

Material entities

Department of Defence

The Department of Defence is responsible for protecting and advancing Australia’s strategic interests through the promotion of security and stability; the provision of military capabilities to defend Australia and its national interests; and the provision of support for the Australian community and civilian authorities as directed by the Australian Government.

The department’s total budgeted assets for 2025–26 are $161.9 billion, with specialist military equipment, land and buildings, and infrastructure, plant and equipment representing 59 per cent, 17 per cent and 7 per cent, respectively, as shown in Figure 4. Employee provisions, encompassing the defined benefit superannuation provisions, are attributable to 90 per cent of total budgeted liabilities.

Figure 4: Department of Defence’s total budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

The Department of Defence has been classified by the ANAO as a high risk engagement. This engagement risk rating reflects the number and quantum of key areas of financial statements risk that will be a focus of the audit, as well as, the: nature, magnitude and complexity of the department’s operations and strategic environment, including a highly decentralised control environment and the use of various IT systems that operate independently of each other; the high level of public interest and scrutiny of the department’s activities; and the number and financial significance of complex accounting estimates in the financial statements, including the fair value of specialist military equipment and military defined benefit superannuation liabilities, which are subject to higher levels of estimation uncertainty.

There are six key risks for the Department of Defence 2024–25 financial statements that the ANAO has highlighted for specific audit coverage, four being risks that the ANAO considers potential key audit matters (KAMs).

- The change management process in relations to Defence's development and implementation of the new Enterprise Resource Planning (ERP) replacing the functionality of a number of key systems that are integral to financial management. (KAM – Change management of ERP)

- The valuation and accuracy of specialist military equipment, which includes defence weapons platforms, assets under construction, and associated spare parts. The measurement of specialist military equipment at fair value involves a high degree of management judgement, due to the specialised nature of the assets and the subjectivity of the valuation. The subjectivity in the valuation assessment is due to the difficulty in obtaining the replacement costs of assets with a similar capability in the absence of an active market, the selection and application of appropriate indices, the determination and assessment of appropriate useful lives, and the identification of indicators of impairment. There is also complexity, and a high degree of judgement is exercised in the cost attribution model that allocates accumulated capitalised costs on large scale acquisition projects between individual platform assets, associated spares and inventory. The balance of specialist military equipment as at 30 June 2024 was $88.6 billion. (KAM – Valuation and accuracy of specialist military equipment)

- The valuation and disclosure of administered employee provisions, due to the complexity of the calculations and high degree of judgement in selecting key long-term assumptions (including such matters as salary growth and discount rates, pension indexation rate, pension take-up rate and invalidity retirements). The provision balance as at 30 June 2024 was $138.2 billion. (KAM – Valuation and disclosure of administered employee provisions)

- The existence and completeness of inventories, due to the variety and quantity of inventory, which is managed across a large number of geographically dispersed locations. A large volume of transactions are processed daily, inventory is managed through multiple systems and is subject to complex system interfaces. The balance of inventory as at 30 June 2024 was $9.6 billion. (KAM Completeness and existence of inventory)

- Management override of controls. Fraud, including management override of established control processes, is a presumed significant risk of material misstatement according to ASA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of a Financial Report due to management’s unique position and ability to commit fraud by manipulating accounting records or overriding controls that otherwise may appear to be operating effectively.

- The valuation and accuracy of general assets that comprise land and buildings, infrastructure, plant and equipment, heritage and cultural assets and intangible assets. These balances also include assets under construction. The valuation of general assets involves a high degree of management judgement due to the selection and application of valuation methodologies, subjectivity in determining appropriate useful lives, and the assessment of the financial impact of indicators of impairment.

Australian Signals Directorate

The purpose of the Australian Signals Directorate (ASD) is to defend Australia from global threats and advance Australia’s national interest through the provision of foreign signals intelligence, cyber security and offensive cyber operations, as directed by government. The Australian Cyber Security Centre (ACSC) leads the Australian Government’s efforts to improve cyber security and aims to make Australia the most secure place to connect online.

ASD’s total budgeted assets for 2025–26 are $2.9 billion, with plant and equipment, buildings and infrastructure and intangible assets accounting for 45 per cent, 28 per cent and 11 per cent, respectively, as shown in Figure 5.

Figure 5: Australian Signals Directorate budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are three key areas of risk for ASD’s 2024–25 financial statements.

- Measurement and recognition of non-financial assets, particularly related to the valuation and capitalisation of assets under construction. Investment in technology is central to ASD’s core operations and this will be supported through the REDSPICE program which is a significant, multi-year investment in ASD’s cyber and intelligence capabilities. ASD are required to comply with requirements for the capitalisation of expenditure as prescribed by the Australian Accounting Standards, and complexity of this judgement is increased by the compartmentalised nature of operational assets, and increasing capital projects associated with REDSPICE.

- Transactions managed through shared service arrangements with the Department of Defence (Defence), particularly given the significance of the outlays managed by Defence and weaknesses identified in Defence’s ITC environment. Defence will assist ASD in administering an estimated $1.60 billion of cash outlays in 2024–25. ASD is supported by Defence through the provision of a corporate shared services agreement that covers a significant proportion of financial management processes and supports the preparation of the annual financial statements. This is a focus area due to the significance of the transactional processing that is undertaken by Defence, and the reliance on the internal controls implemented by Defence to appropriately manage transactions on behalf of ASD.

- Transition to Defence’s new Enterprise Resource Planning (ERP). ASD rely on Defence’s key financial systems to hold and generate information critical to all areas of the financial statements audit. Defence have been developing and implementing a new ERP, which will be replacing the functionality of 25 Defence systems, including systems that are integral to financial management.

Defence Housing Australia

Defence Housing Australia (DHA) is responsible for providing housing and related services to members of the Australian Defence Force and their families, consistent with Defence’s operational requirements. To meet these requirements, DHA is responsible for constructing, purchasing and leasing houses for Australian Defence Force personnel.

DHA’s total budgeted assets for 2025–26 are $6.3 billion, with inventories and land and buildings attributable to five per cent and 92 per cent, respectively, as shown in Figure 6. Sales of goods and rendering of services account for almost all revenue and lease liabilities account for 71 per cent of total budgeted liabilities.

Figure 6: Defence Housing Australia budgeted financial statements by category ($’000)

Source: ANAO analysis of 2025–26 Portfolio Budget Statements.

There are five key risks for DHA’s 2023–24 financial statements.

- The valuation and significant judgements applied in management’s assessment of the net realisable value of DHA’s inventory.

- The assessment of impairment of DHA’s investment properties, given the volume, complexity and judgement applied in calculating the required inputs.

- The accounting for, and reporting of, DHA’s revenue from housing services provided to Defence. The sale of inventories and the proceeds from the sale of investment properties, due to the number of revenue streams, the volume and complexity of transactions, and the impact of the application of Australian accounting standard AASB 15 Revenue from Contracts with Customers on revenue recognition, measurement and disclosure.

- Management override of controls. Fraud, including management override of established control processes, is a presumed significant risk of material misstatement according to ASA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of a Financial Report due to management’s unique position and ability to commit fraud by manipulating accounting records or overriding controls that otherwise may appear to be operating effectively.

- The accounting for DHA’s leases, due to the complexity involved in calculating the value of leased assets and liabilities in accordance with Australian accounting standard AASB 16 Leases. Accounting for properties acquired during the year as investment properties has been assessed as a risk primarily due to a change in management’s policy of deviating away from sale and lease back of properties.