Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

ANAO's Approach to Auditing Climate and Energy

Please direct enquiries through our contact page.

Sam Khaw, Director - Performance Audit Services Group Australian National Audit Office, delivered a presentation as a part of an international seminar ‘Training of the Sustainable Development Goals: Energy transitions as part of the Green Economy’ (an initiative of INTOSAI’s Working Group on Environmental Auditing), in Bali, Indonesia on 30 November 2023. The presentation was titled The Australian National Audit Office's Approach to Auditing Climate and Energy (including Agriculture, the Environment, and Water).

Slides

The slidedeck for the presentation can be downloaded at Related documents on this page. The text of the slides is available below.

Outline

- Overview of Australia’s government structure and updated climate agenda

- Overview of the Auditor-General and the ANAO including audit mandate and methodology

- Development of potential performance audit topics through the Annual Audit Work Program

- Potential performance audits on the 2023-24 AAWP

- Perspectives and challenges on risks

- Recent climate- and energy-related ANAO performance audits

- Audit execution and methods

- Assessing audit impacts – case study

- Trends identified and relationship to the Green Economy, including lessons learned

- Conclusion

Overview

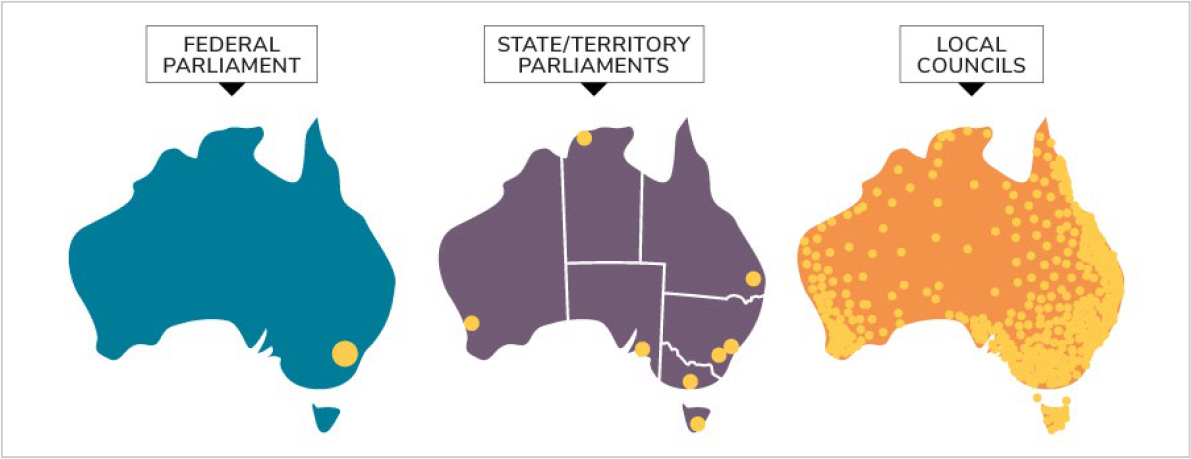

Levels of government in Australia

Source: The roles and responsibilities of the three levels of government - Parliamentary Education Office

Federal

The federal government raises money to run the country by collecting taxes on incomes, goods and services, and company profits, and spends it on national matters.

Sate

State and territory government also raise money from taxes but receive more than half their money from the federal government and spend it on state and territory matters.

Local

Local councils collect taxes – rates - from all local property owners and receive grants from federal, state and territory governments, and spend this on local matters.

The Auditor General and the ANAO

- The Auditor-General for Australia is responsible under the Auditor-General Act 1997 for auditing Australian Government entities and reporting to the Parliament of Australia.

- The Auditor-General’s main functions include financial statements audits, performance audits, performance statements audits, and assurance reviews.

- The ANAO’s green economy-related audits are generally conducted under the Auditor-General’s performance audit mandate.

Australian National Audit Office

- Independent public sector entity

- ANAO assists the Auditor-General in delivering the mandate under Auditor-General Act 1997

- Reports to the Parliament

- Conducts around 250 financial statement audits and 40 performance audits per year

ANAO performance audits

- ANAO performance audits are conducted in accordance with the Australian National Audit Office Auditing Standards.

- The ANAO Audit Manual sets the ANAO’s policies and guidance in the for the ensuring the planning, execution and reporting stages of the performance audit process.

- A guide outlining ANAO’s approach to performance audits is also available.

Performance audit methodology

- The ANAO’s performance audit activities involve the independent and objective assessment of all or part of an Australian Government entity’s operations and administrative support systems.

- Performance audits may involve multiple entities and examine common aspects of administration or the joint administration of a program or service.

- The audits can include consideration of:

- economy (minimising cost);

- efficiency (maximising the ratio of outputs to inputs);

- effectiveness (the extent to which intended outcomes were achieved);

- ethics (the extent to which the use of public resources is consistent with the core beliefs and values of society); and

- legislative and policy compliance.

- The ANAO’s audit manual is available at www.anao.gov.au/work/audit-manual

Australia’s updated climate agenda

- Australia’s federal government changed after an election in May 2022.

- Australia submitted an updated Nationally Determined Contribution to the UNFCCC in June 2022, committing to:

- 43 per cent emissions reduction by 2030; and

- net zero by 2050.

- In September 2022, these targets were formally legislated when the Climate Change Act 2022 was passed by the Parliament.

- There is also a range of new and revised legislation that include reference to the targets.

New policies and projects

The Australian Government is in the process of developing and implementing new climate and energy policies, projects, plans, and strategies to meet its updated targets.

Key initiatives include:

- Changes to the key policy regulating industrial emissions, known as the Safeguard Mechanism.

- Renewable Energy Target of 82%, supported by the CIS.

- Development of offshore wind and continuing development across other renewable energy industries.

- Bid to co-host COP31 with neighbours in the Pacific.

- Changes to climate risk and disclosure frameworks, intended to improve transparency and accountability across community, industry, and government.

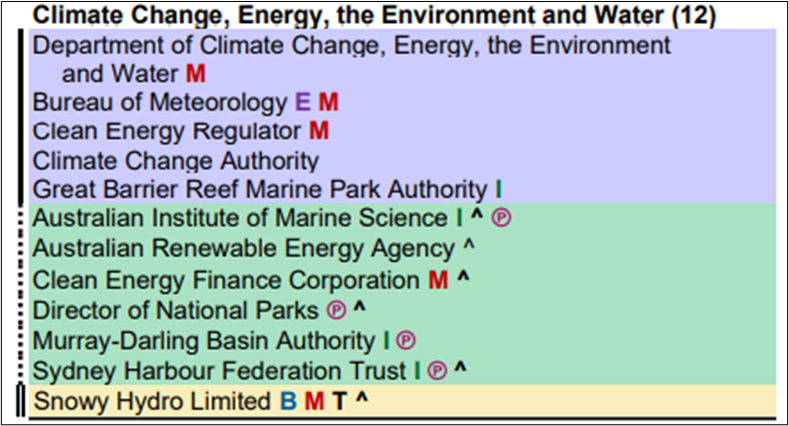

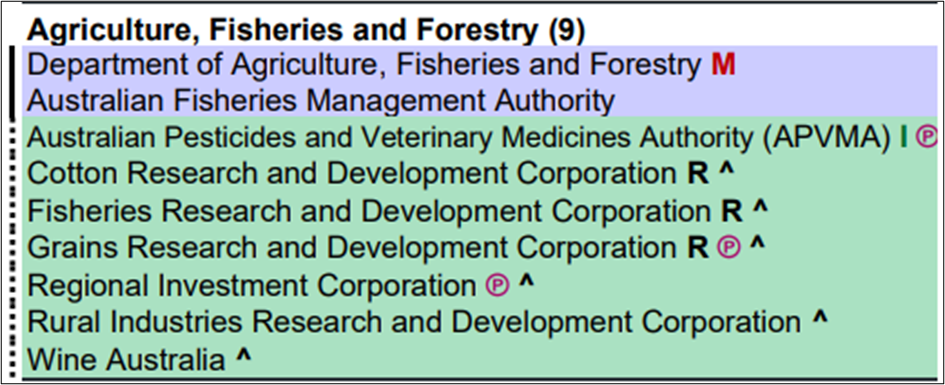

Portfolio responsibilities

From mid-2022, portfolio responsibilities and associated Australian Government departments were revised, including:

- the creation of the Department of Climate Change, Energy, the Environment and Water, focused on climate, energy, environment, water, and heritage.

- the formation of the Department of Agriculture, Fisheries and Forestry, focused on agricultural industries and trade, including biosecurity.

Portfolio entities

Source: PGPA Act Flipchart and List | Department of Finance

Energy in Australia

Source: Guide to energy network ownership - Energy Networks Australia

Development of potential performance audit topics through the annual audit work program

How are potential performance audit topics developed?

Annual audit workplan

- The Auditor-General publishes an annual audit work program (AAWP) in July each year. An overview of the AAWP process is available on the ANAO’s website.

- The 2023–24 AAWP includes 95 potential performance audit and assurance review topics.

- The ANAO’s performance targets are to present 45 audits in 2023–24 and 48 audits a year in both 2024–25 and 2025–26.

- Potential audit topics are developed through a process that considers:

- audit priorities of the Parliament;

- feedback from Australian Government entities and the public; and

- internal ANAO environment scanning and risk assessment.

Requests for audit

The Auditor-General receives requests for audit from members and senators of the Parliament of Australia.

These requests and the Auditor-General’s response are published on the ANAO website.

Recent requests on climate and energy topics have included:

- Western Sydney Airport offsets

- Supporting Reliable Energy Infrastructure Program

- Administration of the Disaster Recovery Funding Arrangements

- Management of the Beetaloo Cooperative Drilling Program

- Integrity of carbon credit methodology determinations

- Community Batteries for Household Solar

For each AAWP, the Joint Committee for Public Accounts and Audit identifies the audit priorities for the Australian Parliament.

AAWP environmental scanning and risk assessment

Environmental scanning

- Australia has a renewed focus on climate, with many policies and projects aimed or re-framed at meeting the increased targets.

- This has underscored the interconnectedness of climate change to agriculture, environment, water, energy, infrastructure, scientific research and accounting, and national security topics.

- As part of planning, we also consider whether enough time has passed for an appropriate inquiry into the topic. For example, there may be programs announced in mid-2022 that are now progressed enough to consider as part of the 2024-25 AAWP.

ANAO performance audit planning

The Auditor-General selects AAWP topics to enter the performance audit planning process. Performance audit planning activities required by the ANAO audit manual include:

- Understanding the entity and activity subject to audit

- Pre-audit engagement with the responsible entity

- Assessment and management of materiality and risk

- Builds on information collected during the AAWP process

- Producing the Audit Work Plan

- Presents the audit’s objective, criteria, budgeting and timing to the Auditor-General for approval

- Planning the audit procedures

- If the Audit Work Plan is approved, detailed planning of the audit’s procedures for analysing the criteria is undertaken.

Potential climate and energy audits

Potential audits included in the 2023-24 Annual Audit Work Program

- Australian Antarctic Program

- Bureau of Meteorology’s management of assets

- Community Batteries for Household Solar Program

- Delivery of Snowy 2.0

- Management of biodiversity offset obligations by government business enterprises

- Rewiring the Nation – early implementation

- Establishment of the Australian Infrastructure Financing Facility for the Pacific

- Effectiveness of NOPSEMA’s administration of regulatory frameworks for offshore energy operations and greenhouse gas storage in Commonwealth waters

In-progress audits

In-progress audits included in the 2022-23 Annual Audit Work Program

Climate and energy-related topics:

- Governance of climate change commitments

- Issuing, compliance and contracting of Australian Carbon Credit Units

Other related topics in the branch:

- Design and early implementation of the National Soil Strategy

- Digital reform of the agricultural export systems

- Corporate planning in DCCEEW

Challenges

- The breadth of Australian Government entities involved in climate, energy, and the green economy make auditing in this space complex.

- In a project to summarise and visualise the range publicly announced programs being implemented by the Australian Government, the ANAO identified 127 relevant programs across 42 entities.

- The ANAO has the capacity to conduct 4-5 performance audits per year that relate to the green economy or climate change and the environment.

- Subject matter expertise and technical nature of some topics.

- Contested science and political positions.

- Pace of change in both public administration and science.

- Vague definitions and unknowns.

How are the challenges addressed?

The ANAO is developing a multi-year strategy for auditing in the climate change and environment space.

- It will be a coordinated body of work – covering all aspects of audit – financial, performance, performance statements, including how we can incorporate sustainability reporting.

- It will consider risks to the Australian Government achieving its international obligations and lessons from international SAIs.

Recent audits – Energy

Select performance audits conducted since 2019

- Grant Program Management by the Australian Renewable Energy Agency (ARENA)

- Investments by the Clean Energy Finance Corporation (CEFC)

- Award of Funding under the Supporting Reliable Energy Infrastructure (SREI) Program

- Snowy 2.0 Governance of Early Implementation (Snowy)

Grant Program Management by the Australian Renewable Energy Agency

About ARENA

- ARENA is a corporate Commonwealth entity established under the Australian Renewable Energy Agency Act 2011 with objectives to improve the competitiveness of renewable energy technologies; and to increase the supply of renewable energy in Australia.

- ARENA achieves its objectives by providing financial assistance such as grants for:

- research, development, demonstration, commercialisation or deployment of renewable energy technologies, or the storage and sharing of information and knowledge about renewable energy technologies; and

- collecting, analysing, interpreting, and disseminating information and knowledge relating to renewable energy technologies and projects.

Audit objective

To assess the effectiveness of grant program management by ARENA.

- At the time of the audit, the ARENA Act included $2.2 billion in funding from the Australian Government for the period 2012-13 to 2021-22.

- There were nearly 1000 applications for funding over this period, with less than half approved.

- The amount requested in each application could differ to the amount ultimately approved by ARENA.

- ARENA uses two grant funding processes: continually open application rounds, and targeted competitive funding rounds.

- Most funding was awarded through continually open rounds.

Audit criteria

Criterion 1: Does grant selection support the achievement of ARENA’s objectives?

Criterion 2: Are grant funding agreements managed effectively?

Criterion 3: Does evaluation of grant programs indicate that ARENA is achieving its objectives?

Audit methodology

Audit procedures included:

- examination of ARENA documentation;

- analysis of data from the grant management system;

- sample testing of application assessments and funding agreement management documentation;

- observation of grants assessment processes;

- field visits to projects funded by ARENA;

- consideration of public contributions to the ANAO; and

- interviews with ARENA staff.

Conclusion

‘While ARENA’s grant program management is largely effective, its evaluation and performance reporting frameworks do not clearly demonstrate that its grant funding is increasing the supply and competitiveness of renewable energy in Australia beyond what would otherwise have occurred.’

‘ARENA’s external evaluations since 2017 do not clearly demonstrate the extent to which ARENA’s programs are impacting on its legislative objectives of improving the supply and competitiveness of renewable energy in Australia.’

Investments by the Clean Energy Finance Corporation

About the CEFC

- The CEFC is a corporate Commonwealth entity established under the Clean Energy Finance Corporation Act 2012.

- The CEFC independently invests, directly and indirectly, in clean energy technologies to facilitate increased flows of finance into the clean energy sector and facilitate the achievement of Australia’s greenhouse gas emissions and targets.

- Clean energy technologies are defined in the legislation as energy efficiency technologies; low emission technologies; and renewable energy technologies.

- From 1 July 2018, at least half of the funds invested by the CEFC must be in renewable energy technologies.

- The responsible minister provides the CEFC Board with an Investment Mandate specifying the expected investment performance and policy direction.

Audit objective

To assess the effectiveness of the selection, contracting and ongoing management of investments by the CEFC and the extent to which the CEFC is meeting its legislated objective.

- The Investment Mandate at the time of the audit was set in May 2020.

- Under the Investment Mandate, the CEFC is to act and consider its actions in certain ways across core and non-core activities.

- The audit examined the financial performance of the CEFC’s investment portfolio since its inception in 2012, and the CEFC’s selection and management of investments from 1 July 2017 to 31 December 2019.

- The audit did not examine individual investment decisions but examined arrangements the CEFC had in place to manage risks associated with such investments.

Audit criteria

Criterion 1: Does the CEFC have effective arrangements in place to assess potential investments and manage and report on the performance of its investments?

Criterion 2: Has the CEFC effectively met its objective under the Clean Energy Finance Corporation Act 2012 consistent with legislative requirements and directions?

Audit methodology

Audit procedures included:

- analysis of CEFC documents on investment policies and strategies, consideration and approval or rejection of investment proposals and the ongoing management of its investments;

- sample testing and analysis of investments against type of technology, investment sector, and investment instrument;

- analysis of potential investments under consideration;

- consideration of statutory and other relevant reviews;

- analysis of the overall performance of the CEFC’s investment portfolio;

- interviews with CEFC staff; and

- interviews with major Australian Government stakeholders: ARENA, DISER, and the Department of Finance

Conclusion

‘The CEFC has largely met its legislated objective of facilitating increased flows of finance into the clean energy sector, consistent with legislative requirements and directions.’

‘The CEFC’s arrangements to manage and report on investments are largely suitable. There is a need for the CEFC’s policy statement to include more detail on its ESG policies.’

‘The CEFC has not yet met the target benchmark rates of return set by the Investment Mandate and does not have a strategy in place to meet them.’

‘While the CEFC has facilitated increased flows of finance into the clean energy sector, the extent to which it has leveraged additional funds is unclear.’

Award of Funding under the Supporting Reliable Energy Infrastructure Program

About the SREI Program

- Announced on 26 March 2019 by the Australian Government as a $10 million, two-year program.

- Funding was to support:

- a bankable feasibility study of a proposed coal plant;

- the procurement of a strategic study to examine current and future energy needs of certain regions; and

- a series of ad hoc, non-competitive grants to support feasibility studies and business cases for projects identified through the strategic study.

Audit objective

To examine whether the award of funding under the Supporting Reliable Energy Infrastructure Program was informed by an appropriate assessment process and sound advice that complied with the Commonwealth Grant Rules and Guidelines (CGRGs).

- The Australian Government grants policy framework applies to all non-corporate Commonwealth entities subject to the PGPA Act.

- The CGRGs established under the PGPA Act contain the key legislative and policy requirements and explain the better practice principles of grants administration.

- It is the responsibility of officials to advise ministers of the requirements of the CGRGs.

Audit criteria

Criterion 1: Has the department established key program arrangements that are consistent with the CGRGs?

Criterion 2: Has the department assessed grant applications in accordance with the program guidelines?

Criterion 3: Has the department provided appropriate advice to inform decision-making?

Audit methodology

Audit procedures included:

- examination and analysis of DISER records, including email records from DISER and from DAWE; and

- engagement with DISER staff

Limited assurance vs. performance audit

- This audit commenced in September 2020 as a limited assurance review of the program.

- Based on the procedures performed and the evidence obtained, it was decided in December 2020 to increase the level of assurance and complete the engagement as a performance audit.

Conclusion

‘The award of funding under the Supporting Reliable Energy Infrastructure Program was not fully informed by an appropriate assessment process and sound advice on the award of grant funding. Aspects of the approach did not comply with the Commonwealth Grants Rules and Guidelines.’

Snowy 2.0 Governance of Early Implementation

About Snowy

- ‘Snowy Hydro Limited’ owns, manages, and maintains the Snowy Mountains Hydro-electric Scheme. This comprises 18 major dams; nine power stations; two pumping stations; and 225 kilometres of tunnels, pipelines and aqueducts.

- Snowy Hydro Limited is an unlisted company incorporated under the Corporations Act 2001.

- On 29 June 2018, the Commonwealth of Australia became Snowy Hydro Limited’s sole shareholder.

- Snowy Hydro Limited is subject to the PGPA Act frameworks for Commonwealth companies and government-owned business enterprises.

Audit objective

To examine the effectiveness of Snowy Hydro Limited’s governance arrangements for early implementation of Snowy 2.0, the expansion to the Snowy Hydro Scheme.

- Snowy 2.0 was intended to expand the pumped hydro-electric generation capacity of the Snowy Hydro Scheme with an additional 2000 megawatts of generating capacity, and approximately 350,000 megawatt hours of storage to the National Energy Market.

- Snowy 2.0 involves construction of an underground power station and around 27 kilometres of tunnels.

- As at July 2021, Snowy 2.0 was expected to deliver its first power generation in 2024-25 and be completed in 2026-27.

Audit criteria

Criterion 1: Have effective governance frameworks been established to delivery Snowy 2.0?

Criterion 2: Are there appropriate arrangements to manage the Snowy 2.0 engineer, procure and construct (EPC) contract?

Criterion 3: Does Snowy Hydro Limited effectively monitor and report on the progress of Snowy 2.0?

Audit criterion – Focus

Criterion 3: Does Snowy Hydro Limited effectively monitor and report on the progress of Snowy 2.0?

- Snowy Hydro Limited was provided with an equity injection to a subscription cap of $1.38 billion to proceed with the Snowy 2.0 project.

- Snowy Hydro Limited is using an engineer, procure and construct contract to complete most of the Snowy 2.0 project. The contracted sum is $5.11 billion, which makes up more than 85 per cent of the total project cost approved by Snowy Hydro Limited.

- Criterion 3 was designed to assess if the entity:

- effectively managed project and transmission risk, which includes engagement with government and industry stakeholders.

Audit methodology

Audit procedures included:

- examination of Snowy Hydro Limited documentation;

- a virtual site tour;

- meetings with Snowy Hydro Limited staff, including ‘walkthroughs’ to demonstrate business processes related to Snowy 2.0;

- meetings with two Australian Government shareholders: DISER and the Department of Finance; and

- meeting with the Australian Industry Participation Authority whose role is to evaluate, approve and publish summaries of AIP plans for major projects, as well as to monitor compliance and report on the implementation of plans under the Australian Jobs Act 2013.

Conclusion

‘Snowy Hydro Limited has established appropriate monitoring and reporting arrangements for Snowy 2.0. Reporting to the Snowy Hydro Limited Board of Directors (the Board) and the shareholder provides clear oversight of the progress of the project including identification and escalation of key risks. The project is exposed to significant risks, in particular those related to transmission network upgrades required for Snowy 2.0. Snowy Hydro Limited manages transmission risk within the existing regulatory framework, which includes engagement with government and industry stakeholders. Snowy Hydro Limited has implemented actions within the areas it can control.’

Supporting findings

Sub-criterion 3.1: Has Snowy Hydro Limited established arrangements to monitor the progress of Snowy 2.0?

‘Snowy Hydro Limited has established appropriate arrangements to monitor the progress of Snowy 2.0. Monitoring arrangements include monthly progress reports from the contractor. Snowy Hydro Limited’s use of an earned value management approach allows the contractor’s performance to be measured against baseline figures.’

Sub-criterion 3.2: Does Snowy Hydro Limited report to stakeholder entities and Ministers on the progress of Snowy 2.0?

‘Snowy Hydro Limited has implemented a strategy to engage with community and industry stakeholders throughout the life of Snowy 2.0. Snowy Hydro Limited regularly reports to shareholder departments and ministers on the progress of Snowy 2.0. This has included engagement on transmission network upgrades required for Snowy 2.0.’

Administration of the Disaster Recovery Funding Arrangements

About the DRFA

- Through the Disaster Recovery Funding Arrangements 2018, the Australian Government provides financial assistance for a proportion of state and territory governments’ expenditure on disaster relief and recovery measures.

- States and territories submit an annual claim to the Australian Government for the DRFA-related expenditure the state incurred in the previous financial year.

- The Australian Government then assesses the claims and makes payment on a proportion of the expenditure to the state or territory.

Audit overview

The objective of this audit was to assess the effectiveness of the National Recovery and Resilience Agency’s (the agency) administration of the Disaster Recovery Funding Arrangements (DRFA).

The ANAO proposes to examine:

- Does the agency appropriately administer DRFA funding eligibility, cost assessment and payment activities?

- Does the agency appropriately administer assurance activities for the DRFA?

- Does the agency appropriately monitor and report on DRFA performance?

Audit methods and evidence collection

Audit evidence was gathered through:

- Information requests made to the agencies;

- ANAO audit team directly collecting evidence through remote access;

- Bulk extracts of electronic files and email accounts, analysed through analytical software for unstructured data.

The audit methods included:

- assessing the agencies’ design and implementation of DRFA administrative activities;

- analysis of the agencies’ records;

- meetings with NRRA and NEMA officials and demonstrations of DRFA process; and

- considering contributions from state administrative agencies and members of the public.

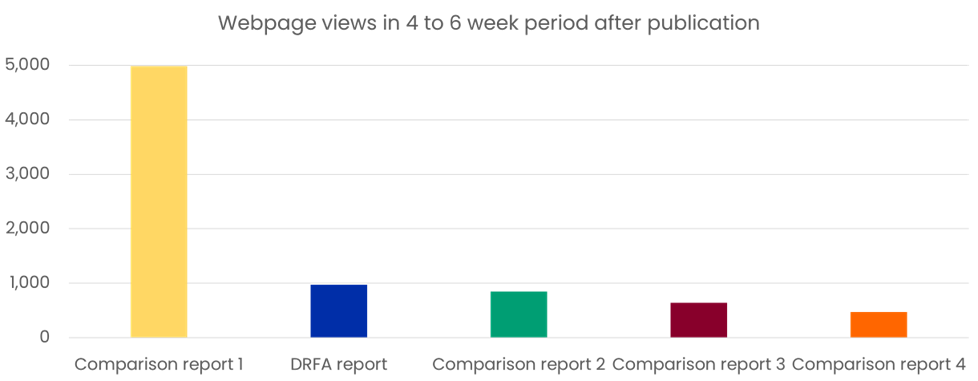

DRFA audit specific impact

Parliamentary interest

- Parliamentarians raising the audit report in Parliamentary Committees.

- Briefings provided to Parliamentarians and their staff.

Public and media interest

- Limited media coverage, an example of media coverage:

- Disaster recovery payments expected to double | PerthNow

- Auditor-General’s reports published on the ANAO’s website in both webpage and PDF formats.

- Publishing in both formats improves the accessibility of the reports.

- Fully publishing the reports as webpages allows the full reports to be accessed through search engines.

Website engagement

Website engagement with five performance audit reports published on the ANAO website in May and June 2023.

Recent audits – Relationship to the Green Economy

|

Audit report |

Relationship |

|

Snowy 2.0 Governance of Early Implementation |

Renewable energy, and other elements of climate change adaptation and mitigation activities, can be a major infrastructure investment. Good governance over procurement, contract management, and expenditure is key for major projects. Maintaining effective stakeholder relationships is significant for community buy-in and the just transition. |

|

Award of Funding under the Supporting Reliable Energy Infrastructure Program |

Predicting energy needs and ensuring these are met while also transitioning away from coal is important for a just transition under climate change mitigation strategies. Predictions and modelling should be utilised when determining which programs to invest in. Grant and procurement programs must comply with relevant guidelines, regardless of their role in the Green Economy. |

|

Investments by the Clean Energy Finance Corporation |

Investment in the deployment of renewable energies is key to ensure their propagation and contribution to climate change mitigation. Where this investment is not being provided privately, it may be supplemented with public funds. Confidence in government support of clean renewable energy infrastructure can reduce the risk associated with investing in research and development. Programs must comply with relevant legislation and instruction, regardless of their role in the Green Economy. |

|

Grant Program Management by the Australian Renewable Energy Agency |

Research and development behind renewable energy approaches can be government funded, especially where private investment is weak. Government support can drive the development of necessary technologies to progress a climate mitigation approach. The objectives of ARENA include ‘improve the competitiveness of renewable energy technologies’. Improves competitiveness at the research and development stage can increase the proportion of investment funding for deployment which is privately provided. It is valuable to audit against the objectives of a policy, in this case holding the distinction between investing in renewable energy infrastructure or investing in more than would otherwise exist. |

What are the lessons learnt in auditing the Green Economy?

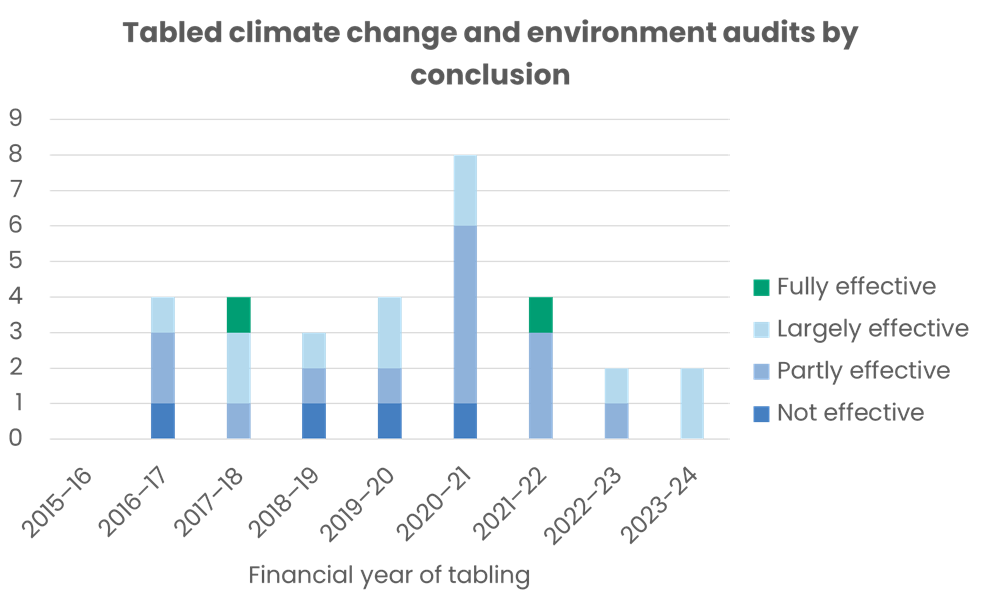

Since 2015–16, the ANAO has tabled 31 audits relating to the green economy (with a focus on climate change and the environment)

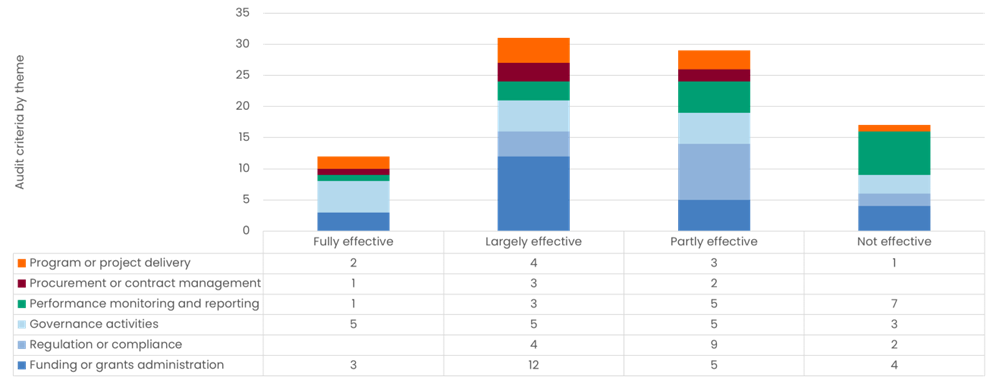

Themes by audit criteria

Across 30 of these 31 audits, there have been 89 audit criteria.

Recent audits – Trends identified

Select performance audits conducted since 2019:

- Weaknesses in monitoring and evaluation.

- Lack of clarity around the guidelines used and the decisions made to provide funding, including documentation of decisions and alignment with objectives.

Overall performance audit program:

- Entities not consistently meeting requirements in routine areas of public administration, including record-keeping, procurement and grants administration, and integrity and ethics.

- In the last five years, the ANAO has made negative comments on record-keeping in over 90 per cent of performance audit reports presented to Parliament.

Overall performance audit impact

ANAO Performance Measure 8: Percentage of recommendations included in performance audit reports agreed to by audited entities.

Target: 90%

Method: The number of recommendations agreed to (without qualification) by audited entities, divided by the total number of recommendations made, within the current financial year.

Why: The ANAO provides entities with audit findings and recommendations based on observations during the conduct of performance audits. These findings and recommendations are aimed at assisting entities to improve their performance, internal controls, and business processes. Entities are more likely to fully implement recommendations that are agreed to without qualification.

Performance measures

ANAO Performance Measure 9: Percentage of ANAO recommendations implemented within 24 months of a performance audit report being presented.

Target: 70%

Method: The number of recommendations implemented within 24 months of a performance audit being presented to the Parliament, divided by the total number of recommendations.

Why: To measure the impact that the ANAO’s audit work has on public administration, the ANAO measures the percentage of recommendations that are implemented by audited entities after a performance audit has been tabled. This measure captures the recommendations that are implemented by audited entities within 24 months, resulting in improvements to the public sector control environment.

Results reported in ANAO’s Annual Reports

|

Measure |

Target |

2021–22 |

2020–21 |

2019–20 |

2018–19 |

2017–18 |

|

8: Recommendations fully agreed |

90% |

95% |

92% |

91% |

90% |

85% |

|

9: Recommendations implemented after 24 months |

70% |

86% |

79% |

86% |

79% |

81% |

Measuring results

- Measure 8 does not include recommendations that entities agreed to with qualification, unless the qualification did not contradict the overall recommendation.

- Measure 9 is based on entity self-reporting of implementation.

- The ANAO has undertaken a series of performance audits on entities’ implementation of parliamentary and ANAO recommendations.

- The audits undertaken to date in this series have identified that 20 per cent of recommendations that entities had reported as implemented were assessed by the ANAO as not implemented.

References

- Legislation and standards | Australian National Audit Office (ANAO)

- ANAO Audit Manual | Australian National Audit Office (ANAO)

- Work program | Australian National Audit Office (ANAO)

- ANAO Corporate Plan 2023–24 | Australian National Audit Office (ANAO)

- ANAO Annual Report 2022–23 | Australian National Audit Office (ANAO)

- Audit insights | Australian National Audit Office (ANAO)

Conclusion

- ANAO performance audits target specific programs.

- This enables insights into patterns of strengths and weaknesses.

- Implementing an intentional strategy for climate change audits that includes agriculture, environment, energy, and water will ensure the ANAO has coverage over the breadth of relevant programs.