Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Performance Statements Auditing in the Commonwealth — Outcomes from the 2023–24 Audit Program

Please direct enquiries through our contact page.

The focus of this report is on the 2023–24 performance statements audits of 14 entities. The third year of the implementation of the performance statements audit program has shown that entities continue to improve their strategic planning and performance reporting processes and practices.

Executive summary

1. Performance information is important for public sector accountability and transparency as it shows how taxpayers’ money has been spent and what this spending has achieved. The development and use of performance information is integral to an entity’s strategic planning, budgeting, monitoring and evaluation processes.

2. Annual performance statements are expected to present a clear, balanced and meaningful account of how well an entity has performed against the expectations it set out in its corporate plan. They are an important way of showing the Parliament and the public how effectively Commonwealth entities have used public resources to achieve desired outcomes.

The needs of the Parliament

3. Section 5 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) sets out the objects of the Act, which include requiring Commonwealth entities to provide meaningful performance information to the Parliament and the public. The Replacement Explanatory Memorandum to the PGPA Bill 2013 stated that ‘The Parliament needs performance information that shows it how Commonwealth entities are performing.’1 The PGPA Act and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) outline requirements for the quality of performance information, and for performance monitoring, evaluation and reporting.

4. The Parliament’s Joint Committee of Public Accounts and Audit (JCPAA) has a particular focus on improving the reporting of performance by entities. In September 2023, the JCPAA tabled its Report 499, Inquiry into the Annual Performance Statements 2021–22, stating:

As the old saying goes, ‘what is measured matters’, and how agencies assess and report on their performance impacts quite directly on what they value and do for the public. Performance reporting is also a key requirement of government entities to provide transparency and accountability to Parliament and the public.2

5. Without effective performance reporting, there is a risk that trust and confidence in government could be lost (see paragraphs 1.3 to 1.6).

Entities need meaningful performance information

6. Having access to performance information enables entities to understand what is working and what needs improvement, to make evidence-based decisions and promote better use of public resources. Meaningful performance information and reporting is essential to good management and the effective stewardship of public resources.

7. It is in the public interest for an entity to provide appropriate and meaningful information on the actual results it achieved and the impact of the programs and services it has delivered. Ultimately, performance information helps a Commonwealth entity to demonstrate accountability and transparency for its performance and achievements against its purposes and intended results (see paragraphs 1.7 to 1.13).

The 2023–24 performance statements audit program

8. In 2023–24, the ANAO conducted audits of annual performance statements of 14 Commonwealth entities. This is an increase from 10 entities audited in 2022–23.

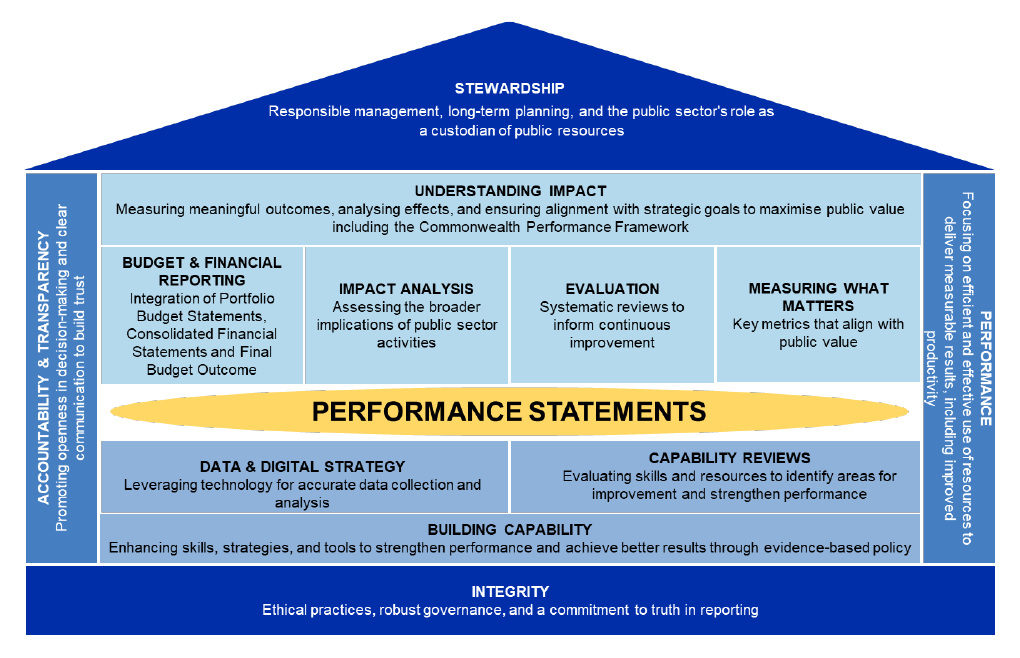

9. Commonwealth entities continue to improve their strategic planning and performance reporting. There was general improvement across each of the five categories the ANAO considers when assessing the performance reporting maturity of entities: leadership and culture; governance; reporting and records; data and systems; and capability.

10. The ANAO’s performance statements audit program demonstrates that mandatory annual performance statements audits encourage entities to invest in the processes, systems and capability needed to develop, monitor and report high quality performance information (see paragraphs 1.18 to 1.27).

Audit conclusions and additional matters

11. Overall, the results from the 2023–24 performance statements audits are mixed. Nine of the 14 auditees received an auditor’s report with an unmodified conclusion.3 Five received a modified audit conclusion identifying material areas where users could not rely on the performance statements, but the effect was not pervasive to the performance statements as a whole.

12. The two broad reasons behind the modified audit conclusions were:

- completeness of performance information — the performance statements were not complete and did not present a full, balanced and accurate picture of the entity’s performance as important information had been omitted; and

- insufficient evidence — the ANAO was unable to obtain enough appropriate evidence to form a reasonable basis for the audit conclusion on the entity’s performance statements.

13. Where appropriate, an auditor’s report may separately include an Emphasis of Matter paragraph. An Emphasis of Matter paragraph draws a reader’s attention to a matter in the performance statements that, in the auditor’s judgement, is important for readers to consider when interpreting the performance statements. Eight of the 14 auditees received an auditor’s report containing an Emphasis of Matter paragraph. An Emphasis of Matter paragraph does not modify the auditor’s conclusion (see Appendix 1).

Audit findings

14. A total of 66 findings were reported to entities at the end of the final phase of the 2023–24 performance statements audits. These comprised 23 significant, 23 moderate and 20 minor findings.

15. The significant and moderate findings fall under five themes:

- Accuracy and reliability — entities could not provide appropriate evidence that the reported information is reliable, accurate and free from bias.

- Usefulness — performance measures were not relevant, clear, reliable or aligned to the entity’s purposes or key activities. Consequently, they may not present meaningful insights into the entity’s performance or form a basis to support entity decision making.

- Preparation — entity preparation processes and practices for performance statements were not effective, including timeliness, record keeping and availability of supporting documentation.

- Completeness — performance statements did not present a full, balanced and accurate picture of the entity’s performance, including all relevant data and contextual information.

- Data — inadequate assurance over the completeness, integrity and accuracy of data, reflecting a lack of controls over how data is managed across the data lifecycle, from data collection through to reporting.

16. These themes are generated from the ANAO’s analysis of the 2023–24 audit findings, and no theme is necessarily more significant than another (see paragraphs 2.12 to 2.17).

Measuring and assessing performance

17. The PGPA Rule requires entities to specify targets for each performance measure where it is reasonably practicable to set a target.4 Clear, measurable targets make it easier to track progress towards expected results and provide a benchmark for measuring and assessing performance.

18. Overall, the 14 entities audited in 2023–24 reported against 385 performance targets in their annual performance statements. Entities reported that 237 targets were achieved/met5, 24 were substantially achieved/met, 24 were partially achieved/met and 82 were not achieved/met.6 Eighteen performance targets had no definitive result.7

19. Assessing entity performance involves more than simply reporting how many performance targets were achieved. An entity’s performance analysis and narrative is important to properly inform stakeholder conclusions about the entity’s performance (see paragraphs 2.37 to 2.44).

Connection to broader government policy initiatives

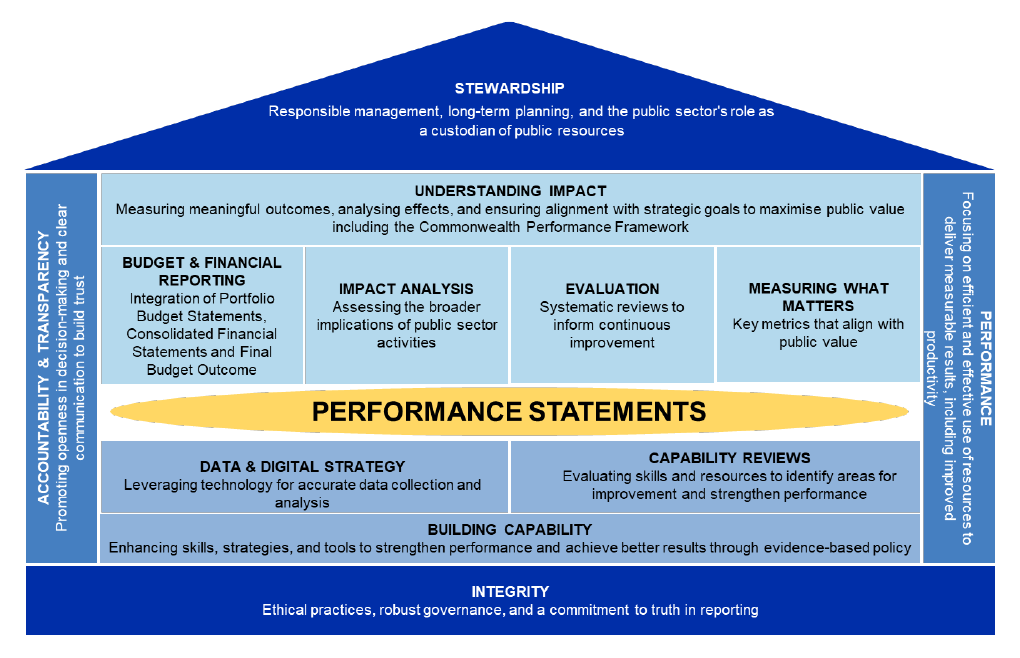

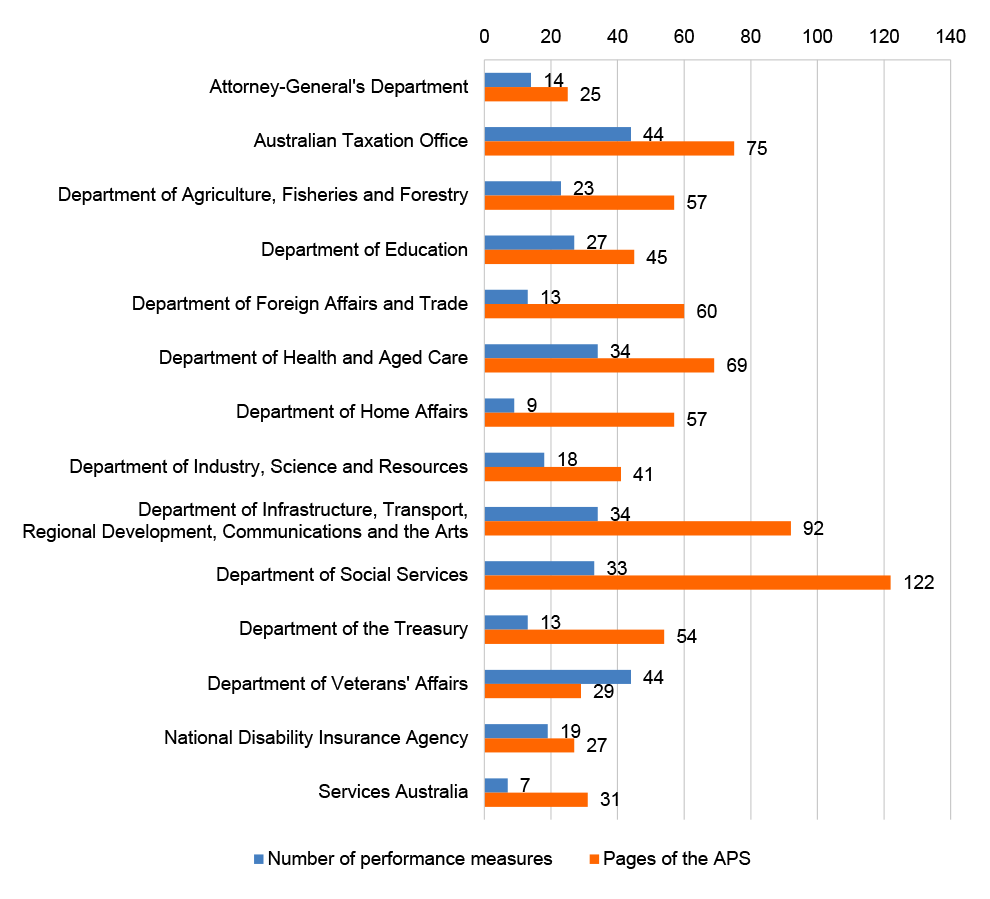

20. Performance statements audits touch many government policies and frameworks designed to enhance government efficiency, effectiveness and impact, and strengthen accountability and transparency. This is consistent with the drive to improve coherence across the Commonwealth Government’s legislative and policy frameworks that led to the PGPA Act being established.8 The relationship between performance statements audits and existing government policies and frameworks is illustrated in Figure S.1.

Figure S.1. Relationship of performance statements audits to government policies and frameworks

Source: ANAO analysis.

The future direction of annual performance statements audits

21. Public expectations and attitudes about public services are changing.9 Citizens not only want to be informed, but also to have a say between elections about choices affecting their community10 and be involved in the decision-making process, characterised by, among other things, citizen-centric and place-based approaches that involve citizens and communities in policy design and implementation.11 There is increasing pressure on Commonwealth entities from the Parliament and citizens demanding more responsible and accountable spending of public revenues and improved transparency in the reporting of results and outcomes.

22. A specific challenge for the ANAO is to ensure that performance statements audits influence entities to embrace performance reporting and shift away from a compliance approach with a focus on complying with minimum reporting requirements or meeting the minimum standard they think will satisfy the auditor.12 A compliance approach misses the opportunity to use performance information to learn from experience and improve the delivery of government policies, programs and services.

23. Performance statements audits reflect that for many entities there is not a clear link between internal business plans and the entity’s corporate plan. There can be a misalignment between the information used for day-to-day management and governance of an entity and performance information presented in annual performance statements. Periodic monitoring of performance measures is also not an embedded practice in all Commonwealth entities. These observations indicate that some entities are reporting measures in their performance statements that may not represent the highest value metrics for running the business or for measuring and assessing the entity’s performance (see paragraphs 4.32 to 4.35).

Developments in the ANAO’s audit approach

24. Working with audited entities, the ANAO has progressively sought to strengthen sector understanding of the Commonwealth Performance Framework. This includes a focus on helping entities to apply general principles and guidance to their own circumstances and how entities can make incremental improvements to their performance reporting over time. For example:

- in 2021–22, the ANAO gave prominence to ensuring entities understood and complied with the technical requirements of the PGPA Act and the PGPA Rule;

- in 2022–23, there was an increased focus on supporting entities to establish materiality policies that help determine which performance information is significant enough to be reported in performance statements and to develop entity-wide performance frameworks; and

- in 2023–24, there was an increased focus on assessing the completeness of entity purposes, key activities and performance measures and whether the performance statements present fairly the performance of the entity (see paragraphs 4.36 to 4.38).

Appropriate and meaningful

25. For annual performance statements to achieve the objects of the PGPA Act, they must present performance information that is appropriate (accountable, reliable and aligned with an entity’s purposes and key activities) and meaningful (providing useful insights and analysis of results). They also need to be accessible (readily available and understandable).

26. For the 2024–25 audit program and beyond, the ANAO will continue to encourage Commonwealth entities to not only focus on technical matters (like selecting measures of output, efficiency and effectiveness and presenting numbers and data), but on how to best tell their performance story. This could include analysis and narrative in annual performance statements that explains the ‘why’ and ‘how’ behind the reported results and providing future plans and initiatives aligned to meeting expectations set out in the corporate plan.13

27. It is difficult to demonstrate effective stewardship of public resources without good performance information and reporting. Appropriate and meaningful performance information can show that the entity is thinking beyond the short-term. It can show that the entity is committed to long-term responsible use and management of public resources and effectively achieving results to create long lasting impacts for citizens (see paragraphs 4.39 to 4.45).

Linking financial and performance information

28. The ‘Independent Review into the operation of the PGPA Act’14 noted that there would be merit in better linking performance and financial results, so that there is a clear line of sight between an entity’s strategies and performance and its financial results.15

29. Improving links between financial and non-financial performance information is necessary for measuring and assessing public sector productivity. As a minimum, entities need to understand both the efficiency and effectiveness of how taxpayers’ funds are used if they are to deliver sustainable, value-for-money programs and services. There is currently limited reporting by entities of efficiency (inputs over outputs) and even less reporting of both efficiency and effectiveness for individual key activities.

30. Where entities can demonstrate that more is produced to the same or better quality using fewer resources, this reflects improved productivity.

31. The ANAO will seek to work with the Department of Finance and entities to identify opportunities for annual performance statements to better link information on entity strategies and performance to their financial results (see paragraphs 4.46 to 4.51).

Cross entity measures and reporting

32. ANAO audits are yet to see the systemic development of cross-sector performance measures as indicators where it has been recognised that organisational performance is partly reliant on the actions of other agencies. Although there are some emerging better practices16, the ANAO’s findings reveal that integrated reporting on cross-cutting initiatives and linked programs could provide Parliament, government and the public with a clearer, more unified view of performance on key government priorities such as:

- Closing the Gap;

- women’s safety;

- housing;

- whole-of-government national security initiatives; and

- cybersecurity.

33. Noting the interdependence, common objectives and shared responsibility across multiple government programs, there is an opportunity for Commonwealth entities to make appropriate reference to the remit and reporting of outcomes by other entities in annual performance statements. This may enable the Parliament, the government and the public to understand how the work of the reporting entity complements the work done by other parts of government.17

34. As the performance statements audit program continues to broaden in coverage, there will be opportunities for the ANAO to consider the merit of a common approach to measuring performance across entities with broadly similar functions, such as providing policy advice, processing claims or undertaking compliance and regulatory functions. A common basis for assessing these functions may enable the Parliament, the government and the public to compare entities’ results and consider which approaches are working more effectively and why (see paragraphs 4.52 to 4.56).

1. Introduction

This chapter explains the context and progress of the Australian National Audit Office’s (ANAO’s) performance statements audit program.

The needs of the Parliament

The Parliament and public expect performance information to show how well Commonwealth entities are performing in achieving their purposes. Without appropriate and meaningful performance reporting, there is a risk that trust and confidence in government could be diminished.

Entities’ need for meaningful performance information

Performance information is integral to how a Commonwealth entity plans and operates to achieve its purposes. Strategic and concerted leadership is required to embrace meaningful performance reporting as key to good management and effective stewardship of public resources.

The 2023–24 performance statements audit program

Entities continue to improve their strategic planning and performance reporting. There were mixed results across each of the five categories the ANAO considers when assessing the performance reporting maturity of entities: leadership and culture; governance; reporting and records; data and systems; and capability.

1.1 Governments across Australia are grappling with how to deliver better public services, meet growing demand with limited resources, and making a significant contribution to productivity in the national economy.18

1.2 Good performance information helps to assess what works, and what does not work. It gives insight into changes and interventions that offer the most promise to improve the delivery of public policies, programs and services. Good performance information supports entities to improve the link between strategy and execution and achieve sustainable high performance.

The needs of the Parliament

1.3 Parliament requires clear and transparent information about how Commonwealth entities are performing and whether public resources are being used properly19 for the purposes intended. By having access to appropriate and meaningful performance information, Parliament can better hold entities accountable for their performance. This in turn helps to ensure government policies, programs and services are meeting the needs of citizens.

1.4 The Parliament, through the Public Governance, Performance and Accountability Act 2013 (PGPA Act), recognises that performance of the public sector is more than financial.20 That is, when assessing performance in the public sector, the focus should not only be on how much is spent but, importantly, on how well it is spent to achieve desired outcomes.

1.5 The Parliament’s Joint Committee of Public Accounts and Audit (JCPAA) has a particular focus on improving the reporting of performance by entities. In September 2023, the JCPAA tabled its Report 499, Inquiry into the Annual Performance Statements 2021–22. The Chair stated, in his foreword to that report:

Unlike financial reporting, which has been subject to Australian National Audit Office (ANAO) audits for decades, performance reporting has been underdeveloped and under resourced.

As the old saying goes, ‘what is measured matters’, and how agencies assess and report on their performance impacts quite directly on what they value and do for the public. Performance reporting is also a key requirement of government entities to provide transparency and accountability to Parliament and the public.21

1.6 The JCPAA’s report made three recommendations to improve the process and impact of performance statements audits and received responses to these recommendations from the Department of Finance and the ANAO during 2023–24.22 The responses from the ANAO and the Department of Finance highlight the importance of collaboration between auditors, policymakers, and government entities to improve performance reporting.

Entities need meaningful performance information

1.7 A fundamental change introduced by the PGPA Act was to place emphasis on the importance of strategic planning. It introduced the requirement for Commonwealth entities to prepare corporate plans23 that clearly articulate an entity’s key priorities and objectives and the outcomes it hopes to achieve. The corporate plan is the primary planning document of an entity.24

1.8 A good corporate plan is a comprehensive document that outlines the entity’s purposes, strategic direction, key activities and performance expectations. It not only guides day-to-day operations but also guides long-term effectiveness in achieving the purposes of the entity. The corporate plan needs to set out the entity’s operating context and the plans and strategies the entity has to establish the capability it needs to deliver on the entity’s key activities, which include details of any organisation or body that will make a significant contribution to achieving objectives.25

1.9 The PGPA Act requires an accountable authority to measure and assess their entity’s performance in achieving its purposes in the reporting period and prepare and present annual performance statements within their annual reports.26 The Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) also sets out the matters to be included in an entity’s annual performance statements.

1.10 An entity’s annual performance statements report the actual results achieved against the performance measures and planned results, including targets where set, that were included in the entity’s corporate plan.27 By providing appropriate, meaningful and accessible data on results, entities can show how well they are achieving their purposes and that they are managing public resources properly.

1.11 Information presented in performance statements can help entities to learn from experience and foster a culture of continuous improvement. By regularly reviewing and reflecting on performance data, Commonwealth entities can identify areas for innovation and change. This can lead to more effective delivery of programs and services and better outcomes for citizens. Performance information should, therefore, not be primarily a technical or administrative matter, without a strong link to organisational management or policy. It should direct attention towards organisational objectives and influence future performance and not be only a tool for measuring past activities.

1.12 A key challenge for entities is to effectively align their internal (operational) and external (accountability) performance information. External measures provide insight into how well the entity is achieving its purposes, while internal measures help identify areas where internal activities and processes can be improved to enhance those external outcomes. Entities can benefit from reviewing and aligning both sets of measures through their annual business planning processes.

1.13 In many respects, the success or failure of an entity’s use of performance information will depend on the maturity and sophistication with which the management of that information is handled by leaders and senior managers of an entity. Strategic and concerted leadership is required to embrace meaningful performance reporting as essential to good management and the effective stewardship of public resources.

Performance statements auditing

1.14 The ANAO was funded as part of the 2021–22 Budget to implement the ongoing program of performance statements audits. This funding establishes assurance of non-financial reporting as a core component of assurance to the Parliament.

1.15 Table 1.1 shows the expansion in the number of performance statements audits since the commencement of the ongoing program of audits in 2021–22. Adding new entities to those already being audited enables the ANAO to leverage knowledge gained from auditing an entity over time. This improves the efficiency, effectiveness, sustainability and value for money of the audit program. The progressive rollout is also achieving its intended benefit of improving the preparedness of first year auditees to engage with the audit.

Table 1.1: Entities in the ANAO annual performance statements audit program

|

2021–22 |

2022–23 |

2023–24 |

2024–25 |

|

A total of 10 entities, comprising the 6 entities audited in 2021–22 and the following 4 entities:

|

A total of 14 entities, comprising the 10 entities audited in 2022–23 and the following 4 entities:

|

A total of 21 entities, comprising the 14 entities audited in 2023–24 and the following 7 entities:

|

Note a: Machinery of Government changes on 1 July 2022 changed the former Department of Agriculture, Water and the Environment (DAWE) to the Department of Agriculture, Fisheries and Forestry (DAFF).

Note b: Machinery of Government changes on 1 July 2022 changed the former Department of Education, Skills and Employment to the Department of Education.

Source: ANAO.

1.16 The ANAO’s annual performance statements audit program has grown from six audits in 2021–22, the first year of the program, to 10 audits in 2022–23, and then 14 entities in 2023–24. There are currently 21 audits underway in 2024–25. As explained in the ANAO’s 2024–25 Corporate Plan, the audit program is scheduled to reach 26 audits in 2025–26, and onwards.28

1.17 This measured growth in the performance statements audit program has allowed the ANAO to refine its methodology and adapt to the diversity of non-financial data across government entities. Over these initial years, the ANAO has uplifted its capacity and capability, including adopting an educative approach to help entities improve their performance statements. The ANAO has also standardised approaches to promote consistency in auditing performance measures with similar characteristics across audited entities.

The 2023–24 performance statements audit program

1.18 The focus of this report is on the 2023–24 performance statements audits of 14 entities. The third year of the implementation of the performance statements audit program has shown that entities continue to improve their strategic planning and performance reporting processes and practices.

1.19 The 2023–24 audits observed that there was broad improvement across each of the five categories the ANAO considers when assessing the performance reporting maturity of entities:

- Leadership and culture — Leadership develops a culture at the entity of valuing and applying performance information to improve accountability and performance at all levels of the business.

- Governance — An effective entity-wide performance framework explicitly links the entity’s purposes and key activities to measurable goals and objectives for individual teams and senior executives.

- Data and systems — Data and IT systems for performance measurement and reporting are reliable, secure and well-documented.

- Capability — An appropriately skilled and dedicated performance reporting area coordinates performance reporting across the entity.

- Reporting and records — Performance statements are clear, meaningful and tailored to user needs. Records are accurate, complete, reliable, and easily retrievable.

1.20 The 2023–24 audits have identified common areas of challenge for auditees. A common theme is whether performance measures are supported by reliable and verifiable data and methodologies. Another theme concerns entities having effective quality assurance processes for reported results. The issue of whether an entity’s performance information was complete was also a recurring theme in 2023–24 performance statements audit findings (see Chapter 2).

Entities’ engagement with the 2023–24 audits

1.21 The acting Auditor-General provided the auditor’s reports for all 14 audits to the Minister for Finance on 1 November 2024, compared to 20 December 2023 in 2022–23 when the last of 10 auditor’s reports was provided to the Minister for Finance. This demonstrates that the ANAO and audited entities are strengthening their capability and capacity to deliver audits in a more timely manner. The ANAO considers that there are still opportunities to further improve the audit process and drive efficiencies for itself and auditees.

1.22 The terms of engagement for each performance statements audit states that the accountable authority is responsible for providing the ANAO with access to all information that is relevant to the preparation of the annual performance statements. The timely provision of this information is key to providing the Parliament with reasonable assurance over whether the entity’s annual performance statements are free from material misstatement in a timely manner. It is important, therefore, that the entity understands and complies with the terms of engagement.

1.23 During the 2023–24 performance statements audit program, three entities — the Department of Health and Aged Care (DoHAC), the Department of Education (DoE) and the Department of Home Affairs (Home Affairs) — advised the ANAO that there were legal restrictions to sharing certain requested information. Accordingly, the Auditor-General wrote to their accountable authorities on 25 October 2023, 16 January 2024 and 31 May 2024 respectively, issuing notices under paragraphs 32(1)(a) and 32(1)(c) of the Auditor-General Act 1997. The ANAO is advising the Parliament through this report of the exercise of those statutory information gathering powers, under section 32 of the Auditor-General Act 1997.

Improving audit efficiency and effectiveness

1.24 The ANAO is continuing to evolve its audit approach to improve audit efficiency and effectiveness, including conducting audit procedures on the half yearly results of entities that have embedded the practice of periodic reporting. An innovation in 2023–24 was the use of ‘strategic briefings’ at the commencement of an audit to engage senior leadership in the operating context and the priorities of the entity. These have been effective forums for the audit to better understand the appropriateness of the key activities, performance measures and targets in the entity’s corporate plan and the factors that influence entity performance.

1.25 The ANAO has derived internal efficiency gains through audit process improvements. Some audited entities have indicated, however, that they have not benefited to the same degree as the ANAO from these changes. Accordingly, in 2024–25, the ANAO will focus on identifying and implementing practices that could lead to shared efficiencies.

1.26 Better practices implemented by entities during the 2023–24 audit program to meet their obligations for preparing accurate performance information include:

- centralised audit coordination — creating a dedicated performance statements audit coordination team, including a single point of contact (audit liaison);

- clear audit preparation policies — establishing standardised audit preparation process, including a centralised document management system to store and categorise documents for easy access by auditors;

- data integrity — developing policies that emphasise the importance of, and responsibility for, data integrity across all performance information and end-to-end mapping of the data lifecycle relevant to each performance measure;

- timely response to auditor requests — establishing audit request registers to document auditor queries and requests for information; and

- conducting a post audit debrief and continuous improvement session with the ANAO.

1.27 Entities can also take proactive steps to improve audit efficiency. Strategies that can be implemented by audited entities include:

- early and clear communication with the ANAO;

- preparing and organising audit documentation in advance of audit commencement;

- resolving discrepancies or issues identified by the ANAO during the audit as quickly as possible; and

- conducting a self-assessment of key risks before the audit and sharing this analysis with the ANAO.

2024–25 performance statements audit program

1.28 The audit cycle for 2024–25 will provide the most comprehensive overview of government performance reporting since the PGPA Act commenced, some 10 years ago.

1.29 On 21 June 2024, the acting Auditor-General wrote to the Minister for Finance to propose expanding the performance statements audit program in 2024–25 to include 21 entities.29 The Minister responded on 2 July 2024, requesting that the Auditor-General undertake assurance audits of 21 entities’ 2024–25 performance statements under section 40 of the PGPA Act.30

1.30 This enabled the ANAO to commence formal engagement with 2024–25 auditees. It will allow interim audit findings to be issued earlier and enable entities to incorporate changes in 2025–26 corporate plans.

1.31 Significantly, in 2024–25 the ANAO will gain a lens over the policy initiatives, programs and services of all the 16 portfolio Departments of the Executive government, as well as one Parliamentary department and four other material entities (the Australian Taxation Office (ATO), the National Disability Insurance Agency (NDIA), the National Indigenous Australians Agency (NIAA) and Services Australia). This audit coverage will provide an insight into entity performance relating to more than 90 per cent of annual budget expenditures.

1.32 The expanded audit coverage also means that there will be opportunities to assess how entities perform individually as well as collectively, and in particular on whole-of-government and ‘joined up’ initiatives.31

Mandatory audits of annual performance statements

1.33 Conducting annual audits of performance statements ensures that the Parliament receives the same level of assurance on performance statements for the entities audited as it does for their financial statements. Currently, the PGPA Act makes provision for annual performance statements to be examined by the Auditor-General at the request of the Minister for Finance or the responsible minister.32 This is a different process to the initiation of financial statements audits, which are mandatory and do not require a Ministerial request.33

1.34 The JCPAA has recommended legislative change on three separate occasions, to enable the Auditor-General to initiate performance statements audits without the need for approval.34 The ANAO strongly supports legislative change to enable mandatory annual audits of performance statements. Experience suggests that intermittent external review of performance information is unlikely to improve performance measurement and reporting.

Structure of this report

1.35 This report presents the 2023–24 audit findings and observations (chapter 2), assessments of auditees’ maturity in performance reporting (chapter 3), and comments on the potential future direction of the ANAO’s performance statements program (chapter 4).

1.36 Accordingly, the report seeks to respond to the then JCPAA Chair’s comments in JCPAA Report 499 that the ‘ANAO will keep developing its performance statements audits as its rollout expands’.35

1.37 The performance results of the 14 audited entities appear in Appendix 1, along with audit findings and the ANAO’s assessment of each entity’s maturity in performance reporting. Further background on the audits and on the audit cycle appear in appendices 2 and 3 respectively. The ANAO’s audit finding categories are in Appendix 4.

2. Results from the 2023–24 performance statements audits

Chapter coverage

This chapter discusses the results from the 2023–24 annual performance statements audits. It outlines key findings and observations on how entities are presenting their performance information.

Audit conclusions and additional matters

The 2023–24 audits show that entities continue to improve their strategic planning and performance reporting. Nine of the 14 auditees (64 per cent) received an unmodified auditor’s report, compared to six of 10 auditees (60 per cent) in 2022–23.

Eight of the 14 auditees (57 per cent) received an auditor’s report containing an Emphasis of Matter paragraph (which draws the reader’s attention to a matter in the performance statements that is important for the reader to consider when interpreting those statements), compared to six of 10 (60 per cent) auditor’s reports with an emphasis of matter in 2022–23.

Audit findings

A total of 66 findings were reported to entities at the end of the final phase of the 2023–24 performance statements audits. These comprised 23 significant (A), 23 moderate (B) and 20 minor (C) findings.

The significant and moderate findings fall under five themes:

- Accuracy and reliability — this arose where entities could not provide sufficient and appropriate evidence that the reported information is complete, accurate and free from bias.

- Usefulness — this concerned performance information that may not provide insights into the entity’s performance or form a basis for driving better entity decision making.

- Preparation — these concerned preparing performance statements, including timeliness, record keeping and availability of supporting documentation.

- Completeness — this arose where performance statements contained material omissions.

- Data — this involved a lack of controls and assurance over data entry, extraction and reporting.

Measuring and assessing performance

Entities reported results against 385 targets in 2023–24. Of these, 237 targets were achieved/met, 24 were substantially achieved/met, 24 were partially achieved/met and 82 were not achieved/met. Eighteen targets had no definitive result.

2.1 Findings and recommendations are communicated to entities at several stages during the audit to enable entities to address issues before finalising their performance statements. Where findings remain unresolved, these can be addressed by entities in the following year. Appendix 3 provides an outline of the audit cycle.

2023–24 performance statements audits

2.2 The 2023–24 audits were conducted applying the following audit criteria:

- Are the entity’s key activities, performance measures and specified targets appropriate to measure and assess the entity’s performance in achieving its purposes?

- Are the performance statements prepared based upon appropriate records that properly document and explain the entity’s performance?

- Do the annual performance statements present fairly the entity’s performance in achieving the entity’s purposes in the reporting period?

2.3 The ANAO applied these criteria to determine its audit conclusion as to whether each audited entity’s performance statements:

- present fairly the entity’s performance in achieving its purposes; and

- are prepared, in all material respects, in accordance with the requirements of Division 3 of Part 2-3 of the Public Governance, Performance and Accountability Act 2013 (the PGPA Act).

2.4 Fair presentation of the entity’s performance includes whether the performance statements provide complete and accurate information to measure and assess the performance of the entity in achieving its purposes in the reporting period. Fair presentation also requires the presentation of performance information in a way that is not misleading to users, and that important information is not concealed or obscured, as this may also be misleading.

Timing and overall results

2.5 The overall timing and results from the 14 entities audited in 2023–24 are outlined in Table 2.1.

Table 2.1: Results of 2023–24 performance statements audits

|

Entity |

Date APS signed |

Date audit report issued |

Report type |

EoM |

|

Attorney-General’s Department (AGD) |

23 Sep 24 |

23 Sep 24 |

✔ |

|

|

Australian Taxation Office (ATO) |

2 Oct 24 |

3 Oct 24 |

Q |

E |

|

Department of Agriculture, Fisheries and Forestry (DAFF) |

2 Oct 24 |

3 Oct 24 |

✔ |

E |

|

Department of Education (DoE) |

3 Sep 24 |

13 Sep 24 |

✔ |

|

|

Department of Foreign Affairs and Trade (DFAT) |

13 Sep 24 |

13 Sep 24 |

✔ |

|

|

Department of Health and Aged Care (DoHAC) |

16 Oct 24 |

24 Oct 24 |

Q |

E |

|

Department of Home Affairs (Home Affairs) |

20 Sep 24 |

4 Oct 24 |

Q |

E |

|

Department of Industry, Science and Resources (DISR) |

1 Oct 24 |

2 Oct 24 |

✔ |

|

|

Department of Infrastructure, Transport, Regional Development, Communications and the Arts (DITRDCA) |

13 Sep 24 |

13 Sep 24 |

✔ |

E |

|

Department of Social Services (DSS) |

1 Oct 24 |

11 Oct 24 |

✔ |

E |

|

Department of the Treasury |

25 Sep 24 |

25 Sep 24 |

✔ |

|

|

Department of Veterans’ Affairs (DVA) |

23 Sep 24 |

25 Sep 24 |

Q |

|

|

National Disability Insurance Agency (NDIA) |

4 Oct 24 |

4 Oct 24 |

Q |

E |

|

Services Australia |

10 Oct 24 |

14 Oct 24 |

✔ |

E |

Key: ✔ auditor’s report unmodified Q auditor’s report contains a qualification E auditor’s report contains an ‘Emphasis of Matter’ (EoM).

Source: ANAO.

2.6 Consistent with the requirements of the PGPA Act, the Auditor-General provided auditor’s reports to the Minister for Finance on 1 November 2024. The Minister for Finance tabled the auditor’s reports in each House of Parliament on 28 November 2024.

Audit conclusions and additional matters

2.7 Overall, the results from the auditor’s reports of the 2023–24 performance statements audits are mixed. As outlined in Table 2.1, nine of the 14 auditees received an auditor’s report with an unmodified conclusion36 and five received a qualified audit conclusion identifying material areas where users could not rely on the performance statements, but the affect was not pervasive to the performance statements as a whole.

2.8 The two broad reasons behind the modified audit conclusions were:

- completeness of performance information — the performance statements were not complete and did not present a full, balanced and accurate picture of the entity’s performance as important information had been omitted; and

- insufficient evidence — the ANAO was unable to obtain enough appropriate evidence to form a reasonable basis for the audit conclusion about the entity’s annual performance statements.

2.9 Table 2.2 shows that the proportion of audited entities that received a qualified audit conclusion has been gradually decreasing.37 A qualified audit conclusion is the most common type of modified audit conclusion and means that the performance statements met the ANAO’s audit criteria, except for one or more areas where the performance statements either did not materially comply with the audit criteria or, due to a lack of evidence available from the auditee, the ANAO was unable to determine if the information presented was materially correct. The proportion of entities’ measures that were the subject of a modified conclusion increased in 2023–24, compared to 2022–23.

Table 2.2: Summary of audit conclusions

|

Reporting year |

Number of audited entities |

Number of Entities with qualified audit conclusions |

Proportion of entities that received qualified conclusion (%) |

Measures subject to qualified conclusion as % of all entities’ measures |

|

2023–24 |

14 |

5 |

36 |

10a |

|

2022–23 |

10 |

4 |

40 |

4b |

|

2021–22 |

6 |

3 |

50 |

7c |

Note: This table represents performance measures that were subject of a modified conclusion in 2023–24. As in 2022–23, in 2023–24 some modified conclusions relate to the omission of performance information. Modified conclusions relating to omissions are not captured in Table 2.3.

Note a: 32 of the 332 measures reported by the 14 auditees in 2023–24.

Note b: Twelve of the 294 measures reported by the 10 auditees in 2022–23.

Note c: Thirteen of the 199 measures reported by the six auditees in 2021–22.

Source: ANAO analysis

2.10 Where appropriate, an auditor’s report may separately include an ‘Emphasis of Matter’ paragraph, which does not modify the auditor’s conclusion. An Emphasis of Matter paragraph is a tool available to auditors to draw the reader’s attention to an important matter presented in the performance statements that, in the auditor’s judgement, is fundamental to the users’ understanding of the information in the performance statements. As shown in Table 2.1, eight of the 14 auditees received an auditor’s report containing an Emphasis of Matter paragraph.

2.11 Appendix 1 explains the reasons for the ANAO’s modified conclusions and Emphasis of Matter paragraphs.

Audit findings

2.12 Audit findings are reported to entities when the ANAO identifies potential business or performance reporting risks. Often these risks arise from deficiencies within internal control processes or frameworks. Weaknesses in internal controls increase the possibility that an entity will not prevent or detect a material misstatement in its performance statements in a timely manner.

2.13 The nature of the audit findings will determine whether they also result in a modification to the auditor’s report. This includes whether the ANAO can obtain sufficient appropriate evidence from the auditee, or other sources, that the identified deficiency (in internal control, processes or reporting framework) was sufficient to conclude that there was no material misstatement. The ANAO considers that findings remain outstanding until the auditee implements a response that appropriately mitigates the relevant risk on an ongoing basis. The rating scale for findings for the 2023–24 audit program is included in Appendix 4.

Audit findings by category and entity type

2.14 Table 2.3 summarises findings by category presented to entities in 2023–24. It shows that in 2023–24:

- a total of 66 findings were reported to entities at the end of the final phase of the 2023–24 performance statements audits. These comprised 23 significant (A), 23 moderate (B) and 20 minor (C) findings;

- of the 72 findings at the interim 2023–24 phase, 38 were resolved by the end of the final phase (53 per cent). By comparison, in 2022–23, 30 of the 46 findings at the interim phase (65 per cent) were resolved by the end of the final phase;

- repeat entities resolved 14 of 49 findings from the prior year at the end of interim phase (29 per cent) and 31 of 48 interim findings by the end of the final phase (65 per cent); and

- new entities resolved seven of 26 interim findings by the end of 2023–24 (27 per cent).

2.15 These results indicate that the ANAO’s performance statements audit program continues to enable entities to resolve findings during the audit process. Careful planning by entities is required at the beginning of the reporting period to effectively resolve previous year’s findings. DSS resolved six of the eight findings from the interim to the final phase of the audit, reflecting a well-planned approach to remediating these findings and ongoing communication with the ANAO.

Table 2.3: Performance statements audit findings by category

|

Category |

Closing position 2022–23 |

Resolved findings at interim |

New findings at interim |

Total findings at the end of interim |

Resolved findings at final |

New findings at final |

Closing position 2023–24 |

|

A — Significant |

|||||||

|

Repeat entities (audited in 2022–23) |

16 |

6 |

3 |

13 |

6 |

5 |

12 |

|

Newly audited entities |

N/A |

N/A |

8 |

8 |

2 |

5 |

11 |

|

Subtotal |

16 |

6 |

11 |

21 |

8 |

10 |

23 |

|

B — Moderate |

|||||||

|

Repeat entities |

13 |

3 |

3 |

13 |

12 |

12 |

13 |

|

Newly audited entities |

N/A |

N/A |

11 |

11 |

3 |

2 |

10 |

|

Subtotal |

13 |

3 |

14 |

24 |

15 |

14 |

23 |

|

C — Minor |

|||||||

|

Repeat entities |

20 |

5 |

7 |

22 |

13 |

6 |

15 |

|

Newly audited entities |

N/A |

N/A |

5 |

5 |

2 |

2 |

5 |

|

Subtotal |

20 |

5 |

12 |

27 |

15 |

8 |

20 |

|

Total |

49 |

14 |

37 |

72 |

38 |

32 |

66 |

Source: ANAO.

Significant and moderate findings by theme

2.16 There were 23 significant (A) and 23 moderate (B) 2023–24 audit findings, related to the following themes:

- Accuracy and reliability — entities could not provide sufficient and appropriate evidence that the reported information is reliable, accurate and free from bias.

- Usefulness — performance measures were not relevant, clear, reliable or aligned to the entity’s purposes or key activities. Consequently, they may not present meaningful insights into the entity’s performance or form a basis to support entity decision making. One way this can be achieved is through the PGPA Rule’s requirements for a measure to have a target, where practicable, that is challenging but achievable.

- Preparation — entity preparation processes and practices for performance statements were not effective, including timeliness, record keeping and availability of supporting documentation.

- Completeness — performance statements were not complete and did not present a full, balanced and accurate picture of the entity’s performance as important information had been omitted. 38

- Data — inadequate assurance over data extraction and reporting and a lack of controls over how data is managed across the data lifecycle, from data collection through to reporting.

2.17 These themes are generated from the ANAO’s analysis of the 2023–24 audit findings. Table 2.4 categorises the significant and moderate audit findings presented to entities in 2023–24.

Table 2.4: Significant and moderate audit findings unresolved 2023–24 by theme

|

|

Accuracy and reliability |

Usefulness |

Preparation |

Completeness |

Data |

|

Attorney-General’s Department |

– |

– |

– |

– |

– |

|

Australian Taxation Office |

– |

2 |

1 |

1 |

1 |

|

Department of Agriculture, Fisheries and Forestry |

1 |

– |

1 |

1 |

1 |

|

Department of Education |

– |

1 |

1 |

1 |

– |

|

Department of Foreign Affairs and Trade |

2 |

– |

– |

– |

– |

|

Department of Health and Aged Care |

1 |

1 |

2 |

1 |

– |

|

Department of Home Affairs |

3 |

1 |

1 |

2 |

2 |

|

Department of Industry, Science and Resources |

– |

1 |

1 |

– |

2 |

|

Department of Infrastructure, Transport, Regional Development, Communications and the Arts |

– |

– |

– |

1 |

– |

|

Department of Social Services |

2 |

– |

– |

– |

– |

|

Department of the Treasury |

– |

– |

– |

– |

– |

|

Department of Veterans’ Affairs |

– |

1 |

– |

– |

1 |

|

National Disability Insurance Agency |

1 |

– |

1 |

2 |

– |

|

Services Australia |

1 |

|

– |

3 |

– |

|

Total (% of all A and B findings) |

11 (24%) |

9 (20%) |

8 (18%) |

11 (22%) |

7 (16%) |

Source: ANAO analysis.

Recommendations for improvement

2.18 When reporting to entities on the progress and the outcomes of a performance statements audit39, the ANAO provides entities with recommendations for improvement. The purpose of the recommendations is to provide guidance to the management and those charged with governance on areas that could improve the entity’s internal controls, performance statements reporting processes, or overall governance. These recommendations aim to help strengthen the entity’s operations and provide a path to improvement.

Observations of entities’ performance information

2.19 Performance statements need to be customised to reflect the nature of the entity and its operating context. Each entity must judge the most appropriate structure and type of performance information to measure and assess the achievement of its purposes.

2.20 The ANAO has observed that many entities do not currently have a systematic approach to make these judgements. An enterprise-wide performance framework can assist an entity to identify a key activity and determine the types of measures that are suited to assessing a key activity.40 It can establish the basis for why the entity’s purposes, key activities and performance measures and targets are framed as they are and how they might evolve over time, illustrating an entity’s commitment to efficiency, effectiveness, transparency and accountability.41

Structure of performance information

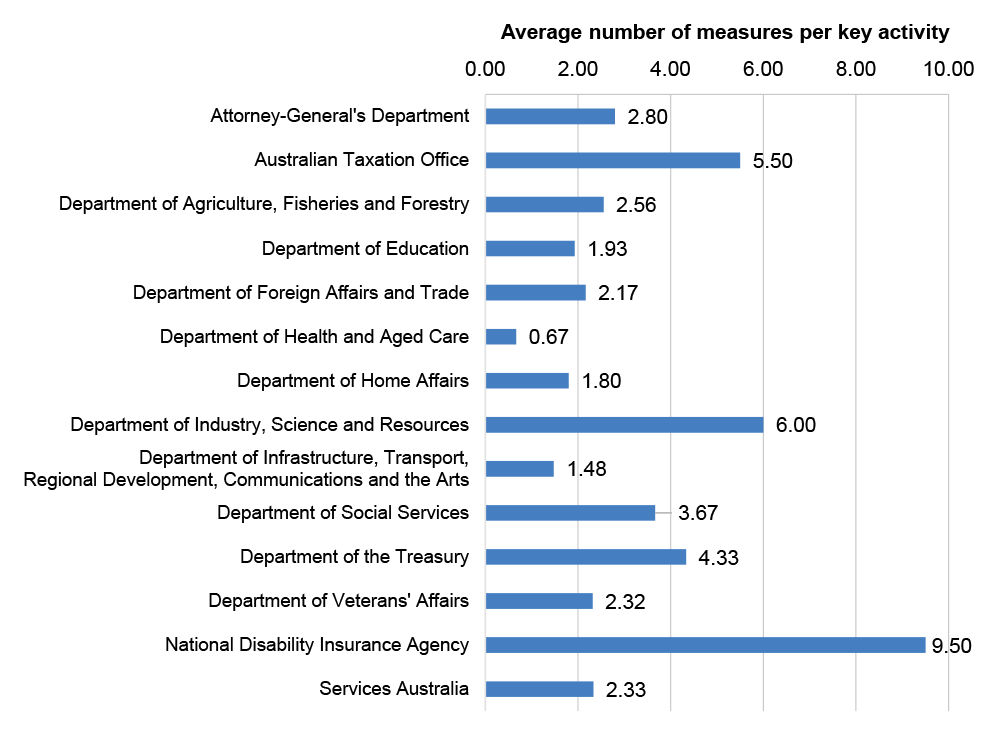

2.21 Figure 2.1 shows the average number of performance measures used by each of the 14 entities to assess a key activity. On average, entities used 3.4 measures to assess a key activity.

Figure 2.1: Number of measures per key activity for each entity: 2023–24

Source: ANAO analysis.

2.22 There is no one-size-fits all approach to determining the appropriate number of performance measures for each key activity or entity purpose. Given the complexity of many government policies, programs and services and their impact on citizens, it is unlikely that one measure would be sufficient to focus attention on the critical areas of an entity’s business or to measure and assess performance. That said, the focus should be on the outcomes that stakeholders care about most and whether each measure is necessary to assess the entity’s performance.

Types of performance measures

2.23 Different stakeholders can have different views of what constitutes performance in the public sector, particularly high performance. Entities are likely to require an appropriate mix of performance measures to provide a comprehensive picture of their performance in achieving their purposes.

2.24 The Commonwealth Performance Framework is designed to encourage entities to develop a diverse set of performance measures to assess whether they are achieving their purposes. This can include a combination of input, output, quality, efficiency and effectiveness measures. Where reasonably practicable, it is expected that an entity will have both quantitative and qualitative performance measures to capture the multiple dimensions of the entity’s performance.42 Audits have observed that some entities are beginning to consider appropriate measures to demonstrate the achievement of outcomes, benefits and impact.

2.25 Effectiveness measures are generally the most direct way to assess how well a program or service is delivered to achieve its intended objectives. It might be expected that entities will use a higher proportion of effectiveness measures as programs mature and as the entity’s capability for performance reporting matures. Over time, entities could consider developing more outcome and impact measures that focus on the end result or longer-term impact of a policy or program as part of a balanced suite of performance measures.

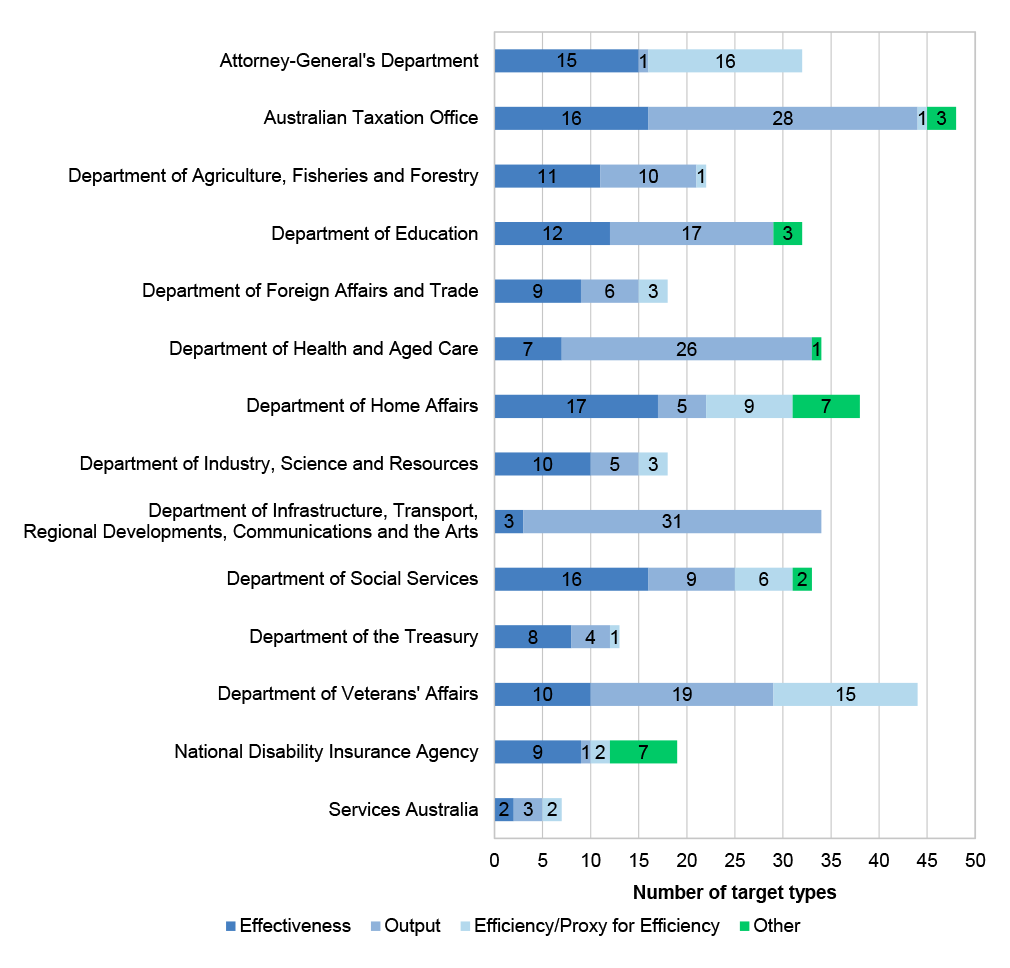

2.26 Figure 2.2 shows that the 14 entities predominantly used ‘output’ and ‘effectiveness’ targets to assess their performance. These target types account for 79 per cent of all targets used by the entities. For the purpose of comparison, the below analysis has been done at the target rather than the measure level, as some entities have measures that contain multiple targets of different types.

Figure 2.2: Target types across entities’ 2023–24 performance statements

Source: ANAO assessment of entities’ targets, including where entities identify an efficiency proxy in performance statements. In some cases, entities’ classifications may differ from the ANAO’s classifications.

2.27 Efficiency or proxy efficiency targets accounted for 15 per cent of all targets — 60 of the 393 targets.43 Proxy efficiency targets accounted for 57 of the 60 efficiency targets. The proxy efficiency targets mainly relate to the timeliness of the process to produce an output (such as answering a call or processing a claim); they do not directly assess these outputs based on the inputs used.

2.28 There were three performance targets assessed by the ANAO as efficiency targets: :

- the NDIA’s efficiency measure reported ‘NDIA spend (Program 1.2) as a proportion of NDIS spend’. The result for this measure was achieved, with a five per cent cost against a target of six per cent;

- the ATO’s performance measure ‘Cost of collection – Cost to collect $100’ which shows the trend in the ATO’s costs of collections of taxation receipts; and

- the Department of Agriculture, Fisheries and Forestry’s performance measure ‘Equal or reduced cost of levies administration compared with levies disbursed’(Measure IG-02).

2.29 The targets in the ‘other’ category (six per cent of all targets) describe an entity’s activities or inputs. They do not assess an output or an outcome that is produced or achieved by the entity. Activity measures, on their own, are generally not helpful in reporting results that reflect the achievement of an entity’s purposes. They may be appropriate in the early stages of a key activity or program where there is not any delivery to measure.

2.30 Figure 2.3 shows each entity’s use of target types for the 2023–24 reporting period. Eleven of the 14 entities used a combination of output, effectiveness and efficiency (or efficiency proxy) targets. Education, Health and Infrastructure did not report an efficiency or a proxy efficiency target. Entities may have more targets than measures given that some entities might develop more than one target for a measure.

Figure 2.3: Target types across entities, 2023–24a

Note a: Given there are composite targets with components of different types, the sum of targets included in tables 2.1 and 2.2 do not match other tables.

Source: ANAO analysis.

Stability of performance measures over time

2.31 The PGPA Rule requires that an entity’s performance measures must provide a basis for an assessment of the entity’s performance over time.44

2.32 Stability of relevant performance measures can play a role in demonstrating stewardship of public resources by providing consistent, reliable data that can be tracked over time and used to evaluate how well public resources are being managed. Without consistency, the value of performance information is significantly diminished, as users would find it difficult to evaluate how well an entity is performing over time or whether it is effectively meeting its long-term goals.

2.33 Over time, some change in an entity’s performance measures is to be expected. This will reflect a range of circumstances including:

- the evolution of existing policies and programs;

- change in policy direction through circumstances, including a change in government;

- change in an entity’s functions following Machinery of Government changes; and

- the availability of better data and/or methods leading to new performance measures to replace existing measures.

2.34 Good measures that provide meaningful information on performance may not be evident until after measurement has been underway for some time and entity performance data and systems have had time to mature. Therefore, reviewing and revising performance measures as the entity’s performance reporting capability improves reflects good practice.

2.35 Table 2.5 presents the proportion of each entity’s 2023–24 performance measures that were identical or comparable to the measures in the entity’s 2021–22 corporate plan. The comparison of measures over three reporting periods has been used to gauge the extent to which an entity’s measures would enable a reader to assess performance over time.

2.36 Table 2.5 shows that for 13 of the 14 entities, a majority of their 2023–24 performance measures were identical or comparable to the measures in their 2021–22 corporate plan. Four of the 14 entities (29 per cent) had a greater than 80 per cent consistency of measures over the three reporting periods. As entities continue to improve their performance information, it is expected that the suite of measures will stabilise over time.

Table 2.5: Entities’ 2023–24 performance statements measures — comparable or identical to 2021–22 corporate plan measures

|

Entity |

Identical measures |

Comparable measures |

New measuresa |

Total measures |

% identical or comparable |

|

Attorney-General’s Department |

9 |

3 |

2 |

14 |

86 |

|

Australian Taxation Office |

27 |

7 |

10 |

44 |

77 |

|

Department of Agriculture, Fisheries and Forestry |

4 |

9 |

10 |

23 |

57 |

|

Department of Education |

17 |

4 |

6 |

27 |

78 |

|

Department of Foreign Affairs and Trade |

2 |

6 |

5 |

13 |

62 |

|

Department of Health and Aged Care |

22 |

3 |

9 |

34 |

74 |

|

Department of Home Affairs |

0 |

7 |

2 |

9 |

78 |

|

Department of Industry, Science and Resources |

5 |

4 |

9 |

18 |

50 |

|

Department of Infrastructure, Regional Development, Communications and the Arts |

13 |

6 |

15 |

34 |

56 |

|

Department of Social Services |

19 |

3 |

11 |

33 |

67 |

|

Department of the Treasury |

6 |

1 |

6 |

13 |

54 |

|

Department of Veterans’ Affairs |

41 |

1 |

2 |

44 |

95 |

|

National Disability Insurance Agency |

16 |

0 |

3 |

19 |

84 |

|

Services Australia |

5 |

2 |

– |

7 |

100 |

Note a: Measures considered a new measure for the purposes of reporting in the annual performance statements 2023–24 (i.e. does not appear in any form in the entity’s 2021–22 corporate plan).

Source: ANAO analysis of Entities’ 2021–22 corporate plan and 2023–24 annual performance statements.

Measuring and assessing performance

2.37 Setting out clear performance expectations and reporting progress against them is essential for program and service improvement, and for good performance reporting to Parliament and the public. Performance targets provide a benchmark against which progress can be measured. Without clear performance targets, it is difficult to assess whether the results achieved represent good performance.

2.38 When preparing a corporate plan, the PGPA Rule requires entities to specify targets for each performance measure for which it is reasonably practicable to set a target.45 Where possible, targets for performance measures should be specific, measurable and reportable.46

2.39 Overall, the 14 entities audited in 2023–24 reported against 385 performance targets in their performance statements. Table 2.6 provides a summary of entity performance against the targets set in their corporate plans.

Table 2.6: Entity performance against performance targets

|

Reporting year |

Achieved |

Substantially achieved |

Partially achieveda |

Not achieved |

No definitive resultb |

Total |

|

2023–24 |

237 |

24 |

24 |

82 |

18 |

385 |

Note a: Twelve of the 294 measures reported by the 10 auditees in 2022–23.

Note b: This includes target results of ‘No Target’, ‘Target Removed’, ‘Not Applicable’, ‘Baseline Established’, ‘Data Not Available’, ‘Unable to be Determined’, ‘Ongoing’.

Source: ANAO analysis of reported results.

2.40 As shown in Table 2.6, entities reported that they achieved or substantially achieved 261 (68 per cent) performance targets. They also reported that 82 (21 per cent) performance targets were not achieved.

2.41 Performance targets should be set thoughtfully and carefully. They should be challenging but achievable, balancing ambitious goals with realistic expectations. Where a target has historically been exceeded, or is static for a period of time, entities should review the target or explain why the target has been maintained at a certain level.47

2.42 Entities should take care to ensure that targets do not promote adverse results or distort behaviour, which can undermine an entity’s performance framework.

2.43 Entities should be cautious of a focus on short-term wins that may undermine long-term goals. For example, where an entity focuses on improving efficiency to a point where the quality of services is substantially decreased, or practices are adjusted to meet a target rather than achieve desired outcomes. Developing a balanced set of performance measures and providing meaningful narrative and analysis in performance statements about the factors contributing to performance results can help to properly inform stakeholders about the entity’s performance, address potential concerns from stakeholders and avoid inappropriate conclusions or decisions by stakeholders.48

2.44 Assessing entity performance involves more than simply reporting on the number of performance targets achieved. An entity’s performance analysis and narrative are important to tell the story behind the numbers and properly inform stakeholder conclusions about the entity’s performance.

2.45 Meaningful narrative and analysis in performance statements can transform simple results into meaningful insights, which offer context, interpretation and explanation that enhance stakeholder understanding of the entity’s performance results. It can also summarise what the entity has learned during the reporting period and how that knowledge will be applied to improve operations. This can help to build public trust and accountability as it shows the entity is not only reporting on data and metrics but actively using evidence and results to learn and refine key activities and strategies.

2.46 Case study 1 describes the approach that DVA has taken to set performance targets for specific measures and to describe the factors that impacted the results achieved.

|

Case study 1. Department of Veterans’ Affairs: Setting of performance targets is important |

|

The Department of Veterans’ Affairs set a target for its 12 timeliness measures in Outcome 1 (‘To support financial wellbeing of veterans and their families’) at 50 per cent. Three of these targets were achieved in the reporting period:

In order to understand the entity’s performance, the reader needs to look beyond simply the number of measures achieved and the level of achievement for each measure, and consider the analysis provided to explain the results relative to their targets. In this case, the narrative and analysis presented in the performance statements explains that the results have been impacted by several contributing factors, including a significant increase in the number of claims, the complexity of applications received and DVA’s efforts to address the backlog of claims. The analysis included in the performance statements is aimed at facilitating stakeholder understanding and address potential concerns from stakeholders.a |

Note a: Department of Veterans’ Affairs, Annual Report 2023–24, pp. 45–47, available from: dva.gov.au/sites/default/files/2025-01/dva-annual-reports-2023-24.pdf [accessed 7 February 2025].

3. The maturity of entities’ performance reporting processes

Chapter coverage

This chapter discusses the performance reporting maturity of 2023–24 auditees against five categories that the ANAO considers are essential to drive organisational performance, promote accountability and transparency and demonstrate effective stewardship of public resources.

Leadership and culture — Effective leadership plays a critical role in shaping an entity’s culture, strategic direction, decision-making and overall success. Ultimately, leadership is a key determinant of entity performance. The ANAO assessed that 10 of the 2023–24 auditees had either an ‘Advanced’ or ‘Embedded’ performance culture.

Governance — Governance structures that establish clear roles and responsibilities, ensure accountability and transparency, promote ethical behaviour, foster high performance and long-term sustainability help entities to build and maintain public trust. The ANAO assessed that four entities had ‘Advanced’ or ‘Embedded’ governance processes to monitor and report performance information.

Data and systems — To produce high quality performance information on a consistent basis, entities require information technology (IT) systems and processes that can generate complete, accurate and timely data. The ANAO assessed one 2023–24 auditee as ‘Advanced’ in terms of its ability to use data and IT systems to produce complete and accurate performance information.

Capability — Capability relates to the knowledge and skills within an entity to design, measure and report high quality performance information on an ongoing basis. The 2023–24 audits indicate that the performance statements audit program is influencing change to improve entities’ capability for performance reporting.

Reporting and records — High quality performance reporting enhances accountability and transparency by ensuring that performance information is consistently collected, reported and accessible to stakeholders. It builds trust with stakeholders and enhances the entity’s ability to meet its objectives and achieve its purposes. With only three audited entities in 2023–24 achieving a rating of ‘Advanced’, and three remaining at ‘Developing’, work remains to be done across the sector to ensure that performance information is appropriate and meaningful.

3.1 The Commonwealth Performance Framework requires entities to set out what they plan to achieve, how they will measure and assess their performance and what success looks like. Section 15 of the Public Governance, Performance and Accountability Act 2013 (the PGPA Act) requires, among other things, that the accountable authority of a Commonwealth entity must govern the entity in a way that promotes the achievement of the purposes of the entity.49

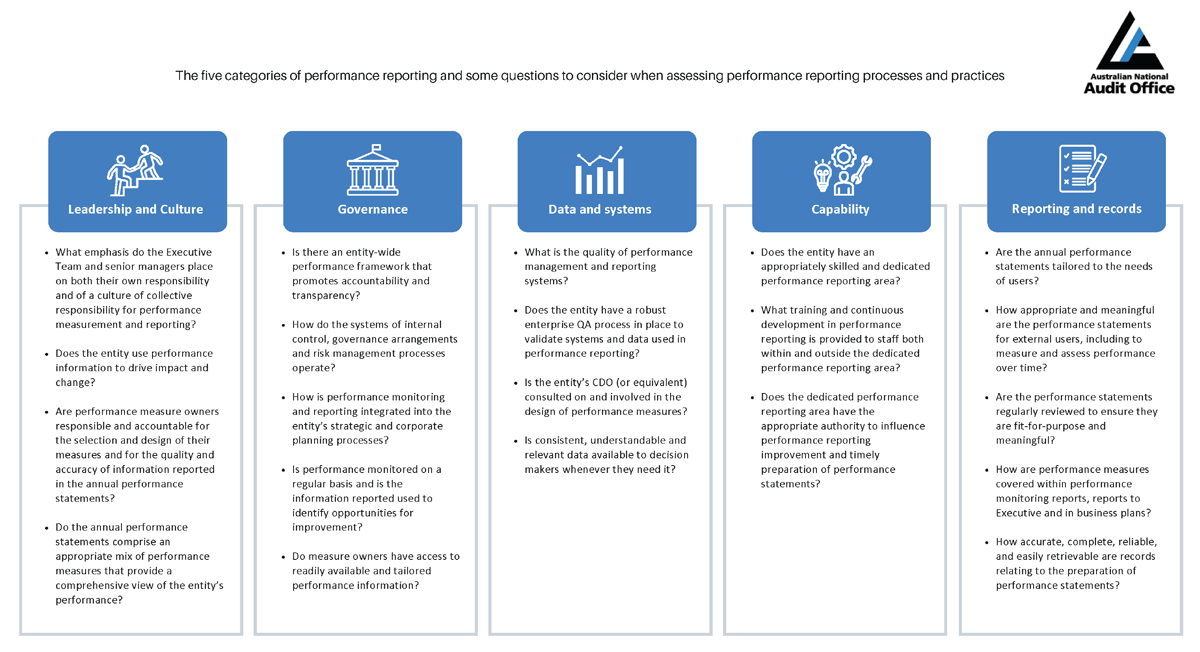

3.2 To determine entity progress and capacity to produce meaningful performance information, the ANAO has developed a model to assess the maturity of entity performance frameworks and reporting processes and practices. The ANAO’s model assesses maturity under five categories:

- Leadership and culture;

- Governance;

- Data and systems;

- Capability; and

- Reporting and records.

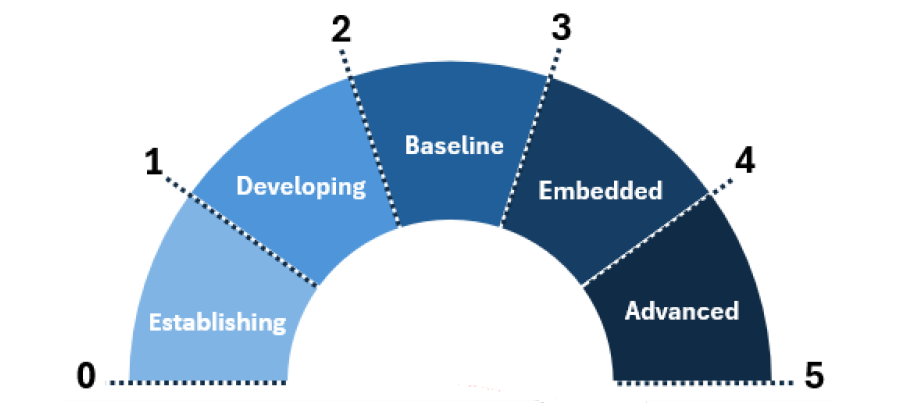

3.3 Maturity was assessed against five levels with ‘Establishing’ being the lowest level and ‘Advanced’ the highest as shown in Figure 3.1.

Figure 3.1: Maturity assessment levels

Note: Based on feedback, including from the Expert Advisory Panel50, the ‘maturity dial’ presented in Figure 3.1 was refined at the end of the 2023–24 reporting period. The nomenclature previously used for the five maturity levels has been adjusted to better reflect an entity’s progression. This rewording does not impact the ANAO’s actual consideration of an entity’s maturity.

Source: ANAO.

Summary of entities’ maturity

3.4 Table 3.1 shows the ANAO’s average maturity assessment of the 14 entities in the 2023–24 performance statements audit program against the five maturity categories. Appendix 2 provides background and suggested questions for entities to consider when assessing performance reporting processes and practices.

Table 3.1: Assessment of entities’ performance reporting maturity

|

Maturity category |

Leadership and culture |

Governance |

Data and systems |

Capability |

Reporting and records |

|

Average |

3.3 |

3.1 |

2.6 |

3.0 |

2.8 |

Source: ANAO analysis.

3.5 Table 3.1 shows that across the 14 entities, ‘Leadership and culture’ was the most mature of the five categories and ‘Data and systems’ was the least mature.

3.6 One auditee was assessed as ‘Advanced’ in terms of its ‘data and systems’. While some modest improvement was observed from 2022–23 to 2023–24, audits for many entities have found that similar issues persist year-on-year, sometimes due to the expense or time taken to remediate them. However, there is evidence of a higher degree of internal cooperation between IT teams and business areas, presenting opportunities for innovative solutions and improvement.

3.7 The Attorney-General’s Department (AGD) and Treasury, which have been audited since 2020–21 and 2021–22 respectively, have measures that do not typically rely on complex data and systems and generally involve manual processes. Both entities have:

- strong oversight by internal bodies such as the Audit and Risk Committee;

- sign-off of detailed information packs by senior staff to ensure measures are appropriate and results are certified;

- implemented the performance framework throughout the entity, including documentation of roles and responsibilities;

- high-quality methodology documentation;

- internal quality assurance procedures; and

- regular reporting timeframes (for example, AGD’s quarterly reporting and Treasury uses a mid-cycle performance review).

Maturity is improving

3.8 Table 3.2 shows that for the 10 repeat audits51, average maturity has increased from 2.7 in 2022–23, which corresponds to the ranking ‘Baseline’, to 3.0 in 2023–24, moving the dial to the next category of ‘Embedded’. The ‘repeat’ auditees increased in maturity across all five factors, with the largest average increases in ‘capability’ (0.6) and ‘governance’ (0.5). With the exception of ‘data and systems’, the repeat auditees’ average maturity against each factor was assessed in 2023–24 as ‘Embedded’.

Table 3.2: Comparison of entities’ performance reporting maturity

|

Maturity category |

2022–23 |

2023–24 10 comparative entities |

2023–24 All 14 entities |

|

Leadership and culture |

3.0 |

3.3 |

3.3 |

|

Governance |

2.6 |

3.1 |

3.1 |

|

Data and systems |

2.4 |

2.7 |

2.6 |

|

Capability |

2.6 |

3.2 |

3.0 |

|

Reporting and records |

2.8 |

3.0 |

2.8 |

|

Overall average |

2.7 |

3.1 |

3.0 |

Source: ANAO analysis.

3.9 Across the 14 entities audited in 2023–24, average maturity increased from 2022–23 and was higher on average in four of the five factors. The year-on-year improvement in entity maturity demonstrates that the audit function can help to facilitate improvement in performance reporting, as well as contributing to broader development of governance arrangements, capability and data and systems.

Analysis of the five categories of performance reporting

Leadership and culture

3.10 Effective leadership plays a fundamental role in shaping an entity’s performance culture, strategic direction, decision-making and overall success. Ultimately, leadership is key to entity productivity and performance.

3.11 The leadership of an entity plays a central role in the development, implementation and adaptation of an entity’s corporate plan. A clear and compelling corporate plan helps enhance performance and drive an entity towards its long-term goals.

3.12 The corporate plan is not just about key activities and performance measures but about how an entity’s purposes will be achieved. Leadership’s cultural influence ensures that the corporate plan objectives and targets are pursued in a way that aligns with the entity’s values. For example, if ‘customer-centricity’ is a core value, customer satisfaction could be a central performance measure. The success of the corporate plan relies on leadership’s commitment to implement it effectively, including development of a relevant, useful and balanced set of performance measures, challenging but achievable targets and regular monitoring of performance.

3.13 For 2023–24, 10 audited entities achieved a rating of ‘Embedded’ or ‘Advanced’. This suggests that, broadly speaking, senior executives in the sector are engaging positively with performance statements audit and seeking to drive an entity culture that values high quality performance information and reporting, including periodic monitoring and incorporation in key business processes such as business planning.

Governance

3.14 Governance structures that establish clear roles and responsibilities, ensure accountability and transparency, promote ethical behaviour, foster high performance and long-term sustainability and help entities to build and maintain public trust. They are essential for ensuring effective stewardship of public resources.

3.15 The Explanatory Memorandum to the PGPA Bill states that the third object of the Act52, is to require Commonwealth entities, among other things, to:

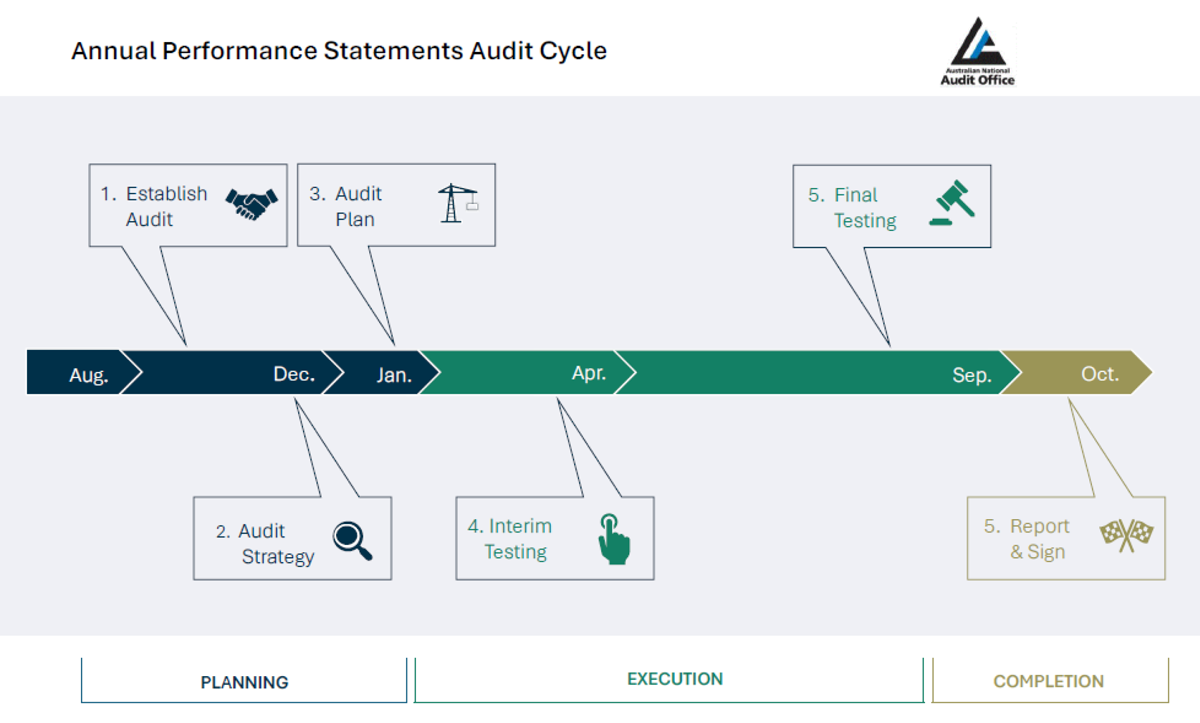

meet high standards of governance—good governance provides the foundation for high performance and community confidence in the public sector. Good governance is grounded in accountability, transparency, leadership, integrity and stewardship and in responsiveness to the needs and aspirations of citizens. The governance arrangements for entities should clearly spell out the roles, responsibilities and accountabilities of leaders and officials.53