Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Management, Administration and Monitoring of the Indemnity Insurance Fund

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the departments of Health and Human Services’ administration, including oversight and monitoring arrangements, for the Indemnity Insurance Fund.

Summary and recommendations

Background

1. The Indemnity Insurance Fund was established in 2011 to consolidate seven existing government assistance schemes providing medical and professional indemnity support for medical practitioners and midwives. The relevant schemes, established between 2003 and 2010, aimed to address market failure and stabilise the medical indemnity industry after Australia’s largest provider of medical indemnity cover, United Medical Protection, was placed in provisional liquidation in May 2002. From 1 July 2003, all providers of medical indemnity insurance were required to be licensed under the Insurance Act 1973, supervised by the Australian Prudential Regulatory Authority.

2. Priorities for the Indemnity Insurance Fund are: promoting stability in the medical indemnity insurance industry; keeping premiums affordable for doctors; and ensuring availability of professional indemnity insurance for eligible midwives.

3. Funding for the Indemnity Insurance Fund is provided from special appropriations and departmental appropriations to the departments of Health and Human Services. Total expenditure under the schemes since the commencement is estimated to be under $0.45 billion.

4. In February 2014, the National Commission of Audit recommended that the Commonwealth scale back its subsidies for medical indemnity insurance and reported that there is evidence that the market is normalising—average premiums had declined since 2003–04 to become more affordable and net assets and reported profits in the industry had increased. The Government’s response to the National Commission of Audit report was that ‘Reforms to Medical Indemnity will be considered following the 2014–15 Budget’.1

Audit objective and criteria

5. The audit objective was to assess the departments of Health and Human Services’ administration, including oversight and monitoring arrangements, for the Indemnity Insurance Fund.

6. To form a conclusion against the objective, the ANAO adopted the following high level criteria:

- the Department of Health has in place and ensures adequate oversight and probity for the Indemnity Insurance Fund.

- the Department of Health has implemented a proper system for monitoring, review and reporting to the Minister including assessing priorities for the Indemnity Insurance Fund, consistent with the aims and objectives of the Indemnity Insurance Fund; and

- the Indemnity Insurance Fund and associated schemes are supported by sound administrative arrangements.

Conclusion

7. The government’s package of regulatory and financial measures, established to address market failure in the early 2000s, was informed by a range of expert advice and subject to monitoring and a number of independent reviews during the first five years of its implementation. Overall, the design and implementation of these measures significantly improved the financial viability of insurers and ensured the availability and general affordability of indemnity insurance. The measures implemented however, resulted in a significant financial risk transfer to the Commonwealth.

8. The Department of Health does not have fit-for-purpose monitoring and reporting arrangements in place to assess the impact of the measures—including regulatory and other legal reforms on the stability of the indemnity insurance market, the affordability of premiums or importantly, the government’s exposure to risk. The departments of Health and Human Services developed and documented bilateral management and administrative arrangements to support the delivery of the Indemnity Insurance Fund’s support measures. While these arrangements set out each entity’s roles and responsibilities, documented mechanisms for cross-entity risk management were not in place. Both entities’ internal and external guidance materials need to be reviewed and updated.

9. There is scope for the entities to review and put measures in place to ensure that the information and data collected from insurers against the schemes is accurate and relevant to better inform actuarial assessments, risk analysis and the measurement and reporting of the performance of the schemes against the Indemnity Insurance Fund’s objectives. There is also a need for the entities to improve the relevancy and completeness of public and internal performance indicators, including implementing measures to monitor and report the actual cost to the government to administer the Indemnity Insurance Fund.

Supporting findings

10. A range of expert analysis, advice and stakeholder consultations informed the government’s response to the financial crisis in the medical indemnity insurance market. Following the early phases of this response, monitoring and a number of reviews by experts were conducted examining the financial and other measures adopted. However, there was limited consideration of the risk exposure to the Commonwealth and a longer-term exit strategy for a point in time when the market was determined to have stabilised and insurance premiums were considered affordable.

11. Overall, the financial strength of the medical indemnity insurance market has improved significantly since the Indemnity Insurance Fund schemes and Australian Prudential Regulation Authority’s regulatory oversight were introduced in 2002. In the years following the government’s response, net assets and capital holdings of insurance providers has improved markedly, with providers’ market share also largely stabilised.

12. Since 2003–04, there have also been improvements in the affordability of average insurance premiums paid by most medical specialities. Professional indemnity insurance for midwives continues to be available.

13. The Department of Health however, does not have an effective monitoring arrangement in place or a strategy for consulting stakeholders to support its policy and administrative responsibilities for assessing the stability of the indemnity insurance market. Information received by the Department of Health on professional indemnity insurance for midwives is also limited.

14. To date, the Department of Health has not reviewed or evaluated the Indemnity Insurance Fund legislation, supporting regulatory and other legal reforms, or the schemes’ financial assistance packages for their impact on the availability and affordability of indemnity insurance. The Department of Health’s reporting to its Minister on the Indemnity Insurance Fund’s performance and risks is largely ad hoc and driven by external processes, for example the annual Budget process. Overall, the Department of Health’s arrangements for review, analysis and advice to its Minister on the Indemnity Insurance Fund schemes, including risks and performance against the Indemnity Insurance Fund’s objectives and priorities, are limited.

15. Although, the roles of the Australian Government entities, including contracted insurers, for delivery of Indemnity Insurance Fund-related regulation and administrative responsibilities are generally clear, the Department of Health has not established any regular intragovernmental or stakeholder engagement arrangements to coordinate or communicate Indemnity Insurance Fund-related policy and regulatory developments.

16. There is no coordinated cross-entity risk management arrangement in place for medical indemnity matters, including the Indemnity Insurance Fund and related schemes. Bilateral management arrangements for the medical indemnity programs between the departments of Health and Human Services are governed by joint agreements. However, no overarching bilateral risk management plans or formal arrangements have been established for the Indemnity Insurance Fund schemes.

17. The Department of Health does not have any risk management plans, including regular assessment, monitoring and mitigation arrangements in place to support its Indemnity Insurance Fund-related policy responsibilities. The Department of Human Services has established suitable risk management plans and review arrangements to support its Indemnity Insurance Fund-related administrative responsibilities.

18. The bilateral agreements between the departments of Health and Human Services set out key administrative arrangements intended to support the operation and delivery of the Indemnity Insurance Fund schemes.

19. There is scope to improve the relevancy and completeness of the departments of Health and Human Services’ public and internal performance indicators.

20. The Department of Health published the Indemnity Insurance Fund guidelines which outline key aspects of the Indemnity Insurance Fund’s administrative arrangements. The Department of Human Services established a range of internal guidance materials to assist its administration of the Indemnity Insurance Fund’s schemes. However, some of the guidance materials contain inaccuracies and need to be reviewed and updated.

21. The Department of Human Services’ claims assessment process, a series of manual and paper-based processes, was supported by a reasonable quality assurance process. Human Services delayed the development of a medical indemnity online claiming system, which is intended to realise efficiencies for both insurers and the department; the department’s new electronic claiming system was expected to be delivered by October 2016. However, the department advised the ANAO that the project has been further delayed and a new implementation date has not yet been identified.

22. During 2014–15, due to problems with the functionality of its Health Professional Online System, the Department of Human Services implemented data transfer arrangements, albeit temporarily, and did not document its consideration of the risk of any compromise of the confidentiality of midwives’ personal information.

23. There is scope to improve the Department of Human Services’ Indemnity Insurance Fund data integrity controls. In particular, the relevance, accuracy, and consistency of data provided by insurers, including to the Australian Government Actuary.

24. The departments of Health and Human Services do not report on the costs of administering the Indemnity Insurance Fund and related schemes in a consistent and transparent manner.

25. While the department of Health publicly reports its Indemnity Insurance Fund departmental costs, Human Services does not report on its own Indemnity Insurance Fund-related costs.

26. The Department of Health has not recently reviewed the basis on which the administration fees paid to insurers are calculated to ensure ongoing value for money to the government. To improve transparency, there would be particular benefit in the departments of Health and Human Services’ analysing and reporting on the costs of Indemnity Insurance Fund administration over time.

27. Further, the reasonableness of the current administration costs needs to be considered by the Department of Health in undertaking a ‘first principles review’ of the Indemnity Insurance Fund and related schemes.

Recommendations

|

Recommendation No. 1 Paragraph 2.93 |

The Department of Health should conduct a ‘first principles review’ of the Indemnity Insurance Fund and related schemes prior to the 2017–18 Budget. Health’s response: Agreed with qualification. |

|

Recommendation No. 2 Paragraph 2.95 |

Subject to the outcome of this ‘first principles review’, the Department of Health should develop and implement a fit-for-purpose monitoring and reporting arrangement for the Indemnity Insurance Fund, legislation, and related schemes that provides its Minister with timely, robust analysis of the Indemnity Insurance Fund’s performance and risks to government. Health’s response: Agreed. |

|

Recommendation No. 3 Paragraph 3.17 |

That the Department of Health establish suitable governance and stakeholder engagement arrangements, including risk management plans, to support its and other shared responsibilities for the administration of the Indemnity Insurance Fund and related schemes. Health’s response: Agreed. |

|

Recommendation No. 4 Paragraph 3.44 |

That the departments of Health and Human Services review their Indemnity Insurance Fund administrative arrangements to:

Health’s response: Agreed. Human Services’ response: Agreed. |

Summary of entity responses

The Department of Health

I am pleased that the ANAO found that the medical indemnity and midwife professional indemnity schemes continue to improve the affordability of medical indemnity insurance premiums. The Government’s contribution strengthens the medical indemnity industry, and ensures professional indemnity for private midwives remains available, which are key objectives of the Indemnity Insurance Fund schemes. The report has highlighted important areas for improvement, particularly with regard to re-establishing appropriate frameworks to ensure good governance, stakeholder engagement and risk management.

The Department of Health’s implementation of the ANAO ‘s recommendations, including those in partnership with the Department of Human Services, will provide sound and timely advice to the Australian Government on the operation of and risks associated with, the Medical Indemnity and Midwife Professional Indemnity schemes.

The Department of Human Services

The Department of Human Services (the department) welcomes this report and notes that the ANAO found that the department has established suitable risk management plans and review arrangements to support the administration of payments under the Indemnity Insurance Fund (IIF). The report also concluded that the department’s claims assessment process is supported by reasonable quality assurance processes.

The department considers that implementation of the audit recommendations will further enhance the department’s administration of the IIF, and will work with the Department of Health to improve its shared administrative responsibilities.

1. Background

What is medical indemnity insurance?

1.1 Medical indemnity insurance provides financial protection (to the extent set out in the insurance contract) to both medical practitioners and patients in circumstances where a patient sustains an injury (or ‘adverse outcome’) caused by negligence or an otherwise unlawful act.

1.2 All medical practitioners are required to hold medical indemnity insurance in order to practice privately, as a condition of their professional registration. In this regard, the availability of affordable medical indemnity insurance contributes to the stability in supply of Australia’s health services. Further, it supports patients’ access to relevant medical services, including mitigating the potential for additional fees stemming from high insurance costs.2

The medical indemnity ‘crisis’

1.3 Until 2001, most medical indemnity insurance cover was provided by medical defence organisations—which differed from general insurance providers as cover was provided on a discretionary basis.3 The 2001 financial collapse of HIH Insurance Limited—a major reinsurer of United Medical Protection Limited/Australasian Medical Insurance Limited (UMP/AMIL), Australia’s largest medical defence organisation—was a critical event for the medical indemnity insurance industry. It was also a catalyst for increased government intervention in the medical indemnity insurance industry, including substantial legal, regulatory and funding reform.

1.4 UMP/AMIL was placed into provisional liquidation in May 2002 ‘…which resulted in a potential lack of indemnity cover for many doctors’ in Australia’.4 At the same time, medical practitioners experienced significant increases in the insurance premiums being levied by all medical indemnity providers. In extreme cases, some medical practitioners were paying indemnity insurance premiums representing over a third of their incomes while others left the profession or ceased certain high-risk procedures like obstetrics.5

1.5 For the Australian Government, these events created two broad, inter-related and complex policy issues that needed immediate attention while recognising that any longer-term solution would require a whole-of-government approach.

The development of appropriate policy responses to these issues presents serious challenges, because of the complexity of contributing factors and the range of interested stakeholders, including not only Commonwealth and state and territory governments but also patients, doctors, insurers and other groups.6

1.6 Between 2002 and 2010, the Australian Government implemented a range of financial and regulatory measures to prevent an immediate collapse of the insurance industry and to support the availability and affordability of medical indemnity insurance. These measures were underpinned by tort law reform7 at the state and territory level.

The Indemnity Insurance Fund

1.7 The Indemnity Insurance Fund (IIF) was an Australian Government initiative administered by the Department of Health (Health) designed to consolidate funds that provide Commonwealth support for medical and professional indemnity insurance for medical practitioners.8 Funding was previously separately administered through five general medical indemnity schemes and two professional indemnity for midwives schemes.9 In this context, the IIF’s primary objective was to streamline the administration of the existing schemes with the following priorities:

- promote stability of the medical indemnity insurance industry—to ensure the ongoing stability of the medical indemnity insurance industry, the department will continue to monitor the operations and activities of medical indemnity insurers;

- keep premiums affordable for doctors—a stable and competitive medical indemnity industry assists in keeping medical indemnity premiums affordable for doctors; and

- ensure availability of professional indemnity insurance for eligible midwives—the government contracted an insurer, Medical Insurance Group Australia, to provide professional indemnity insurance to eligible midwives.10

1.8 As of July 2016, the financial support measures in place, consolidated under the IIF, include the: Premium Support Scheme; High Cost Claims Scheme; the Exceptional Claim Scheme; Run-off Cover Scheme; Incurred-But-Not-Reported Scheme; Midwife Professional Indemnity Commonwealth Contribution Scheme; and the Midwife Professional Indemnity Run-off Cover Scheme. A summary of each of the schemes under the IIF and their purpose is set out in Table 1.1.

Table 1.1: Schemes within the Indemnity Insurance Fund

|

Scheme |

Purpose and key features |

|

Incurred-But-Not-Reported (IBNR) Scheme |

To cover unfunded medical indemnity insurers’ liabilities that were incurred but not reported as at 30 June 2002. The government covers the costs of claims from unfunded liabilities. Members contributed to these costs through support payments. UMP/AMIL has been the only provider to participate in the scheme. UMP support payments ceased in 2007–08. |

|

Premium Support Scheme (PSS) |

To assist eligible practitioners with the cost of medical indemnity insurance through payment of subsidies (through insurers applying a reduction in premiums), where medical indemnity costs exceed 7.5 per cent of their gross private medical income. The relevant premium periods and applicable subsides were:

|

|

High Cost Claim Scheme (HCCS)(a) |

To place downward pressure on premiums, particularly for doctors in high-risk areas by lowering the amount insurers pay out and reducing the amount of reinsurance insurers need to buy to fund large claims. For each claim over $300 000, the government reimburses medical indemnity insurers 50 per cent of the insurance pay out over $300 000 up to the limit of the practitioner’s cover. Claims that exceed the insurance contract limit (generally $20 million) can trigger an ECS. |

|

Exceptional Claim Scheme (ECS) |

To remove risk from practitioners for very high claims so that practitioners are not personally liable. The government pays 100 per cent of the cost of private practice claims that are above the limit of a practitioner’s medical indemnity insurance (generally $20 million). |

|

Run-off Cover Scheme (ROCS) |

To provide secure insurance for doctors who have left private practice. The government pays the costs of valid medical indemnity insurance claims (including the costs related to managing claims) made against doctors eligible for ROCS including those that have retired, deceased or are on maternity leave. The ongoing cost of ROCS is met over time by a ROCS support payment paid by insurers to the Government. The Australian Government Actuary notes that ‘In practice, the cost is met by a loading on practitioners’ medical indemnity insurance premiums’. |

|

Midwife Professional Indemnity (Commonwealth Contribution) Scheme (MPIS) |

To ensure availability of professional indemnity insurance for privately practicing eligible midwives. The insurer pays the first $100 000 for each claim. The government will pay 80 per cent of the insurance pay out exceeding $100 000 up to $2 million, and 100 per cent of the amount exceeding $2 million. |

|

Midwife Professional Indemnity Run-off Cover Scheme (MPIROC) |

To provide secure indemnity insurance for midwives who have left private practice. The government will pay, via the insurer, 100 per cent of each eligible ROC claim that is notified after a midwife leaves the workforce or retires. |

Note a: This scheme has three threshold levels, which are dependent on the date the claim was first notified to the insurer: 1 January 2003 to 21 October 2003, $2 000 000; 22 October 2003 to 31 December 2003, $500 000 and on or after 1 January 2004, $300 000.

Source: Department of Health, Medical Indemnity website. Available from: <http://www.health.gov.au/internet/main/publishing.nsf/Content/budget2011-flexfund-indemnity19.htm>.

Administrative arrangements

1.9 Health has policy responsibility for the IIF, including its seven schemes, as well as defined responsibilities under relevant legislation.

1.10 The Department of Human Services (Human Services), under its Medicare program, is responsible for administering payments to relevant insurers for all of the medical indemnity package measures.

1.11 Under tripartite contracts with Health and Human Services, the premium support and professional indemnity for midwives schemes are jointly administered by Human Services and medical indemnity insurance providers, with Health retaining overall policy and financial responsibility.11

1.12 Within the Treasury portfolio, the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investment Commission (ASIC) provide regulatory supervision (see Appendix 3).12

1.13 Funding for the IIF is made through special appropriations for medical indemnity and midwives professional indemnity with separate appropriations for Health’s departmental expenses. Reported actual expenditure under the IIF schemes including special appropriations for the period 2004–05 to 2014–15 was under $0.45 billion13 with departmental expenses of $7.1 million over the same period.14 A summary of financial arrangements for the IIF schemes is set out in Appendix 2.

1.14 Human Services receives funding for administering its responsibilities under the IIF schemes through broader departmental appropriation.15

Audit approach

1.15 The audit objective was to assess the departments of Health and Human Services’ administration, including oversight and monitoring arrangements, for the Indemnity Insurance Fund.

1.16 To form a conclusion against the audit objective, the ANAO adopted the following high-level criteria including the:

- Department of Health has implemented a proper system for monitoring, review and reporting to the Minister including assessing priorities for the IIF, consistent with the aims and objectives of the IIF;

- Department of Health has in place and ensures adequate oversight and probity for the IIF; and

- the IIF and associated schemes are supported by sound administrative arrangements.

Audit methodology

1.17 The audit methodology included:

- interviewing key officials in the departments of Health and Human Services, the Treasury, as well as the Australian Government Actuary;

- interviewing and/or surveying key external stakeholders including: ASIC; APRA; relevant medical and professional midwife indemnity insurers; and peak medical and midwife organisations16;

- reviewing relevant documentation from the departments of Health and Human Services;

- analysis of data collected in relation to claims, payments and other reporting in relation to the IIF schemes; and

- reviewing available information technology design documentation for the proposed Department of Human Services electronic payment system for analysis of suitability of key quality and integrity controls.

1.18 The audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of approximately $563 750.

2. Design, monitoring and review of the Indemnity Insurance Fund and the Commonwealth’s exposure to risk

Areas examined

This chapter considers the government’s intervention in the medical indemnity insurance sector and the design of the various schemes; and whether the Department of Health is actively monitoring, reviewing and advising government on the Indemnity Insurance Fund schemes’ achievements, including the ongoing need for government assistance and the Commonwealth’s exposure to risk.

Conclusion

The government’s package of regulatory and financial measures, established to address market failure in the early 2000s, was informed by a range of expert advice and subject to monitoring and a number of independent reviews during the first five years of its implementation. Overall, the design and implementation of these measures significantly improved the financial viability of insurers and ensured the availability and general affordability of indemnity insurance. The measures implemented however, resulted in a significant financial risk transfer to the Commonwealth.

The Department of Health does not have fit-for-purpose monitoring and reporting arrangements in place to assess the impact of the measures—including regulatory and other legal reforms on the stability of the indemnity insurance market, the affordability of premiums or importantly, the government’s exposure to risk.

Areas for improvement

The ANAO has made two recommendations aimed at undertaking a ‘first principles review’ of the Indemnity Insurance Fund and schemes prior to the 2017–18 Budget, and consistent with undertaking the review, establishing fit-for-purpose monitoring and reporting arrangements.

Did sound analysis and advice support the government’s decision to establish the medical indemnity schemes?

A range of expert analysis, advice and stakeholder consultations informed the government’s response to the financial crisis in the medical indemnity insurance market. Following the early phases of this response, monitoring and a number of reviews by experts were conducted examining the financial and other measures adopted. However, there was limited consideration of the risk exposure to the Commonwealth and a longer term exit strategy for a point in time when the market was determined to have stabilised and insurance premiums were considered affordable.

2.1 In December 2001, the Prime Minister announced that ‘the government would convene, in early 2002, a high-level forum on medical indemnity insurance [the Medical Indemnity Review Panel] with the aim of developing a coordinated approach to issues including re-insurance, prudential arrangements, litigation and settlement levels’.17

2.2 In light of the cross jurisdictional nature of the issues, the government engaged with Commonwealth, state and territory forums18, and stakeholders including: legal associations, the Australian Medical Association and other peak medical bodies, along with medical indemnity insurers and lobby groups.

2.3 External advice was sought from various experts on options for, and the design of, the proposed financial schemes.

2.4 The initial government measures included: underwriting by government of all Incurred-But-Not-Reported (IBNR) liabilities not adequately provisioned for (IBNR Scheme);19 subsidies for medical practitioners in high risk specialties (Medical Indemnity Subsidy Scheme); assistance to medical indemnity providers to help reduce the impact of high cost claims (High Cost Claims and Exceptional Claims Schemes); and the introduction of a new regulatory framework for insurers, placing providers of medical indemnity insurance under the regulatory supervision of the Australian Prudential Regulatory Authority (APRA)20 underpinned by tort law reforms.

2.5 The introduction of these measures (in particular the High Cost Claims and Exceptional Claims Schemes) was, in effect, a financial risk transfer to the Commonwealth. While consideration of insurers’ medical indemnity outlays—including the level of risk that they carried, the integration of risk management into the insurance process, and risks associated with a doctor’s personal liability—were well documented, there was limited evidence of consideration of the risk exposure to the Commonwealth.

2.6 The government’s response to market failure in the medical indemnity insurance industry was phased over time, driven by events within the medical indemnity and broader insurance industries as illustrated in Figure 2.1.

Figure 2.1: Timeline of key indemnity insurance events from 2002 to 2016

Source: ANAO analysis.

Third party arrangements to monitor the indemnity insurers and the market

2.7 In 2002, the Australian Institute of Health and Welfare (AIHW) was commissioned to develop a national database of medical indemnity claims and their outcomes—referred to as the Medical Indemnity National Collection (MINC) and report on the data annually.21 The reports from 2008–09 to 2012–13 included both public and private sector claims data as available.22 The final report was published on 11 July 2014.

2.8 In 2002, APRA was also commissioned to establish the National Claims and Policies Database which provides aggregated, public data on public liability and professional indemnity insurance.23 The database was established to increase transparency and provide data for analysis by insurers and government for monitoring, review and policy development.

2.9 From 2003 to 2008, the Australian Competition and Consumer Commission (ACCC) monitored the schemes, and reported on the Australian Government’s medical indemnity reforms24 (including the High Cost Claims Scheme (HCCS) and the Run-off Cover Scheme (ROCS)) as well as Commonwealth, state and territory tort law reforms.25

2.10 The Australian Government Actuary (AGA) is also required to annually report to the Minister on the Run-off Cover Schemes26, as discussed at paragraph 2.61.

Reviews of the government’s support measures

2003 Medical Indemnity Policy Review

2.11 During 2002–03, the Medical Indemnity Review Panel (the Review Panel) held an inquiry into Australia’s medical indemnity insurance system, reporting in December 2003 with 15 recommendations—12 of which directly related to the schemes now consolidated under the IIF. The government accepted all recommendations, including that by mid-2005, an evaluation be conducted of the effectiveness of the new measures, including current market arrangements.27

2004 Review of Competitive Neutrality in the Medical Indemnity Insurance Market

2.12 In December 2004, the Minister for Health and Ageing, the Minister for Revenue and Assistant Treasurer commissioned the Review of Competitive Neutrality in the Medical Indemnity Insurance Market. The review concluded, among other things, that the specific assistance provided to United Medical Protection Limited/Australasian Medical Insurance Limited (UMP/AMIL) through the IBNR Indemnity Scheme (and not granted to any other medical indemnity provider) had resulted in a competitive advantage.28

2.13 The Australian Government accepted the review’s findings and legislated to remove the competitive advantage by requiring that UMP/AMIL, who had benefited from the IBNR Indemnity Scheme, make a series of repayments to the government. In 2005–06, UMP repaid to the government a sum of $56 million to settle its competitive advantage payment liability.29

2007 Medical Indemnity Policy Review

2.14 Consistent with its 2003 report, in December 2005, the Review Panel reconvened and conducted a post implementation review of the government’s medical indemnity measures. Key recommendations from the review were that the existing package of medical indemnity measures should continue and a stakeholder forum be established to monitor indemnity matters in a ‘…timely, proactive and consultative manner by the industry, medical profession and government.’30 The stakeholder forum is further discussed in paragraphs 2.20 and 2.31–2.32.

National Maternity Services Review and Plan

2.15 In 2008, Health undertook a national review of maternity services.31 These findings and recommendations informed the development of the National Maternity Services Plan. A key commitment under this plan was that the ‘Australian Government would oversee reforms to the maternity workforce, including support for professional indemnity insurance for eligible midwives’.32

2.16 In 2010 regulatory changes for midwives combined with the reported limited commercial availability of insurance for privately practicing midwives33, led to the government establishing two related indemnity insurance schemes—largely modelled on the existing High Cost Claims and Run-off Cover Schemes:

- The Midwife Professional Indemnity (Commonwealth Contribution) Scheme; and

- The Midwife Professional Indemnity Run-off Cover Scheme.

Legal arrangements

2.17 The gradual rollout of the government’s medical indemnity support measures resulted in amendments to or the passage of 12 pieces of primary legislation affecting medical indemnity insurance and regulation, supported by 20 regulatory instruments.

2.18 Policy and administrative responsibility for the legislative package is spread across Health and Human Services, and the relevant regulators—APRA and ASIC, within the Treasury portfolio.

2.19 The key pieces of legislation governing the Indemnity Insurance Fund’s administration and payments are the Medical Indemnity Act 2002 and the Midwife Professional Indemnity (Commonwealth Contribution) Scheme Act 2010. Details of primary legislation and allocated administrative responsibilities are set out in Appendix 3.

Longer term strategy for assessing government support

2.20 The government consulted widely when establishing the initial support measures; the Review Panels were convened (see paragraphs 2.1, 2.11 and 2.14) and review processes were in place for the first five years after the package of measures were implemented. The 2007 Review Panel was forward looking, recommending the establishment of a stakeholder forum (see paragraph 2.14) and on-going monitoring of the High Cost Claims Scheme to ensure ‘…it continued to be effective as a means for bringing about stability’ and tort law reform in States/Territories ‘…with particular reference to the impact of the reforms on the cost of medical indemnity insurance’. While the 2007 Review Panel noted it was too early to review some of the measures and therefore did not recommend a subsequent formal review, it did note that the stakeholder forum should ‘…refer matters as appropriate, including to a higher level policy forum’.34

2.21 An evaluation strategy was never developed and while a target of up to five years was set for medical defence organisations to meet APRA’s regulatory (capital) requirements,35 other key performance or impact metrics were not established to assist in determining, at a future point, when the market was stabilised, premiums were assessed as affordable, insurance was considered to be available. In this regard, a broader exit strategy for winding back government intervention was not defined.

Did the design of the Indemnity Insurance Fund schemes promote stability, availability and affordability of medical indemnity and professional indemnity?

Overall, the financial strength of the medical indemnity insurance market has improved significantly since the Indemnity Insurance Fund schemes and Australian Prudential Regulation Authority’s regulatory oversight were introduced in 2002. In the years following the government’s response, net assets and capital holdings of insurance providers has improved markedly, with providers’ market share also largely stabilised.

Since 2003–04, there have also been improvements in the affordability of average insurance premiums paid by most medical specialities. Professional indemnity insurance for midwives continues to be available.

2.22 The final reports from the Review Panel36 and the ACCC37 indicated that the design of the schemes, in conjunction with regulatory oversight and tort law reform, had improved the industry stability and the affordability and availability of medical indemnity cover.38

2.23 In 2002, prior to the introduction of regulatory oversight, the medical indemnity insurance industry reported a very low net asset position of $11 million and was struggling to cover its liability position of approximately $1750 million.39 APRA’s regulatory requirements included that insurers must have a minimum capital holding of 150 per cent of projected liabilities.40

2.24 Over the following two years, net assets of the industry improved rapidly, increasing to $119 million in 2003, and then to $280 million in 2004.41 In 2009, the ACCC reported that all of the insurers had exceeded APRA’s minimum capital requirements.42 In particular, the ACCC’s 2009 report also indicated that the solvency position across the five medical indemnity insurers43 was strong with total assets exceeding total liabilities by $619 million.44

2.25 The ANAO’s analysis of the industry’s market share of medical indemnity insurance, by premium revenue and by number of policies held as at 30 June 2015, showed that while Avant Insurance was the dominant provider, other insurers also held significant market positions (see Figure 2.2 below). ANAO analysis suggests that market share has been relatively stable over time.

Figure 2.2: Market concentration comparisons

Source: ANAO analysis of 2015 Annual Reports published by medical indemnity insurers.

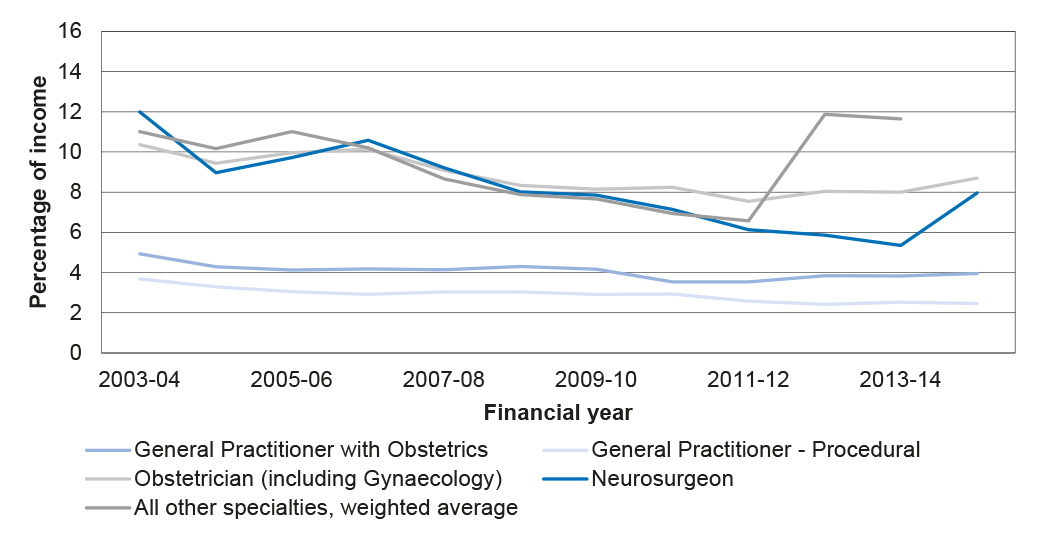

2.26 The ACCC’s 2009 report indicated that average premiums—as a share of private income, were well below the 30 per cent level that some specialities were paying in the early 2000s.45 The ANAO’s analysis indicated improvement in the affordability of medical indemnity insurance premiums over time, with average premiums across a range of specialities either flat or having fallen. (See Figure 2.3 below).

Figure 2.3: Average premiums for medical indemnity insurance, by specialty, before the Premium Support Scheme subsidies

Source: ANAO analysis of Human Services’ data.

2.27 Similarly, in February 2014, the National Commission of Audit noted that there was evidence that the market was normalising, with a decline in average premiums since 2003 with net assets and reported profits in the industry increasing.46

2.28 The measures put in place by the Australian Government also supported the availability of insurance for practicing midwives, with consideration of affordability built into the design of the Midwife Professional Indemnity Scheme, with a cap of $7500 set on premiums. This is further discussed in paragraph 2.88.

Does Health monitor the performance of relevant insurers and the market?

The Department of Health does not have an effective monitoring arrangement in place or a strategy for consulting stakeholders to support its policy and administrative responsibilities for assessing the stability of the indemnity insurance market. Information received by the Department of Health on professional indemnity insurance for midwives is also limited.

2.29 Health’s Flexible Fund Guidelines: Indemnity Insurance Fund (IIF Guidelines) are publically available on its website and set out administrative details on the roles and responsibilities of the Minister for Health, including that the Minister was responsible for reviewing and setting Fund priorities.47 The IIF Guidelines further state that ‘these priorities will at all times reflect the aims and objectives of the Fund, but may change over time to address emerging issues that will support more effective indemnity insurance schemes’.48

2.30 Under the IIF Guidelines, Health is responsible for monitoring the operations and activities of medical indemnity insurers, regularly monitoring the industry, and liaising with medical indemnity insurers about their cost structures.49 More detail on the IIF Guidelines is discussed in paragraphs 3.29–3.31.

Stakeholder Forum

2.31 In response to the Medical Indemnity Policy Review Panel recommendation that a stakeholder forum be established to monitor medical indemnity measures (see paragraph 2.14),50 the Medical Indemnity Insurance Association of Australia (MIIAA) suggested to Health that its existing quarterly meetings with insurers and the Australian Medical Association could ‘…fulfil the requirement of a stakeholder forum with some minor changes’. Health agreed, noting that ‘…this would be a good feedback loop for government and that you [the MIIAA] intend to provide the Department with six monthly reports on the discussions you have’. Health further indicated to MIIAA that it wanted to be kept advised about further developments.

2.32 Health advised the ANAO that the stakeholder forum was established and teleconferences were ‘…held regularly through the transition period’. The MIIAA consulted stakeholders including for its half-yearly reports to the (then) Department of Health and Ageing on issues raised during the stakeholder forum.51 From 2007 to 2010, the MIIAA also held annual medical indemnity forums. Health officials had not attended the stakeholder or the annual medical indemnity forums in recent years and were unable to advise when attendance ceased, or provide any records of these stakeholder discussions, such as forum agendas, meeting outcomes or half yearly reports.52

Other monitoring arrangements

2.33 Health’s monitoring arrangements for medical indemnity include the AGA’s annual reports (see paragraph 2.61) providing information on:

- the Run-off Cover Schemes for medical indemnity and professional indemnity for midwives (a legislative requirement);

- an actuarial review of liabilities for Run-off Cover Schemes, the HCCS, the Exceptional Claims Scheme (ECS) which was principally for the purposes of annual Budgets, and Health’s financial statements; and

- ad hoc requests for advice on claims and liability estimates.53

2.34 The AGA reports and ANAO’s analysis indicates that the actuarial projections, provided by insurers to the AGA (via Human Services), had limitations:

- the data only includes claims against the High Cost Claims Scheme rather than for all claims, limiting the AGA’s capacity to monitor claims over time that may potentially become high cost;

- inconsistencies in the data collected, for example, insurers did not use the same list of medical practitioner specialty codes when providing claims data; and

- the AGA’s 10 reports on the Run-off Cover Scheme for medical indemnity insurers covering the period from 2004–05 to 2013–14 indicate that there were discrepancies and inconsistencies in the data provided by medical indemnity insurers.54

2.35 Health was also unable to demonstrate that it had ever used the APRA National Claims and Policies Database for monitoring and reporting purposes. In July 2016, Health advised the ANAO that it had re-engaged with APRA to discuss data sharing and analysis.

2.36 The ANAO identified scope for improving the quality and quantity of data provided by insurers for Health to better inform the minister responsible for reviewing and setting the IIF priorities.

Auditing the Indemnity Insurance Fund schemes

2.37 According to the IIF Guidelines, Human Services is responsible for the payment and audit of funds expended under the IIF schemes.55 Human Services advised the ANAO that the IIF compliance function moved to Health in September 2015, following machinery of government changes. Health advised the ANAO that Human Services maintained responsibility for the payment and quality assurance of medical indemnity payments, while Health is responsible for broader audits of Indemnity Insurance Fund schemes, including the audit of medical indemnity insurers and Medicare providers where required.

2.38 In 2006–07, Human Services audited selected payments against claims made by five medical defence organisations under the IIF schemes. Other audits conducted have included:

- a 2008 internal audit of the Incurred-But-Not-Reported (IBNR) Scheme; and

- an April 2010 external audit that reviewed the key processes and controls in place to administer the IBNR Scheme, on behalf of Health.

2.39 In September 2011, a broader internal audit—Program Integrity Review of Medicare Australia’s Administration of the Medical Indemnity Program, was conducted. Recommendations from the Program Integrity Review included that a comprehensive risk-based compliance audit on the program be considered. The ANAO was advised by Human Services that its Compliance Division did not rank the programme risk high enough to perform an audit at that time.

2.40 Health has not undertaken any internal or externally commissioned audits of the performance or administration of the IIF schemes.

Monitoring the stability of the medical indemnity insurance market

2.41 The IIF Guidelines state that ‘to ensure the ongoing stability of the medical indemnity industry, the department [Health] will continue to monitor the operations and activities of medical indemnity insurers’.56

2.42 Evidence from third party monitoring processes suggest that, following implementation of the government’s reform package, the medical indemnity insurance market stabilised relatively early, and market failure dissipated (see paragraphs 2.24–2.26). The ACCC’s final report in 2009 noted that ’… insurers are in a much stronger capital position compared to when they were established, moving away from an objective of raising capital to maintaining capital’.57

2.43 Moreover, when reporting to its Minister prior to the release of the Medical Indemnity National Collection report Australia’s medical indemnity claims 2010–11 in 2012, Health advised its Minister that ‘the report reinforces the view that the medical indemnity industry had stabilised in the last few years following a period of relative instability’.

2.44 In addition to the ANAO’s analysis of insurers’ market share in 2015 (see Figure 2.2), the ANAO’s additional analysis of relevant insurers’ recent financial positions—including the Medical Insurance Group Australia (MIGA)—as the sole supplier of midwives’ indemnity insurance, is outlined in Table 2.1.

Table 2.1: Key measures of relevant indemnity insurers’ profitability

|

|

|

2013 |

2014 |

2015 |

|

Net Revenues |

$m |

$m |

$m |

|

|

Avant |

195.3 |

212.5 |

230.1 |

|

|

MDA National |

– |

58.3 |

58.8 |

|

|

MIGA |

23.5 |

36.3 |

38.8 |

|

|

Medical Indemnity Protection Society (MIPS) |

97.7 |

85.1 |

94.4 |

|

|

Total |

316.5 |

392.2 |

422.1 |

|

|

Profits |

|

|

|

|

|

Avant |

115.7 |

107.5 |

66.1 |

|

|

MDA National |

– |

11.1 |

14.9 |

|

|

MIGA |

11.9 |

2.2 |

4.6 |

|

|

Medical Indemnity Protection Society (MIPS) |

33.4 |

35.4 |

20.2 |

|

|

Sum |

161.0 |

156.2 |

105.8 |

|

|

Capital multiples |

rate |

rate |

rate |

|

|

Avant |

2.93 |

2.92 |

2.16 |

|

|

MDA National |

– |

– |

– |

|

|

MIGA |

3.11 |

3.17 |

2.83 |

|

|

Medical Indemnity Protection Society (MIPS) |

4.43 |

4.90 |

4.67 |

|

Note a: Blanks denote where data is unavailable. Net revenue for MIPS refers to total income, as data on net earned premium is not provided. MIPS data provided on Total Comprehensive Income for the Year excludes expenses, which is not equivalent to net revenue.

Source: ANAO analysis of the annual reports of insurers.

2.45 While some insurers had posted declining profits in more recent years, capital adequacy multiples for all insurers are in excess of two—well above capital requirement levels set by APRA.58

2.46 Insurers have also considerably strengthened their net asset position over time. The ANAO’s analysis indicates that in 2015, medical indemnity insurers reported net asset holdings of $1935 million across the four active insurers, rising from an estimated $619 million59 across five insurers (including QBE Insurance Group) in 2009.

2.47 While Health reports annually against a number of Key Performance Indicators (see Table 3.1), since its 2012 Medical Indemnity National Collection report to its Minister, Health had not otherwise analysed or reported on the stability of the indemnity insurance market.

Monitoring the availability of professional indemnity insurance for midwives

2.48 Health and Human Services have a contract with MIGA to provide professional indemnity insurance to eligible privately practicing midwives (see paragraph 3.3).60 MIGA was the only provider of professional indemnity insurance to midwives in the Australian market.61 Under this contract, Health established monitoring arrangements with MIGA reporting annually on:

- the number of policy holders and premium information;

- marketing activities of the insurer;

- take-up rates and evaluation of education and risk management activities provided by MIGA; and

- claims notifications and advisory support.

2.49 Human Services advised the ANAO that there were 130 eligible midwives that held policies as at 31 December 2015. There are significantly less midwives participating in the midwife professional indemnity scheme than the 700 midwives originally forecast to be practicing nationally by the end of the third year of the scheme.

2.50 Health does not have any other monitoring arrangements in place for the market or insurance for eligible midwives.

Does Health review and report on the Indemnity Insurance Fund’s performance and risks, including to its Minister?

To date, the Department of Health has not reviewed or evaluated the Indemnity Insurance Fund legislation, supporting regulatory and other legal reforms, or the schemes’ financial assistance packages for their impact on the availability and affordability of indemnity insurance. The Department of Health’s reporting to its Minister on the Indemnity Insurance Fund’s performance and risks are largely ad hoc and driven by external processes, for example, annual Budget requests to bring forward savings. Overall, the Department of Health’s arrangements for review, analysis and advice to its Minister on the Indemnity Insurance Fund schemes, including risks and performance against the Indemnity Insurance Fund’s objectives and priorities, is limited.

2.51 Health provides overall policy and programme support and advice to the Minister and was responsible for the policy development and administrative oversight of the indemnity insurance schemes.62 Under the programme agreements between Health and Human Services, Health was responsible for maintaining and reviewing the legislation supporting the IIF to ensure that legislation supports the policy intent.63

Arrangements established to review indemnity insurance

Reviewing Indemnity Insurance Fund legislation

2.52 In December 2015, Health received its Minister’s agreement to request approval to align sunsetting clauses for 15 of the medical indemnity legislative instruments until 1 October 2019 (five of the 15 legislative instruments were due to sunset between 1 April and 1 October 2016) to allow for a thematic review of the legislation.64 The purpose of the review was ‘to consider the relevant pieces of legislation as a whole, with a view to simplifying and streamlining the legislation, with a particular focus on deregulation.’

2.53 Approval to align the sunset clauses was provided by the Attorney-General’s department on 11 February 2016. Health advised that the thematic review is planned to commence following the Mid-year Economic and Fiscal Outlook 2016–17.

2.54 As no comprehensive review of the IIF-related legislative package had been undertaken to date, the thematic review and its findings, once available, should also be considered in the context of the recommendations in this audit report.

Review of regulatory and other legal reforms

2.55 As discussed in paragraph 1.6, in addition to relevant IIF subsidy schemes, a number of regulatory and legal reforms were implemented to support the stability and availability of medical indemnity insurance in the early 2000s.65

2.56 Broader actuarial sector and ACCC’s reviews indicated that the reforms had a positive impact. In November 2004, United Medical Protection (UMP) indicated that its insurer, Australian Medical Protection Limited ‘…would make significant reductions in premiums for 2005’ on the basis of a number of factors including medical indemnity and extensive tort law reforms. In 2005, the ACCC made a positive assessment of the short term impact of tort law reform, observing that: ‘…the majority of insurers took tort law reform into account in setting their aggregate premium pools for 2005–06’.66

2.57 In December 2006, the Minister for Revenue and Assistant Treasurer reported that the positive impact of regulatory intervention noting that ‘…the changes made to the laws of negligence across Australia have had a positive impact on the availability and affordability of public liability and professional indemnity insurance’.67 This 2006 report also noted that the government’s medical indemnity assistance package, which included regulatory reform, had resulted in a reduction in premiums. It added that the expected flow-on effects from the impact of increased risk management practices, after tort law reforms were introduced, would be seen in the long term.

2.58 Since 2006, Health has not reviewed or reported on the impact of the related regulatory interventions on the market to the government or its Minister.

Commissioned reviews

2.59 In 2011, Health commissioned an internal review of ‘…selected information and data presented publicly in the ACCC reports’, which included an overview of the IIF schemes, analysis on trends in costs and premiums and the commercial justification of premiums. This 2011 review confirmed that ‘…the medical indemnity insurance industry remains in a sound financial condition …’

2.60 Since 2011, there have been no further reviews commissioned. Health advised the ANAO that its focus had centred on the annual Budget process. Health also has not developed an evaluation strategy or undertaken a broader impact evaluation of the IIF-related reforms and financial assistance package.

Reporting on Indemnity Insurance Fund risks and performance

Parliamentary reporting on the Run-off Cover Schemes

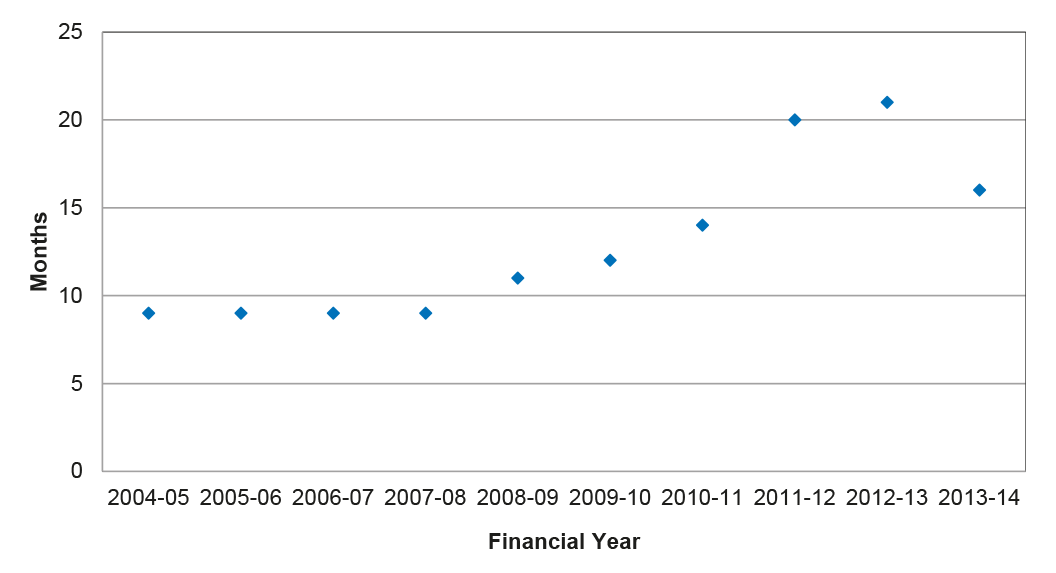

2.61 The AGA reports annually to Health on the Run-off Cover Schemes for medical indemnity and midwives.68 Under s. 34ZW of the Medical Indemnity Act 2002 and s. 48 of the Midwife Professional Indemnity (Commonwealth Contribution) Scheme Act 2010, the Minister was required to request the AGA to prepare advice and report on the Run-off Cover Schemes for medical indemnity and midwives within 6 months after the end of the financial year and table the reports in the Parliament within 15 sitting days after receipt of the reports. Generally, Health briefs its Minister ahead of this tabling. Figure 2.4 shows the gap in tabling of the AGA reports from 2004–05 to 2013–14.

Figure 2.4: Tabling of Australian Government Actuary reports in Parliament: time between reporting period (end of financial year) and actual tabling (months)

Source: ANAO analysis.

2.62 As illustrated in Figure 2.4, the time between actual tabling of the AGA reports and the relevant periods they cover has increased progressively since the 2007–08 report, with Report Number 9 tabled in March 2015, some 21 months from the end of the 2012–13 data period.

2.63 The cost of the Run-off Cover Schemes (ROCS) was met over time by a ROCS support payment paid by insurers to the government; in this way, the Run-off Cover Schemes are designed to be cost neutral to the government. The AGA’s 2013–14 report noted that the total ROCS revenue for medical indemnity insurers (from the insurers’ support payments) to date was greater than the government’s liabilities in ROCS.69 However, AGA further notes that claims are ‘…lumpy in nature’ and ‘volatile’ and there was uncertainty related to liabilities the government faces.70 In addition to its legislative requirements, this ongoing uncertainty of ROCS liabilities heightens the need for Health to provide timely advice to its Minister.

The Department of Health’s reporting to its Minister

2.64 Since 2010, apart from briefing its Minister on the AGA’s Run-off Cover Schemes reports and the now ceased Australian Institute of Health and Welfare’s Medical Indemnity National Collection reports (see paragraph 2.7), Health’s advice to the government and its Minister over time was focussed on:

- administrative matters, including: the renewal of the Premium Support Scheme contracts and the midwives scheme contract; and advising the Minister when insurers notify Health that they are exiting the market or potentially entering the medical indemnity/professional indemnity (midwives) market; and

- related Budget proposals over time, including:

- the consolidation of the schemes into the IIF as part of the 2011–12 Budget;71

- the phased reduction in the PSS subsidy rate from 80 to 70 cents in the dollar as part of the 2012–13 Budget;

- similar PSS subsidy reductions in the 2013–14 Budget, which reduced the subsidy to 60 cents in the dollar;

- a proposal to further reduce the PSS subsidy rate to 55 cents in the dollar, to be considered following negotiations with the medical profession. Following Health’s advice, the government agreed no further changes to support for medical indemnity would occur before the 2015–16 Budget;

- the government’s consideration of a scale back of its medical indemnity subsidies as part of the 2015–16 Budget. Again, following Health’s advice, the government agreed to delay further changes until the 2016–17 Budget; and

- as part of the 2016–17 Budget, Health advising the government to defer options to reduce the level of government involvement in the medical indemnity insurance industry, noting the uncertainty with the proposed medical injury stream of the no fault National Injury Insurance Scheme (NIIS).72

2.65 Health advised the ANAO that any proposed review or change to the IIF schemes is dependent on the NIIS. The Department of the Treasury (Treasury) had policy responsibility for the NIIS. Health met with Treasury on medical indemnity insurance and the NIIS issues on 17 February 2016, at a meeting with insurance providers. At this meeting, Treasury noted that it is working with the states and territories on developing the medical treatment injury stream of the NIIS and will be reporting back to the Council of Australian Governments at the end of 2016.

2.66 In February 2014, the National Commission of Audit recommended that the Commonwealth scale back its subsidies for medical indemnity insurance and reported that there was evidence that the market was normalising—average premiums had declined since 2003 to become more affordable and net assets and reported profits in the industry had increased. The government’s response to the National Commission of Audit report was that ‘Reforms to Medical Indemnity will be considered following the 2014–15 Budget’.73

2.67 Health did not provide any written advice to its Minister on the 2014 National Commission of Audit findings, although Health advised the ANAO that it did brief its Minister orally on 5 December 2014 as part of Budget processes and also on 19 January 2015, as part of incoming Minister discussions. Health did not though advise its Minister more broadly on the IIF schemes, including on risk and performance against the IIF’s objectives and priorities.

Reporting on medical indemnity insurance premium affordability

2.68 One of the priorities of the IIF was to ensure that medical indemnity insurance premiums are affordable for medical practitioners.74 Two schemes had an effect on premium affordability: the Premium Support Scheme (PSS) and the High Cost Claims Scheme (HCCS).

Premium Support Scheme

2.69 As noted in paragraph 1.11, Health administers the PSS contracts with each insurer. These contracts define the parameters of the PSS and identify the specific payments to insurers for costs associated with their roles in administering the PSS. There were 1597 participants75 in the PSS in 2013–14; 1496 in 2014–15; and 1177 in 2015–16. In general, the PSS provides a subsidy for medical practitioners where their insurance premium was calculated to be more than 7.5 per cent of their income.76

2.70 As noted in paragraph 2.26, the ANAO’s analysis indicates that average premiums had generally fallen over time for a range of medical practitioner specialities. Table 2.2 sets out further ANAO analysis on premium affordability, including details of medical practitioners receiving the PSS subsidy, average incomes, and the average premium before and after the subsidy.

Table 2.2: Participation levels and impact of the Premium Support Scheme, 2013–14(a)

|

Specialty |

Doctors in PSS |

PSS cost per doctor |

Private income |

Premium set by insurers, prior to PSS subsidy |

Premium, including PSS subsidy |

||

|

|

|

$ 000 |

$ 000 |

$ 000 |

Per cent of income (b) |

$ 000 |

Per cent of income |

|

GP with obstetrics |

177 |

8 |

383 |

15 |

4 |

7 |

2 |

|

GP procedural |

531 |

3 |

309 |

8 |

3 |

5 |

2 |

|

Obstetrician(c) |

293 |

15 |

695 |

56 |

8 |

41 |

6 |

|

Neurosurgeons |

45 |

11 |

878 |

47 |

5 |

36 |

4 |

|

Other specialities(d) |

551 |

2 |

85 |

10 |

12 |

7 |

9 |

Note a: Data for 2013–14 used, as income data for 2014–15 was incomplete.

Note b: Significant proportions of these speciality groups continue to receive PSS subsidies due to MISS grandfathering arrangements.

Note c: Includes gynaecology.

Note d: Weighted average across all other specialities.

Source: ANAO analysis on Human Services’ PSS data.

2.71 For 2013–14, on average, initial premiums set by insurers were generally less than 10 per cent of income. While there was no agreed benchmark for the proportion of a medical practitioner’s income that should be allocated to insurance, rates of 10 per cent have been noted internationally.77 After the PSS subsidy, the majority of average 2013–14 premiums fell below 7.5 per cent. Other observations include:

- the average premium for procedural General Practitioners, before the PSS, was low, between two and four per cent of income;

- the average premium for neurosurgeons, before the PSS is applied, had dipped to below 7.5 per cent of average income. Despite this, 22 per cent of the number of doctors who were receiving a subsidy under the PSS in 2013–14 (1597 doctors) continue to receive PSS subsidies, largely due to a greater proportion of neurosurgeons (compared to all other specialists) still qualifying for a subsidy through the Medical Indemnity Subsidy Scheme;78

- the average premium for General Practitioners with obstetrics had been persistently below the 7.5 per cent cut-off; and

- currently medical practitioners operating in rural areas are eligible for the subsidy regardless of whether their premium exceeds the 7.5 per cent income threshold. However, ANAO analysis shows that most medical practitioners in rural areas are General Practitioner proceduralists who generally face the lowest average premiums.79

2.72 Separately, the ANAO identified that, for PSS eligibility purposes, rural areas are those defined in accordance with the Rural, Remote and Metropolitan Areas 3-7 (RRMAs) which was based on 1991 data. The ANAO’s analysis indicated that some health programs define rural areas using the more current Modified Monash Model, for example, the General Practice Rural Incentive Program.80 Under the Modified Monash Model, some PSS participants may no longer be classified as rural.

2.73 Under the memorandum of understanding between Health and the AGA, the AGA will, if requested, provide actuarial advice on the PSS. While the AGA received data from Human Services on premiums, Health had not asked the AGA to provide any advice on the affordability of premiums.

2.74 Health does not regularly analyse the PSS data, or review premium affordability and whether the scheme was appropriately targeted in line with the original policy intent. Health had used the PSS data to review select policy parameters, on an ad hoc basis, for example, the assessment of rural areas—although this analysis was not conveyed to its Minister.

2.75 In contrast to Health’s role in the private health insurance market, there were no oversight arrangements in place in the medical indemnity insurance market to review and assess premiums and the impact of the PSS on Commonwealth outlays over time.81

High Cost Claims Scheme

2.76 Premium affordability was also affected by the HCCS. The HCCS reduced insurers’ costs by reducing the payout normally borne by insurers for high cost claims. In a relatively competitive market, the HCCS subsidy would generally be factored into the premium rates set by insurers, and would therefore have the effect of reducing premiums. In 2009, the ACCC noted that ‘…all insurers appropriately considered HCCS and ROCS in their premium determinations’.82

2.77 Health has not undertaken any analysis or provided advice to its Minister on the impact of the HCCS on premium affordability since the reduction to the HCCS threshold amounts in 2004.

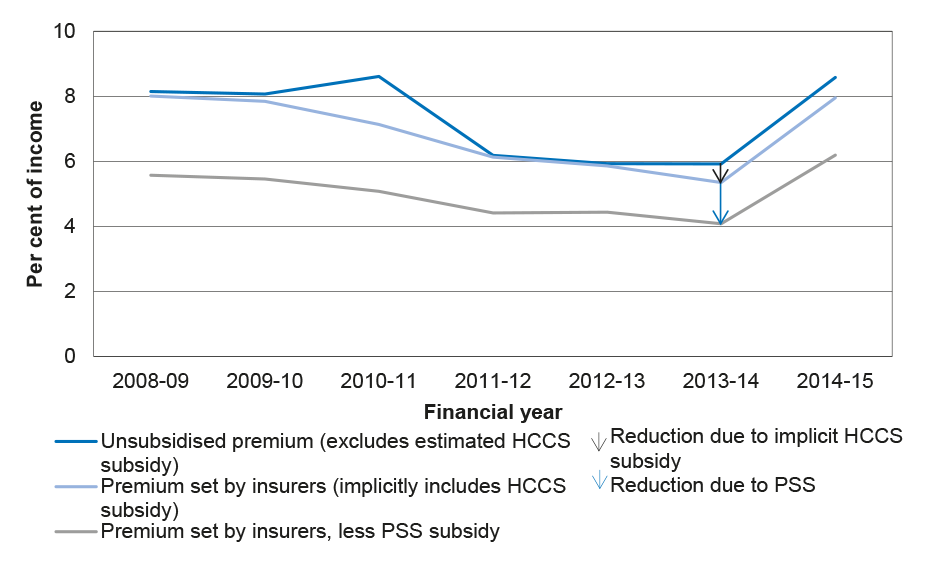

2.78 Using 2013–14 data on neurosurgeons as an example83, the ANAO’s analysis indicates that premiums for neurosurgeons would have been around one per cent higher, as a proportion of their income, without the HCCS, shown in Figure 2.5.

Figure 2.5: Impact of the High Cost Claims and Premium Support Schemes on premiums paid by neurosurgeons for medical indemnity insurance as a percentage of income

Note: Assumes the average impact of the HCCS on premiums is the HCCS payout in a year proportionate to the number of medical practitioners.

Source: ANAO analysis of Human Services’ data.

2.79 In 2006, the AGA advised the Medical Indemnity Policy Review Panel (the Review Panel) that an increase in the High Cost Claims threshold would result in savings for the government. In 2007, the Review Panel reported that the HCCS was still in its infancy, and it was difficult to estimate the impact of any change in the threshold. The Review Panel further advised the government that at that time, the HCCS should continue to operate for several years without change, and be monitored by the ACCC over the period.

2.80 The $300 000 minimum threshold for a high cost claim had not been reviewed since 2004. Over time, the policy intent of the HCCS had potentially been eroded because the threshold had not been subject to indexation. In this context, and all other things being equal, a number of claims would not have been considered to be high cost had inflation been considered through an appropriation indexation rate. For example, if the $300 000 threshold had increased in line with average weekly earnings (AWE), then $300 000 in 2005 would be valued at $439 000 in 2015. In this scenario, the government now bears the cost of those claims between $300 000 and $439 000 in 2015, due to inflation alone.

2.81 The ANAO’s analysis indicates that had the HCCS minimum threshold for the HCCS been subject to annual increases in line with AWE, 27 per cent of the HCCS claims paid by the government in 2015 would not have been eligible. The ANAO’s further high level analysis of HCCS data on expected payments made to insurers from 1 July 2004 suggests that approximately $33 million of the anticipated $190 million cost of the HCCS would have been saved by indexing the threshold based in line with AWE.84

Reporting on increasing High Cost Claim Scheme liabilities and risks to government

2.82 The overall financial exposure and risk to government is increasing over time, as the number of large claims ($550 000 and above) under the HCCS grows over time. The ANAO’s analysis of the government’s increasing financial and risk exposure is set out in Figure 2.6.

Figure 2.6: Growth in High Cost Claims Scheme large claims over time

Source: ANAO analysis of Human Services’ HCCS data.

2.83 The government’s growing liability associated with the HCCS is further illustrated in Table 2.3, which sets out for the period from 2004 to 2015:

- HCCS payments to insurers;

- estimates of remaining claim payments, known as the reported incurred cost (RIC);

- estimates of the expected final claims settlement costs; and

- estimates of the increases over time, associated with large claims. In this regard, the gap between the RIC (the third column) and estimated settlement costs (fourth column) is known as the Incurred But Not Enough Reported (IBNER). For HCCS purposes, the IBNER relates to any claim that will ultimately settle above the $300 000 threshold.

Table 2.3: High Cost Claims Scheme payments to insurers

|

Notification Year |

HCCS Paid to Date as at 30 June |

Reported Incurred Cost |

Estimated Settlement |

IBNER |

|

|

$million |

$million |

$million |

(%) |

|

2004 |

13.928 |

15.688 |

18.089 |

15.3 |

|

2005 |

21.854 |

35.983 |

37.362 |

3.83 |

|

2006 |

19.346 |

21.915 |

21.590 |

-1.48 |

|

2007 |

16.223 |

20.818 |

25.397 |

22.00 |

|

2008 |

25.289 |

34.576 |

40.321 |

16.62 |

|

2009 |

25.784 |

37.196 |

44.974 |

20.91 |

|

2010 |

16.169 |

28.329 |

29.209 |

3.11 |

|

2011 |

17.988 |

32.793 |

41.072 |

25.25 |

|

2012 |

13.951 |

26.851 |

46.065 |

71.56 |

|

2013 |

13.653 |

38.440 |

49.856 |

29.70 |

|

2014 |

5.146 |

38.826 |

66.509 |

71.30 |

|

2015 |

4.184 |

30.008 |

54.683 |

82.23 |

|

Total |

193.516 |

361.424 |

475.128 |

N/A |

Source: ANAO analysis of Human Services’ data on claims and liabilities.

2.84 Some of the claims presently below the $300 000 threshold will become large over time. These potential HCCS claims are not presently included in the data provided to Human Services under the Scheme’s contracts with insurers. Where there was a significant gap between the RIC and the actuarial estimate, there was greater uncertainty surrounding the numbers of large claims. To be able to reasonably forecast the number of large claims, additional data85 would be required.

2.85 Unlike the self-funding model for the ROCS, insurers make no contribution to offset the cost of the HCCS. In addition, the government bears 50 per cent of the liability for large claims up to $20 million, rising to 100 per cent for those claims above this, through the Exceptional Claims Scheme (ECS). Given the volume of large claims from 2011 onwards where the estimated settlement was at least 25 per cent or greater than the RIC, it would be expected that the number of large claims would continue to increase from the number known today. In this regard, the government would face increasing exposure to risk (and financial cost) over time.

2.86 Consistent with its policy and Fund oversight responsibilities, Health should undertake further analysis to fully assess the government’s risk exposure with respect to the HCCS and the ECS, and report on risk mitigation options to its Minister, including options for containing this increasing financial risk.

Reporting on the availability and affordability of Midwife Professional Indemnity Scheme

2.87 The availability of professional indemnity insurance (PII) for eligible midwives was one of the IIF’s priorities. Although affordability of PII premiums for midwives was not an identified priority for the IIF, the IIF Guidelines note that the Minister would review the priorities ‘…to address emerging issues that will support more effective indemnity insurance schemes’.86

2.88 ANAO analysis of premium information in the MIGA reports shows that the method of calculating premiums changed from 2011–12 to 2012–13. Premiums had always been capped at $7500 for midwives. However, in 2010–11 and 2011–12, the level of premiums was determined on the basis of the number of women (and their babies) receiving midwifery services. From 2012−13, the determination of premiums was on the basis of gross income, bringing it more into line with the PSS.

2.89 The ANAO analysed premiums paid by midwives for indemnity insurance from 2013–14, as outlined in Table 2.4.

Table 2.4: Midwives premiums as a proportion of income

|

Gross income band of midwife |

Option A annual premium (providing intrapartum care) |

Option B annual premium (no intrapartum care) |

Premium as a proportion of gross income -Option A (%)(a) |

Premium as a proportion of gross income -Option B (%)(a) |

|

$90,000 or higher |

7500 |

3400 |

8.3 |

3.8 |

|

$70,000– $89,999 |

6500 |

3000 |

9.3 |

3.3 |

|

$50,000– $69,999 |

5000 |

2250 |

10.0 |

2.5 |

|

$25,000– $49,999 |

3375 |

1530 |

13.5 |

1.7 |

|

Less than $25,000 |

2400 |

1350 |

9.6 |

1.5 |

Note a: The proportion is calculated on the minimum amount of gross income the premium level applies to.

Source: ANAO analysis from MIGA 2013–14 and 2014–15 annual reports to Health.

2.90 For those privately practicing midwives who do not provide intrapartum care (while the woman is in labour), premiums are 3.8 per cent or below as a proportion of their gross income. For midwives who do provide intrapartum care, premiums are much higher. For instance, midwives earning $25 000 per annum pay 13.5 per cent of their gross income on PII, whereas midwives earning between $25 000 and below $33 750 pay over 10 per cent of their income on PII.

2.91 To be able to advise its Minister on this and related matters, Health would need to obtain additional data from insurers, and then undertake further analysis to assess the affordability of PII. This analysis may include an assessment of the impacts of the Midwives Professional Indemnity Scheme.

Summary

2.92 Since 2003, the IIF and related financial support schemes (including the relevant midwives’ schemes) were established to address market failure in the indemnity insurance sector and rising premiums for medical professionals and midwives (from 2010). The IIF and its schemes had not been fully evaluated since that time, nor have the IIF’s overall priorities been assessed or reviewed. There had also been no assessment of the impacts of current regulatory arrangements and the need for, or extent of, any on-going government intervention. This needs to be addressed in light of the ANAO’s findings which highlight that:

- the existence and extent of market failure in the contemporary medical indemnity insurance market has dissipated over time;

- the financial position, including solvency, of medical indemnity insurers was stable with 2015 annual reporting showing net assets of approximately $1935 million across the four active insurers;

- premiums for medical indemnity insurance, both in absolute terms and as a share of income, had been falling or had been generally flat since the early 2000s; and are now generally affordable for most medical practitioners;

- premiums for some midwives are high;

- HCCS payment thresholds had not been reviewed since 2004, and any analysis would benefit from access to more complete and quality assured data; and

- Health’s monitoring, analysis and reporting arrangements on the government’s financial and risk exposures, especially with respect to the HCCS and ECS, is limited.

Recommendation No.1

2.93 The Department of Health should conduct a ‘first principles review’ of the Indemnity Insurance Fund and related schemes prior to the 2017–18 Budget.

Health’s response: Agreed with qualification.