Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Snowy 2.0 Governance of Early Implementation

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- To provide assurance to Parliament that Snowy Hydro Limited has appropriate arrangements in place to effectively deliver the Snowy 2.0 project.

Key facts

- Snowy 2.0 includes the construction of an underground power station and around 27 kilometres of tunnels between two reservoirs in the Snowy Mountains.

- Snowy Hydro Limited is using an engineer, procure and construct (EPC) contract to complete most of the Snowy 2.0 project.

- The EPC contracted sum is $5.11 billion, which makes up more than 85 per cent of the total approved project costs.

- The EPC contracted schedule is for first power generation in 2024–25 and project completion in 2026–27.

What did we find?

- Snowy Hydro Limited’s governance of the early implementation of Snowy 2.0 is effective.

- Snowy Hydro Limited has established effective governance frameworks to deliver Snowy 2.0.

- Snowy Hydro Limited has established appropriate arrangements to manage the Snowy 2.0 engineer, procure and construct (EPC) contract.

- Snowy Hydro Limited has established appropriate monitoring and reporting arrangements for Snowy 2.0.

What did we recommend?

- No recommendations are made to Snowy Hydro Limited.

$1.38 billion

Australian Government’s equity investment in Snowy Hydro Limited for Snowy 2.0.

$5.11 billion

Contracted sum under the Snowy 2.0 engineer, procure and construct (EPC) contract.

350,000

Megawatt hours of storage Snowy 2.0 is expected to add to the National Electricity Market.

Summary and recommendations

Background

1. In December 2018, Snowy Hydro Limited made a final investment decision to proceed with Snowy 2.0. Snowy 2.0 is a pumped hydro project designed to add 2000 megawatts of on-demand generation and approximately 350,000 megawatt hours of large-scale storage to the National Electricity Market. Snowy 2.0 includes the construction of an underground power station and around 27 kilometres of tunnels within the Kosciuszko National Park in the Snowy Mountains region of New South Wales.

2. Snowy Hydro Limited is using an engineer, procure and construct (EPC) contract to complete most of the Snowy 2.0 project. The contracted sum under the EPC contract is $5.11 billion. This makes up more than 85 per cent of the total Snowy 2.0 project cost approved by Snowy Hydro Limited.

3. Snowy Hydro Limited is an unlisted company incorporated under the Corporations Act 2001. On 29 June 2018, the Commonwealth became Snowy Hydro Limited’s sole shareholder. Snowy Hydro Limited is subject to the Public Governance, Performance and Accountability Act 2013 (PGPA Act) frameworks for Commonwealth companies and government-owned business enterprises (GBE).

Rationale for undertaking the audit

4. Snowy Hydro Limited has been provided an equity injection to a subscription cap of $1.38 billion to proceed with the Snowy 2.0 project. Snowy Hydro Limited is financing the remainder of the project from debt funding. The audit provides assurance to Parliament that Snowy Hydro Limited has appropriate arrangements in place to effectively deliver Snowy 2.0.

Audit objective and criteria

5. The audit objective was to examine the effectiveness of Snowy Hydro Limited’s governance arrangements for early implementation of Snowy 2.0, the expansion to the Snowy Hydro Scheme.

6. To form a conclusion against this objective, the following high-level audit criteria were adopted.

- Have effective governance frameworks been established to deliver Snowy 2.0?

- Are there appropriate arrangements to manage the Snowy 2.0 engineer, procure and construct (EPC) contract?

- Does Snowy Hydro Limited effectively monitor and report on the progress of Snowy 2.0?

Conclusion

7. Snowy Hydro Limited’s governance of the early implementation of Snowy 2.0 is effective.

8. Snowy Hydro Limited has established effective governance frameworks to deliver Snowy 2.0. These governance frameworks provide the Snowy Hydro Limited Board of Directors (the Board) with appropriate oversight, including the information required to inform decision-making. The Snowy 2.0 risk management framework supports the ongoing oversight of risks. Procurement and contract management frameworks provide an appropriate basis for Snowy Hydro Limited’s delivery of Snowy 2.0.

9. Snowy Hydro Limited has established appropriate arrangements to manage the Snowy 2.0 EPC contract. The EPC contract management arrangements have provided Snowy Hydro Limited with a sound basis for managing the performance of the EPC contractor. Snowy Hydro Limited should continue to implement these contract management arrangements over the life of the project.

10. Snowy Hydro Limited has established appropriate monitoring and reporting arrangements for Snowy 2.0. Reporting to the Board and the shareholder provides clear oversight of the progress of the project including identification and escalation of key risks. The project is exposed to significant risks, in particular those related to transmission network upgrades required for Snowy 2.0. Snowy Hydro Limited manages transmission risk within the existing regulatory framework, which includes engagement with government and industry stakeholders. Snowy Hydro Limited has implemented actions within the areas it can control.

Supporting findings

Governance frameworks

11. The Board has appropriate oversight of Snowy 2.0, including assurance over key assumptions of the business case. Snowy Hydro Limited established specific governance frameworks aligned with the risk and complexity of the project. These arrangements provide a clear framework for approval and ongoing management, including risk management, of the project. (See paragraphs 2.3 to 2.38)

12. Snowy Hydro Limited implemented appropriate procurement policies and procedures for Snowy 2.0. Snowy Hydro Limited supplemented its pre-existing procurement framework with a specific framework for the EPC procurement. These frameworks were supplemented by probity management mechanisms. Snowy Hydro Limited has established an appropriate contract management framework for Snowy 2.0. The Snowy 2.0 contract management framework builds on Snowy Hydro Limited’s pre-existing framework to align with the scale and complexity of the project. Snowy Hydro Limited’s quality of compliance reporting against the Snowy 2.0 Australian Industry Participation Plan was of an appropriate standard. Prior to March 2022, reporting against this plan did not meet the timeframes set under the Australian Jobs Act 2013. (See paragraphs 2.39 to 2.57)

Management of the engineer, procure and construct contract

13. Snowy Hydro Limited developed and executed an EPC contract that was designed to support Snowy 2.0 outcomes. This was achieved by assessing a range of contracting options to identify an approach best suited to successfully delivering the project and incorporating project deliverables and risk allocation into the contract. (See paragraphs 3.3 to 3.30)

14. Snowy Hydro Limited’s approach to negotiation and execution of the EPC contract demonstrated value for money. Snowy Hydro Limited assessed bids from potential tenderers against price and non-price factors and maintained competitive tension by involving more than one potential tenderer until the final decision. (See paragraphs 3.31 to 3.42)

15. Snowy Hydro Limited has established arrangements to effectively monitor the EPC contractor’s performance against cost and schedule. This includes appropriately managing the EPC contract’s monthly payment process. Contract management and control arrangements have been appropriately implemented. Snowy Hydro Limited also developed procedures to provide assurance over the contractor’s activities in relation to workplace health and safety, quality and environmental management. (See paragraphs 3.43 to 3.67)

Monitoring and reporting

16. Snowy Hydro Limited has established appropriate arrangements to monitor the progress of Snowy 2.0. Monitoring arrangements include monthly progress reports from the contractor. Snowy Hydro Limited’s use of an earned value management approach allows the contractor’s performance to be measured against baseline figures. (See paragraphs 4.3 to 4.13)

17. Snowy Hydro Limited has implemented a strategy to engage with community and industry stakeholders throughout the life of Snowy 2.0. Snowy Hydro Limited regularly reports to shareholder departments and ministers on the progress of Snowy 2.0. This has included engagement on transmission network upgrades required for Snowy 2.0. (See paragraphs 4.14 to 4.48)

Summary of entity response

18. The proposed audit report was provided to Snowy Hydro Limited. Snowy Hydro Limited’s summary response to the report is provided below. An extract of the proposed report was provided to Future Generation Joint Venture. Full entity responses are at Appendix 1.

Snowy Hydro welcomes the ANAO’s audit findings that the Company’s governance of the early implementation of the project is effective with no recommendations raised. The audit concluded that the Company has appropriate arrangements in place to govern, monitor and report on the project; including in relation to managing the contract with our Principal Contractor Future Generation JV. Snowy Hydro would like to acknowledge the highly rigorous yet constructive approach of the ANAO audit team at all times.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Procurement

Contract management

1. Background

Introduction

1.1 On 15 March 2017, Snowy Hydro Limited announced commencement of a feasibility study into expanding the pumped hydro-electric generation capacity1 of the Snowy Mountains Hydro-electric Scheme.2 This expansion project would become known as Snowy 2.0. Snowy Hydro Limited completed the feasibility study process in December 2017.

1.2 In December 2018, Snowy Hydro Limited made a final investment decision to proceed with Snowy 2.0. The engineer, procure and construct (EPC) contracted schedule is for first power generation in 2024–25 and project completion in 2026–27. Appendix 3 provides a timeline of key project milestones.

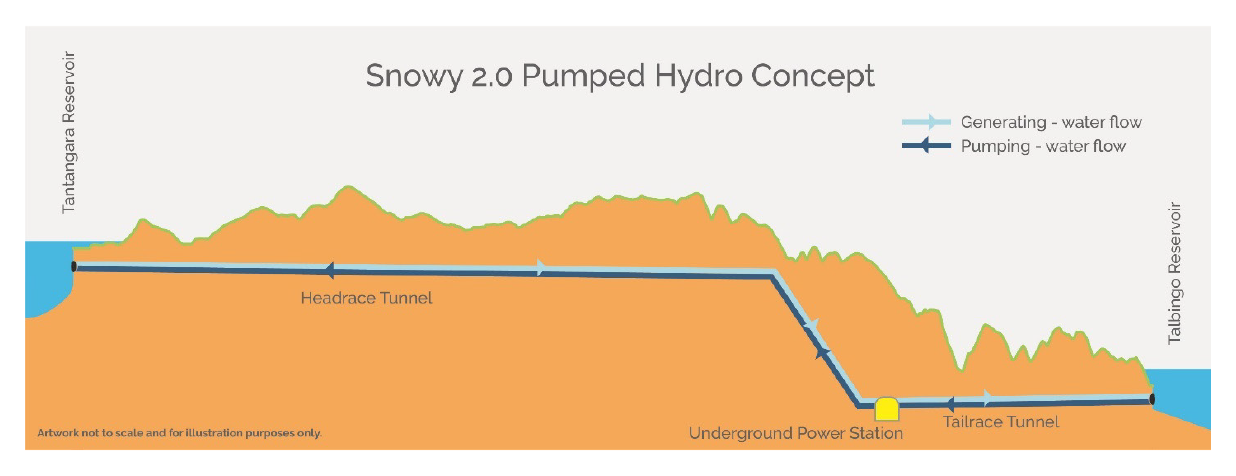

1.3 Snowy 2.0 includes the construction of an underground power station and around 27 kilometres of tunnels between Tantangara and Talbingo Reservoirs (Figure 1.1). The reservoirs and supporting infrastructure are within the Kosciuszko National Park in the Snowy Mountains region of New South Wales (Figure 1.2).

1.4 Snowy 2.0 is intended to provide an additional 2000 megawatts of renewable electricity generating capacity and approximately 350,000 megawatt hours of storage to the National Electricity Market (NEM).3

Figure 1.1: Snowy 2.0 pumped hydro concept

Source: Snowy Hydro Limited.

Figure 1.2: Map of the Snowy Mountains Hydro-electric Scheme including Snowy 2.0

Source: Snowy Hydro Limited.

The National Electricity Market

1.5 The NEM connects power from electricity generators to large industrial energy users and local electricity distributors across Queensland, New South Wales, the Australian Capital Territory, Victoria, South Australia, and Tasmania.

1.6 The Australian Energy Market Operator (AEMO) has identified the NEM is in a period of change, moving from a centralised system dominated by large coal fired power stations to a decentralised system of renewable generators and energy storage resources.4

1.7 As part of the 2020 Integrated System Plan (ISP) published in July 2020, AEMO projected the NEM will require over 26 gigawatts of new variable renewable energy generation supported by up to 19 gigawatts of new dispatchable energy resources5 to replace coal fired electricity generation by 2040.6

1.8 In 2021, AEMO indicated the need for dispatchable resources may be greater than projected in the 2020 ISP. AEMO analysis indicates over 60 gigawatts of dispatchable capacity may be required by 2050 to efficiently support variable renewable energy.7

1.9 Meeting the demand for increased renewable energy generation and dispatchable energy storage was the basis of the decision to proceed with Snowy 2.0.8

Legislative structure, ownership and governance

1.10 Snowy Hydro Limited is an unlisted company incorporated under the Corporations Act 2001. On 29 June 2018, the Commonwealth of Australia (the Commonwealth) became Snowy Hydro Limited’s sole shareholder. Snowy Hydro Limited also became a Commonwealth company on this date.9

1.11 The Public Governance, Performance and Accountability Act 2013 (PGPA Act) frameworks for government-owned business enterprises (GBE) apply to Snowy Hydro Limited from this date.10 Chapter three of the PGPA Act sets out requirements with which Commonwealth companies are to comply to meet appropriate standards of public sector accountability.

1.12 The Commonwealth’s ownership interest in Snowy Hydro Limited is represented by two shareholder ministers: the Minister for Energy and Emissions Reduction, and the Minister for Finance. Shareholder ministers provide Snowy Hydro Limited guidance on purpose, role and activities through a Statement of Expectations.11 Snowy Hydro Limited provides a dividend to the Commonwealth as the sole shareholder. The dividends were $217.8 million in 2019–20 and $122.7 million in 2020–21.

1.13 Internal governance of Snowy Hydro Limited is provided through its Board of Directors (the Board). The Snowy Hydro Limited Company Constitution requires that there must be a minimum of five and a maximum of nine Directors appointed to the Board. The Board has ultimate responsibility for the performance of the company and is accountable to the Commonwealth as Snowy Hydro Limited’s sole shareholder and to the Parliament. The Board has delegated authority over the day-to-day management of Snowy Hydro Limited to the Chief Executive Officer.12

Delivery arrangements for Snowy 2.0

1.14 Snowy Hydro Limited is using an engineer, procure and construct (EPC) contract to complete most of the Snowy 2.0 project.13 The Snowy 2.0 EPC contract is based on the International Federation of Consulting Engineers’ (FIDIC) ‘Conditions of Contract for EPC/Turnkey Projects’.14 Under this type of contract, a lead contractor is responsible for engineering, procurement and construction activities required to build the infrastructure to the standards set out by Snowy Hydro Limited as the project owner.

1.15 In April 2019, Snowy Hydro Limited executed the Snowy 2.0 EPC contract with Future Generation Joint Venture as the lead contractor.15 The EPC contract includes one named subcontractor responsible for the electrical and mechanical work associated with hydro-electric power station elements of the project.16

1.16 The contracted sum under the EPC contract is $5.11 billion. This makes up more than 85 per cent of the total Snowy 2.0 project cost approved by Snowy Hydro Limited. The electrical and mechanical element of the contract makes up around 15 per cent of the total contract sum of $5.11 billion under the EPC contract.

1.17 Project costs not included in the EPC contract include early road works, environmental approvals and compliance, electricity grid connections, insurance, contingency and owner’s costs. Owner’s costs are Snowy Hydro Limited’s costs of developing and managing the project, including employees and third-party advisors.

Rationale for undertaking the audit

1.18 Snowy Hydro Limited has been provided an equity injection to a subscription cap of $1.38 billion to proceed with the Snowy 2.0 project.17 Snowy Hydro Limited is financing the remainder of the project from debt funding. The audit will provide assurance to Parliament that Snowy Hydro Limited has appropriate arrangements in place to effectively deliver the Snowy 2.0 project.

1.19 Under subsection 17(2) of the Auditor-General Act 1997 (the Act), performance audits of GBEs such as Snowy Hydro Limited can be conducted only at the request of the Joint Committee of Public Accounts and Audit (JCPAA). The Auditor-General received this request from the JCPAA in August 2021.

Audit approach

Audit objective, criteria and scope

1.20 The objective of the audit was to examine the effectiveness of Snowy Hydro Limited’s governance arrangements for early implementation of Snowy 2.0, the expansion to the Snowy Mountains Hydro-electric Scheme.

1.21 To form a conclusion against this objective, the following high-level audit criteria were adopted.

- Have effective governance frameworks been established to deliver Snowy 2.0?

- Are there appropriate arrangements to manage the Snowy 2.0 engineer, procure and construct (EPC) contract?

- Does Snowy Hydro Limited effectively monitor and report on the progress of Snowy 2.0?

1.22 The scope of the audit focused on Snowy Hydro Limited’s governance arrangements during the early implementation of the Snowy 2.0 project including:

- Snowy 2.0 governance, procurement and contract management frameworks;

- contract management of the Snowy 2.0 EPC contract, including sample testing of monthly EPC payments; and

- monitoring and reporting on the Snowy 2.0 project, including internal and external performance reporting and advice to shareholder ministers.

1.23 The audit scope did not include the Commonwealth’s purchase of New South Wales and Victoria’s shares of Snowy Hydro Limited; shareholder approval of Snowy 2.0 and associated equity investment in Snowy Hydro Limited; Snowy Hydro Limited’s other operations or projects; Commonwealth or state governments’ environmental assessment processes; the appropriateness of the technical or feasibility assessments; or decisions by AEMO and other entities in relation to connections and transmission.

Audit methodology

1.24 The audit methodology involved examination of Snowy Hydro Limited documentation, a virtual site tour18 and meetings with Snowy Hydro Limited staff including demonstrations of Snowy 2.0 business processes. The audit team also met with:

- two shareholder departments: the Department of Industry, Science, Energy and Resources, and the Department of Finance; and

- the Australian Industry Participation Authority.

1.25 The audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of $386,000.

1.26 The team members for this audit were Jacqueline Hedditch, Joshua Francis, Jake Farquharson and Corinne Horton.

2. Governance frameworks

Areas examined

This chapter examines whether Snowy Hydro Limited has established effective governance frameworks to deliver Snowy 2.0.

Conclusion

Snowy Hydro Limited has established effective governance frameworks to deliver Snowy 2.0. These governance frameworks provide the Snowy Hydro Limited Board of Directors (the Board) with appropriate oversight, including the information required to inform decision-making. The Snowy 2.0 risk management framework supports the ongoing oversight of risks.

Procurement and contract management frameworks provide an appropriate basis for Snowy Hydro Limited’s delivery of Snowy 2.0.

Areas for improvement

The ANAO suggested that Snowy Hydro Limited continue to focus on timely reporting against the Australian Industry Participation Plan.

2.1 Governance involves the systems and processes in place that shape, enable and oversee the management of an organisation.19 Company directors have an obligation to act with care and diligence under the Corporations Act 2001.20 The Public Governance, Performance and Accountability Act 2013 (the PGPA Act) requires Commonwealth companies ‘meet high standards of governance, performance and accountability’.21

2.2 Effective governance arrangements for a project of Snowy 2.0’s scale and complexity would be expected to include:

- appropriate oversight from the Board;

- implementation of procurement policies and procedures; and

- establishing appropriate contract management arrangements.

Does the Board have appropriate oversight over Snowy 2.0?

The Board has appropriate oversight of Snowy 2.0, including assurance over key assumptions of the business case. Snowy Hydro Limited established specific governance arrangements aligned with the risk and complexity of the project. These arrangements provide a clear framework for approval and ongoing management, including risk management, of the project.

2.3 The Statement of Expectations issued in 2018 states that ‘the Board [of Snowy Hydro Limited] has ultimate responsibility for the performance of the Company and is accountable to the Government as its sole shareholder.’ An updated Statement of Expectations published in 2021 specifies that the Board is accountable to ministers for: the performance of Snowy Hydro Limited; internal governance of Snowy Hydro Limited; setting strategic direction and culture; compliance with external governance frameworks; and timely, accurate and transparent provision of information.

Governance framework

2.4 The Snowy Hydro Limited Board Charter (the Board Charter) sets out that the role of the Board is to:

act in the best interests of Snowy Hydro; ensure that Snowy Hydro’s business objectives are aligned with shareholder expectations; and guide and monitor Snowy Hydro’s strategies, policies and performance to optimise performance and create shareholder value, while having regard to employee, community and other stakeholder interests.22

2.5 The Department of Finance maintains a resource management guide for government-owned business enterprises (GBEs) in relation to board and corporate governance, financial governance and planning and reporting.23 The guide provides the following guidance to GBEs in relation to the composition of the board:

GBE boards and any subsidiaries are to comprise directors with an appropriate mix of skills, who are to be appointed on the basis of their individual capacity to contribute to the board, having an appropriate balance of relevant skills (such as commerce, finance, accounting, law, marketing, workplace relations, management and other skills relevant to the GBE’s operations) to enable them to contribute to the achievement of the GBE´s objectives.24

2.6 The Board’s composition has changed since the December 2018 Snowy 2.0 final investment decision.25 Five of the current members were appointed between March 2019 and August 2020.

2.7 Snowy Hydro Limited advised the ANAO that the changes in composition reflect the changing requirements of the company relating to the scale of the project. A 2019 internal review of the Board, initially scheduled for November 2018, was deferred until after the final investment decision to enable consideration of the specific skills required for Snowy 2.0. The review also considered the tenure of previous Board members.

2.8 Snowy Hydro Limited assessed the skills and experience of the Board members, in particular those joining the Board following the final investment decision, against its skills matrix. Snowy Hydro Limited found they are consistent with the skills matrix and provide coverage of the necessary skill areas.

2.9 The Board Charter states it will ‘meet as required to facilitate the effective discharge of its duties and will generally meet at least ten times each year.’ The Board met at least ten times in each calendar year 2018, 2019, 2020 and 2021. Snowy Hydro Limited advised the ANAO that in addition to the Board’s regular meeting schedule, two additional meetings in 2018 and four additional meetings in 2020 covered specific Snowy 2.0 matters or milestones.

Reporting structure

2.10 Snowy Hydro Limited has established specific governance arrangements for the Snowy 2.0 project. Figure 2.1 provides an overview of the Snowy 2.0 governance framework. The roles and responsibilities of all relevant committees are articulated in their respective charters. This includes appropriate reporting arrangements.26

Figure 2.1: Snowy 2.0 project governance framework

Note a: The Snowy 2.0 Funding Committee has been inactive since the execution of the funding strategy.

Note b: The Snowy 2.0 Project Team is also referred to as the Owner’s Team.

Source: ANAO presentation of Snowy Hydro Limited documentation.

Key decision points and assurance over assumptions

2.11 The Board established several key decision points for approval to progress with Snowy 2.0. The key decision points were the feasibility study, the final investment decision, and the notice to proceed. These decision points are discussed below. Appendix 3 provides an overview of all project milestones.

Feasibility study

2.12 In March 2017, Snowy Hydro Limited announced the proposed Snowy 2.0 project would commence with a feasibility study.27 The purpose of the feasibility study was to determine whether Snowy 2.0 was technically feasible. The feasibility study also:

- provided a project cost estimate and timeframes;

- sought to establish a business case to support investment in Snowy 2.028;

- included an investment case, cost estimate and commercial and business analysis modelling; and

- outlined a range of further work required prior to the final investment decision.

2.13 The feasibility study was approved by the Board in December 2017.

Final investment decision

2.14 Following approval of the feasibility study, Snowy Hydro Limited commenced the final investment decision process (FID process). This included consideration of the final Snowy 2.0 business case.

2.15 The business case considered several scenarios, including a comparison of ‘build’ and ‘do not build’ scenarios, various outcomes relating to the Integrated System Plan, a downside case scenario, and other National Energy Market scenarios as modelled by an external provider.29 The business case was approved by the Board on 21 November 2018.

2.16 The FID process also involved due diligence and preparatory work such as detailed assessment of project elements including health and safety, the business case and funding strategy, procurement and contracting, probity, technical design, environmental approvals, and risk management. Snowy Hydro Limited sourced opinions from external advisors to support these detailed assessments.30

2.17 The FID process included re-examination of key assumptions set out in the feasibility study, including financing and cost modelling. These assumptions were set out in the funding strategy. The funding strategy provided analysis on financing Snowy 2.0 and the project’s impact on Snowy Hydro Limited’s credit rating.

Financing

2.18 The funding strategy sets out funding requirements against four capital expenditure scenarios31: a $5.4 billion ‘low case’; a $5.9 billion ‘base case’; a $6.4 billion ‘high case’; and a $6.9 billion ‘worst case’.

2.19 The final investment decision documentation also included correspondence from eight potential future financiers indicating their interest in providing debt facilities to Snowy Hydro Limited for the construction of Snowy 2.0. These financiers were provided with public and confidential information about Snowy 2.0 and engaged with both Snowy Hydro Limited and its financial adviser to develop a detailed understanding of the project.

2.20 Snowy Hydro Limited formed the view that collectively the correspondence indicated that the company would be able to secure more credit capacity than required.

Credit rating

2.21 The funding strategy further considered six commercial scenarios for their impact on Snowy Hydro Limited’s credit rating, including assessment by S&P Global.32 These six scenarios were:

- ‘base case’ — a ‘defensible and commercially robust base case for the consolidated Snowy hydro business including the funding of Snowy 2.0’;

- ‘National Electricity Market downside case’ — a scenario that considers the implied value of capacity in the National Electricity Market being 15 per cent lower than base case and an average decrease of 25 per cent in the buy/sell net revenue for the duration of the modelled period33;

- ‘hydrology dry case’ — a scenario that considers both immediate and long-lasting effects of less water inflows to the Snowy Mountains Hydro-electric Scheme resulting in a material reduction in Snowy Hydro Limited’s access to water for hydro-electricity generation;

- ‘capex downside case’ — a scenario that considers a total capital expenditure that exceeds the base case by $1.0 billion with no extension of the project delivery schedule;

- ‘composite downside case’ — a scenario that considers negative events in both Snowy Hydro Limited’s existing business operations and the financing of Snowy 2.0; and

- ‘“Black swan34” downside case’ — this scenario takes the composite downside case and adds the hydrology dry case.

2.22 Snowy Hydro Limited considers that a rating of BBB– or above is essential to continue operations. However, Snowy Hydro Limited prefers a BBB+ rating. The funding strategy outlined that Snowy Hydro Limited has maintained the same BBB+ credit rating since the company became an entity under the Corporations Act 2001 in July 2002.

2.23 The funding strategy stated that ‘under all of the scenarios S&P [Global] believes that Snowy Hydro will be able to maintain its satisfactory business risk profile.’ Against all six scenarios, the credit rating organisation provided an indicative rating of BBB– or above.

2.24 Further, the strategy stated that the credit rating organisation ‘concluded that Snowy Hydro is expected to maintain its investment grade credit rating under the base case as well as all of the downside scenarios.’ On 30 June 2021, Snowy Hydro Limited retained its BBB+ rating.

Final investment decision approvals

2.25 On 12 December 2018, the Board reached a final investment decision and approved Snowy Hydro Limited to proceed with Snowy 2.0. Following Board approval and consistent with the requirements of Snowy Hydro Limited’s constitution, a recommendation was presented to the shareholder ministers to approve the final investment decision. Shareholder approval was provided in February 2019.

2.26 The final investment decision approval provided for Snowy 2.0 to proceed in three stages:

- early access road works involving upgrades to access roads to main access tunnel construction location;

- early works including exploratory works35, design development and procurement of long lead time items; and

- all other works on the project, known as main works.36

Notice to proceed

2.27 The final phase of the decision-making process was to issue the notice to proceed under the engineer, procure and construct (EPC) contract with the selected contractors.37 The notice to proceed decision included reconsideration of the business case including finalising financing arrangements, as well as key risks and proposed treatments.

2.28 The Board approved the notice to proceed on 16 July 2020.38 Shareholder approval was provided in August 2020.

2.29 Snowy Hydro Limited continues to utilise the governance framework outlined in Figure 2.1 above for the ongoing management of the Snowy 2.0 project. Details of ongoing management are discussed throughout Chapters Three and Four.

Risk management

2.30 GBE boards are responsible for managing risks.39 The Board Charter states that the Board is responsible for ‘oversight and review of the principal risks facing Snowy Hydro, including ensuring that appropriate standards of accountability, risk management and corporate governance are in place’.

2.31 Snowy Hydro Limited determined the addition of a large, complex infrastructure project to its operations required adjustments to its business-as-usual risk management approach. A third-party provider was engaged to develop a project specific risk management framework for Snowy 2.0.

Risk assessment at final investment decision

2.32 Over 120 individual risks relevant to Snowy 2.0 were identified as part of the FID process. Snowy Hydro Limited assessed these individual risks for materiality and grouped them into 12 risk categories. These became known as the top 12 risks.40

2.33 As outlined in Appendix 4, the top 12 risks were assigned:

- an inherent risk rating at final investment decision. This was the risk level at final investment decision without using mitigations to reduce the impact or severity. The top 12 risks at the final investment decision were assigned an inherent risk rating of ‘Extreme’ or ‘High’;

- a current risk rating at final investment decision. This considered the mitigations in place at final investment decision; and

- a target risk rating. This is the risk rating if all identified mitigations are actioned.

Ongoing risk management

2.34 Snowy Hydro Limited maintains a consolidated Snowy 2.0 risk register which includes both the top 12 risks and all active individual risks. As at March 2022, there are 135 active individual risks. Snowy Hydro Limited monitors the consolidated risk register. The top 12 risks are reviewed and reported monthly to governance committees. The project team reviews the individual risks on a six-weekly cycle. Snowy Hydro Limited has retired three key risks where the risk is no longer considered relevant (see Appendix 4).

2.35 Snowy Hydro Limited also reports on key risks to shareholder departments (see paragraphs 4.26 to 4.32).

Shared and transferred risk

2.36 Shared risk refers to risks that arise from objectives shared between multiple entities.41 Risk transfer is a risk management strategy that involves shifting of a risk from one party to another by using contractual arrangements to reach an agreement, such as the purchase of insurance policies and indemnities.42

2.37 Snowy Hydro Limited assessed the top 12 risks to determine whether they were able to be shared with or transferred to the contractor, as well as the extent to which these risks were to be shared or transferred. Appendix 4 outlines the target extent of risk transfer and the key mechanisms adopted to facilitate this transfer.

2.38 Snowy Hydro Limited utilised the EPC contract as the key mechanism for formalising risk allocation and transfer arrangements. The EPC contract’s risk allocation and transfer mechanisms are discussed further in paragraphs 3.25 to 3.30.

Have appropriate procurement and contract management frameworks been implemented?

Snowy Hydro Limited implemented appropriate procurement policies and procedures for Snowy 2.0. Snowy Hydro Limited supplemented its pre-existing procurement framework with a specific framework for the EPC procurement. These frameworks were supplemented by probity management mechanisms.

Snowy Hydro Limited has established an appropriate contract management framework for Snowy 2.0. The Snowy 2.0 contract management framework builds on Snowy Hydro Limited’s pre-existing framework to align with the scale and complexity of the project.

Snowy Hydro Limited’s quality of compliance reporting against the Snowy 2.0 Australian Industry Participation Plan was of an appropriate standard. Prior to March 2022, reporting against this plan did not meet the timeframes set under the Australian Jobs Act 2013.

2.39 The shareholder ministers’ Statement of Expectations requires that Snowy Hydro Limited:

- ensures the Snowy 2.0 procurement processes are open, transparent, competitive and reflect value for money43; and

- take all appropriate actions to ensure the project is delivered on-time and on-budget in accordance with agreed parameters.44

2.40 The Australian Government Contract Management Guide indicates that good contract management arrangements support the management of risk and achievement of value for money and procurement objectives.45 Snowy Hydro Limited recognises the importance of effective contract management in both its existing contract management framework46 and the framework established specifically for Snowy 2.0 contracts.47

Snowy 2.0 procurement and contract management frameworks

2.41 The procurement and contract management frameworks for Snowy 2.0 built on Snowy Hydro Limited’s pre-existing frameworks. Snowy Hydro Limited’s pre-existing procurement policies and procedures were used for Snowy 2.0 procurements except for the EPC contract related procurement.48 A specific procurement approach was developed for the EPC contract. The implementation of this EPC procurement framework is discussed in paragraphs 3.33 to 3.42.

2.42 The Snowy 2.0 contract management approach builds on Snowy Hydro Limited’s pre-existing framework. At the feasibility stage in 2017, Snowy Hydro Limited identified that its existing framework needed to be amended to appropriately manage contracts of the scope and complexity required. The final investment decision papers supporting the Board’s December 2018 decision described the development and implementation of these amendments. This included developing Snowy 2.0 specific contract management policies, processes and systems.

2.43 Figure 2.2 provides an overview of key policy and procedural documents that make up the Snowy 2.0 procurement and contract management frameworks.

Figure 2.2: Key procurement and contract management framework documents

Note: Not all procurement and contract management framework documents reviewed during the audit are shown in this figure.

Note a: These are Snowy Hydro Limited’s standard procurement and contract management framework documents. These existed prior to the Snowy 2.0 project.

Note b: These Snowy 2.0 contract management framework documents are relevant to all Snowy 2.0 contracts. These were developed in recognition of the additional risk and complexity of the Snowy 2.0 contract management compared to business-as-usual contract management at Snowy Hydro Limited.

Note c: The scale, risk and complexity of the Snowy 2.0 EPC contract compared to other Snowy 2.0 contracts requires additional EPC contract specific management plans.

Note d: These documents provided the framework for the procurement activities described in paragraphs 3.31 to 3.42.

Source: ANAO presentation of Snowy Hydro Limited documents.

2.44 Snowy Hydro Limited’s procurement framework includes guidance related to achieving value for money, encouraging competition, ethics and probity, and effective contract management. This framework was in place at the commencement of the Snowy 2.0 project feasibility work in 2017.

2.45 Snowy Hydro Limited’s ‘Procurement Procedure’ document sets out four procurement goals that are aligned with the CPRs.

- Acquire goods, equipment, services and/or works from external suppliers that meet the quality requirements of Snowy Hydro Limited.

- Achieve Snowy Hydro Limited’s commercial outcomes.

- Undertake procurement within acceptable risk limits, including commercial risk to Snowy Hydro Limited’s business, technical risk to plant and equipment, and risk of harm to employees, contractors or the environment.

- Undertake procurement with the most efficient use of time and resources.

2.46 Snowy Hydro Limited classifies its procurement activities for Snowy 2.0 into four categories (Table 2.1).49

Table 2.1: Snowy 2.0 procurement categories

|

Snowy Hydro Limited category |

Snowy Hydro Limited description |

Proportion by counta |

Proportion by valuea |

|

Competitive source |

Multiple parties are involved in the procurement process. |

7.4% |

96.6% |

|

Connections, licenses and agencies |

Agreements with organisations such as government agencies, transport or electrical authorities. |

3.1% |

1.4% |

|

Assignment under existing framework |

Sourced through supplier panels with pre-negotiated rates and conditions. |

60.6% |

1.3% |

|

Direct source |

Agreements where a multi-party process was not undertaken, and the other categories do not apply. |

28.9% |

0.7% |

Note a: Percentages calculated on a May 2022 data set.

Source: ANAO analysis of Snowy Hydro Limited data.

2.47 Snowy Hydro Limited’s contract management framework covers the key elements of contract management as set out in the Australian Government Contract Management Guide. This includes mechanisms for contract governance, performance management, supplier relationship management, and contract administration. The implementation of EPC contract management activities under this framework is examined in paragraphs 3.33 to 3.67 and 4.4 to 4.13.

2.48 Snowy Hydro Limited’s Snowy 2.0 contract register documents 323 contracts related to Snowy 2.0 (Table 2.2). The EPC contract described in paragraphs 1.14 to 1.17 is around 90 per cent of Snowy Hydro Limited’s Snowy 2.0-related contract value and spend.

Table 2.2: Snowy 2.0 project contracts

|

Committed Value |

Number of contracts |

Total value committed (%) |

Total spend to March 2022 (%) |

|

Over $100 million |

1a |

92.3% |

90.0% |

|

$20 million > $99.9 million |

7 |

5.2% |

6.2% |

|

$1 million > $19.9 million |

27 |

1.7% |

2.2% |

|

$100,000 > $999,999 |

119 |

0.7% |

1.0% |

|

Up to $99,999 |

169 |

0.1% |

0.6% |

|

Totals |

323 |

100.0% |

100.0% |

Note a: This is the Snowy 2.0 EPC contract.

Source: ANAO analysis of Snowy Hydro Limited data set from May 2022.

Probity management

2.49 Those responsible for the governance of Commonwealth entities must promote the ethical management of public resources and establish and maintain appropriate systems relating to risk management and oversight and internal controls.50 This includes policies and procedures regarding the management of conflicts of interest. Such policies and procedures should apply to all contractors, consultants and advisory bodies employed by, or associated with, the entity.51 Each Statement of Expectations issued by the shareholders confirms the need for these types of arrangements to be established for Snowy 2.0 procurement.52

2.50 In relation to probity management for Snowy 2.0, Snowy Hydro Limited has implemented the following mechanisms.

- A Board-approved code of conduct policy. The code of conduct policy establishes that employees are accountable for declaring all actual, perceived or potential conflicts of interest and must declare any conflict of interest as soon as it arises.

- A procedure for declaring gifts and conflicts of interest. This procedure directs employees to disclose conflicts of interest in writing to their senior manager immediately upon their becoming aware of the actual or potential conflict of interest.

- Adopted the existing code of conduct policy and declaring gifts and conflicts of interest procedure for Snowy 2.0, supplemented by a Project Charter, which describes the required standards of behaviour relevant to the project.

- A conflict of interest register. This register includes declarations and evidence of oversight of potential conflicts related to the Snowy 2.0 project.

2.51 Nothing came to the ANAO’s attention that the probity management mechanisms do not provide a sufficient basis to manage conflicts of interest.

Probity management in Snowy 2.0’s engineer, procure and construct procurement

2.52 Snowy Hydro Limited identified the EPC procurement process as a high probity related risk for Snowy 2.0. To manage this risk, Snowy Hydro Limited required all personnel involved in the Snowy 2.0 tender assessment to confirm that they had read the relevant policies and did not have any conflicts with the policies or the listed contractors.53 This was in addition to the established Snowy Hydro Limited procedure for declaring gifts and conflicts of interest which requires employees to declare actual or potential conflicts as they arise.

2.53 Snowy Hydro Limited engaged an external provider to undertake a review of probity management arrangements for the EPC procurement processes. This review did not identify any material probity risks which have not been identified, assessed and or mitigated by Snowy Hydro. A report documenting this probity review was included with the final investment decision material presented to the Board in December 2018.

Australian Industry Participation Plan

2.54 The Australian Jobs Act 2013 requires proponents of major projects to submit an Australian Industry Participation Plan (AIP Plan) and submit AIP Plan compliance reports to the Australian Industry Participation Authority (AIP Authority).54 Major projects are defined as projects with capital expenditure likely to exceed $500 million.

2.55 Snowy Hydro Limited was largely compliant with the Australian Jobs Act 2013. Reporting to the AIP Authority was non-compliant with the required timeframes though the ANAO noted an improving trend in submission timeframes (Table 2.3).55 The most recent report for the 24 June 2021 to 23 December 2021 period was submitted on time.

Table 2.3: Snowy Hydro Limited compliance with AIP Plan reporting timeframes

|

Period |

Report due |

Date of report |

Overdue? |

|

24 June 2019 – 23 December 2019 |

24 March 2020 |

27 November 2020 |

Yes: over 8 months |

|

24 December 2019 – 23 June 2020 |

24 September 2020 |

12 March 2021 |

Yes: over 5 months |

|

24 June 2020 – 23 December 2020 |

24 March 2021 |

27 May 2021 |

Yes: over 2 months |

|

24 December 2020 – 23 June 2021 |

24 September 2021 |

14 October 2021 |

Yes: under 1 month |

|

24 June 2021 – 23 December 2021 |

24 March 2022 |

24 March 2022 |

No |

Source: ANAO analysis of AIP Plan reports against AIP Plan approval letter requirements.

2.56 Snowy Hydro Limited advised the ANAO that initially the principal EPC contractor required time to establish the monitoring and reporting framework necessary to meet reporting requirements. Snowy Hydro Limited withheld an amount of interim payment to the main EPC contractor in October 2020 as questions received from the AIP Authority required a response. Snowy Hydro Limited subsequently reported an improved level of engagement from the contractor, and the withheld payment was released.

2.57 Snowy Hydro Limited should continue to focus on the timeliness of compliance reporting to the AIP Authority. This will support ongoing transparency of its activities to provide opportunities for Australian industry to compete for work.

3. Contract management

Areas examined

This chapter examines whether there are appropriate arrangements to manage the Snowy 2.0 engineer, procure and construct (EPC) contract.

Conclusion

Snowy Hydro Limited has established appropriate arrangements to manage the Snowy 2.0 EPC contract. The contract management arrangements have provided Snowy Hydro Limited with a sound basis for managing the performance of the contractor. Snowy Hydro Limited should continue to implement these contract management arrangements over the life of the project.

3.1 Contract management refers to the activities undertaken to manage the performance of a contract including achieving agreed outcomes and meeting key deadlines. Effective contract management requires development of a contract that supports the achievement of intended outcomes, selection of the most appropriate contractor, and ongoing monitoring of performance.

3.2 To assess whether Snowy Hydro Limited has appropriate arrangements to manage the Snowy 2.0 EPC contract56, the ANAO examined whether:

- development of the EPC contract supported Snowy 2.0 outcomes;

- contract negotiation and execution demonstrated value for money; and

- Snowy Hydro Limited effectively monitors the contractor’s performance.

Did the development of the EPC contract support Snowy 2.0 outcomes?

Snowy Hydro Limited developed and executed an EPC contract that was designed to support Snowy 2.0 outcomes. This was achieved by assessing a range of contracting options to identify an approach best suited to successfully delivering the project and incorporating project deliverables and risk allocation into the contract.

3.3 Snowy 2.0 was developed as a commercial business opportunity for Snowy Hydro Limited. The shareholder expects Snowy 2.0 to support the delivery of reliable, secure and affordable energy in Australia.57 Contract arrangements for Snowy 2.0 need to deliver against quality, cost and time requirements to realise outcomes that will generate commercial value and meet shareholder expectations.

Assessment of contracting approaches

3.4 Snowy Hydro Limited articulated the following position as part of developing its Snowy 2.0 contracting strategy in 2017.

- Snowy Hydro Limited is the owner of the project, and ultimately responsible for its success or failure. This accountability cannot be delegated.

- Snowy Hydro Limited does not have the internal resources or capability to execute Snowy 2.0 without external contractors.

- Snowy Hydro Limited does not have the necessary systems in-house to control a project of this scale and complexity. It must either develop them or buy them in.

- Snowy Hydro Limited remains directly accountable for some aspects of the project, for example, stakeholder engagement, legal and regulatory, trading and portfolio considerations, though they may be supplemented with external expertise.

Selecting the primary contracting approach

3.5 Snowy Hydro Limited reviewed four potential contracting approaches during the feasibility stage in 2017.58 Differences between the approaches included the contracting method to be used, the number of main contracts, and whether Snowy Hydro Limited would engage a contract management consultant or develop in-house contract management capability.

3.6 The preferred contracting approach identified was to:

- use the International Federation of Consulting Engineers’ (FIDIC) ‘Conditions of Contract for EPC/Turnkey Projects’ contracting method to deliver Snowy 2.0 to Snowy Hydro Limited specified requirements as a turnkey solution for a contracted price59;

- engage a single principal EPC contractor; and

- develop capability in Snowy Hydro Limited to manage the EPC contract.

3.7 This approach was the preferred option based on the risk management benefits and a contracted fixed price. The 2017 review concluded the EPC contract was the most advantageous in five of the eight assessment categories. These five categories were overhead costs, exposure to cost overruns, market attractiveness, exposure to execution and coordination risk, and exposure to technical integrity risk. The development of an ‘Owner’s Team60’ would also separate the Snowy 2.0 project from Snowy Hydro Limited’s existing operations.

3.8 The use of a single EPC contract managed by a Snowy Hydro Limited project team was endorsed by the Snowy Hydro Limited Board of Directors (the Board) at both the feasibility study approval in December 2017 and final investment decision in December 2018.

Project and contract deliverables

3.9 The aim of contract management is to ensure that all parties meet their obligations to deliver the objectives of the contract.61 A contract requires clearly documented deliverables if the contracting organisation is to achieve its outcomes. Clearly documented deliverables will include information about quality, cost and schedule. The Snowy 2.0 EPC contract incorporates clear deliverables in the recitals section at the highest level of the contract (see extract in the box below).

|

Extract from the Snowy 2.0 EPC contract’s Formal Instrument of Agreement |

|

Recitals:

|

Source: EPC/Turnkey Contract for the execution of the Snowy 2.0 Pumped Hydro Electric Scheme Capacity Upgrade Project, executed 5 April 2019, Recitals section, page (i).

3.10 The statements outlined in Box 1 are supported by Clause 4.1 of the Snowy 2.0 EPC contract, which places general obligations on the contractor. In summary, these obligations require the contractor to deliver the project in accordance with the time, budget and specific design requirements established elsewhere in the contractual documentation. Table 3.1 outlines the key elements of the Snowy 2.0 EPC contract and how they define contract deliverables.

Table 3.1: Key Snowy 2.0 EPC contract elements

|

Contract elementa |

Summary |

|

The Formal Instrument of Agreement |

The overarching instrument which sets out all of the documents that comprise the contract as well as some high-level terms between the parties. The agreement is made up of 40 ‘Clauses’ over 252 pages. 38 ‘Schedules’ and eight ‘Exhibits’ are attached. |

|

Contract Data set out at Schedule 1 |

Documents data on deliverables such as dates for completion of specific sections of work as well as the project overall, key payments, compensation and damages. |

|

Additional contract schedules – Geotechnical Baseline Report (GBR) Schedule, Daywork Schedule, Schedule of Payments and Schedule of Performance Guarantees |

The GBR schedule presents a baseline of anticipated subsurface conditions. This baseline sets the costs. Actual geotechnical conditions encountered are compared to the baseline and costs paid under the contract are adjusted to match the encountered conditions. The Day Work Schedule specifies the rates to be paid for various trades, activities and machinery. These rates are used to make claims under the Schedule of Payments. The Schedule of Payments sets out the total amount that can be claimed for payment items, and along with Rules of Credit define how these costs can be claimed. The Schedule of Performance Guarantees outlines general performance requirements as well as several specific performance measures determined to be critical. It also specifies the damages payable to Snowy Hydro Limited if these performance requirements are not met. |

|

Conditions of Contract and the Schedules other than those mentioned in the line above |

These schedules include a range of information on contract deliverables, such as the contractor’s Basis of Programme (Schedule 3) explaining how it will deliver the contracted works. |

|

Employer’s Requirements |

The document that ‘describes the purpose(s) for which the Works are intended and specifies the scope, design and/or other performance, technical and evaluation criteria for the Works.’ The Employers Requirements at Exhibit B of the Snowy 2.0 EPC contracts is made up of 59 documents over 1496 pages. |

|

Exhibits (other than the Employer’s Requirements) |

These exhibits include environmental and planning approvals, transmission connection related material and technical plans and drawings. |

Note a: Presented in the contractual order of priority under the Formal Instrument of Agreement’s Clause 1.5.

Source: ANAO review of Snowy 2.0 EPC contract documents.

Quality — EPC contract employer’s requirements

3.11 Detailed requirements for the construction of Snowy 2.0 are outlined in the Employer’s Requirements. The Employer’s Requirements details the scope of work, including quality and technical specifications and Snowy Hydro Limited’s expectations of the contractors for the project including commissioning62 and handover.

3.12 Snowy Hydro Limited commenced development of the Employer’s Requirements during the feasibility study where key technical and operational requirements of Snowy 2.0 were outlined.

3.13 The Employer’s Requirements were used to inform the procurement and contract negotiation process and were also refined as part of this process. This iterative approach was intended to ensure the Employer’s Requirements were appropriately balanced.

3.14 The Employer’s Requirements are included at Exhibit B of the EPC Contract.

Cost — EPC contract payment schedule

3.15 Snowy Hydro Limited controls the costs of the EPC contract through Clause 14 Contract Price and Payment and Schedule 10 Schedule of Payments. Clause 14 (b) states:

The Contractor acknowledges and agrees that, subject to the terms of the Contract, the Contract Price is:

(i) a fixed and firm price that includes the Contractor’s profit and overhead and all costs and expenses that the Contractor may incur in executing the Works and performing the Contractor’s Activities and any of its other obligations under the Contract; and

(ii) not subject to any adjustment, escalation or rise and fall, other than adjustments, additions and/or deductions in accordance with the Contract.

3.16 Schedule 10 of the EPC contract sets the payment items the EPC contractor can claim. The payment schedule has 319 payment items across 17 categories. These categories relate to:

- early works;

- main works;

- electrical and mechanical works;

- incentives and risk sharing; and

- escalation.

3.17 Each payment item includes identification of the work to be completed, a rule of credit describing the circumstances for payments to be released, and the total amount that can be claimed for that payment item.

3.18 Each payment item is linked to one of 14 rules of credit. The rules of credit reflect different circumstances that are required to be met for Snowy Hydro Limited to release payments for items.63 Circumstances include when:

- design work is completed, materials have been purchased, or construction activities have been completed; or

- certain events have occurred, such as tunnel conditions that are different to the geotechnical baseline or situations triggering incentive or risk sharing payments.

3.19 The rules of credit recognise that some contracted costs may be variable within the amounts set in the payment schedule. For example, the rules of credit associated with the supply of materials64 are that payments are made based on the amount of material used. Therefore, if less material is used than was estimated in the EPC contract, the amount paid will be less than the amount in the EPC payment schedule.

Development of EPC payment schedule

3.20 The EPC contract’s costings and payment schedule were developed and refined through the feasibility and tendering processes. Snowy Hydro Limited commenced the cost estimate with its third-party engineering and costing advisors during the feasibility study stage. The costing and payment schedules were part of the competitive tender process. Snowy Hydro Limited’s third-party engineering and costing advisors continued to provide advice on the costing elements of bids during the tender assessment and approval.

3.21 The Board was provided advice on EPC contracting costing at its approvals of the feasibility study, final investment decision, and notice to proceed with main works decision.

Timeframes — EPC contract scheduling of works

3.22 The EPC contract includes clauses related to the scheduling of works, including Clause 8 Commencement Delays and Suspension and Clause 10 Employer’s Taking Over. These clauses require the contractor to deliver the contracted works in line with timeframes set out in the contract schedules.

3.23 EPC contract Schedule 1 Contract Data sets key delivery dates for the taking over65 of each section of work to Snowy Hydro Limited (Table 3.2). The contracted date for handover of the whole of the works is in fourth quarter of 2026–27.

Table 3.2: Period for completion of each section of work under the EPC contract

|

Section of work |

Contracted period for completiona |

Approved variationb |

|

Cable yard and gas insulated switchyard |

Q2 2024–25 |

Q4 2024–25 |

|

Intake structures and power waterway |

Q2 2024–25 |

Q1 2025–26 |

|

Progressive commissioning of generators units 1 to 6 |

Q1 2025–26 to Q4 2025–26 |

Q2 2025–26 to Q2 2026–27 |

|

Power station |

Q4 2025–26 |

Q2 2026–27 |

|

Whole of works |

Q2 2026–27 |

Q4 2026–27 |

Note a: These periods reflect the dates in the executed EPC contract’s programme from April 2019.

Note b: These periods reflect the varied approved completion dates as of February 2022. See paragraphs 3.55 to 3.60. Approved variations were less than six months.

Source: Snowy Hydro Limited documents.

3.24 The EPC contractor’s detailed 217-page Basis of Programme document is included in the EPC contract as Schedule 3. This document lists milestones and expected completion dates for the detailed construction path leading to the delivery of the specified sections above. This programme is also used to support the management of the contractor’s performance and monitoring of the progress of Snowy 2.0 overall.66

Risk allocation and transfer

3.25 The Snowy 2.0 contract includes risk allocation and transfer mechanisms. The contractual arrangements requiring the contractor to deliver the contracted work to specified quality, cost and timeframes is a risk transfer mechanism. Allocation and transfer of risk is supported by the adoption of a geotechnical baseline report (GBR) and schedule, and warranties and performance guarantees established in the EPC contract.

Geotechnical baseline report and schedule

3.26 Snowy Hydro Limited identified uncertainty of ground conditions and groundwater as one of the top 12 risks (see paragraphs 2.30 to 2.38 and Appendix 4). Snowy Hydro Limited and the contractor developed a GBR and associated payment schedule to provide a specific risk allocation mechanism between Snowy Hydro Limited and the contractor.67

3.27 The use of the GBR is an example of risk allocation through contractual arrangements. Case study 1 provides an overview of the development of the GBR and its application in risk allocation.

|

Case study 1. Risk allocation through the geotechnical baseline report mechanism |

|

During 2017 and 2018, geotechnical investigations established a baseline of expected geological conditions expected to be encountered during excavation of the tunnel system for Snowy 2.0. Investigations including drilling deep boreholes, surface mapping, laboratory and on-site testing. The geotechnical baseline report (GBR) documented this baseline and was part of the tender material. The two civil tenderers were required to include expected tunnelling rates and costs based on the geological conditions set out in the GBR in their tenders. This allowed Snowy Hydro Limited to competitively assess the timing and costs of tunnelling through the expected geological conditions between the tenderers. The GBR and its payment and timing schedule are incorporated in the EPC contract (see Table 3.1). This provides a risk allocation mechanism whereby Snowy Hydro Limited bears the risk related to the sub-surface conditions and the EPC contractor bears the risk of production rates and cost of excavation and support within the sub-surface conditions (see Appendix 4). Snowy Hydro Limited advised the Board that without the GBR the likely cost of the project would have increased significantly to allow the contractor to accept the risk associated with the variability of the geological conditions. The EPC contract’s GBR schedule documents ‘classes’ for expected ground conditions and associated tunnelling costs and times. This establishes agreed cost and time values for different underground conditions and a cost and time baseline for the planned tunnel route. If actual conditions vary to the expected conditions, the GBR ground condition classes establish pre-agreed variations to costs and time allowed under the contract. Actual geotechnical conditions encountered are compared to the baseline and costs paid and time allowed under the contract are increased or decreased to match the encountered conditions. The GBR is operationalised into daily construction activities with regular data collection and assessment activities occurring against the GBR. This includes processes for both Snowy Hydro Limited and the contractor to agree on the assessments of actual ground conditions under the GBR. Any disagreement with the GBR assessment is addressed through the EPC contract dispute and arbitration clauses (see paragraphs 3.59 to 3.60). The GBR forms part of the adjustable components of the overall contract price. The contractor submits a claim for works executed as part of the monthly claim process (see paragraphs 3.50 to 3.54). Further reporting against the GBR occurs to the project governance committees including the Snowy 2.0 Committee, the Snowy 2.0 Executive Governance Committee and the Board (see paragraph 2.10). |

Warranties and performance security

3.28 Snowy Hydro Limited’s transfer of risk though the EPC contract is supported by warranties through testing and defect provisions and the requirement for the contractor to maintain performance security.

3.29 The EPC contract’s testing and defect provisions allow Snowy Hydro Limited to confirm the works are delivered to the standards set in the Employer’s Requirements and require actions to be taken if these standards are not met.

3.30 The performance security is a set of ‘unconditional, irrevocable, fully enforceable unconditional insurance bonds payable on first demand’.68 Ten different securities are required under the contract. This includes insurance bonds in relation to the performance of works and performance against several key functional specifications.

Did the contract negotiation and execution demonstrate value for money?

Snowy Hydro Limited’s approach to negotiation and execution of the EPC contract demonstrated value for money. Snowy Hydro Limited assessed bids from potential tenderers against price and non-price factors and maintained competitive tension by involving more than one potential tenderer until the final decision.

3.31 The Commonwealth Procurement Rules contain a value for money principle.69 Value for money includes both cost and non-cost factors. Competition is a key element of the Australian Government’s procurement framework and helps deliver value for money. Each version of the Statement of Expectations issued by the shareholders required Snowy Hydro Limited to ‘ensure its procurement processes are open, transparent, competitive and reflect value for money’.

3.32 The approach Snowy Hydro Limited adopted for contract negotiation and execution was integrated with the procurement approach outlined in paragraphs 2.41 to 2.45. This approach includes four procurement goals focused on achieving value for money.

Pre-tender submission

3.33 Snowy Hydro Limited’s procurement and contract negotiations involved early and ongoing engagement with industry. This was supported by appropriate planning and timeframes. Table 3.3 provides an overview of Snowy Hydro Limited’s EPC procurement activities prior to receiving tender submissions.

Table 3.3: Snowy 2.0 EPC procurement activities prior to tender submissions

|

Stage |

Dates |

Activities |

|

Develop owner’s capability |

First half 2017 |

|

|

Expressions of Interest |

June to July 2017 |

|

|

Early contractor consultation |

July to December 2017 |

|

|

Civil Request for qualifying bids |

February to April 2018 |

|

|

Electrical and mechanical Request for Information and Testing Phase |

April to August 2018 |

|

Source: ANAO presentation of information provided by Snowy Hydro Limited.

3.34 Snowy Hydro Limited’s efforts to demonstrate value for money are evident in the pre-tender activities.

- Early contractor consultation provided an opportunity early in the process for Snowy Hydro Limited to develop its understanding of the project’s requirements (quality), budget (costs) and schedule (time).

- An EOI process was used to shortlist potential tenders. This process assessed interested parties against delivery capability, capacity and contractor experience.

- During model tests of the proposed hydro power generating units, Snowy Hydro Limited assessed if electrical and mechanical tenders were of the required quality.

Tender issue and evaluation

3.35 The tender process for the EPC procurement occurred between May 2018 and January 2019. This involved issuing the civil works tender to two participants and the electrical and mechanical works tender to four participants in May 2018. Table 3.4 provides an overview of Snowy Hydro Limited’s EPC procurement activities from the issue of tenders through to evaluation.

Table 3.4: Table 3.4 : Snowy Hydro Limited’s Snowy 2.0 EPC procurement activities — tender issue and evaluation

|

Stage |

Dates |

Activities |

|

Establishment of Tender Evaluation Steering Committee (TESC)a |

September 2018 |

|

|

Evaluation |

October 2018 (electrical and mechanical) November 2018 to January 2019 (civil) |

|

|

Best and final offers |

October 2018 (electrical and mechanical) December 2018 (civil) |

|

|

Decision |

November 2018 (electrical and mechanical); January 2019 (civil) |

|

|

Negotiations with successful tenderers |

November 2018 to April 2019 |

|

Note a: The TESC comprised members of Snowy Hydro Limited’s executive management and technical staff.

Source: ANAO presentation of information provided by Snowy Hydro Limited.

3.36 Snowy Hydro Limited assessed value for money during both tender evaluations. Prior to making a final decision for the civil EPC procurement, Snowy Hydro Limited compared the final bids and conducted a normalisation process. Snowy Hydro Limited also conducted a normalisation process for the electrical and mechanical procurement as part of the price evaluation.

3.37 The normalisation process was included in the tender evaluation plans and involved identifying and analysing the areas in which the bids were different. Where Snowy Hydro Limited determined that adjustments were required to allow for comparison of bids, cost or time was added or subtracted. This was informed by technical assessment of the bids and Snowy Hydro Limited worked with the owner’s engineer and the main advisory firm to complete this process.70

3.38 Factors considered by evaluators included the underlying assumptions of each bid, risk, and the practicality of designs. Where an element of a proposal was assessed as not fully delivering against the employer’s requirements, additional cost or time was added to the proposal.

3.39 Quality was also considered during the evaluation of both tenders. The technical merit of both civil tenders was evaluated by the owner’s engineer, and the first-placed tenderer achieved a higher score than the second-placed tenderer. The models developed by the electrical and mechanical tenderers were also tested and scored. The first-placed electrical and mechanical tenderer’s model achieved the highest score.

3.40 Snowy Hydro Limited maintained competitive tension throughout the entire EPC procurement process by including more than one tenderer until the final decision point in both procurement processes. The second placed tenderers were retained as standby options during contract negotiations. In both procurements, the successful tenderer submitted a best and final offer that was lower than competing offers.

Contract execution

3.41 Following the evaluation process, Snowy Hydro Limited negotiated an EPC contract with the preferred civil and electrical and mechanical tenderers. This resulted in a single EPC contract incorporating the successful civil work package tenderer as the lead contractor and the successful electrical and mechanical work package tenderer as a named subcontractor.71

3.42 The Snowy 2.0 EPC contract was executed on 5 April 2019. This was followed by the notice to proceed with exploratory works in 2019 and main works in 2020.

Does Snowy Hydro Limited effectively monitor the contractor’s performance?

Snowy Hydro Limited has established arrangements to effectively monitor the EPC contractor’s performance against cost and schedule. This includes appropriately managing the EPC contract’s monthly payment process. Contract management and control arrangements have been appropriately implemented. Snowy Hydro Limited also developed procedures to provide assurance over the contractor’s activities in relation to workplace health and safety, quality and environmental management.

3.43 The importance of effectively monitoring contractor performance is recognised in both the Australian Government and Snowy Hydro Limited procurement and contract management frameworks.

3.44 The Snowy 2.0 feasibility study, documentation supporting the final investment decision and contract management framework documents identify that Snowy Hydro Limited needs to undertake the following activities to effectively monitor the EPC contractor’s performance: schedule and cost management; contract administration; financial management72; and performance and progress reporting.73

Schedule and cost management

3.45 Snowy Hydro Limited’s schedule and cost management activities for the Snowy 2.0 EPC contract are described in the Snowy 2.0 Earned Value Performance Management Plan.74 This plan sets out 11 steps for managing the Snowy 2.0 project’s schedule and costs. These steps and evidence of implementation are outlined in Table 3.5.

Table 3.5: Snowy 2.0 Earned Value Performance Management Plan implementation

|

Step |

Summary from Snowy 2.0 Earned Value Performance Management Plan |

Evidence of implementation |

|

1. Decompose the project |

A work breakdown structure that records ‘what’ is being delivered by dividing Snowy Hydro Limited’s Employer’s Requirements into definable products or services. |

The Employer’s Requirements are described in paragraphs 3.11 to 3.14. |

|

2. Assign responsibility |

An organisational breakdown structure that records ‘who’ is responsible for delivering each product or service in the work breakdown structure. |

To manage the work and organisational breakdown structures, Snowy Hydro Limited implemented costing and scheduling software designed for managing major construction projects. |

|

3. Schedule the work |

Schedule baselining, monitoring and reporting in a construction project schedule management information system to be used by both Snowy Hydro Limited and the contractors. The contractors are responsible for managing the schedule of their scope. Snowy Hydro Limited is responsible for tracking critical project milestones, assessing and validating contractors reported progress, and managing Snowy Hydro Limited’s deliverables. |

This scheduling supports the management of the contract schedule described in paragraphs 3.22 to 3.24. |

|

4. Develop time-phased budget |

Project budgets are to be assigned to a level of granularity that supports appropriate management. |

Project budgeting activities support the management of the payment schedule described in paragraphs 3.15 to 3.21. |

|

5. Assign objective measures of performance |

The plan identifies methods for calculating progress. The plan states these measures are the Rules of Credit that are defined in contract. |

The rules of credit are set in the EPC contract’s schedule of payments described in paragraphs 3.15 to 3.21. |

|

6. Set the performance measure baseline |

Baselining the performance measures sets the reference point against which schedule and cost performance is measured and reported.

|

The EPC contract was baselined at notice to proceed decision in July 2020. |

|

7. Authorise and perform the work |

The plan states that for all work that is in scope, authorisation is required from the Project Director or their authorised delegate and that authorisation is required when budgeted work is committed, committed work is changed, budget reallocation is required, payment request are made, or performance deviates outside parameters. |

The EPC contract management framework describes a range of process for authorising and approving works (see paragraphs 2.39 to 2.48). |

|

8. Accumulate and report performance data |

The plan outlines a range of performance reporting including earned value, cost and schedule metrics; monthly progress reporting from the contractor; and weekly, monthly and annual reporting from the Owner’s Team to Project Director and Snowy Hydro Limited’s management. |

Performance reporting is described in paragraphs 4.4 to 4.13. |

|

9. Analyse project performance data |

The plan outlines a range of performance analysis metrics and information that are to be assessed to monitor schedule and costs. |

Performance reporting is described in paragraphs 4.4 to 4.13. |

|

10. Take management action |

Management action may be required in response to past or forecast cost or schedule variances. Potential actions identified in the plan include directions to accelerate or take remedial actions, authorise additional resources, changes in approach, scope change, directing work to be performed by others, or the relaxation of requirements, obligations or constraints. |

See analysis of payments process at paragraphs 3.48 to 3.54 and variations at 3.55 to 3.60. |

|

11. Maintain the baseline |

Maintaining the baseline occurs by having change control processes to ensure that only approved changes are made to the baselined schedules and cost. |

See analysis of variations at paragraphs 3.55 to 3.60. |

Source: ANAO analysis of Snowy Hydro Limited documentation including the Snowy 2.0 Earned Value Performance Management Plan.

Contract administration