Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

2022–23 Aids to Navigation Maintenance Procurement

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Aids to Navigation (AtoN) are navigational tools which support coastal navigation safety. Types of AtoN include: traditional lighthouses, beacons and buoys. Since 2001, the Australian Maritime Safety Authority (AMSA) has contracted for the maintenance of the network of AtoN.

- The audit was undertaken in response to a request from the Minister for Infrastructure, Transport, Regional Development and Local Government.

Key facts

- A procurement through a Request for Tender was undertaken between August 2022 and July 2023.

- One tender for AtoN maintenance was received, from the incumbent contractor. Tender evaluation concluded that a value for money outcome had not been achieved and AMSA decided not to enter into a contract.

- In August 2023, the unsuccessful tenderer made a procurement complaint to AMSA. AMSA’s investigation concluded that the alleged breaches of the Commonwealth Procurement Rules had not occurred.

What did we find?

- AMSA’s management of the procurement was largely effective.

- AMSA took largely appropriate steps to encourage open and effective competition.

- Tender evaluation was planned and undertaken consistently with the approach to market and the Commonwealth Procurement Rules. On the basis of the evaluation results, it was appropriate that AMSA not award a contract. AMSA has not provided clear and accurate reasons for why it did not award a contract.

- Important elements of a framework for conducting the procurement ethically were in place including a probity plan and the engagement of a probity advisor. There were some shortcomings with implementation of the framework.

What did we recommend?

- There were four recommendations related to: improving procurement processes; ensuring communication aligns with tender evaluation results; and better planning for and managing of probity risk.

- AMSA agreed to all 4 recommendations.

485

number of Australian Government AtoN.

1

compliant tender.

$225m

contracted cost of AtoN maintenance between 2006 and 2024.

Summary and recommendations

Background

1. The Australian Maritime Safety Authority (AMSA) is responsible for providing the Australian Government’s network of marine Aids to Navigation (AtoN) to the commercial shipping industry that meets international standards. Since 2001, AMSA’s AtoN maintenance program has been implemented continuously through one external contractor, with the current contract due to end on 30 June 2024.

2. Between August 2022 and July 2023 AMSA undertook an open procurement process for the provision of AtoN maintenance services. One tender was received, which was from the incumbent contractor. After completing a full evaluation of the tender that was received, including a value for money assessment, a contract for the maintenance of the AtoN was not awarded.

Rationale for undertaking the audit

3. This performance audit of the AtoN maintenance procurement was undertaken in response to a request from the Minister for Infrastructure, Transport, Regional Development and Local Government (the minister).1 The request from the minister referenced concerns about the conduct of the procurement from the unsuccessful tenderer. This performance audit provides assurance to Parliament on the effectiveness of AMSA’s management of the 2022–23 AtoN maintenance procurement.

Audit objective and criteria

4. The audit objective was to assess the effectiveness of AMSA’s management of the 2022–23 AtoN maintenance procurement.

5. To form a conclusion against the objective, the following high-level criteria were adopted.

- Did AMSA take appropriate steps to encourage open and effective competition?

- Was the tender evaluation planned and undertaken consistently with the Request for Tender?

- In its management of the procurement process and when dealing with complaints from the unsuccessful tenderer, did AMSA act ethically and has it been accountable and transparent?

Conclusion

6. AMSA’s management of the 2022–23 AtoN maintenance procurement was largely effective. Achieving value for money is the core rule of the Commonwealth Procurement Rules (CPRs) and the result of the open tender conducted by AMSA identified that the tender received for AtoN maintenance services did not demonstrably represent value for money. Accordingly, and consistent with the CPRs, it was not in the public interest for AMSA to award a contract for AtoN maintenance services. In its debriefing of the unsuccessful tenderer for the AtoN maintenance services contract, and its public statements about the tender outcome, AMSA did not clearly communicate the reasons for not awarding the AtoN contract.

7. AMSA took appropriate steps to design and conduct the procurement in a way that would deliver open and effective competition. This included taking on board information obtained through a market sounding exercise. The tender closing date was also extended twice, at the request of potential tenderers. Some additional steps could have been taken in pursuit of the goal of open and effective competition, in recognition that there was an incumbent contractor, as follows:

- disclosing the weighting of the evaluation criteria, as this would have communicated to potential tenderers that their capability and capacity was more important than whether they had experience in providing the services being tendered. Identifying the weightings would also have allowed AMSA to meet the requirement under the CPRs that request documentation disclose the relative importance of the criteria; and

- clearly communicating to potential tenderers that the draft AtoN contract included with the Request for Tender (RFT) involved changes from the existing contract. This would not detract from tenderer’s responsibility to inform themselves about the services they were tendering to provide.

8. In response to the RFT, AMSA received one tender (from the incumbent contractor) for the AtoN contract. An absence of competition makes it more difficult for the procuring entity to be satisfied that that it has obtained value for money.

9. AMSA’s evaluation of the tender received for AtoN maintenance was planned and undertaken consistent with the RFT. The tender that was received was assessed as compliant. It was scored at 65.3 per cent against the four evaluation criteria included in the RFT, with AMSA identifying the scores as ‘marginal’ in a number of areas. As required by the CPRs and the RFT, tender evaluation was completed by AMSA undertaking a value for money assessment. That assessment concluded that a value for money outcome had not been achieved. On the basis of the evaluation results, AMSA’s conclusion that it was not in the public interest to award a contract was appropriate and complied with the CPRs. AMSA has not provided clear and accurate reasons for why it did not award a contract in its debrief of the unsuccessful tenderer or publicly.2

10. Important elements of a framework for conducting the procurement ethically were in place including a probity plan and the engagement of a probity advisor. There was no probity plan in place for the industry engagement activities that informed the design of the RFT. There were also a number of shortcomings in the implementation of the probity framework for the RFT, including insufficient risk management and a lack of evidence that all procurement personnel received probity briefings and completion of conflict of interest declarations. AMSA’s investigation of the procurement complaint made by the unsuccessful tenderer under the Government Procurement (Judicial Review) Act 2018 was timely and scoped appropriately. There were errors in the investigation report although those errors did not affect the findings that the alleged breaches of the CPRs had not occurred.

Supporting findings

The approach to market

11. Prior to, and separate from the RFT, AMSA conducted a market sounding exercise. This was conducted by AMSA issuing an open Request for Information (RFI). The 14 submissions received by AMSA:

- provided information about the likely level of market interest in the AtoN maintenance and level 1 Emergency Towage Capability (ETC) services contracts. There was no market interest in the AtoN contract separate to the ETC contract, seven respondents indicated interest in both contracts and seven respondents were interested solely in the ETC contract; and

- provided information that AMSA used to confirm the design of the contracts included in the subsequent approach to the market. AMSA decided to offer separate contracts for AtoN maintenance and ETC, as well as the opportunity to lodge a tender for both, and lengthened the proposed duration of the contracts (to ten years, with extension options for up to a further five years). (See paragraphs 2.1 to 2.9)

12. With the objective of having competition for the contracts, the procurement was conducted by way of an open RFT with the tender closing date extended twice. In addition to designing the RFT in a way intended to encourage competition, AMSA extended the tender closing date twice at the request of potential tenderers. To encourage competition, there would have been benefits in AMSA informing potential tenderers of the criteria weightings and also highlighting that some changes were proposed to the contract for AtoN maintenance compared with the existing contract.

13. The RFT did not result in competing tenders being received for the AtoN maintenance contract. Most of the respondents to the RFI did not proceed to lodge a tender. Seven RFI respondents indicated they were likely to tender for both contracts with six of those not proceeding to tender for both contracts (although one of those six did tender for the ETC contract). No RFI respondents indicated they were likely to tender for the AtoN contract alone. One tender for the AtoN contract was received, from the incumbent contractor. The incumbent contractor also tendered for the ETC contract. This was the only respondent that tendered to provide both services. (See paragraphs 2.10 to 2.22)

Tender evaluation

14. AMSA implemented appropriate arrangements to govern the evaluation of tenders. (See paragraphs 3.1 to 3.10)

15. An evaluation plan was documented and approved prior to tenders closing. The evaluation plan was consistent with the RFT, with the exception of including criteria weightings that had not been disclosed in the RFT. (See paragraphs 3.11 to 3.13)

16. The tender received for AtoN maintenance services was evaluated in the manner required by the RFT. At the conclusion of tender evaluation, AMSA was unable to conclude that the tender offered value for money. This conclusion drew upon evaluation results against the four weighted criteria, as well as analysis of the price tendered. AMSA also took into account the nature and extent of contractual non-compliance identified, and the related risks, in identifying that tender clarification would, in effect, amount to bid repair. (See paragraphs 3.14 to 3.32)

17. AMSA has not clearly communicated the reasons for not awarding the AtoN contract. The result of the tender evaluation was that the tender received for the AtoN maintenance services had been assessed to not represent value for money. Statements by AMSA that a value for money assessment was not completed, or that the tendered price for AtoN maintenance services was not evaluated, are inconsistent with AMSA’s tender evaluation records:

- A Value for Money Assessment Report was prepared, and signed in June 2023 by each member of the two Procurement Evaluation Committees. It applied the methodology set out in the RFT to assess the value for money offered by the tenders received for the two contracts. This included comparing tendered prices to the pre-tender estimate, other ETC tenders (where there was competition) and to the cost of the existing AtoN maintenance contract (where there was no competition).

- The final Tender Evaluation Report, signed in June 2023 by each member of the Consolidation Evaluation Panel, recorded the Panel’s assessment of whether the tender received for AtoN maintenance services, as well as the tenders received for ETC services, represented value for money.

18. The value for money assessment, documented in these two evaluation reports, was relied upon by AMSA to support it awarding a contract for ETC services to the tender assessed as offering the best value for money. The same documents set out the evaluation conclusion that the one tender received for the AtoN maintenance services did not represent a value for money outcome and a contract should not be awarded.

19. If AMSA had not completed a value for money assessment, as AMSA has stated was the case, it would have been inconsistent with the RFT, as well as a breach of the CPRs. (See paragraphs 3.33 to 3.38)

Ethics, accountability and transparency

20. A probity plan was not in place to govern the industry engagement activities that informed the design of the procurement process. A probity plan was in place for the RFT process, and an external probity advisor was engaged. AMSA did not specifically assess probity risk and did not fully adhere to the probity plan requirements for procurement personnel to receive probity briefings and make conflict of interest declarations. The probity advisor provided an interim report at the completion of tender evaluation, and a final report following completion of the procurement process. (See paragraphs 4.1 to 4.26)

21. AMSA engaged a probity advisor for the RFT process and an internal audit of the procurement was undertaken. The commissioning of the internal audit did not follow AMSA’s internal processes and AMSA’s Board Audit and Risk Committee was not informed of the limitations regarding the assurance level of the work that was undertaken. The format of the report, a brief email, was not fit for its purpose. (See paragraphs 4.27 to 4.37)

22. There have been three complaints by the unsuccessful tenderer in relation to the AtoN tender.

- An August 2023 complaint under the Government Procurement (Judicial Review) Act 2018 alleging breaches of the CPRs was handled appropriately by AMSA. The investigation was appropriately scoped and completed in a timely fashion. There were two errors of fact3 in the investigation report. Those errors did not affect the investigation’s conclusion that the alleged contraventions of the CPRs had not occurred.

- In November 2023 the unsuccessful tenderer alleged that the Chair of the AMSA Board had a conflict of interest. AMSA advised the Department of Infrastructure, Transport, Regional Development, Communications and the Arts that the results of the evaluation process, and the decision that a contract should not be awarded, was not influenced by the Chair or any other member of the Board.

- Also in November 2023, the unsuccessful tenderer made allegations about the conduct of the chair of the Consolidation Evaluation Panel. Once it became aware of those allegations in January 2024, AMSA took timely and appropriate action to investigate, finding that there was no evidence to support the allegations. (See paragraphs 4.38 to 4.69)

Recommendations

Recommendation no. 1

Paragraph 2.19

The Australian Maritime Safety Authority strengthen its procurement controls and better inform the market by setting out in its request documentation the relative importance of the evaluation criteria that will be applied.

Australian Maritime Safety Authority response: Agreed.

Recommendation no. 2

Paragraph 2.22

When re-tendering contracts, the Australian Maritime Safety Authority consider the benefits to encouraging competition by identifying any major changes proposed to the contractual arrangements in the request documentation.

Australian Maritime Safety Authority response: Agreed.

Recommendation no. 3

Paragraph 3.37

When debriefing tenderers and in any public statements on the results of procurement processes, the Australian Maritime Safety Authority promote transparency by ensuring the reasons it provides are consistent with the tender evaluation reports.

Australian Maritime Safety Authority response: Agreed.

Recommendation no. 4

Paragraph 4.16

To effectively manage probity risks in procurement activities, the Australian Maritime Safety Authority:

- include an assessment of probity risks and identify how they should be managed within the risk register for large and/or complex procurements; and

- have in place a probity plan that governs any pre-procurement activities including industry engagement and addresses the way it will engage with any incumbent contractor(s) during the planning for, and conduct of, the procurement process.

Australian Maritime Safety Authority response: Agreed.

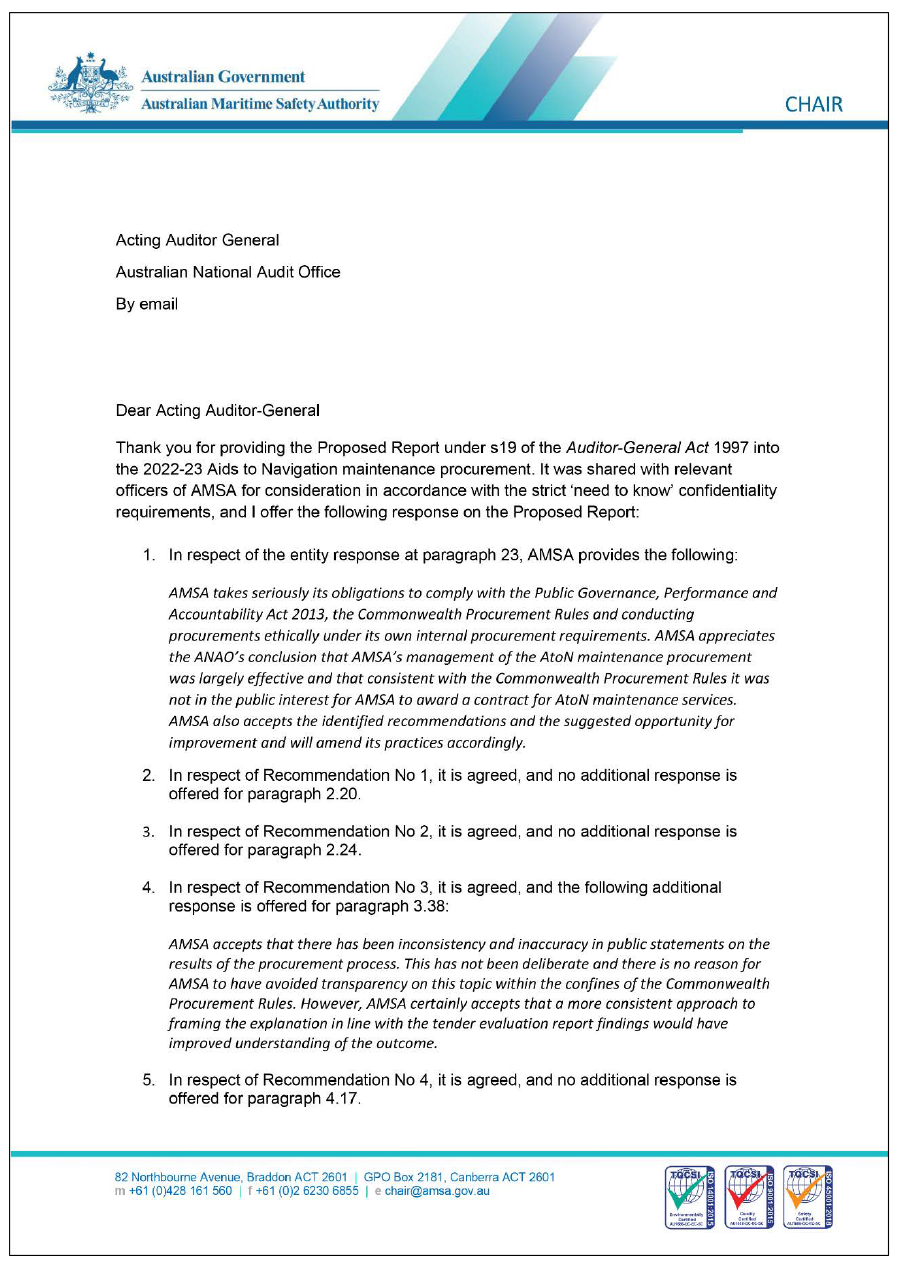

Summary of entity response

23. The proposed final report was provided to the Australian Maritime Safety Authority and extracts were provided to the Department of Infrastructure, Transport, Regional Development, Communications and the Arts. The summary response from AMSA to the report is provided below (the department did not provide a summary response). The full response from each entity is at Appendix 1.

Australian Maritime Safety Authority

AMSA takes seriously its obligations to comply with the Public Governance, Performance and Accountability Act 2013, the Commonwealth Procurement Rules and conducting procurements ethically under its own internal procurement requirements. AMSA appreciates the ANAO’s conclusion that AMSA’s management of the AtoN maintenance procurement was largely effective and that consistent with the Commonwealth Procurement Rules it was not in the public interest for AMSA to award a contract for AtoN maintenance services. AMSA also accepts the identified recommendations and the suggested opportunity for improvement and will amend its practices accordingly.

Key messages from this audit for all Australian Government entities

24. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Procurement

1. Background

Introduction

1.1 The Australian Maritime Safety Authority (AMSA) is a regulatory safety authority responsible for delivering services in relation to maritime safety, aviation and marine search and rescue and protection of the Australian marine environment.

1.2 AMSA was established under the Australian Maritime Safety Authority Act 1990. It is a corporate Commonwealth Entity subject to the Public Governance, Performance and Accountability Act 2013. The accountable authority is an Australian Government appointed Board.

Background

1.3 As part of its purpose, AMSA is responsible for providing the Australian Government’s network of marine Aids to Navigation (AtoN). The network administered by AMSA consists of 485 visual and electronic AtoN4 located at 380 sites around Australia’s coastline (see Figure 1.1). It includes: conventional lighthouses;5 radar transponder beacons; Automatic Identification System stations; unlit beacons; metocean equipment and supporting communication infrastructure.

Figure 1.1: Aids to Navigation network map

Source: AMSA.

1.4 The AtoN are used as tools by seafarers to support safe coastal navigation, prevent loss of life and marine pollution that could result from wrecked or stranded vessels. The AtoN supplement other navigation and safety systems on board vessels such as: onboard navigational lighting; radar systems; global positioning systems; and charts. Other external measures that contribute to navigation safety include: compulsory pilotage in specific areas; designated shipping routes; and broadcast of maritime safety information to alert mariners of AtoN outages and other hazards.

1.5 AMSA conducts maintenance and a program of capital works on its AtoN network to support reliable operation, including its target6 to ensure operation to meet international standards.

Contracting for AtoN maintenance

1.6 Since 2001,7 a significant part of the AtoN maintenance program has been implemented through an external contractor (Australian Maritime Systems Group Pty Ltd). According to AusTender reporting, the two most recent contracts ran from January 2006 to February 2014 at a cost of $118 million and then from February 2014 to June 2024 at a cost of $137 million for both the AtoN maintenance and the level 1 Emergency Towage Capability (ETC).8

1.7 In August 2022, AMSA issued an open Request for Tender (RFT) to identify suitably qualified contractors to deliver either, or both, AtoN maintenance and ETC Services. The one RFT9 covered two contracts: the first for maintenance of the AtoN network that AMSA is responsible for, and the second for ETC. The latter was to be delivered by a dedicated ‘emergency towage vessel’ for emergency towage and first response capability in the northern Great Barrier Reef (north of Mourilyan) and Torres Strait.10 The ETC contract requires that when not required for emergency response, drills or training, the ‘emergency towage vessel’ be made available to support AtoN maintenance within its area of operation.

1.8 One tender was received for the AtoN contract, from the incumbent contractor, Australian Maritime Systems Group Pty Ltd (AMS Group). The incumbent was also the only entity to tender to undertake both AtoN maintenance and provide ETC services. After completing a full evaluation of the AtoN tender that was received, a contract for the maintenance of the AtoN was not awarded. AMSA’s completed value for money assessment recorded that:

- in the absence of competition, and with an unclear tender response as evidenced by the low moderated score (of 65.3 per cent), it was not possible to confirm whether value for money had been obtained;

- the benefits from comparing the price to the pre-tender estimate was limited because the estimate was based on 100 per cent conformance to the terms of the draft contract whereas the tender response was not consistent with, or did not address to AMSA’s satisfaction, key aspects of the proposed contract. In addition to the pre-tender estimate, AMSA compared the tendered price to the amount it was paying under the existing contract, and identified that there was a significant increase in price; and

- given the nature and extent of the non-compliances and lack of information within parts of the tender, using the provisions of the RFT that permitted tender clarification would amount to bid repair rather than clarification, including a possible increase in price.11

1.9 The RFT did not allow AMSA to terminate the procurement in part. Rather, the RFT allowed AMSA to award one rather than both contracts.

1.10 For ETC services,12 eight tenders were received from four entities, including four tenders from the incumbent contractor. Four tenders from three respondents (including two from the incumbent) were shortlisted applying the three criteria for this contract set out in the RFT. Each was evaluated, with the tender submitted by Smit Lamnalco identified as offering the best value for money. A 10-year contract with Smit Lamnalco for the Torres Strait and Great Barrier Reef was announced on 20 December 2023.13 The contract includes extension options in AMSA’s favour of up to five years.

1.11 Separate procurement processes for AtoN maintenance commenced on 9 February 2024. Rather than one contract covering the whole of Australia as per the unsuccessful tender, the second procurement sought tenderers to fulfil eight separate regional area contracts, along with a contract for a central technical support and logistics contract.

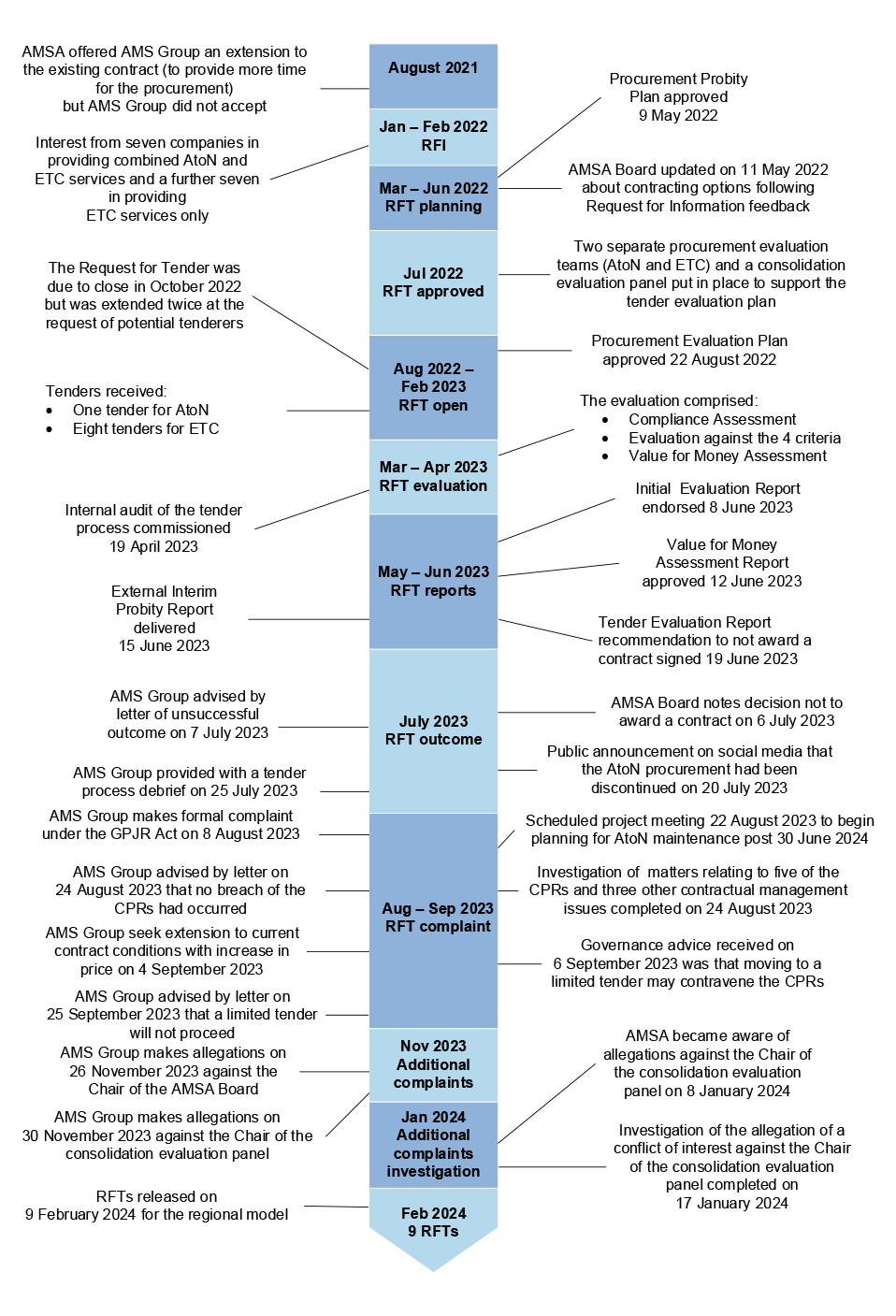

1.12 Figure 1.2 summarises the key stages and key events in the conduct of the 2022–23 AtoN maintenance procurement.

Figure 1.2: Timeline of key events of the 2022–23 AtoN maintenance procurement

Source: ANAO analysis of AMSA records.

Rationale for undertaking the audit

1.13 This performance audit of the AtoN maintenance procurement was undertaken in response to a request from the Minister for Infrastructure, Transport, Regional Development and Local Government (the minister). The request from the minister referenced concerns about the conduct of the procurement from the unsuccessful tenderer (on 8 August 2023 the tenderer had made a complaint to AMSA under the Government Procurement (Judicial Review) Act 2018).14 This performance audit provides assurance to Parliament on the effectiveness of AMSA’s management of the 2022–23 AtoN maintenance procurement.

Audit approach

Audit objective, criteria and scope

1.14 The audit objective was to assess the effectiveness of AMSA’s management of the 2022–23 AtoN maintenance procurement.

1.15 To form a conclusion against the objective, the ANAO examined:

- Did AMSA take appropriate steps to encourage open and effective competition?

- Was tender evaluation planned and undertaken consistently with the Request for Tender?

- In its management of a procurement process and when dealing with complaints from the unsuccessful tenderer, did AMSA act ethically and has it been accountable and transparent?

1.16 The audit assessed AMSA’s management of the procurement against relevant parts of the Commonwealth Procurement Rules (CPRs). The audit scope did not include:

- the contract for ETC services contained in the same procurement;

- an assessment of how the maintenance of AtoN interacts with ETC services;

- the technical component of services provided (or required to be provided) for the AtoN network;

- the services and user satisfaction with the services provided by the AtoN network; or

- the procurements for the provision of AtoN maintenance which commenced on 9 February 2024.

Audit methodology

1.17 The audit team:

- examined relevant records relating to the procurement process;

- conducted meetings with staff involved in the procurement; and

- reviewed one submission from the incumbent contractor.

1.18 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $155,000.

1.19 The team members for this audit were Rowena Thomson, Kai Clark, Renina Boyd and Brian Boyd.

2. The approach to the market

Areas examined

The ANAO examined whether the procurement process involved open and effective competition.

Conclusion

AMSA took appropriate steps to design and conduct the procurement in a way that would deliver open and effective competition. This included taking on board information obtained through a market sounding exercise. The tender closing date was also extended twice, at the request of potential tenderers. Some additional steps could have been taken in pursuit of the goal of open and effective competition, in recognition that there was an incumbent contractor, as follows:

- disclosing the weighting of the evaluation criteria, as this would have communicated to potential tenderers that their capability and capacity was more important than whether they had experience in providing the services being tendered. Identifying the weightings would also have allowed AMSA to meet the requirement under the Commonwealth Procurement Rules (CPRs) that request documentation disclose the relative importance of the criteria; and

- clearly communicating to potential tenderers that the draft Aids to Navigation (AtoN) contract included with the Request for Tender (RFT) involved changes from the existing contract. This would not detract from tenderer’s responsibility to inform themselves about the services they were tendering to provide.

In response to the RFT, AMSA received one tender (from the incumbent contractor) for the AtoN contract. An absence of competition makes it more difficult for the procuring entity to be satisfied that that it has obtained value for money.

Areas for improvement

The ANAO made two recommendations to AMSA aimed at encouraging increased competition in procurement processes.

2.1 Competition is a key element of the Australian Government’s procurement framework set out in the CPRs.15 Effective competition requires non-discrimination and the use of competitive procurement processes.

2.2 Generally, the more competitive the procurement process, the better placed an entity is to demonstrate that it has achieved value for money. Competition encourages respondents to submit more efficient, effective and economical proposals. It also ensures that the purchasing entity has access to comparative services and rates, placing it in an informed position when evaluating the responses. Openness in procurement involves giving suppliers fair and equitable access to opportunities to compete for work while maintaining transparency and integrity of process.

Was there adequate engagement with industry in planning the procurement approach?

Prior to, and separate from the RFT, AMSA conducted a market sounding exercise. This was conducted by AMSA issuing an open Request for Information (RFI). The 14 submissions received by AMSA:

- provided information about the likely level of market interest in the AtoN maintenance and level 1 Emergency Towage Capability (ETC) services contracts. There was no market interest in the AtoN contract separate to the ETC contract, seven respondents indicated interest in both contracts and seven respondents were interested solely in the ETC contract; and

- provided information that AMSA used to confirm the design of the contracts included in the subsequent approach to the market. AMSA decided to offer separate contracts for AtoN maintenance and ETC, as well as the opportunity to lodge a tender for both, and lengthened the proposed duration of the contracts (to ten years, with extension options for up to a further five years).

2.3 Under the CPRs when a business requirement arises, officials should consider whether a procurement will deliver the best value for money. The CPRs identify that stakeholder input is an important consideration to this.16 One area of possible stakeholder input involves the conduct of market sounding involving potential tenderers to inform the design of the procurement process.17

2.4 On 28 January 2022, a RFI was released by AMSA via AusTender to inform the Statement of Requirements and other procurement documentation. It provided ‘background information and preliminary considerations and ideas for discussion with interested parties in relation to performing the Services’ and outlined that AMSA was seeking information that:

- provided an understanding of market interest in providing AtoN maintenance and/or ETC services;

- indicated market capacity and capability to provide the services;

- enabled understanding of market initiatives and improvements to AtoN maintenance and ETC services; and

- clarified the risks and potential opportunities associated with delivery of the services.

2.5 There were 71 downloads of the RFI documents and 14 responses were received. None of the 14 submissions expressed interest in the provision of AtoN maintenance only. Seven were interested in providing AtoN maintenance and ETC services, while the other seven were interested in the provision of the ETC services only.

2.6 The findings were documented in the RFI Summary Report and included:

- increasing the contract term from the proposed 8 years to 10 years (with three extension options of two years, two years and one year);

- that AMSA should approach the market with two separate contracts; and

- there was a ‘fair amount’ of interested parties looking to provide services for both contracts.

2.7 AMSA finalised the approach to market documentation to reflect feedback on the length of the contract and splitting the AtoN Maintenance and ETC services into two contracts.

2.8 AMSA advised the ANAO in February 2024 that:

- none of the respondents to the RFI suggested that the contract be changed from covering the whole of Australia to a regional model and, while this had been discussed within AMSA prior to the procurement, this approach was not pursued due to the likely increase in administrative costs of managing multiple contracts (this is the approach AMSA is now adopting via a new approach to the market); and

- AMSA expected multiple submissions to the tender based on the response to the RFI.

Separate engagement with incumbent contractor

2.9 In addition to the RFI process, AMSA representatives met with the incumbent contractor on 19 January 2022 to discuss the existing contracts and identify from the contractor’s perspective where there could be improvements for future contracts (see paragraphs 2.20 to 2.21). AMSA recorded that ‘the scope of the meeting was to understand the soft, relational aspects of the contracts from the contractor’s perspective’.

Did the Request for Tender process result in a sufficient number of competing proposals being received?

With the objective of having competition for the contracts, the procurement was conducted by way of an open RFT with the tender closing date extended twice. In addition to designing the RFT in a way intended to encourage competition, AMSA extended the tender closing date twice at the request of potential tenderers. To encourage competition, there would have been benefits in AMSA informing potential tenderers of the criteria weightings and also highlighting that some changes were proposed to the contract for AtoN maintenance compared with the existing contract.

The RFT did not result in competing tenders being received for the AtoN maintenance contract. Most of the respondents to the RFI did not proceed to lodge a tender. Seven RFI respondents indicated they were likely to tender for both contracts with six of those not proceeding to tender for both contracts (although one of those six did tender for the ETC contract). No RFI respondents indicated they were likely to tender for the AtoN contract alone. One tender for the AtoN contract was received, from the incumbent contractor. The incumbent contractor also tendered for the ETC contract. This was the only respondent that tendered to provide both services.

2.10 AMSA conducted a single procurement seeking the provision of two categories of services, AtoN and ETC. Under this approach, AMSA issued a single Conditions of Tender with separate draft contracts for each service category and a separate statement of requirements for each service category.

2.11 The procurement approach involved AMSA issuing an open RFT on 23 August 2022. The tender period was set as nine weeks in the RFT, to close on 24 October 2022.

2.12 There were nine addenda to respond to, or clarify, potential respondents’ questions. Two of the addenda involved AMSA granting, at the request of potential tenderers, extensions to the tender closing date, initially to 28 November 2022 and then to 27 February 2023 (resulting in a 27 week tender open period, three times longer than the nine weeks originally offered). At the time of the second extension, AMSA also advised potential tenderers that it had extended the cut off time for requests for information under the RFT to 10 February 2023.

2.13 The tender was downloaded by 133 registered users and 15 went on to access the additional information that was available via a Secure File Transfer Protocol (SFTP).

2.14 Tenders closed on 27 February 2023. The RFT process resulted in competition for the ETC contract with eight tenders received from four entities,18 including four tenders from the incumbent contractor. The RFT did not result in competition for the AtoN contract.

2.15 There was not a high conversion of submissions to the RFI into tenders. Specifically, three of the 14 respondents (21 per cent) that provided a submission to the RFI proceeded to lodge one or more tenders, as set out in Table 2.1.

Table 2.1: Conversions of responses to the Request for Information into tenders

|

Contract option |

AtoN alone |

ETC alone |

AtoN and ETC |

|

Request for Information |

No interest |

Responses from seven entities |

Responses from seven entities (including the incumbent) |

|

Tenders received from companies that responded to the Request for Information |

One tender (incumbent) |

Three entities submitted seven tenders, comprising:

|

Nil |

|

Tenders received from companies that did not respond to the Request for Information |

Nil |

One tender |

Nil |

Source: ANAO analysis of AMSA records.

Criteria weightings

2.16 The CPRs require that request documentation include the evaluation criteria and, if applicable, the relative importance of those criteria (such as any weighting).19

2.17 AMSA’s tender evaluation plan identified the same four evaluation criteria for the AtoN services contract as had been included in the RFT. It also outlined the same staged approach to evaluation as had been set out in the RFT. A key difference between the evaluation plan and the RFT was that the evaluation plan outlined criteria weightings that had not been disclosed in the RFT (see Table 2.2). Not disclosing the relative importance of the criteria was inconsistent with the CPRs.

Table 2.2: AtoN maintenance procurement evaluation criteria

|

Evaluation criteria |

Weighting |

|

Compliance: Environment Health and Safety/Quality Questionnaires |

20% |

|

Experience and expertise: the extent to which the Tenderer is assessed as having the experience and demonstrated expertise to meet the requirements set out in the Statement of Requirements and the draft Contract |

20% |

|

Capability and capacity: the extent to which the Tenderer is assessed as having the capability and capacity to meet the requirements set out in the Statement of Requirements and the draft Contract |

40% |

|

Technical: the extent to which the Tenderer is assessed as having the technical experience to meet the requirements set out in the Statement of Requirements and the draft Contract |

20% |

Source: AMSA Procurement Evaluation Plan.

2.18 Informing potential respondents of the evaluation criteria, and any weightings of those criteria, helps to promote competition as well as provide transparency.20 By not identifying to potential tenderers the criteria weightings, AMSA missed the opportunity to communicate that the capability and capacity of tenderers was more important than experience and demonstrated expertise. This is valuable information for potential tenderers in circumstances where there is an incumbent contractor, noting that the earlier RFI process had identified a lack of market interest in the AtoN maintenance contract alone (see paragraph 2.5).

Recommendation no.1

2.19 The Australian Maritime Safety Authority strengthen its procurement controls and better inform the market by setting out in its request documentation the relative importance of the evaluation criteria that will be applied.

Australian Maritime Safety Authority response: Agreed.

Changes in contractual requirements

2.20 AMSA undertook its own analysis of areas for improvement. In addition, as outlined at paragraph 2.9, in January 2022 AMSA met with the incumbent contractor to obtain the contractor’s perspective on possible improvements to the contracts as part of AMSA’s procurement planning.

2.21 The draft AtoN maintenance contract in the RFT package released in August 2022 included a number of changes from the existing contract. AMSA’s Value for Money Assessment Report of June 2023 identified ten ‘major21 differences’ from the current contract that may drive price changes (see Table 2.3). There would have been benefits in AMSA highlighting to potential tenderers that the draft contract included a number of changes from the existing contract, as part of its approach to encouraging competition by highlighting that the procurement was not limited to an exercise in rolling over the existing contractual requirements.22 This would not have been inconsistent with the RFT requirement that the tenderers inform themselves of the requirements and declare that they have not relied on anything else, including any representation made by AMSA.

Table 2.3: Major changes for the AtoN contract with potential cost impacts

|

Additions |

Reductions |

|

Introduction of a new preventative maintenance task to be conducted once within the 10-year contract term that affects approximately 25 sites |

Approximately 50 AtoN sites were changed from an annual visit site to a two yearly |

|

Introduction of a new preventative maintenance task to be conducted once within the 10-year contract term that affects approximately 60 sites |

Removed the purchase costs of buoys that affects approximately 60 sites within the contract term |

|

Introduction of Lead Risk Works which could be conducted at every visit that affects approximately 40 sites |

Removed technical innovations where the contractor pays for upgraded or replaced AtoN equipment |

|

Introduction of more detailed protective coating surface preparation for offshore pile structures which is to be conducted 5 times within the 10-year contract term that affects approximately 25 sites |

Introduction of annual fee escalation from agreed indexation factors (this change was introduced to mitigate the current inflation risk from a fixed price offer over a 10-year term) |

|

Introduction of stricter AtoN availability requirements that may affect outage and failure response pricing |

Major maintenance threshold/risk remained the same in principle but was made clearer with respect to repair or replace when beyond repair |

Source: ANAO analysis of AMSA records.

Recommendation no.2

2.22 When re-tendering contracts, the Australian Maritime Safety Authority consider the benefits to encouraging competition by identifying any major changes proposed to the contractual arrangements in the request documentation.

Australian Maritime Safety Authority response: Agreed.

3. Tender evaluation

Areas examined

The ANAO examined whether the tender evaluation was planned and undertaken consistently with the approach to market and with the objective of identifying a compliant tender that represented value for money.

Conclusion

AMSA’s evaluation of the tender received for Aids to Navigation (AtoN) maintenance was planned and undertaken consistent with the Request for Tender (RFT). The tender that was received was assessed as compliant. It was scored at 65.3 per cent against the four evaluation criteria included in the RFT, with AMSA identifying the scores as ‘marginal’ in a number of areas. As required by the Commonwealth Procurement Rules (CPRs) and the RFT, tender evaluation was completed by AMSA undertaking a value for money assessment. That assessment concluded that a value for money outcome had not been achieved. On the basis of the evaluation results, AMSA’s conclusion that it was not in the public interest to award a contract was appropriate and complied with the CPRs. AMSA has not provided clear and accurate reasons for why it did not award a contract in its debrief of the unsuccessful tenderer or publicly.

Areas for improvement

The ANAO made one recommendation aimed at promoting transparency over the reasons for tender outcomes.

3.1 Achieving value for money is the core rule of the CPRs. Officials responsible for a procurement must be satisfied, after reasonable enquiries, that the procurement achieves a value for money outcome.23 The CPRs state that achieving value for money requires a consideration of the relevant financial and non-financial costs and benefits of each submission.24 Unless it has been determined by the entity not to be in the public interest to award a contract (for example, because tender evaluation has concluded that none of the tenders received represents value for money), a contract must be awarded to the tenderer that the entity has determined:

- satisfies the conditions for participation;

- is fully capable of undertaking the contract; and

- will provide the best value for money, in accordance with the essential requirements and evaluation criteria specified in the approach to market and request documentation.

Were appropriate governance arrangements in place for the evaluation of tenders?

AMSA implemented appropriate arrangements to govern the evaluation of tenders.

3.2 Following receipt and compliance checks, tender submissions progressed to one of two Procurement Evaluation Committees. One committee was responsible for evaluating tenders for AtoN services, the other was responsible for evaluating tenders for level 1 Emergency Towage Capability (ETC) services. The role of the Procurement Evaluation Committees was to undertake individual assessment against the criteria in the RFT (four criteria for AtoN, three criteria for ETC), convene for the moderation process and then draft an ‘initial summary and options report’. Each committee had three members and a ‘non-scoring chair’. All members were AMSA employees and two officers were on both committees.

3.3 Additional AMSA resources were made available to assist with evaluation of:

- quality, health, safety and environment compliance;

- non-compliance with the contract conditions; and

- commercial assessment of the offered prices.

3.4 The Procurement Evaluation Committees were also able to access advice from ‘Approach to Market personnel’ which comprised 12 internal staff from across AMSA. There were three external contractors that provided advice on probity, financial viability assessment and quantity surveying.

3.5 The evaluation assessments of the separate Procurement Evaluation Committees went to the Consolidation Evaluation Panel for review. The Consolidation Evaluation Panel comprised the chairs of each of the Procurement Evaluation Committees as members and was chaired by AMSA’s Executive Director – Response. Its role was to review the value for money options of the individual services, and to consider whether a single service provider for both AtoN and ETC was preferable to separate contracts. The Consolidation Evaluation Panel was not involved in the scoring of tenders.

3.6 In addition to reviewing draft evaluation reports, the external probity advisor Management Options Pty Ltd (see paragraph 4.7) invoiced AMSA for having attended 1.25 hours of the Consolidation Evaluation Panel meeting on 27 April 2023 and 45 minutes of the meeting on 26 May 2023.

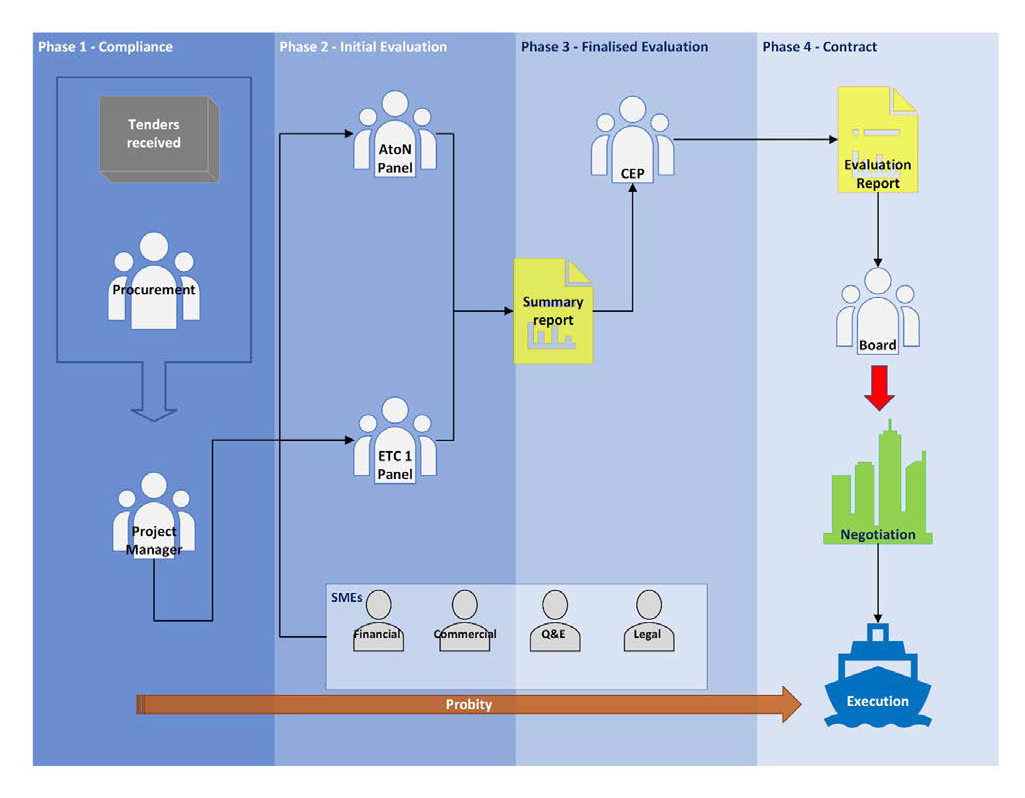

3.7 Figure 3.1 summarises the evaluation governance arrangements.

Figure 3.1: Governance arrangements for tender evaluation

Note: ‘SME’ means subject matter expert.

‘CEP’ means Consolidation Evaluation Panel.

Source: AMSA’s approved evaluation plan.

Decision-making arrangements

3.8 As a Commonwealth corporate Entity, AMSA derives its power to enter into arrangements involving the commitment of relevant money from its enabling legislation and its body corporate nature. The accountable authority is the AMSA Board, appointed by the minister. Its role is to decide the objectives, strategies and policies to be followed by AMSA and to ensure AMSA performs its functions in a proper, efficient and effective manner.

3.9 AMSA’s Corporate Authorisation Summary documents the Accountable Authority’s Instructions25 in relation to approval or commitment of relevant money. The Corporate Authorisation Summary that was in force during the procurement sets out that amounts less than or equal to $5 million were delegated to the Chief Executive Officer of AMSA. Any two members of the AMSA Board26 could approve amounts less than or equal to $7.5 million, while amounts above this were to be agreed by the full Board. As the procurement value was above $7.5 million, this required the AMSA Board to agree to a procurement outcome that resulted in the approval of relevant money (as outlined in Figure 3.1). For the AtoN contract, this did not occur as the Consolidation Evaluation Panel concluded at the end of tender evaluation that a contract should not be awarded for the AtoN maintenance service.

3.10 As per its standard processes, the Board ‘noted’ at its 6 July 2023 meeting that ‘the AtoN maintenance component of this tender did not produce a value for money outcome as assessed by the evaluation team’ and that ‘AMSA intends to end the procurement process’.

Was an evaluation plan documented that was consistent with the Request for Tender?

An evaluation plan was documented and approved prior to tenders closing. The evaluation plan was consistent with the RFT, with the exception of including criteria weightings that had not been disclosed in the RFT.

3.11 An evaluation plan should be established before market responses are sought.27 Drafting the evaluation plan and RFT together helps to avoid any inconsistencies between the evaluation plan and requirements specified in RFT documentation, and to ensure that the evaluation methodology proposed in the plan is consistent with the RFT.

3.12 AMSA planned to finalise the evaluation plan on the same day that the RFT was finalised (both planned for 22 August 2022). The evaluation plan was approved by the CEO of AMSA on 22 August 2022. It was updated and approved again on 12 December 2022 with clarified details relating to process and personnel. The RFT was released one day later than planned, on 23 August 2022, with a closing date of 24 October 2022 (nine weeks). At the request of potential tenderers, two extensions were granted by AMSA and the RFT closed on 27 February 2023.

3.13 The contents of the evaluation plan were consistent with the RFT, with the exception of AMSA not disclosing in the RFT the weighting of the four evaluation criteria (see paragraphs 2.16 to 2.19).

Did AMSA evaluate tenders in accordance with the Request for Tender?

The tender received for AtoN maintenance services was evaluated in the manner required by the RFT. At the conclusion of tender evaluation, AMSA was unable to conclude that the tender offered value for money. This conclusion drew upon evaluation results against the four weighted criteria, as well as analysis of the price tendered. AMSA also took into account the nature and extent of contractual non-compliance identified, and the related risks, in identifying that tender clarification would, in effect, amount to bid repair.

3.14 Consistent with the CPRs, the RFT set out that the objective of evaluation of tenders was to: ‘identify the Tenderer which represents the best value for money.’

3.15 The RFT provided that AMSA may:

- shortlist tenders at any time during the evaluation process (10.4.3), without identifying the criteria that may be applied to any shortlisting; and

- ‘at any time exclude from consideration Tenders that in AMSA’s opinion are incomplete or clearly not competitive. However, AMSA may consider such Tenders and seek clarification’ (10.4.4).

3.16 There was no shortlisting undertaken as part of the AtoN procurement (one tender was received) and AMSA did not exclude the tender it received from consideration.

3.17 The RFT stated that the evaluation of tenders would initially consider responses for the AtoN maintenance service and ETC services individually in two stages and would be completed with AMSA considering overall value for money outcomes.

3.18 As it was conducted as one procurement with two contracts that permitted tenderers to submit a response for one or both contracts, the evaluation approach involved consolidated evaluation reports being prepared. Specifically, the conduct and results of the evaluation were documented in an Initial Evaluation Report (endorsed 8 June 2023), a Value for Money Assessment Report (signed by the six panel members between 8 June and 12 June 2023) and a Tender Evaluation Report (signed by the panel chair and all members of both evaluation committees between 15 June and 19 June 2023).

Stage 1: compliance assessment

Conditions for participation

3.19 The RFT identified two Conditions for Participation.

3.20 The tender for AtoN maintenance (as well as those for ETC services) was assessed to meet the first Condition (which required the tenderer and each of its proposed subcontractors not be bankrupt, insolvent or subject to external administration or have been in the last 5 years).

3.21 The second Condition related to the shadow economy and refers to dishonest and criminal activities that take place outside the tax and regulatory systems. The tenderer for AtoN maintenance, as well as two of the tenderers for the ETC services contract, was initially assessed to not meet the second Condition. The relevant Procurement Evaluation Committee and the Consolidation Evaluation Panel considered that because most tenderers missed this requirement, it suggested the omissions were unintentional and tenderers were provided the opportunity to provide the required documentation.

3.22 Following the provision of a valid Statement of Tax Record through tender clarification28 the tender for AtoN maintenance services was assessed as compliant.

Minimum content and format requirements

3.23 The tender for AtoN maintenance services was assessed as compliant with the minimum content and format requirements.

Stage 2: evaluation against the four criteria

3.24 The quality, health, safety and environment compliance evaluation was completed on 20 March 2023. It resulted in a score of 19 out of 20. Each questionnaire was worth 10 points, with the tender receiving 10 points for the quality questionnaire and 9 points for the environment, health and safety questionnaire.

3.25 The individual evaluations of the three scoring members of the Procurement Evaluation Committee were completed on 16 March 2023, 20 March 2023 and 22 March 2023. The moderation process took place on 24 March 2023 and was recorded in a consolidated assessment spreadsheet. The chair of the Procurement Evaluation Committee recorded the moderation discussion.

3.26 The probity advisor’s invoicing recorded that he had attended, observed and provided probity advice at the first moderation meeting for the AtoN evaluation on 24 March 2023. The interim probity report stated that:

The Probity Advisor attended the evaluation moderation meeting of the PEC for the AToN component of the Approach to Market. It was evident that PEC members had a clear understanding of the evaluation methodology and their probity obligations. The Probity Advisor observed that each member had individually assessed and scored the tender responses against the criteria. The Probity Advisor observed open and sound discussions by PEC members in arriving at the moderated scores and supporting comments.

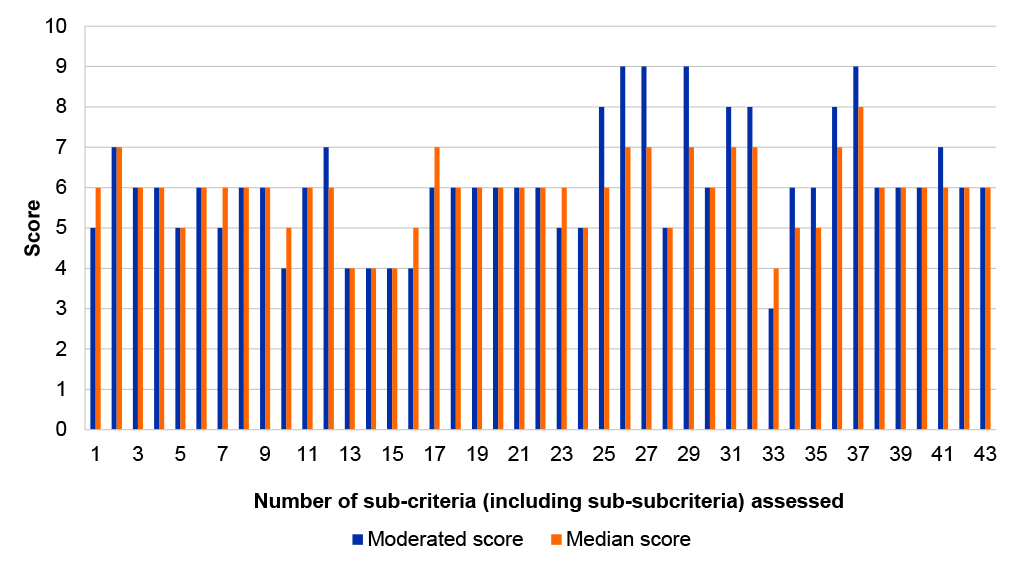

3.27 Figure 3.2 compares the median score of the three scoring members against the final moderated outcome. In seven instances the moderated score was lower and in twelve instances the moderated score was higher.

Figure 3.2: Median score of three scoring members and final moderated scorea

Note a: The overall score was 57.9 per cent (also referred to by AMSA as ‘marginal’).

Source: ANAO analysis of the Procurement Evaluation Committee consolidated assessment sheet.

3.28 Table 3.1 outlines the moderated overall scores converted to the weighted criteria. Adding in the 19 out of 20 assessment score for quality, health, safety and environment compliance (see paragraph 3.24) the total moderated scoring result for the evaluation criteria was 65.3 per cent. AMSA ‘did not set a threshold below which a moderated score would be unacceptable’ although the evaluation result was described as ‘low’. Specifically, in relation to the experience and expertise, capability and technical evaluation criteria,29 the combined score of which was 46.3 out of 80 (or 57.9 per cent) AMSA’s Tender Evaluation Report stated this, ‘did not provide a level of confidence that the contract requirements (including all deliverables) will be met to the required standard’. The Tender Evaluation Report further concluded that ‘the non-compliances listed are major commercial exceptions that may increase the tendered price’.

Table 3.1: AMS Group Procurement Evaluation Committee moderated scores

|

Tender requirements |

|

|

|

Evaluation criteria |

Weighting |

AMS Group score |

|

Experience & expertise |

20 |

11.75 |

|

Capability & capacity |

40 |

20.8 |

|

Technical |

20 |

13.75 |

|

Total |

80 |

46.3 |

Source: ANAO analysis of the Procurement Evaluation Committee consolidated assessment sheet.

Value for money assessment

3.29 The RFT clearly set out how AMSA would assess value for money, through an approach that was consistent with the CPRs, as follows:

The Value for Money assessment will include:

- Compliance and risk assessments for all tenderers against the conditions for participation and evaluation criteria, including relative ranking of tenderers against each criterion;

- Scores against weighted criteria;

- An explanation of the key areas for discrimination between the tenderers;

- An overall assessment of the risks associated with each Tenderer and their capacity to perform, including an indication of the risk management strategies that are considered necessary;

- Non-compliance to the draft contracts;

- Financial viability;

- An explanation of the actions that would be necessary to enter into a contract;

- Contracting risks and opportunities; and

- Total price and any discount arrangements offered.

3.30 AMSA documented its value for money analysis, consistent with the considerations outlined in the RFT. Invoicing from the probity advisor recorded that they reviewed a draft value for money assessment report on 24 and 25 April 2023,30 and an updated version of the value for money assessment report on 7 June 2023.31

3.31 The finalised Value for Money Assessment Report of 12 June 2023 included a comparison of the tendered price to the pre-tender estimate (which was premised on full tenderer compliance with the draft contract, whereas the tender received was assessed to involve non-compliances) as well as to the amount it was paying the incumbent contractor to provide AtoN maintenance services.32 The value for money evaluation report recorded that:

In the absence of competition, with an unclear tender response evident by the low moderated score, it is not possible to confirm whether value for money has been obtained for the AtoN Maintenance Services.

3.32 In turn, the Tender Evaluation Report signed by the Consolidation Evaluation Panel chair on 19 June 2023 recorded as follows in relation to the AtoN contract:

The AtoN maintenance procurement resulted in a single tender from the incumbent provider (Australian Maritime Systems Group, AMSG). The subsequent value for money decision was not clear cut. The tender scores were marginal in a number of areas.33 The tendered price was significantly higher than currently paid for a similar service, although close to the pre-tender estimate. Overall, the Consolidation Evaluation Panel (CEP) concluded that the AtoN component of the Tender did not deliver a Value for Money outcome.

Has AMSA clearly communicated the reasons for not awarding a contract?

AMSA has not clearly communicated the reasons for not awarding the AtoN contract. The result of the tender evaluation was that the tender received for the AtoN maintenance services had been assessed to not represent value for money. Statements by AMSA that a value for money assessment was not completed, or that the tendered price for AtoN maintenance services was not evaluated, are inconsistent with AMSA’s tender evaluation records:

- A Value for Money Assessment Report was prepared, and signed in June 2023 by each member of the two Procurement Evaluation Committees. It applied the methodology set out in the RFT to assess the value for money offered by the tenders received for the two contracts. This included comparing tendered prices to the pre-tender estimate, other ETC tenders (where there was competition) and to the cost of the existing AtoN maintenance contract (where there was no competition).

- The final Tender Evaluation Report, signed in June 2023 by each member of the Consolidation Evaluation Panel, recorded the Panel’s assessment of whether the tender received for AtoN maintenance services, as well as the tenders received for ETC services, represented value for money.

The value for money assessment, documented in these two evaluation reports, was relied upon by AMSA to support it awarding a contract for ETC services to the tender assessed as offering the best value for money. The same documents set out the evaluation conclusion that the one tender received for the AtoN maintenance services did not represent a value for money outcome and a contract should not be awarded.

If AMSA had not completed a value for money assessment, as AMSA has stated was the case, it would have been inconsistent with the RFT, as well as a breach of the CPRs.

- transparency in procurement activities, including by officials taking steps to enable appropriate scrutiny of their procurement activity; and

- following the rejection of a submission or the award of a contract, officials must promptly inform affected tenderers of the decision and that debriefings be made available, on request, to unsuccessful tenderers outlining the reasons their submission was unsuccessful.34

3.34 AMSA’s communication of the reasons for not awarding a contract have not been consistent with records of its tender evaluation and so have not provided the transparency required by the CPRs. Specifically:

- AMSA’s record of the debrief it provided to the unsuccessful tenderer stated that the decision not to proceed was made on the basis of the technical score and, when pressed about whether the price was considered, there was insufficient information to inform a value for money assessment;

- in response to the procurement complaint from the unsuccessful tenderer, AMSA obtained legal advice with the advice recording that: ‘We are instructed that the delegate decided before the value for money assessment that the only tender submitted in relation to AtoN services was lacking in technical detail, and therefore scored too low to necessitate a formal value for money assessment’;35and

- on 25 March 2024 AMSA gave evidence to the Rural and Regional Affairs and Transport Legislation Committee that: ‘We did not actually proceed to a value-for-money assessment on the basis of the marginal technical score.’36

3.35 Value for money is the core rule of the CPRs. Consistent with the CPRs, the RFT required that the evaluation of tenders ‘be completed with AMSA considering overall value for money outcomes’. If AMSA had not conducted a value for money assessment it would have acted inconsistently with the RFT it released to the market, and also breached the CPRs. In a letter dated 9 April 2024 to the Chair of the Rural and Regional Affairs and Transport Legislation Committee, the CEO of AMSA corrected the evidence provided on 25 March 2024 including:

To be clear, the tender evaluation did proceed to a Value for Money assessment and concluded that the AtoN component of the tender did not deliver a Value for Money outcome.

3.36 AMSA’s statements that value for money was not assessed are inconsistent with its procurement records. Those records show that AMSA assessed value for money in the manner required by the RFT (see paragraphs 3.29 to 3.32). Reflecting that AMSA conducted one procurement with two contracts that permitted tenderers to submit a response for one or both contracts, consolidated evaluation reports were prepared, including in relation to value for money. The Value for Money Assessment Report was signed by the six members of the two Procurement Evaluation Committees (by three members on 8 June 2023, two members on 9 June 2023 and one member on 12 June 2023). The Value for Money Assessment report documented the value for money conclusion reached in relation to each of the two contracts, as follows:

- the one tender received for AtoN maintenance services ‘does not present AMSA with a value for money option’; and

- two tenders received for ETC services were assessed as representing value for money, with the preferred tender identified as the one assessed as offering the ‘greatest value for money’.

Recommendation no.3

3.37 When debriefing tenderers and in any public statements on the results of procurement processes, the Australian Maritime Safety Authority promote transparency by ensuring the reasons it provides are consistent with the tender evaluation reports.

Australian Maritime Safety Authority response: Agreed

3.38 AMSA accepts that there has been inconsistency and inaccuracy in public statements on the results of the procurement process. This has not been deliberate and there is no reason for AMSA to have avoided transparency on this topic within the confines of the Commonwealth Procurement Rules. However, AMSA certainly accepts that a more consistent approach to framing the explanation in line with the tender evaluation report findings would have improved understanding of the outcome.

4. Ethics, accountability and transparency

Areas examined

The ANAO examined whether, in its conduct of a procurement process and when dealing with complaints from the unsuccessful tenderer, AMSA acted ethically and has been accountable and transparent.

Conclusion

Important elements of a framework for conducting the procurement ethically were in place including a probity plan and the engagement of a probity advisor. There was no probity plan in place for the industry engagement activities that informed the design of the Request for Tender (RFT). There were also a number of shortcomings in the implementation of the probity framework for the RFT, including insufficient risk management and a lack of evidence that all procurement personnel received probity briefings and completion of conflict of interest declarations. AMSA’s investigation of the procurement complaint made by the unsuccessful tenderer under the Government Procurement (Judicial Review) Act 2018 was timely and scoped appropriately. There were errors in the investigation report although those errors did not affect the findings that the alleged breaches of the Commonwealth Procurement Rules (CPRs) had not occurred.

Areas for improvement

The ANAO made one recommendation relating to more comprehensive coverage of probity plans, including risk assessment and a suggestion for improving probity administration records.

4.1 The CPRs require that procuring entities act ethically throughout the conduct of a procurement process. Ethical behaviour includes recognising and dealing with actual, potential and perceived conflicts of interest, dealing with potential suppliers, tenderers and suppliers equitably and carefully considering the use of public resources.37 The CPRs also require that, if a complaint about a procurement is received, relevant entities must apply timely, equitable and non-discriminatory complaints handling procedures.38

4.2 The CPRs also require accountability and transparency. Accountability means that officials are responsible for the actions and decisions that they take in relation to procurement and for the resulting outcomes. Transparency involves relevant entities taking steps to enable appropriate scrutiny of their procurement activity.

Was a probity management framework in place?

A probity plan was not in place to govern the industry engagement activities that informed the design of the procurement process. A probity plan was in place for the RFT process, and an external probity advisor was engaged. AMSA did not specifically assess probity risk and did not fully adhere to the probity plan requirements for procurement personnel to receive probity briefings and make conflict of interest declarations. The probity advisor provided an interim report at the completion of tender evaluation, and a final report following completion of the procurement process.

Risk assessment, including of probity risks

4.3 AMSA has an enterprise level Risk Management Framework which sets out that AMSA risk methodology ‘is aligned to, and based, upon the international standard on risk management (ISO 31000:2018)’.

4.4 The AMSA procurement area provides internal specific advice on risk in procurement to staff on AMSA’s intranet. This includes:

Throughout all stages of the procurement and contract management processes, it is necessary to be aware of risks, their sources or causes, and their potential impacts. Where the procurement is of significant size and complexity, overall risk is likely to be medium or high and so a risk assessment should be undertaken. Formally documented risk assessments should be undertaken for complex and covered procurements, and encompass the entire procurement and contract management lifecycle. Regular review/monitoring/controlling of risks and risk treatments should occur throughout the procurement/contract life-cycle.

4.5 A brief dated 21 July 2021 to the AMSA Executive outlined the procurement strategy. It included the advice that ‘a risk register will be developed and maintained throughout the procurement’. A paper to the 22 September 2021 AMSA Board stated the same. This did not occur.

4.6 As a result, there was no specific assessment of probity risk. Such an assessment would have been of value to inform decisions about the evaluation governance arrangements including, for example, the likely extent of any probity advice that might be required during the conduct of the procurement. The change in Chair of the AMSA Board during the latter stages of the tender process would have also required an update to any risk assessment.

Engagement of probity advisor and provision of probity reports

4.7 An external probity advisor, Management Options Pty Ltd, was engaged by AMSA. The external probity advisor reported to the Project Manager.

4.8 The probity advisor was engaged via a Request for Quote process in December 2021 with four firms invited to respond. In April 2024, AMSA advised the ANAO that:

AMSA selected candidate organisations with the appropriate skills based on the knowledge and experience of AMSA staff. The approach was consistent with AMSA’s internal procurement framework. How those four (4) specifically came to be selected as candidates was not recorded.

4.9 Two responses were received with the higher ranked candidate, with a lower hourly rate, successful. AMSA approved an engagement for a nine-month period, with a commencement date of 1 April 2022, an end date of 19 December 2022, and valued at $23,716 (GST inclusive). By November 2023, the contract had been varied four times, extending its duration out to 25 months (an end date of 31 March 2024) and increased the maximum fee to $28,193 (GST inclusive), which reflected an additional 10 hours of probity advice compared with the 98 hours originally contracted for.

4.10 The probity plan required the probity advisor to provide a written interim probity report on the procurement process. The interim report, addressed to the AMSA Chief Executive Officer (CEO), was provided on 15 June 2023, at the conclusion of tender evaluation. The interim report made no adverse findings. It stated that the probity advisor was of the opinion that:

- The processes developed and executed for inviting tenders were fair,

- The evaluation methodology facilitated the objectives of the ATM,

- Appropriate steps for identifying, clarifying and managing conflicts of interest were put in place,

- Probity advice was sought and considered,

- The methodology for the maintenance of confidentiality and security was satisfactory,

- The tender was consistent with the fundamentals of CPRs, and

- The Tender Evaluation Report and supporting documents provides a defensible record of the actions and decisions of the relevant PECs and CEP and supports the recommendations therein.

4.11 The probity plan also required that a written final probity report be provided following the completion of any contract negotiations and after tenderer debriefings.39 The debriefing to the unsuccessful tenderer for the AtoN maintenance services contract was held on 25 July 2023 with the award of the ETC services contract announced on 20 December 2023.

4.12 The final probity report (dated 9 April 2024) included the findings from the interim report with the additional finding that: ‘the debriefing processes were consistent with the Probity Plan and the expected standards of probity under the Commonwealth Procurement Rules’.

Probity plan

4.13 A probity plan for the combined AtoN maintenance and ETC services procurement was developed, with the first draft prepared by the probity advisor. The probity plan was endorsed by the senior AMSA personnel responsible for the procurement, including the chair of the Consolidation Evaluation Panel, as well as by the probity advisor. It was approved by the AMSA CEO on 9 May 2022. The probity arrangements were incorporated into the approved Procurement Evaluation Plan.

Industry engagement activities prior to the procurement

4.14 The CPRs state that all potential suppliers must be treated equitably based on their commercial, legal, technical and financial abilities.40 When an incumbent provider competes for new work, it may have (or be perceived to have) certain advantages, such as understanding of an agency’s needs, established relationships with agency staff, and knowledge that is not available to other potential suppliers.41

4.15 As the market sounding undertaken by AMSA, and AMSA’s engagement with the incumbent contractor to inform the procurement approach, was not defined as being part of the procurement process the probity plan did not apply to those activities. A separate probity plan was also not in place to govern the industry engagement activities that preceded the procurement.42

Recommendation no.4

4.16 To effectively manage probity risks in procurement activities, the Australian Maritime Safety Authority:

- include an assessment of probity risks and identify how they should be managed within the risk register for large and/or complex procurements; and

- have in place a probity plan that governs any pre-procurement activities including industry engagement and addresses the way it will engage with any incumbent contractor(s) during the planning for, and conduct of, the procurement process.

Australian Maritime Safety Authority response: Agreed.

Conflict of interest declarations

4.17 Department of Finance guidance to entities on ethics and probity in procurement states that ‘persons involved in the tender process, including contractors such as legal, commercial or probity experts, should make a written declaration of any actual, potential or perceived conflicts of interest prior to taking part in the process.’43 Consistent with this guidance, each person involved in the procurement process was required to complete a confidentiality and conflict of interest declaration. Any identification of a real, potential or perceived conflict of interest was to be assessed by ‘the Consolidation Panel Chair and/or Project Sponsor, in consultation with AMSA’s procurement section and the [external] probity advisor’.

4.18 AMSA maintained a conflict of interest and confidentiality declaration register for procurement personnel. The register identified 33 declarations.

4.19 There were 31 declaration forms in AMSA’s records. AMSA advised the ANAO in March 2024 that, in relation to the two people who did not complete forms (although both were listed in the Procurement Evaluation Plan), one did not have a role in the procurement and the other did not provide expert knowledge nor was in a decision-making role. That individual was an administrative officer for the procurement, for example they authorised AusTender notices for publication and signed procurement correspondence.

4.20 Of the 31 declaration forms in AMSA’s records: one was not signed by a witness; two did not declare whether they did or did not have a conflict of interest;44 and one declared they both did, and did not, have a conflict of interest.45

4.21 The tender evaluation report stated that ‘a probity briefing on the management of probity risk was given to all participants in the tender evaluation (on 23 May 2022, 15 June 2022 and 23 February 2023 respectively) before evaluation of the tenders’. Inconsistent with this statement, the probity register recorded that seven of 25 procurement personnel (or 28 per cent) had not attended a probity briefing. Emails show that the external probity advisor advised the Project Manager: ‘I strongly suggest we hold two briefings to catch everyone’ and provided two dates for this. The Project Manager responded: ‘ … it is difficult to arrange a time with more than two attendees’. AMSA’s record of who received probity briefings and on what dates, did not align with an accepted invoice from the probity advisor for twenty staff (nine individuals received a briefing on 23 May 2022, four individuals received a briefing on 15 June 2023 and the members of the Procurement Evaluation Committee and Consolidation Evaluation Panel were briefed on 23 February 2023).

4.22 AMSA advised the ANAO in March 2024 that nine experts from three commercial businesses46 were involved in the procurement. Of these, five completed declarations stating they had no conflict of interest which were correctly recorded in the register. The individuals were not recorded as attending a probity briefing and AMSA confirmed to the ANAO in April 2024 that they had not attended a probity briefing. Four others were not listed in the register and declaration forms were not on file.

|

Opportunity for improvement |

|

4.23 AMSA implement processes requiring:

|