Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of the Explosive Ordnance Services Contract

The objective of the audit was to assess whether Defence is effectively managing the EO Services Contract.

The audit focused mainly on Defence's contract management framework, including the arrangements to monitor the contractor’s performance in delivering services under the contract. The audit also examined the processes used by Defence to develop the current version of the contract and the extent to which the revised contract, as negotiated in 2006, provides an assurance of better value for money when compared to the original contract signed in 2001.

Summary

Introduction

Management of explosive ordnance in Defence

1. The management of explosive ordnance[1] is integral to military capability, essential to the operations of the Australian Defence Force (ADF) and involves considerable levels of expenditure. This audit focuses on the Department of Defence’s (Defence’s) contractual arrangements for storing and distributing its $3.1 billion inventory of explosive ordnance, representing some 60 per cent of Defence’s reported total inventory at 30 June 2010.[2]

2. In July 2001, Defence engaged Thales Australia (the contractor) to store explosive ordnance at Defence depots under the Explosive Ordnance Services Contract (the EO Services Contract). Under the terms of the contract, the contractor also maintains Defence’s explosive ordnance, distributes it to ADF users, receives returns of explosive ordnance from them and disposes of surplus or obsolete items. The services provided under the EO Services Contract are an essential component of ADF capability and have cost Defence $398 million over the nine years to 30 June 2010.

3. This audit is the fourth in a current series of ANAO performance audits examining aspects of the major stages of Defence’s and the Defence Materiel Organisation’s (DMO’s) management of explosive ordnance. The major stages are:

- the identification of explosive ordnance requirements and the acquisition of the explosive ordnance—aspects of which were examined in Audit Report No.24 2009–10, Procurement of Explosive Ordnance for the Australian Defence Force (March 2010) and in Audit Report No.37 2009–10, Lightweight Torpedo Replacement Project (May 2010);

- the storage of explosive ordnance at Defence explosive ordnance depots and distribution of explosive ordnance to ADF users—the focus of this audit;

- the sustainment or management of the explosive ordnance throughout its useful life;

- the management of explosive ordnance by the end users of this materiel in Defence—the focus of Audit Report No. 37 2010–11, Management of Explosive Ordnance held by the Air Force, Army and Navy (April 2011); and

- the disposal of explosive ordnance not consumed during its useful life, or otherwise declared excess or obsolete.

4. The management of explosive ordnance carries capability, safety, security, reputational and environmental risks across all stages of the explosive ordnance life cycle. The effective management of the EO Services Contract by Defence is an important part of managing those risks and supporting ADF capability.

The Explosive Ordnance Services Contract

5. Until 1997, each of the three Services (Navy, Army and Air Force) was responsible for managing its own explosive ordnance logistics. In response to the 1997 Defence Efficiency Review, Defence consolidated these functions into a new tri-Service organisation, the then Joint Ammunition and Logistics Organisation (JALO), and initiated a four-year program to market-test the storage and distribution of explosive ordnance. In May 2004, following the 2003 Defence Procurement Review, JALO’s functions were reallocated between the Defence Materiel Organisation (DMO) and Defence. Since March 2008, the Directorate of Explosive Ordnance Services (DEOS) within the Explosive Ordnance Branch of Defence’s Joint Logistics Command (JLC) has been responsible for the administration of the EO Services Contract.

6. Following market-testing, Defence entered into the EO Services Contract with Australian Defence Industries Limited (now Thales) in June 2001 for the storage, distribution and maintenance of both guided and non-guided explosive ordnance for the ADF.[3] The contract was for a period of ten years from 2001–02 to 2010–11, and included an option for Defence to extend the contract for a further five years.

7. Under the EO Services Contract, explosive ordnance storage and distribution services are centred on the contractor's management of 17 Defence-owned explosive ordnance storage and distribution facilities (depots). The contract provides for services such as:

- unloading imported explosive ordnance from commercial merchant vessels;

- positioning explosive ordnance at depots to meet ADF demands;

- issuing and transporting explosive ordnance to ADF units;

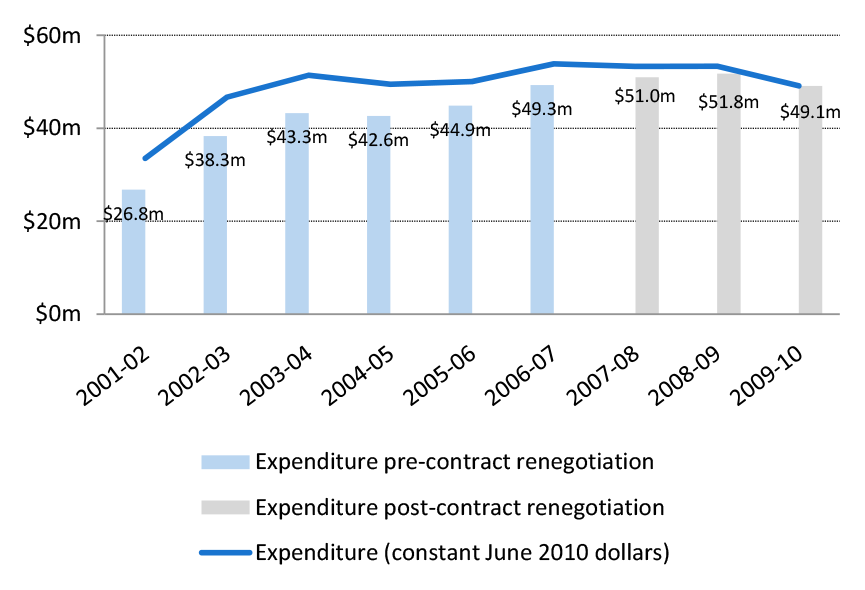

- accepting returns of explosive ordnance from ADF units; and

- ammunitioning and de-ammunitioning Navy ships.[4]

8. In 2004, Defence commissioned a major review of the EO Services Contract. The review was prompted by concerns over the higher than expected cost of the contract. In 2002–03, the first full year of operation, the contract cost of $38.3 million was $14 million more than originally estimated, and in 2003 04 the cost of $43.3 million was $8.9 million more than originally estimated. These cost overruns threatened the savings Defence expected from outsourcing explosive ordnance storage and distribution services.

9. The findings of the 2004 review prompted Defence and the contractor to jointly examine the identified major contractual issues in 2005 and 2006. By September 2006, they agreed to a major contract revision, which was signed in October 2006 and became effective from 1 July 2007. At that time, Defence exercised its option to extend the contract by a further five years to 15 years total, with the renegotiated end date being 2016. [5]

10. The revised contract aimed to improve the scope and efficiency of the services provided to Defence and to achieve better value for money. This was to be achieved by requiring continuous improvement efficiencies of at least two per cent a year (of real cost savings) and through a stronger performance management framework (PMF). The PMF enables the contractor’s and Defence’s performance to be monitored against an expanded range of performance measures. It provides financial incentives for the contractor to improve its performance against the performance measures, and annual performance reviews can result in payments to the contractor for excellent performance, or rebates from the contractor to the Commonwealth in the case of unsatisfactory performance.

11. Furthermore, contract extensions of up to a year can be granted for overall performance at or above a specified standard.[6] As there is no limit in the contract on the number of performance-based contract extensions, the duration of the revised contract can potentially be extended indefinitely, provided that the contractor’s performance continues to meet the required performance standards. In commercial terms, the performance-based contract tenure arrangements of the EO Services Contract are called ‘evergreen’ provisions.

Audit approach

12. The objective of the audit was to assess whether Defence is effectively managing the EO Services Contract. The audit focused mainly on Defence's contract management framework, including the arrangements to monitor the contractor’s performance in delivering services under the contract. The audit also examined the processes used by Defence to develop the current version of the contract and the extent to which the revised contract, as negotiated in 2006, provides an assurance of better value for money when compared to the original contract signed in 2001.

Overall conclusion

13. Defence has established mechanisms, including well-developed performance management and monitoring frameworks, to support the effective management of the EO Services Contract. Defence’s oversight includes an annual program of audits to improve the contractor’s stock accuracy and integrity, and oversight of the security of the contractor’s arrangements for transporting explosive ordnance.

14. Defence’s 2006 contract renegotiation was effective in better specifying the services to be delivered, establishing a performance management framework, and in setting improvement and cost-reduction targets. Increases in contract costs have levelled off following the contract renegotiation, while marked improvements in the timeliness of the contractor’s deliveries of explosive ordnance to ADF units have been achieved.

15. Defence and the contractor have been working cooperatively to identify areas of efficiency that could be derived from greater control on the use of services on offer and reductions in input costs. Nonetheless, there remain opportunities for Defence to obtain additional contract efficiencies, including by revisiting the margins paid for some contract elements and improving the forecasting of its explosive ordnance requirements. This could occur as part of Defence’s regular reviews of the EO Services Contract costs, as provided for in the contract.

16. As noted at paragraph 11, there is currently no limit in the EO Services Contract on the number of performance-based contract extensions available to the incumbent contractor. Provided the contractor continues to meet contractually defined performance standards, the contract can potentially be extended indefinitely. Long-standing advice provided to agencies by the Department of Finance and Deregulation (Finance) is that such evergreen provisions do not provide the necessary assurance that the value for money requirements of the policy framework in the Commonwealth Procurement Guidelines (CPGs) will be met, and that they are likely to limit competition.

17. It is not clear from departmental records why Defence considered it necessary to provide for both a five year contract extension and the inclusion of evergreen provisions in the renegotiated contract in order to meet the contractor’s priority for an increase in contract tenure. Entering into an evergreen arrangement as part of the 2006 contract renegotiations reduced the Commonwealth’s ability to satisfy the requirements to test value for money over the long term because there is no certainty on when a further approach to the market will be made. Accordingly, in the course of its regular contract review process, Defence should seek to incorporate a contract expiry date to allow for the services provided under the EO Services Contract to be market-tested.

18. The ANAO has made four recommendations aimed at improving Defence’s management of contract risks, its forecasting models, the contract Cost and Price Model, and recommending that Defence seek a firm end date for the contract.

Key findings

Business planning and risk management

19. DEOS has established business planning for managing the distribution and storage of explosive ordnance and was largely responsible for conducting the 2006 renegotiation of the EO Services Contract between Defence and the contractor. This resulted in improvements to the contract and its extension from 10 to 15 years.

20. In accordance with the EO Services Contract, the contractor has implemented a soundly-based risk management framework and maintains a risk register. ANAO found that risks were indentified and included in the contract risk register. Nevertheless, there is scope for more clearly specifying risks and ensuring they are regularly reviewed and updated.[7] Additionally, DEOS could improve its risk management practices by addressing risks to Defence that are not addressed in the contractor’s risk register.

21. Defence’s management includes maintaining oversight of the ordnance managed by the contractor and identifying and managing risks. So far, Defence’s risk management has focused mainly on maintaining oversight of ordnance stock integrity. As the contract arrangements have matured and the contractor’s performance in this area has been satisfactory consistently, Defence advised ANAO that it now intends to place more emphasis on managing other contract risks. These risks include achieving ongoing savings on the cost of the contract, and maintaining the contract’s complex Cost and Price Model.[8]

Contract renegotiation and contractor performance

22. Having identified in 2004 that the cost of the EO Services Contract was significantly higher than had been projected, Defence initiated formal contract negotiations with the contractor. In October 2006 a number of improvements were incorporated into the renegotiated contract. These included a detailed statement of the services to be provided, the establishment of fixed costs for the contractor maintaining an agreed level of capability to deliver and store explosive ordnance, and a Cost and Price Model for contract services, including agreed price indices. Other significant additions were contractual commitments to continuous improvement and cost reduction, a performance management framework, and a revised risk management framework.

23. Since the commencement of the renegotiated contractual arrangements in July 2007, contract financial performance has improved, as indicated in Figure S.1. In constant-dollar terms, the cost of the EO Services Contract has stabilised. In nominal terms, the EO Services Contract costs in 2009–10 were $49 million, representing a reduction of around 5.1 per cent on the cost of the contract in 2008–09 and only a little more than the cost of the contract in 2006 07. Savings on the total contract costs from 2008–09 to 2010–11 have been close to or above the target of 2 per cent of total contract costs.

24. Defence data for 2007–08, 2008–09 and 2009–10 also indicates that the contractor has (at the 99 to 100 per cent level) met all of Defence’s non-operational demands[9] for issues of explosive ordnance. The contractor achieved similar levels of performance for operational demands in 2008–09 and 2009 10, improving on 2007–08 performance. Importantly, this occurred in conjunction with good performance against measures of the accuracy of contractor stock records. Accordingly, Defence assessed the contractor as performing at a high level and made incentive payments to the contractor totalling $200 970 in 2008 09 and $270 727 in 2009–10, for performance in those years.[10]

Figure S.1: Total expenditure on explosive ordnance storage and distribution, 2001 02 to 2009–10

Note: Net amount after considering all cost recoveries for operations, DMO payments and other units, weapons, munitions and explosives and construction costs This other expenditure amounted to $0.52 million in 2007–08, $2.84 million in 2008–09 and $9.09 million in 2009–10. The composition of these costs, which includes a small amount of expenditure on work done by another contractor outside the EO Services Contract, is detailed in paragraphs 4.2 and 4.3

Source: ANAO analysis of Defence data.

25. To date, contract amendments providing for performance-based contract extensions of one year have been made, based on the contractor’s performance in each of 2008–09 and 2009–10. These contract amendments have extended the EO Services Contract’s total length from 15 years to 17 years, ending in 2018 rather than 2016. Further extensions may be available, depending on the contractor’s future performance.

Financial management of the Contract

26. As set out in the renegotiated EO Services Contract, Defence and the contractor are to use their best endeavours to achieve savings of two per cent each year. The ANAO considers that potential future savings and efficiencies could be achieved through:

- Better management of the Cost and Price Model, which is complex and elevates the risk of errors in amounts and calculations. Some errors in the model were found by the ANAO. Defence would benefit from reviewing the model to ensure that it is delivering accurate results and that it is sustainable over the long term.

- More effective and efficient forecasting by Defence of its explosive ordnance demands. While almost all ordnance was delivered in full and on time in 2009–10, only 39 per cent was forecast in Defence’s explosive ordnance management system. More efficient forecasting mechanisms, notably for ordnance items in short supply, could reduce the burden of forecasting on ADF units and still give the contractor sufficient notice to pre-position explosive ordnance at depots.

- The secure storage of explosive ordnance by ADF units (for instance, during extended exercises) where this is more cost-effective than the contractor collecting explosive ordnance for overnight storage and re-delivering it to the exercise area the following day.

- Developing generic disposal plans for certain items of unserviceable explosive ordnance, thus speeding up the disposal of these items and reducing contractor workloads.

27. Improving contract performance is important, as over 50 per cent of the contract costs are fixed and directed toward ensuring that the contractor maintains the capability to deliver explosive ordnance as required. Among the reasons Defence sought to renegotiate the contract in 2006 was the high margins it was paying for the services provided.[11] Notwithstanding the 2006 renegotiation, Defence continues to pay a similar margin, estimated at 10.6 per cent.[12] Because the contractor can recover all costs—including a profit margin—from Defence, the financial risks to the contractor are reduced. This suggests that Defence would benefit from seeking to revise the current margins, including those for labour and administration.

Evergreen contract provisions

28. ANAO recognises that it is essential that Defence maintains the capability for the effective provision of explosive ordnance storage and distribution services. The current contractual arrangements to guarantee explosive ordnance capability include entering into a 15 year contract, meeting substantial fixed costs, and including evergreen provisions to further extend the contract if high performance standards are met.

29. However, the advantages of these arrangements must be considered in the context of the requirements of the Commonwealth Procurement Guidelines (CPGs). Long-standing advice to agencies by Finance[13] is that evergreen provisions are inconsistent with the CPGs. They can substantially delay or preclude an approach to the market within a reasonable period, prevent a demonstration that the value for money principle is being achieved, and reduce competition.

30. While the EO Services Contract contains provisions that allow the contract to be terminated for convenience, it does not contain a firm end date, after which Defence would again approach the market for the delivery of explosive ordnance storage and distribution services. Provided that the contractor continues to meet specified performance standards, the contract could be extended indefinitely. Defence advised ANAO that it plans to carry out a detailed analysis of the value for money provided by the contract.

Summary of agency response

31. Defence appreciates the comprehensive audit undertaken by the ANAO and concurs with the majority of findings and recommendations in the audit report. The report confirms Defence's view that the Explosive Ordnance Services Contract is being managed effectively and is providing an excellent level of service to Defence. The report also identifies a number of potential areas for improvement, including some that had already been identified by Defence and which are planned to be pursued throughout 2011.

32. Defence does not agree that the establishment of a firm date for expiry of the contract is the only effective way to ensure value for money. Defence believes that unique review provisions currently contained in the contract which provide full cost visibility, yearly contract reviews and a full contract review every five years are appropriate to ensure value for money.

ANAO Comment

33. The ANAO notes Defence’s advice that areas for improvement raised in this report will be pursued throughout 2011.

34. Defence has not agreed with the recommendation directed towards the establishment of a firm end date for the EO Services Contract, which would allow the market to be tested. The EO Services Contract has been extended to 2018 at this time, some 17 years after the initial contract was signed. While contract extensions have been performance-based, 17 years is a lengthy period for such a contract given the benefits that can be derived from periodically re-testing the market; hence the ANAO recommendation. Defence administers other large scale, high value, complex contracts for which it has in place settled practices for market-testing at definite intervals.[14]

Footnotes

[1] The definition of explosive ordnance in the Defence Security Manual encompasses all munitions containing explosives, nuclear fission or fusion materials and biological and chemical agents. This includes bombs and warheads; guided and ballistic missiles; artillery, mortar, rocket and small arms ammunition; all mines, torpedoes and depth charges; demolition charges; pyrotechnics; clusters and dispensers; cartridge and propellant actuated devices; electro-explosive devices; clandestine and other improvised explosive devices; and all similar or related items or components explosive in nature.

[2] Defence’s inventory is reported at cost, adjusted where applicable for loss of service potential. The costs of inventories are assigned by using a weighted average cost formula. Department of Defence, Defence Annual Report 2009–10, Volume 1, p. 214.

[3] Australian Defence Industries Limited was acquired from the Australian Government by a joint venture involving Transfield and Thomson-CSF in November 1999. Thomson-CSF was renamed Thales in 2000, with the name of its Australian subsidiary becoming Thales Australia. In 2006, Thales Australia acquired full ownership of ADI Ltd and absorbed the company into its corporate structure. The maintenance services, which include a range of workshop repairs and scheduled maintenance, are not specifically examined in this audit.

[4] These terms encompass the delivery of explosive ordnance to Navy ships, loading explosive ordnance onto Navy ships and unloading explosive ordnance from Navy ships.

[5] The total of 15 years includes the five years for which the EO Services Contract had already been in operation at the time the variation was negotiated.

[6] A change to the contract negotiated in 2006 provides that, commencing in 2008, the period of the contract will be extended for specified periods of up to a year if, following an annual performance review, the contractor’s assessed level of performance meets performance standards listed in the contract, and the contractor was not in breach of the contract during the period under review.

[7] For instance, some risks were stated in very general terms, others had no identified mitigation strategies, while others had not been reviewed for some time.

[8] The Cost and Price Model is a complex spreadsheet-based application that calculates the actual costs of the individual services provided to Defence by the contractor under the EO Services Contract, and then adds agreed ‘margins’ to determine the price payable by Defence.

[9] Explosive ordnance demands for ADF activities undertaken on operations or during war-fighting.

[10] One performance payment of $77 600 was made in 2002–03 under arrangements that applied before the contract was renegotiated in 2006.

[11] Defence estimated that it was paying a weighted average margin of 9.48 per cent for services included in the Service Offerings component of the EO Services Contract and that the contractor was making additional profits on the costs to which these margins were applied (‘margin on margin’ profits), bringing the contractor’s total weighted average profit margin to around 14 per cent. Using ABS data for 2004, Defence also noted that at the time the Contract was being renegotiated the transport and storage sector made a profit before tax of around 4 per cent (see paragraph 3.78). However, Defence accepted that this margin may have been low and more recent ABS data indicate that the Transport, Postal and Warehousing sector had a profit margin of 13.0 per cent in 2006–07 11.8 per cent in 2007–08 and 9.2 per cent in 2008–09 (see ABS, Australian Industry 2008–09, 8155.0, 28 May 2010).

[12] Because base contract costs, on which the margin is applied, were tightened in the 2006 contract revision, it is likely that current base contract costs more accurately reflect actual costs. As a result, it is likely that the contractor is making a smaller overall margin, even though the weighted rate of the margin is similar.

[13] Department of Finance and Administration, ‘Procurement Policy Framework: Frequently Asked Questions’, November 2005, p. 27. Similar advice is currently also available to agencies on the website of the Department of Finance and Deregulation, see Procurement Policy Framework Frequently Asked Questions’, updated February 2009, Q79, <http://www.finance.gov.au/procurement/procurement-policy-and-guidance/procurement-policy-faqs.html> [accessed 20 April 2011].

[14] See for example: Auditor-General, Garrison Support Services, ANAO audit report No.11 2009–10, November 2009, pp. 33, 99, 124-125.