Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Management of Detained Goods

The objective of the audit was to assess the effectiveness of Customs and Border Protection’s arrangements for managing the safe and secure storage and disposal of detained goods.

Summary

Introduction

1. The Australian Customs and Border Protection Service’s (Customs and Border Protection) role is to prevent, deter and detect the illegal movement of people and goods entering Australia. It also seeks to facilitate legitimate trade and travel, and to collect border-related revenue and statistics. These roles require Customs and Border Protection to balance the often competing priorities of facilitating trade while protecting the Australian border.

2. The majority of goods enter Australia without intervention. However, all goods are subject to customs control, and some are targeted for inspection. In 2011–12, Customs and Border Protection reported that it had:

- processed 29.1 million air passengers arriving in, or departing from, Australia1;

- cleared 14 456 ships arriving from overseas, with 6760 boarded and inspected;

- inspected 102 247 sea cargo containers;

- inspected approximately 1.51 million air cargo consignments; and

- inspected approximately 41 million international mail items.2

3. Inspection activities may identify goods that are prohibited from entering Australia under any circumstances.3 In addition, some goods, such as firearms and drugs, are restricted and may only enter Australia after relevant permits are granted.4 As these goods pose risks to the community, goods suspected of being prohibited or restricted are detained by Customs and Border Protection pending further investigation.

4. All detained goods are recorded in Customs and Border Protection’s Detained Goods Management System as individual items.5 Customs and Border Protection advised that it had detained 124 792 items in 2011–12, an increase of 44 per cent on the 86 559 items detained in 2007–08. While the nature of detained goods can vary, approximately 90 per cent (112 242) of these goods were recorded in the Detained Goods Management System as weapons, firearms, tobacco or drugs in 2011–12.

Managing detained goods

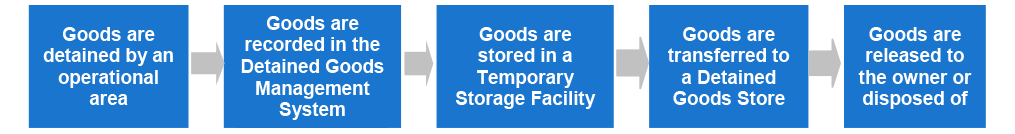

5. Many operational areas and officers are involved in detaining goods. Once detained, staff are required to store them in an approved place known as a Detained Goods Store or Temporary Storage Facility as soon as is practical. Figure S1 represents the process for managing detained goods.

Figure S1 Detained goods management process

Source: ANAO representation.

6. In the majority of cases, a detaining officer transfers goods to one of 65 Temporary Storage Facilities which are co-located with their operational area. Temporary Storage Facilities are responsible for storing detained goods for a ‘minimum period of time’ before transferring them to a Detained Goods Store for long-term storage. Detained Goods Stores consist of two co-located facilities; a customs store and an armoury.6 A customs store is used to store non-firearms goods, while an armoury is primarily used to store firearms, but may also store some non-firearms goods.

7. While some detained goods are released to their rightful owner, they may also be ‘condemned and forfeited to the crown’. As the owner of the goods, Customs and Border Protection may dispose of them as it sees fit, including by destroying them. Customs and Border Protection outsource the destruction of goods, but maintains oversight of this process.

8. Irrespective of where goods are stored, they should be secure and accounted for. Customs and Border Protection has developed a number of guidelines that outline its control and accountability framework for managing detained goods. These include conducting regular stocktakes, the use of tamper-evident seals on some packages and a requirement that two staff be present during the transfer and destruction of goods. In addition, storage facilities have a range of physical security features such as alarm systems and, in the case of armouries, closed-circuit television cameras. The agency also requires that storage facilities restrict the number of staff who have access to detained goods.

Reform within Customs and Border Protection

9. During the course of the audit, the Minister for Home Affairs announced the establishment of the Customs Reform Board. The Board was established in December 2012 after the arrest of a second Customs and Border Protection officer from Sydney International Airport for abuse of office and precursor importation offences as part of a two year investigation by the Australian Federal Police, Customs and Border Protection and the Australian Commission for Law Enforcement Integrity. The joint investigation resulted in the arrest of two further officers in February 2013.7 The Board has been asked to provide advice to the Minister for Home Affairs regarding structural and cultural reforms to improve Customs and Border Protection’s law enforcement capability, integrity culture and business systems.

10. In relation to detained goods, Customs and Border Protection has investigated a number of allegations made about the integrity of certain officers since 2007. Eleven cases have been investigated by the Integrity and Professional Standards Branch. In eight investigations no impropriety was found, and two investigations were ongoing at the time of audit. In the remaining case (a series of three related investigations), an officer pleaded guilty to misapplying public property and resigned his position.8 In addition, an ongoing investigation was being undertaken regarding the possible theft of goods at a facility contracted to destroy them.9 In this case, a decision on whether charges would be laid against the owners of the destruction facility is being considered by the Commonwealth Director of Public Prosecutions.

11. Customs and Border Protection has announced that it will strengthen its focus on integrity, security and risk management through a major reorganisation of key functions in this area. In addition, a capability review of its professional standards function is also being undertaken.10

12. New legislation has also been introduced to provide Customs and Border Protection with powers to strengthen its integrity framework by:

- conducting targeted integrity testing of officers suspected of engaging in corrupt activities;

- enabling its Chief Executive Officer to make a determination that an officer’s employment can be terminated for serious misconduct;

- introducing mandatory reporting requirements for its employees to report serious misconduct and corrupt activities; and

- alcohol and other drug testing.11

13. The enhancements to the legislation and administrative frameworks applicable to Customs and Border Protection will also necessarily require measures to ensure alignment of staff to the new approaches and organisational goals.

Audit objective and criteria

14. The objective of the audit was to assess the effectiveness of Customs and Border Protection’s arrangements for managing the safe and secure storage and disposal of detained goods. In particular, the audit examined whether Customs and Border Protection has:

- effective governance arrangements to support the management of detained goods;

- developed, and consistently applies, sound processes for handling and monitoring detained goods during their storage, transport and disposal; and

- appropriate arrangements to assure itself that storage facilities provide a safe and secure environment for detained goods.

15. The audit assessed Customs and Border Protection’s management of goods in Temporary Storage Facilities and Detained Goods Stores. The detention of goods and the processes to monitor the transfer of goods from the detaining officer to a Temporary Storage Facility, as well as the commercial arrangements for the storage of certain goods were outside the scope of this audit.

Overall conclusion

16. Customs and Border Protection’s role is to prevent, deter and detect the illegal movement of people and goods entering Australia, while also facilitating legitimate trade. For 2011–12, Customs and Border Protection has reported that some 42.6 million items were inspected12, and advised that 124 792 items were detained because of prohibitions or restrictions on entry, or where import duties had not been paid. The operating environment for the management of detained goods is complex, with over 70 facilities responsible for storing and accounting for such goods. This complexity places a premium on Customs and Border Protection designing effective administrative arrangements and then implementing those arrangements.

17. Following a review of Detained Goods Management in 2009, Customs and Border Protection has been enhancing its administrative framework to control and account for detained goods. The framework, which is now generally sound, is outlined in a series of internal guidelines that establish the requirements for transferring goods between facilities, as well as those being released or destroyed. These guidelines also set out the physical security requirements for the storage of detained firearms, including the use of alarm systems and closed-circuit television cameras. The agency requires that all storage facilities conduct regular stocktakes and firearms counts and has implemented a Quality Assurance Program to monitor compliance with its control and accountability framework. Monthly reports are provided to senior management regarding the performance of Detained Goods Stores; there is no similar reporting framework for Temporary Storage Facilities.

18. Although Customs and Border Protection’s framework to control and account for detained goods is generally sound, the implementation of some key controls by staff at various facilities fell short of the agency’s requirements, reducing the overall effectiveness of the framework and its security environment. These shortcomings included:

- goods that were selected for destruction were accessible to staff in two facilities visited by the ANAO for up to one month prior to destruction and the goods were not re-verified before destruction;

- seals used to alert staff to potential interference with the goods were not tamper-evident and the poor application of seals to some packages increased the risk that goods could be removed from their packages, and the packages destroyed, without the theft being detected;

- closed-circuit television camera footage was not retained at all armouries for the full period between monthly firearms counts, as required by internal guidelines; and

- the area covered by cameras varied between facilities.

19. There are also weaknesses in the operation of the Detained Goods Management System used to record all detained goods. Limitations in the system require some operational staff to have administrator access. These officers, who also work in close proximity to detained goods, have the ability to delete records, increasing the risks to the accountability of detained goods. The risks associated with the system have not been assessed and use of the system is not monitored. Against this background, it is important that Customs and Border Protection institute compensating controls for known system weaknesses and to assess any other risks to the effective operation of the system.

20. During the course of the audit, the ANAO opened 528 packages of detained goods and compared their contents against the corresponding electronic records in the Detained Goods Management System. There were no goods identified as missing and 14 items had discrepancies in the recorded quantities. These discrepancies included small quantities of narcotics (1.2 grams or less), cigarettes (more than 10 000 sticks) and counterfeit makeup (two items). Customs and Border Protection advised the ANAO that these discrepancies are most likely due to counting errors, wastage when testing powders, or an estimation error when counting bulk tobacco.13 Also, in response to the ANAO’s finding that the seals used were not tamper-evident, Customs and Border Protection advised that it checked the contents of another 4697 items in October 2012 and identified 24 discrepancies. Eighteen of these discrepancies involved larger quantities of goods being held in storage than were recorded in the Detained Goods Management System.14 This testing provided some assurance that the vulnerability of the seals had not been exploited. Customs and Border Protection has advised the ANAO that it has now replaced the seals.

21. Weaknesses in the detained goods management control framework and security arrangements can be and, in the past have been, exploited by staff or contractors. The risks inherent in managing detained goods, many of which are of an illicit or restricted nature, means that Customs and Border Protection requires ongoing assurance that its control framework is sound and being implemented as intended. In addition to changes already being introduced by Customs and Border Protection during the course of the audit, which reflects positively on the responsiveness of agency management to address matters raised, and the broader organisational changes being introduced as explained in paragraph 11, the ANAO has made three recommendations directed towards improving performance monitoring of Temporary Storage Facilities, assessing the risks associated with the use of the Detained Goods Management System, and retaining camera footage for the periods between firearms counts.

Key findings by Chapter

Governance Arrangements (Chapter 2)

22. The National Manager Cargo Operations is responsible for most Detained Goods Stores and some Temporary Storage Facilities. A number of other operational areas, such as those processing passengers at international airports, manage other storage facilities.

23. Customs and Border Protection has developed a planning framework that includes the preparation of an agency-wide risk and annual business plan, as well as division, branch and team level business plans. In addition Cargo and Trade Division has developed a draft risk register to record key operational risks. This suite of documents provides adequate coverage of detained goods.

24. National guidelines outline the detained goods management control framework. The guidelines were approved by the relevant National Director, and have been reviewed and reissued twice since 2008 to continue to enhance the control framework.15 Nevertheless, the guidelines could have been clearer and were sometimes inconsistent with other related guidance. Staff from some facilities interviewed by the ANAO also advised that they do not use the guidelines. In addition, the lack of formal training and a standardised induction package has resulted in inconsistent practices being implemented across regions. During the course of the audit, Customs and Border Protection advised that it will review and update the guidelines, and develop national training and induction packages.

25. Storage facilities undertake quarterly and biannual stocktakes of detained goods by cross-checking the records in the Detained Goods Management System with goods in storage.16 In total, five items have been identified as missing in the past four stocktakes.17 An annual Quality Assurance Program and internal audits also provide positive and timely opportunities to improve the management of detained goods, but some recommendations, although accepted, have not been implemented across all storage facilities.18 The outcomes of stocktakes and the Quality Assurance Program are reported to Customs and Border Protection’s senior management.

26. The reporting of outcomes from regular stocktakes and quality assurance reviews provides a useful indicator of overall performance of storage facilities. In addition, monthly reports are provided to the National Manager Cargo Operations against the Detained Goods Stores’ key performance indicator that measures the percentage of goods retained by each store for more than 120 days. However, there is no centralised monthly reporting of performance for Temporary Storage Facilities. Customs and Border Protection has acknowledged that there would be benefits in developing performance indicators for Temporary Storage Facilities, including monitoring and reporting the timeframes that firearms and non‑firearms goods are stored.

Managing Detained Goods (Chapter 3)

27. Customs and Border Protection has a control framework to account for detained goods during their transfer, release or destruction. This framework includes the use of two officers to complete the processes and cross-checking of electronic records with labels attached to the goods.

28. The audit team conducted site visits to storage facilities in four states and territories and observed the transfer of goods between facilities, the release of goods to importers and the destruction of goods at three commercial destruction facilities.19 Files for 352 items were also examined to verify that processes had been documented and implemented effectively. While some issues of non-compliance were identified, these occurred at a single or small numbers of facilities.

29. At two facilities visited by the ANAO, goods selected for destruction were accessible to staff for up to one month prior to their actual destruction. In this circumstance, there was a risk that the goods could be stolen and any discrepancy is unlikely to be identified as those goods were not re-verified as being complete prior to destruction. Customs and Border Protection had not fully implemented the recommendation from its Review of Detained Goods Management Processes in 2009 that all facilities use lockable containers to secure goods selected for destruction.20

30. Since 2009, Customs and Border Protection has required the use of tamper-evident seals to more efficiently manage detained goods, while maintaining accountability. These seals are designed to identify potential interference with goods. It also means that Customs and Border Protection does not need to regularly re-check the contents of the packages, providing efficiencies for the agency. However, ANAO testing showed that: the two most recent types of seal were not always tamper‑evident; seals were sometimes applied in a way that allowed goods to be accessed without breaking the seal; and staff did not always respond appropriately to evidence of tampering.

31. Customs and Border Protection’s operational staff and managers were aware that the seals were not tamper-evident, yet for approximately 12 months, no effective action was taken to resolve this shortcoming, reflecting weaknesses in the agency’s management arrangements. Customs and Border Protection has advised the ANAO that it has now replaced the seals and has drafted guidance to assist staff to understand their responsibilities in using the seals. In addition, the agency advised that to provide assurance that goods were properly accounted for during this period, it checked the contents of 4697 packages against the Detained Goods Management System records and that 24 discrepancies were identified. Eighteen of these discrepancies involved larger quantities of goods being held in storage than were recorded in the Detained Goods Management System.21 This testing provides some assurance that the vulnerability of the seals had not been exploited.

Detained Goods Management System (Chapter 4)

32. The Detained Goods Management System was introduced in April 2006. While the system was seen as an interim measure, it has now been operating for almost seven years. Customs and Border Protection advised that the system was unstable in 2008, but this issue was resolved and future instability is considered unlikely based on annual monitoring. However, there is no back-up system. In response to any short or long-term outages, the agency advised that it would resort to manual processes and paper records. While this strategy has been documented in operational Business Continuity Plans, Customs and Border Protection advised that it has not conducted any testing to confirm that this is a practical alternative, particularly in the longer‑term. The risks associated with the use of the system have also not been properly assessed.

33. The majority of Detained Goods Management System users are restricted to ‘read only’ or ‘standard’ access. However, 12 staff, including eight operational staff, have been granted administrator access. As these operational staff who work in close proximity to detained goods have the ability to delete records, there is an increased risk that an electronic record could be deleted and the corresponding goods stolen without detection. The Detained Goods Management System has a fully auditable trail, but user activity has not been monitored to identify potential misuse of the system.

34. The ANAO opened 528 items in store to cross-check the quantity of goods with its corresponding Detained Goods Management System record. No items were missing but for 14 items (2.7 per cent) there was a discrepancy with the quantity of the goods. The discrepancies included small quantities of narcotics (with 1.2 grams or less), cigarettes (more than 10 000 sticks) and counterfeit makeup (two items). Customs and Border Protection advised the ANAO that these discrepancies are most likely due to counting errors, wastage when testing powders, or an estimation error when counting bulk tobacco.22

Security of Detained Goods (Chapter 5)

35. Customs and Border Protection has promulgated detailed physical security requirements specifically for armouries and Temporary Storage Facilities. Similar requirements for customs stores have not been prepared.

36. Storage facilities have implemented a range of physical security features, including alarm systems and the use of closed-circuit television cameras. Customs and Border Protection also monitors access to detained goods with visitor registers and by updating access codes to storage facilities.

37. During the audit, the ANAO observed that one facility had adopted the practice of leaving the armoury open during the day, in contravention of the Firearms Guidelines.23 This increased the accessibility of staff to firearms and reduced the overall impact of physical security arrangements. Customs and Border Protection advised that the facility is now kept closed.

38. Cameras were installed in all the armouries, and at three of the four customs stores, visited by the ANAO.24 Where installed, cameras increase the level of assurance of the security and control of detained goods. However, while camera footage from armouries is required to be retained for the period between monthly firearms counts, this did not always occur in six of the eight facilities reviewed. In the event that the theft of firearms has been identified in monthly firearms counts, camera footage may not be available for the full period in which the theft occurred. Customs and Border Protection advised that this vulnerability had not, to its knowledge, been exploited.

39. An internal review of 50 storage facilities in 2011 identified that 41 facilities were not fully compliant with the Firearms Guidelines. Nevertheless, Customs and Border Protection considered these issues of non‑compliance were low risk and the facilities were approved for continued use pending the conduct of protective security risk assessments, to be completed by 2015. At the time of the audit, 29 of the 98 Customs and Border Protection sites (30 per cent) had either not had a protective security risk assessment completed or did not have a current risk assessment under internal guidelines.25 This included some facilities that store high-risk detained goods.

Safety Aspects of Managing Goods (Chapter 6)

40. Storage facilities conduct biannual occupational health and safety assessments to identify and manage the risks associated with moving and storing large quantities of goods. In addition, facilities have implemented a number of strategies to build ongoing safety awareness, such as induction programs, discussions at weekly meetings and the use of posters with safety messages.

41. Detained Goods Store staff have reported 136 safety incidents since 2006–07. Many of these incidents were of a minor nature, with muscle strains and repetition injuries accounting for around 30 per cent (41) of the incidents reported.26 The risk of muscle strains is generally managed through the provision of manual handling training and equipment. Nevertheless, there were some inconsistencies in the type of equipment used between facilities and only one facility was applying warning stickers to heavy items. Customs and Border Protection advised that it will promote awareness and implement consistent practices across facilities.

42. Hazardous goods are rarely detained. However, appropriate strategies are available to Customs and Border Protection staff where necessary, including having the goods destroyed immediately or removing the goods to a commercial storage facility that specialises in storing such goods.

43. Customs and Border Protection has implemented psychometric testing to manage the risk that Detained Goods Store staff with access to firearms and weapons may commit acts of harm to themselves or to others. However, this strategy is not applied to staff in Temporary Storage Facilities. There would be merit in Customs and Border Protection re-assessing its approach to psychometric testing for those Temporary Storage Facilities where firearms are stored for longer periods or that manage large quantities of weapons.

Summary of Customs and Border Protection’s response

44. The proposed report was provided to Customs and Border Protection for formal comment. Customs and Border Protection provided the following summary response, and the formal response is shown at Appendix 1.

Customs and Border Protection welcomes the report and commends the professionalism and level of engagement demonstrated by the ANAO audit team throughout the audit. The recommendations and supporting information contained within the report are accepted by Customs and Border Protection.

Customs and Border Protection appreciates the feedback provided in the report, recognising that the overall administrative framework to control detained goods is generally sound, and that Customs and Border Protection have responded and actioned a number of issues identified during the course of the audit.

Recommendations

|

Recommendation No.1 Paragraph 2.49 |

To measure performance of Temporary Storage Facilities in managing detained goods, the ANAO recommends that Customs and Border Protection develops appropriate key performance indicators for these facilities, and reports against them in the monthly management reports. Customs and Border Protection Response: Agreed. |

|

Recommendation No.2 Paragraph 4.29 |

To enhance the administration of the Detained Goods Management System, the ANAO recommends that Customs and Border Protection:

Customs and Border Protection Response: Agreed. |

|

Recommendation No.3 Paragraph 5.30 |

To strengthen the overall security of detained goods, the ANAO recommends that Customs and Border Protection align the period that closed‑circuit television camera footage is retained at each facility storing firearms with the timing of monthly firearms counts. Customs and Border Protection Response: Agreed. |

Footnotes

[1] Interventions on arrival and pre-departure include questioning, targeted baggage examinations and personal searches.

[2] Australian Customs and Border Protection Service, Annual Report 2011–12, <http://customs.gov.au/webdata/resources/files/annualreport2011-12.pdf> p.ii [accessed 1 February 2013].

[3] There are four types of prohibited goods including certain breeds of dangerous dogs, diamonds from Cote d’Ivoire, embryo clones and suicide devices.

[4] There are a large number of categories of restricted goods including firearms, weapons, drugs, tobacco, hazardous waste and pornographic material.

[5] The agency refers to these as items within the Detained Goods Management System. Where a single detention may involve multiple types of goods, each type is recorded as a separate item under one of 10 categories.

[6] An armoury may also be co-located with a Temporary Storage Facility in some cases. For example, the Sydney Gateway Facility that processes international mail has a Temporary Storage Facility and an armoury.

[7] Australian Customs and Border Protection Service <http://customs.gov.au/site/130212mediastatement_officersarrested.asp> [accessed 27 March 2013].

[8] It has been reported that the case did not involve personal enrichment or theft. <http://www.theage.com. au/victoria/customs-crime-smoked-out-20100701-zqm5.html> [accessed 21 March 2013].

[9] <http://www.theage.com.au/victoria/trapdoor-hid-contraband-under-the-nose-of-customs-20120525-1zadt.html> [accessed 21 March 2013].

[10] Australian Customs and Border Protection Service <http://customs.gov.au/site/130322mediarelease.asp> [accessed 26 March 2013].

[11] Australian Customs and Border Protection Service <http://customs.gov.au/site/mediaStatement20130316.asp> [accessed 21 March 2013].

[12] Australian Customs and Border Protection Service, Annual Report 2011–12, <http://customs.gov.au/webdata/resources/files/annualreport2011-12.pdf> p.30-31 [accessed 1 February 2013].

[13] The discrepancy involving 10 200 cigarettes was the equivalent of one box missing (10 000 sticks) and an additional box that had been opened and was missing a carton of cigarettes (200 sticks). As a result, the ANAO considered it unlikely that this discrepancy was caused by an estimation error. Customs and Border Protection has advised that it is conducting further enquiries in relation to this discrepancy.

[14] In conducting this testing, Customs and Border Protection advised that it had located an additional 81 tablets (including Dianabol, Stanazolol and Diazapam), 1537 sticks of cigarettes, two butterfly chains, three knives and one bottle of alcohol. Those items that were recorded in the Detained Goods Management System where the goods were missing included one ‘stop cold’ tablet, 85 sticks of tobacco, 400 grams of molasses tobacco, one blow pipe and two rifle casings. Regarding the rifle casings, Customs and Border Protection also advised that these had been released to the owner and that the Detained Goods Management System had not been updated.

[15] The National Director Cargo and Trade provides executive oversight of the detained goods function. The guidelines are made up of a series of documents and individual documents were reviewed between March 2008 and March 2009, and then again between December 2010 and May 2012.

[16] Customs and Border Protection conducts biannual stocktakes of all goods and quarterly stocktakes of high value, sensitive and firearms goods.

[17] The missing items included two flick knives, a laser pointer and pharmaceutical drugs.

[18] These recommendations include the use of lockable containers to secure goods selected for destruction and the use of registers to record the details of visitors who have accessed detained goods.

[19] The audit team visited four customs stores, five armouries and four TSFs across New South Wales, Victoria, Western Australia and the Australian Capital Territory.

[20] Customs and Border Protection has advised that the recommendation from its Review of Detained Goods Management Processes in 2009 has been fully implemented in seven of the eight Detained Goods Stores. In the eighth facility, lockable containers cannot be used due to work health and safety concerns related to the use of the lockable containers at the main destruction facility. As an alternative, and in response to the ANAO’s audit, Customs and Border Protection advised that goods selected for destruction at that facility are now placed in tamper-evident sealed boxes prior to destruction.

[21] In conducting this testing, Customs and Border Protection advised that it had located an additional 81 tablets (including Dianabol, Stanazolol and Diazapam), 1537 sticks of cigarettes, two butterfly chains, three knives and one bottle of alcohol. Those items that were recorded in the Detained Goods Management System where the goods were missing included one ‘stop cold’ tablet, 85 sticks of tobacco, 400 grams of molasses tobacco, one blow pipe and two rifle casings. Regarding the rifle casings, Customs and Border Protection also advised that these had been released to the owner and that the Detained Goods Management System had not been updated.

[22] The discrepancy involving 10 200 cigarettes was the equivalent of one box missing (10 000 sticks) and an additional box that had been opened and was missing a carton of cigarettes (200 sticks). As a result, the ANAO considered it unlikely that this discrepancy was caused by an estimation error. Customs and Border Protection has advised that it is conducting further enquiries in relation to this discrepancy.

[23] Customs and Border Protection advised that this armoury door was open during the day to allow staff to access non‑firearms goods more easily.

[24] Customs and Border Protection advised that, nationally, cameras are installed in all armouries and four of the eight customs stores. Closed-circuit television cameras are not mandatory for customs stores, as they do not store firearms. Temporary Storage Facilities are permitted to store firearms only for a maximum of 120 hours, as these facilities are not as secure as an armoury.

[25] Customs and Border Protection advised that, because of changes in personnel in the three areas responsible for managing the regional security adviser network, it is unable to give the reasons why some protective security risk assessments were not up-to-date at the time of the audit.

[26] Around 44 per cent (18) of muscle strain and repetition injuries involved back related pain.