Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Implementation of Parliamentary Committee and Auditor-General Recommendations — Department of Finance

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The appropriate and timely implementation of agreed recommendations is an important part of realising the full benefit of a parliamentary inquiry or an audit, and for demonstrating accountability to the Parliament.

- This is the sixth in a series of audits. This audit examined recommendations directed to the Department of Finance (Finance).

Key facts

- A schedule of outstanding government responses to parliamentary committee reports is generally presented to the Parliament twice a year.

- Across the Australian Government, one per cent of Senate committee reports and one per cent of House of Representatives committee reports were responded to within the agreed timeframes in the reporting period ending in June 2023.

What did we find?

- Finance has partly implemented the 18 agreed parliamentary committee and Auditor-General recommendations examined in this audit, and its governance arrangements and implementation planning for managing agreed recommendations are partly fit-for-purpose.

What did we recommend?

- The Auditor-General made three recommendations relating to Finance’s: implementation planning; monitoring arrangements; and whole-of-government guidance.

- Finance agreed to the recommendations.

3 out of 6 (50%)

parliamentary committee recommendations fully or largely implemented by Finance.

6 out of 12 (50%)

Auditor-General recommendations fully or largely implemented by Finance.

Summary and recommendations

Background

1. The Department of Finance (Finance) is a central agency that supports the Australian Government’s budget process and public sector resource management, governance and accountability frameworks.1 As a department of state, framework policy owner and material entity, Finance regularly receives recommendations as part of parliamentary committee inquiries and external audit activity by the Australian National Audit Office (ANAO).

2. Parliamentary committee and Auditor-General reports identify risks to the successful delivery of government outcomes and can provide recommendations to address them. Successful implementation of agreed2 recommendations by Australian Government entities requires effective governance arrangements promoting a strong accountability framework, with implementation approaches that set clear responsibilities and timelines for addressing the required actions.

3. The Auditor-General provides independent assurance and reporting to the Parliament as to whether the Executive arm of government is operating and accounting for its performance in accordance with the Parliament’s intent. The Auditor-General’s functions include annual audits of entities’ financial statements, audits of entities’ performance statements, and reviews of entity operations through a program of performance audits. As part of a performance audit, audited entities have the opportunity to provide a formal response to the Auditor-General, which is included in the performance audit report. Where entities agree to Auditor-General recommendations this represents a commitment to Parliament that the entity will undertake the actions agreed to.3

4. This is the sixth in a series of performance audits that has examined the effectiveness of Australian Government entities’ implementation of agreed recommendations from parliamentary committee and Auditor-General reports.4

Rationale for undertaking the audit

5. Parliamentary committee reports and Auditor-General reports, which are prepared for the Parliament, have identified risks to the successful delivery of outcomes by Finance and areas where administrative or other improvements could be made. A number of the identified risks and opportunities relate to Finance’s stewardship of whole-of-government frameworks intended to promote the efficient, effective, economical and ethical use of public resources by entities.5

6. The appropriate and timely implementation of agreed recommendations is an important part of realising the full benefit of a parliamentary inquiry or ANAO audit and demonstrating accountability to the Parliament. For a central agency, the implementation of agreed recommendations relating to whole-of-government frameworks it administers will address identified issues regarding their operation and will support improved public sector performance. This audit provides assurance to the Parliament that recommendations directed to Finance are being implemented as agreed.

Audit objective and criteria

7. The audit objective was to examine whether the Department of Finance (Finance) has implemented a selection of agreed parliamentary committee and Auditor-General recommendations.

8. To form a conclusion against the audit objective, the following high-level criteria were adopted.

- Does Finance have fit-for-purpose governance arrangements to respond to, monitor and implement agreed recommendations?

- Were agreed recommendations effectively implemented?

9. The ANAO reviewed Finance’s implementation of 18 agreed recommendations, comprised of six parliamentary committee recommendations and 12 Auditor-General recommendations.

Conclusion

10. Finance has partly implemented the 18 agreed parliamentary committee and Auditor-General recommendations examined in this audit, and its governance arrangements and implementation planning for managing agreed recommendations are partly fit-for-purpose.

11. Finance has partly fit-for-purpose governance arrangements to respond to, monitor and implement agreed parliamentary committee and Auditor-General recommendations. Finance’s internal arrangements are inconsistent and focus on agreed recommendations made by the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA) and the Auditor-General. They are less focused on agreed recommendations made by other parliamentary committees.

12. Finance has established a fit-for purpose internal system which provides functionality to track its implementation of recommendations, but does not adopt a consistent approach, or apply the full functionality of its system, to its management of all agreed parliamentary and Auditor-General recommendations.

13. There is scope for Finance to apply a fit-for-purpose approach across all types of agreed recommendations, to support its delivery of outcomes in accordance with parliamentary expectations.

14. Finance does not have an internal requirement to develop implementation plans for agreed recommendations, and its implementation planning for the 18 recommendations examined in this audit was partly fit-for-purpose.

15. Eight recommendations were implemented (44 per cent), one was largely implemented (six per cent), one was partly implemented (six per cent), and two were not implemented (11 per cent). For six recommendations, implementation was ongoing (33 per cent). The closure of four recommendations assessed by Finance as ‘implemented’ was not supported by adequate evidence.

Supporting findings

Governance

16. Finance has arrangements in place to identify and respond to the recommendations of all parliamentary committees. Finance’s arrangements include the assignment of responsible officers.

17. Finance has arrangements in place to monitor, report on and close recommendations of the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA). However, they are not clearly documented. Finance does not have such arrangements in place for the recommendations of other parliamentary committees (refer paragraphs 2.4 to 2.54).

18. Finance has documented its internal responsibilities and processes for identifying, responding to and monitoring agreed Auditor-General recommendations.

19. Finance does not have documented processes for identifying implementation actions for agreed Auditor-General recommendations.

20. Finance has documented internal responsibilities and processes for closing and reporting on agreed Auditor-General recommendations (refer paragraphs 2.55 to 2.69).

21. Finance has established a fit-for-purpose internal system (the recommendation tracker) which provides functionality to track its implementation of recommendations, including documenting responsible officers, risk ratings, due dates, updates provided by responsible officers and supporting attachments. With the application of risk mitigation arrangements, appropriate controls are in place to support the integrity of data within Finance’s system.

22. Finance does not adopt a consistent approach, or apply the full functionality of its system, to its management of agreed parliamentary and Auditor-General recommendations. Finance does not require the establishment of risk ratings or due dates for its implementation of agreed JCPAA or Auditor-General recommendations and does not monitor its implementation of agreed non-JCPAA parliamentary committee recommendations.

23. There is scope for Finance to apply a fit-for-purpose approach across all types of agreed recommendations, to support its delivery of outcomes in accordance with parliamentary expectations (refer paragraphs 2.70 to 2.78).

Implementation of recommendations

24. Finance does not have an internal requirement to develop implementation plans for agreed recommendations. For the 18 agreed recommendations examined in this audit, Finance assigned an action officer and responsible officer for 17 recommendations, did not assign a risk rating for any of the recommendations, and assigned an implementation timeframe for four recommendations (refer paragraphs 3.4 to 3.7).

25. Finance monitored the implementation of the five JCPAA recommendations and 12 Auditor-General recommendations examined in this audit. Finance did not centrally monitor implementation of the non-JCPAA recommendation. Implementation updates for the JCPAA recommendations commenced eight months after the government response agreeing to the recommendations was tabled in Parliament. Finance’s monitoring of one Auditor-General recommendation was also delayed (refer paragraphs 3.8 to 3.19).

26. Of the 18 agreed parliamentary committee and Auditor-General recommendations examined in this audit, eight were implemented (44 per cent), one was largely implemented (six per cent), one was partly implemented (six per cent) and two were not implemented (11 per cent). For six recommendations, implementation was ongoing (33 per cent).

27. The ANAO’s review indicated that the closure of four recommendations that Finance assessed as implemented was not supported by adequate supporting evidence.

28. There were four recommendations from Auditor-General Report No. 1 2022–23 Award of Funding under the Building Better Regions Fund that were ‘noted’ by Finance as requiring government consideration. Finance advised government to implement one recommendation and to not implement three recommendations (refer paragraphs 3.20 to 3.34).

Recommendations

Recommendation no. 1

Paragraph 2.28

The Department of Finance strengthen its internal planning arrangements for the implementation of agreed parliamentary committee and Auditor-General recommendations by:

- recording information on implementation responsibilities consistently in its internal recommendation tracker system; and

- establishing and documenting internal requirements for assigning risk ratings, setting implementation timeframes and identifying key actions required for implementation.

Department of Finance response: Agreed.

Recommendation no. 2

Paragraph 2.37

The Department of Finance document and extend its internal arrangements for monitoring the implementation of agreed recommendations made by the Joint Committee of Public Accounts and Audit, to the agreed recommendations made by other parliamentary committees.

Department of Finance response: Agreed.

Recommendation no. 3

Paragraph 2.41

The Department of Finance review its relevant whole-of-government guidance to entities to reinforce the benefits — for accountability, the delivery of undertakings made to the Parliament, and improved public sector performance — of entities having arrangements to monitor the implementation of agreed parliamentary recommendations.

Department of Finance response: Agreed.

Summary of entity response

29. Finance’s summary response is provided below and its full response is included at Appendix 1.

The Department of Finance (Finance) welcomes the report and agrees to the ANAO’s three recommendations to the extent they relate to the effective implementation of parliamentary committee and Auditor-General recommendations directed at improving Finance’s performance.

Finance notes the report recognises the established processes in place to respond to and monitor the implementation of JCPAA and Auditor-General recommendations and will continue to further strengthen and document these processes consistent with the opportunities for improvement identified by the ANAO.

30. The improvements observed by the ANAO during the course of the audit are at Appendix 2.

Key messages from this audit for all Australian Government entities

31. This is the sixth in a series of ANAO performance audits that has examined the effectiveness of entities’ implementation of agreed recommendations from parliamentary committee and Auditor-General reports. In June 2021 the ANAO published an audit insights product, Audit Insights: Implementation of Audit Recommendations, drawing on this audit series for the benefit of all Australian Government entities.6

32. Below are further key messages identified in this audit and which may be relevant for the operations of other Australian Government entities.

Governance and risk management

1. Background

Introduction

1.1 The Department of Finance (Finance) supports the Australian Government’s budget process and public sector resource management, governance and accountability frameworks.7 As a department of state, framework policy owner and material entity, Finance regularly receives recommendations as part of parliamentary committee inquiries and external audit activity by the Australian National Audit Office (ANAO).

1.2 Parliamentary committee and Auditor-General reports identify risks to the successful delivery of government outcomes and can provide recommendations to address them. Successful implementation of agreed8 recommendations by Australian Government entities requires effective governance arrangements promoting a strong accountability framework, with implementation approaches that set clear responsibilities and timelines for addressing the required actions.

1.3 Committees of the Australian Parliament, including the Joint Committee of Public Accounts and Audit (JCPAA), consist of members from one or both Houses of Parliament. Parliamentary committee inquiries ‘investigate specific matters of policy or government administration or performance’.9 Where a parliamentary committee has made policy recommendations, the responsible Minister prepares and tables a government response in Parliament. Where the JCPAA has made administrative recommendations, an entity’s accountable authority may prepare and deliver an ‘Executive Minute’ response to the committee secretary.10

1.4 The Auditor-General provides independent assurance and reporting to the Parliament as to whether the Executive arm of government is operating and accounting for its performance in accordance with the Parliament’s intent. The Auditor-General’s functions include annual audits of Commonwealth entities’ financial statements, audits of entities’ performance statements, and reviews of entity operations through a program of performance audits. As part of a performance audit, audited entities have the opportunity to provide a formal response to the Auditor-General, which is included in the performance audit report.

1.5 This is the sixth in a series of performance audits that has examined the effectiveness of Australian Government entities’ implementation of agreed recommendations from parliamentary committee and Auditor-General reports.11 Details of the previous audits can be found in Appendix 3 of this audit report. The ANAO has also published insights from this series of reports, for the benefit of all entities.12

Timeliness of responses to parliamentary committees

1.6 The tabling in Parliament of an agreed response to a parliamentary committee or Auditor-General recommendation is a formal commitment by the government or an entity to implement the recommended action.

1.7 In this audit series, the Auditor-General has reported on instances where entities have not effectively demonstrated implementation of all agreed recommendations examined by the ANAO.13 In response to these findings, the Secretary of the Department of the Prime Minister and Cabinet (PM&C) wrote to departmental secretaries on 7 August 2019 as follows:

The presentation of documents to the Parliament is an important component of the Government’s accountability to the Parliament and the broader community. It is critical for responsible agencies to monitor and implement the parliamentary committee’s recommendations agreed to by the Government.

Accordingly, I strongly encourage departments and agencies to finalise Government responses to parliamentary committee reports in a timely manner so that the Government can table its response to a committee report within the timeframes established through the respective resolutions of the House of Representatives and the Senate.

…

In addition to providing timely responses to Committee reports, it is important that departments and agencies have processes in place to monitor the implementation of the recommendations accepted by the Government. This includes Secretaries providing regular updates to their Minister(s) on implementation progress.

1.8 The PM&C Secretary also asked that recipients ‘distribute my letter to agencies within your portfolio’. Finance advised the ANAO that it could not find supporting documentation to indicate that the letter was shared by the Finance Secretary with the department’s portfolio entities.14

Parliamentary reporting

1.9 The President of the Australian Senate (President) and the Speaker of the House of Representatives (Speaker) present a report to the Senate and House, respectively, on the status of all government responses twice a year.15 Reports remain on this schedule until:

- a response is received;

- the relevant committee agrees that a response is no longer expected; or

- a request to remove an inquiry from the list is received and agreed.

1.10 Table 1.1 (below) outlines the key results from the President’s reports at 31 December 2022 and 30 June 2023. Report responses are required within three months of a report being presented to the Senate.

Table 1.1: Senate — outstanding government responses at 31 December 2022 and 30 June 2023a

|

Description |

Number |

Percentage |

Number |

Percentage |

|

|

At 31 December 2022 |

At 30 June 2023 |

||

|

No. of reports with a response |

31bc |

9 |

40bd |

11 |

|

No. of reports with a response that was received within the specified timeframe |

4 |

1 |

3 |

1 |

|

No. of reports with a response but received late |

27c |

8 |

37d |

10 |

|

No. of reports with no response |

319 |

91 |

333 |

89 |

|

Total number of reports included in the schedule |

350e |

100 |

373e |

100 |

|

Shortest timeframe taken to respond |

< 1 month |

– |

1 month and 2 days |

– |

|

Longest timeframe where a response was provided |

25 months (2 years and 1 month) |

– |

147 months (12 years and 3 months) |

– |

|

Latest pending response (not yet received) |

239 months (19 years and 11 months) |

– |

248 months (20 years and 8 months) |

– |

Note a: Includes Senate and joint committee data. The numbers in the table can fluctuate as reports are added and removed from the schedule. The circumstances under which reports are removed from the schedule is outlined in paragraph 1.9. The ANAO identified discrepancies between Senate and House reporting and could not obtain assurance over the completeness and accuracy of this data. For example, some joint committee reports were not included in the reporting.

Note b: Total numbers include 14 partial responses in the December 2022 report and 14 partial responses in the June 2023 report. Partial responses occur where responses have been received for some but not all recommendations. This typically occurs where recommendations are directed at multiple entities.

Note c: Fifteen JCPAA reports were listed in the President’s December 2022 report. There were no complete responses and 12 partial responses. All responses were late.

Note d: Sixteen JCPAA reports were listed in the President of the Senate’s June 2023 report. There were 12 partial responses, three interim responses and one outstanding response. All responses that were due to be provided were late.

Note e: The time allowed for responding had expired for the 319 reports with no response in the December 2022 report and had not yet expired for 23 of the 333 reports with no response in the June 2023 report.

Source: ANAO analysis of Senate reporting.

1.11 Table 1.2 (below) outlines the key results from the Speaker’s report at 30 November 2022 and 20 June 2023. Report responses are required within six months of a report being presented to the House.

Table 1.2: House — outstanding government responses at 30 November 2022 and 20 June 2023a

|

Description |

Number |

Percentage |

Number |

Percentage |

|

|

At 30 November 2022 |

At 20 June 2023 |

||

|

No. of reports with a response |

38bc |

22 |

30bd |

20 |

|

No. of reports with a response that was received within the specified timeframe |

11 |

6 |

2 |

1 |

|

No. of reports with a response but received late |

27c |

16 |

28d |

18 |

|

No. of reports with no response |

132 |

78 |

122 |

80 |

|

Total number of reports included in the schedule |

170e |

100 |

152e |

100 |

|

Shortest timeframe taken to respond |

< 2 months |

– |

< 1 month |

– |

|

Longest timeframe where a response was provided |

39 months (3 years and 3 months) |

– |

27 months (2 years and 3 months) |

– |

|

Latest pending response (not yet received) |

162 months (13 years and 6 months) |

– |

119 months (9 years and 11 months) |

– |

Note a: Includes House and joint committee data. The numbers in the table can fluctuate as reports are added and removed from the schedule. The circumstances under which reports are removed from the schedule is outlined in paragraph 1.9. The ANAO identified discrepancies and could not obtain assurance over the completeness and accuracy of this data. For example, some joint committee reports were not included in the reporting.

Note b: Total numbers include 15 partial responses in the November 2022 report and 12 partial responses in the June 2023 report. Partial responses occur where responses have been received for some but not all recommendations. This typically occurs where recommendations are directed at multiple entities. An Executive Minute to the JCPAA is recorded as a partial response.

Note c: Seventeen JCPAA reports were listed in the Speaker’s report. There were 14 responses provided, all of these were partial responses, and nine were provided late. Three reports have received no response and are overdue.

Note d: Fourteen JCPAA reports were listed in the Speaker’s report. There were 11 responses provided, all of these were partial responses, and all were provided late. Three reports have received no response and two are overdue.

Note e: The time allowed for responding had not yet expired for: 27 of the 132 reports with no response in the November 2022 report; and 14 of the 122 reports with no response in the June 2023 report.

Source: ANAO analysis of House of Representatives reporting.

1.12 In summary, Tables 1.1 and 1.2 (above) indicate that very few responses to parliamentary committee reports were received in the required timeframes. During the reporting period ending in June 202316:

- one per cent, or three of the 373 Senate and joint committee reports, received a response within the three-month timeframe; and

- one per cent, or two of the 152 House and joint committee reports, received a response within the six-month timeframe.

1.13 The ANAO has also reported, in this series of performance audits, that compliance with expected response times has been low for the Parliamentary committee recommendations reviewed by the ANAO.

Department of Finance

1.14 The Administrative Arrangements Order (AAO) sets out the matters dealt with by the Department of Finance, which is a Department of State and the lead entity in the portfolio.17 Many of the matters listed in the AAO are dealt with by portfolio entities.18

1.15 The department directly administers a range of matters, which it summarised as follows in its 2022–23 Annual Report:

Our responsibilities encompass the full range of public administration functions from developing policy through to implementing and reviewing programs. We have stewardship of whole-of-government frameworks to provide accountability and deliver outcomes.

Our responsibilities include:

- supporting the delivery of the Budget and key economic updates

- supporting the management and use of public resources

- supporting sound commercial decision making

- delivering and facilitating shared services, common ICT services, whole-of-government procurement arrangements, and insurance and risk management

- supporting parliamentarians and their staff and ensuring safe and respectful Commonwealth parliamentary workplaces

- leading development of the Data and Digital Government Strategy for the APS, and

- administering the DATA Scheme through the National Data Commissioner and their office.19

1.16 In its 2023–24 Corporate Plan, the department described its purpose as follows:

Finance provides high quality advice, frameworks and services to achieve value in the management of public resources for the benefit of all Australians.20

1.17 The department is a ‘central agency’, with a variety of whole-of-government policy, advising and co-ordination roles, as listed above. As a central agency, Finance is also a model for other entities in its execution of functions under the frameworks it administers.21

1.18 Under the framework established by the Public Governance, Performance and Accountability Act 2013 (PGPA Act), the department’s accountable authority is the Secretary of Finance. The Secretary is also an agency head under the Public Service Act 1999 (PS Act), and the department’s officials are Australian Public Service (APS) employees subject to the PS Act.22

1.19 Table 1.3 shows the department’s budget and staffing levels for 2023–24.

Table 1.3: Budget and average staffing levels, Department of Finance, 2023–24

|

Entity |

Average staffing levela |

Total resourcing ($million) |

|

Department of Finance |

1,550 |

63,774.4 |

Note a: Average staffing level is a method of counting that adjusts for casual and part-time staff to show the average number of full-time equivalent employees.

Source: Australian Government, Portfolio Budget Statements 2023–24, Budget Related Paper No. 1.7: Finance Portfolio, Commonwealth of Australia, Canberra, 2023.

Rationale for undertaking the audit

1.20 Parliamentary committee reports and Auditor-General reports, which are prepared for the Parliament, have identified risks to the successful delivery of outcomes by Finance and areas where administrative or other improvements could be made. A number of the identified risks and opportunities relate to Finance’s stewardship of whole-of-government frameworks intended to promote the efficient, effective, economical and ethical use of public resources by entities.23

1.21 The appropriate and timely implementation of agreed recommendations is an important part of realising the full benefit of a parliamentary inquiry or ANAO audit and demonstrating accountability to the Parliament. For a central agency, the implementation of agreed recommendations relating to whole-of-government frameworks it administers will address identified issues regarding their operation and will support improved public sector performance. This audit provides assurance to the Parliament that recommendations directed to Finance are being implemented as agreed.

Audit approach

Audit objective, criteria and scope

1.22 The audit objective was to examine whether the Department of Finance (Finance) has implemented a selection of agreed parliamentary committee and Auditor-General recommendations.

1.23 To form a conclusion against the audit objective, the following high-level criteria were adopted.

- Does Finance have fit-for-purpose governance arrangements to respond to, monitor and implement agreed recommendations?

- Were agreed recommendations effectively implemented?

1.24 For the purposes of this audit, an ‘agreed’ recommendation means:

- agreed by Finance (for recommendations directed to the department); and

- noted by Finance (for recommendations directed to government that relate to Finance responsibilities and which require government consideration).24

1.25 To allow sufficient time for implementation, the agreed recommendations examined in Chapter 3 of this audit were limited to the following two categories.

- Parliamentary committee reports tabled between December 2020 and July 2022, where a government response was received prior to 31 July 2023, including those agreed to or noted, with an action item allocated to Finance.

- Auditor-General reports tabled between December 2020 and July 2022.

1.26 The scope of this audit did not include:

- parliamentary committee reports where the subject of the report was a review of annual reports; or

- recommendations that were agreed to by other entities within the Finance portfolio.

1.27 The ANAO reviewed Finance’s implementation of 18 agreed recommendations, comprised of six parliamentary committee recommendations and 12 Auditor-General recommendations. Table 1.4 (below) lists the source and number of agreed recommendations examined in this audit. For details of the recommendations selected for review, see Appendix 4 and Appendix 5.

Table 1.4: Parliamentary committee and Auditor-General reports and recommendations examined in this audit

|

Author |

No. of reports |

No. of agreed recommendations |

|

Senate Foreign Affairs, Defence and Trade Legislation Committee |

1 |

1 |

|

Joint Committee of Public Accounts and Audit |

1 |

5 |

|

Auditor-General |

5 |

12 |

|

Total |

7 |

18 |

Source: ANAO analysis.

Audit methodology

1.28 The audit involved:

- reviewing entity documentation such as guidelines, procedures, management reports, audit committee papers, meeting minutes, briefing materials, implementation plans, closure packs and other supporting evidence relating to monitoring progress and reporting against agreed recommendations;

- examining Information Technology (IT) system controls and supporting documentation for those systems used to manage recommendations; and

- meetings with relevant entity staff.

1.29 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $250,000.

1.30 The team members for the audit were James Sheeran, Stephanie Gill, Alexandra McFadyen, Kelvin Le and Susan Drennan.

2. Governance

Areas examined

This chapter examines whether the Department of Finance (Finance) has fit-for-purpose governance arrangements to respond to, monitor and implement agreed parliamentary committee and Auditor-General recommendations.

Conclusion

Finance has partly fit-for-purpose governance arrangements to respond to, monitor and implement agreed parliamentary committee and Auditor-General recommendations. Finance’s internal arrangements are inconsistent and focus on agreed recommendations made by the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA) and the Auditor-General. They are less focused on agreed recommendations made by other parliamentary committees.

Finance has established a fit-for purpose internal system which provides functionality to track its implementation of recommendations, but does not adopt a consistent approach, or apply the full functionality of its system, to its management of all agreed parliamentary and Auditor-General recommendations.

There is scope for Finance to apply a fit-for-purpose approach across all types of agreed recommendations, to support its delivery of outcomes in accordance with parliamentary expectations.

Areas for improvement

The ANAO made three recommendations aimed at Finance: strengthening its internal planning arrangements for the implementation of agreed recommendations; documenting and extending its arrangements for monitoring the implementation of agreed JCPAA recommendations to all agreed parliamentary committee recommendations; and reviewing relevant whole-of-government guidance to reinforce the benefits of entities having arrangements to monitor the implementation of agreed parliamentary recommendations.

The ANAO identified two opportunities for improvement relating to Finance: amending its template on machinery of government matters to require entities to identify outstanding parliamentary committee recommendations when transferring functions between entities; and extending its internal assurance arrangements, for the scrutiny of agreed JCPAA and Auditor-General recommendations, to all agreed parliamentary committee recommendations.

2.1 The tabling in Parliament of an agreed response to a parliamentary committee or Auditor-General recommendation is a formal commitment by the government or an entity to implement the recommended action.

2.2 Key observations from previous ANAO audit activity include the importance of governance arrangements to respond to, monitor and implement recommendations. These arrangements include:

- establishing processes and responsibilities for responding to recommendations;

- clearly assigning responsibility for the progression of individual recommendations;

- having systems in place to monitor and track the implementation of recommendations; and

- reporting to and review by audit committees.25

2.3 Entities that do not have fit-for-purpose processes or procedures for the implementation of recommendations increase the risk of inconsistency in administration and decision-making. They are also less likely to implement recommendations in accordance with commitments made to the Parliament, which is an indicator of the entity’s commitment to improving public administration and accountability to Parliament.

Does Finance have fit-for-purpose governance arrangements and processes to respond to, monitor and implement agreed parliamentary committee recommendations?

Finance has arrangements in place to identify and respond to the recommendations of all parliamentary committees. Finance’s arrangements include the assignment of responsible officers.

Finance has arrangements in place to monitor, report on and close recommendations of the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA). However, they are not clearly documented. Finance does not have such arrangements in place for the recommendations of other parliamentary committees.

2.4 In assessing governance arrangements, the ANAO considered if Finance had established roles and responsibilities for the oversight of its implementation of recommendations, and a risk management framework.

2.5 In assessing processes, the ANAO considered if Finance had clear and documented guidance on the steps involved in implementing a recommendation, including identifying and responding to recommendations, implementation planning, monitoring, closure and reporting.

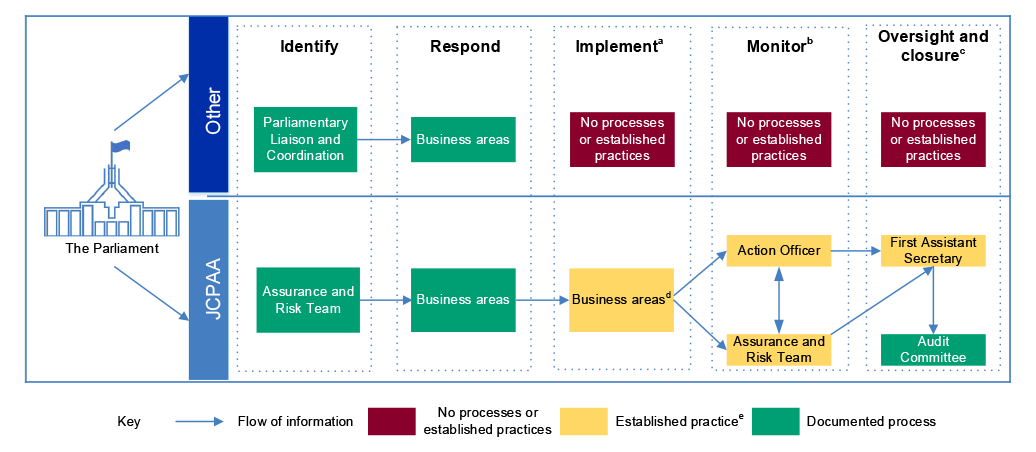

2.6 Figure 2.1 (below) illustrates the ANAO’s analysis of Finance’s internal governance arrangements, processes and practices, and maps the responsibilities within Finance to respond to, monitor and implement agreed parliamentary recommendations.

2.7 In summary, Figure 2.1 indicates the following.

- Finance has arrangements in place to identify and respond to the recommendations of all parliamentary committees. Finance’s arrangements include the assignment of responsible officers.

- Finance has arrangements in place to monitor, report on and close recommendations of the JCPAA. However, they are not clearly documented.

- Finance does not have arrangements in place to monitor, report on and close recommendations of other parliamentary committees.

Figure 2.1: Department of Finance — processes and established practices to respond to, monitor and implement agreed parliamentary committee recommendations

Note a: Includes planning for implementation and implementation activities.

Note b: ‘Monitor’ refers to the administrative process of compiling updates on the implementation of recommendations and preparing reports.

Note c: As discussed in paragraphs 2.50 and 2.51, between November 2022 and June 2023, Finance documentation indicated that the Audit Committee approved closure of JCPAA recommendations. In June 2023 Finance’s Audit Committee clarified that its role is to endorse closure.

Note d: Finance assigned responsibility to Action Officers and Responsible Officers but did not have processes for assigning risk ratings, timeframes or implementation actions/activities.

Note e: The ANAO considered an established practice to be actions that were consistently followed to achieve an outcome, but the practice was not documented.

Source: ANAO analysis of Finance information.

Arrangements for identifying parliamentary committee recommendations

2.8 The existence of processes that identify all parliamentary committee reports and recommendations relevant to an entity demonstrates accountability and provides assurance to responsible ministers, the entity’s accountable authority and the Parliament that the issues identified in committee reports are being considered.

2.9 Government responses to parliamentary committee reports are prepared by the portfolio lead entity, which consults with other entities as required. The Department of the Prime Minister and Cabinet’s (PM&C) Tabling Office identifies and notifies the relevant department that it is the lead entity for the government response. Finance advised the ANAO that it is the lead entity for most government responses in the Finance portfolio.26

2.10 Finance has a process in place for identifying relevant parliamentary recommendations where it is the lead entity. Finance’s Parliamentary Liaison and Coordination (PLC) team monitors relevant parliamentary inquiries and confirms with PM&C’s Tabling Office that Finance is the lead entity for a government response. Further, JCPAA inquiries are monitored by Finance’s Assurance and Risk team and PGPA Communications business area.27

Managing machinery of government changes

2.11 Machinery of government (MOG) changes occur when the Australian Government decides to reorganise how it manages its responsibilities.28 This can result in responsibility for the implementation of recommendations transferring between portfolios. One MOG change occurred during the period reviewed in this audit (discussed in paragraph 1.25), which resulted in Finance assuming additional responsibilities.29

2.12 As a central agency, Finance has a whole-of-government role in respect to MOG changes. Finance’s website links to ‘tools and templates’ for MOG changes, which includes a ‘Common Task Tool’. The ‘Common Task Tool’ prompts entities to identify outstanding recommendations from audits and parliamentary inquiries.

2.13 Finance has also developed a ‘Due Diligence Template’ for MOG changes, which is intended to facilitate the exchange of information between entities subject to a MOG change.30 The template references governance and financial management information, contracts, ongoing legal action and audits in progress. The template does not reference parliamentary committee recommendations transferring between entities due to a MOG change. Finance advised the ANAO that:

If a function transfers due to a machinery of government change and they are the lead on a government response, the change of portfolio is captured as part of the next six-monthly Status of Government Responses report prepared for the Department of [the] Prime Minister and Cabinet (PM&C).

Any function transferring into Finance will bring with them their relevant work program. Should they be carrying a parliamentary recommendation this will transfer with the function and will continue to be actioned as required by the business area.

2.14 There is scope for Finance to consider amending the Due Diligence Template for MOG changes to include a reference to any key parliamentary matters to be transferred between entities, such as outstanding parliamentary committee recommendations.

|

Opportunity for improvement |

|

2.15 To assist the identification and effective transfer of functions following machinery of government (MOG) changes, Finance could consider amending its ‘Due Diligence Template’ for MOG changes to include a reference to any key parliamentary matters such as outstanding parliamentary committee recommendations. |

Arrangements for responding to parliamentary committee recommendations

2.16 Establishing clear arrangements for responding to parliamentary committee recommendations assists an entity to understand the intent of the recommendation and identify appropriate and achievable activities to address the identified risks. Responding to parliamentary committee recommendations is the responsibility of government, with departments providing advice.

2.17 Finance has documented its internal responsibilities and processes for responding to parliamentary committee recommendations. Finance’s Parliamentary Liaison and Coordination team (PLC, discussed in paragraph 2.10) identifies the relevant Finance business area, which is assigned responsibility for preparing the proposed government response for consideration by its Minister(s) and, as necessary, the Prime Minister.

Timeliness of responses

2.18 Entities are required by the Parliament to respond to parliamentary committee reports within three or six months, depending on the type of committee.31 This timeframe includes ministerial consideration.

2.19 Finance advised the ANAO that the business area leading the government response is aware of the timeframes and will actively manage the response against them, however this requirement is not documented. Finance does not actively monitor response timeframes. Finance provides updates to PM&C through PM&C’s ‘Status of government responses in the Senate to parliamentary committee reports.’

2.20 Table 2.1 (below) indicates that in the past five years, 20 per cent of parliamentary committee recommendations directed to Finance were responded to within the set timeframes.32

Timeliness of Finance responses to parliamentary committee recommendationsa

|

Description |

Number |

|

No. of reports relevant to Finance |

22 |

|

No. of recommendations relevant to Finance |

44 |

|

No. of recommendations responded to |

19 |

|

No. of recommendations for which a response was tabled within Senate and House of Representatives timeframes |

9b |

|

Percentage of responses to parliamentary committee recommendations tabled within Senate and House of Representatives timeframes |

20% |

Note a: Recommendations directed to Finance from July 2018 to July 2023 and responded to within Senate and House of Representatives timeframes. This includes recommendations in parliamentary committee reports which reference Finance in the text of the recommendation. There may be additional recommendations relevant to Finance that were not captured.

Note b: PM&C Tabling Guidelines state that government responses to joint committee recommendations are required within three months (Department of the Prime Minister and Cabinet, Tabling Guidelines, PM&C, Canberra, 2022, p. 11).

Note c: As at December 2023, the JCPAA advises entities that government responses are due within six months of the recommendation being made. (Parliament of Australia, Joint Committee of Public Accounts and Audit, Role of the Committee, available from https://www.aph.gov.au/Parliamentary_Business/Committees/Joint/ Public_Accounts_and_Audit/Role_of_the_Committee [accessed 11 December 2023]).

Note d: For JCPAA recommendations, the ANAO has applied the six month timeframe.

Source: ANAO analysis of parliamentary committee reports.

2.21 As discussed in paragraph 1.7, the Secretary of the Department of the Prime Minister and Cabinet wrote to departmental secretaries on 7 August 2019 as follows:

The presentation of documents to the Parliament is an important component of the Government’s accountability to the Parliament and the broader community. It is critical for responsible agencies to monitor and implement the parliamentary committee’s recommendations agreed to by the Government.

Accordingly, I strongly encourage departments and agencies to finalise Government responses to parliamentary committee reports in a timely manner so that the Government can table its response to a committee report within the timeframes established through the respective resolutions of the House of Representatives and the Senate.

2.22 Finance’s performance in responding to parliamentary recommendations is not consistent with those expectations nor the expectations of the Parliament, which has well-established timeframes for responses. A stronger focus on meeting accountability obligations, including through timely responses to parliamentary recommendations, would contribute to improved public sector performance.

Arrangements for implementing parliamentary committee recommendations

2.23 Timely and successful implementation of parliamentary committee recommendations is facilitated by fit-for-purpose implementation plans that clearly identify the intent of the recommendations and associated actions, set clear responsibilities and timeframes for addressing required actions and measures of success and/or outcomes to be realised. Where implementation plans are not prepared, past audit evidence indicates that actions are not always implemented to address the identified issue, not implemented in a timely way, or not implemented at all.33

Assigning responsibility and implementation planning

2.24 Finance has documented processes for assigning internal responsibility for the implementation of parliamentary committee recommendations directed to it. However, there is inconsistency in its recording of relevant information. Action officers and responsible officers34 for JCPAA recommendations are recorded in Finance’s recommendation tracker system.35 Equivalent information for the recommendations of other parliamentary committees is not centrally recorded.

2.25 Finance does not have documented processes for planning its implementation of parliamentary committee recommendations. There are no documented requirements for:

- assigning risk ratings;

- setting implementation timeframes; or

- identifying key specific actions or activities required to implement recommendations.

2.26 Assigning risk ratings can help identify the impact on the entity if recommendations are not implemented. Establishing timeframes for implementing recommendations, and meeting them, is another way entities can ensure recommendations are implemented and that any risks or issues that led to the recommendations being made are addressed in a timely fashion.

2.27 There is scope for Finance to strengthen its implementation planning by: recording information on responsibilities consistently in its recommendation tracker system; and documenting requirements for assigning risk ratings, setting implementation timeframes, and identifying key actions required for implementation. Establishing a requirement to identify key actions would provide greater assurance that implementation is likely to be in accordance with the intent of the recommendation, particularly where recommendations are complex or technical in nature. It would also assist those responsible for reviewing status updates and recommendation closure reports (including senior leaders and the audit committee) as actions completed could be compared to the planned actions or activities. There would also be benefit in extending such arrangements to Finance’s implementation planning for Auditor-General recommendations (discussed in paragraphs 2.61 to 2.63).

Recommendation no.1

2.28 The Department of Finance strengthen its internal planning arrangements for the implementation of agreed parliamentary committee and Auditor-General recommendations by:

- recording information on implementation responsibilities consistently in its internal recommendation tracker system; and

- establishing and documenting internal requirements for assigning risk ratings, setting implementation timeframes and identifying key actions required for implementation.

Department of Finance response: Agreed.

2.29 Finance will strengthen internal planning arrangements for the implementation of Auditor-General recommendations, and parliamentary committee recommendations directed to Finance, through a consistent record of implementation responsibilities and appropriate internal arrangements to establish and assign risk ratings, implementation timeframes and key actions for implementation.

2.30 As discussed in paragraph 3.17, in the context of its planning, there is also scope for Finance to factor in any implementation timeframes proposed by parliamentary committees.

Monitoring and oversight of parliamentary committee recommendations

2.31 Effective monitoring requires oversight arrangements and an approach that accurately tracks progress and records the actions of the business area, or individual, responsible for implementing a recommendation.

2.32 Under its Charter, one of the Finance Audit Committee’s roles is ‘to review and give independent advice regarding the appropriateness of the department’s … system of internal control’. Listed as part of Finance’s control framework are: ‘relevant parliamentary committee reports and external reviews, internal and ANAO audit reports, providing advice to the Secretary about significant issues identified and the implementation of agreed actions.’

2.33 In March 2019, the Finance Audit Committee requested options for centrally monitoring JCPAA recommendations as part of the audit recommendation tracking process. Finance agreed to brief the Audit Committee on open JCPAA recommendations from August 2019. In August 2019 Finance reported to the Audit Committee that it had sought advice from divisions within Finance and no division reported having open JCPAA recommendations. The first update on JCPAA recommendations was provided to the Audit Committee in June 2021. Prior to this, Finance records indicate that the department regularly advised the Audit Committee that it had sought advice from divisions regarding open JCPAA recommendations and that no business area had advised of any open JCPAA recommendations.

2.34 Finance’s arrangements for monitoring JCPAA recommendations are not clearly documented in its documentation on tracking recommendations. However, Finance follows the process for monitoring Auditor-General recommendations, which is documented. Prior to an Audit Committee meeting, Finance’s Assurance and Risk team requests updates on open recommendations. Updates are prepared by action officers in Finance’s recommendation tracker system and approved by the responsible officer (First Assistant Secretary/SES Band 2 level). The Assurance and Risk team presents updates in a report prepared for the Audit Committee. Finance provided written updates on the implementation of JCPAA recommendations at all 11 Audit Committee meetings held between October 2021 and November 2023 (the period for which recommendations assessed in this audit were open). As discussed in paragraph 3.11, there was a delay in reporting the recommendations under review in this audit.36

2.35 Finance has not established monitoring or oversight arrangements for the implementation of non-JCPAA recommendations. In November 2023, Finance advised the ANAO that it ‘predominantly monitors recommendations from the JCPAA and the ANAO (noting their oversight roles) as the recommendations go to the frameworks we are responsible for, namely the PGPA.’ In October 2023, Finance advised the ANAO that:

Monitoring and oversight of implementation of non-JCPAA parliamentary committee recommendations is the responsibility of the relevant line area having already been allocated lead responsibility for the Government response to the inquiry report. Having regard to the nature of the Government response and the identified commitments, the appropriate line area manages implementation of the desired outcomes from the recommendations given the direct relevance to the work of the area. This recognises the authority, knowledge and expertise of the line area with responsibility for delivering the intended outcomes of the activity in question. Overall accountability resides with the relevant SES leadership role for meeting obligations to support Finance delivering against its purpose for the government of the day.

2.36 There is scope for Finance to fully document its existing monitoring and oversight arrangements applying to JCPAA recommendations, and to extend those arrangements to include agreed recommendations made by all parliamentary committees.

Recommendation no.2

2.37 The Department of Finance document and extend its internal arrangements for monitoring the implementation of agreed recommendations made by the Joint Committee of Public Accounts and Audit, to the agreed recommendations made by other parliamentary committees.

Department of Finance response: Agreed.

2.38 Finance will document the internal arrangements for monitoring the implementation of agreed recommendations made by the JCPAA and by other parliamentary committees where Finance is responsible for implementation noting different arrangements may be appropriate for administrative recommendations directed to entities as compared to recommendations directed to the Government which go to matters of legislation and policy.

2.39 Other reports in this audit series have presented similar findings regarding inconsistency in entity arrangements for the oversight of parliamentary committee recommendations, or the absence of such arrangements.37 These findings have informed the ANAO Insights product on Implementation of Recommendations published in June 2021.38

2.40 As discussed in paragraph 1.15, Finance states that it has ‘stewardship of whole-of-government frameworks to provide accountability and deliver outcomes.’ This includes the framework for entity audit committees established under the finance law. As a central agency, Finance also has a role as a model for other entities in its execution of functions under the frameworks it administers.39 There is an opportunity for Finance to reinforce the benefits — for accountability, the delivery of undertakings made to the Parliament, and improved public sector performance — of entities having arrangements to monitor the implementation of agreed parliamentary recommendations. Finance’s Resource Management Guide (RMG) No. 202, on the role of audit committees, currently provides examples of functions audit committees could undertake, including ‘reviewing the implementation of agreed recommendations from ANAO audits or JCPAA and other parliamentary committee reports directed to the entity.’40

Recommendation no.3

2.41 The Department of Finance review its relevant whole-of-government guidance to entities to reinforce the benefits — for accountability, the delivery of undertakings made to the Parliament, and improved public sector performance — of entities having arrangements to monitor the implementation of agreed parliamentary recommendations.

Department of Finance response: Agreed.

2.42 Finance notes that Resource Management Guide 202: Audit Committees already provides that an accountable authority could include additional requirements within its audit committee charter to ‘[satisfy] itself that the entity has appropriate mechanisms for reviewing relevant parliamentary committee reports, external reviews and evaluations of the entity and implementing, where appropriate, any resultant recommendations’ (source section 1.5 RMG-202).

2.43 Finance will review this guidance and consider whether additional information should be included in RMG-202, noting different arrangements may be appropriate for administrative recommendations directed to entities as compared to recommendations directed to the Government which go to matters of legislation and policy.

Closure and reporting of parliamentary committee recommendations

Closure of recommendations

2.44 When recommendations have been implemented, it is important they are formally closed and that prior to closure, evidence of implementation is subject to an appropriate level of scrutiny to ensure recommendations have been implemented in full and in accordance with the intent of the recommendation.

2.45 While not specifically identified in Finance’s process documentation, in practice JCPAA recommendations are subject to a closure process.41 For the period reviewed in this audit, Finance did not have documented responsibilities and processes for the closure of recommendations made by other parliamentary committees.

2.46 On 8 November 2022, Finance established a requirement for a closure request form to be completed prior to recommendations being closed, which it has applied to JCPAA and Auditor-General recommendations. The form includes fields for ‘Details of Implementation’ and ‘Supporting Evidence’ and requires approval by the recommendation’s Responsible Officer (First Assistant Secretary/SES Band 2). Finance advised the ANAO in October 2023 that ‘supporting evidence is available to the Audit Committee upon request’. Finance further advised the ANAO in November 2023 that there were ‘no records of the Audit Committee members requesting further evidence’ relating to recommendations within the scope of this audit that had been closed.

2.47 Recommendations made in internal audits and management-initiated reviews are subject to scrutiny by Finance’s internal audit function before being presented to the Audit Committee. For the recommendations under review closed prior to November 202342, Finance did not provide the ANAO with evidence of a comparable quality assurance check applying to the closure of parliamentary committee recommendations, to help the Audit Committee determine if there is adequate evidence for closure and whether the intent of the recommendation had been met.

2.48 In November 2023, in the course of this audit, Finance introduced a Standard Operating Procedure for audit recommendations, which established a requirement that all closure packs for JCPAA and Auditor-General recommendations be reviewed by the Head of Internal Audit and Finance’s internal audit function prior to being submitted to the Audit Committee for its endorsement. Extending this requirement to other parliamentary committee recommendations would also help Finance’s Audit Committee determine if there is adequate evidence for the closure of those recommendations.

|

Opportunity for improvement |

|

2.49 Finance could extend its internal assurance arrangements, for the scrutiny of agreed JCPAA and Auditor-General recommendations, to all agreed parliamentary recommendations. |

Clarifying the role of Finance’s Audit Committee

2.50 Finance’s internal closure request form for recommendations that was in use between November 2022 and June 2023 had a field for recording the Audit Committee’s ‘approval’ of closure. This was contrary to the role of audit committees outlined in Finance’s whole-of-government guidance on audit committees, Resource Management Guide No. 202, which states that:

An audit committee has no managerial responsibilities. It does not make decisions in relation to the entity’s processes and functions. It is intended to provide independent advice to the accountable authority.43

2.51 The minutes from Finance’s June 2023 Audit Committee meeting recorded that ‘Committee members observed that the Audit Committee endorses, rather than approves the actions taken to implement and close internal and external audit recommendations. … Closure packs are approved by First Assistant Secretary and provided to Audit Committee for endorsement.’ The internal form template was updated, for the August 2023 Audit Committee meeting, to reflect this. This change was also captured in the November 2023 Standard Operating Procedure referred to in paragraph 2.48.

External reporting

2.52 Entities are required to provide updates to PM&C on outstanding government responses to parliamentary committee inquiries. Finance advised the ANAO that as the portfolio department, it will lead most government responses. PM&C provides guidance on how to prepare these reports and Finance documentation indicates that it provided input when requested by the PM&C Tabling Office.

2.53 Entities are not required to report on the implementation status or closure of agreed recommendations to the Parliament, unless requested.44 The JCPAA requested that Finance report back on one recommendation examined as part of this audit. The JCPAA’s Report 484 The Administration of Government Grants (2020) was tabled in December 2020 and Recommendation 3 was that Finance undertake a review and report to the committee on its outcomes within six months of the report’s tabling.45

2.54 The government response to this recommendation stated that: ‘The Government supports the Department of Finance undertaking a review … and reporting back to the Committee once this work is completed.’ The June 2022 update captured in Finance’s internal recommendation tracker stated that: ‘With the change of Government, this comeback is extinguished. The Recommendation 3 review will be rolled into the broader review of the CGRGs [Commonwealth Grants Rules and Guidelines].’46 At November 2023 the review was not finalised and the JCPAA had not received a report on Recommendation 3.

Does Finance have fit-for-purpose governance arrangements and processes to respond to, monitor and implement agreed Auditor-General recommendations?

Finance has documented its internal responsibilities and processes for identifying, responding to and monitoring agreed Auditor-General recommendations.

Finance does not have documented processes for identifying implementation actions for agreed Auditor-General recommendations.

Finance has documented internal responsibilities and processes for closing and reporting on agreed Auditor-General recommendations.

2.55 Auditor-General reports are prepared for the Parliament and provide independent reporting and assurance on entities’ administration. They identify risks to the successful delivery of government outcomes and provide recommendations to address them. Where entities agree to Auditor-General recommendations this represents a commitment to Parliament that the entity will undertake the actions agreed to.47

2.56 Figure 2.2 (below) illustrates Finance’s internal processes and established practices to respond to, monitor and implement agreed Auditor-General recommendations. In summary, Finance:

- has documented its internal responsibilities and processes for identifying, responding to and monitoring agreed Auditor-General recommendations;

- does not have documented processes for identifying implementation actions for agreed Auditor-General recommendations; and

- has documented internal responsibilities and processes for closing and reporting on agreed Auditor-General recommendations.

Figure 2.2: Department of Finance — processes and established practices to respond to, monitor and implement agreed Auditor-General recommendations

Note a: Includes planning for implementation and implementation activities.

Note b: ‘Monitor’ refers to the administrative process of compiling updates on the implementation of recommendations and preparing reports.

Note c: As discussed in paragraphs 2.50 and 2.51, between November 2022 and June 2023, Finance documentation indicated that the Audit Committee approved closure of Auditor-General recommendations. In June 2023 Finance’s Audit Committee clarified that its role is to endorse closure.

Note d: Finance assigned responsibility to Action Officers and Responsible Officers but did not have processes for assigning risk ratings, timeframes or implementation actions/activities.

Note e: The ANAO considered an established practice to be actions that were consistently followed to achieve an outcome, but the practice was not documented.

Source: ANAO analysis of Finance information.

Arrangements for identifying and responding to Auditor-General recommendations

Identifying recommendations

2.57 The Auditor-General provides a copy, or relevant extract, of each proposed performance audit report to the accountable authority of an entity involved in the audit, and requests written comments from the accountable authority within 28 days.48 This process was documented by Finance.

Responding to recommendations

2.58 Finance has documented responsibilities and processes to respond to Auditor-General recommendations. Finance’s Assurance and Risk team performs a central coordination role and identifies the responsible business area/s during an ANAO audit. The identified business area is responsible for drafting a proposed Finance response to Auditor-General recommendations. The final response is approved by the Secretary.

2.59 In their responses, entities should clearly state whether they intend to implement the audit recommendation. For the 12 Auditor-General recommendations assessed as part of this audit, Finance ‘agreed’ to eight and ‘noted’ four. The four ‘noted’ recommendations related to amending the grants framework. Finance’s response was that amendments to the Commonwealth Grants Rules and Guidelines (CGRGs) required government consideration.49

2.60 Finance responded to all Auditor-General recommendations directed to it in the past five years and the responses were included in the performance audit reports.

Arrangements for implementing Auditor-General recommendations

Assigning responsibilities

2.61 Finance has documented processes for assigning responsibility for implementing Auditor-General recommendations. The business area responsible for implementing a recommendation assigns an action officer and responsible officer (First Assistant Secretary/SES Band 2 level) for the Auditor-General recommendation. Both officers are recorded in Finance’s recommendation tracker system.

Implementation planning

2.62 Finance does not have documented implementation planning processes for Auditor-General recommendations. There are no requirements for:

- assigning risk ratings for these recommendations;

- setting implementation timeframes for these recommendations; or

- identifying specific actions or activities required to implement these recommendations.

Risk management

2.63 Finance has established internal risk management policies and supporting frameworks. However, as discussed in paragraph 2.25, Finance did not apply risk ratings to the parliamentary committee recommendations reviewed in this audit. Similarly, Finance did not apply risk ratings to the Auditor-General recommendations reviewed in this audit.

Monitoring and oversight of Auditor-General recommendations

2.64 Finance has documented its process for monitoring the implementation of Auditor-General recommendations and utilises an electronic recommendation tracker to record updates.50

2.65 Finance’s Audit Committee has been assigned a role to oversee the implementation of Auditor-General recommendations.51 Finance’s Audit and Risk team manages the central monitoring of Finance’s implementation of Auditor-General recommendations.

2.66 Finance provided written updates on the implementation of Auditor-General recommendations at each of the nine Audit Committee meetings held between February 2022 and November 2023 (the period for which recommendations assessed in this audit were open).52

Closure and reporting arrangements for Auditor-General recommendations

2.67 Finance’s closure processes for Auditor-General recommendations are the same as those adopted for JCPAA recommendations. This includes a closure request form, to be approved by the responsible officer, which is presented to Finance’s Audit Committee. As discussed in paragraph 2.48, in November 2023 Finance established a requirement for the Head of Internal Audit53 and its internal audit function to review recommendation closure packs for JCPAA and Auditor-General recommendations.

2.68 The JCPAA examines all Auditor-General reports tabled in Parliament and can request updates from entities regarding the implementation of Auditor-General recommendations, including as part of JCPAA inquiries into Auditor-General reports.

2.69 The JCPAA requested an update on the implementation of one Auditor-General recommendation reviewed as part of this audit. In June 2023, the committee requested that Finance provide an update within 12 months on the implementation of recommendations from Auditor-General Report No. 21 2021–22 Operation of Grants Hubs.54 At November 2023 Finance had not provided this update, and the time available to respond had not expired.

Does Finance have effective systems to monitor the implementation of agreed recommendations?

Finance has established a fit-for-purpose internal system (the recommendation tracker) which provides functionality to track its implementation of recommendations, including documenting responsible officers, risk ratings, due dates, updates provided by responsible officers and supporting attachments. With the application of risk mitigation arrangements, appropriate controls are in place to support the integrity of data within Finance’s system.

Finance does not adopt a consistent approach, or apply the full functionality of its system, to its management of agreed parliamentary and Auditor-General recommendations. Finance does not require the establishment of risk ratings or due dates for its implementation of agreed JCPAA or Auditor-General recommendations and does not monitor its implementation of agreed non-JCPAA parliamentary committee recommendations.

There is scope for Finance to apply a fit-for-purpose approach across all types of agreed recommendations, to support its delivery of outcomes in accordance with parliamentary expectations.

2.70 Entities should have fit-for-purpose arrangements for tracking the implementation of agreed recommendations. What constitutes fit-for-purpose will depend on the size of the entity, the nature of its business, its governance structure and the number and frequency of recommendations requiring attention.55

2.71 Finance uses a collaborative cloud-based software tool, known as the recommendation tracker, to monitor JCPAA and Auditor-General recommendations. The system provides functionality to track the implementation of recommendations, including documenting responsible officers, risk ratings, due dates, updates provided by responsible officers and supporting attachments.

2.72 When establishing systems, entities should ensure there are sufficient controls to maintain complete and accurate data, to facilitate effective monitoring and reporting on the implementation status of recommendations.

2.73 Access to Finance’s recommendation tracker is restricted and managed manually at the list level or item level, by Finance’s Assurance and Risk team. There are no formal processes for access removal or revalidation. These Information Technology system control weaknesses are mitigated as follows.

- Data changes are logged and monitored in real time.

- Unauthorised changes can be corrected through backups.

2.74 Having regard to these risk mitigation arrangements, appropriate controls are in place to support the integrity of data within the recommendation tracker.

2.75 Finance action officers manually enter and update agreed JCPAA and Auditor-General recommendations in the recommendation tracker. Prior to an Audit Committee meeting (five times per year), Finance’s Assurance and Risk team requests progress updates on open JCPAA and Auditor-General recommendations. As part of this process, the responsible officer is required to approve the update. There are no further quality control checks conducted. The status of the recommendations is recorded as ‘open’ or ‘closed’.56

2.76 For the recommendations examined as part of this audit, at October 2023 the recommendation tracker:

- contained the five agreed JCPAA recommendations under review;

- did not contain the one agreed non-JCPAA recommendation under review57; and

- contained all agreed Auditor-General recommendations under review.

2.77 As discussed in this chapter, Finance does not adopt a consistent approach, or apply the full functionality of its system, to its management of agreed parliamentary and Auditor-General recommendations. Finance does not require the establishment of risk ratings or due dates for its implementation of agreed JCPAA or Auditor-General recommendations and does not monitor its implementation of agreed non-JCPAA parliamentary committee recommendations.

2.78 An overarching finding of this audit is that there is scope for Finance to apply a fit-for-purpose approach across all agreed recommendations, to support its delivery of outcomes in accordance with parliamentary expectations.

3. Implementation of recommendations

Areas examined

This chapter examines whether the Department of Finance (Finance) effectively implemented the 18 agreed recommendations under review, comprising five recommendations of the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA), one made by the Senate Foreign Affairs, Defence and Trade Legislation Committee, and 12 Auditor-General recommendations.

Conclusion

Finance does not have an internal requirement to develop implementation plans for agreed recommendations, and its implementation planning for the 18 recommendations examined in this audit was partly fit-for-purpose.

Eight recommendations were implemented (44 per cent), one was largely implemented (six per cent), one was partly implemented (six per cent), and two were not implemented (11 per cent). For six recommendations, implementation was ongoing (33 per cent). The closure of four recommendations assessed by Finance as ‘implemented’ was not supported by adequate evidence.

3.1 Effective and timely implementation of agreed recommendations contributes to realising the full benefit of a parliamentary committee inquiry or an ANAO audit and demonstrates accountability to the Parliament.58

3.2 The ANAO reviewed Finance’s implementation of 18 agreed recommendations, comprising five JCPAA recommendations, one made by the Senate Foreign Affairs, Defence and Trade Legislation Committee, and 12 Auditor-General recommendations. The selected recommendations are set out in Appendix 4 and Appendix 5 of this audit report.

3.3 As discussed in paragraph 2.2, entities benefit from robust planning arrangements and strong senior management oversight and monitoring arrangements to ensure the effective and timely implementation of agreed recommendations.

Were there fit-for-purpose implementation plans for each of the selected recommendations?

Finance does not have an internal requirement to develop implementation plans for agreed recommendations. For the 18 agreed recommendations examined in this audit, Finance assigned an action officer and responsible officer for 17 recommendations, did not assign a risk rating for any of the recommendations, and assigned an implementation timeframe for four recommendations.

3.4 Finance does not have an internal requirement to develop implementation plans for agreed recommendations. In the absence of such arrangements, the ANAO examined whether Finance assigned roles and responsibilities, timeframes and risk ratings for selected recommendations.

3.5 For the 18 recommendations examined in this audit, Finance:

- assigned an ‘action officer’ and ‘responsible officer’ for 17 recommendations (94 per cent of all recommendations)59;

- did not assign a risk rating for any recommendation; and

- assigned an implementation timeframe for four Auditor-General recommendations (22 per cent of all recommendations).60

3.6 The four recommendations assigned an implementation timeframe had a ‘revised due date’61 set several months after the reports, in which they appear, were tabled in Parliament.62 None of the four recommendations had a due date set prior to this time.63