Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Governance of the Tiwi Land Council

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- This audit is part of a series of audits of the governance of the Northern Territory (NT) Land Councils. It was conducted to provide independent assurance to Parliament that the Land Councils’ governance arrangements are effective in meeting legislative obligations.

- Land Councils play an important role in securing rights and realising benefits for Aboriginal constituents. Many stakeholders rely on the efficient and effective operation of the Land Councils.

Key facts

- The Tiwi Land Council (TLC) was established under the Aboriginal Land Rights (Northern Territory) Act 1976 (ALRA).

- The TLC is also a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

- The TLC’s jurisdiction covers the Tiwi Islands.

- The Council is comprised of 32 members from eight clans.

What did we find?

- The Tiwi Land Council's (TLC) governance arrangements under the ALRA and the PGPA Act are partly effective.

- There are instruments of delegation under the ALRA, however there is a lack of clarity as to whether the accountable authority can delegate.

- The TLC’s governance arrangements under the ALRA are partly effective.

- The TLC’s arrangements to promote the proper use and management of resources under the PGPA Act are largely inappropriate.

What did we recommend?

- There were 13 recommendations to the TLC, one aimed at documenting governance arrangements; six aimed at improving governance arrangements under the ALRA; and six aimed at improving governance arrangements under the PGPA Act.

- There was also one recommendation to the National Indigenous Australians Agency (NIAA) to clarify the NT Land Council accountable authority’s ability to delegate.

- The TLC and the NIAA agreed to the recommendations.

2030

Aboriginal and Torres Strait Islander population of the Tiwi Islands at the 2021 census.

$4.3m

Received by the TLC from Aboriginals Benefit Account for operations in 2021–22.

$5.9m

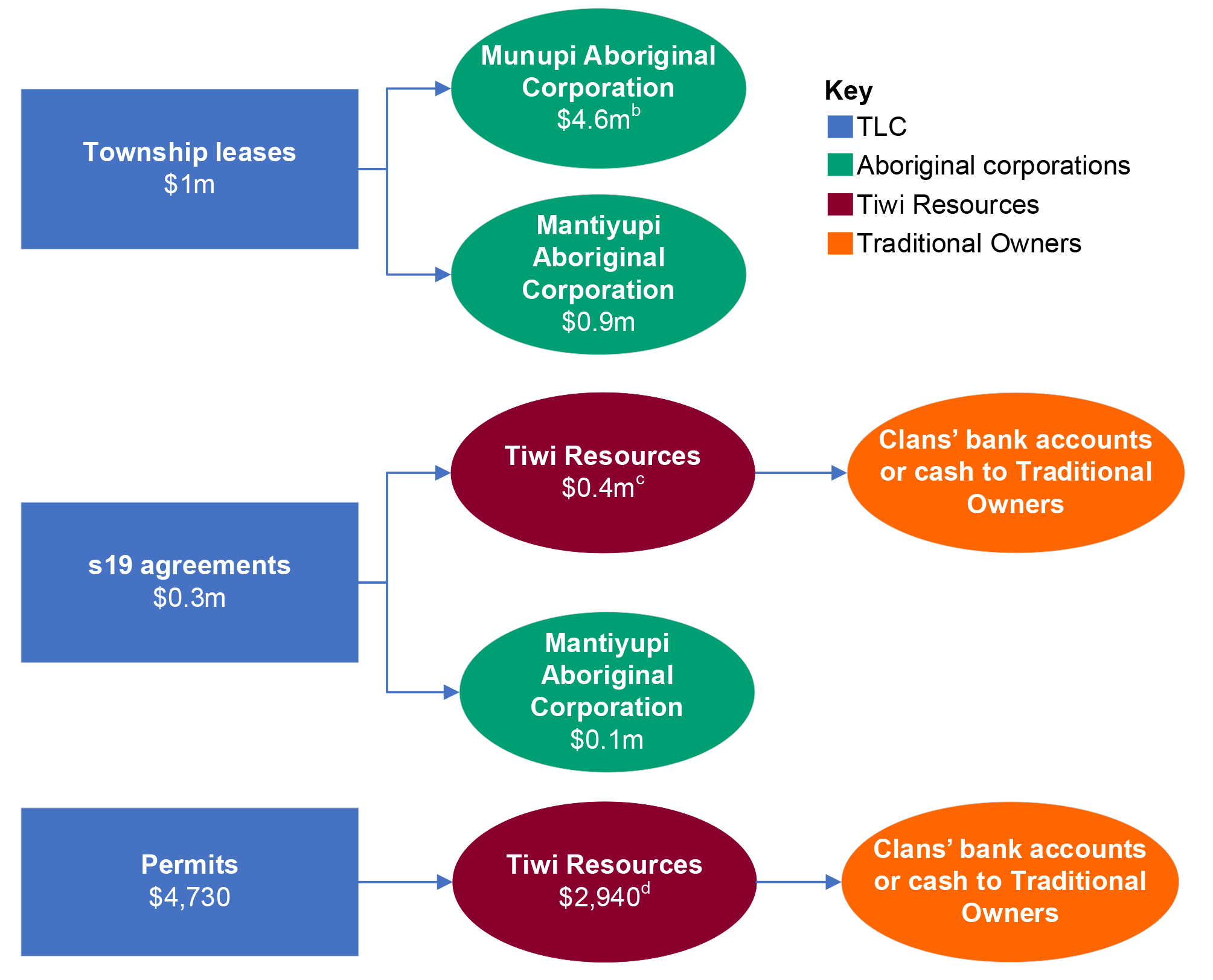

Land use and other payments distributed to Traditional Owners and Aboriginal corporations in 2021–22.

Summary and recommendations

Background

1. Four Northern Territory (NT) Land Councils are established under the Aboriginal Land Rights (Northern Territory) Act 1976 (ALRA) to represent the interests of Aboriginal people within their respective regions and assist them with the management of Aboriginal land. The four NT Land Councils are corporate Commonwealth entities and must comply with the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule).

2. The Native Title Act 1993 (NTA) provides for the Land Councils’ responsibilities as native title representative bodies. The NTA provides a mechanism for the recognition of the rights and interests of Aboriginal and Torres Strait Islander people in land and waters according to their traditional laws and customs.

3. The Tiwi Land Council (TLC) was established in 1978 to represent the Aboriginal people of the Tiwi Islands, which includes Melville and Bathurst Islands. The Council has 32 members comprised of four representatives from each of the eight clans or ‘Country’ groups of the Tiwi Islands. In 2021–22, the TLC received $4.3 million from the Aboriginals Benefit Account for its operations and approximately $1.3 million from land use rents, royalties and access permits.

Rationale for undertaking the audit

4. This performance audit is part of a series of audits of the governance of the NT Land Councils. It was conducted to provide independent assurance to Parliament that the Land Councils’ governance arrangements are effective in meeting legislative obligations under the ALRA, the NTA and the PGPA Act.

5. Land Councils play an important role in securing rights and realising benefits for Aboriginal constituents. Many external stakeholders, including government entities, non-government organisations, and Indigenous and non-Indigenous businesses, rely on the efficient and effective operation of the Land Councils.

Audit objective and criteria

6. The objective of the audit was to assess the effectiveness of the governance of the Tiwi Land Council under the Aboriginal Land Rights (Northern Territory) Act 1976 and the Public Governance, Performance and Accountability Act 2013.

7. To form a conclusion against this objective, the following high-level criteria were applied.

- Has the TLC appropriately exercised its decision-making authority under the Aboriginal Land Rights (Northern Territory) Act 1976 and the Public Governance, Performance and Accountability Act 2013?

- Is the TLC effectively governing its legislative functions under the Aboriginal Land Rights (Northern Territory) Act 1976?

- Has the TLC established appropriate arrangements to promote the proper use and management of resources?

Conclusion

8. The Tiwi Land Council’s governance arrangements under the Aboriginal Land Rights (Northern Territory) Act 1976 and the Public Governance, Performance and Accountability Act 2013 are partly effective.

9. Land Council decision-making authority is exercised under multiple pieces of legislation. The delegation of functions and powers under this legislative framework is complex. While the TLC has instruments of delegation for functions and powers under the ALRA, a lack of specificity raises questions over whether financial functions and powers belonging to the TLC accountable authority under the PGPA Act have been validly delegated by the Council. Greater clarity is required for the NT Land Councils in relation to how accountable authority delegations are meant to be implemented under the two Acts.

10. The TLC’s governance of its legislative functions under the ALRA is partly effective. Governance arrangements to manage operations are deficient with respect to appointments, meetings and training. The governance arrangements to support the exercise of the TLC’s key legislative functions are not fully fit for purpose. Since September 2022 the TLC has commenced addressing some of these deficiencies.

11. The TLC’s arrangements to promote the proper use and management of resources are largely inappropriate. The TLC’s policy framework and arrangements for risk management, fraud control and managing conflicts of interest are incomplete, not appropriately established, and inconsistently implemented. The TLC’s corporate plan and annual report, including performance statements, are not fully consistent with legislative requirements. The TLC’s Audit Committee, while properly established, is not effective in the delivery of some of its mandatory functions.

Supporting findings

Exercise of decision-making authority

12. The TLC has delegation instruments for powers and functions that belong to the Council under the ALRA. Greater specificity in the delegation instruments in relation to the functions and powers that are being delegated would improve the instruments and provide greater clarity to delegates. (See paragraphs 2.5 to 2.15)

13. A financial delegation instrument made in 2021 by the Council may invalidly attempt to delegate powers and functions that belong to the TLC accountable authority under the PGPA Act. A lack of specificity with regard to legislative sections in the delegation instrument makes this difficult to determine. There is no governance document regarding how the CEO and Chair of the TLC (the joint accountable authority) expect to manage their joint responsibilities. There is also a lack of clarity as to whether the accountable authority of the TLC has any power to delegate under the PGPA Act and ALRA. (See paragraphs 2.16 to 2.28)

Governance under the Aboriginal Land Rights (Northern Territory) Act 1976

14. The TLC’s arrangements to manage its operations are partly appropriate. An approved method of choice is followed, however Ministers have raised concerns about the way in which Trust members appointed Council members and the lack of female representation. The Minister for Indigenous Australians has requested a revised method for her approval. There is no handbook outlining, or induction into, the roles and responsibilities of Council, Trust or Management Committee members, and ongoing training is limited. The 2018 recruitment of the previous CEO (who was dismissed by the Council in July 2022) was not competitive and his performance was not reviewed as required. There are approved meeting rules, which are largely followed, however their implementation does not fully support informed decision-making. Registers of Council members, Trust members and Traditional Owners are established. (See paragraphs 3.4 to 3.43)

15. The ANAO assessed the TLC governance arrangements for the key legislative functions.

- Negotiating land use and access — The TLC has procedures to negotiate and monitor section 19 agreements and permits, however these are not robust or complete.

- Assisting with commercial and other activities — Arrangements to perform this function were largely undeveloped, however there have been developments in governance arrangements since June 2021. The TLC’s function to provide assistance with the protection of sacred sites has been operational primarily since early 2020 and has been appropriate.

- Consulting with Aboriginal people and obtaining consent — Although the TLC holds clan meetings, the minutes do not set out how consent was achieved. There are no procedures to guide the systematic establishment of consent. Improvements were made to the consultation process in November 2022. The TLC does not have a process for dispute or complaint resolution.

- Distributing royalties and payments — Most funds are distributed through an Aboriginal corporation, Tiwi Resources. The TLC has documented processes for distribution based on Council resolutions, however it does not seek assurance that Tiwi Resources has distributed the funds in accordance with these resolutions. (See paragraphs 3.1 to 3.77)

Arrangements to promote the proper use and management of resources

16. While there is a risk management policy, the risk register is not complete or up to date. In terms of the policy framework, some essential policies do not exist. Of those that exist, several need to be improved and all need to be appropriately authorised. There is a lack of training on policies. The TLC has commenced a program of improvement of its policy framework. (See paragraphs 4.2 to 4.15)

17. The TLC does not have effective arrangements to support the integrity of its operations. The TLC is not compliant with the Commonwealth fraud rule. There are no regular fraud risk assessments, there is a lack of fraud training for staff, and there is no mechanism for reporting of incidents of fraud or suspected fraud. The TLC’s management of conflicts of interest is ineffective. There is no register of interests for senior employees. A register of pecuniary interests required under the ALRA is not used by all Council members, and there is no management plan for declared pecuniary interests. Conflict of interest management during meetings, as recorded in minutes, is inconsistent. (See paragraphs 4.17 to 4.35)

18. The TLC 2021–2025 Corporate Plan complied with most of the PGPA Rule requirements. The primary weakness was in performance measures and targets, which were not clearly defined and were too focused on activities at the expense of outputs and outcomes. This impedes understanding of the TLC’s performance against its key purposes. The draft 2021–22 Annual Report was untimely and was in draft form at March 2023. Council members and the accountable authority were not substantively involved in the development of the Corporate Plan and Annual Report. There is a lack of assurance over performance reporting. (See paragraphs 4.37 to 4.46)

19. The TLC does not have an internal audit function. The TLC has established an Audit Committee which does not execute its mandatory functions effectively. The Audit Committee does not appropriately review the TLC’s performance reporting; system of risk oversight and management; and system of internal control. The Audit Committee’s mandatory reporting requirements were partly met. (See paragraphs 4.48 to 4.58)

Recommendations

Recommendation no. 1

Paragraph 2.20

The Tiwi Land Council establish a governance document setting out:

- how the accountable authority (that is, the CEO and Chair) intends to operate, with specific reference to those decisions which require joint authority, and those which can be made independently by one or the other party; and

- the role of the accountable authority under the PGPA Act and the role of the Council under the ALRA.

Tiwi Land Council: Agreed.

Recommendation no. 2

Paragraph 2.23

The National Indigenous Australians Agency, in consultation with relevant stakeholders, clarify the conditions and requirements under which a Land Council accountable authority may delegate its functions and powers.

National Indigenous Australians Agency: Agreed.

Recommendation no. 3

Paragraph 3.23

The Tiwi Land Council:

- develops a handbook or manual documenting the functions, roles and responsibilities of Council, Management Committee and Trust members, including the Council Chair and Deputy Chair; and

- provides initial and regular refresher training to members of the Council and the Tiwi Aboriginal Land Trust about their roles and responsibilities.

Tiwi Land Council: Agreed.

Recommendation no. 4

Paragraph 3.28

The Tiwi Land Council:

- implement its recruitment policy for all new appointments, including when recruiting a permanent CEO; and

- establish performance plans for all its staff, including the CEO, and monitor and review performance against that plan periodically.

Tiwi Land Council: Agreed.

Recommendation no. 5

Paragraph 3.33

The Tiwi Land Council:

- implement the ALRA requirement to provide the Management Committee meeting rules to the Minister for Indigenous Australians; and

- increase the accessibility of the Council and Management Committee meeting rules and minutes (which could include the use of the TLC website, newsletter, radio and social media platforms to promote how the rules and minutes can be accessed).

Tiwi Land Council: Agreed.

Recommendation no. 6

Paragraph 3.38

The Tiwi Land Council:

- review key governance documents in accordance with meeting rules; and

- implement meeting rules aimed at facilitating member understanding of matters discussed.

Tiwi Land Council: Agreed.

Recommendation no. 7

Paragraph 3.55

The Tiwi Land Council:

- develop an implementation plan to address the deficiencies in the management of section 19 agreements and permits that were identified in the 2020 and 2022 reviews; and

- monitor section 19 agreements to detect and address any non-compliance with agreement conditions, including non-financial conditions.

Tiwi Land Council: Agreed.

Recommendation no. 8

Paragraph 3.77

The Tiwi Land Council improve the processes supporting the distribution of payments by seeking evidence from Tiwi Resources to demonstrate that all payments that are processed by Tiwi Resources have been made in accordance with the Council resolution.

Tiwi Land Council: Agreed.

Recommendation no. 9

Paragraph 4.7

The Tiwi Land Council:

- update and periodically review the risk management policy and ensure that it is aligned with the Commonwealth Risk Management Policy, by including risk appetite, and risk monitoring and reporting arrangements;

- update and periodically review the enterprise risk register; and

- ensure that the enterprise risk register considers risk ownership, controls, and risk tolerance; and includes mitigations for risks that are considered outside of tolerance.

Tiwi Land Council: Agreed.

Recommendation no. 10

Paragraph 4.15

The Tiwi Land Council:

- develop and implement a framework for the development, approval and ownership of its policies;

- provide mandatory and role-related training for Council members and staff to ensure that policies are appropriately understood; and

- include in the policy framework consideration of how compliance with mandatory and role-related training will be monitored.

Tiwi Land Council: Agreed.

Recommendation no. 11

Paragraph 4.21

The Tiwi Land Council:

- produce a fraud control framework that is aligned to the Commonwealth fraud rule;

- conduct fraud risk assessments regularly;

- implement mechanisms to prevent and detect fraud that are proportionate to identified fraud risks;

- implement mechanisms to record and report fraud to the Audit Committee; and

- ensure that the fraud control system is reviewed and endorsed by the Audit Committee.

Tiwi Land Council: Agreed.

Recommendation no. 12

Paragraph 4.35

The Tiwi Land Council:

- consistently apply its requirement for a declaration of pecuniary interests and monitor non-compliance;

- develop documented management plans for declared conflicts of pecuniary interests;

- strengthen management and recording of conflicts during Council and Management Committee meetings; and

- include, in governance training and guidance, material on the management of conflict of interest.

Tiwi Land Council: Agreed.

Recommendation no. 13

Paragraph 4.46

The Tiwi Land Council improve the processes to develop its corporate plan, annual report and performance statements to ensure that:

- the corporate plan is compliant with legislative requirements;

- Council members and the accountable authority consider and approve the content;

- performance measures and targets are clearly defined and provide meaningful information about the TLC’s performance against its key purposes or activities; and

- a process exists to provide assurance over the completeness and accuracy of the performance results published in annual reports.

Tiwi Land Council: Agreed.

Recommendation no. 14

Paragraph 4.58

The accountable authority of the Tiwi Land Council ensure that it establishes an Audit Committee that executes the requirements of the Audit Committee Charter.

Tiwi Land Council: Agreed.

Summary of entity response

20. The TLC’s summary response is provided below and its full response is included at Appendix 1. An extract of the draft report was also provided to the National Indigenous Australians Agency (NIAA). The NIAA’s response can be found at Appendix 1. The improvements observed by the ANAO during the course of this audit are at Appendix 2.

Tiwi Land Council

The Tiwi Land Council has engaged with the ANAO throughout the period of the review and has considered the findings including the thirteen recommendations. The TLC takes from this report the desirability of strengthening its governance, revising policy and introducing new policies and procedures as appropriate. The TLC accepts the recommendations and has commenced their implementation. The TLC is particularly committed to member and staff training in all aspects of its governance particularly in the areas of risk management, HR process and agreement making and monitoring. This includes substantial reform in a number of areas. The TLC has sought and engaged appropriate new staff positions and external expertise and advice to undertake, complete and continue, where ongoing, this work.

1. Background

Introduction

1.1 Four Northern Territory (NT) Land Councils are established under the Aboriginal Land Rights (Northern Territory) Act 1976 (ALRA) to represent the interests of Aboriginal people within their respective regions and assist them with the management of Aboriginal land: the Tiwi Land Council (TLC), the Central Land Council (CLC), the Northern Land Council (NLC) and the Anindilyakwa Land Council (ALC).

Legislative framework

1.2 In addition to the ALRA, the NT Land Councils operate under two key legislative frameworks:

- the Native Title Act 1993 (NTA), which provides for the Land Councils’ responsibilities as Native Title Representative Bodies; and

- the Public Governance, Performance and Accountability Act 2013 (PGPA Act) and the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule), which set the Land Councils’ requirements as corporate Commonwealth entities.1

Aboriginal Land Rights (Northern Territory) Act 1976

1.3 The ALRA was the first legislation in Australia that enabled Aboriginal and Torres Strait Islander people to claim land rights for Country where traditional ownership could be proven. The ALRA recognises Aboriginal people’s spiritual affiliation and traditional responsibility for Country as the basis for ownership of land.

1.4 The Aboriginal Land Commissioner undertakes inquiries into traditional land claims in the NT.2 Upon the Aboriginal Land Commissioner’s satisfaction that the Traditional Owners3 have been correctly identified according to Aboriginal law, he or she provides a report to the Commonwealth minister responsible for the administration of the ALRA and the Administrator of the NT.4 The Commonwealth minister decides whether to recommend to the Governor-General of Australia to grant all or part of the land under claim.

1.5 Once land has been granted, it is held by a Land Trust5, and Traditional Owners manage their land with the help of their Land Council. Aboriginal land is a form of ‘inalienable’ freehold, which means it cannot be bought or sold, and Traditional Owners of the land have the right of exclusive access and the power to veto proposals to access or use land. As at 2016 Aboriginal people held freehold title to approximately 50 per cent of the NT land mass and 85 per cent of its coastline.6

Native Title Act 1993

1.6 Determinations of native title recognise the ongoing connection of Aboriginal and Torres Strait Islander peoples to specific areas of land and waters. Successful claims under the NTA give Aboriginal and Torres Strait Islander peoples a collection of rights, which may include exclusive possession or such rights as the right to camp, hunt, use water, hold meetings, perform ceremony and protect cultural sites.7 As at 2016 native title had been recognised over 238,120 square kilometres (17 per cent) of land and waters in the NT.8

1.7 Under the ALRA, land rights usually comprise a grant of freehold title to Aboriginal peoples. By contrast, native title arises as a result of recognition, under Australian common law, of pre-existing Indigenous rights and interests according to traditional laws and customs. It does not provide for a process to grant ownership of the land as the ALRA does.9

Public Governance, Performance and Accountability Act 2013

1.8 The four NT Land Councils are corporate Commonwealth entities10 and as such also must comply with the requirements of the PGPA Act and Rule. The four NT Land Councils are also registered as charities with the Australian Charities and Not-for-profits Commission (ACNC).11

Governance structures under the ALRA and NTA

Northern Territory Land Councils

1.9 The CLC and NLC were established in 1973 as part of the Australian Government’s Aboriginal Land Rights Commission (Woodward Royal Commission) to inquire into the appropriate way to recognise Aboriginal land rights in the NT. The function of the Land Councils at that time was to represent the views of Aboriginal people to the Woodward Royal Commission. The CLC and NLC are responsible for the southern and northern parts of the NT, respectively.

1.10 On 26 January 1977 the Woodward Royal Commission’s recommendations were realised through the enactment of the ALRA, which established the CLC and NLC as independent statutory authorities with powers and responsibilities to assist Aboriginal people to acquire and manage their traditional land and seas. The ALRA also made provision for the establishment of other Land Councils in the NT. This led to the creation of the TLC in 1978 (representing the Aboriginal people of Bathurst and Melville Islands) and of the ALC in 1991 (representing the Aboriginal people of the Groote Archipelago).

1.11 The structure of the Land Councils consists of representatives chosen by Aboriginal people living in the region, referred to as ‘members of the Council’, and an administrative arm managed by a Chief Executive Officer (CEO), who is appointed by the Council. The accountable authority of the TLC is defined in the PGPA Rule (section 7A) as the group of persons made up of the Chair of the Land Council and the CEO of the Land Council.

1.12 The Aboriginals Benefit Account was established under the ALRA in 1976 and is the primary source of revenue for the Land Councils. Aboriginals Benefit Account distributions include funding for the administration of Land Councils, royalty payments for distribution to Traditional Owners, and grants to benefit Aboriginal people living in the NT.

Native Title Representative Bodies

1.13 Once a native title determination is made, the NTA prescribes that native title holders must establish a prescribed body corporate12 to manage and protect their native title rights and interests. Native Title Representative Bodies are organisations appointed under the NTA and funded by the National Indigenous Australians Agency (NIAA) to assist Indigenous people with all aspects of their native title claims, and in some cases the management of native title rights once a claim has been determined. There are 14 Native Title Representative Bodies in Australia, including two in the NT. The NLC is the Native Title Representative Body for the northern region, including the Tiwi Islands and Groote Archipelago, and the CLC represents those within the NT’s southern region.

National Indigenous Australians Agency

1.14 The NIAA was established as an executive agency in May 2019 to provide advice to and support the Minister for Indigenous Australians (the Minister), including in relation to Land Councils and the exercise of his or her powers under the ALRA and the NTA.13 These functions were previously undertaken by the Department of the Prime Minister and Cabinet. The NIAA advised the ANAO that:

While [NIAA] is not involved in the daily operations of land councils, it does provide support where required, performance monitoring and some administrative oversight. A range of branches within the [NIAA] provide information and support on various issues, including land and native title programs, Indigenous Portfolio Bodies Section, environment and rangers programs, specific policy and program areas for grants activities, and finance teams.

1.15 Land Councils engage with the NIAA in relation to the administration of funds for operational and capital expenses (from the Aboriginals Benefit Account), land management programs and annual reporting obligations.

Functions of the Land Councils

1.16 The Land Councils’ key functions, under subsection 23(1) of the ALRA, are to:

- negotiate and enter into Aboriginal land use and access agreements with third parties on behalf of Traditional Owners and of other Aboriginal persons interested in the land;

- assist in carrying out commercial activities;

- assist with traditional land claims and the protection of sacred sites;

- consult with Aboriginal people in the Land Council area about the management of land, and protect their interests; and

- supervise, and provide administrative or other assistance for, Land Trusts in the area.

1.17 Section 35 prescribes how Land Councils must distribute the money received from Aboriginal land use and access.

1.18 The key functions of Native Title Representative Bodies are set out in section 203B of the NTA. They are: facilitation and assistance; certification; dispute resolution; notification; agreement making; and internal review. The powers and duties of Native Title Representative Bodies in respect of money received under the NTA arise from the general law and the terms of the relevant agreement.

1.19 The ALRA prescribes that, in carrying out its functions, a Land Council must not take any action unless it is satisfied that Traditional Owners understand the nature and purpose of the action and consent to it; and any Aboriginal group that may be affected by the proposed action has been consulted. The NTA prescribes that the Native Title Representative Body must consult with native title holders and for some of the functions, be satisfied that they consent to the course of action being taken on their behalf. Given that the vast majority of claims to land under the ALRA are settled as at March 202314, facilitating the benefits that can be derived from land rights has been identified by the larger NT Land Councils as an increasing focus and priority.

1.20 A core objective of both the ALRA and the NTA is to establish and support land rights of Traditional Owners (under the ALRA) and native title holders (under the NTA). Land Councils are required to have the capability to confirm the identity and traditional connection of specific individuals to particular areas of land. To this end, Land Councils may collect anthropological data and engage specialist expertise.

1.21 Appendix 3 provides more detail on the Land Councils’ powers, functions and duties under the ALRA, the NTA and the PGPA Act.

Land use and access arrangements

1.22 The main types of arrangements for land use and access under the ALRA and NTA, and how the monies received from these arrangements are distributed, are shown Table 1.1.

Table 1.1: Land use and access arrangements

|

Land use and access arrangements |

Description |

Legislation |

Selected provisions |

Payment distribution |

|

‘Royalty equivalents’ |

Mining monies |

ALRA |

Subsection 64(3) |

The monies take the form of royalties. Under the ALRA subsection 64(3), a defined amount of mining royalties must be debited from the Aboriginals Benefit Account from time to time and paid to Land Councils for distribution to Aboriginal corporations. |

|

‘Part IV agreements’a |

Mining and exploration monies |

ALRA |

Part IV (sections 42, 43, 44, and 46) |

The monies are specified in an agreement with the land use applicant. Payments are made to Aboriginal corporations, Traditional Owners or another entity as defined in an agreement that is established under Part IV of the ALRA. |

|

‘Section 19 (s19) agreements’a |

Primarily non-mining and some mining related monies |

ALRA |

Sections 15, 16 and 19 |

The monies are specified in an agreement with the land use applicant. Payments are made to Aboriginal corporations, Traditional Owners or another entity, as defined in an agreement that is not established under Part IV of the ALRA. |

|

‘Township leases’b |

Township lease monies |

ALRA |

Section 19A |

The monies derive from township leases. Payments are made to Aboriginal corporations. |

|

‘Permits’ |

Enabling access to aboriginal land or roads |

ALRA |

Section 70 |

Fees are payable to and defined by the Land Council. |

|

‘Native title agreements’a |

Any monies from land use for land subject to native title claim |

NTA |

Various |

The monies are specified in an agreement with the land use applicant. Payments are made to native title holders. |

Note a: Payment arrangements are made as per instructions from Traditional Owners and native title holders.

Note b: In this table, township leases are voluntary agreements between Traditional Owners and the Australian Government, established by the Executive Director of Township Leasing under ALRA section 19A. The Executive Director of Township Leasing manages the land in the township on behalf of the Traditional Owners and the community for up to 99 years, including sub-leases to business and governments and the protection of sacred sites. In the area of the TLC, the Executive Director of Township Leasing holds two Township Leases over the townships of Wurrumiyanga, Milikapiti and Wurankuwu.

Source: ANAO analysis.

About the Tiwi Land Council

1.23 The TLC’s jurisdiction covers the Tiwi Islands, which are located 80 kilometres north of Darwin in the Arafura Sea. The Tiwi Islands consist of two large, inhabited islands (Melville and Bathurst) and numerous smaller uninhabited islands. At the 2021 census, the population of the Tiwi Islands was 2348, including 2030 Aboriginal and/or Torres Strait Islander people. Three major communities are serviced by regular transport services operating from Darwin.

Figure 1.1: Map of the Tiwi Islands

Source: Tiwi Land Council.

1.24 The Council has 32 members comprised of four representatives from each of the eight clan or ‘country’ groups of the Tiwi Islands. There is one female member at December 2022. The Chair was appointed to the position in 2012 and, as at December 2022, was in his fourth three-year term. The Council elects an Executive Management Committee (Management Committee) from amongst its members, which is responsible for assessing and advising upon various land use and development proposals and which refers matters requiring decisions to the Council. The Management Committee has nine members (one representative from each clan and the Chair of the Council).

1.25 As at December 2022, 15 full time staff positions were funded (including that of the CEO), and 11 of these positions were filled. The TLC operates primarily from Darwin. In 2021–22 the TLC received $4.3 million from the Aboriginals Benefit Account for its operations. In addition, the TLC received $5.3 million under the NT Indigenous Economic Stimulus Package in 2021–22 and $8 million in 2020–21.15 It also received $1.3 million from the Australian and NT governments for special projects, and $1.3 million in income from rents and royalties to be distributed to Traditional Owners, Aboriginal corporations or other entities.

1.26 In November 2021 the Chair of the TLC Audit Committee engaged EY Australia to undertake a governance review of its operations. The final report (April 2022) found that:

- financial controls and governance practices needed improvement;

- key policies including relating to conflicts of interest, procurement, gifts and benefits and risk management did not exist;

- the TLC’s method to elect Council members resulted in a Council that ‘does not currently provide a proportionate representation of the interests of [those] living in the area of the TLC’ as ‘only 1 of 32 TLC members is female’, that there were ‘divergent views as to the cultural relevance and appropriateness of male dominated decision making’ and that ‘a number of traditional owners have indicated a preference for a democratic election process akin to that of the Central Land Council’s method of choice’; and

- the TLC was at risk of not complying with its obligations under the ALRA and PGPA Act.

1.27 In May 2022 the Council decided to suspend the CEO on full pay and on 5 July 2022, the Council agreed to remove the CEO. An interim CEO took his position in August 2022 and an interim Business Manager was appointed in September 2022.

Rationale for undertaking the audit

1.28 This performance audit is part of a series of audits of the governance of the NT Land Councils. It was conducted to provide independent assurance to Parliament that the Land Councils’ governance arrangements are effective in meeting legislative obligations under the ALRA, the NTA and the PGPA Act.

1.29 Land Councils play an important role in securing rights and realising benefits for Aboriginal constituents. Many external stakeholders, including government entities, non-government organisations, and Indigenous and non-Indigenous businesses, rely on the efficient and effective operation of the Land Councils.

Audit approach

Audit objective, criteria and scope

1.30 The objective of the audit was to assess the effectiveness of the governance of the Tiwi Land Council under the Aboriginal Land Rights (Northern Territory) Act 1976 and the Public Governance, Performance and Accountability Act 2013.

1.31 To form a conclusion against this objective, the following high-level criteria were applied.

- Has the TLC appropriately exercised its decision-making authority under the Aboriginal Land Rights (Northern Territory) Act 1976 and the Public Governance, Performance and Accountability Act 2013?

- Is the TLC effectively governing its legislative functions under the Aboriginal Land Rights (Northern Territory) Act 1976?

- Has the TLC established appropriate arrangements to promote the proper use and management of resources?

Audit methodology

1.32 The audit involved:

- reviewing legislation, regulations, policies and best practice standards;

- reviewing TLC documentation, including charters, meeting papers and minutes, policies and procedures, annual reports, corporate plans and correspondence;

- visits to the NT including Darwin and the Tiwi Islands;

- observing meetings of the Council, Management Committee, Audit Committee and clans;

- meetings with Council members and TLC staff;

- meetings with members of the Tiwi community, including the eight Tiwi clans;

- meetings with officers from relevant business areas within the:

- Australian Government (including the NIAA, Office of Township Leasing and Office of the Registrar of Indigenous Corporations),

- NT Government (including the Office of the Chief Minister and Cabinet; Department of Infrastructure, Planning and Logistics; and NT Electoral Commission),

- NT local government; and

- nine meetings with and 12 submissions from businesses, Aboriginal corporations, members of the public, peak bodies and non-government organisations operating on the Tiwi Islands and NT mainland.

1.33 The audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of approximately $547,300.

1.34 The team members for this audit were Dr Isabelle Favre, Eliza Glascott, Weinnie Zhou, Grace Sixsmith, Kai Swoboda, Sam Hayward, Graeme Corbett, Daniel Whyte and Christine Chalmers.

2. Exercise of decision-making authority

Areas examined

This chapter examines the functions, powers and responsibilities of the Land Councils under the Aboriginal Land Rights (Northern Territory) Act 1976 (ALRA) and Public Governance, Performance and Accountability Act 2013 (PGPA Act), and whether these have been appropriately delegated for the Tiwi Land Council (TLC).

Conclusion

Land Council decision-making authority is exercised under multiple pieces of legislation. The delegation of functions and powers under this legislative framework is complex. While the TLC has instruments of delegation for functions and powers under the ALRA, a lack of specificity raises questions over whether financial functions and powers belonging to the TLC accountable authority under the PGPA Act have been validly delegated by the Council. Greater clarity is required for the NT Land Councils in relation to how accountable authority delegations are meant to be implemented under the two Acts.

Areas for improvement

The ANAO made one recommendation to the TLC to establish a governance document setting out how the accountable authority wishes to exercise its joint authority; and one recommendation to the Australian Government to clarify the conditions and requirements under which an NT Land Council accountable authority may delegate its functions and powers. The ANAO suggested to the TLC that it increases the specificity of its instruments of delegation; and amends the delegation given to the Chief Executive Officer (CEO) to employ and terminate staff.

2.1 Authorisations and delegations are a fundamental part of good governance. They play an important role in ensuring that the entity is acting in accordance with the legal framework that applies to it. An entity needs to put in place arrangements to devolve decision-making power from the ultimate repository of that power to the relevant officers of the entity, as the ultimate repository of that power cannot do everything.16

2.2 Appendix 4 shows how Land Council decision-makers are defined under the ALRA, Native Title Act 1993 (NTA) and PGPA Act. Under the ALRA, the members of the Council, including an elected Chair and Deputy Chair, are the decision-makers. Under the Public Governance, Performance and Accountability Rule 2014 (PGPA Rule), the accountable authority of the Land Council is defined as the Chair of the Council and the CEO. The former is to be elected by the Council and the latter is to be appointed by the Council under section 27 of the ALRA, which states that the Council may employ staff.

2.3 Whether the Council, Native Title Representative Body or accountable authority has decision-making authority depends upon the decision that is being made and whether that decision relates to powers and functions under the ALRA, NTA17 or PGPA Act, respectively. Appendix 3 outlines the Councils’, Native Title Representative Bodies’ and accountable authorities’ respective powers and functions under the ALRA, NTA and PGPA Act. In summary: the Land Council is the primary decision-maker in relation to the land; Native Title Representative Bodies have the power ‘to do all things necessary or convenient to be done for or in connection with the performance of its functions’; and the accountable authority is the primary decision-maker in relation to performance and proper use of resources under finance law.

2.4 Under the ALRA and PGPA Act, the Land Council and accountable authority’s functions are distinct except for the preparation of budget estimates (ALRA section 34 and PGPA Act section 36) and the preparation of the annual report (ALRA section 37 and PGPA Act section 46). Although functions are clearly distinct with these two exceptions, in practice powers and responsibilities may overlap.

Has the Land Council appropriately delegated its functions and powers under the ALRA?

The TLC has delegation instruments for powers and functions that belong to the Council under the ALRA. Greater specificity in the delegation instruments in relation to the functions and powers that are being delegated would improve the instruments and provide greater clarity to delegates.

2.5 The Australian Government Solicitor has noted that when enabling legislation establishes a board or Council as having ultimate control over the operations of the entity, most commonly the enabling legislation prescribes the CEO or director as the officer responsible for the day-to-day management of the entity.18 This may result in the CEO having ‘implied authority’, although the Australian Government Solicitor advises that even so it is generally better that decision-making power be expressly delegated.19 The ALRA is silent on the role of the CEO (in both their capacity as a CEO and as one of the accountability authorities) or other officials, and an instrument of delegation for functions and powers under the ALRA is therefore required.

2.6 If there is a power to delegate, it will usually be found in the enabling legislation. Appendix 5 shows the ALRA provisions in relation to delegation of powers and functions from the Council to: the Chair of the Council; to committees of the Council; and to Land Council staff, including the CEO. These delegations must be made in writing under the Land Council’s common seal. The ANAO examined whether the decision-making authority as defined in the ALRA is properly exercised by the TLC through the Council’s delegation of ALRA powers and functions.

2.7 The Performance Audit of the Northern Territory Land Councils, conducted by Department of Finance’s Office of Evaluation and Audit20 in 2008 concluded that the TLC did not have a clear instrument of delegation. The audit found that:

- the TLC had recorded the delegation of Council functions and powers through minuted decisions at full Council meetings;

- these minutes made broad ‘catch-all’ statements that did not specifically refer to sections of the ALRA;

- staff needing to clarify whether they had delegated authority were referred to meeting minutes;

- this method of recording delegations lacked transparency and specificity, was inefficient, placed too great a burden on delegates to interpret the minutes, and was non-compliant with section 28 of the ALRA; and

- the management of delegations through multiple internal documents increased the risk of inaccuracy, inconsistency and inefficiency.

2.8 The 2008 audit recommended to the Department of Families, Housing, Community Services and Indigenous Affairs (FaHCSIA)21 that the TLC record in writing under the common seal of the Land Council the functions and powers delegated by the full Council to persons and committees22, and record the functions and powers retained by the full Council.23

2.9 Between 2008 and 2020, the TLC had no delegation instrument recorded in writing under the common seal of the Land Council. There was no explicit and clear delegation of powers and functions to Council committees or to the CEO or staff of the TLC as allowed for under section 28 of the ALRA. No written delegation had been made to the Chair or the Deputy Chair. The ANAO’s analysis of Management Committee and Council meeting minutes identified multiple instances where the Management Committee made decisions without delegation during this period.

2.10 The TLC provided to the ANAO an undated delegation instrument under TLC common seal which described delegations made in May and December 2021.

- Delegations to Council committee — At a 21 May 2021 meeting the Council agreed to make certain delegations to the ‘Council committee’. The delegations covered the power to negotiate leases and licenses of less than $1 million under section 19 of the ALRA24; and to grant agreements, variations and permits.

- Delegations to TLC CEO and other staff — At the 21 May 2021 and a 16 December 2021 meeting, the Council approved and revised expenditure approval limits for the Chair, CEO, General Manager and eight other staff. It delegated to the Chief Financial Officer, Office Manager/Coordinator and Finance Manager the power to make payments in relation to taxes, superannuation, insurance and wages and salaries.

2.11 The delegations to the Council committee did not clearly specify to which committee of the Council the delegations were made; however, it is implied that it is the Management Committee as this is the only Council committee. The delegations appropriately covered functions and powers that are vested in the Council under the ALRA in relation to section 19 leases and licences. The delegation did not specify which legislative powers or functions are being devolved in relation to grants and permits, and this can create ambiguity.

2.12 The financial delegations to TLC CEO and other staff are discussed further at paragraph 2.17.

2.13 In a report to the Land Council in August 2022, the interim CEO (see paragraph 1.27) referred to recent reviews (which included the April 2022 EY governance review (see paragraph 1.26)) in seeking a resolution from the Council that would ‘ensure that the CEO of the Tiwi Land Council has the powers required to fulfill his, or her, duties as CEO and Accountable Authority … [and] protect the TLC … by ensuring staff compliance with legal, financial and ethical requirements’. The interim CEO requested that the Council resolve that:

The Full Council of the Tiwi Land Council delegates to the CEO of the TLC, the power to employ (after receiving HR advice and recommendations) and terminate the employment of all staff of TLC (and to engage consultants) and to determine the terms and conditions of their employment and engagement.

2.14 The full Council passed this resolution on 31 August 2022, and an instrument of delegation was established under the TLC common seal on the same day. The delegation, while valid, could be improved in one respect. Given the CEO is appointed under Section 27 of the ALRA like any other staff member, the specific wording of the resolution would imply that the CEO has the power to determine the terms and conditions of his or her own employment.

|

Opportunity for improvement |

|

2.15 The Tiwi Land Council could improve the instruments of delegation under the ALRA by:

|

Has the accountable authority appropriately delegated its functions and powers under the PGPA Act?

A financial delegation instrument made in 2021 by the Council may invalidly attempt to delegate powers and functions that belong to the TLC accountable authority under the PGPA Act. A lack of specificity with regard to legislative sections in the delegation instrument makes this difficult to determine. There is no governance document regarding how the CEO and Chair of the TLC (the joint accountable authority) expect to manage their joint responsibilities. There is also a lack of clarity as to whether the accountable authority of the TLC has any power to delegate under the PGPA Act and ALRA. The National Indigenous Australians Agency has not supported the TLC in establishing appropriate systems of delegations under the ALRA or the PGPA Act.

2.16 The TLC accountable authority has not established any Accountable Authority Instructions under section 20A of the PGPA Act, and there is no delegation or authorisation instrument relating to the TLC accountable authority’s functions and powers.

2.17 The May and December 2021 instrument described in paragraph 2.10 made financial delegations. A lack of specificity in the instrument means that it is unclear whether the powers and functions that were delegated belong to the Council or to the TLC accountable authority. If the financial delegations related to an accountable authority’s powers and functions under the PGPA Act, the instrument is not validly made as the power to make and delegate these decisions rests with the accountable authority, and not with the Council.

2.18 The Department of Finance advised the ANAO in February 2023 that how the accountable authority is required to operate is a matter for the accountable authority to determine between themselves (noting that they are jointly responsible for fulfilling the duties and legal obligations under the PGPA Act) and that the PGPA Act provides flexibility to accountable authorities to establish systems of internal control most appropriate to their operating environment (noting that this must be consistent with the proper use and management of public resources).

2.19 It is usual practice for an accountable authority made up of multiple individuals, such as boards, to have an operational charter setting out how the accountable authority operates. The TLC does not have such a document.

Recommendation no.1

2.20 The Tiwi Land Council establish a governance document setting out:

- how the accountable authority (that is, the CEO and Chair) intends to operate, with specific reference to those decisions which require joint authority, and those which can be made independently by one or the other party; and

- the role of the accountable authority under the PGPA Act and the role of the Council under the ALRA.

Tiwi Land Council response: Agreed.

2.21 The TLC will assign the necessary review work and compilation to a team consisting of the Principal Legal Officer (PLO), Project Officer (PO) and Human Resource (HR) Manager. External advice will be sought including from similar organisations and others as part of this process.

2.22 The Finance Minister delegates some of his or her functions and powers to the accountable authority of an entity under section 107 of the PGPA Act. Section 110 of the PGPA Act indicates when an accountable authority may delegate to an official of a non-corporate Commonwealth entity. This provision does not apply to corporate Commonwealth entities, which are legally separate from the Commonwealth. In the case of corporate Commonwealth entities, the delegation requirements should be specified in the enabling legislation — in this case the ALRA. However, the ALRA is silent regarding delegations by the Land Council accountable authority as defined by the PGPA Act. It appears that the accountable authority of a Land Council is not able to delegate his or her functions and powers under existing legislation.

Recommendation no.2

2.23 The National Indigenous Australians Agency, in consultation with relevant stakeholders, clarify the conditions and requirements under which a Land Council accountable authority may delegate its functions and powers.

National Indigenous Australians Agency: Agreed.

2.24 While noting the report is primarily a matter for the Tiwi Land Council, the National Indigenous Australians Agency (the Agency) agrees to Recommendation no. 2.

2.25 As part of the Agency’s ongoing support to Northern Territory Land Councils, we will work with relevant stakeholders to clarify the conditions and requirements under which an accountable authority may delegate its functions and powers taking into account both the Aboriginal Land Rights (Northern Territory) Act 1976 (ALRA) and the Public Governance Performance and Accountability Act 2013 (PGPA).

2.26 According to the Order to Establish the NIAA as an Executive Agency25, the NIAA’s functions include to:

- lead and coordinate Commonwealth policy development, program design and implementation and service delivery for Aboriginal and Torres Strait Islander peoples;

- build and maintain effective partnerships with Aboriginal and Torres Strait Islander peoples, state and territory governments and other relevant stakeholders to inform whole-of-government priorities for Aboriginal and Torres Strait Islander peoples;

- analyse and monitor the effectiveness of programs and services for Aboriginal and Torres Strait Islander peoples, including programs and services delivered by bodies other than the [NIAA]; and

- coordinate Indigenous portfolio agencies and advance a whole-of-government approach to improving the lives of Aboriginal and Torres Strait Islander peoples.

2.27 The NIAA advised the ANAO that its role in relation to the NT Land Councils includes: representing the Land Councils to Commonwealth agencies on key issues; providing advice to the Land Councils on compliance with the PGPA Act in relation to annual reports and operational plans; providing budget support to Land Councils; supporting governance reviews of the Land Councils; and providing advice to the Minister on all decisions required under the ALRA. The NIAA advised the ANAO that it is not involved directly in Land Council operations.

2.28 As part of this audit, the ANAO approached the NIAA regarding a potential recommendation to the NIAA to support the Tiwi Land Council to develop appropriate delegation instruments. The NIAA responded that ‘This is a matter for the Tiwi Land Council’.

3. Governance under the Aboriginal Land Rights (Northern Territory) Act 1976

Areas examined

This chapter examines whether the Tiwi Land Council (TLC) has effectively governed its legislative functions under the Aboriginal Land Rights (Northern Territory) Act 1976 (ALRA).

Conclusion

The TLC’s governance of its legislative functions under the ALRA is partly effective. Governance arrangements to manage operations are deficient with respect to appointments, meetings and training. The governance arrangements to support the exercise of the TLC’s key legislative functions are not fully fit for purpose. Since September 2022 the TLC has commenced addressing some of these deficiencies.

Areas for improvement

The ANAO made six recommendations to the TLC aimed at: providing training to Council, Management Committee and Trust members and documenting their roles and responsibilities; implementing a recruitment policy and conducting performance reviews; providing the Management Committee meeting rules to the Minister for Indigenous Australians and increasing the accessibility of the Council and Management Committee rules and meeting minutes; fully implementing Council and Management Committee meeting rules; addressing the deficiencies in the TLC’s management of section 19 agreements and permits; and improving the assurance processes for payment distribution. The ANAO suggested to the TLC that it more clearly documents meeting discussions.

3.1 The Northern Territory (NT) Land Councils’ key purpose is to assist in claiming Aboriginal land and once a claim has been granted, to manage Aboriginal land on behalf of Traditional Owners and other Aboriginal people living in the area of the Land Council. To achieve this purpose, the ALRA prescribes that specific governance arrangements must be in place for Land Councils to manage their operations. The arrangements relate to: appointments to key governance positions; the establishment and conduct of Council and committee meetings; and the establishment of registers of Council and Land Trust members, and of Traditional Owners.26

3.2 Land Councils must also establish governance arrangements to support the delivery of their key legislative functions, which pertain to three main types of activities.

- Negotiation and assistance — Land Councils must assist Traditional Owners and Aboriginal people with land claims27, negotiate on behalf of Traditional Owners and other Aboriginal people with third parties wanting to use or access Aboriginal land; and assist Aboriginal people to carry out commercial activities and protect sacred sites.28

- Consultation and consent — Land Councils must consult with Traditional Owners and Aboriginal people in the area of the Land Council about the management of land and endeavour to protect their interests.29

- Distribution of royalties and payments — Land Councils must distribute royalties and other payments, such as rents, to, or on behalf of, Traditional Owners.30

3.3 Land Councils and Land Trusts are exempt from compliance with the Freedom of information Act 1982.31 There are also no appeal or review mechanisms in the ALRA. This reinforces the importance of effective governance arrangements to support the management of Land Councils’ key activities.

Has the Land Council established and implemented appropriate governance arrangements to manage its operations?

The TLC’s arrangements to manage its operations are partly appropriate. An approved method of choice is followed, however Ministers have raised concerns about the way in which Trust members appointed Council members and the lack of female representation. The Minister for Indigenous Australians has requested a revised method for her approval. There is no handbook outlining, or induction into, the roles and responsibilities of Council, Trust or Management Committee members, and ongoing training is limited. The 2018 recruitment of the previous CEO (who was dismissed by the Council in July 2022) was not competitive and his performance was not reviewed as required. There are approved meeting rules, which are largely followed, however their implementation does not fully support informed decision-making. Registers of Council members, Trust members and Traditional Owners are established.

Appointment of key governance positions

3.4 The ALRA prescribes how Council and Land Trust32 members, including the Chair and Deputy Chair of the Council, must be appointed (see Appendix 6). The ALRA specifies that:

- Council members shall be chosen by Aboriginal people living in the area of the Land Council in accordance with a ‘method of choice’, which is to be approved by the Minister; and

- Land Trust members shall be appointed by the Minister based on nominations from the Council.

Development of the TLC’s method of choice

3.5 The TLC method of choice as at March 2023 was approved by the Minister for Indigenous Australians (the Minister) on 4 February 2017. It replaced the previous method of choice approved in 1992. The key characteristic of the 1992 method of choice was that the Council was comprised of the appointed members of the Land Trust and others who were solely selected by the Land Trust members.

3.6 Successive Ministers for Indigenous Australians had expressed their concerns with the TLC’s 1992 method. The concerns, documented in several letters to the TLC Chair between 2011 and 2017, related primarily to the role of Trust members in appointing other Council members; and to the lack of female representation. Between 2011 and 2017, the Ministers approved short-term, interim appointments to the Land Trust (between three and 12 months) ‘to allow the Tiwi Land Council time to review its current processes and work towards amending the method of choice for appointment to the Land Council.’ In advice related to the development of the 2017 method of choice, the TLC advised the Department of the Prime Minister and Cabinet in 2014 that:

The fact that power to appoint members of the Land Council is vested in members of the Land Trust, reflects Aboriginal culture (including that of the Tiwi Islanders) and the concept that decisions are made by community elders. The appointment process of such elders is fluid and typically considers a potential appointee’s seniority within the community, ancestry, experience and personal and family ties to the land. Whilst community consensus can often play a small role, the appointment process is in large part not democratic.

3.7 The 2017 method of choice establishes that:

- the eight members of the Tiwi Aboriginal Land Trust — one member representing each clan — are automatically members of the Council;

- in meetings of each of the eight clans, arranged by TLC staff, recommendations for Land Council members are sought from clan members, and approved by the ‘senior traditional Aboriginal owner(s)’ from each clan; and

- from the recommendations, the Trust member representing the clan selects a maximum of three persons who become members of the Council for a period of three years and can be re-appointed.

3.8 While the 2017 method partly addressed the Ministers’ concerns outlined in paragraph 3.6 by requiring Trust members to base their choice on a list of names recommended by their respective clan members, the Ministers’ concerns relating to Trust members being automatic members of the Land Council, and gender imbalance amongst the members, were not addressed.

3.9 At six clan meetings attended by the ANAO in June 2022, a consistent theme was concern about the method of choice: that Trust members had too much power over the selection of Council members; and that not enough women are members of the Council.33 Several other stakeholders with activities related to the TLC expressed similar concerns to the ANAO.

3.10 In a letter dated 7 December 2022 the Minister expressed her support for an ‘improved gender and diverse representation on the [Council]’. The Minister encouraged the TLC to consider appropriate revisions to the method of choice to reflect updated processes and to focus on strong governance. In December 2022 the Minister indicated to the TLC that she expected to be provided with a revised method of choice for her approval. In May 2023 the TLC advised the ANAO that a revised method of choice would be provided to the Minister following clan and other group consultations and discussions.

Land Trust member appointments

3.11 The method to nominate Trust members is not documented in the 2017 method of choice, or in TLC policy documents. The ALRA does not require that the nomination method for Land Trust members be specified.

3.12 On 5 December 2017 the Minister appointed the eight clan members nominated by the TLC to the Tiwi Aboriginal Land Trust, for five years. The TLC advised the ANAO that the Trust members had been recommended by the clans.

3.13 The five-year term for the 2017 appointments expired on 4 December 2022. In preparation for the selection of the new Trust members, the TLC planned a series of meetings with the eight clans, to be conducted in November 2022. However, following the first clan meeting held on 16 September 2022, the TLC wrote to the Minister on 28 November 2022 to request an extension of the current Trust membership until 30 June 2023, to which the Minister agreed on 7 December 2022. The letter to the Minister noted, in support of the request:

There is considerable disquiet among the wider Tiwi population with this [Trust member] election process that is seen as non-democratic and lacking in transparency.

3.14 The Minister stated that she expected a more formal procedure for nomination of Trust Members to be developed and implemented by 30 June 2023. In May 2023 the TLC advised the ANAO that it had commenced conducting a series of workshops with clan members and Council members with the aim of developing a method to nominate Trust members that is more aligned with community expectations. These workshops were scheduled to be completed in May 2023, prior to the end of Trust members’ extended term. The TLC also advised that the workshops would discuss the options of advertising the election on notice boards and in social and conventional media; conducting information sessions with clans prior to the election; and conducting the election of Trust members by secret ballot. The TLC expects that the Trust member elections to be conducted in June 2023 will be administered by the Australian Electoral Commission.

Council member appointments

3.15 The most recent Council member appointments were made in December 2020, and were conducted in accordance with the approved method of choice. Meetings with the eight clans were conducted in November and December 2020 during which 88 persons were recommended by the clans for consideration by the Land Trust members (including 28 women, 32 per cent). Based on the clans’ recommendations, the Land Trust members nominated 24 Land Council members in December 2020, of which one was a woman (four per cent). To inform the community, the TLC affixed A4 size notices to community notice boards two to three days before the meeting dates (Figure 3.1). The notice indicated that a copy of the notice had been sent to ‘senior Traditional Aboriginal owners’ of the relevant clan, however the TLC was unable to provide evidence to the ANAO that this had been done.

Figure 3.1: Meeting notice for November 2020 Council member appointments

Source: Tiwi Land Council.

3.16 The TLC advised the ANAO that awareness of disqualifying characteristics (see Appendix 6) was gained through local knowledge, which TLC staff then investigate further by requesting a certificate of proceedings from the Local Court of the NT. Given the small size of the Tiwi community, the TLC’s approach to exercising due diligence in relation to Council member disqualifying events is appropriate.

3.17 In May 2023 the TLC CEO advised the ANAO that the Council had provided its support to the co-opting of five additional members to the Land Council, as allowed under subsection 29(2) of the ALRA, and that these five additional members would be women. The co-opting of additional members was to be further discussed during the May 2023 clan and Council members workshop (see paragraph 3.14).

Election of the Chair and Deputy Chair

3.18 The process to elect the Chair and Deputy Chair of the TLC was established in 1983 and approved by the Minister in 1984. It consists of an exhaustive ballot process in which the candidates with fewest votes are eliminated in successive rounds of voting. Subsequent to the December 2020 Land Council member appointments, the Chair and Deputy Chair of the Land Council were elected in February 2021. The February 2021 election process conformed to the process that had been approved by the Minister in 1984. The outcome of the February 2021 election was approved by the Minister on 15 March 2021.

Remuneration of Council Chair and members

3.19 The remuneration of Council members is determined by the Remuneration Tribunal.34 As at March 2023 the prescribed remuneration of the Chair as a full-time office holder was $130,650. The prescribed daily fees for Council members including the Deputy Chair were $344 (when engaged on the functions or duties of the Land Council); or $520 (when engaged on business of the Management Committee).35 As March 2023 none of the members of the Council were also employees of the TLC.

3.20 Under subsection 7(11) of the Remuneration Tribunal Act 1973, a full-time public office holder is prohibited from receiving remuneration for holding, or performing the duties of, another public office. As at March 2023, the TLC Chair held, in addition to his full-time paid position as the Chair of the Council, two paid positions and one unpaid position in other entities. It is not clear to the ANAO that the Chair holding multiple paid positions in other organisations is consistent with the Remuneration Tribunal Act 1973. The ANAO did not examine whether the Chair’s performance of duties for other entities impact on his capacity to complete his duties for the Council as a full-time remunerated public office holder.

Guidance and training for Council and Trust members

3.21 There is no handbook or manual documenting the roles and responsibilities of Council members, Chair, Deputy Chair, Trust members and Council committees. One of the recommendations to the Department of Families, Housing, Community Services and Indigenous Affairs (FaHCSIA) in the 2008 audit of the TLC (see paragraph 2.8) was that FaHCSIA should identify and document the delegated functions of TLC Council sub-committees.

3.22 There is no induction or training for new Council and Trust members. In December 2021 the TLC organised for the Australian Institute of Company Directors to deliver training aimed at developing Council members’ governance skills. The training program covered governance, finance, strategy and risk. The attendance lists demonstrate that of the 32 Council members, 26 attended at least one day of the three-day course, including 18 who attended the course in its entirety. No other governance training had been delivered to Council members since at least 2018. Council meeting minutes indicate that the TLC Principal Legal Officer occasionally provides information to Council members relating to their duties, for instance about the operation of the method of choice or of the code of conduct.

Recommendation no.3

3.23 The Tiwi Land Council:

- develops a handbook or manual documenting the functions, roles and responsibilities of Council, Management Committee and Trust members, including the Council Chair and Deputy Chair; and

- provides initial and regular refresher training to members of the Council and the Tiwi Aboriginal Land Trust about their roles and responsibilities.

Tiwi Land Council response: Agreed.

3.24 The TLC has identified several external sources of expertise and with their assistance intends to develop and provide the above. Process to be overseen by Chief Finance Officer (CFO) and PLO to ensure necessary compliances.

Chief Executive Officer appointments, conditions and review

3.25 The TLC recruitment policy requires staff positions, including the CEO’s, to be advertised and applications to be assessed by a panel before the selected candidate is approved by the full Council. The last substantive CEO was not recruited in accordance with the TLC recruitment policy.

- In February 2018 the CEO was initially appointed as acting CEO by the Land Council (following the resignation of the prior CEO), having occupied the position of Deputy CEO since September 2016.

- On 1 August 2018 the acting CEO was appointed to the substantive CEO position by the Land Council, for a period of three years. Council meeting minutes do not indicate whether the CEO was assessed by a panel. Minutes from a meeting preceding this decision included discussion that the position be advertised, however this was not done.

- On 1 August 2021 the CEO’s contract was renewed for a period of three years, following a resolution from the Council on 15 February 2021.

3.26 Council meeting rules state that the Council should review the CEO’s performance annually. The 2018 Council meeting minutes relating to the CEO’s initial appointment demonstrate there was discussion in relation to the length of the CEO’s contract, and no discussion about remuneration or performance expectations. The employment contract included a statement of duties relating to the delivery of responsibilities under the ALRA and the Public Governance, Performance and Accountability Act 2013 (PGPA Act). There was no performance plan documenting specific performance expectations and there is no record of performance review in meeting minutes between 2019–20 and 2021–22 or in any other documentation. Reviews of the CEO performance were not conducted in other fora.

3.27 On 5 July 2022 a majority of the Council voted to dismiss the CEO from employment on the grounds of poor performance. The Minister was informed of this decision in accordance with the PGPA Act section 91. A confidential deed of settlement was executed on 28 July 2022, which included an employee termination payment of $371,706. An interim CEO was appointed by the Council on 4 July 2022 and commenced his duties on 16 August 2022, initially for a period of six months. In March 2023 the interim CEO’s appointment was extended to 16 February 2024. One of the responsibilities of the interim CEO is to recruit a permanent CEO.

Recommendation no.4

3.28 The Tiwi Land Council:

- implement its recruitment policy for all new appointments, including when recruiting a permanent CEO; and

- establish performance plans for all its staff, including the CEO, and monitor and review performance against that plan periodically.

Tiwi Land Council response: Agreed.

3.29 The TLC commenced this process in late 2022 using external HR advice for staffing matters including work contracts. The TLC’s PO also obtained the recruitment policies of a number of other similar organisations including Territory Land Councils and has commenced work to review them for TLC suitability. In 2022 the TLC sought funding for and engaged a HR Manager and commenced the reform processes. This position has been tasked with working with the PO to complete the policy formulation. All positions over the past months have now followed policy by being advertised, (in print and other media) and applicants assessed by a committee that has often included external members. This committee makes the relevant recommendations to the CEO for the engaging of staff. It is expected that this will be regularised in the updated recruitment policy being prepared.

3.30 The TLC has also sought examples of Performance Evaluation procedures and documentation used by similar organisations and has tasked the HR Manager with assisting the PO to review and recommend an appropriate policy and procedure for the TLC.

Establishing and implementing meeting and committee rules

Establishment of committees

3.31 The TLC has established one committee in accordance with the ALRA (see Appendix 6), the Management Committee. The Management Committee is comprised of ten members (a representative of each of the eight clans, plus the Chair and Deputy Chair of the Council). The Management Committee’s functions, roles and responsibilities are not documented.

Establishment and communication of Council and Management Committee meeting rules

3.32 The TLC has not complied with all the requirements of the ALRA (see Appendix 6) in relation to the establishment and communication of Council and Management Committee meeting rules.

- In accordance with the ALRA, the TLC Council meeting rules were submitted to the Minister on 27 November 2017 and approved on 28 June 2018.

- According to the draft 2021–22 Annual Report, the meeting rules for the Management Committee were provided to the Minister in March 1995. The rules have been amended since that time. However, the TLC has not provided the current version of the rules to the Minister.

- The ALRA prescribes that meeting rules and minutes must be made available for inspection. The TLC advised the ANAO that meeting rules and minutes are available for inspection upon request from the CEO. However, the TLC does not promote the fact that meeting rules and minutes are available, which reduces the transparency of the process.

Recommendation no.5

3.33 The Tiwi Land Council:

- implement the ALRA requirement to provide the Management Committee meeting rules to the Minister for Indigenous Australians; and

- increase the accessibility of the Council and Management Committee meeting rules and minutes (which could include the use of the TLC website, newsletter, radio and social media platforms to promote how the rules and minutes can be accessed).

Tiwi Land Council response: Agreed.

3.34 The TLC intends to pass on to the Minister the rules as required.

3.35 The TLC has recently engaged a Media Officer (MO) who has been tasked with updating the land council’s social and other media and recommendation 5b is among the changes to be implemented.

Implementation of meeting rules

3.36 The ANAO analysed the minutes of the Council and Management Committee meetings in 2021–22 to determine whether meeting rules had been complied with.36 Overall, meeting rules were implemented appropriately in relation to meeting frequency, quorum and decision-making processes.37 One exception was in relation to the annual review of key governance documents. Between 1 July 2019 and 30 June 2022:

- the meeting rules were reviewed by the Management Committee in 2020–21 and 2021–22, and not in 2019–20;

- the register of interests was reviewed by the Council once in December 2021; and