Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Governance and Integrity of the Northern Australia Infrastructure Facility

Please direct enquiries through our contact page.

The objective of the audit was to examine the effectiveness of governance and integrity arrangements for the Northern Australia Infrastructure Facility (NAIF).

Summary and recommendations

Background

1. The Northern Australia Infrastructure Facility (NAIF) is a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), established from 1 July 2016 under the Northern Australia Infrastructure Facility Act 2016 (NAIF Act).

2. The objective of the NAIF is ‘to provide grants of financial assistance to the States and Territories for the construction of Northern Australia economic infrastructure’, which is defined in the NAIF Act as infrastructure that provides a basis for economic growth in Northern Australia and stimulates population growth in Northern Australia.1 It can include infrastructure located outside Northern Australia that satisfies the statutory definition. The NAIF Act provided for $5 billion to be appropriated from the Consolidated Revenue Fund for this purpose. The NAIF Board has until 30 June 2021 to make decisions to provide financial assistance.

Rationale for undertaking the audit

3. On 14 June 2017, the Senate referred an inquiry into the governance and operation of the NAIF to the Senate Economics References Committee, which tabled its Final Report on the results of the inquiry on 6 July 2018.2 The Final Report stated that a significant number of submissions to the Committee related to a ‘proposal for NAIF funding to build a railway line from the Carmichael coal mine to the Abbot Point port’.3 The report included 12 recommendations covering:

- governance changes with the addition of a second responsible minister, structured engagement with the Clean Energy Finance Corporation, publication of Indigenous Engagement Strategies and Indigenous representation on the Board;

- publication of conflicts of interest, publication of more detail about investment decisions, prioritisation of projects with high local content, and allocating funds to the tourism industry; and

- a review of NAIF transparency, a more transparent transaction pipeline, more resources in Darwin, and more transparency in senior staff remuneration.

4. The NAIF Act provides for a statutory review of the operation of the Act to be undertaken as soon as possible after the period of three years beginning when the Act commenced (as soon as possible after 1 July 2019). The statutory review must consider whether the time limit of 30 June 2021 for making decisions should be extended, and the appropriate governance arrangements after that date.4

Audit objective and criteria

5. The objective of the audit was to examine the effectiveness of governance and integrity arrangements for the NAIF.

6. To form a conclusion against the audit objective, the ANAO adopted the audit criteria:

- Does the NAIF have in place a sound governance framework that is fit-for-purpose?

- Has the NAIF implemented arrangements that support effective integrity and transparency in relation to its operations?

7. The audit scope did not address the merits of Northern Australia infrastructure policy, ministerial appointments to the Board, or particular decisions to grant financial assistance.

Conclusions

8. The NAIF’s arrangements to support the integrity of decision making were not fully effective. While NAIF has established appropriate governance and policy frameworks, decision support processes were not sufficiently transparent or evidenced to demonstrate projects have been treated in a consistent manner.

9. The NAIF has an appropriate governance framework, including systems of risk management and internal control, and effective arrangements with the Export Finance and Insurance Corporation (Efic) as its key service provider. Appropriate oversight is provided to the Minister for Resources and Northern Australia through reporting and regular meetings. While the Board adopted a flexible approach to strategy, only a small number of projects were assessed as addressing an identified infrastructure need, and amendments to the Investment Mandate changed the scale and scope of projects that the NAIF Board was considering beyond its original purpose. Remuneration policies and practices were not consistent with public sector governance standards, and information governance requires attention to meet National Archives standards and improve transparency.

10. The NAIF did not implement effective arrangements to support integrity and transparency throughout all elements of its operations. The NAIF had an appropriate integrity policy framework and the management of conflicts of interest was effective, however the NAIF adopted but did not adequately implement the Protective Security Policy Framework. Arrangements for engaging with stakeholders were generally effective. Arrangements for ensuring the integrity of decision support processes were not effective, with insufficient evidence that all applicants were evaluated in a consistent manner throughout the assessment stages. The Board placed reliance on the CEO to present projects for Board consideration, and the Board has not made any Investment Decisions to refuse financial assistance for the applications presented.

Supporting findings

Governance

11. The NAIF’s governance framework is in accordance with relevant legislative and policy requirements. The NAIF has an appropriate statutory framework, Board processes and suite of governance policies. The NAIF provides the Minister for Resources and Northern Australia with oversight of its governance and decision-making through transaction pipeline reports and weekly meetings with the Minister’s office, but did not keep minutes of these meetings. The NAIF Board has oversight of the Chief Executive Officer and staff, however remuneration policies and practices were not consistent with public sector governance standards.

12. While NAIF origination strategies promoted the achievement of its purpose: NAIF facilitated origination has not generated a significant or sustained increase in either the annual number of new projects or the annual number of successful applications; and only a small number of projects considered by the NAIF Board were assessed as addressing an infrastructure need identified through a Commonwealth, State or Territory assessment process, pipeline, or priority list. The eligibility criteria for financial assistance were substantially broadened in order to increase the number of Investment Decisions.

13. The NAIF has developed an appropriate system of risk oversight and management that is consistent with the requirements of the Commonwealth Risk Management Policy and relevant Australian Prudential Regulation Authority (APRA) and Australian Stock Exchange (ASX) governance standards.

14. The NAIF has developed a system of internal control which is appropriate for its requirements. The NAIF Board adopted a blended system that relied primarily on service providers’ policies and practices to provide coverage broadly equivalent to the model accountable authority instructions. The blended system has an inherent risk of insufficient clarity in relevant roles and responsibilities which should be monitored.

15. The Service Agreement and preceding inter-entity arrangement between the department and Efic were effective in supporting the establishment and operation of the NAIF, and had benefits for Efic in relation to demand management and the development of staff capability. Aspects of the NAIF’s contract management of the Service Agreement could be improved to ensure ongoing value for money is maintained and evidenced.

16. The NAIF’s information governance requires improvement to meet National Archives of Australia standards. The NAIF has implemented Freedom of Information and Information Publication Scheme processes. The NAIF published information about decisions to grant financial assistance as required by the Investment Mandate, but did not publish information about decisions not to grant financial assistance. The NAIF did not always disclose assessment criteria and processes, or non-confidential information about decisions.

Integrity and transparency

17. The NAIF had an appropriate integrity policy framework. The integrity compliance program was largely reliant on induction training and self-reporting, which could be supplemented by ongoing training, pro-active compliance reviews and internal audit coverage.

18. The management of conflicts of interest was effective. The NAIF Board approved a conflicts of interest policy that applied to Board members and staff. The NAIF Board implemented sound declaration practices at Board meetings, and sound recusal practices at Board meetings and in Board papers. Declarations were more likely to be made after conflict checks were conducted or when an application reached the due diligence stage, indicating that there would be value in conducting conflict checks for all proposals from the earliest stage.

19. The NAIF adopted but did not adequately implement the Protective Security Policy Framework. The NAIF relied on service providers’ security risk management policies and practices, and more recently approved policies specific to its own circumstances in areas such as business continuity. The NAIF did not use security classification and dissemination limiting markers on official documents. Some NAIF Board members used non-official email accounts to conduct official business and make decisions on projects with commercial and political sensitivities.

20. The NAIF implemented arrangements for engaging with stakeholders which were generally effective. The Board exercised regular oversight of stakeholder engagement. While the NAIF conducted regular consultation with government stakeholders with assistance from the department, providing more complete information to these stakeholders would help to identify and manage shared risks. The NAIF has draft bilateral protocols for statutory consultation with State and Territory jurisdictions under the Master Facility Agreements, and with Infrastructure Australia.

21. The arrangements for ensuring the integrity of decision support processes were not effective. The NAIF Board placed reliance on the CEO to determine whether a project progressed to the strategic assessment stage in circumstances where it is unclear why certain projects were presented to the Board and not others, and the Board has not made any Investment Decisions to refuse financial assistance for the applications presented to it. There was insufficient evidence that all projects were evaluated in a consistent manner throughout the assessment stages, and the NAIF sent letters of support or term sheets before applicants provided appropriate supporting documentation. There was no apparent consistency in how site visits were planned, conducted, documented or reported to the NAIF Board.

22. The NAIF Board met minimum external reporting obligations, but did not set measures that provided clear accountability and transparency in relation to its performance, did not measure the realisation of public benefit, and did not meet key performance targets in 2017–18.

Recommendations

Recommendation no.1

Paragraph 2.34

The NAIF publish criteria and all information necessary for applicants to submit complete applications for grants of financial assistance.

The Northern Australia Infrastructure Facility response: Agree.

Recommendation no.2

Paragraph 2.72

The NAIF develop an information governance framework, electronic data and records management system, and appropriate records disposal authorities in line with National Archives of Australia requirements.

The Northern Australia Infrastructure Facility response: Agree.

Recommendation no.3

Paragraph 2.79

The NAIF publish more information about decisions, public benefit assessments, environmental assessments and Indigenous engagement strategies.

The Northern Australia Infrastructure Facility response: Agree.

Recommendation no.4

Paragraph 3.24

The NAIF cease the use of all non-official email accounts and servers to conduct official business.

The Northern Australia Infrastructure Facility response: Agree.

Recommendation no.5

Paragraph 3.60

The NAIF select projects at each assessment stage on a consistent and transparent basis in accordance with published criteria, and retain adequate documentation to record the rationale for decisions made and actions undertaken.

The Northern Australia Infrastructure Facility response: Agree in principle.

Recommendation no.6

Paragraph 3.70

The NAIF revise its performance measures and targets to provide clearer accountability and transparency in the measurement of its performance, and measure and report on the realisation of public benefit.

The Northern Australia Infrastructure Facility response: Agree.

Entity response

23. The proposed audit report was provided to the Northern Australia Infrastructure Facility. The full response, including ANAO rejoinders to that response, are reproduced at Appendix 1. The summary response is reproduced below.

NAIF agrees to ANAO Recommendations 1-4 and 6 agrees in principle to Recommendation 5. NAIF’s full response is at Appendix 1 and in responses to those Recommendations provided in the report.

NAIF agrees with the ANAO that principles of accountability and transparency are essential to maintaining public confidence in the quality of public administration.

NAIF disagrees with the ANAO finding that NAIF’s arrangements to support the integrity of NAIF decision making were not fully effective in terms of either transparency or evidence of consistent treatment of projects.

NAIF’s decision making criteria are transparent being comprehensively set out in a list of five mandatory criterion and at least 27 requirements in the NAIF Act and Investment Mandate that the Board must consider in making an Investment Decision.

NAIF publishes information, at all times balancing transparency with its best practice statutory obligations to maintain commercial in confidence information, in order to deliver on its mandate.

Documentary evidence exists for all NAIF decisions to progress projects through NAIF’s various stages. NAIF does not accept that the examples provided at paragraphs 3.45–3.51 are evidence of a lack of clarity as to why particular projects were presented to the Board and not others.

The NAIF process has been designed to deliver on its objective of accelerating infrastructure development. It involves a test (applied at the strategic assessment stage) requiring that a project demonstrates potential to meet all criteria. There is a separate test which requires the NAIF CEO to have formed a view that a project if it were presented to the Board, the Board would be likely to exercise its discretion to decline an Investment Proposal.

NAIF also disputes the ANAO’s statements at paragraph 3.50. There were no instances where a project that did not have the potential to meet the criteria was recommended to be moved to due diligence.

All decisions have been made against consistent and correct criteria. NAIF accepts and has acted to ensure there is more consistency in documentation by different executives for the strategic assessment stage (in being clear the analysis at that stage relates to a potential to meet criteria). A lack of decisions by the NAIF Board to refuse financial assistance for the applications presented to it is also not reflective of any issue with NAIF’s process.

The ANAO analysis (at paragraphs 3.40-3.41) focussing on the time projects are in the NAIF system is not evidence of any inconsistency or lack of integrity of NAIF’s decision making process and is not determinative of an outcome. As a result of both the unique project and proponent characteristics and the overlay of commercial judgement, projects progress at different rates which creates variability in timing to progress. That is not evidence of a lack of consistency of approach or process. NAIF applies the same process consistently to the differing parameters of each project to assess against the NAIF requirements.

ANAO (at paragraph 3.42) asserts that NAIF should ensure it makes a decision to grant or refuse all projects expeditiously and to a 30 June 2021 deadline. NAIF’s response is that projects may not be ready to be managed by NAIF to such an outcome. NAIF is actively seeking to progress projects quickly where feasible but it does not discount any opportunity peremptorily and it does not control project timelines.

24. The Department of Industry, Innovation and Science (the department) was provided with extracts of the report containing those sections where the department was specifically mentioned. The department did not provide comment.

Key messages from this audit

Accountability and transparency

Principles of accountability and transparency are essential to maintaining public confidence in the quality of public administration. The Australian Parliament and the Australian Government give these principles specific expression in legislative and policy standards that apply to the powers, functions and duties of public sector bodies, including corporate Commonwealth entities such as the Northern Australia Infrastructure Facility (NAIF).

This audit concluded that the NAIF’s arrangements to support the integrity of decision making were not fully effective. While the NAIF established appropriate governance and policy frameworks, decision support processes were not sufficiently transparent or evidenced to demonstrate that projects had been treated in a consistent manner.

It is concerning that the NAIF’s response reflects a view that these findings are unjustified on the basis that they fail to consider the application of ‘expert commercial judgement’ in the decision making process.

The general duty imposed on officials in all Commonwealth entities to act honestly, in good faith and for a proper purpose5 necessitates the demonstration of matters taken into consideration in arriving at a decision. While the use of expert judgement may be appropriate, this does not reduce the expectation that the use of this judgement is transparent and clearly documented. This audit found insufficient evidence of the specific circumstances considered in moving some projects forward in the decision making process in preference to other projects — whether these considerations took the form of expert judgement or otherwise.

The accountable authority of a Commonwealth entity must govern the entity in a way which demonstrates to the Parliament, and the Australian Public, that it is promoting the proper use and management of public resources.6 It is incumbent on the NAIF Board, which has responsibilities with respect to the allocation of $5 billion of public funds, to understand its accountabilities and responsibilities in this regard.

1. Background

Introduction

1.1 The Australian Government has established a policy focus on developing Northern Australia — comprising the Northern Territory and those parts of Western Australia and Queensland above the Tropic of Capricorn.7

1.2 In June 2014, the Department of the Prime Minister and Cabinet released the Green Paper on Developing Northern Australia.8 Inviting comment for the development of a White Paper, it proposed six broad policy directions for Northern Australia: infrastructure; land; water; business, trade and investment; education, research and innovation; and governance.

1.3 On 4 September 2014, the Joint Parliamentary Select Committee on Northern Australia tabled the Pivot North report.9 The report included 14 recommendations on the provision of new or existing infrastructure in Northern Australia, and the establishment of a rural investment fund to provide opportunities for investors to participate in rural infrastructure development projects.

1.4 In January 2015, Infrastructure Australia10 released the Northern Australia Audit — Infrastructure for a Developing North report. The report assessed critical gaps in Northern Australian economic infrastructure — the transport (airports, ports, rail and road), energy (generation and transmission), water and communications sectors. The report concluded that processes and policy frameworks for the evaluation of major projects need to improve to avoid unwanted or stranded infrastructure investment; there may be merit in considering multi-user investment with some social amenity; Government investment should only proceed where there is a clearly defined value to the taxpayer; and strengthened infrastructure network planning and coordination merits consideration.11

1.5 On 12 May 2015, the Australian Government announced the establishment of the Northern Australia Infrastructure Facility (NAIF) under the Department of the Treasury, stating that ‘the loan facility will be open for applications from 1 July 2015’.12

1.6 This was followed in June 2015 by the release of the Our North, Our Future: White Paper on Developing Northern Australia.13 In line with the preceding Green Paper, the White Paper contained a range of measures including ‘infrastructure to support growth’ and outlined the Government’s infrastructure investment strategy. It provided further detail on the NAIF, linking it to the Northern Australia infrastructure projects pipeline with the statement that ‘projects wanting funding from the Northern Australian Infrastructure Facility will benefit from being on the pipeline’.14 In October 2015, the Treasury informed the Senate that Treasury officials had met with ‘over 100 individuals across 40 or so different companies’.15

1.7 Following machinery of government changes on 30 September 2015, responsibility for the NAIF moved to the Minister for Resources, Energy and Northern Australia16, and the Government commenced consultation on draft legislation to establish the NAIF as a separate entity.17 The Minister stated in the second reading speech on 17 March 2016 that over 200 stakeholders were consulted on the bill and ‘through the consultation process, 40 projects with an indicative capital value of $21 billion have been identified as potential NAIF projects…around half have been identified in Infrastructure Australia’s Northern Australia audit’.18

Figure 1.1: NAIF timeline

Source: ANAO analysis.

The Northern Australia Infrastructure Facility

Structure and governance

1.8 The NAIF is a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), established from 1 July 2016 under the Northern Australia Infrastructure Facility Act 2016 (NAIF Act) with a Chair, a Board and a Chief Executive Officer (CEO).19

1.9 The NAIF Board is responsible to the Minister for Resources and Northern Australia (the Minister), who is advised by the Office of Northern Australia within the Department of Industry, Innovation and Science (the department).20 The Minister appoints and provides direction to the NAIF Board, the NAIF Board appoints and provides direction to the CEO, and the CEO engages and provides direction to staff as required.21

1.10 The Minister provides statutory direction to the NAIF through an Investment Mandate.22 The purpose of the Investment Mandate is to direct the NAIF in relation to the performance of the functions of the NAIF as set out in section 10 of the NAIF Act. The Investment Mandate requires that the NAIF must have regard to Australian best practice government governance principles, and Australian best practice corporate governance for Commercial Financiers, when performing its functions.23

1.11 As at 3 December 2018, the NAIF directly employed 25.6 full-time equivalent staff members with an operating budget of $9.535 million for the 2018–19 financial year24, and had offices in Cairns, Sydney, Brisbane and Perth.

1.12 Corporate services, and services for grants of financial assistance, have been provided by a mixture of NAIF staff, staff seconded from the Export Finance and Insurance Corporation (Efic) to the NAIF, and fee-based services provided by Efic to the NAIF under a Service Agreement.25 Efic is a corporate Commonwealth entity, established and operating under the Export Finance and Insurance Corporation Act 1991, as amended to empower Efic to provide and charge for these services.26 Efic’s purpose is to facilitate and encourage Australian export trade by the provision of insurance and financial services and products.

Investment framework

1.13 The objective of the NAIF is to provide grants of financial assistance to the States and Territories for the construction of Northern Australia economic infrastructure27, which is defined in the NAIF Act as infrastructure that provides a basis for economic growth in Northern Australia and stimulates population growth in Northern Australia. It can include infrastructure located outside Northern Australia that satisfies the statutory definition.28 The NAIF Act provided for $5 billion to be appropriated from the Consolidated Revenue Fund for this purpose.29 The NAIF Board has until 30 June 2021 to make decisions to provide financial assistance.30

1.14 The NAIF Board is responsible for considering applications by Project Proponents31 against the eligibility criteria set out in the NAIF Act and the Investment Mandate, and the assessment criteria developed by the Board, and making Investment Decisions.32 The NAIF Board established a four stage framework for assessing proposals in the ‘transaction pipeline’, as set out in Figure 1.2.33

Figure 1.2: The NAIF four stage assessment framework

Source: NAIF, Application and Approval Procedure, Annexure 2.

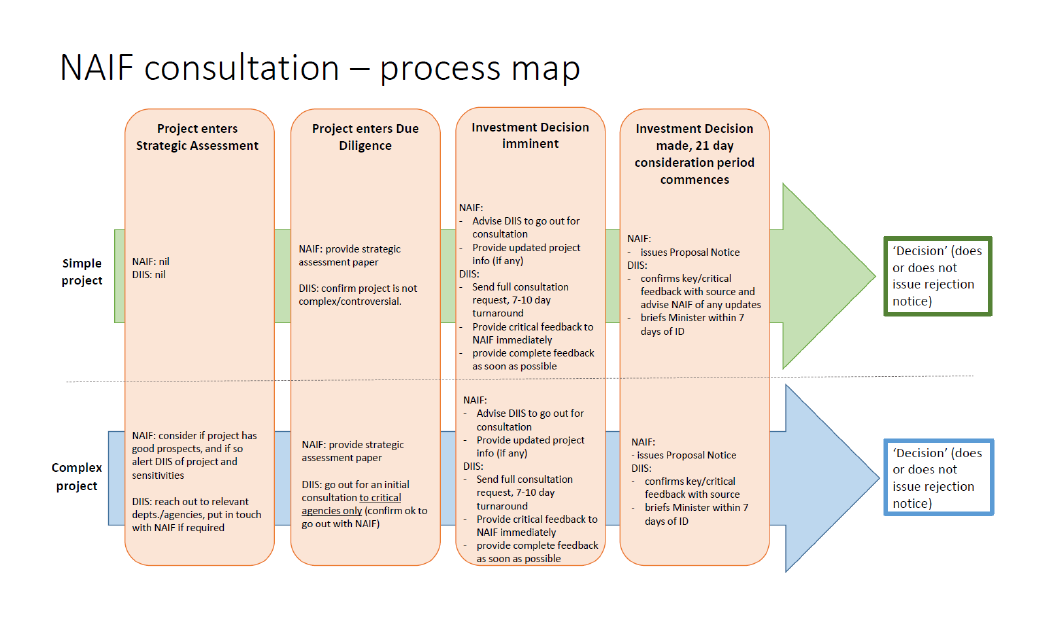

1.15 The Investment Mandate permits the NAIF to have a high risk tolerance in relation to factors that are unique to investing in Northern Australia economic infrastructure, including but not limited to, Northern Australia’s distance and remoteness and climate.34 The NAIF must commence consultation with the relevant State or Territory jurisdiction as soon as practicable after receiving an Investment Proposal, must consult Infrastructure Australia on decisions greater than $100 million, and can consult with relevant government stakeholders as appropriate.35 The NAIF Board must make decisions, and does so based on advice from the CEO and staff.36

1.16 If the NAIF Board decides to grant financial assistance, it must provide the Minister with a written proposal notice.37 The Minister considers the proposal38 and receives advice from the department, which in turn consults other Australian Government agencies relevant to the proposal. Neither the Minister nor the relevant State or Territory jurisdiction can direct the NAIF to grant financial assistance to specific projects; however, each can determine that financial assistance should not be provided.39 If the Minister does not provide a rejection notice within the consideration period, which can be between 21 and 60 days, the NAIF Board can make an Investment Decision.40 When the NAIF Board makes an Investment Decision, it must notify the Project Proponent as soon as practicable, and within 30 business days must publish information regarding the Investment Decision on its website.41

1.17 The department and the NAIF have established Master Facility Agreements (MFA) with Queensland, the Northern Territory and Western Australia that cover the origination, assessment, execution and administration of financial assistance to, and concessional loans to Project Proponents by, the relevant State or Territory jurisdiction.42

1.18 Unlike commercial financiers, the NAIF is not a party to the loan contract, does not recognise loans as assets in its balance sheet, and does not carry financial risk or reward. The financial assistance arrangements (illustrated at Figure 1.3) operate as follows:

Concessional financial assistance, in the form concessional loans, will be funded by a special appropriation, attributable to the Department of Industry, Innovation and Science (Industry) as the Accountable Authority.

A Master Facility Agreement (MFA) will provide a contractual arrangement between the Commonwealth (represented by Industry), NAIF corporate Commonwealth entity and the States, for the provision of the concessional financial assistance. This will enable each of the States to provide concessional finance to the project proponents as a pass-through arrangement. Further, MFA absolves the States of any exposure to variability in cash flows, including those arising from credit risk and market risk.

The Commonwealth will not be a direct party to the loan contract with the project proponent. The MFA provides for the financial assistance to be made via the States to the project proponents and repayment of funds to the Commonwealth.43

Figure 1.3: Financial assistance arrangement for concessional loans

Source: Department of Industry, Innovation and Science, Accounting Policy for Concessional Loans Provided by the Northern Australia Infrastructure Facility 2017–18.

1.19 The department’s accounting policy further states that ‘the risk of default will be borne by the Commonwealth and not the States’, the department ‘will recognise these loans as assets in its administered balance sheet’ with the Secretary as the accountable authority, and loans ‘will be assessed at each reporting date to assess whether there is any objective evidence that they are impaired’.44

1.20 Concessional loans are those loans provided on terms that are more favourable than the proponent could obtain from other financing sources on a commercial basis. The concessional elements provided by the NAIF can include longer loan tenor, lower interest rates and fee structures, extended periods of capitalisation of interest beyond construction completion, deferral of loan repayments, ranking lower than commercial financiers (subordinate rather than senior or pari passu debt), limited or no recourse loans, or alternative financing mechanisms such as financial guarantees to commercial financiers.45 The Investment Mandate requires that the Board ‘must limit the concessions offered to the minimum concessions the Board considers necessary for the Investment Proposal to proceed’.46

1.21 After establishment on 1 July 2016, the NAIF Board made its first decision to grant financial assistance in September 2017. In December 2017, the department commissioned Mr Anthony Shepherd AO to conduct a review (the Shepherd review) to ‘recommend ways to accelerate project development and ensure the NAIF can best meet its legislated objective’.47 The Shepherd review recommended specific changes to NAIF and government practices and broadening the Investment Mandate in order to increase the volume of decisions. The Minister subsequently amended the Investment Mandate, which took effect from 2 May 2018. By 31 December 2018, the NAIF had made six final Investment Decisions totalling $263.98 million (see Table 1.1), of which $13.57 million had been drawn down by 30 January 2019.

Table 1.1: Final Investment Decisions (1 July 2016–31 December 2018)48

|

Decision date |

Proponent |

Goods/services involved |

Loan Amount (up to) |

Location |

|

29 September 2017 |

Onslow Marine Support Base Pty Ltd |

Development of a marine supply facility including wharf and harbour expansion |

$16.8 million |

WA |

|

3 May 2018 |

Humpty Doo Barramundi Pty Ltd |

Development of a solar farm, a medium fish nursery, processing equipment and adult fish feeding systems |

$7.18 million |

NT |

|

14 May 2018 |

Voyages Indigenous Tourism Australia Pty Ltd |

Airport runway, taxiway and apron upgrade, runway lighting and provision of contractor accommodation |

$27.5 million |

NT |

|

15 June 2018 |

James Cook University |

Building of a Technology Innovation Complex, a 10,000m2 centre for students, industry partners and researchers |

$98.0 million |

QLD |

|

2 August 2018 |

Pilbara Minerals Limited |

Upgrading the public Pippingarra Road |

$19.5 million |

WA |

|

28 August 2018 |

Sheffield Resources Limited |

Construction of infrastructure including LNG power station and reticulation, site accommodation village and processing facility and also upgrading of existing local road and port infrastructure all to support the Thunderbird Mineral Sands Project |

$95.0 million |

WA |

|

Total |

|

|

$263.98 million |

|

|

155 |

99 |

216 |

128 |

84 |

Source: NAIF website (https://naif.gov.au/corporate-reporting/naif-investment-decision-notifi…), 1 February 2019.

Audit approach

1.22 The objective of the audit was to examine the effectiveness of governance and integrity arrangements for the Northern Australia Infrastructure Facility.

1.23 To form a conclusion against this objective, the ANAO adopted the following high level criteria:

- Does the NAIF have in place a sound governance framework that is fit-for-purpose?

- Has the NAIF implemented arrangements that support effective integrity and transparency in relation to its operations?

1.24 In undertaking the audit, the audit team:

- examined relevant NAIF documents, including Board papers, management reports, policies, procedures, frameworks, external reviews and internal audits;

- interviewed NAIF and service provider staff; and

- sought written and verbal feedback from government stakeholders with statutory roles under the NAIF Act and Investment Mandate.

1.25 The audit was open for citizen contributions, including from NAIF applicants and Project Proponents, non-governmental stakeholders and the general public — no contributions were received. The ANAO did not approach individual applicants for NAIF financial assistance, Project Proponents or non-government stakeholders for comment.

1.26 The audit was conducted in accordance with ANAO Auditing Standards49 at a cost to the ANAO of approximately $564,445. Audit team members were Christopher Swain, Chirag Pathak, Anne Kent and Paul Bryant.

2. Governance

Areas examined

The ANAO examined whether the Northern Australia Infrastructure Facility (NAIF) has in place a sound governance framework that is fit-for-purpose.

Conclusion

The NAIF has an appropriate governance framework, including systems of risk management and internal control, and effective arrangements with the Export Finance and Insurance Corporation (Efic) as its key service provider. Appropriate oversight is provided to the Minister for Resources and Northern Australia through reporting and regular meetings. While the Board adopted a flexible approach to strategy, only a small number of projects were assessed as addressing an identified infrastructure need, and amendments to the Investment Mandate changed the scale and scope of projects that the NAIF Board was considering beyond its original purpose. Remuneration policies and practices were not consistent with public sector governance standards, and information governance requires attention to meet National Archives standards and improve transparency.

Recommendations

The ANAO made two recommendations to improve transparency by publishing criteria and more information about Investment Decisions.

Is the NAIF’s governance framework in accordance with relevant legislative and policy requirements?

The NAIF’s governance framework is in accordance with relevant legislative and policy requirements. The NAIF has an appropriate statutory framework, Board processes and suite of governance policies. The NAIF provides the Minister for Resources and Northern Australia with oversight of its governance and decision-making through transaction pipeline reports and weekly meetings with the Minister’s office, but did not keep minutes of these meetings. The NAIF Board has oversight of the Chief Executive Officer and staff, however remuneration policies and practices were not consistent with public sector governance standards.

Legislative framework

2.1 The NAIF’s legislative framework, as set out in the Public Governance, Performance and Accountability Act 2013 (PGPA Act), the Northern Australia Infrastructure Facility Act 2016 (NAIF Act) and the Investment Mandate, requires that the NAIF Board must:

- govern the NAIF in a way that promotes the proper use and management of public resources for which the Board is responsible, the achievement of the purposes of the NAIF, and the financial sustainability of the NAIF;

- not act in a way that is likely to cause damage to the Commonwealth Government’s reputation, or that of a relevant State or Territory government; and

- have regard to Australian best practice government governance principles, and Australian best practice corporate governance for Commercial Financiers, when performing its functions.

Ministerial oversight

2.2 The Minister appoints the Chair and other Board members50 and is accountable to the Parliament for the governance of the NAIF. In turn, the NAIF Board must keep the Minister informed of the activities of the NAIF; give the Minister any reports, documents and information in relation to those activities as the Minister requires; and otherwise keep the Minister informed.51

2.3 The Minister must give directions to the NAIF about the performance of the NAIF’s functions by legislative instrument — the Investment Mandate — and the NAIF must take all reasonable steps to comply with the Investment Mandate.52

2.4 The Investment Mandate provides a statutory framework for ministerial oversight of NAIF governance, and the ministerial consideration process set out in the NAIF Act provides a framework for ministerial oversight of decisions to grant financial assistance:

- there are safeguards in the NAIF Act intended to prevent ministers from using the Investment Mandate mechanism to direct, or have the effect of directing, the NAIF to provide financial assistance to a particular project or person53;

- the Explanatory Statement to the 2016 Investment Mandate states that ‘Subject to the Minister’s limited powers of direction with respect to Investment Decisions…the Facility will make investment decisions independently of the Commonwealth’54; and

- the Explanatory Statement to the 2018 Investment Mandate similarly states that ‘Within the scope of the Investment Mandate, the Facility will make individual investment decisions independently of the Commonwealth. Those decisions are subject only to the Minister’s limited powers of rejection set out in section 11 of the NAIF Act’.55

2.5 In addition to the statutory oversight mechanisms:

- the Minister provided the NAIF with a Statement of Expectations56 that outlined the Minister’s ‘expectations on the operation and performance of the NAIF, beyond that considered by the legislative framework’, and on 3 January 2019, the NAIF responded with a Statement of Intent ‘outlining how NAIF will direct its operations’; and

- the NAIF provided the Minister with information about projects in the transaction pipeline through monthly transaction pipeline reports to the Minister and the Department of Industry, Innovation and Science (the department), and weekly meetings with the Minister’s office and departmental staff about applications for financial assistance progressing through due diligence or other significant developments. While the NAIF circulated in advance of each meeting a list of projects to be discussed, no minutes were kept.57

2.6 If the NAIF Board proposes to provide financial assistance, the NAIF must give the Minister written notice of the proposal to do so (a proposal notice).58 Between 1 July 2016 and 30 September 2018, the NAIF gave six proposal notices to the Minister.

2.7 The Minister has a statutory 21 day consideration period for proposal notices, and can extend this to a total of 60 days, before which time the department cannot provide the proposed financial assistance.59 Under the NAIF Act, the Minister does not give formal approval of a proposal, but at any time during the consideration period may notify the NAIF in writing that the financial assistance should not be provided (a rejection notice).60

2.8 The Minister may issue a rejection notice only if satisfied that providing the proposed financial assistance would:

- be inconsistent with the objectives and policies of the Commonwealth Government;

- have adverse implications for Australia’s national or domestic security; or

- have an adverse impact on Australia’s international reputation or foreign relations.61

2.9 A ministerial rejection notice must be accompanied by the Minister’s written reasons for the notice, and within 20 sitting days after the rejection notice is given, the Minister must table the notice in each House of the Parliament.62 To date, the Minister has not rejected any proposals.

The NAIF Board

2.10 The NAIF Board was established and operates under Part 5 of the NAIF Act. It consists of the Chair and between four and six other members. The Minister appoints the Chair and members in writing on a part-time basis for a period not exceeding three years. There is no statutory bar to reappointment. Remuneration is set by the Australian Government Remuneration Tribunal. The Minister may terminate appointments on statutory grounds such as misbehaviour, incapacity or bankruptcy. The inaugural Chair occupied the position from July 2016 to April 2018. The appointment of the next Chair, who had served as acting Chair since May 2018, occurred on 1 August 2018.

2.11 The NAIF Board operates under the NAIF Board Charter. The NAIF Board created one subcommittee, the Board Audit and Risk Committee (BARC), which operates under the NAIF Board Audit and Risk Committee Charter. Both Charters were approved by the NAIF Board at its first meeting on 10 August 2016, revised following legal review on 20 June 2017, updated on 14 June 2018, and are publicly available on the NAIF website.

2.12 The Chair must convene at least two Board meetings each financial year, and Board procedure is set out in the NAIF Act and the NAIF Board Charter. In the two and a half years between establishment on 1 July 2016 and 31 December 2018, the NAIF Board held 29 meetings. This frequency of meetings reflected the volume of work associated with the governance requirements for a newly established entity, together with the transaction pipeline of proposals requiring consideration. The NAIF Board has a forward work program, regular standing items on its agenda, and its papers were prepared to a consistent and transparent standard.

2.13 The NAIF Board commissioned a review of its effectiveness by an external corporate governance consultant. The resulting March 2017 report noted that the Board ‘has applied itself with great effect to the governance challenges of a start-up board’ and ‘has produced effective, plain English Board documentation that encapsulates good practice in a modern Australia boardroom’ (sic). It also recommended areas for further development in Board planning and practices. The NAIF Board should continue to seek ongoing review of its performance where appropriate.

Chief Executive Officer (CEO) and staff

2.14 The NAIF Board appoints the CEO by written instrument on a full-time or part-time basis for a period of up to five years. CEO remuneration is set by the Australian Government Remuneration Tribunal. The CEO may resign, and the Board may terminate the appointment on statutory grounds such as misbehaviour, incapacity, unsatisfactory performance or bankruptcy.

2.15 The NAIF Board appointed an interim CEO from 18 August 2016 until an executive search was completed, and an ongoing CEO on 24 October 2016 for a fixed period ending on 31 October 2019. The CEO is responsible for the day-to-day administration of the NAIF, and must act in accordance with policies determined by the NAIF Board. The responsibilities and duties of the CEO are outlined in the NAIF Board Charter. The NAIF Board has provided regular policy and other direction to the CEO, and the CEO has provided regular reports to the NAIF Board on the ongoing operations of the NAIF.

2.16 The employment and remuneration of NAIF staff is governed by section 38 of the NAIF Act, the PGPA Act requirement for the proper use and management of public resources, and the Investment Mandate requirement to have regard to best practice governance principles, such as:

- the Workplace Bargaining Policy — which directly applies to the NAIF as a corporate Commonwealth entity;

- job families, work level standards and other remuneration-related policies developed by the Australian Public Service Commission (APSC);

- Prudential Standard CPS 510 Governance and Prudential Practice Guide PPG 511 Remuneration developed by the Australian Prudential Regulation Authority (APRA); and

- the Australian Stock Exchange (ASX) Corporate Governance Principles and Recommendations (used by the NAIF in its Senate Inquiry submission).

2.17 The NAIF Board’s functions under the NAIF Board Charter include to ‘review and approve the executive remuneration policy framework’.

2.18 The NAIF Board approved a remuneration policy on 20 June 2017, almost one year after the establishment of the NAIF and after the engagement of four senior staff members. The NAIF stated that prior to the adoption of the NAIF remuneration policy, it operated with reference to the Efic remuneration policy. The NAIF reported aggregate information on executive salaries under the Executive Remuneration Reporting framework, but did not publish the NAIF remuneration policy.

2.19 The NAIF remuneration policy states that ‘Market salary will be determined by comparing each employee’s salary, to salary data from the financial services sector’. The NAIF did not assess proposed job roles against the APSC Job Family Model and work level standards to determine whether the financial services sector was an appropriate benchmark for each of these roles.63

2.20 The NAIF used financial services sector salary data obtained from the Financial Institutions Remuneration Group64, and paid average total remuneration to six executives equivalent to Australian Public Service departmental deputy secretaries.65

2.21 The NAIF submitted an Assessment of Remuneration Proposal and CEO Declaration to the Australian Public Service Commissioner to contain non-promotion salary increases over a three-year period to an average of 2 per cent per annum.66 On 23 August 2017, the Board approved salary increases for three employees of 25 per cent (from $200,000 to $250,000), 15.6 per cent (from $216,300 to $250,000) and 7.7 per cent (from $325,000 to $350,000) respectively. These were described as salary increases ‘in line with promotions’. The three employees receiving the salary increases remained in the same roles before and after the increases.67

2.22 The NAIF remuneration policy stated that ‘The provision of annual performance awards is discretionary. Bonuses are considered, where set objectives are met and the organisations values have been demonstrated over the course of the year’ (sic), but did not explicitly link the calculation of performance-based remuneration to the achievement of measured performance outcomes or risk, which is inconsistent with relevant APRA and ASX standards.68

2.23 The NAIF Board approved bonus payments for four employees of 25–30 per cent of their total salary packages (between $200,000 and $350,000) for the period 1 July 2016–30 June 2017.69 While the NAIF had not made any Investment Decisions during this period, the bonus payments were based on meeting performance targets relating to the NAIF ‘governance framework [being] established’ and ‘development of [a] potential investment proposal pipeline’.70 Internal documents71 demonstrated that these bonus payments were also partly intended to have the effect of topping up base salaries.

2.24 The NAIF Board considered and approved remuneration policies and practices on advice from the CEO, but did not establish a remuneration subcommittee as recommended by relevant APRA and ASX standards.72

Governance policies and practices

2.25 The department provided Efic $2.301 million in 2016–17 to support the establishment and initial operation of the NAIF as a corporate Commonwealth entity. As a result, the NAIF Board was provided at its first meeting with a number of draft governance policies, based on existing Efic policies. The Board modified these draft policies to meet the needs of the NAIF, approved a number of these policies within its first six months, and regularly reviewed the majority of these policies, including obtaining legal review.

2.26 For activities and functions where there was no specific NAIF policy, procedure or framework, the NAIF Board adopted a number of its service provider’s internal governance policies, including fraud control, information security, and human resources policies.73 The Board was provided with copies of some but not all of the adopted policies. On 16 November 2017, the NAIF appointed a Manager Compliance and Risk function whose role included reviewing the adopted policies, and included these policies in a compliance plan.

Did the NAIF’s strategy promote the achievement of its purposes?

While NAIF origination strategies promoted the achievement of its purpose: NAIF facilitated origination has not generated a significant or sustained increase in either the annual number of new projects or the annual number of successful applications; and only a small number of projects considered by the NAIF Board were assessed as addressing an infrastructure need identified through a Commonwealth, State or Territory assessment process, pipeline, or priority list. The eligibility criteria for financial assistance were substantially broadened in order to increase the number of Investment Decisions.

2.27 The NAIF Board’s selection and implementation of strategies that promote the achievement of its purposes is an important component of its duty to govern the NAIF.74

2.28 In the second reading speech to the NAIF Bill in 2016, the Minister for Resources, Energy and Northern Australia stated that ‘Northern Australia has great potential for economic and population growth, but it needs the right backbone economic infrastructure to drive that growth’ and that the NAIF ‘will support the private sector to construct transformative economic infrastructure for northern Australia’.75 The Minister further stated that ‘these major projects may include airports, ports, roads, rail, energy, water, and communications infrastructure. These are the types of economic infrastructure needed to further open the North for business, and to deliver wider public benefits for the rest of Australia’.

2.29 As set out in the second reading speech, Green Paper, Pivot North report, Northern Australia Audit and White Paper:

- the scale of infrastructure is described in terms such as ‘fundamentally enabling’, ‘backbone’, ‘transformative’ and ‘major project’;

- the scope of economic infrastructure is defined to include infrastructure in the transport (airports, ports, rail and road), energy (generation and transmission), water and communications sectors; and

- the purpose is identified as delivering public benefit by addressing the drivers of market failure in economic infrastructure investment, including short loan tenor available to applicants and higher investment risk caused by distance, remoteness and climate and other factors unique to investing in Northern Australia economic infrastructure.76

Origination strategies

Proponent-led origination

2.30 The 2015–16 Budget papers stated that ‘the loan facility will be open for applications from 1 July 2015’. This opening date was almost one year before eligibility criteria were set out in the NAIF Act and Investment Mandate, and before the NAIF was established and thus could develop or publish assessment criteria.

2.31 The NAIF Board was provided at its first meeting on 10 August 2016 with a transaction pipeline of 60 projects. Two years later, in August 2018, and after changes to the Investment Mandate, three of these 60 projects had progressed to either the due diligence or execution stages. By November 2018, this had increased to four projects, and the NAIF had assessed 47 of these 60 projects as not proceeding.

2.32 Following its establishment, the NAIF:

- took 16 months to finalise assessment criteria, during which time it continued to invite, accept and assess project proposals; and

- did not make seven of ten documents outlining assessment criteria, including the Applications and Approvals Procedure, publicly available.77

2.33 While publicising the NAIF as soon as possible may have raised interest amongst potential proponents, inviting proposals before developing and publishing the criteria for financial assistance reduced the opportunity for potential proponents and investors to consider whether their projects would meet these criteria, and increased the risk that the NAIF would receive proposals that would not meet these criteria.

Recommendation no.1

2.34 The NAIF publish criteria and all information necessary for applicants to submit complete applications for grants of financial assistance.

The Northern Australia Infrastructure Facility response: Agree.

2.35 The NAIF Act and published Investment Mandate provide a comprehensive list of five mandatory criteria and at least an additional 27 requirements that the NAIF Board must either consider, have regard to or be satisfied with in making an Investment Decision. In addition the NAIF website publishes a detailed outline containing other information required as a project is assessed. Notwithstanding this existing transparency NAIF undertakes to assist proponents by publishing case studies and further guidance.

NAIF-facilitated origination

2.36 In April and June 2017, the NAIF Board considered and endorsed a strategic plan including both proponent-led and NAIF-facilitated origination strategies. NAIF-facilitated origination involved the NAIF working with governments, industry and other stakeholders to identify projects that were unlikely to be brought forward solely through the existing proponent-led process. The strategic plan described this approach as ‘actively identifying and facilitating transformative opportunities’.

2.37 The 2017–18 Corporate Plan reported that as at 30 June 2017, the NAIF Board, CEO and staff had collectively met with more than 1500 interested stakeholders and presented at 15 events, reaching audiences of over 2000 people. This included travel at the invitation of Austrade to the People’s Republic of China, the United States of America and Canada to present to potential institutional investors.

2.38 Since the implementation of the NAIF-facilitated origination strategy:

- the annual number of new projects in the transaction pipeline remained relatively steady in 2016 (94), 2017 (91) and 2018 (81, to 22 August 2018); and

- the annual number of successful applications (projects at the due diligence stage or beyond, by origination date) — remained relatively steady in 2016 (seven), 2017 (eight) and 2018 (seven, to 22 August 2018).78

The data does not demonstrate a clear relationship between the NAIF-facilitated origination strategy and a significant or sustained increase in either the annual number of new projects or the annual number of successful applications.

2.39 In January 2018, the Shepherd Report noted ‘The resource intensity of monitoring and supporting projects in the pipeline, despite a low number being potentially viable and eligible projects, may not be the best use of resources’.79 The Shepherd Report also noted:

Many projects on the NAIF long list are unlikely to ever reach investment stage. It is a truism in development that your success varies inversely with the size of the list you are working on.

…

It may be sensitive from a public relations perspective, it would be more productive for NAIF to concentrate its limited resources on less projects. For example, those projects that are investment ready or are closer to investment readiness and are assured of support from the relevant State or Territory.

2.40 While advice was qualified as to the risks to pipeline projections in reports, and subsequent reports provided updated information, pipeline reporting consistently overestimated the health and maturity of the transaction pipeline compared to the Investment Decisions actually made by the NAIF Board. For example:

- on 15 November 2017, the CEO reported to the NAIF Board proposals for approximately $1.6 billion in finance were in due diligence for ‘potential close by June 2018’;

- the CEO noted in the report that ‘There is a degree of uncertainty around potential financial close dates given the NAIF mandate requirements (including issues around whether a gap will be established) and the timing of when potential proponents will provide due diligence material to NAIF for assessment’; and

- by 30 June 2018, the NAIF Board had made Investment Decisions to provide $149.48 million in financial assistance (9.3 per cent of the predicted amount).80

Jurisdiction-led project selection model

2.41 In August 2017, prior to any grants of financial assistance being made, and amongst attempts at accelerating known projects, the NAIF Board also agreed to consider the merits of a jurisdiction-led project selection model. This recognised that the Board, in making a decision, must consider a preference for projects that address an infrastructure need identified through a Commonwealth, State or Territory assessment process, pipeline, or priority list such as the Northern Australia Infrastructure Audit.81 The NAIF met regularly with jurisdictions at ministerial and senior executive levels to discuss its origination efforts. Six of 27 projects considered by the NAIF Board at the strategic assessment stage were assessed by the NAIF as addressing an infrastructure need identified through a Commonwealth, State or Territory assessment process, pipeline, or priority list.82

Changing the criteria for financial assistance

2.42 From April 2017 to April 2018, the NAIF made a number of requests to the Minister to modify the Investment Mandate in order to make more projects eligible for financing, including existing applications under consideration.

2.43 In December 2017, the department commissioned the Shepherd review ‘to recommend ways to accelerate project development and ensure the NAIF can best meet its legislated objective’. Following the Shepherd review, the Minister revised the Investment Mandate with effect from 2 May 2018.83 All but one Investment Decision by the NAIF Board has post-dated this change.

Small-scale projects and removal of the debt cap

2.44 The original 2016 Investment Mandate included as a non-mandatory criterion that the proposed project be seeking financing from the NAIF for an amount of $50 million or more.84 This non-mandatory criterion was consistent with the White Paper, which observed that ‘Governments’ role is to create successful business environments, not successful businesses’.85 On 28 August 2017, the NAIF Board requested the Minister review this non-mandatory criterion, on the basis that ‘the Executive continued to report confusion from stakeholders about this requirement’.

2.45 The 2016 Investment Mandate also required as a mandatory criterion that NAIF loan monies were not the majority source of debt funding, and that the proponent needed to show that NAIF finance would not exceed 50 per cent of total debt for the proposed project. This requirement was ‘in keeping with the principle that the Facility will work in partnership with Commercial Financiers and any other financiers, who should provide an equal or majority source of finance’86 and was consistent with the White Paper’s observation that ‘It is not the Commonwealth Government’s role to direct, or be the principal financier of, development’.87 It was also consistent with the intended role of the NAIF as a market gap financier — ‘The Facility will fill the gaps in the infrastructure financing market for Northern Australia by supplementing private financing for Projects that produce benefits to the region’.88

2.46 Both criteria were removed from the revised 2018 Investment Mandate, increasing risks that:

- the NAIF would attract and be required to assess and manage a large number of small projects — by August 2018, the pipeline of 266 projects included 44 projects seeking $50 million or less in finance, and 41 projects seeking more than $50 million (181 projects had no amount listed). Around half of the projects with a known financing amount were therefore small-scale projects, an increase from 27 per cent the previous year;

- the NAIF would predominantly finance small-scale projects — between 1 July 2016 and 31 December 2018, all six Investment Decisions related to small-scale projects, four of which fell within the former non-mandatory criterion threshold of $50 million, and none of which exceeded the $100 million minimum threshold for consultation with Infrastructure Australia; and

- the Australian Government would in effect carry the majority of the risk of non-repayment of debt in projects that were below investment grade.89

The interpretation of Northern Australia economic infrastructure

2.47 The object of the NAIF Act is ‘to provide grants of financial assistance to the States and Territories for the construction of Northern Australia economic infrastructure’, and defines Northern Australia economic infrastructure as ‘infrastructure that: (a) provides a basis for economic growth in Northern Australia; and (b) stimulates population growth in Northern Australia’.90

2.48 In May 2016, the Explanatory Statement to the 2016 Investment Mandate stated that ‘The Board will preference multiple user infrastructure that benefits the broader economy. It is not intended that the Facility fund a project’s operating assets (such as plant and equipment)’. The Explanatory Statement to the 2018 Investment Mandate did not include this statement.

2.49 Mandatory criterion 1 in the 2016 Investment Mandate required that ‘The proposed Project involves construction or enhancement of economic infrastructure’ and provided that economic infrastructure ‘includes, but is not limited to, rail, water, energy and communications networks, ports and airports’. In the Senate debate on the NAIF Bill, the Minister for Northern Australia stated ‘I want to make clear that we are talking about infrastructure investment, not mines, not hotel rooms and not individual businesses…As the government has always said, for infrastructure like rail lines, airports, water infrastructure et cetera’.91

2.50 The 2018 Investment Mandate amended mandatory criterion 1 to read ‘Northern Australia economic infrastructure’, and the Explanatory Statement included a significantly expanded list of potential projects: ‘ports, airports, rail, roads, water, energy and communications networks, social infrastructure (including health facilities, education facilities, research facilities, training and related accommodation facilities), processing facilities (including abattoirs and agricultural processing plants) and transhipment vessels’.

2.51 This interpretation of the term ‘Northern Australia economic infrastructure’ to include non-economic infrastructure such as social infrastructure, processing facilities and transhipment vessels reflected the interpretation adopted by the NAIF Board as early as February 2017.

Is there an appropriate system of risk oversight and management?

The NAIF has developed an appropriate system of risk oversight and management that is consistent with the requirements of the Commonwealth Risk Management Policy and relevant Australian Prudential Regulation Authority (APRA) and Australian Stock Exchange (ASX) governance standards.

2.52 The NAIF Board is subject to legislative and policy requirements that it establish and maintain an appropriate system of risk oversight and management.92

2.53 The NAIF Board approved a risk management policy on 20 September 2016. The Board Audit and Risk Committee (BARC) endorsed a revised version of this policy on 13 February 2018, which the NAIF Board approved on 14 February 2018.

2.54 The BARC endorsed, and the NAIF Board approved, a risk management framework on 10 February 2017 which was subject to regular review and revision from April 2017 to August 2018, and an extract of the framework was published on the NAIF website. The framework included a statement on the NAIF’s risk appetite and risk tolerances, and sets out four broad categories of risk:

- strategic — risks related to meeting strategic objectives and expectations of key stakeholders;

- investment decisions — project assessment and credit related risks;

- governance, legal and regulatory — compliance with relevant obligations such as confidentiality, conduct and anti-money laundering and counter-terrorism financing; and

- operational — risks associated with running a viable and efficient business including resourcing, business continuity, outsourcing and health and safety.

2.55 The risk management policy and framework are consistent with the requirements of the Commonwealth Risk Management Policy and relevant APRA and ASX governance standards. The NAIF adopted the Three Lines of Defence (3LOD) risk management and assurance model. The risk management policy and framework set out roles and responsibilities for the Board, the BARC and executive management, and the BARC considered risk-related issues at regular meetings.

2.56 In July 2017, the NAIF engaged a consultant to review its risk management framework, and the Board approved and implemented the resulting recommendations. On 16 November 2017, the NAIF appointed an executive specifically responsible for risk (other than assessment of credit risk on individual transactions). The NAIF Board appointed an internal audit provider on 20 December 2017 and subsequently developed an internal audit plan through to 2020. From March 2018, the NAIF provided the Board with quarterly risk management and compliance reports. These measures should assist the NAIF to continue to develop its system of risk oversight and management.

2.57 The NAIF worked closely with Efic to assess credit risk in investment decision-making. The Efic chief credit officer approved risk ratings and oversight. While the NAIF did not verify risk ratings, the NAIF verified that assigned rating numbers were within the NAIF’s risk tolerance.

Is there an appropriate system of internal control?

The NAIF has developed a system of internal control which is appropriate for its requirements. The NAIF Board adopted a blended system that relied primarily on service providers’ policies and practices to provide coverage broadly equivalent to the model accountable authority instructions. The blended system has an inherent risk of insufficient clarity in relevant roles and responsibilities which should be monitored.

2.58 The NAIF Board is responsible for establishing and maintaining an appropriate system of internal control.93 The NAIF Board delegated responsibility for monitoring the system to the BARC in August 2016, and issued instructions to the CEO. The BARC provided assurance and review through the risk management framework, which identified a number of key enterprise risks relating to internal control. Information about the establishment of components of the internal control system was provided to the NAIF Board through CEO reporting, and specific reporting on the monitoring of internal controls was provided to the Board from March 2018.94

2.59 The NAIF’s system of internal control is documented in a suite of policies, procedures and inter-entity agreements including:

- NAIF governance policies (as approved over time);

- Efic governance policies (in the absence of NAIF policies);

- the Service Agreement, which required Efic to comply with its own policies unless a NAIF policy applied;

- the NAIF CEO Instruments of Delegation; and

- arrangements with the department and Efic for the portfolio management of loans, including the accounting entries and financial information the department requires from the NAIF and Efic.

2.60 Together, these arrangements provide coverage broadly equivalent to the six core topics in the Department of Finance’s model accountable authority instructions.95 The NAIF’s internal control documents are authored by separate entities96 and the framework to manage the suite of documents has not always been clear. In February 2018, an issue with policy document version control highlighted the importance of having a centralised accessible location for internal control documents, supported by a management process to safeguard against the NAIF and relevant Efic staff not having access to the current documents, or lacking awareness of where these documents are located. In September 2018, the NAIF created an Intranet site with relevant policies.

2.61 Although the NAIF Board remains responsible for the system, significant elements are managed by Efic staff providing corporate services under the Service Agreement in the key areas of financial controls, security controls and credit risk assessments. Whilst the Board determined that reliance on its service provider in these areas was appropriate, the blended system also increased the risk of insufficient clarity in relevant roles and responsibilities, for example:

- the delivery of agency security adviser services only covered physical security in one location, despite the NAIF’s presence across four offices; and

- the blended system created inherent potential conflicts of duties for Efic staff providing services to the NAIF analogous to key executive roles — for example, when providing financial advice, negotiating annual payment schedules under the Service Agreement, providing legal advice, or in the management and consequences of Efic staff recusals from NAIF executive and Board processes.

2.62 The NAIF should consider using its internal audit and compliance programs to test the system of internal control in light of these risks.97

Is the Service Agreement mechanism effective?

The Service Agreement and preceding inter-entity arrangement between the department and Efic were effective in supporting the establishment and operation of the NAIF, and had benefits for Efic in relation to demand management and the development of staff capability. Aspects of the NAIF’s contract management of the Service Agreement could be improved to ensure ongoing value for money is maintained and evidenced.

2.63 From an early stage it was intended that Efic would provide corporate and grant services to support the establishment and operation of the NAIF. Engagement between the Treasury and Efic commenced from May 2015.

2.64 In the second reading speech introducing the Northern Australia Infrastructure Facility (Consequential Amendments) Bill 2016, the Minister for Resources, Energy and Northern Australia stated that the legislation ‘does not mean that Efic will have to be used as a service provider for the NAIF, but amending the EFIC Act to allow Efic to undertake these services will ensure this is an option that is available to the NAIF. I am keen to utilise existing Commonwealth capabilities, achieve cost-effectiveness and provide for flexibility in the delivery of this important policy’.98 This statement summarised the benefits of the arrangement for the NAIF.

2.65 On 15 March 2016, the department entered into a grant agreement with Efic to support the establishment and operation of the NAIF. The grant term was extended and amount increased from $0.800 million by 31 August 2016 to $1.280 million by 30 November 2016, and to a total of $2.301 million by 31 March 2017.99 Efic’s governing legislation was also amended to allow Efic to provide and charge for services to the NAIF and similar entities.

2.66 On 5 April 2017, the NAIF entered into a Service Agreement with Efic for a range of corporate and grant services.100 The Service Agreement is not published in full on the NAIF website, but a high level summary, including the types of services offered by Efic, was published on the NAIF and Efic websites.101

2.67 The Service Agreement provided that the parties must annually negotiate a payment schedule of charges, and that charges included under a payment schedule must be calculated and claimed on a cost recovery basis only. Invoices were presented on a monthly basis, substantiated with detailed extracts of expenses by line item, and approved for payment by the NAIF CEO on recommendation of the NAIF Chief of Staff.

2.68 The Service Agreement and preceding inter-entity arrangement was effective in supporting the establishment and operation of the NAIF and avoided some duplication of corporate and grant services capabilities. The Service Agreement also had benefits for Efic in relation to demand management and the development of staff capability.

2.69 The Service Agreement complied with most of the mandatory inclusions for an inter-entity agreement set out in the model accountable authority instructions102. The following gaps were noted:

- the agreement did not have a fixed term103 — the usual mechanism for triggering periodic reassessment of value for money — but lasts indefinitely until terminated;104

- the agreement required the parties to ‘use their best endeavours to develop, as soon as practicable, Key Performance Indicators (KPIs) relating to the availability of ICT and the performance of the Services’ — however, KPIs were not developed relating to the performance of corporate and grant services, meaning that there is no benchmark against which to objectively measure and assess the quality of service delivery; and

- the agreement provided for quarterly service management meetings with specific topics to be discussed — however, aside from ongoing operational contact, there was no evidence that quarterly service management meetings occurred or were documented.

How are information governance requirements managed?

The NAIF’s information governance requires improvement to meet National Archives of Australia standards. The NAIF has implemented Freedom of Information and Information Publication Scheme processes. The NAIF published information about decisions to grant financial assistance as required by the Investment Mandate, but did not publish information about decisions not to grant financial assistance. The NAIF did not always disclose assessment criteria and processes, or non-confidential information about decisions.

2.70 The NAIF must exercise effective governance of information resources in accordance with section 15 of the PGPA Act, in line with specific legislation such as the Archives Act 1983, the Freedom of Information Act 1982 (FOI Act) and the Privacy Act 1988, the Information Management Standard and principles issued by the National Archives of Australia (NAA), and Australian best practice government governance principles such as the non-binding Principles on open public sector information published by the Office of the Australian Information Commissioner (OAIC).

2.71 The NAIF did not implement a NAA-compliant information governance framework and did not use a NAA-compliant electronic data and records management system.105

Recommendation no.2

2.72 The NAIF develop an information governance framework, electronic data and records management system, and appropriate records disposal authorities in line with National Archives of Australia requirements.

The Northern Australia Infrastructure Facility response: Agree.

2.73 NAIF has commenced engagement with the National Archives of Australia (NAA) on the implementation of an information governance framework, including data and records management, in line with NAA requirements. NAIF will progress this work over 2019 to meet the requirements of the Australian Government’s Digital Continuity 2020 Policy.

2.74 The NAIF Board approved an FOI policy on 10 August 2016, and regularly reviewed this policy in conjunction with legal advice. Reports provided by the NAIF to the OAIC indicated that FOI requests were processed in a timely manner.106

2.75 The NAIF published corporate information on its website as required by the Information Publication Scheme, but did not publish a proportion of its operational material relating to applications and assessments (refer to paragraph 2.32).107 Instead, proponents needed to contact the NAIF directly in order to obtain the necessary information to make an application.

2.76 The NAIF must publish certain information within 30 business days of an Investment Decision.108 The NAIF published information within statutory timeframes for all decisions to offer a Financing Mechanism made between 1 July 2016 and 1 December 2018. No information was published about decisions not to offer a Financing Mechanism during the same period, which reduced the opportunity for potential applicants, the public and the Parliament to understand the assessment process and the NAIF’s interpretation of the criteria for financial assistance.109

2.77 The NAIF did not always disclose:

- many of its assessment criteria and processes;

- transaction pipelines and project summaries, even when applicants consented or themselves lawfully disclosed this information to the market and media; or

- non-confidential information about decisions, public benefit assessments, environmental assessments and Indigenous engagement strategies.