Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Design and Implementation of the Australian Apprenticeships Incentive System

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Vocational Education System, which includes apprenticeships and traineeships, aims to ensure a skilled workforce that can meet demand and promote economic growth.

- An audit of the Australian Apprenticeships Incentive System (the Incentives System) during phase one provides assurance to the Parliament on the effectiveness of the design and implementation of the program by the Department of Employment and Workplace Relations.

Key facts

- The objective of the Incentives System is to contribute to the development of a highly skilled and relevant Australian workforce that supports economic sustainability and competitiveness.

- A potential impact of the program set out in the Regulation Impact Statement was an expected increase in commencements by around 11,500 per year for each of the first two years then 5,500 per year ongoing, compared with pre-COVID levels.

What did we find?

- The design and implementation of the Incentives System was largely effective.

- The design of the program took into account various reviews and evaluations, and options were developed for government consideration. The program guidelines are consistent with the Commonwealth Grant Rules and Guidelines 2017.

- Appropriate compliance monitoring is in place; however, the approach to performance measurement and monitoring needs improvement. The planned review of the program had not been finalised as at March 2024.

What did we recommend?

- There was one recommendation to the Department of Employment and Workplace Relations (DEWR) relating to developing internal and external performance measures that can provide a clear view of program impact.

- DEWR agreed to the recommendation.

$318.6m

Provided by the Incentives System since 1 July 2022 to 31 December 2023.

40,043

Employers assisted through the Incentives System to 31 December 2023.

120,494

Apprentices assisted through the Incentives System to 31 December 2023.

Summary and recommendations

Background

1. Australia’s vocational education and training (VET) system is designed to ensure skills are developed in wide range of occupations, through practical school-based and work-based learning. Apprenticeships and traineeships are key components of the VET system and are an employment arrangement that combines paid work with a structured program of on-the-job and off-the-job training.

2. The Australian Apprenticeships Incentive System (the Incentives System) commenced on 1 July 2022, and replaced the Australian Apprenticeships Incentive Program which had been in place since 1998. The Incentives Systems aims to contribute to the development of a highly skilled and relevant Australian workforce that supports economic sustainability and competitiveness, and the program is the responsibility of the Department of Employment and Workplace Relations (DEWR).

3. The Incentives System received $2.994 billion in funding from 2022–23 to 2026–27 and since 1 July 2022 to 31 December 2023 has paid $318.6 million in financial supports to employers, apprentices and training organisations.

Rationale for undertaking the audit

4. The Incentives System began on 1 July 2022 and provides financial support to apprentices, employers and Registered Training Organisations. Funding of $2.994 billion over five years from 2022–23 has been allocated to the Incentives System. An audit of the Incentives System at the mid-point in its implementation is timely in order to provide assurance to the Parliament on the implementation of the new system and its program management.

Audit objective and criteria

5. The audit objective was to assess whether the design and implementation of the Incentives System by DEWR is effective.

6. To form a conclusion against the objective, the Australian National Audit Office (ANAO) applied the following high-level criteria.

- Has the Incentives System been effectively designed and implemented to support the intended program objectives?

- Have appropriate compliance and program monitoring arrangements been established for the Incentives System?

Conclusion

7. The design and implementation of the Incentives System was largely effective.

8. The design and implementation of the Incentives System was effective in supporting the new program’s objective. The Regulation Impact Statement developed for the Incentives System set out options which were informed by external reviews of the apprenticeships, skills and training environment, and evaluations of the former Australian Apprenticeships Incentives Program. The program guidelines align with the mandatory requirements of the Commonwealth Grants Rules and Guidelines 2017, and the corresponding factsheets and guidance are consistent with the program guidelines. The Apprenticeships Data Management System (ADMS) has appropriate controls in place to ensure the correct processing of applications and claim payments.

9. DEWR has implemented largely effective compliance and program monitoring arrangements for the Incentives System. It undertakes a compliance monitoring activity to assess Australian Apprenticeships Support Network (AASN) providers’ compliance with the administration of the Incentives System. DEWR has established the capability to collect a range of data on the Incentives System and apprenticeships, through ADMS. There are regular internal reports prepared on the Incentives System; however, there are no internal performance measures in place to support these reports. The current target for the external performance measure on the Incentives System does not demonstrate that the program is meeting its intended objectives. A review and evaluation of the Incentives System to inform phase two from 1 July 2024 had not significantly progressed as at March 2024.

Supporting findings

Design and implementation

10. The design of the Incentives System was informed by external reviews of the broader apprenticeships environment and evaluations of the Australian Apprenticeships Incentives Program. This culminated in a Regulation Impact Statement that set out three options for the new Incentives System, which incorporated the findings of the reviews and evaluations and identified challenges and lessons learned. The option selected by government resulted in the implementation of the current Incentives System. (See paragraphs 2.2 to 2.24)

11. Program guidelines were developed for the Incentives System which comply with the mandatory requirements of the Commonwealth Grants Rules and Guidelines 2017. A range of factsheets and reference guides were produced which support the guidelines. These guidelines and supporting documents provide the necessary information to assist AASN providers to administer the Incentives System, and for employers and apprentices to understand their claiming entitlements and obligations. (See paragraphs 2.25 to 2.36)

12. ADMS — the IT system used by DEWR to administer the Incentives System — has appropriate controls in place to ensure the correct processing of applications and claim payments. ADMS also contains system controls that maximise the automated completion of key processes and minimise manual interventions. (See paragraphs 2.37 to 2.52)

Compliance and program monitoring

13. The primary compliance monitoring activity undertaken by DEWR is a review of AASN providers’ compliance with the administration of the Incentives System, as part of the AASN contractual obligations. The results of the two most recent compliance rounds undertaken in 2022–23 found that AASNs were largely compliant with the requirements of the Incentives System in terms of eligibility advice, fee-for-service and claim accuracy but were not compliant for processing timeliness. In 2023 DEWR implemented a second compliance activity which reviews the AASN providers’ assessment of apprentices and employers’ eligibility for Incentives System payments and whether decisions to override eligibility are being correctly recorded. The initial results of this activity show that AASNs are correctly applying the program guidelines in assessing eligibility. (See paragraphs 3.2 to 3.24)

14. DEWR collects a range of data on the Incentives System and apprenticeships through ADMS. This data functionality is an emerging capability which was not previously available in the previous Australian Apprenticeships Incentives Program. While there is regular reporting undertaken by DEWR on the Incentives System take-up numbers and expenditure, there are no internal performance measures in the reports to provide an indication of program effectiveness. There is an external performance measure on the Incentives System, but the target to maintain apprenticeship commencements to pre-COVID levels does not demonstrate whether the program is meeting its intended objective. (See paragraphs 3.25 to 3.47)

15. DEWR committed to undertaking a checkpoint review around the end of 2023 and as at March 2024 this had not been completed. The government approved a broader strategic review of the Incentives System to be completed in mid-2024. These two reviews aim to inform policy changes for phase two of the Incentives System beginning on 1 July 2024. (See paragraphs 3.48 to 3.54)

Recommendations

Recommendation no. 1

Paragraph 3.44

The Department of Employment and Workplace Relations develops complementary internal and external performance measures and targets for the Incentives System that provide a clear view of program effectiveness and the extent to which the program objective is being achieved.

Department of Employment and Workplace Relations response: Agreed.

Summary of entity response

The department welcomes the audit’s recommendations and the overall positive findings. In particular the department welcomes the ANAO’s recognition that the design and implementation of the Australian Apprenticeships Incentive System was ‘effective’ in supporting the program’s objective and was informed by relevant reviews and evaluations.

The department agrees to the ANAO recommendation to develop complementary performance measures and targets for the Incentive System that provide a clear view of program effectiveness and the extent to which the program objective is being achieved.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Performance and impact measurement

Policy/program implementation

1. Background

Introduction

1.1 Australia’s vocational education and training (VET) system is designed to ensure skills are developed in a wide range of occupations, through practical school-based and work-based learning. Apprenticeships and traineeships (referred to as apprenticeships in this report) are key components of the VET system and are an employment arrangement that combines paid work with a structured program of on-the-job and off-the-job training.

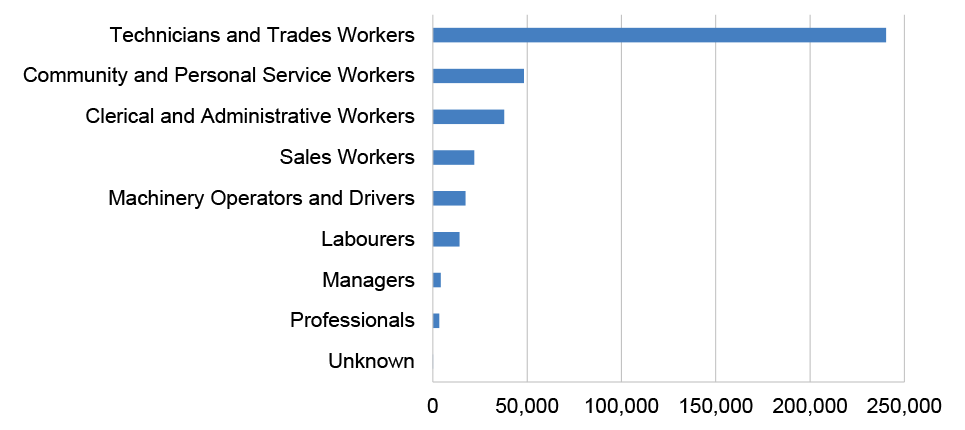

1.2 Apprenticeships are undertaken in a range of occupations, as shown in Figure 1.1.

Figure 1.1: Australian apprentices by major occupation type March 2023

Note: Seventy-five occupations were listed as ‘unknown’.

Source: National Centre for Vocational Education Research data 31 March 2023.

1.3 The Australian Apprenticeships Incentive System (the Incentives System) commenced on 1 July 2022 and its objective is to ‘contribute to the development of a highly skilled and relevant Australian workforce that supports economic sustainability and competitiveness’. The Incentives System supports Australian apprenticeships in priority occupations listed on the Australian Apprenticeships Priority List1, and provides financial support to Australian apprentices and their employers.

1.4 The Incentives System is the responsibility of the Department of Employment and Workplace Relations (DEWR) and supports Outcome 2 of DEWR’s strategic purpose – Promote growth in economic productivity and social wellbeing through access to quality skills and training. It is managed through DEWR’s Skills and Training Group by Apprenticeships Policy Branch and Apprenticeships Operations Branch.

1.5 The Incentives System is delivered through the Australian Apprenticeships Support Network (AASN) which consists of seven service providers, located in all states and territories as well as the Torres Strait, that are contracted by DEWR to support employers and prospective apprentices to enter into an Australian apprenticeship arrangement. Under the contractual arrangements in 2023–242 the AASNs were:

- Apprenticeship Support Australia;

- Sarina Russo Job Access Pty Ltd;

- VERTO Ltd;

- MEGT (Australia) Ltd

- Top End Group Training Pty Ltd;

- The BUSY Group Ltd; and

- MAS National Ltd.

1.6 The services offered by AASNs are free of charge to apprentices and employers.3 Services to assist apprentices include help to find an employer, find the right training course, support to make Incentives System payment claims, and providing general support and advice. Services available to employers include matching them with a suitable apprentice, facilitating the execution of the contract with the apprentice, and providing advice and support.

The Incentives System

1.7 The Incentives System replaced the Australian Apprenticeships Incentives Program (AAIP) which was introduced in 1998 and closed to new recipients on 30 June 2022. The key difference between the two programs is that financial supports are available to apprentices as well as employers under the Incentives System, whereas the AAIP primarily provided financial supports to employers. Differences in the supports offered under the AAIP and the Incentives System are set out in Table 1.1.

Table 1.1: Supports available through the Australian Apprenticeships Incentives Program and the Incentives System

|

|

AAIP |

Incentives System |

|

Supports for employers |

Commencement Incentive Rural and Regional Skills Shortage Incentive Declared Drought Area Commencement Incentive Mature Aged Workers Commencement Incentive Australian School-Based Apprenticeship Commencement Incentive Australian School-based Apprenticeship Retention Incentive Recommencement Incentive Completion Incentive Group Training Organisations Certificate II Completion Incentive Declared Drought Area Completion Incentive Mature Aged Worker Completion Incentive Support for Adult Australian Apprentices Australian Apprentice Wage Subsidy Disabled Australian Apprenticeship Wage Support |

Priority Wage Subsidya Hiring Incentivea Disability Australian Apprenticeship Wage Support |

|

Supports for apprentices |

Additional Identified Skills Shortage Paymentb Living Away from Home Allowance Off-the-job Tutorial, Mentor and Interpreter Assistance |

Australian Apprentice Training Support Payment New Energy Apprentice Support Payment Living Away from Home Allowance Off-the-job Tutorial, Mentor and Interpreter Assistance |

|

Occupation eligibility |

National Skills Needs List |

Australian Apprenticeships Priority List |

|

Priority occupations |

Aged Care, Child Care, Disability Care Workers and Enrolled Nurses |

As per the priority list |

Note a: For an employer to receive wage subsidies, their apprentices must be undertaking an apprenticeship in priority occupations as listed on the Australian Apprentices Priority List. All other apprenticeship occupations are eligible for the hiring incentive.

Note b: The Additional Identified Skills Shortage payments were two payments of $1000 available to apprentices who commenced and completed occupations experiencing national skills shortages. The payment differs from the support payments available under the Incentives System which are incremental payments available during specific periods throughout the apprenticeship.

Source: Australian Apprenticeship Incentives System Reform Regulation Impact Statement.

Roles and responsibilities

1.8 While DEWR is responsible for the overall administration of the Incentives System, there are various stakeholders involved in the Incentives System.

- Apprentices — individuals undergoing either apprenticeships or traineeships involving structured on-the-job and off-the-job training leading to formal qualifications.

- Employers — employ apprentices and provide them on-the-job training and support to complete their apprenticeship.

- AASN providers — work with employers and apprentices on behalf of DEWR to administer the Incentives System, including recruitment, providing eligibility assessment, support to claim payments, training and other assistance.

- Group Training Organisations (GTOs) — employ apprentices who then work for host employers to receive on-the-job training.

- Registered Training Organisations (RTOs) — approved education providers, such as TAFE, where the apprentice receives training.

- State and Territory Training Authorities (STAs) — responsible for their respective state or territory VET. They monitor GTOs and RTOs and certify training agreements and employment arrangements for apprentices.

Program administration

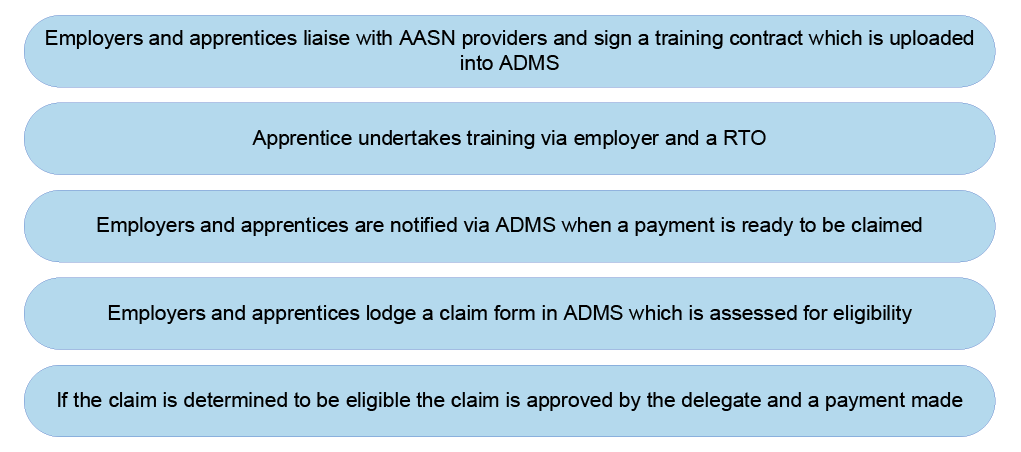

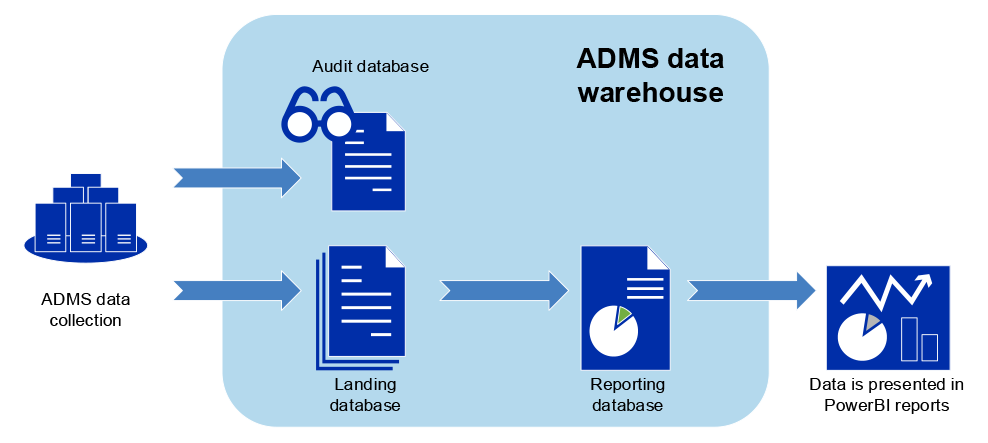

1.9 Administration of the Incentives System is through DEWR’s Apprenticeship Data Management System (ADMS). ADMS enables stakeholders to complete required tasks including making claims for payments under the Incentives System. A high-level overview of the process is set out in Figure 1.2.

Figure 1.2: Incentives System processes

Note: The training contract can be signed either in ADMS or offline and then uploaded into ADMS.

Source: Australian National Audit Office (ANAO) analysis of the Incentives System process.

Budget and expenditure

1.10 As at the 2023–24 Mid-Year Economic and Fiscal Outlook, the Incentives System was allocated $2.994 billion from 2022–23 to 2026–27. Funding for the AAIP continues under grandfathering arrangements, where an employer or apprentice continues to receive their eligible payment until the training and qualification is completed or the apprenticeship ceases. A breakdown of the budget for both programs is shown in Table 1.2.

Table 1.2: Incentives System budget 2022–23 to 2026–27

|

Program |

2022–23 Actual ($millions) |

2023–24 Budget ($millions) |

2024–25 Forward estimate ($millions) |

2025–26 Forward estimate ($millions) |

2026–27 Forward estimate ($millions) |

Total 2022–23 to 2026–27 ($millions) |

|

Australian Apprenticeships Incentive System |

78.43 |

633.71 |

922.52 |

789.23 |

570.13 |

2,994.01 |

|

Australian Apprenticeship Incentives Program |

3,664.00 |

1,337.73 |

226.76 |

106.53 |

5.09 |

5,340.11 |

|

Total |

3,742.43 |

1,971.44 |

1,149.28 |

895.76 |

575.22 |

8,334.13 |

Source: Portfolio Budget Statement 2022–23 Budget Related Paper No. 1.6 Employment and Workplace Relations and 2023–24 Mid-Year Economic and Fiscal Outlook estimate.

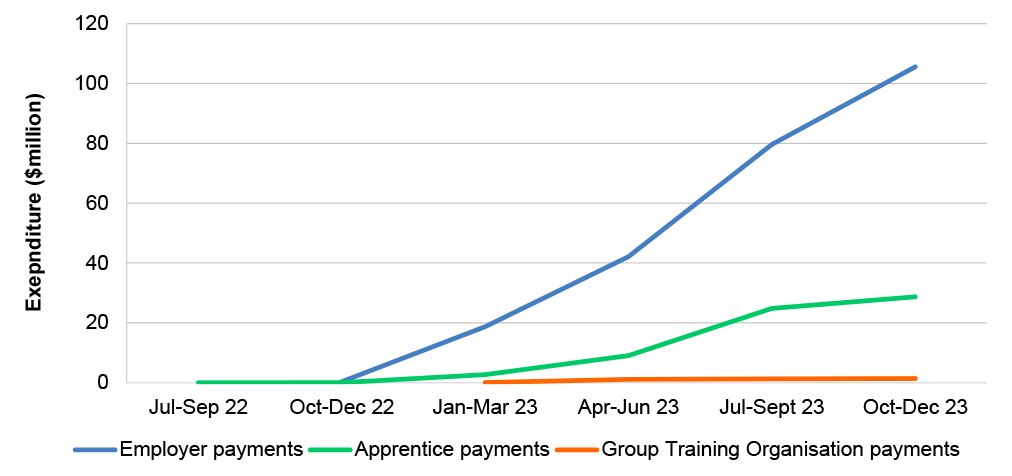

1.11 The expenditure on Incentives System payments from 1 July 2022 to 31 December 2023 is provided in Figure 1.3.

Figure 1.3: Incentives System expenditure

Note: Payments were minimal in the first quarter because claims can only be made after the three-month claiming period under the program guidelines. Group training organisations received $3,822,298 between January 2023 and December 2023.

Source: ANAO analysis of Incentives System performance reports.

1.12 Since 1 July 2022 to 31 December 2023, the Incentives System has provided assistance to 40,043 employers and 120,494 apprentices.

Incentives System as a grant program

1.13 The Commonwealth Grants Rules and Guidelines 2017 (CGRGs)4 are a legislative instrument under subsection 105C(1) of the Public Governance, Performance and Accountability Act 2013 and establish the Australian Government’s overarching grants policy framework. Sections 2.3 and 2.4 of the CGRGs state:

2.3 For the purposes of the CGRGs, a ‘grant’ is an arrangement for the provision of financial assistance by the Commonwealth or on behalf of the Commonwealth:

a. under which relevant money or other CRF money is to be paid to a grantee other than the Commonwealth; and

b. which is intended to help address one or more of the Australian Government’s policy outcomes while assisting the grantee achieve its objectives.

2.4 The CGRGs apply to all forms and types of grants. Grants may take a variety of forms, including payments made:

a. as a result of competitive or non-competitive selection processes;

b. where particular criteria are satisfied; or

c. on a one-off or ad hoc basis.

Program guidelines

1.14 In line with the CGRGs, the Australian Apprenticeships Incentive System Program Guidelines state that ‘In accordance with paragraph 2.3 of the CGRGs, payments under the Incentives System are defined as a ‘grant’ and are subject to the provisions of the CGRGs’. The program guidelines set out the requirements for the administration and delivery of the Incentives System and the payments available.

Legislative authority to make payments

1.15 The legislative authority which enables DEWR to make payments under the Incentives System is provided by section 1062A of the Social Security Act 1991 — ‘Arrangements and grants relating to assisting persons to obtain and maintain paid work’ — which came into effect on 2 April 2022.5

1.16 Legislative authority can also be exercised under item 554 in Part 4 of schedule 1AB of the Financial Framework (Supplementary Powers) Act 1997:

To provide funding, including for apprentices and employers of apprentices, to encourage and support the commencement and completion of apprenticeships.

1.17 The Secretary of DEWR has delegated authority to approve claims for payments under the Incentives Systems to the Assistant Secretary of Apprenticeship Operations Branch (Senior Executive Service Band 1).

Rationale for undertaking the audit

1.18 The Incentives System began on 1 July 2022 and provides financial support to apprentices, employers and RTOs. Funding of $2.994 billion over five years from 2022–23 has been allocated to the Incentives System. An audit of the Incentives System at the mid-point in its implementation is timely in order to provide assurance to the Parliament on the implementation of the new system and its program management.

Audit approach

Audit objective, criteria and scope

1.19 The audit objective was to assess whether the design and implementation of the Incentives System by DEWR is effective.

1.20 To form a conclusion against the objective, the ANAO applied the following high-level criteria:

- Has the Incentives System been effectively designed and implemented to support the intended program objectives?

- Have appropriate compliance and program monitoring arrangements been established for the Incentives System?

1.21 The scope of the audit included the implementation of the Incentives System and ongoing monitoring and evaluation of the program noting the end date for phase one is 30 June 2024. The establishment of procedural guidelines, processes, systems and assurance mechanisms used to deliver the Incentives System were examined. The interactions with the states and territories (in terms of the regulatory and training elements) and the involvement of the Australian Apprenticeships Support Network for initial eligibility assessments, were also reviewed.

1.22 Areas out of scope for this audit were the broader operations of the AASNs, Trade Support Loans and Australian Apprentice Support Loans.

Audit methodology

1.23 The audit methodology involved:

- examination of Incentives System documentation including policies, program guidelines, process maps, systems specifications, budget information;

- determining how program guidelines and process are implemented in practice, through walkthroughs of the key processes undertaken by DEWR;

- reviewing the systems used to process Incentives System payments and manage the program from DEWR’s perspective and determining if the IT general controls are suitable to provide assurance on data and payment accuracy, including through system walkthroughs;

- assessing performance measures, metrics, and reporting arrangements;

- analysis of Incentives System data sets;

- assessing compliance activities and results since 1 July 2022; and

- meetings with DEWR staff.

1.24 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $352,000.

1.25 The team members for this audit were Renina Boyd, Dr Vivian Turner, Jiyoung Kim, Qing Xue, Claire Holden, James Wright and Michelle Page.

2. Design and implementation

Areas examined

This chapter examines whether the Australian Apprenticeships Incentive System (the Incentives System) was effectively designed and implemented to support the intended program objectives.

Conclusion

The design and implementation of the Incentives System was effective in supporting the new program’s objective. The Regulation Impact Statement developed for the Incentives System set out options which were informed by external reviews of the apprenticeships, skills and training environment, and evaluations of the former Australian Apprenticeships Incentives Program. The program guidelines align with the mandatory requirements of the Commonwealth Grants Rules and Guidelines 2017, and the corresponding factsheets and guidance are consistent with the program guidelines. The Apprenticeships Data Management System has appropriate controls in place to ensure the correct processing of applications and claim payments.

2.1 Delivering Great Policy, available through the APS Academy6, sets out four principles:

- clear on intent — clear policy intent so the advice is relevant and outcomes-focused;

- well informed — forward looking, utilising lessons learned, and seeking input from stakeholders;

- practical to implement — work with those involved in implementation, try multiple options for a practical solution, and plan for an evaluation; and

- influential — the right stakeholders have been engaged throughout the process and advice is tailored to each audience.

Was the design of the Incentives System informed by a clear evidence base as well as lessons learned from the Australian Apprenticeships Incentives Program?

The design of the Incentives System was informed by external reviews of the broader apprenticeships environment and evaluations of the Australian Apprenticeships Incentives Program. This culminated in a Regulation Impact Statement that set out three options for the new Incentives System, which incorporated the findings of the reviews and evaluations and identified challenges and lessons learned. The option selected by government resulted in the implementation of the current Incentives System.

External reviews

2.2 In November 2018, the Honourable Steven Joyce (the former New Zealand Minister for Tertiary Education, Skills and Employment) was appointed by the Prime Minister to lead a review into Australia’s vocational education and training sector. The 2019 report, Strengthening Skills: Expert Review of Australia’s Vocational Education and Training System7, recommended simplifying apprenticeship incentives to increase take-up by employers and apprentices. It also recommended that the National Skills Commission develop a new National Skills Priority List for apprentices with an annual consultation process to ensure it targets required skills.8

2.3 The Productivity Commission’s 2020 National Agreement for Skills and Workforce Development Review9 highlighted that reforms to the apprenticeship system should ‘focus on reducing barriers to the supply of apprentices, lifting completion rates, and simplifying the hiring process for employers’. It also noted that completion rates could be improved by matching apprenticeships to employers, courses and support needs, mentoring apprentices, and making apprenticeships more flexible. Employer incentives could also be improved by better targeting incentives, either through changing the payments available to 12 and 24 month progress payments and improving their ease of access, or through reorientating the funding to screen and support apprentices.

Reviews and evaluations of the Australian Apprenticeship Incentives Program

Australian Apprenticeship Incentives Review 2020

2.4 The National Skills Commission (now Jobs and Skills Australia (JSA)) engaged Deloitte in July 2020 to undertake a review of the Australian Apprenticeships Incentives Program (AAIP) to determine the effectiveness of the apprenticeship incentives provided by the AAIP. The review sought to determine drivers of changes to apprentice and employer behaviours in response to historical changes to AAIP eligibility, amount, timing, recipient and payment mechanisms. The review was informed by economic modelling of data from the Training Youth Information Management System (TYIMS)10, the Longitudinal Survey of Australian Youth11 and a literature review and behavioural analysis. The AAIP review was completed in October 2020.

2.5 The review concluded that apprenticeship commencements had decreased over time as the AAIP most effectively incentivised shorter, non-trade traineeships. It also determined that employer incentives should reflect the relative cost of training in order to be effective, with larger incentives needed to increase employment levels in areas of skills shortage. Lastly, it detailed that evidence-based refinements of the AAIP require further research and experimentation, with a suggestion to test alternative wage supplement schemes with a variety of amounts and types of payments.

Surveys

2.6 In 2021, Wallis Social Research was contracted by the Department of Education, Skills and Employment to perform qualitative and quantitative surveys of employers and apprentices. The department sought to determine what non-financial support and incentives would encourage apprentices to complete their training and employers to hire apprentices and maintain apprentice employment. The results found that:

- greater support and mentorship was needed from Registered Training Organisations (RTOs) and Australian Apprenticeship Support Network (AASN) providers for both employers and their apprentices throughout the apprenticeship;

- there was inadequate time given to both employers and apprentices during the sign-up process, with contact from the AASNs before the sign-up being helpful;

- apprentices required more time to understand the training contract they were being asked to sign and only eight per cent considered AASNs as a point of support;

- some apprentices had no contact from their AASN provider after signing the contract;

- employers experienced an administrative burden in completing paperwork which could be improved with help from the AASNs; and

- feedback indicated that RTOs did not always provide high quality courses in the fields required nor pastoral support to apprentices.

Other reviews

2.7 Five review activities targeted to specific payments available under the AAIP were undertaken by the department during 2021–22, summarised in Table 2.1.

Table 2.1: AAIP evaluations for specific payments

|

Evaluation |

Purpose |

Outcomes |

|

Boosting Apprenticeship Commencements (BAC)a Survey (February 2021) |

To determine employers’ experiences with BAC. |

Smaller businesses deemed BAC more important. The more important the BAC was for the business the more likely the apprenticeship recruitment had not been previously planned. |

|

Apprenticeship elasticity review (May 2021) |

To determine the response of employers and individuals to different apprenticeship incentive payments. |

Fifty-seven per cent of employers would increase the number of apprentices they intend to hire in response to an incentive. Sixty-one per cent of individuals would start an apprenticeship based on a financial incentive. |

|

Additional Identified Skills Shortage (AISS) Impact Analysis (April 2021) |

To determine the retention and commencement rate of apprentices supported by the AISS. |

AISS encouraged commencements. Retention of AISS recipients was 3.6 times as likely as non-recipients. |

|

Australian Apprentice Wage Subsidy (AAWS) Evaluation (August 2022) |

To determine whether the AAWS increased rural and remote employer participation in the apprenticeships system. |

AAWS increased rural and remote employer participation. However, it was difficult to determine if these employers were already intending to hire an apprentice with evidence suggesting these employers were intending to hire. |

|

Supporting Apprentices and Trainees (SAT)b Evaluation (August 2022) |

To determine the impact of the SAT wage subsidy on retention and re-hiring of apprentices. |

SAT payments increased employer participation in the apprenticeships system, improved apprenticeship retention rates, and reduced redundancies. |

Note a: BAC payments were introduced in October 2020 to encourage employers to hire apprentices. The payment provided 50 per cent of the apprentice’s wage for the first 12 month period from the date of commencement.

Note b: SAT payments were introduced in April 2020 to support small businesses to retain apprentices or to re-engage displaced apprentices during the COVID-19 pandemic. This was expanded to include medium businesses from 1 July 2020. A subsidy of 50 per cent of the apprentice’s wages was available for eligible employers for wages paid between 1 January 2020 (for small businesses) or 1 July 2020 (for medium businesses) and 31 March 2021.

Source: Australian National Audit Office (ANAO) analysis of evaluation reports provided by Department of Employment and Workplace Relations (DEWR).

2.8 Overall, the reviews, surveys and evaluations of the AAIP and the skills and workforce environment in Australia raised issues with the AAIP and the broader apprenticeships system. The findings and recommendations provided led to the approach to review and replace the AAIP with a simpler system and more targeted financial and non-financial supports.

Review and replacement of the National Skills Needs List

2.9 The AAIP had three separate priority lists which informed eligibility for certain payments.12

- The first list was the National Skills Needs List (NSNL) which was introduced in 2007 and sought to increase apprenticeships in areas of persistent skills shortage. In the 15 years it was in place, it was updated once in 2011. Of the 65 occupations on the list, 85 per cent were trade-based.

- The second was the AAIP Priority List, introduced in 2012, which consisted of aged care, child care and enrolled nursing, with disability care added in 2013.

- The third list related to the AISS Apprentice Commencement payment, introduced in 2019. The AISS aimed to support apprenticeships in occupations experiencing national skills shortages and targeted 12 occupations which faced a shortage of qualified workers and were determined to be in an area of national skills shortage. The AISS occupations were already on the NSNL.

2.10 A review of the NSNL began in August 2019 by the Department of Employment, Skills, Small and Family Business due to identified shortcomings in the list and its methodology. These shortcomings primarily related to the frequency of updates to the NSNL and the criteria used to define the scope of the list. Public consultations with industry and other stakeholders were performed in August 2019 and December 2019. Feedback confirmed that a new priority occupations list was required which was ‘forward looking’ and ‘responsive to changes in skills shortages’. Fifty-five per cent of respondents agreed with an annual update of the list. Concerns were raised around annual updates disrupting workforce planning and increasing the administrative burden. Feedback on the proposed methodology received ‘broad high-level support’ from respondents with consultation during the assessment process being emphasised in submissions.

Introduction of the Australian Apprenticeships Priority List

2.11 On 1 July 2022 the Australian Apprenticeships Priority List replaced the NSNL, AAIP priority list and AISS payment list with the proposed methodology reviewed by stakeholders. The new priority list is based on the JSA Skills Priority List incorporating skills that are currently in shortage or are forecast to be, and are skilled occupations with an apprenticeship pathway.13 These two data points are used to compile the Priority List; however, no direct stakeholder consultation is performed when the list is updated annually which is not consistent with the proposed methodology. Skills shortage is determined by JSA and relates to the ability to fill vacancies, with occupations with fill rates below 67 per cent highly likely to be in shortage.

2.12 The list is updated by DEWR in line with changes to the JSA Skills Priority List, which is published annually. The first update of the priority list was on 1 January 2023, increasing from 77 to 111 occupations.14 In advice for the 2023–24 Budget, DEWR noted that ‘The addition of 39 new occupations on the 1 January 2023 Priority List is budgeted to have an additional cost impact of $196.6 million on the Australian Apprenticeships Incentive System over five years from 2022–23.’

Development of the Incentives System

2.13 Incentives for Australian Apprenticeships, announced as part of the 2019–20 Budget, was to be implemented on 1 July 2020. Its intention was to simplify the AAIP by reducing incentive categories and extending some eligibility criteria, thereby responding to the Strengthening Skills review. The Incentives for Australian Apprenticeships program was to have 15 payment types (the AAIP had 30) with streamlined eligibility requirements.

2.14 Implementation of the Incentives for Australian Apprenticeships was delayed due to the COVID-19 pandemic, which also resulted in additional payments for apprenticeships.15 The Incentives for Australian Apprenticeships program was redeveloped into the Australian Apprenticeships Incentive System in response to the further reviews of the apprenticeships system and AAIP (discussed from paragraphs 2.2 to 2.6 and Table 2.1), along with lessons learned from the COVID-19 pandemic (refer to the analysis of the BAC and SAT payments in Table 2.1).

2.15 A Regulation Impact Statement (RIS) was produced to guide the changes.16 The RIS detailed the need for a more fiscally sustainable model of apprenticeship incentives that are better targeted to support commencements and completions in priority occupations and address skills shortages.

2.16 The RIS was informed by the Strengthening Skills review, the National Agreement for Skills and Workforce Development Review, the Wallis Surveys, data from the National Centre for Vocational Education Research17, and workshops with stakeholders. Feedback which led to the options presented in the RIS included providing apprentices more financial and non-financial support, reducing barriers to sign-up, targeting priority skills via apprenticeships, continuing to encourage increased commencements and ensure completions are considered.

2.17 The RIS set out five challenges to consider when reforming apprenticeship payments, set out in Table 2.2.

Table 2.2: Challenges outlined in the RIS

|

RIS challenge number |

Description |

|

1 |

Incentives should be targeted to address skill shortages in priority occupations to ensure a steady pipeline of skilled workers and minimise the risk of future workforce shortages. |

|

2 |

Costs remain high and are increasing, for both the employer and the apprentice. |

|

3 |

Incentives do not adequately target the decision maker. Recent research shows the apprentice makes most decisions throughout the apprenticeship, yet most incentives target the employer. |

|

4 |

The complexity of the incentives system is hard for employers and apprentices to navigate and understand. |

|

5 |

Non-financial support is needed, such as job matching and mentoring, with evidence highlighting the positive impact non-financial support can have on apprenticeship completion rates. |

Source: Australian Apprenticeship Incentives System Reforms Regulation Impact Statement.

2.18 The ANAO analysed the issues identified from the key reviews and evaluations (see paragraphs 2.2 to 2.8) and the corresponding challenges from the RIS. The results are set out in Table 2.3.

Table 2.3: Issues identified in key apprenticeship reviews

|

Target |

Review |

Issues identified |

RIS challenge number |

|

Apprentice

|

Productivity Commission |

|

3 |

|

2 |

||

|

5 |

||

|

Wallis Surveys |

|

5 |

|

|

4 |

||

|

NCVER reports |

|

3 |

|

|

5 |

||

|

Employer

|

Strengthening Skills Review |

|

1 |

|

Productivity Commission |

|

2 |

|

|

2 |

||

|

2 |

||

|

Wallis Surveys |

|

4 |

|

|

5 |

||

|

AASNs

|

Productivity Commission |

|

4 |

|

National Australian Apprenticeship Associationa |

|

3 |

|

|

4 |

||

|

1 |

||

|

All |

||

Note a: The National Australian Apprenticeship Association produced a technical paper ‘A blueprint for strengthening apprenticeships’ in February 2022 which recommended 14 initiatives to improve the apprenticeship system.

Source: Australian Apprenticeship Incentives System Reform Regulation Impact Statement and ANAO analysis.

2.19 The RIS compared the initial option for the Incentives for Australian Apprenticeships program with two other options. The first option was only targeted to apprenticeships in priority occupations and the second option was a two phased step-down18 approach which was to become the current Incentives System. This option included payments to apprentices in priority occupations, unlike the AAIP which focused on payments for employers. No analysis was undertaken by the department on potential impacts if apprenticeship payments were ended or if a completely different system of payments was introduced.

2.20 The Office of Impact Analysis19 assessed the RIS as adequate, and indicated it would have benefited from greater public consultation with stakeholders and further analysis on its social and economic impacts.

2.21 The RIS provided an analysis of how the three options would address the five challenges, set out in Table 2.4.

Table 2.4: Options for apprenticeship programs

|

Option |

Detail of proposal |

Expected benefits, drawbacks and outcomes |

|

1: Introduce the Incentives for Australian Apprentices (no further reform) |

|

Benefit

Drawback

Impact

|

|

2: Employer hiring incentive (priority occupations) |

|

Drawback

Impact

|

|

3: A phased option of the Australian Apprenticeships Incentive System with the flexibility to respond to economic conditions |

Phase 1 from 1 July 2022 to 20 June 2024

Phase 2 from 1 July 2024

|

Benefit

Drawback

Impact

|

Source: Australian Apprenticeship Incentives System Reform Regulation Impact Statement and ANAO analysis.

Establishment of the new Incentives System

2.22 Submissions were provided by DEWR to the government in February and March 2022 detailing the new Priority List methodology and the options for the new Incentives System. The government agreed to the two-phased approach to the Incentives System in March 2022. This option met the apprenticeship challenges listed in the RIS by targeting incentives towards areas of skills shortages, providing financial support to both employers and apprentices, simplifying the incentives available and thereby reducing the administrative burden, and maintaining in-training support for apprentices. It also provides a step down from the additional payments provided during COVID-19, returning to pre-COVID investment levels during the second phase.

2.23 The Minister for Skills and Training was briefed in May 2022 and approved the grant guidelines in June 2022 (discussed at Table 2.6). Information provided to the minister on the implementation pathway for the Incentives System comprised plans for public communication and stakeholder engagement, contract variations with the AASNs, information on the legislative authority for payments, required system and business process changes, operational arrangements provided for in the grant guidelines, exemption from grants hub and policy issues and impacts.

2.24 The first phase of the Incentives System, from 1 July 2022 to 30 June 2024, provides a subsidy for both priority and non-priority occupations. Table 2.5 provides a summary of the payments available during the first phase of the Incentives System and how the payments incorporate feedback from reviews.

Table 2.5: Supports available during phase one of the Incentives System

|

Payment |

Description |

Amount |

Duration |

Incorporation of reviews |

|

Employers |

||||

|

Priority Wage Subsidy |

Employers can claim a portion of wages paid to Australian apprentices employed in occupations on the Priority List |

10 per cent of wages for the first and second 12-month period (up to $1,500 per quarter) Five per cent of the wages paid for the third 12-month period (up to $750 per quarter) |

Up to three years |

Payments targeted towards areas of skills shortage |

|

Hiring Incentive |

Supports employers of apprentices undertaking a Certificate II or above qualification not listed on the Priority List |

$1,750 for a full-time Australian Apprentice $875 for a part-time Australian Apprentice |

A one-off payment made at six and 12 months |

Encourages apprenticeship commencements |

|

Disability Australian Apprenticeship Wage Support |

Aims to encourage employers to provide apprenticeships to people with disability undertaking a Certificate II or a higher-level qualification |

Wage subsidy of $104.30 per week for a full-time Apprentice (or pro rata basis) |

12 months for long-term or permanent disability Specific period for a temporary disability |

Encourages apprenticeship commencements |

|

Apprentices |

||||

|

Australian Apprenticeship Training Support Payment |

Financial assistance for apprentices undertaking a certificate III level or qualification in an occupation listed on the Priority List |

$1,250 every six months (up to $5,000 in total) for a full-time apprentice $625 every six months (up to $2,500) for a part-time apprentice |

Up to two years |

Encourages apprenticeship commencements |

|

New Energy Apprenticeship Support Paymenta |

Provides direct financial assistance to apprentices in the clean energy sector |

Payments available at six, 12, 24, 36 months and at completion, up to $10,000 for full-time apprentice and up to $5,000 for part-time |

Specified periods |

Payments targeted towards areas of skills shortage |

|

Living Away from Home Allowance |

Provides assistance to apprentices who are required to move from their parents or legal guardians for the first time for an apprenticeship or supplementary training |

$77.17 per week for first 12 months $38.59 per week for the second 12 months $25.00 per week for the third 12 months |

Up to three years |

Providing financial support to apprentices |

|

Registered Training Organisations |

||||

|

Off-the-Job Tutorial, Mentor, and Interpreter Assistanceb |

Additional support for off-the-job training is available to apprentices with a disability |

$38.50 per hour up to $5,500 per year for tutorial assistance $38.50 per hour up to $5,500 per year for mentor or interpreter assistance |

While concurrently eligible for Disability Australian Apprenticeship Wage Support (whether claimed or not) |

Providing non-financial support to apprentices |

Note a: The New Energy payment was introduced on 1 January 2023 and informed by consultations with Industry Associations, Unions and Peak Bodies.

Note b: Tutoring, mentoring and interpreter assistance is only available to Registered Training Organisations.

Source: Australian Apprenticeships Incentive System Guidelines and ANAO analysis.

Have suitable guidelines and processes been developed to support effective and consistent service delivery of payments?

Program guidelines were developed for the Incentives System which comply with the mandatory requirements of the Commonwealth Grants Rules and Guidelines 2017. A range of factsheets and reference guides were produced which support the guidelines. These guidelines and supporting documents provide the necessary information to assist AASN providers to administer the Incentives System, and for employers and apprentices to understand their claiming entitlements and obligations.

Development of the program guidelines

2.25 Commonwealth grant programs are required to comply with the Commonwealth Grants Rules and Guidelines 2017 (CGRGs).20 As the current Incentives System falls within the definition of a grant program (discussed previously in paragraphs 1.13 to 1.14), grant opportunity guidelines are required for the program.21 Grant guidelines which are clear, comprehensive, and consistent with policy objectives assist in ensuring accurate administration of the program through supporting quality decision-making. Regular reviews of the guidelines allow for updates to address program implementation issues or changes to policy, which ensures the guidelines remain accurate and up-to-date.

2.26 The Australian Apprentice Incentives System Program Guidelines (the guidelines) are the primary documentation for the program and provide key information on the program.

- An overview of the Incentives System, the purpose of the guidelines and the Australian Apprenticeship Support Network, and policies and funding of the Incentives System.

- Primary eligibility requirements, standard requirements for claiming payments and additional eligibility considerations.

- For each payment type detail on the payment type, eligibility requirements, payment schedule and rates, information on claiming payments and administrative information.

- Information on general administrative matters — how payments are made, withholding or refusing payment and suspect claims, debt recovery, waivers and review of decisions, taxation, conflicts of interest, privacy and freedom of information.

2.27 The guidelines were developed by DEWR staff and supported by internal legal advice where required. In developing the guidelines DEWR considered implementation issues and took account of multiple scenarios, for example, how different payment options may incentivise uptake of apprenticeships.

2.28 As part of the CGRGs, entities are required to undertake a risk assessment for the grant opportunity and determine an overall risk rating to inform the management and release of the program guidelines. DEWR assessed the program guidelines for the Incentives System as ‘medium’ risk, based on advice from the Australian Government Solicitor. In May 2022 the Department of Finance agreed to the medium risk rating and the Minister for Finance approved the release of the guidelines on 25 June 2022.22

2.29 The initial program guidelines were published on GrantConnect23 on 29 June 2022. The guidelines have been reviewed and updated three times since the program commenced on 1 July 2022.

- The guidelines published on 15 December 2022 were updated to include the New Energy Apprenticeships, which came into effect on 1 January 2023.

- The guidelines published on 11 August 2023 had minor administrative updates, with the priority list also updated to include annual changes.

- Updated guidelines were published on 21 December 2023, and included minor administrative updates, predominantly clarifying the eligibility of apprentices for payments. A revised Priority List to commence on 1 January 2024 was also published.

2.30 From May 2022 to December 2023, the responsible ministers were provided briefings on the Incentives System seeking approval of (or providing advice on) the program guidelines or changes to policy, as set out in Table 2.6.

Table 2.6: Ministerial briefings for the Incentives System

|

Date |

Minister |

Summary of briefing |

|

May 2022 |

Employment |

Seeking approval of the initial guidelines |

|

June 2022 |

Skills and Training |

Noting the implementation pathway for the Incentives System and seeking approval of factsheets |

|

June 2022 |

Finance |

Seeking approval of release of the guidelines due to medium risk rating |

|

November 2022 |

Skills and Training |

Seeking approval to the eligibility criteria for the New Energy Apprenticeships and noting the implementation approach |

|

November 2022 |

Skills and Training |

Seeking approval of updated guidelines to include the New Energy Apprenticeships |

|

December 2022 |

Finance |

Noting guideline updates due to policy changes |

|

August 2023 |

Skills and Training |

Noting the administrative updates to the guidelines |

|

December 2023 |

Skills and Training |

Noting the administrative updates to the guidelines |

Source: ANAO analysis of ministerial submissions provided by DEWR.

Alignment of the program guidelines with the CGRGs

2.31 The ANAO assessed the program guidelines published in August 2023 against the CGRGs and the results are set out in Table 2.7.

Table 2.7: Assessment of the program guidelines with the CGRG mandatory requirements and key principles

|

CGRG requirement or key principle |

ANAO analysis of Incentives System August 2023 guidelines |

|

Guidelines must be consistent with the Public Governance, Performance and Accountability Act 2017 (PGPA Act) and PGPA Rule (section 3.4; mandatory requirement). |

The guidelines are consistent with the requirements of the PGPA Act and Rule. |

|

Make guidelines available on GrantConnect (section 5.2; mandatory requirement). Develop and revise guidelines for significant changes, ensuring they are consistent with the CGRGs (section 4.4; mandatory requirement and section 8.7; key principle). |

The guidelines were first published on GrantConnect at the beginning of the program (1 July 2022) and updated on 15 December 2022, 11 August 2023 and 23 December 2023 to incorporate changes. |

|

Develop clear, consistent and well-documented grant guidelines (section 8.6; key principle). Grant opportunity guidelines should include (as relevant):

|

The guidelines contain the following sections:

|

|

At a minimum, guidelines for one-off or ad hoc grant opportunities should include the purpose or description of the grant, the objectives, the selection process, any reporting and acquittal requirements and the proposed evaluation mechanisms (section 9.3; key principle). |

|

|

Guidelines are tailored based on potential risks and specific circumstances, taking into consideration the capability of potential grantees and grantees; the policy outcomes being sought; the purpose, value and duration of a grant; the nature and type of deliverables; governance; accountability requirements; and the nature and level of the risks involved (section 9.3; key principle). |

|

|

Clearly inform potential grantees of terms and conditions they will need to meet during the life of the grant, such as financial and performance reporting (section 8.7; key principle). |

Apprentices and employers sign a Training Contract and Training Plan upon initiation of the apprenticeship. These documents are prepared and signed with the assistance of the AASNs. |

|

The clarity of guidelines should be tested with stakeholders prior to their release (section 8.7; key principle). |

Guideline clarity was not tested with non-government stakeholders. |

|

Explanation of how the proportionality principle is to be applied (section 9.6; key principle) |

As this grants program is a series of payments administered through service providers, the proportionality principle has been applied through the administration of the payments by the AASN providers. Through AASNs assisting in completing the administration required this minimises the complexity for applicants whilst ensuring consistent application of the guidelines. The role of the AASNs is detailed throughout the guidelines. |

|

Specification of performance measures (section 10.8; key principle). |

Performance measures are not specified in the guidelines but a performance measure for the Incentives System is included DEWR’s corporate plan and annual reports (see paragraphs 3.36 to 3.41). |

|

Set out who the decision-makers for different grants administration processes (section 12.4; key principle). |

Part A section 3.3 details that the Deputy Secretary of the Skills and Training Group is delegated to approve the commitment and expenditure of relevant money.a AASNs are detailed throughout the guidelines to provide administrative services. |

|

Clearly outline what constitutes a conflict of interest (section 13.8; key principle). |

Part G section 6 sets out information on conflicts of interest |

|

Equitable and transparent selection of recipients which best represent value with relevant money (section 13.9; key principle). |

The primary eligibility for the program is detailed in part B, specific eligibility for each of the payment types are detailed in parts D to F. Decisions related to eligibility are documented the in Apprenticeship Data Management System (ADMS). |

|

Waiving or amending selection criteria (section 13.14; key principle). |

Part G section 4: ‘Waivers and review of decisions’. |

Note a: The Secretary of DEWR has authorised delegation related to arrangements and grants for the purposes of section 1062A of the Social Security Act 1991 to the Senior Executive Service (SES) Bands 2 and 3 (up to the limit of the appropriation available for the relevant program) and the SES Band 1 (up to the value of a particular grant not exceeding $10 million). In practice, a SES Band 1 approves claims for payment under the Incentives System (refer to paragraph 1.17).

Source: ANAO analysis of the Incentives System Program Guidelines against the CGRGs

2.32 Overall, the program guidelines align with each of the CGRG mandatory requirements and key principles.

Supporting documentation

2.33 AASN providers are contracted to support the administration of the Incentives System on behalf of the Australian Government. They facilitate the training contract process and assist apprentices and employers to claim payments and complete other administrative matters. AASNs also run screening services to assist potential apprentices identify suitable apprenticeship pathways and provide in-training support during apprenticeships, such as mentoring.

2.34 DEWR has developed a range of factsheets (frequently asked questions/FAQS) to assist AASN providers, employers and apprentices to understand and/or administer the Incentives System. These factsheets cover topics such as: an overall summary of the Incentives System; the Priority List; New Energy Support Payments; school-based apprenticeships; hiring incentive payments; disability support payments; and taxation information.

2.35 The fact sheets contain clarifying information on each topic. For example, documents relating to payments provide an overview of the payment type, eligibility requirements, how payments are to be calculated, and the role of AASNs and State and Territory Training Authorities (STAs) in the claim process. Appendix 3 sets out examples of how the factsheets for the Priority Wage Subsidy, Hiring Incentive and Apprentice Training Support Payment align with the program guidelines.

Consultation with apprentices

2.36 DEWR has consulted with apprentices on their Incentives System experience. Workshops were held with apprentices to understand motivations and challenges experienced during their apprenticeships. A survey of apprentices was performed to understand their low claiming rates.

- A temporary blanket waiver of the three-month claim period for the Australian Apprentice Training Support Payment was enacted from 1 April 2023 because some cohorts of apprentices were experiencing difficulty in meeting the identity verification and Tax File Number requirements. The waiver allows apprentices to submit a manual claim via their AASN if the period to submit their first claim has expired.

- Due to the low claiming rates by apprentices, DEWR surveyed apprentices in September 2023 to identify barriers to claiming payments. Preliminary results from the survey indicated that the complexity of claiming, including the need to provide a Tax File Number, training plans and accurate information was a key factor.

Are appropriate systems in place to ensure accurate processing of payments?

ADMS — the IT system created by DEWR to administer the Incentives System — has appropriate controls in place to ensure the correct processing of applications and claim payments. ADMS also contains system controls that maximise the automated completion of key processes and minimise manual interventions.

Apprenticeships Data Management System (ADMS)

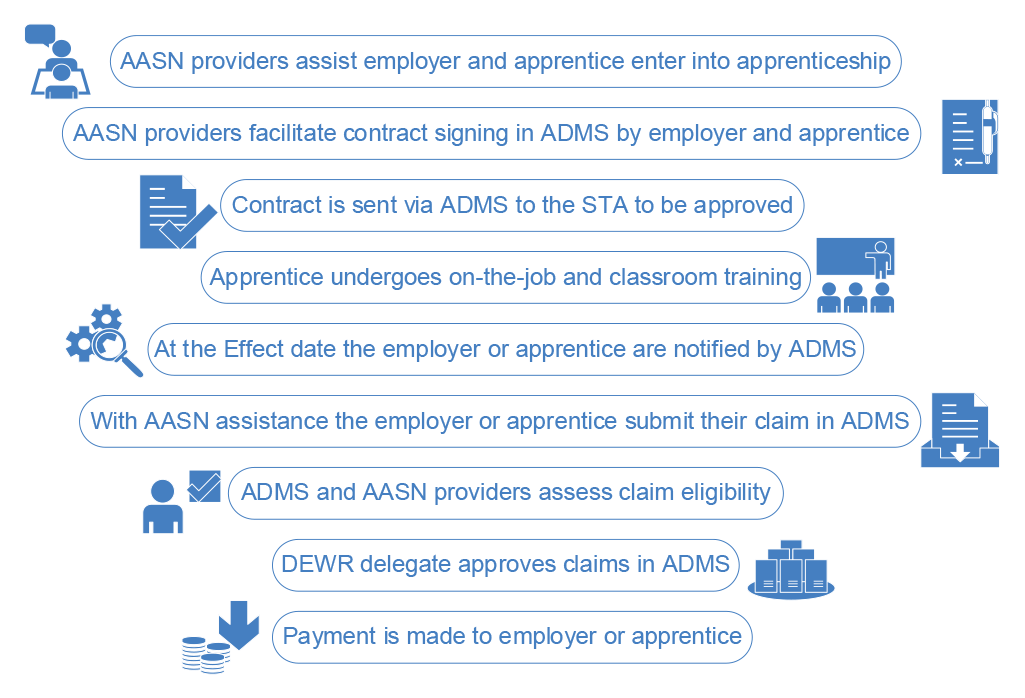

2.37 ADMS is the primary mechanism for the administration of the Incentives System. As shown in Figure 2.1, AASNs connect apprentices with employers and facilitate the signing of training contracts and STAs approve the training contract. The apprenticeship then progresses, with the apprentice undertaking on-the-job and classroom training. Once the effect date24 is reached, the employer or apprentice is notified of their eligibility to claim a payment through ADMS and AASNs. AASNs can assist employers and apprentices to submit their claim and assess claim eligibility.25 If the claim is determined to be eligible, the DEWR delegate approves the claim and a payment is made.

Figure 2.1: ADMS functionality for administration of the Incentives System

Source: ANAO analysis.

2.38 In November 2023 ADMS had 223,820 active users. ADMS is used by employers and apprentices, AASNs, STAs, Services Australia and DEWR. Each type of user is provided different levels of access based on user requirements as set out in Table 2.8.

Table 2.8: User functionality in ADMS

|

User type |

Available functionality |

|

AASN provider staffa |

Complete Training Contracts in consultation with apprentices and employers. Create claim applications, edit application, assess initial eligibility, override eligibility (discussed further at paragraphs 3.22 to 3.24), assess claim applications which cannot be automatically verified. |

|

Apprentice |

Submit claim applications, including checking the status of claim applications and uploading evidence to support claim applications. |

|

Employer |

Submit claim applications, including checking the status of claim applications and uploading evidence to support claim applications. |

|

DEWR staff |

Transfer employees and apprentices between AASN providers, approve special claims, manage STA updates, assist AASNs with issues. |

|

DEWR delegate |

Approve claim payments. |

|

STA staff |

Training contract authorisations.b |

|

Services Australia staff |

Administration of payments.c |

Note a: Different levels of access are provided to AASN staff members based on their level of responsibility and delegation.

Note b: STAs use their own systems which communicate with ADMS to perform this function.

Note c: Services Australia verifies Priority Wage Subsidy claims that are not verified through the automated process in ADMS. Services Australia is not involved in service delivery for any other Incentives System payments. Services Australia cannot amend the information provided by an employer in a claim, it can only verify that the evidence supports the amount claimed OR return it to the employer with instructions on what amendments need to be made.

Source: ANAO analysis.

Development of the system

2.39 ADMS was developed to replace TYIMS due to its increasing obsolescence. ADMS was developed as an in-house solution as this was determined to offer the greatest control over its development, provide the lowest risk to delivery, and provide greater potential for reuse across related systems. ADMS was designed to offer an improved user experience, increase efficiency and productivity, provide enhanced reporting capabilities, and have a greater adaptability to policy and program changes.

2.40 The second pass business case for the development of ADMS was approved by the government in August 2020, and the original approved budget for ADMS was $92.9 million. DEWR advised the ANAO that as at 31 December 2023, the revised overall budget26 for ADMS was $124.96 million and $99.74 million had been spent on the development of ADMS.

2.41 ADMS development was split into four phases.

- Phase 1 from late 2020 to July 2021, sought to stabilise the previous system, TYIMS, and introduce new Application Programming Interfaces to assist with integration with AASN and STA systems.

- Phase 2 from July 2021 to June 2022, saw the development of early infrastructure and the building of user profiles.

- Phase 3 from July 2022 to June 2023, began the replacement of TYIMS with externally available releases of ADMS.

- Phase 4 from July 2023 to June 2024, will result in final enhancements to the user experience.

2.42 A summary of ADMS releases is provided at Appendix 4. Initial functionality in ADMS related to single touch payroll data exchange and user interfaces for each user profile. Progressive releases were timed for when functionality was required. For example, claim applications for the hiring incentive and apprentice support payments were released in December 2022, with the first claim periods for these payments due in January 2023.

2.43 In November 2023 the second last piece of core functionality in TYIMS was decommissioned with AASNs now performing almost all their business in ADMS. From March 2024 payments are processed and managed in ADMS and all claim types have been moved into ADMS.

Testing system functionality

2.44 System walkthroughs of ADMS and its interactions with the other systems — TYIMS and SAP — showed that the system controls could be relied upon to ensure that ADMS accurately administers the Incentives System. Controls ensured that claims were processed accurately, and the required evidence was recorded in ADMS, for example claimant details, eligibility assessment and claims approved..

2.45 Third party data interactions with ADMS were also reviewed: STA reference data for training courses; Single Touch Payroll27 data from the Australian Taxation Office; and the Unique Student Identifier with the Department of Education. The latter two processes are real time and automated within ADMS and the system controls are appropriate to ensure that the correct evidence is uploaded into ADMS. The STA reference data is uploaded ADMS in a timely manner and errors resolved where identified.

System guidance

2.46 A series of factsheets and reference guides were produced to assist with the administration of the Incentives System and using ADMS, particularly while the system was being rolled out. These documents are produced and updated to incorporate changes to the Incentives System and ADMS as required, and contain information on a range of topics including:

- registering for ADMS;

- logging into ADMS using myGovID28;

- providing payslips as wage evidence;

- an overview of the claim application process;

- how to create employer profiles;

- checking the status of a claim application; and

- how to assess applications.

2.47 Appendix 4 (Table A.4) lists the ADMS guidance documents and how they align with the program guidelines. DEWR advised that a detailed ADMS user guide is being developed in preparation for final project closure in early 2024.

Communication and training

2.48 AASNs receive regular email communications and training presentations on changes to the Incentives System and ADMS. Feedback received from AASNs informs communication and training requirements. DEWR advised that training material is developed for AASN providers, employers and apprentices for all functionality upon its release.

Gateway reviews

2.49 Gateway reviews are overseen by the Department of Finance and aim to support effective delivery of major IT projects within entities.29 Five gateway reviews have been completed during the development of ADMS with a final end-stage review due in September 2024. A summary of the reviews, the ratings and the number of recommendations is shown in Table 2.9.

Table 2.9: Summary of ADMS gateway reviews and outcomes

|

Review stage |

Date completed |

Number of recommendations |

Ratinga |

|

First-Stage |

11 December 2020 |

12 |

Green/Amber |

|

Mid-Stage |

27 August 2021 |

7 |

Green/Amber |

|

Mid-Stage Short-Form Review: Readiness for Service |

9 March 2022 |

5 |

Green |

|

Mid-Stage |

24 March 2023 |

8 |

Green |

|

Mid-Stage Short-Form Review |

13 December 2023 |

5 |

Green |

Note a: Red was defined as: ‘Successful delivery of the program/project appears to be unachievable. There are major issues on program/project definition, schedule, budget, quality or benefits delivery. The program/project may need to be re-baselined and/or overall viability re-assessed.’

Amber was defined as: ‘Successful delivery of the program to time, cost, quality standards and benefits realisation appears feasible but significant issues already exist requiring management attention. These need to be addressed promptly.’

Green/Amber was defined as: ‘Successful delivery of the program to time, cost, quality standards and benefits realisation appears probable however constant attention will be needed to ensure risks do not become major issues threatening delivery.’

Green was defined as: ‘Successful delivery of the program/project to time, cost, quality standards and benefits realisation appears highly likely and there are no major outstanding issues that at this stage appear to threaten delivery significantly.’

Source: ANAO analysis of gateway reviews.

2.50 Recommendations were made against categories including business case and benefits, governance and planning, risk management, and readiness for service or the next stage. Of the 32 recommendations made to DEWR up until the March 2023 review, 29 had been noted by Finance as addressed or fully addressed in subsequent gateway reviews. DEWR has since fully addressed two of the remaining recommendations and the one recommendation from the March 2023 gateway review relating to a transition plan for decommissioning TYIMS was marked as partially addressed and in progress in the December 2023 review.

2.51 The March 2023 gateway review highlighted the success of the ADMS project and recommended DEWR:

- consider harnessing the ADMS approach to project implementation within the department; and

- consider sharing the successes achieved through the ADMS approach to project implementation with other areas of government.30

2.52 The December 2023 gateway review subsequently found that:

…the ADMS project has further matured since the last review. Lessons have been learned from releases and are being actively sought through stakeholder engagement. This, along with continued workforce stability, business SMEs [subject matter experts] working alongside DSD in Agile delivery teams, and an effective dedicated SRO [senior responsible officer] model, has resulted in increasingly successful releases, most recently on 24 November 2023.

External stakeholders acknowledged recent project successes and reiterated the benefits the new system is now creating. This positive position has been facilitated by a comprehensive and well implemented change management and engagement strategy.

3. Compliance and program monitoring

Areas examined

This chapter examines whether there were appropriate compliance and program monitoring arrangements in place for the Australian Apprenticeships Incentive System (the Incentives System).

Conclusion

The Department of Employment and Workplace Relations (DEWR) has implemented largely effective compliance and program monitoring arrangements for the Incentives System. It undertakes a compliance monitoring activity to assess Australian Apprenticeships Support Network (AASN) providers’ compliance with the administration of the Incentives System. DEWR has established the capability to collect a range of data on the Incentives System and apprenticeships, through the Apprenticeships Data Management System (ADMS). There are regular internal reports prepared on the Incentives System; however, there are no internal performance measures in place to support these reports. The current target for the external performance measure on the Incentives System does not demonstrate that the program is meeting its intended objectives. A review and evaluation of the Incentives System to inform phase two from 1 July 2024 had not significantly progressed as at February 2024.

Areas for improvement

The ANAO recommended that DEWR reviews the external performance measure for the Incentives System and develop internal performance measures to support the reporting it undertakes. The ANAO also suggested that DEWR implements a process that captures business requirements when developing or adjusting data reports.

3.1 Establishing appropriate external and internal performance measures, and ensuring regular reporting against those measures, provides a view of program effectiveness and impact. A program of compliance activities that is linked to risk provides assurance that the program is being administered appropriately and facilitate continuous improvement.

Have appropriate compliance and program monitoring arrangements been established for the Incentives System?

The primary compliance monitoring activity undertaken by DEWR is a review of AASN providers’ compliance with the administration of the Incentives System, as part of the AASN contractual obligations. The results of the two most recent compliance rounds undertaken in 2022–23 found that AASNs were largely compliant with the requirements of the Incentives System in terms of eligibility advice, fee-for-service and claim accuracy but were not compliant for processing timeliness. In 2023 DEWR implemented a second compliance activity which reviews the AASN providers’ assessment of apprentices and employers eligibility for Incentives System payments and whether decisions to override eligibility are being correctly recorded. The initial results of this activity show that AASNs are correctly applying the program guidelines in assessing eligibility.

Identification of risk

3.2 DEWR’s Enterprise Risk Management Policy and Framework require risk assessments to be developed at the enterprise level as well as the strategic and operational levels (the latter which cover policies, programs and projects, procurements, contracts and events).

3.3 DEWR has identified risks related to the Incentives System and mitigations to assist in managing each risk (see Appendix 5). The key risk relating to the Incentives System is ‘compliance breaches of the Incentives System’ and two of the treatments include:

- clear and consistent advice on the program guidelines and supporting material for Australian Apprenticeships Support Network (AASN) providers; and

- compliance monitoring of AASNs.

Compliance

Compliance workplan

3.4 The DEWR Skills and Training Compliance Governance Committee oversees compliance of skills and training programs. Its 2023–24 Compliance Workplan sets out the compliance activities to be undertaken for the administration of the Incentives System.

Table 3.1: Incentives System compliance activities 2023–24

|

Compliance activities |

Responsible team |

Actions |

|

Eligibility breaches – apprentice is director/shareholder of employer entity |

Compliance Intelligence and Compliance Delivery |

Compliance reviews Intelligence data matching |

|

Eligibility breaches – employer is claiming concurrent apprenticeship and employment wage benefits |

Compliance Delivery |

Compliance reviews Data matching |

|

Eligibility breaches – employer is claiming concurrent apprenticeship and other wage subsidies |

Compliance Delivery |

Compliance reviews |

|

Eligibility and payment accuracy breaches – employer claims after cessation or completion of apprenticeships |

Compliance Intelligence and Compliance Delivery |

Compliance reviews Prioritise compliance activities |

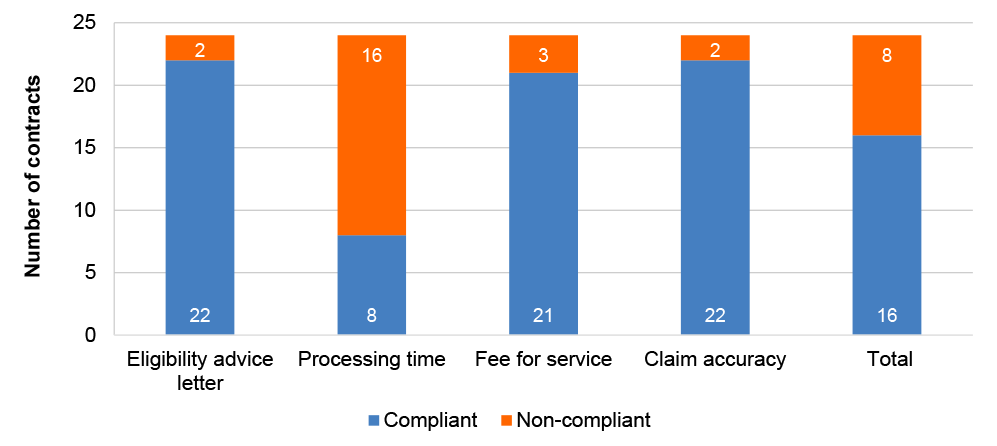

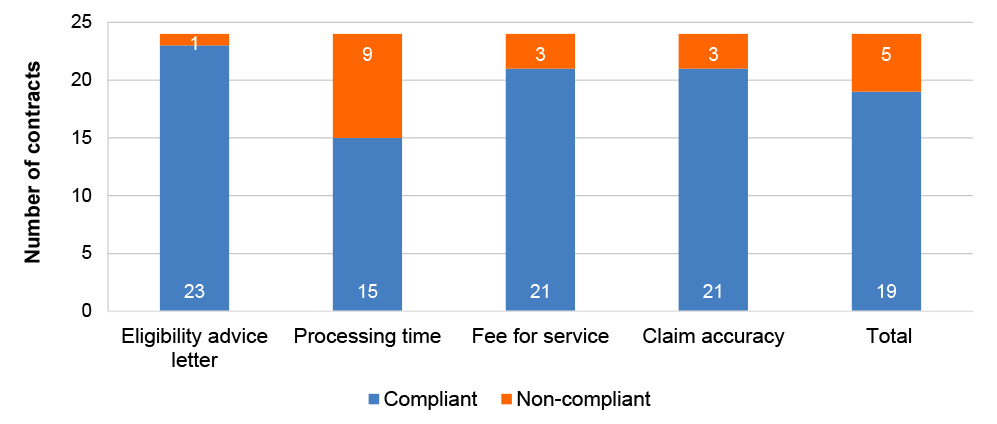

|