Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Agency Management of Special Accounts

A Special Account is a mechanism used to record amounts in the Consolidated Revenue Fund that are set aside for specified purposes. A total of $3.40 billion was reported as held in Special Accounts as of 30 June 2003, with $10.33 billion reported as credited to Special Accounts in 2002-03 and $10.06 billion in reported payments (debits) from these Accounts. The audit examined the establishment, management and abolition of Special Accounts by Commonwealth agencies, as well as compliance with legal requirements

Summary

Introduction

The Australian Constitution provides for a Consolidated Revenue Fund (CRF), formed from all revenues and moneys raised or received by the Government. Payments from the Treasury of the Commonwealth are required to be authorised by an appropriation, made by law.

A Special Account is a mechanism used to record amounts in the CRF that are set aside for specified purposes.1 The Financial Management and Accountability Act 1997 (FMA Act) provides an appropriation for the purposes of each Special Account, up to the balance of the Special Account.

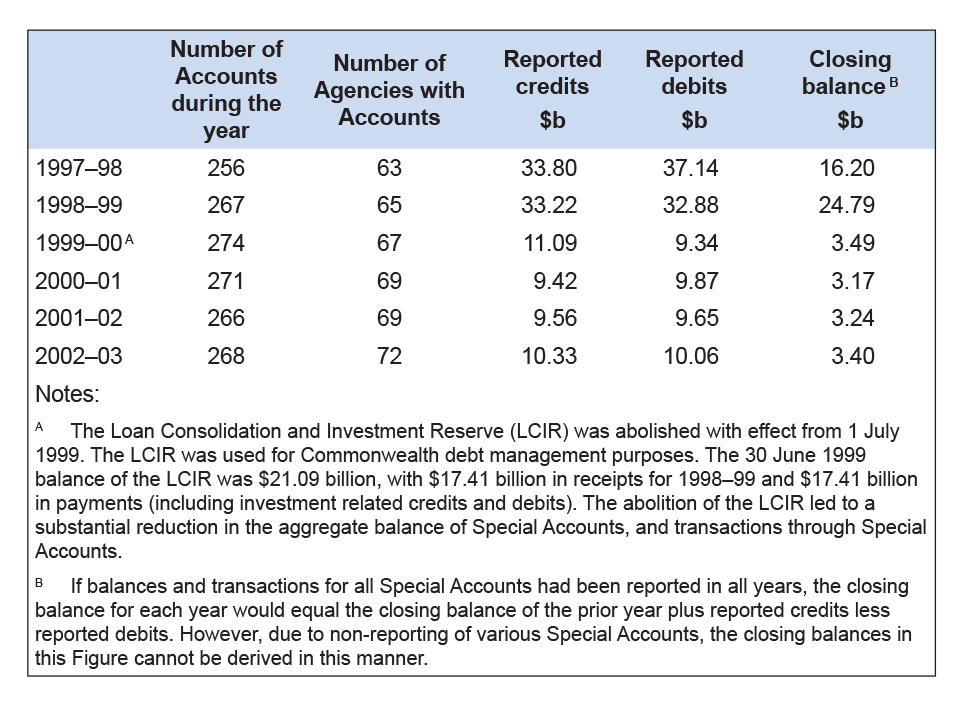

As of November 2003, 241 Special Accounts were in existence.2 A total of $3.40 billion was reported as held in Special Accounts as of 30 June 2003 (see Figure 1). During 2002–03, $10.33 billion was reported as credited to Special Accounts, with $10.06 billion in payments (debits) from Special Accounts.3

Figure 1 Special Account Activities Since the Introduction of the FMA Act

Notes:

A The Loan Consolidation and Investment Reserve (LCIR) was abolished with effect from 1 July 1999. The LCIR was used for Commonwealth debt management purposes. The 30 June 1999 balance of the LCIR was $21.09 billion, with $17.41 billion in receipts for 1998–99 and $17.41 billion in payments (including investment related credits and debits). The abolition of the LCIR led to a substantial reduction in the aggregate balance of Special Accounts, and transactions through Special Accounts.

B If balances and transactions for all Special Accounts had been reported in all years, the closing balance for each year would equal the closing balance of the prior year plus reported credits less reported debits. However, due to non-reporting of various Special Accounts, the closing balances in this Figure cannot be derived in this manner.

Source: ANAO analysis.

Audit scope and objectives

The audit scope included all Special Accounts (and their predecessors) that have existed at sometime during the time since the FMA Act commenced operation on 1 January 1998. The audit objectives were to:

- identify all Special Accounts that have existed;

- assess the efficiency and effectiveness of the establishment, management and abolition of these Special Accounts; and

- assess compliance with the legislative requirements (including those of the FMA Act and the Finance Minister's Orders promulgated under that Act).

To address the first audit objective, the audit commenced with a census of all Commonwealth agencies. This was combined with analysis of each reported Special Account to confirm that the Account existed at law, and had been properly disclosed by the relevant agency. The second and third audit objectives were met by an assessment of the overall governance framework for Special Accounts, together with a detailed examination of the management of 19 Special Accounts administered by six agencies. These 19 Special Accounts had reported closing balances totalling $1.23 billion as of 30 June 2003, with total reported transactions (credits and debits) of $7.60 billion during 2002–03.

Key Findings

Establishment and abolition

Special Accounts can be created by a Finance Minister's Determination under the FMA Act. These Determinations may be disallowed by the Parliament. Special Accounts can also be established by the passage of separate legislation. Abolition of Special Accounts requires a Determination to be made by the Finance Minister or, for those Accounts established by legislation, by repeal of the legislation in whole or part.

There has been uncertainty about the number and identity of Special Accounts that exist. ANAO has concluded that a total of 297 Special Accounts (and their predecessors) have existed at sometime during the time since the FMA Act commenced operation. By November 2003, 56 of these Accounts had been abolished such that there are currently 241 Special Accounts in legal existence. Of these, 199 have been established by Determinations, with the remaining 42 established under legislation other than the FMA Act.

Disclosure

Financial reporting on the use of appropriations (including Special Accounts) is an important accountability function. However, a significant number of agencies have not recorded and reported all their Special Accounts. In 2001–02, 41 per cent of Special Accounts were not reported in agency financial statements.

In the second quarter of calendar year 2003, both ANAO and the Department of Finance and Administration (Finance) identified to agencies the Special Accounts for which they were responsible. ANAO also identified to each relevant agency which Special Accounts the agency had failed to report in its 2001–02 financial statements so that these oversights could be corrected in the 2002–03 financial statements.

In combination with work undertaken by Finance, this process resulted in a significant improvement in disclosures in 2002–03 financial statements, with 17 per cent of Special Accounts not being reported. There is no apparent reason for Special Accounts to have been unreported in 2002–03. This is the case even where there is no balance and/or no transactions, as each Account represents an appropriation that may be credited with amounts to be spent on various matters.

In respect of financial statements in agencies' annual reports, there has been a longstanding requirement to report all Special Accounts. (Some Special Accounts also have separate statutory reporting requirements.) During 2002–03, Finance took steps to enhance the disclosure requirements for Special Accounts in the Portfolio Budget Statements, the Consolidated Financial Statements and financial statements in agencies' annual reports. As a result, Finance expects that, in future, all Special Accounts should be identified in these documents.

Legislation that established 11 Special Accounts requires separate annual reports to be prepared and tabled in each House of the Parliament in respect of these Accounts.4 This requirement has been met in recent years for each of the 11 Special Accounts. However, ANAO identified four Accounts where a substantial period of time elapsed between the conclusion of the relevant financial year and the tabling of one or more annual reports. While particular timeframes are not specified, the legislation establishing each of these four Accounts requires that a report be prepared as soon as practicable after the end of each financial year.

Non-existent but reported Special Accounts

ANAO identified 19 instances in 13 agencies where the agency had recorded and/or reported in its financial statements the existence of a Special Account when no Special Account had been legally established. The immediate concern raised by this finding was that there may have been no legal appropriation under the FMA Act to make more than $486 million in payments from these so-called “Special Accounts”. Accordingly, there was a risk that there had been widespread, persistent breaches of Section 83 of the Constitution. Section 83 states that no money shall be drawn from the Treasury of the Commonwealth except under an appropriation made by law.

According to legal advice obtained by ANAO, Section 83 of the Constitution is not breached where payments purportedly made from a non-existent Special Account could have been legitimately recorded against another, valid, appropriation. In relation to the 19 instances where a non-existent Special Account had been reported, there were no instances of the audit opinion on the financial statements being qualified on the grounds that Section 83 of the Constitution had been breached. However, in 12 instances across eight agencies, it was concluded that the agency had not met its responsibility under Section 48 of the FMA Act to keep accounts and records in such a manner that ensures the limit on any appropriation is not exceeded. Disclosure of this contravention was made in the respective agencies' 2002–03 financial statements.

The reporting of non-existent Special Accounts also drew attention to uncertainty about whether or not an appropriation is required for expenditure of money held by the Commonwealth on trust for others. Recent legal advice to Finance and other agencies on the issue has been inconsistent. Should it be resolved that an appropriation is required to spend money held on trust, changes to financial management procedures will be necessary for some agencies. ANAO considers that continuing uncertainty about whether or not an appropriation is required for expenditure of trust money is not conducive to sound financial management.

Recording of Special Account balances

ANAO undertook a more detailed examination of the management of 19 Special Accounts administered by six agencies, including consideration of the accuracy of reporting of these Accounts. Errors were found to exist in the reported balance of seven of those Accounts, totalling some $575 million. The major cause of these errors was that agencies had not recorded and reported cumulative credits over a number of years to various Accounts totalling $544 million. All errors were corrected in the 2002–03 financial statements.

As appropriations authorise only the drawing and spending of public money, a Special Account balance should not, by definition, be negative. However, five instances were identified where the amounts reported as being debited exceeded the amounts available for payment from that Special Account. This indicated that the standing appropriation provided by the FMA Act in each of these instances had been exceeded, and the overdrawn funds had been spent without appropriation under law.

The results of the performance audit work also resulted in a closer examination of Special Account disclosures in ANAO's audits of 2002–03 financial statements.

Appropriation controls

Maintaining proper records of the credits and debits to a Special Account is essential to the management of these appropriations. For appropriation management purposes, each Special Account should be recorded as a ledger account in the financial system of the administering agency.

Accounting practices in agencies for recording amounts credited to, and debited from, Special Accounts vary. Most of the six agencies examined in detail maintained accrual based records of Special Account transactions within their financial systems. As Special Account transactions and balances are supposed to be accounted for on a cash basis, these records require adjustment to determine the balance of the appropriation. In some instances, this adjustment has led to errors in reporting the balance of the Account.

Having an appropriation available for the use of public money is not, in itself, sufficient for such money to be spent. For agencies subject to the FMA Act, a valid Drawing Right is required to have been issued before payments of public money may be made from, and debits recorded against, appropriations. In two of the four agencies where the administration of Drawing Rights for Special Account appropriations was examined, ANAO found that valid Drawing Rights had not been issued for transactions on 13 Special Accounts. Since 1 July 1999, when responsibility for maintaining appropriation ledger records was transferred to agencies from Finance, $618 million in payments have been made from, and debited against, the relevant Special Accounts by these two agencies.

Credits to Special Accounts

The Determination or legislation establishing a Special Account usually provides the legal authority for amounts to be credited to the Account. For 16 of the 19 Special Accounts examined in detail by the ANAO, the amounts to credited to the respective Accounts were within the categories of specified credits. The three exceptions all related to crediting of income from investment activities. Legal advice obtained by the administering agency during the course of the audit provides some support for the approach taken. Nevertheless, from 1 July 2003, two of these three Accounts are no longer being credited with interest.

Where legislation requires (as opposed to permits) amounts to be credited to a Special Account, this crediting occurs by operation of law without any administrative action needing to be taken. However, ANAO found that two agencies had not recorded and reported transactions on their Special Account appropriations in a way that was consistent with the legislation that established the respective Accounts.

The first instance involved the Rural Transactions Centres Account. The relevant legislation required $70 million in social bonus funds from the second tranche sale of Telstra shares (Telstra 2) to be credited in 1999 to this Account.5 However, only $61.7 million was recorded and reported against the Account in 1999–2000. The non-compliance with the legislative requirements was corrected by the administering agency in 2002–03, when the balance of the Account was increased by $8.3 million.

The second instance involved the Natural Heritage Trust of Australia (NHT) Account. At the time of ANAO's audit, a total of $2.394 billion had been credited to the NHT Account by virtue of both annual appropriations and the self-executing Natural Heritage Trust of Australia Act 1997 (NHT Act). However, only $1.909 billion of these funds had actually been recorded and reported by the administering agency. The $485 million difference resulted from the following errors:

- By operation of law6, the first $250 million in Telstra 2 proceeds was to be credited to the NHT Account in 1999. However, rather than recording this amount as being credited to the Account in 1999 by virtue of the provisions of the legislation, as was required, the agency obtained an annual appropriation in 2001–02 to credit $250 million to the NHT Account. This meant that, in substance (but not in the agency's records), $250 million was credited to the NHT Account on two separate occasions.

- The NHT Act requires that a fixed income percentage of eight per cent of the uninvested 30 June balance of the Account be credited to the Account each year. These credits also occur by operation of law without any administrative action being taken. However, over a number of years, the agency recorded the taking up of annual appropriation monies to fund interest credits to the Account. This resulted in two amounts of interest being credited each year to the Account.

As reported in the agency's 2002–03 financial statements, $379 million has been debited from the NHT Account. This comprised $250 million in Telstra 2 sale proceeds and $129 million in interest funded from annual appropriations.7

Special Account purposes

The FMA Act provides a standing appropriation for the purposes of each Account, up to the balance of the Account. In this context, ANAO identified four Accounts in respect of which debits had been reportedly made for purposes other than those specified in the establishing legislation or Determination, or there were doubts about whether the debits accorded with the purpose of the Account.

Legal advice to agencies on the management of Special Accounts has identified at least two circumstances in which amounts may be debited other than for the stated purposes. The first involves correcting clerical errors. The second is when the crediting of an Account occurred through the exercise of a discretion by an official, and the exercise of that discretion was actuated by a fundamental mistake of fact or law. ANAO's audit identified only one instance of a fundamental mistake leading to a Special Account being debited other than for the purposes of the Account.

Overall conclusions

In terms of the audit objectives, ANAO concluded as follows:

- there has been uncertainty since the introduction of the FMA Act about the number and identity of Special Accounts that exist.8 After detailed examination of all available records, ANAO found that a total of 297 Special Accounts have been established since the FMA Act commenced. Of these, 56 have subsequently been abolished, leaving 241 Accounts in existence as at November 2003;

- many agencies need to improve their management of Special Accounts. There has been widespread non-reporting of Special Accounts, and significant inaccuracies in the financial disclosures on some of those Accounts that have been reported. Further, appropriation management procedures were found to be inadequate in a number of agencies; and

- there has been non-compliance with a number of legislative requirements. This includes those provisions of the FMA Act (and subordinate legislation) relating to: the management of appropriations; the keeping of proper accounts and records; and the reporting of all Special Accounts. There has also been inadequate understanding within agencies of, and non¬compliance with, aspects of the legislation that has established particular Special Accounts. This includes where legislation requires amounts to be credited to a Special Account.

The results of the audit were that deficiencies were identified in the management of 12 of the 19 Special Accounts examined in detail by ANAO. This included Special Accounts not being credited with amounts that legislation required to be credited and debits being recorded against Special Accounts that were outside the specified expenditure purposes of the Account. Inaccuracies in the reported balance of seven Special Account appropriations were one consequence of the deficiencies identified during the course of the audit.

The audit demonstrates that there is significant scope for agencies to improve their financial management and reporting practices in respect of their Special Accounts. The improvements to Special Account disclosure requirements and the development and publication in October 2003 of Special Account Guidelines by Finance have provided a stronger platform for enhancing the financial management, reporting and transparency of Special Accounts. However, further improvement in administration must also come from greater understanding of, and increased care and attention to, legislative requirements and appropriation management practices by agencies responsible for the management of individual Special Accounts.

ANAO made 13 recommendations to improve management of, and accountability for, Special Accounts.

Agency responses

Agencies that responded to the draft report agreed, or agreed with qualification, to all recommendations. In addition, Finance and the Department of the Treasury (Treasury) provided summary comments on the report, as follows.

Finance

Finance agrees with ANAO's conclusions regarding the financial framework as it applies to Special Accounts and will act to implement those parts of the report relevant to Finance's responsibilities.

With regard to the Special Accounts framework, Finance has recently:

- thoroughly reviewed the authority for all Special Accounts;

- enhanced the transparency of the operation of Special Accounts through greater disclosure requirements in Portfolio Budget Statements, the Consolidated Financial Statements and the financial statements in agency annual reports; and

- issued comprehensive guidance to agencies on the management of Special Accounts.

This work provides a stronger platform for enhancing agencies' management of Special Accounts and compliance with the financial framework.

Treasury

Treasury values the work undertaken by the ANAO to highlight the complexities associated with (and importance of) the management of Special Accounts within Australian government agencies. Treasury agrees with the ANAO's overall conclusion that there is scope for agencies to improve their financial management and reporting practices in respect of their Special Accounts. To this end, Treasury is currently reviewing various aspects of its management of Special Accounts in conjunction with the Australian Government Solicitor and Finance.

Footnotes

1 Inquiry into the Draft Financial Framework Legislation Amendment Bill, Joint Committee of Public Accounts and Audit, Report 395, August 2003, Appendix J.

2 Of the 268 Special Accounts that existed at some time during 2002–03, 29 have subsequently been abolished. An additional two Special Accounts have been established to date in 2003–04. This meant that there were 241 Special Accounts in existence as at November 2003.

3 Transactions on Special Accounts are recorded as credits (which increase the balance of the Account and the related appropriation) and debits (which reduce the balance of the Account and the related appropriation).

4 These requirements are in addition to the requirements for each agency to report the financial transactions and position on each Special Account in the notes to its financial statements.

5 In 1999, the Telstra (Further Dilution of Public Ownership) Act 1999 was passed to enable the Telstra 2 sale to proceed. Among other things, this legislation made amendments to provide for a $671 million social bonus to be funded from the proceeds of the Telstra 2 sale. Each element of the social bonus was to be credited to a Special Account.

6 NHT Act, Section 22A.

7 The difference between the $485 million in credits not previously recorded and the $379 million debited to correct the mistakes relates to $49 million of corrections made during 2002–03, $37 million of interest earned on amounts credited in error (legal advice was that these amounts could not be debited) and a recalculation by the administering agency of the amount of annual appropriation revenue previously credited to the Account that had been in the nature of interest (resulting in $21 million being debited).

8 See Paragraphs 2.33 to 2.39.