Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration of Australian Business Number Registrations Follow-up Audit

The objective of this follow-up audit is to assess the Tax Office's progress in implementing the recommendations of Audit Report No.59 2002–03, Administration of Australian Business Number Registrations, having regard to any changed circumstances, or new administrative issues, affecting the implementation of those recommendations.

Summary

Introduction

The Australian Business Number is a unique 11-digit number that was created as a new identifier for business and as a key element of the Australian Government's framework for A New Tax System. Instituted in July 1999 by the enactment of A New Tax System (Australian Business Number) Act 1999 (the Act), the ABN is administered by the Australian Taxation Office (Tax Office) with the Commissioner of Taxation to occupy the formal position of Registrar.

The Act also established the Australian Business Register (ABR) as the register for all ABNs and the Commissioner of Taxation as the Registrar. The ABR collects, verifies and stores basic business information1 supplied by businesses with an ABN. Some of this information is available to the public.

The ABR is a whole-of-government initiative, primarily developed to make it easier for businesses to transact business with Australian Government agencies. An objective of the Act is to reduce the number of government registration and reporting requirements by making the system available to State, Territory and local government regulatory bodies.

By 30 June 2000, the Tax Office had issued approximately 2.9 million ABNs in preparation for the commencement of A New Tax System and the Goods and Services Tax. In June 2002, the Tax Office implemented a new ABR database separate from other Tax Office Systems to store ABNs and other business information.

The Australian National Audit Office commenced an audit of the administrative effectiveness of the ABN registration process and the Tax Office's implementation and management of the ABR in 2002. Audit Report No 59. 2002–03 Administration of the Australian Business Number Registrations was tabled in June 2003. This period of time coincided with the ABR transitioning from a project environment to a ‘business as usual' environment.

The adoption of the ABR by other agencies is central to achieving the objectives of the Act. The previous audit noted that as of May 2003, 11 agencies had signed a Memorandum of Understanding (MOU) to use the ABR and another 13 MOUs were in progress. This compares with a Tax Office target of 271 agencies participating in the ABR for 2002–032.

Audit scope and objective

The objective of this follow-up audit is to assess the Tax Office's progress in implementing the recommendations of Audit Report No.59 2002–03, Administration of Australian Business Number Registrations, having regard to any changed circumstances, or new administrative issues, affecting the implementation of those recommendations.

As the ABR has now been operating in a ‘business as usual' environment for about four years, the governance framework of the ABR was also reviewed with the objective of extracting any ‘lessons learnt' that may be useful in developing other whole-of-government initiatives.

Conclusions

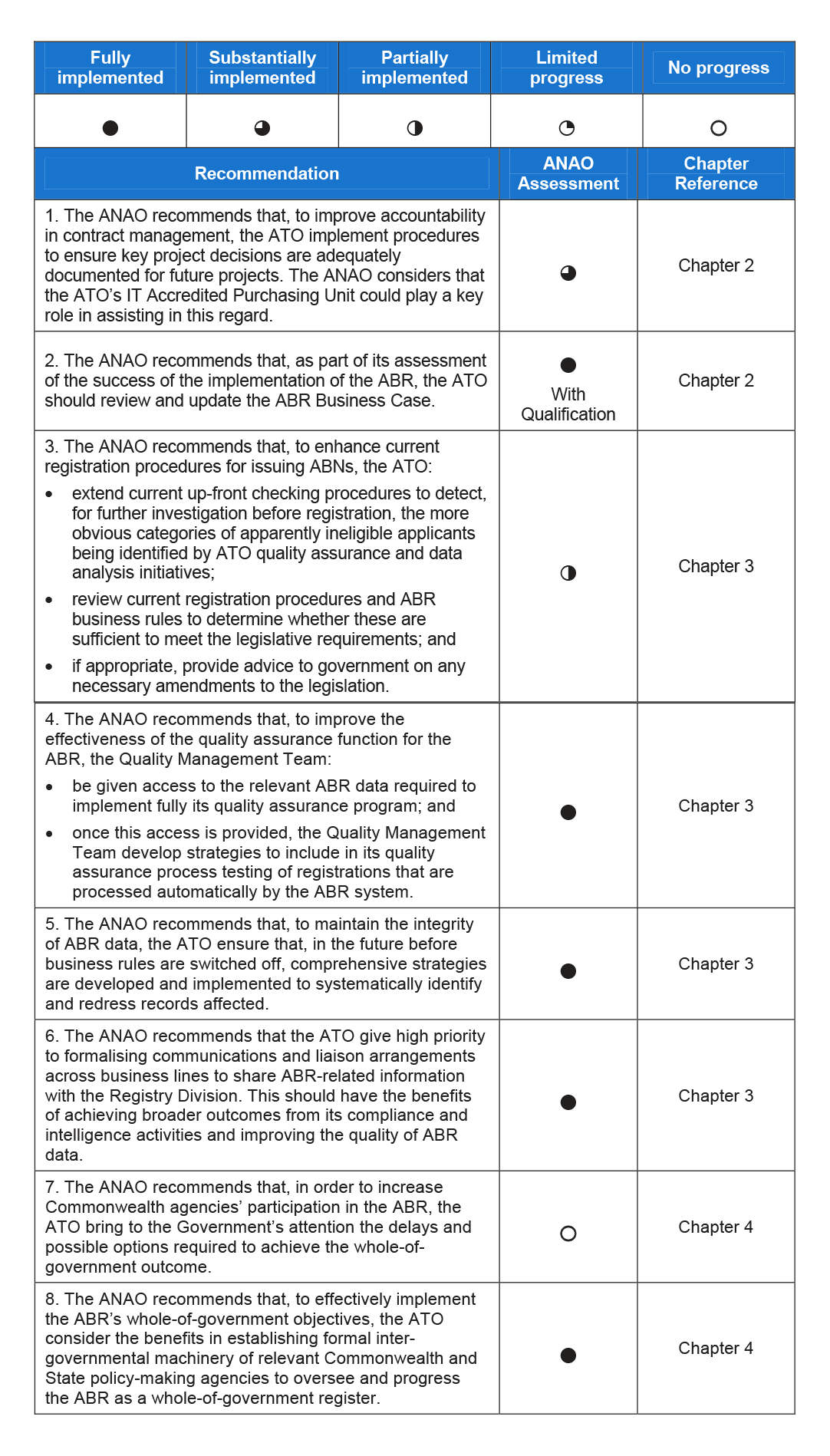

Overall, the Tax Office has substantially implemented the recommendations of the previous audit. The Tax Office's progress in implementing the recommendations is summarised in Table 1.

The development of the ABR within the Tax Office has resulted in the Tax Office becoming both custodian and primary user of the system. Over the last four years of the ABR's operation, the focus of attention has been on ensuring the administrative efficiency of the ABR to achieve the Tax Office's key objectives relating to the introduction of the GST.

However, this focus has arguably been at the expense of the other original objectives and expectations for the ABR in terms of reducing the number of government registration and reporting requirements for business, and making it easier for business to deal with Government at all levels. Notwithstanding the separate role of Registrar and the segregation of the ABR system, the management of the ABR has been largely subsumed into the Tax Office's general governance framework.

Three issues emerged in relation to the governance framework for the ABR in the ‘business as usual' environment of the Tax Office, having regard to the Registrar's role as custodian of the register and administrator of ABNs under the Act. These are:

- Strategic and business plans for the ABR have not been developed and documented to provide a sound planning and performance measurement base for the ABR, and to provide appropriate direction to Tax Office staff.

- Limited reporting to Government of delays in the level of agency take up of the ABN as a common identifier (previous recommendations 7 and 8).

- Subsuming the ABR into Tax Office operations has reduced management attention on specific ABR outcomes.

Table 1 Tax Office's progress in implementing the recommendations of the 2002–03 audit.

This follow-up audit grouped the earlier recommendations into three themes with subsequent chapters discussing the Tax Office's progress in implementing the recommendations within these themes. The themes are:

- ABR Governance Arrangements (Chapter 2);

- Improving the Integrity of ABR Data (Chapter 3); and,

- Whole-of-Government Issues (Chapter 4).

Chapter 5 discusses the governance arrangements of the ABR, drawing on observations made in assessing the Tax Office's implementation of the previous audit's recommendations. Specifically, the chapter focuses on the planning, monitoring and reporting by the Tax Office on the whole-of-government outcomes of the ABR and highlights some matters to be considered by agencies when developing whole-of-government initiatives.

Recommendations

The ANAO has made four new recommendations. Three recommendations are directed at improving the governance framework for the ABR and one at improving the uptake of the ABR by agencies in order to achieve whole-of-government outcomes.

The Tax Office has agreed to the four recommendations made in this report.

Summary of agency response

The Tax office considers that through the use of technologies the ABR was ahead of its time as one of the first large-scale government transaction initiatives to leverage the internet. There were also expectations that other agencies, including those from the State and Territories, would be in a position to develop connections that would see them relying on the ABR as a key channel for interactions with businesses.

This pioneering intent has challenged the progress of the ABR and resulted in it not advancing as quickly as foreshadowed in the Tax Office's original plans. However, this is a challenge that is not limited to the Tax Office and extends to other government agencies, Federal and State.

Tax Office has responded to the slower than expected progress and shifted from an approach of maximising the number of agencies accessing ABR data to a more targeted approach focusing on those government agencies that will contribute most significantly to achieving the intent of the ABR. This is demonstrated by the Tax Office's continued support of whole of government service delivery projects that will benefit from connections to the ABR whilst also assisting to realise the vision of the ABR.

As noted in the report, the ABR has now been operating as 'business as usual' for approximately four years. The report consolidates the achievements of the ABR to date and Tax Office acknowledges that there are lessons to be learnt when developing plans to realise the strategic, whole of government objectives for the ABR.

While the Tax Office is pleased with the assessment that there has been substantial implementation of the recommendations from the previous audit, the ATO also acknowledges the continuing challenge to harness further whole-of-government opportunities through the ABR.

Footnotes

1 A complete list of information held by the ABR is available from the help pages of the ABR website <www.abr.gov.au>.

2 ABR Business Case dated November 2000