Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

2023–24 Major Projects Report

Please direct enquiries through our contact page.

Audit snapshot

What is the purpose of the MPR?

The Major Projects Report (MPR) is an annual review of the Department of Defence’s (Defence’s) major Defence equipment acquisitions, undertaken at the request of the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA). Its purpose is to provide information and assurance to the Parliament on the performance of selected acquisitions at 30 June 2024.

This year it includes 21 Major Projects. This is the seventeenth MPR since its commencement in 2007–08.

What did we find?

The Australian National Audit Office (ANAO) reviewed the Defence information in the 21 Project Data Summary Sheets (PDSSs) and the Statement by the Secretary of Defence, excluding the forecast information, against the requirements of the 2023–24 Major Projects Report Guidelines (the Guidelines).

Based on the review procedures and the evidence obtained, the Auditor-General concluded that, with one exception, nothing came to her attention that caused her to believe that the information reviewed was not prepared in accordance with the Guidelines. The one exception was:

- For all project PDSSs, Section 6 — Lessons Learned: the Guidelines require disclosure of a description of the project lessons that have been learned. Due to deficiencies in Defence’s governance process over lessons learned, the ANAO is unable to obtain sufficient appropriate audit evidence to conclude whether the lessons learned disclosed are materially misstated or materially correct, resulting in a limitation of scope.

The Auditor-General also drew attention to disclosures within the Statement by the Secretary of Defence that some information in 20 PDSSs has not been published due to Defence’s assessment that the information would or could reasonably be expected to cause damage to the security, defence or international relations of the Commonwealth.

What is reviewed?

Defence prepares Project Data Summary Sheets (PDSSs) on selected major Defence equipment acquisition projects in accordance with guidelines endorsed by the JCPAA. The PDSSs cover:

- Background and government approvals

- Financial performance

- Schedule performance

- Delivery against agreed scope

- Risks and issues

- Lessons learned by the project

- Management accountability for the project

The ANAO reviews the information in Defence’s PDSSs in accordance with ANAO Auditing Standards specified by the Auditor-General under the Auditor-General Act 1997. This year Defence decided that certain information was not for publication in 20 of the 21 PDSSs on security grounds. This is an increase of eight projects when compared with the 2022–23 MPR. The ANAO has reviewed the information not published by Defence and assessed this information as part of its assurance review.

$81.0bn

was the value of the 21 Defence Major Projects at 30 June 2024.

8 of 21

Defence Major Projects experienced in-year schedule slippage.

94.5%

was the expected delivery against agreed scope across the Major Projects at 30 June 2024 — with seven of the 21 projects reporting that some elements of capability/scope delivery 'were under threat' or 'unlikely to be met'.

Due to the complexity of material and the multiple sources of information for the 2023–24 Major Projects Report, we are unable to represent the entire document in HTML. You can download the full report in PDF or view selected sections in HTML below. PDF files for individual Project Data Summary Sheets (PDSS) are also available for download.

!Part 1. ANAO Review and Analysis

Summary

Background

1. The Department of Defence’s (Defence) Capability Acquisition and Sustainment Group (CASG) manages the process of bringing new specialist military equipment into service for the Australian Defence Force (ADF). Since October 2022, the Naval Shipbuilding and Sustainment Group (NSSG) has had responsibility for building and sustaining maritime capabilities.1 At 30 June 2024, Defence was managing 568 major and 99 minor acquisition projects, with a total acquisition cost of $245 billion.2 Defence capitalised $10.3 billion from these projects in 2023–24.3

2. The Major Projects Report (MPR) contains Defence information and commentary on a selection of its major projects (the Major Projects) and assurance and analysis of that information by the Australian National Audit Office (ANAO). This report is the seventeenth annual MPR.

3. Major Projects are selected for inclusion in the MPR based on criteria endorsed by the Parliament’s Joint Committee of Public Accounts and Audit (JCPAA).4 The projects represent a selection of the most significant major projects managed by CASG (16 projects) and NSSG (five projects) (see Table S.1).

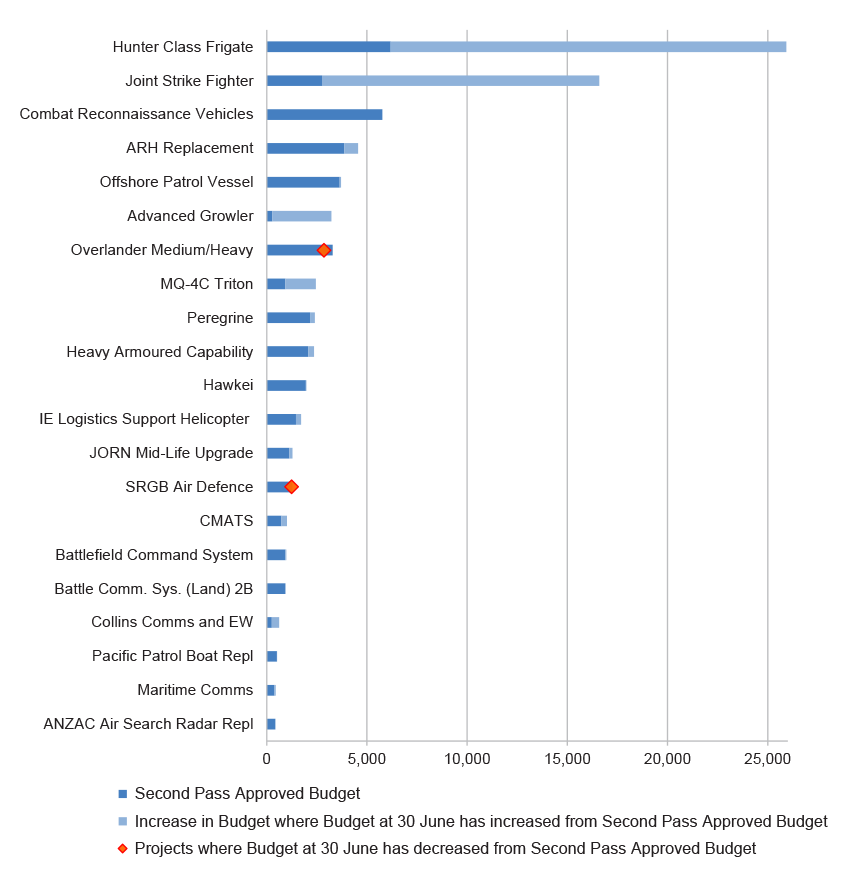

4. The total approved budget for the 21 Major Projects included in this report is approximately $81.0 billion, which is 33.1 per cent of the total $245 billion budget for major and minor Defence acquisition projects (or 48.3 per cent of the total budget for projects managed by CASG and NSSG).

Selected projects

5. The 21 Major Projects selected for review comprise of seven SEA projects, seven LAND projects, six AIR projects and one joint (JNT) project. These projects and their government approved budgets, at 30 June 2024, are listed in Table S.1.

Table S.1. 2023–24 MPR — selected projects and approved budgets at 30 June 2024

|

Project number (Defence capability plan) |

Project name (on Defence advice) |

Project abbreviation (on Defence advice) |

Managed by |

Approved budget ($m) |

|

SEA 5000 Phase 1 |

Hunter Class Frigate Design and Construction |

Hunter Class Frigatea |

NSSG |

25,924.0 |

|

AIR 6000 Phase 2A/2B |

New Air Combat Capability |

Joint Strike Fightera |

CASG |

16,589.1 |

|

LAND 400 Phase 2 |

Combat Reconnaissance Vehicles |

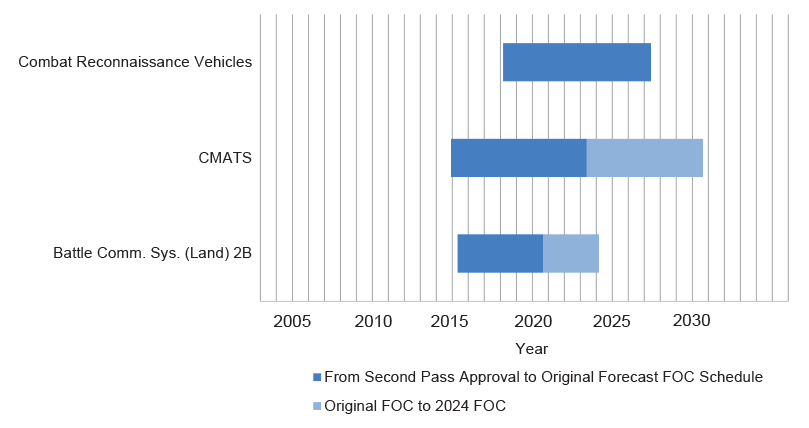

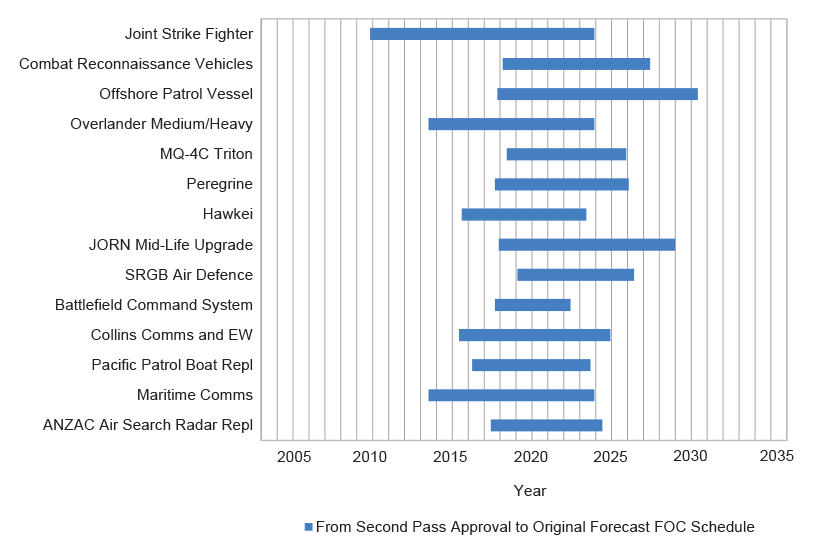

Combat Reconnaissance Vehiclesa |

CASG |

5,774.7 |

|

LAND 4503 Phase 1 |

Armed Reconnaissance Helicopter (ARH) Replacement |

ARH Replacementb |

CASG |

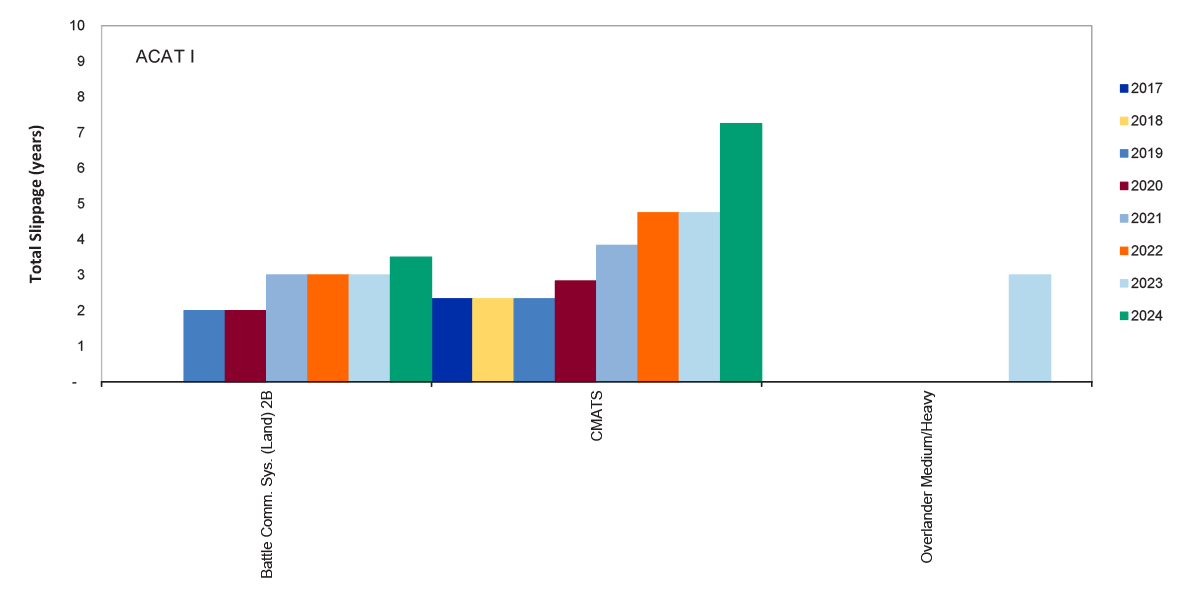

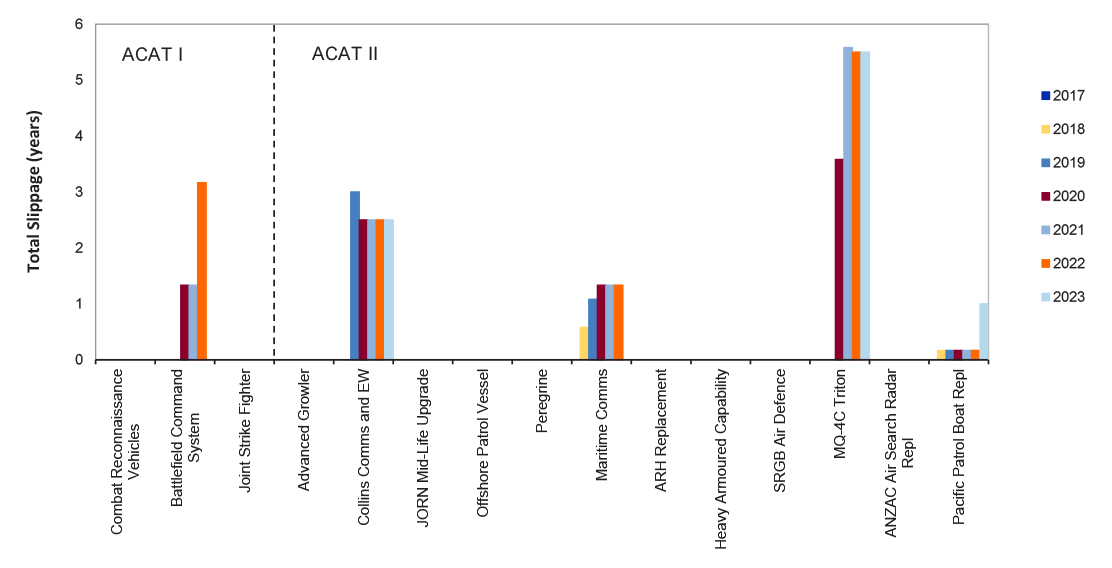

4,560.4 |

|

SEA 1180 Phase 1 |

Offshore Patrol Vessel |

Offshore Patrol Vessela |

NSSG |

3,704.8 |

|

AIR 5349 Phase 6 |

Advanced Growler Development |

Advanced Growler |

CASG |

3,222.2 |

|

LAND 121 Phase 3B |

Medium Heavy Capability, Field Vehicles, Modules and Trailers |

Overlander Medium/Heavya |

CASG |

2,862.9 |

|

AIR 7000 Phase 1B |

MQ-4C Triton Remotely Piloted Aircraft System |

MQ-4C Triton |

CASG |

2,447.7 |

|

AIR 555 Phase 1 |

Airborne Intelligence, Surveillance, Reconnaissance and Electronic Warfare (ISREW) Capability |

Peregrine |

CASG |

2,394.8 |

|

LAND 907 Phase 2/ LAND 8160 Phase 1 |

Main Battle Tank Upgrade, Combat Engineering Vehicles |

Heavy Armoured Capability |

CASG |

2,359.6 |

|

LAND 121 Phase 4 |

Protected Mobility Vehicle — Light (PMV-L) |

Hawkeia |

CASG |

1,976.0 |

|

SEA 9100 Phase 1 |

Improved Embarked Logistics Support Helicopter |

IE Logistics Support Helicopterb |

CASG |

1,710.4 |

|

AIR 2025 Phase 6 |

Jindalee Operational Radar Network |

JORN Mid-Life Upgradea |

CASG |

1,285.6 |

|

LAND 19 Phase 7B |

Short Range Ground Based Air Defence |

SRGB Air Defence |

CASG |

1,241.1 |

|

AIR 5431 Phase 3 |

Civil Military Air Management System |

CMATSa |

CASG |

1,010.0 |

|

LAND 200 Tranche 2 |

Battlefield Command System |

Battlefield Command Systema |

CASG |

972.5 |

|

JNT 2072 Phase 2B |

Battlespace Communications System Phase 2B |

Battle Comm. Sys. (Land) 2B |

CASG |

948.6 |

|

SEA 1439 Phase 5B2 |

Collins Class Communications and Electronic Warfare Improvement Program |

Collins Comms and EWa |

NSSG |

616.1 |

|

SEA 3036 Phase 1 |

Pacific Patrol Boat Replacement |

Pacific Patrol Boat Repl |

NSSG |

517.5 |

|

SEA 1442 Phase 4 |

Maritime Communications Modernisation |

Maritime Commsa |

CASG |

441.8 |

|

SEA 1448 Phase 4B |

ANZAC Air Search Radar Replacement |

ANZAC Air Search Radar Repla |

NSSG |

429.4 |

|

Total (21 projects) |

|

|

|

80,989.2 |

Note a: This is one of 12 projects examined in an ANAO performance audit. See Appendix 1, on p. 88, for more information.

Note b: This is one of two projects included in the MPR for the first time in 2023–24.

Source: Defence’s Project Data Summary Sheets (PDSSs) are provided in Part 3 of this report.

Rationale for undertaking the review

6. The MPR is prepared at the request of the Parliament. The JCPAA has stated that the objective of the MPR is ‘to improve the accountability and transparency of Defence acquisitions for the benefit of Parliament and other stakeholders.’5 The JCPAA commissions the MPR in the public interest, for the benefit of users of the report inside and outside the Parliament. The MPR informs parliamentary scrutiny and the national conversation on major Defence acquisitions, and is intended to assist users by adopting a consistent reporting format over time and through the inclusion of summary and longitudinal analysis prepared by the ANAO.

7. Defence’s major Defence equipment acquisition projects remain the subject of parliamentary and public interest due to their: high cost and contribution to national security in a changing strategic environment; the challenges involved in completing them within the specified budget and schedule, and to the required capability; and their contribution to industrial and employment policy objectives.

Conduct of the review

8. Defence is expected to prepare Project Data Summary Sheet (PDSS) information for the ANAO to review in accordance with the 2023–24 Major Projects Report Guidelines (Guidelines), endorsed annually by the JCPAA (included in Part 4 of this report).6 The status of the Major Projects selected for review is reported in the Statement by the Secretary of Defence (included in Part 3 of this report) and a Project Data Summary Sheet (PDSS) prepared by Defence for each of the Major Projects (included in Part 3 of this report).

9. The ANAO has reviewed each of the PDSSs prepared by Defence as a ‘priority assurance review’ under subsection 19A(5) of the Auditor-General Act 1997 (the Act), which allows the ANAO full access to the information gathering powers under the Act.

10. The ANAO’s review provides limited assurance7 and was undertaken in accordance with the ANAO Auditing Standards. The ANAO’s review included an assessment of Defence’s systems and controls, including the governance and oversight in place, to ensure appropriate project management. The ANAO sought representations and confirmation from Defence senior management and industry (through Defence) on the status of the selected Major Projects.

11. The objective of this ANAO assurance engagement and the ANAO review procedures is to allow the Auditor-General to provide independent assurance to the Parliament whether the PDSSs have been prepared in accordance with the Guidelines, including the status of the Major Projects selected for review. A summary of the Auditor-General’s conclusion is set out in paragraphs 26 to 29. The full conclusion is found in the Auditor-General’s Independent Assurance Report in Part 3 of this report.

12. Certain forecast information found in the Defence PDSSs, such as Australian Industry Capability (AIC), forecast dates, expected capability/scope delivery performance and future risks are excluded from the scope of the ANAO’s review.8 These exclusions to the scope of the review are due to a lack of Defence systems from which to provide complete and/or accurate evidence in a sufficiently timely manner to facilitate the review. Accordingly, the Auditor-General’s Independent Assurance Report does not provide assurance in relation to this information. However, where material inconsistencies between the information disclosed in these excluded sections and the ANAO’s understanding from performing review procedures on the in-scope information are identified, the Auditor-General’s conclusion is qualified. This has been an area of focus of the JCPAA over a number of years9 and it is intended that all components of the PDSSs will eventually be included within the scope of the ANAO’s review.

13. In addition to the review procedures performed in relation to the PDSSs, the ANAO has undertaken an analysis of the PDSSs, including longitudinal analysis.10

14. Defence provides additional insights and context in its commentary and analysis contained in Part 2 of the MPR. This commentary and analysis is not included in the scope of the ANAO’s assurance review. Information on significant events occurring post 30 June 2024 is outlined in the Statement by the Secretary of Defence contained in Part 3 of the MPR and is included in the scope of the ANAO’s assurance review.

Treatment of classified information

15. The Guidelines endorsed by the JCPAA set out the information to be included by Defence in its PDSSs for each MPR project, including forecast dates and capability information. The Guidelines also provide (see paragraph 1.22 of Part 4) that:

Defence is responsible for ensuring information of a classified nature is made available to the ANAO for review, as it relates to the data contained within the PDSSs. Defence will provide data for inclusion in the final MPR in a way that allows for unclassified publication. Defence will provide advice to the ANAO on the classification of information contained across all PDSSs.

2023–24 MPR — not for publication material

16. In the course of preparing the 2023–24 MPR, Defence advised the ANAO of its decision that certain information relating to forecast dates11, capability delivery information, variance information and risks and issues was not for publication (NFP), and would not be included in the relevant PDSSs for 20 of the 21 projects (see paragraphs 18 to 26 and Table S.2 and Table S.3).12 This is an increase from:

- 12 projects reported in the 2022–23 MPR; and

- four projects reported in the 2021–22 MPR.

17. As required by the MPR Guidelines, the not for publication information was provided to the ANAO for review. The ANAO obtained limited assurance over the information provided where it was within the scope of the review procedures.

18. As was the case since the 2021–22 MPR, the 2023–24 report does not provide the same level of information compared to reporting prior to 2020–21 and provides a reduced level of transparency and accountability to Parliament and other stakeholders.

19. In contrast to the 2021–22 MPR, the ANAO is in a position to publish aggregate analysis on: total schedule slippage across this year’s projects; average schedule slippage across this year’s projects; and in-year schedule slippage across this year’s projects (see Table S.7). This results from the increase in the number of PDSSs, which have not disclosed Final Operational Capability (FOC) forecast dates — from nine last year to 18 this year.13 The larger number of projects with information not disclosed this year means that it is not possible to derive the ‘not for publication’ information for individual projects from the aggregate analysis. The impacts on the ANAO’s analysis of schedule performance are discussed further in paragraphs 60 to 68.

20. The 2022–23 and 2023–24 MPRs provide the user with more aggregate performance information than in the 2021–22 MPR, it does not provide the same level of information on individual project performance compared to the 2020–21 MPR and prior years.

21. The Secretary of Defence has stated in Part 2 of this year’s MPR that:

In accordance with the Joint Committee of Public Accounts and Audit 2023–24 MPR Guidelines (Guidelines), Defence is responsible for ensuring that the information in the MPR is suitable for unclassified publication. Australia’s strategic circumstances have markedly changed since the MPR was first implemented. Defence has assessed that some details, both in respect of individual projects and in aggregate, would or could reasonably be expected to cause damage to the security, defence or international relations of the Commonwealth without sanitisation of the data. There are 20 projects in this MPR in which some new or updated information has not been published on security grounds.

Defence provided the required information to the ANAO to conduct their assurance and analysis activities.14

22. The Secretary has further stated in this year’s Statement by the Secretary of Defence that:

A security classification review of the information contained within the PDSSs for release in the 2023–24 MPR has been completed.

The purpose of the security review is to ensure that each individual PDSS reflects data at an ‘unclassified’ level and to confirm the aggregated information is not a risk to national security, and is suitable for public release through tabling in Parliament.

It is assessed that some details, both with respect to independent projects and in the aggregate, would or could reasonably be expected to cause damage to the security, defence or international relations of the Commonwealth without sanitisation of the data. These details have been removed from the relevant PDSS. This is marked in the PDSS by the terms “NFP” meaning Not for Publication, or “Delayed” meaning delayed from the Original Planned date or the Forecast date in the 2023–24 PDSS.15

23. Table S.2 lists the 20 PDSSs affected by Defence’s position on publication and their approved budgets. The affected PDSSs represent 95.2 per cent of all PDSSs. The affected projects represent 98.8 per cent of the aggregate approved budget for the MPR projects as a whole.

Table S.2. PDSSs indicating that certain information is not for publication and approved budgets for affected projects

|

Project number (Defence capability plan) |

Project abbreviationa (on Defence advice) |

Approved budget ($m) |

|

SEA 5000 Phase 1 |

Hunter Class Frigate |

25,924.0 |

|

AIR 6000 Phase 2A/2B |

Joint Strike Fighter |

16,589.1 |

|

LAND 400 Phase 2 |

Combat Reconnaissance Vehicles |

5,774.7 |

|

LAND 4503 Phase 1 |

ARH Replacement |

4,560.4 |

|

SEA 1180 Phase 1 |

Offshore Patrol Vessels |

3,704.8 |

|

AIR 5349 Phase 6 |

Advanced Growler |

3,222.2 |

|

LAND 121 Phase 3B |

Overlander Medium/Heavy |

2,862.9 |

|

AIR 7000 Phase 1B |

MQ-4C Triton |

2,447.7 |

|

AIR 555 Phase 1 |

Peregrine |

2,394.8 |

|

LAND907 Phase 2/LAND 8160 Phase 1 |

Heavy Armoured Capability |

2,359.6 |

|

LAND 121 Phase 4 |

Hawkei |

1,976.0 |

|

SEA 9100 Phase 1 |

IE Logistic Support Helicopters |

1,710.4 |

|

AIR 2025 Phase 6 |

JORN Mid-Life Upgrade |

1,285.6 |

|

LAND 19 Phase 7B |

SRGB Air Defence |

1,241.1 |

|

AIR 5431 Phase 3 |

CMATS |

1,010.0 |

|

LAND 200 Tranche 2 |

Battlefield Command System |

972.5 |

|

SEA 1439 Phase 5B2 |

Collins Comms and EW |

616.1 |

|

SEA 3036 Phase 1 |

Pacific Patrol Boats Replacement |

517.5 |

|

SEA 1442 Phase 4 |

Maritime Comms |

441.8 |

|

SEA 1448 Phase 4B |

ANZAC Air Search Radar Repl |

429.4 |

|

Total projects/approved budget affected by NFP decisions |

20 |

80,040.6 |

|

Percentage of projects/approved budget affected by NFP decisions |

95.2% |

98.8% |

Note a: Content aligns to the 2023–24 MPR Guidelines, Table 2 and is documented in the respective 2023– 24 PDSSs.

Source: ANAO analysis of Defence’s 2023–24 PDSSs.

24. Table S.3 provides information on the sections of the 20 affected PDSSs that have been impacted by Defence not publishing certain information relating to forecast dates, capability delivery information and variance information.

25. Defence did not disclose the FOC forecast date in the PDSS for 18 projects (2022–23: nine). Of these, 16 projects did not disclose due to NFP considerations (2022-23: eight), and two projects did not have a settled FOC date (2022–23: one). This represents 85.7 per cent of PDSSs that did not include FOC dates this year.16

Table S.3. PDSSs — sections affected by not for publication decisionsa

|

Project |

Section 3.3 of PDSS Information not for publication |

Other sections of PDSS Information not for publication |

|

SEA 5000 Phase 1 Hunter Class Frigate Design and Construction (POI) (Hunter Class Frigate) |

Initial Materiel Release (IMR) Initial Operational Capability (IOC). Capability, milestone dates and variance information. |

Section 1.2 and Section 2.1 – information relating to funding and schedule performance. Section 3.1, Section 3.2 and Section 4.2 – information relating to milestone dates and variance. Section 5.1 - information relating to Major Risk 1. |

|

AIR6000 Phase 2A/2B New Air Combat Capability (Joint Strike Fighter) |

Final Materiel Release (FMR). Final Operational Capability (FOC). Post-Final Operational Capability. Capability, milestone dates and variance information, and in Notes 1 and Note 3. |

Section 1.2 - information relating to FOC and the process leading to FOC. Section 1.3, Section 3.2 – information relating to capability weapons delivery, delays of acceptance of final air vehicles and in Note 8 in Section 3.2. Section 2.1 – information in Note 3. Section 2.2A – information relating to details in the explanation. Section 4.2 – FMR and FOC dates and post-final operational capability details. Section 5.3 – information relating to major project issues. |

|

LAND400 Phase 2 Mounted Combat Reconnaissance Capability (Combat Reconnaissance Vehicles) |

Final Materiel Release (FMR) Final Operational Capability (FOC) Capability, milestone dates and variance information. |

Section 1.3, 5.1 and 5.3 – information relating to air transportability dates, Active Protection System, and key risks. Section 3.1 – information relating to critical design forecast dates and variance. Section 3.2 – information relating to Block II forecast dates and variance. |

|

LAND4503 Phase 1 Armed Reconnaissance Helicopter Replacement (ARH Replacement) |

Initial Materiel Release (IMR) Initial Operational Capability (IOC) Final Materiel Release (FMR) Final Operational Capability (FOC) Capability, milestone dates and variance information. |

Section 1.2, Section 1.3, Section 3.2 and Section 4.2 – information relating to unique capability, test and evaluation dates and references to milestone dates and variance. |

|

SEA 1180 Phase 1 Offshore Patrol Vessel |

Final Materiel Release (FMR) Final Operational Capability (FOC) Capability, milestone dates and variance information. |

Section 3.2 – information relating to milestone dates and variance for OPVs and in Note 4. Section 4.2 – information relating to FMR and FOC dates. |

|

AIR 5349 Phase 6 Advanced Growler Development (Advanced Growler) |

Materiel Release 2 to 9 MTTES RFT 1 to 4 Tranche 2 Investment Committee Tranche 2 Second Pass Approval Tranche 1 Initial Operational Capability (IOC) Tranche 1 Operational Capability (OC2) Capability, milestone dates, variance information and in Notes 3. 4 and 6. |

Section 1.1, Section 1.2, Section 3.1, Section 3.2 and Section 4.2 – information relating to capability, milestone dates and variance. |

|

LAND 121 Phase 3B Medium Heavy Capability, Field Vehicles, Modules and Trailers |

Note 4, information in relation to caveats. |

Section 1.2, Section 1.3 – information relating to schedule performance, caveats and project major issues. Section 3.2 – information relating to milestone dates and variance for MHGA/MHGS, and vehicles and a Note. Section 4.1 – information relating to caveats with FOC. Section 4.2 – information relating to FMR and FOC. Section 5.2 – information relating to caveats. Section 5.3 – information relating to major issues and a major project issue. |

|

AIR 7000 Phase 1B MQ-4C Triton Remotely Piloted Aircraft System (MQ-4C Triton) |

In Service Date (ISD). Initial Materiel Release (IMR). Initial Operational Capability (IOC). Final Materiel Release (FMR). Final Operational Capability (FOC). Capability, milestone dates and variance information and notes. |

Section 1.2, Section 1.3, Section 3.2, Section 4.1 and Section 4.2 –information relating to capability, other current related project information and milestone dates and variance. |

|

AIR 555 Phase 1 Airbourne Intelligence, Surveillance, Reconnaissance and Electronic Warfare (ISREW) Capability (Peregrine) |

Initial Materiel Release (IMR). Initial Operational Capability (IOC). Final Materiel Release (FMR). Final Operational Capability (FOC). Capability, milestone dates and variance information and Note 5. |

Section 1.2, Section 1.3, Section 3.2 Section 4.1 and Section 4.2 –information relating to cost performance, capability, other current related project information, schedule dates and variances, including in Notes 3 and 5 of Section 3.2. |

|

LAND 907 Phase 2/ LAND 8160 Phase 1, Main Battle Tank Upgrade, Combat Engineering Vehicle (Heavy Armoured Capability) |

Initial Materiel Release (IMR). Initial Operational Capability (IOC). Final Materiel Release (FMR). Final Operational Capability (FOC). Capability, milestone dates and variance information. |

Section 1.2 – information relating to schedule progress. Section 3.1, Section 3.2 and Section 4.2 – information relating to milestone dates and variance, including in Notes 3 and 5 of Section 3.2. |

|

LAND 121 Phase 4 Protected Mobility Vehicles Light (Hawkei) |

Nil. |

Section 1.2 – information relating to capability. Section 3.2 – information relating to milestone dates, variance and in Note 7. Section 4.1 – information relating to the red category. |

|

SEA 9100 Phase 1 Improved Embarked Logistics Support Helicopter (IE Logistics Support Helicopter) |

Initial Materiel Release (IMR.) Initial Operational Capability (IOC) Final Materiel Release (FMR) Final Operational Capability (FOC) Capability, milestone dates and variance information and a Note. |

Section 1.2 – information relating to schedule. Section 3.2 and Section 4.2 – information relating to milestone dates and variance, including a Note in Section 3.2. |

|

AIR 2025 Phase 6 Jindalee Operational Radar Network (JORN Mid-Life Upgrade) |

Initial Operational Capability (IOC). Materiel Release 2 (MR2). Operational Capability 2 (OC2). Final Materiel Release (FMR) Final Operational Capability (FOC) Capability, milestone dates and variance information. |

Section 1.2, Section 3.1, Section 3.2 and Section 4.2 – information relating to milestone dates, variance and capabilities. |

|

LAND 19 Phase 7B Short Range Ground Based Air Defence (SRGB Air Defence) |

Final Materiel Release (FMR) Final Operational Capability (FOC) Capability, milestone dates and variance information. |

Section 1.2, Section 2.3B, Section 3.2 and Section 4.2 – information relating to weapons quantities and milestone dates and variance. |

|

AIR 5431 Phase 3 Civil Military Air Management System (CMATS) |

Nil. |

Section 5.3 – information relating to a major project issue. |

|

LAND 200 Tranche 2 Battlefield Command System |

Initial Materiel Release (IMR). Initial Operational Capability (IOC). Final Materiel Release (FMR.) Final Operational Capability (FOC.) Capability, milestone dates and variance information. |

Section 1.2 – information relating to scheduling. Section 3.1, Section 3.2 and Section 4.2 – information relating to milestone dates and variance. |

|

SEA 1439 Phase 5B2 Collins Class Communications and Electronic Warfare Improvement Program (Collins Comms and EW) |

FMR MWES. FMR Stage 2. Final Operational Capability (FOC) stage 1, 2 & MWES. Reasons for delay are not for publication. Capability, milestone dates and variance information, in Note 10 and two Notes. |

Section 1.2, Section 1.3, Section 2.1 Section 4.2 and Section 5.3 – information relating to milestone dates, constitution of material releases and major project issues, including in Note 3 to Section 2.1.

|

|

SEA 3036 Phase 4 Pacific Patrol Boat Replacement (Pacific Patrol Boat Repl) |

Final Materiel Release (FMR) Final Operational Capability (FOC) Capability, milestone dates and variance information |

Section 1.2, Section 1.3, Section 3.2 and Section 4.2 – information regarding milestone dates and variance. Section 1.3 information regarding a major project issue.

|

|

SEA 1442 Phase 4 Maritime Communications Modernisation (Maritime Comms) |

Materiel Release 7 — Ship #7. Final Materiel Release (FMR). Final Operational Capability (FOC) Capability, milestone dates and variance information. |

Section 3.2 and Section 4.2 – information relating to milestone dates and variance.

|

|

SEA 1448 Phase 4B ANZAC Air Search Radar Replacement (ANZAC Air Search Radar Repl.) |

Final Materiel Release (FMR). Final Operational Capability (FOC). Capability, milestone dates and variance information and in Note 7. |

Section 1.2, Section 3.2 and Section 4.2 – information relating to milestone dates and variance.

|

Note a: Information not for publication that has changed from 2022–23 is marked in italics.

Note: LAND 4503 Phase 1 ARH Replacement and SEA 9100 Phase 1 IE Logistics Support Helicopter are included in the MPR for the first time in 2023–24.

Source: ANAO analysis of Defence’s 2023–24 PDSSs.

26. Defence’s decision to not disclose forecast dates, capability delivery information and variance information for the 20 projects, as outlined in Table S.3, reduces the level of transparency and accountability to Parliament and other stakeholders. The Auditor-General has included an Emphasis of Matter17 in the Independent Assurance Report (see the next section and Part 3 of this report).

Overall outcomes

Summary of the Auditor-General’s conclusion

27. The Auditor-General’s Independent Assurance Report for 2023–24 is found in Part 3 of this report.

28. Based on the review procedures and the evidence obtained, the Auditor-General concluded that, with one exception, nothing came to her attention that caused her to believe that the information reviewed was not prepared in accordance with the Guidelines.

29. The one exception was Section 6 — Lessons Learned for all 2023–24 PDSSs. The Guidelines require disclosure of a description of the project lessons that have been learned. Deficiencies in Defence’s processes in identifying lessons learned resulted in a limitation of the scope of the ANAO’s review. As a result, the ANAO was unable to obtain sufficient appropriate audit evidence to conclude whether the disclosure of the lessons learned in the PDSSs is in accordance with the requirements of the Guidelines.

30. The Auditor-General also included an Emphasis of Matter paragraph to draw attention to disclosures within the Statement by the Secretary of Defence (found in Part 3 of this report) that some information in 20 PDSSs has not been published due to Defence’s assessment that the information would or could reasonably be expected to cause damage to the security, defence or international relations of the Commonwealth.18

Statement by the Secretary of Defence

31. The Statement by the Secretary of Defence (Statement) was signed on 11 December 2024. The Secretary’s statement provides his opinion that the PDSSs for the 21 major acquisition projects that form part of the MPR ‘comply in all material respects with the Guidelines and reflect the status of the projects as at 30 June 2024’.

32. The Secretary included commentary on the non-publication of information by Defence in 20 PDSSs (see paragraphs 21 to 22).

33. The Statement also details significant events occurring post 30 June 2024, which materially impact the projects included in the report and should be read in conjunction with the individual PDSSs. The Statement includes information on nine projects.19

- Maritime Communications Modernisation (SEA 1442 Phase 4).

- Pacific Patrol Boat Replacement (SEA 3036 Phase 1).

- Medium Heavy Capability Field Vehicles, Modules and Trailers (LAND 121 Phase 3B).

- Battlefield Command System (LAND 200 Tranche 2).

- Main Battle Tank Upgrade/ Combat Engineering Vehicles (LAND 907 Phase 2/LAND 8160 Phase 1).

- Jindalee Operational Radar Network (AIR 2025 Phase 6).

- New Air Combat Capability (AIR 6000 Phase 2A/2B).

- MQ-4C Triton Remotely Piloted Aircraft System (AIR 7000 Phase 1B).

- Battlespace Communications System Phase 2B (JNT 2072 Phase 2B).

Key observations

34. The ANAO’s review (found in Part 1 of this report) includes Defence’s project management and reporting arrangements contributing to the overall governance of the Major Projects. A summary of observations is provided below.

Non-publication of information by Defence leading to limited analysis

35. As discussed at paragraphs 16 to 26, Defence has not published certain information in 20 PDSSs (2022–23: 12). The 2022–23 and 2023–24 MPR provides the user with more aggregate performance information than in the 2021–22 MPR. It does not provide the same level of information on individual project performance compared to the 2020–21 MPR and prior years.

JCPAA recommendations and requests

36. Chapters 1 and 2 of this MPR detail Defence’s implementation of JCPAA recommendations from the JCPAA Report 496: Inquiry into the Defence Major Projects Report 2020–21 and 2021–22 and Procurement of Hunter Class Frigates (Interim Report on the 2020–21 and 2021–22 Defence Major Projects Report).20 This includes prior JCPAA requests relating to Defence’s acquisition governance: governance for entry to the Projects of Interest and Projects of Concern lists; implementation and compliance with internal policies for contingency funding and lessons learned; and defining terms relating to a delta or deviation from the achievement of a Major Project milestone.21

37. Defence provided a response in December 2023 to all three recommendations made by the JCPAA in its Report 496.22 Defence agreed with all three recommendations and outlined improvements in policies and practice implemented by Defence since the 2022–23 MPR.

38. In June 2024 the JCPAA tabled Report 503: Inquiry into the Defence Major Projects Report 2020–21 and 2021–22 and Procurement of Hunter Class Frigates.23 The committee made six recommendations relating to: provision of confidential submissions and briefings on information withheld from publication; updates on changes arising from internal review findings; updates on the Hunter Class Frigate project; the assessment of design maturity in future projects; implementation of a new record keeping framework and new Chief Information Governance Officer role; and amendments to the Commonwealth Procurement Rules. These recommendations, where applicable to the MPR, are also reported on in Chapters 1 and 2 of the 2023–24 MPR.

39. In its Report 503, the Committee24:

…acknowledges that there are external accountability and assurance mechanism in place to scrutinise Defence activities other than the MPR. The Committee considers however that the MPR is an important accountability mechanism that should continue for the foreseeable future, as it provides a structured level of scrutiny and granularity across major capability projects that would not be provided through these other processes.

40. On 29 February 2024, the JCPAA commenced an inquiry into the 2022–23 Major Projects Report. This inquiry will consider the scope and Guidelines, which underpin the MPR and assess whether the MPR process continues to provide appropriate transparency and accountability to the Parliament in relation to Defence’s capability acquisition expenditure and remains fit for purpose into the future. The inquiry report is yet to be released.

Auditor-General reports

Tabled in the Parliament

41. Auditor-General Report No. 21 2022–23 Department of Defence’s Procurement of Hunter Class Frigates was tabled in the Parliament in May 2023. This performance audit report included two recommendations to Defence, which were to improve: compliance with record keeping requirements; and advice to government on whole-of-life costs and value for money.

42. In July 2024, Recommendation 1 relating to compliance with record keeping requirements was closed by Defence after it reported that: NSSG introduced mandatory record keeping training; updated its onboarding processes; and undertook a review of record management practices in the Hunter Class Frigates Branch.

43. At December 2024, Recommendation 2 remains open. This relates to procurement advice to the Australian Government on major capital acquisition projects that documents the basis and rationale for proposed selection decisions, including information on the department’s whole-of-life cost estimates and assessment of value.

Performance audits underway

44. At December 2024, the ANAO is conducting four performance audits that may have a link to projects in the MPR.

- The effectiveness of Defence’s administration of contractual obligations to maximise Australian industry participation.25

- The effectiveness of the Department of Defence’s sustainment arrangements for Navy’s Canberra Class fleet amphibious assault ships (Landing Helicopter Dock).26

- The effectiveness of Airservices Australia’s management of the OneSKY contract.27

- Defence’s Collins Class Life of Type Extension — planning and implementation.28

Impact of Defence reviews

45. During 2023–24, four Defence reviews were concluded:

- National Defence: Defence Strategic Review 202329;

- Enhanced Lethality Surface Combatant Fleet: Independent Analysis into Navy’s Surface Combatant Fleet 202430;

- 2024 National Defence Strategy31; and

- 2024 Integrated Investment Program.32

46. The National Defence: Defence Strategic Review 2023 identified33:

Defence’s current approach to capability acquisition is not fit for purpose. The system needs to abandon its pursuit of the perfect solution or process and focus on delivering timely and relevant capability.

47. The ANAO may monitor impacts of these reviews across Major Projects as Defence implements the first 2023–2025 — Enhanced Force-In-Being capability milestone34, and milestones into future years.

48. The Defence Chapter (Part 2) draws attention to the above reviews as well as the Defence Industry Development Strategy and Treatment of Classified and Sensitive Information.

49. Where Major Projects have identified an impact from the outcomes of the reviews identified in paragraph 45, these have been disclosed in the relevant PDSS in Part 3 (Hunter Class Frigate, Combat Reconnaissance Vehicles, Offshore Patrol Vessel, Overlander, Hawkei, Battlefield Command System, and Battle Comm. Sys.).

Defence acquisition governance

50. When reviewing Defence’s PDSSs, the ANAO considered the following items:

- Defence’s use of the Independent Assurance Review (IAR) process to report on the status of acquisition projects. In 2023–24, Defence completed an IAR on 18 of the 21 projects in this report (see paragraphs 1.22 to 1.24).35

- Defence’s approach to entry and exit from the Projects of Interest and Projects of Concern lists (see paragraphs 1.25 to 1.41).

- Defence’s reporting to senior department leadership and government stakeholders on the delivery of capability to the Australian Defence Force (ADF) (see paragraphs 1.42 to 1.50).

- The importance of capturing government decisions in internal Defence documentation and ensuring that Materiel Acquisition Agreements are appropriately aligned with these decisions (see paragraphs 1.52 to 1.57).

- Defence’s implementation of business systems to report on the status of acquisition projects (see paragraphs 1.55 to 1.57).

- Defence’s implementation of the Smart Buyer Framework to support strategic decision making in the acquisition of major projects. The framework was used at the Second Pass government approval stage for two of the projects in this year’s MPR (see paragraphs 1.58 to 1.61).

- Defence’s implementation of Australian Industry Capability (AIC) expectations in the acquisition of major projects (see paragraphs 1.62 to 1.71).36

- Defence’s use of project contingency funds (see paragraphs 1.78 to 1.85). Three MPR projects expended contingency funds in 2023–24: SRGB Air Defence, CMATS and Pacific Patrol Boat Repl.

- The status of CASG’s Risk Management Reform Program and the establishment of the CASG Risk Management Framework (see paragraphs 1.86 to 1.91).

- Projects that had not fully met the requirements of CASG’s Risk Management Manual Version 1 and Financial Policy (titled Management Of Defence Capability Project Contingency) for contingency allocation (see paragraph 1.83) and risk management (see paragraph 1.89).

- The status of CASG’s Lessons Learned policy. The internal policy was updated in February 2022 and Defence is yet to fully implement it, including the compliance monitoring arrangements undertaken by the CASG Lessons Board (see paragraphs 1.92 to 1.105).

- Defence’s declaration of significant capability milestones with ‘caveats’ or ‘deficiencies’, and Defence guidance on the use of such terms37 (see paragraphs 1.106 to 1.111).

Project performance analysis

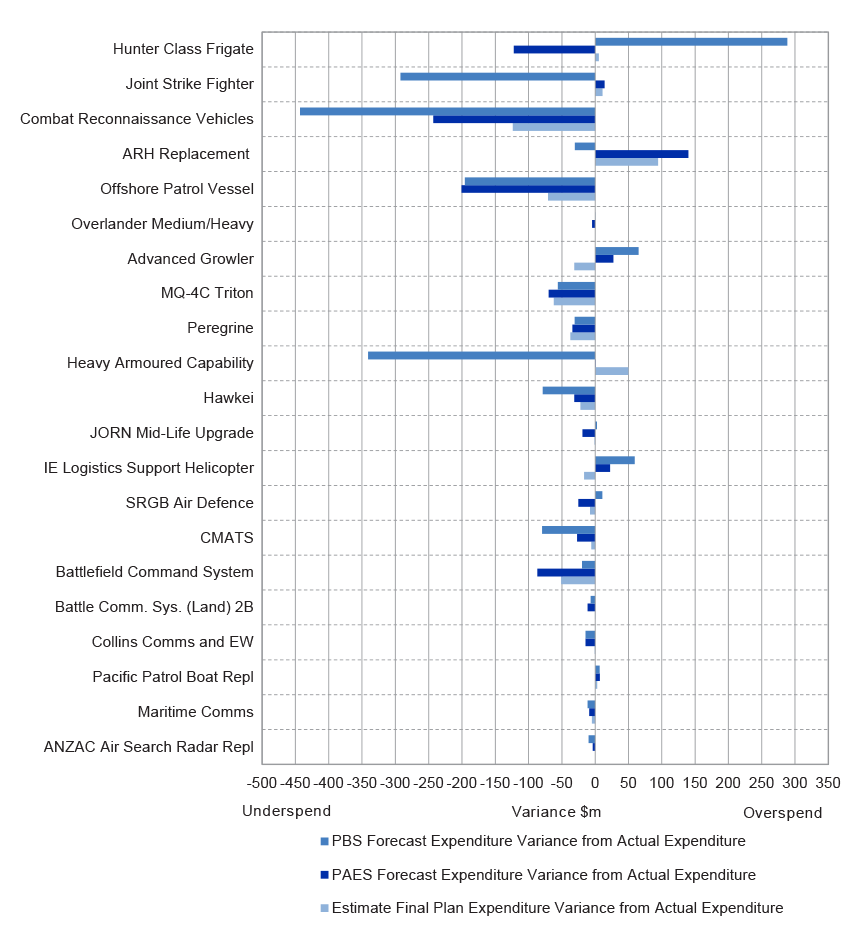

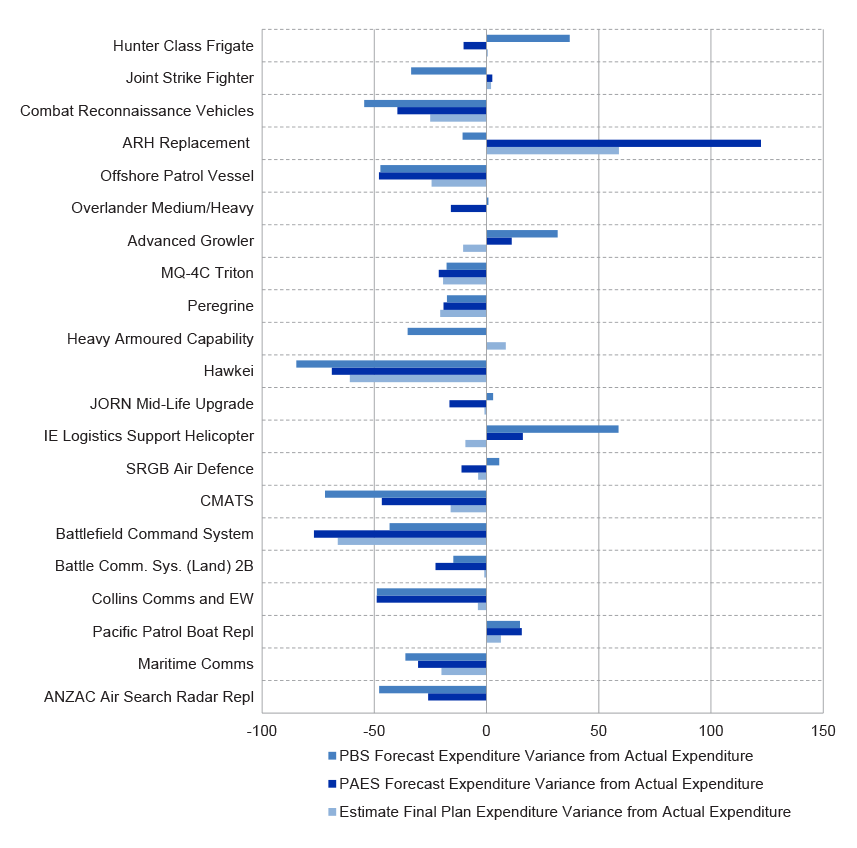

51. In addition to its limited assurance review, the ANAO has undertaken an analysis of the PDSSs. The three aspects of project performance analysed in this report were cost, schedule and the delivery of capability/scope.

52. As discussed in paragraph 35, Defence has decided to not publish certain information in 20 PDSSs (2022–23: 12). The not for publication information includes forecast dates, capability delivery information and variance information. The affected PDSSs are set out in Table S.2 and Table S.3.

53. In common with the MPRs since 2021–22, the 2023–24 report does not provide the same level of transparency and information for users compared to the 2020–21 MPR and prior years. The ANAO is in a position to publish aggregate analysis across the 2023–24 Major Projects on: total schedule slippage, average schedule slippage, and in-year schedule slippage (see Table S.7 and paragraph 35). This results from the increase in the number of PDSSs which have not disclosed a Final Operational Capability (FOC) forecast date — from nine in 2022–23 to 18 in 2023–24. The larger number of affected projects this year means that it is not possible to derive the ‘not for publication’ information for individual projects from the aggregate analysis.

54. A summary of the ANAO’s cost, schedule and capability/scope analysis is set out below and a detailed analysis is found in Chapter 2: Analysis of project performance.

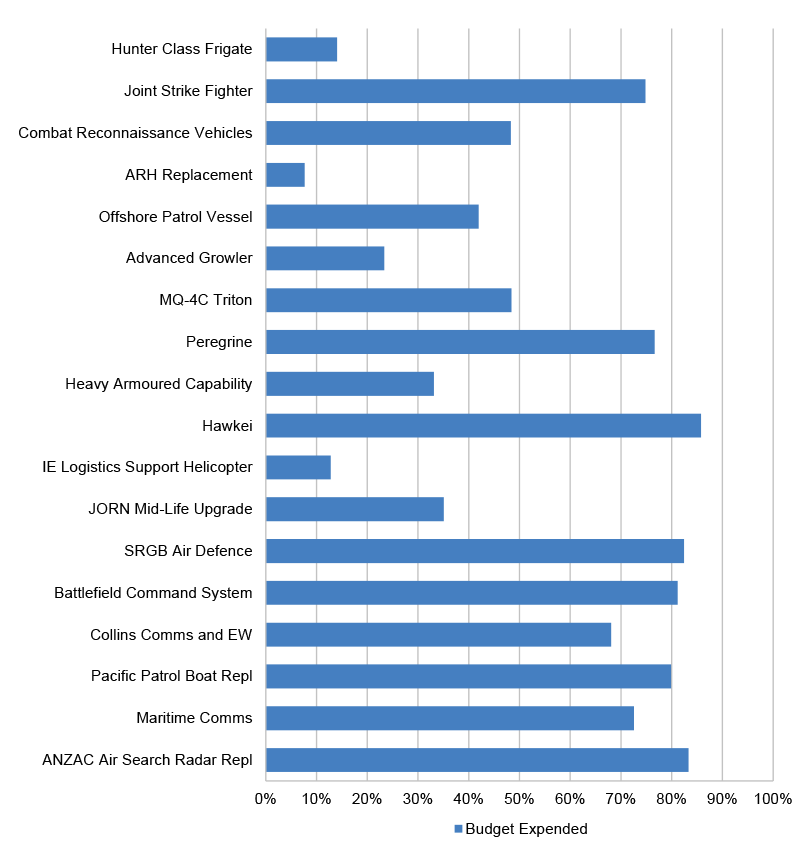

Cost analysis

55. The first principal component of project performance examined in this report is cost management, which is an ongoing process in Defence’s administration of the Major Projects. Defence has reported that all 21 projects in this year’s MPR could continue to operate within the total approved budget of $81.0 billion. The SRGB Air Defence, CMATS and Pacific Patrol Boat Repl projects drew upon contingency funds to complete project activities (see paragraph 1.81).

56. The total approved budget for the 21 Major Projects has increased by $40.9 billion (74.4 per cent) since initial Second Pass Approval by government (2022–23: $22.8 billion).

57. Budget variations greater than $0.5 billion are detailed in Table S.4.38

58. As the MPR focuses on the approved capital budget for Defence acquisition, the ongoing costs of project offices, training, replacement capability, and other sustainment factors, are not reported here.

59. Cost information was not affected by Defence’s decision to not publish certain information in 20 PDSSs this year.

Table S.4. Total Budget variations over $0.5 billion — post initial Second Pass approval by variation typea b

|

Project |

Variation type |

Explanation |

Year |

Amount ($bn) |

|

Scope increases |

|

|

34.5 |

|

|

Hunter Class Frigate |

Second Pass Approval (Batch 1 Production) |

2023–24 |

19.7 |

|

|

Joint Strike Fighter |

58 additional aircraft at Stage 2 Second Pass Approval |

2013–14 |

10.5 |

|

|

MQ-4C Triton |

Second Pass Approvals Tranche 2 and 3 |

2019–20 |

0.9 |

|

|

Second Pass Approval Tranche 4 |

2020–21 |

0.2 |

||

|

Subsequent Government Approval (additional air vehicle and sustainment funding for first 7 years) |

2022–23 |

0.3 |

||

|

Advanced Growler |

Government Interim Pass Approval |

2019–20 |

0.3 |

|

|

Second Pass Approval for Tranche 1 acquisition and sustainment of mid-band capability and training range upgrades |

2022–23 |

2.6 |

||

|

Real cost increases |

|

|

0.7 |

|

|

Overlander Medium/Heavy |

Project supplementationc ($684.2m) and additional vehicles, trailers and equipment ($28.0m) at Revised Second Pass Approval |

2013–14 |

0.7 |

|

|

Other budget movements |

|

|

0.2 |

|

|

Scope increase/budget transfers (net) |

Other scope changes and transfers under $0.5 billion for all remaining Projects |

Various |

0.2 |

|

|

Price Indexation — materials and labour (net) (to July 2010)d |

0.4 |

|||

|

Exchange Variation — foreign exchange (net) (to 30 June 2024) |

5.0 |

|||

|

Total |

40.9e |

|||

Note a: For the variations related to all Major Projects and their value, refer to Table 2.1 and Table 2.2 of this report. For the breakdown of in-year variation, refer to Table 2.1 of this report.

Note b: For Major Projects with multiple Second Pass Approvals, this table shows variations from the initial approval.

Note c: Defence has advised that ‘project supplementation’ is a unique term used to describe the approvals history of this project as follows: ‘The original amount of $2,549.2 million, was the Government decision to split Phase 3 into Phase 3A and 3B. In 2011, Government approved Second Pass approval of Phase 3A and the ‘Interim Pass’ Government approval for Phase 3B. The decision to grant Phase 3B ‘Interim Pass’ was to allow greater bargaining power for Defence while negotiating Phase 3A. Phase 3B was always going to return to Government for formal Second Pass approval, which occurred in July 2013, once contract negotiations were complete.’

Note d: Before 1 July 2010, projects were periodically supplemented for price indexation, whereas the allocation for price indexation is now provided for on an out-turned basis at Second Pass Approval.

Note e: Figures do not add precisely due to rounding.

Source: ANAO analysis of Defence’s 2023–24 PDSSs.

Schedule analysis

60. Final Operational Capability (FOC) is the key milestone that forms the basis for the majority of the ANAO’s schedule analysis, including aggregate analysis of total schedule slippage across projects, average schedule slippage across projects, and in-year schedule slippage across projects.

61. In 2023–24, a total of 18 of the 21 projects (85.7 per cent) (2022–23: nine projects, 45 per cent) either did not disclose the FOC forecast date in the PDSS (16 projects) or did not have a settled FOC date (two projects).39

- Defence has decided to not publish FOC forecast dates in 16 PDSSs (2022–23: eight) (Joint Strike Fighter, Combat Reconnaissance Vehicles, ARH Replacement, Offshore Patrol Boats, Advanced Growler, Peregrine, Heavy Armoured Capability, MQ-4C Triton, IE Logistics Support Helicopter, SRGB Air Defence, JORN Mid-Life Upgrade, Battlefield Command System, Maritime Comms, Collins Comms and EW, Pacific Patrol Boat Repl, and ANZAC Air Search Radar Repl). This represents 76.2 per cent of all PDSSs.40

- Two of the PDSSs did not include an FOC forecast date (2022–23: one). The Hunter Class Frigate project did not have an FOC milestone approved by government at 30 June 2024 and the Hawkei was in negotiations with contractors as a result of changes resulting from the Defence Strategic Review.41 This represents 9.5 per cent of all PDSSs.

62. In 2022–23 and 2023–24 as an increased number of projects did not disclose their FOC forecast date, the ANAO is able to publish information in aggregate as it would not disclose the individual Major Projects, which have not reported FOC forecast dates (see paragraph 35). The ANAO has provided a summary longitudinal analysis in relation to: total schedule slippage across the 21 projects, average schedule slippage across the projects, and in-year schedule slippage across the Major Projects (see Table S.7 on page 25).

63. At 30 June 2024, the aggregate schedule performance for the 21 Major Projects were as follows.

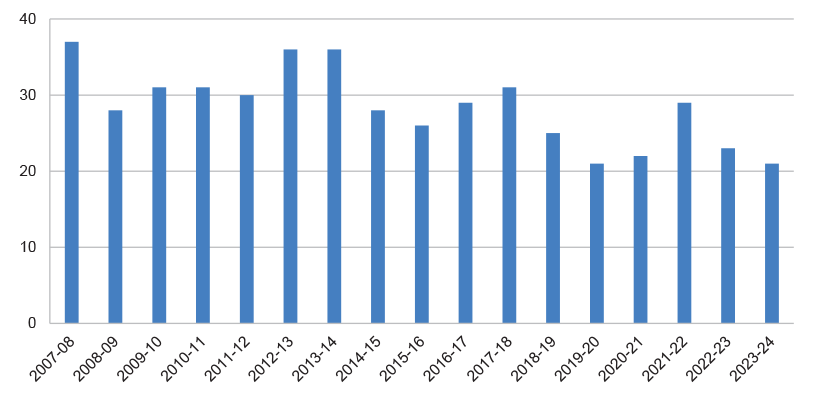

- Total schedule slippage was 442 months when compared to the initial schedule (2022–23: 453 months42). This represents a 21 per cent increase since Second Pass Approval.

- Average schedule slippage per project was 25 months (2022–23: 25 months), representing a six per cent increase since Second Pass Approval.

- In-year schedule slippage totalled 96 months (2022–23: 101 months), representing a four per cent increase since Second Pass Approval, and a decrease of five months from the prior year.

64. Delivering Major Projects on schedule continues to present challenges for Defence. Schedule slippage can affect when the capability is made available for operational release and deployment by the ADF, as well as the cost of delivery.

65. Table S.5 provides details of in-year and total schedule slippage by project43, except where Defence has indicated that project information is not for publication (NFP). For 2023–24, the in-year schedule slippage across the 21 Major Projects was four per cent, which represents a decrease of one per cent from 2022–23.44

Table S.5. In-year and total schedule slippagea from original planned Final Operational Capability milestone

|

Project |

In-year (months) |

Total (months) |

|

Hunter Class Frigateb |

TBD |

NFP |

|

Joint Strike Fighter |

NFP |

TBD |

|

Combat Reconnaissance Vehicles |

NFP |

NFP |

|

ARH Replacement |

NFP |

NFP |

|

Offshore Patrol Vessel |

NFP |

NFP |

|

Advanced Growlerc d |

NFP |

NFP |

|

Overlander Medium/Heavy |

0 |

0 |

|

MQ-4C Triton |

NFP |

NFP |

|

Peregrine |

NFP |

NFP |

|

Heavy Armoured Capability |

NFP |

NFP |

|

Hawkei |

TBA |

TBA |

|

IE Logistics Support Helicopters |

NFP |

NFP |

|

JORN Upgrade |

NFP |

NFP |

|

SRGB Air Defence |

NFP |

NFP |

|

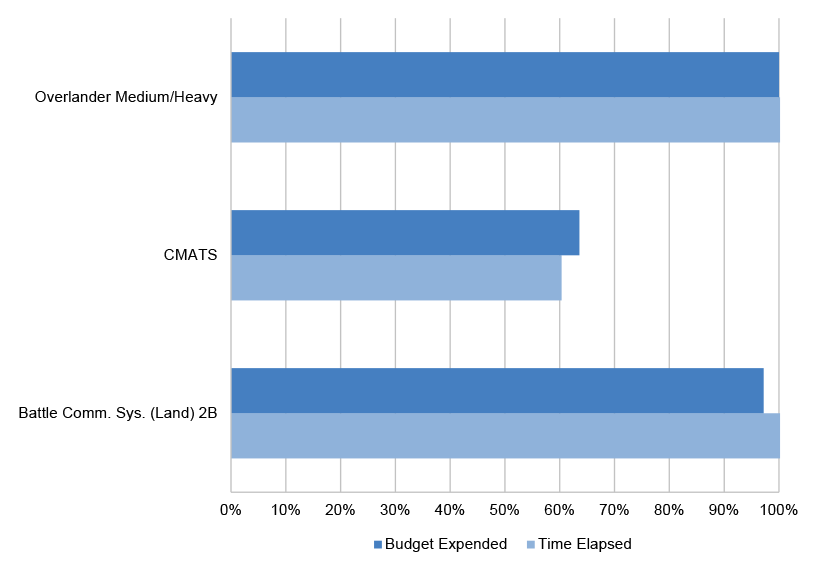

CMATS |

30 |

87 |

|

Battlefield Command System |

NFP |

NFP |

|

Battle Comm. Sys. (Land) 2B |

6 |

42 |

|

Collins Comms and EW |

NFP |

NFP |

|

Pacific Patrol Boat Repl |

NFP |

NFP |

|

Maritime Comms |

NFP |

NFP |

|

ANZAC Air Search Radar Repl |

NFP |

NFP |

|

Total (months) |

96 |

442 |

|

Total (per cent) |

4% |

21% |

Note a: Slippage refers to a delay in the current forecast date compared to the original government approved date of FOC. These figures exclude delays to a project’s schedule that do not result in slippage past the original government approved date, and schedule reductions over the life of the project.

Note b: This project had no FOC capability milestone approved by government at 30 June 2024.

Note c: This project’s FOC milestone had not been approved by government at 30 June 2024. The MPR analysis has referred to the current final scheduled operational milestone for this project (Tranche 1 Operational Capability 2). It is anticipated that subsequent government approvals will introduce new operational capability milestones including an FOC milestone.

Note d: This project has reported its slippage in months but has not reported the Original Planned and Current Planned dates for its final milestone. The non-publication of these dates, while publishing a slippage figure, means that this project is reported on individually in some parts of the ANAO’s analysis and not in other parts.

Source: ANAO analysis of the 2023–24 Defence PDSSs.

66. Since 2007–08, MPRs have reported that the management of platform availability has contributed to slippage in some projects.45

67. Projects with developmental content have continued to experience delays. These projects are MQ-4C Triton, CMATS, and Battle Comm. Sys. (Land) 2B.46

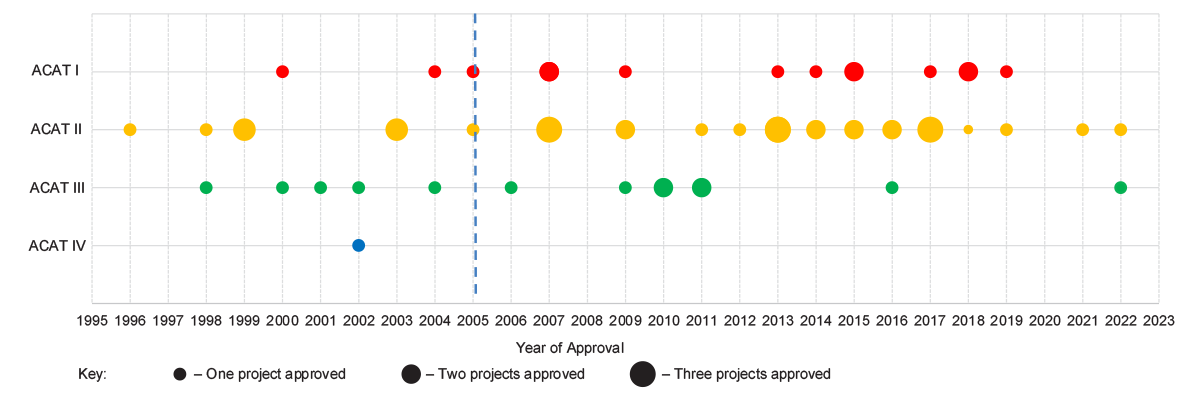

68. The MPR includes ANAO analysis relating to each project’s Acquisition Categorisation (ACAT) level, as reported by Defence.47 The analysis indicates that since 2013 there has been an increase in the number of projects at the more complex ACAT I and ACAT II levels. ACAT I projects carry a higher level of technical risk.

Capability/scope analysis

69. The third principal component of project performance examined in this report is progress towards the delivery of capability as approved by government. While the measures of Materiel Capability / Scope Delivery Performance disclosed in 4.1 of each PDSS is excluded from the scope of the limited assurance review, it is included in this ANAO analysis to provide further perspective on project performance.

70. The Hunter Class Frigate PDSS does not report quantified capability/scope information as this project did not have approved materiel capability/scope to be delivered at 30 June 2024. This project instead reports narratives describing its current project activities.

71. In 2023–24, the aggregated PDSSs reporting in Section 4.1 Measures of Materiel Capability/Scope Delivery Performance was as follows.

- Represented as ‘green’48: 12 projects (57 per cent) report they will deliver all capability/scope requirements (2022–23: nine). This represents an increase of 12 per cent from the prior year.

- Represented as ‘amber’49: Four projects (19 per cent) report they have experienced challenges with expected capability/scope delivery (2022–23: five). This represents a decrease of six per cent from the prior year. The projects were: Offshore Patrol Vessel, MQ-4C Triton, Peregrine and Battlefield Command System.

- Represented as ‘red’50: Five projects (24 per cent) report they are unable to deliver all the required capability/scope by FOC (2022–23: six). This represents a decrease of six per cent from the prior year. The projects were: Offshore Patrol Vessel, Hawkei, Overlander Medium/Heavy, Battle Comm. Sys. (Land) 2B and Battlefield Command System. (See Table 2.5)

- Represented as ‘blue’51: One project (0.5 per cent) (Pacific Patrol Boat Repl.) reports an increase in project materiel capability/scope delivery (2022–23: one). This represents similar percentages to the prior year.52

72. Table S.6 summarises the percentage of capability/scope Defence expects will be delivered by the Major Projects. The assessment is at 30 June 2024, as reported by Defence.53

Table S.6. Capability/scope delivery

|

Expected capability/scope — percentage (Defence reporting) |

2021–22 MPR (%) |

2022–23 MPR (%) |

2023–24 MPR (%) |

|

High confidence (Green) |

87 |

94 |

94.5 |

|

Under threat, considered manageable (Amber) |

10 |

1 |

1.4 |

|

Unlikely or removed from scope (Red) |

3 |

6 |

3.6 |

|

Added to scope (Blue) |

0a |

0b |

0.5 |

|

Total |

100c |

100c d e |

100c |

Note a: In this year Pacific Patrol Boat Repl delivered an additional element of capability/scope at FOC (which equated to approximately five per cent of project scope). Across all the Major Projects this percentage rounded to zero per cent.

Note b: In this year ANZAC Air Search Repl delivered an additional element of capability/scope at FOC (which equated to approximately 0.1 per cent of project scope). Across all the Major Projects this percentage rounded to zero per cent.

Note c: The Hunter Class Frigate and Future Subs projects are excluded from this analysis, as their capability/scope delivery was not quantified in these years (Future Subs was reported in 2021–22 only).

Note d: In the 2022–23 Major Projects Report, the Battlefield Command System (LAND200 Tranche 2) was excluded from this analysis due to the Auditor-General’s Qualified Conclusion, see paragraphs 2.8 to 2.9 and the Independent Assurance Report in Part 3 of that report.

Note e: Figures do not add precisely due to rounding.

Source: Defence PDSSs in Major Projects Reports and ANAO analysis.

73. In addition to reporting on expected capability/scope delivery, Defence has continued the practice of including in the PDSS information (except for certain projects discussed in Table S.3) on contractual remedies for projects, including stop payments and liquidated damages.54 Details on application of contractual remedies are discussed at paragraph 2.33.

Summary longitudinal analysis

Summary analysis — 2021–22 to 2023–24

74. Table S.7 summarises published PDSS data on Defence’s progress toward delivering the capabilities for the Major Projects covered in this 2023–24 report. The table compares current data with that reported in the two prior editions of the MPR (2021–22 and 2022–23).

Table S.7. Summary longitudinal analysis 2021–22 to 2023–24a

|

|

2021–22 MPR |

2022–23 MPR |

2023–24 MPR |

|

Schedule and cost performance |

|||

|

Number of Projects |

21 |

20 |

21 |

|

Total Approved Budget at 30 June |

$59.0 bn |

$58.6 bn |

$81.0 bn |

|

Total Approved Budget at final Second Pass Approval |

$56.8 bn |

$54.0 bn |

$75.5 bn |

|

Total Expenditure Against Total Approved Budget |

$34.6 bn (58.7%) |

$34.4 bn (58.7%) |

$35.4 bn (43.7%) |

|

Total In-year Expenditure Against In-year Budget |

$5.7 bn (96.2%) |

$4.2 bn (98.0%) |

$4.5 bn (94.2%) |

|

Total Budget Variation since initial Second Pass Approval b |

$17.5 bn (29.7%) |

$22.8 bn (39.0%) |

$40.9 bn (74.4%) |

|

Total Budget Variation since final Second Pass Approval c |

$2.2 bn (3.9%) |

$4.6 bn (7.8%) |

$5.49 bn (13.4%) |

|

In-year Approved Budget Variation |

-$0.7 bn (-1.2%) |

$4.3 bn (7.9%) |

$19.9 bn (32.6%) |

|

Total Schedule Slippaged m |

●e |

453 months (23%) |

442 months (21%) |

|

Average Schedule Slippage across Projectsm |

●e |

25 months (6%) |

25 months (6%) |

|

In-year Schedule Slippagem |

●e |

101 months (5%) |

96 months (4%) |

|

Risks, issues, and capability/scopem |

|||

|

Total Reported Risks and Issuesf g |

114 |

88 |

71 |

|

Expected Capability/scope (Defence Reporting)h i

|

87% |

94% |

94.5% |

|

10% |

1% |

1.4% |

|

3% |

6% |

3.6% |

|

0% j |

0%k l |

0.5% |

Refer to paragraph 35 in Part 1 of this report.

Note a: The Major Projects included in each MPR will differ, based on entry and exit criteria in the Guidelines endorsed by the JCPAA, which are in Part 4 of this report. The entry and exit of projects should be considered when comparing data across years.

Note b: See Table S.4 for a breakdown of the major components of this variance and Table 2.1 for all real variations.

Note c: Where a project has multiple Second Pass Approvals, the budget at Second Pass Approval reported in the header refers to the total budget in the final Second Pass Approval. The figures in this row use this methodology.

Note d: Slippage refers to a delay in the current forecast date compared with the original government approved date of FOC. Slippage can occur due to late delivery, increases in scope or at times can be a deliberate management decision.

Note e: The ANAO was unable to publish this analysis in 2021–22 due to the non-publication by Defence of FOC information in three PDSSs and because four projects did not have approved FOC dates.

Note f: The grey section of the table is excluded from the scope of the ANAO’s priority assurance review, due to a lack of Defence systems from which to obtain complete and accurate evidence in a sufficiently timely manner to facilitate the ANAO’s review.

Note g: The figures represent the combined number of open ‘high’ and ‘very high’ risks and issues reported in the PDSSs across all projects. Risks and issues may be aggregated at a strategic level.

Note h: These figures represent the average predicted capability/scope delivery across the Major Projects. This method reduces the effect of an individual project’s size on the aggregate figure.

Note i: The Hunter Class Frigate and Future Subs projects are excluded from this analysis, as their capability/scope delivery was not quantified in these years (Future Subs was reported in 2021–22 only).

Note j: In 2023–24, Pacific Patrol Boat Repl delivered an additional element of capability/scope at FOC, which equated to approximately five per cent of project scope. This percentage was rounded to zero per cent when compared across all the Major Projects.

Note k: In 2023–24, ANZAC Air Search Radar Repl delivered an additional element of capability/scope at FOC, which equated to approximately 0.1 per cent of project scope. This percentage was rounded to zero per cent when compared across all the Major Projects.

Note l: Figures do not add precisely due to rounding.

Note m: In 2022–23 the data pertaining to the Battlefield Command System (LAND200 Tranche 2) was excluded from this analysis due to the Auditor-General’s Qualified Conclusion, see paragraphs 2.8 to 2.9 and the Independent Assurance Report in Part 3 of that report.

Source: ANAO analysis of PDSSs across multiple years.

1. The Major Projects review

1.1 The Major Projects Report (MPR) contains Department of Defence (Defence) information and commentary on a selection of its major acquisition projects (Major Projects) and independent assurance and analysis of that information by the Australian National Audit Office (ANAO). This chapter provides the ANAO’s overview of the scope and approach adopted for its limited assurance review of the 21 Project Data Summary Sheets (PDSSs) prepared by Defence for the 2023–24 MPR. The chapter also includes information and commentary on developments in Defence’s acquisition governance processes, based on the ANAO’s review.

Review scope and approach

1.2 In 2012, the Joint Committee of Public Accounts and Audit (JCPAA) identified the ANAO’s review of Defence PDSSs as a priority assurance review, under subsection 19A(5) of the Auditor-General Act 1997 (the Act). This provided the ANAO with full access to the information gathering powers in the Act. The ANAO’s review of the individual PDSSs, which are included in Part 3 of the MPR, was conducted in accordance with the ANAO Auditing Standards set by the Auditor-General under section 24 of the Act. These standards incorporate the Australian Standard on Assurance Engagements (ASAE) 3000 Assurance Engagements Other than Audits or Reviews of Historical Financial Information, issued by the Australian Auditing and Assurance Standards Board.

1.3 The following forecast information provided by Defence is excluded from the scope of the ANAO’s review: Sections 1.2 and 4.1 — Current status and Measures of Materiel Capability/Scope Delivery Performance; Sections 1.3 and 5 — Major Risks and Issues; Section 2.4 - Australian Industry Capability (AIC); and forecast dates where included. These exclusions are due to deficiencies in Defence systems from which to provide complete and/or accurate evidence, in a sufficiently timely manner to complete the review. Accordingly, the Independent Assurance Report by the Auditor-General does not provide assurance in relation to this information. However, where material inconsistencies between the information disclosed in these excluded sections and the ANAO’s understanding from performing review procedures on the in-scope information are identified, the Auditor-General’s conclusion is qualified.

1.4 The ANAO’s review procedures are sufficient and appropriate for the purpose of providing an Independent Assurance Report in accordance with the ANAO Auditing Standards. Review procedures performed on individual PDSSs are designed to provide limited assurance. These procedures are not as extensive, in terms of the extent of evidence required, as those performed in performance audits, performance statement audits and financial statement audits conducted by the ANAO, which provide reasonable assurance. The level of assurance provided by this review, in relation to the 21 major Defence equipment acquisition projects, is less than that provided by the ANAO’s program of performance, financial statements and performance statements audits.55

1.5 In addition to the assurance review, the ANAO considers developments in Defence’s acquisition governance processes (information and commentary on Acquisition governance appears in this chapter) and undertakes analysis of Defence’s PDSSs (information and commentary on systemic issues, and in-year and longitudinal analysis for the Major Projects, appears in Chapter 2: Analysis of project performance). This commentary and analysis is provided for information and does not constitute a review or audit and is not intended to provide assurance.

1.6 The ANAO’s review was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $2.1 million.

Review methodology

1.7 The ANAO’s review of the information presented in the individual PDSSs included:

- examining relevant internal systems, processes and internal controls, including governance and assurance mechanisms such as audit and other oversight committees that support the development of the Statement of the Secretary of Defence and the PDSSs;

- reviewing documents, holding meetings with Defence personnel and conducting analysis to assess the presentation of the PDSSs;

- considering industry contractor comments provided on draft PDSS information;

- examination of representations by Defence to support the Lessons Learned narratives included in Section 6 of the PDSS;

- analysis of project information, cost, Australian Industry Capability (AIC), schedule, progress towards delivery of required capability, risks and issues, lessons learned, and longitudinal analysis across these key elements of the Major Projects over time;

- assessing the assurance provided by Defence senior management attesting to the accuracy and completeness of the PDSSs;

- examination of representations by the Chief Finance Officer supporting the project financial assurance and contingency statements;

- examination of representations by the Vice Chief of the Defence Force (VCDF) supporting the non-disclosure of information for publication after security review;

- examination of confirmations, provided by the Capability Managers, relating to each project’s progress toward Initial Materiel Release (IMR), Final Materiel Release (FMR), Initial Operational Capability (IOC) and Final Operational Capability (FOC); and

- examination of the Statement by the Secretary of Defence, including significant events occurring post 30 June 2024, and management representations by the Secretary of Defence.

1.8 The ANAO’s review of PDSSs also focused on project management and reporting arrangements contributing to the overall governance of the Major Projects. The ANAO considered:

- resolution of matters described in the 2022–23 Auditor-General’s Independent Assurance Report relating to the LAND200 Tranche 2 Battlefield Command System PDSS56;

- developments in acquisition governance (see paragraphs 1.17 to 1.108);

- the financial framework, particularly as it applies to the project financial assurance and contingency statements (see Section 2 of the PDSSs);

- schedule management and test and evaluation processes (see Section 3 of the PDSSs);

- declaration of exceptions (caveats or deficiencies) to materiel capability/scope (see paragraphs 1.105 to 1.110);

- the Defence Risk Management Framework, and the completeness and accuracy of major risks and issues data (see Section 5 of the PDSSs);

- the Defence Lessons Repository, CASG Lessons Program, and the completeness and accuracy of lessons learned data within the system (see Section 6 of the PDSSs); and

- the impact of acquisition issues on sustainment to ensure the PDSS is a complete and accurate representation of the acquisition project.

1.9 The ANAO also considered whether there were any material inconsistencies between the information disclosed in the sections outside the scope of the review and the ANAO’s understanding from performing review procedures on the in-scope information.

Project Data Summary Sheets

Preparation and review processes

1.10 A quality PDSS preparation process by Defence will reduce the risk of untimely and/or inaccurate reporting and will reduce the incidence of multiple reviews for the same project.

1.11 As part of the MPR process, Defence’s PDSS preparers receive guidance on expectations and have three57 opportunities (in most instances) to refine the PDSSs before the ANAO finalises its assurance review. The ANAO and Defence MPR team conduct educative activities, including visits, with Major Project teams in the pre-30 June period58 to promote awareness of the MPR Guidelines and mitigate errors and quality issues in Defence’s PDSS preparation. For the 2023–24 MPR, the ANAO completed its first assessment of the PDSSs in the pre-30 June period and the final two assessments in the post-30 June period, as agreed with Defence.59

1.12 Defence’s enhancement of its internal management methodology and quality assurance approach for the MPR has involved the use of standardised PDSS templates, the creation of some standardised financial reports and the continued development of internal guidance materials for projects preparing their individual PDSSs. Ongoing quality issues relating to Defence’s preparation of PDSSs as required by the MPR Guidelines, following the ANAO’s assessment of the first versions of the PDSSs, were identified and documented in an Interim Management Letter provided to Defence on 2 September 2024.

1.13 Quality issues included instances where evidence packs were incomplete60 and inappropriately mapped61, sections of the PDSSs were not updated to reflect current year content62, and use of obsolete PDSS templates.63 These issues related to elements of financial data, schedule milestone dates, quantities of materiel, risks and issues and lessons learned.

1.14 The ANAO advised Defence of the material errors and quality issues it identified in the PDSSs following the review of PDSS version one and version two. This process continued for a selected number of PDSSs after what was intended to be the ANAO’s third and final review of the PDSSs.64 This has informed the ANAO’s assurance review and the Auditor-General’s conclusion (see the Independent Assurance Report found in Part 3 of this report).

1.15 Efficiencies could be gained through Defence process and system standardisation65, including the development and generation of standard reports from Defence’s Financial Management and Information System (FMIS), Enterprise Resource Planning system (ERP) as it is implemented, Predict! (the Defence risk management system), the Defence Lessons Repository and continued engagement and review by Defence leaders.

Defence reporting in PDSSs — lessons learned and non-disclosures

1.16 The MPR Guidelines require PDSSs to include information on project lessons (at the strategic level) that have been learned. Projects are to state whether ‘systemic lessons’ have been identified. The Auditor-General’s Independent Assurance Report in respect of the 2022–23 MPR included a Qualified Conclusion on the basis that information on Lessons Learned disclosed in Section 6 of the PDSSs did not satisfy the requirements of the MPR Guidelines and was materially inconsistent with evidence obtained by the ANAO.66

1.17 In its review of the 2023–24 MPR, the ANAO examined the Defence Lessons Repository (the DLR), which predominantly stores and maintains lessons learned to be incorporated into future policy and practice. The ANAO has determined that it is not able to rely on the DLR to gain assurance over lessons learned due to deficiencies in processes. Defence has disclosed 74 project level lessons in PDSSs and is unable to demonstrate why these lessons were categorised as strategic lessons compared with other lessons in the DLR.

1.18 As summarised in paragraphs 27 to 30 and 1.15, the Auditor-General has expressed a Qualified Conclusion in the Independent Assurance Report (found in Part 3 of this report), on the basis that due to deficiencies in Defence’s processes over lessons learned, the ANAO is unable to obtain sufficient appropriate audit evidence to conclude whether the disclosure of the lessons learned in the PDSSs is in accordance with the requirements of the Guidelines.

1.19 Defence advised the ANAO on 5 December 2024 of its decision that certain information is not for publication (NFP) and has not been included in the relevant PDSSs for 20 projects, similar to the prior two MPRs. The NFP information includes forecast dates, capability delivery information and variance information. The affected PDSSs are set out in Table S.2 and Table S.3. Commentary provided by the Secretary of Defence on this matter is reproduced at paragraphs 21 to 22.

Acquisition governance

1.20 Consistent with prior years, the ANAO considered Defence’s Major Project acquisition governance processes when planning and conducting the review for the 2023–24 MPR. While some of these processes are now established, others continue to mature or require further development to achieve their intended impact.

Defence Independent Assurance Reviews

1.21 The Defence Independent Assurance Review (IAR) process provides the Defence Senior Executive with assurance that projects and products will deliver approved objectives and are prepared to progress to the next stage of activity. These management-initiated reviews consider a project’s status while sufficient time remains for corrective action to be implemented.67

1.22 IARs are intended to commence at project initiation and are conducted through to FOC; for higher-complexity projects, ideally on an annual basis. They are an important input to key acquisition and sustainment decision points or milestones.68

1.23 During 2023–24, 18 of the 21 Major Projects (2022–23: 13) had completed an IAR.69

Projects of Concern and Projects of Interest

1.24 The Projects of Concern (POC) process is intended to manage:

…the remediation of underperforming projects. This is achieved through close collaboration and high engagement with senior Defence and industry partner management, led by the Minister for Defence Industry, to agree and implement a plan to resolve significant commercial, technical, cost and/or schedule difficulties.70

1.25 Similarly, there is a related Projects of Interest (POI) process where projects are monitored internally by Defence to ‘ensure issues are remediated and that the project does not progress to a POC’.71 Formal monitoring of POIs commenced in July 2016. Prior to this time, POIs were referred to as ‘underperforming projects’.

1.26 Table 1.1 outlines the two MPR projects classified as a POC (2022–23: 2) and seven MPR projects classified as POI (2022–23: 4).

Table 1.1: 2023–24 MPR Projects of Concern and Interest

|

Project of Concern |

Project of Interest |

|

AIR 5431 Phase 3 CMATS |

SEA 5000 Phase 1 Hunter Class Frigates |

|

SEA 1180 Phase 1 Offshore Patrol Vessel |

AIR 6000 Phase 2A/2B Joint Strike Fighter |

|

– |

LAND 400 Phase 2 Combat Reconnaissance Vehicles |

|

– |

AIR 555 Phase 1 Peregrine |

|

– |

AIR 2025 Phase 6 JORN Mid-Life Upgrade |

|

– |

LAND 121 Phase 4 Hawkei |

|

– |

LAND 200 Tranche 2 Battlefield Command System |

Source: Defence Ministerial Reporting on Projects of Concern and Interest at 30 June 2024.

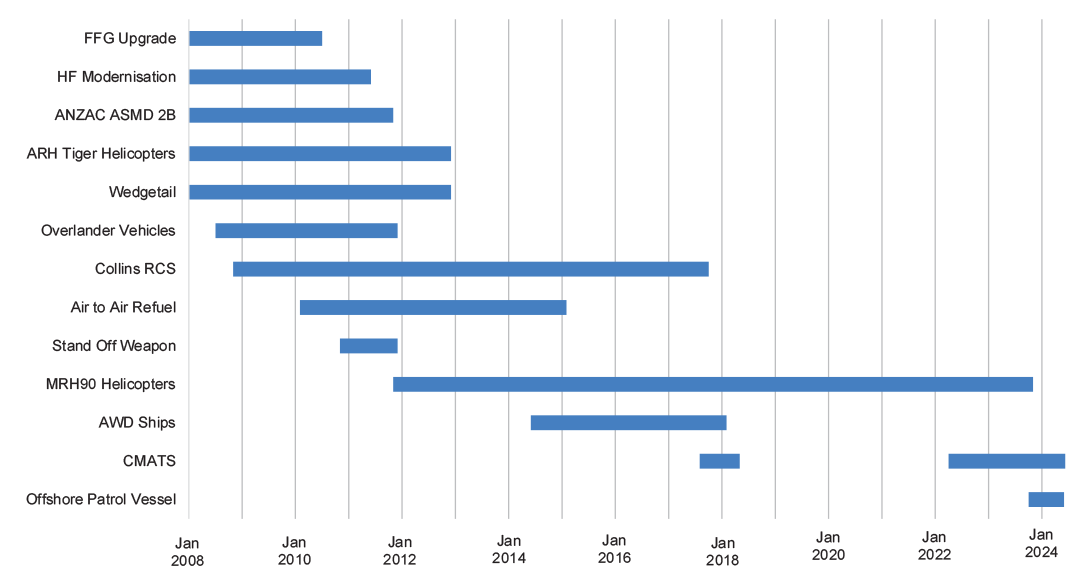

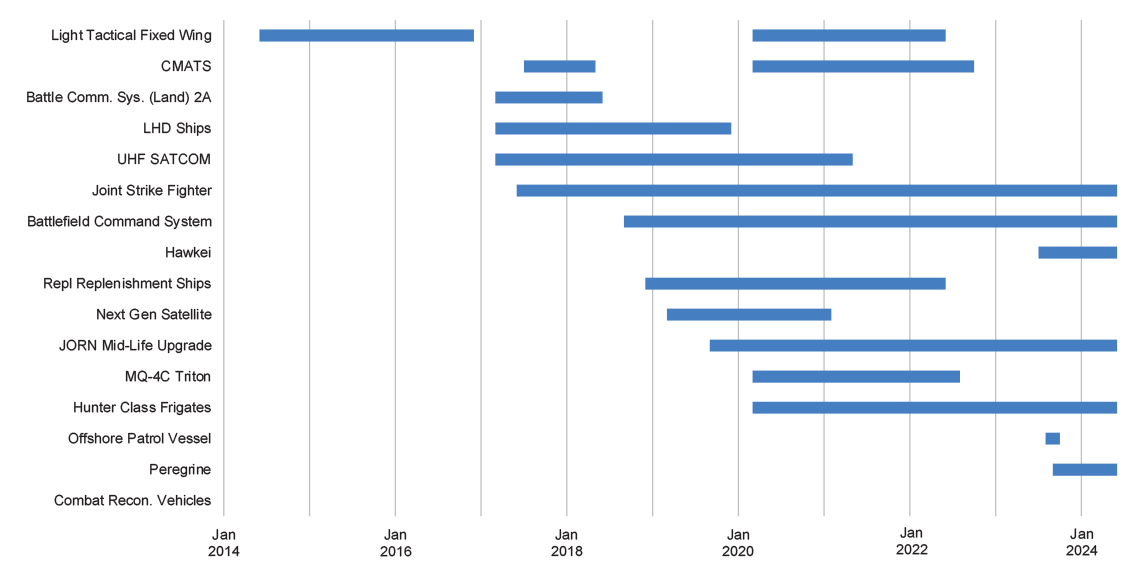

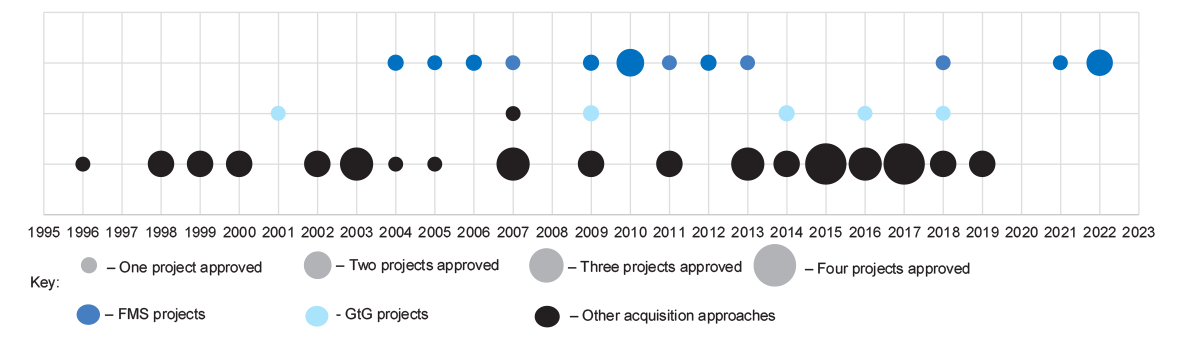

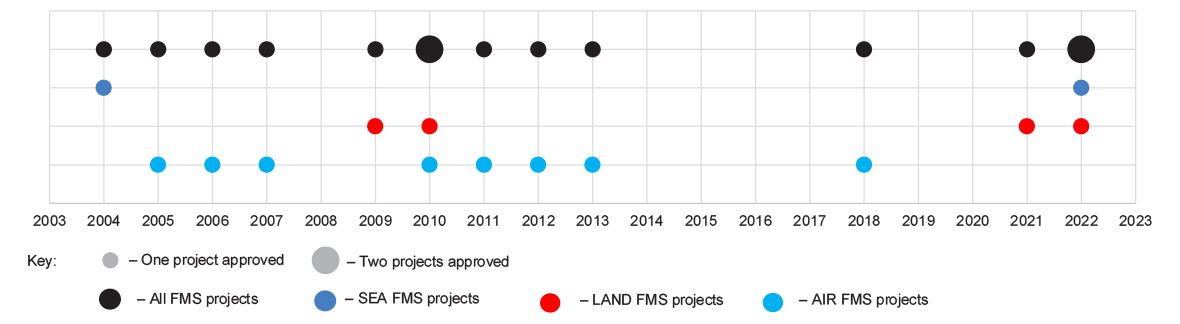

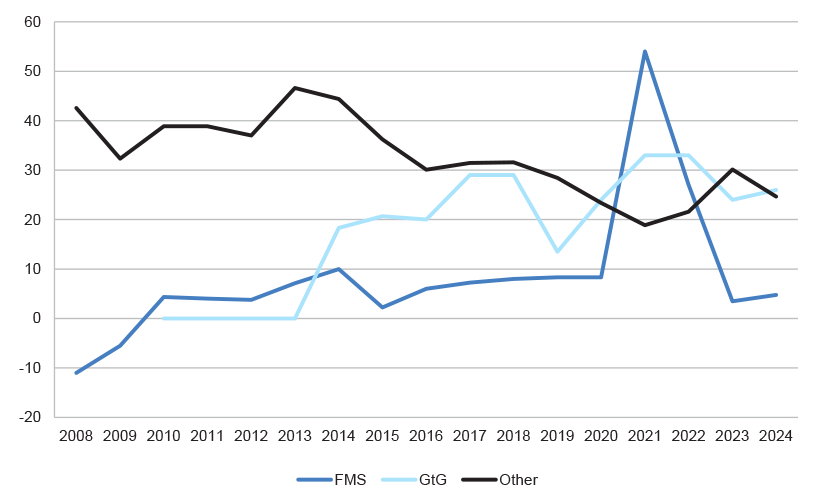

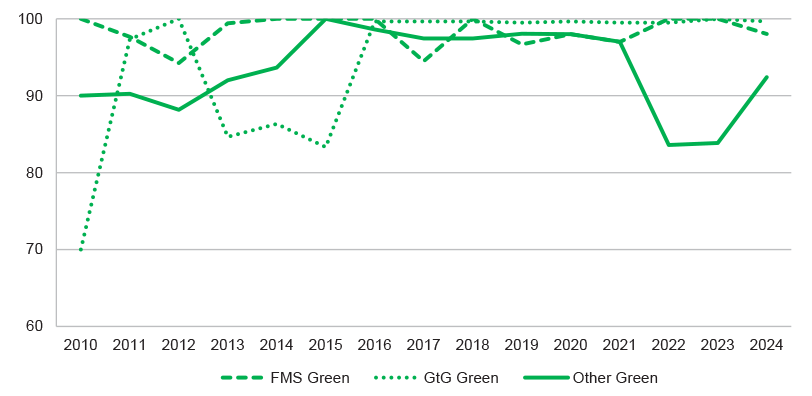

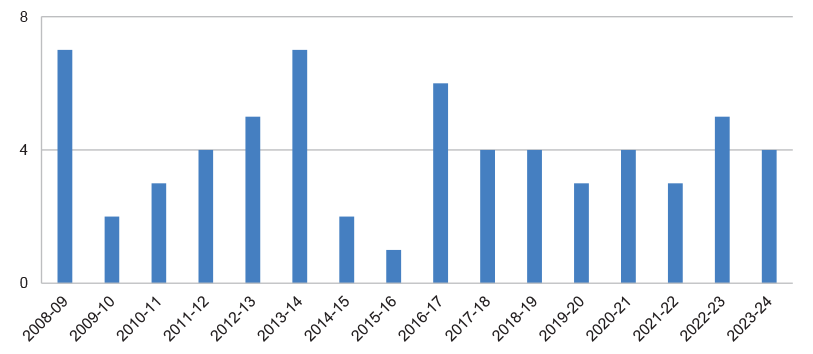

Projects of Concern (POC)