Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Interim Phase of the Audits of the Financial Statements of Major General Government Sector Entities for the year ending 30 June 2016

Please direct enquiries relating to reports through our contact page.

The Australian National Audit Office (ANAO) publishes two reports annually addressing the outcomes of the financial statement audits of Commonwealth entities, and the Consolidated Financial Statements of the Australian Government, to provide Parliament an independent examination of the financial accounting and reporting of public sector entities. This report focuses on the results of the interim audit phase, including an assessment of entities’ key internal controls, of the 2015–16 financial statements audits of 21 departments and other major General Government Sector (GGS) entities. These entities contribute 95 per cent of GGS revenues and expenses.

Executive summary

1. The primary purpose of financial statements is to provide relevant, reliable information to users about a reporting entity’s financial position. In the public sector, the users of financial statements include Ministers, Parliament, and the community. The preparation of timely and accurate audited financial statements is also an important indicator of the effectiveness of entity’s financial management, which fosters confidence in an entity on the part of users.

2. The Australian National Audit Office (ANAO) publishes two reports annually addressing the outcomes of the financial statement audits of Commonwealth entities, and the Consolidated Financial Statements of the Australian Government, to provide Parliament an independent examination of the financial accounting and reporting of public sector entities.

3. This report focuses on the results of the interim audit phase, including an assessment of entities’ key internal controls, of the 2015–16 financial statements audits of 21 departments and other major General Government Sector (GGS) entities. These entities contribute 95 per cent of GGS revenues and expenses. Significant and moderate audit findings are reported to the responsible Minister(s), and all findings are reported to those charged with governance of each entity.

4. The second report, Audits of Australian Government Entities for the year ending 30 June 2016, reports on the results of the 2015–16 final audits of the financial statements of all Australian Government controlled entities and the CFS.

Summary of audit findings and related issues

Entity internal controls

5. A central element of the ANAO’s financial statement audit methodology and the focus of the interim phase of ANAO audits, is a sound understanding of an entity’s environment and internal controls. This understanding informs our audit approach, including the reliance placed on entity systems to produce financial statements that are free from material misstatement. To do this, the ANAO uses the framework contained in the Australian Auditing Standard 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment (ASA 315).

6. Overall, the entities included in this report had established processes and frameworks to support the implementation of effective internal controls for the preparation of financial statements that are free from material misstatement.

Summary of audit findings

7. A total of 79 findings were reported to the entities included in this report as a result of interim audits. These comprised 1 significant, 17 moderate and 61 minor findings. The level of significant and moderate audit findings is consistent with the 2014–15 results. The 2015–16 results relating to minor audit findings represent an improvement compared to the interim results of 2014–15 where 95 minor findings were reported.

8. Seventy-two per cent of significant and moderate findings were in the areas of: compliance and quality assurance frameworks supporting program payments, revenue collection and financial reporting; and management of IT controls, particularly the management of privileged users. These areas warrant further attention by entity management.

9. Entities have an ongoing responsibility to monitor the effectiveness of their systems and related controls to be confident of the integrity of the financial information reported to management and in their annual financial statements.

Reporting and auditing frameworks

Improving the quality and timeliness of financial reporting

10. There are ongoing initiatives by both Australian and international standard setters to reduce the volume and complexity of disclosures in financial statements.

11. The Department of Finance has indicated its intention to enable entities to move to a Reduced Disclosure Regime in future reporting periods that will allow for certain disclosures to be omitted from annual financial statements. The Department of Finance also intends to shorten the timeframes for preparing and auditing financial statements to facilitate timelier annual reporting to Parliament.

12. The ANAO supports initiatives that make financial statements easier to read, and generates timelier annual reporting to the extent that the needs of Parliament are met.

Enhancing performance reporting

13. Each Commonwealth entity is required to produce a corporate plan at least once each reporting period. The corporate plan is intended to be the primary planning document for entities. Entities and companies are also required to present a performance statement in annual reports. These statements will provide an assessment of the extent to which entities have succeeded in achieving their purposes, as outlined in corporate plans.

Auditor’s report on the financial statements

14. In December 2015, the Australian Auditing and Assurance Standards Board issued revised standards dealing with auditor reporting. The revisions were made with the aim of increasing the transparency and value of auditor reporting and will apply to financial years ending on or after 15 December 2016. The ANAO is early adopting aspects of the revised auditor reporting standards for 2015–16.

15. The Australian Auditing and Assurance Standards Board also introduced a new auditing standard, ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report. In 2015–16, the ANAO is undertaking a limited pilot of reporting key audit matters for a number of material Commonwealth entities to assess risks and to inform the developments of ANAO methodology in this area. The ANAO expects to amend its auditing standards to include reporting on key audit matters from 2016–17.

Cost of this report

16. The cost to the ANAO of producing this report is approximately $420 000.

1. Summary of audit findings and related issues

Chapter coverage

This chapter provides:

- an overview of the ANAO’s audit approach to financial statements audits;

- a summary of observations regarding the internal controls of those entities included in this report; and

- a summary of audit findings identified at the conclusion of the interim audit.

Conclusion

The 21 entities included in this report had established processes and frameworks to support the implementation of effective internal controls.

A total of 79 findings were reported to the entities included in this report as a result of interim audits. These comprised 1 significant, 17 moderate and 61 minor findings. The level of significant and moderate audit findings is consistent with the 2014–15 results. The 2015–16 results relating to minor audit findings represent an improvement compared to the interim results of 2014–15 where 95 minor findings were reported.

Seventy-two per cent of significant and moderate findings were in the areas of: compliance and quality assurance frameworks supporting program payments, revenue collection and financial reporting; and management of IT controls, particularly the management of privileged users. These areas warrant further attention by entity management.

Entities have an ongoing responsibility to monitor the effectiveness of their systems and related controls to be confident of the integrity of the financial information reported to management and in their annual financial statements.

Introduction

1.1 The ANAO publishes two reports annually addressing the outcomes of the financial statements audits of Commonwealth entities and the Consolidated Financial Statements of the Australian Government (CFS) to provide Parliament an independent examination of the financial accounting and reporting of public sector entities.

1.2 This report focuses on the results of the interim audit phase, including an assessment of entities’ key internal controls, of the 2015–16 financial statements audits of departments and other major General Government Sector (GGS) entities that collectively represent 95 per cent of total GGS revenues and expenses. A listing of these entities is provided in Appendix 1.

1.3 This report also includes a discussion of a moderate audit finding identified in 2014–15 relating to the CFS preparation process (refer to paragraph 2.16) and a discussion of a moderate audit finding identified in the 2015–16 interim audit in Airservices Australia (refer to paragraphs 3.22.1 to 3.22.13). These findings are not included in the discussion of issues in this chapter.

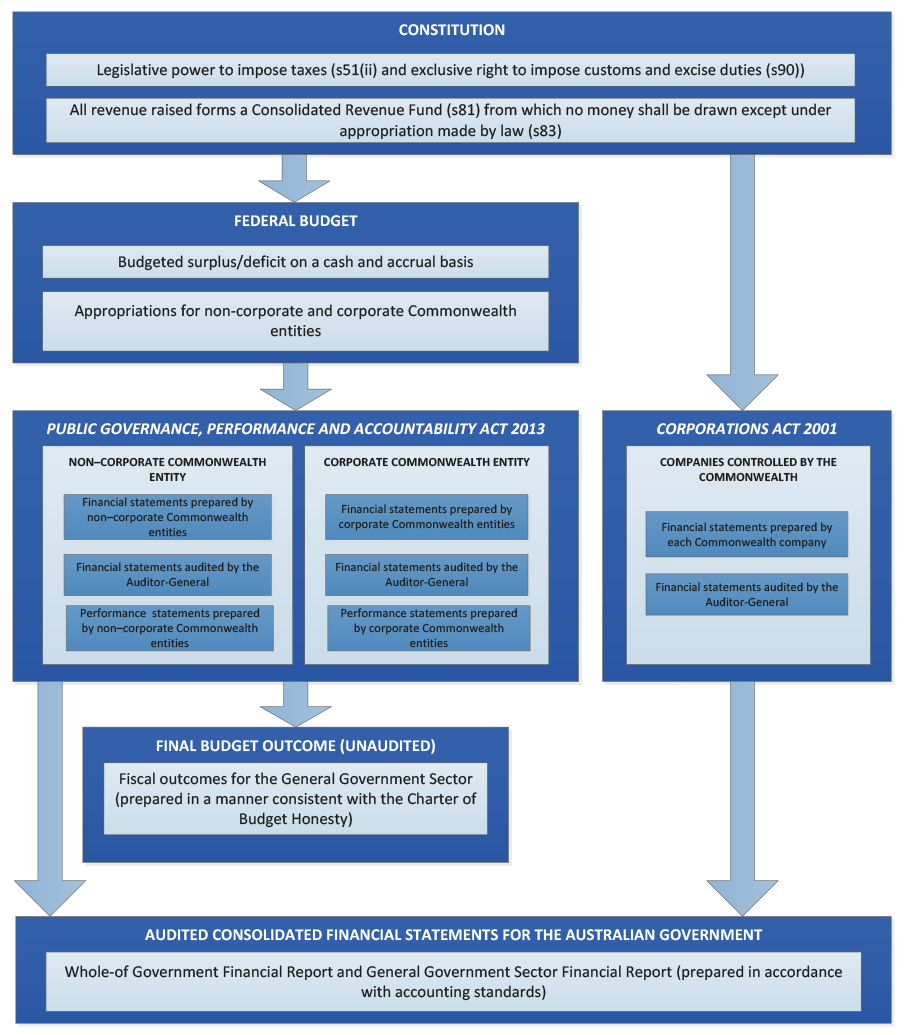

1.4 The CFS are required under section 48 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act). The Finance Minister is required to prepare and deliver the CFS to the Auditor-General by 30 November each year. The CFS are prepared in accordance with AASB 1049 Whole-of-Government and General Government Sector Financial Reporting and the Department of Finance has operational responsibility for the preparation of the CFS for the Finance Minister.

1.5 Government accountability and transparency is supported by the preparation and audit of the CFS. The CFS and the associated financial analysis provide information to assist users in assessing the annual financial performance and position of the Australian Government. The CFS present the consolidated whole of government financial results inclusive of all Australian Government controlled entities, as well as the GGS financial statements.

1.6 In the final audit phase the ANAO completes its assessment of the effectiveness of key controls for the full year, substantively tests material balances and disclosures in the financial statements, and finalises its audit opinion on all entities’ financial statements. The results of the 2015–16 final audits of the financial statements of all Australian Government controlled entities and the CFS will be included in the ANAO Audit Report Audits of Australian Government Entities for the year ending 30 June 2016, which is expected to be tabled in December 2016.

Figure 1.1: ANAO financial statements audit process

1.7 Accountable Authorities of GGS entities subject to the PGPA Act are required to govern their entity in a way that promotes the proper use and management of public resources, the achievement of the purposes of the entity and the entity’s financial sustainability. This requires the development and implementation of effective corporate governance arrangements and internal controls designed to meet the individual circumstances of each entity. These processes also assist in the orderly and efficient conduct of the entity’s business, and compliance with applicable legislative requirements, including the preparation of annual financial statements that present fairly the entity’s financial position, financial performance and cash flows.

1.8 A central element of the ANAO’s financial statement audit methodology, and the focus of the interim phase of ANAO audits, is a sound understanding of an entity’s environment and internal controls relevant to assessing the risk of material misstatement in the financial statements. This understanding informs our audit approach, including the reliance we may place on entity systems to produce financial statements that are free from material misstatement.

1.9 The auditor’s understanding of the entity, its environment and its internal controls, helps the auditor design the work needed and respond to significant risks that bear on financial reporting. The key areas of financial statements risks determined as a result of this planning approach are discussed in Chapter 3 for each entity included in this report.

1.10 In accordance with generally accepted auditing practice, the ANAO accepts a low level of risk that the audit procedures will fail to detect that the financial statements are materially misstated. This low level of risk is accepted because it is too costly to perform an audit that is predicated on no level of risk. Specific audit procedures are performed to ensure that the risk accepted is low. These procedures include, obtaining knowledge of the entity and its environment, reviewing the operation of internal controls, undertaking analytical reviews, testing a sample of transactions and account balances, and confirming significant year end balances with third parties.

1.11 This chapter outlines observations made by the ANAO whilst obtaining this understanding, and the summarised results of detailed testing of entities’ underlying control activities.

Understanding entities and their environments

1.12 The ANAO uses the framework in ASA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment to consider the impact of different elements of an entity’s internal controls framework on the design and conduct of an audit. Figure 1.2 outlines these elements.

Figure 1.2: Elements of entity internal controls

Source: ASA 315 Identifying and assessing the risk of material misstatement through understanding the entity and its environment, paragraph A58.

1.13 This chapter discusses each of these elements and outlines our observations based on our review of aspects of each entity’s internal control, relevant to the risk of material misstatement to the financial statements, including the detailed results of our interim audits.

Control environment

1.14 The ANAO Better Practice Guide, Public Sector Governance: Strengthening performance through good governance published in June 2014, detailed fundamental elements of good governance structures. These elements underpin an effective control environment and include:

- developing strong leadership at all levels of the entity, with a focus on ethical behaviour and continuous improvement;

- maintaining governance systems and processes that are fit for purpose;

- optimising performance through planning, engaging with risk, innovation, and performance monitoring, evaluation and review;

- focusing on openness, transparency and integrity, engaging constructively with stakeholders and promoting accountability through clear reporting on performance and operations; and

- where appropriate, participating in collaborative partnerships to more effectively deliver programs and services, including partnerships outside government.

1.15 In assessing an entity’s control environment that supports the preparation of financial statements that are free from material misstatement, the ANAO reviews aspects of the governance structures. The ANAO considers whether management has established frameworks and processes that promote positive attitudes, awareness and actions concerning the entity’s internal controls and their importance in the entity. The main elements reviewed include; governance structures relevant to the preparation of the financial statements, audit committee and assurance arrangements; and systems of authorisation, recording and procedures.

1.16 All entities included in this report had established executive management structures that met at least monthly, in the form of Executive Committees and sub-committees, supporting financial decision making at the strategic and operational levels.

1.17 All entities had an Audit Committee, with the size and composition of each varying from entity to entity. Membership ranged in number from seven to three, depending on the size and complexity of the entity’s operations and all had at least three members who were not staff members of the entity. All Committee’s had established a charter which reflected the key elements required by the Public Governance, Performance and Accountability Rule 2014.

1.18 Consistent with previous years, consideration of financial performance including accrual information was included on the agendas of all 21 entities’ executive and audit committees. The financial information provided to the entities’ executives was supplemented by non-financial operational information. Regular reporting of this nature to executive and audit committees places entities in good stead to improve the quality of AASB 1055 Budgetary Reporting note disclosures. ANAO Report No.15 2015–16, noted that more than 75 per cent of entities’ disclosures required some improvement in the implementation of this standard’s requirements. The ANAO will assess all entities’ progress in this area during the 2015–16 final audit.

1.19 Clear accountability structures are important in establishing a strong internal control environment for the purposes of preparing the financial statements. The involvement of those charged with governance is an important element of these structures. Just as important is ensuring that staff at all levels understand their own role in the control framework. This can be achieved through the issuance of Accountable Authority Instructions1, and delegation instruments. All 21 entities reviewed had established Accountable Authority Instructions and delegations reflecting current business arrangements.

1.20 The results of the 2015–16 interim audits identified that the entities included in this Report have appropriate frameworks in place to provide direction, guidance and control over financial management and to support the preparation of the 2015–16 financial statements. The ANAO identified 10 significant and moderate audit findings relating to: weaknesses in compliance and quality assurance frameworks supporting: program payments; revenue collection; and financial reporting. These weaknesses indicate a need for management in these entities to focus attention on:

- maintaining effective governance over third party or joint service delivery; and

- the risk management arrangements that support the effective engagement with risk in the delivery of programs.

1.21 Further detail relating to these issues is provided at paragraphs 1.76 to 1.78.

Risk assessment processes including fraud control

1.22 The PGPA Act sets out an accountable authority’s responsibilities in regard to the establishment of appropriate risk oversight and management in their entity.2 An understanding of an entity’s risk assessment process is essential to an effective and efficient financial statement audit. The ANAO reviews how entities identify risks relating to their financial statements, how these risks are managed and considers the risk of material misstatement of an entity’s financial statements.

1.23 All entities reviewed had a risk management process to develop and update risk management plans at the organisational and work area levels. In addition, each had developed processes for the identification and notification of risks relevant to financial statement preparation either as part of the overall risk management plan, or through a targeted risk identification exercise. The monitoring of risks, and the entities’ implementation of risk management strategies, was typically assigned to either an executive committee and/or the audit committee.

Fraud control management

1.24 The Commonwealth Fraud Control Framework outlines the principles for fraud control within the Australian Government and sets minimum standards to assist entities in carrying out their responsibilities to combat fraud against their programs. As with risk management plans, fraud control plans need to be reviewed regularly and updated when significant changes to roles or functions occur, so that they reflect an entity’s current fraud risk and control environment. There are benefits in entities assessing their fraud risks as part of their risk management processes.

1.25 The importance of entities establishing effective fraud control arrangements is recognised in section 10 of the Public Governance, Performance and Accountability Rule 2014, which specifies that Accountable Authorities must develop and implement a fraud control plan for their entity. The Framework requires entities to conduct fraud risk assessments regularly and when there is a substantial change in the structure, functions or activities of the entity.

1.26 As part of the ANAO’s 2015–16 interim audits, the ANAO identified that all entities included in this report had established a fraud control plan. These plans were monitored, reviewed and updated when required.

1.27 Entities had also assigned responsibility for the oversight and monitoring of fraud control strategies and initiatives to specified fraud and governance roles or dedicated branches and the audit committee.

Monitoring of controls

1.28 Entities undertake many types of activities as part of their monitoring of control processes, including external reviews, self-assessment processes, post-implementation reviews and internal audits. The level of review of these activities by the ANAO is determined through a risk assessment approach that takes into consideration the nature, extent and timing of each activity and the activities application to the preparation of the financial statements. Given the significance of the internal audit function to Australian Government entities, this function is reviewed by the ANAO each year to gain an understanding of its contribution to the overall control environment.3

1.29 Internal audit is a key source of independent and objective assurance advice on an entity’s risk framework and internal control. Depending on the role and mandate of an entity’s internal audit function, it can play an important role in assessing the adequacy of both the financial systems that underpin an entity’s financial statements, and the preparation process.

1.30 As part of its financial statement audit coverage, the ANAO reviews the activities of internal audit in accordance with ASA 610 Using the Work of Internal Auditors. The ANAO approach takes into account the work completed by internal audit, and, where appropriate, reliance is placed on it to ensure an effective audit approach.

1.31 The ANAO observed that internal audit coverage in the entities included in this report is based on an internal audit plan that is aligned with entities’ risk management plans and includes a combination of audits that address assurance, compliance, performance improvements and IT systems reviews. In addition, recommendations from management, audit committees and external influences, such as the ANAO work program, are factors considered in the development of internal audit work plans.

1.32 The extent of ANAO’s reliance on internal audit coverage varies between entities, and greater reliance is placed on internal audit where the work is focused on financial controls and legislative compliance. The ANAO continues to encourage entities to identify opportunities for internal audit coverage of key financial systems and controls as a means of providing increased assurance to Accountable Authorities to support their expressing an opinion on the entity’s financial statements.

Information systems

1.33 An entity’s information system is used extensively for the processing of financial information that is used to prepare its financial statements. As a consequence, the review of each entity’s information system and its related controls forms a significant part of the ANAO audit examination of internal controls. Information system controls include entity-wide general controls that establish an entity’s IT infrastructures, policies and procedures, together with specific application controls that validate, authorise, monitor and report financial and human resource transactions.

1.34 Table 1.1 outlines the areas of focus used by the ANAO in assessing entities’ information system controls, including common controls tested to determine the effectiveness of those systems in supporting complete and accurate financial statements reporting.

Table 1.1: Information system controls – areas of focus

|

Area of focus |

Control element |

Control subject to ANAO assessment |

|

IT General controls |

IT security |

|

|

IT change management |

|

|

|

Application controls |

Financial management information systems (FMIS) Human resources information systems (HRMIS) |

|

|

Business continuity arrangements |

Significant systems supporting financial reporting (including FMIS & HRMIS) |

|

Source: ANAO compilation.

1.35 Observations from the ANAO’s interim audit phase relating to entities’ information system controls are provided under the IT Control environment section included in Control activities below. Refer to paragraphs 1.43 to 1.75.

Control activities

1.36 As part of the interim audit phase, the ANAO assesses the effectiveness of key controls identified during the planning stages. This assessment is made at a point in time and provides the Parliament and entities an insight into weaknesses which have the potential to impact the financial statements at year end. The broad categories of control activities assessed by the ANAO include entities’:

- IT control environment;

- compliance and quality assurance frameworks;

- accounting and control of non-financial assets;

- revenue, receivables and cash management processes;

- human resources financial processes;

- purchases and payables management; and

- other control matters relevant to the financial statements.

1.37 Figure 1.3 presents the percentage of total audit findings by category, identified for the 21 entities considered in this report during the 2015–16 interim audits.

Figure 1.3: 2015–16 interim audit findings – by category

Source: ANAO compilation of interim findings.

1.38 The following section provides a summary of interim audit findings identified in these categories across the past four financial years, as well as making observations regarding common weaknesses identified in the 2015–16 interim audits across the different finding categories outlined above.

Interim audit findings

1.39 The ANAO rates audit findings according to the potential business or financial management risk posed to the entity. The rating scale is presented in Table 1.2.

Table 1.2: Findings rating scale

|

Rating |

Description |

|

Significant (A) |

Issues that pose a significant business or financial management risk to the entity. These include issues that could result in a material misstatement of the entity’s financial statements. |

|

Moderate (B) |

Issues that pose a moderate business or financial management risk to the entity. These may include prior year issues that have not been satisfactorily addressed. |

|

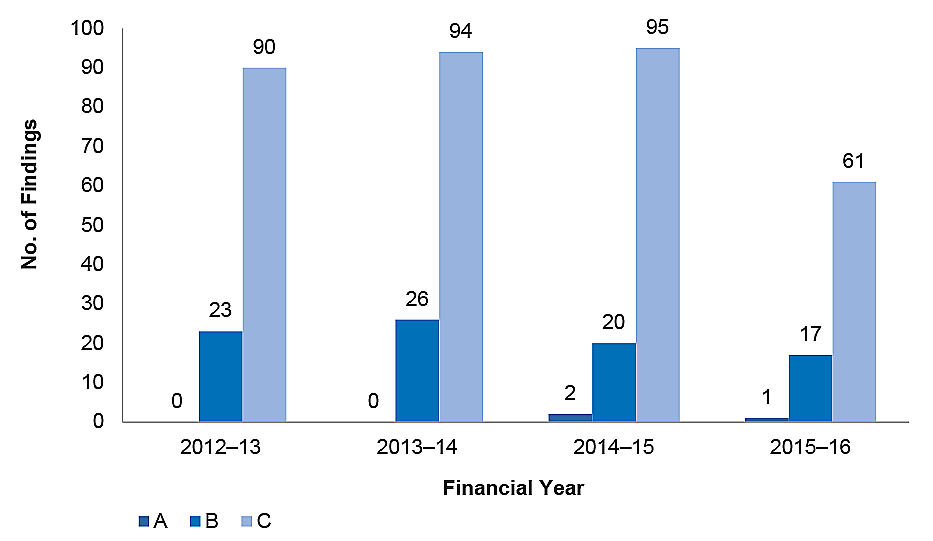

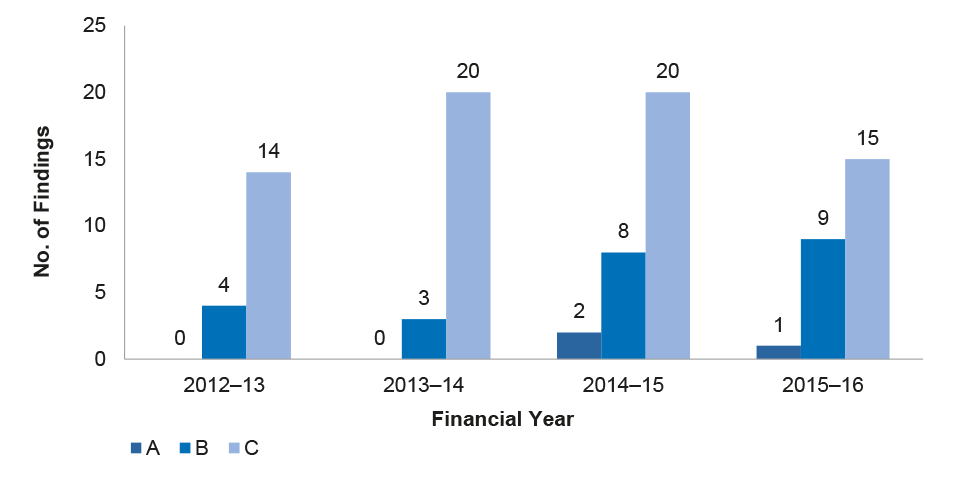

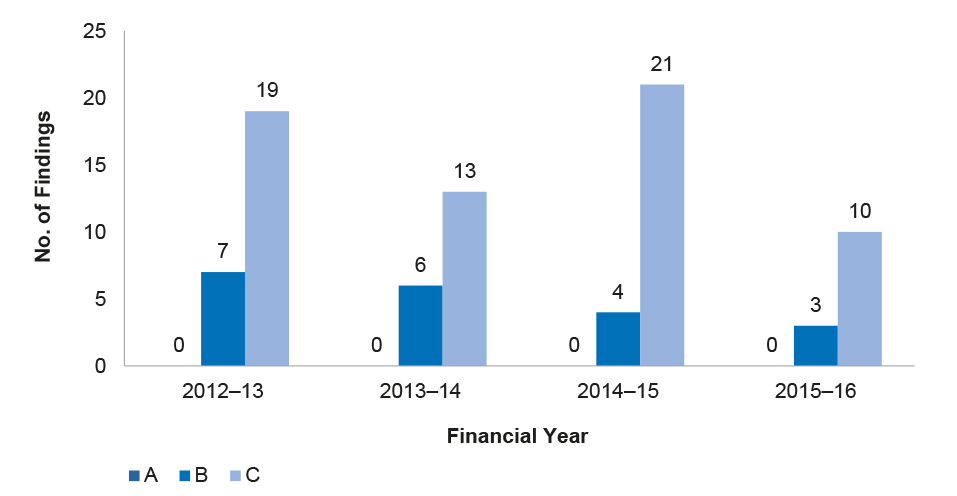

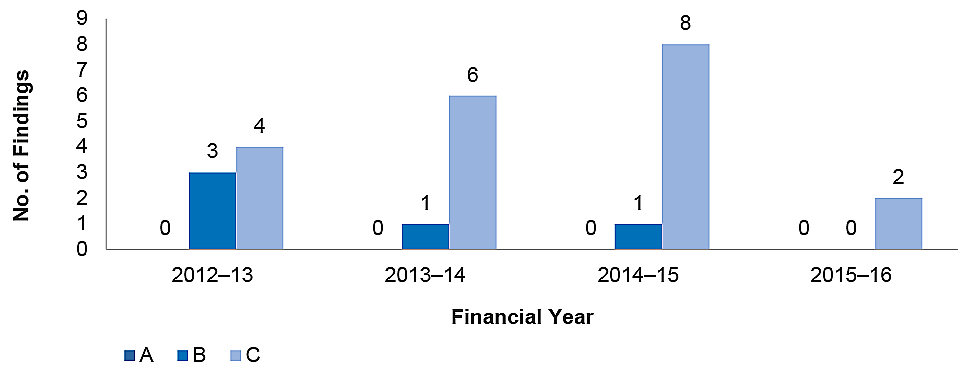

Minor (C) |

Issues that pose a low business or financial management risk to the entity. These may include accounting issues that, if not addressed, could pose a moderate risk in the future. |

1.40 A summary of all significant, moderate and minor audit findings identified at the conclusion of the interim audit phase across the past four financial years is presented in Figure 1.4 below.

Figure 1.4: Aggregate audit findings

1.41 Over the last four years, there has been an overall reduction in the number of significant, moderate and minor audit findings. As demonstrated in the figure above, there was an improvement in the number of minor findings identified during the 2015–16 interim period, compared to 2014–15, with the number of overall findings decreasing by approximately 35 per cent.

1.42 While the reduction in minor findings reflects positively on the actions of entities in resolving identified weaknesses, the modest reduction in significant and moderate findings indicates there are still specific areas requiring improvement. Table 1.3 summarises the number of significant, moderate and minor findings per category in 2015–16 and common weaknesses noted in each.

Table 1.3: Significant, moderate and minor audit findings by category

|

Category |

Significant |

Moderate |

Minor |

Main areas of weakness |

|

IT control environment |

– |

3 |

26 |

|

|

Compliance and quality assurance frameworks |

1 |

9 |

15 |

|

|

Revenue, receivables and cash management |

– |

1 |

4 |

|

|

Accounting and control of non-financial assets |

– |

3 |

10 |

|

|

Human resources financial processes |

– |

1 |

2 |

|

|

Purchases and payables management |

– |

– |

2 |

|

|

Other control matters |

– |

– |

2 |

|

|

Total |

1 |

17 |

61 |

79 |

Source: ANAO compilation of interim findings.

Information Technology control environment

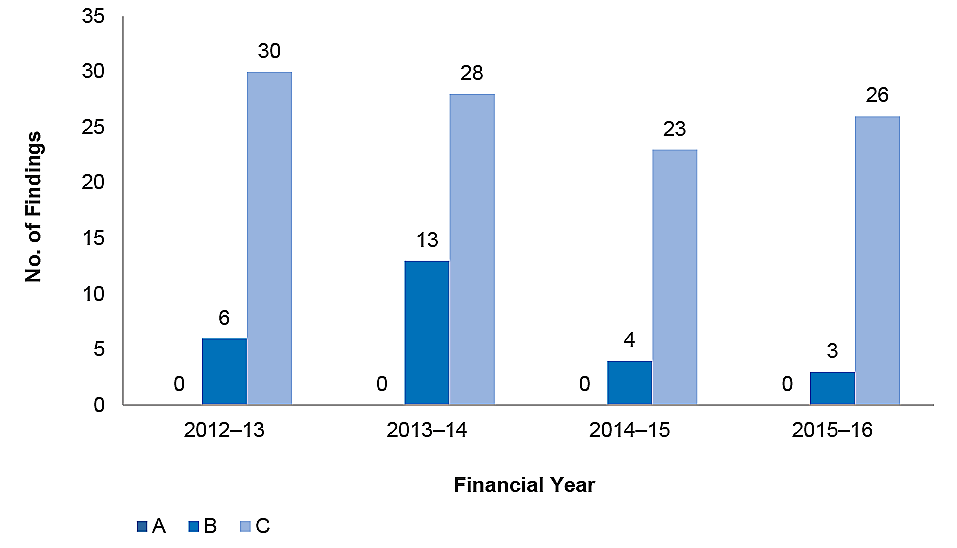

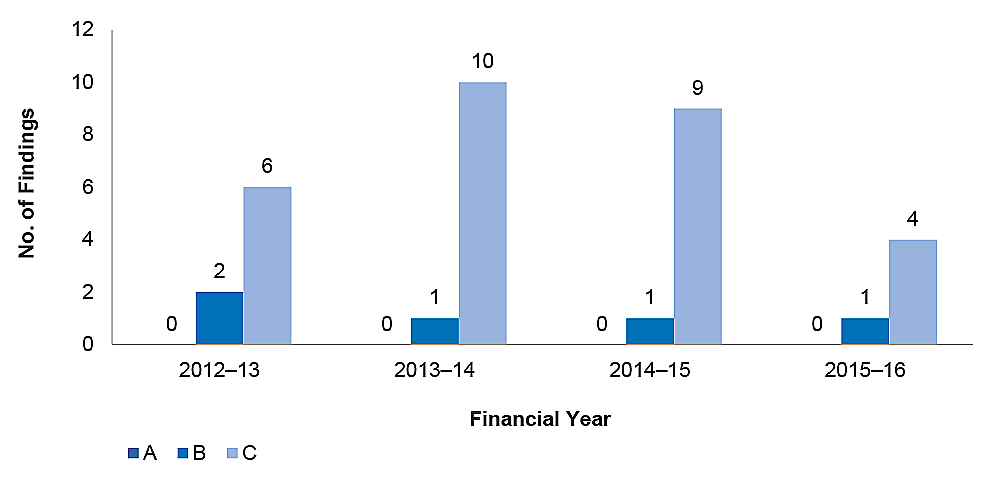

1.43 As mentioned in paragraph 1.33, the review of information systems and related controls is an integral part of an entity’s control environment. Figure 1.5 demonstrates the trends in interim audit findings related to entities’ overall IT control environments from 2012–13 to 2015–16.

Figure 1.5: IT control environment audit findings

1.44 Findings related to entities’ IT control environments represented 37 per cent of total findings identified during the 2015–16 interim period—the highest proportion of all findings categories. Four moderate findings were reported in 2014–15 and have now been resolved. Three new moderate findings were identified during the 2015–16 interim audit phase in two entities—the Attorney-General’s Department (one finding) and the Department of Defence (two findings). Further detail regarding these findings can be found at paragraphs 3.2.22 and 3.4.37 respectively.4

1.45 A cross entity performance audit, ANAO Report No. 37 2015–16 Cyber Resilience, was tabled by the ANAO in May 2016. This audit reviewed the ICT arrangements of four entities and assessed compliance with the four mandatory ICT security strategies in the Australian Government Information Security Manual (ISM).5 The observations and recommendations in the Cyber Resilience report are consistent with issues identified during the interim audits, particularly in relation to improvements in IT security arrangements and the management and monitoring of privileged user access.6

1.46 An overview of the weaknesses7 identified during the 2015–16 interim audits for the entities included in this report relating to the information system control elements: IT security; IT change management; IT application controls; and business continuity management is provided below.

IT Security

1.47 IT security is concerned with protecting an entity’s information assets from internal and external threats. It includes controls to prevent or detect unauthorised access to systems, programs and data.

1.48 As discussed at paragraph 1.12, ASA 315 provides guidance on identifying and assessing the risks of material misstatement of financial statements, including risks associated with an entity’s IT environment. Many of the risks identified in ASA 315 can be mitigated through effective implementation of IT security controls. The extent of controls implemented in an entity may vary depending on the particular business and operational circumstances.

1.49 The key controls that address risks relating to IT security and that are assessed by the ANAO as part of the interim audit are:

- IT security governance;

- general and privileged user access; and

- monitoring and reporting.

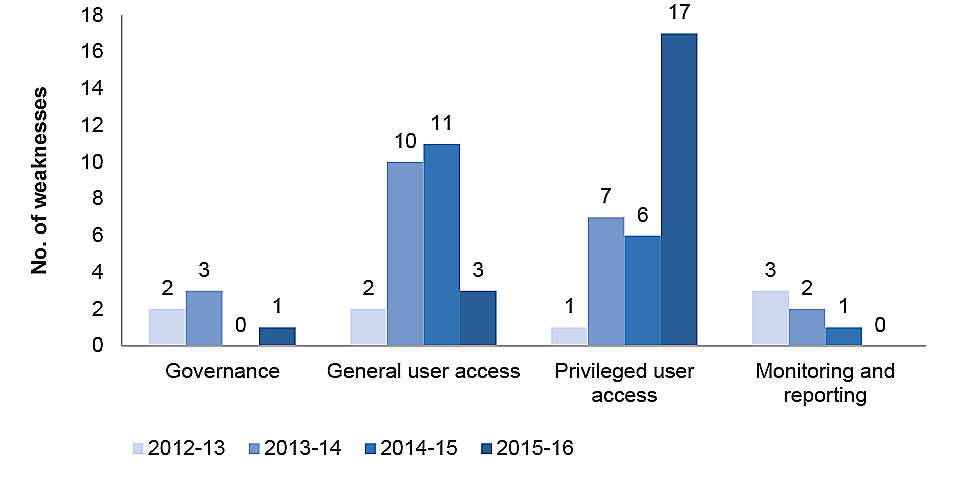

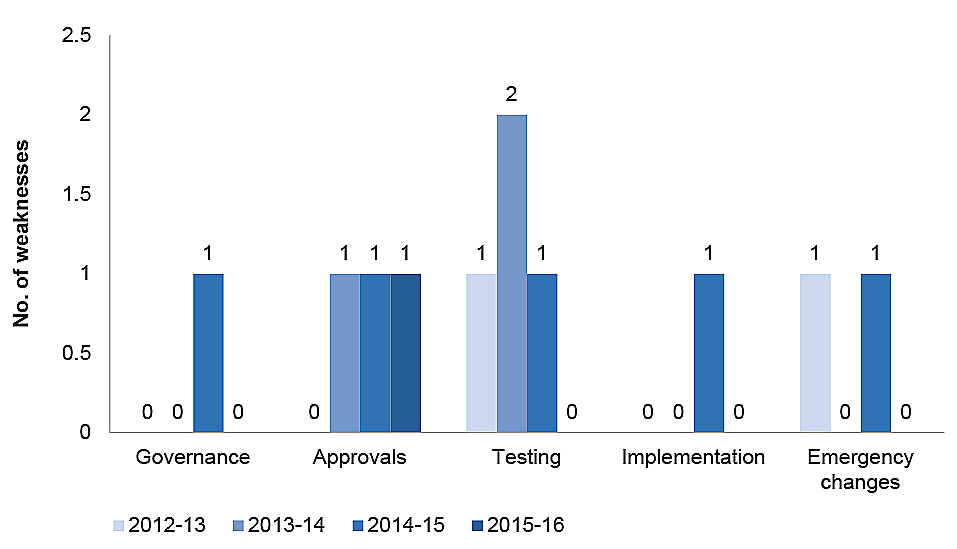

1.50 Figure 1.6 illustrates the trends in matters observed by the ANAO in entities’ IT security arrangements between 2012–13 and 2015–16.

Figure 1.6: IT security arrangements 2012–13 to 2015–16

1.51 The ANAO observed that entities continue to effectively manage security governance and processes for monitoring and reporting security events.

1.52 Three weaknesses in general user access controls were identified in 2015–16, representing a decrease in this area compared to the prior two periods. Areas for ongoing improvement include the removal of user access once employment has ended and the performance of regular user access reviews.

1.53 As part of reviewing IT security arrangements, the ANAO examines different groups of privileged users, including:

- application administrators, sometimes referred to as super users;

- database administrators;

- system administrators; and

- network or domain administrators.

1.54 The ANAO identified a significant increase in entities not managing privileged user access8 in 2015–16 with 17 weaknesses identified. While issues were not typically identified with the management of application administrators, risks associated with the other groups of privileged users appeared to be less well recognised and controlled. Areas for improvement include:

- minimising the number of users granted privileged access to systems and data;

- regular monitoring and review of privileged user access and activity; and

- prompt removal of privileged access when it is no longer required.

1.55 These issues increase the risk of unauthorised changes being made to systems and data, or unauthorised data leakage. Entities should review their management of this area in light of the requirements of the ISM and the risks to their operational environment.

IT Change Management

1.56 IT change management provides a disciplined approach to making changes to the IT environment. It includes controls to prevent unauthorised changes being introduced, and to ensure that the implementation of authorised changes does not disrupt normal business operations.

1.57 The ANAO observed that changes to entities’ IT environments were managed using a standardised process, usually based on the Information Technology Infrastructure Library9. This process was well understood and well managed. Issues were identified in only one entity in relation to the authorisation of changes.

1.58 Figure 1.7 illustrates the trends in issues identified by the ANAO in entities’ IT change management controls between 2012–13 and 2015–16.

Figure 1.7: IT change management arrangements 2012–13 to 2015–16

1.59 The number of weaknesses in relation to IT change management has remained very low over the past four years. This demonstrates the maturity of the IT change management process in most entities. The following factors contribute to this maturity:

- existence of an internationally accepted framework for change management (Information Technology Infrastructure Library), with associated training and a professional qualification; and

- availability of standard software tools with built-in workflow controls, to support the implementation of this framework.

IT Application Controls

1.60 Australian Government entities rely on two key financial reporting systems in the preparation of financial information. These are the financial management information system (FMIS) and the human resource management information system (HRMIS).

1.61 The ANAO assesses entities’ key FMIS and HRMIS controls in view of their importance for financial reporting. Areas of focus include:

- changes to the systems or data that are not assessed through the entity’s IT change management system. These are changes that only affect the users of the FMIS or the HRMIS and are therefore often out of scope for the main change management process;

- changes to master data, including banking details;

- controls over invoice payment and payroll processing; and

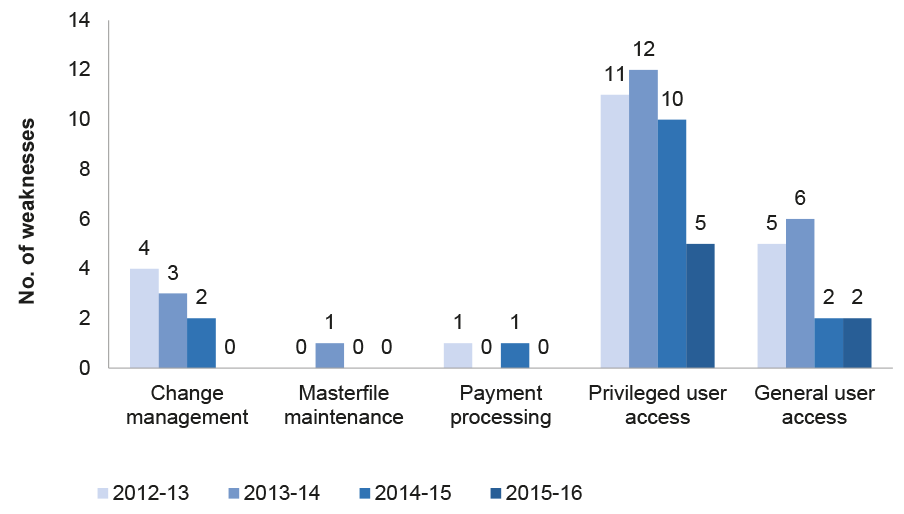

- management of general and privileged user access to the FMIS and HRMIS.

1.62 FMIS and HRMIS applications include standard controls to provide assurance over the completeness, accuracy and authorisation of master data and payments. These controls have been well-implemented in the entities reviewed. In addition, all entities were found to manage changes at the application level to ensure that only authorised changes are made.

1.63 Privileged user access includes the ability to bypass normal application controls or make changes to system settings. This access is often necessary to fully administer applications, however it should be restricted and monitored to reduce the risk of errors or unauthorised activity. Entities’ management of application privileged user access remains an area that requires management attention. Five weaknesses were identified in the 2015–16 interim audits (2014–15: ten weaknesses).

1.64 Weaknesses identified in the 2015–16 interim audits included entities not having adequate logging and/or monitoring of privileged user activity. Only one entity had weaknesses in controls over general user access.

1.65 Application change management, masterfile maintenance and payment processing controls continue to be managed by entities.

1.66 Figure 1.8 illustrates the trend in weaknesses observed by the ANAO in relation to entities’ application controls between 2012–13 and 2015–16.

Figure 1.8: Application control arrangements 2012–13 to 2015–16

Business Continuity Management

1.67 Business Continuity is defined as the capability of an entity to continue delivery of products or services at acceptable predefined levels following a disruptive incident.10 It includes three key elements:

- effective back-up and recovery arrangements, to ensure that current versions of key IT systems and data are available to be recovered from;

- business continuity planning, including the development, maintenance and testing of a business continuity plan for each key business area to ensure that the entity can continue operations while waiting for systems and data to be restored; and

- disaster recovery planning, including the development, maintenance and testing of a disaster recovery plan to ensure that IT systems can be recovered in line with defined business requirements.

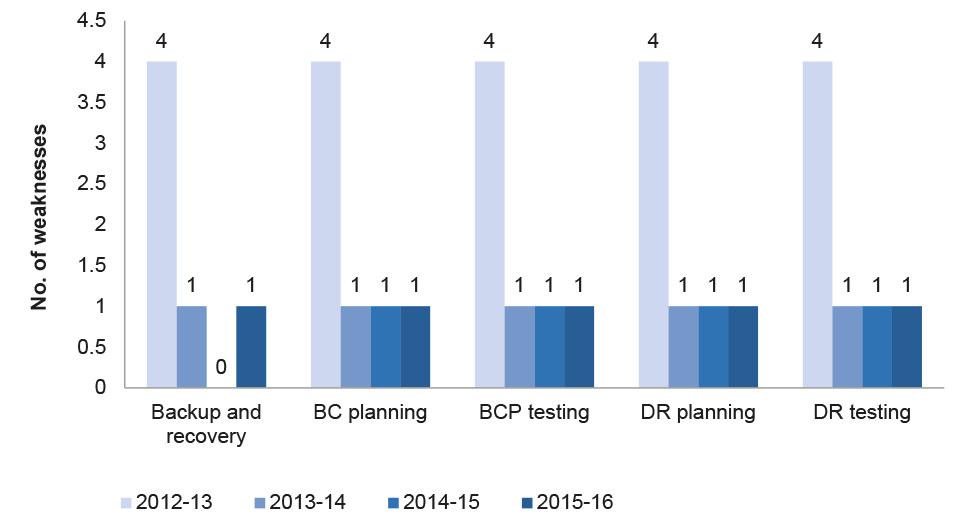

1.68 The ANAO assesses entities’ business continuity arrangements in view of the potential for a disruptive event to impact on financial reporting. In 2012–13 and 2013–14, the review focussed specifically on business continuity arrangements for the FMIS and HRMIS. From 2014–15, the scope of the review was broadened to include all significant financial and information technology systems.

1.69 All but one entity had business continuity and disaster recovery plans and testing arrangements that catered for all of the entity’s significant financial and information technology systems, and were appropriate to their business circumstances.

1.70 Consistent with 2014–15, the ANAO observed that an unplanned event had been used by some entities for the testing and review of business continuity and disaster recovery plans rather than a scheduled test event. Such an approach may increase the risk of entities having an inadequate response to such incidents when they occur in the future. Risks of relying on an unplanned event include the potential for a lack of a coordinated approach or a lack of preparation for the type of incident experienced.

1.71 Entities should ensure that they are in a position to test their business continuity plans if an unplanned event was not to occur for some time.

1.72 All but one entity had well established backup and recovery processes. Backup and recovery arrangements underpin an entity’s business continuity and disaster recovery plans, and may also be used to support the resumption of business operations. As such, it is important that entities continue to ensure backup and recovery arrangements are in place.

1.73 Figure 1.9 illustrates the trend for issues identified by the ANAO in entities’ business continuity arrangements between 2013 and 2016.

Figure 1.9: Business continuity arrangements 2012–13 to 2015–16

1.74 As noted above, this area was initially assessed only in relation to the FMIS and HRMIS, and was broadened to include other financial and information technology systems. This has not had a noticeable effect on the results observed. Since 2013–14, this area has been consistently addressed by most entities, with only one entity in each year failing to demonstrate adequate measures. This has not been the same entity in each year.

1.75 Overall, the majority of IT controls continued to be effective in most entities included in this Report during 2015–16. Consistent with observations in previous years, the management of user access arrangements, including privileged users, is an area requiring improvement. In light of the risk posed to systems and data by inadequate user access controls, entities and audit committees should focus attention on these matters as soon as possible.

Compliance and quality assurance frameworks

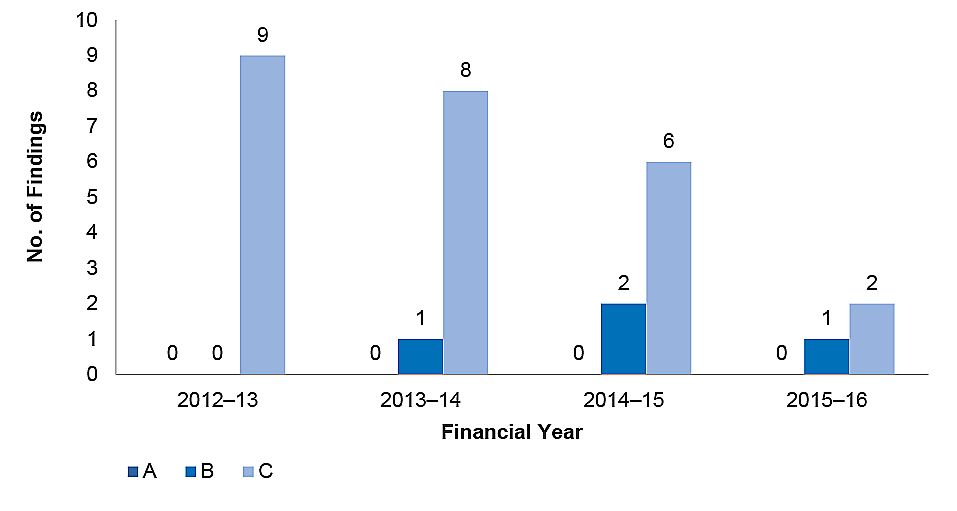

1.76 The business of government requires, in many circumstances, placing reliance on internal and external systems, parties and information in decision making processes. For this reason, the implementation of effective compliance frameworks, and processes that provide assurance regarding the completeness and accuracy of information, are integral to an entity’s internal control. Figure 1.10 demonstrates the trends in interim audit findings related to entities’ compliance and quality assurance frameworks from 2012–13 to 2015–16.

Figure 1.10: Compliance and quality assurance frameworks audit findings

1.77 The number of significant and moderate audit findings remains consistent with the 2014–15 interim audit results. There has been an improvement in the number of minor audit findings related to entities compliance and quality assurance frameworks between 2014–15 and 2015–16 from 20 findings to 15.

1.78 These findings mainly related to weaknesses in entities processes to obtain assurance over information sourced from third parties in administering payments, compliance frameworks supporting revenue collection, and completeness and accuracy of consolidation of divisional or disparate information supporting financial reporting.11

1.79 As discussed in paragraph 1.20 above, the ANAO identified that the entities included in this report have appropriate frameworks in place to provide direction, guidance and control over financial management and to support the preparation of the 2015–16 financial statements. The findings discussed in paragraph 1.78 indicate a need for management in these entities to focus attention on:

- maintaining effective governance over third party or joint service delivery arrangements; and

- the risk management arrangements that support the effective engagement with risk in the delivery of programs.

Accounting and control of non-financial assets

1.80 Entities control a diverse range of non-financial assets on behalf of the Commonwealth, with the main asset classes being land and buildings, specialist military equipment, leasehold improvements, infrastructure, plant and equipment, inventories and internally-developed software.

1.81 The number of audit findings related to entities’ controls in this area over the last four years is presented in Figure 1.11 below.

Figure 1.11: Accounting and control of non-financial assets audit findings

1.82 The moderate and minor audit findings reported during the 2015–16 interim period related largely to the Department of Defence. As Defence is responsible for the largest proportion of non-financial assets in the General Government Sector it is positive to see the significant improvement on the previous financial year, where 17 of the 25 reported findings related to Defence. Three moderate findings reported to Defence in 2014–15 remain unresolved. Further detail regarding these findings can be found at paragraphs 3.4.19 to 3.4.26.

1.83 The remaining findings covered a range of items and entities including: the monitoring of assets under construction; appropriateness of impairment assessments; and weaknesses in stock take procedures.

Revenue, receivables and cash management

1.84 The key financial statement items related to revenue and receivables consist of Parliamentary appropriations, taxation revenue, customs and excise duties and administered levies. Other revenue is also generated by entities from the sale of goods and services and a range of other sources including interest earned from cash funds on deposit. Cash management involves the collection and receipt of public monies and the management of official bank accounts.

1.85 Figure 1.12 outlines trends in findings related to revenue, receivables and cash management identified during interim phases between 2012–13 and 2015–16.

Figure 1.12: Revenue, receivables and cash management audit findings

1.86 The small number of findings identified in this category indicates that entities typically place a proper emphasis on establishing strong controls in relation to revenue and cash management processes, and understand the potential for control weaknesses to lead to fraud or misuse of public monies. While at least one moderate audit finding has been reported each year, once identified, entities’ resolved the identified weaknesses by the conclusion of the audit. New arrangements and circumstances in each year have given rise to different control weaknesses being identified.

1.87 Further information regarding the 2015–16 moderate audit finding relating to the Department of Defence can be found in Chapter 3, paragraph 3.4.32.

Human resource financial processes

1.88 Human resources encompass the day-to-day management and administration of employee entitlements and payroll functions. Expenditure associated with employee benefits represents the largest departmental expenditure item for most entities and employee entitlement liabilities are typically the largest liability. It is therefore important for entities to establish robust controls in these areas to support complete and accurate payment and recording of transactions.

1.89 Figure 1.13 indicates entities have made a concerted effort to address the identified control weaknesses, and maintaining or strengthening existing controls relating to human resource processes over the past four years.

Figure 1.13: Human resources financial processes audit findings

1.90 The one moderate and two minor findings identified in 2015–16 related to identified weaknesses in entities’ processes relating to commencement or termination of employees and controls supporting the payment of allowances. These findings were also reported in 2014–15.

1.91 Further detail regarding the unresolved moderate audit finding, related to the Department of Immigration and Border Protection, can be found in Chapter 3, at paragraph 3.13.24.

Purchases and payables management

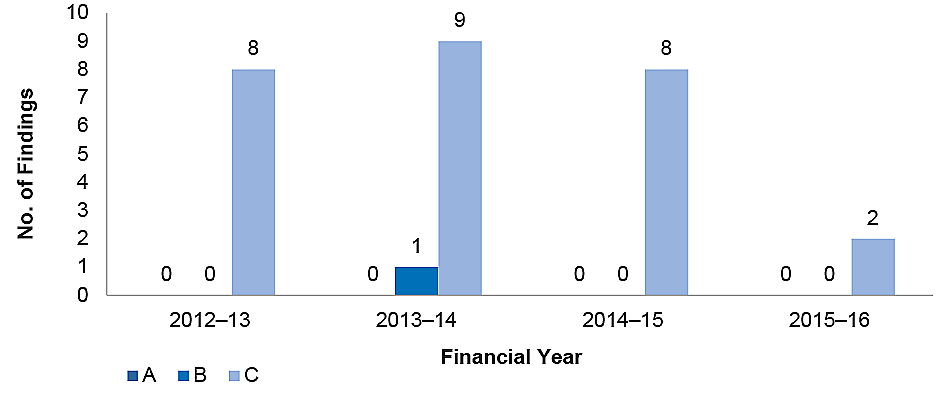

1.92 The main financial statement components of purchases and payables are payments to, or due to, suppliers including contractor and consultancy expenses, lease payments and general administrative and utility payments. These payments typically comprise the other significant departmental expenditure item of entities. The number of audit findings identified in this category over the past four financial years is presented in Figure 1.14.

Figure 1.14: Purchases and payables management audit findings

1.93 The figure above demonstrates the controls in this area for entities included in this report are typically strong, with one moderate finding and no significant audit findings identified in the past four years. The significant decrease in minor findings from 2014–15 to 2015–16 reflects positively on actions taken by entities to address identified control weaknesses, with only one finding remaining unresolved from 2014–15.

1.94 An aspect of purchases and payables management includes entities’ control and use of Commonwealth credit and payment cards. ANAO Audit Report No. 33 2015–16 Defence’s Management of Credit and Other Transaction Cards, assessed whether Defence is effectively controlling the use of Commonwealth credit cards for official purposes in accordance with legislative and policy requirements. The audit concluded that Defence does not have a complete and effective set of controls to manage the use of credit and other transaction cards.

1.95 In light of the results of Audit Report No. 33, and observations made in previous financial statements and performance audits, the ANAO has commenced a cross-entity audit, Controls Over Credit Card Use. The audit objective is to assess whether selected Australian Government Entities are effectively controlling the use of credit cards for official purposes in accordance with legislative and entity requirements. The results of this audit will inform the audit approach during planning for the 2016–17 financial statements audits.

Other control matters

1.96 Other control matters typically include items regarding general reconciliation processes, the management and implementation of service level agreements or memoranda of understanding, and matters affecting the administration of government programs, including grants. The number of audit findings identified in this category over the past four financial years is presented in Figure 1.15.

1.97 At the conclusion of the 2015–16 interim audit, one minor audit finding remains unresolved and one new minor finding was reported. The unresolved finding was previously reported as a moderate audit finding to the Department of the Prime Minister and Cabinet, and has been downgraded to a minor finding as a result of work carried out by the entity. Further detail can be found at Chapter 3, paragraph 3.16.15.

Figure 1.15: Other control matters audit findings

2. Reporting and auditing frameworks

Chapter coverage

This chapter outlines recent and future changes to the public sector reporting framework including improving the quality and timeliness of financial reporting and enhancing performance reporting. This chapter also discusses changes to the Australian auditing framework relating to the auditor’s report on financial statements.

Summary of developments

Initiatives by Australian standard setters and the Department of Finance are in place to improve the quality of entities’ financial reporting.

There are also initiatives underway to improve the timeliness of financial reporting with the Joint Committee of Public Accounts and Audit stating that bringing forward the delivery of the annual reports of Australian Government entities would be both valuable and viable.

Enhancements to performance reporting include Commonwealth entities being required to: publish a corporate plan by 31 August each reporting period; and include a performance statement in entities’ annual reports. ANAO audit coverage in this area will be a focus in future performance audit work programs. Under the current legislative framework, Parliament does not receive the same level of assurance on the quality of performance statements as it does for financial statements as audits of performance statements are not mandated.

In December 2015, the Australian Auditing and Assurance Standards Board issued a suite of new and revised standards dealing with auditor reporting. A number of revisions were made to enhance the value of auditors’ reports by providing greater transparency about the audit that was performed. The ANAO expects to amend its auditing standards to include reporting on key audit matters from 2016–17.

Introduction

2.1 The Australian Government’s financial reporting framework is based, in large part, on standards made independently by the Australian Accounting Standards Board (AASB). The framework is designed to support decision-making by, and accountability to, the Parliament.

2.2 The AASB bases its accounting standards on the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). Because IFRS are designed primarily for use by private sector and for-profit organisations, the AASB amends the IFRS to reflect significant transactions and events that are particularly prevalent in the public and not-for-profit private sectors. In doing so, it takes into account standards issued by the International Public Sector Accounting Standards Board.

2.3 The Finance Minister prescribes additional reporting requirements for Australian Government entities. These are contained in the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015. This rule is made under the PGPA Act.

2.4 The audits of the financial statements of Australian Government entities are conducted in accordance with the ANAO Auditing Standards, which are made by the Auditor-General under section 24 of the Auditor-General Act 1997. The ANAO Auditing Standards incorporate, by reference, the auditing standards made by the Australian Auditing and Assurance Standards Board (AUASB). The AUASB bases its standards on those made by the International Auditing and Assurance Standards Board (IAASB), an independent standard setting board of the International Federation of Accountants.

2.5 The financial reporting and auditing frameworks that applied in 2015–16 are illustrated in appendices 2 and 3 of this report.

Recent changes to the Australian public sector reporting framework

Transactions with related parties

2.6 AASB 124 Related Party Disclosures requires an entity to disclose transactions with its related parties. The AASB has extended the application of this standard to all not-for-profit public sector entities for reporting periods beginning on or after 1 July 2016.

2.7 From 1 July 2016, all Australian Government controlled entities will be required to identify and disclose related party transactions in the notes to the financial statements. This will include significant transactions between Ministers and their departments and between Cabinet Ministers and all Australian Government entities.

2.8 The Department of Finance is coordinating arrangements for the centralised collection of information relating to Ministers. The Department of Finance will provide this information to entities to assist in preparing the disclosures.

Improving the quality and timeliness of financial reporting

2.9 There are ongoing initiatives by both Australian and international standard setters to reduce the volume and complexity of disclosures in financial statements.

2.10 In 2014, the AASB published a staff paper12 proposing ways in which entities can remove unnecessary clutter from their financial statements. In July 2015, the AASB amended AASB 101 Presentation of Financial Statements as a result of the IASB’s project to improve disclosures. The amendments clarify that entities are only required to disclose information that is relevant to users of their financial statements. The amendments apply to reporting periods beginning on or after 1 January 2016.

2.11 In July 2015, the AASB relieved not-for-profit public sector entities from the requirement to make certain disclosures about the fair value of property plant and equipment. The AASB granted this relief because it considered that the requirement imposed challenges and costs for the public sector that would not impact the private sector to the same extent.

2.12 Australian Accounting Standards include a Reduced Disclosure Regime (RDR) option that allows for certain disclosures to be omitted from annual financial statements. As the RDR is not permitted at the whole-of-government level, the Department of Finance needs to collect information that might not be reported in entity financial statements, but is required for the whole-of-government statements. Finance has indicated its intention to enable entities to move to RDR in future reporting periods.

2.13 The ANAO supports these initiatives, to the extent that the needs of Parliament are met. Entities need to take advantage of these initiatives, if the full potential for change is to be achieved. Australian Government entities have responded positively to this challenge, but greater efforts in this area are still possible.

2.14 An important attribute of any report is its timeliness. Recently, the Joint Committee of Public Accounts and Audit stated that bringing forward the delivery of the annual reports of Australian Government entities would be both valuable and viable13. Achieving this may require, amongst other things, entity financial statements to be prepared and audited earlier than is now the case.

2.15 The Department of Finance intends to shorten the timeframes for preparing and auditing financial statements to facilitate timelier annual reporting to the Parliament. This is likely to require greater efforts by some entities to enhance existing processes for the preparation of financial statements.

2.16 In 2014–15, the ANAO reported a moderate audit finding to the Department of Finance in relation to a number of weaknesses associated with the process to prepare the CFS.14 These weaknesses related to:

- assets (including specialist military equipment) that are required to be measured at fair value being measured at cost in the CFS (refer to paragraphs 3.4.10 to 3.4.12 for further discussion of this issue);

- adjustments not identified by the Department of Finance’s quality assurance process;

- timely consideration of accounting treatments for new or changed circumstances; and

- inconsistent accounting and disclosure treatments by individual entities not being addressed at the CFS level.

2.17 The Department of Finance has commenced remediation of these weaknesses by:

- undertaking an analysis of budget measures for potential accounting issues to support their early resolution; and

- developing data collection arrangements, using a supplementary reporting pack, to gather additional information from entities required for the consolidated financial statements (CFS) in 2015–16.

2.18 These arrangements will also support adoption of the Reduced Disclosure Regime by Australian Government entities in future reporting periods discussed at paragraph 2.12 above. The ANAO will review these processes as part of the 2015–16 final audit.

2.19 Finalisation of the Department of Finance financial reporting rules and guidance by 31 December each year will also support the timely preparation and audit of financial statements.

Enhancing performance reporting

2.20 Financial reporting is only one element of reporting by not-for-profit entities. Such entities are established to deliver services, and users need reports on entities’ performance in delivering those services. While there has been a focus on public sector performance measurement and reporting for some years, further improvement in this area is required.

2.21 The PGPA Act now requires each Commonwealth entity to produce a corporate plan at least once each reporting period and provide it to the responsible Minister and the Finance Minister. The corporate plan is intended to be the primary planning document for entities. The first corporate plans were required to be published by 31 August 2015.15

2.22 Each Commonwealth entity is also required to include a performance statement in its annual report. These statements will provide an assessment of the extent to which entities have succeeded in achieving their purposes, as outlined in their corporate plans. The Department of Finance has issued guidance to entities on the preparation of performance statements. The first performance statements will be included in entity annual reports for 2015‒16.

2.23 These changes are intended to be a catalyst for improving the quality of performance information in the public sector.

2.24 The PGPA Act does not require performance statements to be audited. The Act does provide that the responsible Minister or the Finance Minister may request the audit of performance statements by the Auditor-General. The Auditor-General also has the discretion to conduct audits of performance statements under the Auditor-General Act 1997. ANAO audit coverage in this area will be a focus in future performance audit work programs. Under the current legislative framework, Parliament does not receive the same level of assurance on the quality of performance statements as it does for financial statements as audits of performance statements are not mandated.

Future changes to the public sector reporting framework

2.25 New accounting standards have been released that will significantly change accounting for financial instruments16 and leases17 in future years. These standards are not specifically written for the public sector, but the public sector will be affected by the changes.

2.26 Further changes to the financial reporting framework are expected over the next few years, as projects by Australian and international accounting standard setters lead to new accounting standards for both the public and private sectors.

2.27 Projects specific to the public sector include new accounting requirements for recognition of revenue and reporting of service performance information.

2.28 The AASB has developed proposals18 to change the way not-for-profit entities recognise income from non-commercial transactions such as grants and appropriations. Currently, entities recognise income from these transactions when they receive, or are eligible to receive, funds. Under the proposals, entities would recognise income as they fulfil their obligations, if any, to the party providing the funds. This is expected to lead, in some cases, to later recognition of income and closer matching of income with related expenses.

2.29 Under other proposals issued by the AASB19, not-for-profit entities would be required to report service performance information annually on their efficiency and effectiveness in meeting their service delivery objectives. Entities would be allowed to report this information in the same report as their financial statements, in a separate report or in a variety of different reports. The information could be reported qualitatively, quantitatively, as a narrative discussion, or in a combination of these forms. Where an entity has published information about its planned service performance, it would also report on the variance between its planned and its actual service performance.

2.30 Projects aimed primarily at the private sector, but with public sector implications, include the continuing initiative to improve the quality of disclosures in financial statements.

Changes to the Australian auditing framework

Auditor’s report on financial statements

2.31 In December 2015, the Australian Auditing and Assurance Standards Board issued a suite of new and revised standards dealing with auditor reporting.20 A number of revisions were made in the standards with the aim of increasing the transparency and value of auditor reporting. In a key change to the form of the auditor’s report, the auditor’s opinion on the financial statements will form the first section of the report, directly followed by the basis of the opinion.

2.32 The content of the auditor’s report will change to add information about the ability of the entity to continue operating and the auditor’s responsibilities, particularly those relating to auditor independence and audit procedures around the entity’s annual report. These revisions to the auditing standards will apply to financial years ending on or after 15 December 2016. The ANAO is early adopting these aspects of the revised auditor reporting standards.

2.33 The auditor reporting suite also included a new auditing standard ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report. The purpose of communicating key audit matters is to enhance the value of the auditor’s report by providing greater transparency about the audit that was performed. Communicating key audit matters provides additional information to users of financial statements to assist them in understanding those matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements. Key audit matters may relate to, for example, the highest risks of material misstatement, highly uncertain accounting estimates or significant events or transactions during the reporting period. Communicating key audit matters may also assist users to understand the entity and the areas of significant management judgment in the financial statements.

2.34 The standard applies from 15 December 2016 to audits of listed entities’ financial statements and also in circumstances where the auditor otherwise decides or is required by law to communicate key audit matters in the auditor’s report. The ANAO is considering how it might appropriately apply the principles of ASA 701 to audits of Commonwealth Entities and Commonwealth Companies. In the 2015–16 audit cycle, the ANAO is conducting a limited pilot of key audit matter reporting to assess risks and to inform developments of ANAO methodology in this area. A report on key audit matters will be presented to the accountable authorities, directors, audit committees and senior management of these entities for their information. These reports will be in addition to the published auditor’s report on the financial statements. The ANAO expects to amend its auditing standards to include reporting on key audit matters from 2016–17.

3. Results of the interim audit phase by entity

Chapter Coverage

This chapter summarises the results of the interim audits of the 2015–16 financial statements of 21 entities covered by this report. These entities comprise the portfolio departments and other entities that account for 95 per cent of the revenues and expenses of the General Government Sector and are presented in Table 3.1.

The final results of the financial statement audits of all Government entities, including those covered by this report, will be summarised in the Auditor-General’s report Audits of the Financial Statements of Australian Government Entities for the year ending 30 June 2016, expected to be tabled in December 2016.

Audit results

The ANAO identified an improvement in entities addressing previously reported findings. Eighteen significant and moderate findings were reported to the entities covered by this report at the completion of the 2015–16 interim phase compared with 22 in 2014–15.

Introduction

3.01 The ANAO’s assessment of the overall risk of material misstatement of the financial statements is based on professional judgement relating to the entity’s particular circumstances. The financial audit planning process involves joint procedures with performance audit and takes into account each entity’s environment and governance arrangements, its system of internal control, and prior year financial and performance audit findings. These planning processes inform the identification of areas of key risk that have the potential to impact on the integrity of the financial statements.

3.02 The ANAO’s interim phase of the audit focuses on the steps taken by entities to manage these risks, including their systems of internal control.

3.03 This chapter reflects portfolio arrangements existing at 30 June 201621 and outlines the following information for each of the reported entities:

- the entity’s primary role as reflected in its Portfolio Budget Statements;

- 2015–16 appropriation funding and key financial statements items;

- key areas of financial statements risk;

- ANAO’s assessment of the overall risk of material misstatement of the financial statements; and

- the status of significant and moderate audit findings at the completion of the interim audit, and the conclusion relating to audit coverage to date.

Results of financial statement audits

3.04 Table 3.1 presents a summary of new and unresolved significant and moderate findings22 at the conclusion of our 2015–16 and 2014–15 interim audits.

3.05 Details of the findings summarised below can be found in the relevant entity’s ‘Audit results’ section.

Table 3.1: Significant and moderate findings by entity

|

Entity |

Interim 2015–16 |

Final 2014–15 |

Interim 2014–15 |

|||

|

|

New findingsa |

Unresolved findingsb |

New findingsa |

Unresolved findingsb |

New findingsa |

Unresolved findingsb |

|

Department of Agriculture and Water Resources |

0 |

0 |

0 |

0 |

0 |

0 |

|

Attorney-General’s Department |

1 |

1 |

1 |

1 |

1 |

1 |

|

Department of Communications and the Arts |

0 |

0 |

0 |

0 |

0 |

0 |

|

Department of Defence |

2 |

7 |

6 |

1 |

1 |

7 |

|

Department of Veteran’s Affairs |

0 |

0 |

0 |

0 |

0 |

2 |

|

Department of Education and Training |

0 |

1 |

0 |

0 |

0 |

1 |

|

Department of Employment |

0 |

0 |

0 |

0 |

0 |

1 |

|

Department of the Environment and Energy |

0 |

0 |

0 |

0 |

0 |

0 |

|

Department of Finance |

0 |

0 |

0 |

0 |

0 |

0 |

|

Future Fund Management Agency and the Board of Guardians |

0 |

0 |

0 |

0 |

0 |

0 |

|

Department of Foreign Affairs and Trade |

0 |

0 |

0 |

0 |

0 |

1 |

|

Department of Health |

0 |

0 |

0 |

0 |

0 |

0 |

|

Department of Immigration and Border Protection |

1 |

2 |

3 |

0 |

0 |

1 |

|

Department of Industry, Innovation and Science |

0 |

0 |

0 |

0 |

0 |

0 |

|

Department of Infrastructure and Regional Development |

0 |

0 |

0 |

0 |

0 |

0 |

|

Department of Prime Minister and Cabinet |

0 |

1 |

1 |

1 |

1 |

1 |

|

Department of Social Services |

0 |

0 |

1 |

1 |

0 |

1 |

|

Department of Human Services |

0 |

1 |

1 |

0 |

0 |

1 |

|

Department of the Treasury |

0 |

0 |

0 |

0 |

1 |

0 |

|

Australian Office of Financial Management |

0 |

0 |

0 |

0 |

0 |

0 |

|

Australian Taxation Office |

1 |

0 |

0 |

0 |

0 |

1 |

|

TOTAL |

5 |

13 |

13 |

4 |

4 |

18 |

Note a: Minor findings identified previously but upgraded to a moderate or significant finding are considered new for the purposes of this table.

Note b: Findings transferred to another entity as a result of Machinery of Government changes, which remain unresolved, are treated as repeat findings for the purposes of this table.

Source: 2014–15 and 2015–16 ANAO audit correspondence.

3.1 Department of Agriculture and Water Resources

Overview

3.1.1 The Department of Agriculture and Water Resources23 (Agriculture) is responsible for developing and implementing policies and programs that: advance the prosperity of Australia's agricultural, fisheries, food and forestry industries; safeguard Australia against animal and plant pests and diseases; and improve water use efficiency and the health of rivers, communities, environmental assets and production systems.

3.1.2 Annual appropriation funding of $337.9 million (departmental) and $392 million (administered) was provided to Agriculture in 2015–16 to support the achievement of the department's outcomes.24 Agriculture was also budgeted to receive special appropriation funding of $856.5 million.25 Special appropriation funding is provided to the department largely for payments to primary industry corporations and bodies.

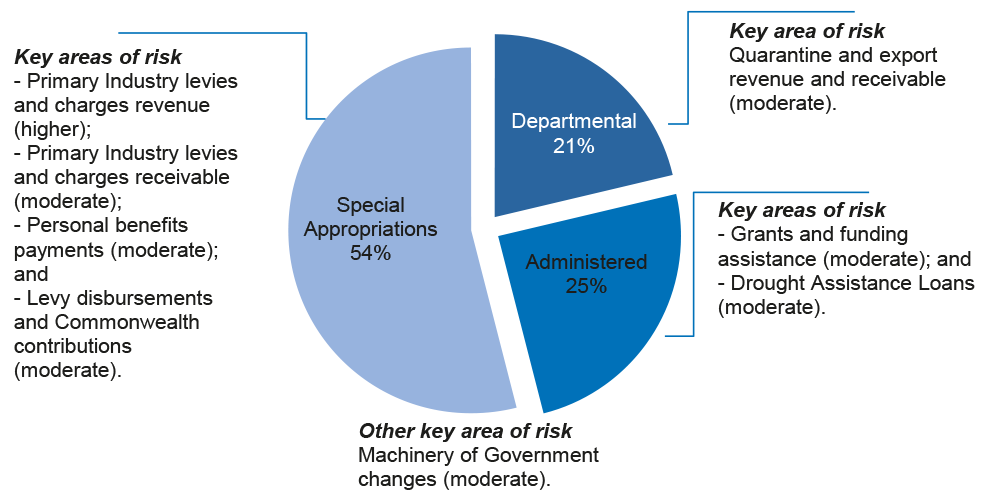

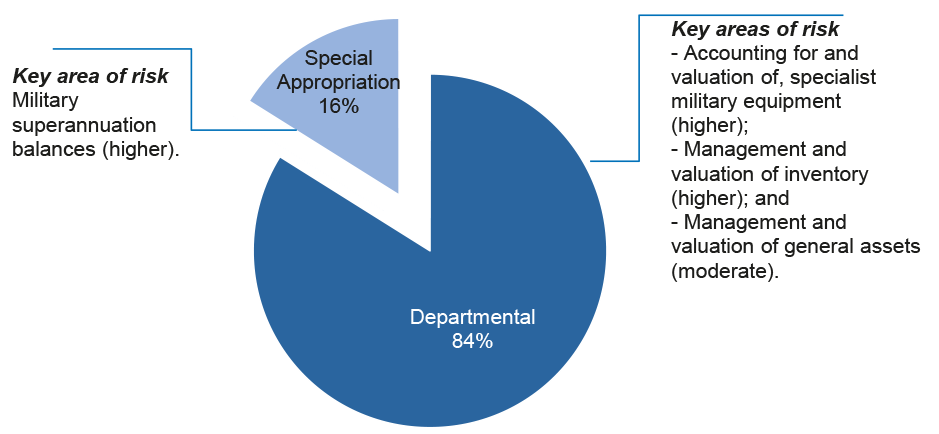

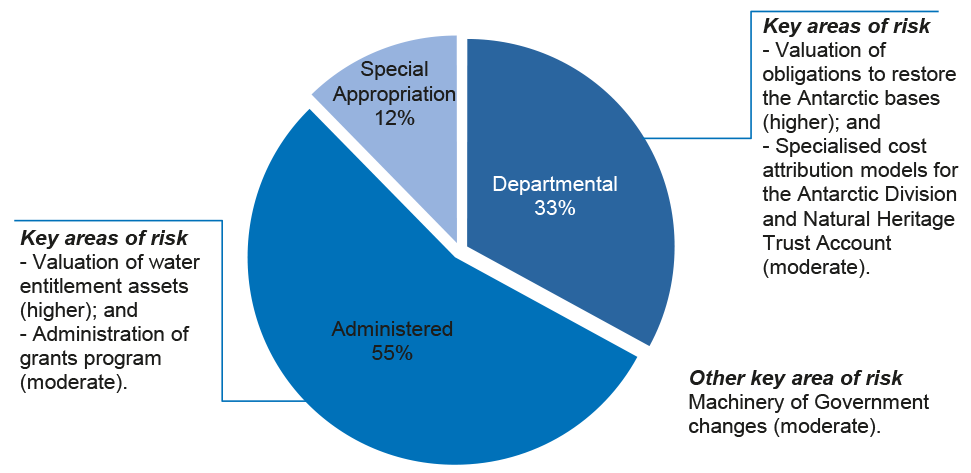

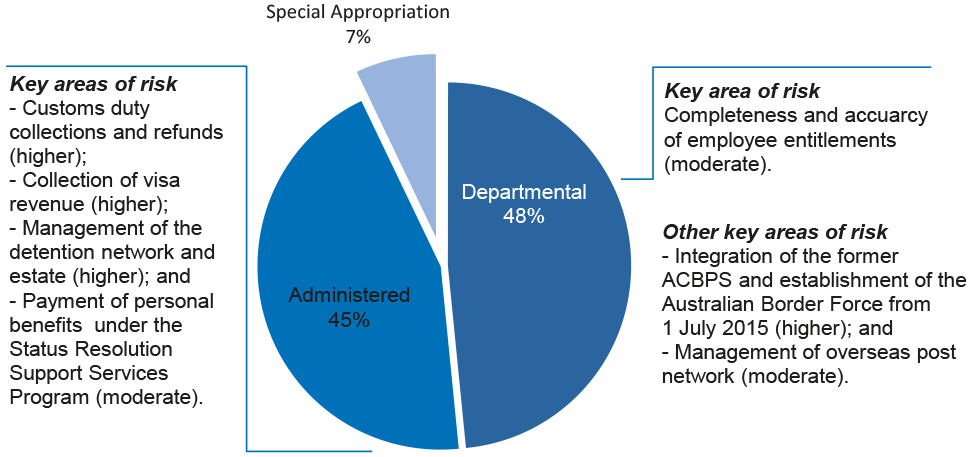

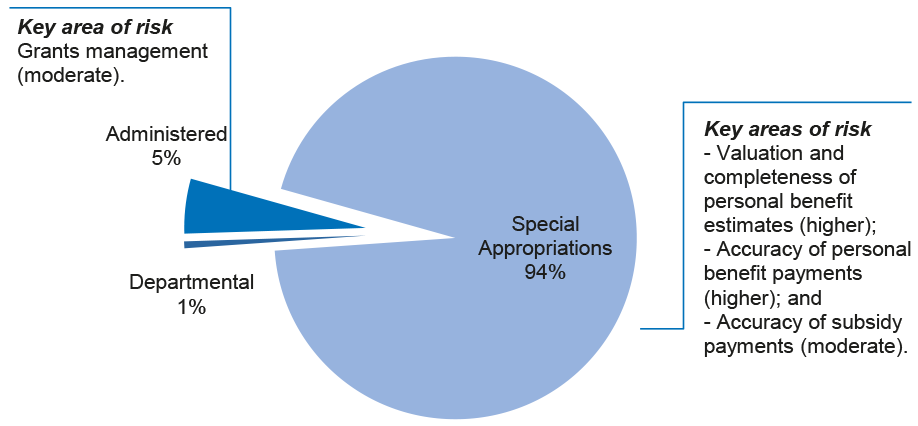

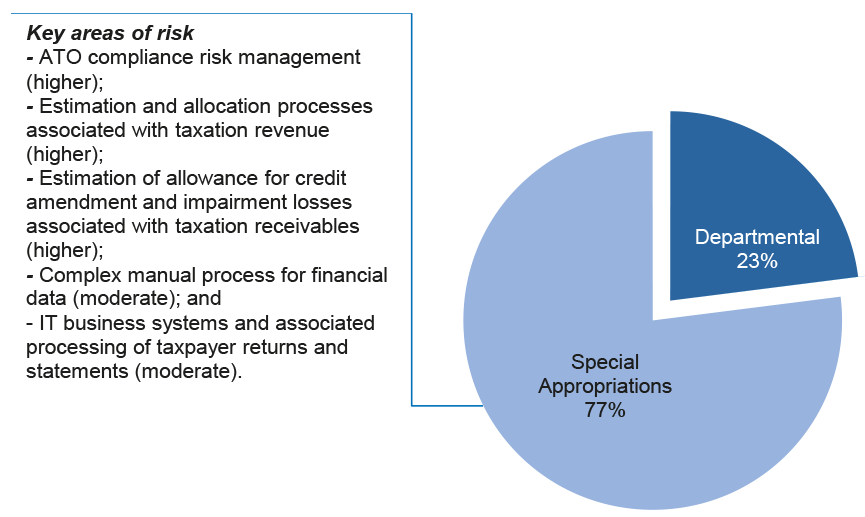

3.1.3 Figure 3.1 shows departmental, administered and special appropriation funding as a percentage of total annual funding, and the key areas of financial statements risk.

Figure 3.1: Appropriation funding and key areas of financial statements risk

3.1.4 The ANAO's audit approach identifies key areas of risk that have the potential to impact on Agriculture's financial statements. The ANAO's risk identification process considers the nature of the financial statements items and an understanding of Agriculture's environment and governance arrangements, including its financial reporting regime and system of internal control.

3.1.5 In light of the key areas of risk and the ANAO's understanding of the operations of the department, the ANAO has assessed the risk of a material misstatement as moderate.

Key financial statements items26

3.1.6 Table 3.2 and Table 3.3 provide a summary of the key 2015–16 departmental and administered estimated financial statements items.

Table 3.2: Key expenses and own-source income

|

Expenses and own-source income |

Departmental estimated actual ($m) 2015–16 |

Administered estimated actual ($m) 2015–16 |

|

Total expenses |

755.6 |

1,327.0 |

|

Employee benefits |

468.5 |

- |

|

Suppliers |

243.3 |

44.1 |

|

Grants and disbursements |

13.7 |

1,061.0 |

|

Personal benefits |

- |

79.2 |

|

Assets transferred to related entities |

- |

129.6 |

|

Other |

30.1 |

13.1 |

|

Total own-source income |

416.2 |

608.3 |

|

Sale of goods and rendering of services |

392.9 |

- |

|

Levies and taxes |

- |

514.0 |

|

Other |

23.3 |

94.3 |

|

Net cost of services |

339.4 |

718.7 |

Table 3.3: Key assets and liabilities

|

Assets and liabilities |

Departmental estimated actual ($m) 2015–16 |

Administered estimated actual ($m) 2015–16 |

|

Total Assets |

305.3 |

1 644.5 |

|

Trade and other receivables |

101.1 |

619.5 |

|

Investments |

12.0 |

339.0 |

|

Property, plant and equipment |

32.4 |

508.8 |

|

Intangibles |

99.2 |

108.0 |

|

Other |

60.6 |

69.2 |

|

Total Liabilities |

215.3 |

119.7 |

|

Employee provisions |

130.3 |

- |

|

Grants |

- |

117.9 |

|

Other |

85.0 |

1.8 |

|

Net assets |

90.0 |

1 524.8 |

Source: Agriculture's estimated average staffing level for 2015–16 is 4 250.

3.1.7 The results of recent performance audits relevant to the financial management or administration of Agriculture's operations are also considered in identifying key areas of financial statements risk.

3.1.8 Audit Report No.28 2015–16 Administration of the Concessional Loans Program was tabled on 28 April 2016 examining the effectiveness of Agriculture's establishment and administration of Farm Finance and Drought concessional loans programs. A recommendation in the report was for Agriculture to obtain appropriate assurance that all relevant funding agreement requirements have been met before related payments are released.27

3.1.9 This recommendation aligns to the key area of financial statements risk related to drought assistance loans set out in Table 3.4 of the following section.

Key areas of financial statements risk

3.1.10 The ANAO undertakes appropriate audit procedures on all material items and focusses audit effort on those areas that are assessed as having a higher risk of material misstatement of the financial statements. Areas highlighted for specific audit coverage in 2015–16 are provided in Table 3.4.

Table 3.4: Key areas of financial statements risk

|

Relevant financial statements line item |

Key area |

Audit risk rating |

Factors contributing to risk assessment |

|

Administered levies and taxes revenue |

Primary industry levies and charges revenue |

Higher |

|

|

Administered other receivables |

Primary industry levies and charges receivable |

Moderate |

|

|

Administered grants expenses |

Levy disbursements and Commonwealth contributions |

Moderate |

|

|

Departmental sale of goods and rendering of services |

Quarantine and export revenue and receivable |

Moderate |

|

|

Administered other revenue (interest revenue) Administered other receivables (repayments of advances and loans) |

Drought assistance loans |

Moderate |

|

|

Administered personal benefits expense |

Personal benefits payments |

Moderate |

|

|

Multiple items |

Machinery of Government changes, comprising water resources and associated policy transferred from the Department of the Environment |

Moderate |

|

|

Administered grants expenses |

Grants and funding assistance |

Moderate |

|

3.1.11 As an integral part of the interim audit, the ANAO also assesses the IT general and application controls for key systems that support the preparation of Agriculture's financial statements.

Audit results