Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2015

This report complements the interim phase report published in June 2015, and provides a summary of the final audit results of the audits of the Consolidated Financial Statements for the Australian Government and the financial statements of 253 Australian Government entities.

Executive summary

1. The primary purpose of financial statements is to provide relevant, reliable information to users about a reporting entity’s financial position. In the public sector, the users of financial statements include Ministers, Parliament and the community. The preparation of timely and accurate audited financial statements is also an important indicator of the effectiveness of an entity’s financial management, which fosters confidence in an entity on the part of users.

2. The Australian National Audit Office (ANAO) publishes two reports annually addressing the outcomes of the financial statement audits of Commonwealth entities, Commonwealth companies and the Consolidated Financial Statements of the Australian Government.

3. The first of these, Audit Report No.44 2014‑15 Interim Phase of the Audits of the Financial Statements of Major General Government Sector Entities for the Year Ending 30 June 2015, outlined the results of the interim audits of the 2014‑15 financial statements of major General Government Sector entities.

4. This report provides a summary of the results of the final audits of the financial statements of Australian Government entities and the Consolidated Financial Statements as at 2 December 2015. These audit results have been reported to the responsible Minister(s) and those charged with governance of each entity.

Consolidated Financial Statements

5. The Consolidated Financial Statements present the consolidated whole of government financial results inclusive of all Australian Government controlled entities, as well as the General Government Sector financial report. These statements were signed by the Minister for Finance on 30 November 2015.

6. A qualified auditor’s report on the 2014‑15 Consolidated Financial Statements was issued on 1 December 2015. The auditor’s report expressed the qualified opinion that, except for the possible effects of the non-compliance with AASB 1049 Whole of Government and General Government Sector Financial Reporting in relation to the valuation of specialist military equipment, the statements complied with Australian Accounting Standards and presented fairly the financial position of the Australian Government.

7. The Australian Government has advised that it is committed to preparing the CFS in accordance with applicable accounting standards, including recognising specialist military equipment at fair value where this can be done reliably, and intends to finalise the assessment to measure specialist military equipment at fair value in time for inclusion in the 2015–16 CFS.

Financial audit results

8. The Auditor-General and senior staff under delegation also issued auditor’s reports on 253 entities’ 2014‑15 financial statements up until 2 December 2015. All auditor’s reports, except the auditor’s report on the Consolidated Financial Statements, were unmodified.

9. A total of 271 findings were reported to entities as a result of our 2014‑15 financial statement audits. These comprised three significant, 30 moderate and 238 minor findings. Findings in the areas of information technology controls, and quality assurance frameworks for financial reporting and compliance frameworks, in particular, warrant further attention by entity management and audit committees as these represent over 60 per cent of significant and moderate audit findings, and 54 per cent of total findings.

Improving financial statement disclosure

10. There is a global push to improve the usefulness of financial reporting by making disclosures less generalised and more meaningful. One of the main ways this can be achieved is through an increased focus on applying the concept of materiality to financial statement disclosure. While this concept is long-standing, both standard setters and reporting entities are increasingly recognising the value of streamlining financial statements disclosures to provide more meaningful information.

11. Fifty per cent of material entities improved the presentation of their 2014‑15 financial statements. Commonly, this resulted in a reduction of 20 to 30 pages in the length of the statements by removing immaterial disclosures and those that were not directly relevant. The Consolidated Financial Statements and six entities made more substantive improvements, which enhanced the financial statements’ overall readability. There is scope for more entities to enhance the readability of future financial statements by building on the approaches adopted by a number of entities in 2014‑15.

12. The Department of Finance has advised that it is undertaking work with a view to implementing a Reduced Disclosure Regime under AASB 1053 Application of Tiers of Accounting Standards from 2015–16. The ANAO supports initiatives that reduce the compliance workload of Australian Government entities and make financial statements easier to read, while preserving sufficient disclosures to satisfy the needs of the Parliament.

AASB 1055 Budgetary Reporting

13. AASB 1055 Budgetary Reporting was introduced in 2014‑15 and required relevant entities’ financial statements to include details of the original budget presented to the Parliament and an explanation of major variances between actual results and the corresponding budget amounts.1

14. The quality of note disclosures varied considerably, with over 70 per cent requiring amendment as a result of review by the ANAO and/or the entity’s audit committee. It is recognised that the implementation of new reporting requirements can often take some time to bed down, and the ANAO worked closely with entities to ensure note disclosures in the signed financial statements met the requirements of AASB 1055. The ANAO considers an improvement in note disclosures in many entities’ 2015–16 financial statements is required.

Financial sustainability

15. An analysis of the factors that influence an entity’s financial sustainability can provide an indication of financial management issues or point to an increased risk that entities may require additional government funding. Our analysis concluded that the financial sustainability of the majority of entities was not at risk. Nevertheless, there would be benefit in government developing performance targets or benchmarks. This would enable entities to assess their own financial sustainability against agreed parameters over time, and against like entities.

Developments in financial reporting and auditing frameworks

16. The main change affecting entities’ 2014‑15 financial statements was the introduction of AASB 1055 Budgetary Reporting referred to earlier.

17. A major change to the auditing framework is the proposal to improve auditor reporting through the introduction of ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report. This standard is expected to apply for reporting periods ending on or after 15 December 2016.

18. Although this standard will apply to audits of the financial statements of listed entities, the ANAO will undertake a trial of reporting key audit matters in 2015–16 involving a number of large Commonwealth entities. Auditor’s reports that include key audit matters prepared as part of the trial will be in addition to the standard auditor’s report on the financial statements. These reports will not be published, however they will be presented to the Accountable Authority for their information.

The year ahead

19. During 2015–16, the ANAO will continue to engage with entities and audit committees on a range of matters including:

- compliance with requirements of the Public Governance, Performance and Accountability framework and AASB 1055 Budgetary Reporting;

- risks associated with findings reported in 2014‑15;

- the trial, in a number of large Commonwealth entities, of reporting key audit matters to Accountable Authorities; and

- opportunities for further improving the presentation of financial statements.

Cost of this Report

20. The cost to the ANAO of producing this report is approximately $440 000.

1. The Consolidated Financial Statements

Chapter coverage

This chapter outlines the results of the audit of the Consolidated Financial Statements of the Australian Government, which includes the Whole of Government and the General Government Sector financial statements for the year ended 30 June 2015, and the Australian Government’s financial outcome for 2014‑15.

Audit Results

The Consolidated Financial Statements were signed by the Minister for Finance on 30 November 2015 and a qualified auditor’s report was issued on 1 December 2015. The auditor’s report expressed the qualified opinion that, except for the possible effects of the non-compliance with AASB 1049 Whole of Government and General Government Sector Financial Reporting in relation to the valuation of specialist military equipment, the statements complied with Australian Accounting Standards and presented fairly the financial operations and position of the Australian Government.

The Australian Government has advised that it is committed to preparing the CFS in accordance with applicable accounting standards, including recognising specialist military equipment at fair value where this can be done reliably, and intends to finalise the assessment to measure specialist military equipment at fair value in time for inclusion in the 2015–16 CFS.

In 2014‑15, the ANAO reported a moderate audit finding in relation to a number of weaknesses associated with the financial statements preparation process.

Background

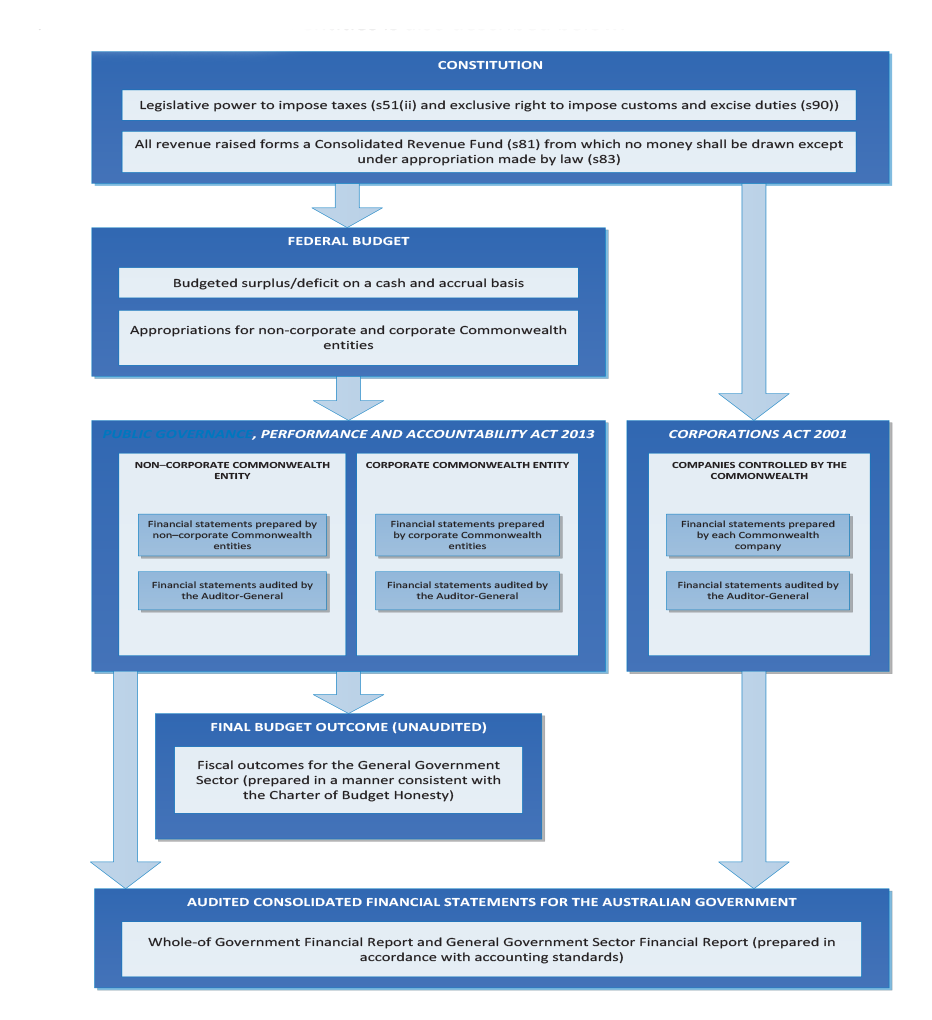

1.1 Government accountability and transparency is supported by the preparation and audit of the Australian Government’s Consolidated Financial Statements (CFS). The CFS and the associated financial analysis provide information to assist users in assessing the annual financial performance and position of the Australian Government.

1.2 The CFS are one source of information on the Government’s financial performance and position. Other information sources include the Budget and Budget updates presented to Parliament2, the Final Budget Outcome3 and Intergenerational reports4. These various sources provide information on a range of policy and financial matters, including the medium-term and intergenerational effect of decisions.

1.3 The CFS present the consolidated whole of government financial results inclusive of all Australian Government controlled entities, as well as the General Government Sector (GGS) financial statements5. The 2014‑15 CFS are prepared in accordance with section 48 of the Public Governance, Performance and Accountability Act 2013 and the requirements of the Australian Accounting Standards, including AASB 1049 Whole of Government and General Government Sector Financial Reporting (AASB 1049). The CFS operating statement and balance sheet are prepared on an accrual basis6, with the cash flow statement prepared on a cash basis.

1.4 The Australian Government supported the introduction of AASB 1049 to achieve the objective of closer harmonisation of the statistical and accounting standards for the reporting of budget and financial statement information. As a result, comprehensive and consistent financial information is presented in both the Budget Papers and the CFS. AASB 1049, by incorporating elements of the conceptual and accounting framework on which the Australian Bureau of Statistics’ Government Finance Statistics (GFS) is based, provides a single framework for financial reporting by governments in Australia. In preparing the CFS, the principles and rules in the GFS Manual are to be applied where compliance with GFS Manual would not conflict with Australian Accounting Standards. Where the Standards provide a choice, the principles or rules in the GFS Manual are to be applied.

Audit Results

Qualified auditor’s report

1.5 The CFS were signed by the Minister for Finance on 30 November 2015 and a qualified auditor’s report was issued on 1 December 2015. The auditor’s report expressed the qualified opinion that, except for the possible effects of the non-compliance with AASB 1049 in relation to the valuation of specialist military equipment, the statements complied with Australian Accounting Standards and presented fairly the financial operations and position of the Australian Government.

1.6 Specialist military equipment, which includes Defence Weapons Platforms (DWPs7), is recorded in the 30 June 2015 Balance Sheets of the Australian Government and of the GGS at cost of $42 652 million (30 June 2014: $41 243 million), net of accumulated depreciation and accumulated impairment losses (the carrying amount).

1.7 At the time of the initial application of AASB 1049 in 2008–09, DWPs were measured in the CFS at cost, as the GFS Manual did not require them to be measured at fair value. In April 2011, the Australian Bureau of Statistics amended the GFS Manual to require DWPs, a component of specialist military equipment, to be measured at fair value consistent with other property, plant and equipment. As a result, DWPs were required to be reported in the CFS at fair value from 2012–13.

1.8 In 2012–13, in response to a request from the Australian Government, the Australian Accounting Standards Board provided the Australian Government transitional relief to not measure and report DWPs at fair value until 2014‑15.

1.9 In early 2015, the Australian Government sought a review of AASB 1049 in relation to the measurement of DWPs, or an extension of the transitional relief provisions previously provided by the Australian Accounting Standards Board. The Board decided in April 2015 that, commencing from 2014‑15, DWPs were to be to be reported at fair value, if fair value can be reliably measured, in accordance with the requirements of AASB 1049.

1.10 The Australian Government, through the Departments of Finance and Defence, has not completed its work to establish reliable measurements of the fair value of specialist military equipment, including DWPs, in time for the 2014‑15 CFS. Consequently specialist military equipment continues to be reported at the cost basis of measurement.

1.11 As a result, the Auditor-General was unable to obtain sufficient appropriate audit evidence over whether a material difference exists between the carrying amount and the fair value of specialist military equipment at 30 June 2015. This is a limitation on the scope of the audit. The auditor’s report noted it is possible that the difference between the carrying amount and the fair value is material at 30 June 2015 to specialist military equipment and the depreciation expense balances, and the associated notes.

1.12 The Australian Government has advised that it is committed to preparing the CFS in accordance with applicable accounting standards, including recognising specialist military equipment at fair value where this can be done reliably. Therefore, the Australian Government intends to finalise the assessment to measure specialist military equipment at fair value in time for inclusion in the 2015–16 CFS.

New audit finding

CFS preparation process

1.13 An important aspect of the financial statements preparation process is the implementation of a quality control and assurance regime that is designed to provide assurance about the accuracy and completeness of the statements, and that they comply with all relevant legislative and policy requirements.

1.14 Consistent with previous years, the preparation of the annual CFS is a significant project. This is due to several factors including:

- the manual nature of the consolidation process;

- the high level of dependency on entities to identify and advise material accounting and auditing issues;

- different accounting policies being applied between entities that need to be adjusted for in the CFS; and

- a large volume of complex and material inter-entity elimination journals.

1.15 In 2014‑15, the ANAO reported a moderate audit finding in relation to a number of weaknesses associated with the process to prepare the CFS.8 These weaknesses resulted in the identification of a large number and dollar value of adjustments through the 2014‑15 audit process.

1.16 Issues identified included:

- assets (including specialist military equipment) that are required to be measured at fair value being measured at cost in the CFS;

- adjustments not identified by the Department of Finance’s quality assurance processes;

- timely consideration of accounting treatments for new or changed circumstances; and

- inconsistent accounting and disclosure treatments by individual entities not being addressed at the CFS level.

1.17 The Department of Finance response is that ‘the CFS consolidation process and quality assurance processes are largely unchanged from those applied and audited in previous years. Finance notes that the ANAO’s expectations around the consolidation process and the nature of Whole of Government consolidation are emerging. Finance will work with the ANAO on planning for next year’s CFS to identify these expectations’.

Australian Government’s financial outcome for 2014‑15

1.18 The reported 2014‑15 operating result9 attributable to the Australian Government was a deficit of $29.0 billion (2013‑14: deficit of $43.1 billion) and a comprehensive result - total change in net worth of negative $44.6 billion (2013‑14: negative $54.6 billion). The fiscal balance10 was a deficit of $46.5 billion (2013‑14: deficit of $42.3 billion) and the reported negative net worth11 position was $309.0 billion (2013‑14: negative $264.7 billion). These outcomes reflect the financial effect of government policies and the economic environment for the year ended 30 June 2015 and the associated movement in assets and liabilities as at the financial year end. These outcomes do not reflect the possible material difference between the reported balances and the fair value of specialist military equipment and the associated depreciation expense balance at 30 June 2015 that resulted in a qualified auditor’s report as discussed at paragraphs 1.5 to 1.12.

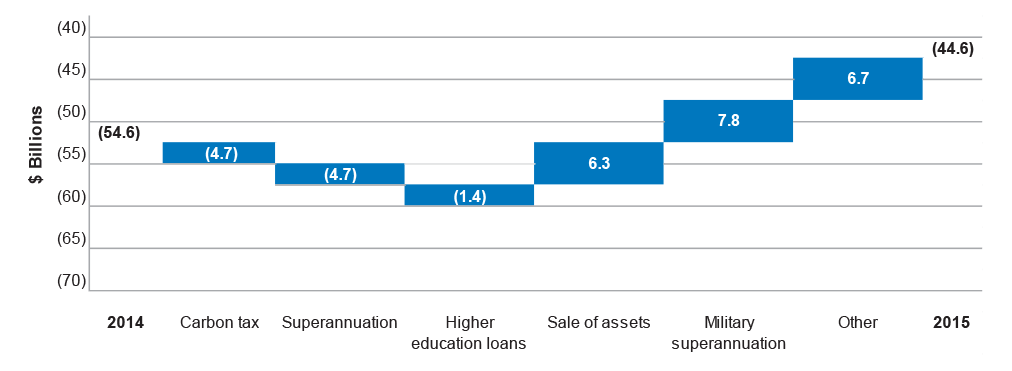

1.19 The analysis of movements from 2013‑14 to 2014‑15 of particular items presented in Figure 1 largely reflects one-off or unusual events that have impacted the 30 June 2015 Australian Government’s comprehensive result – total changes in net worth.

Figure 1.1: CFS comprehensive result – total changes in net worth

1.20 The following commentary explains the main contributors to the change in the CFS Comprehensive result – total change in net worth.

- Carbon tax: In 2014‑15, the carbon tax was repealed resulting in a decrease in carbon tax revenue.

- Superannuation: The movement in the superannuation liability between years is reflected as a gain or a loss in the Australian Government’s operating statement. In 2014‑15, the following factors had the main impact:

- the triennial review in 2014‑15 of the underlying assumptions used to calculate the schemes liabilities. This resulted in changes to the salary growth rate offset by changes in other assumptions, including an increase in the take up of superannuation pensions and the estimated life expectancy of scheme participants; and

- a decrease in the government bond rate from 30 June 2014 to 30 June 2015.

- Higher education loans: This movement is mainly attributable to an increase in the amounts written-off due to the assessment of the recoverability of the loans relating to the Higher Education Loans Programme.

- Sale of assets: The sale of Medibank Private Limited and the recognition of revenue relating to the auction of digital spectrum licences by the Australian Communications and Media Authority in 2014‑15.

- Military superannuation: A one-off adjustment to the indexation arrangements for military superannuation resulted in a loss being recognised in 2013‑14. This did not occur in 2014‑15.

- Other: A range of other factors contributed to the overall increase of $10.0 billion in the Australian Government’s comprehensive result. These included an increase in:

- taxation revenue year-on-year of $11.4 billion (excluding the impact of the decrease in carbon tax revenue referred to above). This was partially offset by an increase in grants to State and Territory governments and non-profit institutions of $9.2 billion; and

- net foreign exchange gains of $4.1 billion largely relating to an increase in the value of foreign currency held by the Reserve Bank of Australia of $6.0 billion. This was partially offset by $2.1 billion foreign exchange losses relating to the Future Fund investment portfolio.

1.21 The following figures show the net financial liabilities of the Australian Government’s General Government Sector as a percentage of gross domestic product relative to some other OECD12 countries, and the Australian Government’s negative net worth and total assets and liabilities.13

Figure 1.2: General Government net financial liabilities14 as a percentage of gross domestic product15

Source: OECD Economic Outlook 95 database at http://www.oecd.org/statistics/. General government accounts are consolidated central, state and local government accounts, social security funds and non-market non-profit institutions controlled and mainly financed by government units.

Figure 1.3: Australian Government’s net worth

Source: Consolidated Financial Statements from 2009–10 to 2014‑15. Figure 1.3 does not reflect the possible material difference between the reported balances and the fair value of specialist military equipment and the associated depreciation expense balance at 30 June 2015 that resulted in a qualified auditor’s report as discussed at paragraphs 1.5 to 1.12.

Figure 1.4: Australian Government’s total assets and total liabilities

Source: Consolidated Financial Statements from 2009–10 to 2014‑15. Figure 1.4 does not reflect the possible material difference between the reported balances and the fair value of specialist military equipment and the associated depreciation expense balance at 30 June 2015 that resulted in a qualified auditor’s report as discussed at paragraph 1.5 to 1.12.

Improving the presentation of the CFS

1.22 The primary purpose of financial statements is to provide relevant and reliable information to users about a reporting entity’s financial position. In line with the global push to improve the usefulness of financial reporting by making the disclosures less generalised and more meaningful, the Department of Finance reviewed the structure and presentation of the CFS. A general discussion on improving the presentation of financial statements is at paragraphs 2.35 to 2.44 of this report.

Actual and potential breaches of the Constitution

1.23 Section 83 of the Constitution provides that no money should be drawn from the Treasury of the Commonwealth except under an appropriation made by law and requires that all spending by the Executive Government from the Consolidated Revenue Fund must be in accordance with an authority given by the Parliament.

1.24 Note 1.12 to the CFS provides information on the Australian Government entities continuing to review their level of compliance with section 83 of the Constitution across all legislation for which they have legislative responsibility.

1.25 In 2014‑15, the ANAO changed its reporting policy in regard to actual and potential breaches of section 83. As a result, the auditor’s report on the CFS did not include a report on other legal and regulatory requirements in respect of these matters. This matter is further discussed at paragraphs 2.57 to 2.63 in chapter 2 of this report.

2. Financial audit results

Chapter coverage

This Chapter provides:

- a summary of audit findings;

- an analysis of the timeliness of financial reporting; and

- an assessment of entities implementation of AASB 1055 Budgetary Reporting, a discussion on improving the presentation of financial statements; and commentary on legislative compliance matters.

Audit results

The ANAO issued one modified and 253 unmodified auditor’s reports as at 2 December 2015 and reported three significant, 30 moderate and 238 minor audit findings.

The main weaknesses identified were in the Information Technology control environment (86 findings), and in compliance and quality assurance frameworks (60 findings).

Weaknesses were also identified in: revenue, receivables and cash management (33 findings); accounting and control of non-financial assets (36 findings); and human resource financial processes (31 findings).

There was a general improvement in financial statement preparation by entities. This is reflected in a reduction of the number of moderate audit findings relating to this area reported in 2014‑15.

Eighty-two per cent of material entities and 85 per cent of non-material entities met the audit clearance timetable set by the Department of Finance, an improvement compared with 2013‑14.

Consistent with the last three years, the auditor’s reports of 76 per cent of entities’ 2014‑15 financial statements were signed within three months of the end of the financial year.

More than 50 per cent of entities made good progress in improving the presentation of their 2014‑15 financial statements. The proposed introduction of a Reduced Disclosure Regime from 2015–16 will further assist improving the presentation of entities’ financial statements.

The quality of AASB 1055 note disclosures presented for audit varied considerably, with 11 per cent requiring substantial amendment and over 60 per cent requiring some amendment following review by the ANAO and/or the entity’s audit committee.

Audit approach

2.1 The Auditor-General Act 1997 establishes the mandate for the Auditor-General to undertake the financial statement audits of all Commonwealth entities, Commonwealth companies and the Consolidated Financial Statements of the Australian Government.16

2.2 Each year the Auditor-General is required to report to the relevant Minister on the financial statements of Australian Government entities.17 The ANAO conducts its financial statement audits in accordance with ANAO Auditing Standards, which incorporate the Australian Auditing Standards.18

2.3 The ANAO’s Audit Report No.44 2014‑15 reported the interim results of the 2014‑15 audits of major General Government Sector entities. The final results of the 2014‑15 audits of the Consolidated Financial Statements and 253 Australian Government entities are presented in this report.19

Audit findings

2.4 The ANAO rates audit findings according to the potential business risk or financial risk posed to the entity. The rating scale is presented in Table 2.1.

Table 2.1: Findings rating scale

|

Rating |

Description |

|

A (Significant) |

Issues that pose a significant business or financial management risk to the entity; these include issues that could result in a material misstatement of the entity’s financial statements. |

|

B (Moderate) |

Issues that pose a moderate business or financial management risk to the entity; these may include prior year issues that have not been satisfactorily addressed. |

|

C (Minor) |

Issues that pose a low business or financial management risk to the entity; these may include accounting issues that, if not addressed could pose a moderate risk in the future. |

|

L1 (Significant legislative finding) |

Instances of significant potential or actual breaches of the Constitution; and instances of non-compliance with the entity’s enabling legislation, legislation that the entity is responsible for administering, and the PGPA Act. |

Source: ANAO reporting policy.

2.5 A summary of significant, moderate and minor audit findings for the period ended 30 June 2015 by findings category is presented in Table 2.2.20

2.6 Although the majority of findings are rated as minor, the findings point to the need for entities to continue to maintain, and in some cases strengthen, their controls environments. This includes being alert to changes in risks and business requirements.

Table 2.2: Significant, moderate and minor findings by category

|

|

Audit findings |

|

||

|

Category |

Significant |

Moderate |

Minor |

Main areas of weakness |

|

Information Technology control environment |

– |

5 |

81 |

|

|

Compliance and quality assurance frameworks supporting financial reporting |

2 |

13 |

45 |

|

|

Revenue, receivables and cash management |

– |

3 |

30 |

|

|

Accounting and control of non-financial assets |

1 |

3 |

32 |

|

|

Human resource financial processes |

– |

1 |

30 |

|

|

Purchases and payables management |

– |

1 |

15 |

|

|

Other |

– |

4 |

5 |

|

|

TOTAL |

3 |

30 |

238 |

271 |

Source: ANAO analysis of audit findings.

2.7 An analysis of these findings in the categories that had the large majority of findings is presented below:

- Information Technology control environment;

- compliance and quality assurance frameworks;

- revenue, receivables and cash management;

- accounting and control of non-financial assets; and

- human resource financial processes.

Information Technology control environment

2.8 The Australian Government has reported that total government IT expenditure in recent years has been between $5 billion and $6 billion per annum.

2.9 The business processes that support financial statement preparation and reporting require the support of IT systems. As a result, an assessment of IT controls is a core component of the assessment of an entity’s control environment, and the financial statement audit process. The ANAO assesses both IT general controls and application controls for significant financial systems.

2.10 Table 2.3 outlines the elements of the IT control environment assessed by the ANAO as part of the 2014‑15 financial statement audits.21

Table 2.3: Main elements of the IT control environment

|

Control Area |

Control Element |

|

General IT controls a |

IT security management |

|

IT change management |

|

|

Application controls b |

Financial management information systems |

|

Human resource management information system |

|

|

Relevant business information systems |

Note a: IT general controls are entity-wide structures, policies, procedures, and standards applied to information systems that support accounting and business processes. Effective operation of these controls helps make sure IT application controls work as intended throughout the financial year.

Note b: IT application controls operate at the accounting and business process level, consisting of access, configuration, and reporting controls. Reliance on the effective operation of these controls provides a means to confirm the accuracy and integrity of entities’ financial statements, particularly high transaction volume accounts. Audit coverage of these controls may be undertaken on a rotation basis.

Source: ANAO compilation.

2.11 Findings in relation to entities’ IT control environments represent 32 per cent of all findings. Weaknesses related to:

- security management, particularly management of privileged and other user access;

- maintaining and updating IT policy documentation and change management processes; and

- non-compliance with the requirements of the Protective Security Policy Framework and the Australian Government Information Security Manual.

Compliance and quality assurance frameworks

2.12 Findings in relation to compliance and quality assurance frameworks represent 22 per cent of all findings.

Compliance frameworks in revenue and expenditure programs

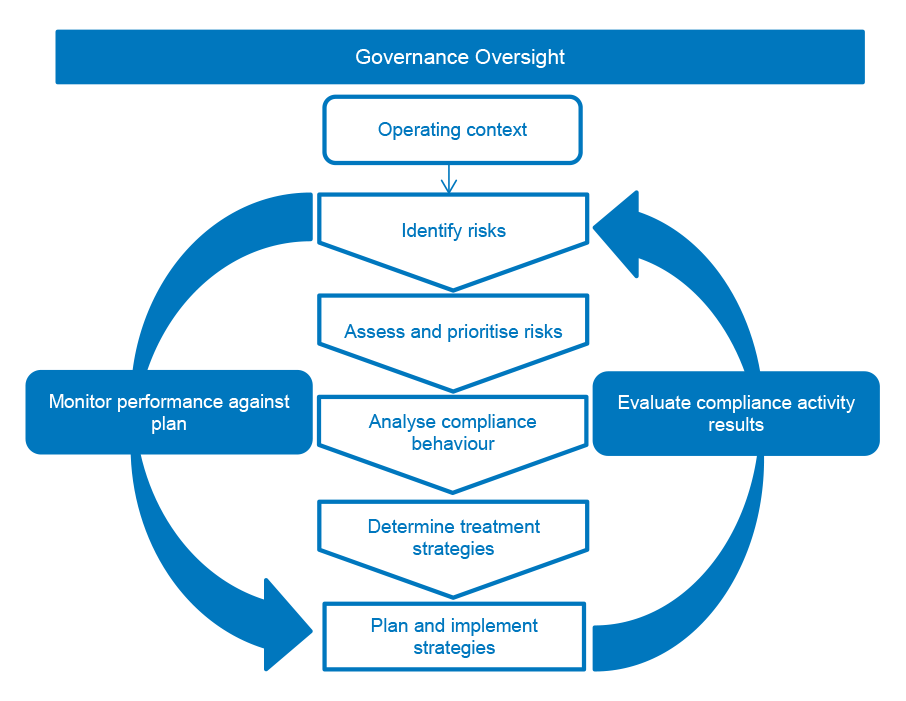

2.13 Compliance risk management is a planned process for the systematic identification, assessment, ranking and treatment of compliance risks relevant to items of revenue (such as tax and duty revenues) and expenditure (such as personal benefit payments) that rely on the self-assessment of obligations or entitlements. Compliance risk management is an iterative process that consists of clear activities to support decision-making. Figure 2.1 provides an example of a compliance risk management process model.

Figure 2.1: Compliance risk management process model

Source: Adapted from Organisation for Economic Co-Operation and Development Guidance Note Compliance Risk Management: Managing and Improving Tax Compliance October 2014.

2.14 The results of the 2014‑15 audits identified weaknesses in:

- documentation supporting evidence of governance oversight and risk assessments; evaluation of results and subsequent adjustments to compliance activity; and, where applicable, consistent application of sampling approaches across all offices/locations; and

- timely implementation of an appropriate compliance framework following a transfer of functions under Machinery of Government changes and/or risk profiles.

Quality control and assurance processes supporting financial reporting

2.15 An important aspect of the financial statements preparation process is the implementation of a quality control and assurance regime that is designed to provide assurance about the accuracy and completeness of the statements, and that they comply with all relevant legislative and policy requirements.

2.16 Improvements were required in the following areas in a number of entities:

- balances subject to estimation and judgement;

- information obtained from external sources and/or business areas;

- the compilation of commitments information; and

- the overall presentation and disclosures in financial statements.

2.17 All entities have an ongoing responsibility to prepare accurate and timely financial statements as a key element of their financial management and accountability obligations.

Revenue, receivables and cash management

2.18 The main components of entities’ revenue and receivables consist of Parliamentary appropriations, taxation revenue, customs and excise duties and administered levies. Other revenue is also generated by entities from the sale of goods and services and a range of other sources including interest earned from cash funds on deposit. Cash management involves the collection and receipt of public monies and the management of official bank accounts.

2.19 In 2014‑15, the Consolidated Financial Statements reported total taxation revenues of $354.9 billion, and non-taxation revenues22 of $33.3 billion and reported cash holdings totalling $4.8 billion.

2.20 Findings related to entities’ revenue, receivables and cash management processes represent 12 per cent of all findings. Weaknesses were identified in the timeliness and completeness of reconciliations, the maintenance of relevant policy documentation, and debt management processes.

Accounting and controls of non-financial assets

2.21 The accounting and control of non-financial assets represents an important aspect of financial management responsibilities and entities control a diverse range of non-financial assets on behalf of the Commonwealth. In 2014‑15, the Consolidated Financial Statements reported total non-financial assets of some $146.0 billion.

2.22 Findings relating to accounting and controls of non-financial assets represent 13 per cent of all findings. Weaknesses were identified in the valuation of assets, timely capitalisation of assets, the maintenance of complete and accurate fixed asset registers, and the appropriateness of impairment assessments.

Human resource financial processes

2.23 The main components of employee expenses consist of salary and wages, leave and other entitlements, employer superannuation contributions, separation and redundancy payments and workers compensation expenses. In 2014‑15, the Consolidated Financial Statements reported $45.4 billion in employee benefits expenses.

2.24 Findings in relation to entities’ human resource financial processes represent 12 per cent of all findings. Weaknesses were identified in: the review processes over payroll information, leave requests and final entitlement calculations; and the adequacy of employee documentation retained in files.

Summary of auditor’s reports issued

2.25 The Auditor-General and his delegates report on the 2014‑15 financial statements of 254 Australian Government reporting entities.

2.26 Table 2.4 is a comparison of the number and type of auditor’s reports issued by the ANAO in 2014‑15 and 2013‑14. Appendix 4 explains in more detail the financial reporting frameworks applicable in the Australian Government and the form and content of auditor’s reports.

Table 2.4: Summary of auditors’ reports issued and outstanding

|

Financial Statement Auditor’s Reportsa |

2014‑15 |

2013‑14 |

|

Unmodified auditor’s reports |

253 |

252 |

|

- Includes emphasis of matter b |

12 |

8 |

|

- Includes other legal and regulatory requirements |

0 |

15 |

|

Modified auditor’s reports c |

1 |

0 |

|

Total issued |

254 |

252 |

|

Auditor’s reports outstanding |

2 |

7 |

|

Total number of audits |

256 |

259 |

Note a: As at 2 December.

Note b: Details are provided in appendix 3.

Note c: Includes the auditor’s report on the Consolidated Financial Statements.

Source: 2013‑14 and 2014‑15 ANAO auditor’s reports.

Quality and timeliness of financial reporting

2.27 There was a general improvement in financial statement preparation by entities. In particular, the financial statement preparation processes of entities affected by Machinery of Government changes improved in 2014‑15. This is reflected in entities meeting audit clearance deadlines (refer to analysis below) and a reduction of the number of moderate audit findings.

2.28 The timely preparation and publication of annual audited financial statements is a key means by which entities meet their financial accountability and legislative obligations.

2.29 Each year, material entities are required to submit audit cleared financial information to the Department of Finance by 15 August. For non-material entities, the date is 31 August. These deadlines are set to assist the Australian Government to prepare the Final Budget Outcome by 30 September and the Consolidated Financial Statements by 30 November each year.

2.30 Figure 2.2 presents an analysis of the percentage of entities that met the deadlines for submitting audit cleared financial information to the Department of Finance. The percentage of material and non-material entities that met these deadlines has shown a small improvement since 2011–12.

Figure 2.2 Material and non-material entity audit clearance

Note a: This analysis excludes subsidiary entities, which are included in the Consolidated Financial Statements through the parent entity. Non-material entities where the ANAO and the Department of Finance agreed a later clearance date have also been excluded.

Source: ANAO analysis of audit clearance dates.

2.31 An analysis of the timeframes in which auditor’s reports on entities’ financial statements were signed is presented in Figure 2.3.

Figure 2.3: Timeframes for signing auditors’ reportsa

Note a: Includes all auditors’ reports issued by 2 December and excludes auditors’ reports on financial statements that do not have a reporting period ending 30 June.

Source: ANAO analysis of the timeframes in which auditors’ reports were issued.

2.32 Consistent with previous years, the audits of 76 per cent of entities’ financial statements were completed within three months of the end of the financial year. This continues to reflect positively on the priority given by entities in meeting their financial reporting responsibilities, and on the financial stewardship of the public sector generally.

2.33 Commonwealth entities are required to provide their annual reports to the responsible Minister by the 15th day of the fourth month after the end of the reporting period for the entity. For 95 per cent of entities, this is 15 October. Annual reports are required to include a copy of the signed financial statements and the auditor’s report. As at 15 October 2015, 94 per cent of those entities had signed financial statements accompanied by an auditor’s report.

2.34 The ANAO works closely with entities to enable the timely completion of financial statements audits. Ninety-nine per cent of 2014‑15 auditors’ reports were issued within two business days of the signed financial statements, which is consistent with the previous four years.

Improving the presentation of financial statements

2.35 The primary purpose of financial statements is to provide relevant and reliable information to users about a reporting entity’s financial position. Financial statements preparation is often a complex task, involving compliance with a large number of requirements reflected in Australian Accounting Standards23 and the Financial Reporting Rules.

2.36 There is a global push to improve the usefulness of financial reporting by making disclosures less generalised and more meaningful. One of the main ways this can be achieved is through an increased focus on applying the concept of materiality to financial statements disclosure. While this concept is long-standing, both standard setters and reporting entities are increasingly recognising the need to streamline financial statements disclosures wherever possible.24

2.37 In March 2015, the ANAO published the Public Sector Financial Statements Better Practice Guide. This guide includes a discussion about the approaches that entities could take in improving the presentation of their financial statements. It also provides a number of examples to illustrate how these approaches can be applied in practice.25

2.38 During 2014‑15 the ANAO engaged with entity management and their audit committees to assist in identifying opportunities to improve the presentation of entities’ 2014‑15 financial statements.

2.39 Thirty four (50 per cent) material entities improved the presentation of their 2014‑15 financial statements. Commonly, this resulted in a reduction of 20 to 30 pages in the length of the statements. While the length of the financial statements is not the primary indicator of their readability, the approaches adopted to achieve this outcome improved the general readability of the statements. The approaches adopted included:

- eliminating information from the Accounting Policy note (Note 1);

- removing immaterial amounts and other information not directly relevant to the entity from the notes;

- adopting a ‘say it once, say it right’ approach by, for example, removing duplication and placing information in the primary statements rather than the notes; and/or

- an assessment of the financial statements against mandatory reporting requirements.

2.40 Feedback from entities suggested that the investment in these approaches was not significant in the context of the total cost of producing the financial statements.

2.41 Six entities and the Consolidated Financial Statements also took the opportunity to make more substantive improvements to their 2014‑15 financial statements. The entities were: the Australian Federal Police; the Australian Postal Corporation; and the Departments of Agriculture, Health, Human Services, and the Prime Minister and Cabinet. These entities decided early in the financial statement planning phase that they would make a more substantive investment in reviewing the way their financial statements were presented to significantly enhance their overall readability.

2.42 Factors that contributed to these entities improving the presentation of their financial statements included:

- early engagement with senior management, the audit committee, the ANAO and Finance;

- making improved financial statement presentation an explicit objective in preparing the statements, and applying appropriate time and resources to achieving this;

- setting materiality parameters to assist in determining note disclosures and considering materiality in both quantitative and qualitative terms;

- making greater use of graphics and diagrams; and/or

- including clearer explanations in the notes on the judgements and estimates underpinning particular financial statement balances.

2.43 Those entities that decided to present their financial statements largely in the same way as previously mainly did so because:

- investing resources in improving financial disclosure was not a priority of the entity in 2014‑15; or

- the entity wanted to learn from the experiences of other entities before investing further resources in the preparation of their financial statements.

2.44 The ANAO will continue to work with entities, their audit committees and the Department of Finance to further improve the presentation of 2015–16 and future financial statements. The Department of Finance has advised that it is undertaking work with a view to implementing a Reduced Disclosure Regime under AASB 1053 Application of Tiers of Accounting Standards from 2015–16. The ANAO supports initiatives that reduce the compliance workload of Australian Government entities and make financial statements easier to read, while preserving the sufficient disclosures to satisfy the needs of the Parliament.

AASB 1055 Budgetary Reporting

2.45 An important development affecting the preparation of the 2014‑15 financial statements for all not-for-profit entities in the General Government Sector was the requirement to comply with AASB 1055 Budgetary Reporting.

2.46 The standard requires relevant entities’ financial statements26 to include details of the original budget presented to the Parliament and an explanation of major variances between actual results and the corresponding budget amounts. The inclusion of this information facilitates users of financial statements making and evaluating decisions about the allocation of scarce resources and for assessing the discharge of an entity’s accountability.

2.47 Finance’s Resource Management Guide 125, Commonwealth Entities Financial Statements Guide, included guidance to entities on the application of this standard.

2.48 As part of the audit of entities’ 2014‑15 financial statements, the ANAO assessed the adequacy of explanations of major variances between actual amounts and original budget amounts presented in entity financial statements.

2.49 The categories used to assess the quality of the AASB 1055 disclosures is presented in Table 2.5.

Table 2.5: Quality of AASB 1055 note disclosures

|

Rating |

Explanation |

|

1 |

Implementation was well planned and note disclosure was informative and well-presented. |

|

2 |

Implementation could have been better planned, with some amendments required to draft note disclosure presented for audit. |

|

3 |

Implementation was poorly planned with substantial amendments required to draft note disclosure presented for audit. |

Source: ANAO rating scale.

2.50 An assessment of the quality of entities’ AASB 1055 note disclosures is presented in Figure 2.4.

Figure 2.4: Assessment of the quality of entities’ AASB 1055 note disclosures

Source: ANAO analysis of note disclosures.

2.51 The quality of note disclosures presented for audit varied considerably, with 11 per cent requiring substantial amendment and over 60 per cent requiring some amendment following review by the ANAO and/or the audit committee. The implementation of new reporting requirements can often take some time to bed down, and the ANAO worked closely with entities to ensure note disclosures in the signed financial statements met the requirements of AASB 1055.

2.52 Factors that contributed to the effective implementation of AASB 1055 and which will assist entities to improve note disclosures in the future included:

- early planning by the entity including discussions between the entity’s finance team, senior management, the audit committee and the ANAO;

- early consideration, where relevant, of how Machinery of Government changes could affect note disclosures;

- a good understanding by the entity finance team of the entity’s budget process, including an understanding of the reasons for budget variances, and regular liaison between entities’ finance and budget teams, where relevant;

- the preparation of a draft disclosure note prior to year-end together with supporting documentation, as part of a financial statement hard or soft close process that assisted in identifying matters that required further consideration or explanation;

- the inclusion of an introduction or pre-amble to the note disclosure that assisted users’ understanding of what the entity considered a significant variance;

- the analysis of variances between budget and actuals at both the aggregate and line item levels; and

- the use of non-technical language to explain major variances.

2.53 The ANAO will continue to work with entities, the Department of Finance and audit committees to improve, where required, entity compliance with the requirements of AASB 1055 as part of the audit of 2015–16 and future financial statements.

Legislative compliance

2.54 In reviewing an entity’s control environment, as part of financial statement audits, the ANAO assesses whether management has established adequate controls to enable the entity to comply with key aspects of the financial management framework.

2.55 The coverage by the ANAO involves assessing key aspects of legislative compliance in relation to annual appropriations, special appropriations, special accounts and the investment of public monies. Audit testing includes confirming the presence of key documents or authorities, and testing of relevant transactions directed at obtaining reasonable assurance about entities’ compliance with these key components of the financial management framework.

2.56 As in previous years, the ANAO identified a high level of legislative compliance. Matters in respect of actual and potential breaches of section 83 of the Constitution, reported in previous years, are discussed at paragraphs 2.57 to 2.63 below.

Section 83 of the Constitution

2.57 Audit Reports No.16 2014‑15 Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2014 and No.44 2014‑15 Interim Phase of the Audits of the Financial Statements of Major General Government Sector Entities for the Year Ended 30 June 2015, discussed entities’ progress in addressing the risk of breaches of section 83 of the Constitution. Section 83 provides that no money should be drawn from the Treasury of the Commonwealth except under an appropriation made by law and requires that all spending by the Executive Government from the Consolidated Revenue Fund must be in accordance with an authority given by the Parliament.

2.58 Our 2014‑15 financial statement audits of relevant entities continued to include a review of the results of risk assessments undertaken by entities in relation to potential section 83 breaches, and actions taken as a result of these assessments.

2.59 In 10 entities, the risk assessments undertaken identified actual and/or potential breaches of section 83, details of which were included in the notes to each entity’s 2014‑15 financial statements. The CFS also included a reference to the aggregate number of actual and potential section 83 breaches reported by entities.

2.60 In four entities, breaches which had occurred in 2013‑14 did not occur in 2014‑15, and as a result the associated significant legislative finding was closed.

2.61 In previous years, the ANAO has included details of actual and/or potential breaches of section 83 in the auditors’ reports under the heading of other legal and regulatory requirements. The reports were unmodified as the financial statements fairly presented the financial operations and position of the entity at year end.27

2.62 In 2014‑15, the ANAO changed its reporting policy and definition in regard to significant legislative findings. The matter was not reported in the auditor’s report where:

- the entity disclosed the details of the actual and/or potential breaches in the notes to the financial statements; and

- the breach was not significant, or the result of a significant breakdown in controls.

2.63 In addition, if the matter had been previously reported and met the above conditions, it was no longer considered to be a significant legislative finding. In light of this change, previously reported findings relating to potential or actual breaches of section 83 have been closed.

Constitutional validity of Commonwealth expenditure

2.64 Audit Report No.16 2014‑15, at paragraphs 5.39 to 5.41, referred to the High Court’s judgement of 19 June 2014 in Williams v Commonwealth (2014) HCA 23, that the Financial Framework Legislation Amendment Act (No. 3) 2012 was not a valid law in its operation with respect to the National School Chaplaincy program, because it was not supported by a Commonwealth legislative power.

2.65 The 2014‑15 Australian Government’s Consolidated Financial Statements and the 2014‑15 financial statements of relevant entities continue to disclose that the Australian Government continues to have regard to developments in case law, including the decision in Williams, as they contribute to the larger body of law relevant to the development of Commonwealth programs. In accordance with its general practice, the Australian Government has indicated that it will continue to monitor and assess risk and decide on any appropriate actions to respond to risks of expenditure not being consistent with constitutional and other legal requirements.

Compliance reporting

2.66 Commencing from the 2006–07 financial year, Chief Executives of each Financial Management and Accountability Act 1997 agency were required to provide an annual Certificate of Compliance. Directors of General Government Sector Commonwealth Authorities and Companies Act 1997 (CAC Act) authorities and wholly-owned companies were also required to provide a report on compliance with relevant aspects of CAC Act legislation. The certificate process is designed to promote awareness and understanding of the requirements of the financial management framework.

2.67 Consistent with established practice, the ANAO obtained, as part of the 2014‑15 financial statement audit process, details of actual or potential breaches of the relevant financial framework referred to in entities’ certificate or other records. The impact of any reported breaches on the financial statements was considered prior to the signing of the auditor’s report.

2.68 At the date of preparation of this report, Finance advised that:

- it was in the process of finalising the analysis of the results of the 2014‑15 process;

- the preliminary analysis indicated that the total number of instances of non-compliance are comparable to the 2013‑14 results (8 712 instances of non-compliance were reported in that year) with most non-compliance relating to grants and procurement. Requirements in relation to these areas have not significantly changed under the new legislative framework; and

- consultations were being held with stakeholders on a compliance framework applicable for 2015–16 and future years that is appropriate to the new legislative framework.

2.69 The ANAO notes that the Independent Review of Whole-of–Government Internal Regulation recommended that Finance cease centrally mandated compliance certification, monitoring and reporting. Irrespective of future whole-of-government arrangements, effective entity arrangements include systems and processes that provide the Accountable Authority with assurance about their entity’s compliance with the Public Governance, Performance and Accountability legislative framework, including Accountable Authority Instructions.

2.70 In 2015–16, the ANAO will assess the arrangements entities have in place, including how Audit Committees meet their responsibilities in relation to entities’ system of internal control.

3. Financial sustainability

Chapter coverage

This chapter provides an analysis of the financial sustainability of entities based on parameters applied to the operating results and balance sheets of material entities.

Results of the analysis

The financial sustainability of the large majority of entities assessed was not at risk. Only six per cent of entities incurred large deficits and only seven per cent of entities’ balance sheets were weak.

The analysis was based on parameters developed by the ANAO, which are applied to entities’ operating results and balance sheets. Our analysis concluded that the financial sustainability of the majority of entities was not at risk. There would, nevertheless, be benefit in government developing performance targets or benchmarks to enable entities to assess their own financial sustainability against agreed parameters over time, and against like entities.

Entities’ financial sustainability

3.1 Integral to our audits is an understanding of an entity and its environment, including an entity’s financial sustainability. Financial sustainability measures the ability of an entity to manage its financial resources so it can meet present and future spending commitments.28 This can provide an indication of financial management issues or can point to an increased risk that entities may require additional government funding. The ANAO assessed the financial sustainability based on parameters29 applied to the operating results and balance sheets of 68 material entities30 and are described in Table 3.1 and Table 3.2.

Analysis of operating results

3.2 The responsibilities of Australian Government entities are established by legislation, or determined by government, and include responsibilities for functions such as policy development, regulatory oversight and/or service delivery. In performing these responsibilities, entities are expected to manage, efficiently and effectively, the public resources made available to them.

3.3 A key measure of an entity’s financial management is its operating result for the year. Although the operating result is not the sole measure of performance of a public sector entity, a history of significant deficits could suggest the need for additional funding, elimination of non-value adding costs, reductions in service levels and/or improved entity financial management.

3.4 Against this background, the ANAO continued its practice of analysing the operating results of all material entities over a three year period. This year the analysis covered the period 2012–13 to 2014‑15. This analysis is based on reported surpluses or deficits after adjusting for unfunded expenses31, where relevant. This approach highlights the full cost of operations, regardless of the particular funding model in place.

3.5 The ANAO grouped material entities into three categories, which are explained in Table 3.1.

Table 3.1: Operating results categories

|

Category |

Parameters |

|

Large deficits a |

Averaged a deficit for the last three years and had two or three deficits greater than five per cent of total expenses. |

|

Small deficits or surpluses a |

Averaged a deficit for the last three years and had one or no deficits greater than five per cent of total expenses; or Averaged a surplus for the last three years less than five per cent of total expenses. |

|

Large surpluses |

Averaged a surplus for the last three years equal to or greater than five per cent of total expenses. |

Note a: In the context of for-profit Commonwealth entities, the equivalent term for deficit is a loss, and surplus is a profit.

Source: ANAO operating results categories.

3.6 Figure 3.1 presents the results of the analysis of entities’ average operating results in the periods 2011‒12 to 2014‒15.

Figure 3.1: Analysis of operating results

Source: ANAO analysis of entities’ operating results.

3.7 Consistent with past results, 47 material entities (approximately 69 per cent) made small surpluses or deficits over the three year period. While a tightening budget environment is likely to increase budget pressures on individual entities, the high percentage of entities in these categories indicates that most entities have appropriately managed their finances for the period under analysis.

3.8 Four entities (approximately six per cent) averaged a deficit or incurred at least two annual deficits greater than five per cent of expenses over the three years. A brief explanation of the reasons why these entities have incurred deficits over the period covered by the analysis is provided below:

- the NBN Group has incurred losses in its start‐up phase, as anticipated in its business plan projections;

- the Department of the Environment’s operating result has been affected by a revised estimate of the cost of making good its Antarctic waste disposal sites; this resulted in an increase in the provision for these costs and the associated expense;

- the Albury-Wodonga Development Corporation incurred losses as it progressively wound up its operations and was abolished on 31 December 2014; and

- the Australian Nuclear Science and Technology Organisation has historically not been fully funded for significant costs associated with the decommissioning of nuclear reactors. This has resulted in the Organisation incurring operating losses for a number of years.

3.9 Seventeen entities (approximately 25 per cent) incurred an average annual surplus greater than five per cent of expenses. In seven cases32, these surpluses arose from the commercial operations of for‐profit entities or the quasi‐commercial operations of not‐for‐profit entities.

3.10 In respect of the other ten entities33 that reported large surpluses, the reasons for the operating results were often related to one-off factors such as: unplanned reductions in expenditure resulting from reduced recruitment activity; the accounting effect of recognising revenue in one period and the related expenditure in another period; and the need to account for donations received as revenue. In other cases, the generation of surpluses was the result of a planned business strategy.

Balance sheet analysis

3.11 All entities are expected to actively manage their underlying financial position, maintaining asset levels to support their operations and ensuring that sufficient funds will be available to meet liabilities as they fall due.

3.12 The ANAO analysed the balance sheet positions of material Australian Government entities as at 30 June 2015. While it is necessary to have regard to the public sector context, the following two measures are generally accepted indicators of the soundness of entities’ balance sheets:

- Liquidity: the extent to which an entity’s liabilities are covered by cash or other financial assets. An entity where liabilities significantly exceed its financial assets may need a future injection of cash from government to meet those liabilities.

- Gearing: the extent to which an entity’s total assets are funded by debt rather than equity. An entity with high gearing may be running down its asset base that could indicate the need for a future capital injection from government.

3.13 The ANAO grouped material entities into the following categories:

Table 3.2: Balance sheet categories

|

Category |

Parameters |

|

Strong |

Entities where financial assets were at least 50 per cent of total liabilities and where equity was at least 25 per cent of total assets. These entities have the strongest balance sheets. |

|

Less strong |

Entities where financial assets were less than 50 per cent of liabilities or where equity is less than 25 per cent of total assets. These entities had weaker balance sheets, either in liquidity or gearing terms. |

|

Weak |

Entities where financial assets were less than 50 per cent of liabilities and where equity was less than 25 per cent of total assets. These entities are the most likely to need additional funding in the future. |

Source: ANAO balance sheet categories.

3.14 The results of the ANAO analysis are presented in Figure 3.2.

Figure 3.2: Balance sheet analysis

Source: ANAO analysis of entity balance sheets.

3.15 Fifty (74 per cent) entities had strong balance sheets. This is comparable to the position since 30 June 2012 and indicates that the balance sheet positions of the large majority of material entities remain sound.

3.16 Four of the entities with weak balance sheets (the Australian Taxation Office, the Defence Materiel Organisation34, the Australian Bureau of Statistics, and the Family Court and Federal Circuit Court) are material entities whose operations are dependent on government policy and on continued funding by the Parliament. On this basis, and provided that appropriate attention is given to liquidity issues in the future, these entities are not at high risk of experiencing liquidity problems. Nevertheless, with a tightening fiscal outlook, it is important that entities in this category continue to monitor their financial position and improve it, where practicable.

3.17 The remaining entity, the Department of the Environment as discussed at paragraph 3.8 had a significant unfunded liability relating to the rehabilitation of its Antarctic sites. The Government’s general policy is to provide cash to meet entity rehabilitation liabilities at the time the work is undertaken. The Department of the Environment has indicated that the Australian Government is committed to maintaining Australia’s ongoing physical presence in the Antarctic and the possible cessation of research activities and the requirement for funding to undertake the rehabilitation of its Antarctic sites is remote.

Conclusion

3.18 An analysis of the factors that influence an entity’s financial sustainability can provide an indication of financial management issues or can point to an increased risk that entities may require additional government funding. Our analysis, based on parameters developed by the ANAO, concluded that the financial sustainability of the majority of entities was not at risk. There would, nevertheless, be benefit in government developing performance targets or benchmarks to enable entities to assess their own financial sustainability against agreed parameters over time, and against like entities.

4. Developments in financial reporting and auditing frameworks

Chapter coverage

This chapter outlines developments in the financial reporting and auditing frameworks relevant to the Australian Government and its reporting entities.

Summary of developments

The main change affecting entities’ 2014‑15 financial statements was the introduction of AASB 1055 Budgetary Reporting referred to earlier. The standard requires relevant entities’ financial statements to include details of the original budget presented to the Parliament and an explanation of major variances.

A major change to the auditing framework is the proposal to improve auditor reporting through the introduction of ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report. This standard is expected to apply for reporting periods ending on or after 15 December 2016.

Although this standard will predominantly apply to audits of the financial statements of listed entities, in 2015–16 the ANAO intends to undertake a trial of reporting key audit matters involving a number of large Commonwealth entities. Auditor’s reports that include key audit matters prepared as part of the trial will be in addition to the standard auditor’s report on the financial statements. These reports will not be published, however they will be presented to the Accountable Authority for their information.

Introduction

4.1 The Australian Government’s financial reporting and auditing frameworks are based, in large part, on standards made independently by the Australian Accounting Standards Board (AASB) and the Australian Auditing and Assurance Standards Board (AUASB). These frameworks are designed to support decision-making by, and accountability to, the Parliament. The financial reporting and auditing frameworks that applied in 2014‑15 are illustrated in appendices 4 and 5 of this report.

4.2 The AASB bases its accounting standards on the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). Because IFRS are designed primarily for use by for-profit organisations, the AASB amends the IFRS to reflect significant transactions and events that are particularly prevalent in the public and not-for-profit private sectors. In doing so, it takes into account standards issued by the International Public Sector Accounting Standards Board.

4.3 The Finance Minister prescribes additional financial reporting requirements for Australian Government entities; from 2014‑15 these are contained in the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015. This rule is made under the Public Governance, Performance and Accountability Act 2013 (PGPA Act) which came into full effect on 1 July 2014.

4.4 The audits of the financial statements of Australian Government entities are conducted in accordance with ANAO Auditing Standards, which are made by the Auditor-General under section 24 of the Auditor-General Act 1997. The ANAO Auditing Standards incorporate, by reference, the auditing standards made by the AUASB. The AUASB bases its standards on those made by the International Auditing and Assurance Standards Board (IAASB), an independent standard setting board of the International Federation of Accountants.

Recent changes to the Australian public sector reporting framework

Budgetary Reporting

4.5 The Australian Government prepares its financial statements under AASB 1049 Whole of Government and General Government Sector Financial Reporting. AASB 1049 requires governments to compare their financial results to the original budgets presented to the Parliament, and to explain major variances.

4.6 In March 2013, the AASB issued AASB 1055 Budgetary Reporting, extending the budget reporting requirements to all not-for-profit entities in the General Government Sector. This standard applies to reporting periods beginning on or after 1 July 2014. A discussion of the implementation of this standard by entities in 2014‑15 is at paragraphs 2.45 to 2.53 of chapter 2.

Transactions with related parties

4.7 AASB 124 Related Party Transactions requires an entity to disclose transactions with its related parties. AASB has recently extended the application of this standard to all not-for-profit public sector entities for reporting periods beginning on or after 1 July 2016. These entities will be required to identify and disclose related parties transactions, such as those with key management personnel. The definition of key management personnel includes Ministers.

Improving the quality of disclosures

4.8 There are ongoing initiatives by both Australian and international standard setters to reduce the volume and complexity of disclosures in financial statements.

4.9 In 2014, the AASB published a staff paper35 proposing ways in which entities can remove unnecessary clutter from their financial statements. In July 2015, the AASB amended AASB 101 Presentation of Financial Statements as a result of the IASB’s project to improve disclosures. The amendments clarify that entities are only required to disclose information that is relevant to users of their financial statements. The amendments apply to reporting periods beginning on or after 1 January 2016.

4.10 In July 2015, the AASB relieved not-for-profit public sector entities from the requirement to make certain disclosures about the fair value of property plant and equipment used in meeting service objectives. The AASB noted that these requirements were posing challenges and costs for the public sector that were not borne to the same extent by the private sector.

4.11 The Independent Review of Whole-of-Government Internal Regulation recommended that the Department of Finance continues to work with the ANAO, the Australian Accounting Standards Board and entities to develop and implement a differential approach to financial reporting to optimise benefits at both the entity and whole-of-government levels. The Department of Finance advised it is undertaking this work with a view to the implementation of a Reduced Disclosure Regime for specified Commonwealth entities under AASB 1053 Application of Tiers of Australian Accounting Standards from 2015–16.

4.12 A discussion on entities improving their 2014‑15 financial statement presentations is at paragraphs 2.35 to 2.44 of chapter 2. The ANAO supports initiatives that reduce the compliance workload of Australian Government entities and make financial statements easier to read, while preserving sufficient disclosures to satisfy the needs of the Parliament. The ANAO Better Practice Guide Public Sector Financial Statements, published in March 2015, includes a discussion and associated examples designed to assist entities to improve the presentation of financial statements.

Future changes to the public sector reporting framework

4.13 Further changes to the financial reporting framework are expected over the next few years, as projects by Australian and international accounting standard setters lead to new accounting standards for both the public and private sectors.

4.14 Projects specific to the public sector include reporting of service performance information and new accounting requirements for grants, taxes and appropriations. Projects aimed primarily at the private sector, but with public sector implications, include the continuing initiative to improve the quality of disclosures, and major revisions to lease accounting.

Changes to the Australian auditing framework

4.15 During 2014‑15 there were no major changes to existing standards or new standards issued by the AUASB related to the audit of the financial statements of Commonwealth entities and Commonwealth companies.

4.16 A number of proposed changes are discussed below.

Auditor reporting

4.17 In April and June 2015, the AUASB released two exposure drafts for new and revised auditing standards aimed at improving auditor reporting, following the release of new and revised standards by the IAASB. The major change proposed is the introduction of a new standard, ASA 701 Communicating Key Audit Matters in the Independent Auditor’s Report. This standard is expected to apply to audits of the financial statements of listed entities and also to circumstances when the auditor otherwise decides or is required by law to communicate key audit matters in the auditor’s report.

4.18 The purpose of communicating key audit matters is to enhance the value of the auditor’s report by providing greater transparency about how the audit was performed. Communicating key audit matters provides additional information to intended users of the financial statements to assist them in understanding those matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements. It may also assist intended users to understand the entity and the areas of significant management judgment in the financial statements.

4.19 This change is proposed to apply for reporting periods ending on or after 15 December 2016. The ANAO intends to undertake a trial of reporting key audit matters in 2015–16 involving a number of large Commonwealth entities. Auditor’s reports including key audit matters prepared as part of the trial will be in addition to the standard auditor’s report on the financial statements. These reports will not be published, however they will be presented to the Accountable Authority for their information. The ANAO will liaise with audit committees on progress and outcomes of the proposed trial.

Other changes to the auditing standards

4.20 In October 2015, the AUASB released an exposure draft of a new standard that would focus the auditor’s attention more explicitly on financial statement disclosures throughout the audit process. The change is proposed to apply for reporting periods ending on or after 15 December 2016.

4.21 The auditing standard-setting Boards are also working on other new and revised standards, including in relation to the audit of special purpose financial reports. Changes to ASA 800 Special Considerations – Audits of Financial Reports Prepared in Accordance with Special Purpose Frameworks and ASA 805 Special Considerations – Audits of Single Financial Statements and Specific Elements, Accounts or Items of a Financial Statement are also expected, based on changes already approved to the IAASB Standards. The proposed changes would bring these two standards in line with the auditor reporting standards for general purpose financial reports.

Conclusion

4.22 Ongoing developments in accounting and auditing frameworks and standards continue to have an impact on the financial reporting responsibilities of public sector entities and on the ANAOʹs auditing methodology. The ANAO will continue to assist Australian Government entities through client seminars and publications that explain new regulatory and accounting requirements.