Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Audits of the Financial Statements of Australian Government Entities for the Period Ended 30 June 2004

This report provides a summary of the final audit results of the audits of the financial statements of all Australian government reporting entities, including the Consolidated Financial Statements for the Australian Government.

Summary

Introduction

This report provides a summary of the final audit results of the audits of the financial statements of all Australian government reporting entities, including the Consolidated Financial Statements for the Australian Government.

This report is the second report on these audits for the financial year ended 30 June 2004, and complements Audit Report No.58 2003–20041 . The latter provided an update of the assessment of audit findings relating to major entity control structures, including governance arrangements, information systems and control procedures, which supported the reporting of public sector financial performance and accountability, through to March 2004.

Audit Report No.58 reported the more significant risk and control issues of major Australian Government entities identified during the interim phase of the financial statements audits that required management attention and action to strengthen and enhance the quality of each respective entity's control structures and to mitigate any potential risks.

The Australian National Audit Office (ANAO) has now updated its understanding of entity business and governance arrangements; re-confirmed entity audit risks; completed audit testing; and largely completed its program of final audits. The audit findings have been fully reported to the management of the entity and to the responsible Minister(s).

This report also outlines the results of reviews of the triple bottom line reports on the Department of Family and Community Services and the Department of the Environment and Heritage.

Results of the audits of financial statements

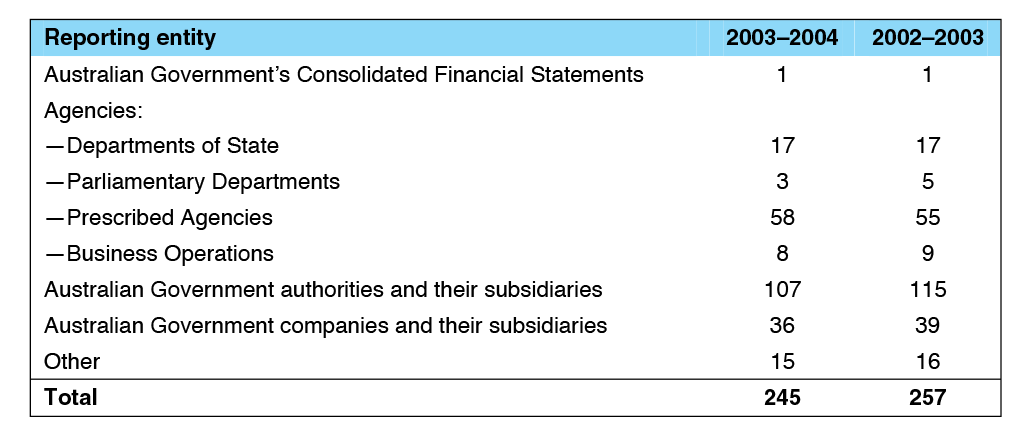

The ANAO is responsible for the audit of the financial statements of 245 Australian Government entities (refer to the following table). The total number reflects the net result of the:

- creation of a prescribed agency and a parliamentary department; and

- the wind-up of a number of Australian Government authorities, companies and three parliamentary departments.

Table 1: Type and number of entities audited

For the 2003-04 financial year, the ANAO has issued 217 unmodified audit opinions (clear opinions); 12 ‘qualified' audit opinions; 7 audit opinions containing an ‘emphasis of matter'; and 4 unqualified opinions containing an ‘other statutory matter'. At the date of this report, 5 sets of financial statements were not presented for audit. It should be noted that opinion on the Department of Defence and Department of Veterans' Affairs statements are included within the qualification numbers. However, these two entities' opinions also contain ‘other statutory matters.' Additionally, the Aboriginal and Torres Strait Islander Commission is also included within the qualification numbers. However, this entity's audit opinion also contained an ‘emphasis of matter.'

The material portion of the Australian Government's revenues, expenses, assets and liabilities in the 2003–2004 financial year are accounted for by a relatively small number of Australian Government entities, notably, the Departments of Defence, Family and Community Services, Health and Ageing, and the Australian Taxation Office. The focus of this report is on the final results of the financial statement audits for the 2003–2004 financial year. Financial management issues (where relevant) arising out of the audits and their relationship to internal control structures are also included in this report.

The report is organised as follows:

- Chapter One—The Australian Government Reporting Framework—provides ongoing commentary on the structure of and issues in relation to the Australian Government's financial framework. Comment is also made on the quality and timeliness of the preparation of entities' annual financial statements.

- Chapter Two—Results of the Audit of the Consolidated Financial Statements of the Australian Government—provides details of the audit of the Consolidated Financial Statements for 2003–2004.

- Chapter Three—Summary Results of the Audits of Financial Statements—describes the final results of audits of the financial statements, and provides details of qualifications and any matters emphasised in audit reports.

- Chapter Four—Results of Final Audit Testing—provides an overview of the results of the year-end substantiation of financial balances. It also provides a summary of continuing significant accounting issues.

- Chapter Five—Results of the Review of Triple Bottom Line Reporting—provides details of the results of audit procedures undertaken to provide a verification statement on the Triple Bottom Line Reports of the Department of Family and Community Services and the Department of the Environment and Heritage.

- Chapter Six—Results of the Audits of Financial Statements by Portfolio—provides the detailed results of the individual financial statement audits and any additional significant control matters identified since Audit Report No.58. It is structured in accordance with the Portfolio arrangements established in the Administrative Arrangements Order of 18 December 2003 as amended by an Order in Council dated 24 June 2004, with effect from 1 July 2004, and an Order in Council dated 21 July 2004. For reporting purposes, this reflects the portfolio arrangements which existed at 30 June 2004.)

Footnotes

1 Control Structures as part of the Audit of Financial Statements of Major Australian Government Entities for the Year Ending 30 June 2004, Audit Report No.58 2003–2004, Canberra 2004.