Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

ANAO 2016-20 Corporate Plan

Please direct enquiries relating to reports through our contact page.

The Australian National Audit Office (ANAO) 2016-20 Corporate Plan is the primary strategic planning document, and outlines how the ANAO intends to deliver against the purpose over the coming four years.

About this plan

The Australian National Audit Office (ANAO) 2016-20 Corporate Plan outlines how the ANAO intends to deliver against the purpose over the coming four years.

The ANAO Corporate Plan is the primary strategic planning document and has been prepared in accordance with paragraph 35 (1)(a) of the Public Governance, Performance and Accountability Act 2013, prepared for the 2016–17 period, covering the 2016–17 to 2019–20 reporting periods.

Four Key Focus Areas (KFAs) provide the framework for delivering on the purpose and strategic focus, and managing and monitoring performance:

- KFA1 - Being independent and responsive;

- KFA2 - Providing value adding audit services;

- KFA3 - Ensuring there is confidence in delivery of audit services; and

- KFA4 - Having the capability to deliver professional services.

This plan recognises that anticipating and responding to changes occurring in a dynamic operating environment, managing risks to business operations and continuing to develop key capabilities will be central to delivering on the ANAO’s purpose in the future. Performance against the plan will be measured based on a combination of the value created (by the ANAO), the value added to the entities we audit, and the value shared with the Australian Parliament and the public.

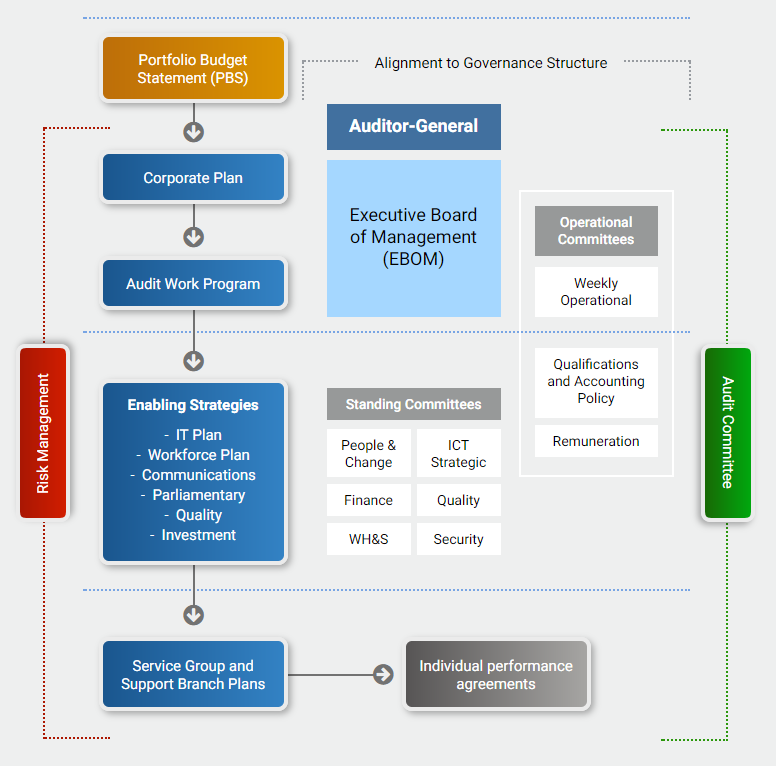

The ANAO’s governance and business planning is facilitated by the ANAO Strategic Planning Framework.

ANAO Strategic Planning Framework

Purpose

Purpose

The purpose of the ANAO is to drive accountability and transparency in the Australian Government sector through quality evidence based audit services and independent reporting to Parliament, the Executive and the public, with the result of improving public sector performance.

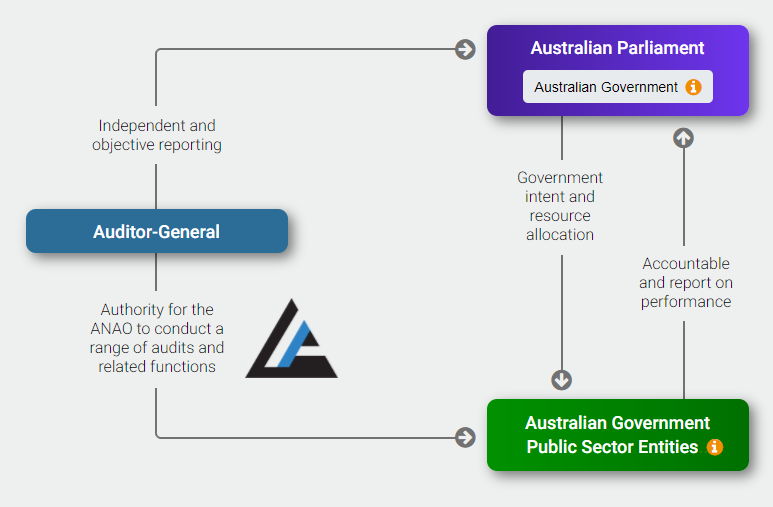

The Executive is accountable to Parliament for its use of public resources and the administration of legislation passed by the Parliament. The Auditor-General scrutinises and provides independent assurance as to whether the Executive is operating and accounting for its performance in accordance with Parliament’s purpose.

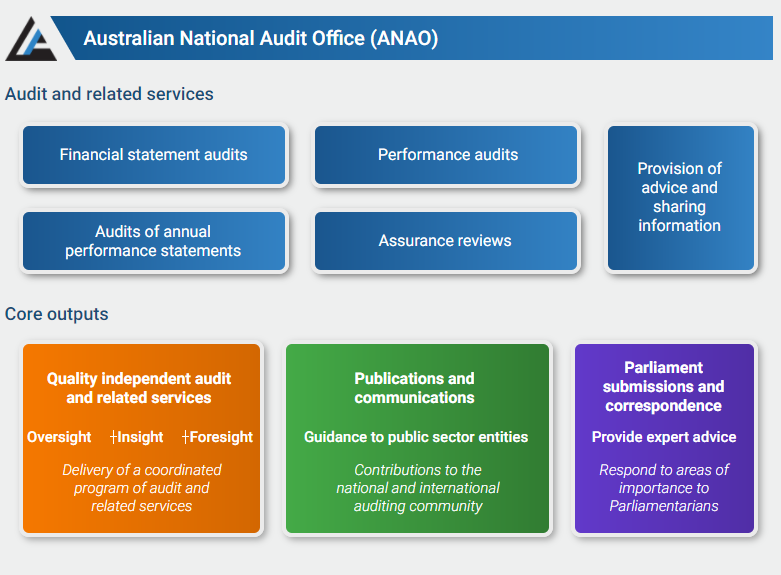

Functions

The Auditor-General is an independent officer of the Australian Parliament whose mandate is set out in the

Auditor-General Act 1997 (the Act). Under the Act, the Auditor‑General delivers:

- Annual financial statement audits of Australian Government entities;

- Audits of annual performance statements of Australian Government entities;

- Performance audits of Australian Government programs and entities;

- Assurance reviews of Australian Government entities; and

- Provision of advice and sharing information, including the publication of better practice guides.

In delivering against this mandate, the Auditor-General is assisted by the ANAO.

Values

The ANAO upholds the Australian Public Service (APS) values as set out in the Public Service Act 1999. The ANAO values of respect, integrity and excellence guide staff in performing their roles with impartiality and neutrality, to a high standard and in the best interests of the Australian Parliament, the Executive and the public.

Key relationships

The ANAO’s primary relationship is with the Australian Parliament, through its ongoing interactions with the Joint Committee of Public Accounts and Audit. Through the audit and related services the ANAO provides to the Parliament, the Australian public can have confidence that the Auditor-General is scrutinising and reporting on the actions of the Executive and whether public funds are being used economically, efficiently, effectively and ethically. The ANAO has an important relationship with the Accountable Authorities of Australian Government Entities, who have primary responsibility for and control over public sector entities' operations. This relationship is also supported by the ongoing engagement undertaken with officials of audited entities.

The ANAO also invests in a number of relationships to support its ability to be a learning organisation through the two-way exchange and sharing of information and practices. This includes the Australasian auditing community as a member of the Australasian Council of Auditors-General. The ANAO also has close links with the international and regional auditing community through the International Organisation of Supreme Audit Institutions and its regional working groups, and contributes to the delivery of the Australian Government’s aid program in the Indo-Pacific region. The ANAO values its relationships with the Australian Accounting Standards Board and the Auditing and Assurance Standards Board, in their roles of setting and maintaining professional and ethical standards for the accounting and auditing professions, which underpin the delivery of quality audit services.

Operating environment

Critical to delivering the ANAO’s purpose is anticipating and responding to changes occurring in a dynamic operating environment. This section sets out the nature of the operating environment that can affect the ANAO’s operations and influence the focus of the program of audit and related services.

Factors that are beyond the ANAO’s control

The ANAO needs to remain alert to the external environmental factors that the Australian Government faces, including the performance of the Australian economy, and the social and political environment. The makeup of the Parliament, and the direction and priorities that it sets, shapes and determines the environment in which the public sector operates.

Fiscal constraint, greater contestability for service delivery and the ongoing implementation of the Government’s public sector agenda requires the public sector to continue evolving. Machinery of government changes impact on the formation of entities and new policies result in the redesign of services. These factors have a direct impact on the delivery of the Auditor-General’s mandate. This requires the ANAO to have a contemporary understanding of the public sector and to responsively deliver an integrated audit work program that provides assurance of public sector performance and the sustainability of an evolving public sector.

Factors partially within the ANAO’s control

Maintaining effective relationships with the Parliament, through a sound appreciation of the respective roles and by operating independently, objectively and transparently is key to delivering on the ANAO’s purpose. The ANAO can influence how it maintains and enhances the confidence of the Parliament through clear communication of the outcomes of audit and related services, and delivering high-quality and evidence-based audit services through appropriate channels.

Factors within the ANAO’s control

The ongoing environmental pressures to operate in a contestable environment, deliver efficiencies and improved experience for stakeholders also apply to the ANAO. To maintain its credibility the ANAO must meet the same standards of performance that it measures other public sector entities against.

Technological factors and the rate of technological change can be a driver of innovation as well as affecting costs and quality. There is substantial scope for efficiencies in service delivery through the use of technology and better targeted, evidence-based spending. Data analytics informs evidence-based policy development, drives risk based compliance and regulatory activities and enables performance monitoring and measurement. It is expected that public sector entities will continue to generate ever increasing volumes of information and data, and that they will manage and analyse data to inform decision making about the effectiveness and efficiency of government services. The adoption of multiple systems and new tools, and the management of data control and security, presents the ANAO with challenges in terms of accessing and mining data as part of the audit evidence base. Adapting and keeping up to speed with technology advancements, while also safeguarding data remains an ongoing challenge for the ANAO.

The ANAO must also remain alert to global and national changes in the auditing profession. Engaging with a network of national and international public sector audit offices and professional bodies, provides the ANAO with the opportunity to collaborate and learn from others. Effectively leveraging these relationships and partnerships can support the methodologies underpinning quality operations and audit services.

These environmental factors influence the ongoing refinement of the ANAO‘s business operations and the development of the Annual Audit Work Program. The Annual Audit Work Program is designed to reflect the ANAO’s strategy and deliverables for the 2015-16 period and inform the Parliament, the public and government entities of the planned audit coverage for the Australian Government sector.

Strategic focus

Four Key Focus Areas (KFAs) provide the framework for the strategies to deliver on the ANAO’s purpose and strategic focus:

Risk

Risk management and oversight

The ANAO aims to foster a positive risk culture where the management of risk is built into business as usual practices. The ANAO’s risk management and oversight includes:

- documenting the identification, analysis and evaluation of risks, including risk response strategies;

- setting out risk management responsibilities;

- formal risk monitoring and review processes, primarily through ANAO governance committees, to:

- ensure identified controls and mitigation strategies remain effective and efficient;

- incorporate successes and failures from lessons learned from risk events into risk response strategies;

- take into account organisational changes and the impact on existing or emerging risks, including their controls and treatments;

- review and update of the risk management policy framework and risk register annually, for review by the ANAO Audit Committee prior to endorsement by the Auditor-General, taking into account the advice of the Executive Board of Management;

- participating in the annual Comcover risk management benchmarking survey as an external assessment of comparative maturity levels;

- ANAO’s internal auditors providing assurance and insights into organisational risks; and

- the ANAO Audit Committee satisfying itself about the systems of risk oversight and management put in place.

The effective management of risks plays an important role in decision making and the successful delivery of the ANAO’s purpose. The ANAO Risk Management Framework aims to strengthen management practices and decision making associated with the ANAO’s business operations.

Strategic risks

The ANAO’s strategic risks are identified in the context of uncertainties impacting the ANAO’s business objectives or the possibility of an event or activity having an adverse impact to such an extent that it prevents the ANAO from achieving its outcomes. Damage to reputation is the most significant consequence of risk management failing, as it goes to the core of the ANAOs integrity as a professional audit organisation.

The ANAO’s strategic risks link directly to one of the four key focus areas as shown in the table below:

Key Focus Area (KFA) | Strategic Risk | Inherent risk rating | Risk tolerance | Residual risk rating |

KFA1: Independent and responsive | Loss of confidence by Parliament in the ANAO | Medium | Low | Medium |

KFA 2: Value adding audit services | ANAO recommendations and findings do not lead to improvements in public sector performance and accountability | Medium | Low | Medium |

KFA 3: Confidence in delivery of audit services | The ANAO does not keep pace, in a contestable environment, with reliable, efficient and professional business practices | High | Low | Medium |

KFA 4: Capability to deliver professional services | The ANAO does not achieve the quality standards required to support its work | High | Low | Medium |

The ANAO duplicates effort by not effectively leveraging the data and information it collects | Medium | Medium | Medium |

Key capabilities

To continue delivering on its purpose and strategic focus into the future the ANAO has identified four key organisational capabilities to invest in. The capability initiatives are planned to be implemented over three years and are expected to be completed by 2018. Monitoring the progress of this program of work will guide an annual update to key capability initiatives.

New models of audit service delivery

Develop and implement new models of audit service delivery that are responsive and cost-effective:

From

Work Program is heavily focused on some but not all parts of AG powers and focuses on performance audit activities

To

Work Program focused on all parts of AG powers, uses a mix of audit approaches to address them and covers all activities of the ANAO

What we will do

Develop and publish a new Work Program that is integrated by themes and risks

Develop new methodologies for:

- annual performance statement audit

- performance audits focusing on efficiency

- performance audits of GBEs

- use of data analytics

Defined policy on mandate and A-G Act

From

Service groups operate as individual audit practices

To

Integrated audit practices leveraging skills, data and tools supported by corporate services delivered centrally

What we will do

Implement one enterprise wide workflow approach for all audit work

Apply an ANAO wide resource model for audit work

Standardise management reporting in audit work

Centralise corporate services

Building fit out and accommodation that best supports more integrated structure

From

Decisions about models of audit service delivery are historical and resource based, and sometimes subject to market testing

To

Insourcing/outsourcing of work is actively considered in planning processes to take account of resourcing, capability and quality

What we will do

Refresh our approach to market for audit services and methodology

Benchmark our services

From

Functional QA Framework which is focussed on compliance with relevant auditing standards

To

Framework based on clear quality strategy aligned to risk management framework

What we will do

Develop and implement revised quality framework with increasing use of QA techniques

Explore external QA options

New models of audit service delivery: implementation timeline

Advanced ICT strategies and systems

Build ICT strategies and systems to ensure a flexible, responsive and connected environment that will support core analytics capability:

From

Limitations in working in real time environment

To

Our people can work from anywhere in real time

What we will do

Develop an ICT strategy for future work and to guide IT investment

Continuing to build our environment to support new ways of working

From

Multiple systems and tools used for common purposes, supported by the business areas

To

Common systems and tools used across enterprise, supported centrally in Corporate

What we will do

Centralise all IT support in Corporate, managed with strong governance

Build IT governance to support innovation

Effective transition to new IT outsource contract

From

Limited use of data and different sample sizes

To

Data analytics is core to delivery with robust methodology and systems

What we will do

Develop data analytics methodology for all audit work

Build IT and people capability

Explore validity of procuring analytics

Advanced ICT strategies and systems: implementation timeline

Contemporary communication capabilities

Adopt and make use of new communication styles, services and applications:

From

External communications are given a soft voice

To

Sharper products with clearer messages which can be leveraged across channels to different audiences

What we will do

Implement communication strategy and plans to operationalise strategy

Investigate more creative presentation of audit information

Develop approach to publishing financial statement audit opinions

Products used to support presentations and briefings to Parliamentarians

Develop an Audit Committee and Chief Financial Officer engagement strategy

From

Internal communications approaches are adhoc

To

Internal communications reflect AG and ANAO tone

What we will do

Regular meetings with SES and staff

Regular updates from Executive

Improve intranet and other internal communications channels

From

Publication process is largely paper-based

To

Publication processes are completely electronic and supported by electronic business tools

What we will do

Transition to full digital publishing of audit products, by exploring a pilot for electronic tabling in the new Parliament

Build electronic work processes behind all products, including trial of new tools

Contemporary communication capabilities: implementation timeline

Leadership capabilities

Form strong relationships, shape and manage business strategy and provide a framework for people development:

From

Attend national and international forums

To

Leading in forums and learning from international and national peers and colleagues

What we will do

Identify and agree the key areas for additional participation and leadership

Strengthen internal arrangements to support our contributions to national and international auditing

Develop tailored technical support programs in the Pacific region

Secondment policy revised and level of organisational commitment agreed for implementation

Establish formal secondment arrangements with organisations such as SAIs, the Big 4 and DTO

From

Audit findings are shared with affected entities

To

Audit insights and themes are shared more broadly and feed into our Work Program

What we will do

Build strategic thinking in our organisation to share insights from the sector

Feed insights into the Work Program

Increase the use of different audit approaches such as limited scope assurance or targeted reviews to deal with risks

From

Planning for audits is resulting in bunching of the program

To

Tabling program is evenly spread throughout the year to give Parliament the opportunity to review

What we will do

Table twelve audit reports per quarter

Resource to plan, including going to market

From

A compliance approach to performance management

To

More regular engagement and discussions between staff that support a high performing culture

What we will do

Develop the ANAO performance framework to better support regular and constructive feedback and establish clear expectations

Review the rewards and recognition framework

From

Limited processes to manage attrition in professional workforce

To

Coordinated processes in place across practices to manage attrition rates

What we will do

Develop staff leadership programs, talent and succession management plans

Develop a workforce strategy, including a revised capability framework

Develop a skills register to enable deployment of skilled and trained staff

Leadership capabilities: implementation timeline

Performance

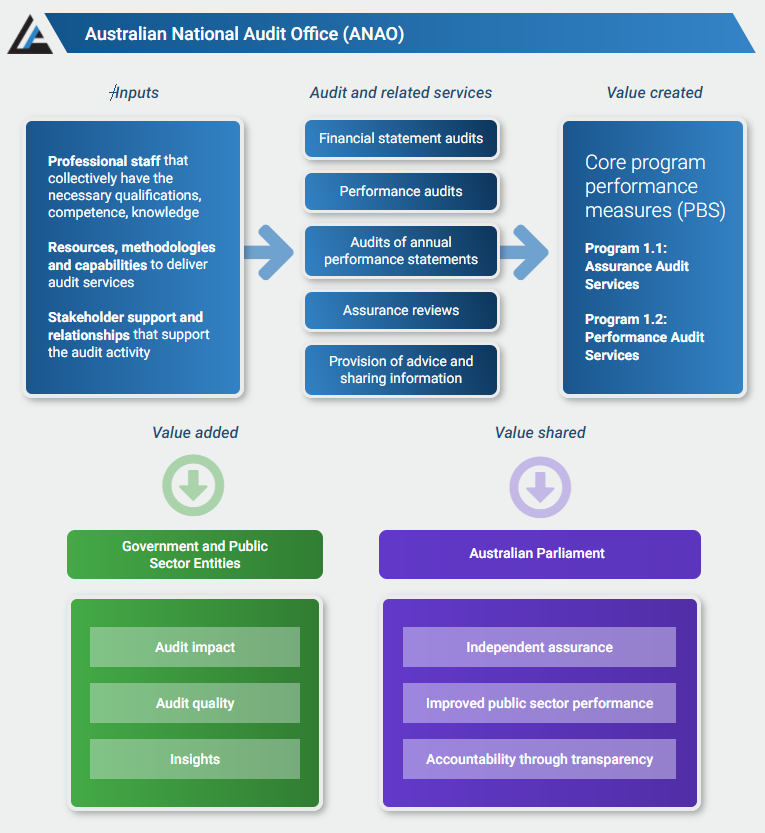

The performance of the ANAO is measured in terms of the audit and related services undertaken over the period of the Corporate Plan. Performance measurement informs Parliament about the ANAO’s performance and delivery of its purpose. The performance framework is also designed for ANAO leadership and staff to understand the impact of the activities they are responsible for, whether these activities are delivering against the ANAO’s purpose and to identify opportunities for improvement.

The performance measures convey a coherent message about what the ANAO expects to achieve in the next four years. The measures will be reported annually over the life of the Corporate Plan and will be reviewed annually. The performance measurement framework is based on measuring a combination of value created (by the ANAO), the value added to entities we audit, and the value shared with the Australian Parliament and public.

The ANAO Portfolio Budget Statements (PBS) sets measurable deliverables that assess our progress. In addition, performance measures for ‘value added’ and ‘value shared’ have been defined in terms of the perceived value of ANAO audit and related services by Parliamentarians, auditees, and Audit Committees.

The following table lists the ANAO’s performance measures and the financial years in which they will be measured.

| Target | |||||

Value created | ||||||

Number of appearances and submissions to Parliamentary committees | 20 |

|

|

|

| |

of the Australian Government’s aid program in the Indo-Pacific region |

|

|

|

| ||

Number of engagements that contribute to public sector auditing | 20 |

|

|

|

| |

Conduct Annual Performance Statements audits |

|

|

|

| ||

| Number of financial statement audit opinions issued | 250 |

|

|

|

| |

| Number of other assurance reports produced | 45 |

|

|

|

| |

| Number of financial statement related reports produced | 2 |

|

|

|

| |

| Number of performance audit reports presented | 48 |

|

|

|

| |

| Number of new or revised Better Practice Guides and other reports produced | 3 |

|

|

|

| |

| Number of audit reports every quarter | 12 |

|

|

|

| |

| Value added | ||||||

| The ANAO QA Program indicates that audit conclusions are appropriate | 100% |

|

|

|

| |

| The ANAO QA Program indicates that the ANAO quality assurance framework is operating effectively | 100% |

|

|

|

| |

| who acknowledge the value added by ANAO audit services | 90% |

|

|

|

| |

Percentage of Australian Government entities that acknowledge:

| 90% |

|

|

|

| |

| Percentage of recommendations included in audit reports agreed by audited entities | 90% |

|

|

|

| |

| Value shared | ||||||

Percentage of expressing satisfaction with:

| 90% |

|

|

|

| |

Average value rating provided by:

|

|

|

|

| ||

| Recommendations made by the ANAO's Independent Auditor are | 100% |

|

|

|

| |