Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Advances to the Finance Minister for the Period 1 July 2019 to 24 April 2020

Please direct enquiries through our contact page.

The Auditor-General undertook a limited assurance review of the Department of Finance’s reporting and administration of the Advances to the Finance Minister (AFM) for the Period 1 July 2019 to 24 April 2020.

Assurance review — section 19A of the Auditor-General Act 1997

INDEPENDENT ASSURANCE REPORT

Advances to the Finance Minister 1 July 2019 to 24 April 2020

Conclusion

Based on the procedures I have performed and the evidence I have obtained, nothing has come to my attention that causes me to believe that, in all material respects:

- the Advance to the Finance Minister (AFM) 2019–20 Determination Nos. 1 to 7 (as registered on legislation.gov.au)1 and the Finance Minister’s weekly AFM media releases2 are not presented completely and accurately for the period 1 July 2019 to 24 April 2020 based on the criteria outlined in this report; and

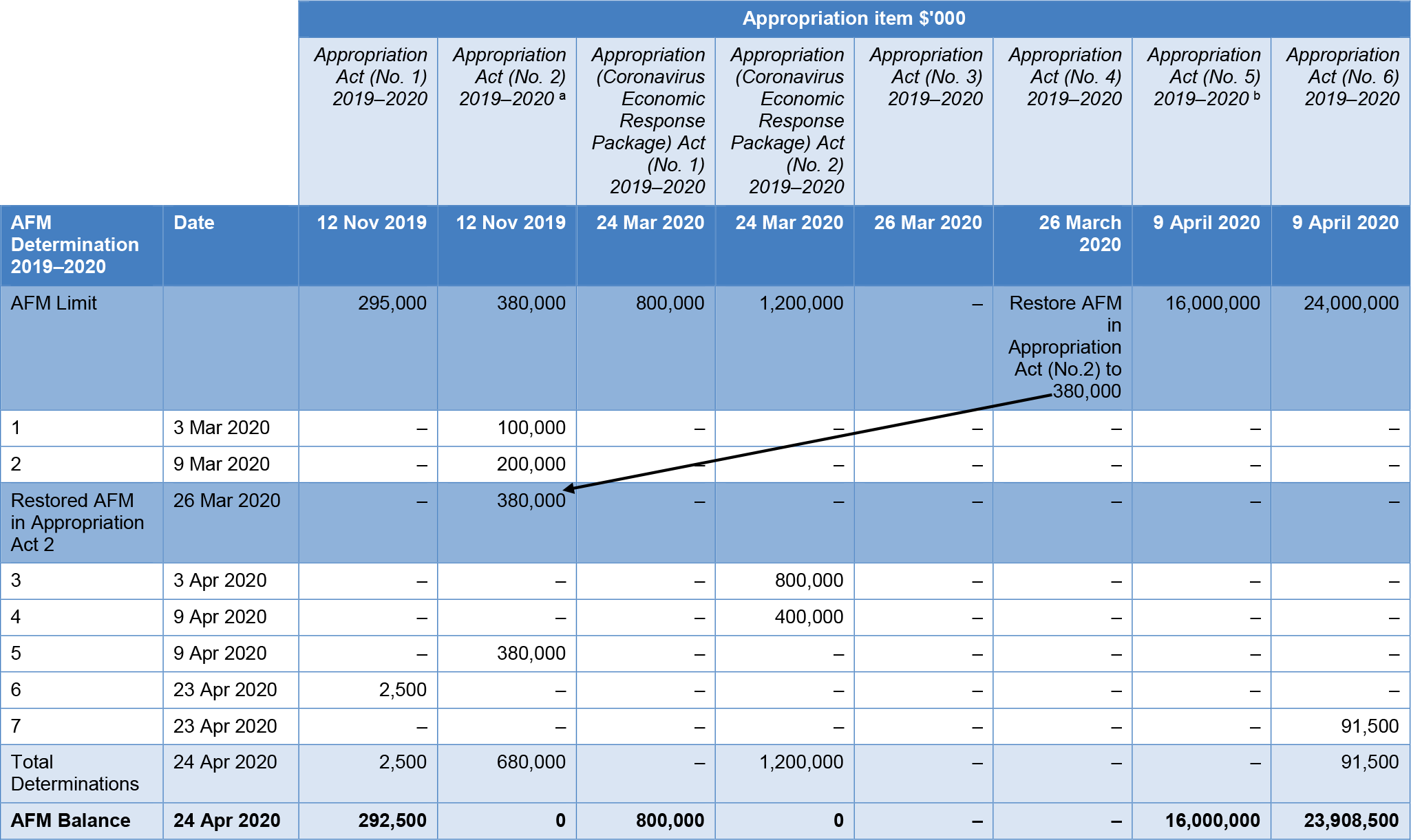

- the internal controls related to the Department of Finance’s administration of AFM were not suitably designed, implemented and operating effectively to achieve appropriate approval, recording and reporting of each AFM during the period.

My limited assurance conclusion has been formed on the basis of the matters outlined in this report.

I have undertaken a limited assurance review of the Department of Finance’s (Finance) reporting and administration of the AFM, in order to express a conclusion on Determinations made from 1 July 2019 to 24 April 2020, based on the following criteria:

- Have accounts and records been appropriately obtained and maintained to support the complete and accurate reporting of AFM, taking into consideration whether:

- Finance has a central register of all applications and approvals;

- all decisions for the AFM have been documented appropriately, including identifying the appropriation act under which each advance is made;

- all accounts and records for the applications for the AFM have been adequately maintained;

- Finance has effective processes in place to obtain assurance from entities over the completeness and accuracy of the information provided to Finance;

- the underlying financial information in relation to the AFM supports the description of the purpose for each amount advanced under the AFM as described in the relevant Determinations (as registered on legislation.gov.au) and the Finance Minister’s weekly AFM media releases; and

- the Finance Minister’s weekly AFM media releases present complete and accurate information about the Determinations made in the relevant week.

- Are the controls related to the Department of Finance’s administration of AFM suitably designed, implemented and operating effectively to achieve appropriate approval, recording and reporting of AFM during the period, taking into consideration whether:

- Finance has guidance or a framework that communicates clearly to entities as to the requirements to apply for the AFM, and whether this was complete, accurate, and compliant with the criteria set out in the Annual Appropriation Acts;

- Finance has an appropriate risk framework for the AFM;

- existing controls are capable of addressing the identified risks effectively;

- Finance has implemented and operated effective controls over the approval process to ensure applications for the AFM are only approved when applying entities provide sufficient information to support its compliance with the criteria set out in the Annual Appropriation Acts; and

- the AFM approval process complied with the criteria set out in the Annual Appropriation Acts.

Basis for conclusion

I have conducted the review in accordance with the ANAO Auditing Standards, which include the relevant Standards on Assurance Engagements ASAE 3000 Assurance Engagements Other than Audits or Reviews of Historical Financial Information (ASAE 3000) and ASAE 3150 Assurance Engagements on Controls (ASAE 3150).

I believe that the evidence I have obtained is sufficient and appropriate to provide a basis for my conclusion.

Responsibilities of the Secretary of the Department of Finance

The Secretary of the Department of Finance is responsible for the administration of the AFM, the preparation of the above-mentioned Determinations and maintenance of supporting accounts and records relevant to the reporting of the AFM in accordance with Appropriation Acts Nos. 1 to 6 2019–20203 and Appropriation (Coronavirus Economic Response Package) Acts Nos. 1 and 2 2019–2020.4

The Secretary is also responsible for such internal control procedures as the Secretary determines necessary to enable the administration of the AFM and preparation of the above-mentioned Determinations that are free from material misstatement, whether due to fraud or error.

Independence and quality control

I have complied with the independence and other relevant ethical requirements relating to assurance engagements, and applied Auditing Standard ASQC 1 Quality Control for Firms that Perform Audits and Reviews of Financial Reports and Other Financial Information, Other Assurance Engagements and Related Services Engagements in undertaking this assurance review.

Responsibilities of the Auditor-General

My responsibility is to express a limited assurance conclusion on whether the Finance Minister’s and the Department of Finance’s reporting of the AFM is complete and accurate, in all material respects, and internal controls related to the AFM were designed, implemented and operating effectively for the period from 1 July 2019 to 24 April 2020, as evaluated against the criteria. The ANAO Auditing Standards require that I plan and perform my procedures to obtain limited assurance about whether anything has come to my attention that the Department of Finance’s reporting of the AFM is not complete and accurate, in all material respects, and internal controls related to the AFM were not designed, implemented and operating effectively for the period from 1 July 2019 to 24 April 2020.

An assurance engagement to report on the design and operating effectiveness of controls involves performing procedures to obtain evidence about the suitability of the design of controls to achieve the control objectives and the operating effectiveness of controls throughout the period.

The procedures performed in a limited assurance review vary in nature and timing from, and are less in extent than for, a reasonable assurance engagement and consequently the level of assurance obtained in a limited assurance review is substantially lower than the assurance that would have been obtained had a reasonable assurance engagement been performed. Accordingly, I do not express a reasonable assurance opinion on the reporting of the AFM or on the internal controls.

I have conducted my limited assurance review by making such enquiries and performing such procedures I considered reasonable in the circumstances, including:

- making enquiries of management and others within the entity, as appropriate;

- examining the internal control design specifications and documentation;

- examining supporting documentation for determinations; and

- evaluating the evidence obtained.

The procedures selected depend on my judgement, including the assessment of the risks that the reporting of the AFM is not complete and accurate or the controls are not suitably designed, implemented or operating effectively.

Inherent limitations

Because of the inherent limitations of an assurance engagement, together with the internal control structure it is possible that, even if the controls are suitably designed and operating effectively, the control objectives may not be achieved so that fraud, error, or non-compliance with laws and regulations may occur and not be detected. Further, the internal control structure, within which the controls that I have assured are designed to operate, has not been assured and no opinion is expressed as to its design or operating effectiveness.

A limited assurance engagement throughout the specified period on operating effectiveness of controls is not designed to detect all instances of controls operating ineffectively as it is not performed continuously throughout the period and the tests performed are on a sample basis. A limited assurance engagement throughout the specified period does not provide assurance on whether complete and accurate reporting of the AFM or the outcome of the evaluation of controls will continue in the future.

Australian National Audit Office

Grant Hehir

Auditor-General

Canberra

4 May 2020

Appendix A — What this report is about

1. This report is the first of a monthly limited assurance review of the Advance to the Finance Minister (AFM), covering the Advances made between 1 July 2019 and 24 April 2020. The objective of this review is to provide Parliament with timely assurance on the AFM made under the Government’s stimulus package response to COVID-19. The review focused on evaluating:

- whether controls have been implemented as designed by the Department of Finance and are operating effectively;

- the supporting information for each AFM;

- the completeness and accuracy of the information included in the Finance Minister’s Determinations (as registered on legislation.gov.au) and the Finance Minister’s weekly AFM media releases; and

- the accuracy and clarity of the description of the purpose for each amount advanced under the AFM.

This Appendix also includes a graphical analysis of the monthly and cumulative Finance Minister’s Determination totals.

Background

2. The AFM is a provision in the annual Appropriation Acts which enables the Minister for Finance (Finance Minister) to provide additional urgently needed appropriation to entities for expenditure in the current year. The Finance Minister may only agree to issue an AFM if satisfied that there is an urgent need for expenditure that is either not provided for or has been insufficiently provided for in the existing appropriations of the entity. The Finance Minister provides the additional appropriation by means of a Determination. Before issuing a determination to increase an entity’s appropriation item, the Finance Minister must be satisfied that the legislative criteria set out in the annual Appropriation Acts are met.

3. Entities may have urgent need for expenditure because forecasts of future expenditure may be based on assumptions that prove to be wrong, assessments of future economic conditions that do not eventuate or circumstances that are unanticipated. It is therefore an established practice to build into estimates of future expenditure some flexibility to account for contingencies. The AFM is a long-standing feature of the Appropriation Bills dating from 1979 when the AFM replaced the Advance to the Treasurer following the establishment in 1976 of the office of the Finance Minister. Typically, the Advance is established in the first Appropriation Acts each year and then replenished whenever supplementary Appropriation Acts are passed.

4. The amounts that can be issued under the AFM provisions are limited to amounts identified in the Appropriation Acts. Advances under Appropriation Act No. 1 are limited to $295 million, whilst advances under Appropriation Act No. 2 are limited to $380 million. Where these limits are close to being exhausted, or are likely to be exhausted, provisions can be made in the Additional Estimates Appropriation Acts for these limits to be restored to the original amounts, irrespective of amounts that had been issued before the commencement of these Acts. This will ensure that there are sufficient amounts within the AFM for the remainder of the financial year. All requests for an Advance must be made in writing and have ministerial support.

5. In response to COVID-19, two additional AFM were enacted for Coronavirus Economic Response Packages - Appropriations Acts No. 1 and No 2 for $0.8 billion and $1.2 billion respectively. Further, two Appropriation Supply Bills 1 and 2 including AFM for $16 billion and $24 billion respectively were passed by Parliament for the 2020–21 financial year. Subsequently, Appropriation Acts No. 5 and No. 6 were passed with the effect of making the AFM of $40 billion in the Supply Bills available to be advanced in the 2019–20 financial year.

Accountability for Advances to the Finance Minister

6. Entities are required to report AFM spending fortnightly to the Department of Finance (Finance). Entities also need to advise how they intend to manage any underspend. To ensure transparency, AFM determinations are:

- registered on the Federal Register of Legislation (FRL);

- tabled in Parliament at the next available opportunity; and

- listed on Finance’s website with a link provided to it on the FRL.

At the end of the financial year, Finance prepares an AFM annual report, which is subject to review by the Australian National Audit Office, detailing all AFMs that have been issued in that financial year. The report is tabled in the Parliament and is made available on Finance’s website.

Overview

7. The Government’s economic response to COVID-19 involved significant stimulus package to address the impact of the pandemic. The total stimulus package announced to date is approximately $327 billion including $7 billion announced prior to COVID-19 being declared a pandemic. The rapid design and implementation of emergency response measures therefore require establishing fit for purpose governance and planning arrangements and maintaining appropriate records and robust controls environment.

8. This report focuses on the AFM issued totalling $1.974 billion to 24 April 2020 out of the available $42.975 billion for the financial year 2019–20.

9. Table 1 below contains details of the seven Determinations made during the period to 1 July 2019 to 24 April 2020.

Table 1: Determinations made as at 24 April 2020

|

AFM |

Dates |

Source of AFM |

Entity |

Purposes |

Advance provided ($'000) |

|

1 |

3 March 2020 |

Appropriation Act No. 2 2019–2020 |

Department of Health |

Procurement of masks for the National Medical Stockpile as part of the Australian Health Sector Emergency Response Plan for Novel Coronavirus. |

100,000 |

|

2 |

9 March 2020 |

Appropriation Act No. 2 2019–2020 |

Department of Health |

Fund the further procurement of masks and other emergency medical or emergency health equipment for the National Medical Stockpile as part of the Australian Health Sector Emergency Response Plan for Novel Coronavirus. |

200,000 |

|

3 |

3 April 2020 |

Appropriation (Coronavirus Economic Response Package) Act (No. 2) 2019–2020 |

Department of Health |

Fund the further procurement of masks and other emergency medical or emergency health equipment to deal with the impact of COVID-19 in Australia. |

800,000 |

|

4 |

9 April 2020 |

Appropriation (Coronavirus Economic Response Package) Act (No. 2) 2019–2020 |

Department of Health |

Fund the further procurement of masks and other emergency medical or emergency health equipment to deal with the impact of COVID-19 in Australia. Determinations 4 and 5 relate to the same AFM application. |

400,000 |

|

5 |

9 April 2020 |

Appropriation Act No. 2 2019–2020 |

Department of Health |

Fund the further procurement of masks and other emergency medical or emergency health equipment to deal with the impact of COVID-19 in Australia |

380,000 |

|

6 |

23 April 2020 |

Appropriation Act No. 1 2019–2020 |

Department of Industry, Science, Energy and Resources |

To support the Government's purchase of oil stocks and the leasing of storage capacity in the United States Strategic Petroleum Reserve – Leasing storage space. Determinations 6 and 7 relate to the same AFM application. |

2,500 |

|

7 |

23 April 2020 |

Appropriation Act No. 6 2019–2020 |

Department of Industry, Science, Energy and Resources |

To support the Government's purchase of oil stocks and the leasing of storage capacity in the United States Strategic Petroleum Reserve – Purchase of oils stocks. |

91,500 |

|

Total |

1,974,000 |

||||

Source: Advance to the Finance Minister Determinations Nos. 1 to 7 of 2019-2020 (see footnote 1).

Advances provided under the Appropriation Acts for the period 1 July 2019 to 24 April 2020

10. The table below details the AFM provisions for the relevant Appropriation Acts, the amount of the provision and the subsequent Finance Minister’s determinations for the period from 1 July 2019 to 24 April 2020. It should be noted that:

- Appropriation Act (No. 3) 2019–2020 and Appropriation Act (No. 4) 2019–2020 restored the maximum limits for Appropriation Act (No. 1) 2019–2020 and Appropriation Act (No. 2) 2019–2020, respectively. Therefore, after the commencement of Appropriation Act (No. 4) 2019–2020, the Finance Minister had access to $380 million under the AFM in Appropriation Act (No. 2) 2019–2020, regardless of the amounts that had already been determined ($300 million). The additional $380 million was used for AFM Determination No. 5 2019–2020.

- AFM amounts in Appropriation Act (No. 5) 2019–2020 and Appropriation Act No. 6 2019–2020 are shared with Supply Act (No. 1) 2020–2021 and Supply Act (No. 2) 2020–2021.5 This means the amounts available under the two Supply Acts in 2020–2021 are reduced for any AFM issued under the 2019–2020 Annual Appropriation Acts 5 and 6.

Table 2: Advance to the Finance Minister balances as at 24 April 2020

Note a: See paragraph 10(a).

Note b: See paragraph 10(b).

Source: ANAO analysis.

Have accounts and records been appropriately obtained and maintained to support the complete and accurate reporting of AFM?

11. Finance has a central register of all applications and approvals for each AFM. The register maintains accounts and records which includes documentation of all decisions made for an AFM. Nothing has come to my attention that causes me to believe that Finance does not have processes in place to obtain assurance over the completeness and accuracy of the information provided from entities. From evaluation of the evidence provided, nothing has come to my attention that the Finance Minister’s weekly AFM media releases do not present complete and accurate information about the Determinations made in the relevant week. The Finance Minister’s first 2019–20 AFM media release was published on 3 April 2020 and referenced the first three Determinations. The following media releases were published during the week each Determination was made.

Are the controls related to the Department of Finance’s administration of Advances to the Finance Minister suitably designed, implemented and operating effectively to achieve appropriate approval, recording and reporting of AFM?

12. Finance provided guidance to entities through the Estimates Memorandum 2019/34 which advises entities of the application and management requirement for an AFM to be compliant with the criteria set out in the Appropriation Acts. Finance has a risk framework for the management of the AFM process through existing controls. Nothing has come to my attention that causes me to believe that Finance has not implemented controls over the approval process to ensure that applications for each AFM have only been approved when applying entities have provided sufficient information to support their compliance with the criteria set out in the Appropriation Acts. From enquires made, nothing has come to my attention that Finance has not suitably designed and implemented controls relating to the AFM’s administration processes and that these controls were not operating effectively to achieve appropriate approval, recording and reporting of AFM during the period.

Figure 1: Trend analysis of monthly and cumulative totals of Finance Minister’s Determinations (1 July 2019 – 24 April 2020)

Source: ANAO analysis.

Figure 2: Timeline of Advance to the Finance Minister legislation, including determinations

Source: ANAO analysis.

Footnotes

1 Advance to the Finance Minister Determination (No. 1 of 2019-2020), available from: https://www.legislation.gov.au/Details/F2020L00220.

Advance to the Finance Minister Determination (No. 2 of 2019-2020), available from: https://www.legislation.gov.au/Details/F2020L00235.

Advance to the Finance Minister Determination (No. 3 of 2019-2020), available from: https://www.legislation.gov.au/Details/F2020L00402.

Advance to the Finance Minister Determination (No. 4 of 2019-2020), available from: https://www.legislation.gov.au/Details/F2020L00421.

Advance to the Finance Minister Determination (No. 5 of 2019-2020), available from: https://www.legislation.gov.au/Details/F2020L00422.

Advance to the Finance Minister Determination (No. 6 of 2019-2020), available from: https://www.legislation.gov.au/Details/F2020L00467.

Advance to the Finance Minister Determination (No. 7 of 2019-2020), available from: https://www.legislation.gov.au/Details/F2020L00468.

2 M Cormann (Minister for Finance), ‘Advances to the Finance Minister in the week ending Friday 3 April 2020’, media release, Parliament House, Canberra, 3 April 2020, available from https://www.financeminister.gov.au/media-release/2020/04/03/advances-finance-minister-week-ending-friday-3-april-2020 [accessed 1 May 2020].

ibid., ‘Advances to the Finance Minister in the week ending Friday, 10 April 2020’, 10 April 2020, available from https://www.financeminister.gov.au/media-release/2020/04/10/advances-finance-minister-week-ending-friday-10-april-2020 [accessed 1 May 2020].

ibid., ‘Advances to the Finance Minister in the week ending Friday, 24 April 2020’, 24 April 2020, available from https://www.financeminister.gov.au/media-release/2020/04/24/advances-finance-minister-week-ending-friday-24-april-2020 [accessed 1 May 2020].

3 Appropriation Act (No. 1) 2019-2020, available from https://www.legislation.gov.au/Details/C2019A00100.

Appropriation Act (No. 2) 2019-2020, available from https://www.legislation.gov.au/Details/C2019A00101.

Appropriation Act (No. 3) 2019-2020, available from https://www.legislation.gov.au/Details/C2020A00033.

Appropriation Act (No. 4) 2019-2020, available from https://www.legislation.gov.au/Details/C2020A00034.

Appropriation Act (No. 5) 2019-2020, available from https://www.legislation.gov.au/Details/C2020A00039.

Appropriation Act (No. 6) 2019-2020, available from https://www.legislation.gov.au/Details/C2020A00040.

4 Appropriation (Coronavirus Economic Response Package) Act (No. 1) 2019-2020, available from https://www.legislation.gov.au/Details/C2020A00025.

Appropriation (Coronavirus Economic Response Package) Act (No. 2) 2019-2020, available from https://www.legislation.gov.au/Details/C2020A00026.

5 Supply Act (No. 1) 2020-2021, available from https://www.legislation.gov.au/Details/C2020A00030.

Supply Act (No. 2) 2020-2021, available from https://www.legislation.gov.au/Details/C2020A00031.