Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Purchase of the ‘Leppington Triangle’ Land for the Future Development of Western Sydney Airport

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Department of Infrastructure’s 2018–19 financial statements valued the Leppington Triangle land at $3,065,000 - a tenth of the price it had paid eleven months earlier. While the ANAO undertook further audit procedures as part of the financial statement audit it was unable to conclude on key aspects of the transaction.

Key facts

- The Leppington Triangle land is expected to be needed in about 30 years should a second runway be constructed in a future stage of the Western Sydney Airport’s development.

- On 31 July 2018, the Australian Government purchased a 12.26 hectare triangular parcel of land for $29,839,026. On the date of purchase, the land was leased back to the seller for 10 years with options to renew totalling a further 10 years. The land was valued at $920,000 for lease-back purposes.

- The land is being used for agricultural purposes. Airport development controls limit alternative uses.

- Nine valuations of the Leppington Triangle land were in the department’s records.

What did we find?

- The Department of Infrastructure did not exercise appropriate due diligence in its acquisition of the Leppington Triangle land. Aspects of the operations of the department fell short of ethical standards.

- An appropriate acquisition strategy was not developed.

- The valuation approach inflated the value of the land, which in turn led to the Australian Government paying more than was proper in the circumstances.

- Decision-makers were not appropriately advised on the land acquisition. Formal briefings omitted relevant information, such as: the purchase price; that the price exceeded all known market valuations of the land; and the method of acquisition.

What did we recommend?

- The Auditor-General made three recommendations addressing the analysis that informs spending decisions, managing probity risks and the approach to obtaining land valuations.

- The Department of Infrastructure agreed to each of the recommendations.

4 times

higher land valuation used by the Department of Infrastructure to arrive at the purchase price than the next highest valuation.

22 times

higher price per hectare paid by the Department of Infrastructure than paid by the NSW government for its portion of the Leppington Triangle.

$26.7m

was the difference between the purchase price and the ‘fair value’ reported in the department’s financial statements.

Summary and recommendations

Background

1. On 31 July 2018, the Australian Government purchased a 12.26 hectare triangular parcel of land for $29,839,026 (GST exclusive) in Bringelly NSW. The land is referred to as the ‘Leppington Triangle’ and it sits adjacent to the Western Sydney International (Nancy-Bird Walton) Airport site (the ‘Western Sydney Airport’). The land acquisition process was undertaken by the undertaken by the Western Sydney Unit within the Department of Infrastructure, Transport, Regional Development and Communications (‘Department of Infrastructure’ or ‘the department’).

Rationale for undertaking the audit

2. For financial reporting purposes at 30 June 2019, the Department of Infrastructure valued the Leppington Triangle land at $3,065,000 - a tenth of the price it had paid eleven months earlier. As required by the Australian Auditing Standards, the ANAO raised this with the department as a significant and unusual transaction. While the ANAO undertook further audit procedures as part of the financial statement audit, it was unable to conclude on key aspects of the transaction based on the information provided to it by the department. In this context a performance audit of the transaction was considered warranted.

3. An examination of the purchase of the Leppington Triangle land would also provide a case study of the extent of the due diligence exercised by the Western Sydney Unit in the department when performing its responsibilities. The Unit’s responsibilities include administering the Australian Government’s investments of $5.3 billion in the Western Sydney Airport and $2.9 billion in the Western Sydney Infrastructure Plan.

Audit objective and criteria

4. The objective of the audit was to examine whether the Department of Infrastructure exercised appropriate due diligence in its acquisition of the Leppington Triangle land for the future development of the Western Sydney Airport.

5. To form a conclusion against this objective, the following high-level criteria were applied:

- Was an appropriate acquisition strategy developed?

- Was an appropriate approach taken to valuing the land?

- Were decision-makers appropriately advised?

Conclusion

6. The Department of Infrastructure did not exercise appropriate due diligence in its acquisition of the Leppington Triangle land for the future development of the Western Sydney Airport. In the course of this audit it became clear that aspects of the operations of the department, both during and after the acquisition, fell short of ethical standards.

7. An appropriate acquisition strategy was not developed. While a strategy was documented and approved:

- it was focussed on incentivising an unwilling seller to dispose of their land some 32 years in advance of when it was anticipated to be needed for the airport expansion, an approach at odds with the department asserting that early purchase allowed it to capitalise on ‘goodwill’ from the landowner;

- the underlying analysis overstated the identified benefits, did not quantify costs and did not address risks; and

- the acquisition approach eventually employed departed from the approved strategy.

8. The approach taken by the Department of Infrastructure to valuing the Leppington Triangle was not appropriate. The approach inflated the value of the land, which in turn led to the Australian Government paying more than was proper in the circumstances.

9. Decision-makers were not appropriately advised on the land acquisition. Formal briefings omitted relevant information, such as: the purchase price; that the price exceeded all known market valuations of the land (see Figure S.1); and the method of acquisition. Advice from the department on value for money was inadequate and unreliable. Decision-maker approval was not evident for some of the actions taken. A subsequent departmental review of the acquisition process lacked rigour and did not provide a reasonable basis for concluding that the transaction was settled for an appropriate value.

10. The incomplete advice provided to decision-makers, and the inadequate response by the department when questions were raised by the ANAO, was inconsistent with effective and ethical stewardship of public resources.

Figure S.1: Comparison of the price paid against nine valuations of the land

Source: ANAO analysis of Department of Infrastructure records.

Supporting findings

Land acquisition strategy

11. The Australian Government expected that it would need the Leppington Triangle when a second runway is constructed at a future stage of the Western Sydney Airport’s development. It estimated that a second runway would be required from around 2050.

12. The Australian Government had sought to acquire the Leppington Triangle in 1989 as part of a larger parcel of land. During a 10-year dispute with the landowner the Australian Government agreed to exclude it from that acquisition process.

13. The key impetus for starting work in 2016 on acquiring the Leppington Triangle was to capitalise on goodwill the department considered had been created by concessions made to the landowner on the route for the realignment of The Northern Road. The route was adjusted so as to run on mostly Australian Government land along the airport boundary rather than through the farm of the landowner. Due diligence and value for money was not demonstrated in the department’s advice supporting the route adjustment.

14. Appropriate consideration was not given to costs and benefits when deciding to acquire the land early. The benefits identified by the department in its advice are questionable and there was no documented consideration of costs. The department did not demonstrate that the benefits of acquiring, and paying for, the land some decades in advance of need outweighed the cost to the Australian Government.

15. The strategy for acquiring the land contained a package of transactions intended to incentivise an unwilling seller, which was at odds with the department’s advice that the early purchase was being pursued so as to capitalise on perceived goodwill from the landowner. Cost estimates were not included in the documented acquisition strategy. After approval was given within the department to progress an acquisition by compulsory process, the approach was changed, without further documented approval, to be an acquisition by agreement with the owner so as to achieve a target date of 31 July 2018.

16. There were shortcomings in the department’s management of probity with its staff. A key requirement was for all Western Sydney Unit officers and advisors to declare conflicts of interest. While the declaration requirement was largely met, a senior officer did not appropriately action probity instructions in relation to a declared conflict. Probity risks were also increased by the approach taken by some staff when engaging directly with landowners.

Land valuation

17. A single valuation of the market value of the land was obtained jointly with the landowner. No valuation of the other types of compensation that may be payable under a compulsory acquisition was obtained.

18. The land valuation was procured by approaching one supplier. The supplier was one of those suggested by the landowner and was then agreed to by the department on the basis that there were no conflicts of interest between the parties. The approach taken was not sufficiently robust in light of the procurement risks. While the cost of the valuation was low (less than $4,000) the importance of the valuation to informing a multi-million dollar purchase meant that an openly competitive procurement approach was warranted.

19. The department gave the valuer inappropriate instructions on the valuation approach to be used and the basis on which the current market value of the land was to be assessed. Specific instructions not to carry out the usual enquiries and investigations associated with a market valuation resulted in a ‘Restricted Assessment’ being obtained, which provides a lower level of assurance than was appropriate for the Australian Government’s purpose. The department did not provide the ANAO with accurate answers when questions were first asked about the valuation approach, which was not ethical behaviour.

20. A sales comparison method was used that, by instruction from the department, assumed a highest and best use reflected in speculative industrial re-zoning potential that was highly unlikely to occur given existing legal restrictions and the requirements associated with the future development of the airport. Negative impacts on land value (for example, airport noise) and restrictions associated with development controls affecting land around airports were not reflected in the valuation.

21. The resulting ‘restricted valuation’ was that the value of the land would likely fall within the range of $28.5 million – $32 million, should a fully researched valuation be undertaken (which did not happen). Overall, the valuation approach required of the valuer by the department increased the cost of the purchase to the Australian Government.

22. The recorded basis for the department accepting the draft valuation report, without edit, was confirmation from the landowner that the report could be finalised. The department did not take up the suggestions offered by the NSW government on the draft valuation report nor take action in response to advice that the NSW government had valued the land substantially lower.

Advice to decision-makers

23. The departmental decision-maker was appropriately advised in 2016 when giving approval to pursue the acquisition of the Leppington Triangle by compulsory process. Thereafter, decision-makers were not advised as to the method of acquisition, which had changed. The land was acquired in July 2018 by way of agreement with the owner.

24. The approach taken by the department of omitting key information in the briefings to decision-makers and Ministers was inappropriate and inconsistent with acting ethically. Decision-makers were not appropriately advised as to the amount to be paid to the landowner. While some briefings outlined the basis on which the market value of the land would be calculated, all omitted to state that value. It was not made evident that the department intended to pay a per hectare rate some 20 times higher than that proposed by the NSW government for its portion of the Leppington Triangle.

25. Decision-makers were not appropriately advised as to the value for money of the terms of the land acquisition. Briefings lacked balance in that, while they presented confirming evidence as to the reasonableness of the proposed land price, they omitted evidence that the price was too high including reference to other valuations of the land. This approach was misleading and did not support informed decision-making. Overall, the lack of transparency evident in briefings concerning the basis for valuations and the price being paid was inconsistent with an ethical approach to public administration.

26. The ANAO identified the revaluation of the acquisition in the department’s financial statements as a significant and unusual transaction and recommended a review be undertaken to determine if integrity and probity were maintained during the process. The ANAO also drew the attention of the department’s Audit and Risk Committee to the issue.

27. A departmental review of the acquisition process did not adequately account for the difference between the purchase price of $29.8 million and the land asset value of $3.1 million. The review process lacked rigour in its approach and in terms of being conducted by officers directly involved with the transaction. The department’s Audit and Risk Committee did not take any action in response to the matters raised by the ANAO.

Recommendations

Recommendation no.1

Paragraph 2.46

The Department of Infrastructure, Transport, Regional Development and Communications prepare comprehensive and balanced written analysis on the benefits, costs and risks of proposals to spend public money.

Department of Infrastructure, Transport, Regional Development and Communications response: Agreed.

Recommendation no.2

Paragraph 2.98

The Department of Infrastructure, Transport, Regional Development and Communications put in place meeting and communication protocols for when staff engage directly with individual landowners, developers or similar parties with heightened probity risks. The protocols should: include guidelines regarding suitable venues; require the presence of at least two departmental representatives; and require properly recorded minutes of meetings and conversations.

Department of Infrastructure, Transport, Regional Development and Communications response: Agreed.

Recommendation no.3

Paragraph 3.84

The Department of Infrastructure, Transport, Regional Development and Communications develop policies and procedures to govern its approach to obtaining purchase valuations.

Department of Infrastructure, Transport, Regional Development and Communications response: Agreed.

Summary of entities’ responses

28. The proposed audit report was provided to the Department of Infrastructure, Transport, Regional Development and Communications. The department’s summary response is provided below and its full response is at Appendix 1.

29. Extracts of the proposed audit report were provided to the Department of Finance, Transport for NSW, the Leppington Pastoral Company, Landrum & Brown, M J Davis Valuations Pty Ltd and the former Secretary of the then Department of Infrastructure, Transport, Cities and Regional Development. Formal responses to the extracts were provided by the Department of Finance, Transport for NSW and Landrum & Brown and are at Appendix 1.

Department of Infrastructure, Transport, Regional Development and Communications

The Department of Infrastructure, Transport, Regional Development and Communications (the Department) notes the ANAO report and agrees with the recommendations.

The Department is concerned by the findings of the report, and is taking actions to address any shortcomings in the processes and decision making arrangements identified in relation to the Leppington Triangle acquisition.

The Department has a long track record of operating consistent with expected standards of integrity and ethics. In light of the allegation of individual breaches of integrity, the matters raised by the ANAO in the report are being investigated to ensure all such matters are fully understood and appropriate action can be taken.

The Department has established an independent review of the transaction arrangements to ensure the findings of the audit are addressed. The Department has also commenced management reviews into matters of staff conduct identified by the ANAO, and will ensure the concerns raised are specifically addressed.

An external probity advisor will be appointed to support ongoing functions related to major projects and land acquisitions, and will assist with the development of guidance materials on obtaining purchase valuations in consultation with the Department of Finance, to ensure that protocols are in line with operations of the Lands Acquisition Act 1989.

The Department notes the ANAO view that the purchase could have been made at a much later date, and considers that consistent with earlier approaches at Badgerys Creek, and with other airports, acquisition of the land as early as practicable has benefits. The acquisition of the Triangle represented the final parcel of land that needed to be acquired for the airport site, creating a complex market situation.

The acquisition of the Triangle came about alongside the establishment of the Western Sydney Airport Company and the public release of the Government’s Airport Plan which committed to a two runway airport.

Early acquisition provided certainty to stakeholders for long term planning, has allowed Western Sydney Airport Company to plan effectively for the entire development of the Airport as identified in the Airport Plan, and has reduced the risk of future challenges on the Airport development.

The Department agrees that the valuation strategy was unorthodox. However, we note that the strategy was developed in consultation with the Department of Finance and the Australian Government Solicitor and was designed to mitigate the risk of costly and lengthy legal challenges.

As the report notes, the land-holding company had previously challenged land acquisitions at the airport site with the Department spending over ten years in legal proceedings.

The Department’s Audit and Risk Committee has been consulted on the audit. They advised the Financial Statements Sub Committee were made aware prior to the Audit and Risk Committee recommending the financial statements be signed by the Secretary, that the accounting treatment of the transaction and its inclusion in the Department’s financial statements, had been accepted by the ANAO and that an unmodified audit opinion would be issued.

The Committee was further advised that the ANAO intended to undertake further audit procedures of the purchase, internal reviews on probity and integrity were being undertaken by the Department, and that the ANAO may conduct a performance audit on the matter at a later stage.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Procurement

Governance and risk management

1. Background

Introduction

1.1 On 31 July 2018, the Australian Government purchased a 12.26 hectare triangular parcel of land for $29,839,026 (GST exclusive). The land is lot 105, Deposited Plan 1236319, in Bringelly NSW and is referred to as the ‘Leppington Triangle’. The land sits adjacent to the Western Sydney International (Nancy-Bird Walton) Airport site (the ‘Western Sydney Airport’). The land acquisition process was undertaken by the Western Sydney Unit within the Department of Infrastructure, Transport, Regional Development and Communications (‘Department of Infrastructure’ or ‘the department’).1

Rationale for undertaking the audit

1.2 For financial reporting purposes at 30 June 2019, the Department of Infrastructure valued the Leppington Triangle land at $3,065,000 - a tenth of the price it had paid eleven months earlier. As required by the Australian Auditing Standards, the ANAO raised this with the department as a significant and unusual transaction. While the ANAO undertook further audit procedures as part of the financial statement audit, it was unable to conclude on key aspects of the transaction based on the information provided to it by the department. In this context a performance audit of the transaction was considered warranted.

1.3 An examination of the purchase of the Leppington Triangle land would also provide a case study of the extent of the due diligence exercised by the Western Sydney Unit in the department when performing its responsibilities. The Unit’s responsibilities include administering the Australian Government’s investments of $5.3 billion in the Western Sydney Airport and $2.9 billion in the Western Sydney Infrastructure Plan.

Audit approach

Audit objective, criteria and scope

1.4 The objective of the audit was to examine whether the Department of Infrastructure exercised appropriate due diligence in its acquisition of the Leppington Triangle land for the future development of the Western Sydney Airport.

1.5 To form a conclusion against this objective, the following high-level criteria were applied:

- Was an appropriate acquisition strategy developed?

- Was an appropriate approach taken to valuing the land?

- Were decision-makers appropriately advised?

1.6 The audit scope extended from identifying the need for the land through to the department’s recording of the transaction in its 2018–19 financial statements. The scope also included examination of the subsequent departmental review of the purchase.

Audit methodology

1.7 The audit involved the collection and examination of Department of Infrastructure records and liaison with key staff. This included consideration of responses to ANAO requests for information, documents maintained in electronic filing systems, advice to government and the departmental email accounts of 14 officers.

1.8 The audit also involved ANAO engagement with the firm the Department of Infrastructure had engaged to value the Leppington Triangle to inform the purchase price, as well as Transport for NSW within the New South Wales Government. NSW Roads and Maritime Services (RMS) is the agency name referred to in this document, as it was in place at the time the Leppington Triangle land was acquired. RMS was dissolved on 1 December 2019 and its functions were assumed by Transport for NSW.

1.9 In considering issues with respect to ethics the ANAO has referenced the Public Governance, Performance and Accountability Act 2013 (PGPA), including the Department of Finance PGPA Glossary, and the Public Service Act 1999, including the Australian Public Service Commissioner’s Directions 2016 (as amended in July 2019).

1.10 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $333,000.

1.11 The team members for this audit were Tracey Bremner, Chérie Simpson, Tiffany Tang, Bradley Medina and Brian Boyd.

2. Land acquisition strategy

Areas examined

The ANAO examined whether an appropriate strategy for acquiring the land was developed.

Conclusion

An appropriate acquisition strategy was not developed. While a strategy was documented and approved:

- it was focussed on incentivising an unwilling seller to dispose of their land some 32 years in advance of when it was anticipated to be needed for the airport expansion, an approach at odds with the department asserting that early purchase allowed it to capitalise on ‘goodwill’ from the landowner;

- the underlying analysis overstated the identified benefits, did not quantify costs and did not address risks; and

- the acquisition approach eventually employed departed from the approved strategy.

Areas for improvement

The ANAO made two recommendations, relating to the department preparing:

- comprehensive and balanced written analysis on the benefits, costs and risks of proposals to spend public money; and

- meeting and communication protocols for when staff engage directly with individual landowners, developers or similar parties with heightened probity risks.

2.1 The acquisition of the Leppington Triangle by the Department of Infrastructure, Transport, Regional Development and Communications (‘Department of Infrastructure’ or ‘the department’) was subject to the Lands Acquisition Act 1989 (LAA). The LAA provides a mechanism for the Australian Government to acquire land for essential public infrastructure (such as for roads, Defence facilities and airports), while respecting the rights of landowners. In addition, the Public Governance, Performance and Accountability Act 2013 (PGPA Act) contains rules governing how departmental officials are to use public resources, including those relevant to the acquisition or management of land as a public resource. As a land acquisition is a type of procurement, the Commonwealth Procurement Rules also apply.

2.2 The ANAO examined whether the Department of Infrastructure’s strategy for acquiring the Leppington Triangle was appropriate in the context of the LAA, the PGPA Act and the Commonwealth Procurement Rules. An appropriate strategy will strike a balance between the rights of the landowner on the one hand and the interests of the Australian Government on the other, including its need for land for public purposes and its need to achieve value with public money. An appropriate strategy will therefore reflect the principles of equity, fairness and transparency and will ensure that public resources are used in an efficient, effective, economic and ethical manner.

Why and when is the land needed?

The Australian Government expected that it would need the Leppington Triangle when a second runway is constructed at a future stage of the Western Sydney Airport’s development. It estimated that a second runway would be required from around 2050.

2.3 Under the LAA, interests in land can only be acquired ‘for a public purpose’, which is a purpose for which the Federal Parliament has power to make laws. The Australian Government’s stated public purpose for acquiring the Leppington Triangle land was ‘trade and commerce with other countries, and among the States’. The stated proposed use for the land was ‘for the purposes of facilitating the development and future expansion of Western Sydney Airport as envisaged by the Airport Plan for Western Sydney Airport, determined on 5 December 2016’.2

2.4 The airport is being developed in stages to match demand. The Airport Plan set out, and provided authorisation for, the stage 1 development. Scheduled to begin operations in December 2026, it will be a single-runway airport.

2.5 The Leppington Triangle is not needed for stage 1. The Leppington Triangle has not been declared part of the airport site and it is not part of the airport lease granted to WSA Co Limited for the purpose of constructing and operating the new airport.3 Subsequent stages have not been designed or approved.

Expected future need for the land

2.6 The stage 1 airport layout was designed to accommodate future expansion, including the future construction of a second runway to meet growth in demand. The Airport Plan contained indicative long-term layouts for reference purposes only, in which the western end of the second runway lies close to the Leppington Triangle (as per Figure 2.1). The Airport Plan identified that this land would therefore need to be acquired for the development and operation of a second runway, also known as the ‘southern runway’.

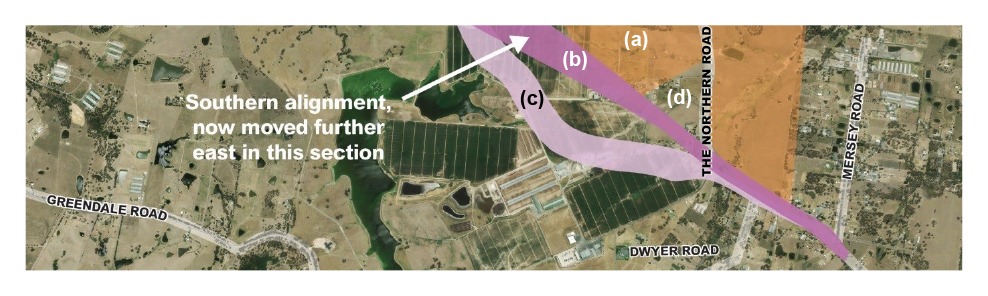

Figure 2.1: Location of the Leppington Triangle relative to the expected location of a second runway

Source: An extract of ‘Figure 17: Indicative Airport Site Land Use Plan (Long Term)’ from the Airport Plan, with two labels added by the ANAO.

2.7 The Australian Government’s ‘Western Sydney Airport Business Case: Updated Business Case for Public Interest Decision’ of December 2016 also outlined the likely need to acquire the Leppington Triangle when a second runway is constructed. The Updated Business Case noted that:

Even if the [southern] runway was shortened or ‘displaced thresholds’ were used to avoid placing runway infrastructure on this land, the noise impacts, on the area directly off the end of the runway, would make the acquisition for mitigations purposes highly likely. The Leppington Triangle is also “land locked” and its value outside of use as part of an airport would be marginal. The shape and scale of the site, and noise mitigation requirements ensure that without the acquisition of the triangle, the potential options for designing the southern runway would be compromised and the width of the midfield terminal area would be limited.

Expected timeframe

2.8 The date the Leppington Triangle is likely to be needed can be estimated by the date a second runway is likely to be needed. The need for a second runway will be triggered when the operational capacity of the airport approaches 37 million passengers per year, which is forecast to occur around 2050.4 To place this level of demand in context:

- 37.1 million passengers used the Melbourne (Tullamarine) airport in 2019; and

- 44.4 million passengers used the Sydney (Kingsford Smith) Airport in 2019.5

Why didn’t the Australian Government already own the land?

The Australian Government had sought to acquire the Leppington Triangle in 1989 as part of a larger parcel of land. During a 10-year dispute with the landowner the Australian Government agreed to exclude it from that acquisition process.

2.9 The Australian Government announced in February 1986 that Badgerys Creek in Western Sydney had been chosen as the location for a second major airport for Sydney. The Australian Government then undertook a series of land acquisitions for the airport site, primarily during the period 1986 to 1991. The resulting site totalled 1,780 hectares.

2.10 In July 1989, the Australian Government published pre-acquisition declarations to acquire 80 hectares of land from the Leppington Pastoral Company Pty Ltd (‘LPC’) for the airport. This land included the Leppington Triangle. The 80 hectares were part of LPC’s base farm in Bringelly, which was then an area of nearly 580 hectares principally used for dairy farming operations.

2.11 LPC challenged the acquisition. Key events in the resulting 10-year dispute included:

- July 1989, LPC requested a reconsideration of the pre-acquisition declarations but the Minister confirmed the declarations as published;

- December 1989, a review by the Administrative Appeals Tribunal;6

- June 1990, a Federal Court of Australia decision;7

- August 1991, agreement to a variation of the pre-acquisition declarations on the terms and conditions set out in a Deed that, among other things, removed the Leppington Triangle from the acquisition and reduced the parcel of land to be acquired to 38.14 hectares;

- December 1991, the acquisition of 38.14 hectares of land from LPC by compulsory process was effected but then there was disagreement on the amount of compensation payable;

- May 1994 to April 1997, Federal Court proceedings;8 and

- December 1999, compensation for the 38.14 hectares was settled out of court.

2.12 The acquisition process was managed by the former Department of Administrative Services.

2.13 One consequence of the acquisition process was that the Leppington Triangle became separated from the rest of LPC’s base farm by a strip of the acquired land, known as the ‘axe handle’ (see Figure 2.2). The acquired land was leased back to LPC.

Figure 2.2: Land compulsorily acquired in 1991 from LPC’s base farm

Source: Submission to Liverpool City Council – Planning Proposal, September 2015, accessed 21 May 2020 from the Liverpool City Council website.

What was the impetus for starting work in 2016 on acquiring the land?

The key impetus for starting work in 2016 on acquiring the Leppington Triangle was to capitalise on goodwill the department considered had been created by concessions made to the landowner on the route for the realignment of The Northern Road. The route was adjusted so as to run on mostly Australian Government land along the airport boundary rather than through the farm of the landowner. Due diligence and value for money was not demonstrated in the department’s advice supporting the route adjustment.

2.14 In 2016, the Department of Infrastructure developed a strategy for acquiring the Leppington Triangle. Events of 2014 through to early 2016 provided a trigger for the acquisition planning to commence. Key events included:

- the Australian Government confirmed in April 2014 that the site for the new airport would be in Badgerys Creek and stated, ‘It is critical that we act now to finalise the necessary planning, including critical road network upgrades’. The upgrades included a realignment of The Northern Road corridor because it bisected the airport site and needed to be closed and available for airport construction;

- a 2014–15 Budget measure provided $77.8 million over four years to establish the Western Sydney Unit to progress the development of the new airport, including related road initiatives;

- a 2014–15 Budget measure provided $2.9 billion over 10 years to deliver a Western Sydney Infrastructure Plan in partnership with the NSW government, which included the realignment of The Northern Road; and

- as outlined below, the department agreed to adjust the proposed road route so as to reduce the impact on LPC and considered an early purchase of the Leppington Triangle would allow the Australian Government to capitalise on the goodwill this concession may have created.

Realignment of The Northern Road

2.15 The Leppington Triangle is located on The Northern Road, which is a key north-south arterial link between Narellan and the M4 Motorway. The road is being upgraded in stages. Stage four included realigning the road to divert it around the Western Sydney Airport site. During July and August 2015, the NSW government undertook public consultation on shortlisted route options for the stage four works. The Northern Road upgrade project was managed by the then NSW Roads and Maritimes Services (RMS).

2.16 The road route needed to be compliant with any required airport operational clearances, ‘such as proposed glide slope restricted areas and obstacle limitation surfaces’.9 According to the published Options Identification Report, ‘This will ensure the airspace around the airport is appropriately protected in the interests of the safety, efficiency or regularity of future air transport operations’.10 The Department of Infrastructure had advised the RMS that compliance was a particular consideration ‘for the proposed southern runway where these clearances are expected to extend beyond the airport boundary.’

2.17 In September 2015, the department advised the Minister for Infrastructure and Regional Development that ‘none of the alignments proposed would adversely impact on future use of the site for aviation purposes’. Further, that, ‘of the proposed options, the eastern alignment is the most favourable in terms of the airport development’.

2.18 On 12 November 2015, the Australian and NSW governments jointly announced that the ‘eastern option’ had been selected as the preferred route. This option had been adjusted since the public consultation period, as illustrated in Figure 2.3. The Preferred Route Option Report, prepared in October and published in November 2015, outlined that:

The alignment for the proposed preferred route between Mersey Road and Willowdene Avenue has changed. The previous alignment was located further to the west to avoid airport operational requirements associated with the southern runway as advised by DIRD [the Department of Infrastructure].

DIRD has now advised that a route closer to the boundary of the airport is possible. This allows a more direct route to be adopted which is preferable to the previous alignment.11

Figure 2.3: Adjustment to the route for the realignment of The Northern Road, bringing it closer to the airport boundary

Note a: The orange-coloured area is part of the airport site.

Note b: The dark-purple area is the subsequently adjusted route.

Note c: The light-purple area is the short-listed route.

Note d: The triangular parcel of land located between the airport site and the adjusted route is the Leppington Triangle.

Source: Extract from Figure ES1-2 ‘Adjusted Eastern Option’, The Northern Road Upgrade Stage 4: Preferred Route Option Report, Parsons Brinckerhoff Australia Pty Limited 2015.

2.19 The Department of Infrastructure had sought the adjustment because it minimised the impact of the road on LPC’s base farm. Moving the route towards the airport reduced the amount of LPC land that needed to be acquired by the NSW government and increased the amount of Australian Government land to be disposed of to the NSW government. The adjusted route ran along the axe-handle land previously acquired from LPC and, due to the road’s width, along one side of LPC’s Leppington Triangle. According to departmental records, LPC had advised in October 2015 that this route was preferable to the shortlisted route options and was more consistent with expectations set during the 1991 land acquisition process.

2.20 The Department of Infrastructure advised the ANAO in September 2020 that:

the relocation of The Northern Road also provided less risk to the commencement of airport earthworks. The previous alignment across LPC land did give rise to a risk that if RMS were unable to acquire the required land earthworks on the airport would be delayed putting at risk the 2026 delivery. The alignment on land held by the government reduced this risk.

Risk that the road may compromise airport operational clearances

2.21 The adjustment placed the road adjacent to the end of the proposed southern runway (see ‘The Northern Road realignment’ in Figure 2.1). On 12 November 2015 — the day the route was announced — the department received preliminary advice on the adjusted route from aviation planning and development firm, Landrum & Brown (L&B). The preliminary advice included that ‘there are serious issues with the proposed Northern road alignment … and I see there is a clear case for a NO GO for the proposed road due to many issues’.

2.22 The next day, the department received detailed advice with supporting documentation from L&B. The advice concluded, ‘In the interest of a Strategic Greenfield Airport Site with unforeseen site conditions, it is recommended to propose the northern road layout … away from the airport boundary toward the southern runway side’.

2.23 The firm had planned to send the detailed advice to RMS that afternoon but was instructed by the Department of Infrastructure to ‘please do not send to any third parties’ [emphasis as per original]. An email from the department to L&B on 17 November stated, ‘I’ll redraft your advice to RMS and copy you in on what I send on … I will tone down the notes to be consistent with what we’ve previously advised’. The firm instead reworded its own advice, including by removing the above quoted recommendation, and provided it to the department in the evening of 17 November. The department provided the reworded advice to RMS on 20 November (this advice is in part quoted in paragraph 2.27 below).

2.24 The Department of Infrastructure, RMS and three advisory firms (including L&B) met on 25 November 2015 to discuss the issues raised in the reworded advice. The record of that meeting includes:

RMS advised the original alignment missed all clearance areas. However subsequent discussion between DIRD [being the Department of Infrastructure] and adjacent property owner Leppington Pastoral Company meant DIRD advised RMS on aligning the road in the location proposed. DIRD has made the decision to proceed knowing the impacts on the public safety zone and the HIAL [high intensity approach lighting]. RMS is following DIRD’s advice as these are airport safety issue [sic].

It is noted that the road will be in place well before runway [sic] is built and so constraints and issues being raised are not an issue for airport opening. The issues are for when second runway is built and operational in some 30 years in the future. It was acknowledged that in this period regulations, airport operations and requirements may change.

2.25 A briefing on, among other things, The Northern Road realignment was submitted to the head of the Western Sydney Unit on 30 November 2015. The briefing did not mention the advice from L&B. While it raised two of the matters that had been of concern to the firm in relation to the impact of the route on the southern runway, the briefing did not afford these the same significance. The briefing advised:

The Northern Road realignment is expected to encroach on the HIAL area required for the western end of the southern runway. The Aviation Infrastructure team [in the department] advises that it should be possible to run the HIAL across the realigned The Northern Road … early indications are that it will cross through the PSZ [Public Safety Zone] proposed at the western end of the southern runway. The Aviation Infrastructure team advises that roads can be aligned through a PSZ without necessarily impacting the purpose of the PSZ.

2.26 A public safety zone or area (PSZ or PSA) is a designated area of land at the end of an airport runway within which development may be restricted in order to control the number of people on the ground at risk of injury or death in the event of an aircraft accident on take-off or landing. The National Airports Safeguarding Framework: Guideline I states, ‘The planning of new transport infrastructure within PSAs should also be carefully considered … The density of occupation of a main road or railway line averaged over a day is comparable to that of residential development … Low intensity transport infrastructure such as minor or local roads could be considered acceptable within PSAs.’ The relevant section of The Northern Road was a four-lane road with allowance for six lanes to meet the projected increase to daily traffic volumes.

2.27 The RMS wrote to the Department of Infrastructure in December 2015 about the risks of not accommodating the clearances that L&B had advised should be provided. The RMS wrote again in March 2016 seeking urgent confirmation from the department that it had reviewed and accepted those risks and that it wanted the RMS to proceed. The letter included:

In light of the recent updated advice from AirServices,12 RMS is seeking confirmation of the alignment in the area of Leppington Pastoral Company. As the current alignment for the road has been justified based on advice from DIRD, RMS would request that DIRD reconfirm that the current alignment proposed for The Northern Road upgrade is the alignment the Commonwealth Government would like progressed.

As outlined in my correspondence of 14 December 2015, RMS is of the understanding that DIRD in directing the alignment of the road in the area of LPC Land has reviewed the risks associated with the alignment as advised to DIRD by their aviation consultant … in the email of 20 November 2015. The specific issues where RMS is of the understanding DIRD has reviewed and accepted the risks and has responsibility for further assessments are:

- The proposed road alignment runs through the HIAL system for Runway 05R.13 L&B has advised that this has the potential to cause serious disruptions to operation on Runway 05R.

- The proposed road alignment runs through the PSZ for Runway 05R. L&B recommends a detailed risk assessment.

- The proposed alignment is clear of the OLS [Obstacle Limitation Surface]. However, DIRD has advised that the road may interfere with “One Engineer Inoperative (OEI) procedures defined for Runway 23L. L&B has suggested further assessment by aviation safety authority.

As RMS is about to commence the Detailed Design of the project and setting boundaries for acquisition the confirmation by DIRD of the alignment required through the Leppington Pastoral Company owned land is requested as a matter of urgency.

2.28 The department replied to the RMS in April 2016, stating: ‘In relation to the [road] alignment and any impact it may have on the HIAL location, the public safety zone and airspace protection … I can confirm the Commonwealth is still comfortable in managing these impacts.’

2.29 In response to the advice to proceed, RMS submitted a request to the Department of Infrastructure for a four-month extension to the project so as to accommodate the change in alignment and associated additional investigations. The department ‘agreed to RMS extending the timeframe for completion of [The Northern Road] works from December 2019 to April 2020 on the basis of concessions the Commonwealth made around the use of Commonwealth land for the realignment to help manage sensitives with the Leppington Pastoral Company.’

Demonstrating due diligence and value for money

2.30 As part of the consultation phase of major infrastructure projects, concerns expressed by affected landowners and other key stakeholders need to be genuinely considered.

2.31 What was not sufficiently evident in the records examined was: the timely exercise of due diligence when advising that the road could run close to the airport boundary; and the consideration of whole-of-life costs when assessing the value for money of adjusting the route.

2.32 Subsequent briefings prepared by the department indicated to decision-makers that the approach taken provided value for money. Those statements were not quantified or supported by analysis. It was not demonstrated that the benefits to the Australian Government outweighed the costs and risks, which included the:

- additional design and engineering costs;

- four-month delay to project completion;

- disposal of Australian Government land and associated reduction in the airport site; and

- impacts/risks to the future planning and operations of the airport of a major road running adjacent to the southern runway.

2.33 Further, there were no briefings found that documented an informed acceptance of those impacts/risks by a decision-maker. The risks were also not included in a risk register with related mitigation strategies identified.

Capitalising on goodwill

2.34 The land the NSW government was to acquire from LPC for the road realignment included a 1.36 hectare portion of the Leppington Triangle.14 In May 2016, the Department of Infrastructure emailed the Department of Finance (which administers the LAA) seeking advice on acquiring the other 12.26 ha. The email outlined that:

Our plans to settle an acquisition strategy have accelerated over the last week or so due to a related issue about the route for the realigned Northern Road … Following discussions with LPC, and internal policy review, we have decided to shift the alignment of the road off LPC’s main property and onto the airport site and a portion of the triangle … Given the Commonwealth’s significant concession on this issue, we have formed the view that it would be in the Commonwealth’s interests to utilise the leverage it may have gained from this concession and commence negotiations with LPC about acquisition [sic] what would be the remaining part of the triangle.

2.35 The land acquisition strategy was finalised in October 2016. The brief seeking approval of the strategy stated in reference to the adjustment to The Northern Road (TNR) route, ‘We have supported this realignment as it would minimise the impact on LPC’s dairy operations without comprising [sic] airport project and TNR requirements, and help build goodwill for the acquisition of the LPC Triangle’. The strategy then stated that ‘an early purchase would allow the Commonwealth to capitalise on any goodwill created by the Commonwealth’s concession to LPC regarding the re-design of TNR onto the axe-handle’.

2.36 Similar references to ‘goodwill’ were contained in four of the seven briefings on the land acquisition subsequently provided to decision-makers, including in both of the briefings sent to the Minister. The departmental records did not evidence that goodwill of tangible benefit to the Australian Government had been generated with the landowner.

Was appropriate consideration given to the costs and benefits of acquiring the land early?

Appropriate consideration was not given to costs and benefits when deciding to acquire the land early. The benefits identified by the department in its advice are questionable and there was no documented consideration of costs. The department did not demonstrate that the benefits of acquiring, and paying for, the land some decades in advance of need outweighed the cost to the Australian Government.

2.37 Advice to government in April 2016 included that the Leppington Triangle was not an immediate priority, as the airport would operate in the northern part of the site until a second runway was required post-2050, and so its acquisition could be deferred. The land was legislatively protected from developments that may adversely impact the future design or operation of the airport, making deferral a viable option.15

2.38 As per the email of May 2016 (quoted in paragraph 2.34 above) plans to settle an acquisition strategy were then accelerated so as to utilise the perceived goodwill gained from the Department of Infrastructure’s concessions on The Northern Road route. The department ultimately acquired the Leppington Triangle on 31 July 2018, some 32 years in advance of expected need for the land. On the date of purchase, the land was leased back to the seller for 10 years with options to renew totalling a further 10 years.

2.39 The ANAO examined whether appropriate consideration was given to costs and benefits when deciding to acquire the land early.

The costs and benefits considered

2.40 A ‘Leppington Pastoral Company land acquisition and disposal strategy’ (referred to as the ‘LPC Strategy’) was approved by the department in October 2016. It outlined, among other things, the intention to acquire the Leppington Triangle ‘within the next few years but ideally by 2019’ [emphasis as per original]. The LPC Strategy stated that, ‘While the LPC Triangle is not required for stage one of the airport development and it is LPC’s preference to retain ownership of the parcel of land for as long as possible, there are a number of reasons to support an earlier acquisition by the Commonwealth of the LPC Triangle’.

2.41 The LPC Strategy set out a ‘case for earlier acquisition’ that focussed on the benefits of this option. Subsequent advice to decision-makers similarly identified the benefits and supported an early acquisition. For example, the department advised the Minister in January 2018 of its intention to move ahead with the acquisition of the Leppington Triangle ‘due to the strong arguments in favour of acquiring this piece of land in the short term’.

2.42 The ANAO examined the six benefits of acquiring the land early that were presented in advice to decision-makers and Ministers from October 2016 to November 2019. An overview of the benefits presented, and of ANAO’s analysis of each, is at Table 2.1.

Table 2.1: Claimed benefits of acquiring the land early and ANAO analysis of each

|

Claimed benefit |

ANAO analysis |

|

‘A small window of opportunity for the acquisition exists because of mutual goodwill with the landowner … |

The records do not demonstrate that there was goodwill generated as a result of the realignment of The Northern Road. The department’s claims as to goodwill are incompatible with other documented statements by the department that the landowner was an unwilling seller, and with its associated strategy of offering a package of transactions to incentivise the landowner to sell (see paragraphs 2.49–2.51 below). Further, it was not evident that any goodwill would be lost, rather than built on, if the purchase was deferred until the land was needed for the second runway as per the landowner’s preference. |

|

The reason is inconsistent with section 15 of the Public Governance, Performance and Accountability Act 2013 as spending public money just because it is available to be spent does not represent the proper use and management of public resources. |

|

|

‘the scarcity of land on or around the airport site would result in further increases in property values, with future announcements about the airport and broader land use planning also expected to result in upwards price movements of airport land and surrounding properties’ |

The reason was negated by the department’s approach of requiring that the land be valued as ‘industrial’ instead of ‘agricultural’ so that ‘the future value of any re-zoning of the land could be assessed in the present’. This approach to valuation was not outlined in the LPC Strategy nor elsewhere approved by a decision-maker. The department was consulted on draft land use plans and was aware in advance of purchase that a future announcement about land use planning would place the Leppington Triangle in the ‘Agriculture and Agribusiness’ precinct of the Western Sydney Aerotropolis, rather than in the more commercial ‘Aerotropolis Core’. Also that the land use planning would introduce more stringent land development controls around the airport. The May and June 2016 drafts of the LPC Strategy stated that ‘because of the location of the Triangle very close to the eastern end of the southern runway any development of the Triangle will be very constrained thereby reducing significantly any potential increase in land value as a result of the airport development’. This statement did not appear in the finalised October 2016 LPC Strategy. |

|

‘LPC is entitled to compensation costs from the Commonwealth for business disruption … Any delays in acquisition will arguably result in higher disruption costs’ |

The department did not pay LPC compensation for business disruption costs nor did it estimate such costs. The LPC strategy stated, ‘No duplication of payments for disturbance costs, to the extent disturbance costs were paid by the Commonwealth as part of the acquisition of the adjoining land in the 1990’s’. The nature and value of other components of business disruption costs were not outlined. |

|

‘so that any future decision on the second runway is not held captive to a protracted negotiation or dispute … to help de-risk the development of the second runway’ |

While the reason supports a timely commencement of the acquisition process, it does not support an allowance of some 32 years. In reliance on the LAA, the Australian Government is able to compulsorily acquire land anywhere in Australia for public purposes. Compulsory acquisition can be used whether or not an owner is willing to sell their land. An owner can claim compensation as soon as the land has been acquired. If an owner exercises their rights of appeal on the amount of compensation payable then the time associated with the appeals process occurs post-acquisition and does not hold the Australian Government ‘captive’ in the way suggested. (See Appendix 2.) |

|

‘To achieve the best possible outcome for the Commonwealth, it would assist if the implementation of the Commonwealth’s LPC acquisition strategy is as closely coordinated with RMS’ process as possible’ |

The potential benefits of coordination were not realised. The RMS provided a February 2017 valuation of the land, which was not then used as a benchmark by the department. The RMS also provided comments on the valuation procured by the department, and suggested that the respective valuers meet to understand the differences in approach. The department did not take up the comments or suggestion. The department underwrote the difference in valuations, with the NSW government paying $148,691 for its 1.363 hectares and the department paying the landowner a further $2,834,623 to align the per hectare price with the department’s valuation. (See further at paragraphs 4.21–4.32 and 4.81.) The result was that the department paid 22 times more per hectare than was paid by the NSW government for its portion of the Leppington Triangle. |

Source: ANAO analysis of Department of Infrastructure records.

2.43 On the whole, the ANAO analysis was that the benefits of early acquisition were overstated.

2.44 There was no consideration of the costs associated with acquiring the land early outlined in the LPC Strategy or in other advice to decision-makers or Ministers.

2.45 The departmental records did not demonstrate that the benefits outweighed the costs to the Australian Government. Accordingly, it was not demonstrated that the strategy of acquiring the land early represented value for money or the economic management of public resources. Property should only be held by the Australian Government where it demonstrably contributes to government outcomes and ownership represents value for money.16

Recommendation no.1

2.46 The Department of Infrastructure, Transport, Regional Development and Communications prepare comprehensive and balanced written analysis on the benefits, costs and risks of proposals to spend public money.

Department of Infrastructure, Transport, Regional Development and Communication’s response: Agreed.

2.47 The Department has existing frameworks and guidance on the requirements associated with developing proposals to spend public money in accordance with the Public Governance, Performance and Accountability Act 2013.

2.48 The Department will review and update existing material to ensure there is a clear requirement for comprehensive and balanced written analysis on the benefits, costs and risks to support proposals to spend public money, and particularly in regard to valuations and land acquisitions. All staff will be reminded of their responsibilities and updated guidance material will be made available to all staff and appropriate training provided.

What acquisition strategy was selected and why?

The strategy for acquiring the land contained a package of transactions intended to incentivise an unwilling seller, which was at odds with the department’s advice that the early purchase was being pursued so as to capitalise on perceived goodwill from the landowner. Cost estimates were not included in the documented acquisition strategy. After approval was given within the department to progress an acquisition by compulsory process, the approach was changed, without further documented approval, to be an acquisition by agreement with the owner so as to achieve a target date of 31 July 2018.

Package of transactions to incentivise the seller

2.49 The departmental records on the planning and selection of an acquisition strategy regularly refer to LPC’s expressed preference to retain the Leppington Triangle for as long as possible, until it was actually required for a second runway. For example, the October 2016 briefing seeking approval of the LPC Strategy stated, ‘LPC would not stand in the way of the second runway development and would consider selling the Triangle to the Commonwealth but nearer to when it is really needed’. The department intended to acquire the land substantially earlier than this — ‘ideally by 2019’.

2.50 In light of LPC being an unwilling seller, the LPC Strategy contained a package of transactions ‘that the Commonwealth could offer to incentivise the LPC’s cooperation to dispose the balance of the LPC Triangle (i.e. the part not required for [The Northern Road realignment]) to the Commonwealth’. It also outlined ‘further inducements … the package could be supplemented with’. Neither the LPC Strategy nor related briefings explained:

- the disconnect between advising that the land should be acquired early to capitalise on goodwill, while also advising that the department should incentivise LPC’s cooperation; and

- why the department considered the legislation that provides the Australian Government with powers to compulsorily acquire land, and that entitles the landowner to compensation on ‘just terms’, was inadequate for the purposes of the Leppington Triangle.

2.51 The key elements of the package of transactions presented ‘to secure the near-term acquisition’ of the 12.26 hectares of the Leppington Triangle, which were then implemented, were to:

- lease the 12.26 hectares of the Leppington Triangle back to LPC for up to 20 years;

- dispose 6.02 hectares of the Australian Government owned ‘axe-handle’ land to the NSW government for The Northern Road realignment;

- lease the other 32.12 hectares of the land to LPC for up to 20 years (that is, the 38.14 hectares of land acquired from LPC in 1991 minus the 6.02 hectares disposed); and

- extinguish a High Intensity Approach Lighting (HIAL) easement that had burdened one of LPC’s properties since 1997, and establish a new HIAL and access easement, as more recent airport planning had shifted the proposed location.

Continuation of the lease for the ‘axe-handle’ land

2.52 Continuing to lease the 32.12 hectares of ‘axe-handle’ land to LPC until 2038 was a substantial concession.

2.53 In October 2014, the Minister had agreed a tenancy transition plan for the Western Sydney Airport. The plan outlined that formal termination notices would be sent to ‘inform the occupants that they have a six month period to vacate.’ Termination notices were sent to the 139 residential tenants and 16 agricultural tenants in November 2014, while the various commercial and major agricultural tenants were consulted ‘to gain an understanding of the issues that may be involved with moving their facilities’.

2.54 In March 2015 the Minister approved termination strategies for each of the four major commercial tenants on the airport site, which included LPC’s tenancy of the axe-handle land. The related advice to the Minister with respect to LPC was to offer an extended 12 months’ notice, so as to maintain goodwill for the potential purchase of the Leppington Triangle:

The potential need to acquire the triangular parcel of land in the future as part of the airport development remains unresolved. While LPC is currently supportive of the airport project and may be open to the idea of selling this land, it would be in project’s interest to maintain goodwill with the tenant.

In summary, we recommend that we provide LPC with 12 months’ notice, which means a likely termination date of around March/April 2016 …

2.55 Notices dated 8 May 2015 were served. The termination of LPC’s lease was to take effect on 16 May 2016. The termination notices for the other three major commercial tenants stated that they would take effect on 16 November 2015.

2.56 LPC’s tenancy on the axe-handle land was later extended from 17 May 2016 to 31 July 2018 via a series of five short-term leases. The leases commenced: 17 May 2016, 17 November 2016, 17 May 2017, 17 November 2017 and 1 March 2018.

2.57 The axe-handle land was part of the airport site. The airport site was leased to WSA Co Limited from 17 May 2018 for the purposes of building and operating the Western Sydney Airport. The department required WSA Co Limited to sublease the axe-handle land to LPC for up to 20 years from 1 August 2018 on the terms the department had negotiated with LPC.17

2.58 In July 2020, the Department of Infrastructure advised the ANAO that:

Both the axe handle lease and the triangle lease provide a mechanism to bring the lease to an end over any areas required for airport development.

2.59 The ANAO’s analysis of the terms of the lease arrangements do not support this advice. Should part of the axe-handle land be required for airport development then it can be released if at least 12 months’ notice is given to LPC and the earliest date it can be released is August 2024. There is no equivalent provision in the Leppington Triangle lease-back arrangement for the land to be made available for airport development. Subsequent advice from the department in July 2020 confirmed that the Leppington Triangle lease did not have a specific mechanism to bring the lease to an end and advised that it was deemed at the time that other clauses in the lease ‘do not preclude the earlier than planned development of the second runway at the airport should it be required’.

Construction of an underpass

2.60 A consequence of the department’s decision to lease the Leppington Triangle back to LPC upon acquisition, was that a road underpass needed to be constructed to allow LPC passage between its base farm and the Leppington Triangle.

2.61 The Australian Government and LPC had entered a Deed in August 1991 in relation to the earlier land acquisition process (as outlined in paragraph 2.11). The Australian Government had agreed through the Deed that, if The Northern Road was re-routed along the axe-handle land, then it would construct a tunnel or other carriageway to enable farm vehicles and animals to pass under the road to the Leppington Triangle.

2.62 In late 2015, the Department of Infrastructure directed RMS to re-route The Northern Road along the axe-handle land. A briefing to the Executive Director of the Western Sydney Unit in November 2015 advised:

If LPC continues to occupy the triangle after the Northern Road realignment has occurred, an access tunnel will need to be provided under the realigned The Northern Road. We understand this will have cost implications for the Commonwealth.

2.63 As the package of incentives allowed LPC to remain on the Leppington Triangle via a lease-back arrangement, the department instructed the RMS in mid-2017 to include an underpass in the design of The Northern Road for LPC’s use. The estimated cost was not included in the briefing materials. According to departmental records of early 2016, it was expected that the underpass would cost around $10 million to construct. The ANAO requested details of the actual cost of the underpass and the Department of Infrastructure advised in June 2020 that, ‘The costing breakdown does not go down to the level of detail requested (i.e. doesn’t have separate figures for the underpass).’18

Cost estimates

2.64 There were no estimates of costs or rental returns provided in the LPC Strategy or in associated briefing material. This makes it difficult to assess the cost-benefit to the Australian Government of the proposed package of transactions. Of particular note was that, while the LPC Strategy stated that the Australian Government would pay relevant land value and compensation costs for the Leppington Triangle, it did not estimate these costs. This was a significant shortcoming.

2.65 In November 2015, the department had proposed to develop an overarching strategy to guide the land acquisition process for the airport project. The decision-maker noted ‘with cost estimates’ when agreeing to this proposal. In February 2016 the department obtained decision-maker approval of the overarching acquisition strategy and approval to ‘pursue valuations of certain interests’ including of the Leppington Triangle. The related briefing advised that:

The acquisition of the Leppington Triangle will likely form a significant part of the overall land acquisition budget and a valuation over this land, supported by indicative values elsewhere, should provide a general indicator of total potential transaction costs (noting however that other costs, such business disruption costs, will ultimately need to be factored into final value estimates following more detailed consideration).

2.66 Planning to obtain a market valuation of the Leppington Triangle commenced but that procurement did not then proceed. The covering brief to the LPC Strategy of October 2016 stated that immediate priorities to progress in the coming months included ‘procuring the services of a valuer’. A valuer was engaged in June 2017. The approach then taken to valuing the land to inform the purchase price is examined in Chapter 3.

2.67 It eventuated that the:

- $29,839,026 price paid by the department to acquire 12.26 hectares of the land was based on the highest valuation19 of the Leppington Triangle obtained (being $30 million for all 13.62 hectares); and the

- $34,344 per annum rent20 paid by LPC to lease the 12.26 hectares back was based on a valuation of $920,000 for the 12.26 hectares continuing to be used for the existing dairy operations.

Method of acquisition selected

2.68 Two methods of acquisition were available for selection under the LAA, being to acquire the Leppington Triangle by compulsory process or to acquire it by agreement. Differences between the methods include the procedures that must be followed by the acquiring agency, the provisions for compensation and the landowner’s rights. Compulsory acquisitions do not need the agreement of the landowner and occur by the Minister for Finance using his or her powers under the LAA, based on the advice of the acquiring agency. Most acquisitions occur by agreement with the landowner, as these are usually simpler and faster and are the Australian Government’s preferred approach.21 (A flowchart setting out the different acquisition processes under the LAA is at Appendix 2.)

2.69 The February 2016 briefing on the overarching acquisition strategy for the airport advised that, ‘Consistent with views expressed by [the Department of Finance], it is proposed that any transactions pursued be sought to be achieved by voluntary agreement in the first instance’. In reference to the Leppington Triangle specifically, it noted that the landowner’s stated objection to the land being purchased until a second runway is required ‘may make voluntary agreement on an early acquisition of the triangle difficult’.

2.70 The LPC Strategy of October 2016 outlined that the method of acquisition for the Leppington Triangle ‘would be by agreement but by way of compulsory acquisition’. That is, the department would seek to reach agreement with the owner that the land be acquired via the compulsory process set out in the LAA.

Target date of 31 July 2018 set

2.71 During November 2017, the department developed a set of ‘commercial principles’ for the acquisition package in consultation with the landowner. The commercial principles included, among other things:

- ‘Acquisition to be with Leppington’s agreement but via compulsory process under the LAA’;

- ‘the acquisition would occur and the compensation payment would be made on or before 31 July 2018 (both parties using best endeavours to meet this timeline)’; and

- ‘In the event that completion is not achieved by 31 July 2018 (through no fault of the Vendor) then interest will be payable at the rate of 8% per annum’.

2.72 Acquiring the land by 31 July 2018 remained the department’s target date thereafter. There was no record of decision-maker approval to agree that interest would be payable if the target date was not achieved (see further at paragraphs 4.44–4.47). The ANAO calculated that the interest payable if the department missed the target date by a single month would be around $218,820, under the terms of the commercial principles and using the GST inclusive purchase price. It was not demonstrated that, if triggered, this commercial principle would have delivered value for money to the Australian Government. Further, the absence of a cap on the total amount payable did not adequately protect public money.

2.73 While the Department of Infrastructure advised the ANAO in July 2020 that the 8 per cent interest had been ‘suggested by LPC but not agreed to by the department’, briefings from the department to Ministers and senior departmental officials had stated that the interest provision had been agreed to by the department. The department advised the ANAO that:

The commercial principles were not intended to be legally binding and this was made clear to LPC; once the technical change from a compulsory acquisition to an acquisition by agreement was made, the 8% interest issue was not pushed by LPC and it did not feature as a term of the final transaction.

Change to the method of acquisition

2.74 The department identified a risk that an acquisition by compulsory process would not be achieved by 31 July 2018. The steps in the process, as outlined by the Department of Finance, were included in the October 2016 briefing to the approver of the LPC Strategy. The department had not completed any of the pre-acquisition steps by November 2017.

2.75 In late November 2017, the department suggested to the landowner that the Leppington Triangle instead be acquired by agreement under the LAA. The reasons given were that ‘the process would be less complex; we may be able to reach a binding agreement on the acquisition considerably earlier, giving both parties certainty at an earlier point; and we could be more confident of completing an approved acquisition by 31 July 2018.’ The landowner indicated it was ‘in general agreeance’ to the suggestion.

2.76 There was no record of a departmental decision-maker approving the change in the acquisition method employed (see paragraphs 4.6–4.8).

2.77 The Leppington Triangle was ultimately acquired on the target date of 31 July 2018 using the acquisition by agreement provisions of the LAA (the acquisition process used was as marked with dashed red lines on the flowchart in Appendix 2).

Equity and fairness

2.78 The Department of Infrastructure’s response of July 2020 to the preliminary findings of this audit included, ‘Given the historical legal relationship with LPC and therefore the sensitivity of the relationship with them, the risk of legal challenge and subsequent delay was a key concern which we think has been understated in the [audit’s report preparation papers]’. The department’s claimed concern is supported by its decision-making records (including its two briefings to the Minister on the acquisition) listing as a ‘sensitivity’ that the landowner was ‘a sophisticated and well-resourced entity’ with ‘access to substantial resources including legal and property advisors’.

2.79 The principles of equity and fairness in land acquisitions involves ensuring affected interest holders are treated fairly on ‘just terms’. An overarching issue with the department’s strategy for acquiring the Leppington Triangle is that it was designed to offer a particular landowner a package of incentives (see paragraphs 2.50–2.51) in excess of the provisions of the LAA. It would be inappropriate for the Australian Government to offer ‘sophisticated and well-resourced’ entities greater inducements to sell than it offers those without ‘access to substantial resources’. If the department expected legal action in response to its acquisition of the Leppington Triangle, then the appropriate strategy would be to rely on the LAA provisions, to maintain sound records, to make transparent decisions and to procure an independent valuation of the landowner’s entitlement to compensation that is robust and defensible.

Did the department employ an appropriate approach to managing probity with its staff, including any conflicts of interest?

There were shortcomings in the department’s management of probity with its staff. A key requirement was for all Western Sydney Unit officers and advisors to declare conflicts of interest. While the declaration requirement was largely met, a senior officer did not appropriately action probity instructions in relation to a declared conflict. Probity risks were also increased by the approach taken by some staff when engaging directly with landowners.

2.80 Accountable authorities of Australian Government entities must govern their entities in a way that promotes, among other things, the ethical use and management of public resources.22 Probity is the evidence of ethical behaviour, and can be defined as complete and confirmed integrity, uprightness and honesty in a particular process. Ethical behaviour includes recognising and dealing with conflicts of interest.

2.81 The ANAO examined the approach taken by the Department of Infrastructure to managing probity with its Western Sydney Unit staff. Given this audit is of a land acquisition, the ANAO focussed on the management of conflicts of interest and of direct engagements with landowners.

Declaration and management of conflicts of interests

2.82 Under the Public Service Act 1999, officials are to take reasonable steps to avoid any conflict of interest in connection with their employment and to disclose details of any material personal interest. Agency heads and Senior Executive Service (SES) employees are subject to a specific regime that requires them to submit, at least annually, a written declaration of their own and their immediate family’s financial and other material personal interests. Agencies may choose to require similar regular written declarations of other officials at particular risk of conflict of interest.23

Corporate policy