Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Implementation of the Commonwealth Scientific and Industrial Research Organisation (CSIRO) Property Investment Strategy

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- Over $500 million in public funds was planned to be spent on CSIRO’s property investment strategy from 2012–13 to 2021–22 (2012 Property Strategy) to support fit for purpose science facilities.

- To fund this investment, the CSIRO aimed to reduce its footprint by consolidating and divesting properties valued at more than $400 million.

Key facts

- In 2011–12, 83 per cent of CSIRO buildings required significant maintenance and an additional $175 million in maintenance expenditure was needed over ten years.

- Adopted in 2012, the 2012 Property Strategy aimed to reduce footprint by 26 per cent and eliminate a forecast annual increase in property operating costs, compared with 2012–13 levels, by 2021–22.

- Property operating costs rose by an average of seven per cent a year from 2012–13 to 2018–19.

- The CSIRO adopted a new 2019–29 Property Strategy in August 2019, to support flexible, safe and financially sustainable facilities.

What did we find?

- The design and implementation of the 2012 Property Strategy was largely not effective.

- The number of CSIRO sites increased from 55 to 58 sites from 2012 to 2019 and the CSIRO building footprint decreased by 10 per cent from 2013 to 2019.

- Appropriate governance arrangements were in place for capital works projects but not for divestment projects.

- The 2019–29 Property Strategy has not been informed by lessons learnt and there has not been an appropriate review of the 2012 property investment strategy. The CSIRO has not established quantifiable targets for the 2019–29 Property Strategy.

What did we recommend?

- The Auditor-General made five recommendations to the CSIRO to improve monitoring and measurement, governance, risk management, reporting and performance targets.

- The CSIRO agreed with the recommendations.

$1.68 billion

value of property portfolio as at 30 June 2019

58

sites in Australia and overseas as at 30 June 2019

7 per cent

annual rise in property operating costs from 2012–13 to 2018–19

Summary and recommendations

Background

1. The Commonwealth Scientific and Industrial Research Organisation (CSIRO) has significant holdings of land and buildings. Its portfolio includes more than 665,878 square metres of built environment, 19,000 hectares of land, 333,000 hectares of pastoral leases and 935 buildings. The 58 CSIRO sites include farms, laboratories, glasshouses, manufacturing equipment, supercomputers and telescopes. For financial reporting purposes, the CSIRO’s property portfolio is valued at $1.68 billion.

2. In December 2012 the CSIRO Board endorsed a 10-year CSIRO property investment strategy (the 2012 Property Strategy) to consolidate the organisation’s national footprint and align ‘infrastructure, science directions and partnerships’. The strategy’s key objectives included:

- stabilising operating expenses and costs of repairs and maintenance;

- reducing the size of the CSIRO’s portfolio;

- co-locating sites and buildings to encourage partnership in the delivery of science; and

- delivering fit-for-purpose scientific facilities.

Rationale for undertaking the audit

3. To undertake its specialised science capabilities, the CSIRO requires fit‐for‐purpose facilities that support science and that will attract and retain leading researchers and scientists. A 10-year property investment strategy was adopted in 2012, at an estimated cost of more than $500 million, to consolidate property holdings and reduce CSIRO’s footprint by 20 per cent with the aim of eliminating the forecast annual increase in operating costs over 2012–13 levels. In 2019, the CSIRO adopted a new 10-year property investment strategy.

Audit objective and criteria

4. The objective of the audit was to assess whether the CSIRO designed and is implementing its property investment strategy in a way that is delivering the intended benefits, and how any lessons learned are being reflected in a new strategy that is being developed. To form a conclusion against the audit objective, the ANAO has adopted the following high level criteria:

- Is the CSIRO on track to reduce the organisation’s property footprint by 20 per cent, and eliminate the forecast annual increase in property operating costs, compared with 2012–13 levels?

- Did the CSIRO establish effective governance arrangements to support the implementation of its 2012 Property Strategy?

- Was the development of the 2019–29 Property Strategy (2019 Property Strategy) appropriately informed by analysis and review of the implementation of the 2012 Property Strategy, and the results that have been achieved?

Conclusion

5. The CSIRO did not design and implement its 2012 property investment strategy in a way that is delivering the intended benefits. The 2019 Property Strategy was not sufficiently informed by lessons learned and does not include any performance targets.

6. The CSIRO’s approach to measuring its property footprint and operating costs is not effective. The evidence indicates that the CSIRO will not achieve the aim of reducing its property footprint by 26 per cent and eliminate the forecast annual increase in operating costs compared with 2012–13 levels.

7. The CSIRO was not effective in establishing governance arrangements to support the implementation of its 2012 Property Strategy. The CSIRO effectively established its capital investment program, but it did not establish effective arrangements to support its capital divestment program, risk management and reporting to its Board. There have been significant delays with the delivery of the planned divestments (with some divestments having been cancelled). The planned divestments were key to CSIRO reducing its property footprint as well as to provide funds for the capital investment required for its proposed property consolidations, both of which were expected to facilitate a greater proportion of the CSIRO’s resources to be spent on scientific and industrial research.

8. The development of the CSIRO’s 2019 Property Strategy has been informed by some lessons learnt, but it was not informed by an appropriate review and analysis of its 2012 Property Strategy. The CSIRO has not established quantifiable targets to measure and be accountable for its performance in delivering the 2019 Property Strategy.

Supporting findings

Measurement of the property footprint and operating costs

9. The CSIRO’s approach to measuring its property footprint was not effective. The CSIRO developed a National Footprint Tool and financial modelling as a precursor to developing its 2012 Property Strategy but the approach did not inform the measurement of its property portfolio footprint. The CSIRO has not undertaken an overarching review of its property utilisation since 2012. The CSIRO does not include all its leased locations and does not measure land as part of its property portfolio footprint, despite land being central to its research activities.

10. The CSIRO’s property footprint has not reduced in accordance with the targets set in the 2012 Property Strategy. The 2012 Property Strategy targeted a 26 per cent reduction in the property footprint and reduction in the number of sites to 41. Planned divestments have been delayed or are no longer planned to progress, and consolidation activity has also been slower than envisaged in the 2012 Property Strategy. As a result, the CSIRO’s:

- number of sites increased by five per cent from 2012–13 to 2018–19;

- building footprint decreased by 10 per cent between 2013 and 2019, although the CSIRO has not included some of its locations in its calculation meaning the aggregate reduction is less across the entire property portfolio; and

- land holdings decreased by one per cent between 2013 and 2019.

11. The CSIRO has not developed an effective approach to measure its property operating costs. Some property operating costs are met by CSIRO business units and others are the responsibility of corporate areas but there are no arrangements in place for all costs to be periodically aggregated and analysed. This is significant given eliminating the forecast annual increase in operating costs over 2012–13 levels was a key rationale for adopting the 2012 Property Strategy.

12. The CSIRO’s property operating costs in 2018–19 were, in real terms, 43 per cent higher than they were in 2012–13, with an average annual growth rate across this period of seven per cent. The ANAO’s analysis is that the CSIRO’s property operating costs in 2021–22 are likely to be higher in real terms than they were in 2012–13.

Governance arrangements

13. The CSIRO has established a partly effective framework and arrangements to implement the 2012 Property Strategy. Of note is that the CSIRO:

- developed principles to implement its property strategy, undertook some consultation and identified roles and responsibilities for the management of its property portfolio;

- implemented appropriate governance arrangements for capital works projects but it did not establish effective governance arrangements for divestment projects;

- established effective change management arrangements; and

- did not have a risk management plan in place for the 2012 Property Strategy and has not appropriately managed the risks to implementation including the risk to revenue from divestment projects not progressing as planned.

14. The CSIRO identified appropriate milestones and deliverables for medium and major capital works projects with planned expenditure of at least $567 million funded in part by property divestments valued at $401 million. Deliverables were identified but the CSIRO did not establish milestones for the divestments planned for Victoria (Highett and Geelong Belmont) or New South Wales (Armidale Arding) sites. Of 18 capital investment projects between 2013 and 2019, 11 were underway or completed, four were planned and three were not proceeding. Of 12 divestments, three were underway, one had been completed, two were planned and six were not proceeding. Between 2012–13 and 2019–20, the CSIRO spent at least $295 million on major investments and achieved divestment revenue totalling $98 million.

15. The CSIRO’s reporting to its Board on progress with the implementation of the strategy has not been appropriate. The reporting has not been regular, has not contained information requested by the Board and has not reported on delivering the aims of the 2012 Property Strategy including the realisation of costs and benefits. The CSIRO has provided adequate reports on the costs against budget of capital works projects and the progress of capital works projects and divestments.

Development of a new CSIRO property investment strategy

16. The development of the new property strategy was not informed by: thorough analysis; a review of the implementation of the 2012 Property Strategy and principles agreed by the CSIRO Board; and its commitment to the Government to reduce its property footprint and operating costs. The CSIRO did not develop any quantifiable targets to measure its performance on delivering the 2019 Property Strategy.

17. The CSIRO established a largely appropriate consultation process, but feedback on the need for more detailed planning, including on divestments and cost analysis, was not incorporated into the strategy. A communications plan was developed for the new strategy.

Recommendations

Recommendation no. 1

Paragraph 2.19

The CSIRO develop a consistent, transparent and effective approach to measure the entirety of its property portfolio footprint.

CSIRO response: Agreed.

Recommendation no. 2

Paragraph 3.20

The CSIRO establish effective governance arrangements for the management of divestment projects including establishing a consistent framework and undertaking detailed planning.

CSIRO response: Agreed.

Recommendation no. 3

Paragraph 3.52

The CSIRO develop a property strategy risk management plan to monitor, assess and guide the mitigation of property strategy implementation risks.

CSIRO response: Agreed.

Recommendation no. 4

Paragraph 3.73

The CSIRO Executive report at least annually to its Board on the progress in implementing its property strategy and the realisation of benefits.

CSIRO response: Agreed.

Recommendation no. 5

Paragraph 4.13

The CSIRO establish quantifiable performance targets for its 2019 Property Strategy.

CSIRO response: Agreed.

Summary of entity response

18. CSIRO did not provide a summary response. CSIRO’s full response can be found at Appendix 1.

Key messages for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit that may be relevant for the operations of other Australian Government entities.

Asset management

1. Background

Overview

1.1 The Commonwealth Scientific and Industrial Research Organisation (CSIRO) has significant holdings of land and buildings. Its portfolio includes more than 665,878 square metres of built environment, 19,000 hectares of land, 333,000 hectares of pastoral leases and 935 buildings. The 58 CSIRO sites (see Figure 1.1)1 include farms, laboratories, glasshouses, manufacturing equipment, supercomputers and telescopes. For financial reporting purposes, CSIRO’s property portfolio is valued at $1.68 billion.2

Figure 1.1: CSIRO sites, June 2019

Source: ANAO analysis of CSIRO information.

1.2 The CSIRO is Australia’s national science agency and CSIRO considers that it is ‘one of the largest and most diverse research agencies in the world’.3 It employs 5915 staff (5359 full time equivalent) dispersed across all Australian states and territories. The CSIRO’s estimated Budget for 2019–20 is $1.76 billion, comprising Australian Government and own-sourced revenue including royalties, and cash reserves.4

1.3 Table 1.1 summarises the CSIRO Budget and property expenditure from 2012–13 to 2018–19.

Table 1.1: CSIRO Budget and property expenditure, 2012–13 to 2019–20

|

|

Total expenditure $m |

Property expenditureb $m |

Property expenditure as a per cent of total expenditure |

|

2012–13 |

1267.5 |

157.1 |

13 |

|

2013–14 |

1270.6 |

224.9 |

18 |

|

2014–15 |

1245.3 |

225.4 |

18 |

|

2015–16 |

1270.6 |

171.1 |

13 |

|

2016–17 |

1292.1 |

186.3 |

14 |

|

2017–18 |

1352.5 |

155.4 |

11 |

|

2018–19 |

1396.4 |

197.5 |

14 |

|

2019–20 |

1437.6a |

197.2c |

14 |

Note a: Budgeted expenses for Outcome 1, CSIRO Budget Statements 2019–20.

Note b: A combination of the annual property operating expenditure (provided by the CSIRO to the ANAO) and annual property capital expenditure (reported to the CSIRO Board) for the CSIRO parent entity (excluding controlled entities).

Note c: Estimated property operating expenditure for 2019–20 (provided by the CSIRO to the ANAO) and CSIRO budgeted capital expenditure (reported to the CSIRO Board) for the CSIRO parent entity for 2019–20.

Source: ANAO analysis of CSIRO annual reports; CSIRO information and reporting to the CSIRO Board on property expenditure.

The development of CSIRO’s Property Investment Strategy

1.4 In 2011–12, the CSIRO undertook a review of the condition of its property portfolio. The review assessed 83 per cent of CSIRO buildings as needing significant maintenance to preserve operational capability. In addition to budgeted repairs, an additional $175 million in maintenance expenditure was seen as needed over the next ten years to meet external compliance requirements and certification standards.5

1.5 In December 2012 the CSIRO Board endorsed a 10-year CSIRO property investment strategy (the 2012 Property Strategy) to consolidate the organisation’s national footprint and align ‘infrastructure, science directions and partnerships’. The strategy’s key objectives included:

- stabilising operating expenses and costs of repairs and maintenance;

- reducing the size of the CSIRO’s portfolio;

- co-locating sites and buildings to encourage partnership in the delivery of science; and

- delivering fit-for-purpose scientific facilities.6

1.6 Key elements of the strategy included the:

- consolidation of sites and capital investment for new facilities in the Australian Capital Territory ($185 million) and Victoria ($30 million);

- divestment7 of CSIRO’s 701 hectare Ginninderra field station in the ACT; and

- consolidation of sites in Sydney (New South Wales) — ‘relocating staff and capability to reduce CSIRO’s footprint’ and undertaking renewal works at the Australian Animal Health Laboratory in Geelong (Victoria) ‘to ensure the facility meets current and emerging regulatory compliance standards as part of the third of life renewal’.

Legislation, powers and rules

1.7 The CSIRO is a part of the Industry, Science, Energy and Resources portfolio.8 It is established and operates under the provisions of the Science and Industry Research Act 1949 (SIR Act) and is a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act)). The SIR Act defines the CSIRO’s primary functions are to:

- carry out scientific research to assist Australian industry, further the interests of the Australian community, contribute to the achievement of Australian national objectives or the performance of the Commonwealth’s national and international responsibilities, and carry out any other purpose determined by the Minister; and

- encourage or facilitate the application or utilisation of the results of such research.9

1.8 The CSIRO has managed its own property portfolio since the 1920s and has the power to acquire, hold and dispose of property.

1.9 Table 1.2 illustrates how legislation, policy and the Australian Government’s property management framework applies to non-corporate Commonwealth entities and the CSIRO.

Table 1.2: Legislation, policy and administrative requirements that apply to CSIRO property management

|

Requirement |

Non-corporate Commonwealth entities |

CSIRO (as a corporate Commonwealth entity) |

|

Legislation and policy (included within the Commonwealth Property Management Framework) |

||

|

PGPA Acta |

◆ |

◆ |

|

Commonwealth Procurement Rulesb |

◆ |

◆ |

|

Land Acquisition Act |

◆ |

◆ |

|

Public Works Committee Actc |

◆ |

◆ |

|

Commonwealth Property Disposal Policy |

◆ |

◆ |

|

Two Stage Capital Works Approval Processd |

◆ |

◆ |

|

Capital Management Plan |

◆ |

◆ |

|

Commonwealth Risk Management Policye |

◆ |

▲ |

|

Commonwealth Property Management Framework (administrative requirements) |

||

|

Property Management Plan |

◆ |

▲ |

|

Property Services Coordinated Procurement Arrangements |

◆ |

■ |

|

Lease Endorsement Process |

◆ |

■ |

|

Occupational Density Targetf |

◆ |

■ |

|

Whole-of-Government (Australian) Leasing Strategy |

◆ |

■ |

|

Australian Government Property Register |

◆ |

■ |

Legend: ◆ mandatory requirement; ▲ the CSIRO applies a non-mandatory requirement; ■ the CSIRO does not apply a non-mandatory requirement.

Note a: Including the requirement for accountable authorities to establish and maintain appropriate systems and internal controls for the oversight and management of risk.

Note b: As a prescribed corporate Commonwealth entity, CSIRO must comply with the Commonwealth Procurement Rules when performing duties related to procurement.

Note c: Capital works projects valued above $15 million require Parliament’s approval, following an inquiry and recommendation by the Parliamentary Standing Committee on Public Works.

Note d: New policy proposals for capital works which are estimated to have a whole-of-life costs of $30 million or more being subject to the Australian Government’s two stage capital works approval process.

Note e: While the CSIRO is not required to comply with the Commonwealth Risk Management Policy, the CSIRO has an enterprise risk management framework which an internal CSIRO review found is aligned to the policy requirements.

Note f: The CSIRO sets its own benchmarks for density which it states are underpinned and in-line with the Occupational Density Target, but notes that its density target guidelines ‘will be applied on a project specific basis and may be varied from time to time to meet operational requirements or building specific limitations’.

Source: Department of Finance and CSIRO documents, ANAO analysis.

Rationale for undertaking the audit

1.10 To undertake its specialised science capabilities, the CSIRO requires fit‐for‐purpose facilities that support science and that will attract and retain leading researchers and scientists. A 10-year property investment strategy was adopted in 2012, at an estimated cost of more than $500 million, to consolidate property holdings and reduce the CSIRO’s footprint by 20 per cent with the aim of eliminating the forecast annual increase in operating costs over 2012–13 levels. In 2019, the CSIRO adopted a new 10-year property investment strategy.

Audit approach

Audit objective, criteria and scope

1.11 The objective of the audit was to assess whether the CSIRO designed and is implementing its property investment strategy in a way that is delivering the intended benefits, and how any lessons learned are being reflected in a new strategy that is being developed. To form a conclusion against the audit objective, the ANAO has adopted the following high level criteria:

- Is the CSIRO on track to reduce the organisation’s property footprint by 20 per cent, and eliminate the forecast annual increase in property operating costs, compared with 2012–13 levels?

- Did the CSIRO establish effective governance arrangements to support the implementation of its 2012 Property Investment Strategy?

- Was the development of the 2019–29 Property Strategy (2019 Property Strategy) appropriately informed by analysis and review of the implementation of the 2012 Property Strategy, and the results that have been achieved?

Audit methodology

1.12 The audit methodology involved:

- review and analysis of relevant documents, including on: governance and administration activities; monitoring and measurement; and advice to CSIRO executives, the Board and the Government;

- consultation with key officials and stakeholders; and

- inspection of science infrastructure and sites where consolidation is occurring.

1.13 The audit was conducted in accordance with the ANAO auditing standards at a cost to the ANAO of $434,857.

1.14 The team members for this audit were Sandra Dandie, Andrew Gavin and Brian Boyd.

2. Measurement of the property footprint and operating costs

Areas examined

The ANAO examined whether the Commonwealth Scientific and Industrial Research Organisation (CSIRO) developed an effective approach to measure its property footprint and operating costs and how its property strategy, footprint and operating costs have changed since the 2012 Property Investment Strategy (2012 Property Strategy) was adopted.

Conclusion

The CSIRO’s approach to measuring its property footprint and operating costs is not effective. The evidence indicates that the CSIRO will not achieve the aim of reducing its property footprint by 26 per cent and eliminate the forecast annual increase in operating costs compared with 2012–13 levels.

Areas for improvement

The ANAO made one recommendation aimed at developing a consistent, transparent and effective approach to monitor and measure the entirety of its property portfolio footprint over time.

The CSIRO should consider its approach and arrangements for the measurement and reporting of total operating costs over time, consistent with the aims of the 2012 Property Strategy.

2.1 The CSIRO developed its 2012 Property Strategy and identified targets for reducing its property footprint by 20 per cent and eliminating its forecast annual increase in operating costs over 2012–13 levels. In order to assess whether the CSIRO is on track to meet its targets, the ANAO examined:

- whether the CSIRO developed an effective approach to measure its property footprint and operating costs; and

- changes in the CSIRO’s footprint and operating costs since 2012.

Did the CSIRO develop an effective approach to measure its property footprint?

The CSIRO’s approach to measuring its property footprint was not effective. The CSIRO developed a National Footprint Tool and financial modelling as a precursor to developing its 2012 Property Strategy but the approach did not inform the measurement of its property portfolio footprint. The CSIRO has not undertaken an overarching review of its property utilisation since 2012. The CSIRO does not include all its leased locations and does not measure land as part of its property portfolio footprint, despite land being central to its research activities.

The National Footprint Project

2.2 In April 2010, the CSIRO Board received a report from its Executive10 on the National Footprint Project. The report indicated the project was initiated to ‘… develop a national view of CSIRO’s current and future footprint directions’. This was to be achieved by the CSIRO reviewing its collaborations with key research partners (universities, publicly funded research agencies and others) and its physical footprint — which was defined and measured through its occupation of sites. The report indicated that:

CSIRO’s footprint has been modelled in a Geographical Information System [GIS], with the key challenge being in describing the many forms of relationships between CSIRO, partners, precincts11, collaborations and networks. Using this system, a spatial view of CSIRO’s key focus areas has been created.

2.3 The report noted that the GIS modelling would ‘… help develop insights and answer strategic questions, including existing research precincts and collaborations’ and that the project resulted in the:

development of an online National Footprint Project Tool, providing a rich information source which, for the first time, provides a much fuller perspective of CSIRO’s sites and interaction and alignment with key research partners.

2.4 The report identified the potential ‘… future state and interactions’ arising from the project, including the activities outlined in Table 2.1.

Table 2.1: National Footprint Project activities

|

Location |

Activities |

|

ACT |

Consolidation of sites in the ACT to the CSIRO Black Mountain site. |

|

NSW |

Consolidation of sites in Sydney to its North Ryde sitea in Sydney and the sale of its Lindfield and Marsfield sites and vacating Macquarie University site early in Sydney to fund the consolidation. |

|

Vic. |

Consolidation of the Highett and Aspendale sites to Clayton in Melbourne and ‘… collocation with the University of Melbourne (or other entities) in the Parkville Precinct …’ to free up capital from the Parkville site. |

|

WA |

Consolidation to the Kensington site in Perth. |

|

Regional Australia |

Colocation in regional areas. |

Note a: The CSIRO consolidation to the North Ryde site was reliant upon approval of a concurrent National Measurement Institute (NMI)]/Administrative Arrangements Order (AAO) new policy proposal (NPP) based on consolidating its Pymble, Lindfield and Marsfield operations at North Ryde. However, the NMI/AAO Sydney site consolidations NPPs did not proceed.

Source: ANAO analysis of CSIRO information.

2.5 The report indicated that the:

… national footprint and pathway forward emerges which has the following characteristics:

- Initial analysis indicates that transfers are undertaken within existing capital envelope (or through sourcing new capital from existing sources — e.g. EIF [Education Investment Fund]12;

- Minimal withdrawal from regional sites — CSIRO’s footprint is not diminished.

- Capital now concentrated in approximately 14 large sites (largely owned by CSIRO). While not yet modelled, it is expected operating costs for these sites would be reduced through consolidation and better utilisation of space and repairs and maintenance budgets.

- Operating costs reduced in other sites through collocation with larger entities, namely universities.

- Focus on collaborations with key universities through the assessment and establishment of strategic external engagement plans.

2.6 The modelling project was to inform the development of the CSIRO’s:

- National Footprint Roadmap (Roadmap) ‘to guide future developments’ with ‘… financial and risk aspects’ to be reconciled with the four year capital plan13; and ultimately the

- 2012 Property Strategy.14

2.7 In October 2019 the CSIRO advised the ANAO that the National Footprint Project Tool was not used to inform revisions to its 2012 Property Strategy and planning and measurement of the CSIRO’s property footprint over time. The CSIRO advised the ANAO that this was because the tool ‘… did not deliver what was expected’.

Measuring footprint for the 10-year 2012 Property Strategy

2.8 In February 2012, the CSIRO Board received a report from the CSIRO Executive identifying a number of pressures to the organisation’s underlying capital sustainability and capacity to deliver science outcomes. In particular:

- an ageing property portfolio requiring significant expenditure on repairs and maintenance, major refits and upgrades, and replacement of facilities;

- a continuing need to fund capital expenditure on scientific and information technology equipment to deliver science outcomes;

- an absence of cash reserves that means ‘CSIRO is now unable to fund the necessary forward program of property maintenance, enhancement and development’; and

- a projected deficit of ‘unfunded’ depreciation.15

2.9 The CSIRO Executive reported to the CSIRO Board that it was exploring opportunities to consolidate its footprint and was developing a long term property strategy, indicating:

The most significant opportunity for reducing the need for capital is by reducing the physical footprint of CSIRO’s property portfolio. Given that a) CSIRO’s depreciation in 4 years will be in excess of double the level of current government depreciation funding, b) that the level of repairs and maintenance currently undertaken is approximately 50% of international benchmarks, and c) that we believe CSIRO’s science space to be underutilised, there would appear to be both opportunity and benefit to pursue space reduction.

2.10 The CSIRO Board noted identified actions to address the capital challenges including that it was ‘… exploring a strategy to half our physical footprint over the longer term’.

2.11 In October 2012, the CSIRO Executive indicated that its:

- space utilisation was over double government mandated benchmarks (averaging 38 square metres per person), and that there was a shortfall between identified potential capital funding ($100 million of royalties from the Wireless Local Area Network (WLAN)16 settlement and $30 million from the Science and Industry Endowment Fund (SIEF)17 and the cost of repairs and maintenance over ten years ($227 million); and

- property strategy would be focussed on avoiding repairs and maintenance on properties identified for vacating or divestment; divesting and optimising return (e.g. public private partnerships or joint ventures) from underutilised high value properties, and concentrating capability where there are duplicate sites undertaking the same science.

2.12 The CSIRO Board, commenting on organisational sustainability cost and revenue initiatives, noted:

- the opportunity to use the precinct strategy to drive productivity and other gains –but noted the risks associated with reducing sites.

- noted that CSIRO is primarily pursing a capital city consolidation strategy, as opposed to reducing the regional site footprint (with a few exceptions).

2.13 The 2012 Property Strategy18 was approved by the Board in December 201219 and included details on:

- the construction of new facilities at the Black Mountain and Clayton sites and relocation of staff from other sites in the Australian Capital Territory (ACT) and Victoria to these sites;

- the divestment of sites in Ginninderra and a portion of Black Mountain (ACT ), Highett and Parkville in Melbourne (Victoria), Marsfield and Lindfield in Sydney (NSW) and Darwin (Northern Territory);

- plans for a second phase of the program to consolidate sites in Sydney (NSW); and

- ongoing repairs and maintenance to CSIRO sites in Hobart (Tasmania), Darwin (Northern Territory), the ACT and the Australian Animal Health Laboratory in Geelong (Victoria).

2.14 In its endorsement of the 2012 Property Strategy, the CSIRO Board requested management ensure that ‘… intended benefits are realised’. See paragraph 3.69 for further details on benefit realisation.

2.15 The CSIRO accounted for its property footprint in its 2012 Property Strategy according to its owned or leased buildings (building footprint )20, measured in square metres. The CSIRO did not include all of its leased locations in its assessment of its property footprint.

2.16 The CSIRO’s land footprint is not captured in the CSIRO’s estimation of property footprint, despite conducting scientific research and research in areas such as agriculture, biosecurity and astronomy involving the CSIRO holding sites that are predominantly large tracts of land rather than buildings.

2.17 The CSIRO’s measurement approach has not been reviewed and is not guided by a specific framework, although the CSIRO noted its 2011–12 property utilisation benchmarking study (data collected in 2011) was assessed on building footprint. The CSIRO has not undertaken an overarching review of its property utilisation since the 2012 study21 and did not develop a comprehensive approach for monitoring and measuring its property footprint over the ten year life of the 2012 Property Strategy.

2.18 The CSIRO Board Chair and Deputy Chair advised the ANAO that they were unaware that the CSIRO property footprint was measured on the basis of building square metres and did not include square metres of land.

Recommendation no.1

2.19 The CSIRO develop a consistent, transparent and effective approach to measure the entirety of its property portfolio footprint.

CSIRO response: Agreed.

2.20 The CSIRO does apply a consistent, transparent and effective approach to measuring the entirety of its property footprint, although acknowledges that while management regularly reports the property footprint for buildings, it does not include the footprint for land. CSIRO agrees that reporting property footprint data, including both building and land areas across multiple years is beneficial and will report annually from 2019-20.

How has the CSIRO’s property footprint changed since the 2012 Property Strategy was adopted?

The CSIRO’s property footprint has not reduced in accordance with the targets set in the 2012 Property Strategy. The 2012 Property Strategy targeted a 26 per cent reduction in the property footprint and reduction in the number of sites to 41. Planned divestments have been delayed or are no longer planned to progress, and consolidation activity has also been slower than envisaged in the 2012 Property Strategy. As a result, the CSIRO’s:

- number of sites increased by five per cent from 2012–13 to 2018–19;

- building footprint decreased by 10 per cent between 2013 and 2019, although the CSIRO has not included some of its locations in its calculation meaning the aggregate reduction is less across the entire property portfolio; and

- land holdings decreased by one per cent between 2013 and 2019.

2012 Property Strategy

2.21 The CSIRO Executive reported to its Board that it would achieve an estimated 20 per cent reduction in its property gross floor area (GFA) from implementing its 2012 Property Strategy, shown in Table 2.2.

Table 2.2: Property footprint comparison-gross floor area (GFA)

|

Property Portfolio |

Existing GFA (m2) |

Reduction (%) |

Activities identified to impact on footprint |

Movement in GFA (m2) |

|

ACTa |

129,728 |

41 |

Consolidation to Black Mountain, vacate Campbell, Crace, Yarralumla, Acton |

-53,707 |

|

Vic. |

238,764 |

15 |

Divestment of Highett and Parkville |

-34,940 |

|

NSW |

150,038 |

36 |

Consolidation to North Ryde, NSW, divestment of Lindfield and Marsfield. |

-53,318 |

|

Qld |

87,204 |

0 |

– |

0 |

|

SA |

22,159 |

0 |

– |

0 |

|

WA |

53,634 |

0 |

– |

0 |

|

Tas. |

23,424 |

0 |

– |

0 |

|

NT |

4,107 |

0 |

– |

0 |

|

Total |

709,058 |

20 |

|

-141,965 |

Note a: The proposed replacement of the Ginninderra site was considered to have no impact on the property footprint given the calculation was on the basis of building footprint.

Source: ANAO analysis of CSIRO Board papers.

2.22 In February 2013, the Government’s agreement was sought for the CSIRO to proceed with a program of rationalisation and realignment of CSIRO property in Canberra (ACT) and Clayton (Victoria) as part of the first phase of implementing the 2012 Property Strategy. The CSIRO Executive reported to its Board on its updated analysis and identified that, after ten years, it expected to have:

- reduced its footprint by 26 per cent22, a revised estimate from the 20 per cent estimate reported to its Board;

- mitigated an estimated $50.9 million of the additional repairs and maintenance costs over the next ten years; achieved utilisation of accommodation consistent with Australian Government benchmark standards; and

- refreshed its significant capital city sites to be fit for purpose in supporting science outcomes.

2.23 In early 2014, the CSIRO Executive discussed reforms and strategy and reported to its Board the intention to reduce the property portfolio to 41 sites in the context of addressing financial pressures.

2.24 From June 2013 to June 2014, the CSIRO’s property portfolio increased from 55 to 57 sites.23 Sites added over this period include the South Australian Health and Medical Research Institute (Adelaide, South Australia) and Santiago (Chile) (see Table 2.5 for details).

The CSIRO 2015–16 Property Plan

2.25 In 2014, the CSIRO Executive developed the 2015–16 Property Plan (2015 Property Plan) (also see paragraphs 3.22 to 3.26). This accounted for phase two of the 2012 Property Strategy, changes in policy (such as location of the National Measurement Institute (NMI)) and other pressures (impacting on the divestment of sites and ultimately the property footprint).

2.26 The 2015 Property Plan proposed program of work is detailed in Table 2.3.

Table 2.3: 2015 Property Plan: program of work

|

|

|

Stabilise operating expenses and costs of repairs and maintenance for the CSIRO’s ageing properties to mitigate the need for cuts to science in supporting these otherwise growing property costs. |

|

Reduce the size of the CSIRO’s now inefficient and underutilised property portfolio which has evolved in piecemeal fashion over the CSIRO’s history while remaining compliant with health and safety requirements and other regulatory standards including space utilisation specifications. |

|

Co-locate sites and buildings (including through lease arrangement where appropriate) with other partners in the Australian innovation system to stimulate and encourage collaboration and partnership in the delivery of science impact, and be close to industry and business centres consistent with the CSIRO’s focus on the translation of science and innovation. |

|

Deliver fit-for-purpose flexible (‘future proofed’) scientific facilities that enable the CSIRO to continue to deliver its science outcomes for national benefit. |

|

Undertake the compliance related upgrade at the Australian Animal Health Laboratory (AAHL) to ensure its continued operation beyond 2017, noting that the CSIRO will pursue co-funding for operating costs that remain unavoidably high due to the specialised nature of the facility. |

Source: ANAO analysis of CSIRO information.

2.27 On 11 May 2015, the Government gave its in-principle support to the plan and activities including :

- the joint venture arrangements for the development and sale of the Ginninderra and Marsfield sites and the straight sale of Aspendale, Highett and Parkville and Darwin sites;

- refurbishment of the Lindfield site in Sydney and the minor fit-out of the Eveleigh, Lucas Heights, Newcastle, Clayton, Werribee, Kensington, and Adelaide sites to facilitate the relocation of staff from the North Ryde and Marsfield sites;

- the refurbishment of the Clayton site to facilitate the relocation of staff from the Parkville and Aspendale sites; and

- critical compliance-related capital works at the Australian Animal Health Laboratory.

2.28 Advice to the CSIRO Board had previously identified that the process involved in CSIRO implementing the strategy could ‘… add 18 months to 2 years’ to the timeline of a project.

2.29 The CSIRO Property Plan noted that:

Sale proceeds derived from the divestment of CSIRO sites and the application of part of CSIRO’s annual capital funding underpins CSIRO’s ability to undertake the construction works envisaged in the Property Plan. A substantial portion of these proceeds are contingent on CSIRO being able to successfully undertake the Ginninderra JV [joint venture].

2.30 By June 2015, the number of sites in CSIRO’s property portfolio had declined back to 55 sites with the CSIRO vacating its leased site in Collingwood (Melbourne, Victoria) and divesting its Armidale Arding site (NSW).

The 2019–29 Property Strategy

2.31 In August 2018, CSIRO commenced the development of a 2019–29 Property Strategy (2019 Property Strategy) that was intended to be reviewed annually. The CSIRO Executive reported to its Board in May 2019 that the 2019 Property Strategy would:

… be agile and flexible to accommodate the changing science landscape, while ensuring that facilities are fit for purpose to meet current and future requirements and will

… provide direction on our current capital position, governance, strategic property principles, and decision making frameworks to ensure CSIRO makes the right investment decisions.

2.32 The CSIRO Executive reported to its Board in August 2019 that:

The CSIRO [new] property strategy aims to address a number of issues, challenges and opportunities. Robust planning and longer lead times for decision making will assist the organisation to better manage the complexity of the portfolio more effectively.

2.33 The 2019 Property Strategy, associated priorities (see Table 4.1), and the 2019–20 Property Implementation Plan, endorsed by its Board in August 2019, was to ‘… provide a ten year, holistic view of CSIRO’s property portfolio and the principles and frameworks that are in place to support robust and financially sustainable decision making’. The 2019 Property Strategy activities are detailed in Table 2.5.

Table 2.4: 2019 Property Strategy activities

|

Activities |

|

ACT and Sydney consolidations, AAHL part-life refurbishment, and Parkville relocation projects. |

|

Myall Vale New Cotton Breeding Research Facilities Project (near Narrabri (NSW), $17.9 million, 2018–22). The PWC approved the project in November 2018. |

|

Canberra Collections Accommodation Project (up to $70 million, 2019–20 to 2022–23) consolidate four Canberra-based national insect, wildlife and plant collections in a new Black Mountain site building. |

|

Perth consolidation project ($16.2 million, 2019–23). |

|

Ten-year lease of newly built office space in the Herston Health Precinct (Brisbane) to accommodate the CSIRO’s e-health research program ($10.5 million). |

|

Divestment of the Ginninderra, Marsfield, Highett, Geelong Belmont, and Aspendale sites. |

Source: ANAO analysis of CSIRO information.

2.34 Although previously planned for divestment, the CSIRO has retained its Parkville site in favour of establishing long-term lease arrangements to generate a rental return for the CSIRO.

2.35 The CSIRO identified some of the challenges related to divestment, citing as an example the Highett site [identified in the 2012 Property Strategy] that had been in progress for over five years. (See Table 3.3 for further details).

2.36 The Ginninderra divestment was noted as being ‘a key component for funding the revitalisation of other CSIRO property infrastructure identified through the 2012 Property Strategy’.

2.37 Between 30 June 2015 and 30 June 2019, the number of sites in CSIRO’s property portfolio increased to 58 sites from 55 sites. Table 2.5 shows the sites added and vacated over the period.

Table 2.5: Changes in CSIRO sites (owned or leased) between June 2015 and June 2019

|

Sites added |

Sites vacated |

|

Australian Technology Park, Sydney (NSW)a (leased) |

Highett, Melbourne (Vic) (owned) |

|

Kensington, Sydney (NSW)a (leased) |

Campbell (ACT) (owned |

|

Spring Hill, Brisbane (Qld)a (leased) |

Griffith (NSW) (leased) |

|

Weipa (Qld) (leased) |

Spring Hill, Brisbane (Qld) (leased) |

|

West Melbourne (Vic.)a (leased) |

Weipa (Qld) (leased) |

|

Canberra City (ACT)a (leased) |

West Melbourne (leased) |

|

Fortitude Valley, Brisbane (Qld) (leased) |

Canberra City (ACT)a (leased) |

|

Docklands, Melbourne (Vic.) (leased) |

Belmont, Geelong (Vic) (owned) |

|

Indian Ocean Marine Research Centre, Perth (WA) (leased) |

Wodonga (Vic) (leased) |

|

Silicon Valley (USA) (leased) |

– |

|

Boorowa (NSW) (owned) |

– |

|

University of New England, Armidale (NSW) (leased) |

– |

Note a: Site added as a result of the merger between the CSIRO and the then NICTA (National ICT Australia), announced in August 2015.

Source: CSIRO Annual Reports.

Changes in CSIRO investment and divestment plans

2.38 The main changes between 2012 Property Strategy and the program of work identified in the 2015 Property Plan and the 2019 Property Strategy are the CSIRO’s:

- confirmation of the approach to fund the 2015 Property Plan by divesting Ginninderra through a conditional sale that CSIRO identified was within its statutory powers;

- decision to retain and consolidate its Sydney sites to its Lindfield site, and to vacate its leased North Ryde site;

- retention of its Parkville site to earn a revenue stream through leasing it to a third party;

- commencement of the Biosecurity Act 2015 that resulted in CSIRO identifying the need to review and re-cost compliance upgrades in the Australian Animal Health Laboratory.

Capital investment progress

2.39 The CSIRO’s major and medium capital investment projects that have been completed or are near to completion since 2012 are:

- ACT — construction of a 15,000 to 18,000 square metre building at Black Mountain, refurbish/undertake capital works to existing buildings/demolition of redundant buildings;

- NSW — purchase, construction of infrastructure and capital works at Boorowa to replace the Ginninderra (ACT) site.

- Victoria — refurbishment of buildings/the construction of a new facility in Clayton; and

- Tasmania — Hobart building refurbishment.

2.40 Capital investment projects approved by the Public Works Committee include the Sydney consolidation and Myall Vale upgrade projects. Paragraphs 3.17 to 3.29 and Appendix 2 provides more detail on capital projects and when each project was identified.

Capital divestment progress

2.41 Table 2.6 shows capital divestment projects aligned with the 2012 Property Strategy, 2015 Property Plan and the 2019 Property Strategy. As at November 2019, the CSIRO’s Armidale Arding site is the only finalised divestment since 2012. The sale of the CSIRO’s Highett and Geelong Belmont sites are to be finalised by 30 June 2020.

2.42 Since 2010, the CSIRO has removed Armidale Chiswick (2012 Property Strategy), the top portion of Black Mountain, Lindfield (2015 Property Plan), Darwin, Parkville and Montpellier (2019 Property Strategy) from its divestment plans.

2.43 The lack of progress in divestments has delayed CSIRO achieving its planned revenue flow and associated reduction in footprint.

Table 2.6: Proposed and achieved divestments

|

Identified divestments |

2010 National Footprint Project |

2012 strategy |

Expected year — revenue |

2015 plan |

Expected year — revenue |

2019 strategy |

Expected year — revenue |

|

Black Mountain (top portion) |

– |

Identified |

2015–16 |

Removed from divestment plans |

– |

– |

– |

|

Ginninderra |

– |

Identified |

2015–16 |

Identified |

2016–17 |

Identified |

2021–22 |

|

Highett |

Identified |

Identified |

2014–15 |

Identified |

2017–18 |

Identified |

2019–20 |

|

Parkville |

– |

Identified |

2015–16 |

Identified |

2017–18 |

Removed from divestment plans |

– |

|

Aspendale |

Identified |

Identified |

Not identified |

Identified |

2024–25 |

Identified |

2024–25 |

|

Geelong Belmont |

N/A |

Identified |

2012–13 |

Not identified |

Not identified |

Identified |

2019–20 |

|

Lindfield |

Identified |

Identified |

Not identified |

Removed from divestment plans |

– |

Removed from divestment plans |

– |

|

Marsfield |

– |

Identified |

2020–21 |

Identified |

2019–20 |

Identified |

2021–22 |

|

Armidale Arding |

Identified |

Not identified |

Not identified |

Not identified |

2016–17 |

– |

– |

|

Armidale Chiswick |

Identified |

Removed from divestment plans |

Not identified |

Removed from divestment plans |

Not identified |

N/A |

– |

|

Darwin |

– |

Identified |

2014–15 |

Identified |

2016–17 |

Removed from divestment plans |

– |

|

Montpellier |

– |

– |

– |

Identified |

Not identified |

Removed from divestment plans |

Not identified |

Legend:

Green = CSIRO’s only finalised divestment; Blue = Sale to be finalised by 30 June 2020; Orange = Removed from CSIRO divestment plans.

Source: ANAO analysis of CSIRO information.

CSIRO’s measurement of its footprint

2.44 The CSIRO Business and Infrastructure Services business unit (CBIS) developed and administers the property investment strategy (see paragraphs 3.8 to 3.9 for further detail on CBIS roles and responsibilities). Prior to the commencement of this audit, the CSIRO did not measure its aggregate property footprint to report against its commitment to the Government in its 2012 Property Strategy.

CSIRO site footprint

2.45 Each year the CSIRO identifies in its Annual Report the number of sites it occupies across Australia and internationally. Figure 2.1 shows ANAO analysis on the number of CSIRO sites, as at 30 June, over time. The number of sites increased from 55 to 58 (five per cent) from 2012–13 to 2019–20.

Figure 2.1: Change in the number of CSIRO sites

Source: ANAO analysis of CSIRO Annual Reports.

Building and land footprint

2.46 Analysing CSIRO data, the ANAO estimated that the CSIRO had reduced its building footprint by 10 per cent (compared to the CSIRO forecast of 26 per cent) and its land footprint by one per cent from 2013 to 2019, shown in Figure 2.2.

Figure 2.2: Building and land footprint (m2)24

Source: ANAO Analysis of CSIRO data.

2.47 The CSIRO’s expectation of meeting its target (26 per cent), based on building footprint, is dependent on no additions to the CSIROs property portfolio, and CSIRO vacating its Crace, Yarralumla (ACT) and North Ryde sites at the end of lease (in mid-2022, mid-2022 and end of 2021 respectively). However, the CSIRO has flagged likely delays to vacating the Crace and North Ryde sites25, the commencement of the Sydney consolidation project including the refurbishment of the Lindfield site, and the sale of the Ginninderra and Marsfield sites by 2021. The CSIRO also identified, in November 2017, that it planned to vacate underutilised sites including its Cairns (end of lease mid-2019 but plans are to extend the lease for one year) and Atherton (owned) sites in Queensland. However, the CSIRO has not identified plans to divest the Atherton site in its 2019 Property Strategy.

2.48 The CSIRO did not regularly review progress in meeting its commitments made to the Government in March 2013 on reducing its property footprint.

Did the CSIRO develop an effective approach to measure its property operating costs?

The CSIRO has not developed an effective approach to measure its property operating costs. Some property operating costs are met by CSIRO business units and others are the responsibility of corporate areas but there are no arrangements in place for all costs to be periodically aggregated and analysed. This is significant given eliminating the forecast annual increase in operating costs over 2012–13 levels was a key rationale for adopting the 2012 Property Strategy.

2.49 All business units pay an overhead charge for energy, property lease and some other semi-fixed costs according to how many square metres the business unit is occupying and the administration of these costs is managed and reported annually by the CSIRO’s Finance business unit (Finance) (see paragraph 3.13 for further details).

2.50 The CBIS scope of services includes payment of some property operating costs (see paragraph 3.9 for further detail). The CBIS pays for costs related to repairs and maintenance on buildings and fencing, security, cleaning and waste.26 The CBIS also pays property overhead costs associated with underutilised accommodation, for instance, when science business units consolidate and there is a resulting reduction in the use of office or laboratory space (a reduction in square meters).

2.51 The CBIS noted that ‘specialised requirements such as maintenance of research instruments, or specific research developed structures are the responsibility and cost of the relevant BU [business unit] however, CBIS will provide support where agreed and where resources allow’.

2.52 The CBIS doesn’t have visibility over the operating costs for CSIRO as a whole, despite being responsible for the property strategy. There is no arrangement in place between CBIS and Finance that facilitates the measurement and reporting of the CSIRO’s total operating costs over time, consistent with the aims of the 2012 Property Strategy.

How have the CSIRO’s property operating costs changed since the 2012 Property Strategy was adopted?

The CSIRO’s property operating costs in 2018–19 were, in real terms, 43 per cent higher than they were in 2012–13, with an average annual growth rate across this period of seven per cent. The ANAO’s analysis is that the CSIRO’s property operating costs in 2021–22 are likely to be higher in real terms than they were in 2012–13.

2.53 As noted at paragraph 1.11, the CSIRO aimed to eliminate its forecast annual increase in its operating costs over 2012–13 levels.

2.54 The CSIRO noted in its 2015 plan that its intention was to deliver an $11.1 million improvement to the operating position of CSIRO over 10 years including a $63.6 million reduction in property operating, repairs and maintenance costs.

2.55 Figure 2.3 shows aggregate property related operating costs from 2012–13 to 2018–19, in real terms. Property related costs grew by 43 per cent in real terms from 2012–13 to 2018–19, growing by an average of seven per cent annually. The trend, delays and changes in the actions included in the 2012 Property Strategy that were to achieve the targeted reduction means CSIRO’s property operating costs in 2021–22 are likely to be higher in real terms than they were in 2012–13.

Figure 2.3: Aggregate property related operating costs from 2012–13 to 2018–19

Source: ANAO analysis of CSIRO data.

3. Governance arrangements

Areas examined

The ANAO examined whether effective governance arrangements were in place to support the implementation of the 2012 Property Investment Strategy (2012 Property Strategy).

Conclusion

The Commonwealth Scientific and Industrial Research Organisation (CSIRO) was not effective in establishing governance arrangements to support the implementation of its 2012 Property Strategy. The CSIRO effectively established its capital investment program, but it did not establish effective arrangements to support its capital divestment program, risk management and reporting to its Board. There have been significant delays with the delivery of the planned divestments (with some divestments having been cancelled). The planned divestments were key to CSIRO reducing its property footprint as well as to provide funds for the capital investment required for its proposed property consolidations, both of which were expected to facilitate a greater proportion of the CSIRO’s resources to be spent on scientific and industrial research.

Areas for improvement

The ANAO made three recommendations aimed at establishing effective governance arrangements for the management of divestment projects; better management of risk; and improved reporting to the CSIRO Board on progress with implementing the property strategy and the realisation of benefits.

3.1 The CSIRO Executive began implementing the 2012 Property Strategy in December 2012. In order to assess whether effective governance arrangements were in place to support implementation, the ANAO examined the:

- CSIRO’s governance framework and implementation arrangements, including the management of risks;

- identification of milestones and deliverables; and

- reporting to the CSIRO Board.

Did the CSIRO establish an effective governance framework and arrangements to implement its property investment strategy?

The CSIRO has established a partly effective framework and arrangements to implement the 2012 Property Strategy. Of note is that the CSIRO:

- developed principles to implement its property strategy, undertook some consultation and identified roles and responsibilities for the management of its property portfolio;

- implemented appropriate governance arrangements for capital works projects but it did not establish effective governance arrangements for divestment projects;

- established effective change management arrangements; and

- did not have a risk management plan in place for the 2012 Property Strategy and has not appropriately managed the risks to implementation including the risk to revenue from divestment projects not progressing as planned.

The development of implementation principles

3.2 As noted in paragraph 1.5, the 2012 Property Strategy was endorsed by the CSIRO Board in December 2012. In endorsing the 2012 Property Strategy, the CSIRO Board approved the principles outlined in Table 3.1. The principles were to inform decisions on the CSIRO’s management and implementation of its property strategy. However, at the time, the CSIRO Executive did not have a framework to guide prioritisation on property decisions on capital investment and divestment.

Table 3.1: 2012 Property Strategy principles, December 2012

|

Principles |

|

|

Appropriate spend of capital expenditure. Minimal but ‘necessary’ capital expenditure will be directed to reduce ongoing operating expenditure and avoid realising identified planned repairs and maintenance where the medium term goal is to vacate or extensively renovate the building. |

|

|

Unlocking value in our property portfolio. CSIRO underutilises a number of high value properties that if released will return significant value to the property portfolio to be used in realising the property strategy. |

|

|

Concentrating capability. A number of sites currently undertake the same or similar science, thereby requiring a duplication of infrastructure. CSIRO can no longer afford to continue to duplicate infrastructure where there is no demonstrable science benefit. |

|

|

Exploration of potential revenue sources to realise the Property Strategy including: Public Private Partnerships, Joint Ventures and optimising return through disposal of properties. |

|

|

Financial Sustainability. The Property Strategy seeks to outline the plans for managing CSIRO’s Property Portfolio over the next ten years and beyond without a requirement for additional money from the Government for the current scope of work. |

|

Source: ANAO analysis of CSIRO information.

Consultation on the 2012 Property Strategy

3.3 There was no overarching consultation plan implemented to support the 2012 Property Strategy.

3.4 In November 2012, the CBIS advised the CSIRO Executive that ‘consultation in respect to the development of the CSIRO property NPP [New Policy Proposal] has included the executive team, Department of Industry, Innovation, Science and Tertiary Education and the Department of Finance and Deregulation’.

3.5 The CSIRO was unable to provide the ANAO with information on any consultation process with its science unit leaders. Subsequently, between August and October 2014, the CSIRO Business and Information Services (CBIS) business unit consulted with science business units and the Executive on a property plan (2015 Property Plan) to support the second phase of the 2012 Property Strategy. In response to the consultation, the CSIRO Executive agreed to examine consolidating in Sydney at the Lindfield site instead of at the North Ryde site as planned in the 2012 Property Strategy. The CBIS also updated the property principles following the consultation.

Roles and responsibilities

3.6 The CSIRO Executive has identified roles and responsibilities for the delivery of property services, planning of capital investments and management of capital works projects. Roles and responsibilities of the Board, Chief Executive and executive team are clearly outlined including in charters and directions statements. The members of the executive team are responsible for business units including science research and enterprise services functions. Appendix 3 provides further detail on the organisational arrangements and the executive team’s breadth of responsibility in the CSIRO.

3.7 The CSIRO Operations Group is responsible for the delivery of the property strategy, led by the Chief Operating Officer (COO). The Operations Group includes the CBIS and Finance business units.

CSIRO Business and Infrastructure Services

3.8 As noted in paragraph 2.44, the CBIS developed and implemented the 2012 Property Strategy and delivers property services to support science. It has almost 250 staff across Australia whose roles include capital works managers, technicians, and stores and logistics officers.

3.9 The CBIS has developed its charter and scope of services that outlines its responsibilities for service provision. CBIS and science unit responsibilities with respect to property are identified in Table 3.2.27 The CBIS monitors space utilisation, consistent with its Accommodation Guidelines, and reviews requirements annually with science business units to determine responsibility for operating costs.

Table 3.2: Summary of scope of service responsibilities, December 2018

|

CBIS responsibility |

Science business unit responsibility |

|

Managing and maintaining facilities — including security, farm services and general cleaning |

Maintenance of research instruments or ‘specific research developed structures’ |

|

Strategic property planning |

Where a facility must meet specific regulatory compliance, the responsibility for funding to meet regulatory compliance requirements varies and is to be agreed between CBIS and business unit |

|

Maintaining an asset register, property data and valuations |

For farm services, all subdivision fences, other farm roads, stock and crop watering systems and other services deemed as research instruments |

|

Managing underutilised property |

Chemical and other hazardous waste disposal |

|

Building and infrastructure-related capital works |

Backup power supply |

|

Monitoring and evaluating the condition of facilities |

|

|

Managing all lease transactions |

|

|

Managing utility supply arrangements and apportionment of utility costs |

|

Source: The CBIS scope of services.

Oversight of projects

Project Boards and control groups

3.10 Project boards and project control groups (see Figure 3.1) were established to provide oversight for medium ($1 million to $15 million) and major (more than $15 million) value capital works projects.28 The CSIRO Executive did not have a governance structure in place to oversee its proposed divestments (identified in Table 2.6).

Figure 3.1: Roles and responsibilities of project boards and control groups

Source: ANAO analysis of CSIRO documents.

3.11 The CSIRO Executive established project boards and control groups to implement capital investment and site remediation projects under the 2012 Property Strategy, 2015 Property Plan and the 2019–29 Property Strategy (2019 Property Strategy), and clearly outlined the roles and responsibilities of the project boards and groups.

Ginninderra, Australian Capital Territory (ACT) divestment project committee

3.12 The Ginninderra Core Leadership Group was established and met for the first time in August 2018 to provide oversight of the Ginninderra divestment. The group has a terms of reference that has been in draft form since October 2019.29

Finance

3.13 The Finance business unit (Finance) works with the CBIS to prepare an annual capital plan, identifying funding for major and minor capital works and maintenance. Finance calculates the rates (per square metre) at which property overhead costs will be allocated to business units for their use of property, and recovers overhead costs. Finance also monitors and reports annually to the Board on capital expenditure.

Capital Management Committee

3.14 The Capital Management Committee oversees the allocation and management of CSIRO’s capital budget. Established under the 2019 Property Strategy, the committee’s role is to:

- make recommendations on capital expenditure;

- review the allocation of capital budgets;

- monitor expenditure; and

- oversee the development, update and execution of the 2019 Property Strategy.

3.15 Terms of reference clearly outline the committee’s role.

Implementation

3.16 As discussed in paragraph 2.13, the CSIRO Executive implemented the 2012 Property Strategy in two phases, commencing in 2012 and in 2015.

Phase one of the property strategy

3.17 In January 2013, the CSIRO Executive submitted proposals to the Government for major capital investment projects to consolidate research to its:

- Black Mountain site (ACT) — costing $185 million from 2014 to 2020; and

- Clayton site in Melbourne (Victoria) — costing $30 million from 2013–2016;

3.18 In February 2013, the CSIRO Executive reported to its Board on updates to the CSIRO’s annual capital management plan, to reflect the planned property strategy expenditure until 2016–17. The Government approved the CSIRO’s capital investment projects in April 2013.30 From September 2013, the CSIRO Executive implemented project boards and control groups (see paragraph 3.10) to oversee capital investment projects. The boards and groups met regularly, established terms of reference, kept meeting papers and recorded action items.

3.19 In December 2013, the CSIRO Executive reviewed and revised its 2014–15 capital expenditure budget to incorporate the approved ACT and Clayton consolidations, and to identify revenue sources, including future divestments, and capital works projects through to 2019–20. The Parliamentary Standing Committee on Public Works (PWC) approved the ACT and Clayton consolidations in March 2014.

Recommendation no.2

3.20 The CSIRO establish effective governance arrangements for the management of divestment projects including establishing a consistent framework and undertaking detailed planning.

CSIRO response: Agreed.

3.21 The CSIRO welcomes ANAO’s supportive remarks regarding its established governance framework and process for the effective management of major and significant projects for all investment projects and some divestment projects depending on size. CSIRO will extend this governance framework to be applied to all divestment projects regardless of size.

Phase two of the property strategy (2015 Property Plan)

3.22 As discussed in paragraph 2.25, the CSIRO Executive developed the 2015 Property Plan (phase two of the 2012 Property Strategy) to consolidate its Sydney operations to the Lindfield site in Sydney (NSW), upgrade the Australian Animal Health Laboratory (AAHL) in Geelong (Victoria), and divest six sites including the Ginninderra (ACT) site (see Box 1) (see Table 2.6 for divestment details). The CBIS commenced a submission to the Government before its Executive approval ‘given the urgency behind much of CSIRO’s property strategy’. The 2015 Property Plan was not presented for endorsement by the CSIRO Board.

3.23 In giving its in-principle approval to the 2015 Property Plan in May 2015 (discussed in paragraph 2.27), including on the joint venture development of the Ginninderra site, the Government requested a comeback submission for the 2016–17 Budget process to provide further detail on capital expenditure and revenue streams.

|

Box 1: Ginninderra divestment |

|

The CSIRO has owned the 701 hectare Ginninderra (ACT) site since the late 1950s and used it as an agricultural research field station. In 2014, the CSIRO Executive noted the divestment of the site would provide a ‘large portion’ of funding for the Sydney consolidation and AAHL part-life refurbishment. The CSIRO Board approved the commencement of the divestment process in 2015, however a governance structure was not documented until 2018. A steering committee (see paragraph 3.12), established in August 2018, has met regularly, noted action items and recorded decisions. From 2015 to 2019 the CSIRO was involved in three unsuccessful attempts at divestment (see timeline in Appendix 4). To enable the relocation of the field station, the Government announced in September 2015 the CSIRO had purchased a 290 hectare farm in Boorowa (NSW). The 2012 Property Strategy identified the need for a replacement site and the 2015 Property Plan planned for expenditure on it. The CSIRO Executive established a project board and control group in 2016 which have met regularly and considered papers on the infrastructure works on the site. |

3.24 In December 2015, the CSIRO Board approved delaying a comeback submission due to ‘significant challenges in confirming key elements of the plan’.31 The 2018 comeback submission’s key elements were:

- the AAHL compliance-related upgrade (entitled the AAHL Part-life Refurbishment Project, $220 million, 2020–21 to 2025–26);

- works to consolidate Sydney sites to Lindfield (entitled the Sydney Consolidation Project, $113.6 million, 2020–2022);

- direct sales of the Marsfield (Sydney, NSW); Parkville and Highett (Melbourne, Victoria) sites, which the CSIRO Executive estimated would total $115.1 million; and

- a $110 million loan from the Commonwealth to the CSIRO to meet cash flow requirements of the AAHL and Sydney projects, to be repaid from the Ginninderra divestment.

3.25 The comeback differed from the 2015 Property Plan that was agreed in-principle by the CSIRO — requesting the $110 million loan, removing the divestment of the Darwin (Northern Territory) site due to ‘changing market conditions’ and postponing the Aspendale (Melbourne, Victoria) divestment due to the higher than expected cost of relocating staff.32 The Government gave its approval in May 2018.

3.26 The PWC approved the Sydney Consolidation Project in October 2019. From September 2016 to January 2020, the CSIRO implemented project boards and control groups to oversee the Sydney, AAHL and Parkville relocation projects. The boards and groups met regularly, established terms of reference, kept meeting papers and recorded action items.

2019–29 Property Strategy

3.27 As shown in Table 2.6, significant investments and divestments were to be implemented between 2012 and 2029. The activities included: ACT (consolidation and divestment of Ginninderra); New South Wales (Sydney consolidation, Myall Vale investment and divestment of Marsfield); Victoria (Clayton consolidation and divestment of Highett, Geelong Belmont and Aspendale); Queensland (Herston Health Precinct investment); and Western Australia (Perth consolidation).

3.28 In 2019, the CSIRO Executive established project boards and control groups for the Myall Vale (NSW) and Perth consolidation (Western Australia) projects. The boards and groups established terms of reference, met regularly, considered papers and noted action items. A project board for the Canberra Collections Accommodation Project was established, with a terms of reference, in November 2019.

3.29 In the 2019 Property Strategy, the CSIRO Executive identified new governance processes for capital investment planning and a property decision-making framework (see Appendix 5 for further detail), and committed to annual internal reviews of the 2019 Property Strategy and consultation with science business units on their property requirements.

Change management and communication

3.30 CSIRO management planned and implemented change management and communication activities for the ACT, Sydney and Clayton consolidation projects, AAHL Part-Life Refurbishment and Perth consolidation project. Project boards and control groups received regular reports on implementation and noted actions.

3.31 The communication activities for the ACT, Clayton and Sydney consolidation projects, Ginninderra divestment and Highett remediation project included communication with: staff affected by consolidations in the ACT, Melbourne and Sydney; communities around the Ginninderra, Highett and Lindfield sites; and local authorities regarding the Ginninderra, Highett and Lindfield sites.

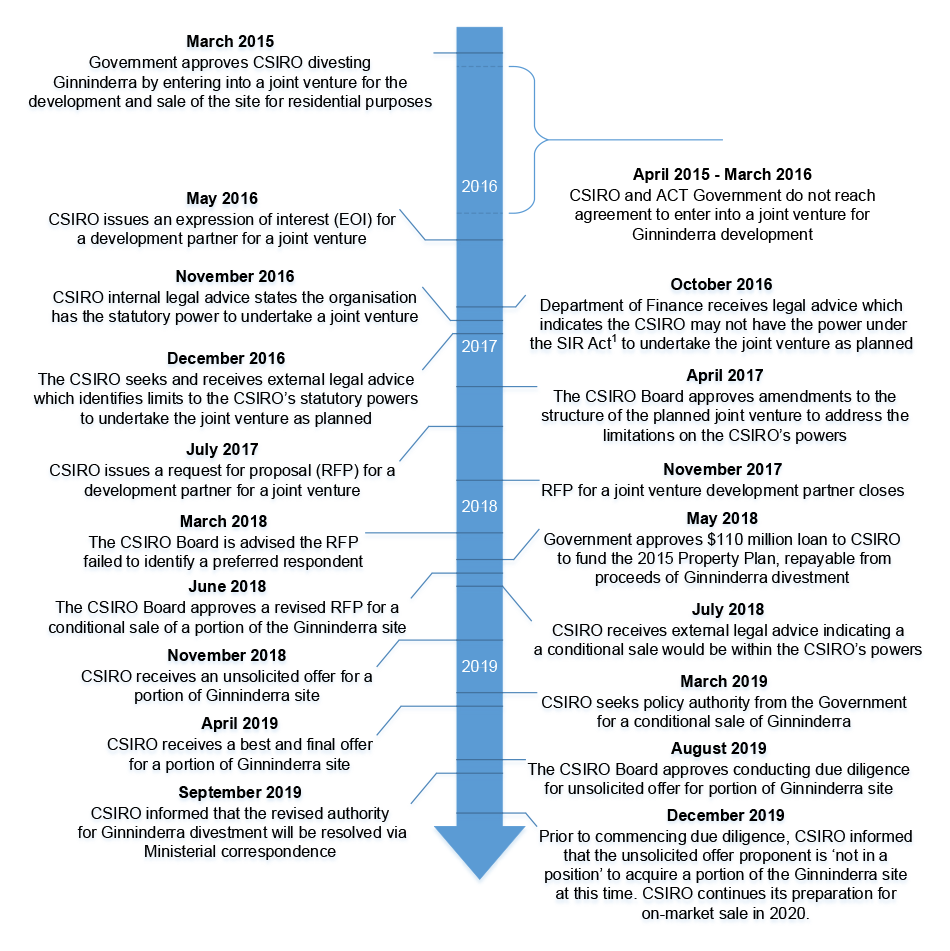

3.32 Figure 3.2 illustrates key events in the implementation of the strategy.

Figure 3.2: Timeline of key events

Note a: The CSIRO and National ICT Australia (NICTA) merged in August 2015 to create the CSIRO entity, Data61.

Source: ANAO analysis of CSIRO documents.

Risk management

Risk framework

3.33 The CSIRO has an Enterprise Risk Management Framework, risk policy and a procedure that ‘sets out the mandatory procedures for the assessment and management of risk’.33 The CSIRO assesses risks in:

- organisational strategic risk assessments conducted annually, which focus on whole-of-entity and strategic risks;

- operations and business unit services risk assessments, which are conducted annually and captured in risk registers; and

- project level risk assessments, which are specific to a CSIRO project. The assessments are conducted at the beginning of each project or during a project and outcomes are ‘captured in a regular status report … and escalated if necessary’.

3.34 The CSIRO Board Audit and Risk Committee monitors and reports to the Board on the ‘adequacy and operation of the risk identification and assessment framework’.

Organisational strategic risk assessments

3.35 The CSIRO Executive noted on three occasions between 2012 and 2018 that implementation of the property strategy depended on the CSIRO’s ability to divest properties — in particular, Ginninderra. In 2013, the CSIRO advised the Government that the risk of failing to proceed with the property strategy would compromise the CSIRO’s ability to avoid the escalating planned repairs.

3.36 Between 2013 and 2018, a number of events delayed or halted divestments and the return of proceeds to the CSIRO to fund the property strategy. These events, summarised in Table 3.3, were reported to the Board.

Table 3.3: Summary of delays and changes to divestment arrangements, 2013–19

|

Year |

Event |

|

2013 |