Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Design and Establishment of the Regional Investment Corporation

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Regional Investment Corporation (RIC) was set up to streamline administration of $4 billion in concessional loans across two schemes for farm businesses and national water infrastructure.

- RIC offered loans from 1 July 2018 which replaced a previous model for farm business loan delivery via the states and territories.

Key facts

- Establishment of RIC was a 2016 election commitment.

- RIC is a corporate Commonwealth entity with an independent Board.

- Loan interest rates are reviewed twice-yearly based on the Commonwealth’s cost of funds.

- RIC contracts its farm business loans management to an external service provider.

What did we find?

- The design and establishment of RIC was largely effective.

- The department provided sound advice to establish RIC but some assumptions could have been more robust.

- RIC’s governance arrangements to administer loan schemes are not yet mature.

- RIC has established appropriate arrangements for loan delivery.

What did we recommend?

- The Auditor-General made four recommendations on RIC that relate to:

- maturing risk management;

- enhanced performance reporting;

- establishing a compliance and assurance strategy for RIC processes; and

- annual tracking of the net cost of the farm business loan scheme (by the department).

$4 billion

has been committed for loans across two schemes, with $2 billion for farm business loans over four years, and $2 billion for national water infrastructure over eight years

$387 million

across 376 farms loans has been approved after the first 18 months operation

113 days

was the average number of business days for processing farm business loan applications from submission to decision in quarter two 2019–20

Summary and recommendations

Background

1. The Regional Investment Corporation (RIC) was established by the Regional Investment Corporation Act 20181 and offered loans from 1 July 2018. It is a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

2. The establishment of RIC was the response to a June 2016 Coalition election commitment to fast-track the delivery of $4 billion2 in Commonwealth drought and water infrastructure loans. Previously loans were delivered via the states and territories.

3. RIC concessional loans to farm businesses are one of 11 measures3 to support farmers facing drought. RIC also administers the National Water Infrastructure Loan Facility (NWILF) which is intended to help states and territories expand water infrastructure.

Rationale for undertaking the audit

4. RIC was set up in 2018 with $4 billion in Commonwealth financing to streamline administration of farm business and water infrastructure concessional loans. The ANAO previously examined the Department of Agriculture, Water and the Environment’s4 administration of concessional loans and found several deficiencies and areas for improvement.5 This audit will examine the effectiveness of the design and establishment of RIC. It will include assessment of whether lessons from prior programs were adopted in the design of RIC and the extent to which its loan arrangements are effective.

Audit objective and criteria

5. The objective of this audit was to assess the effectiveness of the design and establishment of the RIC. To form a conclusion against the audit objective, the ANAO adopted the following high level audit criteria:

- was the design process effective?

- are governance arrangements sound?

- are loan arrangements effective?

Conclusion

6. The design and establishment of RIC was largely effective. RIC is at the early stages of its roll-out of the farm business loans, the NWILF and other products. To optimise the outcomes from its products, RIC needs to improve its governance via enhanced risk management and developing a compliance and assurance strategy. Planned monitoring and evaluation requires review.

7. The design process to establish RIC was largely effective. The Department of Agriculture, Water and the Environment (the department) partially applied lessons from prior programs in developing RIC and managed constitutional constraints on Commonwealth loan delivery. However, it did not analyse the effectiveness of prior loans programs and more robust data should have been used to forecast loan uptake and default rates.

8. The department’s advice on establishing the new entity was sound. The government chose the most costly entity option for RIC. The department followed legislative requirements to establish RIC, obtained stakeholder input on farm business loan settings and provided input for the Board to decide on the external service provider.

9. RIC’s governance arrangements are partially sound. In establishing RIC, the department developed key governance structures and documents for RIC to support its initial operations. RIC is refining its governance arrangements. To ensure sound governance, RIC needs to enhance its risk management and oversight of external service provider data. Improvements are needed to the arrangements for performance management of the loans, including determining methodologies for each performance measure.

10. RIC has established largely effective loan delivery arrangements. A compliance and assurance strategy is needed to ensure compliance with RIC policies and procedures and annual tracking of farm business loan scheme net costs should be established. Uptake of the farm business loans has been increasing and work is underway to reduce processing times. However, there are no loans under the NWILF yet.

Supporting findings

The design process

11. Claims of inconsistent delivery of farm business loans across Australia was a key driver for the establishment of RIC. Establishment of RIC was partially informed by lessons from previous programs and stakeholder input. Previously recognised constitutional constraints on Commonwealth delivery of concessional farm business loans were managed. A prior ANAO audit recommendation to evaluate an earlier concessional drought loan scheme was not completed. Data deficiencies in loan uptake and default modelling noted in the prior audit were not actioned as part of the assumptions for RIC.

12. The advice provided to government on RIC’s design was sound. The department had an appropriate framework for providing advice that allowed identification of key issues, informed by input from other government entities. Three entity structure options were assessed against consistency with the election commitment, ongoing cost and legal risk. The government made a decision that RIC would be a corporate Commonwealth entity to provide independent oversight of the concessional loans despite this being the highest cost option.

13. RIC was established in accordance with legislative requirements and offered loans from 1 July 2018. RIC Board appointments largely reflect the required skill sets. To support RIC’s establishment, the department engaged stakeholders on farm business loan settings. It also undertook market engagement for the farm business loan external service provider, with the final decision taken by the RIC Board. The Board decided that RIC’s head office would be in Orange.

Governance arrangements

14. RIC’s risk management arrangements are not yet appropriate and improvements should include regular reporting on the risk register to the Executive, relevant committees and the RIC Board.

15. Arrangements for administering the farm business loans have been clearly defined in a Memorandum of Understanding between the department and RIC. Responsibilities for administration of the NWILF are clearly defined in a Memorandum of Understanding between the relevant entities. Interest rates for the loan products are reviewed twice-yearly as required by legislation and appropriate accounting treatments for the loans have been established.

16. Performance measures are not yet well developed. RIC has plans in place to review and revise the performance measures over time. The data sources and methodology for evaluating the farm business loans should be specified. Performance measures for the loans should reflect delivery and program objectives, and be publicly reported.

17. RIC has largely appropriate controls in place over its own internal information and communications technology (ICT) environment and systems. While the contract with the service provider stipulates that the provider must put in place appropriate data controls, RIC does not have visibility of these arrangements or their adequacy.

Loan arrangements

18. Appropriate loan service delivery arrangements are in place. There is clear public information on loan eligibility and conditions. The contract with the external service provider (Bendigo Bank) specifies responsibilities and includes provision for RIC to contract additional products. Amendments have been made to loan products in response to the continuing drought with two planned loan products not yet commenced.

19. RIC has been undertaking and planning suitable loan promotion activities, however, the effectiveness of these would be clearer if these activities were assessed against loan uptake data.

20. RIC has a suite of policies and procedures for loan assessments and approvals. The RIC Audit Committee has established an internal audit program that includes review of aspects of loan assessment and approvals. However, a compliance and assurance strategy is needed to ensure assessments and approvals are consistent with the policies and procedures.

21. RIC has not yet set any benchmarks or key performance indicators for the time taken to assess farm business loan applications. Loans that were approved in the second quarter of 2019–20 took an average of 184 days from application to settlement. Uptake of the farm business loans has been increasing and work is underway to reduce the time taken to process loans. The net cash impact of the farm business loans scheme should be monitored annually. There are as yet no loans under the NWILF.

Recommendations

22. This report makes four recommendations, three directed to RIC and the fourth to the Department of Agriculture, Water and the Environment.

Recommendation no.1

Paragraph 3.10

RIC should finalise its risk management policy, including risk reporting requirements and more clearly articulate its risk appetite in line with the adoption of the Commonwealth Framework.

Regional Investment Corporation response: Agreed.

Recommendation no.2

Paragraph 3.68

RIC should update performance measures for the farm business loan scheme and implement baseline data and evaluation methodologies as required.

Regional Investment Corporation response: Agreed.

Recommendation no.3

Paragraph 4.38

RIC should develop and implement a compliance and assurance strategy which covers the accuracy and completeness of loan data from the external service provider and compliance with key RIC policies and procedures for loan assessment and approval.

Regional Investment Corporation response: Agreed.

Recommendation no.4

Paragraph 4.59

At the end of each financial year, the Department of Agriculture, Water and the Environment should review the overall difference between the expenses and revenue for the farm business loans and advise the government of the scheme’s impact on Commonwealth underlying cash.

Department of Agriculture, Water and the Environment response: Agreed.

Summary of entity response

23. Summary responses from audited entities are below. Entities’ full responses are at Appendix 1.

Department of Agriculture, Water and the Environment

The department acknowledges the ANAO’s findings and recommendations and appreciates the opportunity to comment on the audit report on the Design and Establishment of the Regional Investment Corporation (RIC).

The report notes that the department’s role in the design and establishment of the RIC was largely effective and constraints on the program were managed. The report also identifies that the department provided sound advice to the government on the RIC’s design and the RIC was established in accordance with legislative requirements.

The department has adopted a continuous improvement approach to its practices and considered the findings of earlier audits when establishing the RIC. The department considers there are useful findings arising from this audit for any future program or scheme design.

The report places appropriate importance on the need for governance arrangements within the RIC to strengthen risk management and compliance of the scheme, whilst noting the RIC is still maturing and a relatively new entity.

The department considers that the recommendations will improve the loan programs administered by the RIC. The department will continue working closely with the RIC to ensure its loans continue to support growth and resilience in Australian farm businesses and rural and regional communities.

Regional Investment Corporation

The Regional Investment Corporation (RIC) welcomes the audit’s overall conclusions and findings. The RIC is pleased that the ANAO found that the design and establishment of the RIC was largely effective, the department’s advice on establishing the new entity was sound and the RIC has established largely effective loan delivery arrangements.

The RIC agrees with the recommendations of the report directed to the RIC.

The RIC acknowledges the importance of appropriate governance arrangements to administer loan schemes and is taking action to update key governance and risk management documentation as the organisation’s maturity transitions from initial operations.

The RIC is also updating performance measures for the farm business loan scheme and developing its compliance and assurance strategy to better inform performance reporting against delivery and program objectives and consistency with program guidelines, policies and procedures.

The RIC is committed to ensuring its staff are aware of, and fully comply with, their reporting requirements for risk and governance, enabling the RIC to meet its business, legislative and accountability requirements.

Department of Finance

Finance notes the recommendation and findings provided in the extract of the report.

Key messages from this audit for all Australian Government entities

Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Policy/program design

1. Background

Introduction

1.1 The total value of Australian agricultural production (including fisheries and forestry) was approximately $69 billion (2.2 per cent of GDP) in 2018–19. The December 2019 Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) agricultural overview stated that:

The impact of drought continues to be felt across Australia’s agricultural sector, contributing to a forecast unprecedented third consecutive year of falling production.7

1.2 The total value of agricultural production is forecast to be $59 billion in 2019–20.8 The February 2020 crop report notes summer crops in Queensland and northern New South Wales remain well below average.9 In addition, there have been widespread impacts on livestock, crops and farm infrastructure as a result of the bushfires in December 2019 and January 2020.10

1.3 The 2014 Agricultural Competitiveness Green Paper (the Green Paper) observed that some rural segments and regions had higher than the national average and unsustainable debt.11 Current national rural debt (including fisheries and forestry) totals $80.2 billion. Approximately 95 per cent of this was provided by banks, three per cent by pastoral and other finance companies, and two per cent by government.12

The Regional Investment Corporation (RIC)

1.4 The Regional Investment Corporation (RIC) is a corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013 (PGPA Act). It was established by the Regional Investment Corporation Act 2018 (RIC Act),13 with detailed directions set out in the Regional Investment Corporation Operating Mandate Direction 2018 (Operating Mandate). RIC’s governance includes two responsible Ministers with a Board and CEO.14

1.5 RIC’s purpose is to encourage growth, investment and resilience in Australian farm businesses and rural and regional economies.15 The RIC Act states that ‘the rules may prescribe one or more programs to be administered by the Corporation’.16

1.6 Establishment of RIC delivered on a 2016 election commitment to establish a Regional Investment Corporation to fast-track the delivery of $4 billion17 in Commonwealth drought and water infrastructure loans. RIC offered loans from 1 July 201818 with $2 billion available for farm business concessional loans and $2 billion for the National Water Infrastructure Loan Facility (NWILF).

1.7 RIC administers individual farm business loans on behalf of the Department of Agriculture, Water and the Environment (the department).19 For the NWILF loans, both RIC and the Department of Infrastructure, Transport, Regional Development and Communications (Infrastructure) provide advice to the responsible Ministers on individual loans.20 RIC’s centralised administration of farm business loans replaced delivery via the states and territories and was intended to improve loan delivery.21

Concessional loan schemes

1.8 Concessional loans have more favourable terms and conditions than those offered by the commercial finance market, including interest rates below market levels. The Australian Government provides concessional loans as part of broader drought and rural assistance to farm businesses and households.

1.9 As at 30 April 2020 the department’s website lists 11 Australian Government drought and rural support measures including RIC.22 The other measures are the farm household allowance, financial counselling and well-being services, the drought community support initiative, tax deductions, rebates on farm water infrastructure, pest and weed management measures, a water for fodder program in the Murray Darling Basin, climate data and an on-line drought map.

1.10 Various drought and flood support measures, including concessional loans, are also provided by state and territory governments.23 At the time of the 2014 Green Paper, the Australian Government had already introduced Farm Finance Concessional Loans that were to run until June 2015. The paper noted a stakeholder’s suggestion to extend these on a permanent basis to improve profitability and support farmers facing difficult circumstances.

1.11 In the subsequent 2015 Agricultural Competitiveness White Paper (the White Paper),24 the existing drought concessional loan scheme was extended for 12 months. A new drought concessional loan scheme was also established, comprising $250 million a year for 10 years commencing in 2016–17. This later became the RIC scheme termed the farm business concessional loan scheme (with eight years remaining at the time of RIC’s establishment).

RIC loan products

1.12 At commencement, RIC also offered two farm business loan products (farm investment loans and drought loans). These loans provide concessional interest rates to eligible farm businesses that are experiencing financial difficulties but are considered financially viable in the long term.

1.13 After RIC commenced, AgRebuild loans were added to RIC’s loan products in response to flooding in North Queensland.25 On 7 November 2019 amendments were made to the drought loans to further assist farmers by providing an initial two year interest-free period, given the continuing drought (see Figure 1.1). A new loan product (AgBiz loans) was also announced at that time, targeting small businesses providing goods and services to drought-affected farms. Further changes from 24 March 2020 include a broadening of eligibility for drought loans, with applicants no longer required to demonstrate they are located in an ‘affected area’.26

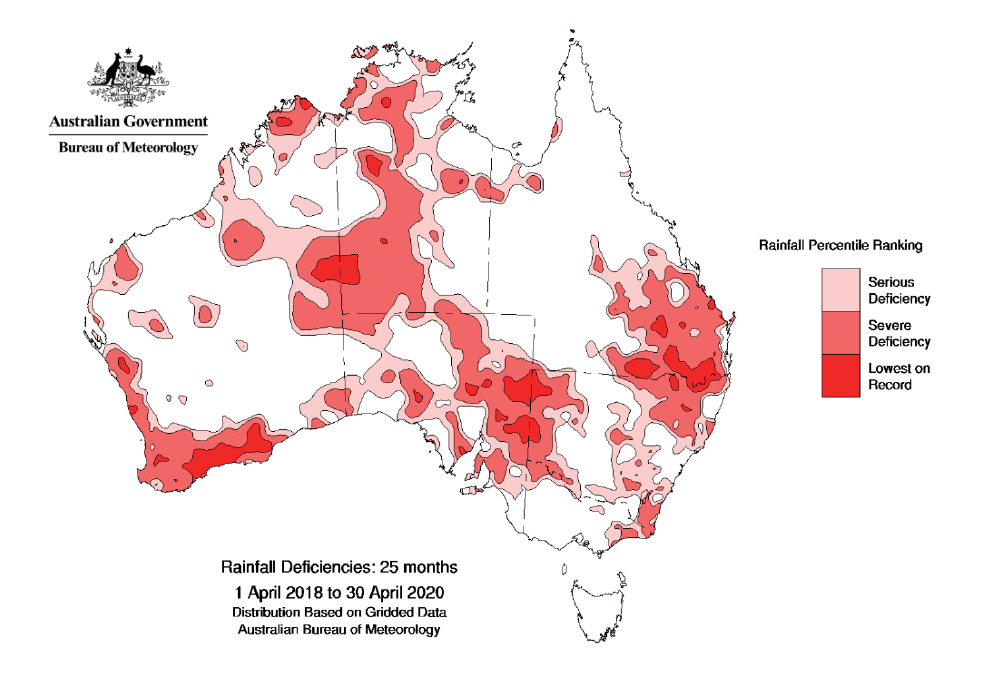

Figure 1.1: Extent of rainfall deficiency across Australia as at 30 April 2020

Source: The Bureau of Meteorology Monthly Drought Statement27

1.14 The $2 billion NWILF was announced in the 2016–17 Commonwealth Budget.28 It complements a key measure in the White Paper — the $1.5 billion National Water Infrastructure Development Fund for which applications are now closed.29 RIC is responsible for administering these loans but policy and program oversight responsibility lies with the infrastructure portfolio.30

1.15 The NWILF is intended to respond to gaps in the capital market for water infrastructure projects. State and territory governments are eligible for the loans, including via public/private partnerships. The loans are for water infrastructure such as dams and pipelines, where these are economically viable.31

Funding for loans and operations

1.16 On commencement it was planned that RIC would deliver $2 billion for farm business loans, with $250 million per year, over eight years, until 30 June 2026. In August 2018, this funding was re-profiled to $500 million per year, over four years, until 30 June 2022. The restructuring of the funding profile reflected the government’s decision to double maximum loan amounts from $1 million to $2 million as part of a suite of measures to further assist drought affected farmers.32

1.17 Funding for the farm business loans is provided via an appropriation to the department that is transferred to RIC as loans are settled. The department accounts for the farm business loans separately to RIC operations.33

1.18 RIC had $2 billion available for loans under the NWILF until the end of 2025–26. While RIC has not assessed any applications for loans under this fund, the New South Wales Government expressed interest in $284 million in NWILF loan funding for two dam projects.34 These are two projects that the Commonwealth has committed to support.

1.19 Funding for RIC’s operating expenses is provided via an appropriation to the department with $12.555 million in 2018–19 and a budget forecast of $15.414 million in 2019–20. Loan funding for water infrastructure is appropriated to and remains with the infrastructure portfolio.

Rationale for undertaking the audit

1.20 RIC was set up in 2018 with $4 billion in Commonwealth financing to streamline administration of farm business and water infrastructure concessional loans. The ANAO previously examined the Department of Agriculture, Water and the Environment’s35 administration of concessional loans and found several deficiencies and areas for improvement.36 This audit examined the effectiveness of the design and establishment of RIC. It will include assessment of whether lessons from prior programs were adopted in the design of RIC and the extent to which its loan arrangements are effective.

Audit approach

Audit objective, criteria and scope

1.21 The objective of this audit was to assess the effectiveness of the design and establishment of the Regional Investment Corporation. To form a conclusion against the audit objective, the ANAO adopted the following high level audit criteria:

- was the design process effective?

- are governance arrangements sound?

- are loan arrangements effective?

Audit methodology

1.22 The main components of the audit methodology were:

- review of advice and briefing material provided to the government by the department;

- review of documentation held by the department, RIC and other entities;

- analysis of loan processing data; and

- interviews with relevant entity staff.

1.23 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $452,895.00.

1.24 The team members for this audit were Katherine Lawrence-Haynes, Kara Ball, Shay Simpson, Carissa Chen, Jacqueline Hedditch and Michael White.

2. Design process

Areas examined

This chapter examines the effectiveness of the design process, implemented by the Department of Agriculture, Water and the Environment37 (the department) to establish the Regional Investment Corporation (RIC).

Conclusion

The design process to establish RIC was largely effective. The department partially applied lessons from prior programs in developing RIC and managed constitutional constraints on Commonwealth loan delivery. However, it did not analyse the effectiveness of prior loans programs and more robust data should have been used to forecast loan uptake and default rates.

The department’s advice on establishing the new entity was sound. The government chose the most costly entity option for RIC. The department followed legislative requirements to establish RIC, obtained stakeholder input on farm business loan settings and provided input for the Board to decide on the external service provider.

2.1 To assess whether the design process to establish RIC was effective, three elements of the design process were examined:

- whether lessons and stakeholder input from previous programs were considered;

- whether sound advice was provided to the government on establishing RIC; and

- whether the entity was established in accordance with legislative requirements.

Were lessons and stakeholder input from previous programs considered?

Claims of inconsistent delivery of farm business loans across Australia was a key driver for the establishment of RIC. Establishment of RIC was partially informed by lessons from previous programs and stakeholder input. Previously recognised constitutional constraints on Commonwealth delivery of concessional farm business loans were managed.

A prior ANAO audit recommendation to evaluate an earlier concessional drought loan scheme was not completed. Data deficiencies in loan uptake and default modelling noted in the prior audit were not actioned as part of the assumptions for RIC.

2.2 To assess whether lessons from previous programs and stakeholder input were considered in the establishment of RIC, four aspects were examined:

- how input, including from stakeholders, informed the concept for RIC;

- whether key findings from a relevant prior audit were considered;

- consideration of loan uptake and default assumptions; and

- how loan scheme constitutional risk was identified and addressed.

Input informing RIC

2.3 The 2016 Coalition election commitment was to establish RIC to:

Streamline Commonwealth financing and concessional loan processing to enable new dams to be financed quickly and ensure concessional drought loans are approved to help farmers in need.

2.4 However, establishing RIC was not informed by any substantive assessment of the effectiveness of the existing loans. The department had not finalised an evaluation strategy for these loans (see paragraph 2.13).

2.5 The National Farmer’s Federation’s 2016–17, 2018–19 and 2019–20 pre-budget submissions38 stated that the lack of a consistent approach to drought measures led to ‘confusion regarding the variety and certainty of assistance measures’. Its 2018–19 pre-budget submission (five months before RIC commenced) supported the establishment of RIC and said that loan administration had been inconsistent between jurisdictions, leading to low uptake.

2.6 A submission to a 2015 Senate Committee inquiry on a Private Members Bill on rural financing options39 stated in reference to concessional drought loans: ‘some states do not have effective machinery for delivery; many have lost the ability or simply refuse to participate.’ The Committee did not support the Bill and said that ‘the creation of a new [rural finance] Commonwealth entity could only be made following a comprehensive review of the nature and level of rural debt in Australia’. It also noted that alternative options would need to be examined.

2.7 In debate on the Regional Investment Corporation Bill 2017, a South Australian senator noted that there had been wide variation across states in the administrative costs for concessional loans, with relatively few loans approved in South Australia compared to other states.40 Auditor-General Report No. 28 2015–16 Administration of Concessional Loans Programs41 on the prior loan programs also stated that the decentralised delivery approach and bilateral agreements between the Commonwealth and each jurisdiction meant there were variations in the timing of access to concessional loans, which should be monitored to manage risks to fairness and consistency (see paragraphs 2.9 to 2.13 for further commentary on this audit).

2.8 There have been various reviews of drought policy in Australia and its effectiveness in supporting long-term productivity. Earlier drought measures included grants to help cover interest costs (not concessional loans). A review undertaken by the Productivity Commission (PC) in 2009, found that interest cost support was ineffective as it targeted farms with high debt and low off-farm income. The PC Trade and Assistance Review 2017–18 stated ‘it is too early to form a clear picture of the take up rates across the many drought programs or which measures are the most desired and effective.’42 Sound evaluation of concessional loan products is required to support future drought policy and delivery of concessional loans (see paragraph 3.65).

Prior audit of concessional loans

2.9 Auditor-General Report No. 28 2015–16 Administration of Concessional Loans Programs43 examined the department’s administration of the two earlier concessional loan schemes44 for farm finance and drought. This audit found that the establishment of the farm business loans was impacted by the department’s limited experience with concessional loan programs, short timeframes and a lack of consultation.

2.10 The audit highlighted that there was no appropriate modelling of demand for loan uptake and that robust data on default rates had not been provided. Further findings noted that the department had not established appropriate arrangements to evaluate the effectiveness of each loan scheme. There were four recommendations, with three agreed and one agreed in part.45

2.11 The department developed an implementation plan for the agreed recommendations that was tabled at its audit committee meeting in June 2016.46 Improvements made in response to the recommendations informed RIC’s set-up. These included improved guidance, policies and oversight for loan assessment and approval and improved documentation of key decisions on design and implementation of the scheme.

2.12 In July 2017 the implementation plan was reported as complete and endorsed by the audit committee. However, two recommendation sub-parts on development of an evaluation strategy for current and future concessional loan programs and reporting were left until RIC’s establishment.

2.13 The department provided RIC with a draft monitoring and evaluation plan for its loan schemes for consideration by its Board47 on inception (see paragraph 3.54). However, an evaluation strategy for the existing concessional loans was never finalised.

Loan uptake and default assumptions

Farm business loans

2.14 Despite concerns identified in Auditor-General Report No. 28 2015–16 Administration of Concessional Loans Programs in regard to data deficiencies for loan uptake and default rates, the prior assumptions of a zero risk price for loan defaults and 100 per cent uptake of loan funding were carried forward to the agreed RIC model. This reflected the department’s advice that the financial risks did not increase with delivery under RIC (management of loan impairments for RIC loans is detailed in paragraphs 3.35 to 3.39).

2.15 The default rate assumption was based on data from the prior loan scheme that was still early in the loan cycle, with principal repayments not due until 2018–19. This would not have provided a reliable estimate.48 The department did not use data that was potentially more comparable, such as farm loan portfolio data held by the banking sector.

2.16 The assumption of 100 per cent uptake of loans was also not substantiated by robust data. There would have been merit in the department reviewing uptake data for previous farm business loan schemes and adjusting for the nature of the new loans and prevailing conditions.

National Water Infrastructure Loan Facility

2.17 The National Water Infrastructure Loan Facility (NWILF) was set up in 2016 to progress significant water infrastructure projects. It was designed to complement the $1.5 billion National Water Infrastructure Development Fund (NWIDF) announced in June 2015.49

2.18 The loan facility was established as demand for the NWIDF was expected to exceed available funding for capital.50 Demand analysis was based on the take-up of the first round of the feasibility component of the NWIDF and estimates of capital funding required for potential projects in the 2014 Water Infrastructure Options Paper.

2.19 The department offered NWILF loans from February 2017 at an interest rate of 2.22 per cent. The Minister for Agriculture and Water Resources approved this rate based on estimated cost neutrality over the life of the scheme (with departmental administration).

2.20 The department’s brief to the Minister on opening of the loan facility noted that administration by RIC was the preferred future option. Under RIC delivery, a rate of 2.55 per cent was estimated, although it was noted that this could be a disincentive given some states’ lower borrowing rates. Nevertheless, an interest rate increase was anticipated when RIC opened.51

2.21 A question at October 2019 Senate Estimates was whether the NWILF is relevant if states can get funds at the same rate. RIC stated that ‘there may be other aspects of the loan that might be attractive, aside from just the interest rate’.52 With some New South Wales interest in NWILF loans (see paragraph 1.18), ongoing monitoring of the factors behind loan take-up will be needed.

Loan scheme constitutional risk

2.22 The Commonwealth of Australia Constitution Act 1901 (the Constitution) establishes the authority and powers of the Commonwealth to undertake its activities. The previous farm loan schemes provided loan funding to states and territories under the state grants power (section 96) and the territories power (section 122) in the Constitution.

2.23 The department considered the constitutional basis and associated risk from the Commonwealth delivering loans direct to farmers, as there is no obvious legislative head of power. In doing so, the department obtained input from the Department of the Prime Minister and Cabinet, Department of Foreign Affairs and Trade, and the Attorney-General’s Department. To reduce risk, the department broadened the purpose of the farm investment loans to draw on trade and commerce provisions. The drought loans53 used the specified drought ‘affected areas’ definition54 to draw on the external affairs power.55 The requirement for the drought loan recipient to be located within an ‘affected area’ was removed in March 2020.

2.24 The department also advised on the compulsory transfer of existing farm loan agreements from state delivery agencies to RIC.56 Based on the level of risk and sunk costs,57 the Minister agreed existing loans would remain with the states to administer, with participants given the opportunity to refinance with RIC.58

Was sound advice provided to the government on establishing RIC?

The advice provided to government on RIC’s design was sound. The department had an appropriate framework for providing advice that allowed identification of key issues, informed by input from other government entities. Three entity structure options were assessed against consistency with the election commitment, ongoing cost and legal risk. The government made a decision that RIC would be a corporate Commonwealth entity to provide independent oversight of the concessional loans despite this being the highest cost option.

2.25 To assess if sound advice was provided to the Australian Government on establishing RIC, three areas were examined (in addition to the matters considered in the previous section):

- the program structure and timing of advice;

- entity structure options; and

- entity costings.

Program structure and timing of advice

2.26 The Minister for Agriculture and Water Resources assigned responsibility to the Department of Agriculture, Water and the Environment59 for establishing RIC. The department developed an appropriate framework for providing advice with an implementation taskforce and program board.

2.27 The department’s initial advice focused on options for the entity structure and loan delivery issues. This advice was provided over eight months from August 2016, until government approval for RIC in March 2017. Advice post-approval focussed on establishment of the new entity and was provided until closure of the RIC program and handover to the new entity in July 2018 (see Appendix 1 for a timeline of key events).

2.28 The department established a taskforce, later recognised as a program, that organised work into nine project streams (see Figure 2.1). There was an overarching program plan with project plans, an implementation schedule, a stakeholder engagement plan and a communications plan.

Figure 2.1: Component projects of the RIC Program

Source: RIC program governance structure (the taskforce comprised the Program Manager and component projects).

2.29 The program board was chaired by a Deputy Secretary of the department. Initial membership comprised six senior officers from the department and later included an observer from the Department of Finance. The program board operated from September 2016 until three months after RIC first offered loans from 1 July 2018.

2.30 The deliberations and decisions of the program board were appropriately documented in agendas, agenda papers, meeting outcome notes and a decision log. Status reports on projects were provided to each meeting covering progress, risks and challenges.60 The department also received assistance from an interdepartmental committee that met three times.

Entity structure

2.31 RIC was established as a corporate Commonwealth entity, informed by departmental advice. This structure aligns with the Department of Finance guidance,61 in that farm business loans could be viewed as a commercial offering. However, RIC does not recognise loans as assets in its balance sheet and does not carry the financial risk of the loans. It is not clear a corporate Commonwealth body was necessary for governance and independence reasons.

2.32 Various options for RIC’s structure were canvassed and the chosen option was the most costly (see paragraph 2.35). Initially four options were assessed against consistency with the election commitment, legal risk, financial implications, and the timeframe for implementation.62 In response to Ministerial direction, the department scoped three further options:

- two non-corporate Commonwealth entity options (a statutory body supported by the department and a separate non-corporate statutory agency); and

- a corporate Commonwealth entity (arms-length commercial governance).63

2.33 The department recommended a statutory body as it offered statutory security for the loans, was aligned with delivering a ‘government program’, was quicker to establish and offered the lowest operating costs. However, the Minister’s preferred option was a separate non-corporate statutory agency. The government’s final decision in March 2017 was that RIC would be established as a corporate Commonwealth entity.

Entity costings

2.34 The Coalition election commitment was for the entity to be fully funded over time from loan interest payments. In November 2016 initial calculations were put forward for interest rates for farm business loans and the NWILF under three structure options for RIC, and for the existing delivery by state agencies.64 In each case the interest rate was calculated by applying an ‘administrative cost margin’ to the government’s borrowing rate, which was based on the intention for cost neutrality over the lives of the schemes.

2.35 The calculations were based on estimates of operational costs and the cost of capital,65 offset by revenue from interest payments.66 Despite being the chosen entity form, over the life of the entity, the corporate Commonwealth entity option was 67 per cent more expensive than a statutory body and 15 per cent more expensive than the non-corporate statutory agency. The costing for RIC was later revised downwards by 11 per cent with adjustments including costs for an external service provider.

2.36 Given the value of interest payments would vary as the loan portfolio rolled out, it recognised that RIC would not be immediately self-funding (net cash costs would accrue in the earlier and later years of the scheme). The department advised that under the final model loan interest is not retained by RIC and is returned to the Consolidated Revenue Fund, with RIC operational costs funded by an annual appropriation. The need for the department to track the actual annual net costs for the loan schemes is covered in paragraphs 4.57 and 4.58 and in recommendation four.

2.37 Auditor-General Report No. 20 of 2019–20 Audits of the Financial Statement of Australian Government Entities for the Period Ended 30 June 2019 noted growth in the loans provided by the Commonwealth, with a large proportion of these being concessional loans.67 Since 2016–17, three new corporate Commonwealth entities, including RIC, have been established to deliver concessional loans. It also noted that there is a significant overhead cost associated with establishing and maintaining a Commonwealth entity irrespective of its size.

2.38 In the Trade and Assistance Review 2017–18,68 the PC noted the proliferation of Commonwealth project finance facilities to fill market gaps but did not mention RIC. It proposed a review of the new financing measures and noted that they ‘have the potential to skew industry assistance to particular firms and projects with minimal public scrutiny until deals are done’.

2.39 The ANAO noted that there is an opportunity for government to draw on existing expertise and structures to manage concessional loans. There could be further scope to review the optimal/ most cost-effective model for delivery of concessional loans.

Was RIC established in accordance with legislative requirements?

RIC was established in accordance with legislative requirements and offered loans from 1 July 2018. RIC Board appointments largely reflect the required skill sets. To support RIC’s establishment, the department engaged stakeholders on farm business loan settings. It also undertook market engagement for the farm business loan external service provider, with the final decision taken by the RIC Board. The Board decided that RIC’s head office would be in Orange.

2.40 To examine if RIC was established in accordance with legislative requirements, five aspects of RIC’s set-up to deliver a functioning entity were considered:

- Board appointments;

- stakeholder engagement;

- use of an external service provider for loan delivery;

- RIC’s location; and

- closure of the overall RIC establishment program.

2.41 As part of its program of work, the department developed draft legislation for the Regional Investment Corporation Act 201869 (Project 2 in Figure 2.1). The RIC Act specifies an independent Board as the accountable authority,70 with members appointed by the responsible Ministers.71

2.42 The Act provides for the responsible Ministers to give directions to RIC. The key vehicle for these directions is the Operating Mandate, which is subordinate legislation that sets out the government’s expectations for the RIC, including the interest rate calculation methodology.72

Board appointments

2.43 Under a specific project for RIC appointments (Project 5 in Figure 2.1), the department undertook a Board member selection process. There was advertising in national media and on Australian Government websites for potential members. A selection panel, and later two senior officials assisted by an executive search agency,73 shortlisted potential candidates for Ministerial approval.74

2.44 The RIC Act requires the Board consist of a Chair and at least two, and no more than four, other members.75 The Board first met in early April 2018 with three members including the Chair. A fourth member was added in late April 2018 and a fifth member in April 2019 (these member totals include the Chair).

2.45 Eligibility for appointment to the Board initially required qualifications, skills or experience in one or more of eight areas, or with expertise relevant to any additional programs. A ninth skills area was added in September 2019 to reflect a new function conferred on the board by the Future Drought Fund Act 2019.76

2.46 The Board’s coverage of the required skills77 is shown in Table 2.1 (changes in capacity reflect changes in Board membership). While individual board appointments have been largely consistent with the required skills sets, coverage of the required skills should be monitored. Emphasis should be placed on skills and experience in credit risk given the risk of loan defaults.

Table 2.1: Regional Investment Corporation Board skills coverage

|

Legislative skills basis for RIC Board appointment |

2018 Apr–Jun |

Jul–Sep |

Oct–Dec |

2019 Jan–Mar |

Apr–Jun |

Jul–Sep |

Oct–Dec |

2020 Jan–Mar |

|

Agribusiness, financial viability in the agricultural sector |

|

|

|

|

|

|

|

|

|

Banking and finance |

|

|

|

|

|

|

|

|

|

Water infrastructure planning and financing |

|

|

|

|

|

|

|

|

|

Issues concerning rural industries and communities |

|

|

|

|

|

|

|

|

|

Economics |

|

|

|

|

|

|

|

|

|

Financial accounting or auditing |

– |

– |

– |

– |

– |

– |

– |

– |

|

Government funding programs or bodies |

|

|

|

|

|

|

|

|

|

Law |

|

|

|

|

|

|

|

|

|

Drought resilience (added September 2019) |

|

|

|

|

||||

Key:

|

|

3+ Board members provide coverage |

|

2–3 members provide coverage |

|

|

1 Board member provides coverage |

– |

No skills coverage on the Board |

Note: The Chair is taken to be a member.

Source: ANAO analysis.

Potential conflict of interest

2.47 The RIC Board Code of Conduct requires that declarations of interest must be sought and recorded at each Board meeting. A declaration of interest was recorded by the Chair at the 10 September 2019 ‘in-camera’ session of the Board given he advised of his intended resignation and acceptance of a role as an Independent Director of RIC’s external service provider. The Chair continued to chair this meeting.

2.48 The main matters covered were RIC’s strategic framework including performance measures, issues with the external service provider registering securities on RIC’s behalf, learnings from a meeting with Ministers on the government’s goal of $100 billion in agricultural production by 2030, the planned launch of AgriStarter loans, the status of a project on Climate Smart loans, the status of the Future Drought Fund Bill and audit and budget updates.

2.49 The Public Government, Performance and Accountability (PGPA) Act 2013 and the PGPA Rule 201478 have provisions for how a member of the accountable authority of a Commonwealth entity must disclose material personal interests that relate to the affairs of the entity. The official must make the disclosure at a meeting of the members of the accountable authority as soon as practicable after the official becomes aware of the interest and this is to be minuted.

2.50 In addition, if a matter in which the official has the interest is being considered at a meeting of the members of the accountable authority, the official must not be present while the matter is being considered at the meeting or vote on the matter.

2.51 The Chair provided his resignation to the responsible Ministers by email on 19 September 2019, effective 3 October 2019.79 In this advice, the Chair noted his recent appointment to the Board of Bendigo Bank, citing this as a conflict of interest with his position on the RIC Board and the reason for his resignation. Section 19 of the PGPA Act requires that the accountable authority must notify the responsible Minister as soon as practicable after the accountable authority becomes aware of any significant issue that has affected the entity.

2.52 The declaration of interest by the Chair was not recorded in the RIC conflicts of interest register on the basis that any potential conflict was removed on resignation. As a result, no mitigation action had been identified to address any potential conflicts of interest. It would have been prudent for the Acting Chair or RIC to investigate the implications of the former Chair’s move to the external service provider when he signalled his resignation.

2.53 The updated risk register that was provided to the February 2020 meeting of the Board included two new risks relating to conflicts of interest. These risks included its Board (initially high risk) and within the external service provider (initially medium risk). The conflict of interest risk target was low after planned treatments. These treatments are internal auditing of conflict of interest disclosures and review of any decisions80 a person made on behalf of RIC if they move to an employer that may pose a conflict of interest.

Stakeholder engagement on loan settings

2.54 The department identified that effective stakeholder engagement would help to ensure the RIC is well understood and utilised. RIC’s Operating Mandate refers to stakeholder engagement to ensure loan products are responsive to prevailing needs. In May 2017, after government approval of the RIC model, the department developed a stakeholder engagement plan for engagement activities up to RIC opening for business on 1 July 2018.

2.55 The plan did not cover engagement activities on the NWILF as the facility was already established. It identified seven categories of stakeholders,81 an approach and level of engagement for each, with targeted engagement to be conducted in four phases.82

2.56 Development of the farm business concessional loan scheme was a specific project for the department (Project 6, Figure 2.1). The department’s engagement on farm business loan settings covered how the broadened scheme purpose would operate and feedback on loan settings guidelines.

2.57 Prior to engagement, the department reviewed eligibility criteria, evidentiary requirements for applicants and loan purpose. This review examined previous concessional loan schemes and was informed by input from a consultant with expertise in administration of farm concessional loans at the state level. The review informed development of draft guidelines for the new scheme and specific matters for stakeholder consultation.

2.58 The draft guidelines were to ensure the scheme met its objectives and remained consistent with the relevant constitutional powers (see paragraph 2.23). The department sought approval from the Minster on the draft loan settings and the issues for stakeholder consultation.83

2.59 Consultation covered how to streamline delivery of loans, the characteristics of ‘financial need’ and ‘viability’ and how to assess these, evidence for eligibility and how to communicate the scheme to farmers. The department met with more than 40 stakeholders across the target groups in the engagement plan.84 Priority issues were identified on practical implementation of eligibility criteria85 and options for loans to new entrants to the farming sector.

2.60 To address these issues the department consulted with individual stakeholders who had offered suggestions, and sought legal and technical advice. The department’s final position on key loan settings was detailed in Schedule 1 to the Operating Mandate.

2.61 The department communicated key stakeholder issues to the program board in November 2017. The issues were also communicated to the Minister in March 2018 as part of seeking approval for the Operating Mandate, and to the RIC Board in May 2018 in finalising the draft loan guidelines. The initial program guidelines largely addressed the issues raised through stakeholder engagement and later changes reflected further feedback.86

Use of an external service provider for farm business loans

2.62 The RIC establishment program included a specific project for a service delivery tender (see Project 4, Figure 2.1). This recognised that the new entity would require support for loan delivery, at least initially, in order to open for business on 1 July 2018.

2.63 The stakeholder engagement plan included a market analysis phase to assess supplier interest, industry capability and service structures for any external loan service provider procurement process. Organisations that were engaged were selected with Australian Bankers’ Association input, based on requirements including experience in agribusiness. Participating organisations comprised six banks, five state-based agencies delivering concessional loans and the Commonwealth’s export finance entity.

2.64 The department used information from the market analysis session to develop a report on service delivery options. Six options were examined, including an open tender, direct sourcing of services from an existing provider and managing loans in-house. Despite feedback indicating limited capacity in the commercial market to meet the expected start date, the department initiated an approach to market by open tender intended to achieve farm business loan availability by 1 July 2018.

2.65 A Request for Expressions of Interest for an external service provider was published on AusTender in February 2018. While the department managed the tender process, the RIC Board was to make the final decision, with this approach confirmed by the Minister.

2.66 Two providers were shortlisted in April 2018 which was reported to the RIC Board. In May 2018, the Board considered a report by the evaluation panel assessing refined responses from the two providers against an evaluation criteria, risk and value for money. In June 2018, the RIC Board agreed to finalise a service agreement with the Bendigo and Adelaide Bank (Bendigo Bank).

Location

2.67 On 16 May 2017 the Minister announced that RIC would be located in Orange, New South Wales. Prior to this, the department had advised the Minister of options to be able to direct the permanent location of the RIC head office based on his stated preference for Orange.

2.68 In its advice, the department identified that as a corporate Commonwealth entity, the permanent location of the RIC would be at the discretion of the RIC Board unless formally stipulated through a legislative instrument. The agreed approach was for a specific provision in the enabling legislation to allow for the responsible Ministers to instruct RIC on its location. The government later agreed to remove this provision in response to Senate debate on the Bill in February 2018.

2.69 At its second meeting, the Board decided that RIC’s head office would be in Orange. This was based on information the department provided on the advantages of Orange over alternatives and the government’s preferred location.

Completion of the RIC establishment program

2.70 RIC offered loans from 1 July 2018 as planned. There were project closure reports for all the RIC project streams (except for the government approval process). The 19 July 2018 overall program closure report concluded that RIC had been established as a corporate Commonwealth entity. All program outputs, including legislative aspects, were closed off.

2.71 The closure report for the project to develop the Operating Mandate as subordinate legislation stated that this instrument had been tabled in Parliament and the project should move into business-as-usual management. The entity establishment closure report concluded that draft corporate policies and procedures and other documents had been provide to RIC’s Board for consideration.

2.72 The department conducted a series of internal audits: Regional Investment Corporation - Systems under Development Audit in 2017–18. This examined overall program governance controls, as well as specific projects from the post-approval phase: RIC Board appointments; transition of water loans; and service delivery procurement. It concluded that planning processes and governance arrangements were largely effective and made nine recommendations. The majority of these prompted updates to the program or risk register and all recommendations were reported as implemented in a September 2018 Internal Audit Assurance Branch final status report.

3. Governance arrangements

Areas examined

This chapter examines whether governance arrangements for the Regional Investment Corporation (RIC) are sound.

Conclusion

RIC’s governance arrangements are partially sound. In establishing RIC, the department developed key governance structures and documents for RIC to support its initial operations. RIC is refining its governance arrangements. To ensure sound governance, RIC needs to enhance its risk management and oversight of external service provider data. Improvements are needed to the arrangements for performance management of the loans, including determining methodologies for each performance measure.

Areas for improvement

The ANAO made two recommendations to establish more comprehensive reporting on risk and enhance evaluation / reporting for farm business loans.

3.1 To assess whether the governance arrangements for the Regional Investment Corporation (RIC) are sound, four key areas that contribute to governance were examined:

- RIC’s risk management framework;

- arrangements for loan administration;

- the establishment of performance measures for RIC activities; and

- the maturity of data controls.

Has an appropriate risk management framework been developed?

RIC’s risk management arrangements are not yet appropriate and improvements should include regular reporting on the risk register to the Executive, relevant committees and the RIC Board.

3.2 Overall RIC’s risk management framework is maturing and its planned improvements (see below) are necessary. When assessed against the Commonwealth Risk Management Capability Maturity Model, RIC’s current maturity is ranked between developed and systematic.87

The risk framework and policy

3.3 As a corporate Commonwealth entity RIC is not required to comply with the Commonwealth Risk Management Policy.88 However, in line with the Board’s instruction, the risk management framework is consistent with the nine elements of this policy and was considered by the Board in December 2018. Finalisation of RIC’s Risk Management Policy is in its business planning activities for 2019–20 and will include risk reporting requirements.89

3.4 Roles and responsibilities for risk management are consistently defined across the risk management framework, Accountable Authority Instructions and charters for the Audit Committee and Board. The Executive Manager Corporate Services is responsible for the risk management framework supported by a governance manger role.

3.5 The Executive Manager Corporate Services reports to the CEO monthly including on risk, with the November 2019 report noting the risk register was being reviewed. The Executive Management Committee considers risk matters at its (at least) monthly meetings.

3.6 RIC has an appropriately detailed enterprise risk register, developed in November 2018 and updated in May and August 2019. The risk register (with 21 risks and separate fraud risks) was updated and reported to the RIC Audit Committee on 4 February 2020. This was further revised with 32 risks (refer to paragraph 2.53 on the additional conflict of interest risks) and reported to the Board on 25 February 2020.

3.7 Under Section 13.1 of the Commonwealth Risk Management Policy an entity must define its risk appetite in a ‘statement or series of statements that describes the entity’s attitude toward risk taking’. RIC’s Risk Appetite Statement states that accepting some risk in business practices promotes efficiency and innovation. The statement does not specify the extent to which it will accept high risks post planned treatments, although it states zero tolerance for workplace health and safety risks.

3.8 Based on existing controls, the latest risk register lists ten high risks90, 15 medium risks and seven low risks. The target risk ratings after additional planned controls are for two remaining high risks, 17 medium risks and 13 low risks. The two remaining high risks relate to risk management and effective implementation of government directions.

3.9 The set of risks changed between the different iterations of the risk register. RIC has stated that there is further work to be done to ensure that the risk register is complete and maintained. In line with elements six and nine91 of the Commonwealth Risk Management Policy, RIC also needs to ensure there is regular reporting to the Executive, relevant committees/Board on the status of all risks and any control gaps.92

Recommendation no.1

3.10 RIC should finalise its risk management policy, including risk reporting requirements and more clearly articulate its risk appetite in line with the adoption of the Commonwealth Framework.

Regional Investment Corporation response: Agreed.

3.11 The Regional Investment Corporation (RIC) will finalise its risk management policy and risk reporting requirements. The RIC has engaged expert advice to assist with the identification of improvements in the evaluation of RIC’s risk appetite. Following a review of the forthcoming recommendations, RIC will more clearly articulate its risk appetite statement in line with the Commonwealth Framework.

Have arrangements for administering loans been clearly defined?

Arrangements for administering the farm business loans have been clearly defined in a Memorandum of Understanding between the department and RIC. Responsibilities for administration of the National Water Infrastructure Loan Facility (NWILF) are clearly defined in a Memorandum of Understanding between the relevant entities. Interest rates for the loan products are reviewed twice-yearly as required by legislation and appropriate accounting treatments for the loans have been established.

3.12 To assess the arrangements for administering the loans, four areas were examined:

- setting of loan scheme interest rates;

- how the loans are accounted for;

- governance documentation, focusing on memoranda of understanding that define entity roles and responsibilities; and

- loan impairment arrangements.

Interest rates

3.13 The Operating Mandate stipulates the Board must set a variable interest rate for both loan schemes93 in accordance with a methodology that is to be agreed by the responsible Ministers.94 The methodology is to set out key components of the interest rate and its process of review.95

3.14 The draft interest rate methodology was prepared by the department and applies the assumptions agreed by the government for administrative cost margins for the loan schemes96 and the Commonwealth’s borrowing costs.97

3.15 In May 2018 the Board reviewed the interest rate methodology prepared by the department. On 22 June 2018 the responsible Ministers agreed that the interest rate put forward by the Board, was consistent with the mandate. The Operating Mandate, including the interest rate methodology, came into effect 16 June 2018.98

3.16 A key element of the methodology is the administrative cost margins applied to the loan schemes. The administrative cost margin was set at 0.88 per cent (farm business loans) and 0.42 per cent (NWILF) above the Commonwealth cost of capital (10 year bond rate).99

3.17 The July 2018 opening rates were 3.58 per cent (farm business loans) and 3.12 per cent (NWILF), given a 2.7 per cent bond rate. As required, RIC reviews the interest rates each May and November based on the current bond rate. Any changes are made in February and August.

3.18 Rates were reduced to 3.11 per cent (farm business loans) and 2.65 per cent (NWILF) in May 2019 (the bond rate had declined to 2.23 per cent). In January 2020, the Acting Chair of RIC advised the responsible Ministers that the interest rates would be reduced on 1 February 2020 based on the November 2019 review (see Table 3.1) This was announced on 31 January 2020, noting that some loans are currently interest-free for two years (see Table 4.1).

Table 3.1: Interest rate spread for the loans at February 2020a

|

A Market rate for agribusiness loansb |

B Commonwealth cost of funds |

C Interest rate for farm business loans |

D Interest rate for NWILF |

|

5.67% |

1.23% |

2.11% |

1.65%c |

Note a: Originally, over the life of the scheme, interest repayments were intended to cover scheme costs through the difference between (C and B) and (D and B), each multiplied by the value of the loans, with this calculation done over all years of the loans, with net present value adjustments.

Note b: This is the most recent estimate provided by RIC. RIC records the interest rate that applicants are paying with their commercial lender when they apply for a RIC loan. However, actual market interest rates vary over time and between customers. The annual value of the concession to farmers (discount expense to the Commonwealth) is based on the difference between A and C multiplied by the value of the loans.

Note c: The annual value of the concession to states and territories is based on the difference between the cost of funds to states and D, multiplied by the value of the loans. If the state borrowing rate is lower than the NWILF interest rate, it will be a cost to the state.

Source: RIC documentation on interest rate reviews.

Accounting for the loan schemes

3.19 The Portfolio Budget Statement (PBS)100 shows that for 2019–20 RIC was allocated $15.414 million for operating expenses as a payment to corporate entities (draw-down) by the department. This excludes farm business loan funds that are accounted for by the department. The budget for operating expenses had $4.148 million in employee expenses with 32 staff forecast and $11.266 million in supplier expenses, including for the external service provider contract.101

3.20 Extra funding for additional administration, including for the for the new AgBiz loans, was allocated to RIC in 2019–20 and reported in the Agency Additional Estimates Statements. This was $63,000 in 2019–20, with $8.3 million extra across the forward estimates.

3.21 However, RIC is forecasting an operating loss of the order of $5 million in 2019–20. A review of RIC administrative costs to inform future funding and interest rates has been scoped. The increased costs are driven by an increase in RIC’s lending services charge under the contract with Bendigo Bank.

3.22 The contract is based on a core volume of 300 loans, with an additional charge for each loan over that. Earlier in 2019–20 RIC had estimated that there would be 550 loan applications but it now estimates 1200 given demand for the two year interest-free period for drought loans.

3.23 The PBS records various departmental drought program ‘expenses not requiring appropriation in the budget year’.102 This includes pre-paid administrative costs for prior drought concessional loan schemes and the ‘discount expense’ for the current farm business loan scheme under RIC ($54.853 million in 2018–19 and forecast at $111.729 million in 2019–20).

3.24 The discount expense is an accounting treatment representing the difference between scheme loan interest rates and the market cost of funds. It is effectively the opportunity cost of not providing the funds at market rates.103

3.25 The 2018–19 departmental annual report records concessional loans interest received as $23.483 million but this includes prior state and territory loan schemes.104 The department advised that RIC received $154,060 in loan and bank interest in 2018–19, with $1.317 million to-date in 2019–20.

3.26 Transactions for the NWILF are recognised in the financial statements of the policy owner, the Department of Infrastructure, Transport, Regional Development and Communications (Infrastructure).105 Annual administered expenses for the NWILF were recorded as not for publication in the 2019–20 Infrastructure PBS, with Infrastructure noting that no loans have yet been issued. Infrastructure advised that the actual number of loans issued for 2019–20 is expected to remain at zero, and did not provide comment on reporting intended for the 2020–21 Budget papers.

Governance documentation

Memoranda of Understanding for the farm business loans

3.27 Two Memoranda of Understanding (MOU) between the department and RIC on administration of the farm business loans and the new AgBiz loans came into effect on 28 January 2020 and clarified relative entity roles. These specify that the department has policy responsibility for RIC and supports the responsible Ministers. RIC is responsible for administration of loans, including making decisions on loan applications and managing loan agreements, including loan enforcement and recovery (refer to Figure 3.1).

Figure 3.1: Arrangements for the farm business loansa

Note a: RIC holds the principal and interest payments before returning these funds (including any interest it earns from these funds) to the Department (AWE) monthly. RIC retains reimbursements from loan recipients for any ‘transaction costs’ it incurs for the loans from third parties.

Source: ANAO analysis of legislation and the relevant MOUs and Portfolio Budget Statements.

3.28 The MOUs require regular meetings between the entities and cooperative information sharing. It stipulates access by RIC to the department’s appropriation for loans, and RIC’s responsibility to return principal and interest payments to the department.106 Under the MOUs, RIC must provide an annual assurance letter to the department on its management of the loans.

Memorandum of Understanding for the National Water Infrastructure Loan Facility

3.29 A three-way NWILF MOU between RIC, the department and Infrastructure came into effect on 9 November 2018. This was also clear on the relative roles of the entities.

3.30 Under the MOU, RIC is responsible for managing loan applications and agreements. The department has policy responsibility and keeps RIC’s responsible Ministers informed on loans and drafts directions to RIC from these Ministers.

3.31 Infrastructure is the policy owner with a focus on program oversight. This oversight includes making and receiving loan payments, and support to the Minister for Infrastructure, Transport and Regional Development.

3.32 Both RIC and Infrastructure provide advice on loan applications to the Minister for Infrastructure, Transport and Regional Development. RIC informs its responsible Ministers on this advice. After a government decision on a loan, RIC’s responsible Ministers direct RIC to enter into a loan agreement and the Minister for Infrastructure, Transport and Regional Development approves the loan funds being provided to Infrastructure (refer to Figure 3.2).

Figure 3.2: Arrangements for the National Water Infrastructure Loan Facility

Source: ANAO analysis of the relevant MOU and Portfolio Budget Statement.

3.33 The MOU states that parties need to ensure all other parties are aware of relevant advice provided to Ministers as early as practicable. Interactions to date have been limited to the pre-application loan phase with RIC being a third party to changes to the loan schemes.

3.34 RIC undertook a review of governance arrangements in May 2019. Given the recommendations of this, RIC developed stakeholder engagement registers (for both loan schemes) and has commissioned work to document NWILF loan processes by the end of February 2020.

Loan impairment arrangements

3.35 The farm business loan MOUs cover RIC’s responsibility for loan enforcement and recovery. As noted in paragraph 2.14, no cost was attributed to the possibility of default on the loans at the time RIC was established. A March 2019 submission to the Minister for Finance on RIC’s prospective involvement in the North QLD flood recovery acknowledged that the introduction of livestock as security could create higher default risks.107

3.36 Under the MOU RIC is to use the department’s model to calculate loan impairment biannually based on RIC’s loan data. RIC is also to pursue the recovery of funds from loan recipients in accordance with RIC’s prudential and arrears management policies and procedures.108 However, the credit risk for the loans resides with the Commonwealth not RIC.

3.37 In line with this, RIC has an arrears and problem loan policy and procedure. RIC may take farm business loan recovery and foreclosure action but any decision on foreclosure (or waiving of a farm business loan) must be made by the Board and cannot be delegated.109

3.38 The RIC review policy and procedure requires the external service provider to undertake an annual problem loan review to monitor for any increase in risk so that appropriate strategies can be put in place to minimise the possibility of loss.110 None have been required to date.111

3.39 In July 2019 the department approved an $8.256 million concessional loan impairment provision for 2018–19 (1.2 per cent of the portfolio’s value, an increase of $7.846 million on the prior year).112 This amount also covers prior loans managed by the states and territories. As at 31 October 2019 RIC and the department had not identified any loan defaults.

Have appropriate performance measures been established?

Performance measures are not yet well developed. RIC has plans in place to review and revise the performance measures over time. The data sources and methodology for evaluating the farm business loans should be specified. Performance measures for the loans should reflect delivery and program objectives, and be publicly reported.

3.40 The extent to which appropriate performance measures113 have been established for the loans that RIC administers was examined by considering:

- internal and external reporting;

- RIC corporate plan performance measures;

- RIC plans for monitoring and evaluation; and

- possible refinements to performance information.

Internal and external reporting

3.41 RIC’s Operating Mandate requires reports to be provided to the responsible Ministers quarterly for farm business loans and annually for NWILF loans. Reports are to include loan uptake and financial performance data. RIC’s reports to its Board include CEO status updates.

3.42 In line with the requirement, quarterly reports on the farm business loan have been provided to the responsible Ministers and the RIC Board. These reports detail the number of loans and their value. The 2018–19 NWILF annual report is qualitative as no loans have been issued and outlined awareness building and stakeholder engagement.

3.43 External reporting occurs predominately through the annual report.114 Given its recent establishment, the 2018–19 RIC Annual Report contains more data than the previous year’s report.115 It includes key statistics on the entity staffing profile of 19 people, that there were 212 loan applications assessed and 166 approved loans valued at $156 million.

3.44 Plans for products, risk management, awareness raising and performance measures were also detailed in the 2018–19 RIC Annual Report.116 Performance measures contained in the annual report reflected the entity’s early stage of operation and the RIC 2018–19 Corporate Plan.117 The performance measures included: building the workforce and systems; establishing procedures; establishing loan delivery; $250 million being available for farm business loans; accurate disbursement of loans; and NWILF roll-out.

RIC’s purpose and corporate plan measures

3.45 The Regional Investment Corporation Act 2018 (the Act) states that RIC’s main functions include administering the farm business and NWILF loans and programs prescribed by the rules in accordance with the Operating Mandate. RIC’s functions also include setting and adjusting loan scheme interest rates, and on its own initiative or at the request of a responsible Minister, provide advice on activities that could be undertaken by the Corporation.118

3.46 RIC’s Operating Mandate states that the Corporation will deliver farm business loans that:

(a) support the long-term strength, resilience and profitability of Australian farm businesses by helping them to build and maintain diversity in the markets they supply, and take advantage of new and emerging opportunities across Australia and overseas; or

(b) assist farm businesses to prepare for, manage through and recover from periods of drought.119

3.47 The Operating Mandate also states that RIC will administer water infrastructure loans to the state and territories to support long-term regional economic growth and development by investing in economically viable water infrastructure that will provide secure and affordable water.