Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Interim Report on Key Financial Controls of Major Entities

Please direct enquiries through our contact page.

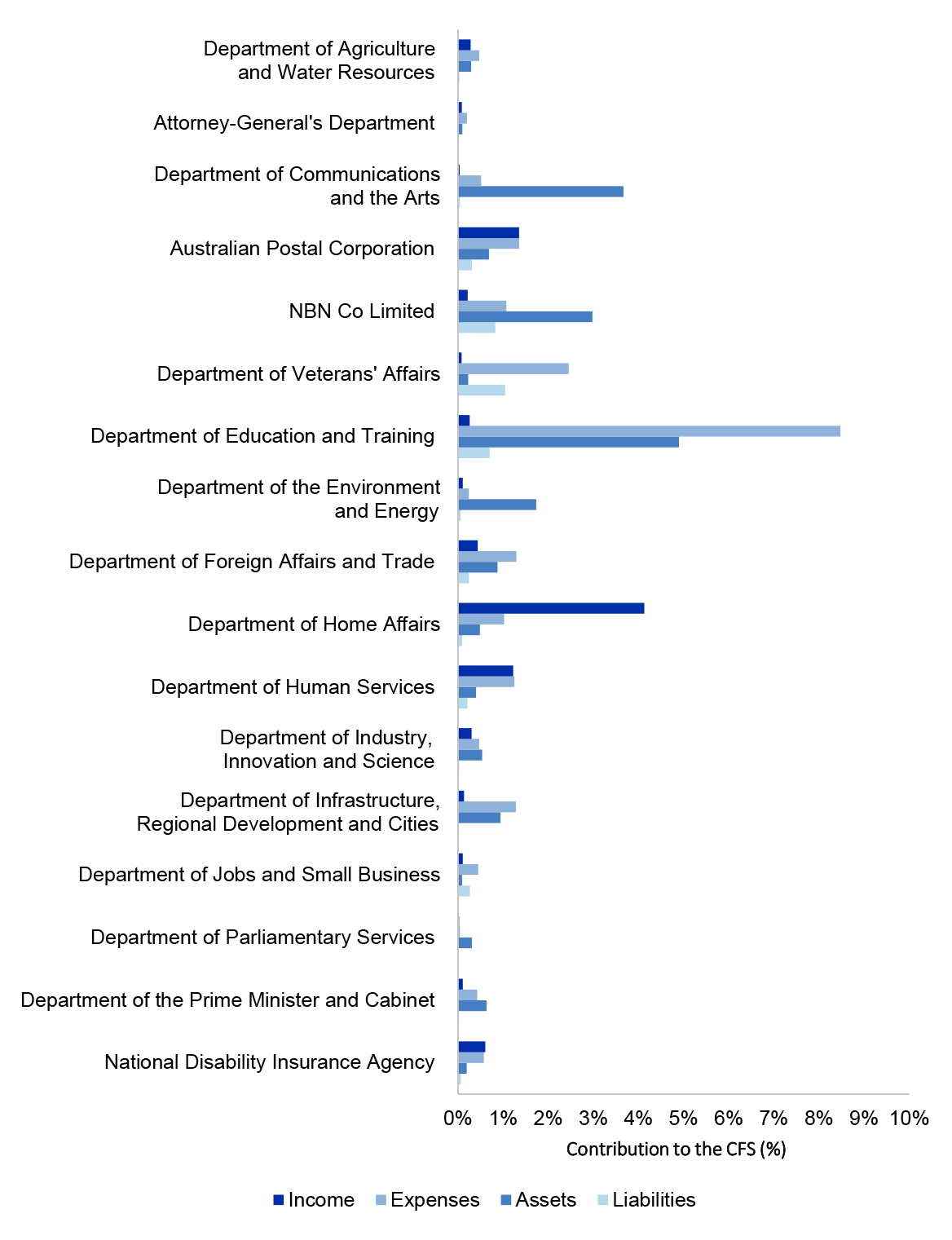

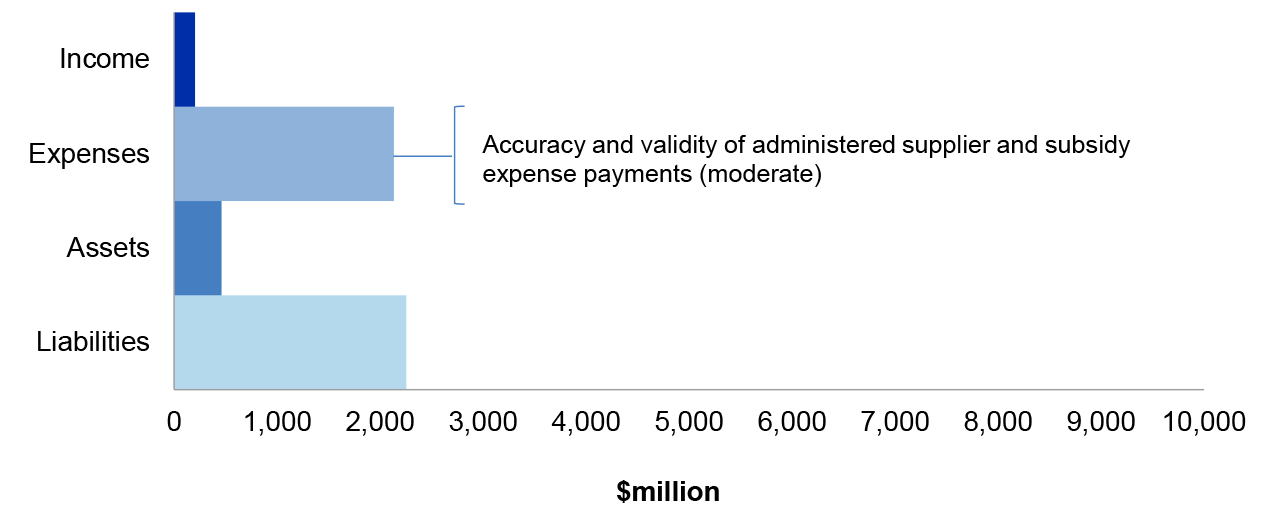

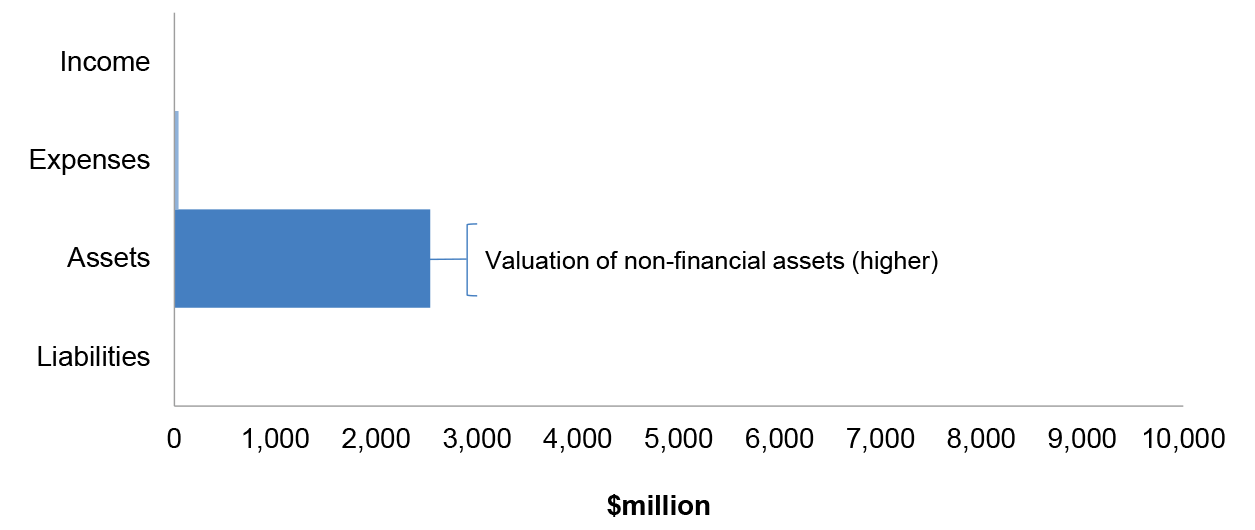

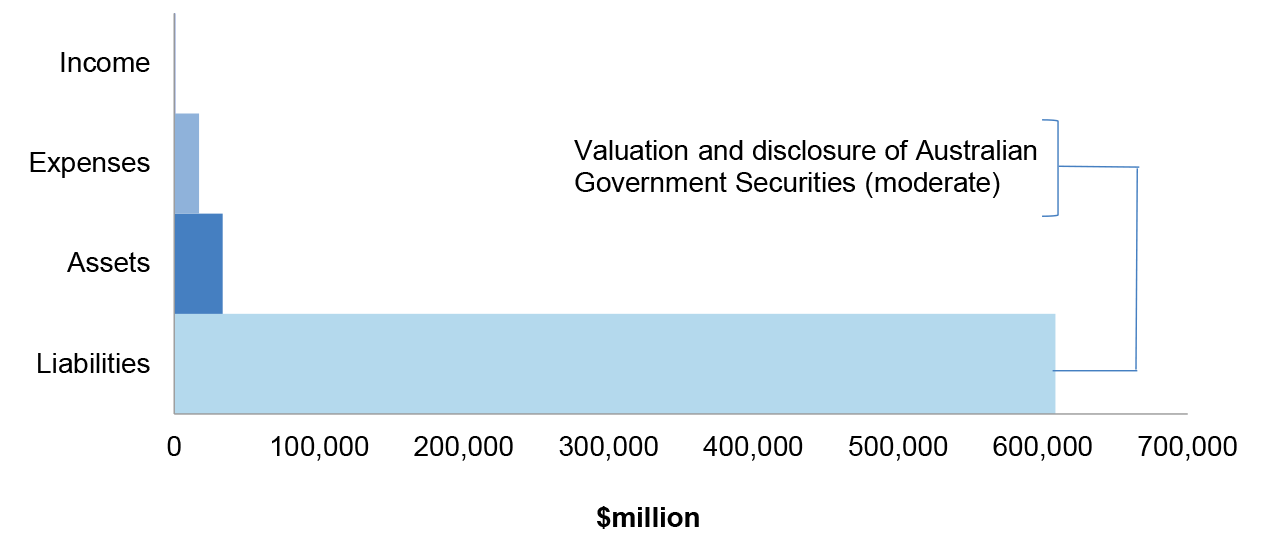

This report focuses on the results of the interim audits, including an assessment of entities’ key internal controls, supporting the 2018–19 financial statements audits. It examines 26 entities, including all departments of state and a number of major Australian government entities. The entities included in the report are selected on the basis of their contribution to the income, expenses, assets and liabilities of the 2017–18 Consolidated Financial Statements of the Australian Government (CFS). Significant and moderate findings arising from the interim audits are reported to the responsible Minister(s), and all findings are reported to those charged with governance of each entity.

Executive summary

1. The ANAO prepares two reports annually that, drawing on information collected during audits, provide insights at a point in time to the financial statements risks, governance arrangements and internal control frameworks of Commonwealth entities. These reports explain how entities’ internal control frameworks are critical to executing an efficient and effective audit and underpin an entity’s capacity to transparently discharge its duties and obligations under the Public Governance, Performance and Accountability Act 2013 (PGPA Act). Deficiencies identified during audits, that pose either a significant or moderate risk to an entity’s ability to prepare financial statements free from material misstatement, are reported.

2. This report, is the first in the series of reports and focuses on the results of the interim audits, including an assessment of entities’ key internal controls, supporting the 2018–19 financial statements audits. It examines 26 entities, including all departments of state and a number of major Australian government entities. The entities included in the report are selected on the basis of their contribution to the income, expenses, assets and liabilities of the 2017–18 Consolidated Financial Statements of the Australian Government (CFS). Significant and moderate findings arising from the interim audits are reported to the responsible Minister(s), and all findings are reported to those charged with governance of each entity.

Summary of audit findings and related issues

Entity internal controls

3. The interim audit phase includes an assessment of the effectiveness of each entity’s internal controls as they relate to the risk of misstatement in the financial statements. At the completion of our interim audits for the 26 entities included in this report we noted that key elements of internal control were operating effectively for 19 entities. For four entities,1 except for particular finding/s outlined in chapter 3, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement. For the Departments of: Defence; Education and Training, and the National Disability Insurance Agency, the ANAO identified a number of findings which reduced the level of confidence that could be placed on key elements of internal control and limited the assurance that could be obtained from that entity’s control framework.

Summary of audit findings

4. A total of 70 findings were reported to the entities included in this report as a result of interim audits, comprising of one significant, 12 moderate and 57 minor findings. This is an increase of one significant and a reduction of 30 minor findings compared with the 2017–18 interim audit results.

5. Fifty-six per cent of findings relate to the management of Information Technology (IT) controls, particularly the management of privileged user access. The continued level of findings indicates that entities need to focus on processes to monitor IT controls to prevent reoccurrence of issues.

Policies reviews for fraud, payment cards and compliance with finance law

6. Accountable authorities duties under Division 2 of the PGPA Act include: promoting the proper use and management of public resources; and reporting to the Minister on significant issues and activities in the entity. In the context of these obligations and a review of entity internal controls, this report includes a focus on and an analysis of, payment card and fraud control policies together with a continued review of compliance with the Commonwealth’s finance law.

7. Review of these areas found that entities’ have an opportunity to learn from each other to strengthen monitoring and reporting processes, leading to increased transparency over compliance with internal policies, building fraud awareness and enhancing assurance that payment card expenditure is appropriate, within delegation and supported by receipts

8. The ANAO observed that entities had processes in place for monitoring and reporting instances of non-compliance with finance law. Following changes to the mandatory external reporting of non-compliance in 2015–16, where entities have reduced their internal reporting of breaches of finance law, this can lead to a lack of visibility over, or capacity to identify, risks and reduce the completeness and relevance of the information provided to the accountable authority.

Reporting and auditing frameworks

Summary of developments

9. Major changes in accounting standards are applicable in 2018–19 and 2019–20 with the implementation of revised standards for financial instruments, revenue and leases. Early engagement in planning for these standards will provide entities with more options for transitioning, time to review and potentially renegotiate underlying contracts and agreements and time to organise and implement necessary FMIS changes.

10. The Independent Review into the operation of the Public Governance, Performance and Accountability Act 2013 and Rule has made a number of recommendations to the Minister for Finance including, for example, bringing forward the date for the tabling of annual reports, removing duplication and improving linkages between accountability documents, and increasing disclosures around remuneration paid to executives and highly paid staff. In response, the Minister for Finance amended the PGPA Rule to require Commonwealth entities to make remuneration disclosures for key management personnel, senior executives and other highly paid staff in annual reports. The Minister for Finance also amended the PGPA (Annual Report) Rules to require Commonwealth companies and Commonwealth entities to publish annual reports online.

Cost of this report

11. The cost to the ANAO of producing this report is approximately $405,000.

1. Interim audit results and other matters

Chapter coverage

This chapter provides:

- an overview of the ANAO’s audit approach to financial statements audits;

- a summary of observations regarding the internal control environments of the entities included in this report;

- a summary of audit findings identified at the conclusion of the interim audits; and

- observations relating to: the establishment and monitoring of credit cards policies; fraud control processes; and reporting relating to compliance with finance law.

Conclusion

Key to the ANAO’s audit process is an assessment of entities’ internal control frameworks as they apply to financial reporting. An effective internal control framework provides the ANAO with a level of assurance that entities are able to prepare financial statements that are free from material misstatement. Deficiencies in the internal control framework increase the necessity for the ANAO to perform additional work during the final audit phase.

At the completion of the interim audits for the 26 entities included in this report the ANAO noted that key elements of internal control were operating effectively for 19 entities. For foura entities, except for particular finding/s outlined in chapter 3, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement. For the Departments of: Defence; Education and Training, and the National Disability Insurance Agency, the ANAO identified a number of findings which reduced the level of confidence that financial statements can be prepared free from material misstatement.

A total of 70 findings were reported to the entities included in this report as a result of interim audits, comprising of one significant, 12 moderate and 57 minor findings. This is an increase of one significant finding and a reduction of 30 minor findings compared with the 2017–18 interim audit results.

Fifty-six per cent of findings relate to the management of Information Technology (IT) controls, particularly the management of privileged user access. The continued level of findings indicates that entities need to focus on processes to monitor IT controls to prevent reoccurrence of issues.

Accountable authorities have duties under Division 2 of the Public Governance, Performance and Accountability Act 2013 (PGPA Act) that include: promoting the proper use and management of public resources; and reporting to the Minister on significant issues and activities in the entity. In the context of these obligations and a review of entity internal controls, this report includes a focus on and an analysis of, payment card and fraud control policies together with a continued review of compliance with the Commonwealth’s finance law.

Review of these areas highlights divergent practices between entities and indicates an opportunity for entities to learn from each other to strengthen their processes. In particular, to build fraud awareness through implementing or improving delivery of appropriate and regular training, and regular review and update of payment card policies consistent with patterns of use. Improved monitoring and reporting across these areas will demonstrate consistent compliance with internal policies and also provide assurance that payment card expenditure is appropriate, within delegation and supported by receipts.

Equally, where entities have reduced their internal reporting of breaches of finance law, this can lead to a lack of visibility over, or capacity to identify, risks and reduce the completeness and relevance of the information provided to the accountable authority.

Note a: The Departments of: Agriculture and Water Resources; Communications and the Arts; Health; and Jobs and Small Business.

Introduction

1.1 The ANAO publishes an Annual Audit Work Program (AAWP) which reflects the ANAO’s strategy and deliverables for the forward year. The purpose of the AAWP is to inform the Parliament, the public and government sector entities of the ANAO’s planned audit coverage for Australian Government entities by way of financial statements audits, performance audits and other assurance activities.

1.2 The financial statements audit coverage, as outlined in the AAWP, includes presenting two reports to the Parliament addressing the outcomes of the financial statements audits of Australian Government entities and the Consolidated Financial Statements of the Australian Government (CFS). These reports provide Parliament with an independent examination of the financial accounting and reporting of Commonwealth public sector entities.

1.3 This report focuses on the results of the interim audits of 26 entities. This includes a review of the governance arrangements related to entities’ financial reporting responsibilities and an examination of the relevant internal controls, including IT system controls that support the preparation of financial statements that are free from material misstatement. The second report presents the final results of the financial statements audits of the CFS and all Australian Government entities.

1.4 The entities included in this report are those entities that contribute significantly to the three sectors of the CFS: the General Government Sector (GGS), Public Non-Financial Corporation (PFNC) sector and Public Financial Corporation (PFC) sector. A listing of these entities is provided in Appendix 1.

1.5 The ANAO conducts its financial statements audits in four phases: planning, interim, final and completion. Figure 1.1 outlines the key elements of each phase.

Figure 1.1: ANAO financial statements audit process

Source: ANAO data.

1.6 A central element of the ANAO’s financial statements audit methodology, and the focus of the planning phase of ANAO audits, is a sound understanding of an entity’s environment and internal controls relevant to assessing the risk of material misstatement in the financial statements. This understanding informs the ANAO’s audit approach, including the reliance that may be placed on entity systems to produce financial statements that are free from material misstatement. The interim phase of the audit assesses the operating effectiveness of controls. In the final audit phase the ANAO completes its assessment of the effectiveness of controls for the full year, undertakes detailed testing of material balances and disclosures in the financial statements, and finalises its audit opinion on entities’ financial statements.

1.7 In accordance with generally accepted auditing practice, the ANAO accepts a low level of risk that an audit will fail to detect the financial statements are materially misstated. This low level of risk is accepted because it is too costly to perform an audit that is predicated on no level of risk. An understanding of the entity, its environment and its controls, helps the ANAO design the required work and respond to risks that bear on financial reporting. The key areas of financial statements risks identified through this planning approach are discussed in chapter 3 for each entity included in this report.

1.8 A key component of understanding the entity and its environment is to understand the governance arrangements established by its accountable authority.2 Accountable authorities of all Commonwealth entities and companies subject to the PGPA Act are required to govern their entity in a way that promotes the proper use and management of public resources, the achievement of the purposes of the entity and the entity’s financial sustainability.

1.9 The development and implementation of effective corporate governance arrangements and internal controls should be designed to meet the individual circumstances of each entity. These processes also assist in the orderly and efficient conduct of the entity’s business and compliance with applicable legislative requirements, including the preparation of annual financial statements that present fairly the entity’s financial position, financial performance and cash flows.

Understanding the entity

1.10 The ANAO uses the framework in the Australian Auditing Standards (ASA) 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and its Environment to consider the impact of different elements of an entity’s internal controls that support the preparation of financial statements. This approach provides a basis for designing and implementing the audit work program that reflects the ANAO’s assessment of the risk of material misstatement. Deficiencies in the internal control framework increase the requirement of the ANAO to perform additional audit work in the final phase. Figure 1.2 outlines these elements.

Figure 1.2: Elements of entity internal controls

Source: ASA 315 Identifying and assessing the risk of material misstatement through understanding the entity and its environment, paragraph A59.

1.11 This chapter discusses each of these elements and outlines observations based on the ANAO’s review of aspects of each entity’s internal controls, relevant to the risk of material misstatement to the financial statements, including the detailed results of the interim audits.

1.12 At the completion of the interim audits for the 26 entities included in this report, the ANAO noted that key elements of internal control were operating effectively for 19 entities. For four entities3, except for particular finding/s outlined in chapter 3, the key elements of internal control were operating effectively to support the preparation of financial statements that are free from material misstatement. For the Departments of: Defence; Education and Training, and the National Disability Insurance Agency, a number of findings were identified which reduced the level of confidence that could be placed on key elements of internal control and that financial statements can be prepared free from material misstatement.

1.13 The key elements of internal controls for the full financial year will be assessed in conjunction with additional audit testing during the 2018–19 final audits.

Control environment

1.14 The PGPA Act sets out the requirements to establish and maintain systems relating to risk and control. Division 2, section 16 of the PGPA Act states that:

The accountable authority of a Commonwealth entity must establish and maintain:

- an appropriate system of risk oversight and management for the entity; and

- an appropriate system of internal control for the entity.

including by implementing measures directed at ensuring officials4 of the entity comply with finance law.5

1.15 An effective control environment is underpinned by a fit-for-purpose governance structure. Indicators of an effective governance structure include whether management has established frameworks and processes that promote positive attitudes, awareness and actions concerning the entity’s internal controls and their importance in the entity. The main elements reviewed included: governance structures relevant to the preparation of the financial statements; audit committee and assurance arrangements; systems of authorisation; and processes for recording financial transactions.

1.16 All entities included in this report have established executive management structures that meet at least monthly, in the form of executive committees and sub-committees, supporting financial decision making at the strategic and operational levels.6 Consistent with previous years, consideration of financial reporting was included on the agendas of all 26 entities’ executive and audit committees. The financial information provided to the entities’ executives was supplemented by non-financial operational information.

1.17 Clear lines of accountability and reporting are important in establishing a strong internal control environment for the purposes of preparing the financial statements. The involvement of those charged with governance is an important element of these structures. Just as important is ensuring that staff at all levels understand their own role in the control framework. This can be achieved through the issuance of accountable authority instructions, and delegation instruments.7 All entities have established accountable authority instructions and delegations reflecting current business arrangements.

Audit committees

1.18 The PGPA Act requires audit committees to be established for Commonwealth entities and Commonwealth companies.8 An independent audit committee is a fundamental principle of good governance.9 The audit committee plays a key role in assisting the accountable authority to fulfil its governance, risk management and oversight responsibilities through the provision of independent assurance and advice.

1.19 Section 17 of the Public Governance Performance and Accountability Rule 2014 (PGPA Rule) sets out the minimum requirements relating to the audit committee of a Commonwealth entity. The key requirements of the PGPA Rule are outlined below.

- A written charter, set by the accountable authority, determining the functions of the audit committee for the entity. These functions must include reviewing the appropriateness of the accountable authority’s: financial reporting; performance reporting; system of risk oversight and management; and system of internal control for the entity.

- Membership of the committee to include at least three persons with appropriate qualifications, knowledge, skills or experience to assist the committee to perform its functions. A majority of committee members and the committee chair, must be independent of the entity.

- Persons that must not be a member of the audit committee: the accountable authority or, if the accountable authority has more than one member, the head; the Chief Financial Officer; and the Chief Executive Officer.

1.20 All entities have established audit committees consisting of a majority of members which were assessed by the entity to be independent. All entities have an audit committee charter that is consistent with their obligations under subsection 17(2) of the PGPA Rule. Each entity has appointed an independent audit committee chair.

Risk assessment processes

1.21 Section 16 of the PGPA Act sets out an accountable authority’s responsibilities in regard to the establishment of appropriate risk oversight and management in an entity. An understanding of an entity’s process to identify and manage risk is essential to an effective and efficient financial statements audit. A review of this process is done to assist the ANAO to, understand how entities identify and manage risks relating to financial statements and assess the risk of material misstatement to an entity’s financial statements.

1.22 All entities included in this report have a process to develop and update risk management plans at the organisational and work area levels. In addition, each entity has developed processes for the identification and notification of risks relevant to financial statements preparation either as part of the overall risk management plan, or through a targeted risk identification exercise. The monitoring of risks, and the entities’ implementation of risk management strategies, was typically assigned to either an executive committee and/or the audit committee.

1.23 For this report the ANAO is providing a detailed analysis of entity Fraud Control Management. This is included in Case Study 1 below.

|

Case study 1. Fraud Control Management |

||||||||||||||

|

The Commonwealth has a principle-based fraud control framework (the framework) which applies to all entities to ensure they have adequate fraud control measures in place. The framework is maintained by the Attorney-General’s Department and consists of three tiered documents:

The framework sets minimum standards to assist entities in carrying out their responsibilities to combat fraud against government programs. This helps to protect public resources, information, property, and the integrity and reputation of entities and the Commonwealth. Commonwealth companies are only required to comply with the Fraud Rule. The Fraud Rule establishes the importance of effective fraud control arrangements and specifies that accountable authorities must conduct regular fraud risk assessments, including when there is a substantial change in the structure, functions or activities of the entity, and develop and implement a fraud control plan for the entity. A fraud control plan should identify how fraud risks will be mitigated and how fraud prevention, detection, investigation and reporting will be handled. Fraud risk assessments and control plans are two of the essential elements of internal control that are considered during the audit process. In assessing the risks of material misstatement of an entity’s financial statements, the ANAO considers misstatements arising from both fraud and error. In respect of fraud, two types of intentional misstatements are relevant — misstatements arising from fraudulent financial reporting and misstatements resulting from the misappropriation of assets. ASA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of a Financial Report contains requirements for identifying the risks of material misstatement due to fraud, and designing audit procedures to detect such misstatement. As with risk management plans, fraud control plans need to be reviewed regularly and updated when significant changes to roles or functions occur, so that they reflect an entity’s current fraud risk and control environment. As part of the 2018–19 interim audits, the ANAO noted that all entities included in this report have established a fraud control plan that has been reviewed within the last two years. Entities have also assigned responsibility for the oversight and monitoring of fraud control strategies and initiatives, to specified fraud and governance roles or dedicated branches and the audit committee. The Fraud Rule also requires that entities must ensure officials are made aware of what constitutes fraud. Entities comply with this requirement using a number of methods including entity wide announcements, participating in fraud awareness week, and training upon commencement with the organisation or ongoing training. The most common practice to demonstrate compliance with this requirement is the inclusion of a mandatory fraud awareness training program. Furthermore, the fraud guidance recommends fraud awareness and integrity training at induction with regular rolling programs as an appropriate mechanism to ensure all officers are aware of their responsibilities.10 Of the entities included in this report, 23 have policies which require mandatory fraud awareness training, with officers to complete the training at regular intervals. Three entities do not require ongoing mandatory training and have the following processes.

Entities use a combination of online learning and face-to-face training programs. The regularity of training differs between entities and ranges from annually to every three years.

Seven entities did not have a process to centrally monitor and report on staff completion of mandatory fraud awareness training as at 30 June 2018.13 In addition to the entities identified above which do not have mandatory ongoing fraud awareness training, as at 30 June 2018 the National Disability Insurance Agency, and the Treasury had also not established mandatory fraud awareness training. The National Disability Insurance Agency and the Treasury introduced mandatory training during the 2018–19 financial year and are in the process of developing systems to capture this information. The NBN Co Limited did not have a report detailing compliance with training requirements as at 30 June 2018. NBN Co Limited has advised compliance is currently monitored with periodic reporting at the manager level. Going forward, reports detailing enterprise wide compliance will also be prepared on a quarterly basis. The Attorney-General’s Department did not have a report detailing compliance with training requirements as at 30 June 2018. The Attorney-General’s Department has advised compliance is monitored manually at the manager level. Nineteen entities have systems that enable entities to track compliance at the enterprise level with mandatory training. The Department of Health and the Reserve Bank of Australia have set an acceptable threshold of 95 per cent compliance with fraud training requirements. The remaining entities aim to achieve a completion rate of 100 per cent. Information held by entities in relation to the percentage of staff completing the fraud awareness training was obtained as at 30 June 2018. Of the 19 entities that track staff completion of training, five entities had compliance rates below 70 per cent as detailed in Table 1.1. Table 1.1: Compliance with mandatory training

Note a: The Department of Communications and the Arts fraud awareness training was not mandatory as at 30 June 2018. The training is mandatory from 1 July 2018.. Source: Data provided by entities. The 19 entities with mandatory training requirements have implemented processes which include reminder emails being sent and escalated through lines of management as considered appropriate. In addition the Departments of: Agriculture and Water Resources; and Defence directly linked the completion of mandatory training to staff performance agreements and ability to access pay progression under their enterprise agreement. Furthermore, the Department of Home Affairs has stated that managers may direct staff to complete the training and failure to follow that directive may be investigated as a potential breach of the APS Code of Conduct. All entities report to their audit committees at least annually providing details on fraud incidents and updates to fraud control activities. The Fraud Control Policy requires all non-corporate entities to report to the Australian Institute of Criminology (AIC) by 30 September each year.14 Reporting to the AIC is considered to be better practice for corporate entities.15 NBN Co Limited is not required to, and did not, report to the AIC. All other entities included in this report provided a report to the AIC. The most recent AIC report was published in 2018 and reported on census information provided by entities in respect of fraud investigations for the 2015–16 year. In addition to reporting to their Minister on significant non-compliance with finance law, four entities also regularly report to their ministers on fraud activities.16 These reports provide additional information on fraud matters including: significant fraud risks; fraud initiatives undertaken by the entity including their effectiveness; and fraud incidents including the entity’s response. Effective fraud training including e-learning to support the development of a fraud awareness culture is key to preventing, detecting and reporting fraud. There is an opportunity for entities to strengthen their fraud awareness training programs and develop systems to monitor staff compliance with requirements. This will assist the accountable authority in discharging their duties under the PGPA Fraud Rule. |

Monitoring of controls

1.24 Entities undertake many types of activities as part of their monitoring of control processes, including external reviews, self-assessment processes, post-implementation reviews and internal audits. The level of review of these activities by the ANAO is determined through a risk assessment approach that takes into consideration the nature, extent and timing of each activity and the activities application to the preparation of the financial statements.

Internal audit

1.25 As part of the financial statements audit coverage, the activities of internal audit are reviewed to gain an understanding of its role and activities in the entity. Where an internal audit function has been established it can play an important role in providing assurance to the accountable authority that the internal control framework is operating effectively. Entities are encouraged to identify opportunities for internal audit coverage of key financial systems and controls as a means of providing increased assurance to accountable authorities to support their opinion on the entity’s financial statements.

1.26 The extent to which the work of internal audit may be able to be used, in a constructive and complementary manner, varies between entities and is more likely to occur where internal audit work is focused on financial controls and legislative compliance. If the ANAO expects to use the work of internal audit, in accordance with ASA 610 Using the Work of Internal Auditors, the ANAO is required to assess whether the internal audit function has: appropriate organisational status; relevant policies and procedures to support their objectivity; an appropriate level of competence; and whether they apply a systematic and disciplined approach in the execution of their work including quality control.

1.27 When it is determined that the work of internal audit can be used to support an effective audit approach, additional work is performed to confirm its adequacy to support the external audit. This will include confirmation that the scope of the work is appropriate, that there is sufficient evidence to support the conclusions drawn and selected re-performance of internal audit’s testing.

1.28 For the entities included in this report it was observed that internal audit coverage is based on an internal audit plan that is aligned with entities’ risk management plans and includes combinations of audits that address assurance, compliance, performance improvements and IT systems reviews. In addition, suggested topics from management, audit committees and external influences, such as the ANAO’s planned performance and financial statements coverage, are factors considered in the development of internal audit work plans.

Reporting relating to compliance with finance law

1.29 The introduction of the PGPA Act resulted in a move from a compliance-based approach to a principle-based framework for Commonwealth entities. To promote the safe custody and proper use of public resources whilst reducing red tape, a greater emphasis is placed on the robustness of an entity’s self-assessment processes, strong governance structures and internal control frameworks to identify risks. A practical example of this is an entity’s requirement to report on compliance with finance law.17

1.30 Prior to 2015–16, General Government Sector entities were required to submit an annual Certificate of Compliance to the Minister for Finance and the responsible Minister summarising all non-compliance with the PGPA Act Framework. From 2015–16, the Department of Finance changed the compliance reporting process to require entities to report only significant non-compliance with the finance law to both the Finance Minister and the responsible Minister.

1.31 To support the change in requirements, the Department of Finance issued guidance in relation to reporting of significant non-compliance through the Resource Management Guide 214 Notification of significant non-compliance with finance law (PGPA Act, section 19) (RMG 214). The guide outlines factors which may be considered when determining whether significant non-compliance occurred including:

- failure to comply with the duties of accountable authorities (PGPA Act section 15 to 19);

- serious breaches of the general duties of officials (PGPA Act sections 25 to 29) including any fraudulent activity by officials;

- systemic issues reflecting internal control failings or high volume instances of non-compliance; and

- non-compliance issues that are likely to impact on the entity’s financial sustainability.

1.32 RMG 214 notes that the accountable authority should consider their entity’s environment when determining whether instances of non-compliance are significant. As part of the interim audits the ANAO considered entities’ application of RMG 214.18

1.33 Entities advised that professional judgement is applied and consideration given, to the nature and volume of breaches when assessing significance.19 Seven entities20 provided further guidance within their definition of significant non-compliance, specifying a financial threshold above which non-compliance would be considered significant. The financial thresholds include: a percentage of either departmental budget amounts or entity determined materiality thresholds; or set dollar figure. The dollar range of thresholds varies from $50,000 to $20 million.

1.34 As part of an audit committee’s governance role, it usually has oversight of the process for collating instances of non-compliance and the subsequent assessment regarding their significance. Changes to mandatory external compliance reporting process in 2015–16 removed the requirement for all instances of non-compliance to be centrally reported to the Department of Finance. As a consequence, the Departments of: Foreign Affairs and Trade; Human Services, and the National Disability Insurance Agency reduced their level of reporting, requiring only significant non-compliance to be reported to their audit committee and accountable authorities. As a central listing of non-compliance is not maintained, these entities have been excluded from the analysis of non-compliance summarised in Figure 1.3. The scope of the PGPA Act compliance reporting process at the Department of Parliamentary Services focused on procurement functions and was not standardised or embedded across the entity.

1.35 In addition to notifying the relevant minister of any significant issues which occur, entities must also report any significant non-compliance in their annual report in line with the PGPA Rule subsection 17AG. The Departments of: Defence, and Industry Innovation and Science reported significant non-compliance with finance law in their 2017–18 annual reports, as outlined below.

- During 2017–18, Defence reported 26 instances of significant noncompliance with the finance law. These [instances related to] transactions which were proven as fraud committed by an official. Defence authorities addressed these instances through criminal, or disciplinary prosecution action. Significant fraud cases are also reported separately to the Minister for Defence in accordance with reporting requirements set out in the Commonwealth Fraud Control Framework.21

- The department [Industry, Innovation and Science] identified significant instances of non-compliance with the finance law, specifically with the Commonwealth Procurement Rules (including consequential breaches relating to section 23 of the PGPA Act). Corrective action has been undertaken, which ensures that the department’s needs for operational efficiency and flexibility are met within a compliant framework.22

1.36 Entities undertake a range of activities to identify instances of non-compliance and support their assessment of whether identified breaches meet the definition of significant. These activities include self-reporting, internal assurance activities, and questionnaires completed by officers holding delegations. Through these processes, in 2017–18 the entities included in this report identified a total of 4,975 instances of non-compliance.23 Two entities reported no non-compliance24, two entities have above 10 percent of the total breaches25 and the remaining 18 entities each reported between one and nine per cent of the non-compliance.

1.37 Figure 1.3 provides the ANAO analysis of instances of non-compliance by category as identified by entities in 2017–18.

Figure 1.3: Non-compliance identified with finance law during 2017–18 by entities

Source: ANAO analysis of non-compliance identified by entities.

1.38 Further details of the areas of non-compliance depicted in Figure 1.3 are detailed below.

- The following three entities identified the highest levels of non-compliance with the Commonwealth Procurement Rules: the Department of Defence (1,682 instances); the Department of Home Affairs (406 instances); and the Department of the Prime Minister and Cabinet (225 instances). Of the non-compliance with Commonwealth Procurement Rules, a high proportion of breaches related to rule 7.16, which requires entities to report contracts entered into or amended over $10,000 on AusTender within 42 days.

- Breaches of section 23 of the PGPA include failure to obtain appropriate delegate approval prior to entering into contracts and exceeding a delegate’s approval. The following three entities identified the highest levels of non-compliance in this area; the Department of Defence (414 instances); the Department of Home Affairs (178 instances); and the Department of Agriculture and Water Resources (175 instances).

- Non-compliance with the Commonwealth Grant Rules and Guidelines predominately resulted from entities not meeting the requirement to publish grants on GrantConnect within 21 days.

- The majority of instances of non-compliance with the PGPA Act, excluding section 23, related to breaches of officer duties under sections 25 and 26 arising from misuse of corporate credit cards.

- The non-compliance with the PGPA Rule relates to failure to document the approvals to enter into arrangements under section 23 of the PGPA Act and banking monies within five days from receipt.

1.39 The collation and reporting of non-compliance allows audit committees and accountable authorities to assess emerging risks and determine training requirements or changes to procedures required to address trends. The ANAO has undertaken a detailed analysis of reporting of non-compliance, over the last three financial years, and observed both divergent practices between entities in identifying and assessing the significance of non-compliance, and a reduction in detailed reporting provided to audit committees and accountable authorities.

1.40 For this report the ANAO is providing a detailed analysis of entity Payment Card Policy and Monitoring, this is included in Case Study 2 below.

|

Case study 2. Payment Card Policy and Monitoring |

|

In line with the government’s agenda to reduce red tape, the Department of Finance26 has communicated that the use of payment cards is the preferred method to pay suppliers for eligible payments27 below $10,000. The cards offer a flexible and efficient way for Australian Government officials to obtain goods or services to meet business needs. A strong control framework that supports transparency and accountability over the use of payment cards is important in managing an entity’s exposure to risks of misuse and fraud arising from the devolved responsibility for purchasing. Payment cards can cover a range of similarly managed products. Our analysis has focused on payment cards including virtual cards28 that are used for minor procurements (up to $10,000) including travel. Unless otherwise specified, the analysis does not include vendor cards (such as fuel cards and Cabcharge FASTCARDs) or credit vouchers (such as Cabcharge eTickets). Comprehensive and effective policies and procedures are essential for accountable authorities to meet their obligations under the PGPA Act to promote the proper use of public resources. It is the card holder’s duty to understand when the facility can be used and to maintain documentation including receipts in discharging their obligations. A strong governance framework for the use of payment cards should be structured to include what is commonly referred to as the three lines of defence:

All entities29 included in this report have a payment card policy or equivalent document which includes permissible expenditure, personal use and acquittals. Three entities have not updated their policy for more than three years.30 Payment card policies should reflect current business practices and provide clear guidance on the entity’s approach to minor procurements. Regular review of policies provides the opportunity to consider the risks and benefits of implementing new payment options. This is particularly important in light of continual change in technology (for example, purchasing through mobile phone applications). Eight entities have updated their policy to directly reflect their position on the use of payment cards in mobile phone applications.31 Entitlement to a payment card varies with the nature and approach to procurement of the entity and can include:

The entities included in this report have a total of 34,000 payment cards issued to officials excluding those related solely to travel. The number and level of staff holding cards varies significantly according to business need. Travel card arrangements also vary between agencies. A number of entities use a limited number of virtual cards covering all employees, whereas other entities issue travel cards on a per employee basis. Some entities may use one card which covers both purchases and travel. All entities had established payment card limits for their cardholders. Most entities set a standard payment card limit applicable to all employees with mechanisms to temporarily increase and decrease limits to align with business requirements. Other entities set limits based on role or position (for example Chief Financial Officers and procurement officers). A combination of transactional and monthly limits are applied. Transactional limits ranged from $1,000 to $30,000. Monthly limits ranged from $2,000 to $100,000. With the exception of one entity32, entities place reliance on bank controls to ensure transaction limits are not exceeded. Nine entities33 advised they undertake additional assurance processes including performing checks to cover risks such as split purchases which may circumvent transactional limits. The policies for all entities either prohibit personal expenditure or specify circumstances when incurring personal expenditure on corporate cards is acceptable. In the event that the card has been accidentally used for personal expenditure, all entities, through either policy or practice, require repayment. The typical timeframe allowed by entities for repayment is within a month.34 One entity allowed up to 60 days for repayment.35 Eight entities36 either did not stipulate a timeframe for repayment or defined the timeframe as ‘soon as practicable’. To mitigate the risk of inadvertent personal use, 10 entities have introduced physical controls including distinguishing their cards (for example, brightly coloured cards) and providing Radio-frequency identification (RFID) blocking sleeves. A robust acquittal process supports accountability with timely independent review supported by appropriate documentation including receipts. An effective process enables identification of incorrect expenditure and payment card misuse in a timeframe which permits an entity to dispute transactions. Acquittals are required to be completed within five to 30 days for 24 entities. The NBN Co Limited and the Department of Defence allow 60 days for the completion of acquittals. Six entities37 have not established formal processes for the ongoing review of the status of monthly acquittals to management. The remaining entities provide regular reporting on unacquitted transactions to varying levels of management or to their executive. Monitoring of purchase card expenditure has been implemented by 23 entities. This includes management initiated risk based reviews and/or internal audits. Three entities38 have not established a formal management assurance process. The results of assurance processes are reported to line management and executive as considered necessary. These reports may also inform each entities’ assessment of PGPA compliance. Requirements to retain and attach documentation to acquittals is established in policy. Six entities39 only require retention of receipts above the Australian Taxation Office’s requirement for substantiation in claiming goods and services tax credits, $82.50. The remaining 19 entities require all receipts, for all transactions regardless of value to be retained. Where receipts are not required, there may be increased opportunity for fraudulent or inappropriate use and transactions cannot be subsequently subject to independent review. It is recommended that entities undertake a risk assessment to inform risk based testing of transactions. For example, the Department of Foreign Affairs and Trade targeted transactions initiated through mobile phone applications (for example, Uber) and transactions under $82.50 for which receipts are not retained. In light of the extensive use of purchase cards and technology changes there is an opportunity for entities to strengthen their policies and increase risk based assurance processes and reporting to management. Assurance that controls are implemented and operating as intended and effective reporting allows management to identify delays in acquittals, trends in inappropriate use and respond to emerging risks. This enables an accountable authority to discharge their duties under the PGPA Act in a transparent manner and further supports their assessment of compliance with finance law. |

Information systems

1.41 A review of an entity’s information systems and related controls forms a significant part of the ANAO’s examination of internal controls. Information system controls include entity-wide general controls that establish an entity’s IT infrastructure, policies and procedures as well as specific application controls that validate, authorise, monitor and report financial and human resource transactions.

1.42 As discussed at paragraph 1.10, ASA 315 provides guidance on identifying and assessing the risks of material misstatement of financial statements, including risks associated with an entity’s IT environment. Where those risks are applicable to an entity’s particular business and operational circumstances, it is expected that the entity will implement appropriate controls to mitigate them, and these controls are assessed by the ANAO.

1.43 Table 1.1 outlines the areas of focus used by the ANAO in assessing an entity’s information system controls, including common controls tested to determine the effectiveness of those systems in supporting complete and accurate financial statements reporting.

Table 1.1: Information system controls — areas of focus

|

Area of focus |

Control element |

Control subject to ANAO assessment |

|

IT general controls |

IT security |

|

|

IT change management |

|

|

|

Disaster recovery arrangements |

Significant systems supporting financial reporting (including FMIS & HRMIS) |

|

Source: ANAO compilation.

1.44 Observations from the ANAO’s interim audit phase relating to entities’ information system controls are provided under the Information Technology Control Environment section included in Interim Audit Results below. Refer to paragraphs 1.56 to 1.76.

Cyber resilience

1.45 In addition to work performed as part of the financial statements audits, the ANAO reviews information systems and related controls as part of its program of performance audits. Since 2013–14, the ANAO has conducted four performance audits to assess the controls over cyber security for fourteen different government entities.40

1.46 The first three of these audits assessed both IT general controls and the selected entities’ implementation of the mandatory Strategies to Mitigate Targeted Cyber Intrusions (commonly known as the top four mitigation strategies) in the Australian Government Information Security Manual (ISM)41, which are required by the Protective Security Policy Framework (PSPF). These controls have been mandatory for non-corporate Commonwealth entities since July 2014. The fourth audit was extended to also review implementation of the four non-mandatory strategies that make up the Essential Eight.42 A fifth audit in this series is being conducted as part of the ANAO 2018–19 Annual Audit Work Program.

1.47 All non-corporate Commonwealth entities are required to undertake an annual point in time self-assessment against the requirements of the PSPF and report the results to the relevant Portfolio Minister, with a copy to be sent to the Secretary of the Attorney-General’s Department and to the Auditor-General.43 These requirements are divided into four categories:

- Governance — to implement and manage protective security protocols;

- Personnel Security — to ensure the suitability of personnel to access Australian Government resources;

- Information Security — to ensure the confidentiality, availability and integrity of all official information; and

- Physical Security — to ensure a safe working environment for employees, contractors, clients and the public, and to provide a secure environment for official assets.

1.48 Prior to October 2018, the strategies to mitigate cyber intrusions formed part of the mandatory information security requirements of the PSPF (INFOSEC 4). The new PSPF commenced on 1 October 2018 and uses a different numbering system, however, the requirement to implement the top four strategies is still reflected in the Framework. For 2018, entities have reported on their compliance with INFOSEC 4 under the version current at the time of reporting. Therefore, the ANAO has continued to use this terminology for this report.

1.49 Figure 1.4 summarises the 2018 PSPF compliance reporting by the 22 entities included in this report that were required to report.44 Twelve entities reported that they were compliant, which is a small increase from the 11 reporting compliance in the previous year. Of the remaining entities, two entities reported partial compliance with INFOSEC 4 and eight entities reported that they were not compliant.

Figure 1.4: Entity Compliance with INFOSEC 4

Source: ANAO Analysis.

1.50 Figure 1.5 summarises the 2018 PSPF compliance reporting across all categories by the 22 entities. INFOSEC 4 continues to be the area of least compliance. This is consistent with the outcomes of the ANAO performance audits, which found that 10 of the 14 entities assessed in those audits were not fully compliant with INFOSEC 4.

Figure 1.5: PSPF compliance comparison by mandatory requirement

Source: ANAO analysis.

1.51 Not implementing the recommended mitigation strategies reduces an entity’s ability to continue providing services while deterring and responding to cyber intrusions. It also increases the likelihood of a cyber intrusion. Recent ANAO reports relating to cyber security include a number of recommendations to assist with this, which entities should review and implement where applicable.

Control activities

1.52 As part of the interim audits, the ANAO assesses the effectiveness of key controls identified during the planning stages. This assessment is made at a point in time and provides the Parliament, the public and entities with an insight into weaknesses that have the potential to impact the financial statements at year end.

Interim audit results

1.53 Audit findings are raised in response to the identification of a potential business or financial risk posed to an entity. Often these risks arise from deficiencies within an entity’s internal control processes or frameworks. Weaknesses in internal controls increase the possibility that a material misstatement of an entity’s financial statements will not be prevented or detected in a timely manner. The ANAO rates audit findings according to the potential business or financial management risk posed to the entity. The rating scale is presented in Table 1.2.

Table 1.2: Findings rating scale

|

Rating |

Description |

|

Significant (A) |

Issues that pose a significant business or financial management risk to the entity. These include issues that could result in a material misstatement of the entity’s financial statements. |

|

Moderate (B) |

Issues that pose a moderate business or financial management risk to the entity. These may include prior year issues that have not been satisfactorily addressed. |

|

Minor (C) |

Issues that pose a low business or financial management risk to the entity. These may include accounting issues that, if not addressed, could pose a moderate risk in the future. |

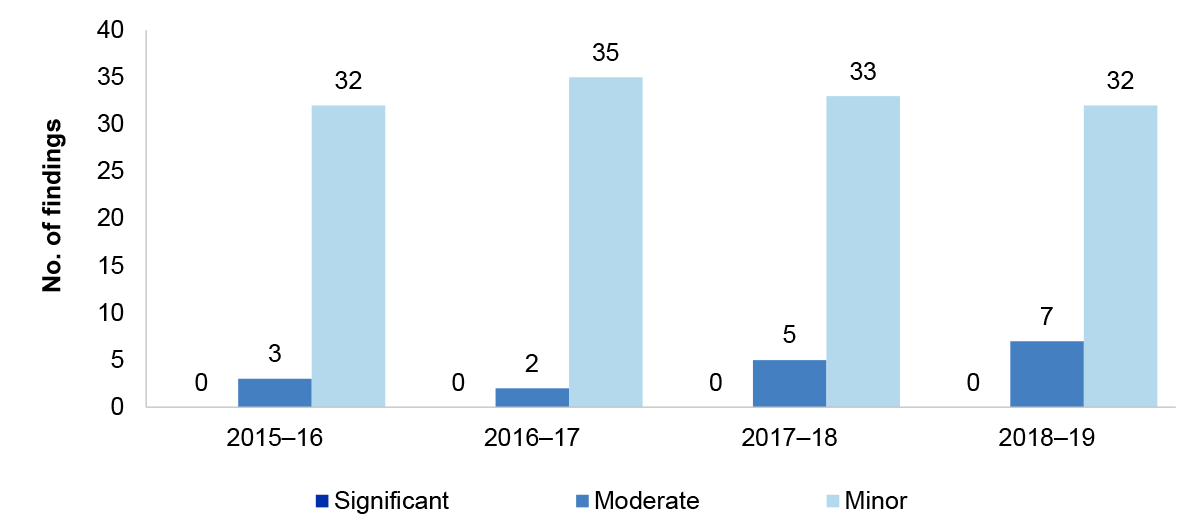

1.54 A summary of all significant, moderate and minor audit findings identified at the conclusion of the interim audit phase across the past five financial years is presented in Figure 1.6 below.

Figure 1.6: Trend in aggregate audit findings 2015–16 to 2018–19

Source: ANAO data.

1.55 The findings have been classified into to broad categories as follows:

- IT control environment;

- compliance and quality assurance frameworks;

- accounting and control of non-financial assets;

- revenue, receivables and cash management processes;

- human resources financial processes; and

- purchases and payables management.

Table 1.3: Audit findings by category for the 2018–19 interim period

|

Category |

Significant |

Moderate |

Minor |

Main areas of weakness |

|

IT control environment |

– |

7 |

32 |

|

|

Compliance and quality assurance frameworks |

– |

3 |

8 |

|

|

Accounting and control of non-financial assets |

1 |

1 |

3 |

|

|

Revenue, receivables and cash management |

– |

– |

2 |

|

|

Human resources financial processes |

– |

– |

5 |

|

|

Purchases and payables management |

– |

– |

3 |

|

|

Other audit findings |

– |

1 |

4 |

|

|

Total |

1 |

12 |

57 |

70 |

Source: Compilation of ANAO interim audit findings.

Information technology control environment

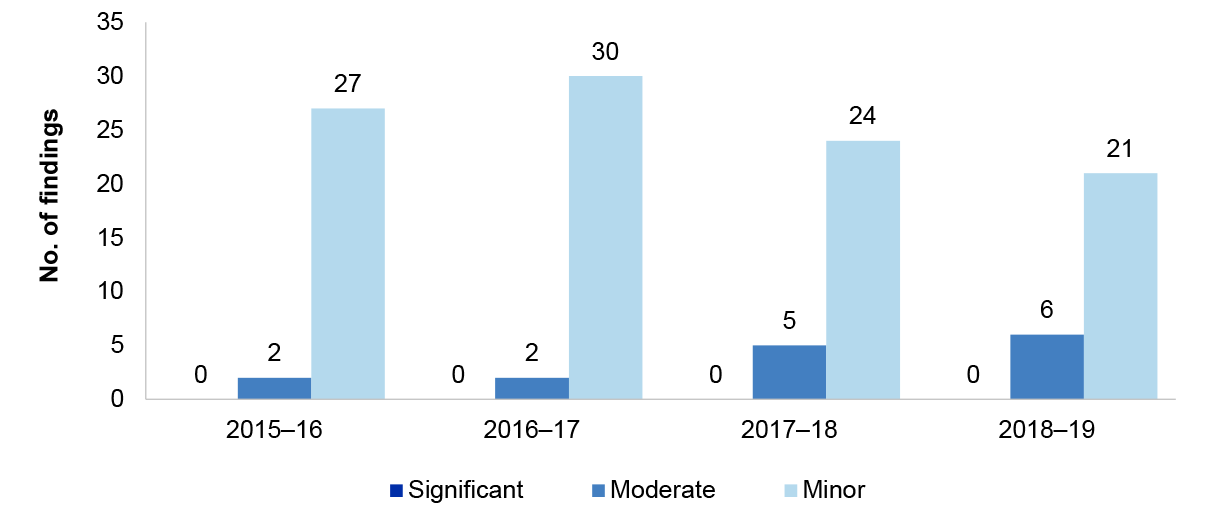

1.56 As described in paragraph 1.41, the review of information systems and related controls is an integral part of an entity’s control environment. Figure 1.7 demonstrates the trends in interim audit findings related to entities’ overall IT control environments from 2015–16 to 2018–19.

1.57 At the time of this report, testing of the operating effectiveness of IT controls had not been completed for three entities45 and therefore those results are not reflected in this summary.

Figure 1.7: IT control environment findings 2015–16 to 2018–19

Source: ANAO data.

1.58 Findings related to entities’ IT control environments represent 56 per cent of total findings identified during the 2018–19 interim period. IT control environment findings continue to represent the highest proportion of all findings. Seven new moderate findings were reported in 2018–19, which is an increase of two from the previous year.46 No moderate findings were carried over from the previous year. The continued level of findings in IT control environments indicates that entities need to focus on processes to monitor IT controls to prevent reoccurrence of issues as recommended by the Joint Committee of Public Accounts and Audit (JCPAA).47

1.59 The information systems control environment findings reported at the conclusion of the 2018–19 interim audits for entities included in this report have been grouped as follows48:

- IT security;

- IT change management; and

- disaster recovery arrangements.

IT Security

1.60 IT security is concerned with protecting an entity’s information assets from internal and external threats. It includes controls to prevent or detect unauthorised access to systems, programs and data. In the context of the financial statements audit, the focus is on the financially significant systems and data only.

1.61 The key controls that address risks relating to IT security and that are assessed as part of the interim audit are:

- IT security governance;

- general and privileged user access; and

- monitoring and reporting.

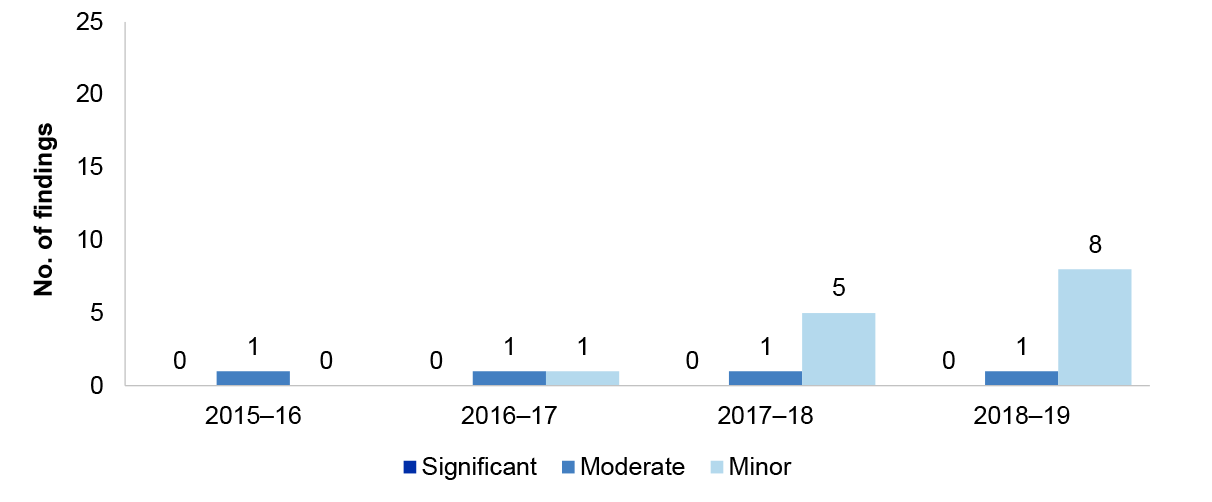

1.62 Figure 1.8 illustrates the trends in findings observed in entities’ IT security arrangements between 2015–16 and 2018–19.

Figure 1.8: IT security findings 2015–16 to 2018–19

Note: The comparative numbers in this figure have been updated to include findings previously categorised as IT application controls which related to IT security.

Source: ANAO data.

1.63 The IT security findings represents 69 per cent of all IT related findings reported in 2018–19. Six moderate findings were reported in the current year (2017–18: five). Further details of the moderate findings are detailed in chapter 3.49 Findings related to:

- logging and monitoring of privileged user activity;

- removal of user access when it is no longer required;

- user access management, including performing regular user access reviews; and

- password configuration.

1.64 Users with administrative access privileges, commonly referred to as privileged users, are able to make significant changes to IT systems configuration and operation, bypass critical security settings and access sensitive information. As part of reviewing IT security arrangements, different groups of privileged users were examined, including:

- application administrators, sometimes referred to as super users;

- database administrators;

- system administrators; and

- network or domain administrators.

1.65 To reduce the risks associated with this access, the ISM recommends that privileged user access be appropriately restricted and when provided, that the access is logged, regularly reviewed and monitored. Five moderate50 and eight minor findings relate to entities that have not implemented adequate logging and monitoring procedures over privileged user accounts. There were also five minor findings relating to access rights for both privileged and regular users not being monitored for appropriateness.

1.66 Entities must remove or suspend user access on the same day a user no longer has a legitimate business requirement for its use.51 Terminating a user account when the user no longer has a requirement to access it, such as upon departure from an entity, can prevent unauthorised use. Two of the moderate findings in relation to privileged user access weaknesses also identified issues with the untimely removal of user access.52 There was also one additional moderate and five minor findings in this area.

1.67 Two minor findings relate to inadequate password controls increasing the likelihood of unauthorised access to systems and data. The ISM provides guidance on the password requirements for Australian Government systems. One minor finding related to policies and procedures not reflecting the current environment.

1.68 The findings within this category increase the risk of unauthorised changes being made to systems and data, or unauthorised data leakage. Entities should review their management of these areas in light of the recommendations of the ISM and the risks to their operational environment.

IT change management

1.69 IT change management provides a disciplined approach to making changes to the IT environment. It includes controls to prevent unauthorised changes being introduced, and to reduce the likelihood that normal business operations are not interrupted with the implementation of authorised changes.

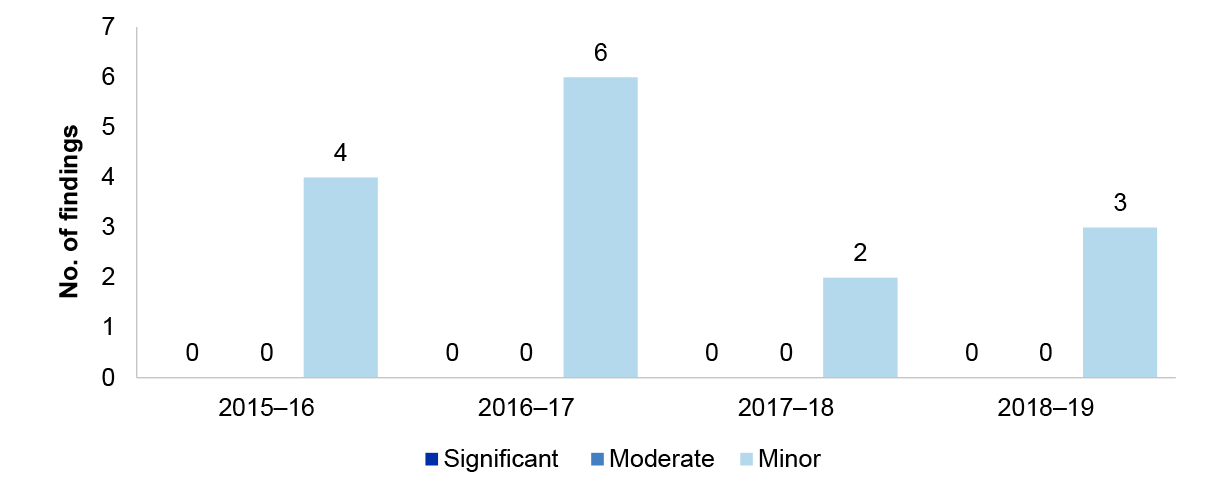

1.70 Figure 1.9 illustrates the trends in findings identified in entities’ IT change management controls between 2015–16 and 2018–19.

Figure 1.9: IT change management findings 2015–16 to 2018–19

Note: The comparative numbers in this figure have been updated to include findings previously categorised as IT application controls which related to IT change management.

Source: ANAO data

1.71 Changes to entities’ IT environments were managed using standardised processes, usually based on the ITIL Framework.53 One moderate and eight minor findings were identified in this area. The moderate audit finding relates to the Department of Agriculture and Water Resources. Further detail can be found in the Department of Agriculture and Water Resources section chapter 3. One minor finding related to data migration performed as part of implementing a change. The remaining findings related to weaknesses in the operation of the change management processes and a lack of segregation between the developer and migrator of a change.

1.72 The number of findings in this area has increased over the last two years. This elevates the risk of unauthorised changes to systems, and may affect the availability or reliability of the overall IT environment. Entities should monitor the operating effectiveness of their IT control environments to mitigate risks.

Disaster recovery arrangements

1.73 Disaster recovery is concerned with the resumption of the IT environment including systems and data. It relies on:

- effective back-up and recovery arrangements, to allow data to be recovered from current versions of key IT systems; and

- disaster recovery planning, including the development, maintenance and testing of a disaster recovery plan to enable IT systems to be recovered in line with defined business requirements.

1.74 The ANAO assesses entities’ disaster recovery arrangements in view of the potential for a disruptive event to impact on financial reporting. Figure 1.10 illustrates the trend for findings identified in entities’ disaster recover arrangements between 2015–16 and 2018–19.

Figure 1.10: Disaster recovery findings 2015–16 to 2018–19

Source: ANAO data

1.75 All entities undertook regular backups of financially significant data and had disaster recovery plans in place. Three entities received minor audit findings relating to not undertaking testing of their disaster recovery plans, two of these have remained unresolved since 2017–18.

1.76 Overall, the majority of IT controls continued to be effective in most entities included in this report during 2018–19. Consistent with observations in previous years, IT Security, particularly with regard to management of user access, continues to be an area requiring improvement to address the risk of inappropriate access to systems and data.

Compliance and quality assurance frameworks

1.77 Entities place reliance on internal and external systems, parties and information in decision-making processes. The implementation of effective compliance and quality frameworks and processes, provides assurance over the completeness and accuracy of information and is integral to the preparation of financial statements that are free from material misstatement.

Figure 1.11: Compliance and quality assurance framework findings 2015–16 to 2018–19

Source: ANAO data

1.78 The three moderate findings related to weaknesses in either assurance processes over information sourced from third parties or risk management practices relating to loan facilities. 54 One of these finding, relating to the National Disability Insurance Agency: Streamlined Access to Scheme — Defined Programs, was first reported in 2016–17 and remains unresolved.

1.79 The number of minor audit findings reported in 2018–19 has significantly decreased compared with 2017–18. There remains a need for entities to focus attention on:

- maintaining effective governance over third party or joint service delivery arrangements;

- implementing quality assurance processes over data integrity;

- developing and implementing risk management frameworks that support the effective management of risk in the delivery of programs; and

- implementing effective quality assurance processes over key financial statements inputs particularly those subject to professional judgement and uncertainty.

Accounting and control of non-financial assets

1.80 Entities control a diverse range of non-financial assets on behalf of the Commonwealth, including land and buildings, specialist military equipment, leasehold improvements, infrastructure, plant and equipment, inventories and internally-developed software.

Figure 1.12: Accounting and control of non-financial assets audit findings 2015–16 to 2018–19

Source: ANAO data.

1.81 The significant and moderate findings were reported to the Department of Defence. They were raised during the 2017–18 final audit phase and remain unresolved.55 The significant audit finding relates to the Department of Defence’s management and monitoring of specialist military equipment and inventory balances. The unresolved moderate audit finding relates to weaknesses in revaluation and impairment processes.

1.82 The three minor audit findings reported in 2018–19 relate to control weaknesses in relation to management of assets under construction, stocktaking processes and integrity of data recorded in the asset register.

Revenue, receivables and cash management

1.83 Revenue and receivables consists of Parliamentary appropriations, taxation revenue, customs and excise duties and administered levies. Revenue is also generated by entities from the sale of goods and services and a range of other sources. Cash management involves the collection and receipt of public monies and the management of official bank accounts.

Figure 1.13: Revenue, receivables and cash management audit findings 2015–16 to 2018–19

Source: ANAO data.

1.84 Consistent with 2017–18, no significant or moderate audit findings have been identified that relate to revenue, receivables and cash management. The two minor audit findings reported in 2018–19 relate to weaknesses in controls supporting the completeness and accuracy of reported revenue.

Human resource financial processes

1.85 Human resources encompass the day-to-day management and administration of employee entitlements and payroll functions. Employee benefits expenditure represents a significant departmental expenditure item for most entities. Employee entitlement liabilities involve estimates and judgements in inputs. It is important for entities to establish robust controls in these areas to support complete and accurate payment and recording of transactions.

Figure 1.14: Human resources financial processes audit findings 2015–16 to 2018–19

Source: ANAO data.

1.86 Consistent with 2017–18 there were no significant or moderate audit findings relating to human resource processes. Minor audit findings have decreased in 2018–19 and relate to weaknesses identified in relation to commencements and terminations of employees and the monitoring of controls over payroll processing and reporting.

Purchases and payables management

1.87 Purchases and payables management covers controls and processes that provide management assurance that payments processed by the entity are complete and accurate. This may include the implementation of appropriate systems of approval or controls designed to ensure that payments processed through the financial management information system are appropriate.

Figure 1.15: Purchases and payables management audit findings 2015–16 to 2018–19

Source: ANAO data.

1.88 The minor findings relate to weaknesses in reconciliation processes and the timely acquittal of credit cards. Reconciliation processes are designed to confirm the completeness and accuracy of payments initiated in business systems and processed through financial management information systems. The ANAO has reviewed the payment card policies and monitoring for the entities included in this report within case study 2.

Other audit findings

1.89 Other audit findings typically include items relating to the: management and implementation of service level agreements or memoranda of understanding; updating or maintaining key governance documentation; and presentation and disclosure in the financial statements.

Figure 1.16: Other audit findings 2015–16 to 2018–19

Source: ANAO data.

1.90 The moderate audit finding, first reported in 2017–18, relates to weaknesses in appropriate exercise of delegations at the National Disability Insurance Agency.56 The weaknesses in this category related to the:

- formalisation and implementation of key corporate documents including agreements with third parties and legislation compliance frameworks; and

- classification of expenditure and the completeness of reconciliations between systems.

2. Reporting and auditing frameworks

Chapter coverage

This Chapter outlines recent and future changes to the public sector reporting framework and the Australian auditing framework relating to the auditor’s report on financial statements.

Summary of developments

Major changes in accounting standards are applicable in 2018–19 and 2019–20 with the implementation of revised standards for financial instruments, revenue and leases. Early engagement in planning for these standards will provide entities with more options for transitioning, time to review and potentially renegotiate underlying contracts and agreements and time to organise and implement necessary FMIS changes.

The Independent Review into the operation of the Public Governance, Performance and Accountability Act 2013 and Rule has made a number of recommendations to the Minister for Finance including, for example, bringing forward the date for the tabling of annual reports, removing duplication and improving linkages between accountability documents, and increasing disclosures around remuneration paid to executives and highly paid staff. In response, the Minister for Finance amended the PGPA Rule to require Commonwealth entities to make remuneration disclosures for key management personnel, senior executives and other highly paid staff in annual reports. The Minister for Finance also amended the PGPA (Annual Report) Rules to require Commonwealth companies and Commonwealth entities to publish annual reports online.

Introduction

2.1 The Australian Government’s financial reporting framework is based, in large part, on standards made independently by the Australian Accounting Standards Board (AASB). The framework is designed to support decision-making by, and accountability to, the Parliament.

2.2 The AASB bases its accounting standards on the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board. As IFRS are designed primarily for use by private sector and for-profit organisations, the AASB amends the IFRS to reflect significant transactions and events that are particularly prevalent in the public and not-for-profit private sectors. In doing so, it takes into account standards issued by the International Public Sector Accounting Standards Board.

2.3 The Finance Minister prescribes additional reporting requirements for Commonwealth entities. These are contained in the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015 (the Rule). The Rule is made under the Public Governance, Performance and Accountability Act 2013 (the PGPA Act).

2.4 The audits of the financial statements of Australian Government entities are conducted in accordance with the ANAO Auditing Standards, which are made by the Auditor-General under section 24 of the Auditor-General Act 1997. The ANAO Auditing Standards incorporate, by reference, the auditing standards made by the Australian Auditing and Assurance Standards Board (AUASB). The Australian Auditing and Assurance Standards Board bases its standards on those made by the International Auditing and Assurance Standards Board, an independent standard setting board of the International Federation of Accountants.

2.5 The financial reporting and auditing frameworks that applied in 2018–19 are illustrated in Appendices 2 and 3 of this report.

Changes to the Australian public sector reporting framework

Changes in the financial framework

2.6 The Independent Review into the operation of the Public Governance, Performance and Accountability Act 2013 and Rule (the PGPA Review), released in September 2018, made a number of recommendations, the responses to which will impact the presentation and preparation of financial statements. The PGPA Review mirrors recommendations made by the Joint Committee of Public Accounts and Audit (JCPAA) in 2017 in response to the Auditor-General’s report number 33 (2016–17)57.

2.7 The Department of Finance has undertaken a number of initiatives in response to the PGPA Review including the development of a ‘Transparency Portal’ for the publication and utilisation of annual reports, the preparation of a Financial Statements Better Practice Guide, and amendments to the PGPA Rules in relation to reporting on executive and highly paid staff remuneration.

Transparency Portal

2.8 The Transparency Portal58 (the Portal) is an online digital reporting tool for the publication and presentation of annual reports of all Commonwealth companies and Commonwealth entities. The Portal was opened for public use in March 2019.

2.9 The Portal has the functionality to:

- provide a single point of access for all Commonwealth company and Commonwealth entity annual reports;

- support compliance with the Commonwealth financial reporting framework through the use of data sets based on the minimum financial reporting and disclosure requirements of the PGPA Act and Financial Reporting Rule;

- enable Portal users to search for and compare financial statements data between entities and between years using viewer generated tables and graphs;

- perform financial ratio analysis with the Portal currently providing users with ratios for total assets to total liabilities and financial asset to liabilities; and

- have entities upload Corporate Plans and Portfolio Budget Statements.

2.10 In April 2019, the Finance Minister amended the PGPA Rule59 to require all Commonwealth companies and Commonwealth entities to publish their 2018–19 annual reports on the Portal. The Rule does not require entities to upload Corporate Plans or Portfolio Budget Statements.

Financial Statements Better Practice Guide

2.11 The Department of Finance has published a Financial Statements Better Practice Guide60 as a practical resource to support finance staff in the financial statement preparation process by including draft timetables, compliance checklists, a range of administrative templates and practical guidance e.g. how to prepare an accounting position paper and what sort of information an auditor is likely to request.

Reporting of Executive Remuneration

2.12 The PGPA Review and JCPAA61 recommended that increased disclosure of Executive and highly paid staff remuneration would be beneficial to users of Commonwealth annual reports and allow for increased transparency.

2.13 In April 2019 the Minister for Finance amended the PGPA Rule62 to require Commonwealth entities63 to disclose in the annual report remuneration of:

- key management personnel;

- senior executive staff in aggregate by $25,000 band starting from a threshold of $0 to $220,000; and

- other highly paid staff in aggregate by $25,000 band starting from a threshold of $220,000.

Performance framework

2.14 The PGPA Act provides the basis for the Commonwealth performance framework. Commonwealth entities are required to publish planned financial and non-financial performance information with the aim of providing more transparent and meaningful information to the Parliament and the public.

2.15 The PGPA review recommended the Finance Minister, in consultation with the JCPAA, should request that the Auditor-General pilot assurance audits of annual performance statements to trial an appropriate methodology for these audits. The Committee should monitor the implementation of the pilot on behalf of the Parliament.