Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Costs and Benefits of the Reinventing the ATO Program

Please direct enquiries relating to reports through our contact page.

The audit objective was to assess the effectiveness of the Australian Taxation Office's processes for estimating and monitoring the costs, savings and benefits associated with the Reinventing the ATO program.

Summary and recommendations

Background

1. Reinventing the ATO is a broad transformational change program focused on achieving the Australian Taxation Office’s (ATO) vision of being a contemporary service oriented organisation. The program was initiated partly in response to the Australian Public Service Commission’s capability review in 2013, which outlined the challenge for the ATO to transform its existing processes, systems, culture and workforce to be more agile, responsive, efficient and effective. At a high level, implementation of the program was expected to better position the ATO to be more contemporary, innovate with technology and meet taxpayer expectations. While productivity benefits and operational savings are expected from the program, they were not a key driver for its implementation.

2. The Reinventing the ATO program formally commenced in 2015 with the release of a ‘blueprint’ that outlined experience shifts for key stakeholders, such as staff and taxpayers, as a result of implementation of the program. The program consists of behavioural and cultural elements, locally managed change and continuous improvement initiatives, as well as six strategic programs that oversee 100 projects. These projects are required to apply the ATO’s corporate project management framework, which was revised in July 2016 to provide a greater focus on the value proposition of projects, including costs and savings.

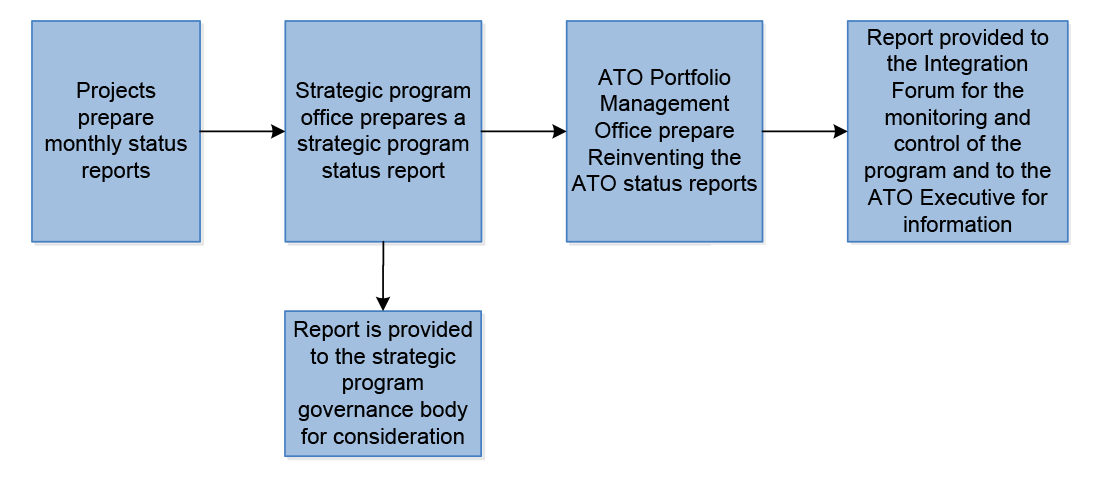

3. The ATO is not managing the entire Reinventing the ATO program using a formal program management methodology, however, governance arrangements have been put in place to support the implementation of the Reinventing the ATO projects, including a program office and strategic program governance bodies.

Audit objective and criteria

4. The audit objective was to assess the effectiveness of the ATO’s processes for estimating and monitoring the costs, savings and benefits associated with the Reinventing the ATO program. The audit criteria were that:

- sound processes were in place for estimating the potential costs, savings and benefits associated with the Reinventing the ATO program; and

- actual costs, savings and benefits associated with the Reinventing the ATO program are measured and monitored.

Conclusion

5. The ATO has sound systems and guidance for estimating and monitoring the costs, savings and benefits associated with Reinventing the ATO projects but the effectiveness of these processes has been compromised by low levels of conformance. As a result, the costs, savings and benefits from these projects cannot be calculated. The ATO never intended to calculate these measures for the entire Reinventing the ATO program as it included many locally managed and cultural change initiatives. The ATO needs to ensure greater conformance to processes for estimating and monitoring project costs, savings and benefits, to provide transparency about the net benefits of programs and support decisions about the commencement, continuation, resourcing and direction of projects.

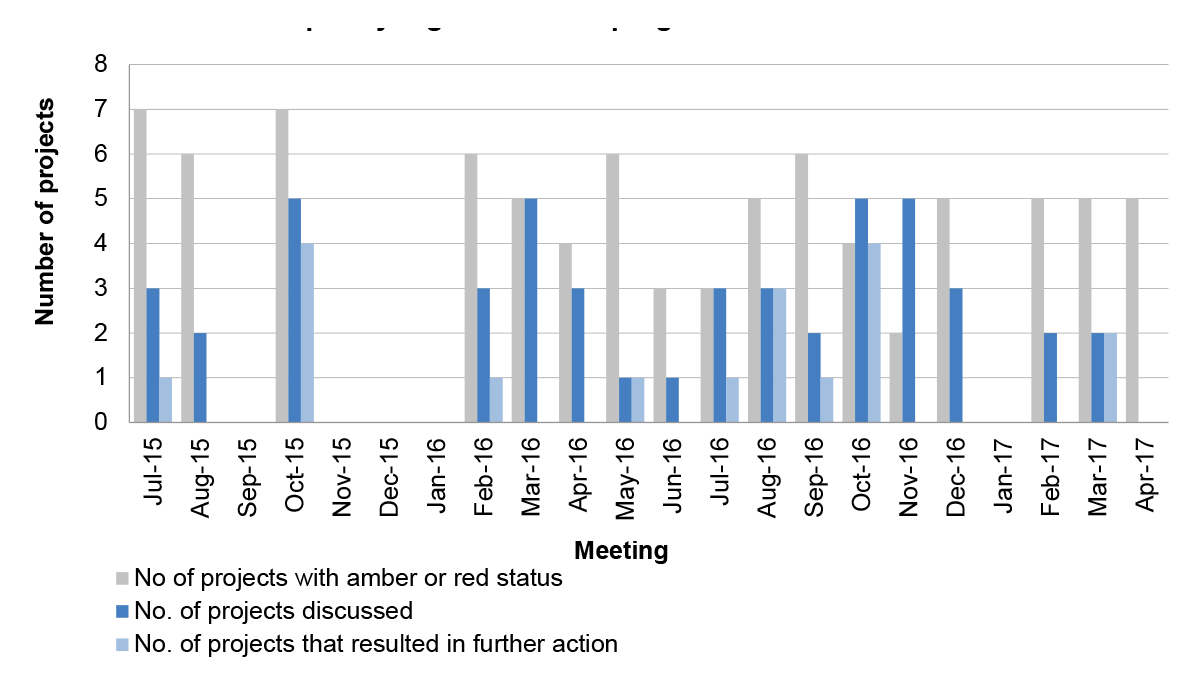

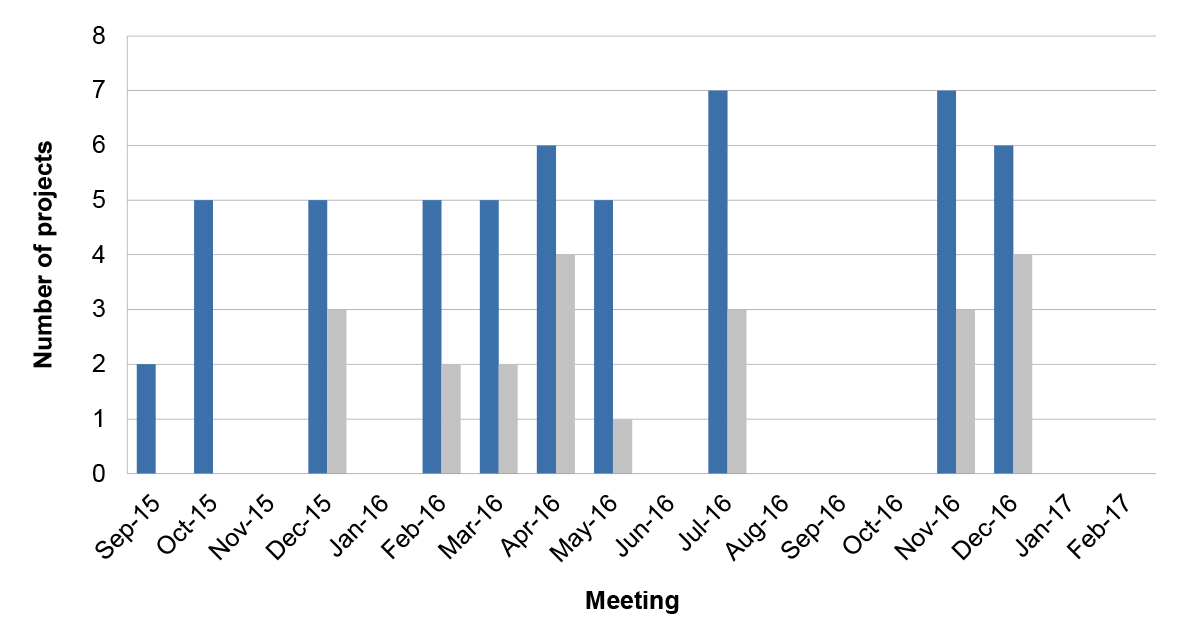

6. The ATO measures benefits from projects through a Connected Benefits Management System that links project and program outcomes to corporate benefits categories and ATO corporate impact areas. There was a general improvement across the ATO’s corporate benefits categories from 2013–14 to 2015–16, particularly relating to the corporate impact areas of willing participation and revenue. Further, the ATO advised of a number of positive business changes, including improved employee engagement, as a result of the Reinventing the ATO program. However, there would have been a higher level of assurance of the benefits from the Reinventing the ATO program if the ATO had identified performance indicators to measure the impact of the program or established a baseline to systematically measure anticipated benefits.

7. The ATO has sound project management processes in place to support the estimation of costs associated with Reinventing the ATO projects but has not always had sound processes for estimating potential savings from the projects. Despite the availability of a cost estimation tool and a requirement to estimate costs in key pre-approval documentation, costs were not consistently recorded in business cases and project plans. Potential savings from the projects were rarely included in this documentation. Detailed processes have been in place to support the estimation of benefits associated with the Reinventing the ATO program, although these processes have often not been applied to projects.

8. Costs and savings associated with the Reinventing the ATO program and most of its projects have not been tracked. However, the ATO recently introduced internal financial benefits reporting that provides a framework for measuring and monitoring savings from Reinventing the ATO projects going forward. The ATO’s benefits measurement approach has been strengthened since the commencement of the Reinventing the ATO program to enhance the profile of benefits and their alignment with broader ATO corporate impact areas when considering the value proposition of potential projects. Nonetheless, a lack of completeness in monitoring and reporting on the achievement of Reinventing the ATO projects, and the program more broadly, has limited transparency about the scale and nature of benefits achieved.

Supporting findings

Estimating costs, savings and benefits associated with Reinventing the ATO projects

9. The ATO has sound processes to support project managers to estimate the costs of Reinventing the ATO projects, including providing a cost estimation tool and having estimated costs assured by the ATO’s Finance team. However, there was not widespread adherence to these processes. Of the 100 Reinventing the ATO projects, 62 had applied the ATO costing tool, of which 34 had costs assured by ATO Finance. Cost information was also infrequently recorded in project documentation such as business cases and project plans—25 Reinventing the ATO projects had final project plans that included estimated project costs.

10. Savings estimates were infrequently included in Reinventing the ATO project pre-approval documentation as required by the ATO’s project management procedures. In early 2017, the ATO implemented a verification process to confirm expected savings from projects, which should improve the accuracy of savings estimates and frequency of inclusion in project management documentation.

11. While the ATO’s guidance has consistently required that project outcomes and benefits are identified and recorded in key project management documentation, conformance with these requirements by Reinventing the ATO projects has been low. Only 56 of the 100 Reinventing the ATO projects outlined expected benefits in project pre-approval documentation, including non-financial benefits and productivity improvements. Under the revised project management approach, the ATO’s benefits management processes have been strengthened to require that project outcomes align with broader ATO organisational priorities.

Measuring and monitoring costs, savings and benefits associated with Reinventing the ATO projects

12. The ATO is unable to measure and monitor the total costs of implementing Reinventing the ATO projects because of low levels of conformance with requirements to track costs—only eight projects included actual costs in status reports and 13 projects included actual costs in closure reports. The magnitude of costs of Reinventing the ATO projects warrants greater attention to measurement and monitoring—as for the 67 Reinventing the ATO projects where data was available, costs were estimated at $300 million from 2013–14 to 2018–19.

13. The ATO has not been tracking the monetary savings associated with the Reinventing the ATO program. However, in April 2017 it implemented internal reporting on financial benefits across the office, including Reinventing the ATO projects. As the reporting process involves the verification of estimated and realised financial benefits, this should better position the ATO to consider realised savings when making operational decisions, such as reallocating resources due to productivity gains.

14. The Reinventing the ATO program has provided a number of benefits, as indicated by the large number of outcomes listed as achieved for individual projects. However, there is a lack of clarity about the results of Reinventing the ATO projects as a consequence of the:

- lack of conformance with the ATO’s processes for monitoring and reporting on the achievement of project outcomes—of 57 closed, cancelled or transferred to business-as-usual, 21 had closure reports that indicated whether project outcomes had been achieved; and

- implementation of the Connected Benefits Management System after the commencement of the program and many projects, and the ATO not accurately identifying the contribution made by Reinventing the ATO projects to corporate priorities.

15. The ATO has identified and discontinued projects as a result of concerns relating to their relevance and progress. Nevertheless, there is scope for the ATO to improve the: frequency of program status reporting to governance bodies; quality of information provided in relation to projects’ status; and use of governance gates.

Recommendations

Recommendation no.1

Paragraph 4.10

The Australian Taxation Office mandates and monitors the recording and reporting of actual project costs for all corporate projects.

Australian Taxation Office response: Partially agreed.

Recommendation no.2

Paragraph 4.50

The Australian Taxation Office enforces the mandating of status reports and governance gate assurance activities to support assessment of the ongoing viability of projects including delivery of expected benefits.

Australian Taxation Office response: Partially agreed.

Summary of entity response

16. The summary response to the report from the ATO is provided below, with the covering letter included in Appendix 1.

The ATO acknowledges the ANAO review and considers the report supportive of our overall approach to estimating and monitoring the costs, savings and benefits associated with projects.

The review recognises the overall intent of the Reinventing the ATO program was to transform our internal culture, providing a stronger connection to the community and an openness and willingness to change in order to maximise willing participation in the tax and superannuation systems. Although some elements were delivered through formally recognised programs of work and projects, a large proportion of the Reinvention Program was driven through localised action in teams, branches and business lines.

Our approaches to strategic planning, investment management, project delivery and change management have evolved and matured since the establishment and of the Reinventing the ATO program in 2015. The review acknowledged that the ATO has developed sound systems and guidance to support project management including estimating and monitoring costs, savings and benefits.

The review also identified that there is scope for the ATO to continue to increase consistency of application as part of maturing our frameworks. The ATO recognises this opportunity and is committed to continuous improvement in relation to project management, including recognising the refinement of frameworks and practices as an area of focus in our corporate plan for 2017–18.

Key learnings for all Australian Government entities

Below is a summary of key learnings identified in this audit report that may be considered by other government entities when managing the costs, savings and benefits associated with programs and projects.

Managing costs, savings and benefits

Measuring program and project performance

1. Background

Introduction

1.1 Responsibilities of the Australian Taxation Office (ATO) include:

- collecting taxation revenue, such as personal income and company taxes;

- administering the goods and services tax on behalf of the Australian states and territories;

- administering a range of programs that result in transfers and benefits back to the community;

- administering major parts of Australia’s superannuation system; and

- administering the Australian Business Register.1

1.2 These responsibilities require interaction with a wide range of stakeholders including individual taxpayers (10.9 million), small businesses (3.8 million) and super funds (597 000). Improving stakeholders’ experiences in dealing with the ATO was one of the key drivers for introducing the Reinventing the ATO program in 2015.

Reinventing the ATO program

1.3 The Reinventing the ATO program is a broad transformational change program focused on achieving the ATO’s vision of being a contemporary service oriented organisation.2 It is aimed at improving taxpayer and staff experiences as well as transforming the ATO’s culture to be more service oriented. At a high level, implementation of the program was expected to better position the ATO to: be more contemporary; innovate with technology; and meet taxpayer expectations. While productivity benefits and operational savings were expected from the Reinventing the ATO program3, they were not a key driver for its implementation.

1.4 The program was initiated partly in response to the Australian Public Service Commission’s capability review in 2013, which outlined the challenge for the ATO to transform its existing processes, systems, culture and workforce to be more agile, responsive, efficient and effective. Initiation of the program was also due in part to an internal review of the ATO’s cultural traits conducted in early 2014.

1.5 The program applies to all aspects of the ATO’s operations, including infrastructure, tools, services and capability. It is expected to create a different internal culture resulting in a stronger connection to the community and an openness and willingness to change in order to maximise the community’s willing participation in the tax and super systems. The program is also expected to generate new products and services aimed at improving the staff and taxpayer experience.4

1.6 The precursor to the program was the ATO’s 2020 Vision and Mission, developed in July 2013. The Reinventing the ATO program formally commenced in 2015 with the release of the Reinventing the ATO Blueprint. The ‘blueprint’ was co-designed with taxpayers and staff and describes their expected experience shifts as a result of the implementation of the program.

1.7 Although not a ‘program’ in the technical sense, Reinventing the ATO encompassed both formal corporate projects, a number of behavioural and cultural elements, and more locally managed change and continuous improvement initiatives driven through localised action in teams, branches and business lines.

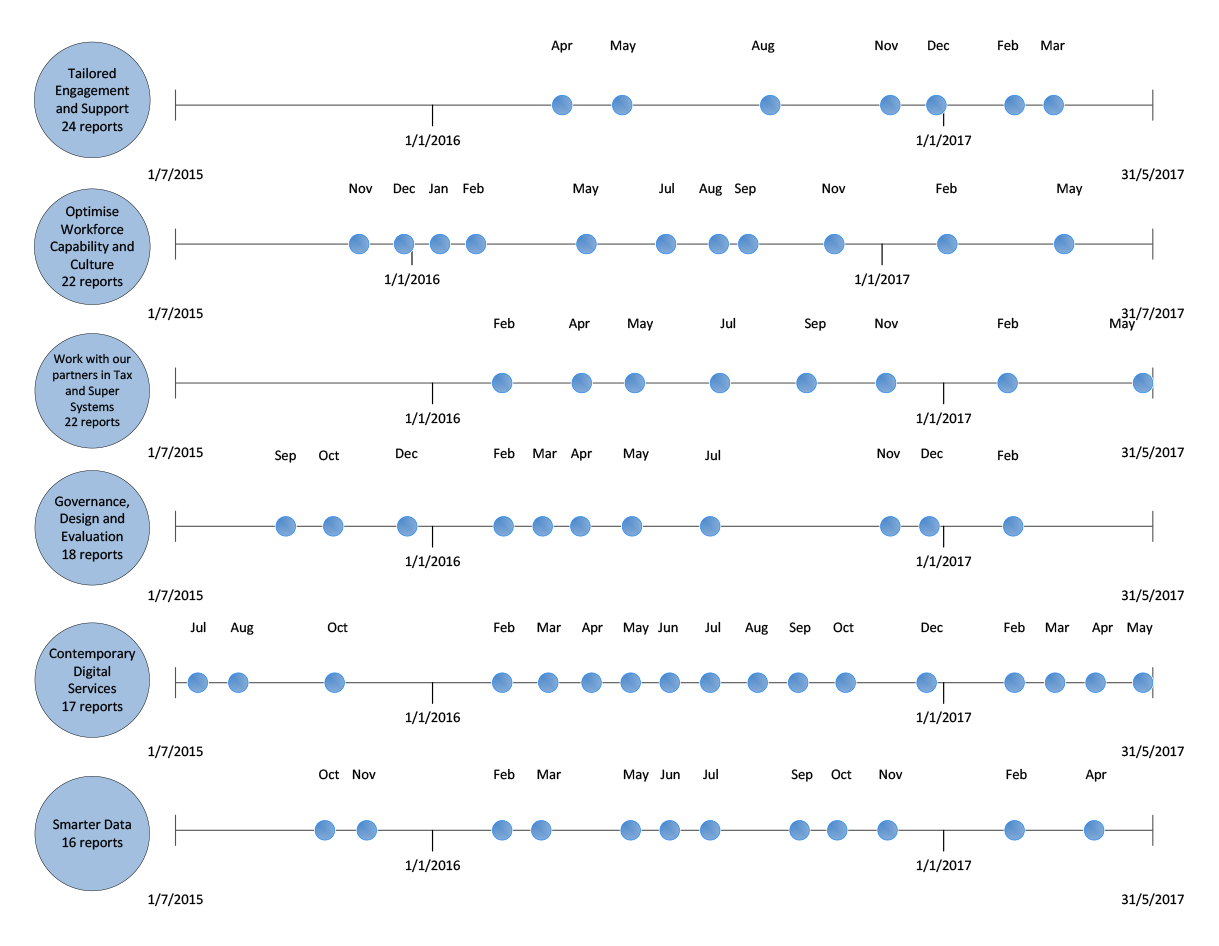

1.8 The Reinventing the ATO program included the establishment of six strategic programs. Existing and new projects have been assigned to one of the six strategic programs, and there are 100 Reinventing the ATO projects (see Appendix 2).5 These projects are required to be managed in accordance with the ATO’s project governance methodology, which requires clear articulation and approval of deliverables, milestones, timeframes, cost and outcomes. The project governance methodology is not applied to the Reinventing the ATO program as a whole. As such, aggregated program costs, savings and performance indicators have not been established.

1.9 The ATO Executive is ultimately responsible for implementation of the Reinventing the ATO program as it sets the strategic direction and priorities for change in the ATO. As illustrated in Figure 1.1, the governance arrangements for the program also included:

- an Integration Forum—responsible for ensuring activities align with the Reinventing the ATO program and that an appropriate level of resources and expertise are allocated to the six strategic programs. The Integration Forum is responsible for providing recommendations, guidance and advice to the ATO Executive in relation to the program as well as providing strategic advice and guidance to the six strategic program governance bodies;

- a Resource Forum—responsible for making recommendations to the ATO Executive on strategic investments, providing strategic oversight of the use of ATO resources and facilitating the allocation and assignment of resources to ATO business outcomes;

- a Reinventing the ATO program office—established to support the delivery of the Reinventing the ATO Blueprint through developing tailored governance arrangements and providing assurance activities to support the strategic programs;

- a Value Management Office—established in 2016, with a central function to provide consultancy services and support to project and program teams for value management, including benefits planning, monitoring and realisation; and

- strategic program governance bodies—responsible for directing and managing implementation of the strategic programs.

Figure 1.1: Reinventing the ATO governance arrangements

Source: ANAO analysis of ATO information.

1.10 The ATO advised that to effectively enable transformation, it was important to strike the right balance with governance, ensuring it was commensurate to the scale and scope of each element and not imposing unnecessary red tape for localised change. Evolving its approaches to strategic planning, investment management, project delivery and change management were also part of the overall cultural change being sought.

Internal audits in relation to the Reinventing the ATO program

1.11 The ATO has undertaken a number of internal audits in relation to the Reinventing the ATO program, as shown in Table 1.1. Notwithstanding sound design of the new benefits management framework6, the audits found scope to improve major elements of the program’s administration, including monitoring of projects’ performance and costs.

Table 1.1: ATO internal audits in relation to the Reinventing the ATO program

|

Name of review |

Overall rating |

High-level findings |

|

Reinventing the ATO (October 2016)a |

Room for improvement |

|

|

Benefits Management Framework (October 2016) |

Satisfactory |

|

|

Rollout of the Culture and Leadership Strategies (August 2016)b |

Room for improvement |

|

|

Corporate Function Review Outcomes (June 2016)c |

Satisfactory |

|

Note a: These findings were made based on a sample of four of the strategic programs.

Note b: Aspects of the Optimise Workforce Capability and Culture program were reviewed as part of this audit. Findings were not limited to the Optimise Workforce Capability and Culture program, and therefore, the high-level findings are not specific to the program.

Note c: Aspects of the Smarter Data program were reviewed as part of this audit. The high-level findings outlined in the table are only those relevant to the Smarter Data program.

Source: ANAO analysis of ATO information.

1.12 The ATO has outlined a number of positive results from the Reinventing the ATO program, which are discussed in Chapter 2.

Audit approach

1.13 The audit objective was to assess the effectiveness of the ATO’s processes for estimating and monitoring the costs, savings and benefits associated with the Reinventing the ATO program.

1.14 To form a conclusion against this objective, the Australian National Audit Office (ANAO) adopted two high-level criteria:

- sound processes were in place for estimating the potential costs, savings and benefits associated with the Reinventing the ATO program; and

- actual costs, savings and benefits associated with the Reinventing the ATO program are measured and monitored.

1.15 The audit focused on the costs, savings and benefits of the 100 Reinventing the ATO projects that contributed to the Reinventing the ATO program, but also examined the benefits delivered by the program as a whole. The audit did not examine the:

- project governance or management arrangements applied to individual projects, the six strategic programs or the Reinventing the ATO program beyond costs, saving and benefits—for example, risk management, communication or governance arrangements;

- selection, prioritisation and delivery of individual projects; or

- locally managed change and continuous improvement initiatives, including those affecting behaviours and cultures in the ATO.

Audit methodology

1.16 The audit methodology included reviewing: relevant project and benefits management templates and guidelines; Reinventing the ATO project documentation and performance reporting; and contributions received through the ANAO’s website.7 The methodology also included interviewing key ATO staff.

1.17 The audit was conducted in accordance with the ANAO’s auditing standards at a cost to the ANAO of approximately $270 000.

1.18 The team members for this audit were Kylie Jackson, Renee Hall and Andrew Morris.

2. Benefits of the Reinventing the ATO program

Areas examined

The ANAO examined the benefits delivered by the Reinventing the ATO program.

Conclusion

The ATO measures benefits from projects through a Connected Benefits Management System that links project and program outcomes to corporate benefits categories and ATO corporate impact areas. There was a general improvement across the ATO’s corporate benefits categories from 2013–14 to 2015–16, particularly relating to the corporate impact areas of willing participation and revenue. Further, the ATO advised of a number of positive business changes, including improved employee engagement, as a result of the Reinventing the ATO program. However, there would have been a higher level of assurance of the benefits from the Reinventing the ATO program if the ATO had identified performance indicators to measure the impact of the program or established a baseline to systematically measure anticipated benefits.

Introduction

2.1 As discussed in Chapter 1, Reinventing the ATO was a broad transformational program focused on improving the client and staff experience. Benefits expected from the program were articulated at a high-level. For example:

- implementation of the program was expected to better position the ATO to be more contemporary, innovate with technology and meet taxpayer expectations; and

- the ‘blueprint’ outlined expected experience shifts for key stakeholders as a result of implementing the Reinventing the ATO program.

The blueprint also stated that ‘ultimately, the true measure of success of our reinvention will be client satisfaction and participation in the tax and super systems’.8

2.2 Some elements of the Reinventing the ATO program were delivered through formally recognised programs of work and projects, with other elements of the program delivered through localised action in teams, branches and business lines.

2.3 The Reinventing the ATO program is supported by a suite of articulated outcomes that include both financial and non-financial benefits arising from Reinventing the ATO projects. While outcomes from these projects have been monitored, the success of the Reinventing the ATO program needs to consider other elements including the cultural and experience changes from less formal and continuous improvement initiatives. However, the ATO has not clearly captured the benefits from these other elements, as it intentionally has not managed or reported on the entire Reinventing the ATO program technically as a ‘program’. In this light, the ATO has not identified performance indicators to measure the benefits delivered by the program or established baselines to measure improvements in key benefit areas.

2.4 To assess the extent of benefits from the Reinventing the ATO program, the ANAO examined the benefits reported at the project level (through the Connected Benefits Management System and ATO benefits performance measures), and more broadly for the program by examining recent ATO annual reports and advice provided by the ATO.

High-level benefits from projects

Connected Benefits Management System

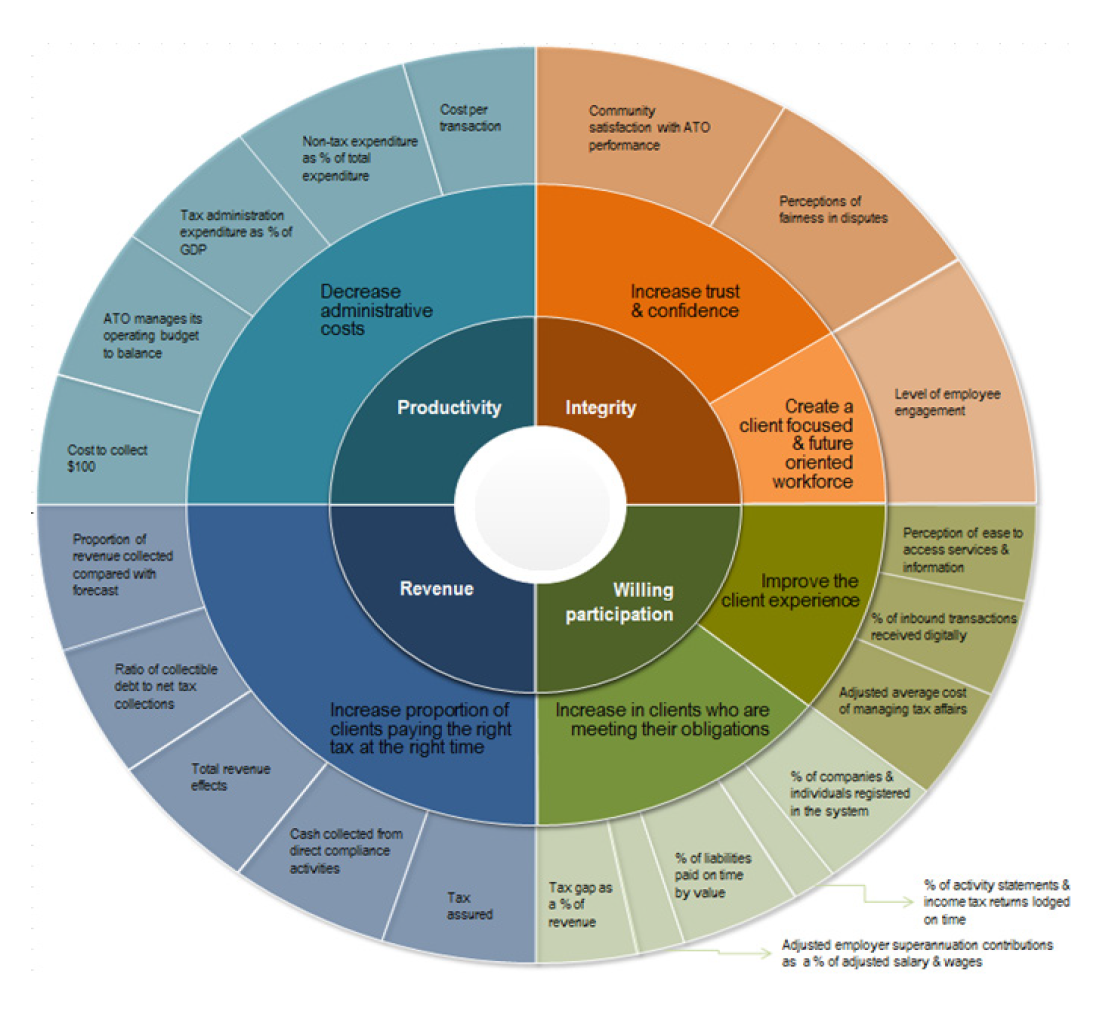

2.5 On 1 July 2016, the ATO introduced the Connected Benefits Management System with the revised corporate project management method. The Connected Benefits Management System links project and program outcomes to defined corporate benefits categories and ATO corporate impact areas. It is intended to measure enterprise-wide investment, not only the impact of the Reinventing the ATO program. Figure 2.1 illustrates the ATO’s benefits categories and their relationship to broader ATO impact areas.

Figure 2.1: Benefits categories in the Connected Benefits Management System

Source: ATO.

2.6 In 2015–16 the ATO had four corporate impact areas: integrity; willing participation; revenue; and productivity, as illustrated by the inner circle of Figure 2.1. The middle circle illustrates how the ATO intends to achieve its corporate impact areas and the outer circle defines the associated benefits categories.9

2.7 There are 21 benefits categories in the ATO’s Connected Benefits Management System that can be considered in the assessment of the impact of programs of work on ATO corporate priorities. The ATO has developed benefits measurement methods for 18 of the 21 categories, which leverage off existing tools and processes, such as surveys, where possible.10 As at August 2017, measurement methods had not been defined for the cost per transaction, total revenue effects and tax assured benefits categories.

2.8 The ATO is tracking and reporting on the contribution from individual projects by monitoring the project outcomes achieved towards these 21 benefits categories. Monitoring is undertaken at an enterprise-wide level, including Reinventing the ATO projects, and the exclusive contribution of the Reinventing the ATO program towards these benefits categories is not monitored by the ATO. Figure 2.2 outlines the main outcomes contributing to ATO benefits performance measures.

Figure 2.2: Outcomes contributing to ATO benefits performance measures, June 2017

Note: The corporate impact of ‘perception that ATO listens and responds to feedback’ is a measure from the ATO 2015–19 corporate plan and not included in the Connected Benefits Management System wheel (refer Figure 2.1). The wheel is aligned to measures from the 2016–20 corporate plan.

Source: ATO portfolio benefits reporting.

2.9 As illustrated in Figure 2.2, the benefits categories that have the largest number of contributing project outcomes are11:

- perception of ease to access services and information (56 project outcomes);

- community satisfaction with ATO performance (44 project outcomes);

- level of employee engagement (39 project outcomes); and

- cost per transaction (26 project outcomes).

Benefits from the program more broadly

2.10 The ATO reports publicly on benefits categories in its performance statements as part of its corporate planning and annual reporting. Since 2013–14, the ATO has been increasing the number of measures reported in its annual reports—from 13 in 2013–14 to 15 in 2014–15 and 18 in 2015–16.

2.11 Table 2.1 outlines the ATO’s performance against the specific benefits categories, as reported by the ATO in its annual reports from 2013–14 to 2015–16. The ANAO assessed12 that performance of seven benefits categories was positive13; four categories had negative performance results; and another four remained stable.14 As noted in paragraph 2.8, these results cannot be wholly attributed to the Reinventing the ATO program and the ATO advised that the program’s exclusive contribution towards these categories cannot be reliably measured.

Table 2.1: Performance of benefits categories

|

Benefits categories |

Reporting period |

Performance |

|

Integrity |

||

|

Community satisfaction with ATO performance |

2014–16 |

Negative |

|

Perceptions of fairness in disputes |

2014–16 |

Positive |

|

Level of employee engagement |

2014–16 |

Positive |

|

Willing participation |

||

|

Perception of ease to access services and information |

2013–16 |

Positive |

|

Percentage of inbound transactions received digitally |

2015–16 |

Baseline set |

|

Adjusted average cost of managing tax affairs |

2013–16 |

Positive |

|

Percentage of companies and individuals registered in the system |

2013–16 |

Individuals – stable Companies – new baseline seta |

|

Percentage of activity statements and income tax returns lodged on time |

2013–16 |

Stableb |

|

Percentage of liabilities paid on time by value |

2013–16 |

Positive |

|

Adjusted employer superannuation contributions as a percentage of adjusted salary and wages |

2013–16 |

Positive |

|

Tax gap as a percentage of revenue |

2013–16 |

Negativec |

|

Revenue |

||

|

Tax assured |

Not reported |

Under development |

|

Cash collected from direct compliance activities |

2013–16 |

Stable |

|

Total revenue effects |

Not reported |

Under development |

|

Ratio of collectible debt to net tax collection |

2013–16 |

Positive |

|

Proportion of revenue collected compared with forecast |

2013–16 |

Negative |

|

Productivity |

||

|

Cost to collect $100 |

2013–16 |

Stable |

|

ATO manages its operating budget to balance |

2013–16 |

Negative |

|

Tax administration expenditure as percentage of Gross Domestic Product (GDP) |

2015–16 |

Baseline set |

|

Non-tax expenditure as percentage of total expenditure |

2015–16 |

Baseline set |

|

Cost per transaction |

Not reported |

Under development |

Note a: This result was considered by the ANAO as stable overall. Results for companies were not comparable to the prior year as a change in methodology occurred in 2015–16.

Note b: Overall result is stable. Percentage of activity statements lodged on time is declining and percentage of tax returns lodged on time is increasing.

Note c: Against this measure, the ATO only reports on the goods and services tax gap in its performance statement (which was negative as reflected in this table). However, in its annual report the ATO also includes reporting on the proportion of tax gap for the luxury car tax (declining), wine equalisation tax (not reported in 2015–16), Pay-As-You-Go withholding (not reported in 2015–16) and fuel tax credits (improving). The methodology for the measure on the tax gap as a percentage of revenue is changing and the ATO intends to report a new baseline in 2016–17.

Source: ANAO analysis of ATO information.

2.12 In addition to the improvements in the seven benefits categories outlined in Table 2.1, the ATO advised that there have been a number of positive changes in the ATO’s business results and performance stemming from, and as a direct outcome of, the Reinventing the ATO program. Examples of positive changes included improved employee engagement, changing lodgment behaviour by taxpayers and dispute resolution approaches. These positive changes occurred in the context of a decrease in the ATO’s workforce of approximately 3500 people due to a redundancy program undertaken in 2014–15.

3. Estimating costs, savings and benefits associated with Reinventing the ATO projects

Areas examined

The ANAO examined whether the ATO has sound processes in place for estimating the costs, savings and benefits associated with Reinventing the ATO projects.

Conclusion

The ATO has sound project management processes in place to support the estimation of costs associated with Reinventing the ATO projects but has not always had sound processes for estimating potential savings from the projects. Despite the availability of a cost estimation tool and a requirement to estimate costs in key pre-approval documentation, costs were not consistently recorded in business cases and project plans. Potential savings from the projects were rarely included in this documentation. Detailed processes have been in place to support the estimation of benefits associated with the Reinventing the ATO program, although these processes have often not been applied to projects.

Areas for improvement

The ANAO made four suggestions aimed at: including estimated project costs and savings in pre-approval documentation for any future Reinventing the ATO projects (paragraph 3.9 and paragraph 3.15); outlining expected outcomes and benefits in pre-approval documentation for future Reinventing the ATO projects (paragraph 3.23); and improving the transparency of outcomes mapping to better identify the expected contribution of existing and planned projects to program outcomes (paragraph 3.27).

Was there a sound basis for estimating the costs associated with Reinventing the ATO projects?

The ATO has sound processes to support project managers to estimate the costs of Reinventing the ATO projects, including providing a cost estimation tool and having estimated costs assured by the ATO’s Finance team. However, there was not widespread adherence to these processes. Of the 100 Reinventing the ATO projects, 62 had applied the ATO costing tool, of which 34 had costs assured by ATO Finance. Cost information was also infrequently recorded in project documentation such as business cases and project plans—25 Reinventing the ATO projects had final project plans that included estimated project costs.

3.1 While the ATO is not applying a program management methodology to the Reinventing the ATO program as a whole, all projects within the scope of the Reinventing the ATO program are required to follow the corporate project management methodology. Most of the projects categorised as Reinventing the ATO projects were already in place prior to the initiation of the Reinventing the ATO program.15 In January 2015, the six strategic Reinventing the ATO programs were established, and existing projects were subsequently allocated to these programs. This process identified integration opportunities with some projects being stopped or amalgamated.

3.2 The ATO had an existing corporate project management approach in place to support the implementation of these projects and any new Reinventing the ATO projects. In July 2016, the ATO revised its project management framework to better support the new portfolio management practices that were introduced as part of the Reinventing the ATO program. The introduction of the framework was also designed to address issues from a project management certificate of assurance exercise undertaken in 2013 as well as an external assessment of the ATO’s project management maturity in 2015.16

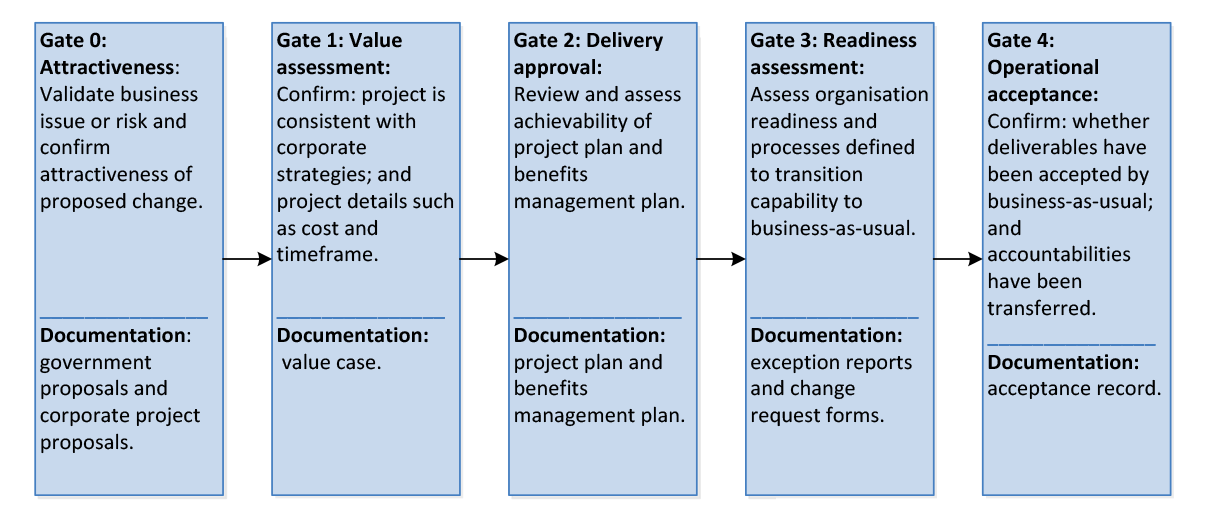

3.3 The revised project management approach was expected to provide a greater focus on the value proposition of projects as well as tailor governance and project management methods to individual projects according to project complexity and risk. This is different from the previous project management approach where projects were classified as one of three tiers17 and then were expected to be managed in line with the ATO’s corporate project management approach relevant to that tier.

3.4 Both approaches included a suite of project management documentation as well as review points throughout projects’ lifecycles. Under the previous project management approach, governance gates were required for Tier 2 projects and were intended to be the points where project sponsors18 determined whether projects should be discontinued or continued with or without modification.19 The governance gates remained as progress decision points under the revised project management approach, however, rather than project sponsors being responsible for these decisions, governance bodies became responsible.20 Figure 3.1 illustrates the purpose of the different governance gates under the revised project management approach, as well as the required project documentation.

Figure 3.1: Governance gates and required documentation under the ATO’s revised project management approach

Source: ANAO analysis of ATO information.

3.5 To support project managers to complete the required project documentation, the ATO provided templates on its intranet. Further, to assist with estimating the costs associated with projects, the ATO also provided a project resource estimation tool on its intranet. The tool estimates the cost associated with project staff and captures expected supplier costs, such as contractors, software, legal, travel and accommodation. The Enterprise Portfolio Office21 was then responsible for having completed cost estimates assured by ATO Finance. Of the 100 Reinventing the ATO projects, 62 had a completed costing tool; of which 34 had been assured by ATO Finance.

3.6 The ATO’s project management frameworks identified the documentation that should have included estimated cost information, as illustrated in Table 3.1. Actual cost information requirements are outlined in Chapter 4.

Table 3.1: Requirement to outline costs in project management documentation

|

|

Previous framework |

Current framework |

|

|

|

Tier 2 |

Tier 3 |

|

|

Concept brief/project proposala |

Indicative overall cost |

Indicative overall cost |

No cost estimate required |

|

Business/value caseb |

Estimated total project cost |

N/A |

Estimated total project cost |

|

Project plan/outlinec |

Detailed project cost to be included |

Estimated total project cost |

Estimated total project cost |

|

Status report |

Estimated total project costs |

Estimated total project costs |

Cost (year-to-date, full year and whole project) |

|

Closure report |

Total approved project cost |

Total approved project cost |

Cost variances |

Note a: Under the revised project management approach, rather than a concept brief, a project proposal is required.

Note b: Under the revised project management approach, rather than a business case, a value case is required.

Note c: Both project management approaches require project plans. However, under the previous project management approach, Tier 2 projects were required to complete project plans while Tier 3 projects were required to complete project outlines.

Source: ANAO analysis of ATO information.

3.7 The ATO advised that there were more than 200 projects in place prior to the initiation of the Reinventing the ATO program, however the re-scoping and amalgamation of projects, as well as the program’s dynamic nature made the number of projects difficult to quantify. At the time of the audit the ATO provided 100 projects in the Reinventing the ATO program for review.22 Sixty-seven projects were initiated under the previous tier-based project management; six were initiated under the revised project management approach; 12 have applied another project management approach (for example, tailoring templates23); and for 19 projects, the methodology applied is unclear.

3.8 Indicative costs were not routinely recorded in project pre-approval documentation as illustrated in Table 3.2. Twenty-five of the 100 Reinventing the ATO projects had final project plans that included estimated project costs.

Table 3.2: Completion of required documentation for Reinventing the ATO projects

|

|

No. of projects that were not required to complete document |

No. of projects without document |

No. of projects with final or draft document with no or incomplete estimated cost information |

No. of projects with final document with estimated cost information |

Total |

|

Concept brief/project proposal |

0 |

59 |

39a |

6b |

104 |

|

Business/value case |

17c |

41 |

25 |

17 |

100 |

|

Project plan/outline |

3c |

39 |

33 |

25 |

100 |

|

Status report |

0 |

49 |

41d |

10e |

100 |

|

Closure report |

44f |

15 |

29g |

12 |

100 |

Note a: Thirteen projects had draft or incomplete scoping documents. Three of these projects were initiated under the revised project management approach and were not required to include cost information. Thirteen of these projects had prepared a concept brief or project proposal, the remaining thirteen had another form of scoping document such as a design document, green paper, policy project briefing, scoping document or workshop.

Note b: Four of these were concept briefs; one was a project proposal; and one was a scoping document.

Note c: Three projects were cancelled or halted prior to reaching the value case preparation stage. These projects were: Improving the business experience, Sub accounting period application and Accounting program of work Phase 2. Therefore, these projects were not required to deliver a business/value case or project plan/outline.

Note d: Twenty-two of these projects had traffic light reporting in relation to budget position. Five had traffic light reporting for budget position for some months and no mention of budget position in other months. Two had traffic light reporting and reported the estimated project cost in less than half of its status reports. A further 12 projects had status reporting that did not reference budget position.

Note e: One of these projects reported its budget for more than half of its status reports but not for all.

Note f: Thirty-six of those projects were in progress at the time of the audit and therefore, did not require closure reports; and seven projects were halted but not cancelled at the time of the audit. Another project was advised by the project office that it did not require a closure report.

Note g: Ten of these 29 projects indicated that a budget was not reported as the project had been undertaken from business-as-usual resources or was now being undertaken as part of business-as-usual resources and three projects indicated that no budget had ever been prepared.

Source: ANAO analysis of ATO information.

3.9 Project costing guidance indicated that projects were to be approved based on their value proposition and/or alignment with ATO priorities. The guidance also indicated that project sponsors would review the project at least monthly to assess its ongoing viability. In particular, sponsors might consider the actual costs to date as well as the projected versus budgeted costs of the project. The absence of cost information in key project documentation did not support value for money assessments during the project scoping, approval or delivery phases. Expected cost estimates should be included in the pre-approval documentation for any future Reinventing the ATO projects.

3.10 The ATO is not managing the Reinventing the ATO program by applying a program management methodology and consequently, did not quantify the cost versus the benefit of the Reinventing the ATO program at an aggregate level. While costs and benefits were expected to have been quantified at a project level, costs were not consistently captured and there is no total Reinventing the ATO program cost estimate.

Was there a sound basis for estimating the savings associated with Reinventing the ATO projects?

Savings estimates were infrequently included in Reinventing the ATO project pre-approval documentation as required by the ATO’s project management procedures. In early 2017, the ATO implemented a verification process to confirm expected savings from projects, which should improve the accuracy of savings estimates and frequency of inclusion in project management documentation.

3.11 The ATO advised that it does not have a savings methodology, however, in early 2017 it implemented a verification process where ATO Finance confirm the value of expected savings indicated in project pre-approval documentation (refer paragraph 4.16).

3.12 Savings estimates associated with individual Reinventing the ATO projects should have been outlined in business cases and project management plans. Savings were to be identified as potential benefits in the business case and project plan templates for Tier 2 projects but not in the project plan template for Tier 3 projects. A financial benefits table was included in the revised business case template but there was no mention of savings in the revised project plan template. Instead, the template indicated that the project benefits management plan should be attached.

3.13 As illustrated in Table 3.3, a small number of Reinventing the ATO projects had identified and estimated savings associated with their projects (16 in total).24 Twelve projects had estimated all expected savings components in either a business case or project plan and six of those had included the calculations to support the savings estimates. The ANAO assessed the six projects that had included calculations and found that three of those estimates appeared to be of a sound basis.25 The ANAO could not assess the remaining three as the supporting calculations were of insufficient detail for two projects and the third was based on an external provider’s estimate.

Table 3.3: Number of projects that identified and estimated savings

|

|

Business/value case |

Project plan/outline |

|

No. of projects that did not require document |

17 |

3 |

|

No. of projects without document |

41 |

39 |

|

No. of projects that did not identify any monetary savings |

15a |

36b |

|

No. of projects that indicated that savings were not expected |

1 |

1 |

|

No. of projects that identified monetary savings but did not estimate them |

15 |

14 |

|

No. of projects that wholly or partly identified and estimated monetary savingsc |

11 |

7 |

|

Total |

100 |

100 |

Note a: Two of these projects did not identify any benefits.

Note b: Six of these projects did not identify any benefits.

Note c: The projects identified in each category are not mutually exclusive and 16 projects in total identified savings in either a value/business case and/or project plan/outline.

Source: ANAO analysis of ATO information.

3.14 Table 3.4 outlines the total estimated monetary savings outlined by Reinventing the ATO projects. As some projects included options, there are ranges for the estimated savings.

Table 3.4: Estimated monetary savings associated with Reinventing the ATO projects

|

Estimated monetary savings in first five years |

Estimated monetary savings per annum after the first five years |

||

|

Low |

High |

Low |

High |

|

$419.5 million |

$598.9 million |

$57.4 million |

$81.6 million |

Note: These figures are based on the estimated savings included in the project planning documentation of 16 Reinventing the ATO projects. The savings estimates do not relate to a specific time period. Eight projects estimated savings over a number of years rather than on a per annum basis; a five-year period was included to accommodate those projects as five years was the longest estimated period. Annual estimates have been recalculated accordingly. Ranges are reflected as two projects included a range of estimated savings. For projects that did not include a range, the total value of savings is included in both the ‘low’ and ‘high’ estimate.

Source: ANAO analysis of ATO information.

3.15 Including savings estimates in value cases and project plans informs value for money assessments. As outlined in paragraph 3.3, the revised project management approach is expected to deliver a greater emphasis on the value proposition of proposed projects. To support informed decision-making of this nature, the ATO needs to improve the consistency with which project cost and savings information is outlined in key project documentation.

3.16 There is no total savings estimate for the Reinventing the ATO program. While the ATO identified productivity offsets associated with the Reinventing the ATO program to support the remuneration increases in its proposed 2015 Enterprise Agreement26, it advised the ANAO that these offsets were ‘intangible’ savings that were expected to be delivered from indirect benefits associated with the program. Examples of these benefits included: addressing ‘irritants’ associated with the ATO’s case management system; simplifying internal interactions as well as those with taxpayers; and engaging with taxpayers through different communication modes, such as social media.

Was there a sound basis for estimating the benefits expected from Reinventing the ATO projects?

While the ATO’s guidance has consistently required that project outcomes and benefits are identified and recorded in key project management documentation, conformance with these requirements by Reinventing the ATO projects has been low. Only 56 of the 100 Reinventing the ATO projects outlined expected benefits in project pre-approval documentation, including non-financial benefits and productivity improvements. Under the revised project management approach, the ATO’s benefits management processes have been strengthened to require that project outcomes align with broader ATO organisational priorities.

3.17 Successive ATO project management frameworks have required that benefits and outcomes be identified and measured for projects. According to these frameworks, outcomes are a change in state; they are the results or impacts that follow from the change the project is making. Outcomes are expected to lead to benefits. Benefits are measurable changes that contribute to the ATO’s corporate objectives, for example increased taxation revenue or increased stakeholder confidence.

Outcomes

3.18 Under the previous project management approach, Tier 2 and 3 projects were required to identify outcomes in the following project management documents: outcomes map; project plan/outline; and benefits management plan.27 Tier 2 projects were also required to outline outcomes in the business case.28 The ATO’s project management guidance indicated that outcomes were to be described in terms of the difference between the current and future state, and the problem that would be addressed. Outcomes were to be categorised according to the group to benefit—community (individuals, small business and tax agents), Government and the ATO.

3.19 The ATO recognised shortcomings in relation to managing outcomes under the previous project management approach, including that project outcome success measures needed improving, and outcomes owners were not always identified. As previously mentioned, a revised project management approach was introduced in July 2016. The revised approach aimed to improve conformance with project management requirements, improve accountability for outcomes and enhance the ATO’s ability to monitor and realise corporate benefits.

3.20 The revised project management guidance indicates that outcomes should be defined for all projects in a value case.29 The value case template focuses projects on linking key project outcomes to corporate priorities and defined corporate benefits categories. In addition to the value case, the revised project management approach requires an outcomes map and benefits management plan or entry in the corporate benefits register.30 The ATO’s guidance states that the level of benefits management planning will vary depending on a project’s assessed level of risk, complexity, change and business impact.31

3.21 Around one-third of the Reinventing the ATO projects had documented intended outcomes in a business or value case, while nearly half had included outcomes in a project plan or outline as illustrated in Table 3.5.

Table 3.5: Number of Reinventing the ATO projects with intended outcomes in planning documentation

|

|

Business value case |

Project outcomes map |

Project plan outline |

Benefit management plan/register |

|

No. of projects that did not require document |

17 |

N/Aa |

3 |

0 |

|

No. of projects with no document |

41 |

67 |

39 |

84 |

|

No. of projects that did not document outcomes |

10 |

n/a |

10 |

1 |

|

No. of projects that documented outcomes |

32 |

33 |

48 |

15 |

|

Total |

100 |

100 |

100 |

100 |

Note a: The ANAO was unable to reliably determine from project management documentation those Tier 2 and 3 projects that were subject to the Department of Finance Gateway review process or an ATO IT review process, or were discretionary projects where the IT component was estimated at greater than $500 000.

Source: ANAO analysis of ATO project documentation.

3.22 Seven projects in the Reinventing the ATO program had all of the required documents for the initial stages of the project. Of those seven projects, five had recorded intended project outcomes in all the required documents.

3.23 Conformance with the ATO’s project management requirements to identify and document expected outcomes and benefits has been low among Reinventing the ATO projects. Defined project outcomes and benefits support informed decision-making as to the value proposition of projects as well as assist projects to remain on track during implementation. Future Reinventing the ATO projects should outline expected outcomes and benefits in pre-approval project documentation.

Outcomes mapping

3.24 The ATO’s outcomes mapping process was strengthened with the introduction of the Connected Benefits Management System and revised project management approach in 2016, with the requirement that outcomes are directly linked to defined corporate benefits categories. This enhancement is expected to better support a project’s value proposition. Project outcomes maps are intended to show the relationship between project outcomes and benefits. Currently the ATO prescribes three types of outcomes:

- capability outcome: when the business can do something that it could not previously do;

- change outcome: when the business exhibits a new behaviour or way of doing something; and

- strategic outcome: a benefit that will arise from doing a program of work.

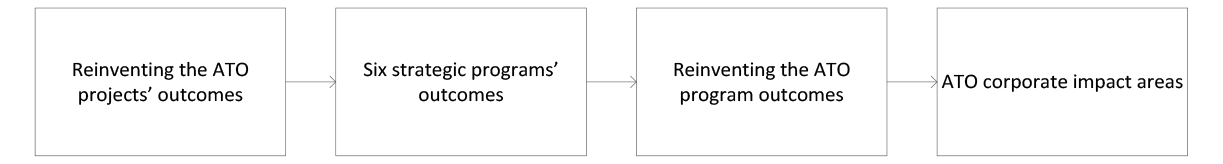

3.25 The Value Management Office facilitated outcomes mapping for the six strategic programs and the Reinventing the ATO program from 2014 to 2016. The strategic programs mapping process assisted the Value Management Office to identify projects that would also benefit from undertaking the mapping process. Project outcomes would contribute to the Reinventing the ATO program outcomes through the six strategic programs as illustrated in Figure 3.2.

Figure 3.2: Expected alignment between project outcomes and ATO corporate priorities

Source: ANAO.

3.26 Thirty-three projects had completed outcomes maps. The ANAO analysed the alignment between the outcomes maps of these 33 projects, the six strategic programs and the Reinventing the ATO program. The ANAO also examined the extent to which outcomes maps linked to the ATO corporate impact areas. As illustrated in Table 3.6, there was a high-level of conformance in identifying programs’ outcomes and corporate priorities on the six strategic programs’ and the Reinventing the ATO program outcomes maps. However, individual Reinventing the ATO projects’ outcomes were not discernible on the six strategic programs’ or the Reinventing the ATO outcomes maps. Further, there was a lower level of conformance among the 33 projects with identifying relevant links on their respective outcomes maps as demonstrated by:

- five projects (15.2 per cent) identified their relevant strategic program outcomes;

- 24 projects (72.7 per cent) identified relevant Reinventing the ATO outcomes; and

- 23 projects (69.7 per cent) identified ATO corporate priorities.

Two of the 33 projects did not identify their own project outcomes on projects maps.

Table 3.6: Project outcomes mapping information

|

|

Project outcomes mapsa |

Six strategic program outcomes maps |

Reinventing the ATO outcomes map |

|

ATO corporate impact areasb |

23 |

✔ |

✔ |

|

Reinventing the ATO program outcomes |

24 |

✔ |

✔ |

|

Strategic program outcomes |

5 |

✔ |

✔ |

|

Project outcomes |

31c |

✘ |

✘ |

Note a: From a total of 33 projects.

Note b: Refer to the inner circle of Figure 2.1 for the ATO corporate impact areas.

Note c: Ten of these projects had outcomes that clearly aligned from their outcomes map to their business case.

Source: ANAO analysis of ATO information.

3.27 Greater transparency of the expected contribution by existing and planned projects to program outcomes would enable the ATO to better prioritise projects that would deliver the greatest value as well as assist it to identify where there are gaps in efforts to achieve intended program outcomes.

Benefits

3.28 Identifying and recording expected project benefits in key project documentation has been required under successive project management frameworks, as illustrated in Table 3.7. Guidance for Tier 2 projects under the previous project management framework included that information on benefits in addition to costs and options assists to present value for money propositions and confirm the viability of projects.

Table 3.7: Requirements to outline benefits in project management documentation

|

|

Previous framework |

Current framework |

|

|

|

Tier 2 |

Tier 3 |

|

|

Business/value case |

Benefits as well as the means to measure them to be identified. |

N/A |

Corporate indicators and benefit categories are to be identified for each planned outcome. |

|

Project plan/outline |

Benefits to be identified and an update on the intended approach to measure them to be included. |

Benefits to be listed. |

Benefits management plan to be attached to project plan.a |

Note a: For simple projects, rather than developing a benefits management plan, benefits are listed in the project log.

Source: ANAO analysis of ATO information.

3.29 The ATO’s Tier 2 project management guidance encouraged the consideration of benefits according to the categories of:

- financial: benefits that can be measured in monetary terms, for example, an increase in taxation revenue;

- non-financial: qualitative benefits such as improved access to systems or greater confidence in the taxation system; and

- savings: quantifiable reductions in the ATO’s running costs.

3.30 Under the revised project management framework, project outcomes are linked directly to existing corporate indicators and benefits categories.32 Further, internal financial benefits are identified as harvestable benefits, reinvested benefits or notional savings.

3.31 As illustrated in Table 3.8, around one-third of the Reinventing the ATO projects had expected benefits outlined in value cases and half of the projects had benefits outlined in project plans. In total, 56 of the 100 projects included expected benefits in at least one pre-approval document.

Table 3.8: Conformance with documenting benefits in project management pre-approval documentation

|

|

Value/business case |

Project plan/outline |

|

No. of projects that did not require document |

17 |

3 |

|

No. of projects that did not have document |

41 |

39 |

|

No. of projects with documentation that did not identify benefits |

7 |

7 |

|

Total no. of projects that identified benefits |

35 |

51 |

|

21 |

26 |

|

35 |

50 |

|

26 |

21 |

Source: ANAO analysis of ATO information.

3.32 To determine whether benefits have been achieved, benefit measurement methods need to be identified and applied. For the Reinventing the ATO program, of those projects that identified benefits:

- 15 projects identified measurement methods in value cases for some or all of the identified benefits and 20 did not; and

- 20 projects identified measurement methods for some or all of the identified benefits in project plans and 31 did not.33

3.33 Benefits and their measurement methods have not been commonly identified and recorded. Consequently, projects’ value proposition and viability may not have been discernible from project management documentation.

3.34 A high level of conformance with the revised project management framework is required to enable the ATO to initiate projects with strong value propositions that contribute to its organisational priorities.

3.35 The ANAO reviewed the documentation for all six projects that were initiated after the introduction of the Connected Benefits Management System and revised project management framework.

3.36 Table 3.9 illustrates that half the projects that were initiated under the revised project management framework have been cancelled, with two of the projects cancelled prior to the development of a value case. For the three projects that remained in flight as at August 2017, two had developed value cases but not an outcomes map. The remaining project had been exempted from developing a value case and outcomes map, and was approved to proceed to developing a project plan.

Table 3.9: Projects in the Reinventing the ATO program initiated under the revised project management framework

|

|

Value case |

Outcomes map |

Project plan |

Benefits management plan |

Document links to Reinventing the ATO |

Project status |

|

Project 1 |

Exempted |

Exempted |

✘ |

✘ |

✘ |

In flight |

|

Project 2 |

Not required |

Not required |

Not required |

Not required |

Not required |

Cancelleda |

|

Project 3 |

✔ |

✘ |

✘ |

✘ |

✔b |

In flight |

|

Project 4 |

Not required |

Not required |

Not required |

Not required |

Not required |

Cancelleda |

|

Project 5 |

✔ |

✔ |

✔ |

✘ |

✔c |

Cancelledd |

|

Project 6 |

✔ |

✘ |

✘ |

✘ |

✔b |

In flight |

Note a: These projects were cancelled as they did not align to organisational priorities.

Note b: These projects identified their key outcomes as Reinventing the ATO program outcomes in their value cases.

Note c: Project contributions to the Reinventing the ATO program were in a briefing update and not the standard project documentation.

Note d: Analysis undertaken by the ATO indicated a lack of benefit from the project and it was consequently cancelled.

Source: ANAO analysis of ATO information.

4. Measuring and monitoring costs, savings and benefits associated with Reinventing the ATO projects

Areas examined

This chapter examines the ATO’s measurement and monitoring of costs, savings and benefits associated with Reinventing the ATO projects.

Conclusion

Costs and savings associated with the Reinventing the ATO program and most of its projects have not been tracked. However, the ATO recently introduced internal financial benefits reporting that provides a framework for measuring and monitoring savings from Reinventing the ATO projects going forward. The ATO’s benefits measurement approach has been strengthened since the commencement of the Reinventing the ATO program to enhance the profile of benefits and their alignment with broader ATO corporate impact areas when considering the value proposition of potential projects. Nonetheless, a lack of completeness in monitoring and reporting on the achievement of Reinventing the ATO projects, and the program more broadly, has limited transparency about the scale and nature of benefits achieved.

Areas for improvement

The ANAO made two recommendations aimed at the ATO: increasing the number of Reinventing the ATO projects that record and report on actual project costs (paragraph 4.10); and improving its application of project management mechanisms to assess the ongoing viability of projects (paragraph 4.50).

Is the ATO measuring and monitoring the costs of implementing the Reinventing the ATO projects?

The ATO is unable to measure and monitor the total costs of implementing Reinventing the ATO projects because of low levels of conformance with requirements to track costs—only eight projects included actual costs in status reports and 13 projects included actual costs in closure reports. The magnitude of costs of Reinventing the ATO projects warrants greater attention to measurement and monitoring—as for the 67 Reinventing the ATO projects where data was available, costs were estimated at $300 million from 2013–14 to 2018–19.

4.1 Project managers are required to track actual project costs using ‘mandated’ status reports.34 The ATO’s costing guidance states that regularly tracking actual costs along with the progress of project deliverables assists with keeping the project on track and maintaining actual expenditure within budget. There is no single process or system for tracking costs for all projects, rather the ATO has a differentiated approach. Project managers and sponsors are responsible for selecting a cost tracking method based on the complexity and scale of their project.

4.2 ATO project management guidance outlines the options available to project managers to track costs, which include:

- Establishing a project cost centre. This approach is promoted where it is considered necessary to capture labour and supply costs associated with the project. Benefits of this approach include being able to access cost information through the ATO’s financial reporting systems. However, as there are high administrative costs associated with establishing and monitoring a cost centre, some business lines have conditions around the establishment of cost centres, including that they cannot be established where estimated project costs are less than $2 million per annum.

- Tracking effort through the ATO Unit Costs Analysis system. This approach only captures ATO staff costs—it does not capture supplier costs. The costing guidance indicates that this approach to tracking costs is suitable for low risk, small to medium sized projects with minimal supplier costs.

- Recording costs in the Enterprise Project Management system. Projects undertaken by the ATO’s Enterprise Solution and Technology business line use this alternative cost recording system.

- Manually recording actual cost information. The ATO’s costing tool can also be used to capture actual cost information. Applying this approach, project managers manually record staff effort and supplier costs in the costing tool. While this approach enables all project costs to be captured and can provide financial reporting that illustrates actual cost compared with budgeted cost, it is resource-intensive.

4.3 The ATO’s costing guidance indicates that the cost tracking approach to be adopted for the project should be documented in ‘relevant project documentation’, such as project plans and business cases.35 As illustrated in Table 4.1, cost tracking methods were not frequently identified in pre-approval documentation for Reinventing the ATO projects.

Table 4.1: Number of Reinventing the ATO projects where the cost tracking method was identified in project pre-approval documentation

|

|

Concept brief/project proposal |

Business/value case |

Project plan/outline |

|

No. of projects that did not require document |

0 |

17 |

3 |

|

No. of projects without document |

59 |

41 |

39 |

|

No. of projects with draft or final document that did not specify a cost tracking method |

45 |

31 |

41 |

|

No. of projects with draft or final document that specified a cost tracking methoda |

Nil |

11 |

17 |

|

Total |

104b |

100 |

100 |

Note a: The projects identified in each category are not mutually exclusive and 25 projects identified a cost tracking method in either a value/business case and/or project plan/outline.

Note b: These figures add to 104 as six projects that were initially scoped were later merged into two projects.

Source: ANAO analysis of ATO information.

4.4 In total, 25 of the 100 Reinventing the ATO projects identified the cost tracking method in project pre-approval documentation. Where the tracking method was identified in project plans, conformance with the ATO’s guidance (paragraph 4.2) varied, as illustrated in Table 4.2. Of the 17 projects that identified a cost tracking method in a project plan, manual tracking was the most common method identified.

Table 4.2: Cost tracking methods identified in project plans

|

Costing model |

No. of times identified in project plans |

|

Combination: cost centre/project costing model/IT costing model |

1 |

|

ATO Unit Costs Analysis system |

1 |

|

Enterprise Solution and Technology costing modela |

2 |

|

Manually track project costs |

8 |

|

Project scheduling tool |

2 |

|

Work breakdown structure |

1 |

|

Spreadsheet |

2 |

|

Total |

17 |

Note a: Two projects identified tracking methods for IT-related costs only.

Source: ANAO analysis of ATO information.

4.5 Actual project costs are required to be included in monthly status reports and closure reports, as illustrated in Table 4.3.

Table 4.3: Requirements to include actual cost information in project documentation

|

|

Previous framework |

Current framework |

|

|

|

Tier 2 |

Tier 3 |

|

|

Status report |

Actual projects costs to date |

Actual projects costs to date |

Actual/forecast costs (year-to-date, full year and whole project) |

|

Closure report |

Total actual costs |

Total actual costs |

Budget variances |

Source: ANAO analysis of ATO information.

4.6 As illustrated in Table 4.4, eight projects reported actual project costs in their status reports. Of the 43 projects that did prepare status reporting but did not report the actual cost of the project: 24 applied traffic light reporting to represent their budget position; two included traffic light reporting and reported the actual project cost in less than half of their status reports; five included either traffic light reporting on budget position or no budget reporting; and 12 did not include any budget information in status reports. As also illustrated in Table 4.4, 43 of the 56 Reinventing the ATO projects that should have had closure reports either did not prepare them or if a report was prepared, it did not include the actual cost of the project.36

Table 4.4: Number of Reinventing the ATO projects where cost information was included in status or closure reports

|

|

Status report |

Closure report |

|

No. of projects that did not require document |

0 |

44 |

|

No. of projects without document |

49 |

15 |

|

No. of projects with draft or final document that did not report actual project costs |

43a |

28b |

|

No. of projects with draft or final document that reported actual project costs |

8c |

13 |

|

Total |

100 |

100 |

Note a: Two of these projects did include the actual project cost but in less than half of their project status reports.

Note b: Six of these projects indicated that no cost was recorded as the project had been undertaken from business-as-usual resources or was now being undertaken as part of business-as-usual resources. One other project indicated that the actual cost of the project had not been captured.

Note c: Two of these projects did not report the actual projects costs in all status reports but reported it in more than half of their reports.

Source: ANAO analysis of ATO information.

4.7 The inconsistency with which project status reports are being prepared, including both the frequency and content of the reporting, does not enable the ATO to effectively measure or monitor the costs associated with the Reinventing the ATO program.37 This finding is supported by an ATO internal audit of the Reinventing the ATO program (October 2016) that found the costs of the Reinventing the ATO initiatives were unclear as was the identity of those responsible for monitoring costs. The ATO further advised that costs are not being tracked at the Reinventing the ATO program level.

4.8 A review of project management documentation38 found that cost estimates were available for 67 projects totalling $300.6 million for the period from 2013–14 to 2018–19. A review of project overviews and closure reports found that 17 of the 67 projects had actual costs recorded totalling $85.0 million.39 Total actual costs were $9.2 million less than the estimated costs for those 17 projects.40 The total estimated cost for those projects with no actual reported cost is $206.4 million (50 projects).

4.9 The ATO’s costing guidance indicates that regularly tracking actual project costs can help project managers to keep their projects on track, and variances between project budgets and actual costs can be useful indicators of project progress. The guidance further states that accurately recording actual cost can assist other project managers to better estimate costs for future projects. In addition to the benefits mentioned in the ATO costing guidance, this information can inform decision-making in relation to cessation or continuation of a project.

Recommendation no.1

4.10 The Australian Taxation Office mandates and monitors the recording and reporting of actual project costs for all corporate projects.

Australian Taxation Office response: Partially agreed.

4.11 We have commenced work to improve the recording and reporting of actual project costs where considered appropriate, including:

- increased governance support to projects, and

- improving our tooling and guidance.

4.12 The ATO will ensure all projects have recording and reporting. The level of investment in the recording and reporting will be considered using a risk-based approach to ensure the balance of recording, reporting and monitoring activities is appropriate relative to the risk, materiality and cost of the project.

Is the ATO measuring and monitoring the savings associated with implementing the Reinventing the ATO projects?

The ATO has not been tracking the monetary savings associated with the Reinventing the ATO program. However, in April 2017 it implemented internal reporting on financial benefits across the office, including Reinventing the ATO projects. As the reporting process involves the verification of estimated and realised financial benefits, this should better position the ATO to consider realised savings when making operational decisions, such as reallocating resources due to productivity gains.

4.13 The ATO advised that savings are not being tracked at the Reinventing the ATO program level.41 Further, there is no guidance to instruct project managers to track or record savings in project management documentation under the old project management approach. The closure report template for the revised project management approach includes a section to report benefits but does not specifically indicate that savings or financial benefits should be reported. Consequently, of the 41 projects with closure reports and the 51 projects with status reports, none reported savings.

4.14 To improve the categorisation and monitoring of project outcomes and benefits, including savings and other financial benefits, the ATO introduced the Connected Benefits Management System in July 2016. Financial benefits were categorised under the system as external or internal and financial or non-financial. Internal financial benefits are further categorised as:

- harvestable financial benefits that are tangible savings, such as funding or staff who can otherwise be redeployed; and

- non-harvestable financial benefits that are intangible productivity savings.

4.15 In April 2017, the ATO commenced formally reporting on internal financial benefits to its Resource Forum.42 In this report, the ATO revised its definition for harvestable benefits to ‘producing a direct budget saving’ and revised the financial benefit categories to:

- notional saving—small productivity savings or cost avoidance measures that cannot be reinvested; and

- reinvested benefit—larger productivity benefits that can be reinvested (such as a full-time equivalent position).

4.16 As indicated in Table 4.5, no projects identified harvestable savings. The projects outlined in Table 4.5 were at different stages in the project lifecycle with some being planned, others in the delivery phase and some that have been closed. For those projects being planned, the estimated financial benefits are being assured by ATO Finance.