Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Australia Post's Efficiency of Delivering Reserved Letter Services

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to examine whether the Australian Postal Corporation (Australia Post) is meetings its Community Service and International obligations efficiently and the effectiveness of Commonwealth shareholders in monitoring value for money.

Summary and recommendations

Background

1. The Australian Postal Corporation (Australia Post) is a Government Business Enterprise (GBE), which provides a regulated monopoly service for letter delivery. It also provides parcel delivery and other related services on a commercial basis. In relation to its letter delivery business, Australia Post is required to meet Community Service Obligations (CSOs); together with other regulations relating to price, frequency, reliability and accessibility for the community; as well as international obligations–these are collectively referred to in this report as Australia Post’s obligations.1 Letter delivery services are classified as either reserved or non-reserved. Reserved services broadly capture the letter services.

2. Nearly three decades have passed since the current regulatory framework relating to Australia Post’s letter delivery service was first established. In that time, fundamental changes have occurred both to patterns of consumer demand for communications technology, as well as the depth and breadth of access to communications infrastructure across Australia.

3. The consequent reduction in demand for letter services has reduced Australia Post’s profitability. At the same time, the rise in e-commerce has increased demand for parcel delivery services. Over time, this has led to the profitable, commercial side of Australia Post’s business funding the losses from the declining letters business. The overall reduction in enterprise profitability has also reduced the dividends paid to Australia Post’s sole shareholder—the Australian Government.

4. In response to these developments, aspects of the regulations relating to the CSOs have been changed, and a number of price increases to the Basic Postal Rate for letter services have been notified. Together, these changes have allowed Australia Post to reduce the losses being sustained by the letters delivery service and return the enterprise to profitability. In addition, Australia Post has implemented strategies to increase the efficiency with which it meets its CSOs. However, given the outlook for letter volumes, these measures are only likely to provide a temporary solution.

5. The Australian Government is the sole owner of Australia Post, represented by the Minister for Finance and the Minister for Communications and the Arts (together, the ‘Shareholder Ministers’). In carrying out their governance responsibilities, the Shareholder Ministers are supported by their respective departments.

Audit objective and criteria

6. The objective of the audit was to examine whether the Australian Postal Corporation (Australia Post) is meeting its obligations efficiently and the effectiveness of Commonwealth shareholders in monitoring value for money.2 To form a conclusion against the audit objective, the following criteria were adopted:

- Has Australia Post implemented strategies to improve the efficiency of meeting its obligations?

- Is Australia Post meeting its obligations efficiently?

- Do the Departments of Finance, and Communications and the Arts, effectively monitor the ongoing costs and benefits of meeting the obligations?

Conclusion

7. Australia Post has developed strategies to improve the efficiency with which it meets its obligations. It has not, however, improved its efficiency in its letters business as quickly as its international counterparts. The Department of Finance (Finance) and the Department of Communications and the Arts (Communications) provide briefing to their respective Ministers on Australia Post’s performance, but greater transparency is required regarding the costs and benefits of the obligations, the distribution of those costs and benefits within the Australian community, and the longer-term strategy for Australia Post’s business model.

8. Australia Post’s strategies to improve its efficiency have focussed on process optimisation and automation along with labour force flexibility, all with the objective of improving labour productivity. Australia Post has been relatively slow in developing and implementing some of these strategies. In particular, Australia Post has not fully implemented its strategies to improve labour productivity, which were to be a key driver of the planned efficiency improvements.

9. Australia Post has improved its efficiency over time, however these improvements have been relatively slow compared to its international peers, particularly in relation to its management of operating costs.

10. While Australia Post monitors and evaluates the efficiency with which it meets its obligations, there would be scope for Australia Post to provide its shareholder with more strategic information on the long-term sustainability of the letters business; changes in Australia Post’s performance over time; and the assumptions driving key forecasts that underpin the enterprise valuation.

11. The dual shareholding arrangements that underpin many Commonwealth Government Business Enterprises (GBEs) are intended to ensure that the public policy objectives delivered by the GBE are balanced by an appropriate focus on financial performance. The guidance underpinning the governance arrangements for GBEs does not distinguish between the roles of Finance, and that of the relevant portfolio entity (in this case, Communications) as advisers to their respective ministers.

12. Finance and Communications have established regular monitoring and reporting mechanisms in their capacity as advisers to the Shareholder Ministers. The departments have also advised Government on the forecast decline in the letter delivery service. This advice supported major changes that were introduced in 2016, and informed the identification of the need for further change. The advice by the departments has typically focussed on the net profitability of Australia Post as a whole and on conservative cost estimates of the CSOs. The entities’ advice has not directly addressed the impact of reserved letter delivery service on Australia Post’s competitive market activities. In addition, Communications, in its role as the lead policy agency, has not advised its Minister on the benefits provided by the CSOs, or the distribution of those benefits within the community. Consequently, the advice has provided the department’s respective ministers with an incomplete picture of the costs and benefits of the CSOs.

13. Generating stakeholder support for policy change, particularly in the context of the current framework of the CSOs, is a lengthy process, and it can be a number of years from developing a proposal through to its implementation. Developing and testing proposals for more fundamental reforms of Australia Post’s business model may take considerably longer. The current regulations underpinning the CSOs have a ‘sunsetting’ date of April 2019. This represents an opportunity for Finance and Communications to re-evaluate the CSOs, and Australia Post’s role in delivering them, into the future.

Supporting findings

Australia Post’s strategies to improve the efficiency of meeting its obligations

14. Australia Post has identified strategies to improve its efficiency in delivering its reserved letters services, having regard to the regulatory and practical constraints faced by its business, and the need to generate support for policy changes impacting on the CSOs. These strategies have focused on reducing labour costs, through such means as process optimisation, automation, and reducing the number of penalty shifts worked. In addition, Australia Post has sought to better utilise its fixed delivery network to grow revenue from existing sources and develop new sources of revenue. However, there would be scope to assess the costs and benefits of providing letters infrastructure over and above the requirements of the CSOs.

15. The strategies adopted by Australia Post to pursue changes to service standards, increase processing efficiency and reduce costs are comparable to postal agencies in other jurisdictions that are facing similar challenges. Australia Post commenced its implementation of these strategies later than its international peers, partly due to challenges in generating the impetus for change. The high fixed costs for operating Australia Post’s delivery network, combined with the long implementation times, have highlighted the need to take a strategic, long-term view and to generate stakeholder support well in advance.

16. Australia Post is yet to realise many of its planned efficiency improvements. Australia Post’s workforce profile, combined with its decisions relating to workforce management, have created challenges in implementing, and realising the benefits of, strategies to improve efficiency, particularly in relation to penalty hours and overall staff numbers.

Australia Post’s efficiency in meeting its obligations

17. Australia Post has not performed as well as its international peers in managing its operating costs, both across its business as a whole and in relation to its letters business. Australia Post has improved its efficiency over time, however these improvements have been relatively slow compared to its international peers, including those that also operate under the constraints of government ownership.

18. Australia Post monitors and evaluates the efficiency with which it meets its obligations. However, there would be scope for Australia Post to provide its shareholder with a more strategic view of the long-term sustainability of the letters business, Australia Post’s performance in respect of reserved services over time, and the impact of the key assumptions underpinning the longer-term enterprise valuation.

Monitoring the costs and benefits of the obligations

19. The roles of Finance and Communications with respect to Australia Post are defined under the Commonwealth GBE Governance and Oversight Guidelines (the Guidelines). The Guidelines confer identical responsibilities for strategic control and oversight of GBEs upon the Portfolio Minister and the Finance Minister (together, the Shareholder Ministers). Consistent with this framework, Finance and Communications have largely taken a joint approach to supporting the governance roles of their respective ministers.

20. Previous changes to the GBE governance arrangements recognised the inherent tension between the role of GBEs as vehicles to deliver Government policy objectives and the Government’s intention that GBEs operate under a commercial framework, with a strong focus on efficiency and financial performance. These changes saw the establishment of the current dual shareholding arrangements, whereby the Government’s interest as both shareholder and policymaker were represented by the Finance Minister, and the relevant portfolio minister, respectively. These reforms also saw the establishment of a GBE unit within the Department of Finance.

21. Accordingly, while the joint briefing approach taken by Finance and Communications may be appropriate in the context of ongoing governance and oversight of Australia Post’s operations, it is unlikely to realise the intent of having dual Shareholder Ministers, particularly in relation to the longer-term, strategic reforms that will be required to ensure the sustainability of Australia Post’s business model.

22. Finance and Communications have recently strengthened their engagement with Australia Post with a view to providing their respective Shareholder Ministers with greater transparency regarding Australia Post’s strategic direction, major initiatives, financial projections, and the assumptions driving these. Finance’s analysis of the financial performance of Australia Post has, however, tended to be largely based on Australia Post’s own financial reporting, and focused on the performance of the enterprise as a whole, as opposed to the ongoing sustainability of the letter delivery service. While there is some evidence that shareholder entities have briefed their ministers in broad terms on Australia Post’s progress in realising efficiencies from its ongoing strategies, recent changes have been implemented to deepen the analysis and briefing.

23. The departments have supported policy changes which have temporarily arrested the impact of declining mail volumes. However, the letters business is anticipated to return to a loss-making position in the short-term. The timeframes required to effect policy change, together with the projected further declines in letters volumes, emphasise the need for further and more substantial policy changes in the immediate future.

24. The Department of Communications and the Arts, in its capacity as policy adviser, has examined benefits of the CSOs in general terms, but not with sufficient granularity to gain a complete understanding as to whom those benefits accrue or the value of those benefits in light of increasing access to communications technologies.

Recommendations

Recommendation no. 1

Paragraph 2.48

Australia Post should identify and address the impediments to improving the efficiency of its letters service, including implementing, and realising the benefits of, its efficiency strategies.

Australian Postal Corporation’s response: Agreed, with qualifications.

Recommendation no. 2

Paragraph 3.27

Australia Post should improve its monitoring and evaluation to:

- facilitate greater shareholder visibility regarding the key assumptions underpinning the longer-term sustainability of the business model underpinning reserved services;

- facilitate monitoring and reporting of trends over time, including in relation to implementation and benefits realisation of key efficiency strategies; and

- examine performance against relevant benchmarks.

Australian Postal Corporation’s response:

- Agreed, with qualifications.

- Agreed.

- Agreed, with qualifications.

Recommendation no. 3

Paragraph 4.16

The Department of Finance should review the GBE guidelines to ensure they give effect to the original policy intention of the dual ministerial shareholding arrangements.

Department of Finance’s response: The Department of Finance did not state whether it agrees or disagrees with the recommendation.

Recommendation no. 4

Paragraph 4.61

The Departments of Finance, and Communications and the Arts, consistent with their respective portfolio responsibilities, should:

- provide their respective Shareholder Ministers with greater transparency over the total costs and benefits of the obligations and the distribution of those costs and benefits within the Australian community;

- review the approach to funding the delivery of the community service obligations through Australia Post’s increasing involvement in competitive markets; and

- review the policy framework relating to Australia Post’s Community Service Obligations in the context of the Australian Government’s broader commitment to providing access to communications infrastructure.

Department of Finance’s response: The Department of Finance did not state whether it agrees or disagrees with the recommendation.

Department of Communications and the Arts’ response: The Department of Communications and the Arts did not state whether it agrees or disagrees with the recommendation.

Summary of entity responses

25. The Australian Postal Corporation’s, the Department of Finance’s and the Department of Communications and the Arts’ summary responses to the proposed report are provided below, with full responses at Appendix 1.

Australia Post

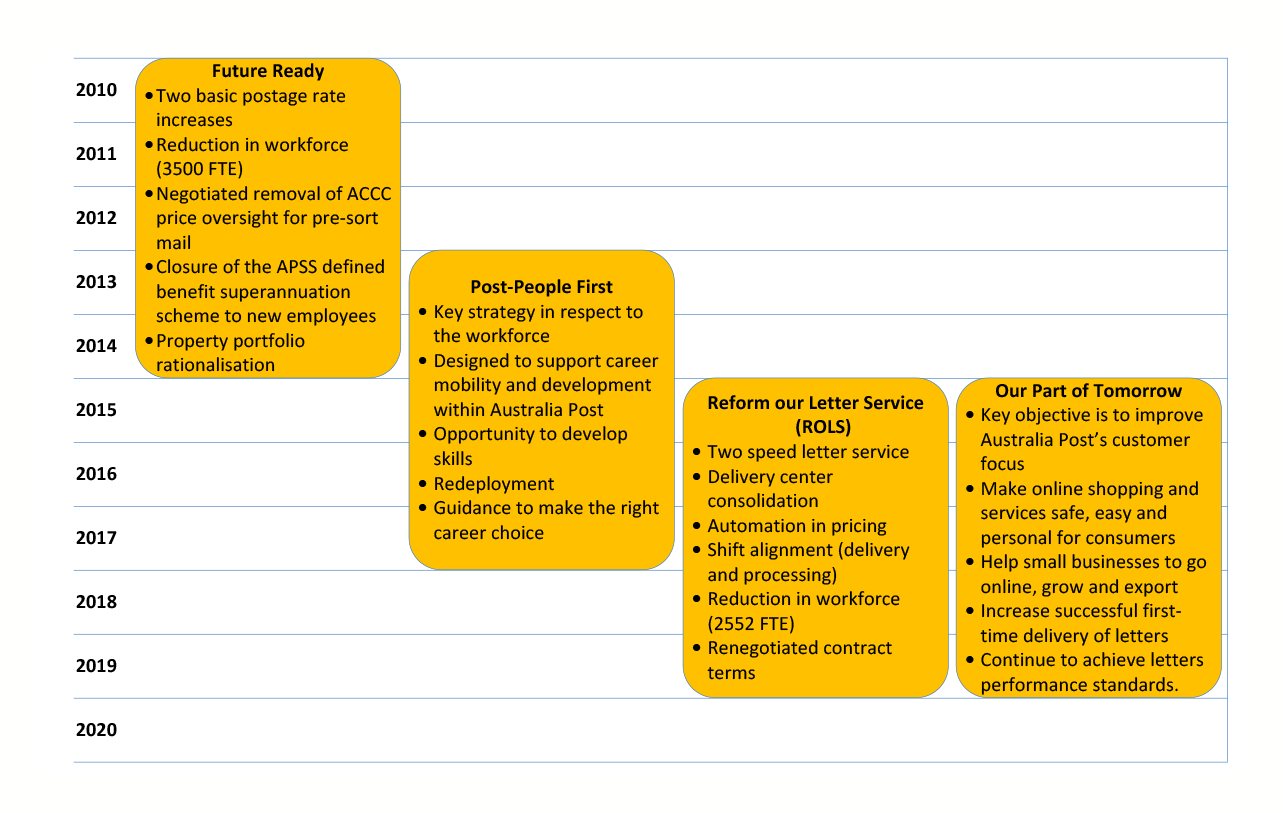

Australia Post is a large, complex and challenging business with a rich history of serving the entire Australian community. Since 2010, we have been implementing a wide-ranging transformation program, called “Future Ready”, in response to the digital disruption of our traditional core business (the letters service). This transformation program has involved investing heavily in our parcels business to secure market share as online shopping has been growing in Australia. This strategy has enabled Australia Post to maintain its nationwide community-based networks and, importantly, provide ongoing and meaningful jobs for the dedicated employees who wish to continue working in our business.

It is of paramount importance to Australia Post that we manage the decline of the community’s use of the letters service in a purposeful and orderly way, while also continuing to deliver against the Community Service Obligations and Prescribed Performance Standards that have been set by our Shareholder (the Commonwealth Government). The ongoing decline in letter volumes and revenue will continue to present significant challenges to Australia Post’s operations and financial performance. For this reason, we are committed to working closely with our Shareholder and other stakeholders to explore options to ensure the ongoing financial viability of the letters service. We will continue to track and report our progress against the targets contained in the 2015 business case that was developed for the Reform our Letters Service (RoLS) program. We are proud of our progress in realising benefits thus far, but we recognise there will be a need for ongoing review and improvement as the community’s use of the letters service continues to decline.

Department of Finance

Finance accepts the recommendations in the report, and has commented on particular recommendations.

Department of Communications and the Arts

The Department notes the ANAO’s findings that the Department has managed its responsibilities as a Shareholder Department by establishing regular monitoring and reporting mechanisms, with a strong focus on informing Ministers on the financial performance of Australia Post. We also note the finding that Shareholder Departments have strengthened engagement with Australia Post to provide greater transparency to Shareholder Ministers on Australia Post’s strategic direction, major initiatives and financial projections.

Recommendation 4 is noted. Shareholder Departments are working with Australia Post to update the method by which the cost of the CSOs is calculated. Australia Post is providing Shareholder Departments with data to allow a better understanding of the value of and distribution of the benefits of the CSOs.

1. Background

Introduction

1.1 The Australian Postal Corporation (Australia Post), is an Australian Government Business Enterprise (GBE) incorporated and operated under the Australian Postal Corporation Act 1989 (APC Act).

1.2 Australia Post provides both regulated and non-regulated services. The regulated services (primarily reserved letter services) require Australia Post to deliver letters, in accordance with prescribed performance standards, in relation to domestic and international mail.3 The non-regulated (or commercial) services include parcels, retail outlets and digital communications. Australia Post competes with other businesses in the provision of these non-regulated services. Australia Post delivers its services through an integrated postal network with significant shared costs between its regulated and non-regulated services.

Government Business Enterprises

1.3 Governments may become involved in commercial activities due to the inability of the private sector to deliver the required products or services; a preference for natural monopolies to be owned and operated by Government; or the desire to fulfil a community service obligation (CSO).4 CSOs arise either when a government requires a public enterprise to carry out activities which it would not elect to do on a commercial basis—which the government does not require other businesses in the public or private sectors to undertake—or which it would only do commercially at higher prices. CSOs are one means of achieving identified policy objectives. Australia Post is subject to CSOs in respect of ordinary letters services (discussed below at paragraph 1.9).

1.4 Government service providers are often commercialised with the objective of increasing the efficiency and effectiveness with which its resources are used. The intention is for these GBEs to be governed within an institutional framework that allows them to focus on the efficiency with which they meet their service delivery requirements. In the context of Australia Post, commercialisation was seen as being a necessary and fundamental pre-condition to improvements in efficiency, placing it on a more commercial footing, bringing it more into line with private sector competitors and subjecting it to the disciplines of the marketplace.5

1.5 However, Australia Post’s status as a Government-owned, regulated monopoly—at least in so far as its reserved services is concerned—means that the incentives associated with competitive markets, and the disciplines associated with raising equity from the market, are more difficult to replicate. Consequently, Australia Post’s obligations to act commercially sit alongside its obligations to meet its community service and other government obligations, including directions by the Minister, government policies and international conventions.6

Ministerial oversight and governance

1.6 Although GBEs often have a legal existence that is independent of government, they are subject to governance and reporting frameworks set out both in their respective enabling legislation as well as broader legislation and rules governing the management of GBEs. Australia Post is a self-funded entity with the Australian Government its sole owner, represented by the Minister for Finance, and the Minister for Communications and the Arts (together, the ‘Shareholder Ministers’). The principle functions of Australia Post under the APC Act are to supply postal services within Australia, and between Australia and places outside Australia.

1.7 While the Australia Post Board and the corporation’s management are responsible for day-to-day operation, certain key decisions and significant events must be notified to the Shareholder Ministers.7

1.8 The Department of Finance (Finance) and Department of Communications and the Arts (Communications), as the principal advisers to the Shareholder Ministers, develop policies relating to postal services, and monitor Australia Post’s compliance with the APC Act and the Commonwealth Government Business Enterprise Governance and Oversight Guidelines8 (the Guidelines). Finance provides oversight and governance through its role in overseeing GBEs. Communications has a dual role as the chief policy advisor and shareholder.

Community Service Obligations (CSOs)

1.9 As noted above, Australia Post is subject to regulation in terms of the service levels provided for its reserved letter services, but not in respect of the other commercial activities it undertakes in competitive markets. The CSOs are set out in section 27 of the APC Act, and require Australia Post to supply a letters service at a uniform rate within Australia for standard postal articles; ensuring that the service is reasonably accessible to all Australians; and meets the social, industrial and commercial needs to the Australian community. Detailed performance standards covering frequency, accuracy, speed of delivery and accessibility of retail outlets and mail boxes are prescribed in the Australian Postal Corporation (Performance Standards) Regulations 1998 (the APC Regulations).9 These are set out in Table 1.1.

Table 1.1: Australia Post’s Community Service Obligations

|

Performance standard |

|

|

2015–16 performance |

||

|

Lodgement |

|

||||

|

10 000 street posting boxes |

15 357 |

||||

|

Delivery timetablesa |

Priority |

Regular |

|

||

|

Delivery within a State |

|||||

|

Metro to metro |

Next business day |

3 business days |

Maintained |

||

|

Same/adjacent country to country |

Next business day |

3 business days |

Maintained |

||

|

All else |

2 business days |

4 business days |

Maintained |

||

|

Delivery between States |

|||||

|

Metro to metro |

2 business days |

5 business days |

Maintained |

||

|

Country to metro |

3 business days |

6 business days |

Maintained |

||

|

Metro to country |

3 business days |

6 business days |

Maintained |

||

|

Between country areas |

4 business days |

7 business days |

Maintained |

||

|

On-time delivery |

|

||||

|

94.0 per cent of reserved services letters |

96.2 per cent |

||||

|

Accessb |

|

||||

|

4 000 retail outlets |

4 392 |

||||

|

2 500 retail outlets in rural and remote areas |

2 551 |

||||

|

Retail outlets located so that: Metropolitan areas – at least 90 per cent of residences within 2.5km of an outlet Non-metropolitan areas – at least 85 per cent of residences within 7.5km of an outlet |

93.6 per cent 88.8 per cent |

||||

|

Delivery frequencyc |

|

||||

|

98.0 per cent of delivery points to receive five days a week |

98.8 per cent |

||||

|

99.7 per cent of delivery points to receive deliveries no less than twice a week |

99.9 per cent |

||||

Note a: Regulation 6.

Note b: Regulation 9.

Note c: Regulation 5.

1.10 The cost of maintaining the letters network to meet the CSOs is largely determined by the formulation of the CSOs as they relate to network coverage, density and delivery frequency.

1.11 Aspects of Australia Post’s letters service are also subject to price regulation. The reserved letters service is a ‘notified service’ under Part VIIA of the Competition and Consumer Act 2010 and is regulated by the Australian Competition and Consumer Commission (ACCC). Australia Post must notify the ACCC if it proposes to increase the price of these services. The ACCC assesses notified price increases on the basis of whether they will lead to an over-recovery of Australia Post’s costs for its letters services.10

1.12 Australia Post also has obligations with respect to the exchange of international mail arising from Australia’s participation in the Universal Postal Union (UPU), of which it has been a member since 1907.11 The UPU obligations require Australia Post to deliver inbound international mail on terms no less favourable than those applied to comparable items in the domestic service, increased by the time normally required for customs clearance. Consequently, changes to the CSOs can have a significant impact on the cost to Australia Post of meeting the international obligations. Australia Post receives remuneration for providing these services from the designated operators for member countries of the UPU for delivering inbound international mail based on provisions set out by UPU treaties, but these payments do not recover the cost of service delivery. This net shortfall is understood to currently be in excess of $50m per annum12, which is partly accounted for in the methodology by which Australia Post quantifies its losses from the letters service.

1.13 In this report, the term ‘obligations’ is used to collectively describe Australia Post’s responsibilities with respect to its CSOs, the prescribed performance standards, as well as its international obligations under the UPU.

Implications for Australia Post’s business model

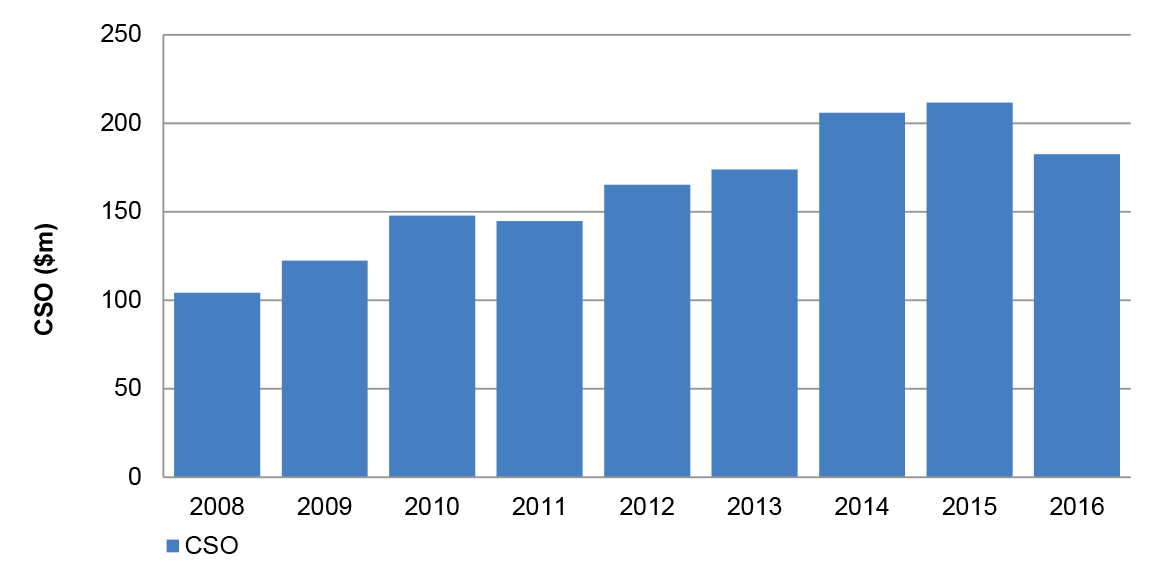

1.14 The losses incurred by Australia Post in meeting its CSOs are expected to increase as letter volumes continue to decline (Figure 1.4). In contrast, Australia Post’s revenues from its commercial operations in the parcels sector continue to grow. In its Annual Report 2016, Australia Post estimated letter volumes had declined by 43 per cent since 2008–09. The losses that Australia Post incurred in meeting its CSOs as set out in section 27 of the APC Act were estimated to be $183 million in 2016, as shown in Figure 1.2.

1.15 The decline in letter volumes is expected to increase as digitisation accelerates. Given the current framework for delivery of the CSOs, this is expected to have a significant impact on Australia Post’s overall enterprise performance.

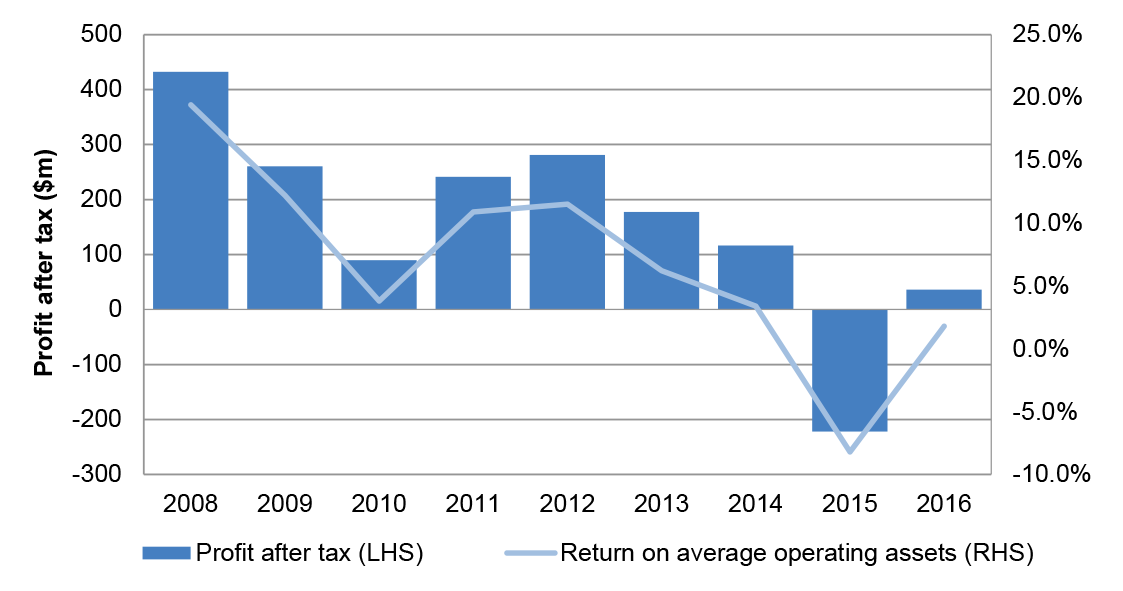

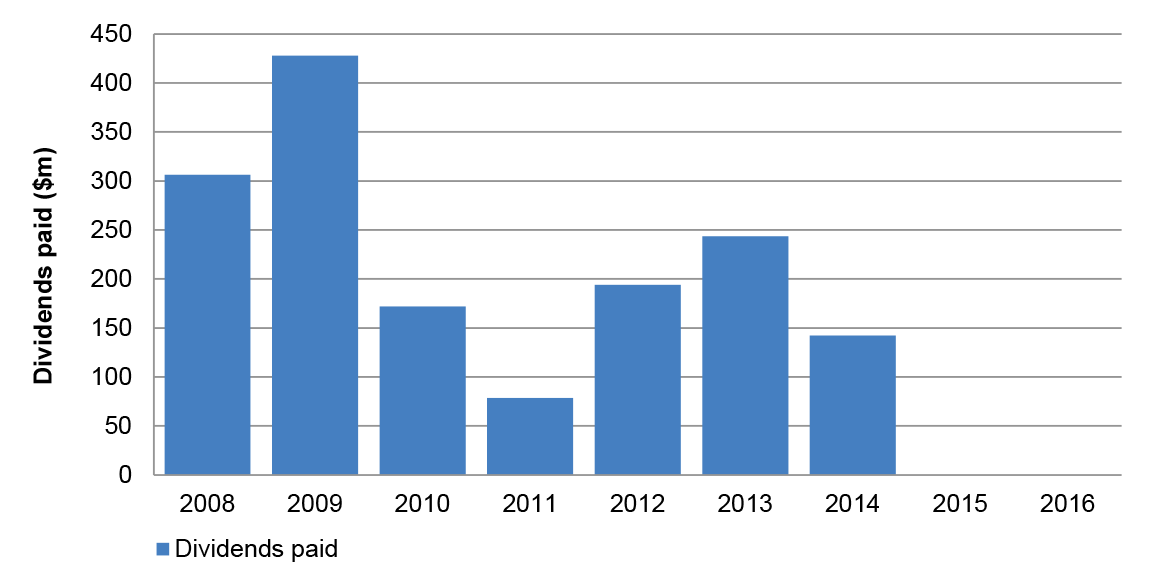

1.16 The significant decline in historical letter volumes are reflected in the following figures on Australia Post’s profitability, CSO costs and dividends between the 2008–09 and 2016–17 financial years. In particular:

- In 2009–10, Australia Post’s profitability was significantly affected by the slowdown in global economic activity and the restructuring costs associated with the Future Ready Program (Figure 1.1). Dividend payments are based on net profit from the previous year, so there is a consequential reduction in dividends paid in 2010–11 (Figure 1.3).

- In 2014–15, the decline in letters contributed to a net loss after tax of $222 million (Figure 1.1)

Figure 1.1: Australia Post’s profitability 2008–2016

Source: ANAO analysis based on Australia Post Annual Reports.

Figure 1.2: Australia Post’s Community Service Obligation costs 2008–2016

Source: ANAO analysis based on Australia Post annual reports.

Figure 1.3: Australia Post’s dividend payments 2008–2016

Source: ANAO analysis based on Australia Post annual reports.

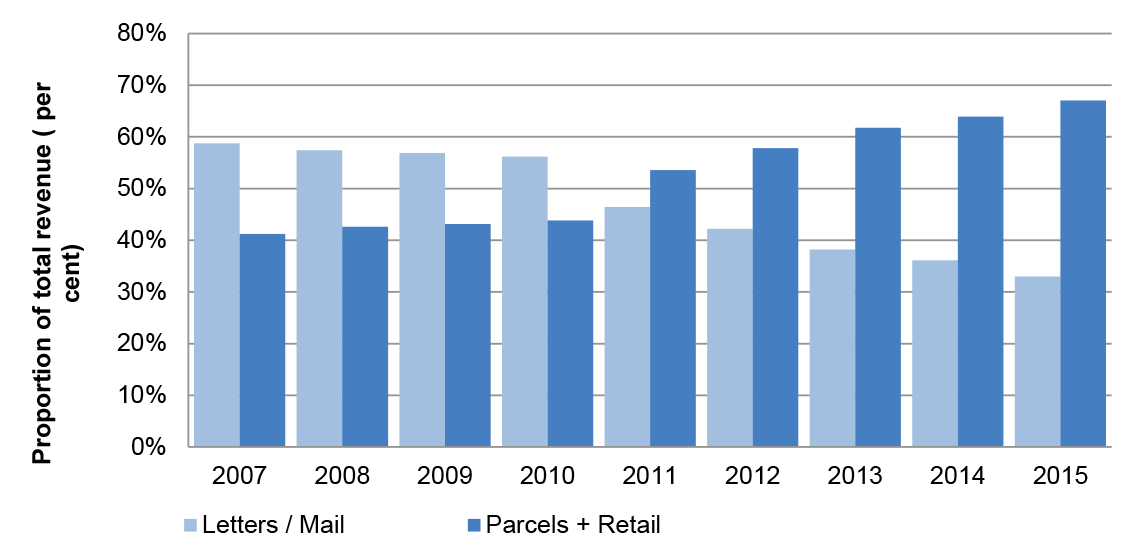

1.17 The decline in letter volumes has resulted in the revenue share of Australia Post’s letter services segment falling from 59 per cent of total revenues in 2007, to 34 per cent in 2015.13 In contrast, the relative size of the competitive business (that is, the parcels and logistics, and retail and agency services) has grown from 41 per cent of total revenues in 2007 to 66 per cent in 2015. This reflects the significant growth in the parcels business (inclusive of acquisitions), which between 2007 and 2013 had a compound annual average growth rate of 13 per cent per annum, growing from $1.2 billion in 2007 to $3.2 billion in 2015 (Figure 1.4).

Figure 1.4: Australia Post’s revenues—proportion of letters vs parcels 2007–2015

Source: ANAO analysis based on Australia Post Annual Reports. This relies on the financial statements in the segment reporting which were impacted by a number of business organisational restructures during this period. Changes have been reflected in the segment notes in the year of the change and comparatives restated to provide a comparative basis.

1.18 The majority of letters delivered by Australia Post are those sent by businesses and governments. Australia Post does not have any specific data on private consumers however it estimates that private consumers generate approximately 3 per cent of addressed letter volumes. This is based on analysis of stamp sales (which is around 10 per cent of addressed letter volumes).14 In addition, the rate of change in the volume of letters sent by individuals has fallen proportionally much faster than the rate of change in the volume of letters sent by businesses and governments (by 57 per cent and 27 per cent respectively between 2008 and 2016).

1.19 The prescribed performance standards (Table 1.1) are set to expire in April 2019. Public consultation on the development of the new prescribed performance standards is expected to be undertaken during 2018.

Audit approach

1.20 The objective of the audit was to examine whether the Australian Postal Corporation is meeting its obligations efficiently; and the effectiveness of Commonwealth shareholders in monitoring value for money.15

1.21 To form a conclusion against the audit objective, the following high level criteria were adopted:

- Has the Australian Postal Corporation implemented strategies to improve the efficiency of meeting its obligations?

- Is the Australian Postal Corporation meeting its obligations efficiently?

- Do the Departments of Finance, and Communications and the Arts, effectively monitor the ongoing costs and benefits of meeting the obligations?

1.22 The audit methodology included reviewing:

- Australia Post’s Executive Board papers, corporate plans, and financial reports;

- price notifications by Australia Post to the ACCC, relating to the Basic Postal Rate;

- reports examining Australia Post’s efficiency and performance, including benchmarking against international comparators; and

- ministerial correspondence and other advice provided by Finance, and Communications.

1.23 Discussions were also held with relevant staff in Australia Post, Finance and Communications.

1.24 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $599 851.

1.25 The team members for this audit were Andrew Rodrigues and EY–Infrastructure Advisory.

2. Australia Post’s strategies to improve the efficiency of meeting its obligations

Areas examined

The ANAO examined whether Australia Post has developed and implemented strategies to improve the efficiency with which it meets its Community Service Obligations (CSOs).

Conclusion

Australia Post’s strategies to improve its efficiency have focussed on process optimisation and automation along with labour force flexibility, all with the objective of improving labour productivity.

Australia Post has been relatively slow in developing and implementing some of these strategies. In particular, Australia Post has not fully implemented its strategies to improve labour productivity, which were to be a key driver of the planned efficiency improvements.

Area for improvement

The ANAO made one recommendation to Australia Post aimed at addressing the delays in implementing, and realising the benefits of, its strategies to improve the efficiency of its reserved services.

Is Australia Post developing strategies to improve its performance in meeting its obligations?

Australia Post has identified strategies to improve its efficiency in delivering its reserved letters services, having regard to the regulatory and practical constraints faced by its business, and the need to generate support for policy changes impacting on the CSOs. These strategies have focused on reducing labour costs, through such means as process optimisation, automation, and reducing the number of penalty shifts worked. In addition, Australia Post has sought to better utilise its fixed delivery network to grow revenue from existing sources and develop new sources of revenue. However, there would be scope to assess the costs and benefits of providing letters infrastructure over and above the requirements of the CSOs.

Opportunities to improve efficiency

2.1 In competitive markets, firms can enhance their efficiency by reducing costs for a given output; increasing output for given cost; more closely matching output and pricing to demand; and ensuring that their business can adapt to changing market conditions.

2.2 As a GBE, Australia Post is required to operate efficiently, price efficiently and earn a commercial rate of return.16 As noted in Chapter 1, Australia Post’s letters delivery service is a regulated monopoly. Consequently, Australia Post faces a number of regulatory, commercial and practical constraints on its delivery of its letters service. These are detailed in Box 1.

|

Box 1: Factors shaping Australia Post’s corporate strategies |

|

Note a: For notified products, the Australian Competition and Consumer Commission must assess the proposed price increases for Australia Post’s notified Reserved Services under sections 95X and 95Z of the Competition and Consumer Act 2010. Notified services represent around 15 per cent of Australia Post’s volume of items delivered (that is, letters and parcels). The ACCC can object to any price increases proposed by Australia Post if it considers that the prices will exceed efficient costs (including an appropriate rate of return). The notified price then indirectly sets the baseline for Australia Post’s negotiation of other prices with customers.

Note b: Australia Post must charge a single uniform rate of postage for its letter service within Australia under section 27(3) of the Australian Postal Corporation Act 1989.

Note c: Australia Post advised that ‘transactional’ mail is relatively inelastic, and is the dominant volume segment. Volumes for promotional mail, which accounts for around 20 per cent of total letter volumes, are more responsive to changes in price.

Note d: Australia Post, Reform our Letter Service: Detailed Design Blueprint Effective 15 July 2014

Note e: People-related costs comprise costs related to staff labour, contract labour, corporate superannuation entitlements, licensees and contractors used for mail delivery services. This is discussed further at paragraph 2.32.

2.3 These factors have imposed some constraints on Australia Post’s ability, in the short-run, to determine its revenues, output, or quality (in terms of service standards) for its reserved letters business, and therefore to improve the efficiency with which it meets its obligations.

Australia Post’s strategies and programs to improve its efficiency

2.4 Given its cost base and regulatory obligations, Australia Post advised that its strategies, objectives and supporting programs to improve its efficiency in meeting its obligations have been shaped by a strong focus on building stakeholder support for major changes to its letters business. Key strategies, objectives and supporting programs are outlined at Table 2.1:

Table 2.1: Australia Post’s strategies and programs to improve efficiency

|

Strategy/Program |

Date |

Description |

|

Future Ready |

2010 |

Future Ready was designed to reshape the enterprise to meet the challenges and opportunities presented to it, and to bring a stronger commercial focus. Its strategic objectives were to manage the decline of the regulated letters business; grow the non-regulated business and manage customers through the change; and support Australia Post’s staff, partners and the community during the process. |

|

Post People First |

2013 |

Key workforce enterprise strategy designed to support career mobility and development by ensuring that staff have access to available jobs within Australia Post. |

|

Reform of our Letter Services (RoLS) |

2015 |

Key program designed to reform the letters delivery service in response to declining letter volumes. |

|

Our Part of Tomorrow |

2015 |

Our Part of Tomorrow was designed to improve Australia Post’s customer focus, with a focus on digital and online markets. Its strategic objectives include: running the current business efficiently; implementing Australia Post’s reform program; accelerating Australia Post’s future in eCommerce delivery; and designing and scaling future eCommerce services. |

Note: Further detail on the timing of Australia Post’s key strategies is included at Appendix 3.

2.5 Broadly, Australia Post’s strategies in respect of its letters service have focussed on:

- process optimisation particularly to increase labour flexibility and reduce costs;

- process automation to use better technology to reduce costs;

- obtaining better utilisation of its delivery network;

- obtaining regulatory approvals to increase the price of its regulated letters products; and

- contributing to the policy discussion on modifying the prescribed performance standards it is required to meet.

Each of these is discussed below.

Changes to service standards

2.6 Australia Post has recognised that two key drivers of the losses it has sustained in meeting the CSOs have been the formulation of the CSOs themselves; and the ongoing decline in letters volumes. Australia Post has put forward changes to the CSOs to reduce the losses from its regulated letters business. Australia Post’s key enterprise strategy from 2010–2014 was embodied in ‘Future Ready’, which was developed partly in response to declining letters volumes, which by 2008 were gathering momentum. This program ultimately led to the introduction of the RoLS program in 2014.

2.7 As part of this process, Australia Post made a number of representations to Government during 2013 and 2014, to build the case for more comprehensive changes to the reserved letter services. These included the:

- 2013–14—2016–17 Corporate Plan;

- Postal Services Review; and

- Advice Paper to the Departments of Finance, and Communications and the Arts.

2.8 Australia Post’s international obligations are also an important driver of its costs. As noted at paragraph 1.12, the Universal Postal Union (UPU) convention requires Australia Post to deliver inbound international mail on terms no less favourable than those applied to comparable items in the domestic service, increased by the time normally required for customs clearance. Australia Post works closely with the Department of Communications and the Arts (Communications) to manage its international obligations as a designated party under the UPU Convention. These obligations are the subject of lengthy multilateral negotiations, the main focus of which is to increase the level of Australia Post’s cost-recovery with regards to its international mail activities (that is, covering inbound and outbound international mail). In addition to the UPU, Australia Post consults with its international peers through regular forums such as Kahala to exchange insights and information17, executive field trips and internal monitoring of movements of international pricing and volume trends.

2.9 The outcomes in this regard are predominantly a function of the prescribed performance standards and cost recovery (that is, prices) applying to the domestic network. Domestic postage prices are not the only factor in determining cost recovery under the UPU; the framework for determining remuneration under the UPU also involves a formula for converting postage rates, as well as a ‘price cap’ on remuneration.18 However, supporting change to its domestic letters delivery obligations is one of the key ways Australia Post can manage the cost of meeting its obligations under the UPU.

Securing price increases

2.10 In respect of Australia Post’s ‘notified services’ (including much of the letters business) the Australian Competition and Consumer Commission (ACCC) assesses whether the proposed prices will exceed efficient costs (including an appropriate rate of return).

2.11 During the period from 2010–15, Australia Post sought and obtained regulatory approval for three increases to the Basic Postage Rate (55 cents to 60 cents; 60 cents to 70 cents; 70 cents to $1.0019) to improve the rate of cost recovery of its letters business. Notwithstanding these increases, prices still did not fully recover the costs of providing the services. Because demand for reserved letters services is relatively inelastic to price20, additional price increases in the Basic Postage Rate have increased total revenue and increased the financial performance of the letters business. However the ability to continually do this would be influenced by regulatory constraints, community expectations, and Australia Post’s objective of generating broad stakeholder support for its proposed changes.

2.12 During this period, Australia Post also negotiated a reduction of ACCC price oversight for ‘PreSort’21 mail in October 2011, which better enabled Australia Post to set more commercial and cost reflective prices for these products.

Leveraging the delivery network

2.13 As noted in Chapter 1, aspects of Australia Post’s delivery network are shared across both its letter and parcel delivery services. Accordingly, Australia Post’s strategies for increasing the efficiency of its letters delivery service have included pursuing economies of scale and scope across its delivery network. These strategies include:

- initiating the program to build our Future Parcels Network;

- launching the MyPost Digital Mailbox;

- acquiring StarTrack, Mail Call, MailPlus and SecurePay; and

- enhancing the retail network (with Superstores, 24/7 zones, Self-service terminals).

2.14 These strategies all seek to improve efficiency by utilising Australia Post’s network infrastructure to generate new sources of revenue or generate additional revenue from existing sources by: increasing network capacity to handle more mail (Future Parcels Network); bringing new revenue streams (MyPost Digital Mailbox, acquisitions) and attracting new customers; and increasing the average spend of existing customers (enhancing the retail network).

2.15 In April 2017, Australia Post announced its intention to merge its parcels, and letters and mail networks to form a new eCommerce Delivery Team. The aim of the merger was to streamline shared functions and costs to improve productivity, and to increase employment mobility for staff between businesses to increase labour utilisation. The merger builds on other efficiency initiatives to increase network utilisation such as using the letters and mail network to deliver small parcels, which commenced in 2013 for parcels up to two kilograms. Australia Post has shifted its strategic focus to an enterprise strategy called ‘Our Part of Tomorrow’, which commenced in 2015. Key objectives relevant to the efficiency of the letters business include:

- increasing successful first-time delivery;

- continuing the move to day-time processing shifts, away from night-time or overtime shifts; and

- installing world-class processing machines, with higher processing speeds and lower error rates.

2.16 Looking forward, Australia Post continues to consider the options to align the process and delivery systems and costs to declining volumes, including options relating to:

- product offering—further slowing down the regular product and price increases;

- further automation of mail handling and consolidation of the network;

- further adapting delivery modes; and

- leveraging new machine and information technology across the supply chain.

2.17 Australia Post still exceeds the levels of service required by the legislated performance standards in respect of the number of street posting boxes (more than 50 per cent above target) and the number of retail outlets (almost 10 per cent above). Australia Post has advised that services provided above the CSOs, and the cost/benefit analysis of these services, is largely driven by community expectations and population growth, including providing new services for growing areas, and the challenges in reducing services in declining demographic areas—particularly rural and remote areas.

2.18 The number of additional posting boxes over and above the legislated standards is significant (for example, 5 357 posting boxes above the standards in 2016–17), which may impose additional costs, notwithstanding post boxes can be used to provide non-reserved services (for example, delivery of some parcels).

Reducing labour costs

2.19 As noted earlier, the majority of Australia Post’s costs in maintaining its letters network are fixed, in the sense that the cost of maintaining the delivery network capable of meeting the CSOs is not significantly impacted by the volumes of mail moving through the network. The most significant cost of maintaining the network is labour costs.

2.20 Consequently, Australia Post’s key strategies to reduce its network costs have focussed on investments in the network infrastructure to optimise and automate processes; reducing the frequency of deliveries (while still meeting its obligations); enhancing workforce flexibility; consolidation of mail processing and delivery; and extending processing shifts through using a longer day time processing window, which enabled an increase in the volume of mail that was automated and also provided opportunities to reduce the number of hours worked at penalty rates. Together, these strategies are intended to deliver savings in labour costs through increased processing efficiency. The total savings from the network and labour force optimisation strategies under RoLs were anticipated to deliver a total of $339 million in savings, which in cost terms would be equivalent to an FTE reduction of nearly 3 500. This would represent around 22 per cent of total labour costs for the reserved letters service workforce.

2.21 In the context of agreeing changes to the reserved letters service delivery framework, Australia Post decided not to seek forced redundancies at the Award level for employees affected by the RoLS program. Australia Post subsequently reflected that decision in its Enterprise Bargaining Agreement, which is current until August 2020. Therefore, actual reductions in staff numbers, relating to the reserved letters network pursuant to the RoLS reform program, were to be achieved through voluntary redundancies.

Table 2.2: Reform our Letters Service—network and labour force optimisation strategies

|

Process |

Description |

Projected savings 2018–19 ($m) |

|

Automation impacts in delivery |

New machines at major mail centres will automate sorting of mail and reduce sorting times and associated labour costs. |

128 |

|

Implementing the National Delivery Model (NDM) |

Under the NDM, regular mail will be delivered every second weekday (as opposed to every weekday), reducing the time and cost of outdoor delivery rounds. |

53 |

|

Increasing automation in Mail Centres |

Investment in new machines will reduce manual work effort, reduce number of required operators per machine and improve throughput rates. |

52 |

|

Shift alignment in delivery |

This will drive savings by increasing the number of non-penalty shifts worked. |

45 |

|

Renegotiating contract terms |

Renegotiation of terms for delivery contractors is expected on more favourable terms for Australia Post. |

33 |

|

Shift alignment in processing |

This will drive savings by increasing the number of non-penalty shifts worked, with all regular mail to be processed during the day.a |

18 |

|

Consolidating processing of regular mail |

Consolidation of mail processing activities will reduce the number of Mail Centres from 15 to 4. |

4 |

|

Consolidating Delivery Centres |

Consolidation of Delivery Centres into existing sites to allow disposal of surplus centres. |

2 |

|

Vehicle optimisation |

Optimisation of vehicle selection for delivery rounds based on conditions, terrain and density (for example, using electric bicycles). |

3 |

|

Street Posting Box optimisation: |

Aligning the Street Posting Box clearance time (that is, cut-off times) with mail centre processing windows. |

0.6 |

|

TOTAL |

|

339 |

Note a: The projected saving from shift alignment in processing is targeted to have been achieved by the end of the 2016–17 financial year. The remaining figures in the ROLS blueprint document are cumulative savings over the four years, targeted to be achieved by the end of the 2018–19 financial year.

Source: Australia Post, 2014, Reform our Letters Service - Detailed Design Blueprint, p. 73, 111.

2.22 The total costs of the network reforms from the RoLS program, including transition, implementation and capital costs, as well as anticipated redundancy incentives, is estimated at $278 million.22

Other relevant corporate programs

2.23 A number of other, often broader, programs have been progressing simultaneously with the RoLS program. These include:

- Australia Post’s Post People First (PP1st) program, which is designed to support career mobility and development within Australia Post;

- work to support the ongoing commercial viability of the licensed post offices (LPOs), and through them the delivery network; and

- property portfolio rationalisations, which are ongoing.

Are Australia Post’s strategies comparable with relevant international postal agencies?

The strategies adopted by Australia Post to pursue changes to service standards, increase processing efficiency and reduce costs are comparable to postal agencies in other jurisdictions that are facing similar challenges. Australia Post commenced its implementation of these strategies later than its international peers, partly due to challenges in generating the impetus for change. The high fixed costs for operating Australia Post’s delivery network, combined with the long implementation times, have highlighted the need to take a strategic, long-term view and to generate stakeholder support well in advance.

International comparisons

2.24 There have been several benchmarking reviews of Australia Post’s performance in delivering its letters delivery service undertaken previously, which provide some evidence that Australia Post has improved the efficiency of meeting its obligations over time.

2.25 The two key reviews were undertaken by Economic Insights (on three separate occasions)23 and WIK-Consult.24

2.26 Economic Insights benchmarked Australia Post’s efficiency against six other countries based on Total Factor Productivity (production of output produced relative to inputs used) and Partial Factor Productivity (inputs of labour, operating expenditure and capital expenditure) parameters and found that the:

- results of the 2009 Productivity Report showed that most of the benefits from Australia Post’s reserved service productivity improvements over the past 12 years have been passed on to consumers in the form of real price reductions.

- 2012 Benchmarking Report concluded that for the unadjusted Total Factor Productivity results, Australia Post ranked second out of its peers.

- 2012 Productivity Report found that Australia Post Total Factor Productivity indexes have outperformed the market sector multifactor productivity over the last 15 years.

2.27 WIK-Consult found that:

- Australia Post’s efficiency in letter operations has lagged behind its international peers, with relatively poor performance in respect of efficiency improvements and cost savings between 2008–2014.

- Australia Post’s modernisation program, which will continue until 2018–19, envisaged savings that were conservative in light of international best practice, but ambitious in light of Australia Post’s past performance.

- Falling letters volumes are common to postal operators around the world, and given these operators are typically already some years ahead of the experience in Australia (in terms of when major letter transformation programs were implemented—between four and nine years before Australia Post’s RoLS program), there is scope to learn from their strategies and approaches.

- There were additional opportunities for Australia Post to increase efficiency and achieve substantial cost savings.

- Flexibility in work place arrangements are crucial to achieving the above outcomes.

2.28 Australia Post acknowledges that it has been relatively slow in adopting automation strategies to improve the efficiency of meeting its obligations. In most other countries the major letter transformation programs began in the 2005–10 period, while Australia Post commenced its RoLS program in 2014. However, Australia Post has also expressed the view that:

- Transformations to the postal network were best made in conjunction with changes to the prescribed performance standards underpinning the CSOs, the latter of which required Government agreement. Designing and gaining support for these reforms took two and a half years, and there were significant stakeholder challenges in building consensus around the need for significant change.

- The fall in letter volumes had been relatively slower in Australia compared to some other countries, at least up to the point when the recent changes were developed.

- Australia Post’s network has some unusual features (for example, the small number of key mail centres) when compared to most of the countries that Australia was benchmarked against, and a customer base with relatively lower customer and mail density, and thus it is difficult to make static and absolute comparisons of efficiency across postal agencies; and

- Australia Post had limited capital at its disposal, particularly given the financial performance of its letter delivery service, and decided to focus more on growing the parcels business to offset the decline in the letters business.

2.29 As noted in Chapter 1, Australia Post’s options to increase the efficiency of its letters delivery service are impacted by the prescribed performance standards underpinning the CSOs. This is not unique to Australia. Further, the relatively late peak in letters volumes in Australia compared with overseas represented an opportunity for Australia Post to learn from the experience overseas. In particular:

- Changes to postal services in Australia requires engagement with numerous stakeholders, including: a heavily unionised workforce in a challenging workplace relations environment; rural and remote stakeholders; and licensed post offices. While changing postal services does have inherent challenges, it has been a highly sensitive issue in many countries. Many comparable postal agencies have managed to build support for the necessary changes more quickly. In most other countries, the major letter transformation programs began in the period from 2005–10, while Australia Post commenced its RoLS program in 2014.25

- The later, more modest fall in letter volumes in Australia compared to some countries may have reduced the urgency of Australia Post’s actions, but overseas experience also signalled the likely outlook in respect of volumes (which has largely been proven to be correct) and could have encouraged Australia Post to respond sooner.

- The unusual features of network (for example, low customer and mail density, the small number of key mail centres) did pose challenges, but other countries with similar networks undertook modernisation sooner. Differences in the operating environment faced by Australia Post compared with its international peers make static and absolute comparisons of efficiency difficult. That said, the WIK report draws its conclusions based on a qualitative assessment of where Australia Post sits on the modernisation path and the trend in operating cost performance over the recent past (that is, it compares the operating cost efficiency improvements each postal agency has made).

- A decision to pursue a growth strategy in the parcels delivery service would not of itself preclude a stronger focus on improving the efficiency of reserved letter services—indeed, a number of postal agencies internationally have done both. In addition, the business cases presented to Australia Post’s Executive Board supporting the investments in network optimisation have invariably shown very positive prospective returns on investment, including after accounting for potential voluntary redundancy payments in some cases.

2.30 The high proportion of fixed costs incurred by Australia Post in maintaining its reserved services delivery network, as well as the long implementation times required to implement changes to the network, highlight the need to take a strategic, long-term view of potential change, and to generate stakeholder support for those changes well in advance. Moreover, these changes were supported by positive internal rates of return.

Has Australia Post implemented its strategies effectively?

Australia Post is yet to realise many of its planned efficiency improvements. Australia Post’s workforce profile, combined with its decisions relating to workforce management, have created challenges in implementing, and realising the benefits of, strategies to improve efficiency, particularly in relation to penalty hours and overall staff numbers.

2.31 As outlined earlier, Australia Post’s cost base for meeting its obligations is largely determined by the requirements of the CSOs, rather than the volume of mail flowing through the network.26 The majority of the network costs are shared between the reserved and non-reserved services. For example, 96 per cent of reserved services costs are ‘attributable costs’ rather than direct costs.27

2.32 The overwhelming majority of the costs of operating Australia Post’s delivery network are comprised of labour costs which make up around 70–80 per cent of total costs for reserved services. Consequently, the ability of Australia Post to realise its efficiency improvements has depended on its ability to deliver the labour cost reductions envisaged in its corporate strategies. The primary strategy to address issues associated with efficiency of reserved services being the RoLS program, which was designed to achieve reductions in costs.

2.33 In addition, Australia Post’s implementation of its strategies have been impacted by:

- the composition of Australia Post’s workforce; and

- Australia Post’s workforce management policies.

Australia Post’s workforce

2.34 Australia Post’s workforce has:

- a significant proportion of permanent and full-time employees, with the majority of employees contracted under the Enterprise Bargaining Agreement and its terms and conditions;

- an average age of 50 years old in the Letters and Mail Network with high average tenure (16 years) and low levels of turnover; and

- historically had a low reliance on voluntary redundancies which made up 2.2 per cent of staff exits between 2014–15 and 2017–18, compared to natural attritions (voluntary retirements and other staff separations) which accounted for 16.1 per cent of total staff departures.

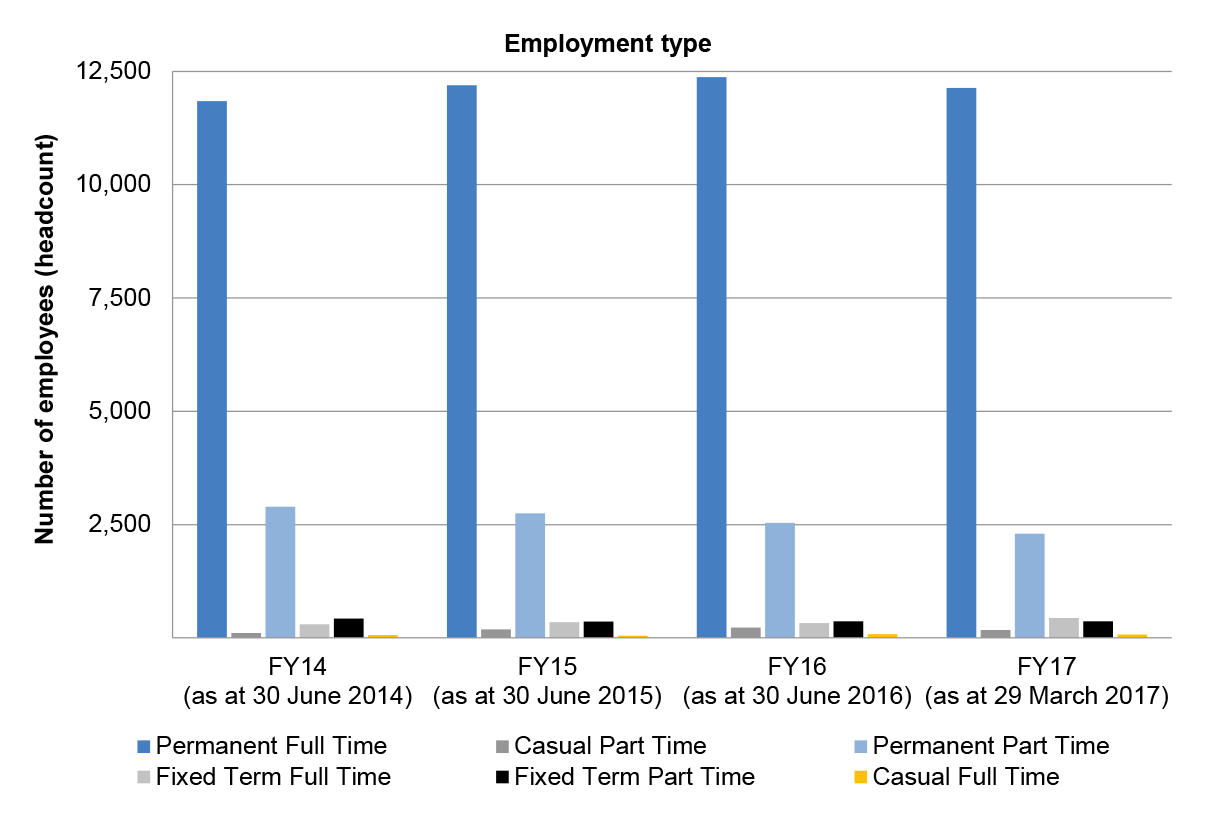

Figure 2.1: Australia Post staffing composition (full time equivalent)

Source: ANAO analysis based on Australia Post data.

Workforce management policies

2.35 The original Postal Service Optimisation business case underpinning RoLS envisaged a cost of $122 million and a reduction in staffing numbers of 1 417. The original announcement of Government policy to support the reforms did not rule out involuntary redundancies to meet the efficiency objectives of the reform program. However, in March 2015, the (then) Managing Director of Australia Post made a commitment that Australia Post ‘would not force redundancy on our people who are directly impacted by operational changes.’ The Managing Director made the commitment in the interests of minimising potential disruptions across the business as a whole (including through any industrial action); as well as minimising any negative impacts on key stakeholder groups, including its employees. However, this commitment was not the subject of formal prior approval from the shareholders; from the Board; or formal consideration at executive management level.

2.36 At the time, Australia Post had taken the view that securing broad stakeholder support would be necessary to underpin the changes required as part of the RoLS program. Australia Post considered its commitment—regarding redundancies arising from operational changes – was necessary to achieve this outcome.

2.37 In early May 2015, Australia Post’s Board endorsed the commitment to no forced redundancies at the Award level for staff affected by the RoLS program. This was subsequently confirmed nearly a year later, in March 2016, when the Government issued its Statement of Expectations (SOE) to Australia Post, which reiterated the commitment to no forced redundancies for the life of the reform for award-level employees impacted by the reforms.28

2.38 Australia Post’s decision not to use forced redundancies in implementing RoLS informed key workforce management programs, including its redeployment program, retraining and employee support, the approach to enterprise bargaining and its engagement with the key labour unions.

Shift alignment

2.39 A significant focus of the RoLS program is to decrease the number of hours worked at penalty rates in distribution centres by reducing the number of employees working night shifts. The 2016–17 to 2019–20 Corporate Plan notes that the shift alignment process has been successful. Australia Post has noted that shift realignment, together with the introduction of a ‘priority’ and ‘regular’ letters service from January 2016, is a significant step in securing savings in the longer term and providing a longer processing window, which Australia Post anticipates will allow greater levels of automation in the near future. However, there is no evidence to show that this initiative has materially reduced the number of penalty hours worked, or achieved the intended cost reductions.

|

Case study: Dandenong Letters Centre |

|

The Dandenong Letters Centre (DLC) was analysed by the ANAO for two pay runs in the four years from 2014–17 to compare ordinary rates with overtime and penalty rates before, during and after the shift alignment process. The analysis considered the proportion of time that employees spent working at ordinary rates, overtime rates (for example, overtime 1.5 times, overtime 2.0 times) and penalty rates (for example, public holiday rates, shift penalty at double time) on average. The analysis shows:

Whilst there is no material decrease in the proportion of overtime and penalty hours to normal hours, it is noted that based on the ANAO’s analysis there has been a 3 per cent ($184 639) cost saving at DLC between 2014 and 2017. Staff numbers reduced by 25 per cent (239 employees) from 2014 to 2017. However significant increases in overtime costs incurred by existing staff offset a large portion of the reductions in base salaries. |

Original labour cost savings targets – Reform Our Letters Service (RoLS)

2.40 The original target for the RoLS program was documented in the 2014 Reform our Letters Service- Detailed Design Blueprint. This targeted:

- headcount reductions of 3 178 by FY19; and

- savings of $339 million by FY19.

Subsequent revisions to labour cost savings targets

2.41 The target was subsequently revised in 2015 following further validation of the Blueprint. The key points were:

- management29 subsequently revised these savings down to $306 million; and

- while there were no specific headcount reductions planned (as the cost program was based on FTEs) the expectation was between 2 500 and 3 000 reductions in FTE as a letters only strategy.

2.42 The reasons for the revision away from the Blueprint are as follows:

- Slower declines in letter volumes than expected – the RoLS blueprint assumed letter declines would occur more quickly than what materialised and Australia Post decided it needed more staff (~200 FTE) to deliver the higher volumes than originally estimated (delivered letter volumes are 7.5 per cent higher than the BCG detailed design and FY18 Draft Corporate plan levels are 11 per cent higher (or ~200 FTEs)).

- Change in strategy since Blueprint – the RoLS blueprint did not allow for a broader strategy of taking small packets from ‘piece rate delivery contractors’ and associated cost reductions there, and giving those packets to postal delivery officers (PDOs) to deliver – so more PDOs were required given the slight shift in strategy since the original Blueprint.

- Update in assumptions about reform – the blueprint assumed regulatory change would occur six months earlier than it eventually did; and that machines could be procured and implemented 12 months earlier than is occurring.

- Blueprint was not an implementation plan – the Blueprint was a detailed consulting piece of strategic work, and not a detailed implementation plan. The higher revenue and adjusted cost savings of $306m have formed part of the past two corporate plans.

Current status

2.43 The current status is as follows:

- In aggregate, Australia Post is planning total reductions of 2 526 by the end of FY19.

- As at 30 June 2017, total workforce reductions have been 826, achieved through Australia Post’s voluntary redundancy program.

- The Corporate Plan assumes further reductions of 1 700 by the end of FY19.

- Australia Post expects that 1 500 of the 1 700 reductions (or 88 per cent of these reductions) will rely on voluntary redundancies.

2.44 Australia Post advised:

- It expects the offers to accelerate as greater automation of processing is brought online, with the majority of savings realised in the 2017-18 and 2018-19 financial years.

- It has identified the list of roles expected to become redundant over time, and has a dedicated team managing systems, processes and capabilities to deal with redeployment, retraining and redundancy, as part of its ongoing program to support the implementation of RoLS.

- Delivery of its voluntary redundancy program is being managed at the local facility level by each local Human Resources Business Partner.

2.45 Australia Post also provides quarterly updates to its Board which includes reporting on the total number of workers in the letters business; the number of staff redeployments; the number of departures through voluntary redundancies and natural attrition; and the number of employees transitioning from night shift to day shift in letter processing centres.

2.46 However, the Board reporting reviewed by the ANAO in the course of this audit does not provide a clear comparison of the progress in achieved FTE (or equivalent cost) reductions against those originally envisaged in the RoLS Blueprint, or as revised by subsequent business cases. In addition, the RoLS Program Control Board Status Report—which notes the progress of network reforms, which form the prerequisite for the planned labour cost reductions—notes that implementation timelines and benefits are unlikely to be achieved as planned due to key business assumptions, risks, and programs of work at enterprise level.

2.47 If Australia Post is able to execute its plans to reduce labour costs, then the savings targeted in the 2015 revision would be achieved. However, these costs reductions rely on the successful and timely implementation of a large-scale voluntary redundancy program. Progress to date does not provide evidence that such a large-scale redundancy program can be implemented in the targeted timeframes.

Recommendation no.1

2.48 Australia Post should identify and address the impediments to improving the efficiency of its letters service, including implementing, and realising the benefits of, its efficiency strategies.

Australian Postal Corporation response: Agreed, with qualifications

2.49 Agreed, with the qualification that the net benefits (considering both cost-out and revenue received) are on track when measured against the 2015 Reform our Letters Service (RoLS) business case. Achieving efficiencies has been impacted by the letter volume mix; the letters automation schedule; the growth in delivery points; and the higher than forecast volume of parcels that is being delivered by our letters network (posties).

Closure of the defined benefit scheme

2.50 Australia Post has also undertaken business-wide reforms that have impacted on the costs of delivering the reserved letters service. Australia Post estimates that the closure of the Australia Post defined benefit scheme (the APSS) to new members from July 2012 has provided cumulative, net benefits of $73m as at July 2017.30

2.51 The Federal Court heard the Communication Workers Union’s (CWU) challenge to the cessation of Average Weekly Ordinary Time Earnings (AWOTE) indexing for APSS members’ super salaries from 20–24 March 2017. If the indexation of superannuation salaries is fully reinstated, a past service cost to reflect the defined benefit obligation would need to be recognised in the Profit and Loss Statement and this would be similar to the benefit of $117 million in 2015. This case is currently in progress.

3. Australia Post’s efficiency in meeting its obligations

Areas examined

The ANAO examined whether Australia Post is meeting its obligations efficiently.

Conclusion

Australia Post has improved its efficiency over time, however these improvements have been relatively slow compared to its international peers, particularly in relation to its management of operating costs.

While Australia Post monitors and evaluates the efficiency with which it meets its obligations, there would be scope for Australia Post to provide its shareholder with more strategic information on the long-term sustainability of the letters business; changes in Australia Post’s performance over time; and the assumptions driving key forecasts that underpin the enterprise valuation.

Area for improvement

The ANAO made one recommendation to Australia Post, aimed improving its shareholder reporting.

Is Australia Post’s performance comparable with relevant international postal agencies?

Australia Post has not performed as well as its international peers in managing its operating costs, both across its business as a whole and in relation to its letters business. Australia Post has improved its efficiency over time, however these improvements have been relatively slow compared to its international peers, including those that also operate under the constraints of government ownership.

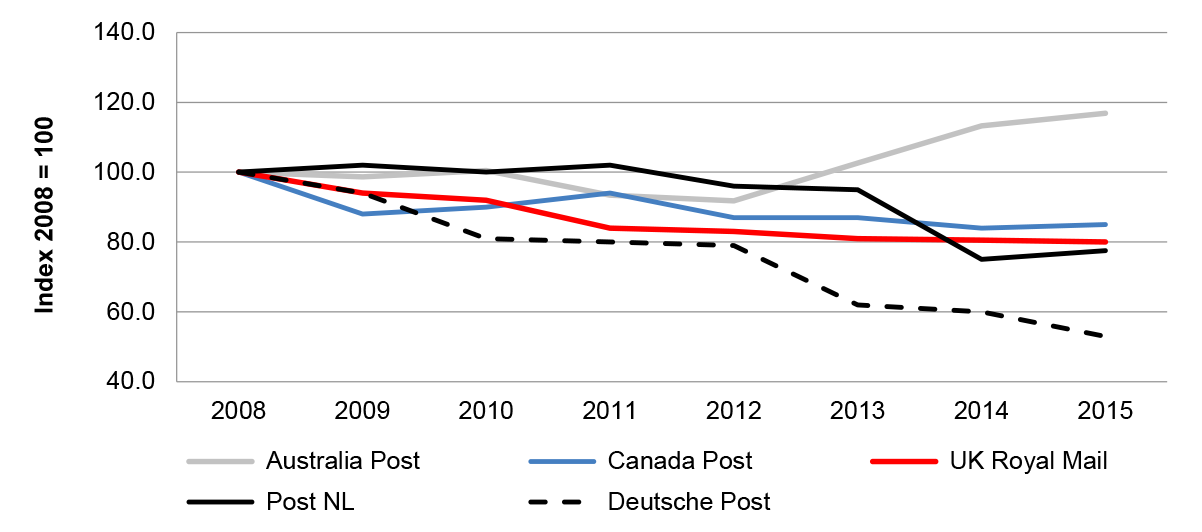

3.1 The ANAO benchmarked the historical cost performance of Australia Post against five international postal agencies from 2008–09 to assess how each operator has improved efficiency over that period.31 The analysis used publicly available information for each postal operator’s letters service, including operating expenses, revenues and volumes relating to letters services, and overall mail volumes (that is, including parcels).

3.2 There were some constraints on this analysis based on the level of detail provided in the publicly available data, particularly as postal operators typically operate shared cost networks (that is, between letters and parcels). In addition, the operating environment for international mail carriers is constantly changing, including:

- policy changes affecting the obligations of each entity that have occurred at different times, which includes government policies and accounting standards; and

- structural changes to mail delivery networks and broader changes in the market, and as a result, changes to cost allocation models and accounting treatments.

Further detail on the methodological approach is included at Appendix 5.

3.3 Notwithstanding these methodological challenges, the benchmarking approach can provide insights into the relative efficiency of each postal agency by focusing on how each agency’s performance has changed over time relative to its own starting point. The key findings are shown in the following figures.

Operating expenses per letter delivered

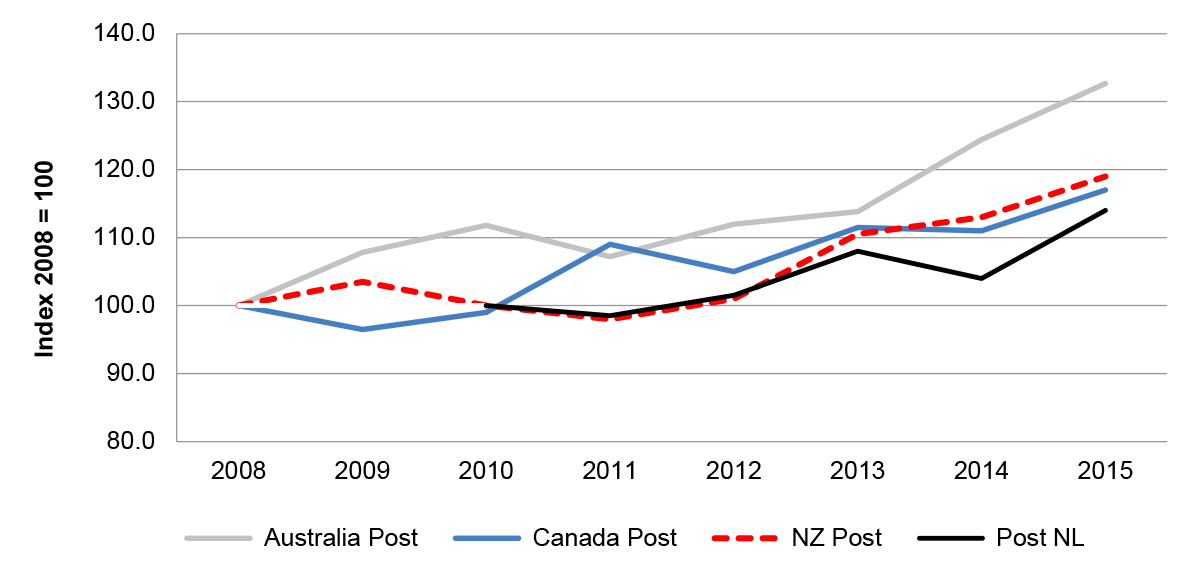

3.4 Figure 3.1 shows letter delivery service expenses32 per unit (that is, per letter) delivered between 2008 and 2015 for Australia Post, Canada Post, New Zealand Post (NZ Post) and Post Netherlands (Post NL).33

Figure 3.1 Letters operating expenses per unit delivered 2008–15

Note: In 2013-14, Australia Post experienced an increase in operating expenses due to a change in accounting standards for defined benefit superannuation funds. The impact on Letters operating costs equal to $56m in 2013-14 and $31m in 2014-15.

Note: In January 2016, Australia Post introduced a two-speed letter delivery timetable which allowed an extra two business days for delivery of regular mail to enable greater flexibility and cost efficiency in its letter processing and delivery operations, which resulted in a reduction in operating expenses.

Source: ANAO analysis based on annual reports, except for Australia Post which has been sourced from the Record Keeping Schedules which is not publicly available.

3.5 Figure 3.5 shows that between the 2008-09 and 2015-16 financial years, letter delivery service operating expenses per unit delivered:

- increased by 33 per cent in Australia34;

- increased by 17 per cent in Canada;

- increased by 19 per cent in New Zealand; and

- increased by 14 per cent in the Netherlands from 2010–2015.

3.6 All countries examined are currently experiencing declines in letter volumes, albeit at different rates. Since 2008, the decline in Australia Post’s reserved letter volumes (-31 per cent) has been equivalent to Canada (-31 per cent) but smaller than the declines in New Zealand (-39 per cent) and the Netherlands (-49 per cent). However, even taking into account the decline in letter volumes, Australia Post’s operating expenses per unit delivered have increased at a higher rate than its counterparts.

Operating expenses per letter delivery point

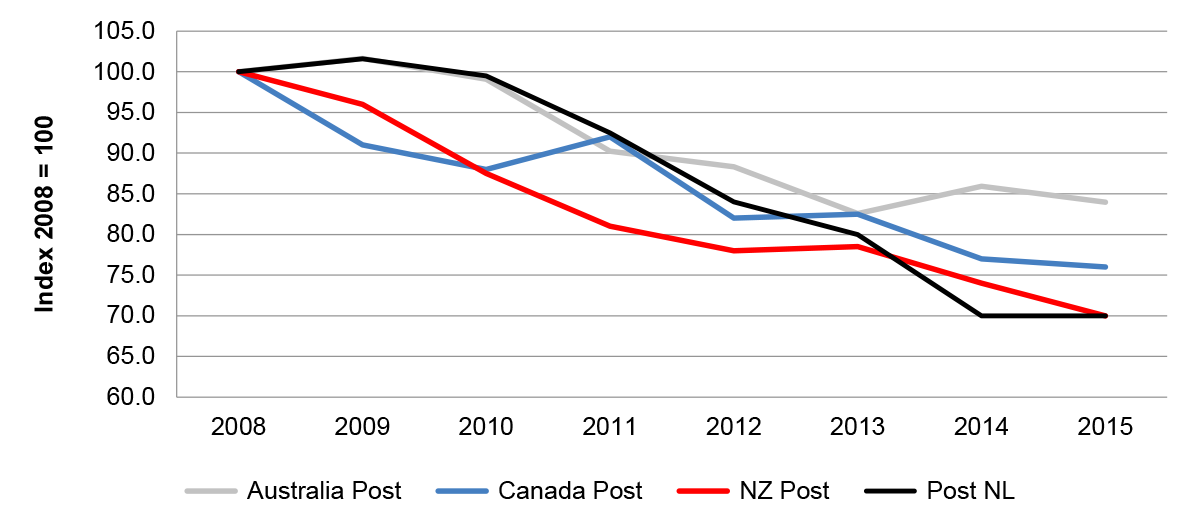

3.7 Given the variability in letter volumes and the nature of the costs of providing letter delivery services, the number of delivery points provides a more stable basis for comparing the trends in operating costs (see Figure 3.2).35

Figure 3.2: Letters operating expenses per delivery point, 2008–15

Note: In 2013-14, Australia Post experienced an increase in operating expenses due to a change in accounting standards for defined benefit superannuation funds. The impact on Letters operating costs equal to $56m in 2013-14 and $31m in 2014-15.

Note: In January 2016, Australia Post introduced a two-speed letter delivery timetable which allowed an extra two business days for delivery of regular mail to enable greater flexibility and cost efficiency in its letter processing and delivery operations, which resulted in a reduction in opex.

Source: ANAO analysis based on annual reports, except for Australia Post which has been sourced from the Record Keeping Schedules which is not publicly available.

3.8 Figure 3.2 shows that between the 2008-09 and 2015-16 financial years, letter delivery service operating expenses per delivery point:

- decreased by 16 per cent in Australia;