Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Administration and governance arrangements relating to the Student Services and Amenities Fee

Please direct enquiries relating to requests for audit through our contact page.

The Auditor-General responded on 23 November 2017 to correspondence from Senators Abetz, Paterson and Reynolds dated 27 October 2017, requesting that the Auditor-General undertake an examination of the administration and governance arrangements relating to the Student Services and Amenities Fee (SSAF). Following a request from Senator Abetz on 17 January 2018 for a more detailed response, the Auditor-General followed-up on 5 April 2018.

Auditor-General's follow-up

5 April 2018

Dear Senator Abetz,

I am writing in response to your email of 17 January 2018, requesting a more detailed response to the Young Liberal Movement’s (YLM) request for an audit of the administration of the Student Services Amenities Fee (SSAF) program, which was supported by Senator Paterson, Senator Reynolds and yourself.

In my response of 23 November 2017 I noted that the decision not to conduct an audit of the administration of the SSAF was made in consideration of a number of factors including: competing audit priorities; available resources; and the benefits to the public sector. The key focus of this initial consideration was on the Commonwealth’s role and resources devoted to administering the SSAF. In the context of planning for the Australian National Audit Office’s (ANAO’s) 2018-19 Annual Audit Work Program, broader consideration of the request has been made to include a close examination of the ANAO’s capability to conduct an audit of the administration of the SSAF across State and Territory jurisdictions.

The ANAO’s performance audits involve the assessment of various aspects of the programs, policies, projects or activities of public sector entities which include: corporate and non-corporate Commonwealth entities; Commonwealth companies; and government business enterprises. In addition to the types of entities noted above, the ANAO is able to conduct performance audits of Commonwealth partners. If the partner, is part of, or is controlled by, the Government of a State or Territory a performance audit can only be undertaken at the request of the responsible Minister or the Joint Committee of Public Accounts and Audit. Commonwealth partners, as defined under the Auditor-General Act 1997 (the Act), is a person or body that the Commonwealth provides money for a particular purpose. The Higher Education Legislation Amendment (Student Services and Amenities) Act 2011 allows universities and other higher education providers to charge a fee for student services and amenities of a non-academic nature. The SSAF is therefore predominately administered by individual universities, who collect fees from students directly for the provision of services, rather than being paid by the Commonwealth. It is therefore my view, that there is a jurisdictional issue in respect to auditing the administration of the SSAF program in State/Territory operated universities, as there is no express provision in the Act, or more broadly the laws of the Commonwealth as defined in the Act, which would grant me in my role as the Commonwealth Auditor-General the power to audit the State/Territory universities administration of the SSAF, as no Commonwealth money is provided for the purpose of the SSAF.

From a Commonwealth perspective, the utilisation of Commonwealth resources to administer the SSAF is limited. The Department of Education and Training provides guidance on the requirements of the SSAF for providers with Commonwealth supported students and conducts investigations into allegations of inappropriate use of the funds collected. I consider an audit of the activities of the Department of Education and Training in relation to its administration of the SSAF or an audit of the administration of the SSAF by the Australian National University (which is in my jurisdiction) would not address the broader matters raised by the YLM or bring substantive benefits to the public sector.

Please do not hesitate to contact me if you have any queries concerning the response provided.

Yours sincerely

Grant Hehir

Auditor-General's response

23 November 2017

Dear Senators Abetz, Paterson and Reynolds

I am writing in response to your letter of 27 October 2017 requesting I undertake an audit of the administration and governance arrangements relating to the Student Services Amenities Fee (SSAF).

As you would appreciate there are many demands on the Australian National Audit Office (ANAO) and any decision to commence audit activity is taken in the context of a range of factors including; benefits to public administration, competing audit priorities, available resources and with a view to achieving balanced coverage across key areas of public sector activity. It is with these factors in mind that I have decided not to undertake a performance audit of the administration of the SSAF at this time.

I would like to take this opportunity to thank you for your interest in the work of the ANAO.

Yours sincerely

Grant Hehir

Correspondence from Senators Abetz, Paterson and Reynolds

Transcript

27 October 2017

Mr Grant Hehir

Auditor-General

Australian National Audit Office

GPO Box 707

CANBERRA ACT 2601

Dear Auditor-General

Our attention has been drawn to the attached letter sent to you by the Young Liberal Movement of Australia in relation to the Student Services and Amenities Fee (SSAF).

We are similarly concerned by the SSAF which collects up to $294 from more than a million tertiary students in Australia who have very little say in how those monies are spent by their universities and student associations. Inexplicably, this fee is levied regardless of students’ need, willingness and ability to access the services and activities for which they are paying.

As outlined in the Young Liberals’ submission to you, there appears to be very little accountability and few safeguards in the administration of this legislation.

Accordingly, we similarly ask that you favourably consider an examination of the administration and governance arrangements relating to the Student Services and Amenities Fee.

Yours sincerely

Eric Abetz

Senator for Tasmania

James Paterson

Senator for Victoria

Linda Reynolds

Senator for Western Australia

Original letter

Attachment from Young Liberal Movement of Australia

Transcript

26 October 2017

Mr Grant Hehir

Auditor-General

Australian National Audit Office

GPO Box 707

CANBERRA ACT 2601

Dear Auditor-General

Student Services and Amenities Fee

We are pleased to write to you to seek the inclusion of a review in the Australian National Audit Office’s forward work programme of the Student Services and Amenities Fee (SSAF) established under the Higher Education Legislation Amendment (Student Services and Amenities) Act 2011.

In short, the SSAF is a Student Tax imposed by government and is severely lacking in accountability and transparency. This letter outlines our very real concerns about the SSAF which we believe warrant a full and extensive audit. We are confident that our concerns are well-founded and would be supported by any independent review.

Overview

Figures released by the Department of Education in response to questions at Senate Estimates show that more than $429 million has been taken from university students since 2012 and funnelled into student unions through the SSAF mechanism. There have been countless revelations of waste and mismanagement by student unions, including spending Student Tax funding on food and alcohol, as well as on affiliation fees to the politically motivated National Union of Students. Despite this, there have only been nine departmental investigations, most of which inexplicably found that the allowed expenditure was within the bounds of the legislation.

The Student Tax hits struggling students the hardest, while benefitting those students who are better off and therefore have more time to engage in activities and the services that it funds. Australian students deserve better and should be able to have confidence in the system.

We seek an independent review by the Australian National Audit Office to specifically examine:

- Whether the Higher Education Legislation Amendment (Student Services and Amenities) Act 2011 adheres to good governance principles;

- Whether the levels of accountability and oversight are appropriate for this government-enforced collection of funds;

- Whether the safeguards in place are adequate; and

- The occurrence of cross-subsidisation within student unions to use SSAF funding on permitted matters while using other funds, made available by virtue of the funding, on matters not permitted under the legislation.

We examine the issues with the Student Tax in this correspondence that highlights the need for an ANAO review.

What is the Student Services and Amenities Fee?

For most of their history, Australian universities had been “closed shops” – students had to become members of their student associations (commonly known as student unions or guilds) in order to be able to enrol and complete their tertiary education. This suited the political left, which for decades monopolised student politics in this country, using student associations as training grounds for generations of future politicians and unionists, and as cash cows for left-wing political causes and campaigns.

All students, regardless of their political beliefs (or lack thereof) were forced to pay for it all through their compulsory student union fees, in fear of having their academic results withheld.

In 2006, the Coalition Government, fulfilling a long-standing commitment, amended the Higher Education Support Act, ending compulsory student unionism and abolishing compulsory up-front student union fees. The philosophy of voluntary student unionism (VSU) influencing these amendments had two prongs: first, students’ right to a tertiary education should not be predicated on membership or payment of a fee to a student union, but rather students should be free to choose whether to join student associations or not; and second, that they should be able to choose which activities of their student association to support financially.

In a blatant breach of Labor’s pre-election commitment “not… to go back to the pre-voluntary student unionism world”1, in October 2011 the Labor Government, with the support of the Greens, passed the Higher Education Legislation Amendment (Student Services and Amenities) Bill 2010. The Bill re-introduced compulsory student fees under the name of SSAF, to be administered by universities and spent on the provision (including through third parties, such as student associations) of specific non-academic services including sporting and recreational activities, employment and career advice, student health and welfare, legal and financial advice, food service and others.

While a commitment to VSU and opposition to compulsory fees are still established Coalition policy, the Labor/Green SSAF regime remains in place at most Australian universities.

Currently, students have to pay up to $294 per year in SSAF, indexed annually. According to information revealed in responses to Questions on Notice from the Department of Education, this amounts to more than $100 million every year.

How are students affected?

Each year, more than 350,000 students are charged the $294 tax, indexed to inflation.

The Student Tax is inequitable amongst students as it is levied regardless of income and regardless of whether the services that it funds are accessed by tax paying students on campus. It is a regressive tax that does not accommodate low-income students or those from indigenous or disadvantaged backgrounds. Furthermore, the Student Tax is levied regardless of whether students have the ability to actually use the services provided by the fee, meaning students who study by correspondence (an increasingly more prevalent educational model) receive no bang for their buck.

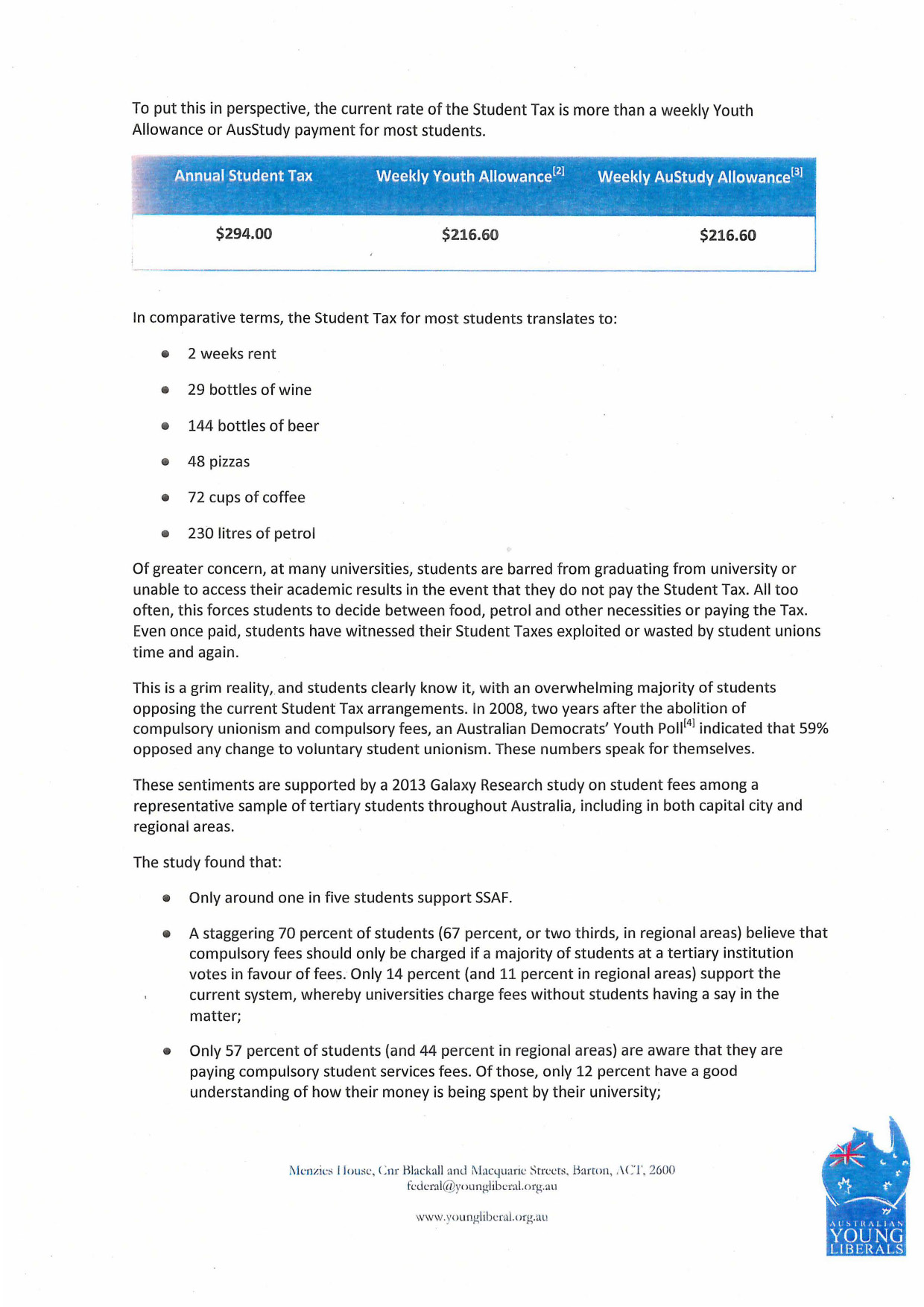

To put this in perspective, the current rate of the Student Tax is more than a weekly Youth Allowance or AusStudy payment for most students.

In comparative terms, the Student Tax for most students translates to:

- 2 weeks rent

- 29 bottles of wine

- 144 bottles of beer

- 48 pizzas

- 72 cups of coffee

- 230 litres of petrol

Of greater concern, at many universities, students are barred from graduating from university or unable to access their academic results in the event that they do not pay the Student Tax. All too often, this forces students to decide between food, petrol and other necessities or paying the Tax. Even once paid, students have witnessed their Student Taxes exploited or wasted by student unions time and again.

This is a grim reality, and students clearly know it, with an overwhelming majority of students opposing the current Student Tax arrangements. In 2008, two years after the abolition of compulsory unionism and compulsory fees, an Australian Democrats’ Youth Poll4 indicated that 59% opposed any change to voluntary student unionism. These numbers speak for themselves.

These sentiments are supported by a 2013 Galaxy Research study on student fees among a representative sample of tertiary students throughout Australia, including in both capital city and regional areas.

The study found that:

- Only around one in five students support SSAF.

- A staggering 70 percent of students (67 percent, or two thirds, in regional areas) believe that compulsory fees should only be charged if a majority of students at a tertiary institution votes in favour of fees. Only 14 percent (and 11 percent in regional areas) support the current system, whereby universities charge fees without students having a say in the matter;

- Only 57 percent of students (and 44 percent in regional areas) are aware that they are paying compulsory student services fees. Of those, only 12 percent have a good understanding of how their money is being spent by their university;

- 52 percent of students don’t believe they are getting value for money from their fees, while a mere 20 percent (and 22 percent in regional areas) – that’s only one in five – think they do; and

- 53 percent of students are in favour of abolishing SSAF; only 15 percent in regional areas are opposed to abolition, well below the national average of 21 percent.

This Galaxy polling reveals the full extent of SSAF’s widespread unpopularity.

Australian students don’t believe the current arrangements offer them value for money and they want to see the end of compulsory fees. As a second best, they want to be given a say in the decision to levy them. Interestingly, anti-SSAF sentiment is even stronger in regional universities, which proponents of compulsory fees inappropriately, and ironically, use as a case study for their necessity.

The most recent data made available in response to Questions on Notice, the SSAF funding collected by universities was:

- $85.1 million in 2012

- $114.9 million in 2013

- $111.0 million in 2014

- $118.3 million in 2015

What is the Student Tax spent on?

While the Higher Education Support Act 2003 does not provide a limited list of items for which the Student Tax can be spent on, the Act expressly provides a list of items not prohibited. This list includes:

- providing food or drink to students on a campus of the higher education provider;

- supporting a sporting or other recreational activity by students;

- supporting the administration of a club most of whose members are students;

- caring for children of students;

- providing legal services to students;

- promoting the health or welfare of students;

- helping students secure accommodation;

- helping students obtain employment or advice on careers;

- helping students with their financial affairs;

- helping students obtain insurance against personal accidents;

- supporting debating by students;

- providing libraries and reading rooms (other than those provided for academic purposes) for students;

- supporting an artistic activity by students;

- supporting the production and dissemination to students of media whose content is provided by students;

- helping students develop skills for study, by means other than undertaking *courses of study in which they are enrolled;

- advising on matters arising under the higher education provider’s rules (however described);

- advocating students’ interests in matters arising under the higher education provider’s rules (however described);

- giving students information to help them in their orientation; and

- helping meet the specific needs of overseas students relating to their welfare, accommodation and employment.

While many of these items are noble in their intent, there are numerous examples of student unions stretching these allowances well beyond the boundaries of what is appropriate. For example, it was reported in 2012 that the Australian National University Student Union used SSAF funds to purchase cupcakes, a jumping castle and on a party at Mooseheads nightclub. While this matter was investigated by the Department of Education, the expenditure was found not to have breached the Act.

In addition, last year at the University of Western Australia, the Student Guild run a series of highly-controversial and politically-motivated events, including an ‘Unhappy Birthday Christopher Pyne’ festival that attracted criticism from dozens of students. The events appeared to have been funded by Student Tax funds but further student investigations were inconclusive and no concrete information was revealed by the Guild.

In October 2015, the University of Newcastle Labor Club breached the legislative requirements by using SSAF revenue for the production of posters promoting an on-campus event featuring local Labor party guest speakers.

Student unions that administer Student Tax funding often have minimal scrutiny and accountability, and can be prone to gross financial mismanagement. For instance, in 2014 it was revealed that the University of Western Australia Student Guild had been defrauded more than $800,000 in finances siphoned away from the Guild to an employee over a three-year period from 2011.

While the Guild commissioned a full financial audit and there was one dismissal, the incident demonstrated unwillingness within the Guild to take strong action. The fact that such large scale theft was only uncovered after three years demonstrates a lack of accountability and transparency within student unions that could equally be applied to rorting Student Tax funds.

Historically, examples of waste and mismanagement by student unions include:

- In 2008, the University of Melbourne Student Union (UMSU) ripped $2,000 from its limited Activities budget to fund an art show titled “From Beards to Badges – a history of the University of Melbourne Student Union (UMSU)”;

- In 2008, UMSU also donated $500 to the legal defence of a man accused of assaulting police officers and damaging a police station during a riot on Palm Island;

- In 2009, UMSU slashed the budget of its Clubs and Societies by $18,000 (24%) in order to fund a $15,000 increase in its donation to the radical National Union of Students (an increase of 30%).

- In 1999, the University of Queensland Student Union spent up to $110,000 producing an edition of the student magazine Semper Floreat focussing on the word “c**t”, as well as the so called “c**t quilt”, sewn by feminist activists from smaller squares with graphic (in both senses of the word) designs representing the activists’ genitalia.

In previous years, one of the Presidents of the Queensland University of Technology (QUT) Guild has used student fees to hire a sports car for himself for the duration of his term.

National Union of Students

While the Act does specifically forbid the spending of Student Tax funding on supporting a political party or the election of public officials, student unions have been creative in their approach to this legislative requirement by supporting political campaigns on particular issues. Unsurprisingly, these campaigns readily align with left-wing political movements, while stopping just short of specifically endorsing political parties or officials. The single best example of this are the fees provided to the National Union of Students by individual student unions each year.

The National Union of Students has been plagued by gross financial mismanagement and factionalism for decades. Run by a series of clashing left-wing factions that stretch from Labor Right (Unity) through to the Marxist ‘Socialist Alternative’ left, decision-making is often halting and incoherent at best. However, thing these groups have been united on is their shared commitment to spending their resources on attacking conservative governments, with the NUS having been responsible for a spate of highly contentious and violent attacks on Parliamentarians, in addition to other violent protests.

Confidential National Union of Students budget information shows that in 2016, they expect to receive $375,000.00 from student unions, largely aimed at funding their highly politicised campaigning. The vast majority of accreditation fees paid to the National Union of Students are Student Taxes collected by student unions – fees paid by students of all political persuasions, not just of one.

In 2009, the University of Sydney SRC paid for delegates to attend the NUS national conference, totalling $11,500. At that conference, internal bickering between the various factions saw the conference unable to reach quorum, and as a result, policies were debated occurred for only one hour and the election of office bearers was unable to take place. As such, $11,500 from a single student union was wasted on a conference that achieved absolutely nothing.

Furthermore, in 2010 and 2013, the NUS ran a campaign during the Federal election called ‘Abbott’s Heaven Your Hell’. This was a blatant political campaign against Tony Abbott and the Liberal Party, run during an election period, designed to manipulate the voting decisions of students. This was despite Young Liberals elected to the NUS executive expressing concerns that such a campaign would not resonate with the broader student population.

We contend that the NUS is an ultra-left wing fiefdom, jealously guarded by a left wing political movement that seeks to push a highly political and extremist social agenda.

Transparency

The Student Tax is regulated under the Higher Education Support Act 2003 that has specific requirements around the expenditure of monies collected. Our concerns with the current framework are two-fold. First, there have been countless anecdotal examples of waste and mismanagement of these funds that is rarely investigated. Second, the list of allowable expenditure is very broad and has been used to purchase such things as food and drinks, and even to throw wild parties.

The department monitors the use of SSAF revenue and its compliance with the legislation, including through:

- requiring participating Higher Education Providers (HEPs)to provide an annual compliance certificate signed by the Vice-Chancellor or Chief Executive Officer confirming that SSAF revenue was raised and expended in accordance with the legislation;

- reviewing the websites of participating HEPs, particularly their reports on actual SSAF expenditure, to ensure that the rates of SSAF and the expenditure of SSAF revenue are consistent with the legislation; and

- establishing a public inbox which enables anyone concerned about a potential breach of the SSAF legislation or guidelines to raise their concerns directly with the department. All the concerns raised with the department are investigated.

Despite assurances from the then-Gillard Government that there is a robust transparency framework in place, only seven investigations have been launched by the Department of Education since 2012 most of which came back all clear. The department’s investigations have included:

In June 2012 it was alleged that the Australian National University Students’ Association (ANUSA) had used SSAF funding to purchase jellybeans for a free give away.

Outcome: The department confirmed that no SSAF revenue had been used to purchase the jellybeans.

In August 2012 it was alleged that the ANUSA had misspent SSAF funding on a function.

Outcome: The department reviewed these claims and determined that no breach of the Act or associated Guidelines had occurred. ANUSA received SSAF funding from the university for food and drink and to support student orientation which are unbelievably allowable expenditures under HESA (subsection 19-38 (4)(a)).

In May 2013 it was alleged that the University of Newcastle breached the legislative requirements by funding the Newcastle University Students’ Association and by supporting Peer Assisted Study Sessions.

Outcome: The department confirmed that the purposes to which the university had allocated SSAF revenue were allowable under the Act. The support of the Students’ Association was considered consistent with the intent of subsection 19-38 (4)(c) of HESA which allows for ‘supporting the administration of a club most of whose members are students’.

The Peer Assisted Study Sessions were considered consistent with ‘helping students develop skills for study, by means other than undertaking courses of study in which they are enrolled’ (subsection 19-38 (4)(o) of HESA).

In April 2014 it was alleged that Charles Sturt University breached the legislation by using SSAF revenue to establish Ally, a programme for lesbian, gay, bisexual, transgender and intersex students.

Outcome: The department determined that the purposes to which the university had allocated SSAF revenue were allowable under subsection 19-38 (4)(f) of the Act as promoting the health or welfare of students.

In August 2014 it was alleged that the University of Melbourne Student Union breached the legislative provisions by using SSAF revenue to support the Labor Party’s launch of its higher education policy.

Outcome: The department confirmed that no SSAF revenue had been used for the event.

In October 2015 it was alleged that the University of Newcastle Labor Club breached the legislative requirements by using SSAF revenue for the production of posters promoting an on-campus event (BBQ) which featured local Labor party guest speakers.

Outcome: The department determined that this case could be interpreted as a breach of subsection 19-38 (2)(a) of HESA, which states that: ‘if the higher education provider pays a person or organisation an amount paid to the provider as a student services and amenities fee, the provider must make the payment on condition that none of the payment is to be spent by the organisation to support …a political party.’

The alleged breach was fully investigated by the University of Newcastle, which determined a potential breach may have occurred. In order to avoid the potential of such breaches occurring in future, the University of Newcastle changed the way in which funding for student clubs and societies is distributed. These new procedures ensure that specific club functions or events (irrespective of the purpose or membership of the club) must meet stricter conditions for approval, in advance of any funding.

These requirements are severely inadequate. Most students who pay their Student Taxes are unable to investigate any breach of expenditure through the published mechanisms, nor would they have confidence in the aforementioned systems to protect against waste, mismanagement or corruption.

In circumstances involving more than one hundred million dollars of students’ money, we firmly believe a good starting point would be considering the same requirements that apply to either trade unions or to companies under those relevant laws.

Conclusion

On every meaningful level, we contend that the Student Tax is bad for the very same students that it claims to assist. It is unfair, undemocratic and unnecessary. Fundamentally, the right to a tertiary education should not be predicated on payment of a compulsory Student Tax.

Importantly, the severe lack of safeguards and oversight for this legislated $100 million fee, the revenue of which is not administered by government, requires a thorough examination. We respectfully request that the ANAO include an examination of SSAF in its forward work programme.

I have copied this letter to a number of Parliamentarians who have expressed an interest in this issue.

Yours sincerely

Aiden Depiazzi

Federal President

Josh Manuatu

Federal Vice President

Footnotes

1 Gavin Moodie, “Government remains reticent about VSU”, The Australian, 27 August 2008, http://www.theaustralian.com.au/news/government--‐reticent--‐about--‐vsu/story--‐e6frg6n6--‐1111117307642http://www.theaustralian.com.au/news/government--‐reticent--‐about--‐vsu/story--‐6frg6n6--‐1111117307642

2 Single, with no children, 18 years or older and required to live away from parental home

3 Single, with no children, living away from home

4 http://www.ipa.org.au/sectors/the-‐global-‐financial-‐crisis/publication/1657/shorts

Original letter