Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Transitional Arrangements for the Cashless Debit Card

Please direct enquiries through our contact page.

Audit snapshot

Why did we do this audit?

- The Auditor-General presented two performance audit reports into the Cashless Debit Card (CDC) program that identified deficiencies in the Department of Social Services’ (the department) monitoring and evaluation of the program.

- The CDC program has attracted parliamentary scrutiny particularly in relation to the impact on individuals and communities.

- This audit provides assurance to Parliament on the effectiveness of the management of the transition from the CDC program to the Enhanced Income Management program.

Key facts

- The Enhanced Income Management program commenced on 6 March 2023.

- The Enhanced Income Management program uses the same technology as the CDC program.

- The Enhanced Income Management program is voluntary for some participants.

What did we find?

- The transitional arrangements for the CDC program to the Enhanced Income Management program were largely effective.

- The Department of Social Services’ (the department) oversight of the transition arrangements was largely effective.

- The design of the Enhanced Income Management program was largely based on appropriate advice and evidence. Monitoring and performance measurement is not sufficiently robust to inform future policy design.

- Services Australia’s limited tender procurement was largely compliant with the Commonwealth Procurement Rules.

What did we recommend?

- There was one recommendation to both entities and three recommendations to the department.

- The department and Services Australia agreed to all.

4039

The number of CDC participants that transferred to the Enhanced Income Management program as at 10 March 2023.

4.5%

The proportion of CDC participants that voluntarily transferred to the Enhanced Income Management program as at 10 March 2023.

10498

The number of participants on the Enhanced Income Management program as at 1 March 2024.

Summary and recommendations

Background

1. Income management is a key activity listed in the Department of Social Services’ (the department’s) Corporate Plan 2022–23.1 Income management2 is a ‘tool that helps people budget their welfare payments and ensures they are getting the basic essentials of life, such as food, housing, electricity and education’.3

2. On 23 May 2021, the Australian Labor Party made an election commitment to abolish the Cashless Debit Card (CDC) program if it were elected to govern. The CDC program facilitated a portion of a participant’s income support payment being allocated to a restricted bank account, accessed by a debit card which did not allow cash withdrawals, or the purchase of alcohol, gambling or cash-like products. The proportion of income was prescribed by legislation. The CDC program had a legislated end date of 31 December 2022.4 On 3 June 2022, the Minister for Social Services issued a press release stating she had held discussions with the department on the cessation of the CDC program.5 The Social Security (Administration) Amendment (Repeal of Cashless Debit Card and Other Measures) Bill 2022 (the Bill) contained legislative amendments to abolish the CDC and implement a new form of income management, the Enhanced Income Management program, on 6 March 2023. The Bill was passed on 28 September 2022 and the relevant provisions establishing the Income Management Program came into effect on 1 October 2022.6

3. CDC participants from the Northern Territory, Cape York and Doomadgee regions were required by legislation to transfer to the Enhanced Income Management program. Participants from Bundaberg, Hervey Bay, the Goldfields, Ceduna and East Kimberley regions were exited from the CDC program and could voluntarily become a participant of Enhanced Income Management.

4. As at 30 September 2022 the department recorded there were 16,616 participants on the CDC program. The department recorded that 4,039 participants were transferred from the CDC program to the Enhanced Income Management program as at 10 March 2023, with 181 of these participants (4.5 per cent) voluntarily choosing to participate in the program. The CDC participants who were not mandated to transfer to the Enhanced Income Management program or who did not volunteer to transfer, did not continue with any form of income management.

5. Services Australia was allocated funding in the October 2022–23 Federal Budget to support the cessation of the CDC program, including the procurement and supply of the new card and the banking and telephony services to support the transition from the CDC program to Enhanced Income Management.

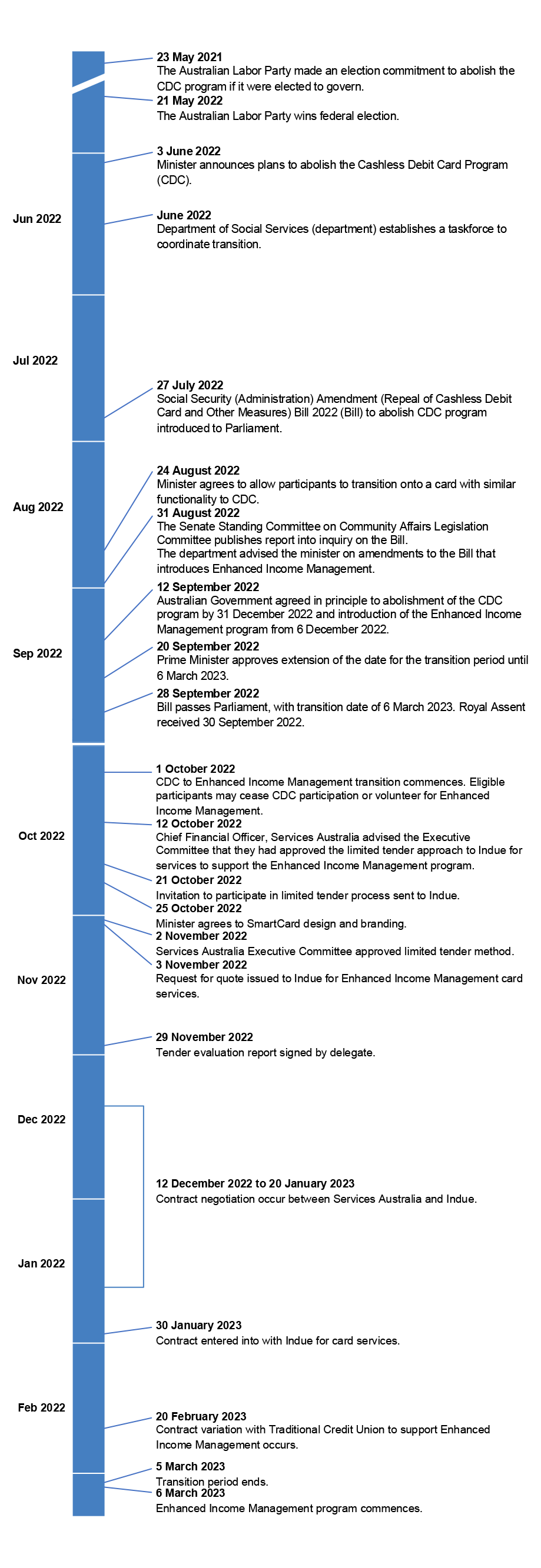

6. Appendix 3 sets out the timeline of key dates for the cessation of the CDC program and the introduction of Enhanced Income Management.

Rationale for undertaking the audit

7. This audit provides assurance to the Parliament on the effectiveness of the management of the transition from the CDC program to the Enhanced Income Management program.

8. The ANAO undertook two previous performance audits of the CDC program. Auditor-General Report No. 1 2018–19 The Implementation and Performance of the Cashless Debit Card Trial examined the department’s implementation and evaluation of the CDC trial.7 The audit found that while the department largely established appropriate arrangements to implement the CDC trial, its approach to monitoring and evaluation was inadequate. It was therefore difficult to conclude if the CDC trial was effective in achieving its objective of reducing social harm and whether the card was a lower cost welfare quarantining approach.

9. Auditor-General Report No. 29 2021–22 Implementation and Performance of the Cashless Debit Card Trail — Follow-on examined the effectiveness of the department’s administration of the CDC program.8 The audit found that the department’s administrative oversight of the CDC program was largely effective, however the department had not demonstrated that the CDC program was meeting its intended objectives.

Audit objective and criteria

10. The objective of the audit was to assess the effectiveness of the transitional arrangements from the CDC program to the Enhanced Income Management program.

11. To form a conclusion against the objective, the following high level criteria were applied:

- Did the department have effective oversight of the transition arrangements?

- Was the design of the Enhanced Income Management program based on appropriate advice and evidence?

- Did Services Australia undertake the procurement process for the Enhanced Income Management program in accordance with the Commonwealth Procurement Rules?

Conclusion

12. The transitional arrangements from the Cashless Debit Card program to the Enhanced Income Management program were largely effective. Robust program monitoring and performance measurement to inform future policy design has not been implemented and no evaluation plan has been developed for the Enhanced Income Management program.

13. The department had largely effective oversight of the transition arrangements.

14. The department established an internal branch to deliver the transition activities and coordinate activities across the Australian Government and utilised the existing joint steering committee with Services Australia, established under the bilateral arrangements, to oversee the transition. The governance arrangements would have been enhanced with appropriate record keeping practices and defined reporting responsibilities. There was regular reporting on operational matters and participation rates to the executives of the department and Services Australia. There was no evidence that shared risks rated ‘high’ on the joint risk register with Services Australia were escalated in accordance with the department’s Risk Management Framework.

15. The department design of the Enhanced Income Management program was largely based on appropriate advice and evidence. There was no evidence the design was informed by ANAO performance audit reports on the Cashless Debit Card (CDC) program, or evaluations and lessons learned from the CDC program. The department’s program monitoring and performance measurement is not sufficiently robust to inform future policy design. No evaluation plan has been developed for the Enhanced Income Management program.

16. Services Australia’s limited tender procurement for the Enhanced Income Management program was largely compliant with the Commonwealth Procurement Rules (CPRs). Probity and conflicts of interest were managed largely in accordance with the CPRs and policy requirements. Services Australia’s engagement with Indue Limited (Indue) during the response period for the request for quote was not consistently documented. Advice to decision-makers was sufficiently detailed and largely documented appropriately. The evaluation committee’s assessment of value for money was informed by expert advice and provided to the delegate. The benchmarking activity due to be undertaken in June 2023, that was a significant factor in Services Australia achieving a value for money outcome, commenced seven months later than the timeframe set out in the contract with Indue.

Supporting findings

Did the Department of Social Services have effective oversight of the transition arrangements?

17. The department established an internal branch, known as the Taskforce, to coordinate activities between the department, Services Australia and the National Indigenous Australians Agency (NIAA), during the transition period. The effectiveness of the Taskforce’s activities would have been enhanced by appropriate record keeping practices. The department utilised an existing joint steering committee with Services Australia, established under the bilateral arrangements, to oversee the transition. The department established a joint risk register to manage shared risks with Services Australia which was reported to the joint steering committee. There was no evidence the joint steering committee monitored progress against the department’s strategy or project management plan for the transition. The Taskforce provided regular reporting on operational matters and participation rates to the department’s and Services Australia’s executives. (See paragraphs 2.3 to 2.42)

18. The department and Services Australia developed a joint risk register for shared risks relating the transition. Each identified risk was accompanied by a risk assessment. The review, amendment and approval of the joint risk registers was not consistently documented. Risks relating to the application of product level blocking technology to the Enhanced Income Management program were not documented in the joint risk register between June 2022 to June 2023. There was no evidence that any of the eight risks rated ‘high’ were escalated in accordance with the department’s Risk Management Framework (RMF). (See paragraph 2.43 to 2.64)

Was the design of the Enhanced Income Management program based on appropriate advice and evidence?

19. The department advised the Australian Government that the Enhanced Income Management program was designed to address community concerns about the proposed legislation to abolish the CDC program, particularly in relation to participants returning to use the older technology offered for the BasicsCard Income Management program. The department provided risk based advice on the date for implementation of the transition to the Enhanced Income Management program. There is no evidence that the design of the Enhanced Income Management program was informed by ANAO audit recommendations, evaluations or lessons learned from the CDC program or other relevant programs. (See paragraphs 3.3 to 3.17)

20. The department’s Corporate Plan contains a performance measure related to participants using their account following the transition from the CDC program to the Enhanced Income Management program. No additional key performance indicators or performance measures have been established. The department regularly monitors data on participant numbers and geographical location and Services Australia produces monthly reporting on the product level blocking used to prevent the sale of restricted items. Services Australia’s reporting does not include all merchants operating product level blocking technology. No evaluation plan was developed for the Enhanced Income Management program. (See paragraphs 3.18 to 3.44)

Did Services Australia undertake the procurement process for the Enhanced Income Management program in accordance with the Commonwealth Procurement Rules?

21. Approval from the Deputy Chief Executive Officer (Deputy CEO) and Services Australia’s Executive Committee for the limited tender issued was appropriately documented. Services Australia engaged a probity advisor and established a probity protocol to support the limited tender process. A conflicts of interest register was established. An assessment of the two declared potential conflicts was not documented. The delegate did not complete a conflict of interest declaration for the procurement activity. Services Australia did not document all interactions with the tenderer during the request for quote response period. (See paragraphs 4.4 to 4.28)

22. The tender evaluation report documented the committee’s assessment of the response to the request for quotation. The spending proposal provided to the delegate summarised the outcomes of the contract negotiations and the reasons for the recommendation to award the contract. (See paragraphs 4.29 to 4.44)

23. The evaluation committee documented its technical, pricing and risk assessment of Indue’s response to the request for quotation and how the outcome of the contract negotiations demonstrated achievement of value for money. The evaluation committee’s assessment was informed by the technical analysis undertaken by a pricing expert who compared Indue’s proposal with the similar services provided under the contract with the Department of Social Services. Services Australia commenced the benchmarking review seven months later than stated in the contract with Indue. (See paragraphs 4.45 to 4.60)

Recommendations

Recommendation no. 1

Paragraph 2.26

The Department of Social Services and Services Australia:

- ensure the terms of reference for all oversight and governance committees and bodies related to income management programs clearly define their reporting structure and responsibilities and, where applicable, refer to the governance arrangements set out in the bilateral agreement or supporting protocols and service agreements; and

- implement mechanisms to gain assurance that all oversight and governance committees and bodies are operating in accordance with the terms of reference.

Department of Social Services response: Agreed.

Services Australia response: Agreed.

Recommendation no. 2

Paragraph 2.57

The Department of Social Services implement controls to gain assurance that risks rated ‘high’ or ‘extreme’ are escalated to the Deputy Secretary and the Executive Management Group consistent with the department’s risk management policy.

Department of Social Services response: Agreed.

Recommendation no. 3

Paragraph 3.31

The Department of Social Services establish appropriate program monitoring to gain assurance that controls implemented for the Enhanced Income Management program, including product blocking technology, are working effectively to achieve the policy intent of the program.

Department of Social Services response: Agreed.

Recommendation no. 4

Paragraph 3.45

The Department of Social Services develop and implement an evaluation plan for the Enhanced Income Management program that is consistent with the Commonwealth Evaluation Toolkit to inform policy design changes and any other relevant programs.

Department of Social Services response: Agreed.

Summary of entity response

24. The proposed audit report was provided to the department and Services Australia. The department and Services Australia’s summary responses are reproduced below. The full responses from both entities are at Appendix 1. Improvements observed by the ANAO during the course of this audit are listed in Appendix 2.

Department of Social Services

The Department of Social Services (the Department) acknowledges the insights and opportunities for improvement outlined in the Australian National Audit Office (ANAO) report on Transitional Arrangements for the Cashless Debit Card (CDC).

The Department welcomes the ANAO’s conclusion that the transitional arrangements from the CDC to the enhanced Income Management (IM) program were largely effective. The Department accepts the conclusion relating to the need to strengthen program monitoring and performance measurement to inform future policy design, as well as the need to implement an evaluation plan for the enhanced IM program.

The Department agrees with all four Recommendations and acknowledges the suggested opportunities for improvement and has taken steps to address these matters.

Services Australia

Services Australia (the Agency) notes the overall finding that the transitional arrangements for the Cashless Debit Card program to the Enhanced Income Management program were largely effective, and that the Agency’s limited tender procurement was largely compliant with the Commonwealth Procurement Rules.

The Agency will continue to work with the Department of Social Services to further strengthen our governance and performance monitoring arrangements related to the Enhanced Income Management program.

Key messages from this audit for all Australian Government entities

25. Below is a summary of key messages, including instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities.

Governance and risk management

Evaluation and monitoring

Procurement

1. Background

Introduction

1.1 Income management is a key activity listed in the Department of Social Services’ (the department’s) Corporate Plan 2022–23.9 Income management10 is a ‘tool that helps people budget their welfare payments and ensures they are getting the basic essentials of life, such as food, housing, electricity and education’.11

1.2 In 2016 the Australian Government introduced the Cashless Debit Card (CDC) trial.12 A portion of a participant’s income support payment was allocated to a restricted bank account, accessed by a debit card which did not allow cash withdrawals or purchase of alcohol, gambling or cash-like products. The proportion of income was prescribed by legislation. The objective of the CDC program was to assist people receiving income support to better manage their finances and to encourage socially responsible behaviour. In 2020, legislation was passed to enable the CDC to be an ongoing program. Section 124PF of the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Act 2020 provided for the CDC program to end on 31 December 2022, unless the minister made transitional rules, by way of legislative instrument, prior to 1 July 2023.13

Cessation of Cashless Debit Card program

1.3 On 23 May 2021, the Australian Labor Party made an election commitment to abolish the CDC program if it were elected to govern. At that time, the CDC program had a legislated end date of 31 December 2022.14 On 3 June 2022 the Minister for Social Services issued a press release stating she had held discussions with the department on the cessation of the CDC program.15

1.4 The Social Security (Administration) Amendment (Repeal of Cashless Debit Card and Other Measures) Bill 2022 (the Bill) was introduced into Parliament on 27 July 2022, to give effect to the election commitment to abolish the CDC program by 31 December 2022. The Senate Standing Committee on Community Affairs Legislation Committee (the Senate Committee) inquiry into the Bill received 83 submissions and held four public hearings. In its report, the Senate Committee noted the following16:

- Support for the abolition of the CDC program due to the lack of evidence that the CDC program met its objectives, and the negative impacts on individuals and communities.

- Support for the CDC program due to the positive impact in communities and questions about the transition.

- Issues specific to the Northern Territory and Cape York, such as concerns that ‘the bill created a framework that allowed the minister to determine that certain NT CDC participants be transitioned onto compulsory Income Management under the Basics Card after the repeal of the program’.

- Impact of the Bill on the work of the Family Responsibilities Commission.17

- Concerns about the future of the Income Management approach.

1.5 The Senate Committee recommended that the Bill be passed subject to the Australian Government working with the Queensland Family Responsibilities Commission to address the matters raised during the inquiry.18

1.6 The Bill was amended to establish the Enhanced Income Management program for specific categories of participants, to commence on or after 6 March 2023. The Enhanced Income Management program was a new ‘tool that helps participants to manage their welfare payments and prioritise spending on essential goods and services’ with modern bank card technology (see paragraphs 3.9 to 3.12). The Bill was also amended to introduce a closure day for the CDC program of 1 October 2022, meaning no new participants could enter the program from this date, and a repeal date of 30 March 2023. The Bill was passed on 28 September 2022 and the relevant provisions came into effect on 1 October 2022.19

1.7 CDC participants from the Northern Territory, Cape York and Doomadgee regions were required by legislation to transfer to the Enhanced Income Management program. Participants from Bundaberg, Hervey Bay, the Goldfields, Ceduna and East Kimberley regions were exited from the CDC program and could voluntarily become a participant of Enhanced Income Management.

1.8 In June 2023 the Social Security (Administration) Act 1999 was amended to enable participants of the BasicsCard Income Management program to move to the Enhanced Income Management program from 4 September 2023.20 From this date no new participants could enter the BasicsCard Income Management program.

1.9 As at 30 September 2022, the department recorded there were 16,616 participants on the CDC program. The department recorded 4,039 participants were transferred from the CDC program to the Enhanced Income Management program as at 10 March 2023, with 181 of these participants (4.5 per cent) voluntarily choosing to participate in the program. The CDC participants who were not mandated to transfer to the Enhanced Income Management program and who did not volunteer to transfer, did not continue with any form of income management.

1.10 As at 23 February 2024, the department recorded there were 19,559 participants in BasicsCard Income Management program and as at 1 March 2024, 10,941 participants in the Enhanced Income Management program, with four per cent of these being voluntary participants.

1.11 Appendix 3 sets out the timeline of key dates for the cessation of the CDC program and the introduction of Enhanced Income Management.

Implementation of Enhanced Income Management

Funding for the transition

1.12 Schedule 2A of the Social Security (Administration) Amendment (Repeal of Cashless Debit Card and Other Measures) Act 2022 required the department to publish the ‘full cost to the Commonwealth of the operation of the cashless debit card scheme’.21 On 28 March 2023 the department published the estimated cost of $234 million on its website.22

1.13 During the Senate Community Affairs Legislation Committee’s 2022–23 supplementary budget estimates hearings on 15 February 2023 the department advised Parliament that the $217 million allocated in the October 2022–23 Federal Budget, including forward estimates to 2025–26, to abolish the CDC program included:

- $158 million for support services for participants on income management programs and those who exited the CDC program and did not transition to Enhanced Income Management program23;

- approximately $30 million for departmental expenses;

- $26 million for the card provider costs;

- $1.5 million for evaluation; and

- $400,000 for communications.24

1.14 Services Australia was allocated funding in the October 2022–23 Federal Budget to support the cessation of the CDC program, including the procurement and supply of the new card and the banking and telephony services to support the transition from the CDC program to Enhanced Income Management. The details of the allocated funding were not published.25 During the Senate Community Affairs Legislation Committee’s 2022–23 supplementary budget estimates hearings on 15 February 2023, Services Australia advised Parliament that the agency had been allocated $50.1 million in funding ‘to abolish the cashless debit card and transition customers to enhanced income management’.26

Bilateral arrangements

1.15 Since 2011, the bilateral relationship between the department and Services Australia has been an ‘appropriated partnership’ arrangement. Under an ‘appropriated partnership’ arrangement, one entity — in this instance, Services Australia — is accountable for delivering services and prioritising service delivery within its funding budget (appropriation); and the other entity — in this instance, the department — retains policy responsibility for those services.

1.16 The Bilateral Management Arrangement (the BMA) sets out the principles and governance arrangements that apply to the relationship between the department and Services Australia. The BMA between the department and Services Australia comprises a high-level Head Agreement signed in April 2023 and a series of subordinate bilateral agreements (called ‘protocols’, ‘service schedules’ or ‘service arrangements’) outlining how the entities will work together to achieve desired outcomes. The department’s bilateral arrangements with Services Australia for the CDC program were set out in the Cashless Debit Card Program Services Arrangement (the CDC Services Arrangement), dated 1 April 2022. The CDC Services Arrangements was due to expire on 31 December 2022, the legislated date for the end of the program. The introduction of the Enhanced Income Management program required new arrangements and a draft Enhanced Income Management Services Schedule (the EIM Schedule) was created in May 2023 to reflect the roles and responsibilities in delivering the new program. The EIM Schedule was approved by Services Australia on 21 March 2024 and the department on 22 March 2024.

Contractual arrangements with service providers

1.17 The department contracted the following companies to support the CDC program.

- Indue Limited (Indue), a financial institution, provided CDC accounts and cards and provided direct support to participants under a contract that started on 26 February 2016. The term of the contract, with variations, is until 30 June 2024 to support CDC cessation activities.

- Traditional Credit Union Limited (TCU), a financial institution, provided financial services to Australians living in remote communities in the Northern Territory, including providing in-language services to Indigenous participants of the CDC program. Indigenous CDC participants in the Northern Territory could choose either Indue or TCU to provide services. The contract with TCU was for the period 22 September 2021 to 31 December 2022.

- DXC Technology Australia Proprietary Limited (DXC), provided the product level blocking technology with point-of-sale providers to support use of the card issued to CDC participants. The contract with DXC was for the period 8 November 2021 to 31 December 2022.

1.18 In August 2022, the department advised the Minister for Social Services that Services Australia would ‘enter into arrangements with Indue and the Traditional Credit Union (TCU) to enable a temporary card with technology capability of the current CDC’ for participants who exited the CDC program and transferred to the BasicsCard Income Management program. The department also advised that Services Australia would provide all client facing services. The temporary card that was initially proposed later became the ‘SmartCard’ following the establishment of the Enhanced Income Management program in September 2022 (see paragraph 1.6).

1.19 The procurement for the new card to support the Enhanced Income Management program was conducted by Services Australia under a limited tender arrangement, with the request for quotation issued to Indue on 3 November 2022 (see paragraph 4.9). The contract was executed on 30 January 2023 (see paragraph 4.39).

1.20 To support the new contract with Indue the existing contracts with TCU and DXC were novated from the department to Services Australia on 1 February 2023 and 9 December 2022 respectively. The contracts were then varied by Services Australia to support the Enhanced Income Management program requirements through till 30 June 2024, with options to extend until 30 June 2026. At June 2024, Services Australia was in the process of extending both contracts to 30 June 2025.

Income management programs

1.21 The features of the three programs that have been part of the Australian Government’s approach to income management are summarised in Table 1.1 below.

Table 1.1: Summary of income management programs

|

|

BasicsCard Income Management program |

Cashless Debit Card program |

Enhanced Income Management program |

|

Period of Operation |

2007 — ongoinga |

1 February 2016 — 5 March 2023 |

6 March 2023 — ongoing |

|

Purpose |

‘helps participants manage their welfare payments and prioritise spending on essential goods and services.’b |

‘aims to reduce the levels of harm associated with alcohol consumption, illicit drug use and gambling.’c |

‘helps participants manage their welfare payments and prioritise spending on essential goods and services.’d |

|

Quarantining Ratese |

The percentage of quarantined funds varied from 50-90 per cent depending on participant circumstances as prescribed by legislation. |

The percentage of quarantined funds varied from 50-90 per cent depending on participant circumstances as prescribed by legislation. |

The percentage of quarantined funds varies from 50-90 per cent depending on participant circumstances as prescribed by legislation. |

|

Restricted Items |

Alcoholic products Tobacco products Pornography Gambling products Some gift cards and other cash-like products Cash withdrawal |

Alcoholic products Gambling products and services Some gift cards and other cash-like products Cash withdrawal |

Alcoholic products Tobacco products Pornography Gambling products and services Some gift cards and other cash-like products Cash withdrawal |

|

Account and Card |

The BasicsCard works with an income management account that does not have a BSB or account number. It will only work at pre-registered BasicsCard merchants and requires a PIN to process payments. Direct payments are processed by Services Australia on participants’ behalf. |

The CDC card provided modern banking functions including contactlessf functionality and the ability to make BPAY bill payments and online shopping. It is linked to a BSB and account number and operates like a regular bank account. The program deployed product level blockingg at merchants that had product level blocking enabled terminals. |

The SmartCard provides modern banking functions including contactlessf functionality and the ability to make BPAY bill payments and online shopping. It is linked to a BSB and account number and operates like a regular bank account. The program deploys product level blockingg at merchants that have product level blocking enabled terminals. |

|

Participant numbers |

19,310 participants as at 1 March 2024. |

16,616 participants, as at 30 September 2022. |

4,039 participants, as at 10 March 2023. 10,498 participants as at 1 March 2024. |

|

Regions |

Northern Territory Kimberley Region, WA Livingstone, Logan and Rockhampton Qld Greater Adelaide and Playford regions, SA Anangu Pitjantjatjara Yakunytatjara (APY Lands) SA Bankstown, NSW Shepparton area, VIC Perth Metropolitan and Peel District, WA Ngaanyatjarra Lands, WA Kiwirrkurra Community, WA |

Northern Territory Bundaberg and Hervey Bay, QLD Cape York and Doomadgee regions, QLDh Ceduna, SA East Kimberley and Goldfields regions, WA |

Northern Territory Bundaberg and Hervey Bay regions Qld Cape York and Doomadgee regions QLDh Ceduna region SA Kimberley region WA Goldfields region WA Livingstone, Logan and Rockhampton regions Qld Greater Adelaide and Playford regions SA APY Lands SA Bankstown area NSW Shepparton area VIC Perth Metropolitan and Peel District regions WA Ngaanyatjarra Lands WA |

Note a: The BasicsCard Income Management program was closed to new participants on 3 September 2023.

Note b: Department of Parliamentary Services, Social Security and Other Legislation Amendment (Welfare Payment Reform) Bill 2007 Bills Digest, Commonwealth of Australia, Canberra, August 2022, available from https://www.aph.gov.au/Parliamentary_Business/Bills_Legislation/Bills_Search_Results/Result?bId=r2852 [accessed 15 April 2024].

Note c: Department of Social Services, Corporate Plan 2020–21, Department of Social Services, Canberra, 2020, available from https://www.dss.gov.au/about-the-department/publications-articles/corporate-publications/department-of-social-services-corporate-plans/department-of-social-services-corporate-plan-2020–21 [accessed 30 April 2024].

Note d: Department of Social Services, Income Management, Department of Social Services, Canberra, 2024, available from https://www.dss.gov.au/our-responsibilities/families-and-children/programs-services/family-finance/income-management [accessed 15 April 2024].

Note e: Quarantine rates are set out in the Social Security (Administration) Act 1999, Parts 3AA and 3B.

Note f: A PIN is required for transactions where contactless payment is not used, and a PIN is required by default for the Enhanced Income Management program SmartCard unless otherwise enabled by a participant.

Note g: Product level blocking technology allows point-of-sale systems to identify individual items that are ‘restricted’. If the point-of-sale system detects a restricted item, the payment will not proceed and the customer can choose whether to pay for the restricted item another way, or not to buy the restricted item. Services Australia, SmartCard product level blocking, Services Australia, Canberra, 2023, available from https://www.servicesaustralia.gov.au/smartcard-product-level-blocking?context=64353 [accessed 6 May 2024].

Note h: These regions fall within the scope of the remit of the Family Responsibilities Commission. Family Responsibilities Commission, Welfare reform communities, FRC, Carins, available from https://www.frcq.org.au/our-communities/ [accessed 6 May 2024]

Source: ANAO analysis of the department’s records and relevant legislation.

Rationale for undertaking the audit

1.22 The ANAO undertook two previous performance audits of the CDC program. The Auditor-General Report No. 1 2018–19 The Implementation and Performance of the Cashless Debit Card Trial examined the department’s implementation and evaluation of the CDC trial.27 The audit found that while the department largely established appropriate arrangements to implement the CDC trial, its approach to monitoring and evaluation was inadequate. It was therefore difficult to conclude if the CDC trial was effective in achieving its objective of reducing social harm and whether the card was a lower cost welfare quarantining approach.

1.23 Auditor-General Report No. 29 2021–22 Implementation and Performance of the Cashless Debit Card Trial — Follow-on examined the effectiveness of the department’s administration of the CDC program.28 The audit found that the department’s administrative oversight of the CDC program was largely effective, however the department had not demonstrated that the CDC program was meeting its intended objectives.

1.24 This audit provides assurance to Parliament on the effectiveness of the management of the transition from the CDC program to the Enhanced Income Management program.

Audit approach

Audit objective, criteria and scope

1.25 The objective of the audit was to assess the effectiveness of the transitional arrangements from the CDC program to the Enhanced Income Management program.

1.26 To form a conclusion against the objective, the following high level criteria were applied:

- Did the department have effective oversight of the transition arrangements?

- Was the design of the Enhanced Income Management program based on appropriate advice and evidence?

- Did Services Australia undertake the procurement process for the Enhanced Income Management program in accordance with the Commonwealth Procurement Rules?

1.27 The cessation period for the CDC program was from 1 October 2022 (the day after royal assent) to 5 March 2023, with Enhanced Income Management commencing on 6 March 2023 (see paragraphs 1.3 to 1.7). The audit has assessed the department’s management of the transitional arrangements by examining the period between 3 June 2022, when the Australian Government announced its intent to abolish the CDC program until June 2023.

1.28 The following were out of scope for this audit:

- service delivery of the CDC;

- the novation of contracts related to the CDC program from the department to Services Australia, and establishment of a tripartite agreement between Services Australia, Indue and TCU (see paragraph 1.17);

- the support services provided by the department for the income management programs; and

- the department’s design or implementation of the legislative amendments contained in Social Security (Administration) Amendment (Income Management Reform) Act 2023 in relation to criteria for those who are required to enter into the Enhanced Income Management and the closure of the BasicsCard Income Management program to new participants (see paragraph 1.8 to 1.11) and all subsequent activity on the future design and management of income management programs.

Audit methodology

1.29 The audit methodology included:

- reviewing documentation held by the department and Services Australia

- meeting with staff from relevant business areas within the department and Services Australia.

1.30 The audit was conducted in accordance with ANAO Auditing Standards at a cost to the ANAO of approximately $649,000.

1.31 The team members for this audit were Margaret Murphy, Freya Mathie, Andrew Han, Alexandra McFadyen, Scott Lang, James Carrington and Alexandra Collins.

2. Oversight of the transition

Areas examined

This chapter examines whether the Department of Social Services (the department) had effective oversight of the transition from the Cashless Debit Card program to the Enhanced Income Management program.

Conclusion

The department had largely effective oversight of the transition arrangements.

The department established an internal branch to deliver the transition activities and coordinate activities across the Australian Government and utilised the existing joint steering committee with Services Australia, established under the bilateral arrangements, to oversee the transition. The governance arrangements would have been enhanced with appropriate record keeping practices and defined reporting responsibilities. There was regular reporting on operational matters and participation rates to the executives of the department and Services Australia. There was no evidence that shared risks rated ‘high’ on the joint risk register with Services Australia were escalated in accordance with the department’s Risk Management Framework.

Areas for improvement

The ANAO made two recommendations for the department in relation to improving the terms of reference for all oversight and governance bodies for income management programs and in relation to endorsement of risk registers and escalation of ‘high’ and ‘extreme’ risks.

The ANAO also identified one opportunity for improvement for the department in relation to documenting review and endorsement of joint risk registers.

2.1 To support effective oversight of an ‘appropriated partnership’29 the entity accountable for a program needs to establish robust bilateral agreements with the delivery entity, which should include clear objectives, defined roles and responsibilities, and effective processes for issue identification and dispute resolution. Bilateral governance bodies should be established at appropriate levels to ensure proactive and strategic management and oversight of the services being delivered. Robust processes for identifying, communicating, and managing shared risks are also important, particularly when the accountable entity’s and delivery entity’s risk tolerances differ.

2.2 The Commonwealth Risk Management Policy aims ‘to embed risk management into the culture and work practices of [Australian Government] entities to improve decision making in order to maximise opportunities and better manage uncertainty’.30 As non-corporate Commonwealth entities, both the department and Services Australia are required to comply with the Commonwealth Risk Management Policy, which requires entities to collaborate to manage shared risks.

Were appropriate governance arrangements established and maintained throughout the transition?

The department established an internal branch, known as the Taskforce, to coordinate activities between the department, Services Australia and the National Indigenous Australians Agency (NIAA), during the transition period. The effectiveness of the Taskforce’s activities would have been enhanced by appropriate record keeping practices. The department utilised an existing joint steering committee with Services Australia, established under the bilateral arrangements, to oversee the transition. The department established a joint risk register to manage shared risks with Services Australia which was reported to the joint steering committee. There was no evidence the joint steering committee monitored progress against the department’s strategy or project management plan for the transition. The Taskforce provided regular reporting on operational matters and participation rates to the department’s and Services Australia’s executives.

Planning for the abolishment of the Cashless Debit Card program

2.3 The department’s brief to the incoming government dated 31 May 2022 noted the election commitment to abolish the Cashless Debit Card (CDC) program (see paragraph 1.3) and that this would be one of the department’s immediate priorities. The department suggested the minister’s engagement with relevant stakeholders would support the timing of the cessation of the CDC program and support services that meet the needs of communities. The department noted that Services Australia was responsible for implementation of most transition arrangements and advised of the legislated sunset date of 31 December 2022 for the program and the end dates of contracts with service providers.31 On 3 June 2022 the Minister for Social Services issued a press release referring to discussions with the department on the cessation of the CDC program.32

2.4 The department’s advice to the Australian Government on the cessation of the CDC program and the design and implementation of the Enhanced Income Management program is set out in paragraphs 3.7 to 3.16.

The department’s management of the transition

2.5 Following the establishment of the Enhanced Income Management program in the Social Security (Administration) Amendment (Repeal of Cashless Debit Card and Other Measures) Act 2022 the department was responsible for:

- transitioning all participants off the CDC program between the 1 October 2022 and 5 March 2023, including closing participant CDC accounts and transferring residual funds from CDC accounts to each participant’s nominated bank account;

- ensuring those participants who had elected to participate and those prescribed by the legislation commenced in the Enhanced Income Management program from 6 March 2023, including replacement of CDC program cards with the SmartCard used for the Enhanced Income Management program;

- delivering support services to those transferring to Enhanced Income Management program and those who exited the CDC program and did not elect to join Enhanced Income Management; and

- providing regular reporting to the minister during the transition.

2.6 The department developed a Cashless Debit Card Transition Strategy (the Transition Strategy) in September 2022. The Transition Strategy sets out the dates for the key milestones and the stakeholder engagement activities to be delivered, including community workshops and the different types of communication channels to be used for participants.

2.7 The department established a project management plan, which encompassed and built upon the Transition Strategy. The plan was endorsed by a Senior Executive Service (SES) Band 2 officer in January 2023. The project’s scope was ‘all aspects required for abolishing the CDC program and the creation of enhanced IM [Income Management] inclusive of consultation, communication activities, procurement, legislative work, engagement and governance.’ The project management plan specified project outcomes, outputs in the short (14 June 2022 to 2 October 2022), medium (3 October 2022 to 5 March 2023) and long term (6 March 2023 to June 2024) as well as key deliverables and relevant responsible executives. There were five work packages to support the project management plan: community-led support services; data and compliance; policy and legislation; procurement and technology; and governance and engagement. The project management plan also referred to the use of a joint risk register established with Services Australia to manage shared risks during the transition (see paragraphs 2.47 to 2.54).

Taskforce

2.8 In June 2022, the department established a branch within the Families and Communities division, known as the Taskforce, to coordinate the operations of the cessation of the CDC program ‘and lead consultation and co-design on the future of Income Management’. The Taskforce’s Statement of Intent broadly defined the branch’s responsibilities, including coordination with Services Australia and the NIAA and reporting to the department’s executive via a weekly status report and dashboard. There was no reference in the Taskforce’s Statement of Intent to the CDC related governance arrangements set out in the bilateral management arrangements, including the role of the CDC Steering Committee which consisted of representatives from both the department and Services Australia established under the Cashless Debit Card Program Services Arrangement (CDC Arrangement) (see paragraphs 1.16 and 2.16).

2.9 The Taskforce’s Statement of Intent outlined the Taskforce’s role to facilitate daily meetings between the department, Services Australia and NIAA. Minutes of the Taskforce’s meetings were documented between 17 June 2022 and 13 July 2022. Details of attendees were not routinely recorded.

2.10 The agenda items recorded in the Taskforce daily standup meeting minutes from 17 June 2022 to 13 July 2022 included:

- an ‘SES cascade’ that covered topics such as policy and legislative progress and the minister’s participation in community consultations;

- updates from Services Australia on items such as the drafting of the information and communications technology (ICT) requirements, development of a ‘questions register’, and costings development33;

- planning of workshops on risk management and mapping of a ‘customer journey’ to show the key steps, processes and functionality required to support a participant engaging with Services Australia for their exit from the CDC program or transition (voluntary or compulsory) to Enhanced Income Management (see paragraph 3.7); and

- updates on stakeholder communication and consultation activities.

2.11 The absence of documentation of the Taskforce’s meetings from July 2022 onwards does not enable an assessment of the effectiveness of the Taskforce’s activities, including monitoring of progress against the Transition Strategy or project management plan.

2.12 The Taskforce’s Project Closure Report for ‘Tranche 1 – Abolishing the Cashless Debit Card’ was endorsed by an SES Band 2 officer in July 2023. The report stated that all project objectives had been met and outputs finalised. This did not account for the fact the timeframe for the long-term outputs in the project plan was June 2024. The following were listed as outstanding activities in the report:

- A review of the impacts of the CDC transition is being undertaken, with a final report due to the Department in late 2023.

- ICT changes relating to the Family Responsibilities Commission (FRC) referral process for IM [income management] (voluntary and compulsory) have been determined and IT solutions built.

- A review of the support brokerage arrangements (identified in the Implementation Readiness Assessment) has been undertaken. The final report with findings has been provided to the SRO for endorsement.

2.13 As part of the Australian Government’s Assurance Review Framework, the Department of Finance conducted an Implementation Readiness Assessment (IRA) on the abolition of the CDC between 30 January 2023 and 3 February 2023.34 The IRA made six recommendations, two of which required urgent action by the department to implement. The department’s abolition of the CDC was rated ‘Green’ which is defined in the Resource Management Guide 106 as ‘successful implementation of the program appears likely and there are no major outstanding issues/risks that appear to threaten implementation significantly.’ In August 2023 the department provided the minister with an update on the status of the implementation of recommendations from the IRA.

Bilateral arrangements

2.14 As discussed in paragraphs 1.15 and 1.16 the department and Services Australia have an ‘appropriated partnership’ bilateral arrangement, which is supported by other agreements that summarise roles and responsibilities of both parties. The secretary of the department is accountable for delivery of all forms of income management.

2.15 The term of the CDC Arrangement between the department and Services Australia was from 1 April 2022 to 31 December 2022.

2.16 The CDC Arrangement set out the following governance arrangements for the CDC program:

- a Cashless Welfare Working Group to oversee operational matters pertaining to both service delivery and program management, comprising of Executive Level 2 officers from the department and Services Australia35; and

- a CDC Steering Committee to oversee the implementation and future direction of the program, comprising of SES Band 1 and 2 officers from the department and Services Australia and SES Band 1 officers from the NIAA and the Department of the Prime Minister and Cabinet (see paragraphs 2.22 to 2.23).

2.17 The CDC Arrangement listed the department’s responsibilities as including CDC program policy and legislation, strategic stakeholder engagement, card provider procurement and contract management; support services, and negotiation and management of agreements on data exchange. Services Australia’s responsibilities included program implementation and service delivery operations for the CDC program.

2.18 A draft Enhanced Income Management Services Schedule (EIM Schedule) was prepared by the department on 4 May 2023. The EIM Schedule was approved by Services Australia on 21 March 2024 and the department on 22 March 2024.

2.19 The EIM Schedule sets out the following governance arrangements:

- a quarterly leadership meeting comprising of Executive Level 2 officers from the department and Services Australia to oversee operational matters; and

- a Steering Committee to oversee the implementation and future direction of the program with the same membership as the CDC Steering Committee.

2.20 In April 2024 the department advised the ANAO the quarterly leadership meetings had not yet started. The Steering Committee had continued to meet following its establishment under the CDC Services Arrangement (see paragraphs 2.22 and 2.23).

2.21 The EIM Schedule reflects the change in roles and responsibilities between the department and Services Australia for the Enhanced Income Management program, with Services Australia responsible for procurement, contract management, and service delivery operations, including telephony channels and face-to-face servicing via service centres. Services Australia is also required to advise the department on service level performance and provide relevant information and data. The schedule specifies a range of weekly program reports Services Australia is required to provide to the department, including product level blocking and point of sale data.

Steering Committee

2.22 At the commencement of the CDC transition period, the Steering Committee operated under the February 2022 terms of reference for the CDC Steering Committee. The CDC Steering Committee’s terms of reference were updated in December 2022 to reflect its role in overseeing ‘the cessation of the CDC and future direction of IM [Income Management]’. The role of the Steering Committee as set out in the December 2022 terms of reference was largely consistent with the role set out in the February 2022 terms of reference. Changes to the terms of reference acknowledge the CDC was ceasing as a program and included additional roles relating to collaborating on legislative amendments; identifying and addressing risks; and project oversight. (see paragraph 2.33) The December 2022 update also included changing its name to the Income Management Steering Committee.

2.23 The Steering Committee terms of reference were re-drafted in April 2023 to reflect the EIM Schedule. As at March 2024 the draft terms of reference had not been finalised. While the December 2022 terms of reference and the April 2023 draft terms of reference acknowledge the existence of the Taskforce, and the reports coordinated by the Taskforce, neither document specifies the reporting lines for the Taskforce, nor the Steering Committee’s relationship with the bilateral governance arrangements. There was no evidence of the Steering Committee reporting to the department’s or Services Australia’s executive committees.

2.24 From February 2022 the Steering Committee’s membership comprised of SES officers from the department, Services Australia, the NIAA and the Department of the Prime Minister and Cabinet. While not listed in the terms of reference, the minutes of meetings note officers from the Department of Health and Aged Care were in attendance from November 2022 onwards.

2.25 The appropriateness of the bilateral arrangements between the department and Services Australia were examined in Auditor-General Report No. 4 2023–24 Accuracy and Timeliness of Welfare Payments.36 The report made recommendations for both entities to improve bilateral arrangements.

Recommendation no.1

2.26 The Department of Social Services and Services Australia:

- ensure the terms of reference for all oversight and governance committees and bodies related to income management programs clearly define their reporting structure and responsibilities and, where applicable, refer to the governance arrangements set out in the bilateral agreement or supporting protocols and service agreements; and

- implement mechanisms to gain assurance that all oversight and governance committees and bodies are operating in accordance with the terms of reference.

Department of Social Services response: Agreed.

2.27 As of 22 March 2024, a new enhanced IM Service Schedule was endorsed. The schedule sets out the following governance arrangement for the enhanced IM:

- Quarterly leadership meeting comprising of Executive Level 2 offices from the Department and Services Australia to oversee operational matters; and

- Steering Committee (meet bi-monthly) to oversee the implementation and operations of the program with the same membership as the CDC Steering Committee.

2.28 The meetings provide an opportunity to discuss operational matters, service delivery, program implementation and management of the enhanced IM program.

2.29 The Department has also implemented clear procedures and controls to ensure governance committees and bodies are operating in accordance with their terms of reference.

Services Australia response: Agreed.

2.30 Services Australia agrees with the recommendation and is committed to continually improving its governance mechanisms and related assurance. Services Australia has already taken steps to make improvements, including updating the Income Management Governance Board Terms of Reference to clearly articulate reporting structures and bilateral arrangements.

2.31 The minutes of Steering Committee meetings from June 2022 to November 2023 record that it met monthly in accordance with its terms of reference between June and December 2022, except for August 2022. In 2023 the Steering Committee met in March, May, July and September 2023.

2.32 The role of the Steering Committee, as set out in the December 2022 terms of reference, was to:

- collaborate on any legislative amendments

- identify and address key practical and strategic considerations for the cessation of the CDC

- guide the transition for current and future [income management] participants, including in the Northern Territory, Cape York region and place-based sites

- ensure the cessation of the CDC and future options are informed by other place based policies (i.e. Empowered Communities and Families Program Reform)

- provide a mechanism for ongoing information sharing and collaboration between the departments on the transition and cessation of the CDC

- identify and address risks and issues related to the cessation of CDC and the future direction of [income management], including those that are shared

- ensure the project remains on track and escalate issues in a timely manner to the Executive

- be responsible for raising, and working to resolve, any whole-of-government issues associated with the cessation of CDC and future direction of [income management].

2.33 ANAO analysis of the minutes of Steering Committee meetings from June 2022 to November 2023 showed that the Steering Committee was a mechanism for information sharing, data sharing and collaboration between the entities in attendance at the meetings. Minutes of the meetings regularly included:

- progress and timing of legislative amendments;

- community consultations on the future direction of the income management programs;

- participant numbers;

- risk management;

- maintaining business as usual services for current participants during the transition; and

- communication with participants and stakeholders.

2.34 Minutes from the November 2022 Steering Committee meeting state that the joint risk register will be ‘updated monthly and endorsed’ by the relevant SES Band 1 from both the department and Services Australia. The risks listed in the joint risk register were noted at each meeting during the period of June 2022 to November 2023. The Steering Committee did not receive an updated risk register at every meeting and it did not receive the May 2023 risk register (see paragraph 2.52).

2.35 Services Australia’s progress of the limited tender procurement for the new card to support the Enhanced Income Management program, such as functionality requirements to inform the request for quote and expected timeframes for completion of the procurement activity, was not discussed at the Steering Committee. The department’s transition strategy, project management plan, and project closure report (see paragraphs 2.6, 2.7 and 2.12) were not provided to the Steering Committee and there was no evidence of it monitoring progress against the relevant outputs and deliverables.

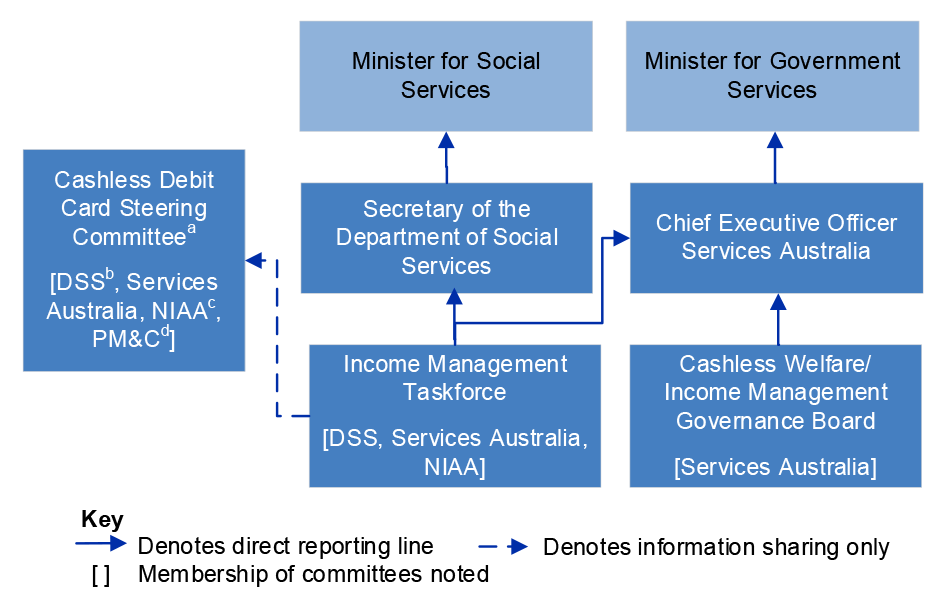

2.36 Figure 2.1 sets out the relationship between the key governance arrangements involved in managing the transition. Services Australia utilised its pre-existing Cashless Welfare Governance Board (Governance Board) to oversee its activities relating to the transition period.37 The Governance Board held fortnightly meetings until October 2022. Meetings after October 2022 were held monthly. While the meetings were minuted, there was no evidence that the department had visibility over the discussions and outcomes of the Governance Board. There was no evidence of the Governance Board reporting to the Taskforce or the Steering Committee. In March 2024 the Governance Board updated its terms of reference to include a section titled ‘reporting’ and noted that ‘key operational outcomes or issues requiring escalation’ will be reported to a nominated SES Band 2 officer and to the department for discussion at the Taskforce or Steering Committee, or decision. The section also noted that ‘unresolved issues’ following escalation to the Steering Committee could then be escalated to the committees established under the bilateral governance arrangements.

Figure 2.1: Key governance arrangements involved in the CDC transition from June 2022 to June 2023

Note a: The terms of reference for the Steering Committee did not establish who the body reports to.

Note b: DSS — Department of Social Services.

Note c: NIAA — National Indigenous Australians Agency.

Note d: PM&C — Department of the Prime Minister and Cabinet.

Source: ANAO Analysis of the department’s and Services Australia’s records.

Monitoring and reporting

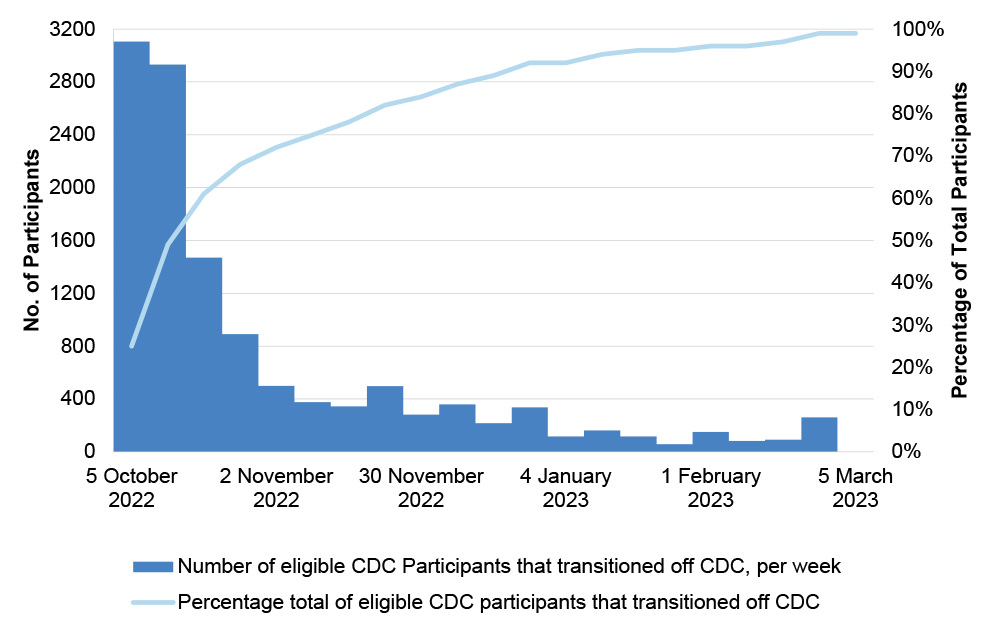

2.37 Those participants of the CDC program who were not prescribed by legislation to transfer to the Enhanced Income Management program, could transition off the CDC program at any time between 1 October 2022 and 5 March 2023. 68 per cent of that eligible cohort chose to exit the CDC program in the first month. Figure 2.2 shows the number of participants who exited the CDC program during the five-month transition period.

Figure 2.2: Exit of participants from the CDC program who were not required to transfer to Enhanced Income Management between 1 October 2022 and 5 March 2023

Source: ANAO analysis of the department’s Weekly Status Reports.

2.38 The Taskforce provided regular updates to the department and Services Australia containing operational data provided by Services Australia. Table 2.1 sets out a summary of the contents and frequency of the regular reporting. The reports were signed off by the department’s relevant SES Band 2 officer and circulated to the department’s secretary, responsible deputy secretary and to Services Australia’s Chief Executive Officer (CEO), Deputy CEO and relevant SES officers.

Table 2.1: Regular reporting by the Taskforce between June 2022 and December 2023

|

Report Title |

Weekly Status Reportsa |

Weekly CDC Cessation Dashboard |

Project Status Reports |

|

Dates Used |

14 June 2022 to 5 April 2023 |

29 September 2022 to 29 March 2023 |

3 April 2023 to December 2023 |

|

Frequency |

Weekly |

Weekly |

Fortnightly |

|

Operational information included |

Achievements of the week. Key risks and issues. Key upcoming activities. Milestones for the transition. |

Key insights and issues. Regional updates. Community and stakeholder engagement (included for January and February 2023 dashboards). |

Achievements of the week. Key risks and issues. Regional updates. Key upcoming activities. Milestones for Enhanced Income Management. |

|

Participant Data included |

Number of new CDC participants by region. Number of CDC participants ceased by region. |

Number of participants who transitioned to Enhanced Income Management program (this week, total to date, remaining to transition). Number of participants who had transitioned by region. Number of First Nations participants. Number of participants who had elected to join Enhanced Income Management. Call volumes and wait times. |

Number of participants by region. Number of First Nations participants. Number of voluntary participants. Number of participants by service provider. Call volumes and wait times. Participants issued SmartCards by provider. |

Note a: Participant data was moved from the Weekly Status Reports to the weekly CDC Cessation Dashboards from 29 September 2022.

Source: ANAO analysis of the department’s records.

2.39 The Weekly Status Reports and the Weekly CDC Cessation Dashboards included updates on topics such as meetings with stakeholders, legislative amendments, contract management and procurement activities, product level blocking, branding and communications.

2.40 The department’s Executive Management Group minutes show that between June 2022 and June 2023 the transition was discussed and noted at seven meetings.

2.41 In August 2023 the department’s secretary was briefed on the status of implementation of the recommendations in the Implementation Readiness Assessment (see paragraph 2.13). One recommendation was reported as complete, two were ‘ongoing’ as business as usual activities, and three were ‘in progress’. An expected completion date was provided for one of the three ‘in progress’ recommendations.

Were fit for purpose arrangements established to identify and manage risks during the transition?

The department and Services Australia developed a joint risk register for shared risks relating the transition. Each identified risk was accompanied by a risk assessment. The review, amendment and approval of the joint risk registers was not consistently documented. Risks relating to the application of product level blocking technology to the Enhanced Income Management program were not documented in the joint risk register from June 2022 to June 2023. There was no evidence that any of the eight risks rated ‘high’ were escalated in accordance with the department’s Risk Management Framework (RMF).

Risk Management Framework

2.42 The department’s RMF dated April 2023 comprises of three components: a Risk Management Policy; a Risk Management Procedure; and an Issues Management Procedure. These documents replaced an earlier RMF dated December 2018 to align with the changes made to the Commonwealth Risk Management Policy effective from January 2023.38

2.43 The 2018 and 2023 versions of the department’s RMF applied during the transition period, and both noted the importance of managing shared risk given the department’s role in delivering government policy relies on cooperation with external agencies and service providers.

2.44 Both the 2018 and 2023 versions of the RMF were consistent with the requirements and guidance of the Commonwealth Risk Management Policy in effect at the time.

2.45 An internal audit conducted from November 2022 to March 2023 reviewed the department’s risk management culture. The audit identified five key findings and made six recommendations, all agreed by management. Appendix 4 contains the findings from the internal audit.

Shared risk management practices

2.46 A joint risk register was established by the Taskforce for shared risks for the transition between the department and Services Australia, including risks relating to contracted service providers. The joint risk register contained a risk assessment for each identified risk, including controls and treatments. The registers contained risks largely focused on procedural issues rather than program outcomes.

2.47 The development of the first risk management plan commenced in July 2022 and it was endorsed in September 2022 by SES Band 1 officers from the department and Services Australia. The plan contained risks relating to the failure of, or delay in, the passage of legislation to abolish the CDC, negative participant experience, ICT and banking services not delivered, data security, systems failures by Services Australia and card providers, overspend and workforce capability.

2.48 A summary of the joint risk management plans between September 2022 and July 2023 is set out in Table 2.2.

Table 2.2: Summary details of the joint risk registers from September 2022 to July 2023

|

Version of the joint risk register |

Approval by the Department |

Approval by Services Australia |

Number of risks |

Number of ‘high’ rated risksa |

|

September 2022 |

SES Band 1 officer 29 September 2022 |

SES Band 1 officer 30 September 2022 |

8 |

3 |

|

October 2022 |

SES Band 1 officer 14 November 2022 |

SES Band 1 officer 14 November 2022 |

7b |

3c |

|

November 2022 |

SES Band 2 officer 9 January 2023 |

SES Band 1 officer 14 December 2022 |

10d |

6 |

|

May 2023 |

SES Band 1 officer 19 May 2023 |

SES Band 2 officer 01 June 2023 |

10e |

6 |

|

July 2023f |

No evidence |

No evidence |

9g |

1 |

Note a: The department’s RMF includes a risk hierarchy of ‘Low’, ‘Medium’, ‘High’ and ‘Extreme’ risk. There were no risks rated ‘extreme’.

Note b: Risk 1 from the September 2022 plan — ‘legislation to abolish the Cashless Debit Card and make Income Management Voluntary does not pass parliament’ was closed and removed.

Note c: Risk 4 from the September 2022 plan — ‘key compliance, legislative and banking obligations are not met’ was upgraded from medium to high risk.

Note d: Four new risks were added — ‘Data analysis activities do not support effective program transition and management and/or are not perceived as being methodologically sound’ which was rated ‘high’, ‘Implementation of enhanced IM does not occur seamlessly, or adversely affects eligible enhanced IM participants/former CDC participants or communities’, ‘Acceptable contracts with third party service providers or required regulatory authorities are not in place within required timeframes to implement eIM [Enhanced Income Management] by 6 March 2023’ which was rated ‘high’ and ‘Legislative instruments and determination to enable enhanced IM are disallowed, or required legislation does not pass Parliament within expected timeframes or is significantly amended’ which was rated ‘high’ and the date the risk was identified was recorded as 1 July 2022.

Risk 5 from the September 2022 plan — ‘System Failures: Services Australia and Card Providers’ from the October 2022 register was omitted from the November 2022 and May 2023 register without out any evidence of it having been closed.

Note e: Six risks related to seamless implementation of Enhanced Income Management, delivery of ICT requirements, engagement with Indue Limited (Indue), contractual arrangements being executed by 6 March 2023 and workforce capability were marked as closed yet still appeared on the register.

Note f: The July 2023 version of the risk management plan was renamed Tranche 2 — Future of Income Management. It included risks relating to the legislative amendments passed in June 2023 (see paragraph 1.8). The Tranche 2 risk register did not include dates for when each of the risks were opened, details of the source, controls or treatments or the supporting risk assessment.

Note g: Five open risks from the May 2023 risk register were either transferred directly or were slightly modified to reflected new changes in the legislation. Three new risks were added relating to implementation adversely affecting participants, ICT deliverables not being on time or effective and failure to implement due to workforce capability. One open risk from the May 2023 version was not transferred relating to security of participant data.

Source: ANAO analysis of the joint risk management plans between July 2022 and July 2023.

2.49 The risk register summary page for the November 2022 version had been updated incorrectly to show the risk ‘data and analysis activities do not support effective program transition’ was a medium risk when it was reported as high in the accompanying risk assessment. The error was not noted by the Steering Committee at the time and the summary page was not corrected in the next approved version (May 2023).

2.50 The joint risk register was aligned with the department’s RMF in effect at the relevant time. The risk assessment contained in the risk management plan included details of the risk’s rating, review date, the risk owner, and source of the risk. Controls and treatments for each risk were detailed. However, some treatments with listed due dates were not updated to clarify if the item had been actioned in time. Control and treatment types ranged from ongoing meetings, regular updates and reports, communication with stakeholders and state and territory governments, data collection and sharing practices with Services Australia, and business as usual activities and policies.

2.51 Minutes from the November 2022 Steering Committee meeting state that the risk register will be ‘updated monthly and endorsed’ by the relevant SES Band 1 from both the department and Services Australia.’ The information provided to the Steering Committee did not demonstrate monthly reviews of the risk register or subsequent changes, other than changes in risk rating. Risks were closed and removed from the register with no record of the rationale or date of the decision kept in the endorsed register. The risk register was provided to the Steering Committee for review at the meetings in October and November 2022 (the September and October versions) and March 2023 (November 2022 version). There is no evidence the Steering Committee received the May 2023 risk register.

2.52 In February 2023 the Taskforce identified a risk ‘that Product Level Blocking (PLB) will not be in place for all merchants from 6 March 2023’ in the weekly status report. This risk was not added to the Joint Risk Register. The joint risk register included a risk titled ‘ICT deliverables required to transition CDC participants off the program and onto enhanced Income Management (eIM) are not delivered on time or are ineffective’. In the accompanying risk assessment, one of the sources of the risk was listed as ‘insufficient (or changing) detail on ICT requirements to properly scope system change’. Product level blocking is not referred to in the risk assessment for this risk.

2.53 In the Weekly Status Report dated 2 to 8 March 2023 the department stated that major retailers, including Coles and Woolworths, reported that product level blocking was active, along with 23 small and medium sized enterprises. In the Project Status Report for the period 3 to 14 July 2023 the department reported approximately 8,000 stores had product level blocking ‘in place’ and 60,000 product level blocking terminals ‘integrated with PLB [product level blocking]’.39 This did not include some major retailers of mixed restricted and non-restricted items who were ‘committed’ to join the program.40 The department continued to report on retailers and banking institutions completing the roll out of product level blocking technology in all but three of the fortnightly Project Status Reports July and December 2023.

Escalation of shared risks

2.54 All versions of the joint risk registers contained risks rated as ‘high’. These risks were as follows.

- Legislation to abolish the Cashless Debit Card and make Income Management Voluntary does not pass parliament and become law (closed in October 2022).

- Implementation of CDC cessation policy adversely affects CDC participants.

- ICT deliverables required to transition CDC participants off the program or onto Enhanced Income Management are not delivered on time or are ineffective.

- Key compliance, legislative and banking obligations are not met (increased in October 2023).

- Data and analysis activities do not support effective program transition and management and/or are not perceived as being methodologically sound (added in November 2022).

- Acceptable contracts with third party service providers, or required regulatory authorities, are not in place within required timeframes to implement the Enhanced Income Management program by 6 March 2023 (added in November 2022).

- Legislative instruments and determination to enable enhanced IM are disallowed, or required legislation does not pass Parliament within expected timeframes or is significantly amended (added in November 2022).

2.55 Risk escalation in accordance with the department’s RMF, requires review by the Chief Risk Officer and approval by the deputy secretary of proposed treatment actions for all risks rated ‘high’. The deputy secretary must also escalate the risk to the department’s Executive Management Group for ‘awareness, treatment authorisation or acceptance of the risk’. These risks are also required to be reviewed monthly with updates on this risk provided to the Executive Management group via the Chief Risk Officer’s monthly report. There is no evidence that any of the treatments for the ‘high’ rated risks from the joint risk management plans were approved by the deputy secretary nor that they were escalated to the Executive Management Group in accordance with policy requirements. The minutes of the Steering Committee meetings did not note any risks requiring escalation.

Recommendation no.2

2.56 The Department of Social Services implement controls to gain assurance that risks rated ‘high’ or ‘extreme’ are escalated to the deputy secretary and the Executive Management Group consistent with the department’s risk management policy.

Department of Social Services response: Agreed.

2.57 The following actions have already been undertaken by the Department in response to this recommendation: