Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Home Ownership Programme

The objective of the audit was to express an opinion on the effectiveness of HOP management having regard to: compliance with applicable Australian Government policies; compliance with internal guidelines to assist loans officers to assess applications and manage loans; and programme performance reporting.

Summary

Background

The dual objectives of the Home Ownership Programme (HOP) are to provide a range of competitive housing loan products to eligible Indigenous Australians who may not qualify for assistance from mainstream lending institutions to assist them to buy and eventually own their home; and to assist in increasing the home ownership rate of Indigenous Australians to 40 per cent by the year 2010.

HOP is delivered through a network of regional Housing Loans Units located in each of the State capital cities, Darwin and six large regional centres. A HOP management team within Indigenous Business Australia in Canberra provides policy guidance and general programme management.

Regional Housing Loans officers assess applications for housing loans or related products against HOP policy and guidelines to assist Indigenous Australians into home ownership and provide aftercare services and support for the life of the loan.

HOP is essentially self–funding from funds received from loan repayments, discharges and interest. New loans are resourced from this funding stream. HOP's self–funding asset base has doubled since 19901 and over the same period HOP has provided housing for more than 21 700 Indigenous Australians. These results are consistent with the principal objects of the Aboriginal and Torres Strait Islander Commission (ATSIC) legislation in relation to housing, which were to promote the development of

self-management and self sufficiency among Aboriginal and Torres Strait Islander peoples; and to further the economic, social and cultural development of Aboriginal and Torres Strait Islander peoples.

At the time of the ANAO's fieldwork for this audit, HOP was delivered to Indigenous Australians by the Aboriginal and Torres Strait Islander Services (ATSIS) on behalf of ATSIC. Following the passage of legislation on 16 March 2005 to amend the Aboriginal and Torres Strait Islander Commission Act 1989, HOP transferred to Indigenous Business Australia (IBA) within the Employment and Workplace Relations portfolio. Indigenous Business Australia is a Commonwealth Authorities and Companies Act 1997 (CAC) agency. HOP's previous responsible agency—ATSIC—was also a CAC agency. During the audit the ANAO was mindful of the government's intention to abolish ATSIC and, as a consequence, focussed the audit on the management of HOP and the operation of the Housing Fund.

Audit scope and objectives

The objective of the audit was to express an opinion on the effectiveness of HOP management having regard to:

- compliance with applicable Australian Government policies;

- compliance with internal guidelines to assist loans officers to assess applications and manage loans; and

- programme performance reporting.

The scope of the audit included an examination of arrangements at HOP's National Office and in three regional locations—Darwin, Perth and Rockhampton—to assess the effectiveness of HOP's internal processes especially with regard to compliance with applicable Australian Government policies. HOP's approach to planning, including risk and fraud management was assessed and the ability of its internal guidelines to support decision–making was examined. A focus of the audit was HOP's programme performance reporting framework. Where appropriate, the ANAO's conclusions and recommendations recognise HOP's transition to a new operating environment.

Overall Conclusion

The ANAO notes that since 1990 the total dollar value of the HOP loan portfolio has more than doubled to around $338 million and that, over the same period, HOP has provided housing for more than 21 700 Indigenous Australians. However, the ANAO concluded that the programme requires improvements in several key areas, especially with regard to the security and protection of client information. Given the sensitivity of client information, the ANAO considers it would be advisable for HOP to develop controls to limit the risk to the programme of inappropriate access or disclosure of client information and provide assurance that the controls established adequately reflect Australian Government requirements.

While the Commonwealth Procurement Guidelines (CPGs) do not formally apply to HOP's outsourced banking and legal services, the CPGs provide a useful framework for HOP to consider significant procurements such as banking and legal services.

HOP management has proposed the review and update of its Funding Procedures manual. Such an initiative will go a long way towards promoting consistency in decision–making across the Housing Loans Units and enabling the identification of key business requirements to be formalised in HOP's loans system and associated procedural guidance.

Key findings

Compliance with applicable Australian Government policies

HOP is currently delivered through Indigenous Coordination Centres (ICCs) in each of the State capital cities and Darwin plus six large regional centres. Housing Loans Units are located in these ICCs and are staffed by Housing Loans officers who, subject to delegations, assess and approve housing loan applications from Indigenous clients and provide aftercare services for the life of the loan.

HOP requires the extensive collection of personal information associated with the financial position of Indigenous home loan applicants. The ANAO found the existing ATSIC loans system (ALS) which supports HOP

decision–making needs updating and review to ensure that system security is compliant with, and better reflects, Australian Government system security policies.

The ANAO found that the management and protection of client information did not meet the requirements of the Privacy Act 1988. In particular, attention to the storage and physical security of client information was uneven across regional Housing Loans Units where relevant physical files are maintained. Arrangements with the ICCs need to be formalised to ensure compliance with Privacy Act requirements.

The ANAO also found that HOP recordkeeping practices were not consistent across regional Housing Loans Units and consequently HOP management was not able to ensure that the requirements of the Archives Act 1983 and the standards set by the National Archives of Australia concerning the documentation of all business transactions and decisions were fully complied with.

The Commonwealth Procurement Guidelines do not apply to HOP and HOP has not market tested its outsourced banking and legal services.

Compliance with HOP procedures

The HOP Business Plan 2002–04 contains a strategy matrix designed to achieve HOP's stated goals. The matrix includes a number of perceived risks to the programme and puts forward strategies to mitigate these risks. The ANAO found this approach to be limited to the risk factors that were largely external to the programme, for example funding levels to meet demand. To further support the planning process, increased attention to internal risks such as fraud risk is also warranted.

The ATSIC Fraud Control Plan 2001–03 was based on a fraud risk assessment conducted in 2000. During 2003–04 the plan continued to apply to HOP operations. The ANAO noted substantial changes in HOP's operating environment since the 2000 assessment and found that the small number of more recent fraud cases, referred to the Fraud Investigation Unit by regional Housing Loans Units, had characteristics which could be moderated through a tightening of the control environment. This was particularly in the areas of establishing pre–existing ownership of a rental or investment property and the application of the First Home Owners Grant to HOP clients.

HOP policy has 14 standard eligibility criteria that HOP applicants have to meet to obtain a standard housing loan. The ANAO assessed compliance with the application and approval process in the following three areas:

- Request For Placement (RFP) on the housing loans application waiting list;

- the HOP loan invitation process; and

- the formal assessment, approval and settlement of the loan.

The ANAO found:

- the level of information required through the RFP process is not aligned with HOP policy concerning the order in which applicants should be placed on its housing loans application waiting list. Applicants are awarded a points score determined through the RFP process. The points score is intended to determine where an applicant is placed on the waiting list. The information sought in the RFP process to generate the points score does not always provide the evidence required to substantiate the priority awarded to the placement of applicants on the waiting list;

- the issuing of invitations to applicants on the waiting list to apply for a housing loan is largely at the discretion of individual regional Housing Loans Units and this means that the management of waiting lists is not uniform across the HOP network;

- HOP has implemented system controls which put in place a regional ceiling on the amount of money HOP will lend for the purchase of a property in a particular town or region;

- procedures to ensure that home insurance was in place prior to loan settlement were followed; and

- Housing Loans officers paid close attention to the findings in the valuation report of the property to be purchased and investigated any adverse findings.

Support for HOP decision–makers

Flow–charted processes in HOP's Funding Procedures manual were designed to align with housing loan processing steps to be taken in ALS, including the generation of standardised forms and letters.

The ANAO found that practices differed between Housing Loans Units with respect to key decision–making steps in the lifecycle of HOP loans. Because of the close interrelationship between processes outlined in the HOP Funding Procedures manual and steps to be taken in ALS that are not necessarily enforced or controlled by the system, the ANAO considers that there is a risk that ALS processing requirements will not be correctly followed where local practices have evolved and are being used.

HOP management recognised that its existing Funding Procedures manual had been superseded in many areas by local work practices and had taken steps to remedy this by undertaking a review and upgrade of its manual. This process provides an opportunity to improve the consistency of ALS processing where deficiencies are identified.

Managing individual loans

Concerning the management of housing loans in arrears, the ANAO is aware that HOP management has regard to commercial practices and to the intent of HOP policy. However, a HOP compliance check found that the monitoring and management of housing loans in arrears was uneven across the regional Housing Loans Units. This aspect of home lending would benefit from a review of successful better practice arrears management across HOP's regional units.

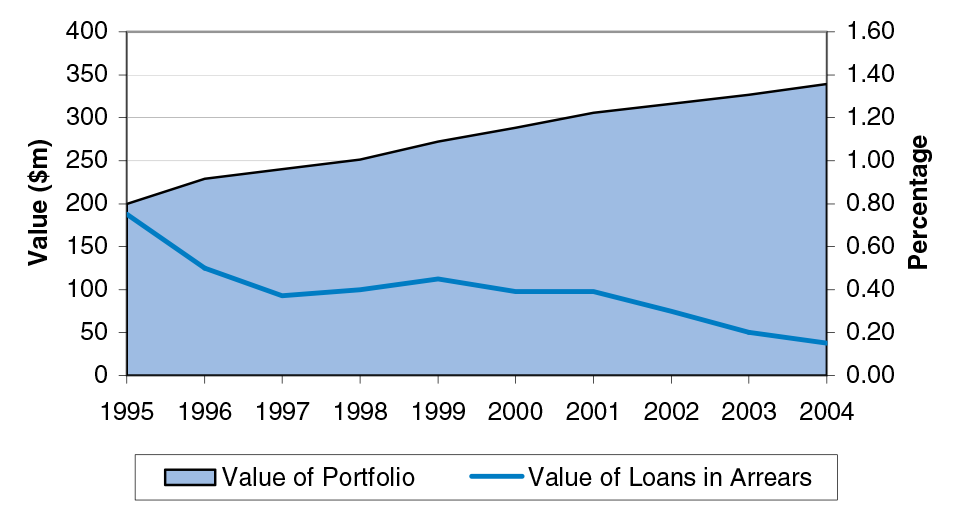

The ANAO considered the relationship between the trend increase in the value of the HOP portfolio with the movement in the value of loans in arrears and found the relationship to be an inverse one. While the portfolio has been increasing steadily, the dollar value of the loans in arrears compared with the current balance of the loans portfolio has been steadily decreasing. At 30 September 2004, there were 145 housing loans in arrears across the HOP portfolio. This represented 4.1 per cent of the total number of loans and around $441 000. This dollar value equalled 0.12 per cent of the current balance of the loan portfolio.

The following figure contrasts the growth in the HOP portfolio with the decreasing value of loans in arrears.

Figure 1: HOP Portfolio Growth and Arrears Decline

Programme performance reporting

The ANAO found that a key HOP quantity measure ‘Increase Indigenous home ownership to 40 per cent by 2010' is not reported against annually. The inclusion of annual milestones would enable HOP to track its progress over the reporting year and indicate its contribution to the longer term goal of increasing Indigenous home ownership to 40 per cent by 2010.

The ANAO found that HOP's quality measures are actually quantity measures and that more detailed information should be provided in the output description to enable stakeholders to understand the significance of the measures.

HOP management employs a broad spectrum of performance information enabling it to accurately monitor financial commitments and expenditure levels against regional budget allocations and make adjustments on a timely basis.

The ANAO found that the lack of client service indicators limited the ability of HOP management to report on the benefits of HOP to its client group in a meaningful way. The development of a client service charter would assist in establishing specific and relevant performance indicators for client service that could be reported annually.

Recommendations

The ANAO has made six recommendations concerning the administration of the Home Ownership Programme. IBA agreed with all the recommendations put forward in this report. The following was IBA's summary response.

As noted in the report, the programme has undergone significant operational changes as part of the Government's initiative to restructure Indigenous Affairs. This has provided both opportunities and challenges for the programme both in terms of its overall management, as well as its regional network delivery arrangements.

Indigenous Business Australia is committed to ensuring the programme continues to deliver positive outcomes for Indigenous Australians, both in terms of improving home ownership participation rates, but also in providing them with the economic independence and empowerment that comes from owning their own home.

Indigenous Business Australia agrees with the recommendations in the report, and believes they will assist in ensuring that its current business planning processes will address the report findings.

Footnotes

1 The loan portfolio value was $152 million upon transfer to ATSIC in March 1990. At 30 June 2004, it was estimated to be in excess of $383 million. During this timeframe, the HOP did not receive any appropriations from general revenue but did receive additional funds of $29.01 million from ATSIC general funds.