Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Australian Taxation Office's Management of Serious Non-Compliance

The objective of the audit was to assess the administrative effectiveness of the Tax Office's strategies to address serious non-compliance. In conducting the audit, the ANAO examined the Tax Office's management framework and arrangements to deter, detect and deal with fraud and serious evasion.

Summary

Introduction

1. The Australian Taxation Office (Tax Office) administers Australia's taxation system and in 2007–08 collected tax and excise revenues of $278.6 billion1 and made related payments of $9.6 billion.2 The Tax Office aims to achieve high levels of voluntary compliance with Australia's tax laws. The Australian tax system is based on self assessment, where the:

claims a taxpayer makes in their tax return are accepted by the Tax Office, usually without adjustment, and an assessment notice is issued. Even though they may initially accept the tax return, the return may still be subject to further review.3

2. The Australian system places responsibility on taxpayers to declare all assessable income and claim only deductions and offsets to which they are entitled. This system has inherent risks of taxpayers not complying with registration, lodgement, reporting and payment obligations. The Tax Office aims to manage these risks through its education and compliance activities. A number of taxpayers deliberately abuse the tax, excise and superannuation systems to evade their obligations or otherwise attempt to defraud the Commonwealth. The Tax Office has mechanisms in place to deter, detect and deal with non-compliant taxpayers.

3. The Tax Office defines serious non-compliance as those forms of behaviour which:

- Involve disengagement, extremes of evasion, abuse of revenue systems, strong resistance to taxation obligations, or serious criminal conduct; and

- have the potential, left unchecked, to significantly undermine public confidence in the administration of the taxation laws.4

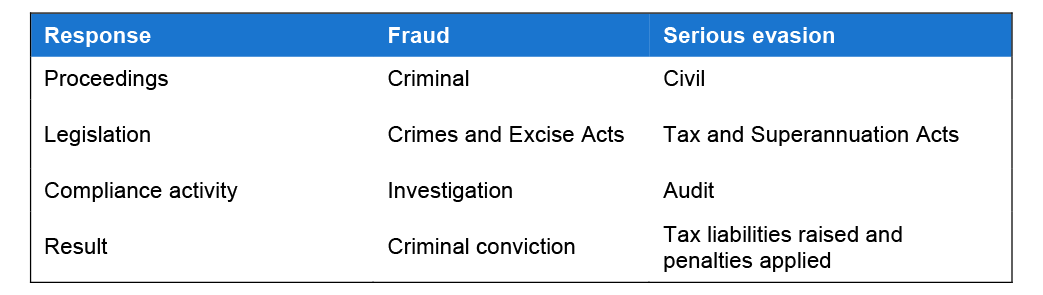

4. The Tax Office's response to serious non-compliance is governed by a legal and policy framework for fraud (criminal matters) and serious evasion (civil matters). Investigations are undertaken for cases of fraud and audits are undertaken for cases of serious evasion. The behaviours of the taxpayer and subsequent distinction between fraud and serious evasion responses are not always clear and the Tax Office responses are not necessarily mutually exclusive. Table 1 summarises the Tax Office's compliance responses for addressing fraud and serious evasion.

Table 1: Summary of the Tax Office's response to fraud and serious evasion

Source: ANAO analysis of Tax Office information.

5. In July 2003, the Tax Office created the Serious Non-Compliance business line (SNC) to focus on the more extreme aspects of evasion and fraud. This involved amalgamating some existing resources from other business lines including combining the major functions of three Tax Office units: Special Audit; Fraud Investigations Unit; and Excise Investigations Unit. SNC is responsible for:

- deterring, detecting and dealing with serious non-compliance behaviour, including fraud against the revenue system;

- deciding whether or not there is sufficient evidence that external fraud exists and for referring cases to the Commonwealth Department of Public Prosecutions (CDPP) or the Australian Government Solicitor (AGS) for possible prosecution; and

- contributing to the collection, collation and provision of certain information for the Attorney-General's Department Annual Fraud Report.5

6. SNC undertakes investigations under the Crimes Act 1914, the Criminal Code 1995, the Excise Act 1901 and to a lesser extent offences under the Tax Administration Act 1953 with the intention of producing a brief of evidence to be used by the CDPP to seek a criminal conviction, or used by the AGS for civil based proceedings. SNC also carries out audits under Australia's tax and superannuation laws with the intention of raising a tax liability, and where appropriate, applying tax penalties.

7. SNC consists of a number of separate operational areas, including Project Wickenby. Project Wickenby is a multi-agency taskforce investigating and prosecuting internationally promoted schemes to avoid or evade Australian taxes and launder money. Project Wickenby was not reviewed as part of this audit.

8. In 2007–08 SNC undertook 178 investigations, with 93 briefs of evidence referred to the CDPP and AGS for prosecution. There were 77 successful prosecutions in 2007–08. SNC also conducted 205 audits and raised liabilities of $191 million.6 As at June 2008, SNC employed 386 staff and was run at an annual cost of approximately $41 million.7

9. The key risks for SNC identified in the 2008–09 Compliance Program were refund fraud (Goods and Service Tax and income tax); secret offshore dealings; organised crime; and risks to the superannuation and excise systems.

Audit objective and scope

Objective

10. The objective of the audit was to assess the administrative effectiveness of the Tax Office's strategies to address serious non-compliance.

11. In conducting the audit, the ANAO examined the Tax Office's management framework and arrangements to deter, detect and deal with fraud and serious evasion.

Scope

12. The audit assessed the effectiveness of the Tax Office's management of the risks of fraud and serious evasion. The focus of the audit was on the SNC business line. The audit also assessed whether the Tax Office has developed a comprehensive and integrated whole of agency approach to managing identified risks relating to fraud and serious evasion. The following activities were excluded from the scope of the audit: Project Wickenby; in-house prosecutions; and internal fraud.

Conclusion

13. Encouraging tax compliance and ensuring that non-compliance is kept to a minimum is a major and ongoing task for revenue agencies around the world.8 Non-compliance in the form of fraud and serious evasion against the Commonwealth has the potential, if left unchecked, to undermine community confidence in Australia's taxation system and reduce voluntary compliance levels. As a result of organised and opportunistic attacks on Australia's taxation system, the Tax Office's response needs to be sustained and innovative. As noted by the Commissioner of Taxation, there are likely to be greater compliance risks across all market segments following the global economic crisis, as taxpayers seek to maximise income from diminishing sources.9

14. The Tax Office has developed a variety of strategies to address the risks of serious non-compliance. These strategies, and the processes underpinning them, have assisted in delivering many prosecutions and successful audit outcomes for 2007–08 as outlined in paragraph 7. Notwithstanding these successes, there is considerable scope for the Tax Office to improve the effectiveness of the arrangements to deter, detect and deal with fraud and serious evasion. To better manage the risks of SNC, it is important that the Tax Office: increases deterrent activities based on sound research and analysis; centrally records all fraud referrals to support intelligence led case selection; clearly links case selection to national strategic priorities; and increases management oversight of cases. The ANAO recognises that the Tax Office has taken significant steps in the last 12 months to improve the administrative effectiveness of processes and practices of SNC activities. In particular, the Tax Office has focussed on better integrating SNC activities across the office and providing for greater oversight of case selection and management. Given the long cycle time of case work, the effectiveness and appropriateness of the recent initiatives is yet to be established.

15. The Tax Office has recently established management arrangements that provide increased support for deterring, detecting and dealing with fraud and serious evasion. The introduction of a Tax Office wide Program Steering Committee and a ‘business-line focused' Program Management Forum has allowed for greater alignment of corporate priorities and risks with project, program and case selection. To enable scrutiny by these new management committees, and moreover to measure the efficiency and effectiveness of approaches to combat fraud and serious evasion, it is important that the Tax Office has systems to accurately and comprehensively monitor and report on SNC activities. The reliance on inadequate historical systems to date has prevented such monitoring and reporting. New systems have been designed to help ensure greater accuracy in the monitoring of SNC activities.

16. The Tax Office has a range of activities designed to deter non-compliant behaviour. Effective deterrence is largely based on convincing those potentially non-compliant taxpayers of the chances of being caught and having sanctions applied to them, and is dependent on detection, investigation and audit capabilities. A number of deterrent activities can have an impact across a range of market segments. However, the Tax Office has only undertaken a small number of deterrent activities targeting fraud and serious evasion, and it is difficult to assess the flow on impact of broad based activities across geographical areas and market segments of taxpayers.

17. The assessment of the effectiveness of deterrent activities targeting fraud and serious evasion, such as marketing and communication, has been limited. The Tax Office was unable to clearly demonstrate whether it had undertaken sufficient deterrent activities, or is pursuing the most appropriate strategies in this regard, as it lacks compliance effectiveness measures to evaluate and monitor its fraud and serious evasion strategies. Recording and analysing the outcomes of deterrent activities, while difficult, would inform future planning and targeting of risks. The Tax Office has started a process to develop such measures whereby the measurement of project effectiveness and risk areas will be implemented.

18. The Tax Office has implemented systems and processes to detect fraud and serious evasion. These systems produce over 3000 potential fraud referrals annually and enable the Tax Office to target its program of compliance activities. To manage the detection capability, the Tax Office has implemented sound cross business line relationships. From the potential fraud referrals, the Tax Office should choose programs of work and cases that target key strategic risks. SNC's ability to target key risks has historically been restricted, as inconsistent criteria have been applied in recording and documenting potential fraud referrals. This limits the ability of the intelligence functions to strategically influence case selection.

19. The Tax Office's systems and processes for dealing with fraud and serious evasion have assisted in delivering prosecutions and have been successful in raising tax liabilities. Despite these results, regional differences and an historical lack of case oversight has resulted in significant variation in the basis for case selection, and inconsistencies in the adoption and application of key practices and processes. To achieve greater returns, both directly and indirectly (through deterrence) from investigations and audits, it is critical that case selection is aligned to national strategic priorities, and that management oversight of individual cases is increased. The revised management model of the Program Steering Committee and Program Management Forum is likely to help in this regard, as two of its core elements involve better integration of SNC activities across the office and greater case management oversight. The full benefit realisation and appropriateness of recent initiatives is still to be determined due to the long cycle time of case work.

Key findings by chapter

Management arrangements (Chapter 2)

20. The development and implementation of sound governance arrangements helps to support the effective management of agencies' programs and service delivery. Fraud and serious evasion risks manifest themselves across numerous business lines within the Tax Office. The SNC Executive sets the strategic direction for this business line and is accountable for implementing the priorities of SNC. The Program Steering Committee (PSC), which includes cross business line representation, primarily provides an advisory role for SNC. The Program Management Forum (PMF) was implemented to manage SNC operational performance.

21. The introduction of the PSC and PMF is designed to assist the Tax Office in providing appropriate strategic management and oversight to SNC. The PMF, along with the introduction of a new case management system, provides management information and can guide case selection to meet national priorities. The PSC facilitates communication of current risks faced by other business lines and allows the Tax Office to manage fraud and serious evasion risks with a whole of office approach. Advice received from the PSC Panel Members of other business lines indicates that the new arrangement has provided them with a greater understanding of the work that SNC undertakes and allows them to manage information flows with SNC.

22. It is a requirement of the Fraud Control Guidelines that government agencies, including the Tax Office, collect information on fraud in response to a survey and provide it to the Attorney-General's Department. The survey is currently conducted by the Australian Institute of Criminology. As indicated previously in paragraph 5, contributing to survey responses is a core function of SNC.

23. There were a number of problems with the accuracy of Tax Office responses to recent surveys. In 2005–06 and 2006–07 the Tax Office used the SNC intelligence database to respond to the survey. ANAO testing indicated an understatement of alleged incidences of fraud in the SNC intelligence database. The full extent of the understatement is unknown due to inconsistent criteria being applied in the recording and documenting of alleged incidences of fraud. A new definition of fraud contained within the 2007–08 survey and the Tax Office's interpretation of the definition resulted in different types of incidences being reported compared to previous years. This revised reporting basis resulted in far fewer reported allegations of potential fraud (498 in 2007–08 compared to over 3000 in the two previous years). Further, the reporting of 498 allegations of potential fraud was not correct as it also included all cases created within SNC on the Tax Office's case management system. The Tax Office is working with the Australian Institute of Criminology to improve the accuracy of its reporting.

24. The Commissioner of Taxation's Annual Report 2007–08, reported that SNC's core activities included the completion of 314 audits—of which 109 audits related to Project Wickenby. The ANAO reviewed a sample of audits from the 205 non-Wickenby audits, testing many elements of the Tax Office's administration of SNC. With regard to reporting, the ANAO found that two of the 44 cases (five per cent) reviewed were incorrectly created and reported as audits. The ANAO notes none of these two occurrences were reported as raising a tax liability.

Deterring fraud and serious evasion (Chapter 3)

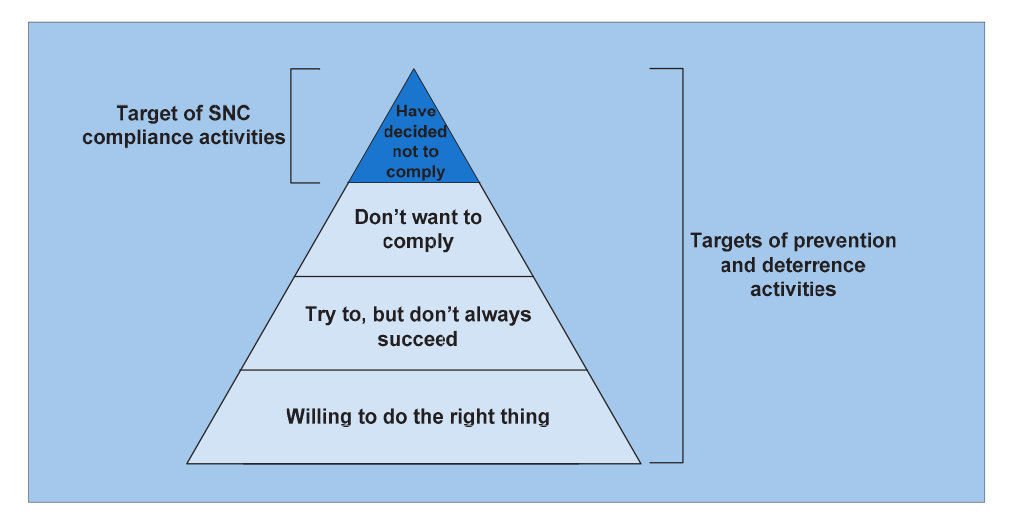

25. The Tax Office tries to make it easy to comply with tax obligations for those taxpayers who are willing to do the right thing. A number of taxpayers deliberately evade their tax obligations, or otherwise attempt to defraud the Commonwealth through the revenue system. Compliance activities carried out by SNC are targeted at those taxpayers the Tax Office has deemed as deciding not to comply, represented by the top section of the compliance model (Figure 1). These compliance activities are used, through programs of communication and other activities, to deter potential serious evasion as well as ensure that those subject to investigation and audits are appropriately dealt with. A primary objective of SNC is enhancing community confidence in the tax system.

Figure 1: Target of SNC compliance activities

Source: ANAO analysis of Tax Office information.

26. The Tax Evasion, Avoidance and Crime Communication Strategy (TEAC Communication Strategy) is an important part of the framework established by the overarching Tax Office Communication Strategy. The TEAC communication strategy outlines a range of activities to deter the supply of and demand for abusive tax practices and strengthen shared support for the integrity of the tax system. The ANAO found that only a limited range of potential activities are actually actioned pursuant to the TEAC Communication Strategy.

27. Recording and analysing outcomes of active compliance and other deterrent activities are important to inform future planning and targeting of SNC compliance risks. While the Tax Office has set a range of effectiveness measures surrounding fraud and serious evasion compliance activities, they typically focussed on direct returns from individual cases and did not inform broader objectives such as enhancing community confidence. To enable the Tax Office to assess the effectiveness of strategies over time, the ANAO considers there should be greater alignment between the Tax Office's performance effectiveness measures and the current deterrence strategies.

Detecting fraud and serious evasion (Chapter 4)

28. The Tax Office has a range of systems and processes to detect fraud and serious evasion. This includes a formal system for the assessment and escalation of reported incidences of potential fraud (over 3000 per year) that is complemented by individual relationships and networks of Tax Office staff. The Tax Office has also developed and implemented a range of computer-based systems to assist in detecting fraud and serious evasion in a real-time environment. Other compliance activities across the entire Tax Office also detect potential incidences of fraud and serious evasion.

29. SNC Intelligence is responsible for identifying and assessing serious strategic and operational fraud risks to the tax system. The area also gathers, collates and analyses intelligence from a range of external sources and other parts of the Tax Office. An inherent difficulty for SNC Intelligence is its resourcing focus towards investigations, and the subsequent lack of assistance to the audit function. This is largely due to the resource intensive initial ‘processing' aspect of fraud referrals received. As a consequence, historically, the role and function of the audit capability within SNC developed with a regional focus that varied across Australia. The revised PMF arrangements seek to bring greater alignment between the regional program of work and national risk priorities.

30. Referral of information is the starting point to any investigation or audit undertaken by SNC. Information referrals form the basis of case selection, and through referrals trends and emerging issues can be identified, assessed and treated. The Tax Office's Corporate Management Practice Statement Fraud Control and the Prosecution Process (Fraud Practice Statement) states that any compliance activity within the originating business line should continue once a referral is made unless SNC provides advice to the contrary. The ANAO found a high level of adherence to the Fraud Practice Statement representing a strong understanding by Tax Office staff outside SNC of their obligations and responsibilities regarding referrals of suspected incidences of fraud.

31. SNC teams in regional offices also receive referrals and information regarding serious evasion or fraud. These referrals may originate from professional relationships developed with law enforcement bodies, government agencies, or other business line staff who may be co located. Consistent with the Tax Office's Fraud Practice Statement, regionally-based staff should also input fraud referrals into the SNC intelligence database. ANAO testing of investigations indicated a high level of regionally driven case selection without SNC Intelligence involvement, or being input into the appropriate database. There was no consistent process for managing or quantifying referrals received in the regions. This impacts on the ability of SNC Intelligence to identify trends as the SNC intelligence database is a significant source of information. There is also a risk that not all information is recorded accurately for reporting requirements.

Dealing with fraud and serious evasion (Chapter 5)

32. Investigations and audits are integral to the Tax Office's approach to managing the risks of fraud and serious evasion. The Tax Office Compliance Model is premised on the belief that it can influence behaviour through responses and interventions. SNC undertakes investigations and audits against perpetrators of fraud and serious evasion. The Tax Office's systems and processes for dealing with fraud and serious evasion have been successful in achieving high rates of custodial sentences and raising tax liabilities as indicated in paragraph 7.

33. Appropriate case selection is crucial to SNC meeting its objectives. Successful case selection should be aligned with national strategic priorities and assist in maintaining and enhancing community confidence. Historically, a regionally focused process allowed significant variances in case selection across Australia. Over time regions have developed particular skill sets and cases were chosen to reflect these skill sets. The Tax Office must effectively leverage from the cases that are chosen under the compliance model to ensure the greatest impact in line with its national strategic objectives.

34. To address the regionally-based focus of previous case selection, the Tax Office has revised its case approval process to greater reflect national and strategic priorities. Established in August 2007, the PMF was set up to, amongst other things, approve cases and programs following consideration at the regional level. The PMF-endorsed National Case Selection Process only came into operation in September 2008, so was not able to be fully assessed as part of this audit.

35. The Commissioner, by law, may only amend a taxpayer's assessment after four years where the Commissioner is of the opinion that there has been fraud or evasion. The Taxation Authorisation Guidelines and Tax Office practice statements require a written determination in the name of a Deputy Commissioner to be made to amend such an assessment. The ANAO found that while not affecting the legality of the assessments, the guidelines were not followed in six of the eleven cases where an opinion was required. The ANAO further found one case where the assessment was amended outside the four year elapsed time period with no opinion of fraud or evasion being made. The Tax Office advised the ANAO that it has subsequently revisited the case with no fraud and evasion opinion, and correctly reissued an amended assessment.

36. Fraud programs managed by Australian Government agencies must be carried out in accordance with the Australian Government Investigations Standards (AGIS). While there is no single set of internal investigation guidelines for Tax Office staff, the Tax Office has an internal work processes website that contains practices and procedures references for all operational investigations staff. The Tax Office also relies on the external training manuals, Practice Notes from the CDPP, and the AGIS as appropriate guidance. The ANAO sought to identify common practice across the regions and adherence to AGIS in selected areas. The ANAO found inconsistent practices in the use of investigation plans, evidence matrices and critical decision records. While these are not mandatory under the AGIS, they are recommended.

37. The Fraud Control Guidelines state that employees who are primarily engaged in preventing, detecting or investigating fraud are to meet the fraud control competency requirements including the completion of a Certificate IV in Government (Investigations). In response to an annual Fraud Survey, the Tax Office identified 298 staff that were dedicated to fraud control yet only 198 staff had formal qualifications. The Tax Office advised that additional training would be undertaken in 2008–09 to address this issue and a new database coming online in the immediate future should be able to provide more accurate information.

38. The Proceeds of Crime Act 2002 (POC Act) enables law enforcement authorities to confiscate the proceeds of crime. In 2006, the Proceeds of Crime Regulations 2002 were amended to include the Tax Office as an enforcement agency for the purposes of the POC Act.10 The Tax Office has yet to develop an operational proceeds of crime capability. In late 2006, internal submissions were developed with options for how the Tax Office should adapt to its new role as an enforcement agency. In late 2006, the Tax Office engaged a consultant to review POC Act implementation related issues. In May 2007, the review was supported by the SNC Executive. As at November 2008, the Tax Office was still in the process of developing the capability. The development of this capability should broaden the options available to the Tax Office in dealing with serious non-compliance.

39. The ANAO made seven recommendations aimed at improving the Tax Office's management of the risks of fraud and serious evasion.

Summary of agency response

40. Thank you for the Australian National Audit Office report and recommendations on improvements to the Tax Office's management of Serious Non-Compliance business line (SNC). SNC's role is to investigate potential tax fraud and serious evasion behaviour. It operates under relevant civil and criminal laws and works closely with other parts of the ATO and agencies. The reality is that this is challenging and demanding work and we appreciate that the report recognises this. We also appreciate the recognition given in the report to a raft of changes that have been implemented in Serious Non-Compliance over the past year to modernise systems and processes and improve our management of this work. As recognised in the report, cases selected for review largely came from those finalised during the 2007-08 financial year and most were commenced and significantly progressed before these changes had been implemented.

41. We have agreed with six of the report's recommendations and agree in part with the other. It is encouraging that, in many instances, changes already being implemented in Serious Non-Compliance are consistent with the general tenor of the recommendations. In relation to recommendation 4 to which we agreed in part, we feel that an important context for evaluating SNC's activities is that they are usually a part of a broader strategy encompassing help, marketing, audits and summary prosecutions to address strategic compliance risks such as micro business compliance, employer obligation compliance, cash economy etc. SNC's role is to treat the most extreme cases on non compliance for such risks. The other activities involved in these strategies were not within the scope of this audit but they also contribute to the overall effectiveness of the approach to treating strategic compliance risks.

42. Finally we note that the review specifically excluded Project Wickenby—focussed on dealing with abusive use of tax havens—from its terms of reference. While Project Wickenby activities and resources were excluded from consideration in this audit they do represent a very substantial commitment of resources and activities of the line. We would like to take this opportunity to thank your audit team—Charles Higgins and Ian McDonald—for their constructive approach to this review.

Footnotes

1 Australian Taxation Office, Commissioner of Taxation Annual Report 2007–08, p. 221.

2 ibid., p. iv.

3 Australian Taxation Office website, Self-assessment and the Taxpayer, <http://www.ato.gov.au/individuals/content.asp?doc=/content/13685.htm> [accessed 28 November 2008].

4 Internal Tax Office document.

5 Australian Taxation Office, Corporate Management Practice Statement—Fraud Control and the Prosecution Process, 2007/02, April 2007.

6 These figures exclude Project Wickenby related activities and resources.

7 Internal Tax Office document.

8 OECD, Forum On Tax Administration: Compliance Sub-Group, Monitoring Taxpayers' Compliance: A Practical Guide Based on Revenue Body Experience, June 2008, pp. 9-10.

9 Commissioner of Taxation, Playing it responsibly - The global financial crisis: an ATO perspective, December 2008, at <http://www.ato.gov.au/corporate/content.asp?doc=/content/00174107.htm>.

10 Proceeds of Crime Amendment Regulations 2006, section 4A.