Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Australian Taxation Office's Implementation of the Change Program: a strategic overview

The objective of this audit was to provide a strategic review on the progress of the Tax Office's implementation of the Change Program.

To achieve this, the ANAO examined:

- the planning for, and governance of, the Change Program, particularly in relation to the management of risk and the assurance framework established by the Tax Office, and its management of contractual arrangements for the project;

- implementation issues associated with Releases 1 and 2 of the Change Program, and more specifically in relation to Release 3, the first use of the new ICP system to process FBT returns; and

- the funding of the Change Program, including measurement and attribution of the costs of the project and consideration of any benefits realisation to date.

Summary

Introduction

1. The Australian Taxation Office (Tax Office) is the Australian Government's principal revenue collection agency. As the main administrator of Australia's tax and superannuation systems its role is to effectively manage and shape the processes and systems which assist taxpayers to meet their tax obligations. In 2007–08, the Tax Office collected $278.1 billion in revenue, and made transfers and payments of $9.3 billion. Payments include income tax refunds, GST input tax credits, excise grants and social benefits. The operating expenses for the Tax Office in 2007–08, totalled $2.8 billion.

2. Tax administration depends crucially on Information and Communications Technology (ICT) systems. ICT systems are required for every phase of tax administration from the registration of a taxpayer, through to the issuance of an assessment and, if necessary, the conduct of compliance investigations.

3. The Tax Office has a wide range of ICT systems; they vary greatly in age, sophistication and the degree to which interaction between them is possible.1 The National Taxpayer System (NTS), which became operational in 1975, is the Tax Office's main system for processing income tax returns. The ATO Integrated System (AIS), which became operational in 1994, is the Tax Office's accounting and transactional processing system covering most of the Tax Office's tax revenue systems.2

4. Until recently Tax Office administrative processes relied on over 180 specialised ICT systems.3 Many had similar functionality but were specific to the various organisational structures of the Tax Office. This was a source of inefficiency and contributed to a number of other administrative difficulties.

5. Following the implementation of the Government's significant tax reforms in 2000, the Tax Office began an initiative to make compliance with tax law easier, cheaper and more personalised. The Tax Office was becoming less able to properly respond to government and community expectations in relation to its role as Australia's principal tax and superannuation administrator. The Tax Office considered that tax administration in Australia in the 21st Century could not proceed efficiently and effectively without it replacing its substantial and complex ICT systems. This initiative was developed under the banner of the Change Program.

Background and context

Planning of the Change Program

6. By 2000 it was clear to the Tax Office its ICT systems were unsustainable. It was taking too long to respond to Government policy initiatives, the community was getting less efficient service and Tax Office staff were finding reduced capability in the Information Technology (IT) platform. In addition, the Tax Office had been aware for some time of inefficiencies in the ICT systems on which the administration of Australia's taxation and superannuation systems depended.

7. The Tax Office had also identified other reasons for embarking on the Change Program additional to the need to replace core ICT systems. These included:

- the need to function as one integrated entity able to address all relevant aspects of taxpayer and tax professional experience of tax administration in a holistic and integrated manner;

- the need to adopt, as efficiently and effectively as possible, better administrative practices and technological facilities in a rapidly changing environment;

- the need to achieve significant productivity improvements in an environment of continuing fiscal constraint;

- continuing to improve community compliance;

- reducing risks to revenue; and

- providing increased confidence in the integrity of Australia's taxation system.

The Intent of the Change Program

8. The Tax Office planned to replace all tax processing ICT systems with one Integrated Core Processing (ICP) ICT system through the Change Program. In addition, the Tax Office planned to replace the large number of specialised ICT systems that supported internal administrative functions with a single management system. Through the Change Program, the Tax Office intended to transform the way the organisation functioned by developing a significantly more cost-effective and integrated system of tax administration providing improved services to the community, including secure online facilities. The intention was to make compliance with tax law easier, cheaper and more personalised. Amongst other things, this would enable taxpayers to be engaged in tax administration in a more differentiated manner having regard to considerations of risk and complexity of tax affairs.

9. The Tax Office Executive approved the Change Program business case on 10 December 2004 with the intention of completing the Change Program by June 2008. The initial release schedule consisted of:

- Release 1 (to be completed by June 2005): The installation of a client relationship management system (CRM); improvements to online systems (tax agent and business portals); and a new system to develop and maintain the content of letters;

- Release 2 (to be completed by September 2006): The installation of a single case and work management system; the introduction of analytical models; enhancements to the CRM; and, enhancements to taxation portals; and

- Release 3 (to be completed by June 2008): The installation of the ICP system for all tax products; extension of the case management system to a wider audience; new tax agent and business portals; and updates to work management, CRM, analytics, content and records management and reporting. The new ICP software would be developed from Accenture's propriety Tax Administration System (TAS), specifically TAS version 4, modified to suit Australia's tax law and to accommodate specific Tax Office requirements.4

10. The Tax Office engaged Accenture under a purchaser/provider contract to develop the Change Program's ICT systems as specified in the implementation schedule.

Change Program governance

11. Governance of the Change Program has been established through a range of committees as well as the Tax Office/Accenture contract and related governance documents. Under the terms of the program implementation contract, delivery of the Change Program against the business case is the responsibility of Accenture. Ultimate accountability for delivery of the Change Program, however, rests with the Tax Office. The governance arrangements allow for flexibility to adapt the Change Program to meet new government requirements and facilitate implementation learnings.

12. Executive management of the Change Program occurs through the Change Program Steering Committee (CPSC) and the Change Program Executive (CPE). The CPSC is chaired by the Commissioner and includes the Second Commissioners. Its role is to ensure the Tax Office delivers the improved client experiences described in Making it easier to comply. The CPSC determines outcomes and priorities for the Change Program and approves significant scope, strategy, design, business case and client experience changes.

13. The governance of the Change Program requires assurance capabilities that are commensurate with the complexity and risks of developing the ICP to the required ‘fit-for-purpose' standard.

International experiences in implementing large scale ICT projects

14. Around the time the Tax Office began planning the Change Program, the Organisation for Economic Co-operation and Development (OECD) released a paper highlighting the experiences of 17 member countries in relation to managing large public sector ICT projects.5 That paper noted that most governments experience problems when implementing large ICT projects. The paper identified a number of factors that need to be addressed properly if governments are to be successful in getting large ICT projects right.

15. Some of the key factors for success outlined in that paper are:

- establishing appropriate governance structures;

- dividing the project into a number of self-contained modules that can be adjusted to changes in circumstances;

- identifying and managing risks;

- holding executive and business line managers accountable; and

- involving end users in the development and implementation.

16. The OECD paper concluded:

The general lesson is not that governments should not take any risks; rather, governments must identify risk, determine which risks they are willing to take, and manage the relevant risk within appropriate governance structures.

17. To ensure the overall success of any large scale ICT project it is necessary to achieve a high level of conformance against each of the key success factors identified in the 2001 OECD paper.

18. By virtue of its nature and scale, implementing the strategic vision and detailed design specifications for a system as diverse and inherently complex as the Change Program would require the Tax Office to establish a structure that addressed these key OECD success factors. Moreover, international experience in both the public and private sectors has shown historically that with large-scale, complex projects there is a very real risk that planning, design and implementation are undertaken on the basis of overly optimistic estimates, with poor contingency planning and an underestimation of the severity and impact of identified risks.

Implementation progress and extensions to project scope

19. Release 1 of the Change Program was fully implemented in April 2006, 10 months later than originally planned, and Release 2 was fully implemented in March 2007, six months later than originally planned.

20. Largely because of legislative changes, the Tax Office expanded the scope of the Change Program several times since the implementation phase commenced. The Tax Office also changed the delivery schedule several times, partially in response to the changes in scope and partially in response to general delays in the Change Program's progress. Although most adjustments to the delivery schedule have been relatively minor, there have been two significant changes to the schedule.

21. The first was in early 2007 when the then Government's superannuation simplification package of new measures was added to the scope of the Change Program and a phased approach for Release 3 was proposed. The second was in mid–2008 following a review in late 2007/early 2008 of general delays in the Change Program's progress when the Tax Office again revised the Change Program's implementation schedule. The 2008 revision to the implementation schedule meant that completion of the Change Program would take two years longer than originally planned.6

22. In December 2007 the Tax Office decided that the initial deployment of ICP should be utilised to process only Fringe Benefits Tax (FBT) returns for the 2007–08 financial year, known as the FBT Release. The Tax Office knew that some of the requisite FBT functionality did not work correctly and proceeded with a phased implementation. The Tax Office had risk mitigation strategies to address identified functionality issues and only released phases after testing. In addition, the warranty arrangements in the Tax Office's contract with Accenture provided the Commonwealth with some protection. The Tax Office considered that the acceptance of incomplete software was justified, given the established risk management arrangements and practical requirements relating to the annual processing of FBT returns.

Change Program funding

23. The Tax Office Executive approved the Change Program business case on 10 December 2004 with the intention of completing the program by June 2008. Under the December 2004 business case the total cost of the Change Program was not to exceed $445 million in direct costs over six financial years, starting in 2003–04 and finishing in 2008–09.7 The Tax Office planned to internally fund this project from its annual appropriations by reducing expenditure on other areas of tax administration.

24. As noted in paragraph 20, since the business case was approved in 2004, the scope of the Change Program changed several times, largely due to legislative changes, and the delivery schedule for the Change Program has also changed a number of times. At 30 June 2009 the budget for the expanded scope Change Program is $774 million finishing in 2010–11. This includes the First Home Savers Account (FHSA), which is outside the business case and for which the Tax Office received $25 million.8 The expansions in scope of the business case required by government (principally superannuation simplification) account for $234 million of the $304 million growth in budget since 2004.

25. Actual expenditure on the Change Program to the end of 2008–09 was $749 million. As at 30 June 2009 the Tax Office estimated that, on the basis of the Change Program being completed during 2010–11, a further $105 million may be spent over the next two financial years, bringing the total forecast expenditure to $879 million, including the $25 million the Tax Office received for the FHSA, which is outside the business case and subject to separate contractual arrangements. Forecast expenditure on the expanded scope of the Change Program is $434 million more than the 2004 business case estimated.9 After taking into account the additional funding provided by government to implement legislative changes (such as superannuation simplification), the Tax Office expects to absorb within its budget appropriation additional estimated expenditure of $247 million over the life of the program.

26. Expenditure by the Tax Office on the Change Program has been capitalised to the extent that such expenditure is expected to provide benefits in future years, consistent with the requirements of Australian accounting standards.

27. The Change Program software, an asset under construction, was written down by $75 million to its recoverable amount as at 30 June 2009. This reflected the Tax Office's assessment of the asset's current replacement cost in accordance with accounting requirements. In making this assessment the Tax Office has excluded any amounts relating to cost overruns and other costs that are not contributing to the functionality required in the completed asset.

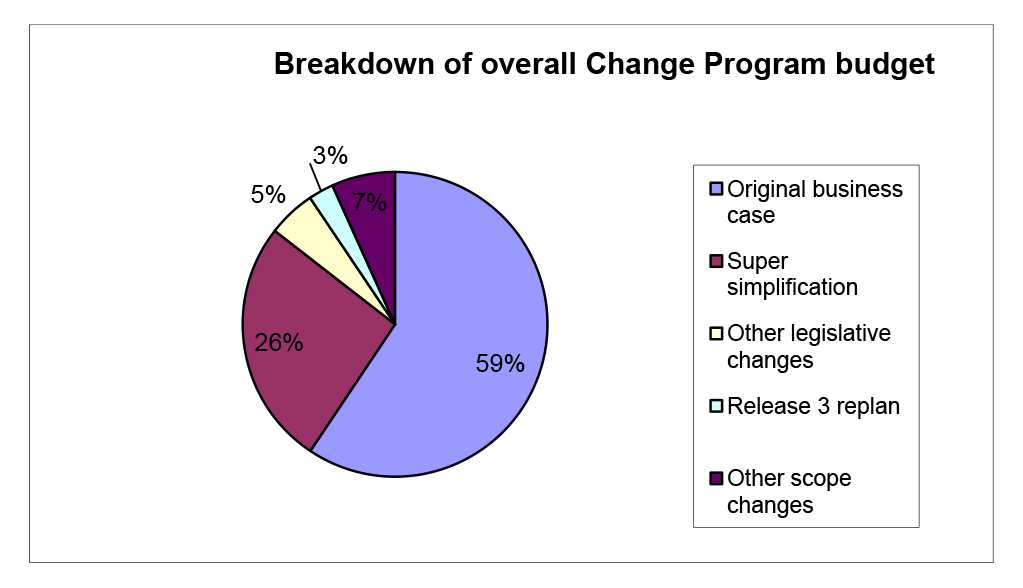

28. The breakdown of the overall Change Program budget as at 30 June 2009 is depicted in Figure 1.

Figure 1 Breakdown of overall Change Program budget at 30 June 2009

Source: Tax Office

Audit objective and scope

29. The objective of this audit was to provide a strategic review on the progress of the Tax Office's implementation of the Change Program.

30. To achieve this, the ANAO examined:

- the planning for, and governance of, the Change Program, particularly in relation to the management of risk and the assurance framework established by the Tax Office, and its management of contractual arrangements for the project;

- implementation issues associated with Releases 1 and 2 of the Change Program, and more specifically in relation to Release 3, the first use of the new ICP system to process FBT returns; and

- the funding of the Change Program, including measurement and attribution of the costs of the project and consideration of any benefits realisation to date.

31. The ANAO considered how international experience for similar sized public sector ICT projects may have highlighted key risk areas for consideration. The ANAO also assessed the Change Program for insights that may be relevant to other Australian Public Service ICT projects, having regard to the new arrangements governing ICT activity by Financial Management and Accountability Act (1997) (FMA Act) agencies following the Government's announcement on 24 November 2008 that it would implement the recommendations of Sir Peter Gershon's report.10

Conclusion

32. The Tax Office's strategic planning for the Change Program, which began during 2001–2002, emphasised the need to achieve broader long term goals that went beyond just replacing and updating existing ICT functionality. The goal was to develop a significantly more cost-effective and integrated system of tax administration that would provide improved services to the community, including secure online facilities.

33. The Change Program business case approved by the Tax Office Executive in December 2004 confirmed that the Tax Office had limited viable options for the long term other than to replace its aging ICT systems.

34. The planning undertaken by the Tax Office formed a sound basis for the formulation of detailed design specifications and operational implementation plans as set out in the Change Program business case.

35. The Tax Office initially established appropriate governance arrangements for the management of the Change Program that were commensurate with the project's anticipated size and complexity as understood in 2004. The Tax Office has since acted on the recommendations of several specially commissioned reviews examining the implementation phases to date, resulting in improved business practices, work schedules and accountability arrangements, and thereby strengthening overall governance.

36. The Tax Office's initial Change Program planning also broadly addressed the key structural elements for success identified in the OECD's 2001 report about avoiding large government ICT failures.11 However, the Tax Office subsequently experienced mixed results in achieving the necessary high levels of individual conformance in relation to three of the five factors, namely dividing the project into more manageable self-contained modules, identifying and managing specific risks, and adequately involving end users in aspects of the development and implementation.

Implementation progress to date

37. The Tax Office initially split the Change Program into three self-contained releases. The implementation of Releases 1 and 2 have improved and transformed key aspects of Tax Office activity that support tax administration. The Tax Office is now better placed to manage internal administration and communication arrangements with taxpayers, tax professionals and the community. Taxpayer information is now available on a national, integrated risk basis, rather than in a fragmented and regional way.

38. Release 3, the largest and most complex of the implementation releases, was originally planned to be a single release rather than a workable number of smaller self-contained modules as suggested in the OECD‘s 2001 report.

39. The Tax Office advised that it had considered splitting Release 3 into several self-contained modules. However, it came to the view that the magnitude and complexity of the interface work required if Release 3 was split into several modules would outweigh any advantages that might come from splitting Release 3 into a more workable number of self-contained modules. The Tax Office advised, however, that the inclusion of superannuation simplification subsequently required it to change this appraisal. The inclusion of superannuation simplification made it necessary to split Release 3 into a number of smaller discrete modules.

40. Notwithstanding the subsequent decision to split Release 3 into smaller discrete modules, implementing the first of these, FBT returns, was further complicated by the insufficient involvement of end users in the development and testing of the FBT functionality. The effect of this, when combined with the size and complexity of Release 3, meant that the Tax Office's original timetable to fully implement a new ICT system for processing tax returns (i.e. the ICP) was ambitious and, in hindsight, optimistic.

41. The implementation of the first of the Release 3 modules, FBT returns, encountered some serious difficulties and highlighted a number of shortcomings in managing implementation risks. A significant factor in the problems encountered with the implementation of FBT, including the General Interest Charge (GIC) calculations, was that the testing and assurance processes were inadequate and not carried out in accordance with existing Tax Office standards.

42. Notwithstanding the limited progress made with Release 3 to date, the new ICP's processing of FBT returns provided a ‘proof of concept' test of the ICP's capacity to process tax returns. This, as well, demonstrated the potential for efficiencies by reducing the extent of manual intervention required of the legacy systems.

43. The timetable for and the scope of the Change Program as set out in the originally approved business case of December 2004 was acknowledged by the Tax Office to be ambitious. As well, subsequent government policy initiatives resulted in the expansion of scope. Management of the Change Program in these circumstances would require a readiness to modify plans and learn from any difficulties experienced as elements of the Change Program were implemented. In this context, success in implementing the phases of the Change Program to date has been mixed, with the implementation of Releases 1 and 2 being generally satisfactory, but the implementation of the FBT Release was less so. The Tax Office considered that the impact of Releases 1 and 2 has been sufficient to demonstrate that implementation benefits exceed original expectations for the functionality delivered. Similarly, the FBT release demonstrates that the ICP is superior to the FBT systems it replaced which operated at a rather low standard of productivity, efficiency and effectiveness.

44. In examining the issues arising from the FBT release and preparing for the releases still to occur, the Tax Office has acted on the recommendations of several specially commissioned reviews, and improved business practices, work schedules, testing and assurance processes and accountability arrangements, thereby strengthening overall governance. This places the Tax Office in a stronger position to anticipate the challenges for the remaining phases of the Change Program. The Tax Office has also publicly reported on the status of the project and acknowledged the Change Program's shortcomings. The Commissioner of Taxation's Annual Report 2007–08 gives a frank account of the impact of the delays in implementing the Change Program and highlights it as one area in which there was scope for improvement. The Commissioner also noted that in spite of the delays to-date Tax Office external risk mitigation strategies have ensured that any difficulties encountered have not adversely impacted the community.

Project funding and the measurement and attribution of costs

45. In embarking on the Change Program, the Tax Office had a particular focus on the monitoring and control of all relevant costs following the decision to internally fund the project. It also established systems to monitor and evaluate benefits. As the major benefits of the Change Program will not eventuate until the new ICT-based tax processing systems are fully implemented during 2010–11 under the revised schedule, the compilation of benefits information was at an early stage at the time of the audit.

46. The ANAO considers that there is scope to improve the quality and type of management information about both the Change Program's costs and benefits. Due to a number of factors, including primarily legislative changes, the expanded Change Program is now scheduled to take at least two and a half more years to complete than was expected in the original business case. As the project is largely internally funded, tracking progress through accurate and timely information about the deferral of benefits, as well as indirect and opportunity costs, is necessary to assist the Change Program Steering Committee in the management and administration of the project.

47. The direct and indirect costs associated with maintaining the legacy systems, and associated processing ‘work-arounds', beyond their anticipated decommissioning dates, will result in increasing financial pressures on the Tax Office. The ANAO also notes that the Tax Office will need to absorb additional estimated expenditure of $247 million, incurred over the life of the Change Program, within its Budget appropriation.

The task ahead

48. Notwithstanding the experience to date, the scale and complexity of the tasks yet to be completed means that the Tax Office still faces significant challenges in finalising the project to a satisfactory standard required for the systems which automate most of Australia's tax administration. There is a significant risk that the deadlines for the completion of further releases may be put under pressure or that functionality in the original scope of the Change Program will be reduced so as to meet current budget and timetable expectations.

49. The experience of the Release 3 FBT implementation has highlighted the importance of end-to-end testing, business pilot with actual production data and full involvement of Tax Office business lines. In addition, there was a need to validate the compliance of the new systems against agreed standards and requirements, including legislative requirements. This will be particularly important for the income tax phase of Release 3 which delivers systems that will automatically finalise tax liabilities and credits for almost all of Australia's approximately 14.5 million tax returns. There is also the potential for further changes to the systems in light of new policy measures arising out of the Henry review.12 Such developments could necessitate a review of work priorities and a further reconsideration of the current implementation schedule.

50. The Tax Office's experience to date underlines the importance during the remainder of the Change Program of:

- closer monitoring of significant risks and corresponding mitigation strategies, and setting higher, more verifiable standards for ‘fitness for purpose' over the quality of work completed by the contractor;

- following sound project management practices during the design, development and assurance stages for future ICP releases; and

- requiring that prior to the release of ICP software into production, end-to-end testing, business pilot with actual production data and assurance processes are completed with the full involvement of Tax Office business areas.13

Australian Public Service (APS) wide considerations

51. The Government's decision to accept the recommendations of Sir Peter Gershon's report means that there will be significant changes to the governance of large ICT projects within FMA Act agencies and to whole-of-government approaches to ICT matters in the future.14 The ANAO considers there are some lessons from the experience of the Tax Office in the implementation of the Change Program which can be applied as the Government moves to implement the recommendations of the Gershon report across the APS.

Recommendations

52. The ANAO made four recommendations directed at ensuring that the Tax Office: fully utilises its available assurance framework for the Change Program work to be completed; strengthens aspects of contract management; establishes a robust performance management framework related to Tax Office activity transformed by successfully implemented Change Program products; and improves the strategic management of the Change Program in relation to the work to be completed by 2010–11.

Chapter Summaries

Background and context (Chapter 1)

Planning for the Change Program

53. By 2000 it was clear to the Tax Office its ICT systems were unsustainable. It was taking too long to respond to Government policy initiatives, the community was getting less efficient service and Tax Office staff were finding reduced capability in the ICT systems. In addition, the Tax Office had been aware for some time of inefficiencies in the ICT systems on which the administration of Australia's taxation and superannuation systems depended. Some of these inefficiencies and shortcomings had been documented in ANAO reports.

54. At the same time there had been increasing public discussion about the performance of the Tax Office's systems in being able to efficiently deal with taxpayers, especially after several major tax reforms including the implementation of A New Tax System in July 2000. Following this major initiative, the Government continued an agenda of change which required a level of responsiveness from the tax system and its administration which challenged the Tax Office's existing ICT systems (referred to as legacy systems in this Report) and processes.

55. The need to replace these legacy systems was one of the key reasons for the Change Program. To assist in defining what would be required of the replacement systems, the Tax Office embarked on a series of community consultations to establish community requirements, especially those of tax professionals and the business community.

Intent of the Change Program

56. The Tax Office recognised that it would be necessary to totally redesign the ICT systems on which the administration of Australia's taxation system would be based. The Tax Office also recognised that the size and complexity of this task required additional expertise to that which it possessed.

57. The original design of the Change Program consisted of three releases; primarily, Release 1 was the installation of a client relationship management system; Release 2 was the installation of a single case and work management system; and with Release 3 being a single integrated system for processing tax returns, including registration and accounting functions.

58. Release 3 would be the most complex phase and would create an ICP System by replacing the Tax Office's major core processing systems, including:

- NTS - National Taxpayer System;

- AIS – ATO Integrated System;

- ATOMS – ATO Matching Systems;

- FBT – Fringe Benefits Tax;

- PAYG – Pay As You Go;

- IPS – Instalment Processing System;

- ECS – Excise Collections System;

- GPS – Generic Payments System; and

- HES – Higher Education Scheme.

59. Release 3 would also replace two existing case management systems: RMS – Receivables Management System (a case management system for actioning outstanding debt) and TDMS – Technical Decision Making System (a case system for actioning complaints, advice, review of decisions and litigation).

The Integrated Core Processing system

60. The Tax Office planned to create an integrated suite of software to process tax returns. The Tax Office found that there was no suitable commercial-off-the-shelf (COTS) software available, but considered that a satisfactory integrated suite of software could be developed from the propriety Tax Administration System (TAS) owned by the global management consulting and technology services company, Accenture. This new suite of software would become known as the ICP system, which would be changed to take into account Australia's tax law, and accommodate specific Tax Office requirements, including the efficient interaction with the proposed single case management system.

Implementation progress and extensions to project scope

61. Release 1 (implementation of the CRM and electronic document storage) was phased in over several months and was fully completed in April 2006, 10 months after the due-for-completion date in the original Implementation Schedule. It affected over 2500 staff and delivered new services.

62. Release 2 was also phased in, being fully completed in March 2007, six months after the original due-for-completion date. It resulted in significant administrative and work practice changes to the Tax Office. It impacted over 13 000 staff in over 1000 teams across 60 sites and improved the way the Tax Office conducts business, moving to enterprise business processes and fewer systems that now contain a consolidated client history. The Tax Office considers the shift has helped it provide a more consistent service and better understand taxpayers' tax affairs.

63. During 2005–06 the Tax Office expanded the scope of the Change Program to include ICT system changes necessary to support new government policy measures in relation to Child Care Rebate, Review of Self Assessment, and the Fuel Excise Reform Program.

64. Also in 2006 the Australian Government announced major reforms to Australia's superannuation system which had a significant impact on the Change Program. The Tax Office is responsible for the implementation of the superannuation simplification changes and this has had a direct impact on the Change Program. The Tax Office had excluded all superannuation systems from Release 3. The Tax Office sought and received funding of $195.8 million to include all superannuation systems, modified to meet the superannuation simplification requirements, into the Change Program. The Tax Office advised the then Government that its legacy systems did not have longer term viability.

65. The changes required to support the superannuation simplification measures were a significant departure from the Change Program's original specifications. Examples of this departure include the need for a superannuation portal to support the Lost Members Register (LMR) requirements and the need for a new high volume, near real-time data matching facility.

66. The Tax Office concluded that incorporating the new superannuation systems within the ICP would be a lesser risk than incorporating them into the existing superannuation systems. However, given the significant risks in either case, the Tax Office also decided to make all necessary changes to the legacy superannuation software. According to the Tax Office, this would enable the legislated superannuation reforms to be administered from legacy software if the Tax Office was unable to meet legislated time frames through the Change Program. In the circumstances, this strategy was a prudent approach to the inherent risks.

67. Having regard to the subsequent course of events, it is evident that the Tax Office underestimated the magnitude and risks associated with the addition to the Change Program of the work necessary to implement superannuation simplification reforms, notwithstanding its mitigation strategy which may have added to the complexity of the Change Program and hence the overall risk.

68. The Tax Office proceeded to modify the Release 3 schedule and negotiate additional costs with Accenture to include superannuation. As a result, the Tax Office expanded the scope of the Change Program to include the superannuation initiatives in Release 3.

69. With the change in government in 2007, the Tax Office had to again further expand the scope of the Change Program to include the systems necessary to support the FHSA initiative introduced by the new Government. Incorporation of FHSA into the Change Program also required modification to the Release 3 schedule and renegotiation of costs with Accenture. The FHSA is not part of the Change Program's business case and is contracted separately.

70. In February 2007 the Tax Office divided Release 3 into several separate releases: FBT and Income Tax, superannuation simplification, and Business Activity Statements to accommodate the Government's requirements for superannuation reform. Later during 2007 the Tax Office made a further split between individual income tax and company tax, with the aim to deliver FBT and company tax in January 2008. In September 2007 the Tax Office deferred deployment of FBT and company tax until March 2008. In February 2008 the Tax Office realised that progress with FBT and company tax was behind schedule and that it would only be feasible to proceed with the FBT component in March 2008. The Tax Office also realised the ICP software would not be ready in time to provide the full FBT functionality required in the original business case. Nevertheless, the Tax Office decided to use the ICP to process FBT returns for the 2007–08 financial year even though it did not have all of the necessary functionality. In view of this the Tax Office established a range of risk mitigation strategies.

71. The three initial sub-releases of Release 3 have now been implemented, although not necessarily fully functional, as follows:

- ICP was deployed into production in March 2008 and by May 2008 was processing FBT returns; and

- LMR functionality was deployed into ICP over September-October 2008; and

- Co-contributions and Superannuation Holding Account special accounts were deployed into production in February 2009.

72. The Change Program is now entering the most difficult and complex phase of the project and there are signs of increasing challenges in achieving a satisfactory outcome from the remaining Change Program sub-releases.

Governance of the Change Program (Chapter 2)

Governance arrangements

73. Corporate governance refers to the processes by which organisations are directed, controlled and held to account. It encompasses authority, accountability, stewardship, leadership, direction and control exercised in the organisation.15

74. Governance of the Change Program involves a range of committees as well as the Tax Office/Accenture contract and related governance documents. Under the terms of the program implementation contract, delivery of the Change Program against the business case is the responsibility of Accenture. Ultimate accountability for delivery of the Change Program, however, rests with the Tax Office.

Organisational arrangements

75. Executive management of the Change Program occurs through the CPSC and the CPE. The CPSC is chaired by the Commissioner and includes the Second Commissioners. Its role is to ensure the Tax Office delivers the improved client experiences described in Making it easier to comply. The CPSC determines outcomes and priorities for the Change Program and approves significant scope, strategy, design, business case and client experience changes.

Assurance arrangements

76. The governance of the Change Program requires assurance capabilities that are commensurate with the complexity and risks of developing the ICP to the required ‘fit-for-purpose' standard. The Tax Office established assurance arrangements to support the management of risks, namely the independent assurer Capgemini, the Tax Office's internal audit branch, the extensive knowledge of business line users available to undertake testing of the new systems, and, from time to time, reviews undertaken by an independent expert. As a result of these arrangements, during 2007 and 2008 the Tax Office received reports about challenges associated with the Tax Office's ‘solution transfer' strategy for design and construction of the ICP, i.e. the transformation of Accenture's TAS into the Tax Office's ICP. The Tax Office assurance arrangements identified the need to strengthen how the various reviews' recommendations were brought forward and acted on by the Tax Office in a timelier manner.

77. Whilst there have been weaknesses in the design and implementation of the Change Program, the Tax Office endeavoured to learn from the processes and avoid any repetition of problems. In this regard, the Tax Office has made use of the opportunity presented by the processing of FBT returns by an early version of the ICP. Importantly, the Tax Office Executive has proceeded to apply those understandings to improve the Change Program's ongoing administration.

Change Program contract administration

78. The Tax Office/Accenture contract is a central feature of the Change Program's governance arrangements. Although it is a purchaser/provider contract, joint Tax Office/Accenture design and development work is a distinctive feature of the arrangements.

79. The accountability of the Tax Office for the specification of outcomes and of Accenture for the provision of goods and services that achieve them has become more complex in practice than originally anticipated. In practice, features of the contract (joint conduct of work and the liability for risk) blur the roles of the Tax Office and Accenture. Complex negotiations between the two parties therefore became an essential feature of day-to-day contract administration.

80. Nevertheless, the contract provides the Commonwealth with a reasonable degree of protection against escalating contractual costs on the one hand and unsatisfactory contracted outputs on the other. The contract requires Accenture to provide goods and services that are ‘fit for purpose' in that they achieve measurable outcomes and to do so on a ‘not to exceed price' basis.

Expanding whole-of-Tax Office performance information

81. Although the full impact of Releases 1 and 2 is evolving, the ANAO found that these releases are improving and transforming key aspects of tax administration as anticipated in the original goals of the Change Program Business Case.

82. Following implementation of Releases 1 and 2, the Tax Office is in a better position to evaluate the efficiency and productivity of the functions of case work and records management on a whole-of-Tax Office basis.

83. Aggregate Tax Office-wide measures of efficiency, productivity, effectiveness and quality of the performance of functions of case work and records management based on Releases 1 and 2 are being developed and applied.

84. Once work now underway to define valid and reliable measures of output, including measures of the quality of the output, is complete it should provide the basis for the Tax Office to evaluate the efficiency and productivity of the individual functions of case work and records management across all areas of the Tax Office where these individual functions are carried out.

85. The new methodologies for productivity and efficiency measurement and evaluation enable the identification of high and low performing groups.16 Where operational areas or groups carry out the same or similar types of output activity but in different locations, the comparison across the differing groups could help to identify the reasons for differing levels of performance. Under-performance by one group producing the similar type of output activity may reflect issues with office design, training, inexperienced staff, poor management, or staff having a range of other, unspecified duties.

The Integrated Core Processing System's processing of FBT returns (Chapter 3)

86. The original approved business case for the Change Program defined the main part of Release 3 as the ICP system for all types of income taxes administered by the Tax Office. In addition, Release 3 would also include an extension of the case management system to a wider audience, implement new tax agent and business portals, and provide updates to work management, CRM, analytics, content and records management and reporting. The Tax Office estimated that Release 3 would account for about $171m or 38 per cent of the total Change Program cost in the 2004 Business Case.17

87. In February 2008 the Tax Office decided to use the ICP to process FBT returns for the 2007–08 financial year. Since the Tax Office knew that some of the FBT functionality did not work correctly, it proceeded with a phased implementation, and with only the functionality required to process FBT returns being enabled. The Tax Office established a range of risk mitigation strategies to address identified functionality issues.

88. The use of the ICP system to process FBT returns was a significant step for the Change Program. It was the first time the ICP system would be made operational to process tax returns. Future stages involving income tax returns would build on this base.

89. In using the ICP to process actual FBT returns, the Tax Office took care to avoid known defects in the broader ICP system. However, a number of additional unanticipated defects in the incomplete ICP's processing of FBT returns emerged. The ANAO considers that the testing and assurance processes for the FBT release, including the General Interest Charge (GIC), were inadequate and could have been more comprehensive so as to uncover these defects. In relation to the GIC, as the Tax Office did not have sufficient confidence in the GIC routines during implementation of the FBT release, the functionality was turned off.

90. The Commissioner established several reviews of internal administration, practices and procedures following the severity of the problems experienced when the incomplete ICP processed actual FBT returns. The reviews found the testing approach and processes to be inadequate, which led to an abnormal number of serious defects. The defects highlighted shortcomings in the quality of the ICP software. The reviews also found that there had been departures from approved governance arrangements which undermined sound decision making.

91. The ANAO found that the CPSC made a considered risk–based decision to proceed with the incremental deployment of the FBT release, thereby providing a ‘proof of concept' test of the ICP's capacity to process tax returns. It was also aimed at avoiding delaying the Change Program by a further 12 months. In reaching this decision the CPSC was briefed about the risks, advantages and disadvantages of the main alternatives. Subsequent investigations revealed insufficiencies in the testing of the FBT release prior to production, the results of which informed CPSC decision-making. In addition, some unanticipated ‘Severity 1 and 2' defects were discovered after the release was deployed. The subsequent rectification of these and the known pre-implementation defects in the FBT release took up to 12 months, because the defects proved more complex than anticipated.

Funding of the Change Program and measurement of costs and benefits (Chapter 4)

92. The endorsed Change Program business case (dated 10 December 2004), states that the total cost of the Change Program was not to exceed $445 million in direct costs18 over six financial years, starting in 2003–04 and finishing in the 2008–09 financial year. The business case provided for the Change Program to be fully funded internally from the Tax Office's annual budget appropriations. The Tax Office established arrangements intended to offset internally funded expenditure by financial benefits arising from productivity improvements.

93. The endorsed business case anticipated that the Change Program's direct financial benefits in the form of improved productivity and efficiency would equal the total amount of Tax Office funds set aside to finance the Change Program.

94. As noted in paragraph 20, since the business case was approved in 2004, the scope of the Change Program changed several times, largely due to legislative changes, and the delivery schedule for the Change Program has also changed a number of times. As a result, the expanded Change Program is now scheduled to take at least two-and-a-half more years to complete than was expected in the original business case. At 30 June 2009 the budget for the expanded scope Change Program is $774 million finishing in 2010–11. This includes the FHSA, which is outside the business case and for which the Tax Office received $25 million and contracted separately. The expansions in scope of the business case required by government (principally superannuation simplification) account for $234 million of the $304 million growth in budget since 2004.

95. Furthermore, delays in the completion of the Change Program have resulted in additional costs and some diminution in the quality of services provided by the Tax Office.19 The additional costs include the deferral of benefits to the Tax Office, including the deferral of productivity benefits, the deferral of benefits to the community, the additional costs of maintaining fully functional legacy systems, and the write-down (i.e. impairment) of assets generated by the capitalised Change Program expenditure.

96. Actual expenditure on the Change Program to the end of 2008–09 was $749 million. As at 30 June 2009 the Tax Office estimated, that on the basis of the Change Program being completed during 2010–11, a further $105 million may be spent over the next two financial years, bringing the total forecast expenditure to $879 million, including the $25 million the Tax Office received for the FHSA, which is outside the business case and contracted separately. Forecast expenditure on the expanded scope of the Change Program is $434 million more than the 2004 business case estimated.20 After taking into account the additional funding provided by government to implement legislative changes (such as superannuation simplification) the Tax Office expects to absorb within its budget appropriation additional estimated expenditure of $247 million over the life of the program.

97. The Tax Office assessed that an impairment write-down of $75 million against the Change Program Release 3 software asset was appropriate at 30 June 2009. This reflected the Tax Office's assessment of the asset's current replacement cost in accordance with Australian Accounting Standard 136, Impairment of Assets (AASB136)21 and Accounting Guidance Note 2007/1 issued by the Department of Finance and Deregulation (AGN 2007/1).

98. This asset comprised internally developed software under construction. The decision to write-down the value of the asset under construction was based primarily on available internal evidence which indicated higher costs from delays and rework associated with the expansion in scope of the Change Program. The Tax Office concluded that the capital component of the increased estimated costs of the Change Program compared to the budget did not represent additional functionality and hence was not appropriate to be capitalised.

99. The additional costs include the deferral of benefits to the Tax Office, including the deferral of productivity benefits, the additional costs of maintaining fully functional legacy systems and the write-down (i.e. impairment) of assets generated by the capitalised Change Program expenditure. The additional costs include, as well, the deferral of benefits to the community.

100. There is a range of indirect and opportunity costs that are relevant to the governance of the Change Program. These include the deferral of benefits expected to accrue but now delayed because the Change Program will now take at least three years more to complete than originally expected. The Change Program's benefits are broader than just the direct financial benefits now monitored.

101. The ANAO considers that it is important to the strategic management of the Change Program for the CPSC to periodically receive additional summary, high level reports about the broad range of costs and benefits attributable to the Change Program and the progress of the Change Program in achieving the strategic goals originally determined.

APS-wide considerations (Chapter 5)

102. The Government's decision to implement the recommendations of Sir Peter Gershon's 2008 report means that there will be significant changes to the governance of large ICT projects within FMA Act agencies and to whole-of-government approaches to ICT matters in the future.22

103. The need for large ICT projects like the Change Program is likely to be a continuing feature of Commonwealth administration. The rationale which necessitated the Change Program will continue to have currency for many public sector agencies. In this context, this audit underlines the importance of carefully considering several factors, as public sector agencies move forward consistent with the Government's response to the Gershon report. This includes the need for agencies to reassess, preferably at arms-length and with the assistance of independent experts, the adequacy of governance arrangements having regard to the key success factors identified in the 2001 OECD paper, as well as considerations such as:

- a tendency for project management and staff to underestimate the complexity of the ICT task and associated risks and to overestimate their ability to do the task and manage the risks;

- the consequences of the inevitable scope changes that occur with large ICT projects;

- any impact of internal decision making processes which may become time consuming depending on the complexity of issues, especially those of policy and legislative interpretation; and

- periodic strategic evaluations of the progress of the project in achieving planned goals having regard to overall direct and indirect costs and benefits.

Tax Office response

104. A summary of the Tax Office response follows:

105. As noted in your report the Change Program is a very significant information and communication technology program. It will replace all our behind the scenes mainframe systems, some of which are over 30 years old, with a single integrated system. In doing so, it will provide the Tax Office with the foundation to better meet the expectations of Government and community. It will also deliver improved client experiences and will provide efficiencies for the Tax Office.

106. We have already seen efficiencies and savings as a result of the Change Program:

- Release 1 provided us with a client relationship management system and online portals. This means staff no longer work, view or operate in multiple systems as client information is now presented in one system.

- Release 2 impacted over 13 000 staff in over 1000 teams across 60 sites and fundamentally changed the way we conduct our business. Staff can now see in one system client contact history, current cases associated with a client, and images of correspondence sent to and from the client. This shift is helping us to provide higher quality and more consistent service.

- Release 3 is still underway and we have already implemented part of the ICP system providing a significantly improved capability to process fringe benefits tax and some superannuation products.

107. The remainder of Release 3 will deliver the other elements of the ICP system which will replace eight more aging mainframe systems and will allow us to process all of our accounts, registrations, forms and payments, and do follow-up work relating to outstanding debts and lodgement.

108. Your report also notes that due largely to legislative changes, such as Superannuation Simplification and First Home Saver Accounts, the Change Program will take longer than was originally planned. This has presented a number of challenges, but we continue to progressively deliver the intended outcomes adapting and refining our approaches to ensure outcomes are met with minimal disruption to the administration of Australia's taxation and superannuation systems.

109. We believe the Tax Office experiences as outlined in the report may provide valuable lessons for other government agencies undertaking or embarking on similar transformational change programs.

110. On behalf of the Tax Office I welcome the report and agree to the recommendations and would like to thank the audit team for the constructive and collaborative way in which this audit was conducted.

111. The Tax Office's response is included in full at Appendix 1.

Footnotes

1 The major processing systems include: NTS AIS; ATOMS; FBT; PAYG; IPS; ECS; GPS; and HES.

2 Commissioner of Taxation Annual Report 1993–94, p. 87.

3 The administrative processes relate to a wide range of functions that support the primary taxation function, including the processing of correspondence and the conduct of investigations and projects.

4 The Tax Office selected the global management consulting, technology services and outsourcing company Accenture to work with it on the initial strategy setting and high level design of what was to become the Change Program. The initial strategy was approved in March 2004 and design work for the ICP began in 2005, two years before a planned deployment in the production environment.

5 OECD Public Management Policy Brief No. 8 – The Hidden Threat to e-Government: Avoiding large government IT failures. March 2001. Available at <http://www.oecd.org/dataoecd/19/12/1901677.pdf> [accessed 15 October 2009].

6 A subsequent review in 2009 has now added another six months to the length of time to be taken until the Change Program is completed.

7 Business Case – Phase 2, Easier, Cheaper and More Personalised Change Program, version 6.3, 10 December 2004, page 2.

8 The FHSA was contracted separately to the Change Program.

9 This amount is the total forecast expenditure of $879 million minus the “not to exceed” business case budget of $445 million.

10 Gershon, P., Review of the Australian government’s use of information and communication technology. Commonwealth of Australia August 2008. See further

http://www.financeminister.gov.au/media/2008/mr_372008.html> [accessed 15 October 2009].

11 OECD op. cit., footnote 5.

12 On 13 May 2008 the Australian Government announced a review of Australia's taxation system. This review, chaired by Dr Ken Henry, Secretary of the Treasury, will look at the current tax system and make recommendations to position Australia to deal with the demographic, social, economic and environmental challenges of the 21st century. The final report is due to be presented to the Treasurer in December 2009. See <http://www.taxreview.treasury.gov.au> [accessed 15 October 2009].

13 “End-to-end testing” requires assessment of systems on a fully integrated basis.

14 Gershon, P., Review of the Australian government's use of information and communication technology. Commonwealth of Australia August 2008.

15 ANAO Better Practice Guide, Public Sector Governance, 2003.

16 Data Envelopment Analysis is a relevant methodology that the Tax Office might wish to consider. It has been actively promoted by the Productivity Commission for the comparative evaluation of service delivery. (See <http://www.pc.gov.au/__data/assets/pdf_file/0006/62088/dea.pdf> [accessed 15 October 2009]. It has also been used by several state governments for this purpose and by the ANAO in several performance audits.

17 ECMP.CP Business Case Phase 2 Version 6.3 10-12–2004; page 43.

18 Business Case – Phase 2, Easier, Cheaper and More Personalised Change Program, version 6.3, 10 December 2004, page 2.

19 The Tax Office anticipated that during implementation of the Change Program some service standards in the Taxpayers' Charter would not be met. The Tax Office advised taxpayers and intermediaries of temporary changes in service levels.

20 This amount is the total forecast expenditure of $879 million minus the ‘not to exceed' business case budget of $445 million.

21 Specifically paragraph 12(g) of AASB136.

22 Gershon, P., Review of the Australian government's use of information and communication technology. Commonwealth of Australia August 2008.