Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Australian Taxation Office's Approach to Managing Self Managed Superannuation Fund Compliance Risks

This second audit report relating to SMSFs examines the effectiveness of the Tax Office's approach to managing SMSF compliance risks. Specifically the ANAO examined the processes the Tax Office uses to:

- identify the risks relevant to SMSFs not complying with their obligations under the SISA, including members accessing their superannuation early;

- mitigate SMSF compliance risks; and

- administer fund wind-ups.

Summary

Introduction

This is the second of two audit reports concerning the Australian Taxation Office's (Tax Office's) administration of self managed superannuation funds (SMSFs) pursuant to the provisions of the Superannuation Industry (Supervision) Act 1993. The first audit report, tabled in June 20071, examined the efficiency and effectiveness of the Tax Office's approach to regulating and registering self managed superannuation funds.

Superannuation is a long-term vehicle for building retirement savings, and is a key element of the Government's policies to address the financial independence of Australia's ageing population.

For taxation purposes, superannuation funds are defined in the Superannuation Industry (Supervision) Act 1993 (SISA) to include schemes which are for the payment of superannuation benefits upon retirement or death.

Superannuation funds can be broadly categorised under SISA into those regulated by the Australian Prudential Regulation Authority (APRA) and SMSFs, which are regulated by the Tax Office. As discussed in the first audit report2 the SISA legislation is complex with a number of SISA provisions and SIS regulations common to APRA and the Tax Office in their regulation of these two very different superannuation market segments.

The Government has recently initiated significant changes that will assist the Tax Office to regulate SMSFs and to simplify applicable administrative functions for SMSF trustees. On 15 March 2007, the Tax Laws Amendment (Simplified Superannuation) Act and related legislation received Royal Assent. These changes generally applied from 1 July 2007.

As at 30 June 2006, the Tax Office was responsible for the regulation of some 320 000 SMSFs (approximately 98 per cent of all complying superannuation funds)3, comprising 616 000 members4(approximately 2 per cent of all superannuation member accounts5). Approximately one quarter (or $209.9 billion) of all superannuation savings was invested through SMSFs. In addition, an estimated $3.95 billion in tax concessions were made available to SMSFs in the 2005–06 financial year.6

SMSFs, by statutory definition, are superannuation funds:

- with fewer than five members (all of whom are trustees7);

- where no trustee of the fund receives remuneration from the fund or any persons for duties or services performed by the trustee in relation to the fund; and

- where no member is an employee of another member (unless that member is a relative).

Audit scope and objective

This second audit report relating to SMSFs examines the effectiveness of the Tax Office's approach to managing SMSF compliance risks. Specifically the ANAO examined the processes the Tax Office uses to:

- identify the risks relevant to SMSFs not complying with their obligations under the SISA, including members accessing their superannuation early;

- mitigate SMSF compliance risks; and

- administer fund wind-ups.

Conclusion

In 1999–2000 the Tax Office assumed regulatory responsibility for SMSFs, a sector of the superannuation industry that had received minimal ‘compliance checking' from previous regulators. At this time, the Tax Office was aware of significant non compliance in a range of areas, however prior to 2003–04 the Tax Office's approach to managing SMSF compliance risks was largely educational. This was in part due to organisational constraints associated with the introduction of A New Tax System and was also consistent with the Tax Office Compliance Model.

The Tax Office's management of compliance risks has been influenced by its initial approach to regulating and registering SMSFs. As noted in the previous SMSF audit report the Tax Office could have taken steps to improve the collection and assessment of registration data, and fund income tax and regulatory return data, prior to issuing SMSFs with complying fund status. This filtering of new SMSFs would have assisted the Tax Office to limit the extent of non-compliance given that the number of SMSFs registered in the period 2000–01 to 2003–04 increased from 210 600 to 281 100.

Specific analysis undertaken by the Tax Office in 2002–03 and 2003–04 revealed high levels of non compliance across the SMSF population and became the catalyst for significant changes to the Tax Office's SMSF compliance approach.

Since 2003–04 the Tax Office has sought to resolve SMSF non compliance through a combination of educational strategies and increased active compliance activity. However, low Tax Office compliance audit coverage and the Tax Office's discretionary use of the SMSF penalty regime has resulted in few funds in breach of the SISA being subjected to remedial measures.

The ANAO considers the implementation of Simplified Superannuation reforms and the additional resources provided to the Tax Office will impact on the Tax Office's management of SMSF compliance risks in the future. In particular, tripling of the SMSF active compliance workforce, the associated increase in audit coverage of SMSFs and the requirement for an annual audit by an approved auditor can be expected to improve SMSF compliance with their SISA and income tax obligations. However, given the continuing significant growth in the number of new SMSFs, the Tax Office will need to monitor the effectiveness of its compliance approach in light of these latest reforms and its ongoing assessment of SMSF compliance.

Notwithstanding the increase in compliance activity, the ANAO considers that the Tax Office has significant potential to establish more effective processes for identifying and mitigating SMSF compliance risks. Until it does so, it will not be in a position to provide adequate assurance that its compliance approach is effective and that SMSFs are complying with their obligations.

Key Findings by chapter

Background and context (Chapter 1)

When the Tax Office assumed responsibility for SMSF regulation it had been noted in the Wallis Inquiry8 that as the members of SMSFs are also trustees of the fund, they were expected to be able to protect their own financial interests. This is in part supported by a number of requirements within the SISA, most notably the requirement for SMSFs to undergo an independent audit examination by an approved auditor.9 The annual audit comprises a financial audit of a fund's accounts and a compliance audit against the SISA requirements.

The annual audit process undertaken by an approved auditor is regarded as a key leverage point in achieving greater compliance by superannuation funds. In September 2001, the Senate Select Committee on Superannuation and Financial Services reviewed the competency requirements of approved auditors.10 In particular, the Committee reviewed the adequacy of auditing and accounting standards; the reporting requirements under the SISA; the quality of audit reports; and the role of professional bodies in improving compliance.

In 2004 the Government passed the Superannuation Safety Amendment Act 2004 (Superannuation Safety Act) to strengthen the prudential regulation of superannuation funds. Measures introduced by the Superannuation Safety Act, such as the introduction of Auditor Contravention Reports (ACRs), had a notable impact on the operations of SMSFs and the regulatory approach of the Tax Office.

Simplified Superannuation

As part of a series of ongoing reforms to simplify and streamline the superannuation system, the Government has recently initiated significant changes to assist the Tax Office to regulate the SMSF regime and to simplify applicable administrative functions for SMSF trustees. The changes delivered by this legislation generally applied from 1 July 2007 and include:

- streamlining fund reporting requirements;

- introducing a trustee declaration form to ensure new trustees, or directors of corporate trustees, understand their duties as trustee of a SMSF;

- requiring approved auditors to lodge a report in the first year of a fund's operation where there has been any contravention of the SISA;

- new administrative penalties for late returns and false statements; and

- increasing the superannuation supervisory levy from $45 to $150 to recover the Tax Office's regulatory costs.

The Tax Office also plans to improve SMSF compliance with income tax and superannuation laws by almost tripling its current case work levels over the next two years. This will involve:

- increasing Tax Office audit coverage of SMSFs by 2.9 per cent of funds (equating to 6500 additional compliance reviews and audits for 2007–08); and

- between 2007–08 and 2009–10, annually undertaking reviews of the returns submitted by 7 per cent of approved SMSF auditors.

Identification and selection of compliance risk cases (Chapter 2)

With over 360 000 SMSFs now currently operating in this market segment, it is to be expected that there will be some level of non-compliance with SISA and income tax obligations. Education of trustees undertaken by the Tax Office during the lifecycle of SMSFs is a broad based activity to address non compliance across the whole market segment. However, it is essential the Tax Office also has a systematic risk based methodology for identifying and resolving specific non compliant SMSF behaviour.

In identifying significant non-compliance in a range of areas when first given responsibility for the regulation of SMSFs, the Tax Office adopted and promoted an educational approach to support SMSF trustees to comply with their obligations between 1999–2000 and 2002–03. Although constrained by resources, the ANAO considers the Tax Office could have done more at the time to better understand SMSF compliance risks originally identified in its 1999–2000 risk assessment.

To assess the extent of SMSF non-compliance, the Tax Office completed two Benchmarking Projects in 2002–03 and 2003–04. The Benchmarking Projects were used to determine an overall measure of compliance for the broader SMSF population.11 Based on the results of the 2003–04 Benchmarking Project, an estimated 9.2 per cent of SMSFs have low levels of compliance with their SISA obligations.

The Benchmarking Projects became the catalyst for significant change to the Tax Office's SMSF compliance approach in 2004–05. Since the Tax Office has not undertaken further Benchmarking analysis, the results of the 2003–04 Project continue to be heavily relied on by the Tax Office when assessing levels of SMSF non compliance. While it is in the process of developing a imprehensive approach to SMSF compliance, capable of producing better compliance intelligence, the ANAO considers that the Tax Office should continue to undertake Benchmarking Projects on a periodic basis.

Since 2004–05 SMSFs have been rated by the Tax Office Executive as a ‘severe' compliance risk. This coincided with the Tax Office being funded in 2004–05 to undertake 3600 compliance audits.

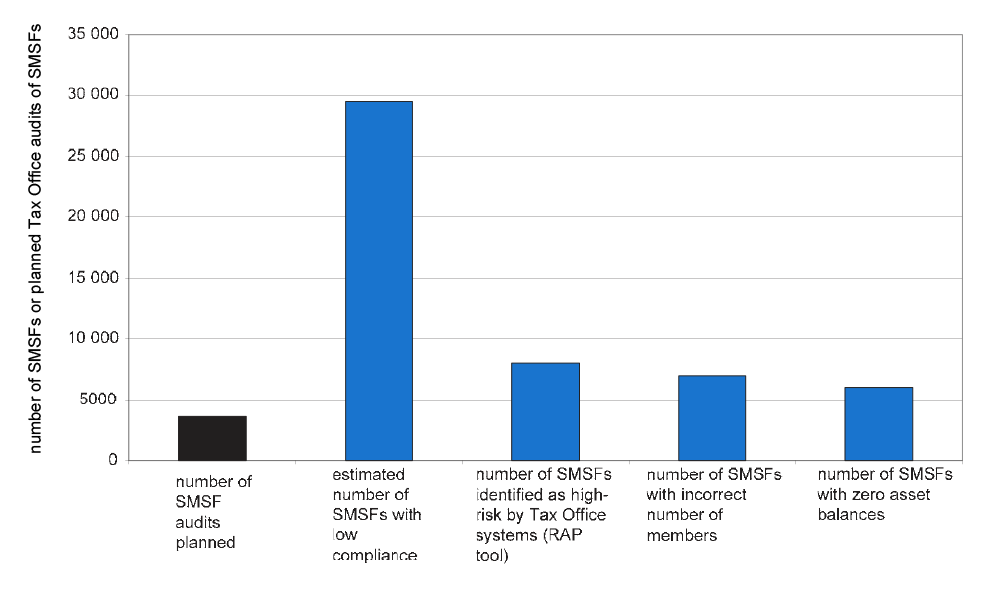

Table 1 below compares the estimated number of SMSFs likely to not be complying with the SISA based on 2001–02 data highlighted in the 2003–04 Benchmarking result, and other high risk indicators derived from Tax Office data, with the number of compliance audits funded for 2004–05.

Table 1 Number of planned Tax Office audits of SMSFs compared to the number of SMSFs likely to not be complying with their SISA obligations in 2004–05

Source: ANAO analysis of Tax Office information

Based on the results of the 2003–04 Benchmarking Study an estimated 28 000 (or 9.2 per cent of the total) funds as at June 2005 potentially had low levels of compliance with their SISA obligations.12 Other indicators of funds likely to not be complying with the SISA included 8000 funds specifically identified by Tax Office systems; 7000 funds with either zero or greater than four members; and 6000 funds with zero asset balances.

The Tax Office advised that the number of SMSFs with low compliance calculated using the 2003–04 Benchmarking Study will have been influenced by various activities, including the following, which may have decreased this number:

- measures introduced by the Superannuation Safety Act from 1 July 2004, such as the ACR which made it mandatory for the notification of breaches to the Tax Office in certain circumstances;

- the release of education products including DIY Super It's your money…but not yet! and the Tax Office presenting over 100 seminars per year to the SMSF community; and

- the influence of the New Trustee Education Campaign on trustees' behaviour in following years.

Notwithstanding the identification of large numbers of funds receiving SMSF tax concessions, but which were at a high risk of SISA non-compliance, the Tax Office audit coverage to address this significant risk profile was very low. Similarly, the Tax Office approach to audit case selection at that time was based on a variety of other indicators that extended beyond those risk indicators highlighted in Table 1. As a result the low level of audit coverage did not focus on the areas of highest risk.

Consequently, the Tax Office did not have an adequate SMSF compliance strategy for the 2004–05 year to respond adequately to the risk profile presented by either its Benchmarking studies or the other key risk indicators available. The ANAO notes the Tax Office proposal to triple its SMSF casework from 2007–08 should enhance its ability to encourage greater SMSF compliance going forward.

The concessional taxation treatment of superannuation is the largest reported single tax expenditure by the Government. There are a large number of SMSFs that have potentially committed multiple serious breaches of the SISA and a significant number are at risk of being penalized, or being deemed as ‘non complying.' If a fund is deemed as non-complying it loses its tax concessional status. The ANAO notes however, that to date, the Tax Office has encouraged funds to rectify breaches where they are found, rather than make funds non-complying. Only when a fund refuses to rectify a serious breach of the SISA or has recurrent breaches would the Tax Office make a fund non complying.

The limited Tax Office compliance audit coverage means that funds in breach of the SISA are unlikely to be subjected to remedial measures and therefore are in a position to receive concessional taxation treatment for their superannuation funds. The ANAO sought to estimate the potential revenue implications in respect of those SMSFs which continue to receive tax concessions but which were most at risk of non compliance.

Using the compliance levels established by the Benchmarking Projects the ANAO analysed the tax concessions claimed by SMSFs from 1999–2000 to 2005–06. The estimated annual average value of income tax concessions claimed by SMSFs during this period was some $2.3 billion per annum. During the same period the minimum estimated annual average value of income tax concessions claimed by SMSFs with potentially multiple serious breaches of the SISA was some $230 million per annum.

Using lodgement information as at March 2007, the Tax Office estimated the amount of income tax not reported by active SMSFs for the period 1999–00 to 2004–05, was approximately $500 million.

In influencing SMSF compliance and thereby minimising the risk to Australian Government revenue, it is important for the Tax Office to generate reliable intelligence about SMSF compliance behaviour. The two main sources of intelligence used by the Tax Office to identify high-risk SMSF compliance cases are the income tax and regulatory returns lodged by funds and information received from approved auditors.

Prior to October 2004 there was no lodgement assessment process to encourage timely, complete and accurate reporting by SMSFs. This included the Tax Office not applying penalties for the late lodgement of regulatory returns, although under the SISA an individual is guilty of an offence if they fail to do so. The ANAO estimates by not applying the regulatory return penalty, the Tax Office has foregone some $29 million in penalty payments.

The Tax Office introduced some interim measures to achieve lodgement compliance in 2005–06. Project work undertaken in late 2006 identified a number of SMSF lodgement compliance issues and the Tax Office has now taken steps to develop a suitable superannuation lodgement enforcement program. The inconsistent approach taken in the past by the Tax Office in applying penalties to SMSFs that have not met their lodgement obligations may have also influenced current SMSF lodgement compliance practices.

The Simplified Superannuation reforms will now only require trustees of SMSFs to lodge a single annual return. New administrative penalties will also apply to SMSFs for failing to lodge documents on time or making false or misleading statements in their returns. The Tax Office considers these changes should improve the accuracy of information reported by SMSFs in the future and help to rectify current inconsistencies in the imposition of lodgement penalties.

The Tax Office is commencing a lodgement enforcement program in 2007–08 directed towards increasing the number of SMSFs that lodge their returns within six months of the due date from the current levels of 70 per cent to 94 per cent by the end of 2009–10.

As noted previously, the Tax Office relies heavily on the work undertaken by approved auditors to report SMSF non-compliance with the SISA. However, the Tax Office did not take any action until 2003–04 to assess whether approved auditors were adequately meeting their obligations. Tax Office reviews indicated a significant proportion of approved auditors did not conduct high quality SMSF audits. The Tax Office is updating its approach and procedures for taking action against approved auditors that do not adequately meet their obligations.

The ANAO examined the extent of approved auditor information collected by the Tax Office from fund returns and found it was generally not adequate to accurately identify the approved auditor shown on the return. The Tax Office advised that changes to the annual return form implemented as part of the Simplified Superannuation reforms, should improve the quality of approved auditor information collected for the 2007–08 financial year onwards.

The implementation of these changes is unlikely to improve the Tax Office's approved auditor data holdings until late 2008 at the earliest. In preparation for this, the ANAO considers there would be benefit from the Tax Office cleansing its existing approved auditor data of erroneous, duplicated and/or incomplete records where possible.

Similarly the ANAO notes that the proposed changes, of themselves, will not allow the Tax Office to validate the bona fides of the fund auditors in terms of their membership of an approved professional organisation through matching its data with the professional bodies' records. The ANAO considers that to improve the verification of approved auditor information, the Tax Office should seek to expand existing working relationships with professional organisations.

The ANAO notes that Simplified Superannuation reforms will mandate the lodgement of an ‘approved form' to replace the auditor contravention reports (ACRs). Previously the ACRs were lodged with the Tax Office after being prepared by approved auditors when they considered SISA breaches were serious and may affect the financial interests of the fund's members. The Tax Office advised that since the introduction of ACRs in 2004, breaches reported by approved auditors have not always aligned with the Tax Office's view of a serious breach. The new legislation will now prescribe those matters to be reported by approved auditors on the approved form.

The Tax Office's approach to selecting high-risk SMSFs for compliance assessment has continued to develop since 2004. The Tax Office is introducing an Operational Analytics (OA) capability to improve its case selection approach for high-risk SMSFs. In addition to improving the focus and basis of its case selection approach, the Tax Office intends that the OA capability will reduce the level of manual review and the potential for inconsistent case selection decision processes relative to the risks identified.

Mitigating and reporting compliance risk cases (Chapter 3)

The Tax Office has adopted a variety of compliance approaches and products to address the various types and severity, of non compliant behaviour. These approaches and products have ranged from SMSF trustee support and assistance (such as education products and rulings) to Tax Office audits and reviews.

When the Tax Office assumed responsibility for SMSFs in late 1999, it identified13 a knowledge deficiency among trustees of small funds in relation to their obligations. The Tax Office conducted a number of educational initiatives to address this knowledge gap, including a campaign contacting new trustees of SMSFs, issuing a number of publications and providing telephony services to SMSF trustees.

The Tax Office could also develop more educative compliance products based on known high-risk areas and target SMSF trustees at all stages of the fund lifecycle rather than only new trustees. The ANAO considers there is scope for the Tax Office to consider the costs and benefits of re-introducing an educative compliance approach similar to the now defunct New Trustee Education Campaign to supplement its evolving Compliance Program.

As part of its education process, the Tax Office will begin to issue SISA interpretative decisions for SMSFs as from September 2007. To avoid public uncertainty about the role and function of the new SISA based superannuation rulings regime these non binding rulings should be clearly differentiated from the existing regime of taxation rulings which is legally binding on the Tax Office. Appropriate processes to support the construction of the new SISA superannuation rulings regime will also be needed.

Following the results of its Benchmarking Projects, the Tax Office adjusted its compliance strategy to focus more on an ‘active compliance' approach from 2003–04. A wide variety of activities is deemed to constitute ‘active compliance' for example, letters, telephone calls and desk and field audits.

The application of penalties for non-compliant SMSF trustee behaviour is an essential component of a well functioning compliance framework. As a consequence of not having a robust active compliance program in place until 2003–04 and the inflexibility of the SISA penalty regime, before 2006, the Tax Office imposed few penalties on SMSF trustees.

In November 2006, to clarify its policy on administering the penalties, the Tax Office issued new practice statements for use by its active compliance staff. As of 1 July 2007 a new penalty regime for SMSFs was introduced under Simplified Superannuation reforms. The effectiveness of the new regime may benefit from an evaluation after an appropriate period to assess the flexibility the Tax Office has in administering the SISA and in applying appropriate penalties to SMSF trustees or their intermediaries.

Self managed superannuation fund wind-ups (Chapter 4)

The wind-up of a SMSF occurs when trustees decide to terminate the fund, usually resulting in SMSF monies being rolled into another superannuation fund. An effective process for winding-up a SMSF is fundamental to the protection of retirement savings and in assisting Tax Office systems to accurately record the number of active SMSFs.

The ANAO found the educational material on wind-ups is inadequate having regard to the importance of this activity. The Tax Office has identified through a review that the adequacy of educational material and the lack of well defined administration processes has created uncertainty for some SMSF trustees involved in winding up of funds. This has created additional workload for the Tax Office in confirming the status of SMSFs that have been wound-up, and has impacted on SMSF reporting.

The ANAO considers the Tax Office should review its educational material provided to SMSF trustees to assist with wind-ups to ensure the content is both appropriate and consistent with the legislative requirements imposed on SMSFs. The ANAO also considers the introduction of a single form to replace the nine currently available methods for trustees to wind-up SMSFs would simplify SMSFs' reporting obligations and reduce current administrative costs.

Recommendations

The ANAO made six recommendations aimed at improving the Tax Office's approach to managing self managed superannuation fund compliance risks. The Tax Office agreed to all of the six recommendations made.

Summary of Agency's Response

The Tax Office welcomes this review and considers the report is supportive of our overall compliance direction in administering self managed superannuation funds (SMSFs).

In keeping with the objective of Australia's superannuation system - to assist and encourage people to achieve a higher standard of living in retirement than would be possible from the age pension alone – the Tax Office does not automatically make a fund non-complying if there is a breach of the superannuation laws. Its role is focussed on retirement income, not revenue protection. It works with trustees to help them meet their superannuation law obligations and preserve their retirement income. In doing so, the Tax Office's aim is to be as least intrusive as possible to the majority of individuals and businesses who want to meet their superannuation law obligations, while at the same time being highly visible to those who are reluctant to comply.

The Tax Office agrees that the implementation of Simplified Superannuation reforms and the additional resources provided to it will impact on the management of SMSF compliance risks in the future. The tripling of SMSF active compliance work, the associated increase in audit coverage of SMSFs and the requirement for an annual audit by an approved auditor are expected to improve SMSF compliance with the superannuation and income tax law obligations.

The Tax Office agrees with the six recommendations contained in the report. Some of the recommendations found in this report were already being implemented prior to the audit, or alternatively are now being implemented. And, as with all activities that are undertaken, the Tax Office continually assess their effectiveness so as to ensure that actual outcomes are aligned with desired outcomes.

Footnotes

1 See ANAO Report No.52 2006–07 The Australian Tax Office's Approach to Regulating and Registering Self Managed Superannuation Funds.

2 ibid, paragraph 2.9

3 Australian Prudential Regulation Authority, Statistics – Quarterly Superannuation Performance June 2006. p. 5.

4 Commissioner of Taxation, Annual Report 2005–06, p. 180

5 As at 30 June 2006 there were some 28.9 million superannuation member accounts in Australia.

6 Tax Office data from its Revenue Analysis Branch.

7 Unless, for example, the member is subject to a legal disability (subsection 17A(3) of the SISA).

8 S. Wallis, March 1997, Financial System Inquiry Final Report.

9 Regulation 1.04 of the SIS Regulations states that an approved auditor may be: (a) the Auditor General of the Commonwealth, a state or territory or (b) a registered auditor under the Corporations Law or (c) be associated in a specified manner with a professional organisation (as prescribed in Sch 1AAA).

10 Senate Select Committee on Superannuation and Financial Services-Prudential Supervision and Consumer Protection for Superannuation, Banking and Financial Services–Third report- Auditing of Superannuation Funds.

11 The Tax Office engaged the Australian Bureau of Statistics to design the selection methodology. The sample of funds selected by the Tax Office is statistically valid, with a target standard error of 0.02 per cent.

12 This was determined by extrapolating the results of the 2001–02 data in the 2003–04 Benchmarking Project to 2004–05 actual data.

13 The Tax Office used information from a variety of sources to assess SMSF trustee knowledge. These information sources include the Australian Prudential Regulation Authority (APRA), workshops conducted with superannuation fund professionals and Tax Office research.