Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

The Approval and Administration of Commonwealth Funding for the WestConnex Project

Please direct enquiries relating to reports through our contact page.

The objective of this audit was to assess whether appropriate steps were taken to protect the Commonwealth's interests and obtain value for money in respect to the $3.5 billion in Commonwealth funding committed to the NSW Government for the WestConnex project.

Summary and recommendations

Background

1. The WestConnex project in Sydney is one of Australia’s largest land transport infrastructure projects. As of December 2016, it was being delivered progressively through three main stages, which have a current estimated total cost of $16.8 billion. It is also the first road project to receive Australian Government support through the provision of a concessional loan.

2. Both the Coalition and the Australian Labor Party announced commitments of at least $1.5 billion in grant funding towards the project prior to the September 2013 Federal Election.1 In May 2014, a further $2 billion concessional loan for the project was announced by the recently elected Australian Government.

3. Advice relating to the eligibility and appropriateness of infrastructure projects for Australian Government funding is the responsibility of the Department of Infrastructure and Regional Development (DIRD). Infrastructure Australia is a separate entity and is responsible for conducting independent assessments of infrastructure projects, as proposed by respective project proponents. These assessments are made publicly available once complete.

4. As of December 2016, construction work on the WestConnex project was underway. Specifically, construction of the main works for the first two stages had commenced, and planning had begun for the third stage (with construction forecast for commencement in 2019 and completion in 2023). By 1 November 2016, all $1.5 billion of Australian Government grant funding had been paid to New South Wales (NSW) and, as of February 2017, $408.1 million of the concessional loan had been drawn down.

Audit objective and criteria

5. The objective of the audit was to assess whether appropriate steps were taken to protect the Australian Government’s interests and obtain value for money in respect to the $3.5 billion in funding committed for the WestConnex project. To form a conclusion against the audit objective, the ANAO adopted the following audit criteria:

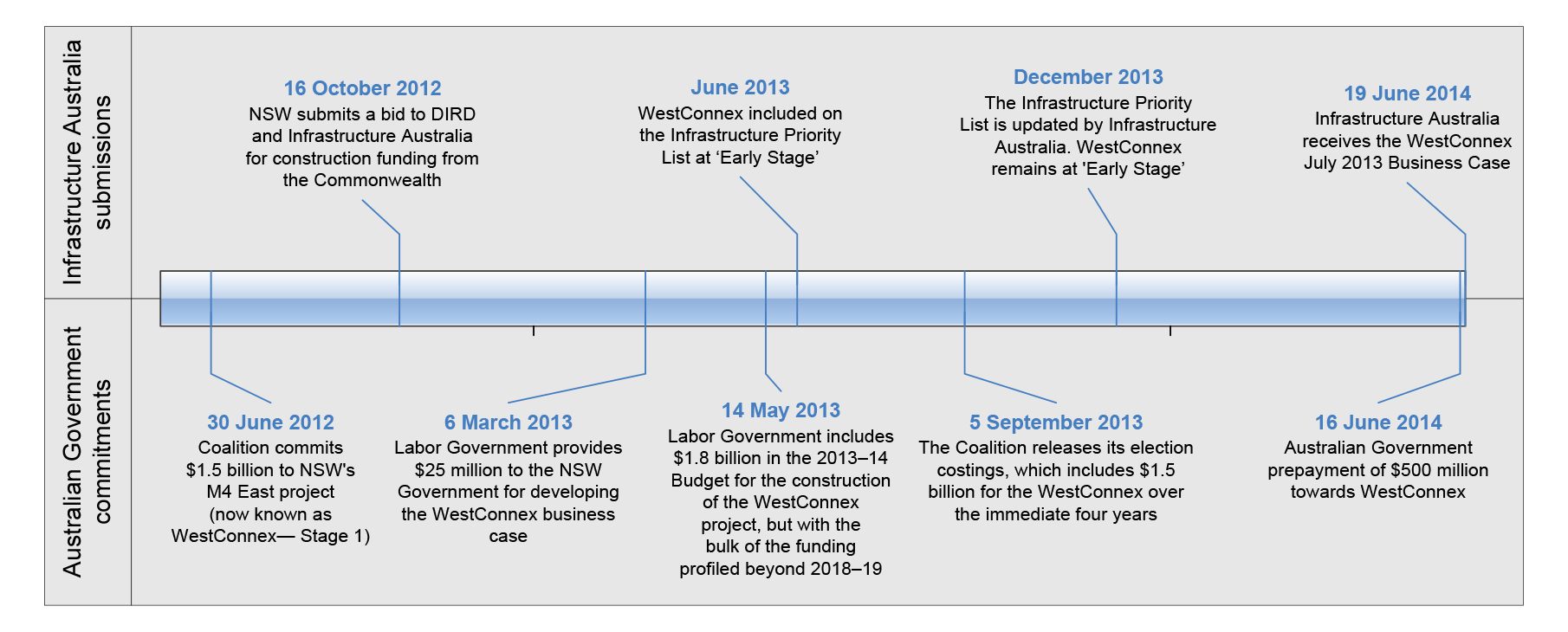

- Was the decision to make a financial commitment to the project informed by appropriate advice and made through the processes that have been established to assess the merits of nationally significant infrastructure investments?

- Were the decisions to approve the commitment of $1.5 billion in direct funding, and make respective milestone payments to date, informed by appropriate advice?

- Was the decision to enter into a $2 billion concessional loan arrangement for the WestConnex project informed by appropriate advice?

- Do the terms of the concessional loan arrangements represent value for money?

Conclusion

6. The Department of Infrastructure and Regional Development took a number of steps to protect the Australian Government’s financial interests, particularly in relation to the risk of the concessional loan not being repaid. The upfront payment and approach to agreeing and adjusting milestones for later payments did not adequately protect the Australian Government’s financial interests. Additionally, the provision of the concessional loan did not achieve the Australian Government’s objective of bringing Stage 2 of the project forward by approximately two years.

7. The WestConnex project had not proceeded fully through the established processes to assess the merits of nationally significant infrastructure investments prior to Australian Government funding being committed. This situation was identified in departmental advice to decision makers prior to decisions being taken.

8. Funds have been paid in advance of project needs. Advice provided prior to the first payment (of $500 million in June 2014) identified that a payment of that magnitude was not yet required. The ANAO estimates that as of November 2016, the total cost of amounts provided in excess of project needs since June 2014 has been approximately $20 million.

9. The May 2014 decision to make the $500 million advance payment led to the project being approved without there being any documented analysis and advice to Ministers that the statutory criteria for giving such approvals had been met. Advice seeking the necessary approval for later payments (of $250 million in June 2015, $450 million in June 2016 and $300 million in November 2016) addressed those criteria. But those three milestone payments were designed and administered in a way that did not adequately protect the Australian Government’s financial interests. This was because, in order not to delay payments, milestones were agreed to after the respective event had already occurred or amended shortly before the payment was due to be made where NSW had not met the milestone.

10. Departmental advice to Ministers focused on the benefits of providing a concessional loan to the WestConnex project. The key benefits identified were the:

- lower net financial impact on the presentation of the Federal Budget of a loan compared with further grant funding (due to the differences in the accounting treatment of loans and grants, and because a loan would earn interest income and be later repaid);

- increased construction activities between 2015‒16 and 2016‒17 from accelerating the second stage; and

- potential to reinvigorate the private sector lending market in relation to demand risk toll roads.

11. But the advice to Ministers did not adequately identify or quantify the costs and risks associated with providing a concessional loan. Key issues that detract from the loan providing value for money include:

- there is evidence that the loan was not needed to accelerate the second stage of WestConnex and, in any event, the project has not been accelerated to the extent projected by DIRD (by up to two years); and

- the interest rate on the loan was set well below comparable market rates with no margin included to cover the Australian Government’s loan administration costs or risks.

Supporting findings

Grant funding of $1.5 billion (Chapter 2)

12. A $1.5 billion contribution towards the project was announced by the Coalition Opposition in June 2012 and reaffirmed prior to and following the September 2013 Federal Election. Similarly, the Labor Government demonstrated its support for the project by providing $25 million towards the development of the business case in March 2013, as well as a commitment of $1.8 billion towards the construction of the project in the May 2013 Budget. The commitments announced by both the Coalition and the Australian Labor Party were made before NSW had finalised the July 2013 WestConnex business case. The business case was provided to DIRD and Infrastructure Australia in September 2013 and June 2014 respectively.

13. The decisions by both parties to provide significant support for the project were inconsistent with the advice produced by both Infrastructure Australia and DIRD. At that stage, Infrastructure Australia had assessed the project as being at a formative stage of development. DIRD’s advice consistently flagged that the project was in the very early stages of development and could not yet be recommended for Australian Government financial support.

14. Ministers were provided with well-considered advice on the advance payment. The advice to Ministers clearly indicated that such a payment would be in advance of project needs.

15. The subsequent May 2014 decision to make the $500 million advance payment led to the project being approved without there being any documented analysis and advice to Ministers that the statutory criteria for giving such approvals had been met. This was because DIRD had not yet received the documentation it required from NSW to undertake an assessment against those criteria. DIRD was advised by NSW in mid-2014 that the state would not be in a position to provide this information until early 2015, once project planning had sufficiently progressed. Further, NSW had informed the Australian Government that it did not require an Australian Government funding contribution until 2014–15.

16. DIRD’s approach to linking payments to the achievement of milestones was not effective as a control. While the payments referred to project milestones, some of those milestones were:

- agreed to after the respective event had already occurred; and

- amended shortly before the payment was due to be made where NSW had not met the milestone.

17. The purpose of these amendments was to ensure that payments would not be delayed.

18. Expenditure of the grant funding was minimal (as a proportion of the Australian Government funding already provided to NSW) until mid to late 2015, once construction activity had commenced for the M4 Widening and King Georges Road Interchange Upgrade (KGRIU) sub-projects. Based on NSW’s expected spending patterns and the actual expenditure reported by NSW to DIRD, the funding has been largely front-loaded into Stage 1. This was to allow for it to be the first section completed and privatised, with those proceeds to be used for the construction of Stage 3.

The $2 billion concessional loan (Chapter 3)

19. A concessional loan for the WestConnex project was recommended as a preferred alternative to further grant funding. This was because concessional loans have a smaller impact on the presentation of the Australian Government Budget than grant funding. A loan to accelerate Stage 2 of the project was also expected to increase construction activities between the 2015‒16 and 2016‒17 financial years and to reinvigorate the private sector lending market when it comes to demand risk toll roads.

20. The approach recommended by DIRD provided a convenient legislative mechanism for loan drawdown. But a tailored approach, similar to that subsequently adopted for the Northern Australia Infrastructure Facility, would have provided a more effective framework.

21. There is evidence that Stage 2 could have progressed towards construction as planned without the concessional loan. The concessional loan was used as a replacement for the financing that could have been obtained from private sector lenders and through the privatisation of Stage 1 in 2019‒20.

22. Negotiation of the loan terms commenced in November 2013. A Memorandum of Understanding (MoU) signed with the NSW Government in May 2014 set out the key commercial principles for the Australian Government loan.

23. There are relatively few features built into the loan contracts for the benefit of the Australian Government in its role as subordinated lender. Nevertheless, the risk that the Australian Government loan will not be repaid was adequately addressed by DIRD.

24. Interest on the Australian Government loan is charged on the loan at 3.3637 per cent per annum, being the yield on the 2033 Australian Government Bond at the time of financial close for the loan. This rate is well below comparable market rates, with the cost of this concession estimated to be at least $640 million. The interest rate on the loan is fixed, meaning the Australian Government is exposed to interest rate risk as the cost of borrowing to finance loan drawdowns will vary over time. The rate includes no margin to cover Australian Government loan administration costs and risk.

25. In addition to providing a $2 billion loan at below market interest rates, the Australian Government has reduced liquidity risk for the NSW Government and senior lenders on WestConnex. This was done by the Australian Government agreeing that no interest will be paid on the loan until 2027. Rather, interest will be accrued and added to the loan balance for the first 12 years. This is a more generous concession than was provided by senior lenders, who agreed to capitalise interest for the first three and a half years (that is, for the period of construction only).

26. The ANAO’s analysis was that DIRD should have provided more comprehensive advice to Ministers on the size and cost of the interest rate concession (relative to a comparable market rate), and obtained specific Ministerial agreement to the loan interest rate including no margin to cover Australian Government loan costs and risk.

27. The estimation of the impact on the fiscal balance of the concessional loan incorporated the effect of the interest capitalisation period. But advice to Ministers did not specifically canvas the merits of agreeing to an extended interest capitalisation period, rather than requiring interest to be paid as it is accrued, or from when construction is completed (as occurs with senior lenders).

28. Notably absent from the advice prior to the Budget, and subsequently, was analysis of impacts of the concessional loan on the Australian Government’s finances for portfolios other than Infrastructure and Regional Development. Specifically, due to the concessional loan being provided by the Australian Government rather than a taxpaying entity, there will be no assessable income from the interest paid on the loan on which company tax will be paid but capitalised interest on the loan as well as capital works depreciation will be available to be claimed as tax deductions.

29. According to the data held by DIRD, Stage 2 is currently less than six months ahead of its originally scheduled completion date. The 13 May 2014 announcement of the accelerated project stated that the project would be completed up to two years earlier than planned.

Recommendation

Recommendation No.1

Paragraph 3.66

The Department of Infrastructure and Regional Development improve the advice on any future loans for major infrastructure projects by:

- developing a more robust and tailored administrative framework to govern the possible provision of loans;

- clearly identifying, and quantifying the impact of, all key aspects of the proposed commercial arrangements; and

- providing Ministers with a range of options on the key terms for agreement on the parameters within which the Department is authorised to negotiate.

Department of Infrastructure and Regional Development response: Agreed.

Summary of entity responses

30. The proposed audit report was provided to DIRD, Infrastructure Australia, the Department of Finance and the Department of the Treasury.

31. Formal responses to the proposed audit report were received from DIRD, Infrastructure Australia and the Department of Finance. A summary of entities’ responses are below, with the full responses provided at Appendix 1.

Department of Infrastructure and Regional Development

The Department of Infrastructure and Regional Development (the Department) notes the ANAO’s findings and agrees with the recommendation in relation to the Department’s involvement with the WestConnex project. The Department has concerns in relation to a number of the audit findings and has provided further comments in its full response.

Infrastructure Australia

Infrastructure Australia notes the report and believes that it accurately reflects Infrastructure Australia’s role in the analysis of the WestConnex project.

Department of Finance

The Department of Finance notes the findings of this report and that the recommendation in the report is consistent with the current Budget Process Operational Rules (BPORs). The BPORs, which took effect from October 2016, strengthen the information requirements to Government on the costs and financial risks associated with loans.

1. Background

The WestConnex project

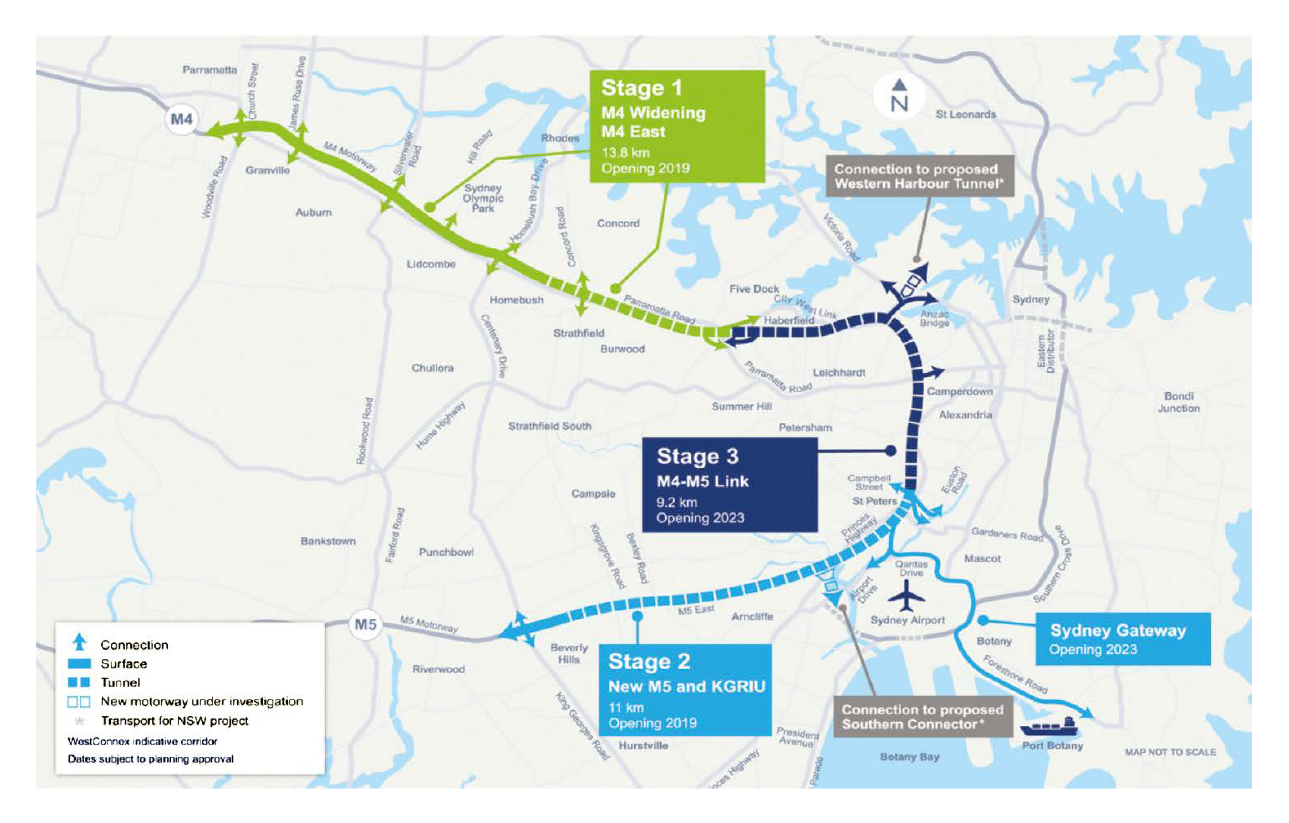

1.1 The WestConnex project was announced as the NSW Government’s next motorway priority project in Sydney in October 2012. Once completed, it will deliver 33 kilometres of new and upgraded motorways linking western and south-western Sydney with the CBD, Kingsford Smith Airport and Port Botany precincts. It is largely being constructed in the existing M4 and M5 corridors and involves approximately 14 kilometres of road above ground and 19 kilometres of tunnels, including a new tunnel connecting the two corridors (see Figure 1.1).

Figure 1.1: Map of the WestConnex project

Source: NSW Government, WestConnex Updated Strategic Business Case, November 2015.

1.2 By the 2013 Federal Election, both the Coalition and the Australian Labor Party had announced significant funding commitments towards WestConnex. Specifically:

- Labor had announced a $1.8 billion direct funding commitment, of which $1.3 billion was profiled for provision beyond 2018–19; and

- the Coalition Opposition had committed $1.5 billion to be provided over the immediate three years, with $250 million initially earmarked for provision in 2013–14.

1.3 Accordingly, the May 2014 Budget included the $1.5 billion Australian Government funding contribution to the project, but with an increase in the quantum of funding to be provided in the first year (see Table 1.1). A further $2 billion concessional loan, specifically for the construction of Stage 2, was announced as part of a new $11.6 billion Infrastructure Growth Package introduced within the May 2014 Budget.

Table 1.1: WestConnex funding profile as outlined at the Mid-Year Economic and Fiscal Outlook (MYEFO) and in the 2014 Budget

|

|

|

14–15 |

15–16 |

16–17 |

17–18 |

|

|

($ million) |

||||

|

Infrastructure Investment Programme—Direct grant funding |

|||||

|

December 2013 MYEFO |

250 |

600 |

650 |

0 |

0 |

|

May 2014 Budget |

500 |

250 |

450 |

300 |

0 |

|

Infrastructure Growth Package—Concessional loan |

|||||

|

December 2013 MYEFO |

- |

- |

- |

- |

- |

|

May 2014 Budget |

0 |

3.8ᵃ |

96.6 |

344.5 |

314.9 |

Note a: The $3.8 million allocation in 2014–15 was for DIRD’s due diligence expenses.

Source: ANAO analysis of 2014 Budget documents, MYEFO documents and DIRD records.

1.4 The terms and conditions for the concessional loan were developed through an iterative process by DIRD, its NSW Government counterparts and their respective advisers between November 2013 and November 2015. The final loan agreement was executed by the Australian Government and WCX FinCo Pty Ltd2 on 20 November 2015.

1.5 The project is being delivered progressively through three stages, which are split into six sub-projects (detailed in Table 2.2). It is also the first major infrastructure project to have received a concessional loan from the Australian Government.

1.6 Construction work on the project is underway. As of December 2016, four of the sub-projects were in the main construction phase (outlined by Figure 1.2). By 1 November 2016, all $1.5 billion of the grant funding had been paid to NSW, and as of February 2017, $408.1 million of the subordinated loan facility had been drawn down.

Figure 1.2: WestConnex key project and funding milestones

Source: ANAO analysis of DIRD and Infrastructure Australia records.

Infrastructure Australia’s assessment

1.7 Infrastructure Australia was established in 2008 to improve the quality of infrastructure planning and investment strategy, and to identify those investments expected to make the biggest impact on Australia’s economic, social and environmental goals for least cost to the taxpayer. Accordingly, it is a goal of Infrastructure Australia that infrastructure funding decisions will be taken following careful planning and rigorous assessments that are based on sufficient evidence. A key role of Infrastructure Australia is to develop Infrastructure Priority Lists.

1.8 While previous iterations of the project had been submitted to Infrastructure Australia3, WestConnex was first submitted to Infrastructure Australia in October 2012 and placed on the Infrastructure Priority List in June 2013. The categories assigned to the WestConnex project on successive priority lists have changed over time as a reflection of the project’s progression (see Table 1.2).

Table 1.2: Progression of the WestConnex project on the Infrastructure Priority List

|

Date of assessment |

Project name as per Infrastructure Priority List |

Categorisation |

Primary source documentation underpinning Infrastructure Australia’s assessment |

|

June 2013 |

WestConnex |

Early Stage |

High level project document |

|

February 2015 |

WestConnex |

Threshold |

July 2013 Business Case |

|

February 2016 |

WestConnex – Stage 3 |

High Priority Initiative |

November 2015 Updated Strategic Business Case and supporting attachments.ᵃ |

|

May 2016 |

WestConnex |

High Priority Project |

|

Note a: Infrastructure Australia continued to work with NSW to obtain additional supporting information between receiving the November 2015 Updated Strategic Business Case (in November 2015) and publishing its May 2016 project assessment.

Source: ANAO analysis of Infrastructure Australia records.

1.9 Following a review of its assessment framework, Infrastructure Australia changed the categories for the reporting of the prioritisation results in January 2016. Figure 1.3 defines each category and identifies these changes.

Figure 1.3: Infrastructure Australia’s categorisations for the Infrastructure Priority list

Note a: Initiatives and Projects which address major problems or opportunities of national significance are classified as ‘high priority’.

Source: ANAO analysis of Infrastructure Australia records.

Audit approach

1.10 The objective of the audit was to assess whether appropriate steps were taken to protect the Australian Government’s interests and obtain value for money in respect to the $3.5 billion in funding committed for the WestConnex project. The audit was undertaken as planned within the ANAO’s 2015–16 forward work program, as well as in response to requests received from the Senate, individual Parliamentarians and citizens.

1.11 To form a conclusion against the audit objective, the ANAO adopted the following audit criteria:

- Was the decision to make a financial commitment to the project informed by appropriate advice and made through the processes that have been established to assess the merits of nationally significant infrastructure investments?

- Were the decisions to approve the commitment of $1.5 billion in direct funding, and make respective milestone payments to date, informed by appropriate advice?

- Was the decision to enter into a $2 billion concessional loan arrangement for the WestConnex project informed by appropriate advice?

- Do the terms of the concessional loan arrangements represent value for money?

1.12 The audit was conducted in accordance with ANAO auditing standards at a cost to the ANAO of approximately $272 000.

2. Grant funding of $1.5 billion

Areas examined

The ANAO examined the advice that informed decisions to make an Australian Government financial commitment to the WestConnex project, as well as the subsequent approvals and payments of grant funding.

Conclusion

The WestConnex project had not proceeded fully through the established processes to assess the merits of nationally significant infrastructure investments prior to Australian Government funding being committed. This situation was identified in departmental advice to decision-makers prior to decisions being taken.

Funds have been paid in advance of project needs. Advice provided prior to the first payment of $500 million in June 2014 identified that a payment of that magnitude was not yet required. The ANAO estimates that as of November 2016, the total cost of amounts provided in excess of project needs since June 2014 has been approximately $20 million.

The May 2014 decision to make the $500 million advance payment led to the project being approved without there being any documented analysis and advice to Ministers that the statutory criteria for giving such approvals had been met. Advice seeking the necessary approvals for later payments (of $250 million in June 2015, $450 million in June 2016 and $300 million in November 2016) addressed those criteria. But those three milestone payments were designed and administered in a way that did not adequately protect the Australian Government’s financial interests. This was because, in order not to delay payments, milestones were agreed to after the respective event had already occurred or amended shortly before the payment was due to be made where New South Wales (NSW) had not met the milestone.

What commitments were made in respect to the WestConnex project and when were they announced?

A $1.5 billion contribution towards the project was announced by the Coalition Opposition in June 2012, and reaffirmed prior to and following the September 2013 Federal election. Similarly, the Labor Government demonstrated its support for the project by providing $25 million towards the development of the business case in March 2013, as well as a commitment of $1.8 billion towards the construction of the project in the May 2013 Budget. The commitments announced by both the Coalition and the Australian Labor Party were made before NSW had finalised the July 2013 WestConnex business case. The business case was provided to the Department of Infrastructure and Regional Development (DIRD) and Infrastructure Australia in September 2013 and June 2014 respectively.

2.1 On 30 June 2012, the Coalition Opposition released a document stating that, if elected, it would work with the states and the private sector to ensure the acceleration of Sydney’s M4 East4 by providing a $1.5 billion contribution as part of its Plan to Reduce Traffic Congestion. The release further stated that the:

- timing of payments for specific projects would depend on construction progress and would be developed in consultation with the state governments; and

- first year of funding for the Plan to Reduce Traffic Congestion would be 2014–15.

2.2 At the time this commitment was announced, the Labor Government had already included a $25 million contribution for the project in its 2012 Budget. This amount was advanced to NSW in one instalment in March 2013, to be used for the development of the business case.

2.3 A further $1.8 billion commitment towards the project was included in the May 2013 Budget5, but with the bulk of the funding profiled for provision beyond the 2018–19 financial year. The Labor Government also attached the following preconditions to that commitment:

- development of a full business case and its submission to and assessment by Infrastructure Australia;

- that the design include suitable connections to the Sydney CBD and Port Botany; and

- that no tolls be imposed on currently untolled existing roads.

2.4 Following the September 2013 Federal Election, the incoming Coalition Government reaffirmed its $1.5 billion commitment by including its election costing profiles for the project in the December 2013 Mid-Year Economic and Fiscal Outlook (MYEFO) statement.

2.5 As illustrated by Figure 2.1, the various WestConnex funding commitments were made significantly in advance of a completed business case for the project being provided to Infrastructure Australia.

Figure 2.1: Australian Government funding commitments

Source: ANAO analysis of DIRD and Infrastructure Australia records.

Were the decisions to provide significant support for the project consistent with the available advice?

The decisions by both the Coalition and the Australian Labor Party to provide significant support for the project were inconsistent with the advice produced by both Infrastructure Australia and DIRD. At that stage, Infrastructure Australia had assessed the project as being at a formative stage of development. DIRD’s advice consistently flagged that the project was in the very early stages of development and could not yet be recommended for Australian Government financial support.

2.6 A key feature of Infrastructure Australia’s role is the transparency and public availability of its infrastructure project assessments. At the time the first commitment was announced, earlier iterations of the project had been submitted to, assessed and published by Infrastructure Australia.6 The WestConnex proposal was first included on the Infrastructure Priority List in June 2013 at ‘Early Stage’. The basis for this categorisation was not a business case but, rather, an October 2012 NSW Government ‘Submission for Nation Building 2 funding’ and the NSW Government publication Westconnex - Sydney’s next motorway priority.

2.7 The NSW bid provided a high-level overview of the problems to be solved by the project including addressing poor service levels from existing roads (including for freight to Sydney’s international gateways); poor urban amenity along Parramatta Road; and expected increases in demand for transport services provided by roads. The submission stated that the project had a preliminary benefit-cost ratio (BCR) of 1.5, a total estimated project cost between $10 and $13 billion ($2012), and required an Australian Government contribution of $1.6 billion. No patronage data was provided in support of this estimate. Infrastructure Australia’s analysis was that:

[b]ased on the material provided, the project is at a formative stage of development; without more detailed information it cannot be considered to have real potential when considered in the context of Infrastructure Australia’s reform and investment framework. … [Infrastructure Australia] has raised concerns in respect of each core element of the framework: strategic alignment, problem evaluation and solution selection.

2.8 The NSW Government provided DIRD with the same submission in October 2012 in response to the Infrastructure Minister’s invitation to state and territory governments to submit funding proposals for assessment and consideration as part of the next five year Nation Building Program (now called the Infrastructure Investment Programme). DIRD’s advice to the Minister for Infrastructure and Transport in November 2012, following the first stage of a two-pass assessment process was that:

[s]ome very large projects, such as the East-West Link project in Melbourne and the WestConnex project in Sydney, will not be sufficiently developed by state governments for them to be adequately assessed by the Department prior to the 2013 budget. Further funding for these projects could be provided through future budget processes if the business cases for the projects demonstrate strong alignment with the key themes and productivity focus of [the Nation Building Program].

2.9 Having this assessment as context and recognising the incoming government’s firm commitment to the project, DIRD recommended in March 2014 that its new Ministers amend the funding profile for the project so as to minimise the funding to be provided in 2013‒14.

2.10 Both the Labor and Coalition Governments (in the May 2013 and May 2014 budgets respectively) decided to include funding for the WestConnex project over the forward estimates.

2.11 A Memorandum of Understanding (MoU) was signed on 16 May 2014. The MoU committed the Australian Government to:

- make a total payment of $1.5 billion to NSW towards WestConnex capital costs; and

- subject to agreement with NSW, provide a loan facility of up to $2 billion to be used to accelerate the delivery of Stage 2 (relative to the timeframes included in the business case).

Did sound advice inform the decision to make an advance payment of $500 million in June 2014?

Ministers were provided with well-considered advice on the advance payment. The advice to Ministers clearly indicated that the payment was made in advance of project needs.

2.12 In November 2013, Ministers agreed the list of projects to be funded through the Infrastructure Investment Programme for the forthcoming five years, as well as the total funding envelope for the programme. An allocation consistent with the Coalition’s election costings was included for WestConnex as part of that list.

2.13 In the lead up to the May 2014 Budget, a decision was taken by Ministers to amend the funding profile for WestConnex. This amendment doubled the planned 2013–14 funding, and extended the provision of Australian Government funding into 2016–17.

2.14 The advice provided by DIRD to its Ministers between November 2013 and June 2014, in respect to the Infrastructure Investment Programme was examined by the ANAO as part of the audit of the Approval and Administration of Commonwealth Funding for the East West Link Project.7 The ANAO’s analysis of that advice was consistent in respect to both the East West Link and WestConnex. Specifically, DIRD provided well-considered advice to its Ministers on a recommended funding profile for projects that were the subject of election commitments, including WestConnex. For example, DIRD’s advice:

- took into account the nature of the election commitment announcement, as well as the funding profile identified in the election costings;

- identified payment profiles that were ‘best for project’ in that they aligned payments with anticipated project progress (see Table 2.1). In particular, based on its analysis of information provided by the NSW Government in respect to WestConnex, DIRD identified that a contribution of $46 million was sufficient in 2013–14; and

- addressed whether making advance payments in respect to WestConnex and certain other projects would compound the existing problem with some states already underspent on their current infrastructure programmes.

2.15 On 22 June 2014, a payment of $500 million was made to NSW for planning, development, procurement and construction costs. Based on the information within DIRD’s Infrastructure Management System (IMS), the Australian Government incurred an additional cost of approximately $14 million8 during 2014‒15 as a result of providing that payment in advance of project needs. The ANAO estimates that as of November 2016, the total cost of providing amounts in excess of project needs since June 2014 has been approximately $20 million.

Table 2.1: Alternative project funding profiles

|

|

2013‒14 |

2014‒15 |

2015‒16 |

2016‒17 |

|

Election costings |

$250m |

$600m |

$650m |

Nil |

|

DIRD’s preferred approach |

$46m |

$445m |

$500m |

$509m |

|

NSW’s preferred profiles |

Nil |

$500m |

$500m |

$500m |

|

Actual payments |

$500m |

$250m |

$450m |

$300m |

Source: ANAO analysis of DIRD records and Fiscal budget impact of Federal Coalition costings, September 2013.

Figure 2.2: Fiscal balance impact of actual payments compared with NSW’s preferred profiles

Source: ANAO analysis of DIRD records and Fiscal budget impact of Federal Coalition costings, September 2013.

Was a robust process employed when the necessary statutory approvals were given for the project ahead of the advance payment?

The May 2014 decision to make the $500 million advance payment led to the project being approved without there being any documented analysis and advice to Ministers that the statutory criteria for giving such approvals had been met. This was because DIRD had not yet received the documentation it required from NSW to undertake an assessment against those criteria. DIRD was advised by NSW in mid-2014 that the state would not be in a position to provide this information until early 2015, once project planning had sufficiently progressed. Further, NSW had informed the Australian Government that it did not require an Australian Government funding contribution until 2014–15.

2.16 The legislative approvals that were prerequisites to the processing of the $500 million advance payment for WestConnex involved approvals under:

- the Financial Management and Accountability Regulations 1997;

- sections 10, 11 and 17(1) of the Nation Building Program (National Land Transport) Act 20099; and

- the Federal Financial Relations Act 2009.

2.17 The advice provided and actions taken for each of these approval processes (as they relate to the Infrastructure Investment Programme projects approved in the 2014 Budget process) were examined by the ANAO as part of a performance audit of the East West Link project.10 Reflecting the similarities with the concurrent approvals of the East West Link and WestConnex, the ANAO’s findings were largely the same in respect to both projects. Specifically, the:

- Prime Minister approved the funding in accordance with the financial management framework for both projects sometime between 7 May and 12 May 201411;

- Assistant Minister for Infrastructure and Regional Development approved three projects, including both the East West Link and WestConnex12, under the land transport legislation on 16 June 2014; and

- the Acting Treasurer signed a national partnership payments determination under the Federal Financial Relations Act on 24 June 2014, providing the final approval required to process the $500 million payment for WestConnex to NSW.

Assessing Infrastructure Investment Programme projects prior to releasing payments

2.18 The administrative arrangements of the Infrastructure Investment Programme are set out in the National Partnership Agreement on Land Transport Infrastructure (NPA) and corresponding Notes on Administration. The NPA was most recently updated and agreed by the Australian and state and territory governments in October 2014. The NPA and notes set out the obligations and administrative processes that funding recipients must follow to claim payments, seek variations to project approvals and comply with the terms and conditions of approved funding. A key component of these arrangements is the submission of a ‘project proposal report’ (PPR) to DIRD by project proponents.

2.19 DIRD has created a PPR template for project proponents to populate with the information necessary for it to conduct a sufficiently rigorous assessment and make informed recommendations to its Ministers. In the audit of the East West Link, the ANAO found that the Victorian Government had worked with DIRD between February and April 2014 to develop a PPR in respect to the first stage of that project. But the timing of the decisions made in the 2014 Budget context concerning funding and advance payments for some Infrastructure Investment Programme projects meant that only some very limited departmental analysis of the PPR was undertaken.

2.20 In respect to DIRD’s analysis of a PPR for the WestConnex project during that same timeframe, the ANAO’s analysis was that a PPR had not been submitted by NSW ahead of the $500 million advance payment. DIRD was advised by NSW in early to mid-2014 that a PPR for the WestConnex project was not likely be available until early 2015. This advice was consistent with an April 2014 letter from the NSW Treasurer to the Assistant Minister for Infrastructure, stating that NSW did not require an Australian Government funding contribution until 2014–15.

2.21 NSW provided DIRD with a first draft of the PPR for WestConnex on 18 February 2015.

Was there a reasonable basis for making subsequent payments totalling $1.2 billion?

DIRD’s approach to linking payments to the achievement of milestones was not effective as a control. While the payments referred to project milestones, some of those milestones were:

- agreed to after the respective event had already occurred; and

- amended shortly before the payment was due to be made where NSW had not met the milestone.

The purpose of the amendments was to ensure that payments would not be delayed.

2.22 An important control mechanism within the management framework for the Infrastructure Investment Programme is the provision of funding in accordance with the achievement of agreed milestones.13 This control is intended to ensure that Australian Government funding is provided as it is needed; for purposes which it was intended; and to encourage timely project delivery.

2.23 Project milestones are agreed upfront in writing between DIRD and project proponents during the development of the PPR, and are included as an attachment to that document. Agreed milestones are entered into DIRD’s IMS, and may be varied. Since a PPR was not submitted prior to the June 2014 payment, project milestones for WestConnex had not been agreed between DIRD and the NSW Government.

PPR and agreed project milestones

2.24 In August 2014, DIRD advised NSW that no further Australian Government funding would be able to flow to the project until an acceptable PPR had been received and assessed; and ministerial approval granted for the next milestone payment.14 Accordingly, the NSW Government worked with DIRD between February and May 2015 to develop a PPR in respect to the ‘delivery phase’ of the first two stages of WestConnex, and the ‘scoping phase’ of the third stage.

2.25 On 1 June 2015, DIRD advised its Minister that it had completed its assessment of the PPR for WestConnex and considered that the project was eligible and appropriate for approval (in terms of the criteria set out in the land transport legislation), and recommended that the $250 million milestone payment requested by NSW be approved.15 Also attached to the briefing was an agreed future project milestone schedule, which DIRD noted was ‘subject to change based on project progress’. In this latter respect, DIRD advised its Ministers that the milestones would be reviewed and possibly renegotiated between the Australian and NSW Governments when separate PPRs for future phases were submitted.

2.26 The Assistant Minister for Infrastructure and Regional Development subsequently varied the project approval instrument on 11 June 2015 to allow for the $250 million payment. In respect to the approach taken to agreeing the PPR with NSW, the ANAO’s analysis was that DIRD had:

- checked the details provided within the PPR to ensure compliance with DIRD’s cost estimation standards set out within the Notes on Administration;

- queried inconsistencies observed within the documentation with NSW; and

- ensured that all details that were required from the proponent had been provided.

2.27 With one exception, the milestones used as the basis for the June 2015 payment were agreed by the parties in retrospect. Specifically, five milestone events were agreed on 11 May 2015, at which time four had already occurred. Those four had already occurred between October 2014 and January 2015 and involved the:

- receipt of planning approvals and the award of the contract for Stage 1A;

- close of tenders for Stage 1B;

- receipt of planning approvals and the award of the contract the King Georges Road Interchange Upgrade; and

- completion of the Strategic Project Definition Plan for Stage 3.

2.28 The remaining milestone occurred one week after the schedule was agreed, on 19 May 2015. That milestone required the close of tenders for the New M5 (Stage 2).

2.29 DIRD advised the Assistant Minister in its June 2015 briefing that the remaining milestones for subsequent payments would be reconsidered in a PPR to be submitted in 2016 (see further at paragraph 2.33).

November 2015 update to the WestConnex business case

2.30 The NSW Government approved an Updated Strategic Business Case for WestConnex in November 2015. This business case was a significant advance on the detail within the previous July 2013 business case, including substantial changes to the project’s scope and total cost. Table 2.2 identifies the changes made by the NSW Government to the overall project’s scope in between business cases.

2.31 In the audit of the East West Link, the ANAO noted an increased level of detail within that project’s 2015 varied project approval instrument as compared with the original 2014 instrument. Specifically, the ANAO’s observation has been that the depth of planning and development for a project at any given time can be gauged by the level of detail contained within respective project approval instruments. The same has been observed in respect to each of the WestConnex project’s approval instruments.

Table 2.2: Changes to the WestConnex scope between October 2012 and November 2015

|

|

October 2012 Preliminary concept |

July 2013 Business Case |

Nov 2015 Updated Strategic Business Case |

|||

|

|

Core elements |

Stage |

Project |

Stage |

Project |

Detailed description |

|

Northern sector |

M4 widening – Parramatta to Strathfield 9.5km |

Stage 1: M4 Parramatta to City West Link 13.5km |

M4 Widening (Church St to Homebush Bay Drive) 7.5km |

Stage 1: M4 Widening M4 East 13.8km |

M4 Widening (Parramatta to Homebush) |

Widening the existing M4 Motorway from Parramatta to Homebush. |

|

M4 extension – Strathfield to Taverners Hill area (Petersham) 6.2km |

M4 East (Homebush Bay Drive to City West Link) 6km |

M4 East (Homebush to Haberfield) |

Extending the M4 Motorway in tunnels between Homebush and Haberfield via Concord. Includes provision for the future connection to M4 – M5 Link. |

|||

|

Tunnel – Taverners Hill to St Peters area via Camperdown area 5.3km |

Stage 2: M5 East & Airport Link 12.5km |

M5 East Duplication St Peters to Beverley Hills (King Georges Road) 11km |

Stage 2: New M5 & KGRIU |

New M5 (Beverly Hills to St Peters) |

Duplicating the M5 East from King Georges Road in Beverly Hills with tunnels from Kingsgrove to a new interchange at St Peters. The New M5 tunnels include provision for a future connection to the proposed Southern Connector and the M4 – M5 Link. |

|

|

King Georges Road Interchange Upgrade (Beverly Hills) |

Upgrade of the King Georges Road Interchange between the newly widened M5 West and the M5 East at Beverly Hills. |

|||||

|

Southern sector |

Sydney Airport Access Link 4.6km |

Airport Link 1.5km |

Sydney Gateway (St Peters to Sydney Airport and Port Botany) |

A high-quality, high-capacity connection between the new St Peters Interchange and the Sydney Airport and Port Botany precinct. |

||

|

M5 East Duplication 7.2km |

Stage 3: M4 City West Link to St Peters 8.5km |

M4 East (City West Link to St Peters) Connections at Parramatta Road and Camperdown |

Stage 3: M4-M5 Link 9.2km |

M4-M5 Link (Haberfield to St Peters) Connections at Rozelle and Camperdown |

Tunnels connecting the M4 East and New M5 via Rozelle and Camperdown. Includes ramps connecting to the St Peters Interchange and an interchange at Rozelle with provision for a future connection to the Western Harbour Tunnel. |

|

Source: ANAO analysis of WestConnex project documents.

Final project approval instrument variation

2.32 In April 2016, DIRD advised the Minister for Major Projects16 on the need to vary the WestConnex project approval instrument to allow for future milestone payments to be made and for formal approval of the remaining $750 million of the Australian Government’s $1.5 billion grant commitment for the project. Specifically, DIRD outlined that:

- additional funding was required to further progress construction for Stages 1 and 2, as well as planning for Stage 3;

- while the entirety of the commitment would be approved, DIRD would only release the Australian Government funding on the achievement of agreed project milestones; and

- the approval was consistent with the requirements of the land transport legislation.

2.33 Although having previously advised its Minister in 2015 that an updated PPR would be required for WestConnex, DIRD’s April 2016 advice to the Minister was silent on whether this had been received or why it was no longer necessary. DIRD advised the ANAO in November 2016 that:

The Department had a copy of the full updated business case for the WestConnex project, which, building on the PPR previously submitted, provided ample detail on the project to make an assessment as presented in the brief to the Minister. It was considered that requiring NSW to produce a separate PPR document on this occasion would have created an unnecessary administrative burden given the additional information available to the Department through the full business case.

2.34 Shortly after the acceptance of the PPR and processing of the June 2015 payment, NSW and DIRD discussed and made minor amendments to the milestones for the 2015–16 period. In May 2016, DIRD and NSW made further amendments to the milestone schedule.17 This was in order to ensure that NSW was able to provide the evidence necessary for the $450 million milestone payment to be made before 30 June 2016 (it was made on 22 June 2016). Specifically:

- Stage 1A was amended from ‘Duck River Bridge complete and open to traffic’ to ‘Final design certificates issued for construction and all eight major girders installed for Duck River Viaduct’; and

- Stage 2 was amended by removing the achievement of ‘environmental studies and documentation complete’.18

2.35 On 11 October 2016, NSW Roads and Maritime Services (RMS) wrote to DIRD advising that the remaining agreed milestones had been achieved, and requested that the remaining $300 million be paid. DIRD approved this request on 19 October 2016, and the final payment was provided to NSW by the Department of the Treasury on 1 November 2016. The milestones relating to that amount were to be achieved throughout the first seven months of the 2016‒17 financial year (see Table 2.3 for specific milestones and dates). The ANAO’s analysis of the final payment was that:

- there was a large difference between the milestones that had been approved in June 2015 and the milestones submitted by RMS with the payment request. Specifically, the new milestones indicated that that none of the 2016–17 milestones agreed in 2015 had been met;

- according to the June 2015 schedule, $120 million was being provided to NSW sooner than had been originally agreed (this amount was linked to milestones that were to be achieved in December 2016 and January 2017); and

- the final milestone payment was approved by DIRD the day after it had reviewed and accepted the monthly expenditure report for October 2016 from RMS, which indicated that:

Table 2.3: Comparison of the approved and actual WestConnex milestone payments for 2016–17

|

Sub-project |

Milestones approved by the Assistant Minister in June 2015 |

Estimated completion date |

Milestones approved by DIRD for payment in November 2016 |

Completion date |

|

M4 Widening |

Stage 1A: New viaduct complete. |

July 2016 |

Stage 1A: Production of 200th bridge girder complete. |

Not advised |

|

Stage 1A: Separable portion 1 complete. |

August 2016 |

|||

|

Stage 1A: Contract complete and Stage 1A open to traffic.ᵃ |

December 2016 |

|||

|

M4 East |

|

|

Stage 1B: Completion of Underwood Road tunnel access shaft and commencement of tunnelling at Contra Park. |

August 2016 |

|

New M5 |

|

|

Stage 2:

|

February 2016 August 2016 |

|

KGRIU |

Stage 2 King Georges Road Interchange: Cooloongatta Bridge complete and open to traffic. |

September 2016 |

|

|

|

Stage 2 King Georges Road Interchange: Completion and Final Milestone—contract complete and open to traffic.ᵇ |

January 2017 |

|

|

|

|

M4-M5 |

Stage 3: Finalisation of procurement & delivery strategy |

July 2016 |

Stage 3: Completion of Stage 3 Concept Design Report. |

September 2016 |

Note a: As at 1 December 2016, Stage 1A was reported as 75 per cent complete.

Note b: As at 1 December 2016, the King Georges Road Interchange Upgrade was reported as 85 per cent complete.

Source: ANAO analysis of DIRD records.

How has the grant funding been spent?

Expenditure of the grant funding was minimal (as a proportion of the Australian Government funding already provided to NSW) until mid to late 2015, once construction activity had commenced for the M4 Widening and King Georges Road Interchange Upgrade sub-projects. Based on NSW’s expected spending patterns and the actual expenditure reported by NSW to DIRD, the funding has been largely front-loaded into Stage 1 to allow for it to be the first section completed and privatised, with those proceeds to be used for the construction of Stage 3.

2.36 The financing strategy for WestConnex was set out by NSW within the 2013 business case. This strategy has been amended over time, but the following key factors have remained consistent:

- the NSW Government has established a new company (the Sydney Motorway Corporation Pty Limited, SMC) to manage the state’s financial interests in WestConnex;

- the viability of WestConnex is linked to the implementation of a toll regime;

- approximately $3.3 billion of combined NSW and Australian Government grant funding was flagged as being required to get the project underway. SMC was to be capitalised with seed capital of $2.65 billion in shareholder funds from this grant funding21; and

- the balance of the funding for the scheme will come from debt and privatisation proceeds raised against tolls on the individual stages of the project, with government capital (the original grant funding) invested into the initial stages of WestConnex recycled into Stage 3.22

2.37 Part of the usual administrative processes for managing expenditure of Infrastructure Investment Programme funding is project proponents’ reporting of monthly expenditure through DIRD’s IMS. Responsibility for this reporting for the WestConnex project sits with NSW RMS. Figure 2.3 illustrates this reported expenditure.

Figure 2.3: Cumulative expenditure against milestone payments (planned and actual)

Note a: DIRD advised the ANAO in December 2016 that the decrease in cumulative expenditure in October 2016 was due to an error within the information reported by NSW (discussed at paragraph 2.39).

Source: ANAO analysis of DIRD records.

2.38 The ANAO’s analysis of the reported use of Australian Government grant funding is that:

- it has been allocated to and expended largely on the delivery of the first stage of WestConnex. While construction work for some of Stage 2 commenced in July 2015, most of the construction work—and therefore expenditure—has been for Stage 1; and

- the reporting of expenditure through DIRD’s IMS is by NSW RMS, rather than by the entity responsible for delivering the project. This approach decreases the visibility DIRD has over incremental expenditure of the Australian Government grant funding, as spending by RMS relates to the passing on of grant payments in full to SMC as equity injections rather than reflecting expenditure by SMC on delivering WestConnex. In this respect, in November 2016 DIRD commented to the ANAO that:

Reporting on the Australian Government grant funding is required to be completed by RMS in the IMS system. This is the case for all NSW road projects in the Infrastructure Investment Programme, including projects that are ultimately delivered by other entities, including local government agencies. The Department disagrees with the statement that “this approach decreases the visibility DIRD has over incremental expenditure”.

2.39 In December 2016, the ANAO requested an update to the IMS monthly reporting information from DIRD for October and November 2016. The expenditure reported by RMS in October 2016 indicated that there had been a decrease in the cumulative expenditure of Australian Government funding of $319.4 million (26 per cent) when compared to the previous month (see Figure 2.3). In respect to this decrease, DIRD explained to the ANAO that it had raised this issue with NSW, and was advised that:

the initial reporting did not reflect the correct split between state and federal, and this was only picked up through a recent financial audit process. [DIRD has been] advised that SMC has now modified its reporting systems to allow for a more accurate split of funding source, and that the October and November reports reflect these changes, which is why the cumulative amounts appear to have dropped and then risen again. There should be consistency in the figures now moving forward.

2.40 In the context of this explanation, it is expected that the reported expenditure of the NSW Government funding would increase by the amount that the expenditure of Australian Government funding had decreased. But rather, the ANAO observed that the monthly reporting for October 2016 indicated that:

- the expenditure of NSW Government funding had increased by $75 million;

- funding from ‘other sources’ had increased by $15 million; and

- total cumulative expenditure across all funding sources had decreased by $229 million.

2.41 In the following month, the reported cumulative expenditure for funding from other sources decreased by $1.48 billion, and NSW expenditure increased by $1.52 billion.

2.42 This situation highlights the need for DIRD to review the process it employs for the collection and validation of reported expenditure by project proponents. It is important that DIRD is able to rely on the information it collects through IMS. The ANAO notes that the risk of inaccurate information is increased in situations where DIRD is relying on information from secondary sources (such as the information being reported by SMC to RMS, then from RMS to DIRD).

2.43 A September 2016 draft DIRD Internal Audit report of the Infrastructure Investment Programme highlighted the unreliability of the information stored within IMS and made a ‘Management Improvement Suggestion’ that the ‘the [responsible] Division undertake a functional review of the IMS to determine whether it adequately supports the [Infrastructure Investment Programme] and identify any risks associated with the current approach of automated and manual processes.’ Therefore, the ANAO has not made a recommendation in respect to reporting information held by the IMS, but notes that the validation of project proponents’ expenditure reporting should be considered as part of that review.

3. The $2 billion concessional loan

Areas examined

The ANAO examined whether the decision to commit to and enter into a $2 billion concessional loan arrangement for the WestConnex project was informed by appropriate advice, and whether the loan arrangements represent value for money.

Conclusion

Departmental advice to Ministers focused on the benefits of providing a concessional loan to the WestConnex project. The key benefits identified were the:

- lower net financial impact on the presentation of the Federal Budget of a loan compared with further grant funding (due to the differences in the accounting treatment of loans and grants, and because a loan would earn interest income and be later repaid);

- expected increase in construction activity between 2015‒16 and 2016‒17 from accelerating the second stage; and

- potential to reinvigorate the private sector lending market in relation to demand risk toll roads.

But the advice to Ministers did not adequately identify or quantify the costs and risks associated with providing a concessional loan. Key issues that detract from the loan providing value for money include:

- there is evidence that the loan was not needed to accelerate the second stage of WestConnex and, in any event, the project has not been accelerated to the extent projected by DIRD (by up to two years); and

- the interest rate on the loan was set well below comparable market rates with no margin included to cover the Australian Government’s loan administration costs or risks.

Area for improvement

The ANAO has recommended that DIRD improve the advice that is provided to decision-makers on future loans for major infrastructure projects by:

- developing a more robust and tailored administrative framework to govern the possible provision of concessional loans to infrastructure projects;

- clearly identifying and quantifying the impact of all key aspects of the proposed commercial arrangements; and

- seeking Ministerial agreement to the parameters within which the department is authorised to negotiate on the key terms of the loan.

Why was a concessional loan recommended for supporting the WestConnex project?

A concessional loan for the WestConnex project was recommended as a preferred alternative to further grant funding. This was because concessional loans have a smaller impact on the presentation of the Australian Government Budget than grant funding. A loan to accelerate Stage 2 of the project was also expected to increase construction activities between the 2015‒16 and 2016‒17 financial years and to reinvigorate the private sector lending market when it comes to demand risk toll roads.

3.1 A concessional loan for the WestConnex project was first recommended to the Australian Government by the Department of Infrastructure and Transport in March 2013. This was in the context of a broader recommendation that approval be given to the department to commence formal negotiations with relevant state governments to use alternative funding options for three ‘megaprojects’23 being supported by the Australian Government. This approval was granted.

3.2 The options suggested were concessional loans, guarantees and phased grants. The department identified the impact of each option on key Budget figures (see Table 3.1), and advised that the various options would have a number of benefits, as well as some negative impacts on the Budget. Among the listed benefits was the potential to:

- attract private sector (including superannuation fund) investment in major Australian infrastructure by providing the sector with secure low risk investment opportunities; and

- reduce the overall reliance on Australian Government grant funding, allowing scarce funds to be targeted in a more effective manner.

Table 3.1: Budget impacts of alternative financing options considered

|

Funding model |

Impact |

||

|

|

Underlying cash balance |

Fiscal balance |

Net debt |

|

Grants or phased grants |

Yes |

Yes |

Yes |

|

Commonwealth Guarantee—not called upon |

No |

No |

No |

|

Commonwealth Guarantee—called upon |

Yes |

Yes |

Yes |

|

Concessional loan |

No |

Yes |

Yes |

|

Equity injection |

No |

No |

Yes |

Note: The advice outlined that no attempt had been made to identify the relative impacts of the models within the table, and the impacts that were outlined did not include the cost of public debt interest to fund each model.

Source: DIRD records.

3.3 While both grants and concessional loans negatively impact the fiscal balance, the relative impact of a concessional loan is far less than that of a grant. This is because the full value of grants payments are recognised as expenses in the years they are provided. In the case of concessional loans, the impact of the loan drawdowns is offset by the recognition of a loan asset. A loan’s impact on the fiscal balance is the net effect of public debt interest expense, accrued interest revenue and the value of the concession on the loan.24 By way of comparison, Table 3.2 shows the fiscal balance impact of the concessional loan as reported in the May 2014 Budget papers alongside the impact had the drawdowns been accounted for as grant funding.

Table 3.2: Comparison of the fiscal balance impact between a grant and a concessional loan

|

|

13–14 |

14–15 |

15–16 |

16–17 |

17–18 |

|

|

($ million) |

||||

|

Grant |

0 |

3.8ᵃ |

226.4 |

854.5 |

831.3 |

|

Concessional loan |

0 |

3.8ᵃ |

96.6 |

344.5 |

314.9 |

Note: The $3.8 million allocation in 2014‒15 was for DIRD’s due diligence expenses.

Source: ANAO analysis of 2014 Budget documents, MYEFO documents and DIRD records.

3.4 In November 2016, DIRD advised the ANAO that the loan also achieved two Australian Government policy goals:

- to increase construction activities within the 2016‒17 and 2017‒1825 financial years (years that central agencies identified requiring stimulus to counteract the drop-off from the mining construction boom) through the acceleration of the Stage 2 project26; and

- to reinvigorate the private sector lending market when it comes to demand risk toll roads. Before the project, there had not been a greenfield toll road financing by private sector debt since before the Global Financial Crisis.

3.5 In this latter respect, the ANAO notes that the demand risk for Stage 2 is primarily borne by the NSW Government (as equity owner); until such time that the project vehicle is sold. Additionally, Stage 2 of the project is not a greenfields toll road. Rather, it involves a mix of greenfield (parts of the New M5) and an expansion of existing roads (widening of the M4 and duplication of the M5 East). Therefore, there is some history of established traffic demand to draw on.

Advice provided to the incoming Australian Government

3.6 Following the September 2013 Election, DIRD provided Ministers with a number of briefings related to WestConnex, and the implementation of the Australian Government’s commitment to it. In respect to a potential loan for the project, Ministers were advised over the following few months that:

- a request for further funding for the WestConnex project from NSW was likely to be forthcoming, and that no further grant funding should be agreed until a broader range of financing options, including concessional loans, had been considered;

- the indicative Infrastructure Investment Programme—based on the Government’s election commitments—contained a funding shortfall of $4.73 billion, which had the potential to be reduced by the use of alternative financing options for key projects, including WestConnex; and

- a proposal had been received from the NSW Government that aimed to accelerate the completion of Stage 2 of WestConnex by up to two years through the provision of a concessional loan of up to $2 billion.27

3.7 The acceleration proposal was consistent with, and designed within the context of, the Government’s intent to create economic stimulus in the construction industry through the Infrastructure Growth Package between 2015‒16 and 2016‒17.

3.8 In November 2013, DIRD advised Ministers that the Government’s capacity to continue to fund infrastructure through traditional grants was no longer sustainable given the changing economic climate and the size of the infrastructure task. As a solution to this issue, DIRD suggested the use of a range of potential alternative financing options, including concessional loans.

Was the loan administered within an effective framework?

The approach recommended by DIRD provided a convenient legislative mechanism for loan drawdown. But a tailored approach, similar to that subsequently adopted for the Northern Australia Infrastructure Facility, would have provided a more effective framework.

3.9 DIRD, in consultation with the Department of Finance, examined the legislative options available for the administration of the WestConnex concessional loan, and infrastructure financing more broadly (for future projects). DIRD advised the Assistant Minister for Infrastructure and Regional Development that the Financial Framework (Supplementary Powers) Regulations 1997 provided the most convenient mechanism to draw down the loan amount. Accordingly, ‘Infrastructure Investment’ was included in Schedule 1AB from June 2015.

3.10 The department provided a proposal on innovative funding and financing to the previous Australian Government for consideration in early 2013. As part of this proposal it committed to coming back to Government with additional advice on risk management strategies and proposed governance arrangements to administer the ‘new model’.

3.11 In February 2016, the Minister for Major Projects released the Australian Government’s Principles to support the use of innovative financing in the delivery of critical transport infrastructure. These principles indicated an intention to increase the use of alternative financing mechanisms.

3.12 The new framework that was put in place for the new Northern Australia Infrastructure Facility (NAIF) in May 2016 differs from the WestConnex approach in significant respects. The facility is led by an independent board and is to offer up to $5 billion over five years in concessional finance to encourage and complement private sector investment in infrastructure that benefits Northern Australia. The Northern Australia Infrastructure Facility Investment Mandate Direction 201628 contains the criteria that must be met in respect to ‘investment’ decisions made by the NAIF board. The criteria include:

- a financing mechanism (for example, concessional loans and debt guarantees) must not be provided unless the board is satisfied the project would not otherwise have received sufficient financing from other financiers;

- projects must meet mandatory financing eligibility criteria;

- the development of a risk appetite statement to guide the board’s investment decisions; and

- returns must cover at least the facility’s administrative costs, and the Australian Government’s cost of borrowing.

3.13 DIRD advised the ANAO in November 2016 that it did not agree with an ANAO suggestion that the NAIF approach merits consideration by DIRD for future land transport infrastructure arrangements. Specifically, DIRD commented to the ANAO that:

The Department’s position has long been that each major infrastructure project is unique, and that a one-size fits all approach to infrastructure funding and financing is not appropriate. It is the Department’s preferred approach that projects with the potential to be financed through methods other than grants are discussed between the Australian Government and the partner state government, with an appropriate approach agreed between the two. The Department provided advice along those lines to government in [respect to the WestConnex project].

The Northern Australia Infrastructure Facility (NAIF) is not relevant to this audit as the audit criteria refer to the decisions and processes that led to the decision to offer the loan.29 As the legislation governing the NAIF was only passed on 3 May 2016, five months after the WestConnex concessional loan was executed, and some two years after the Australian Government agreed to provide the loan, we consider this to not be a relevant comparison. We would also note the NAIF is yet to finalise a loan and would consider it better practice to wait until loans have been issued by NAIF to compare the two approaches.

Was the $2 billion loan needed to deliver Stage 2?

There is evidence that Stage 2 could have progressed towards construction as planned without the concessional loan. The concessional loan was used as a replacement for the financing that could have been obtained from private sector lenders and through the privatisation of Stage 1 in 2019‒20.

3.14 When briefing the Assistant Minister on the acceleration proposal in December 2013, DIRD advised that it had not yet determined whether further additional funding (above the $1.5 billion grant commitment) was required in order to accelerate Stage 2. This was due to the more immediate profiling of funding to NSW as compared with the previous Government’s profiles (see Table 3.3). Subsequent advice did not provide a conclusion in respect to this.

Table 3.3: Funding profiles for WestConnex announced in 2013 by political party

|

|

13–14 |

14–15 |

15–16 |

16–17 |

17–18 |

18–19 |

19–20 onwards |

|

Labor |

$0m |

$0m |

$0m |

$200m |

$100m |

$100m |

$1 400m |

|

Coalition |

$250m |

$600m |

$650m |

$0m |

$0m |

$0m |

$0m |

Source: ANAO analysis of DIRD records.

WestConnex financing strategy

3.15 The NSW Government engaged a financial adviser in late 2012 to develop the financing strategy for the delivery of all three stages of WestConnex. This strategy was finalised in July 2013, along with the project business case, and informed the way in which each of the WestConnex projects were scheduled for delivery.

3.16 The financing strategy report was an attachment to the 2013 business case. But it was not provided to DIRD until mid-March 2014. Had this document been accessible at an earlier stage, DIRD would have been able to take it into account when advising its Ministers about the acceleration proposal.

3.17 The financing strategy outlined that the entire scheme could be delivered over a 10 year period and set out the estimated cashflows (including funding sources and uses) involved in delivering the project.30 A key part of this was the reliance upon privatisation proceeds from the sale of the earlier stages in order to fund the construction of later stages. Stage 2 was reliant upon Stage 1 privatisation proceeds of up to $1.5 billion in its final year of construction (2019‒20). The financing strategy concluded:

It is important to note that in the current case, no further State (or Commonwealth Government) financing is required to deliver WestConnex, based on the financial forecasts generated by SMPO for the Business Case and current market conditions. All required private sector financing can be delivered through either proven financing markets (e.g. project financing based on proven toll revenues) at market based leverage multiples or potential hybrid products that are expected to be able to be structured in a manner that will resonate with investors [emphasis in original].

3.18 As noted at paragraph 3.12, the NAIF framework requires that financing not be provided unless the board is satisfied the project would not otherwise have received sufficient financing from other sources. An international example of stronger governance arrangements in this regard is the United States of America’s Transportation Infrastructure Finance and Innovation Act (TIFIA) Program. The key objectives of the TIFIA Program are to:

- facilitate projects with significant public benefits;

- encourage new revenue streams and private participation;

- fill capital market gaps for secondary/subordinate capital;

- be a flexible, ‘patient’ investor willing to take on investor concerns about investment horizon, liquidity, predictability and risk; and

- limit federal exposure by relying on market discipline.

3.19 An important aspect of the TIFIA Program is that it aims to fill a capital market gap where one exists. Analysis in this regard was not undertaken by DIRD for WestConnex, and the advice available to NSW in July 2013 indicated that a gap did not exist (see paragraph 3.17).

When were the commercial principles for the loan agreed?

Negotiation of the loan terms commenced in November 2013. A Memorandum of Understanding (MoU) signed with the NSW Government in May 2014 set out the key commercial principles for the Australian Government loan.

3.20 Negotiation of the loan terms commenced in November 2013. Negotiations were conducted in phases, with the results from each phase culminating in key documentation including:

- an MoU signed by the Prime Minister and NSW Premier on 16 May 2014 outlining the agreed delivery arrangements for all three stages and an agreed approach to the Australian Government’s funding contributions (including both the $1.5 billion grant component and the $2 billion loan);

- the WestConnex M5 Project Subordinated Concessional Loan Term Sheet, approved by the Assistant Minister for Infrastructure and Regional Development on 17 November 2014—providing a document sufficient for use by NSW when approaching private sector lenders to secure the senior debt component of the project’s finance; and

- execution of the final contract on 20 November 2015 by an appropriately delegated senior DIRD official. The Acting Prime Minister provided the required approvals under the financial management framework five days prior on 15 November 2015.

Key commercial principles for the loan were agreed in May 2014

3.21 The signing of the MoU was a significant event as the MoU established the key commercial principles for the loan. The Ministerial decision to sign the MoU was informed by April 2014 advice from DIRD. DIRD’s advice included that:

- construction of Stage 2 could be completed by up to two years ahead of schedule and the nominal cost of the project potentially reduced from $4.7 billion to $4.5 billion;

- a private sector equity and delivery partner had been introduced to the delivery model, to ‘inject a strong private sector influence and discipline to the project’31; and

- the Australian Government’s interests were to be protected by the security of revenue from tolls.

3.22 The MoU signed on 16 May 2014 outlined that, subject to agreement with NSW, the Australian Government would provide a loan facility of up to $2 billion to be used to accelerate the delivery of Stage 2 (relative to the timeframes included in the business case). An attachment to the MoU set out the commercial principles for the loan, including:

- a tenor of 19 years comprising the period from the date of financial close to the hard maturity date of 1 July 2034;