Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Superannuation Payments for Contractors Working for the Australian Government: Follow-up Audit

The objective of this audit was to determine the extent to which selected agencies have implemented the two recommendations of the previous audit; and the appropriateness of advice provided by Finance and the ATO. To address this audit objective, the audit assessed:

- the roles of Finance and the ATO in clarifying: the interaction of the PB and SG Act; the ongoing role of the PB Act; and mechanisms to monitor Australian Government organisations' compliance with the PB Act;

- the extent to which Finance and the ATO have provided guidance and other support to assist Australian Government organisations manage and meet statutory superannuation obligations for eligible contractors; and

- whether Australian Government organisations have managed and met statutory superannuation obligations for contractors in past and current contracts.

Summary

Background

Compulsory saving for retirement through mandatory superannuation contributions by employers has been a policy of successive Australian governments. Some contractors who operate as individuals/sole traders are also considered to be employees and are therefore entitled to have superannuation contributions paid on their behalf by the entity that contracts them. The key issues are whether: there is an employer-employee relationship at common law in the contract the organisation has entered into with the contractor; or the contract is wholly or principally for labour. In such cases, employers, including Australian Government organisations, are responsible for making these superannuation contributions.

The legal framework concerning employers' obligations for contractors can be technical and complex. The framework is established through a mix of legislation and common law. The two main Acts are:

- the Superannuation (Productivity Benefit) Act 1988 (PB Act); and

- the Superannuation Guarantee (Administration) Act 1992 (SG Act).

The Department of Finance and Administration (Finance) is responsible for administering the PB Act. The Australian Taxation Office (ATO) is responsible for administering the SG Act. Finance provides guidance and advice to Australian Government organisations about PB Act arrangements. The ATO's main role is to provide guidance and advice to employers to help them comply with their superannuation guarantee obligations. One aspect of the role includes assisting Australian Government organisations understand who is an employee for superannuation purposes according to section 12 of SG Act.

To establish whether contractors are employees, courts typically consider a number of indicators. These indicators include whether the employer has the right to control how and what the contractor does, and whether the worker is paid for hours worked and has the right to delegate.

Where a contract has been assessed as not creating a common law employee relationship, it is then necessary to determine whether it is wholly or principally for labour according to s. 12(3) of the SG Act. The main considerations in this regard are whether: the contract is mainly for the person's labour, including mental and artistic effort; the worker is being paid for hours worked; and the worker has the right to delegate. Again, the decision is often a fine balance of many indicators rather than one overriding test.1

The incidence of Australian Government contracts with individuals is small when compared to other contracting arrangements, and has been declining. Of the 4546 contracts entered into by seven agencies examined in this audit,2 only around two per cent were with contractors who were individuals and therefore could possibly have been entitled to superannuation contributions.

Previous audit coverage

In October 2004, the Australian National Audit Office (ANAO) tabled in Parliament Audit Report No.13 2004–05, Superannuation Payments for Independent Contractors working for the Australian Government (the previous audit). That audit examined a number of contracts to determine: whether superannuation obligations had been met; and the level and appropriateness of advice given and received by Australian Government organisations.

The previous audit report acknowledged the difficulties agencies face in establishing whether they have an obligation to provide superannuation for contractors, due to the complexity of the legal issues involved. It concluded that agencies generally lacked awareness of such requirements. The report made two recommendations:

- Recommendation No.1 was directed at Finance and the ATO, and proposed those two agencies clarify: the interaction between the PB and SG Acts; whether there was a continuing role for the PB Act; and mechanisms for monitoring Australian Government organisations' compliance with the PB Act; and

- Recommendation No.2 was directed at Australian Government organisations generally, and proposed they: establish processes that controlled the risks of contracting with individuals; and address the risk that statutory superannuation obligations in past and current contracts have not been met.

Finance and the ATO agreed with Recommendation No.1, and all agencies generally agreed with Recommendation No. 2.

Audit approach

The objective of this audit was to determine the extent to which selected agencies have implemented the two recommendations of the previous audit; and the appropriateness of advice provided by Finance and the ATO. To address this audit objective, the audit assessed:

- the roles of Finance and the ATO in clarifying: the interaction of the PB and SG Act; the ongoing role of the PB Act; and mechanisms to monitor Australian Government organisations' compliance with the PB Act;

- the extent to which Finance and the ATO have provided guidance and other support to assist Australian Government organisations manage and meet statutory superannuation obligations for eligible contractors; and

- whether Australian Government organisations have managed and met statutory superannuation obligations for contractors in past and current contracts.

The methodology for the audit involved an assessment of Finance's and the ATO's activities in administering relevant superannuation legislation, and providing relevant guidance to Australian Government organisations. In addition, the ANAO analysed agency contracts commencing in 2005 to ascertain the likely magnitude of obligations to pay superannuation, and if so, whether payments were made correctly. The audit also assessed agencies' administrative processes for managing superannuation obligations for people contracting as individuals.

The audit included the following agencies: Finance; the ATO; the Australian Bureau of Statistics; CRS Australia; the Department of Foreign Affairs and Trade; the Department of Veterans' Affairs; Geoscience Australia; and Insolvency and Trustee Service Australia.

Audit conclusion

Overall, the ANAO concluded that agencies had largely implemented the recommendations from the previous report.

Finance and the ATO worked together to clarify the ongoing role of the PB Act within the context of broader reform to the superannuation framework for Australian Government organisations. This was reflected in changes to superannuation legislation, including the closure of the PB Act to new employees (including certain contractors) and office holders from 1 July 2006. As the number of contractors covered by the PB Act was expected to decline rapidly, Australian Government organisations will now rarely need to consider both the PB Act and SG Act when assessing whether contractors who are individuals are entitled to superannuation benefits.3

The ANAO concluded that Finance and the ATO have generally provided appropriate advice to Australian Government organisations on changes to the legislative framework and superannuation issues more broadly, including the PB Act, within a challenging environment of major changes to superannuation. The audit has highlighted that, in addition to Finance providing guidance about these issues to human resource staff at Australian Government organisations, it would be worthwhile for procurement staff also to be made aware of these issues, given the central role of procurement in the acquisition of services. In this light, it would be beneficial if the guidance provided by Finance in connection with the Commonwealth Procurement Guidelines could make brief reference to these issues.

The audit has also highlighted that agencies appreciated the assistance of the ATO, but were not always aware of the range of support services it provided. To increase the awareness of its capabilities in this regard, there would be benefit in the ATO more actively promoting the superannuation telephone help line and Provision of Written Advice service4, and the Government superannuation section of its website.

The audited agencies have adopted common approaches to control the risk of having unmet superannuation obligations to contractors. These approaches have mainly involved minimising the incidence of contracting with individuals, and implementing processes and practices to assess whether contractors who are individuals are entitled to superannuation benefits. The audit identified scope for agencies to further refine these approaches in some instances, by: developing contract templates that reduce the risk of unintentionally creating an employment relationship; seeking advice from the ATO about a contractor's entitlement to superannuation benefits; and recording the basis on which staff have assessed contracts with individuals for superannuation entitlements.

Despite the closure of the PB Act, the legal framework for superannuation can impose high costs on employers when assessing entitlements to superannuation benefits for a contractor who is an individual. As discussed above, to minimise costs, many of the audited agencies have reduced the incidence of contracting with individuals. The ANAO notes that avoiding contracts with individuals may not always result in the best outcome for the Australian Government or the community, as contracting with individuals may represent the best value for money in some circumstances.

Key findings

Finance and the ATO's Roles in Administering the PB and SG Acts

Clarifying the role of the PB Act

With the enactment of legislation that closed the PB Act to new employees and contractors from 1 July 2006, the PB Act's overlap with the SG Act has declined. This addressed the complexity of the interaction of the PB Act with the SG Act and Finance's role in administering the PB Act.

Adequacy of guidance provided by Finance

Finance is responsible for policy development, implementation and advice on Australian Government civilian and parliamentary superannuation arrangements and management of the financial aspects of those superannuation arrangements. Finance is also responsible for administering the PB Act. In this role it provides general advice to Australian Government organisations on PB Act arrangements.

Since the previous audit, Finance has disseminated a number of circulars about changes to the superannuation statutory framework, including the closure of the PB Act and issues associated with individuals contracting with the Australian Government; provided information on its superannuation website; and conducted a comprehensive program of seminars on superannuation.

The ANAO considered the activities Finance had undertaken to inform Australian Government organisations of changes to the PB Act were appropriate. It would be beneficial if Finance could extend the targeted dissemination of its guidance material beyond human resource and finance staff to include procurement staff. The audit also found that Australian Government organisations would benefit from Finance preparing a checklist, in consultation with the ATO, which highlights some of the considerations in establishing and managing contracts. Adding a requirement to determine whether an employment relationship exists would reduce the risk that employers do not identify superannuation liabilities.

Adequacy of guidance provided by the ATO

As the administrator of the SG Act, the ATO's main role is to provide guidance and advice to employers to help them comply with their superannuation guarantee obligations. One aspect of the role includes assisting Australian Government organisations understand who is an employee for superannuation purposes according to section 12 of SG Act.

The ANAO found that relevant staff in all of the audited agencies were aware of the SG Act and the PB Act. This knowledge arose both from existing policy and guidance in their own agency, past efforts to consider superannuation obligations for contractors, guidance provided by Finance, and guidance and advice provided by the ATO.

The ATO's two Superannuation Guarantee Rulings5 provide advice to employers about how to assess whether a contractor who is an individual is entitled to superannuation benefits. While these documents comprehensively address a difficult topic, supplementing them with decision-making tools to simplify the process of identifying contractors eligible for superannuation would assist employers, including Commonwealth employers, in meeting their SG Act obligations. The ANAO noted that the ATO was developing such aids at the time of the audit. The ATO, together with Finance, could also supplement advice to Australian Government employers by drawing their attention to other classes of workers who are employees for superannuation purposes under s. 12 of the SG Act.

As noted earlier, while the ATO has developed a considerable amount of material about how to identify superannuation obligations for contractors, some agencies were not aware of its full range of support services. These include the ATO's superannuation telephone help line, Provision of Written Advice service, and the Government superannuation section of the ATO's website.

The ATO provides guidance to agencies about calculating superannuation payments for eligible contractors in a number of documents, via its website <www.ato.gov.au>, and in response to requests to the superannuation telephone information line. Overall, the ANAO found ATO guidance was adequate for the calculation of superannuation entitlements. The ANAO supports the ATO's proposals to improve guidance surrounding the calculation of the Superannuation Guarantee Charge (discussed further below).

Individual Agencies' Management of Superannuation Obligations for Contractors

The ANAO found that 94, or around two per cent, of the 4546 contracts of the audited agencies in 2005 were with individuals. As indicated above, a primary approach taken by many of the audited agencies to control the risk of not meeting superannuation obligations to contractors has been to enter into relatively few contracts with individuals. To implement this strategy, some agencies had contracting policies which stated a preferred position of not contracting with individuals, or allowed results-based contracts only. Such contracts largely avoid the need to pay superannuation, as contractors are not employees if they are paid for achieving results rather than for hours worked.

Further, a comparison of the results of ANAO analysis for the current audit with those from the previous audit indicated a substantial decline in the proportion of contracts with individuals. The previous audit indicated that around 3.4 per cent of contracts entered into by Australian Government organisations in 2002-03 were with individuals, while only 2.1 per cent of the contracts entered into by the seven agencies in this audit were with individuals.7

Contractors with superannuation obligations

The ANAO assessed 36 of the audited agencies' 94 contracts with individuals, and identified seven contractors who could be considered employees for superannuation purposes.8 The selected agencies had identified and paid superannuation for two of these seven contractors.

While these numbers are small, it is possible that agencies may be continuing to under-identify contractors with superannuation entitlements, and consequently not to be meeting all such financial obligations. However, the number of contracts the ANAO considered to have an unmet superannuation obligation did not exceed two9 for any of the seven audited entities. Further, the circumstances in some cases were unique. The nature of the contracts and the surrounding circumstances were as follows:

- one contract was for a musical performance. The ANAO found the contract was not for employment at common law or wholly or principally for labour, but separate provisions in the SG Act created an entitlement to superannuation;

- one contract involved a specialist IT project manager. The person was a non-resident for immigration purposes and had been engaged as a contractor because it was thought that they could not be engaged as an employee under the Public Service Act 1999. The person was considered an employee for superannuation purposes;

- two contracts involved the same specialist IT trainer. The agency had sought general legal advice about the two contracts with the individual and had been advised there were ‘no legal issues' with the contract. The ANAO examined the legal advice, which did not indicate whether superannuation had been considered;

- one contract was for a public service finance manager. The individual was a semi-retired public servant working on a casual, as needs, basis. The contract was executed shortly before the agency implemented more stringent contract clearance processes; and

- the other two contracts were both with semi-retired people working on a casual basis. One contractor was an analyst and the other was a historian. The agency had paid superannuation in both cases.

For the five contracts above where superannuation had not been paid, the four contracting agencies agreed to seek advice from the ATO or a legal opinion about their superannuation liabilities. These agencies also agreed to calculate and meet any superannuation obligation, based on this advice.

The current audit identified an unmet superannuation obligation for 5.3 per cent of the contracts with individuals (representing five contracts) from the seven audited organisations. This compares to 35.3 per cent of contracts with individuals in the previous audit.10 The ANAO found that for the seven entities reviewed, the reduction in unmet superannuation obligations to contractors was largely attributable to a preference to: contract with companies, trusts and partnerships; enter into ‘results-based' contracts with individuals; or engage individuals as part-time and/or non-ongoing Australian Public Service employees.11

Calculating superannuation benefits

Only one of the audited agencies had paid superannuation for contractors the ANAO considered eligible, and had done so for two separate contracts. As the benefit for one of the contractors was paid late, the agency was required to pay interest. The payment met the minimum requirements for an interim benefit under the PB Act.

The ANAO notes that, with the closure of the PB Act to people engaged from 1 July 2006, the SG Act now requires Australian Government employers to calculate any interest amounts paid after the quarterly Superannuation Guarantee Charge12 (SGC) cut-off date using interest calculated so that it compounds daily. Although departments and untaxable authorities are not liable for the SGC, the SG Act applies to them in all other respects. Administratively, this means that for any SG shortfall amounts, Australian Government employers are required to pay to the individual's superannuation account an amount equal to the sum of the shortfalls with interest calculated according to the SG Act. As a consequence, interest amounts payable under the SG Act are now greater than those previously required under the PB Act.13

Determining whether contractors are entitled to superannuation contributions

There are two main parts to determining whether contractors are entitled to superannuation contributions. The first is to establish whether the contractor is an individual, and the second is to establish whether he or she is an employee under common law, or in a contract wholly or principally for labour.14

The ANAO found that agencies had informal approaches to identifying whether a contractor was an individual. Conversely, where agencies had considered a contractor to be an individual, they generally had detailed processes to assess whether he or she was an employee under common law, or in a contract wholly or principally for labour. Nevertheless, given the final decision as to whether a contractor is entitled to superannuation benefits is sometimes a fine balance of many factors, if uncertain, agencies should be mindful of the opportunity to seek advice from the ATO about a contractor's entitlement to superannuation benefits.

The ANAO emphasises the importance of agencies documenting their key considerations in making assessments as to whether a contractor is entitled to superannuation. Having such documentation is likely to reduce the risk that superannuation obligations are not identified and provide evidence that superannuation was properly considered before a contract was signed.

Policies and processes

All seven agencies audited had developed and promulgated a range of policy and guidance material on superannuation obligations to contractors. However, the audit found that guidance material was not current for a number of agencies. The ANAO considers that agencies should review and update guidance material at appropriate intervals to keep it current in light of agencies' ongoing experiences and broader developments.

The ANAO assessed each of the seven agencies as generally having adequate administrative processes in place, given their respective levels of exposure to potential superannuation obligations. Five of the seven agencies audited had established a centralised contracts unit, with specialist contract staff. In the other two agencies, individual business units were responsible for identifying contracts with individuals that may pose a superannuation risk. These business units were supported with checklists to support the assessment of individual contractors.

The ANAO identified a better practice whereby some agencies had standard clauses within contracts that reduced the risk of unintentionally creating an employment relationship, for example, by specifying results-based contracts where this was appropriate. The ANAO suggests that Australian Government organisations consider including such clauses in standard contract templates.

Unmet superannuation liabilities associated with past contracts

The previous audit considered that Australian Government organisations should use a risk-based approach to identify and provide for unmet superannuation liabilities associated with past contracts with individuals.

The current audit found that three of the seven agencies had conducted systematic reviews of past contracts to identify the level of potential superannuation obligations to individual contractors. The remaining agencies indicated the risk of having unmet superannuation obligations was addressed informally and considered to be low. None of these agencies documented the basis for reaching this conclusion.

The ANAO considers that conducting a systematic, risk-based review of past contracts to identify the level of potential superannuation obligations to individual contractors is better practice. Such an exercise may include: focusing on the main contract types or business areas that are likely to involve contracting with individuals; checking whether contractors are individuals by referring to the Australian Business Register; and utilising a checklist containing indicators such as those in Tables 2.1 and 2.2 in the report in considering higher-risk individuals. Agencies should record the basis of their considerations of unmet superannuation liabilities associated with past contracts with individuals.

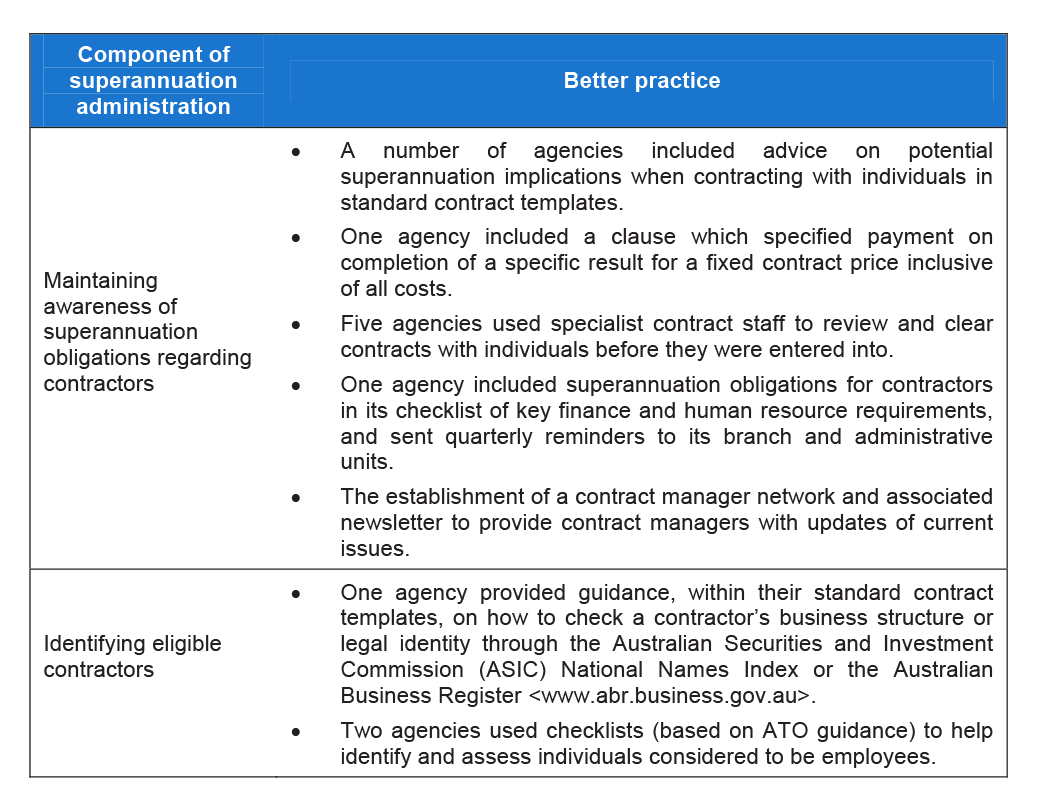

Better practices

Amongst the audited agencies, the ANAO identified a number of administrative arrangements that it considered to be good examples of managing superannuation obligations to certain contractors.

Table 1 Better practices to manage superannuation obligations to contractors

Source: ANAO.

Agencies' comments

Each of the eight audited agencies agreed with the audit report's conclusions and findings. Appendix 1 of the report records each of their responses.

Footnotes

1 In addition, certain workers may be entitled to superannuation benefits under other provisions of s. 12 of the SG Act, even if they are not contracted wholly or principally for labour.

2 These contracts were reported on the Department of Finance and Administration, AusTender–Contracts Reported system for 2005. They represent all contracts entered into by the seven agencies that have a total contract value of $10 000 or more. As such, they cover contracts for goods as well as services.

3 Australian Government organisations would have to consider both the PB and SG Acts only for contractors who are individuals and who had been working continuously for that organisation, on the same contract, since before 1 July 2006. However, as some people covered by the PB Act are office holders who have been appointed for relatively long terms such as five years, it may be some years before the PB Act is completely phased out.

4 The ATO has a superannuation telephone help line and a Provision of Written Advice service accessible to all employers to provide assistance relating to superannuation issues. Through these services, the ATO answers questions regarding employer obligations under the SG Act, and assesses whether a contractor is an employee for superannuation purposes.

5 ATO, Superannuation Guarantee Ruling (SGR 2005/01) and Superannuation Guarantee Ruling (SGR 2005/02). SGR 2005/1 explains when an individual is considered to be an ‘employee' under section 12 of the SG Act. SGR 2005/2 explains how the definitions of ‘employer' and ‘employee' in the SG Act apply to contractual arrangements involving three or more parties, such as through a labour hire company.

6 This refers to the number of contracts listed on Finance's AusTender–Contracts Reported (AusTender) system for the seven audited agencies for the 2005 calendar year. The ANAO also examined records of 2 425 contracts on these agencies' Contract Registers and 1 293 purchase orders. As the extent of overlap between these entries and those on AusTender was not clear, the ANAO primarily reports the analysis of AusTender data.

7 The comparisons between these findings from the current and previous audits are indicative only. The previous audit selected a random sample across many Australian Government organisations. The current audit was selective rather than random, and covered only the seven audited agencies.

8 These findings suggest that considerably fewer than one per cent of contracts examined were with individuals with superannuation entitlements.

9 The ANAO identified only one agency that had two such contracts. These two contracts were with one person working continuously for the agency.

10 As explained in footnote 7, the comparisons between these findings from the current and previous audits are indicative only. The previous audit conducted a random sample across many Australian Government organisations. The current audit was selective rather than random, and covered only the seven audited agencies.

11 A number of the audited agencies explained that they had engaged individuals as part-time and/or non-ongoing Australian Public Service employees to avoid potential uncertainties surrounding the use of contractors, including the need to determine superannuation obligations. Individuals engaged as part-time and/or non-ongoing Australian Public Service employees are entitled to superannuation benefits.

12 The Superannuation Guarantee Charge is the penalty that employers pay to the ATO for non-payment or late payment of superannuation contributions in accordance with the SG Act. The calculation is based on the SG shortfall plus a nominal interest component and an administration fee for the ATO's costs.

13 The ATO advised the ANAO that it was currently developing an on-line Superannuation Guarantee Calculator to assist employers in calculating SGC amounts.

14 It is also necessary to establish whether a contractor is eligible for superannuation under other provisions of the SG Act.