Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Strategies for Addressing the Impacts of Declining Demand for Australian Circulating Coins

Please direct enquiries through our contact page.

The objective of the audit was to assess whether the Royal Australian Mint’s strategies for addressing the impacts of declining demand for Australian circulating coins are appropriate and effective.

Summary and recommendations

Background

1. The Royal Australian Mint (the Mint), established in 1965, is Australia’s national mint and operates under the Currency Act 1965 to produce coinage for the currency requirements of the nation. The Mint is a listed entity within the Treasury portfolio and a non-corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013.

2. The Mint is the sole supplier of Australia’s circulating coins.1 In addition to domestic circulating coins, the Mint produces circulating coins for other countries, and manufactures collector (numismatic) coins2, investor products3, medals, medallions and tokens for domestic and international markets. The Mint is also the custodian of Australia’s National Coin Collection and provides educational and tourist services to local residents and overseas visitors.

3. The Mint is required to provide the seigniorage collected on circulating coins to the Australian Government. Seigniorage is the difference between the sale price of a circulating coin and the cost to produce and distribute it into circulation. The Mint’s core business of producing and supplying Australian circulating coins is facing decline with the emergence of alternative non-cash payment methods enabled by digital technologies. The decline in demand for Australian circulating coins results in reduced seigniorage to the Australian Government. Seigniorage fell from $83.5 million in 2013–14 to $52.0 million in 2017–18.

4. The Mint has identified a range of strategies and opportunities to enable it to achieve its strategic goal of ‘filling the gap’ in seigniorage and address the impacts of declining domestic coin demand. The strategies developed and implemented by the Mint include optimising the seigniorage from Australian circulating coins, utilising excess capacity of its coin manufacturing facilities, and growing its commercial business domestically and internationally. The commercial business of the Mint involves activities in producing and supplying collector coins, foreign circulating coins, investor products, and custom and corporate minting.

Rationale for undertaking the audit

5. The audit was selected to consider ways in which entities can develop strategies to deal with financial challenges associated with changing technologies and business conditions. The audit also aimed to emphasise the need for entities to manage risks associated with using public funds for non-core business, and to conform with relevant legislative requirements.

Audit objective and criteria

6. The objective of the audit was to assess whether the Royal Australian Mint’s strategies for addressing the impacts of declining demand for Australian circulating coins are appropriate and effective.

7. To form a conclusion against the audit objective, the Australian National Audit Office (ANAO) adopted the following high-level criteria:

- Did the Royal Australian Mint have effective arrangements for developing strategies to address the impacts of declining demand for Australian circulating coins?

- Has the Royal Australian Mint’s implementation of the strategies supported it to effectively address the impacts of declining demand for Australian circulating coins?

- Has the Royal Australian Mint implemented the strategies in line with relevant legislative requirements?

Conclusion

8. The Mint has developed and implemented strategies for addressing the impacts of declining demand for Australian circulating coins that are mainly appropriate and effective. While having increased returns from its commercial business, the Mint has not yet achieved its strategic goal of ‘filling the gap’ caused by the reduction in seigniorage through offsetting growth in earnings from its commercial business. Further, the current financial arrangements do not facilitate the return of the Mint’s commercial profits to the Australian Government to support the achievement of the Mint’s strategic goal.

Supporting findings

Arrangements for developing strategies

9. The Mint had effective arrangements in place for developing strategies to address the impacts of declining demand for Australian circulating coins. The strategies were informed by a sound evidence base, rigorous analysis and a robust approval process, and were well-integrated into the Mint’s corporate planning processes. Appropriate governance arrangements were in place whereby the Advisory Board, Senior Management Team, Product Approvals Executive and Audit Committee together provided oversight of the development and implementation of strategic projects, including their performance and management of risks. Notwithstanding the effective arrangements in place, there is no evidence that the Mint contemplated not developing strategies to ‘fill the gap’ to avoid taking on the additional commercial risk.

Effectiveness of implementing strategies

10. The Mint’s implementation of strategies has expanded its commercial business activities and generated growth in commercial revenue and profit. Commercial revenue increased from $52.9 million in 2015–16 to $83.7 million in 2017–18, which represented 58 per cent growth over two years. Net profit for the Mint’s commercial business also grew significantly over the period, from $2.5 million to $13.6 million (444 per cent). In 2017–18 revenue from commercial business activities comprised almost 50 per cent of total revenue from the Mint’s operations.

11. The Mint is yet to achieve its strategic objective of filling the seigniorage gap through growing its commercial business, as seigniorage has declined more than earnings from its commercial business have increased in recent years. Further, the Mint has not yet returned its commercial profits to the Australian Government under current financial arrangements. The Mint has forecast much stronger growth in commercial revenues in coming years through its premium products minting operation. If the Mint continues to strongly grow its commercial activities and revenues, consideration needs to be given to the appropriateness of its current status as a non-corporate Commonwealth entity and existing financial arrangements, to facilitate the return of commercial profits to the Australian Government.

Compliance with legislative requirements

12. In implementing strategies to address the impacts of declining domestic coin demand, the Mint has produced and issued coins in line with relevant requirements in the Currency Act 1965. While not defined in the Act, the Mint should clarify its use of the terms ‘circulating’ and ‘collector’ coins and report these consistently in its various documents. The Mint has also implemented the strategies in line with the requirements of the Public Governance, Performance and Accountability Act 2013. The Mint has not complied with the reporting requirements of the Senate Order on Entity Contracts, and should consider whether to narrow the breadth of confidentiality provisions in corporate minting contracts.

Recommendations

Recommendation no. 1

Paragraph 2.46

The Royal Australian Mint considers the appropriateness of its current governance structure and financial arrangements, and puts options to the Australian Government about these issues to facilitate the return of commercial earnings.

Royal Australian Mint response: Agreed

Recommendation no. 2

Paragraph 2.59

The Royal Australian Mint clarifies its use of the terms ‘circulating’ and ‘collector’ coins, and reports these consistently in its various documents including commercial agreements.

Royal Australian Mint response: Agreed

Recommendation no. 3

Paragraph 2.75

The Royal Australian Mint addresses issues with the content and reporting of confidentiality provisions in commercial contracts, where it is the provider of goods and/or services, to ensure compliance with the requirements of the Senate Order on Entity Contracts.

Royal Australian Mint response: Agreed

Entity response

13. The Mint’s response to the report is provided below.

The Royal Australian Mint

The Royal Australian Mint found the review process to be thorough and comprehensive and a good opportunity, two years into the four year Strategic Plan, to reflect on what it had set out to achieve, what was actually delivered and the degree to which, in that process of delivery, it was compliant. The professionalism of the ANAO team in conducting the review is to be complimented.

Key learnings for all Australian Government entities

Below is a summary of key learnings, including instances of good practice, which have been identified in this audit that may be relevant for the operations of other Commonwealth entities.

Program design

1. Background

The Royal Australian Mint

1.1 The Royal Australian Mint (the Mint) is Australia’s national mint and operates under the Currency Act 1965 to produce coinage for the currency requirements of the nation.4 Established in 1965 to facilitate the transition to the Australian decimal currency system5, since 1983 the Mint has been the sole supplier of Australia’s circulating coins.6

1.2 The Mint is a listed entity within the Treasury portfolio and operates as a non-corporate Commonwealth entity under the Public Governance, Performance and Accountability Act 2013. The Chief Executive Officer is the accountable authority of the Mint who is responsible for managing the Mint on behalf of the Secretary of the Department of the Treasury (the Treasury).

1.3 In addition to domestic circulating coins, the Mint produces circulating coins for other countries7, and manufactures collector (numismatic) coins, investor products8, medals, medallions and tokens for domestic and international markets. As well as being a manufacturing operation, the Mint is a major Canberra tourist attraction and educational destination for school groups from all over Australia with a public gallery, museum and shop that attracted over 326,000 visitors in 2017–18. The Mint aims to promote public understanding of the cultural and historical significance of coins through its tourism and educational services. The Mint is the custodian of Australia’s National Coin Collection and is responsible for collecting and preserving a representative record of Australian coinage history for future generations.

1.4 The Mint is primarily a self-funded entity and receives government funding only for capital projects. The Mint’s goal is to meet the circulating and collector coinage needs of Australia and selected international markets, with a vision to achieve excellence as a profitable mint.

1.5 The Australian Government completed a scoping study into the future commercial arrangements and ownership of the Mint in 2015.9 The Australian Government considered the recommendations of the scoping study as a part of the 2015–16 Budget and announced that: ‘The Royal Australian Mint will be retained in Government ownership in its current form, because it is operating as an effective business and it is well-regarded by its international peers.’10

Coin production

1.6 The two distinct coin types produced by the Mint are circulating coins and collector coins. The minting process for coins is described in Figure 1.1.

Figure 1.1: The minting process

Source: ANAO review of Mint documentation.

Circulating coins

1.7 The Mint produces and supplies Australia’s circulating coins on behalf of the Commonwealth of Australia, as represented by the Treasury, to meet the demands of the Australian economy. The arrangements for the manufacturing, supply and management of circulating coins are outlined in a Memorandum of Understanding for Circulating Coin between the Mint and the Treasury.

1.8 Circulating coins are mass-produced coins used as legal tender for the purpose of trade within Australia, and are made from base metals such as copper, nickel and aluminium. Since the Mint was established in 1965, over 15 billion circulating coins have been produced. The Mint has the capacity to produce up to two million circulating coins each day.

1.9 The Mint supplies circulating coins to the commercial banks at the coins’ face value. A Coin Supply Agreement is in place between the Mint and participating commercial banks to facilitate and manage the flow of circulating coins in the coin supply chain.11 The coin supply chain is overseen by the Coin Consultative Committee, which includes representatives of the Mint and participating commercial banks. Coin activities, holdings and underlying demand are regularly analysed and reported to the Coin Consultative Committee.

1.10 The Mint is required to provide the seigniorage collected on circulating coins to the Australian Government. Seigniorage is the difference between the face value of a circulating coin and the cost to produce and distribute it into circulation. Seigniorage is presented as administered revenue in the Mint’s financial statements as it relates to the course of ordinary activities performed by the Mint on behalf of the Commonwealth of Australia.

1.11 Coins have obverse (heads) and reverse (tails) design. The obverse side of all current Australian legal tender coins features the approved effigy of Her Majesty Queen Elizabeth II. Figure 1.2 shows the reverse side of the six standard Australian circulating coins.

Figure 1.2: Standard Australian circulating coins

|

Denominationa |

Five cents |

Ten cents |

Twenty cents |

Fifty centsb |

One dollar |

Two dollars |

|

Reverse design |

|

|

|

|

|

|

|

Year introduced |

1966 |

1966 |

1966 |

1969 |

1984 |

1988 |

Note a: The one cent and two cent coins were taken out of circulation in February 1992 because they were becoming too expensive to make.

Note b: The dodecagonal (12-sided) 50 cent coins were introduced in 1969 to replace the original circular 50 cent coins that were made of silver and copper.

Source: ANAO representation of coin images provided by the Mint and analysis of Mint information.

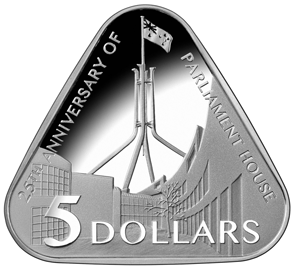

1.12 In addition to the six standard designs, the Mint has produced and released circulating coins that featured designs to commemorate special events, people, or organisations that have had a significant impact on Australian society. Figure 1.3 shows four different commemorative circulating coins released by the Mint.

Figure 1.3: Examples of commemorative circulating coins

|

Commemorative design |

|

|

|

|

|

Year released |

2012a |

2014, 2015, 2016, 2017 |

2017b |

2018 |

Note a: This 2012 Remembrance Day coin was Australia’s first coloured circulating coin.

Note b: The design of this coin depicts the mosaic from the Australian War Memorial’s Hall of Memory.

Source: ANAO representation of coin images provided by the Mint and analysis of Mint information.

Collector coins

1.13 Collector, or numismatic coins, are non-circulating coins intended for coin collectors and the souvenir and gift market rather than for the payment of goods and services. These products, while being legal tender in Australia, are not produced to be used as circulating coins and may be made with precious metals.12 Arrangements for the production of collector coins, and other commercial activities, are described in a Memorandum of Understanding for Commercial Business between the Mint and the Treasury (see paragraph 1.18). The Mint pays royalties to the Australian Government on all collector coins that bear the effigy of Her Majesty Queen Elizabeth II, in accordance with the royalty rates outlined in the Memorandum of Understanding.

Collector coins depict designs that tell stories about Australia, its history, heritage, environment, wildlife, culture and achievements.

1.14 Figure 1.4 shows examples of some collector coins the Mint has released.

Figure 1.4: Examples of collector coins

|

Coin design |

Information about the coin |

|

|

|

|

|

|

|

|

|

|

|

|

Source: ANAO representation of coin images provided by the Mint and analysis of Mint information.

Decline in demand for circulating coins

1.15 A decrease in the use of physical currency due to the growing popularity of alternative methods of payment enabled by digital technology has led to a reduction in demand for domestic circulating coins. Alternative payment methods increasingly used by Australian consumers are contactless card payments (such as ‘tap and go’ payWave and PayPass technology), contact card payments, mobile payments and the New Payments Platform13 transactions.14 The reduction in revenue from the sale of domestic circulating coins results in a decline in the seigniorage being returned to the Australian Government. The Mint forecasts that demand for circulating coins will gradually fall with five cents and 10 cents pieces declining at a faster rate. Figure 1.5 shows that, other than a significant increase in 2015–16, there was a decline in seigniorage in the last five years (from $83.5 million in 2013–14 to $52.0 million in 2017–18).

Figure 1.5: Seigniorage paid to the Australian Government, 2013–14 to 2017–18

Source: ANAO analysis of Mint data.

1.16 In 2015 the Mint estimated that there would be a reduction in seigniorage to the Australian Government of $16 million by 2020, and commenced identifying strategic opportunities that would contribute to ‘filling the gap’ in seigniorage caused by the decline in demand for domestic circulating coins. There has been no direction from the Treasury of the level of seigniorage that the Mint is expected to provide to the Australian Government. There is also no explicit requirement from the Australian Government that the Mint has strategies in place to address the challenges associated with declining coin demand.

1.17 The Mint has developed and implemented a range of strategies to ‘fill the gap’ that include optimising the seigniorage from circulating coins, utilising excess capacity of its coin manufacturing facilities and growing its commercial business domestically and internationally. The commercial business of the Mint involves activities in producing and supplying collector coins, foreign circulating coins, investor products, and custom and corporate minting.

1.18 The Memorandum of Understanding for Commercial Business between the Mint and the Treasury sets out the terms and conditions for the Mint’s commercial business activities, including the provision of additional services to third parties such as vault, tooling and production services. Further, the Memorandum of Understanding for Commercial Business provides that the Mint can retain and reinvest revenues generated from providing services under commercial arrangements with third parties. Revenues and expenses relating to the Mint’s commercial activities are presented as departmental items in the Mint’s financial statements.15 The Australian Government has not provided any expectations regarding the Mint’s commercial business in terms of the level of activities or revenue to be generated.

1.19 The Mint formalised its approach, and risk mitigation activities, to fill the seigniorage gap with the release of the Strategic Plan 2016–2020 (Strategic Plan) in 2016. The Mint has identified in its Strategic Plan that a key risk it is facing is diminishing demand for coins due to emerging technologies.

1.20 The Mint’s strategic intent is to provide value for money solutions and experiences that deliver profitable growth, through innovation and the sustainable utilisation of its assets.16 The Strategic Plan identifies seven goals to which strategies are aligned. These goals are:

- grow profitable revenue and optimise the use of all ‘leveragable’ assets;

- reduce waste;

- satisfy stakeholder expectations;

- provide a safe, secure and sustainable operational environment;

- build on brand awareness;

- have engaged and motivated staff; and

- be responsive, flexible and agile.

Rationale for undertaking the audit

1.21 The audit was selected to consider ways in which entities can develop strategies to deal with financial challenges associated with changing technologies and business conditions. The audit also aimed to emphasise the need for entities to manage risks associated with using public funds for non-core business, and to conform with relevant legislative requirements.

Audit approach

Audit objective, criteria and scope

1.22 The objective of the audit was to assess whether the Royal Australian Mint’s strategies for addressing the impacts of declining demand for Australian circulating coins are appropriate and effective.

1.23 To form a conclusion against the audit objective, the Australian National Audit Office (ANAO) adopted the following high-level criteria:

- Did the Royal Australian Mint have effective arrangements for developing strategies to address the impacts of declining demand for Australian circulating coins?

- Has the Royal Australian Mint’s implementation of the strategies supported it to effectively address the impacts of declining demand for Australian circulating coins?

- Has the Royal Australian Mint implemented the strategies in line with relevant legislative requirements?

1.24 The scope of the audit included an assessment of the key strategies identified in the Mint’s business planning process for addressing the impacts of declining coin demand. The audit focused on the Mint’s strategies for growing its commercial business activities, including the Mint’s numismatic business activities, foreign coin supply, custom minted products and corporate partnership coin programs. The impacts examined encompassed the level of seigniorage returned to the Australian Government, changes to its commercial activities including the risks associated with the changes, and the financial returns achieved for its commercial business.

Audit methodology

1.25 The audit methodology included:

- examination and analysis of documentation relating to the Mint’s circulating coinage activities, commercial business activities, and the development and implementation of strategies to optimise those activities;

- review and analysis of data on the Mint’s financial results achieved for its circulating coinage and commercial business activities;

- interviews with key personnel at the Mint regarding its circulating coinage and commercial business activities; and

- stakeholder consultation with the Treasury and Department of Finance regarding the Mint’s operations.

1.26 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $135,000.

1.27 The team members for this audit were Esther Barnes, Veronica Clement-Jones and Andrew Morris.

2. Strategies for addressing the impacts of declining demand for Australian circulating coins

Areas examined

The ANAO examined whether the Royal Australian Mint (the Mint) has effective arrangements in place for developing strategies to address the impacts of declining demand for Australian circulating coins, including whether the implementation of the strategies has supported the Mint to effectively address the impacts of declining coin demand. The ANAO also examined whether the strategies developed and implemented by the Mint are appropriate and consistent with its legislative mandate.

Conclusion

The Mint has developed and implemented strategies for addressing the impacts of declining demand for Australian circulating coins that are mainly appropriate and effective. While having increased returns from its commercial business, the Mint has not yet achieved its strategic goal of ‘filling the gap’ caused by the reduction in seigniorage through offsetting growth in earnings from its commercial business. Further, the current financial arrangements do not facilitate the return of the Mint’s commercial profits to the Australian Government to support the achievement of the Mint’s strategic goal.

Areas for improvement

The ANAO made three recommendations aimed at the Mint: facilitating the return of commercial profits to the Australian Government (paragraph 2.46); having consistent definitions for ‘circulating’ and ‘collector’ coins in its documents (paragraph 2.59); and addressing issues with the content and reporting of confidentiality provisions in commercial contracts (paragraph 2.75). The ANAO also suggested that the Mint more fully records risk analyses undertaken for commercial products (paragraph 2.19).

Did the Royal Australian Mint have effective arrangements for developing strategies to address the impacts of declining demand for Australian circulating coins?

The Mint had effective arrangements in place for developing strategies to address the impacts of declining demand for Australian circulating coins. The strategies were informed by a sound evidence base, rigorous analysis and a robust approval process, and were well-integrated into the Mint’s corporate planning processes. Appropriate governance arrangements were in place whereby the Advisory Board, Senior Management Team, Product Approvals Executive and Audit Committee together provided oversight of the development and implementation of strategic projects, including their performance and management of risks. Notwithstanding the effective arrangements in place, there is no evidence that the Mint contemplated not developing strategies to ‘fill the gap’ to avoid taking on the additional commercial risk.

2.1 The Mint began to observe a decline in its core business of supplying Australian circulating coins from around 2013 due to the diminishing use of coins by Australian businesses and consumers. Recognising that it could not influence the external factors involved in the decreasing coin usage, the Mint started to explore opportunities to mitigate the impacts of declining coin demand.

Evidence-based arrangements

Strategic and business planning

2.2 The Mint commenced the development of its Strategic Plan 2016–2020 (Strategic Plan) in 2015 to identify a range of opportunities that had the potential to ‘fill the gap’ in seigniorage caused by the decline in revenue from domestic circulating coins. Five workshops were held in 2015 to develop the Strategic Plan.17 In these sessions, the Mint: undertook environmental scans of the marketplace; considered the likely economic and political outlook; identified the strengths, weaknesses, opportunities and threats within the domestic and international markets; and reviewed its key products categories based on their relative market share and growth opportunities. Potential strategies and opportunities to increase the Mint’s circulating coinage and commercial business were discussed along with business constraints and enablers.

2.3 These sessions have influenced the goals, targets and initiatives described in the Strategic Plan and business unit plans, as well as those articulated in the Mint’s corporate plans and annual reports. The ANAO’s review of the records provided by the Mint, in the form of written briefs or agendas for verbal briefings, found that the Mint had informed the responsible Minister regarding its strategic planning and its intention to ‘fill the gap’ caused by the decline in seigniorage. However, there was no record of the Mint considering not ‘filling the gap’ and accordingly not taking on the additional commercial risk associated with maintaining revenue returns to the Australian Government.

2.4 Implementation of the Strategic Plan is supported by annual strategic planning and business unit planning. The annual strategic planning day involves: review of activities undertaken in the preceding year against outcomes achieved; overview of the Mint’s financial performance; identification of key issues to address; consideration of risks and critical enablers; and identification of action items for the next twelve months. Each business unit of the Mint will subsequently produce an annual business plan to outline the key business unit commitments in accordance with the action items identified on the strategic planning day and the strategic goals of the Mint.

2.5 In mid-2017, the Mint embarked on a program to identify new products and processes that could either contribute to continuous improvement or generate more revenue for the circulating coin and commercial business for the next three to five years. The Mint selected projects to progress based on the leveragability of the projects against the Mint’s competencies. Three new projects were selected with one project approved to proceed to the implementation phase.

2.6 Through its various planning processes and the program to identify new products, the Mint has identified a range of strategies to address the challenge of declining coin demand, which include optimising seigniorage and growing its commercial business domestically and internationally. Specific activities, projects or products were developed under each strategy. Table 2.1 outlines the key activities, projects or products developed and implemented by the Mint to help achieve its goal of growing profitable revenue and optimising the use of assets.18

Table 2.1: Key activities, projects and products for growing circulating coin and commercial business

|

Activity / Project / Product |

Description |

|

Circulating coin |

|

|

‘Unique Circulating Coin’ projecta |

A three-phase project that involves a nationwide competition to be run by the Mint in the second half of 2018 where unique circulating coins will be manufactured and released into general circulation for the Australian public to find. The project aims to increase engagement with the Australian public regarding the use and value of coins. |

|

Coin reform proposal |

A proposal that involves changing the metal content of the silver-coloured coins (five cents, ten cents, 20 cents, 50 cents) and reducing the size of the 50 cent coins. The coin reform proposal entails a minimalist approach whereby modified coins would be progressively released in line with demand with no coin repatriation required. This current proposal was submitted to the Treasury in 2016. |

|

Commercial business |

|

|

Corporate minting programs |

The programs involve minting of theme-based products in partnership with large corporations and supplying the products via new distribution channels. The two largest corporate minting programs have involved partnerships with News Corp Australia (News Corp) and Woolworths Limited (Woolworths).

The partnership with Woolworths started in 2016 for the distribution of the 2016 Australian Olympic and Paralympic Team coin program. Woolworths was identified as a partner due to it being a sponsor for the Olympic and Paralympic Games. Due to the success of the Olympic coin program, the Mint and Woolworths entered into a Memorandum of Understanding for annual corporate minting programs from 2017–2021. The Mint has since produced two other themed coin programs for Woolworths — the 2017 Possum Magic program and the 2018 Commonwealth Games program. Each coin program consisted of coloured $2 collector coins that were distributed through Woolworths cash registers to customers as change. The coin programs also included coin collection folders that featured the $2 coins and additional custom coins, which could be purchased from Woolworths retail networks. |

|

Investment products |

Produce and supply premium-priced precious metal products generally limited by mintage domestically and internationally. Examples include two ounce, ten ounce and one kilogram gold coins. |

|

Medals and medallions |

Produce and supply custom minted medals and medallions for national sporting events and private and public institutions. The Mint produced the prize medals for the 2018 Commonwealth Games and will produce the 2018 Invictus Games prize medals. |

|

Foreign circulating coins |

Target Pacific Island and near neighbour countries for the supply of foreign circulating coins. The Mint will also utilise its expertise to advise and assist international central banks and mints on their coinage and business continuity projects should the opportunity arise. |

|

Vault services |

Utilise excess vault capacity to provide secured cash and investment product storage for foreign nations and customers. |

Note a: The ‘Unique Circulating Coin’ project is the approved project identified through the program for new products in 2017 (see paragraph 2.5).

Note b: The 2018 Anzac Centenary coin program comprises a 15-coin collection.

Source: ANAO’s analysis of Mint documentation.

Market research, expert analysis and external engagement

2.7 The projects and products developed by the Mint were largely informed by market research. Market research programs were undertaken by the Mint to understand market sentiment and support the planning of a particular initiative. The Mint used an online research community to test product ideas and gain feedback about product release. The Mint also met with a group of distributor representatives — the Client Advisory Panel — three times a year to share feedback from the industry and discuss ideas for new products, marketing campaigns and improvements. Further, the Mint commissioned external research agencies to conduct research to address more specific concerns or issues. Examples of specific research undertaken included testing a new coin concept for a 2019 circulating coin program and to predict demand for coins (see paragraph 2.27). Specific market research was also conducted with a commercial partner to test product ideas prior to the launch of a corporate minting coin program.

2.8 The development of projects and products was also informed by the Mint’s monitoring and analysis of activities of overseas mints and industry trends globally. The Mint also leveraged the knowledge and business opportunities gained from attending international coin fairs and conferences. The Mint is active in the numismatic industry internationally, whereby the Chief Executive Officer of the Mint is currently the Secretary-General of the Mint Directors Conference and the Mint provides the secretariat function.19

2.9 Some product ideas developed by the Mint required further research and development to determine their feasibility. The Mint had engaged external partners such as the CSIRO to conduct trials to determine the feasibility of novelty product ideas. The Mint had also engaged an economist from the Australian National University to prepare a financial analysis and business case for a proposed project.

Post-implementation reviews and market surveys

2.10 To identify potential issues and make improvements to its products and initiatives, the Mint conducts post-implementation reviews of projects that are of higher risk profile or unusual in nature. Post-implementation reviews were conducted for the 2016 Olympic and 2017 Possum Magic coin programs to evaluate the effectiveness of the programs in achieving desired outcomes and to identify opportunities for improvement for future coin programs. The Mint advised the post-implementation review for the 2018 Commonwealth Games coin program is underway.

2.11 The Mint also undertakes market surveys to determine the effectiveness of promotion initiatives and customer satisfaction with products. In addition, the Mint has conducted annual omnibus surveys to gauge broader consumer sentiment and awareness towards the Mint brand to help it understand market perceptions of its brand and products. The ANAO reviewed the 2017 survey and 2018 survey conducted by Lonergan Research and Colmar Brunton respectively. Both surveys assessed the community perceptions of the Mint and coins in general. In addition, the 2017 survey assessed consumer awareness of the 2016 Olympic coin program, while the 2018 survey assessed awareness of the 2017 Possum Magic coin program.

Governance arrangements

2.12 The Mint requires a detailed business case to be submitted for review and endorsement for internally developed projects and externally driven commercial products. The Senior Management Team provides approval for, and the Advisory Board reviews and provides advice on, business cases developed for new projects. The Mint’s Product Approvals Executive provides endorsement for business cases for proposed commercial products or programs. Figure 2.1 provides an overview of the governance arrangements in place to support the delivery of the Mint’s Strategic Plan.

Figure 2.1: The Mint’s governance arrangements for strategic activities

Source: ANAO analysis of Mint documentation.

Advisory Board and Senior Management Team

2.13 The Mint established the Advisory Board to provide strategic advice to management and review performance against its Strategic Plan.20 The Advisory Board is directly responsible to the Secretary of the Treasury. It is a non-decision making body and has no executive powers or supervisory functions. The Advisory Board meets quarterly21 and is chaired by an independent member.22 Membership includes two additional independent members, the Chief Executive Officer of the Mint and a representative from the Treasury.

2.14 The Strategic Plan developed by the Mint was presented to the Advisory Board for consideration in September 2015. Business cases for projects were subsequently presented to the Advisory Board for consideration. Updates on key projects and activities were also provided at the Advisory Board meetings, including for the News Corp Anzac Centenary Coin Programs, Woolworths Olympic and Possum Magic coin programs, production of medals for the 2018 Commonwealth Games, tenders for foreign circulating coin supply, and the ‘Unique Circulating Coin’ project. Further, the Mint provided updates to the Advisory Board on its financial performance, risk management, budgets, and strategic and business planning outcomes. Records of the meeting minutes showed that the Advisory Board had raised queries and provided guidance on the activities undertaken by the Mint.

2.15 The Senior Management Team23 meets monthly to discuss policy and corporate governance issues and review the activities of the Mint. The ANAO’s review of the Senior Management Team meeting minutes found that matters regularly discussed included the Mint’s financial performance, individual branches’ performance, risk management, coin supply chain, strategic plan implementation, human resources issues, updates on capital expenditure project proposals, and updates on projects and activities undertaken.

2.16 The ANAO’s review of project plans, including the plan for the ‘Unique Circulating Coin’ project, found that comprehensive scoping was undertaken for each project. The project plans outlined the project’s: alignment to the Mint’s strategic goals; objectives and targets; requirements for production, distribution, logistics, marketing and communication; projected costs and revenue; and risk analysis. The business cases for the projects reviewed were approved by the Senior Management Team and considered by the Advisory Board.

Product Approvals Executive

2.17 The Product Approvals Executive24 is the decision-making body within the Mint that provides formal endorsement for proposed commercial products. Business cases developed for proposed commercial products must be presented to the Product Approvals Executive for approval.

2.18 The ANAO examined the business case documentation developed for the Mint’s commercial products, including the News Corp coin programs, Woolworths coin programs, investment gold coins, and 2018 Commonwealth Games medals and medallions. The examination found that market research was undertaken to test product ideas where relevant, and research and development undertaken where required. The product business cases also included an assessment of the Mint’s capacity to deliver the products, the costing and commercial return to be achieved, promotional opportunities and appropriate distribution channels. In making decisions regarding the proposed commercial products, the Product Approvals Executive considered the business cases submitted and scrutinised the product against the criteria of commercial return, alignment with strategic goals, and reputational and political risks.

2.19 The business case documentation requires identification of relevant major risks and their mitigation strategies. The ANAO’s review of business case documentation for commercial products found that the extent to which risks were assessed varied and limited details were often recorded for risks and their mitigation strategies. When risks were raised and advice provided that treatments were in place, no information was provided as to where the risk treatment plan was located. There would be benefit in the Mint aligning the risk reporting requirements in project documentation with the requirements of the Risk Management Framework.

2.20 The ANAO observed records of risks in the Mint’s corporate risk register with respect to commercial projects and declining demand for circulating coins.

Audit Committee

2.21 The Audit Committee reviews and provides independent advice and assurance regarding the appropriateness of the Mint’s financial reporting, performance reporting, and system of risk oversight and internal controls. The Audit Committee meets at least quarterly or more often if required. There are four committee members — an independent chair, a representative from the Treasury, an official from the Australian Office of Financial Management and an official of the Mint.

2.22 The Mint should note the Independent Review into the operation of the Public Governance, Performance and Accountability Act 2013 and Rule report to the Parliament of September 2018. To strengthen the independence of audit committees, the report recommended that all audit committee members for non-corporate Commonwealth entities not be an official of any Commonwealth entity.25

2.23 The ANAO’s analysis of the Audit Committee meeting minutes found that items discussed included business updates on the various activities of the Mint, the coin supply chain, financial performance of the circulating coin and commercial business line, issues pertaining to external audit and internal audit, matters relating to the Mint’s corporate plan and annual performance statement, and security and fraud reporting. In addition, the committee members were informed of major projects and activities undertaken by the Mint such as the Woolworths corporate minting coin program.

2.24 The Advisory Board, Senior Management Team, Product Approvals Executive and Audit Committee provided appropriate oversight and governance of the Mint’s activities and projects. The Treasury, through its representation at the Mint’s Advisory Board and Audit Committee, was made aware of the corporate strategies and activities of the Mint and given opportunity to raise any concerns. In addition to the requirement to develop a detailed business case, all coins produced and issued by the Mint have to be supported by a currency determination approved by the responsible Minister (refer paragraph 2.49), which provides another level of accountability for the Mint’s products and activities.

Has the Royal Australian Mint’s implementation of the strategies supported it to effectively address the impacts of declining demand for Australian circulating coins?

The Mint’s implementation of strategies has expanded its commercial business activities and generated growth in commercial revenue and profit. Commercial revenue increased from $52.9 million in 2015–16 to $83.7 million in 2017–18, which represented 58 per cent growth over two years. Net profit for the Mint’s commercial business also grew significantly over the period, from $2.5 million to $13.6 million (444 per cent). In 2017–18 revenue from commercial business activities comprised almost 50 per cent of total revenue from the Mint’s operations.

The Mint is yet to achieve its strategic objective of filling the seigniorage gap through growing its commercial business, as seigniorage has declined more than earnings from its commercial business have increased in recent years. Further, the Mint has not yet returned commercial profits to the Australian Government under current financial arrangements. The Mint has forecast much stronger growth in commercial revenues in coming years through its premium products minting operation. If the Mint continues to strongly grow its commercial activities and revenues, consideration needs to be given to the appropriateness of its current status as a non-corporate Commonwealth entity and existing financial arrangements, to facilitate the return of commercial profits to the Australian Government.

Impacts on seigniorage from circulating coin business

2.25 While the Mint has developed strategies to optimise the seigniorage to the Australian Government from the supply of domestic circulating coins, the revenue from circulating coin sales continues to be in decline. The Mint’s core business of supplying Australian circulating coins continues to be affected by declining demand for physical currency due to increased popularity of alternative cashless payment methods.

2.26 Figure 2.2 illustrates the decline in demand for domestic circulating coins in the last five years, with reduced revenue from coin sales to commercial banks by the Mint. There was a higher than expected demand for circulating coins in 2015–16, attributed by the Mint to disruptions in the coin supply chain caused by the entrance of two new carriers in the market and greater consumer demand in tighter economic conditions.26 Even though there might be periodic increases in demand, the Mint’s expectation is that demand will continue to fall but at a slower rate, with the lower value five cents and 10 cents pieces likely to decline at a faster rate.

Figure 2.2: Domestic circulating coin sales and revenue, 2013–14 to 2017–18

Source: ANAO analysis of data provided by the Mint.

2.27 In the last quarter of 2017–18, the Mint commissioned market research agency Colmar Brunton to undertake research into consumer behavioural changes associated with cash usage and their impacts on future demand for coins. The research examined consumer behaviour in the previous five years to help predict expected changes in the next five years. The Colmar Brunton research findings indicate that while demand for coins will continue to decrease over the next five years, the decrease is likely to be at a smaller rate. The Mint will consider the research findings when forecasting circulating coin demand and revenue for future years. Further, the Advisory Board has had the research findings under consideration and received a presentation from Colmar Brunton in July 2018.

2.28 The decline in circulating coin sales resulted in reduced seigniorage payments to the Australian Government, as previously shown in Figure 1.5.

2.29 There has been no direction from the Australian Government or the Treasury of the level of seigniorage expected to be provided to the Australian Government. However, in setting the goals to achieve in its strategic planning process for the period 2016–20, the Mint has aimed to limit the impact of reduction in demand for circulating coins to less than $10 million annual decline in seigniorage over the four year period. In 2017–18, the annual decline in seigniorage was $10.0 million.

2.30 Two strategies the Mint has developed for the Australian circulating coin business — the ‘Unique Circulating Coin’ project and ‘minimalist’ coin reform proposal — have the potential to increase seigniorage to the Australian Government. While the ‘Unique Circulating Coin’ project has been executed, the coin reform proposal has not been implemented.

2.31 At the time of this audit, the ‘Unique Circulating Coin’ project was in the early implementation phase whereby the coins had been distributed to the banks to be released into general circulation. The Mint has estimated that approximately $5 million in incremental seigniorage will be achieved from the implementation of the ‘Unique Circulating Coin’ project.27 In addition to optimising seigniorage to the Australian Government, the Mint aims to leverage the ‘Unique Circulating Coin’ project to entice new coin collectors and build the customer base for its commercial business to help increase numismatic revenue.

2.32 The ‘minimalist’ coin reform proposal the Mint submitted to the Treasury in 2016 has not been progressed. The main benefit of the coin reform proposal is a reduction in material costs from changing the metal content and size of coins, thus decreasing production costs of coins and increasing seigniorage to the Australian Government. The Mint conducted a market survey of key stakeholders including the banks, cash-in-transit providers, vending machine operators, retailers and consumers to ascertain market reaction to the coin reform proposal. The feedback from the survey was generally positive with several stakeholders identifying benefits arising from reduced coin weight associated with the changed coin metal content, including lower freight, storage and processing costs, and less occupational health and safety issues. The Mint has estimated that, depending on the options implemented, the coin reform proposal has the potential to provide a net 10-year benefit of $18 million to $65 million to the Australian Government.

Impacts on commercial business

2.33 The reduction in demand for Australian circulating coins has led to under-utilisation of the Mint’s manufacturing capacity and assets. To optimise the use of production capacity and staff skills, the Mint has increasingly pursued a range of commercial business activities. The Mint’s intention is to grow its commercial business profitably to fill the revenue gap caused by the decline in demand for Australian circulating coins.

2.34 The Mint’s commercial business has two components: numismatic business and international business.28 The implementation of the Mint’s strategies for growing its commercial business has resulted in expanded activities and revenue for its numismatic and international businesses in the last five years. The main contributors to the expansion of the Mint’s commercial business in recent years are outlined below.

- Corporate partnerships with Woolworths and News Corp for the minting of themed coin products have represented the most significant commercial collaborations. The corporate minting programs have established new distribution networks and, based on market research conducted on behalf of the Mint, built brand awareness for the Mint.

- Increased foreign circulating coin supply through securing new coin supply contracts. The Mint supplied foreign circulating coins to five Pacific Island countries in 2014–15, whereas in 2017–18 the supply has grown to seven Pacific Island nations — Samoa, Solomon Islands, Tonga, Vanuatu, Cook Islands, Papua New Guinea and Timor-Leste. The Mint also assisted Samoa, Solomon Islands, Vanuatu, Tonga and Cook Islands in implementing reforms of their coinage system. Further, the Mint has produced collector coins for Pacific Island nations to commemorate specific national events.

- Growth in demand from international dealers for the Mint to supply custom minted investment products, which are premium-priced precious metal coins with limited mintage. In recent years the Mint has collaborated with PAMP SA, a private company based in Switzerland, to produce and release gold investment coins into the international market.

- Production of medals and medallions for Australian universities, government institutions and major sporting events. The Mint was the official provider of the 2018 Gold Coast Commonwealth Games prize medals and commemorative medallions. The Mint was the official supplier of prize medals for the 2018 Invictus Games held in Sydney in October 2018.

- Provision of secure storage and vault services to other nations to utilise spare capacity. The Mint currently provides storage solutions for three international clients.

2.35 As illustrated in Figure 2.3, the expansion of the Mint’s commercial business operations has generated revenue growth for both its numismatic and international business in the last five years. In 2015–16, the Mint generated $52.9 million in commercial revenues, an increase of 52 per cent from the previous year. Commercial revenues increased to $72.0 million (36 per cent) in 2016–17 and further to $83.7 million (16 per cent) in 2017–18.

Figure 2.3: Commercial business revenues, 2013–14 to 2017–18

Source: ANAO analysis of data provided by the Mint.

2.36 The corporate partnership with Woolworths for the distribution of coins under the three coin programs (refer paragraph 2.34) contributed to more than half of the Mint’s numismatic business revenues for 2016–17 and 2017–18. An increase in foreign circulating coin sales to the Pacific Island nations and collector coin sales in overseas markets contributed to significant growth (128.7 per cent) in the Mint’s international business revenues in 2015–16.

2.37 The amount of commercial revenues generated as a proportion of the Mint’s total revenues has also increased, as shown in Figure 2.4, with commercial revenues comprising almost 50 per cent of total revenues from its minting activities in 2017–18. The growth in the proportion of commercial revenues generated indicates that the activities undertaken by the Mint are becoming more commercial in nature.

Figure 2.4: Proportion of commercial business revenues, 2013–14 to 2017–18

Source: ANAO analysis of data provided by the Mint.

2.38 The commercial business of the Mint has been profitable since 2014–15 and achieved a significant increase in profitability in 2017–18. Figure 2.5 shows the commercial earnings before interest and tax, and net profit reported by the Mint in recent years.29

Figure 2.5: Commercial business profitability, 2013–14 to 2017–18

Source: ANAO analysis of data provided by the Mint.

2.39 As discussed previously, the strategic goal of the Mint is to fill the seigniorage gap caused by the declining circulating coin demand. In essence, the Mint is aiming to offset the reduction in seigniorage by an increase in the earnings of its commercial business, in order to maintain contributions to government revenue. This has not yet occurred, notwithstanding increases in revenue, as outlined below.

- Comparing 2017–18 to the average of the previous four years, seigniorage declined by $22.7 million and earnings before interest and tax increased by $17.2 million, a net decrease of $5.5 million.

- For the same comparison period, sales to banks reduced by $28.6 million and commercial revenue increased by $37.1 million, a net increase of $8.5 million.

2.40 The Mint is yet to fully achieve its objective of delivering profits to the Australian Government via the return of its commercial business earnings. The current financial arrangements are such that only seigniorage, administered by the Mint on behalf of the Australian Government, is remitted to the Commonwealth’s Official Public Account. The Mint’s commercial earnings — departmental surplus available to the Mint for use in its ongoing operations — are currently not being returned to the Australian Government.

Return on Net Assets

2.41 The Mint measures its overall financial performance by means of Return on Net Assets. The ratio combines the financial performance for the Mint’s commercial business and domestic circulating coinage function. Figure 2.6 shows the method by which the Mint calculates Return on Net Assets.

Figure 2.6: Formula for calculating Return on Net Assets

Note: Net income comprises commercial business profit and seigniorage. Fixed assets are the tangible property used in production, such as machinery and real estate. Net working capital is the Mint’s current assets (receivables and cash) minus its current liabilities (monies owed).

Source: ANAO representation of Mint information.

2.42 The Mint considers that Return on Net Assets provides an indication of how efficient and effective it is in achieving profit using its net assets. A higher Return on Net Assets indicates better profit performance. Figure 2.7 illustrates the Return on Net Assets achieved by the Mint from 2013–14 to 2017–18. The average Return on Net Assets achieved over that period was 49.4 per cent. The Mint has aimed to achieve a target Return on Net Assets of 40 per cent for the period 2018–19 to 2021–22.30

Figure 2.7: Return on Net Assets, 2013–14 to 2017–18

Note: The significant increase in 2015–16 was mainly due to a higher than expected demand for circulating coins, resulting in higher seigniorage and net income for the Mint (refer paragraph 2.26).

Source: ANAO analysis of data provided by the Mint.

Projected revenues

2.43 The Mint is in an increasingly sound financial position mainly due to the strong profitability of its commercial business activities. Based on analysis of historical performance, environmental factors, market research and approved programs that are in progress, the Mint has generated a five-year revenue forecast for its commercial business. The Mint has also undertaken a forecast for Australian circulating coins.31 Figure 2.8 illustrates the Mint’s forecast for its commercial and domestic circulating coin revenues for the next five years.

Figure 2.8: Revenue forecast for commercial business and circulating coins, 2018–19 to 2022–23

Source: ANAO analysis of data provided by the Mint.

2.44 The key contributor to the forecast commercial revenue growth is premium-priced investment products (precious metal coins), which the Mint is anticipating to grow strongly over the next two to three years following the implementation of the strategy it has in place. If the Mint were to achieve its projected revenue, this would substantially increase net earnings and potentially offset the decline in seigniorage. The ANAO notes uncertainties surrounding the accuracy of estimates of such high rates of growth in new markets, as well as the challenge for the Mint to maintain the financial sustainability of its more mature commercial business streams.

2.45 The Mint’s commercial business activities are governed by the Memorandum of Understanding for Commercial Business with the Treasury and not by enabling legislation. The strong commercial focus of the Mint’s operations is atypical of a non-corporate Commonwealth entity. The current arrangement whereby commercial profits of the Mint are not being returned to the Australian Government is inconsistent with the Mint’s strategic goal of growing its commercial business profitability to maintain contributions to government revenue. If the commercial operations of the Mint continue to grow strongly, the Mint should consider putting options to the Treasury and responsible Minister to determine whether the existing non-corporate governance structure and financial arrangements are the most appropriate to support the Mint’s operations and proper use of public resources.

Recommendation no.1

2.46 The Royal Australian Mint considers the appropriateness of its current governance structure and financial arrangements, and puts options to the Australian Government about these issues to facilitate the return of commercial earnings.

Royal Australian Mint response:

2.47 The Royal Australian Mint agrees and will initiate a discussion with Treasury and Finance to determine the most appropriate governance and related financial structure under which not only can it repatriate the current commercial earnings but one that provides it with the most efficient and effective mode of operating, particularly as its commercial business continues to grow.

Has the Royal Australian Mint implemented the strategies in line with relevant legislative requirements?

In implementing strategies to address the impacts of declining domestic coin demand, the Mint has produced and issued coins in line with relevant requirements in the Currency Act 1965. While not defined under the Act, the Mint should clarify its use of the terms ‘circulating’ and ‘collector’ coins and report these consistently in its various documents. The Mint has also implemented the strategies in line with the requirements of the Public Governance, Performance and Accountability Act 2013. The Mint has not complied with the reporting requirements of the Senate Order on Entity Contracts, and should consider whether to narrow the breadth of confidentiality provisions in corporate minting contracts.

Requirements in the Currency Act 1965

2.48 The Currency Act 1965 (Currency Act) establishes legislative provisions in relation to Australia’s currency, coinage and legal tender. The ANAO assessed whether the Mint’s implementation of strategies for addressing the impacts of declining coin demand have been undertaken in line with requirements of the Currency Act.

Currency determination

2.49 Mintage of coins in Australia is required to be approved by the responsible Minister. The Currency Act provides that the Treasurer, via legislative instrument, determines the specifications — denominations, compositions, weight, design and dimensions — of coins issued by the Mint.32 Currency determinations for approved coins are lodged on the Federal Register of Legislation and tabled in Federal Parliament.

2.50 The Mint uses market-based tools to identify and gauge interest in coin themes each year. The Mint also receives submissions of coin themes from a range of individuals and organisations. The Mint determines appropriate themes for commemorative circulating and numismatic coins in accordance with its coin design policies.33 Proposed designs for coin themes that are considered suitable are submitted by the Mint to the responsible Minister for approval under the Currency Act. In seeking approval to produce coins, the Mint includes in its submission to the Minister: the face value; composition; weight; dimensions; mintage level; issue price (GST-inclusive price) of the coins; and period during which the coins will be released.34

2.51 The ANAO reviewed the 57 and 21 numismatic coin designs issued under the News Corp and Woolworths coin programs respectively and found that all the coins were supported by a currency determination approved by the responsible Minister prior to the coin releases.35 Table 2.2 outlines the relevant currency determinations issued to enable the Mint to produce the numismatic coins under the two corporate coin programs.

Table 2.2: Currency determinations for coins produced under the News Corp and Woolworths coin programs

|

Coin program |

Number of coin designs |

Currency determination |

|

News Corp Coin Programs |

||

|

2015 Centenary of Anzac |

14 |

|

|

2016 Centenary of Anzac |

14 |

|

|

2017 Legends of Anzac |

14 |

|

|

2018 Anzac Spirit |

15 |

|

|

Woolworths Coin Programs |

||

|

2016 Olympics |

6 |

|

|

2017 Possum Magic |

8 |

|

|

2018 Commonwealth Games |

7 |

|

Source: ANAO analysis of coins issued under the News Corp and Woolworths coin programs and their corresponding currency determinations.

2.52 The ANAO’s review of currency determinations also found that the Mint sought and received appropriate Ministerial approvals for upcoming numismatic coin releases from the Mint’s 2018–19 commercial products program.

2.53 The Mint includes as many coins as possible in each currency determination submission to the Minister to limit the volume of determinations that have to be submitted each year.36 A consequence is that some coins will have a longer elapsed time than others between the currency determination being approved and the coin release date. For the currency determinations under Table 2.2, there were seven determinations whereby the time between Ministerial approval and the first coin release was one month. The Mint advised that some coins may be intentionally determined at the latest possible date for commercial or competitive reasons given that a registered currency determination is published in the public domain. The Mint also advised that it will, on rare occasions, commence production of a coin prior to the approval of a currency determination in order to meet production schedules and planned delivery dates. The Mint confirmed that the responsible Minister has not disapproved any coin themes submitted in the last three years. If the Minister were to disapprove a coin submitted for determination and the Mint had started production, the Mint would notify the relevant stakeholders, then quarantine and dispose37 of the coins.

Distinction between ‘circulating’ and ‘collector’ coins

2.54 There is neither any reference to nor legislative definition of the terms ‘circulating’ and ‘collector’ coins in the Currency Act. Although there is no distinction between the two coin types in the legislation, the Mint distinguishes between ‘circulating’ and ‘collector’ coins within the context of coin production and the purpose for which coins are supplied.

2.55 In the context of coin production, circulating coins and collector coins are manufactured using different coin presses and struck at different rates and pressure.38 Collector coins have various product finishes (visual appearance) and quality levels, ranging from base level circulating finish to superior level uncirculated finish and premium proof finish. Due to their higher quality level and production costs (and limited supply), collector coins are generally sold at a premium to their face value.

2.56 In the context of coin distribution, Australian circulating coins are those coins supplied by the Mint to the commercial banks for distribution to the general public for the purpose of trade and commerce. The Coin Supply Agreement with the commercial banks states that circulating coins are to be supplied to the banks at the coins’ face value. In accordance with the Memorandum of Understanding for Circulating Coin between the Mint and the Treasury, circulating coins supplied to the banks are the coins for which seigniorage is payable to the Australian Government.39 Collector coins, which are also known as numismatic or uncirculated coins, are supplied to the Mint’s commercial partners, coin dealers, wholesalers or retail customers. Collector coins are intended to be collectibles, souvenirs or gifts rather than to be used as payment for goods and services. In accordance with the Memorandum of Understanding for Commercial Business between the Mint and the Treasury, the Mint pays the Australian Government royalties on all collector coins issued that bear the effigy of Her Majesty Queen Elizabeth II (refer paragraph 1.13).

2.57 The terms ‘circulating’ and ‘collector’ coins are defined in various documents of the Mint, albeit inconsistently. The definitions make reference to the specific type of coins or the purpose of the coins. Table 2.3 outlines the different definitions from various sources.

Table 2.3: Definitions of ‘circulating’ coins and ‘collector’ coins

|

Term |

Definition |

Source |

|

Circulating coin |

A coin that has been issued by a bank. |

Glossary page on the Mint’s website (https://www.ramint.gov.au/glossary) |

|

Circulating coins |

Coins used as legal tender for the purpose of trade in Australia. |

Memorandum of Understanding for Circulating Coin |

|

Circulating coins |

Coins that are in public circulation. |

Indices section of the Mint’s 2016–17 Annual Report |

|

Collector coins |

Non-circulating coins (also referred to as numismatic coins) and are coins intended for coin collectors and souvenir/gift market rather than for payment of goods and services. |

Memorandum of Understanding for Circulating Coin, Memorandum of Understanding for Commercial Business and Coin Supply Agreement with banks |

|

Uncirculated coin |

A coin which has not been distributed or used as currency. |

Glossary page on the Mint’s website (https://www.ramint.gov.au/glossary) |

|

Uncirculated coin |

The description of a coin which has not been in circulation. It may however, suffer from minor production faults such as insignificant rim marks or other slight imperfections. |

Indices section of the Mint’s 2016–17 Annual Report |

Source: ANAO analysis of the Mint’s documents.

2.58 The ANAO’s review of the agreements entered into by the Mint with News Corp and Woolworths for the themed coin programs observed that while the agreements specified the quality level or finish of the coins produced, there was nothing in the agreements that definitively identified whether the coins were ‘circulating’ or ‘collector’ coins. According to the different definitions outlined in Table 2.3, the themed coins could arguably fall into either the ‘circulating’ or ‘collector’ coin categories. The Mint advised that the themed coins were produced at the quality level of collector coins and were intended to be supplied as collector coins. The Mint has treated the themed coins as collector coins in line with the definitions provided in the Memorandum of Understanding for Collector Coin, Memorandum of Understanding for Circulating Coin and Coin Supply Agreement. Accordingly, royalties were paid on the themed coins and the revenues earned were accounted as departmental revenues in the Mint’s financial statements.

Recommendation no.2

2.59 The Royal Australian Mint clarifies its use of the terms ‘circulating’ and ‘collector’ coins, and reports these consistently in its various documents including commercial agreements.

Royal Australian Mint response:

2.60 The Royal Australian Mint agrees that it does need to provide clarity around the use of the terms ‘circulating’ and ‘collector’ coins recognising that coins sold to banks for the primary purpose of transacting are generally accepted as being ‘circulating’. The Mint will discuss with Treasury officials and incorporate definitions into the MOU’s with Treasury.

Issue price of coins

2.61 There is no legislative requirement under the Currency Act with respect to the issue price of circulating coins or collector coins, other than for coins of a denomination of $5 or more and precious metal coins. The issue price of coins of $5 or more and precious metal coins is to be determined by the responsible Minister via currency determination.40

2.62 In line with the Coin Supply Agreement with the commercial banks, the Mint issues circulating coins to the banks at the coins’ face value. This is also in accordance with the terms set out in the Memorandum of Understanding for Circulating Coin between the Mint and the Treasury.

2.63 The Memorandum of Understanding for Commercial Business between the Mint and the Treasury specifies the method to calculate the face value of precious metal coins. The ANAO’s examination of the Mint’s currency determination submissions to the Minister found that the Mint had stated in the submissions whether the face value of precious metal coins was consistent with the specified calculation method. In addition, the Mint had included the proposed issue price of precious metal coins and coins of denomination of $5 or more in the submissions to the Minister.

2.64 Although there is no legislative requirement for the Minister to determine the issue price of other collector coins, the Mint had included the proposed issue price of all collector coins in its currency determination submissions to the Minister. The ANAO’s review of the Mint’s submissions for the currency determinations in Table 2.2 found that the proposed issue price of the coins supplied under the News Corp and Woolworths coin programs was consistent with the pricing in each of the coin program agreements. In addition, the issue price for the themed coins supplied in partnership with News Corp and Woolworths was approved by the Minister.

2.65 For the Woolworths coin programs, the price of each of the $2 themed coins sold to Woolworths was at a marginal premium to the coin’s face value. This is in contrast to other collector coins sold by the Mint, which are usually issued at a substantial premium to their face value. The provisions of the Currency Act do not prevent the Mint issuing the themed collector coins to Woolworths at the agreed pricing. Further details regarding the $2 themed coins issued under the Woolworths coin programs are outlined below.

- The coloured $2 themed coins were produced and issued by the Mint as collector coins (see ‘Corporate minting programs’ in Table 2.1 and paragraph 2.58). No seigniorage was provided to the Australian Government on the basis that the coins were not circulating coins supplied to the commercial banks (see paragraph 2.56). The $2 themed coins were distributed through Woolworths cash registers as change to customers. Some of these $2 themed coins would have been put into public circulation to be used as currency as not everyone who came into contact with the coins kept them as collector coins.41

- The contract price to Woolworths of the themed coins included GST, and was reduced by a marketing allowance to offset some of the costs associated with the marketing and promotion of the coin program.

- Despite the contract price of the coins being at a small premium to their face value, the Mint achieved very positive gross margins for the Woolworths coin programs.

- The Mint advised the ANAO that the pricing of the coin programs, including the themed $2 coins and coins in cards and folders, distributed through Woolworths stores reflected typical retail buyer commercial negotiations.

Requirements in the Commonwealth Resource Management Framework

2.66 The Commonwealth Resource Management Framework governs how officials in the Commonwealth public sector use and manage public resources. The foundation of the framework is the Public Governance, Performance and Accountability Act 2013 (PGPA Act). The PGPA Act establishes a system of governance, performance and accountability for public resources managed by Commonwealth entities and Commonwealth companies. The PGPA Act was intended to ensure that entities demonstrate to the Parliament and the public that resources are being used and managed effectively, efficiently, economically and ethically.

Public Governance, Performance and Accountability Act 2013

2.67 Being a non-corporate Commonwealth entity, the Mint is subject to the PGPA Act including the supplementary Public Governance, Performance and Accountability Rule 2014 (PGPA Rule). The ANAO examined, at a high level, whether the Mint’s implementation of the strategies for addressing the impacts of declining coin demand is in line with relevant aspects of the PGPA Act and PGPA Rule. The ANAO found that the Mint has implemented the strategies in line with the governance, performance and accountability requirements of the PGPA Act and PGPA Rule, as outlined in Table 2.4.

Table 2.4: The Mint’s compliance with the PGPA Act and PGPA Rule requirements

|

Aspects of PGPA Act and PGPA Rule |

Details of the Mint’s compliance |

|

Governance and accountability |

|

|

Duty to keep responsible Minister informed |

|

|

Planning, performance and accountability |

|

Note a: The ANAO did not assess whether: the corporate plan met the content and publication requirements of the PGPA Rule; the Mint’s performance criteria were appropriate; and effectiveness of the systems and processes for performance measurement and reporting.

Source: ANAO analysis.

Confidentiality provisions and Senate Order contracts

2.68 The three coin program agreements between the Mint and Woolworths contained confidentiality provisions that bound the parties to the agreements. The confidentiality clauses prohibited the Mint and Woolworths, without prior written permission of the other party, from revealing or disclosing to any third party the confidential information of the other party. Confidential information was defined in the agreements to be any information in connection with the agreements in any way.42

2.69 The confidentiality provisions were very broad and further covered by an indemnity from the Mint to Woolworths if the Mint disclosed confidential information associated with the agreements. The three agreements contained parliamentary disclosure and ANAO access clauses. The use of broad confidentiality provisions in the agreements was agreed as part of the negotiation of the contract, on the basis of the need to protect commercially sensitive information, intellectual property and commercial interest of Woolworths and the Australian Government. However, the Mint should consider whether it is appropriate to grant such broad confidentiality provisions when entering into commercial agreements on behalf of the Australian Government going forward.

2.70 The Senate Order on Entity Contracts (the Senate Order) is one of a number of mechanisms to encourage accountability and transparency in Australian Government procurement. The Senate Order requires Ministers to table letters in the Senate to outline compliance with the Senate Order for each entity in their portfolio. To support compliance with the Senate Order, non-corporate and corporate Commonwealth entities have to develop an internet listing twice a year that identifies contracts entered into or not fully performed during the preceding calendar or financial year, valued at or above $100,000 (GST-inclusive), along with details relating to each of those contracts.43