Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Senate Order for Departmental and Entity Contracts (Financial Year 2016–17 Compliance)

Please direct enquiries through our contact page.

The objective of this audit was to assess the appropriateness of the use and reporting of confidentiality provisions in a sample of Australian Government contracts.

Auditor-General’s foreword

I am pleased to present the Australian National Audit Office’s (ANAO) performance audit report of the Senate Order for Departmental and Entity Contracts (Financial Year 2016–17 Compliance) the twentieth and final in a series of ANAO audits of compliance with the Senate Order as requested by the Senate.

The Senate Procedural Order of Continuing Effect 11: Departmental and Agency Contracts (The Senate Order/the Order) Order was introduced in 2001 and sought to improve public access to information about government contracting. At that time, the level of information available to the Parliament and to the public about government contracting, had not kept pace with the increased rate of contracting out, particularly in the outsourcing of many functions previously performed by government entities.

A motion by Senator Andrew Murray (Motion No. 489 or ‘the Murray Motion’), which was passed on 20 June 2001, led to the establishment of the Senate Order. The Order has been amended six times since 2001, most recently in 2015. The main principle on which the Senate Order was based is that parliamentary and public access to government contract information should not be prevented, or otherwise restricted, through the use of confidentiality provisions unless there is sound reason to do so.

Since the introduction of the Senate Order the ANAO has conducted 20 cross entity audits of the use of confidentiality provisions in contracts across 140 entities. The proportion of Commonwealth contracts valued at $100,000 or more reported to contain confidentiality provisions has decreased over time, from around 9.7 per cent in the 2009 calendar year to around 4.1 per cent in 2017. Over the first eight years of Senate Order audits the ANAO reported the use of confidentiality provisions across the sample of audited entities only and found a decrease in the use of these provisions from 26 per cent in 2002 to nine per cent in 2008 for the respective samples. In spite of the decreased use of confidentiality provisions, the ANAO has observed that there remains scope for entities to improve their assessment of supplier requests for confidentiality and their documentation of decision-making.

Going forward, there would be merit in the Department of Finance (Finance) monitoring how entities are applying the department’s guidance to support government entities to be more accountable and transparent in their purchasing arrangements. Entities should also engage directly with Finance to discuss the complexities associated with their contracting environment.

Summary and recommendations

Background

1. Inappropriate use of confidentiality provisions in government contracts can impede accountability and transparency in government purchasing. The Senate Procedural Order of Continuing Effect: Entity Contracts1 (the Senate Order/the Order) is based on the principle that parliamentary and public access to government contract information should not be prevented, or restricted, through the use of confidentiality provisions, unless there is sound reason to do so. Successive governments have agreed to comply with the Senate Order and have required entities to put in place suitable procedures to support Ministers to comply with it.

2. The Order requires Ministers to table letters of advice that all entities which they administer have placed on the internet lists of contracts valued at $100,000 or more, by no later than two calendar months after the end of each financial and calendar year. These lists are to:

- include the details of each contract which has not been fully performed or which has been entered into during the previous 12 months; and

- indicate whether the contracts contain confidentiality provisions or other requirements of confidentiality, and a statement of the reasons for the confidentiality.

3. The Department of Finance (Finance) is responsible for the whole-of-government procurement policy and issues guidance to entities on their obligations, as well as tools to assist their awareness and compliance. Finance’s guidance in relation to compliance with the Senate Order includes:

- Resource Management Guide No. 403—Meeting the Senate Order on Entity Contracts (RMG 403)2—which provides advice to entities about how to comply with the Senate Order, including how to use confidentiality provisions appropriately;

- Buying for the Australian Government, Confidentiality Throughout the Procurement Cycle3 (the Guidance)—which contains the Confidentiality Test, which is designed to assist entities to determine the appropriate inclusion of confidentiality provisions in contracts; and

- a dedicated email, procurementagencyadvice@finance.gov.au, to allow agencies to ask Finance questions and raise concerns regarding procurement.

Rationale for undertaking the audit

4. The Auditor General decided to undertake performance audits of entities’ use and reporting of confidentiality provisions as requested under the Senate Order. The coverage of this report reflects requests made to the Auditor-General in the:

- initial Senate Order (20 June 2001) which asked the Auditor-General to examine a number of contracts listed on entity websites and indicate whether there had been any inappropriate use of confidentiality provisions; and

- amended Senate Order (27 September 2001) which requested that the Auditor-General include an examination of a number of contracts that have not been included in a list and to indicate whether the contracts should be listed.

5. This is the second of two reports the Auditor-General was requested to provide to the Senate when the Senate Order was amended on 14 May 20154 and is the twentieth audit of the Senate Order undertaken since 2001.

Audit objective and criteria

6. The objective of the audit was to assess the appropriateness of the use and reporting of confidentiality provisions in a sample of Australian government contracts. The ANAO’s assessment was based on the following criteria:

- confidentiality provisions have been used appropriately in a sample of Australian Government contracts which were reported by the selected entities to contain confidentiality provisions;

- contract information listed on AusTender was accurate; and

- Ministers’ letters have been tabled in accordance with the timing and content requirements of the Senate Order.

7. The entities assessed for criterion one were the: Australian Electoral Commission (AEC); Great Barrier Reef Marine Park Authority (GBRMPA); Department of Home Affairs (Home Affairs)5; and Department of Infrastructure, Regional Development and Cities (Infrastructure).

Conclusion

8. Confidentiality provisions continue to be inappropriately used and reported by Australian Government entities. Transparency in government contracting would benefit from entities reviewing how confidentiality is assessed and reported and seeking assistance from Finance to confirm that there is a sound reason to apply confidentiality provisions in contracts.

9. Overall compliance with the Senate Order is still not being achieved. There remains scope for entities to be clearer in their application of the Department of Finance’s guidance on assessing and reporting confidentiality and for that guidance to provide further context to assist entities to appropriately assess the supplier claims.

10. Financial year 2016–17 results indicate significant improvement in the accuracy of contract information reported on AusTender.

11. For calendar years 2016 and 2017 respectively, 58 per cent and 71 per cent of Ministers’ letters were tabled in accordance with the timing and content requirements of the Senate Order. These results are broadly in line with results for calendar year 2015.

Supporting findings

Use of Confidentiality provisions

12. In the sample of contracts, the ANAO found that for 86 per cent of the contracts examined, the use of confidentiality provisions did not comply with Department of Finance guidance (60 per cent) or the contracts did not contain specific confidentiality provisions and were therefore misreported (26 per cent). The audited entities were not able to consistently demonstrate the objective basis for suppliers’ claims for confidentiality or their reasons for agreeing for the information to remain confidential.

13. The information contained within 53 of the 62 contracts reviewed (85 per cent) aligned with that reported on AusTender.

14. Of the 62 confidential and non-confidential contracts examined by the ANAO, 59 contracts (95 per cent) included both parliamentary disclosure and ANAO access clauses.

Ministers’ letters

15. Ministers provided letters of advice to the Senate for: 50 non-corporate Commonwealth entities (58 per cent) by the due date for the 2016 calendar year reporting period (28 February 2017); and 109 corporate and non-corporate Commonwealth entities (71 per cent) by the due date for the 2017 calendar year reporting period (28 February 2018).

16. The content of the Ministers’ letters issued for non-corporate Commonwealth entities largely complied with the content requirements of the Senate Order for excluded contracts. ANAO analysis of Ministers’ letters for the 2017 calendar year reporting period suggests that some corporate Commonwealth entities could better understand their obligations under the Senate Order regarding excluded contracts.

17. Entities’ listings did not always meet the content requirements of the Senate Order. The most frequent errors in listings were not including the subject matter and not specifying reasons for confidentiality.

18. Sixty per cent of non-corporate Commonwealth entities reported a cost of complying with the Senate Order in the 2016–17 financial year and 53 per cent of corporate Commonwealth entities reported a cost of complying with the Senate Order for the 2017 calendar year. Overall costs ranged from nil to $49,443.

Recommendations

Recommendation no.1

Paragraph 2.14

That all entities meet all mandatory requirements set out in Senate Order 13: Entity Contracts, in particular, that contract listings do not contain any inappropriate confidentiality provisions.

Australian Electoral Commission response: Agreed.

Great Barrier Reef Marine Park Authority response: Agreed.

Department of Home Affairs response: Agreed.

Department of Infrastructure, Regional Development and Cities response: Agreed.

Recommendation no.2

Paragraph 2.24

That all entities document their consideration of supplier confidentiality requests against the Confidentiality Test to provide a record of the reasons for agreeing to any confidentiality provisions and the basis for future decisions.

Australian Electoral Commission response: Agreed.

Great Barrier Reef Marine Park Authority response: Agreed.

Department of Home Affairs response: Agreed.

Department of Infrastructure, Regional Development and Cities response: Agreed.

Entity responses

19. Letters constituting the full responses from each entity are reproduced at Appendix 1. Summary responses provided by the Department of Home Affairs and the Department of Infrastructure, Regional Development and Cities are also included.

Key learnings for all Australian Government entities

Below is a summary of key learnings, including instances of good practice, which have been identified in this and previous audits of the Senate Order that may be relevant for the operations of other Commonwealth entities.

Procurement

1. Background

The Senate Order

1.1 Inappropriate use of confidentiality provisions in government contracts can impede accountability and transparency in government purchasing. To encourage accountability and transparency, Australian Government Ministers are required to report on the use of confidentiality provisions in contracts established by government entities. This requirement was initially established in 2001 under Senate Procedural Order of Continuing Effect: Departmental and Agency Contracts and amended on 14 May 2015—Senate Order 13: Entity Contracts (the Senate Order/the Order).6

1.2 The main principle on which the Senate Order is based is that parliamentary and public access to government contract information should not be prevented, or otherwise restricted, through the use of confidentiality provisions, unless there is sound reason to do so. Successive governments have agreed to comply with the Senate Order7 and have required entities to put in place suitable procedures to support Ministers to comply with it.

1.3 The Senate Order is one of a number of mechanisms to promote transparency in Australian Government contracting. Other mechanisms include the reporting on AusTender8 of procurement contracts, the production of lists of grants—as well as the publication of grants on entities’ websites—and the presentation of selected contract information in entities’ annual reports.9

Reporting required under the Senate Order

1.4 By the last day of February and August each year Ministers must table in the Senate letters advising that the following information10 is listed on the website of each entity they are responsible for:

- [a list identifying] each contract11 entered into by the entity which has not been fully performed or which has been entered into during the previous 12 months, and which provides for a consideration to the value of $100,000 or more;

- details of the contractor, the amount of the consideration, the subject matter of each contract, the commencement date of the contract, the duration of the contract, the relevant reporting period and the twelve-month period relating to the contract listings;

- an indication of whether each contract contains provisions requiring the parties to maintain confidentiality of any of its provisions, or whether there are any other requirements of confidentiality, and a statement of the reasons for the confidentiality; and

- an estimate of the cost of complying with [the] Order and a statement of the method used to make the estimate.12

1.5 In 2001, the Senate requested the Auditor‐General examine a number of the contracts reported to contain confidentiality provisions and report any inappropriate use of these provisions annually.13 This audit is the twentieth in a series of audits conducted by the ANAO since 2001 and meets the Senate’s request that the Auditor-General report findings by 30 September 2018.

Senate Order Guidance

1.6 The Department of Finance (Finance) is responsible for the whole-of-government procurement policy and issues guidance to entities on their obligations, as well as tools to assist their awareness and compliance. Finance’s guidance in relation to compliance with the Senate Order includes:

- Resource Management Guide No. 403—Meeting the Senate Order on Entity Contracts (RMG 403)14—which provides advice to entities about how to comply with the Senate Order, including how to use confidentiality provisions appropriately;

- Buying for the Australian Government, Confidentiality Throughout the Procurement Cycle15 (the Guidance)—which contains the Confidentiality Test16, which is designed to assist entities to determine the appropriate inclusion of confidentiality provisions in contracts; and

- a dedicated email, procurementagencyadvice@finance.gov.au, to allow agencies to raise questions and concerns regarding procurement.

Audit objective, criteria and scope

1.7 The objective of the audit was to assess the appropriateness of the use and reporting of confidentiality provisions in a sample of Australian government contracts. The ANAO’s assessment was based on the following criteria:

- Ministers’ letters have been tabled in accordance with the timing and content requirements of the Senate Order;

- confidentiality provisions have been used appropriately in a sample of Australian Government contracts which were reported by the selected entities to contain confidentiality provisions; and

- contract information listed on AusTender was accurate.

Audit Methodology

1.8 In conducting the audit the ANAO:

- examined Ministers’ letters of advice for the:

- 2016 and 2017 calendar years relating to all non-exempt non-corporate Commonwealth entities; and

- 2017 calendar year relating to corporate Commonwealth entities17;

- completed a desktop review of non-corporate and corporate Commonwealth entity website Senate Order listings for the 2016–17 financial year and 2017 calendar year respectively; and

- examined a sample of 46 confidential and 16 non-confidential contracts for the 2016–17 financial year obtained from four designated entities. The:

- Australian Electoral Commission (AEC);

- Great Barrier Reef Marine Park Authority (GBRMPA);

- Department of Home Affairs (Home Affairs)18; and

- Department of Infrastructure, Regional Development and Cities (Infrastructure).

1.9 The entities examined included one entity that has not previously been subject to the Senate Order audit (GBRMPA) and two entities that had been designated previously but not for some years (AEC and Infrastructure). Each of these three entities had a high proportion of confidential contracts compared with other Commonwealth entities. The sample also included one entity (Home Affairs), previously covered by Senate Order testing, with a high value of confidential contracts when compared to other entities. The confidentiality assessment conducted by the ANAO is based on the requirements set out in the current Senate Order and Finance guidance.19

1.10 The sample of contracts containing confidentiality provisions obtained from the entities represents all relevant contracts the entities listed on the AusTender Senate Order listing over the reporting period. This sample is described further at paragraph 2.5. The non-confidential contracts were randomly selected. The contract sample does not represent the use of provisions by all entities across the Commonwealth.

1.11 Where previous Senate Order audits designated entities with excluded contracts, these exclusions were tested for accuracy.20 None of the four designated entities for the current Senate Order audit reported any excluded contracts for the 2016–17 financial year testing period.

1.12 For these entities, Table 1.1 outlines the procurement information reported in the 2016–17 financial year Senate Order listings.

Table 1.1: Summary of procurement contract information reported by the audited entities in the 2016–17 financial year Senate Order listings

|

Contract information |

AEC |

GBRMPA |

Home Affairsa |

Infrastructure |

|

Total number of procurement contracts reported |

387 |

47 |

2,198 |

506 |

|

Total value ($ millions) of procurement contracts |

$408 |

$32 |

$16,170 |

$965 |

|

Total number of reported confidential contractsb and the percentage of procurement contracts reported as containing confidentiality provisions |

23 5.9% |

6 12.7% |

18 0.82% |

8 1.6% |

|

Total value ($ millions) of reported confidential contracts |

$50.4 |

$9.4 |

$5,211 |

$42.4 |

|

Percentage value of reported confidential contracts against total procurement contracts |

12.4% |

29.3% |

32.2% |

4.4% |

|

Contract sample information |

||||

|

Number of the contracts reported as containing confidentiality provisions, sampled in audited entities and contract value in millions |

22 $39.4 |

6 $9.4 |

10 $5,116.1 |

8 $42.4 |

|

Number of the contracts not reported as containing confidentiality of provisions, in sampled audited entities and contract value in millions |

4 $0.9m |

4 $0.8 |

4 $2.4m |

4 $1.7 |

|

Total number of contracts (confidential and non-confidential) sampled in each entity and total contract value in millions |

26 $40.2 |

10 $10.2 |

14 $5,118.5 |

12 $44.1 |

Note a: Contracts sampled from the Department of Home Affairs only included contracts entered into by the then Department of Immigration and Border Protection over the relevant period.

Note b: The ANAO’s sample excluded nine contracts that had been reported in previous Senate Order reporting periods to avoid duplication.

Source: ANAO analysis of AusTender data.

1.13 The audit was conducted in accordance with the ANAO Auditing Standards at a cost to the ANAO of approximately $326,900.

1.14 The team members for this audit were Hannah Climas, Tracy Cussen, Michael Fitzgerald, Christine Preston and Sally Ramsey.

2. Use of confidentiality provisions

Areas examined

This chapter examines the appropriateness of the use and reporting of specific confidentiality provisions in a sample of contracts and whether the details of the sampled contracts were accurately listed on AusTender.

Conclusion

Overall compliance with the Senate Order is still not being achieved. There remains scope for entities to be clearer in their application of the Department of Finance’s guidance on assessing and reporting confidentiality and for that guidance to provide further context to assist entities to appropriately assess the supplier claims.

Financial year 2016–17 results indicate significant improvement in the accuracy of contract information reported on AusTender.

Areas for improvement

The ANAO made two recommendations aimed at improving the transparency of reporting of government contracting.

Were confidentiality provisions used appropriately in the sample of contracts?

In the sample of contracts, the ANAO found that for 86 per cent of the contracts examined, the use of confidentiality provisions did not comply with Department of Finance guidance (60 per cent) or the contracts did not contain specific confidentiality provisions and were therefore misreported (26 per cent). The audited entities were not able to consistently demonstrate the objective basis for suppliers’ claims for confidentiality or their reasons for agreeing for the information to remain confidential.

2.1 Entities are required to identify in their contract listings whether any of the listed contracts contain confidentiality provisions.21 The two types of provisions that entities are to identify are described in Resource Management Guide No. 403—Meeting the Senate Order on Entity Contracts (RMG 403) as:

- those that make specific information contained in the contract confidential (referred to in the Order as ‘provisions requiring the parties to maintain confidentiality of any of its provisions’); and

- those that protect the confidential information of the parties that may be obtained or generated in carrying out the contract but cannot be specifically identified when the contract is entered into (referred to in the Order as ‘other requirements of confidentiality’).

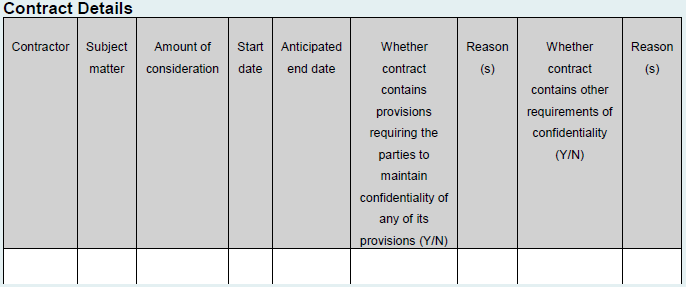

2.2 Table 2.1 outlines the differences between the two types of specific confidentiality provisions and provides examples of how they may be applied.

Table 2.1: Description of the two specific confidentiality provision types

|

Confidentiality provision type |

Description |

Example of the use and reporting of the provision type |

|

Requires the parties to maintain the confidentiality of any contract provisions |

Relates to specific confidential information that is actually contained in the contract |

The contract specifies that pricing information in the contract is to remain confidential. The pricing information in the contract provides sufficient information to make a reasonable estimate of the supplier’s profit margin. Senate Order contract listing details:

|

|

Other requirements of confidentiality |

Relates to confidential information obtained or generated in performing the contract |

The contract specifies that the results of employee medical testing to be generated as part of the contract’s performance are to remain confidential as disclosure would cause detriment. Contract listing details:

|

Source: ANAO, based on RMG 403.

2.3 Entities are to identify the reasons for the inclusion of confidentiality provisions under specific categories in the contract listing that has been placed on AusTender. Should a contract contain a confidentiality provision that does not fall within a standard category, entities are to identify the provision as ‘other’ and provide a reason for the inclusion of the provision. Of the 1049 contracts listed as containing confidential provisions for the 2017 calendar year, 1556 reasons22 were recorded on AusTender. Table 2.2 outlines the reason(s) recorded in AusTender for the use of confidentiality provisions in government contracts.

Table 2.2: The use of confidentiality provisions in government contracts: calendar year 2017

|

Standard categories |

Number of provisions |

|

Internal costing/profit information |

625 |

|

Trade secrets (including intellectual property) |

342 |

|

Other |

246 |

|

Privacy Act 1988 |

160 |

|

Public Interest |

135 |

|

Statutory secrecy provisions |

48 |

|

Total reasons recorded on AusTender |

1556 |

Source: ANAO analysis.

The appropriate use of confidentiality provisions in a sample of contracts

2.4 To assess the appropriateness of the use of confidentiality provisions for the purposes of this audit the ANAO reviewed a sample of contracts identified as containing confidentiality provisions. In order to undertake this assessment, the ANAO had regard to Finance’s current guidance, Buying for the Australian Government, Confidentiality throughout the Procurement Cycle (the Guidance). The Confidentiality Test outlined in the Guidance establishes four criteria (as shown in Table 2.3), all of which must be met for a supplier’s information to be considered confidential.

Table 2.3: The Confidentiality Test

|

Criterion 1: The information to be protected is specifically identified |

|

A request for inclusion of a provision in a contract that states that all information is confidential does not pass this test. Individual items of information, for example pricing, must be separately considered. However, where an entity contract may be used for future cooperative procurements entities generally should not include provisions that would prevent other Commonwealth agencies from accessing the terms and conditions, including pricing of the contract. |

|

Criterion 2: The information is commercially ‘sensitive’ |

|

The information should not generally be known or ascertainable. The specific information must be commercially ‘sensitive’ and it must not already be in the public domain. A request by a potential supplier to maintain the confidentiality of commercial information would need to show that there is an objective basis for the request and demonstrate that the information is sensitive. |

|

Criterion 3: Disclosure would cause unreasonable detriment to the owner of the information or another party |

|

A potential supplier seeking to maintain confidentiality would normally need to identify a real risk of damage to commercial interests flowing from disclosure which would cause unreasonable detriment. For example, disclosure of internet price lists would not harm the owner, but disclosure of pricing information that reveals a potential supplier’s profit margins may be detrimental. |

|

Criterion 4: The information was provided under an understanding that it would remain confidential |

|

This requires consideration of the circumstances in which the information was provided and a determination of whether there was a mutual, express or implied understanding that confidentiality would be maintained. The terms included in request documentation and in draft contracts will impact on this. For example, a request for tender and draft contract which included specific confidentiality provisions would support an assertion by a potential supplier that the entity has agreed to accept information on the understanding that it would remain confidential. |

Source: Finance, Buying for the Australian Government, Confidentiality throughout the Procurement Cycle, paragraph 9.

2.5 To select the confidential contracts for the audit, the ANAO identified all contracts that had been reported by the four audited entities in their procurement contract listings on AusTender for the 2016–17 financial year. Of these listed contracts, the ANAO identified those that contained provisions requiring the parties to maintain confidentiality of provisions.23 Forty-six confidential contracts were examined for this audit.

Applying the Confidentiality Test

2.6 The Confidentiality Test applies to supplier contract provisions. From the ANAO’s sample of 46 confidential contracts:

- 43 contracts contained supplier contract provisions and were examined against the Confidentiality Test; and

- three contracts contained Commonwealth confidentiality clauses only and were not examined against the Confidentiality Test.24

2.7 Of the 43 contracts examined, confidentiality provisions were appropriately used and reported for six contracts (14 per cent). The results of the ANAO’s analysis, based on the application of the Confidentiality Test to the reported confidentiality provisions, are shown in Figure 2.1.

Figure 2.1: Contract analysis result: appropriateness of the use and reporting of supplier confidentiality provisions

Note: Areas of incorrect reporting and/or use of confidentiality provisions are shown with dark blue shading.

Source: ANAO analysis.

Confidential information in the contract is specifically identified (Criterion 1 and Criterion 4 of the Confidentiality Test)

2.8 For a contract to be assessed as meeting Criterion 1 of the Test, at least one contract provision must specifically identify the information that is to be protected.25 In the audit sample, 32 of the 43 contracts (74 per cent) identified specific information to be kept confidential and the remaining 11 contracts did not identify specific information to be kept confidential.

Information is commercially sensitive and would cause detriment if made public (Criterion 2 and Criterion 3 of the Confidentiality Test)

2.9 The Confidentiality Test states that for information to be considered confidential it must be shown to be commercially sensitive and that the disclosure of the information would cause unreasonable detriment to the owner of the information or another party. This type of information would not normally be in the public domain. Examples of information that may be included in contracts requiring protection through the use of confidentiality provisions include:

- pricing information that would reveal a supplier’s cost or profit margins;

- unique industrial processes, formulae, product mixes, customer lists, engineering and design drawings and diagrams, and accounting techniques;

- personal information requiring protection under the Privacy Act 1988; and

- information of a nature that should be protected on the basis of public interest or under statutory secrecy provisions.26

2.10 The ANAO assessed 32 contracts which had specifically identified the information to be protected through the use of confidentiality provisions against Criteria 2 and 3 of the Confidentiality Test. Of these 32 contracts, six were assessed as meeting Criteria 2 and 3 of the Confidentiality Test. As already noted, each contract may contain multiple provisions to be kept confidential and consequently multiple reasons may be reported. In addition, work orders and other similar contracts, may be entered into under an overarching deed of agreement. Confidentiality provisions agreed to in the deed will then apply to the individual orders.27 Of the 26 contracts assessed as not meeting Criteria 2 and 3:

- 25 claimed protection of supplier internal costing/profit information, but the contracts did not contain pricing information which revealed the suppliers’ internal costs or profit margins;

- two claimed confidentiality under the Privacy Act 1988, but did not contain information of a personal nature as described by the Act; and

- three claimed intellectual property, but did not contain uniquely original or proprietary information.28

Trends in the use of confidentiality provisions

2.11 Figure 2.2 outlines the trends over time in the use of confidentiality provisions in contracts. There has been improvement in meeting Criterion 1 of the Confidentiality Test, which requires that the information to be protected is specifically identified. In the current audit, 32 of the 43 contracts assessed met this criterion (see also paragraph 2.8). Of the 11 contracts assessed as not meeting Criterion 1, seven were a reporting error. For these seven contracts information that would be generated in carrying out the contract was identified. These contracts were incorrectly reported as containing confidential provisions instead of as having ‘other requirements of confidentiality’ (see paragraph 2.1).

Figure 2.2: Trends in the appropriate use of confidentiality provisions in contracts over timea

Note a: Results for 2006 to 2015 are for calendar years. Results for 2016–17 represent the financial year.

Source: ANAO analysis.

2.12 In each of the ANAO’s audits of the Senate Order since 200629, apart from 2015, fewer than 40 per cent of contracts were assessed as meeting the Confidentiality Test. In the 2016–17 financial year, fourteen per cent of contracts were assessed as meeting the Confidentiality Test. The results of this audit indicate that there continues to be an inappropriate use and misreporting by entities of the types of confidentiality provisions and reasons for their use.

2.13 Given the continued misuse of confidentiality provisions in government contracts demonstrated across ANAO audits of the Senate Order, entities should review internal processes to ensure compliance is improved. There would be merit in the Department of Finance periodically checking how entities are applying the Guidance and confirming that any documented reasons for agreeing to confidentiality provisions are adequate.

Recommendation no.1

2.14 That all entities meet all mandatory requirements set out in Senate Order 13: Entity Contracts, in particular that contract listings do not contain any inappropriate confidentiality provisions.

Australian Electoral Commission response: Agreed.

2.15 The AEC accepts this recommendation. The AEC is of the view that this would be best addressed through reviewing the Department of Finance’s Confidentiality Test and improving related guidance material.

Great Barrier Reef Marine Park Authority response: Agreed.

Department of Home Affairs response: Agreed.

2.16 The Department of Home Affairs is committed to ensuring that contract information is accurately reported on AusTender. The department considers that the audit has been useful in focusing attention on aspects of contract reporting where improvements can be made through better procedures, education and guidance.

Department of Infrastructure, Regional Development and Cities response: Agreed.

Assessing and documenting reasons for contract confidentiality

2.17 For the sampled entities the ANAO observed that the documentation of reasons for agreeing to any supplier confidentiality provisions was generally absent. Information within the contracts themselves is often limited to advising that the information is ‘commercially sensitive’ without providing a rationale for that assertion or indicating how the information, if disclosed, would cause unreasonable detriment to the provider or a third party.

2.18 Across the 2010 to 2015 calendar years the ANAO assessed that it is common that confidentiality is incorrectly claimed in relation to costing/profit information. For contracts sampled over this period, 66 per cent of contracts assessed by the ANAO as not meeting Criterion 2 and/or 3 contained provisions relating to costing/profit information.

2.19 The Guidance requires a case-by-case assessment of a suppliers’ request and identifies categories of information that may meet the requirements of the Confidentiality Test and further examples of information that would not generally be considered to be confidential. For example, the price of an individual item or group of items would not generally meet the Test. Aspects of costing/profit information that may meet the Test include: internal costing information or information about profit margins; and pricing structures (where the information would reveal whether a supplier was making a profit or loss on the supply of a particular good or service).

2.20 This guidance is by necessity not prescriptive. However, it is expected that entities examine each supplier request and, at a minimum, under the Confidentiality Test criteria:

- ensure that a supplier has demonstrated an objective basis for their request for confidentiality and

- demonstrate a real risk that disclosure would cause unreasonable detriment prior to the entity agreeing to the provision.

2.21 The Guidance neither defines the terms ‘unreasonable detriment’ or ‘commercially sensitive’ nor provides additional clarification to entities as to how they should assess whether a supplier has provided sufficient justification for their request.

2.22 The Guidance advises that the entity’s assessment of the supplier’s claims and the reasons for agreeing to the inclusion of confidentiality provisions should be documented.30 Although this is not a mandatory requirement, documenting these decisions would increase both transparency and accountability.

2.23 In circumstances where the Guidance is found to be open to interpretation, for example in the assessment of ‘unreasonable detriment’, there would be merit in entities engaging with Finance to ensure that decisions around confidentiality are based on sound reasons and so that future revisions to the Guidance include necessary points of clarification.

Recommendation no.2

2.24 That all entities document their consideration of supplier confidentiality requests against the Confidentiality Test to provide a record of the reasons for agreeing to any confidentiality provisions and the basis for future decisions.

Australian Electoral Commission response: Agreed.

2.25 The AEC accepts this recommendation, and intends to implement processes for ensuring detailed reasons behind the acceptance of any confidentiality provisions in contracts are appropriately documented.

Great Barrier Reef Marine Park Authority response: Agreed.

Department of Home Affairs response: Agreed

2.26 The Department will review and amend its guidance materials to assist staff to more accurately understand, implement, and report on confidentiality provisions in contracts. This material will be supported by advice and support on confidentiality provisions by procurement specialists with the Department.

2.27 Currently, assessments of confidentiality claims are conducted as part of the tender evaluation report and finalised during the negotiation stage. The Confidentiality Test is applied to all confidentiality claims prior to presentation to the delegate for sign off and awarding the contract. The proposed improvements will increase compliance with the Contract Management Manual (CCM) requirements at this stage.

Department of Infrastructure, Regional Development and Cities response: Agreed.

Alignment of AusTender Senate Order reporting with the contract sample from audited entities

The information contained within 53 of the 62 contracts reviewed (85 per cent) aligned with that reported on AusTender.

2.28 To assess the reliability of information published on AusTender, the ANAO compared the contract information reported in the 2016–17 Senate Order listing against the actual contracts sampled and supporting documentation. The sample comprised the 46 contracts described in paragraph 2.5, which were reported to contain confidentiality provisions, and another 16 randomly selected contracts (four per designated entity) that were reported as not containing confidentiality provisions.

2.29 The assessment (as outlined in Table 2.4) involved a review of the contract details (contractor, subject matter, amount of consideration, commencement date, and anticipated end date) as well as the type and reasons for confidentiality provisions provided by the entity. Based on these criteria, the information contained within 53 contracts (85 per cent) aligned with that reported on AusTender.31

Table 2.4: Alignment of reported information—procurement contracts

|

|

AEC |

GBRMPA |

Home Affairs |

Infrastructure |

Total |

|

Number of contract notices sampled |

26 |

10 |

14 |

12 |

62 |

|

Contractor Name matched |

26 |

10 |

14 |

12 |

62 |

|

Subject Matter matched |

26 |

10 |

14 |

12 |

62 |

|

Start Date matched |

26 |

10 |

13a |

11 |

60 |

|

Anticipated End Date matched |

24 |

6 |

14 |

12 |

56 |

|

Contract Value matched |

26 |

6 |

14 |

11 |

57 |

|

Number of contracts for which all basic details were correctly reported on AusTender |

24 |

5 |

13 |

11 |

53 |

Note a: The department advised that this date was subsequently amended on AusTender.

Source: ANAO analysis.

Did entities include parliamentary disclosure and ANAO access clauses?

Of the 62 confidential and non-confidential contracts examined by the ANAO, 59 contracts (95 per cent) included both parliamentary disclosure and ANAO access clauses.

2.30 Legislation can require Government entities to disclose the details of contracts, regardless of any contractual obligations to maintain confidentiality. This may include disclosure of information consistent with the Freedom of Information Act 1982 or disclosure of discoverable information that is relevant to a case before a court. In addition, entities may be required to facilitate the disclosure of, or access to, contractual information by the Parliament, its committees, and the Auditor-General to comply with accountability obligations.

2.31 Accordingly, and as recommended in the Commonwealth Procurement Rules (CPRs)32, Australian Government contracts should contain clauses that advise suppliers, regardless of contract confidentiality, that the:

- disclosure of contract‐related information may occur to the Parliament or parliamentary committees; and

- ANAO can access a contractor’s records and premises.

2.32 Of the 62 contracts examined by the ANAO, 59 contracts (95 per cent) contained a parliamentary disclosure clause and an ANAO access clause (see Table 2.5).33 This result represents an increase on Calendar Year 2015 results. ANAO Audit Report No. 18, 2016–17, Confidentiality in Government Contracts: Senate Order for Entity Contracts (Calendar Year 2015 Compliance) noted that 69 per cent of contracts sampled contained appropriately worded parliamentary disclosure clauses, and 79 per cent included ANAO access clauses in contracts.

Table 2.5: Parliamentary and ANAO access clauses

|

Entity |

No. of Contracts examined |

Parliamentary disclosure clauses |

ANAO access clauses |

||

|

|

|

No. |

% |

No. |

% |

|

AEC |

26 |

25 |

96 |

25 |

96 |

|

GBRMPA |

10 |

10 |

100 |

10 |

100 |

|

Home Affairs |

14 |

12 |

86 |

13 |

93 |

|

Infrastructure |

12 |

12 |

100 |

12 |

100 |

|

Total |

62 |

59 |

95 |

60 |

97 |

Source: ANAO analysis.

3. Ministers’ letters

Areas examined

This chapter examines whether Ministers’ letters have been tabled in accordance with the timing and content requirements of the Senate Order, and whether entities’ internet listings met the content requirements of the Senate Order.

Conclusion

For calendar years 2016 and 2017 respectively, 58 per cent and 71 per cent of Ministers’ letters were tabled in accordance with the timing and content requirements of the Senate Order. These results are broadly in line with results for calendar year 2015.

Did Ministers table their letters of advice in the Senate by the due date?

Ministers provided letters of advice to the Senate for: 50 non-corporate Commonwealth entities (58 per cent) by the due date for the 2016 calendar year reporting period (28 February 2017); and 109 corporate and non-corporate Commonwealth entities (71 per cent) by the due date for the 2017 calendar year reporting period (28 February 2018).

3.1 The Senate Order requires Ministers to table letters advising Parliament that each entity they administer has placed on the internet a list of contracts in accordance with the Senate Order and that the list can be accessed through the entity’s home page. Amendments to the Senate Order34 require Minister’s letters to provide advice about both non-corporate and corporate Commonwealth entities (except trading Public Non-Financial Corporations35) from 1 July 2017. Prior to 1 July 2017, the Senate Order applied to non-corporate Commonwealth entities only.36

3.2 A letter must be tabled by the Minister by: 28 February (29 February in leap years) for calendar year reporting; and 31 August for financial year reporting. The ANAO examined Ministers’ letters provided to the Senate for the 2016 and 2017 calendar year reporting periods.

3.3 For the 2016 calendar year reporting period, Ministers’ letters covering 50 non-corporate Commonwealth entities (58 per cent) were received by the Senate on or before the due date 28 February 2017. Ministers’ letters covering an additional 34 non-corporate Commonwealth entities (40 per cent) were received by the Senate within one week of the deadline, and letters covering the remaining two non-corporate Commonwealth entities were tabled within one month of the deadline.

3.4 Ministers’ letters covering 109 corporate and non-corporate Commonwealth entities (71 per cent) for the calendar year 2017 reporting period, were received by the Senate on or before the due date 28 February 2018. Ministers’ letters covering an additional 27 corporate and non-corporate Commonwealth entities (18 per cent) were received by the Senate within one week of the deadline, and letters covering the remaining 18 entities (12 per cent) were tabled within one month of the deadline.37

3.5 As shown in Figure 3.1, the results for 2016 and 2017 are broadly in line with the results for the 2015 calendar year (65 per cent of letters tabled by the due date) and the average since 2008.38 Ministers tabled all letters within one month of the reporting date in both 2016 and 2017 which was an improvement on the 2015 calendar year reporting period when Ministers tabled their letters for 16 entities more than one month late.

Figure 3.1: Entities with Ministers’ letters tabled by the due date

Source: ANAO analysis including previous ANAO reports.

Did Ministers’ letters comply with the content requirements of the Senate Order for excluded contracts?

The content of the Ministers’ letters issued for non-corporate Commonwealth entities largely complied with the content requirements of the Senate Order for excluded contracts. ANAO analysis of Ministers’ letters for the 2017 calendar year reporting period suggests that some corporate Commonwealth entities could better understand their obligations under the Senate Order regarding excluded contracts.

3.6 Minister’s letters are to indicate the extent of, and reasons for, non-compliance with the Senate Order, and when full compliance is expected to be achieved. Finance Resource Management Guide No.403–Meeting the Senate Order on Entity Contracts (RMG 403) issued by the Department of Finance (Finance) advises that Ministers may use the following three explanations to indicate the reasons for non-compliance, as appropriate:

- the list is not up to date—this reason may be used when the list does not include all relevant contracts and/or associated information (e.g. amount of consideration) for the period to which that letter relates;

- not all entities are included—this reason may be used when lists have not been completed for all entities administered by the Minister; and/or

- contracts all of which are confidential are not included—this reason may be used when a complete contract(s) has not been included by virtue of the fact that the entire contract(s) has been excluded from disclosure. The letter should also outline the reason(s) why entire contracts have been excluded from disclosure.39

3.7 RMG 403 states that excluding contracts from listings would happen only on rare occasions. The categories of exclusion include, but are not limited to, circumstances where disclosure of the existence of the contract/s would be contrary to: the public interest; statutory secrecy provisions; or the Privacy Act 1988.40

3.8 Further, RMG 403 advises that Ministers should provide the reasons why entire contracts have been excluded from disclosure in their letters of advice. Although the Guidance does not specify whether the number of excluded contracts must be noted in the letters, the template provided to assist entities to comply with the Senate Order implies that they should. Generally Ministers’ letters do provide both the number of excluded contracts and the reason for exclusion.

3.9 The number of contracts excluded from reporting over the 2016 and 2017 calendar years is shown in Table 3.1.

Table 3.1: Entities reporting excluded contracts in 2016 and 2017 Minister’s letters of compliance with the Senate Order

|

|

|

Number of excluded contracts |

|

|

Type of Entity |

Name of Entity |

2016 calendar year |

2017 calendar year |

|

Non-corporate Commonwealth entity |

Office of the Director of Public Prosecutions |

Not specified |

Not specified |

|

Department of Defence |

Not specified |

Not specified |

|

|

Department of Foreign Affairs and Trade |

3 |

1 |

|

|

Office of National Assessments |

15 |

18 |

|

|

Total for non-corporate Commonwealth entities |

18 |

19 |

|

|

Corporate Commonwealth entities |

Australia Council |

N/A |

27 |

|

Australian Broadcasting Corporation |

469 |

||

|

Australian National Maritime Museum |

5 |

||

|

National Museum of Australia |

4 |

||

|

Special Broadcasting Service Corporation |

646 |

||

|

Australian Institute of Marine Science |

19 |

||

|

Australian Nuclear Science and Technology Organisation |

63 |

||

|

Commonwealth Scientific and Industrial Research Organisationa |

746 |

||

|

Indigenous Business Australia |

25 |

||

|

Total for corporate Commonwealth entities |

N/A |

2004 |

|

Note a: CSIRO’s Ministers’ letter noted that its listing ‘may contain errors or omissions due to technical issues with… internal systems and processes, which currently do not have the functionality required to readily comply with these specific reporting requirements and format.

Source: ANAO analysis of 2016 and 2017 Minister’s letters of compliance with the Senate Order.

3.10 The reasons recorded for exclusion generally aligned with RMG 403 for each of the non-corporate Commonwealth entities. Two-thirds (six) of the nine corporate Commonwealth entities, including the three entities with the largest number of excluded contracts, reported reasons for exclusion such as ‘commercial’; ‘commercially sensitive’; ‘confidentiality’; and ‘trade secrets’ which suggests a misunderstanding between reporting confidential contracts versus excluding contracts.

3.11 As this is the first year the broader requirements of the Senate Order apply to corporate Commonwealth entities, the results outlined in Table 3.1 indicate that there would be merit in Finance working with these entities to develop a consistent understanding of their obligations under the Senate Order.

Did the listings meet the content requirements of the Senate Order?

Entities’ listings did not always meet the content requirements of the Senate Order. The most frequent errors in listings were not including the subject matter and not specifying reasons for confidentiality.

Reporting of contracts for corporate and non-corporate Commonwealth entities

3.12 ANAO analysis of Senate Order internet listings for the 2016–17 financial year was conducted for non-corporate Commonwealth entities only. ANAO analysis of Senate Order internet listings for the 2017 calendar year reporting period was conducted for corporate Commonwealth entities only.

3.13 In order to comply with the Senate Order, entities must place a listing on their websites of all contracts entered into during the relevant 12 month period. Finance guidance indicates that non-corporate Commonwealth entities should refer to AusTender Senate Order reports to fulfil this obligation for their procurement contracts. See paragraph 3.19 for analysis of this requirement. Non-procurement contracts should be listed on the entity’s website.

3.14 Finance has provided a template (reproduced in Figure 3.2) to assist entities to meet their internet listing requirements. While the template itself is optional to use, all information listed is required under the Senate Order.41

Figure 3.2: Template for contract listing

Source: Department of Finance, Resource Management Guide No. 403—Meeting the Senate Order on Entity Contracts, p. 22.

3.15 For the 2016–17 financial year reporting period, 31 of the 86 (36 per cent) non-corporate Commonwealth entities identified and reported a list of non-procurement contracts. A further 17 entities reported that no non-procurement contracts had been entered into. The remaining 38 entities did not identify whether they did or did not have non-procurement contracts.

3.16 The website listings of the 31 non-corporate Commonwealth entities that had non-procurement contracts were tested for consistency with the content of Figure 3.2. Twenty-six entities’ lists (84 per cent) complied with the content requirements. The information that was not provided included subject matter, contract commencement/end date and specifically identifying whether the contract contains confidentiality provisions and, if so, the reason.

3.17 For the 2017 calendar year reporting period, of the 66 corporate Commonwealth entities that were required to provide a listing:

- 52 corporate entities (79 per cent of corporate Commonwealth entities required to provide a listing under Senate Order) identified and reported a list of contracts;

- one entity reported that no contracts had been entered into; and

- 13 entities did not identify whether they had contracts, and therefore did not meet the Senate Order requirements.

3.18 Thirty one of the 52 corporate Commonwealth entities’ internet listings of contracts complied with the content requirements in Figure 3.2 (60 per cent of entities that reported contracts for the 2017 calendar year testing period).

Reporting of procurement contracts for non-corporate Commonwealth entities

3.19 The Senate Order was amended in May 2015 to allow for procurement contracts valued at or above $100,000 to be reported by reference to a complying report on AusTender.42 To satisfy the requirement, a link to AusTender’s Senate Order report from a non-corporate Commonwealth entities’ website is considered acceptable for the purposes of reporting procurement contracts.

3.20 For the 2016–17 financial year, 78 of the 86 non-corporate Commonwealth entities (91 per cent) placed links on their websites to either the AusTender home page or the AusTender Senate Order report page.43 These AusTender links were placed either on a ‘contracts’ or ‘Senate Order’ reporting page within the website itself, or inside a separate downloadable document listing the entity’s non-procurement contracts. Three additional entities provided their contract list directly on their website rather than directing to AusTender.

Did the relevant entities provide an estimated cost of compliance?

Sixty per cent of non-corporate Commonwealth entities reported a cost of complying with the Senate Order in the 2016–17 financial year and 53 per cent of corporate Commonwealth entities reported a cost of complying with the Senate Order for the 2017 calendar year. Overall costs ranged from nil to $49,443.

3.21 Under the Order, entities are required to provide an estimate of the cost of complying with the Senate Order for each listing along with an overview of the method used to reach the estimate. The estimate should be based upon the cost of the resources required to comply with the Senate Order. Entity requirements to report to AusTender under the Commonwealth Procurement Rules should not be included in these estimates.

3.22 Of the 86 non-corporate Commonwealth entities, 52 (60 per cent) reported a cost of complying with the Senate Order in the 2016–17 financial year.44 The reported costs ranged from ‘nil‘ to $11,282.03. The remaining 34 non-corporate Commonwealth entities did not report a cost.

3.23 In the 2017 calendar year, of the 66 corporate Commonwealth entities:

- 35 (53 per cent) entities reported a cost of complying with the Senate Order. Costs ranged from ‘nil’ to $49,443; and

- 31 (47 per cent) entities did not report a cost.

Table 3.2: Cost of complying with the Senate Order

|

Description |

Number of entities compliant with paragraph (2)(d) of the Order, and the reported cost of compliance |

|||

|

|

CY2013 |

CY2014 |

CY2015 |

FY2016–17 (non-corporate Commonwealth entities only) |

|

Number of entities that reported both the cost of compliance and method used to calculate the cost of compliance (when required to do so) |

82 |

72 |

89 |

50 |

|

Total cost reported |

$274,607 |

$237,124 |

$127,303 |

$102,126 |

|

Average cost per entity |

$3,156 |

$3,162 |

$1,430 |

$1,964 |

Source: ANAO analysis.

Appendices

Appendix 1 Entity responses

Australian Electoral Commission

Great Barrier Reef Marine Park Authority

Department of Home Affairs

Department of Infrastructure, Regional Development and Cities

Appendix 2 Senate Procedural Order of Continuing Effect 13: Entity Contracts

(1) There be laid on the table, by each minister in the Senate, in respect of each entity administered by that minister, or by a minister in the House of Representatives represented by that minister, by not later than 2 calendar months after the last day of the financial and calendar year, a letter of advice that:

- a list of contracts in accordance with paragraph (2) has been placed on the Internet, with access to the list through the entity’s home page; and

- includes an assurance by the entity head that the listed contracts do not contain any inappropriate confidentiality provisions.

(1A) Order 1(b) takes effect from 1 July 2017.

(2) The list of contracts referred to in paragraph (1) indicate:

- each contract entered into by the entity which has not been fully performed or which has been entered into during the previous 12 months, and which provides for a consideration to the value of $100 000 or more;

- the contractor, the amount of the consideration and the subject matter of each such contract, the commencement date of the contract, the duration of the contract, the relevant reporting period and the twelve-month period relating to the contract listings;

- whether each such contract contains provisions requiring the parties to maintain confidentiality of any of its provisions, or whether there are any other requirements of confidentiality, and a statement of the reasons for the confidentiality; and

- an estimate of the cost of complying with this order and a statement of the method used to make the estimate.

(2A) For the purposes of paragraph (1)(a) as it applies to procurement contracts only, access from an entity’s home page may include a link to a complying report on AusTender. If an entity has contracts to report other than procurement contracts, there must be a dedicated link to a list of such contracts from an entity’s home page in addition to any link to AusTender.

(3) If a list under paragraph (1) does not fully comply with the requirements of paragraph (2), the letter under paragraph (1) indicate the extent of, and reasons for, non-compliance, and when full compliance is expected to be achieved. Examples of non-compliance may include:

- the list is not up to date;

- not all relevant entities are included; and

- contracts all of which are confidential are not included.

(4) Where no contracts have been entered into by an entity, the letter under paragraph (1) is to advise accordingly.

(5) In respect of contracts identified as containing provisions of the kind referred to in paragraph (2)(c), the Auditor-General be requested to provide to the Senate, by not later than 30 September 2016 and 30 September 2018, a report indicating that the Auditor-General has examined a number of such contracts selected by the Auditor-General, and indicating whether any inappropriate use of such provisions was detected in that examination.

(6) In respect of letters including matter under paragraph (3), the Auditor-General be requested to indicate in a report under paragraph (5) that the Auditor-General has examined a number of contracts, selected by the Auditor-General, which have not been included in a list, and to indicate whether the contracts should be listed.

(7) The Finance and Public Administration References Committee consider the ongoing operation of the order and report on relevant developments from time to time.

(8) This order has effect on and after 1 July 2001.

(9) In this order:

complying report on AusTender’ means a report in respect of an individual entity that meets the requirements of this order in respect of procurement contracts;

‘entity’ means a Commonwealth entity within the meaning of the Public Governance, Performance and Accountability Act 2013, but does not include a trading Public Non-financial Corporation as classified by the Australian Bureau of Statistics;

‘inappropriate confidentiality provision’ means a confidentiality provision that is not in accordance with guidance issued by the Department of Finance on compliance with this order and approved by the Finance and Public Administration References Committee; and

‘previous 12 months’ means the period of 12 months ending on either 31 December or 30 June in any year, as the case may be.

(9A) Until 1 July 2017, entity is taken to mean a non-corporate Commonwealth entity within the meaning of the Public Governance, Performance and Accountability Act 2013.

(20 June 2001 J.4358, amended 27 September 2001 J.4994, 18 June 2003 J.1881, 26 June 2003 J.2011, 4 December 2003 J.2851, 1 March 2007 J.3527, 14 May 2015 J.2601).45

Footnotes

1 The Senate Procedural Order of Continuing Effect 13: Entity Contracts, 14 May 2015 is reproduced in full at Appendix 2.

2 Department of Finance, Resource Management Guide No. 403—Meeting the Senate Order on Entity Contracts, February 2017.

3 Department of Finance (Finance), Buying for the Australian Government, Confidentiality throughout the Procurement Cycle: Practice, [Internet], available from <https://www.finance.gov.au/procurement/ procurement-policy-and-guidance/buying/contract-issues/confidentiality-procurement-cycle/practice.html > [accessed May 2018].

4 Senate Procedural Order of Continuing Effect 13: Entity Contracts, 14 May 2015, paragraph five.

5 Contracts examined from the Department of Home Affairs included only those entered into by the Department of Immigration and Border Protection. The Audit Work Plan and contract sample was approved before the Department of Home Affairs was formally established on 20 December 2017.

6 The Order was formerly known as the Senate Procedural Order of Continuing Effect: Departmental and Agency Contracts and has been amended six times. The current Order, amended 14 May 2015, is reproduced in full at Appendix 2.

7 Commonwealth of Australia, Senate Hansard, Senate Order on Government and Agency Contracts: Government Response, pp. 26668—26669, Monday 27 August 2001.

8 Introduced in September 2007, AusTender is the Australian Government’s web-based procurement information system for the centralised publication of Australian Government business opportunities, annual procurement plans, multi-use lists, contracts and entity agreements, available from <https://www.tenders.gov.au/> [accessed March 2018].

9 Australian Government, Requirements for Annual reports - for Departments, Executive Agencies and other non-corporate Commonwealth entities, Prime Minister and Cabinet, 2015.

10 For the purposes of the Senate Order a list may be a complying report on AusTender for procurement contracts and an entity is required to provide access to this via a link from its home internet page. If the entity has contracts to report other than procurement contracts, there must be a dedicated link to a list of such contracts from the entity’s home page in addition to any link to AusTender.

11 For the purposes of the Senate Order, the term ‘contract’ applies to all forms of Government agreements, based on their legal status, rather than the name given to the arrangement. This includes procurement contracts, lease arrangements, and sales contracts and certain grants, funding agreements and employment contracts.

12 See paragraphs (2)(a)–(d) of the Order, reproduced at Appendix 2.

13 The Senate, Finance and Public Administration References Committee, Departmental and Agency Contracts, Report on the on the first year of operation of the Senate order for the production of lists of departmental and agency contracts, 12 December 2002, pp. 16 and 36.

14 See footnote 2.

15 See footnote 3.

16 The Confidentiality Test is described further from paragraph 2.4

17 From 1 July 2017 the Senate Order applied to Corporate Commonwealth entities.

18 Contracts examined from the Department of Home Affairs included only those entered into by the Department of Immigration and Border Protection. The Audit Work Plan and contract sample was approved before the Department of Home Affairs was formally established on 20 December 2017.

19 See footnotes 1–3.

20 The Senate Order allows for certain contractual arrangements to be excluded from disclosure on the listing, with notification of such exclusion to be included through the minister’s letter of compliance. Guidance issued by Finance advises that it is expected that this would happen only on rare occasions. Finance Resource Management Guide No.403–Meeting the Senate Order on Entity Contracts, paragraph 44, p. 13.

21 Senate Procedural Order of Continuing Effect 13: Entity Contracts, 14 May 2015, paragraph 2 (c).

22 Contracts may have multiple confidentiality provisions and therefore multiple reasons recorded.

23 A total of 55 contracts, across the four audited entities, were reported to contain confidentiality provisions relevant to the 2016–17 Senate Order reporting period. Nine of these contracts had also been reported in previous Senate Order reporting periods covered by previous ANAO audits and were therefore excluded from analysis to avoid duplication.

24 These contracts were only excluded for the Confidentiality Test. They were examined for the assessment outlined in paragraph 2.29–2.32.

25 The ANAO considers Criterion 4 to be met if Criterion 1 is met. This is based on an assumption that where a contract specifically identifies the information to be protected, and has been signed by both parties, then both parties understand and agree that the information is to remain confidential.

26 Finance, Resource Management Guide 403-Meeting the Senate Order on Entity Contracts, ‘Standard categories of confidentiality information,’ pp. 9–10, Canberra.

27 In the ANAO’s sample of 43 contracts there were three overarching deeds that applied to 13 individual contracts.

28 A single contract can claim confidentiality for multiple reasons.

29 This analysis was first reported in ANAO Audit Report No.7 2007–08 Senate Order for Departmental and Agency Contracts (Calendar Year 2006 compliance).

30 Department of Finance, Buying for the Australian Government, Confidentiality throughout the Procurement Cycle: Practice, Awarding a Contract, paragraph 13.

31 Amendments to contracts over $10,000 are required to be reported to AusTender. This does not include amendments to dates. Some contract details may not align to the AusTender listing as a result.

32 Finance, Commonwealth Procurement Rules, 1 January 2018, section 7.22 p. 18.

33 There was one additional contract that contained an ANAO access clause but not a Parliamentary access clause.

34 See Finance Resource Management Guide No.403 – Meeting the Senate Order on Entity Contracts, p. 5. As the result of a 2014 inquiry Senate Order for Departmental and Agency Contracts, the Senate Standing Committee on Finance and Public Administration broadened the application of the Senate Order to include corporate Commonwealth entities (excluding trading Public Non-Financial Corporations) from 1 July 2017.

35 As classified by the Australian Bureau of Statistics.

36 Parliamentary Departments, the Australian Secret Intelligence Service and Australian Security Intelligence Organisation are not entities for the purpose of the Senate Order and/or are exempt from reporting. These entities were excluded from ANAO analysis in this chapter.

37 From 1 July 2017, Ministers’ letter must include an assurance by the entity head that the listed contracts do not contain any inappropriate confidentiality provisions. The letters are intended to provide an accountability mechanism—informing the Parliament that entities have complied with the requirements of the Senate Order. The ANAO noted that the Senate Order and Department of Finance’s Guidance are not aligned in regard to where the entity head’s statement of assurance should be provided and further clarification could be provided.

38 A similar figure has been presented in ANAO audit reports since 2008.

39 Finance Resource Management Guide No.403–Meeting the Senate Order on Entity Contracts, paragraph 13, p. 7.

40 Finance Resource Management Guide No.403 – Meeting the Senate Order on Entity Contract paragraph 44, p. 13.

41 Department of Finance, Resource Management Guide No. 403—Meeting the Senate Order on Entity Contracts, p. 8.

42 Entities have been required to publish details of all procurement contracts and entity agreements valued at or above $10,000 on AusTender since September 2007. As with the reporting requirements of the Senate Order, for each contract reported on AusTender, the entity must report the supplier, subject matter, period and total value (or estimated value) of the contract. Also like the Senate Order, AusTender requires entities to report the existence of confidentiality provisions in contracts and to identify the reasons for including such provisions. Department of Finance, Resource Management Guidance 403: Meeting the Senate Order on Entity Contracts, item 37, p. 7.

43 Finance’s guidance only identifies non-corporate Commonwealth entities as being required to provide a link to AusTender for the purposes of reporting on procurement contracts. Finance Resource Management Guide No.403 – Meeting the Senate Order on Entity Contracts, paragraph 20-25, p. 9.

44 Two of these 52 entities did not identify the method used to estimate their cost of compliance.

45 Parliament of Australia, Senate Procedural Orders and Resolutions of the Senate of Continuing Effect, No. 13, Entity Contracts. [Internet], last amended 14 May 2015, available from <http://www.aph.gov.au/Parliamentary_Business/Chamber_documents/Senate_chamber_documents/standingorders/d00/Procedural_orders_of_continuing_effect/d05> [accessed March 2018].