Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

Reporting of Expenditure on Consultants

Parliamentary Committees, particularly Senate Estimates Committees, have for many years taken an interest in the use of consultants by Australian government agencies. In this context, and having regard to the extent of expenditure by FMA Act agencies on consultants, the objective of this audit was to assess the accuracy and completeness of Australian government agencies' reporting of expenditure on consultants.

Summary

Background

The Public Service Act 1999 (the Public Service Act) devolved to the heads of Australian Government agencies1 the power to engage, terminate and determine the employment terms and conditions of their employees. Agencies may also enter into arrangements with service providers who may be either contractors or consultants 2. This allows agencies considerable flexibility to determine the best way to use their resources to deliver government programs in a manner that is consistent with legislation and government policy.

Typical uses of consultants are to:

- investigate or diagnose a defined issue or problem;

- carry out defined research, reviews or evaluations;

- provide independent advice, information or creative solutions to problems; and

- provide specialised skills, knowledge or services which the agency may not possess.

While the cost for a consultant on a per diem basis may be higher than that of an employee, an advantage of consultants is that they can be engaged for a specific task for a specific period of time, thus providing greater resourcing flexibility for non ongoing tasks.

The definition of a consultant as opposed to a contractor had been problematic for agencies for some years. To address this, in July 2004, the Department of Finance and Administration (Finance) issued guidance for FMA Act agencies3. As a result of this clearer definition, effective from the 2003–04 reporting year, many agencies found that arrangements which they had previously regarded as consultancies were more accurately defined as contractors, resulting in a drop in the reported number and value of consultancies from 2002–03 to 2003 04. This has made year-on-year comparisons difficult. Consequently, this report covers only the 2003–04 reporting year.

Audit scope

In 2003–04, 73 agencies were covered by the Financial Management and Accountability Act 1997 (the FMA Act). The Requirements for Annual Reports for Departments, Executive Agencies and FMA Act Bodies (the annual report requirements4), published by the Department of Prime Minister and Cabinet (PM&C) require agencies to publish details of all consultancies valued at over $10 000 that were let in the financial year. In total, the 73 agencies reported consultancy expenditure of $361 million in 2003–04.

In addition to the requirement to report on consultancies in annual reports, there are two other public reporting regimes with which FMA Act agencies are required to comply:

- The Commonwealth Procurement Guidelines (CPGs) require agencies to report all contracts (including consultancy contracts) greater than $2 0005 in the Gazette Publishing System (GaPS); and

- the Senate Order for Departmental and Agency Contracts (known as the Senate Order or the Murray Motion) requires FMA Act agencies to report on their website all contracts (including consultancy contracts) greater than $100 000 including identification of those which contain confidentiality provisions.

There are areas of overlap between the three regimes. For example, a consultancy contract with a value of more than $100 000 should be reported in all three. The ANAO cross-checked between the three regimes to assess the consistency, accuracy and completeness of reporting in them.

Audit objective

Parliamentary Committees, particularly Senate Estimates Committees, have for many years taken an interest in the use of consultants by Australian government agencies. In this context, and having regard to the extent of expenditure by FMA Act agencies on consultants, the objective of this audit was to assess the accuracy and completeness of Australian government agencies' reporting of expenditure on consultants.

Audit conclusions

The reporting of expenditure on consultants is one of agencies' many accountability obligations. The focus of this audit was reporting of consultants expenditure in accordance with the annual report requirements. Close analysis of this reporting as well as reporting in GaPS and Senate Order listings, revealed that greater care should be taken by agencies in reporting expenditure on consultants. Specifically:

- in response to the audit findings, most of the 73 agencies covered by this audit acknowledged inadequacies in their reporting of expenditure of consultancies. In total, 85 per cent advised the ANAO that they would take some form of corrective action. This ranged from advising the ANAO of changes to processes for preparing their 2004–05 annual reports to the issuing of a corrigendum to their 2003–04 annual reports; and

- in terms of the accuracy and completeness of reporting across the three reporting regimes, the ANAO found that none of the 73 FMA Act agencies had correctly reported in all three regimes.

In this context, the audit identified overlaps across each of the three reporting regimes in that the same consultancy contract is often required to be reported in all three regimes. In addition, different data is required in each of the regimes for the same contract. This has contributed to the difficulties agencies have experienced in reporting accurate and complete data on their use of consultants.

Accordingly, the ANAO has recommended that the relevant central agencies, in consultation with key Parliamentary Committees, affected agencies and other stakeholders, examine options for improving the accuracy of reporting of Government procurement. This includes examining the merits of rationalising the number of reporting regimes while still meeting stakeholders' requirements. Efficiencies can be expected to result from this with consequential cost savings.

Recommendations

The ANAO has made three recommendations. Most importantly, Recommendation No. 2 is aimed at addressing the overlaps and inefficiencies evident in the current approach of having three discrete reporting regimes for Government procurement, including the reporting of expenditure on consultants. If well implemented, the ANAO believes that this recommendation has potential to deliver cost savings to agencies while improving the quality of data reported.

The ANAO has also recommended that the Department of Defence set, and report against, the expected time by which on-going contracts will be reported in its Senate Order listings (Recommendation No.1). The final recommendation relates to correcting omissions or incorrect inclusions of expenditure on consultants in agencies' annual reports.

Recommendations were not made in relation to agency controls and procedures because the majority of agencies acknowledged deficiencies in their reporting and indicated that action would be taken to address these. In this context, apart from agencies reviewing the integrity of their systems of data capture, there would be benefit in agencies reviewing their quality assurance arrangements over information reported on consultants.

Entity responses

The majority of responding agencies agreed with all recommendations. The exceptions were:

- the Department of Defence which disagreed with Recommendation 1 (see paragraph 4.21);

- the Department of Foreign Affairs and Trade, which disagreed with Recommendation 3 (see paragraph 5.30); and

- the Bureau of Meteorology which agreed with qualification with Recommendation 2. The Bureau commented that the level of non-compliance across the agencies, and the need for efficiency in reporting suggests that an assessment of the scope and purpose of the requirements of the reporting framework should be undertaken. It further commented that it is likely that better ways of making information on consultancies available to Parliament and the general public, can be found (see paragraph 5.20).

There was widespread support, including from the Departments of Prime Minister and Cabinet, and Finance and Administration, for the key recommendation (No.2, aimed at addressing the overlaps and inefficiencies evident in the current approach of having three discrete reporting regimes for Government procurement, including the reporting of expenditure on consultants). Detailed responses to the recommendations are at Appendix 6.

Key findings

Reporting of consultancies in annual reports (Chapter 2)

All 73 agencies covered by this audit compiled a list of consultancies. Sixty agencies provided the lists within their 2003–04 annual reports. A further five had the lists available on request and, after being requested, provided them to the ANAO. The remaining eight agencies reported that their lists were on their website6. With effect from the 2004–05 reporting year, the ‘available on request' option has been removed.

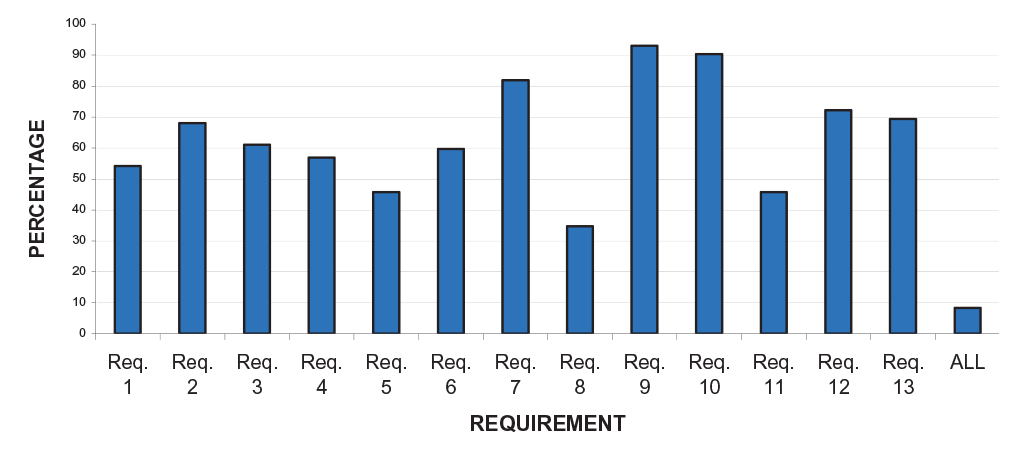

However, the ANAO found that only seven of 73 agencies reported information against all 13 of the requirements relating to consultancies. Figure 1 shows the percentage of audited agencies that met each of the annual report requirements.

Figure 1 Proportion of FMA Act agencies reporting against annual report requirements

Source: ANAO analysis of FMA Act agencies’ 2003–04 annual reports

Of the 13 annual report requirements, five are particularly important. The five relate to the reporting of details of consultancies let, contract prices and actual expenditure, as follows:

- summary statement detailing the number of contracts let during 2003–04 (Requirement 1);

- summary statement detailing the total actual expenditure during 2003–04, regardless of when the contract was let (Requirement 2); and

- list of all consultancy contracts let in 2003–04 with a contract price of $10 000 or more (annual report requirements 6, 7 and 117).

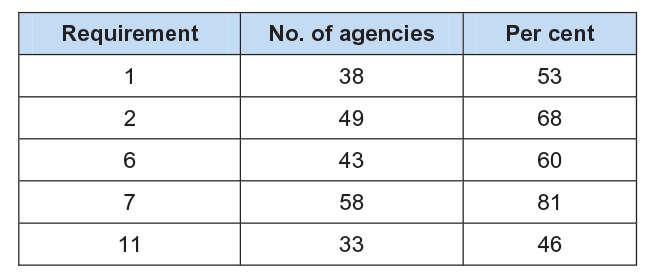

Compliance with the key requirements was better than overall compliance. Specifically, 15 agencies (21 per cent) reported information against all five of the key annual report requirements. However, many agencies did not report data against one or more. Figure 2 shows how many agencies reported information against each of the five key annual report requirements.

Figure 2 Number and proportion of agencies meeting key annual report requirements

Source: ANAO analysis of FMA Act agencies’ 2003–04 annual reports

The ANAO undertook more detailed analysis of the content of 31 of the 73 agencies' annual reports (including all 17 Departments of State and the six agencies which reported information against all of the annual report requirements). This analysis identified that 30 of the 31 agencies had either:

- omitted consultancies from their annual reports;

- reported incorrect amounts as the contract price; or

- included consultancies which were not let in 2003–04 and should therefore not have been reported.

Reporting of procurement in the Gazette Publishing System (GaPS) (Chapter 3)

In 2003–04, FMA Act agencies were required to report all procurement activity valued at more than $2 000 in GaPS. Where the procurement is the subject of a contract, agencies are required to show the total contract price.

The ANAO found deficiencies in GaPS data. In relation to the reporting of consultancies in GaPS, this included:

- 72 per cent of the 31 selected agencies confirmed that they had described expenditure in GaPS as being for consultancies when they were, in fact, non-consultancy contracts;

- 79 per cent of the 31 selected agencies confirmed that they had omitted consultancies from GaPS; and

- 96 per cent of the 31 selected agencies confirmed that some or all GaPS figures relating to consultancies were payment amounts, rather than contract values as required.

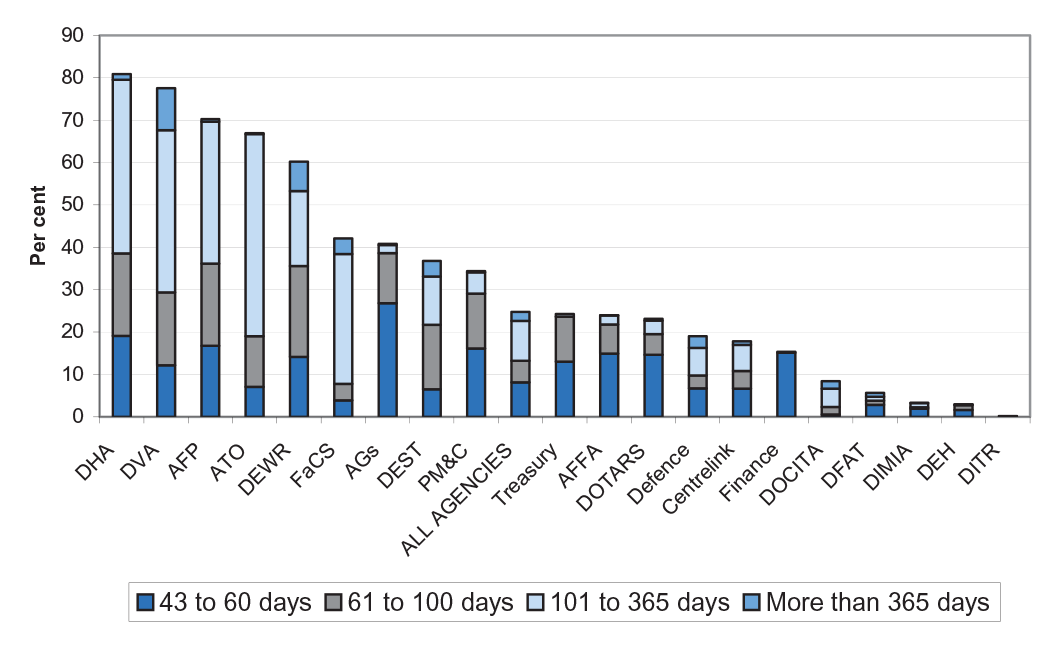

In 2003–04, FMA Act agencies recorded more than 186 000 entries in GaPS relating to procurement generally (that is, not just in relation to consultants). The ANAO identified the number of entries that met the requirement to report expenditure in GaPS within six weeks of the start date of the contract. The results are reflected in Figure 3, which shows that GaPS entries are often made after the due date.

Figure 3 Proportion of GaPS entries exceeding 42 day reporting requirement period, selected FMA Act agencies

Note: In this figure, the selected agencies are all Departments of State and the three largest non-

Departmental FMA Act agencies.

Source: ANAO analysis of data download from Department of Finance and Administration, August 2005

The value of GaPS entries reported outside the required time limit was $7.7 billion. Further, 3 656 entries with a total value of $916 million were not reported in GaPS until more than one year after the reported contract start date. Some contracts were not reported for several years.

Reporting of consultancies in Senate Order (Chapter 4)

In accordance with an order of the Senate, all FMA Act agencies are required to report contracts that they enter into with a value of $100 000 or more, together with information on any confidentiality provisions which may be contained in each contract. This means that any consultancy reported in an agency's annual report worth more than $100 000 should also be reported in the agency's Senate Order listing.

The ANAO's Senate Order audits have focussed on the processes used to compile agencies' internet listings and the use of confidentiality provisions in contracts. In comparison, this performance audit, which has a broader scope, involved a substantive examination of the accuracy and completeness of reports, relying on data reported across the three reporting regimes.

In this context, the ANAO cross-checked agencies' 2003–04 annual reports with their Senate Orders for the same period. The result of this work was that:

- 55 per cent of the 31 selected agencies confirmed that they had omitted consultancies from their Senate Orders.

- 39 per cent of consultancies reported in all 73 FMA Act agencies' annual reports worth more than $100 000 were not accurately reported in Senate Orders; and

- 24 per cent of consultancies reported in all 73 FMA Act agencies' annual reports worth more than $100 000 were not reported at all in Senate Orders.

These results lend further weight to one of the recommendations of the ANAO's most recent Senate Order audit 8which recommended that agencies reconcile their Senate Order listings with GaPS and their internal accounting systems.

Footnotes

1 Most Commonwealth Government agencies are defined by the legislation that governs them. As at July 2005, the are 86 agencies governed by the Financial Management and Accountability Act 1997 (including Departments of State) and 104 bodies governed by the Commonwealth Authorities and Companies Act 1997. This report relates to FMA Act agencies. For more detail, see paragraph 1.1.

2 In broad terms, a consultant provides an intellectual output that assists with agency decision-making, with the output reflecting the independent views of the service provider. By comparison, a contractor provides day-to-day services and is usually under the direct supervision of the agency.

3 Guidance on Identifying Consultancies For Annual Reporting Purposes, Financial Management Guidance No.12, Department of Finance and Administration, July 2004 <http://www.finance.gov.au/ctc/identifying_consultancies_for_.html>. An extract from this document is reproduced at Appendix 3.

4 The annual report requirements are approved by the Joint Committee of Public Accounts and Audit (JCPAA) under s63(2) and s70(2) of the Public Service Act 1999. The effect of this is to make them legally binding on Departments of State and Executive Agencies. As a matter of Government policy, they also apply to FMA Act agencies. A copy of the latest revision (June 2005) can be found ath ttp://www.pmc.gov.au/guidelines/docs/annual_report_requirements.pdf>. The previous version (June 2004), which applied for the period covered by this report, is no longer available electronically.

5 The threshold was increased to $10 000 with effect from 1 January 2005.

6 In seven of these eight cases, the lists were not on the website when the audit commenced, but were placed on the website during the course of the audit.

7 Requirement 6 is for a list of all consultancies let in the year. Requirement 7 specifies that only consultancies with a value of $10 000 or more should be included and Requirement 11 states that the amount to be reported should be the contract price, not payments actually made.

8 Audit Report No. 11, 2005-06, p.28